Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - HMS HOLDINGS CORP | exh_322.htm |

| EX-32.1 - EXHIBIT 32.1 - HMS HOLDINGS CORP | exh_321.htm |

| EX-31.2 - EXHIBIT 31.2 - HMS HOLDINGS CORP | exh_312.htm |

| EX-31.1 - EXHIBIT 31.1 - HMS HOLDINGS CORP | exh_311.htm |

| EX-23.2 - EXHIBIT 23.2 - HMS HOLDINGS CORP | exh_232.htm |

| EX-23.1 - EXHIBIT 23.1 - HMS HOLDINGS CORP | exh_231.htm |

| EX-21.1 - EXHIBIT 21.1 - HMS HOLDINGS CORP | exh_211.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2017 | |

| Or | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to | |

Commission File Number 000-50194

HMS HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

11-3656261 (I.R.S. Employer Identification No.) |

|

5615 High Point Drive, Irving, TX (Address of principal executive offices) |

75038 (Zip Code) |

(Registrant’s telephone number, including area code)

(214) 453-3000

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Name of each exchange on which registered | |

| Common Stock $0.01 par value |

The Nasdaq Stock Market LLC (Nasdaq Global Select Market) |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer x | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes o No x

The aggregate market value of the registrant’s common stock held by non-affiliates as of June 30, 2017, the last business day of the registrant’s most recently completed second quarter was $1.5 billion based on the last reported sale price of the registrant’s common stock on the Nasdaq Global Select Market on that date. Solely for purposes of this disclosure, shares of common stock held by executive officers, directors and persons who hold 10% or more of the outstanding shares of common stock of the registrant as of such date have been excluded because such persons may be deemed to be affiliates. This determination is not necessarily a conclusive determination for any other purposes.

There were 82,891,340 shares of common stock outstanding as of February 16, 2018.

Documents Incorporated by Reference

Unless provided in an amendment to this Annual Report on Form 10-K, the information required by Part III is incorporated by reference to the registrant’s 2018 proxy statement, to the extent stated herein. Such proxy statement or amendment will be filed with the SEC within 120 days of the registrant’s fiscal year ended December 31, 2017.

HMS HOLDINGS CORP. AND SUBSIDIARIES

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

Glossary of Terms and Abbreviations

| 2017 Form 10-K | HMS Holdings Corp. Annual Report on Form 10-K for the year ended December 31, 2017 | |

| ACA | Patient Protections and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010 | |

| ACO | Accountable Care Organization | |

| ADR | Additional Documentation Request | |

| ASC | Accounting Standards Codification | |

| ASO | Administrative Service Only | |

| ASU | Accounting Standards Update | |

| CHIP | Children's Health Insurance Program | |

| CMS | Centers for Medicare & Medicaid Services | |

| CMS NHE | CMS National Health Expenditures | |

| COSO | Committee of Sponsoring Organizations of the Treadway Commission | |

| Credit Agreement | The Amended and Restated Credit Agreement dated as of May 3, 2013, as amended by Amendment No. 1 to Amended and Restated Credit Agreement dated as of March 8, 2017, and as further amended by Amendment No. 2 to Amended and Restated Credit Agreement, dated as of December 19, 2017, by and among HMS Holdings Corp., the Guarantors party thereto, the Lenders party thereto and Citibank, N.A. as Administrative Agent | |

| DRA | Deficit Reduction Act of 2005 | |

| DSO | Days Sales Outstanding | |

| ERISA | Employment Retirement Income Security Act of 1974 | |

| Exchange Act | Securities Exchange Act of 1934, as amended | |

| FASB | Financial Accounting Standards Board | |

| HIPAA | Health Insurance Portability and Accountability Act of 1996 | |

| HITECH | Health Information Technology for Economic and Clinical Health | |

| IRC | Internal Revenue Code | |

| IRS | U.S Internal Revenue Service | |

| LIBOR | Intercontinental Exchange London Interbank Offered Rate | |

| MCO | Managed care organization | |

| MMIS | Medicaid Management Information Systems | |

| PBM | Pharmacy Benefit Manager | |

| PHI | Protected health information | |

| PI | Payment Integrity | |

| R&D Credit | U.S. Research and Experimentation Tax Credit pursuant to IRC Section 41 | |

| RAC | Recovery Audit Contractor | |

| RFP | Request for proposal | |

| SEC | U.S. Securities and Exchange Commission | |

| Securities Act | Securities Act of 1933, as amended | |

| Section 199 Deduction | U.S. Production Activities Deduction pursuant to IRC Section 199 | |

| SG&A | Selling, general and administrative | |

| TPL | Third-party liability | |

| U.S. GAAP | United States Generally Accepted Accounting Principles | |

| VHA | Veterans Health Administration | |

| 2011 HDI Plan | HDI Holdings, Inc. Amended 2011 Stock Option and Stock Issuance Plan | |

| 2006 Stock Plan | HMS Holdings Corp. Fourth Amended and Restated 2006 Stock Plan, as amended by Amendment No. 1 to the HMS Holdings Corp. Fourth Amended and Restated 2006 Stock Plan dated as of February 16, 2012 | |

| 2016 Omnibus Plan | HMS Holdings Corp. 2016 Omnibus Incentive Plan | |

| 2011 HDI Plan | HDI Holdings, Inc. Amended 2011 Stock Option and Stock Issuance Plan | |

| 2017 Tax Act | Tax Cuts and Jobs Act of 2017 | |

| 401(k) Plan | HMS Holdings Corp. 401(k) Plan | |

| 1 |

Cautionary Note Regarding Forward-Looking Statements

For purposes of this 2017 Form 10-K, the terms “HMS,” “Company,” “we, “us, and “our” refer to HMS Holdings Corp. and its consolidated subsidiaries unless the context clearly indicates otherwise. Included in this 2017 Form 10-K are “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. From time to time, we also provide forward-looking statements in other materials we release to the public, as well as oral forward-looking statements. Such statements relate to our current expectations, projections and assumptions about our business, the economy and future events or conditions. They do not relate strictly to historical or current facts.

We have tried to identify forward-looking statements by using words such as “aim,” “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “future,” “intend,” “likely,” “may,” “plan,” “project,” “seek,” “strategy,” “target,” “will,” “would,” “could,” “should,” and similar expressions and references to guidance, although some forward-looking statements may be expressed differently. These statements include, among other things, information concerning our future growth, business strategy, strategic or operational initiatives, our future operating or financial performance, our ability to invest in and utilize our data and analytics capabilities to expand our capabilities, the benefits and synergies to be obtained from completed and future acquisitions, the future performance of companies we have acquired, the future effect of different accounting determinations or remediation activities, the sufficiency of our sources of funding for working capital, capital expenditures, acquisitions, stock repurchases, debt repayments and other matters, our future expenses, interest rates, tax rates and financial results, the impact of changes to U.S. healthcare legislation or healthcare spending affecting Medicare, Medicaid or other publicly funded or subsidized health programs, and other statements regarding our possible future actions, business plans, objectives and prospects.

Forward-looking statements are not guarantees and involve risks, uncertainties and assumptions that are difficult to predict. Actual results may differ materially from past results and from those indicated by such forward-looking statements if known or unknown risks or uncertainties materialize, or if underlying assumptions prove inaccurate. These risks and uncertainties include, among other things:

| § | our ability to execute our business plans or growth strategy; |

| § | our ability to innovate, develop or implement new or enhanced solutions or services; |

| § | the nature of investment and acquisition opportunities we are pursuing, and the successful execution of such investments and acquisitions; |

| § | our ability to successfully integrate acquired businesses and realize synergies; |

| § | variations in our results of operations; |

| § | our ability to accurately forecast the revenue under our contracts and solutions; |

| § | our ability to protect our systems from damage, interruption or breach, and to maintain effective information and technology systems and networks; |

| § | our ability to protect our intellectual property rights, proprietary technology, information processes and know-how; |

| § | significant competition for our solutions and services; |

| § | our failure to maintain a high level of customer retention or the unexpected reduction in scope or termination of key contracts with major customers; |

| § | customer dissatisfaction, our non-compliance with contractual provisions or regulatory requirements; |

| § | our failure to meet performance standards triggering significant costs or liabilities under our contracts; |

| § | our inability to manage our relationships with information and data sources and suppliers; |

| § | reliance on subcontractors and other third party providers and parties to perform services; |

| § | our ability to continue to secure contracts and favorable contract terms through the competitive bidding process; |

| § | pending or threatened litigation; |

| § | unfavorable outcomes in legal proceedings; |

| § | our success in attracting qualified employees and members of our management team; |

| § | our ability to generate sufficient cash to cover our interest and principal payments under our credit facility, or to borrow or use credit; |

| § | unexpected changes in tax laws, regulations or guidance and unexpected changes in our effective tax rate; |

| § | unanticipated increases in the number or amount of claims for which we are self-insured; |

| 2 |

| § | our ability to develop, implement and maintain effective internal control over financial reporting; |

| § | changes in the U.S. healthcare environment or healthcare financing system, including regulatory, budgetary or political actions that affect healthcare spending or the practices and operations of healthcare organizations; |

| § | our failure to comply with applicable laws and regulations governing individual privacy and information security or to protect such information from theft and misuse; |

| § | our ability to comply with current and future legal and regulatory requirements; |

| § | negative results of government or customer reviews, audits or investigations; |

| § | state or federal limitations related to outsourcing or certain government programs or functions; |

| § | restrictions on bidding or performing certain work due to perceived conflicts of interests; |

| § | the market price of our common stock and lack of dividend payments; and |

| § | anti-takeover provisions in our corporate governance documents. |

These and other risks are discussed under the headings “Part I, Item 1. Business,” “Part I, Item 1A. Risk Factors,” “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Part II, Item 7A. Quantitative and Qualitative Disclosures about Market Risk” of this 2017 Form 10-K and in other documents we file with the SEC.

Any forward-looking statements made by us in this 2017 Form 10-K speak only as of the date on which they are made. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. We caution readers not to place undue reliance upon any of these forward-looking statements. You are advised, however, to consult any further disclosures we make on related subjects in our Form 10-Q and Form 8-K reports and our other filings with the SEC.

Market and Industry Data

This 2017 Form 10-K contains market, industry and government data and forecasts that have been obtained from publicly available information, various industry publications and other published industry sources. We have not independently verified the information and cannot make any representation as to the accuracy or completeness of such information. None of the reports and other materials of third party sources referred to in this 2017 Form 10-K were prepared for use in, or in connection with, this report.

Trademarks and Tradenames

We have a number of registered trademarks, including HMS®, as well as the corresponding HMS + logo design mark, HMS IntegritySource®, Eliza® and Essette®. These and other trademarks of ours appearing in this report are our property. Solely for convenience, trademarks and trade names of ours referred to in this 2017 Form 10-K may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names. This report contains additional trade names and trademarks of other companies. We do not intend our use or display of other companies' trade names or trademarks to imply an endorsement or sponsorship of us by such companies, or any relationship with any of these companies.

| 3 |

PART I

Founded in 1974, HMS is a leading provider of cost containment solutions in the U.S. healthcare marketplace. We use innovative technology, extensive data services and powerful analytics, to deliver coordination of benefits, payment integrity and care management and consumer engagement solutions to help healthcare payers improve financial performance and clinical outcomes. We provide coordination of benefits services to government and commercial healthcare payers and sponsors to ensure that the responsible party pays healthcare claims. Our payment integrity services ensure healthcare claims billed are accurate and appropriate, and our care management and consumer engagement technology helps risk-bearing organizations to better engage with and manage the care delivered to their members. Together these various services help customers recover erroneously paid amounts from liable third parties; prevent future improper payments; reduce fraud, waste and abuse; better manage the care their members receive; engage healthcare consumers to improve clinical outcomes while increasing member satisfaction and retention; and achieve regulatory compliance. We currently operate as one business segment with a single management team that reports to the Chief Executive Officer.

HMS began its operations as Health Management Systems, Inc., which became our wholly owned subsidiary in March 2003 when we assumed its business in connection with the adoption of a holding company structure. In recent years HMS has grown both organically and through targeted acquisitions of businesses that helped expand our product suite, including IntegriGuard, LLC (2009), HealthDataInsights, Inc.(“HDI”) (2011), Essette, Inc. (“Essette”) (2016), Eliza Holding Corp. (“Eliza”) (2017) and others. The acquisitions of Essette and Eliza significantly expanded the breadth of solutions we offer entities taking risk, creating a new care management and consumer engagement vertical for HMS.

We were originally incorporated in the State of New York in October 2002 and reincorporated in the State of Delaware in July 2013. Our principal executive offices are located at 5615 High Point Drive, Irving, Texas 75038, and our telephone number is (214) 453-3000. As of December 31, 2017, we had approximately 2,500 employees. Additional information about HMS is available on our website at www.hms.com.

Copies of our recent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and Proxy Statements, as well as amendments to these reports or statements, are available free of charge on our website through the Investor Relations page, as soon as reasonably practicable after we electronically file them with, or furnish them to, the SEC. These materials, as well as similar materials for SEC registrants, may be obtained directly from the SEC through their website at http://www.sec.gov. You may also read and copy materials we furnish to or file with the SEC at the SEC’s Public Reference Room at 100 F Street NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

The content of any website referred to in this 2017 Form 10-K is not incorporated by reference into this filing unless expressly noted. References to the URLs for these websites are intended to be inactive textual references only.

| 4 |

Our Solutions

Our services are applicable to federal, state and commercial health plans and other healthcare entities taking payment risk. Our coordination of benefits and payment integrity services are designed to address errors across the payment continuum, beginning with an individual’s enrollment in a program before any medical service is rendered, to pre-payment review of a claim by a payer, through recovery where identification of an improper payment is made via audit. Our services address a wide spectrum of payment errors, including eligibility and coordination of benefits errors, the identification and investigation of potential fraud, and determinations that claim amounts paid were improper and our services extend to most claim types. Our care management and consumer engagement services also assist customers in managing quality, risk, cost and compliance across all lines of business. As a result of these services, customers received billions of dollars in cash recoveries in 2017, and saved billions more through the prevention of erroneous payments, improved clinical outcomes for their members, and reduced enrollment turnover.

In general, our range of products and services include the following:

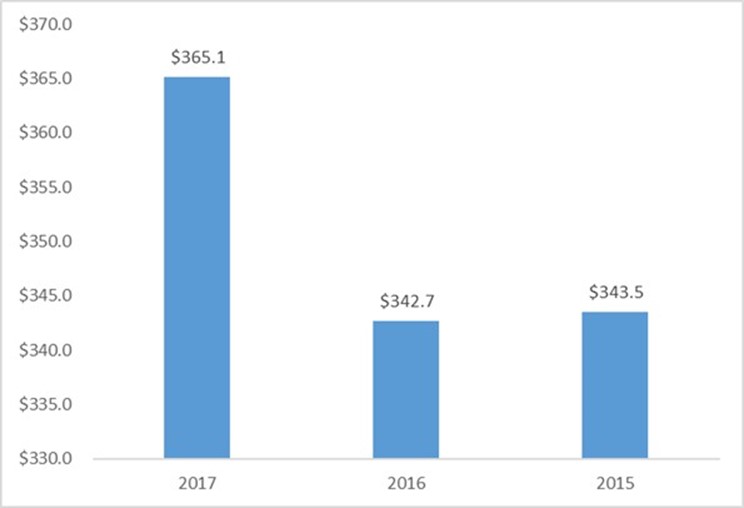

COB SERVICES

Coordination of Benefits

Our coordination of benefits services are provided primarily for state governments and Medicaid managed care plans and draw principally upon proprietary information management and data mining techniques designed to ensure that the correct party pays a healthcare claim. We offer cost avoidance services, which include providing validated insurance coverage information that is used by payers to coordinate benefits properly for future claims. With validated insurance information, Medicaid payers can avoid unnecessary costs by ensuring that they pay only after all other insurance coverage available has been exhausted, thereby complying with federal regulations that require Medicaid to be the payer of last resort. Nevertheless, due to a variety of factors, some Medicaid claims are paid even when there is a known responsible third party. Our government-sponsored program customers rely on us to identify those claims that were paid in error and recover these payments from the liable third party. Further, we also provide services to assist customers in identifying other third-party insurance and recovering medical expenses where a member is involved in a casualty or tort incident. Lastly, for Medicaid agencies exclusively, we provide estate recovery services to identify and recover Medicaid expenditures from the estates of deceased Medicaid members in accordance with state policies. For the years ended December 31, 2017, 2016 and 2015, our coordination of benefit services represented 73.4%, 72.2% and 71.2% of our total revenue, respectively.

| 5 |

ANALYTICAL SERVICES

Payment Integrity

Our payment integrity services are designed to ensure that healthcare payments are accurate and appropriate. These services are applicable to all customers that HMS serves, including federal and state governments, commercial health plans and other at-risk entities. Our solutions are designed to verify that medical services are utilized, billed and paid appropriately. We combine data analytics, clinical expertise and proprietary algorithms and technology to identify improper payments on both a pre-payment and post-payment basis; identify and recover overpayments/underpayments; detect and prevent fraud, waste and abuse; and identify process improvements. For the years ended December 31, 2017, 2016 and 2015, our payment integrity services represented 20.0%, 27.6% and 28.8% of our total revenue, respectively.

Care Management and Consumer Engagement

Our care management and consumer engagement solutions help our customers manage the care delivered to their members with a focus on improving clinical outcomes and patient engagement. We offer a broad foundation of technology and service solutions to support a health engagement management framework, which enable health plans and other risk-bearing entities to better manage costs and clinical outcomes and improve their member experience. Our care management and consumer engagement vertical leverages HMS data and analytics with a combination of Essette and Eliza solutions currently aimed at care management, risk management and member engagement in order to provide customers with a tailored, integrated platform that addresses core healthcare industry challenges on an enterprise scale. For the years ended December 31, 2017 and 2016, our care management and consumer engagement services represented 6.6% and 0.2%, of our total revenue, respectively.

Intellectual Property

Our ability to develop and maintain the proprietary aspects of our technology and operate without infringing the proprietary rights of others are important to our business and competitive position. We establish and protect our proprietary technology and intellectual property through a combination of patents, patent applications, trademarks, copyrights, domain names, and trade secrets, including know-how, confidentiality and invention assignment agreements, security measures, non-disclosure agreements with third parties, and other contractual rights.

We own a number of patents and trademarks that are important to HMS. As of December 31, 2017, our patent portfolio is comprised of approximately 50 domestic and international patents, and we are currently pursuing numerous patent applications in the United States and around the world. We have a number of registered trademarks, including HMS®, and the corresponding HMS + logo design mark, HMS IntegritySource®, Eliza®, Essette® and other registered and common law trademarks. We also hold copyrights relating to certain aspects of our products and services. While we consider all of these proprietary rights important in the operation of our business, we do not believe any one individual technology is essential to our business.

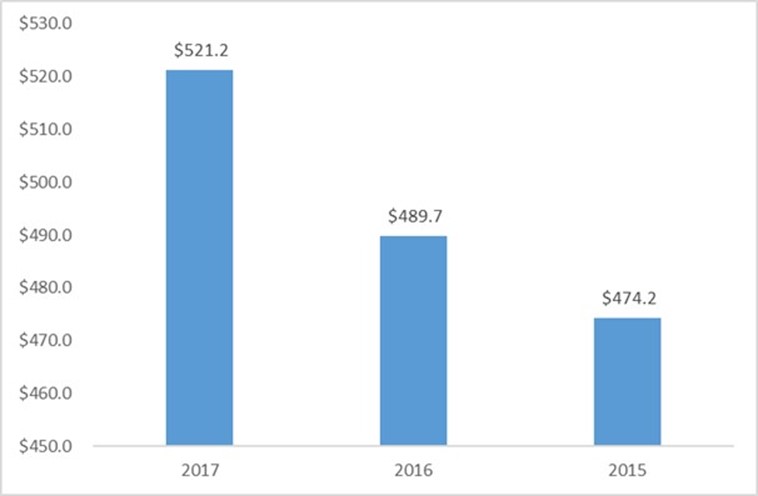

Customers

We provide our solutions to customers across a broad range of entities within the healthcare industry, including health plans, state agencies, federal programs, private employers and other at-risk providers. For the years ended December 31, 2017, 2016 and 2015, our total revenue was $521.2 million, $489.7 million and $474.2 million, respectively. No single customer accounted for 10% or more of our total revenue during any period presented.

The composition of our 10 largest customers changes periodically. For the years ended December 31, 2017, 2016 and 2015, our 10 largest customers represented 39.5%, 40.6% and 44.0% of our total revenue, respectively. The current terms of our agreements with these customers have expiration dates ranging between 2018 and 2023. Several of our contracts, including those with some of our largest customers, may be terminated for convenience. The early termination of a contract with one of our significant customers may have an adverse effect on our financial condition, results of operations and cash flows.

| 6 |

We provide products and services under contracts (or subcontracts) that contain various revenue structures, including contingent revenue and to a lesser extent fixed-fee arrangements. Many of our state government contracts have terms ranging from three to five years, including renewal terms at the option of the customer. In many instances, we provide our services pursuant to agreements that are subject to periodic reprocurements. Because we provide our services pursuant to agreements that are open to competition from various businesses in the U.S. healthcare insurance benefit cost containment arena, we cannot provide assurance that our contracts, including those with our largest customers, will not be terminated for convenience, awarded to other parties, or renewed. Additionally, we cannot provide assurance that our contracts, if renewed, will have the same fee structures or otherwise be on satisfactory terms.

Industry Trends and Opportunities

U.S. healthcare expenditures continue to escalate and consume a large proportion of the U.S. GDP, presenting challenges for payers who wish to contain and reduce costs while also promoting quality healthcare outcomes. These aims are the same across all at-risk entities, including commercial health plans and government healthcare programs, such as Medicaid and Medicare.

Within the commercial market, health plans sell policies directly to individuals (on the open market or via health insurance exchanges), contract with employers to underwrite their employees’ care, or contract with self-insured employers to oversee benefit administration to their employees. This market also includes a growing number of risk bearing provider-sponsored plans that operate and market health plan benefits. According to CMS NHE projections, private health insurance covered approximately 200.1 million individuals at a cost of $1.2 trillion in 2017.

Several commercial health plans also offer government-sponsored lines of business, including partnering with Medicare, Medicaid and CHIP to oversee care delivery for beneficiaries enrolled in those programs. Government managed care grew out of pressures to contain the growth of state and federal program spending and to address general concerns about healthcare access. In most states, managed care is currently the predominant delivery system for Medicaid. As of July 2017, all states except three had some form of managed care in place, including the District of Columbia. Among the 39 Medicaid programs (38 states plus the District of Columbia) with comprehensive risk-based MCOs, 29 states reported that 75% or more of their Medicaid beneficiaries were enrolled in MCOs as of July 1, 2017. More states continue to carve-out complex populations as well as behavioral health services into MCO contracts. Of the 32 Medicaid programs (31 states plus the District of Columbia) that opted to expand Medicaid eligibility levels pursuant to the ACA, 27 states were using MCOs to cover newly eligible adults as of July, 2017. Of those 27 states, 24 states covered more than 75% of beneficiaries in this group through risk-based managed care. It is unclear at this time how, if at all, efforts in Congress to “repeal and replace” the ACA could affect any of the state expansions or potential future growth of Medicaid lives and expenditures. As Congress continues to debate proposals to repeal major portions of the ACA, including the ACA’s Marketplace and Medicaid coverage expansions, as well as other proposals to fundamentally restructure Medicaid’s financing structure, the implications of these proposals remain unclear.

Similarly, managed care health plans also continue to assume risk for Medicare lives, with the Kaiser Family Foundation estimating that 33% of all Medicare beneficiaries, or 19.0 million lives, were enrolled in a Medicare Advantage Plan in 2017. HMS also continues to serve government-sponsored agencies’ legacy fee-for-service programs at the state and federal level. These plans are generally reliant on and susceptible to the government appropriations process that determines their budget and governs the number of beneficiaries they serve.

According to the CMS NHE projections, Medicare programs in 2017 covered approximately 57.7 million people at a cost of approximately $718.7 billion and Medicaid/CHIP covered approximately 79.9 million people, costing approximately $604.1 billion. Altogether, it is projected that the government programs we serve covered approximately 137.6 million people at a total cost of approximately $1.32 trillion in 2017.

CMS projects Medicaid spending and enrollment will grow 6.0% and 1.7%, respectively in 2018 over 2017. CHIP spending is expected to grow 6.7% in 2018 over 2017, and CHIP enrollment is expected to increase 3.5% in 2018 over 2017. As commercial and government health plans continue to focus on strategies to contain costs across their different lines of business, we will continue to focus on serving them and meeting their evolving needs. Regardless of the program, coordinating benefits among a growing number of healthcare payers and ensuring that claims are paid appropriately represents an enormous challenge for our customers and an ongoing opportunity for us.

| 7 |

Regulatory Environment

The market for cost containment solutions is large and growing, driven by increasing healthcare costs and payment complexities. For 2018, Medicare and Medicaid are projected to pay approximately 45.3% of the nation’s healthcare expenditures and serve over 140.7 million beneficiaries. Many of these beneficiaries are enrolled in managed care plans, which have the responsibility for both patient care and claim adjudications. Since 1985, we have provided state Medicaid agencies with services to identify third parties with primary liability for Medicaid claims, and since 2005, we have provided similar services to Medicaid managed care plans.

In 2006, Congress enacted the DRA and created the Medicaid Integrity Program under the Social Security Act to increase the government’s capacity to prevent, detect and address fraud, waste and abuse in the Medicaid program. Later that year, Congress passed the Tax Relief and Health Care Act of 2006, which established the Medicare RAC program. HDI was awarded one of the first contracts under the program. In October 2016, CMS made a new round of awards and we again were awarded a region. These measures, at both the federal and state level, have strengthened our ability to identify and recover erroneous payments on behalf of our customers.

The ACA was signed into law in 2010. It included many provisions impacting healthcare delivery and payment programs, including employer-sponsored health coverage, expansion of the Medicaid program, health insurance exchanges with premium subsidies, and payment integrity efforts. In 2017, Congress considered the revision or repeal of some or all of the ACA. Options that have been considered include issuing block grants or establishing per capita caps for state Medicaid populations, and looking at program design alternatives for future enrollment criteria. We will monitor ACA-related changes as they develop and assess their potential impact, as well as any opportunities they may present for our customers and for us.

Competition

The U.S. healthcare insurance benefit cost containment marketplace is a dynamic industry with a range of businesses currently able to offer cost containment services, both directly or indirectly (through subcontracting), to some or all of the various healthcare payers. In addition, with improvements in technology and the growth in healthcare spending, new businesses are incentivized to enter this marketplace. Many healthcare payers also have the ability to perform some or all of these cost containment services themselves and choose to exercise that option. Competition is therefore robust as customers have many alternatives available to them in their effort to contain healthcare costs.

We compete based on a variety of factors, including our ability to perform a wide range of coordination of benefits and payment integrity related functions; proven results to maximize recoveries and cost avoidance; our in-depth government healthcare program experience; clinical staff expertise; extensive insurance eligibility database; proprietary systems and processes; existing relationships with various customers and other industry stakeholders; and our ability to provide customers with actionable intelligence to improve clinical outcomes and patient engagement.

Within our core coordination of benefits services, we compete primarily with large business outsourcing and technology firms, claims processors and PBMs, clearinghouses, healthcare consulting firms, smaller regional vendors and other TPL service providers. In addition, we frequently work with customers who may elect to perform some or all of their recovery and cost avoidance functions in-house. The competitive environment for payment integrity services includes some of the same companies that provide coordination of benefits services. Within the care management and risk analytics sector, we compete primarily with vendors who provide these and other population health management technology services. Companies with whom we compete across our product offerings include:

| § Accenture | § Cotiviti Corporation | § Inovalon | § SCIO Health Analytics |

| § CaseNet | § Equian, LLC | § LexisNexis | § Verscend Technologies, Inc. |

| § Change Healthcare | § Experian Health | § MedHok | § Welltok |

| § Cognizant/TriZetto Healthcare Products | § Optum | § DXC Technology Solutions | § Conduent |

| § IBM Watson Health | § Performant Financial Corp. | § ZeOmega |

| 8 |

Business Strategy

We believe that the steadily increasing enrollment and rising expenditures for Medicare and Medicaid, with most new enrollees entering managed care plans; an aging U.S. population with an increasing concentration of individuals with high cost chronic conditions and often co-morbidities; and the overall complexity of the healthcare claims payment system in the U.S. all combine to create substantial growth opportunities for the suite of cost containment solutions we offer.

We also believe these factors present growth opportunities for our care management and consumer engagement solutions. We expect to grow our business over the course of 2018 and beyond, both organically and inorganically, by leveraging existing key assets (e.g., our data, analytics, in-house expertise, and distribution channel) and pursuing a number of strategic objectives or initiatives, including:

| § | Expanding the scope of our relationship with existing customers – by selling additional products and services, including those designed to improve member engagement and improve clinical outcomes. |

| § | Adding new customers – by marketing to commercial health plans, including Medicaid managed care and Medicare Advantage plans, at-risk group and individual health lines of business and ASO; government healthcare payers, including Medicaid agencies, state employee health benefit plans and CHIP; at-risk provider organizations and ACOs; and commercial employers. |

| § | Introducing new “homegrown” products and services – through internal development initiatives designed to enhance or expand our existing suite of cost containment solutions. |

| § | Utilizing big data – to create a more nimble operating environment, create operating efficiencies, improve the yield on our existing product suite and identify new revenue opportunities within our current service delivery models. |

| 9 |

| § | Promoting automation and innovation to improve the efficiency and effectiveness of our services – by continuing to implement new technology and process improvements designed to increase recovery yields, increase customer satisfaction, and achieve greater operating efficiencies. |

| § | Building out our new care management and consumer engagement technology platform – by continuing to grow a broad foundation of technology and service solutions to help customers better manage quality, cost and compliance across all lines of business. Our first steps in this strategy were the acquisition of Essette and Eliza. |

| § | Prudent deployment of capital – by investing in internal growth initiatives; selectively investing in capabilities, technologies, and assets to complement our core cost-containment expertise; building care management and care coordination adjacencies to complement the Essette and Eliza acquisitions; and expanding our data analytics capabilities. Our focus may include acquisitions that represent long-term growth potential, target high-growth areas, are accretive to earnings, and fill a strategic need in our business portfolio as we seek to provide increasingly comprehensive solutions to our customers. We may also repurchase our shares, pursuant to a two-year $50 million authority granted by our Board of Directors in November 2017. |

| 10 |

Our business is subject to significant risks, including the risks and uncertainties described below. You should carefully consider these risks, as well as the other information in this 2017 Form 10-K, including our Consolidated Financial Statements and the related Notes. The occurrence of any of these risks could adversely affect our business, financial condition, results of operations, and cash flows in a material way.

Risks Relating to Our Company

Our ability to expand our business will be adversely affected if we fail to implement our growth strategy.

The size and the scope of our business operations have expanded over the past several years, and we currently intend to continue to grow and expand into new areas of the healthcare industry; however, such growth and expansion carries costs and risks that, if not properly managed, could adversely affect our business. Our future growth will depend on, among other things, our ability to successfully execute our business plans, which includes retaining existing customers, attracting new customers and improving our operations, all while remaining competitive. We must also be flexible and responsive to our customers’ needs and to changes in the political, economic and regulatory environment in which we operate. The greater size and complexity of our expanding business puts additional strain on our administrative, operational and financial resources and can make optimal resource allocation more difficult to determine. We may not be able to maintain or accelerate our growth. A failure to anticipate or properly address the demands and challenges that our growth strategy and potential diversification may have on our resources and existing infrastructure may result in unanticipated costs and inefficiencies and could negatively impact our ability to execute on our business plans and growth goals, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

If we fail to innovate and develop new or enhanced solutions and services, or if these solutions and services are not adopted by our customers, it could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Part of our growth strategy depends on our ability to respond to the evolving healthcare landscape with new and enhanced solutions and services that our existing and potential customers are willing to adopt. The development, marketing and implementation of these solutions and services may require that we make substantial financial and resource investments. We face risks that our new or modified solutions and services may not be responsive to customer preferences or industry changes, and that the solution and service development initiatives that we prioritize may not yield the gains that we anticipate, if any. If we are unable to predict market preferences or healthcare industry changes, or if we are unable to develop or adapt solutions and services that are responsive to existing and potential customers’ needs, we may fail to expand our business, which could constrain our future revenue growth and materially adversely affect our business, financial condition, results of operations and cash flows.

Our acquisition strategy may subject us to considerable business and financial risk.

Historically, to achieve our strategic goals, we have made a significant number of acquisitions that have expanded the solutions and services we offer, provided a presence in complementary business lines, or expanded our geographic presence and/or customer base. For example, we acquired IntegriGuard, LLC in September 2009; Verify Solutions, Inc. in December 2009; Allied Management Group-Special Investigation Unit in June 2010; Chapman Kelly, Inc. in August 2010; HDI in December 2011; MedRecovery Management, LLC in December 2012; Essette in September 2016; and Eliza in April 2017.

| 11 |

We intend to pursue future acquisitions that will continue to expand and diversify our business and to periodically engage in discussions regarding such possible acquisitions. We are subject to risks and uncertainties relating to our ability to identify suitable potential acquisition candidates, to consummate additional acquisitions that will be advantageous to us, and to successfully integrate future acquisitions. Future and potential business acquisitions involve a number of risk factors that could affect our operations, including, but not limited to:

| § | diversion of management’s attention and other resources; |

| § | our ability to successfully and timely integrate operational, accounting and technology functions, policies, processes, systems and controls, and to implement these functions, policies, processes, systems and controls, without incurring substantial expenses, delays, difficulties or other issues; |

| § | our ability to integrate personnel and human resource systems as well as the cultures of the acquired business; |

| § | our ability to retain or replace the key personnel of the acquired business; |

| § | our ability to maintain relationships with the customers of the acquired business and further develop the acquired business; |

| § | our ability to cross-sell our solutions and services and the solutions and services of the acquired business to our respective customers; |

| § | customer dissatisfaction or performance problems with the acquired business; |

| § | our ability to comply with regulatory requirements and avoid potential conflicts of interest in markets that we serve; |

| § | the misuse of intellectual property by the personnel of the acquired business; |

| § | our ability to successfully enter into unfamiliar markets; |

| § | assumption of unanticipated legal or financial liabilities and/or negative publicity related to prior acts by the acquired business; |

| § | we may become subject to litigation or other claims in connection with the acquired business, including claims from terminated employees, customers, former shareholders or third parties; |

| § | we may become significantly leveraged as a result of incurring debt to finance an acquisition; |

| § | the acquired business may not perform as projected which could negatively impact earnings or contingent consideration; |

| § | we may suffer impairment of goodwill and other acquired intangible assets; and |

| § | we may suffer dilution to our earnings per share. |

If we fail to adequately address these risks, or to successfully integrate the businesses that we acquire, we may not realize cost efficiencies, synergies or other benefits that we anticipated when selecting our acquisition candidates, and our reputation, business, financial condition, results of operations and cash flows could be materially adversely affected.

You will not be able to rely on our operating results in any particular period as an indication of our future performance because they are subject to significant fluctuation which may cause the market price of our common stock to decrease significantly.

Our revenue and operating results may fail to match our past or projected performance and could vary significantly from period-to-period as a result of a number of factors, some of which are outside of our control. We have experienced fluctuations in our revenue and operating results in the past and they may vary in the future for reasons that include, but are not limited to:

| § | fluctuations in sales activity given our sales cycle; |

| § | the length of contract and implementation periods; |

| § | the commencement, completion or termination of contracts during any particular quarter; |

| § | contract costs and expenses, which may be incurred in periods prior to revenue being recognized; |

| § | the timing of period revenue recovery projects and third party payers’ claim adjudication; |

| § | the billing and budgeting cycles of our customers; |

| § | the timing of government procurement activities, including when contract awards are announced and the time required to resolve bid protests; |

| § | contract renewal discussions, which may result in delayed payments for services already performed; |

| § | changes in the pricing structure or other significant terms in our contract, or the scope of services we perform; |

| § | technological and operational issues affecting our customers, including delays in payment receipt for previously recognized revenue due to delays in certain customers processing our findings through their systems, and restrictions on our ability to use or access certain data or a lack of integrity or quality in the data or information we receive from certain data sources; |

| § | adjustments to age/quality of receivables and accruals as a result of factors such as delays involving contract limitations or changes, subcontractor performance deficiencies or internal managerial decisions not to pursue identified claim revenue from customers; |

| 12 |

| § | the impact of service disruptions or delays in the systems or operations of subcontractors, partners, vendors and other third party providers on which we rely on to deliver a single-source solution or service to our customers; |

| § | changes in applicable laws; |

| § | changes in accounting policies or guidelines concerning the timing of recognition of revenue; and |

| § | regulatory changes or general economic conditions as they affect healthcare providers and payers. |

We cannot predict the extent to which future variations could occur due to these or other factors. In addition, occasionally our state and federal customers are requested by third party payers to refund payments that we previously recovered for our customers. If our state and federal customers choose to refund money in response to these requests, regardless of whether an error actually occurred in connection with the payments, we may also be required to return contingent revenue which we were previously paid associated with such refunded payment. Consequently, our operating results are subject to significant fluctuation for any particular quarter, fiscal year, or other period, and may not be indicative of future periods. Our business is also subject to seasonal patterns resulting from increased efforts at year-end by certain customers to generate additional savings, complete compliance obligations and close gaps in care. However, taken as a whole, we do not consider our operations to be seasonal to any material degree. Due to all of these factors, our revenue and operating results are difficult to predict and are subject to significant fluctuation, which may cause the market price of our common stock to decrease significantly.

We face challenges associated with forecasting the revenue under our contracts, and any failure to accurately forecast such revenue could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We may not be able to accurately estimate the factors upon which we base our contract pricing, or the costs and timing for implementing and completing contracts. For a majority of our customer contracts, the payment of our fee is contingent upon the recoveries received by our customers. We also have cost-plus or time-and-material based contracts with the federal government where our revenue is recognized based on costs incurred plus an estimate of the negotiated fee earned. Our ability to earn a profit on these contracts requires that we accurately estimate the costs involved with these contracts and assess the probability of achieving certain outcomes or milestones within the contracted time period. In addition, we cannot predict with certainty the costs or the period in which implementation or contracts may be completed when we introduce new solutions or services into the marketplace. We may also face a long implementation period with a new customer or a new contract with an existing customer, making it difficult to reliably forecast revenue under those contracts. If we do not accurately estimate the costs and timing for completing projects, or if we encounter increased or unexpected costs, delays, failures, liabilities or risks, including those outside of our control, our contracts could prove unprofitable for us or yield lower profit margins than anticipated. Although we believe that we have recorded adequate provisions in our financial statements for losses on our fixed-price and cost-plus contracts where applicable, as required under U.S. GAAP, our contract loss provisions may not be adequate to cover all actual future losses.

System interruptions or failures could expose us to liability and harm our business.

Our data and operation centers are essential to our business and our operations depend on our ability to maintain and protect our information systems. We attempt to mitigate the potential adverse effects of a disruption, relocation or change in operating environment; however, the situations we plan for and the amount of insurance coverage that we maintain may not be adequate in every case. Despite systems redundancy and security measures, our systems and operations are vulnerable to damage or interruption from, among other sources:

| § | power loss, transmission cable cuts and telecommunications failures; |

| § | fire, flood, earthquake and other natural disasters; |

| § | hardware failures or software defects; |

| § | operator error; |

| § | cyber security breaches; and |

| § | physical break-ins, sabotage, intentional acts of vandalism, terrorist attacks and other events beyond our control. |

| 13 |

In addition, while there are backup systems in many of our operating facilities, an extended outage of utility or network services supplied by third party IT vendors or providers may delay or disrupt the delivery or performance of the solutions and services we provide for our customers. If we encounter a lengthy business interruption, or in the event our business continuity plans and business interruption insurance coverage are not adequate or fail to compensate us on a timely basis, we could suffer operational disruptions, disputes with customers, civil or criminal penalties, regulatory problems, increases in administrative expenses, loss of our ability to produce timely and accurate financial and other reports, damage to our reputation or customer relationships or other adverse consequences, any of which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Our systems and networks and those of third parties on which we rely may be subject to cyber security breaches and other disruptions that could compromise our information and harm our business.

In the ordinary course of our business, we rely heavily upon our technology systems and networks, as well as on the products and services of third-party providers, to input, transmit, maintain and communicate the confidential and proprietary data we receive from our customers and other data suppliers (e.g. private insurance plans, financial institutions, etc.). In addition, subcontractors, teaming partners or other third-party vendors may receive or utilize this information on our behalf in support of the services we perform for our customers. The secure processing and maintenance of this information is critical to our operations and business strategy. Although we have spent significant resources to implement security and privacy programs and controls, train our workforce and augment our security measures with the implementation of new technologies and processes, our information technology and infrastructure, and those of third parties on which we rely, have been, and will likely continue to be subject to computer hacking, acts of vandalism or theft, malware, computer viruses or other malicious codes, phishing, employee error or malfeasance, catastrophes, unforeseen events or other cyber-attacks. To date, we have seen no material impact on our business or operations from these attacks, however, we may be unable to implement adequate preventive measures to protect against such compromises in the future or to effectively adapt our security measures to evolving security risks. As a result, our technology systems, including our data and our customers’ data, could be accessed improperly, made unavailable, improperly modified, corrupted or otherwise breached or compromised, or we could suffer system disruptions, shutdowns and denials of service. Similarly, we could be materially adversely affected by the loss of proprietary, trade secret or confidential technical and financial data if our internal networks are compromised. The occurrence of any of these events could harm the market perception of the effectiveness of our security measures, lead to reputational damage or the loss of our customers’ confidence in our solutions and services, negatively affect our ability to attract new customers, cause existing customers to terminate or not renew our solutions and services, or to deter them from using our solutions or services in the future, all of which could reduce our revenue, increase our expenses and expose us to potential liability under privacy, security or other applicable laws and regulations. We could also be forced to expend significant resources in response to a security breach, including investigating the cause of the breach, repairing system damage, remediating vulnerabilities in our security procedures, increasing cyber security protection costs by deploying additional personnel and protection technologies, paying regulatory fines and litigation costs, and resolving legal claims and regulatory actions, all of which could increase our expenses, divert the attention of our management and key personnel away from our business operations and materially adversely affect our business, financial condition, results of operations and cash flows.

If we are unable to protect our proprietary technology, information, processes, know-how, and other intellectual property and intellectual property rights, or become subject to claims of infringing or misappropriating the intellectual property of third parties, the value of our solutions and services may be diminished and our business may be materially adversely affected.

Our success as a company depends in part upon our ability to protect our core technology and intellectual property. Our expanding operations and efforts to develop new solutions and services also make protection of our intellectual property more critical. We seek to protect our intellectual property and other proprietary information through a combination of patent, trademark, copyright, trade secret and unfair competition laws, confidentiality agreements and invention assignment agreements with employees, consultants and other third parties, as well as through the terms of our agreements with customers and vendors, and other security measures. However, the steps we have taken to deter misappropriation of intellectual property may be insufficient to protect our proprietary information. Misappropriation of our intellectual property by third parties, or any disclosure or dissemination of our confidential and proprietary business intelligence, queries, algorithms and other similar information by any means, could undermine any competitive advantage we currently derive or may derive from that intellectual property. For example, our current or former employees, consultants or other third parties may unintentionally or willfully disclose our trade secrets, know-how or other confidential and proprietary information to competitors. Competitors have also attempted to use state open records and/or federal Freedom of Information Act laws to obtain our proposal responses and other documents we provide to our government customers. We cannot be certain that our efforts to protect the confidential and proprietary trade secret information or intellectual property in these proposals or other documents will always be successful, due to the many factors underlying the various state and federal decisions to release information in response to open records requests (even in spite of our objections and efforts to protect such information). In addition, there remains the possibility that others will independently develop competing technologies that may be equivalent or superior to ours. If our efforts to protect our intellectual property and other proprietary rights are inadequate to prevent unauthorized use or appropriation by third parties or our employees, the value of our brand and other intangible assets may be diminished and others may be able to more effectively compete with our business by offering solutions or concepts that are substantially similar to ours, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

| 14 |

In addition, third parties may claim that we are infringing upon or misappropriating their intellectual property, or assert other legal challenges to our intellectual property. Our exposure to risks related to the use of intellectual property may also increase as a result of acquisitions because third parties may make infringement and similar or related claims after we have acquired technology. Any of these situations could cause us to expend significant time and resources and to incur substantial costs associated with litigation or legal proceedings that may be necessary to defend ourselves or to enforce our intellectual property rights, in which we may not ultimately prevail, and could result in our being prevented from furnishing certain solutions and services.

We face significant competition for our solutions and services and we expect competition to increase, which could materially adversely affect our business, financial condition, results of operations and cash flows.

The market for healthcare cost containment solutions is intensely competitive, driven by rapidly changing technologies, evolving industry standards and customer demands to become more efficient. Our competitors range in size from large, diversified national companies to small, specialized firms, and could include current or former subcontractors or teaming partners seeking to establish direct relationships with our customers in order to perform similar services as the prime contractor, as well as current and prospective customers that elect to perform recovery and cost avoidance functions in-house or to develop in-house capacities for solutions and services that we provide or hope to provide. Consolidation among vendors and healthcare providers, as well as the merging of some of our competitors or formation of business alliances with other competitors, have contributed to the increasingly competitive environment. For example, certain state customers have combined or “bundled” TPL services under large-scale IT procurements, allowing MMIS vendors to partner with less experienced TPL identification vendors based on preferred relationships or favorable pricing. In addition, companies that have invested in proprietary technology different from our own solution and service offerings, such as front-end analytics, have emerged as new competitors due to the rapidly evolving healthcare landscape. There is also increasing sophistication in the solutions and services that our competitors are developing that may become more efficient or appealing to our customers. In order to remain competitive, we may need to quickly develop and market new and enhanced solutions and services responsive to emerging technologies and changes in the healthcare industry, which may require that we make substantial financial and resource investments.

We may not be able to compete successfully against our existing or future competitors. Some of these competitors have significantly greater financial and technical resources, and others have longer operating histories and greater name recognition than we do in certain markets. They may be able to (i) offer lower prices or negotiate fee reductions on our current solutions and services, (ii) respond more quickly than we can to new and emerging technologies and changing customer requirements, (iii) devote greater resources to the sale of their products and the development and implementation of new and improved systems, solutions and services for customers that we serve, and (iv) pursue various acquisitions that allow them to rapidly amass a wide array of capabilities. We may be forced to lower our pricing, unexpectedly increase or enhance our technological or data capabilities, or modify our solution or service offerings. Notwithstanding any changes we make in response to increased competition, the demand for our solutions and services may decrease as a result of increased competition. A failure to be responsive to our existing and potential customers’ needs or the changing industry landscape could hinder our ability to maintain or expand our customer base, hire and retain new employees, pursue new business opportunities, complete future acquisitions and operate our business effectively. Any inability to compete effectively could materially adversely affect our business, financial condition, results of operations and cash flows.

| 15 |

Our business could be materially adversely affected if we fail to maintain a high level of customer retention, if our customers elect to reduce the scope of our contracts or terminate them before their scheduled expiration dates or if we fail to meet performance standards under our customer contracts.

We historically have derived and expect to continue to generate a significant portion of our revenue from a limited number of large customers at the federal and state level. Our contracts with these customers are subject to periodic renewal and some permit them to terminate their contracts on short notice, with or without cause. If a customer is dissatisfied with the quality of our work or if we fail to meet performance standards under our contracts, or if our solutions, technical infrastructure or services do not comply with the provisions of our contractual agreements or applicable regulatory requirements, customers might seek to reduce the scope of the services we perform or prematurely terminate their agreements with us, or we could incur additional costs that may impair the profitability of a contract and damage our ability to obtain additional work from that customer, or other current or prospective customers. For example, some of our contracts contain liquidated damages provisions and financial penalties related to performance failures, which if triggered, could materially adversely affect our reputation, business, financial condition, results of operations and cash flows. We also may be required to disclose such liquidated damages or other financial penalties assessed against us in connection with future bids for services with other customers.

In addition, government customers are subject to financial pressures or pressure from stakeholders that may cause them to terminate contracts for our services that may be regarded as non-essential or to redefine or reduce the scope of our contracts by, for example, significantly reducing the volume of data that we are permitted to audit or renewing the contract at lower performance fee levels. Despite our right to prompt and full payment under the terms of our contracts, we could face challenges in obtaining timely or full payments for our properly provided services from our customers. If there is a substantial reduction in the scope of our services under, or a termination of, any of our key contracts with our major customers, or if we are exposed to significant costs, liabilities or negative publicity, our ability to compete for new contracts with current or prospective customer could be damaged and our business, financial condition, reputation, results of operations and cash flows could be materially adversely affected.

Any failure to maintain effective information processing systems and the integrity of the data in, and operations of, those systems could materially adversely affect our business, financial condition, results of operations and cash flows.

Our ability to conduct our operations and accurately report our financial results depends on the integrity of the data in our information systems and the processes performed by those systems. As a result of the services we provide, we process a number of complex transactions that require us to access, store, retrieve, manipulate, manage and transmit our customers’ information and data, external data, as well as our own data. Although we have invested a great deal of time and resources in developing systems, processes and controls that protect the integrity of the data, such measures cannot provide absolute security. It is possible that failures or errors in hardware and software, including those in third-party technology, or technical deficiencies in our systems could result in data loss or corruption, or cause the data that we collect, utilize or disseminate to be incomplete or contain inaccuracies that our customers regard as significant. In addition, these information systems and applications require continual maintenance, upgrading and enhancement to meet our operational needs, satisfy customer requests and handle our expansion and growth. Despite our testing and quality control measures, we cannot be certain that errors or system deficiencies will not be found and that remediation can be done in a timeframe that is acceptable to our customers, or that customer relationships will not be impaired by the occurrence of errors or the need for remediation. In addition, implementation of upgrades and enhancements may cost more, take longer or require more testing than originally expected. Situations may also arise in which the accuracy of our data analysis or the content and quality of our work product is central to the disposition of claims, controversies or litigation between our customers and third parties that would require us to allocate significant resources to fulfilling our contractual obligations to provide our customers with full and complete access to records, analysis and back-up documentation of our work. Assuring our capacity to fulfill these obligations as well as actually fulfilling them could impose significant burdens on our infrastructure for data storage, maintenance and processing, and require us to incur increased costs to supplement our personnel, data storage and computing resources, which could materially and negatively impact other business operations.

| 16 |

We depend on many different entities to supply information and an inability to successfully manage our relationships with a number of these suppliers may harm the quality and availability of our solutions and services.

We obtain the data used in our solutions and services from many sources, including commercial health insurance plans, financial institutions, managed care organizations, government entities and non-government entities. From time to time, challenges arise in managing and maintaining our relationships with data sources that are not our customers and that furnish information to us pursuant to a combination of voluntary cooperation and legal obligations under laws and regulations that are often subject to differing interpretation. For example, data suppliers could seek to limit or end our access to and use of their data if they determine that certain uses of data for our customers are not permitted by our agreements, or such suppliers may make errors in compiling, transmitting or accurately characterizing data or have technological limitations that interfere with our receipt or use of the data we rely on them to provide. If a number of our information sources become unable or unwilling to provide us with certain data under terms of use that are acceptable to us and our customers, or if laws and regulations for use and protection of this data changes in a way that disincentivizes our suppliers, or imposes unacceptable or unreasonable conditions or risks on us, we may not be able to obtain new or favorable agreements with alternative data suppliers. In addition, our ability to normalize and fully utilize the information we have received from various data sources in order to enhance and improve current solutions for our customers is an important component of our growth strategy. Although we believe that we have the legal and contractual rights necessary to normalize and use the data we have obtained from these sources for potential or contemplated products and service offerings, we cannot provide assurance that these entities will permit the use of their data for these purposes. If we lose a number of our data sources or access to certain data and are unable to identify and reach the requisite agreements with suitable alternative suppliers or fail to successfully integrate them into our solutions and services, or if there is a lack of accuracy or integrity in the data that current or future suppliers provide, we could experience service disruptions, increased costs, reduced quality of our solutions and services, or performance penalties under our customer contracts, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We may rely on subcontractors and other third party providers to provide customers with a single-source solution or service or we may serve as a subcontractor to a third party prime contractor. If these parties fail to satisfy their obligations to us or if we are unable to maintain these relationships, our business, financial condition, results of operations and cash flows could be materially adversely affected.

In some areas of our business we may engage subcontractors, teaming partners, vendors or other third party providers to provide our customers with a single-source solution or service for a broader range of service needs. These third parties include software vendors, utility and network providers and other information technology service providers. Our ability to deliver and implement solutions and serve our customers effectively depends on these third parties meeting our service standards in both timeliness and quality, and in certain instances, on our ability to obtain customer approval for the use of these third party subcontractors. While we believe that we perform appropriate due diligence on these third parties and take adequate measures to ensure that they comply with the appropriate laws and regulations, we cannot guarantee that they will comply with the terms set forth in their agreements with us. Performance deficiencies or misconduct by subcontractors, teaming partners, vendors or other third party providers may be perceived as inadequacies in our solutions or services or cause us to fail to fulfill our contractual obligations to our customers, which could materially adversely affect our customer relationships and reputation, result in termination of a customer contract, and subject us to a dispute with our customer. In addition, if our third party service providers terminate or refuse to renew their relationships with us or offer their products to us in the future on less advantageous terms, we may not be able to perform or deliver solutions or services for existing customers as expected.

Similarly, we are and may in the future be engaged as a subcontractor to a third party prime contractor. Subcontracting arrangements where we are not the prime contractor pose unique risks to us because we do not have control over the customer relationship, and our ability to generate revenue under such subcontracts is dependent on the prime contractor, its performance and relationship with the customer, and its relationship with us. We cannot be certain that the prime contractor will provide adequate and timely services to the customer, comply with the terms of its prime contract with the customer or its subcontract agreement with us, or that it will construe its contractual rights and obligations in a reasonable way, act appropriately in dealing with us or customers, and remain in compliance with the relevant laws, rules or regulations. Any failure of the prime contractor to adequately perform its obligations under the prime contract or to comply with applicable laws, rules and regulations could materially adversely affect our reputation and subject us to a dispute with the prime contractor or the customer. In the event a prime contract is terminated, whether for non-performance by the prime contractor or otherwise, our subcontract will similarly terminate, and the resulting contract loss could materially adversely affect our business, financial condition, results of operations and cash flows.

| 17 |

We obtain a portion of our business through competitive bidding in response to government requests for proposals. Reprocurements and future contracts may not be awarded through this process on the same level or our contract awards may be challenged by interested parties which could materially adversely affect our business, financial condition, results of operations and cash flows.

In order to market our solutions and compete for contracts with existing and potential state and federal customers, we are often required to respond to government-issued RFPs. These RFP responses typically require us to assemble and submit a large volume of information within a rigid timetable, and to accurately estimate our cost structure for servicing the proposed contract, the time required to establish operations and the likely terms of any proposals submitted by our competitors. We may also be required to disclose the occurrence of any negative events suffered by our business, such as customer disputes, a government inquiry or an adverse judgment or settlement in litigation or a legal proceeding, which could impair our ability to win the contract at issue or have a material adverse effect on our reputation in the industry.