Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Pfenex Inc. | d541236d8k.htm |

NYSE American: PFNX Exhibit 99.1

This presentation, including the accompanying oral presentation (the “Presentation”), includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are based on current expectations, estimates and projections based on information currently available to management. These forward-looking statements include, among others, statements regarding the future potential of Pfenex's product candidates, including future plans to advance, develop, manufacture and commercialize its product candidates; potential market opportunities for Pfenex’s product candidates; Pfenex's expectation to receive data from the PF708 clinical program in the second quarter of 2018, its expectation to submit an NDA for PF708 in the third quarter of 2018, and the projected commercial US launch of PF708 in the third quarter of 2019; Pfenex’s belief in its cash position to support key development milestones and that it has more than twelve months of cash runway; the expected patent expiration timelines for Lucentis, Forteo, and other branded reference drugs; developments and projections relating to competitors and the industry, including support of the US administration for development of medical countermeasures; expected milestones for Px563L/RPA563, including the timing of the potential Phase 2 study initiation in 2019; the potential procurement contract for Px563L/RPA563 if within ten years of approval; expectations with regard to future milestone and royalty payments from Pfenex’s collaboration with Jazz Pharmaceuticals and that Pfenex is on track to meet key 2018 development milestones under the Jazz collaboration; expectations with respect to Pfenex’s ability to receive future payments under its government contracts; Pfenex’s expectations regarding the use of abbreviated regulatory pathways for the approval of its product candidates, including use of the 505(b)(2) regulatory pathway for PF708 and the 351(k) pathway for PF529; Pfenex's expectations regarding the timing and advancement of clinical trials and the types of future clinical trials for its product candidates; and Pfenex's expectation for potential strategic partnership opportunities to maximize value for advancement of PF582, PF529, and its other product candidates. Forward-looking statements are typically identified by words like “believe,” “anticipate,” “could,” “should,” “estimate,” “expect,” “intend,” “plan,” “project,” “will,” “forecast,” “budget,” “pro forma,” and similar terms. Factors that could cause Pfenex’s results and expectations to differ materially from those expressed in forward-looking statements include, without limitation, Pfenex’s need for additional funds to support its operations; its success being dependent on PF708, Px563L/RPA563, and its other product candidates; Pfenex’s reliance on its collaboration partner’s performance over which Pfenex does not have control; failure to achieve favorable results in later clinical trials for PF708, Px563L/RPA563, or its other product candidates or receive regulatory approval; delays in its clinical trials or in enrollment of patients in its clinical trials; failure to market PF708, Px563L, or its other product candidates due to the existence of intellectual property protection owned or controlled by a third party and directed to PF708, Px563L/RPA563, or its other product candidates; PF708, Px563L/RPA563 and its other product candidates may cause serious adverse side effects or have properties that delay or prevent regulatory approval or limit their commercial profile; if approved, risks associated with market acceptance, including pricing and reimbursement; Pfenex’s ability to enforce its intellectual property rights; adverse market conditions; and changes to laws and government regulations involving the labelling, approval process, funding and other matters affecting biosimilars, therapeutic equivalents to branded products and vaccines. Forward-looking statements represent Pfenex’s management’s beliefs and assumptions only as of February 27, 2018. You should read Pfenex’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2017, including the Risk Factors set forth therein, and its subsequent reports filed with the SEC, including the Risk Factors set forth therein, completely and with the understanding that Pfenex’s actual future results may be materially different from what Pfenex expects. Except as required by law, Pfenex assumes no obligation to update these forward-looking statements publicly, or to update the reasons why actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future. Safe Harbor Statement Pfenex

Clinical stage development and licensing biotechnology company focused on leveraging its Pfenex Expression Technology® to improve protein therapies for unmet patient needs Advanced pipeline of therapeutic equivalents, vaccines, biologics and biosimilars Key pipeline products drive significant near term catalysts and address a >$10B market Seasoned management with extensive competencies from early R&D to regulatory filing, commercialization and partnership management Cash position that supports key milestones and >12 months runway Overview Pfenex

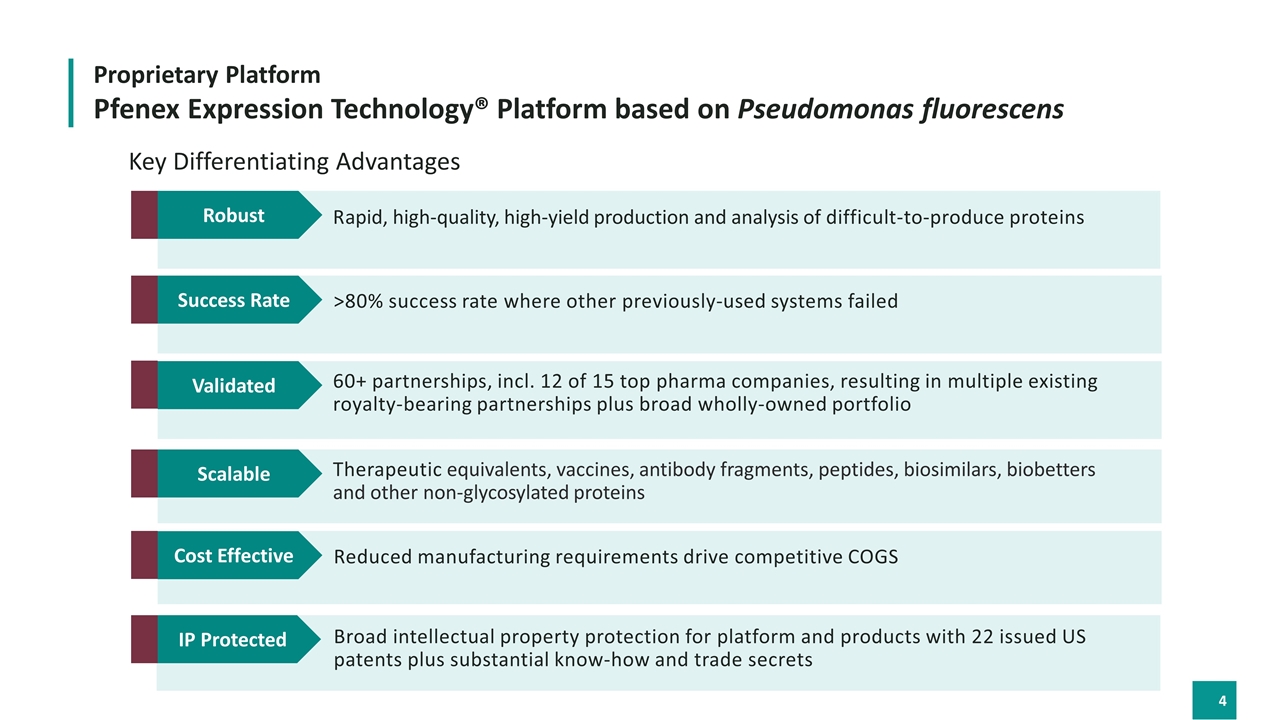

Pfenex Expression Technology® Platform based on Pseudomonas fluorescens Proprietary Platform 60+ partnerships, incl. 12 of 15 top pharma companies, resulting in multiple existing royalty-bearing partnerships plus broad wholly-owned portfolio Validated Scalable Therapeutic equivalents, vaccines, antibody fragments, peptides, biosimilars, biobetters and other non-glycosylated proteins Cost Effective Reduced manufacturing requirements drive competitive COGS IP Protected Broad intellectual property protection for platform and products with 22 issued US patents plus substantial know-how and trade secrets Key Differentiating Advantages >80% success rate where other previously-used systems failed Success Rate Rapid, high-quality, high-yield production and analysis of difficult-to-produce proteins Robust

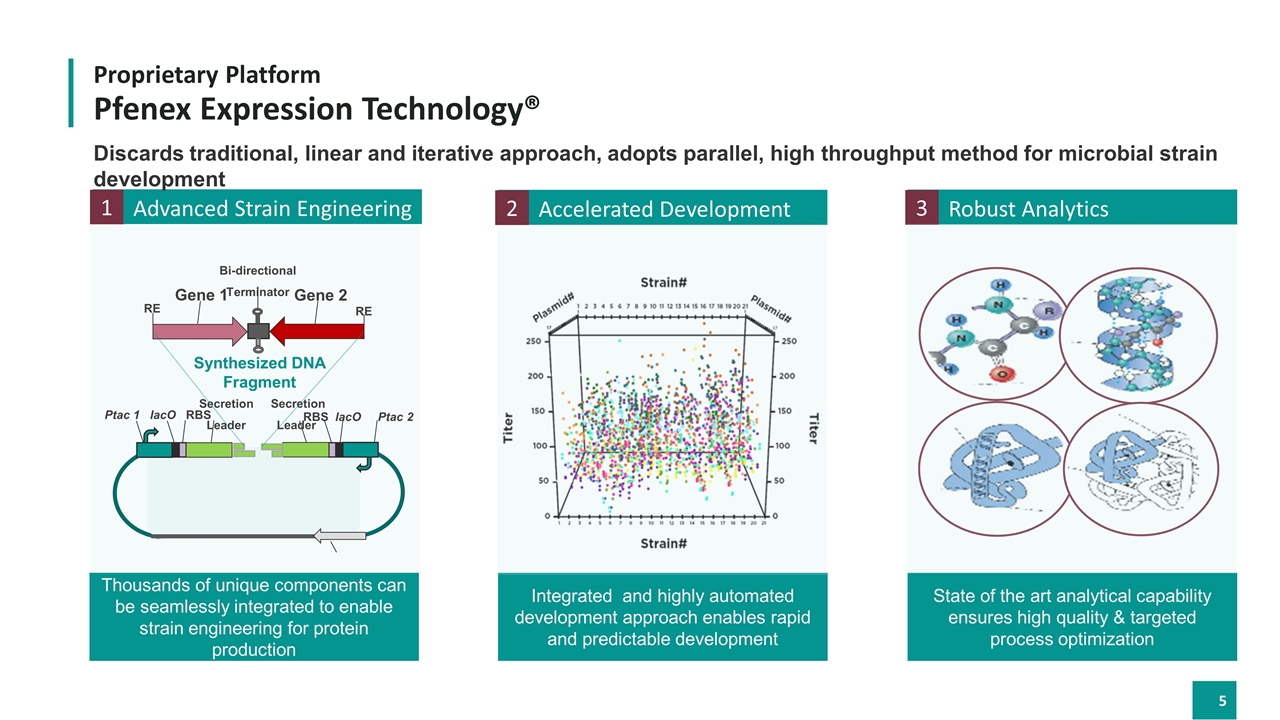

Proprietary Platform Pfenex Expression Technology® Robust Analytics State of the art analytical capability ensures high quality & targeted process optimization 3 Advanced Strain Engineering 1 Accelerated Development 2 Integrated and highly automated development approach enables rapid and predictable development Thousands of unique components can be seamlessly integrated to enable strain engineering for protein production Discards traditional, linear and iterative approach, adopts parallel, high throughput method for microbial strain development Ptac 1 lacO RBS RBS lacO Ptac 2 Secretion Leader Secretion Leader RE RE Gene 1 Gene 2 Bi-directional Terminator Synthesized DNA Fragment

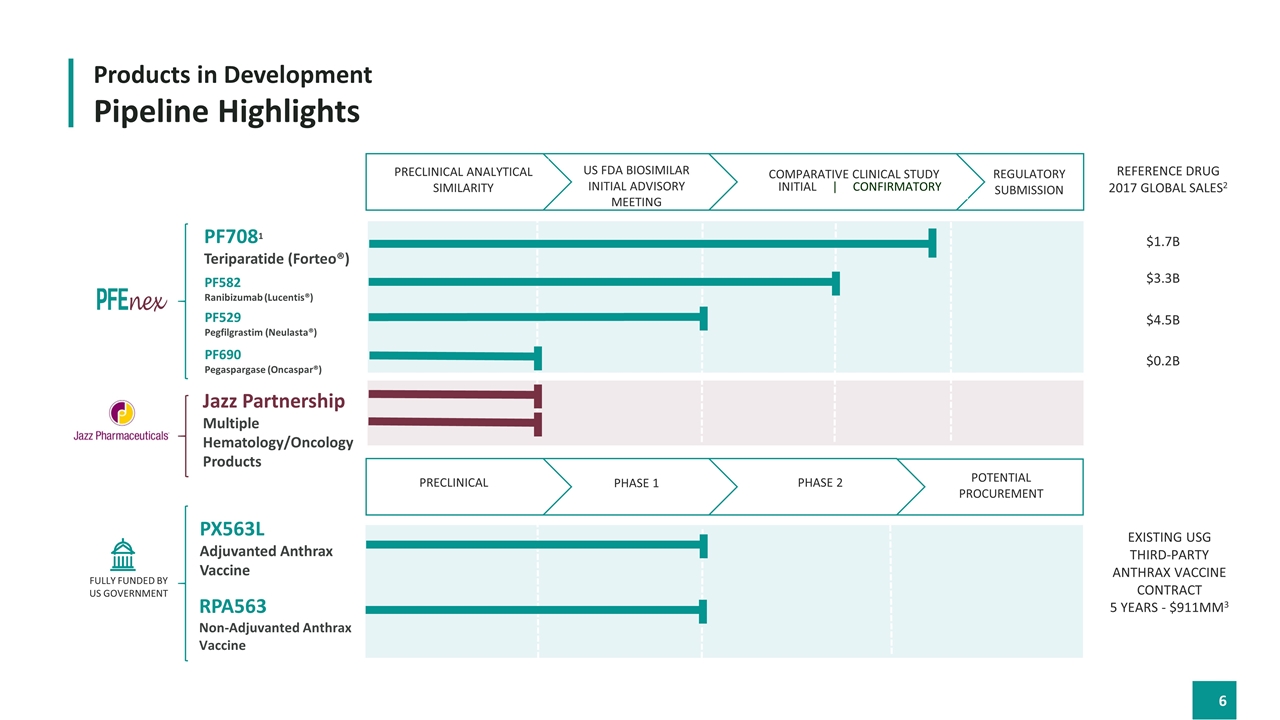

Products in Development Pipeline Highlights Existing USG THIRD-PARTY Anthrax Vaccine Contract 5 Years - $911MM3 $1.7B Reference drug 2017 Global sales2 $3.3B $4.5B $0.2B PF7081 Teriparatide (Forteo®) PF582 Ranibizumab (Lucentis®) PF529 Pegfilgrastim (Neulasta®) PF690 Pegaspargase (Oncaspar®) Jazz Partnership Multiple Hematology/Oncology Products Preclinical Phase 1 Phase 2 PX563L Adjuvanted Anthrax Vaccine RPA563 Non-Adjuvanted Anthrax Vaccine FULLY FUNDED BY US GOVERNMENT POTENTIAL Procurement REGULATORY submission Initial | CONFIRMATORY Us fda biosimilar Initial advisory meeting Preclinical Analytical Similarity Comparative clinical study

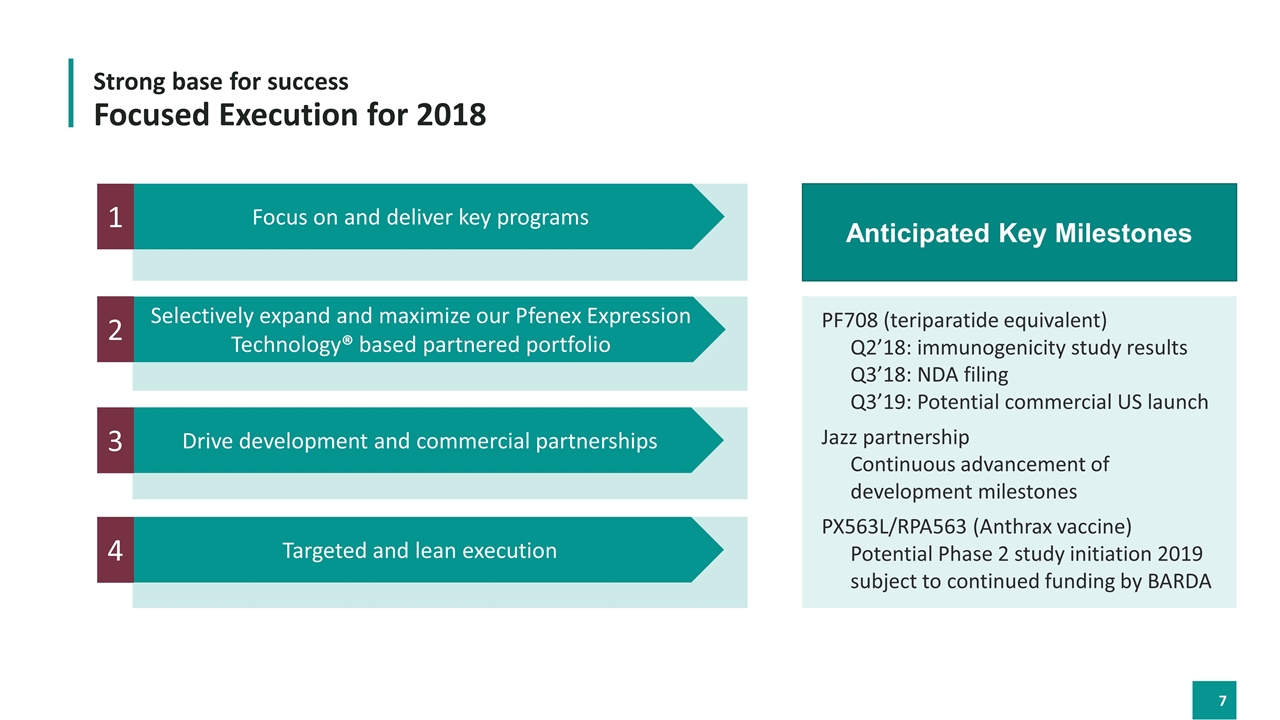

Focused Execution for 2018 Focus on and deliver key programs 1 Selectively expand and maximize our Pfenex Expression Technology® based partnered portfolio 2 Drive development and commercial partnerships 3 Targeted and lean execution 4 Strong base for success Anticipated Key Milestones PF708 (teriparatide equivalent) Q2’18: immunogenicity study results Q3’18: NDA filing Q3’19: Potential commercial US launch Jazz partnership Continuous advancement of development milestones PX563L/RPA563 (Anthrax vaccine) Potential Phase 2 study initiation 2019 subject to continued funding by BARDA

Strong Financial Position Financials Shares Outstanding 23.5 million as of September 30, 2017 Total Cash $48.6 million as of September 30, 2017 $18.5 million Jazz process development and amendment signing milestone Q4’17 Runway Cash position that supports key milestones and >12 months runway

Evert (Eef) Schimmelpennink (Aug 2017) CEO, President, Director and Secretary Patrick K. Lucy Chief Business Officer Hubert Chen Chief Medical & Scientific Officer Senior Management Board of Directors Experienced Management New and Established Leadership Aligned to Drive Growth John Taylor Dennis Fenton Philip Schneider Robin Campbell Mayda Mercado Vice President, Quality Susan Knudson (Feb 2018) Chief Financial Officer Jason Grenfell-Gardner (May 2017) Sigurdur Olafsson (May 2017)

Products in Development

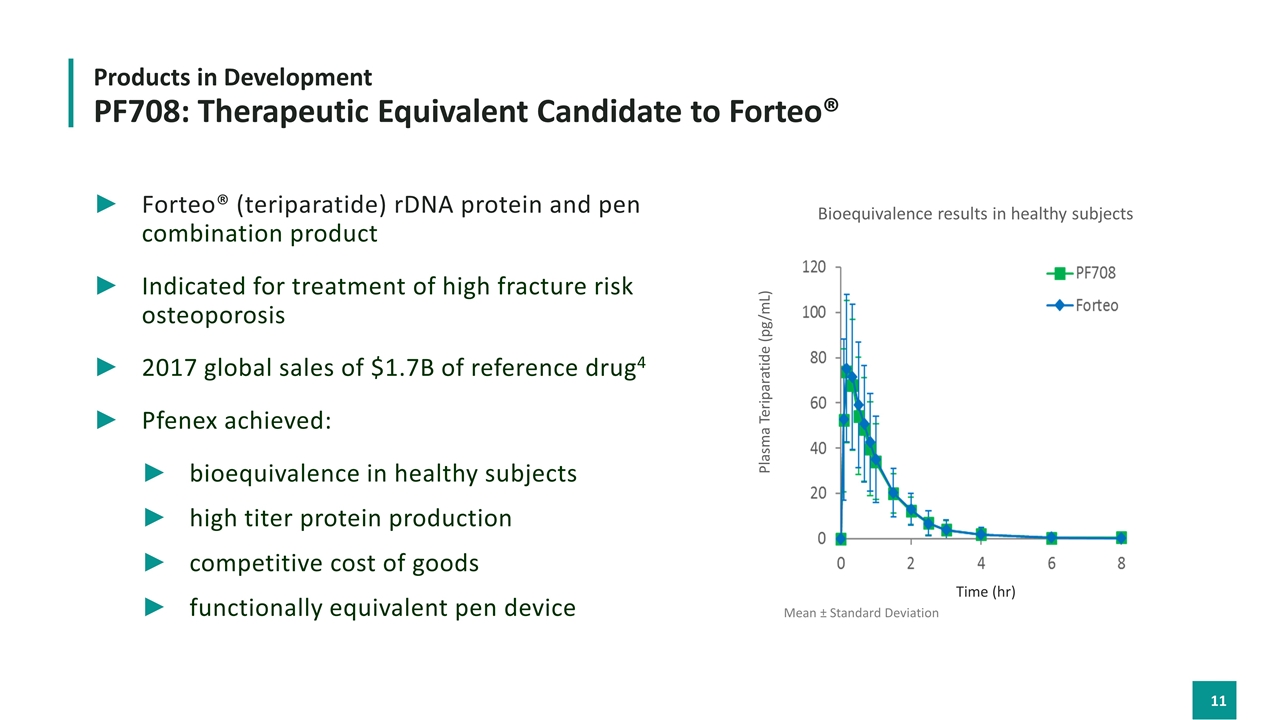

Forteo® (teriparatide) rDNA protein and pen combination product Indicated for treatment of high fracture risk osteoporosis 2017 global sales of $1.7B of reference drug4 Pfenex achieved: bioequivalence in healthy subjects high titer protein production competitive cost of goods functionally equivalent pen device Plasma Teriparatide (pg/mL) Products in Development PF708: Therapeutic Equivalent Candidate to Forteo® Mean ± Standard Deviation Time (hr) Bioequivalence results in healthy subjects

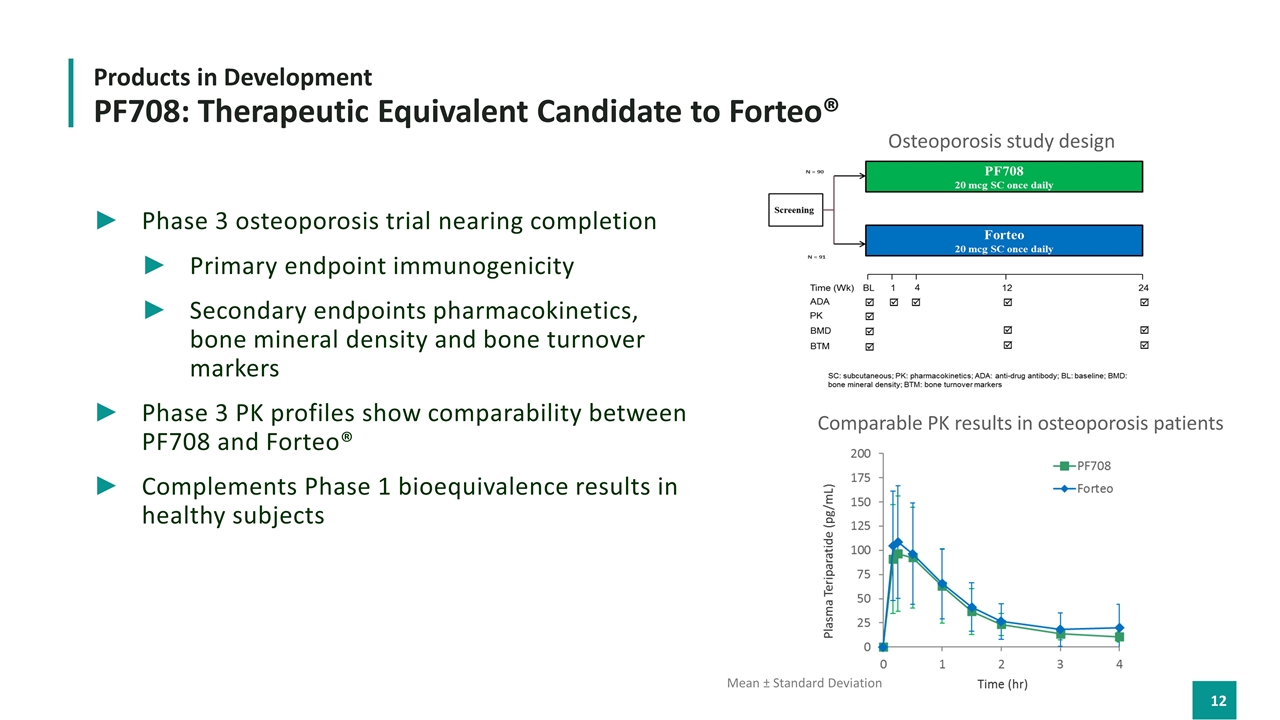

Phase 3 osteoporosis trial nearing completion Primary endpoint immunogenicity Secondary endpoints pharmacokinetics, bone mineral density and bone turnover markers Phase 3 PK profiles show comparability between PF708 and Forteo® Complements Phase 1 bioequivalence results in healthy subjects Products in Development PF708: Therapeutic Equivalent Candidate to Forteo® Mean ± Standard Deviation Comparable PK results in osteoporosis patients Osteoporosis study design

Products in Development PF708: Therapeutic Equivalent Candidate to Forteo® Pfenex PF708 PF708 (teriparatide [rDNA] injection) Key upcoming program milestones: Primary endpoint of immunogenicity anticipated in Q2’18 505(b)(2) NDA filing expected Q3’18 Projected commercial US launch Q3’19 Strong IP strategy that is expected to support launch at market formation Latest expiry of Orange Book listed teriparatide method of treatment, formulation and/or API patent expected in August 2019 in the US5 Clear commercially succinct pathway with or without A/B rating

Pfenex granted Jazz worldwide rights to develop and commercialize multiple Pfenex Expression Platform based hematology/oncology product candidates Key program highlights: Up to $224.5MM in upfront and potential milestone payments including up to $84.5MM non-sales related Tiered royalties on net sales $18.5MM process development and amendment signing milestone achieved Q4’17 On target to meet key 2018 development milestones Products in Development Jazz Pharmaceuticals/Pfenex Partnership

Awarded BARDA contract in August 2015 Key program highlights: US Government funds up to $143.5MM of advanced development Potential procurement contract if within 10 years of FDA approval US administration has demonstrated strong support for development of medical countermeasures Current sole sourced contract is valued at close to $1B for a 5 year supply6 Products in Development Px563L/RPA563: Next Generation Anthrax Vaccine Candidates

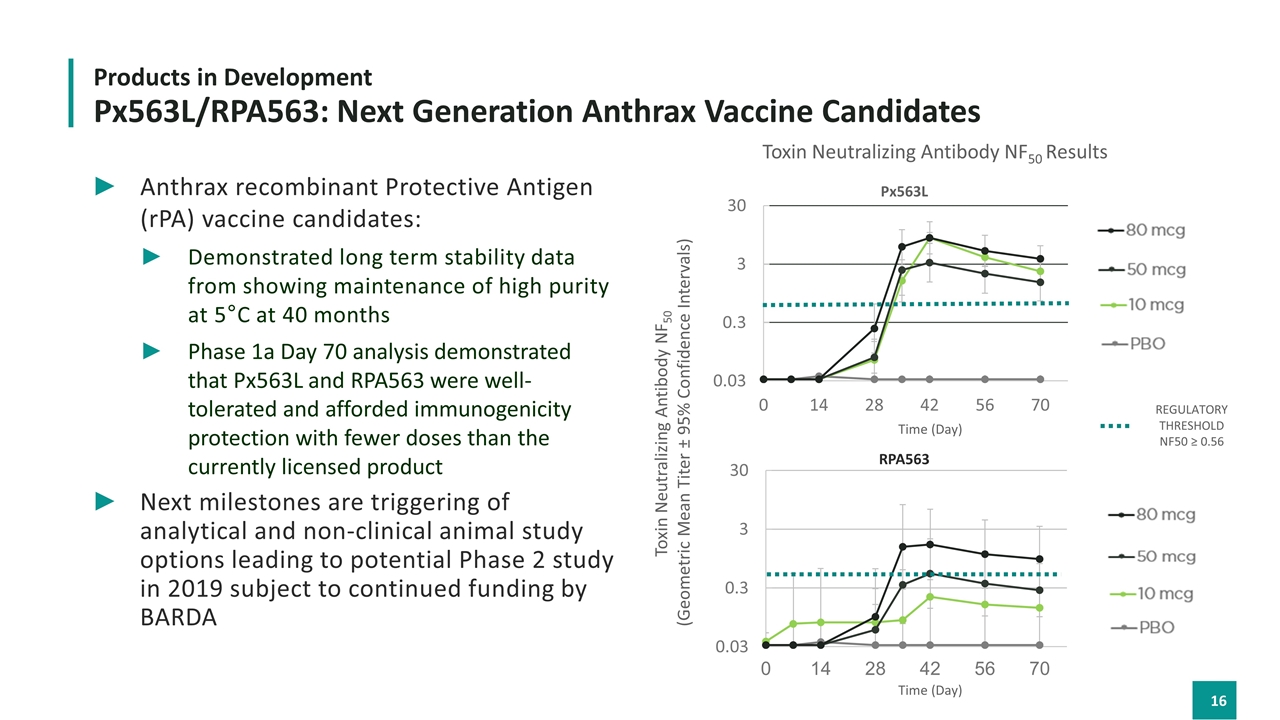

Anthrax recombinant Protective Antigen (rPA) vaccine candidates: Demonstrated long term stability data from showing maintenance of high purity at 5°C at 40 months Phase 1a Day 70 analysis demonstrated that Px563L and RPA563 were well-tolerated and afforded immunogenicity protection with fewer doses than the currently licensed product Next milestones are triggering of analytical and non-clinical animal study options leading to potential Phase 2 study in 2019 subject to continued funding by BARDA Products in Development Px563L/RPA563: Next Generation Anthrax Vaccine Candidates Toxin Neutralizing Antibody NF50 Results Toxin Neutralizing Antibody NF50 (Geometric Mean Titer ± 95% Confidence Intervals) Time (Day) Time (Day) RPA563 Px563L REGULATORY THRESHOLD nf50 ≥ 0.56

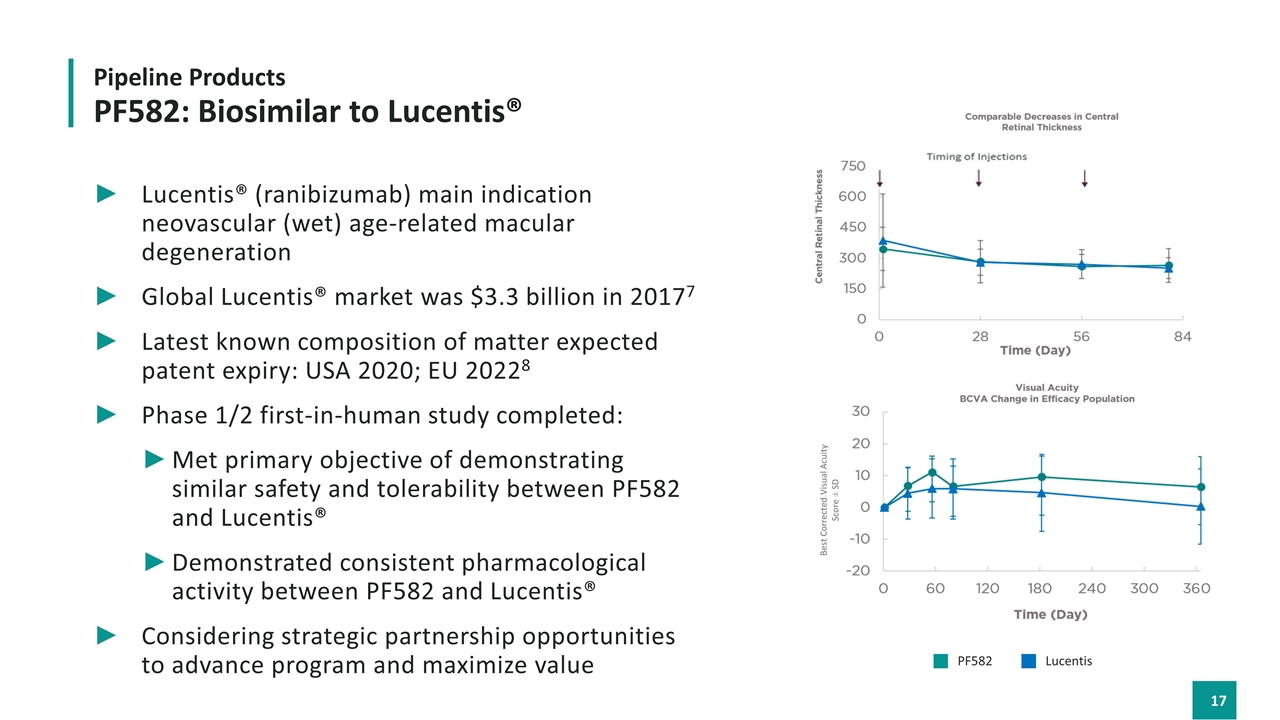

Lucentis® (ranibizumab) main indication neovascular (wet) age-related macular degeneration Global Lucentis® market was $3.3 billion in 20177 Latest known composition of matter expected patent expiry: USA 2020; EU 20228 Phase 1/2 first-in-human study completed: Met primary objective of demonstrating similar safety and tolerability between PF582 and Lucentis® Demonstrated consistent pharmacological activity between PF582 and Lucentis® Considering strategic partnership opportunities to advance program and maximize value Pipeline Products PF582: Biosimilar to Lucentis® Best Corrected Visual Acuity Score ± SD PF582 Lucentis

Neulasta® (pegfilgrastim) is indicated for the prevention of febrile neutropenia in patients receiving cytotoxic chemotherapy Neulasta® global sales in 2017: $4.5 billion9 Production process developed and extensive analytical comparability to reference product completed Successfully completed a Biosimilar Initial Advisory Meeting(BIAM) US FDA feedback for PF529 supports the feasibility of development under the 351(k) biosimilar pathway Considering strategic partnership opportunities to advance program and maximize value Pipeline Products PF529: Biosimilar Candidate to Neulasta®

Proven success developing complex therapeutic proteins with Pfenex Expression Technology® platform Proven Platform Near-term Catalysts Strong Cash PF708 immunogenicity study results Q2’18 and NDA submission Q3’18; Continuous advancement of development milestones in Jazz partnership programs; Potential Phase 2 Anthrax vaccine study initiation 2019 subject to continued funding by BARDA Cash position that supports key milestones and >12 months runway Strong base for success Positioned well to drive value $ Attractive Portfolio Differentiated portfolio of therapeutic equivalents, vaccines, biologics and biosimilars Scalable Technology Opportunity to select additional partnered and wholly owned products for development up to various stages in cycle

References 1. Being developed via the 505(b)(2) pathway in the United States 2 Based on publicly available 2017 sales data for the third party branded pharmaceutical company 3 https://www.sec.gov/Archives/edgar/data/1367644/000136764416000084/form8kearningsq3q2016.htm 4 Eli Lilly Q4’17 and Full Year 17 Earnings Release dated January 31, 2018 5 Forteo® teriparatide patent, U.S. patent no. 7,351,414 B2; 6,977,077; and 7,163,684 6 https://www.sec.gov/Archives/edgar/data/1367644/000136764416000084/form8kearningsq3q2016.htm 7 Roche Finance Report 2017 and Novartis Annual Report 2017 8 GaBI Online, http://www.gabionline.net/Biosimilars/General/Biosimilars-of-ranibizumab 9 Amgen Annual Report 2017

NYSE American: PFNX