Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - GIBRALTAR INDUSTRIES, INC. | q42017exhibit321.htm |

| EX-32.2 - EXHIBIT 32.2 - GIBRALTAR INDUSTRIES, INC. | q42017exhibit322.htm |

| EX-31.2 - EXHIBIT 31.2 - GIBRALTAR INDUSTRIES, INC. | q42017exhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - GIBRALTAR INDUSTRIES, INC. | q42017exhibit311.htm |

| EX-23.1 - EXHIBIT 23.1 - GIBRALTAR INDUSTRIES, INC. | q42017exhibit231-eyconsent.htm |

| EX-21 - EXHIBIT 21 - GIBRALTAR INDUSTRIES, INC. | q42017exhibit21.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES ACT OF 1934 |

For the fiscal year ended December 31, 2017 | |

OR | |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to | |

Commission File Number 0-22462 | |

GIBRALTAR INDUSTRIES, INC.

(Exact name of Registrant as specified in its charter)

Delaware | 16-1445150 | |

(State or other jurisdiction of incorporation organization) | (I.R.S. Employer Identification No.) | |

3556 Lake Shore Road, P.O. Box 2028 Buffalo, New York | 14219-0228 | |

(address of principal executive offices) | (zip code) | |

Registrant’s telephone number, including area code: (716) 826-6500 | ||

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each class | Name of each exchange on which registered | |

Common Stock, $0.01 par value | NASDAQ Global Select Market | |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by checkmark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x.

Indicate by checkmark if the registrant is not required to file report pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment to this Form 10-K. ¨

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definition of “large accelerated filer”, “accelerated filer”, “small reporting company”, and "emerging growth company" in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Large accelerated filer | x | Accelerated filer | ¨ | Non-accelerated filer | ¨ | Smaller reporting company | ¨ | Emerging growth company | ¨ |

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the Common Stock outstanding and held by non-affiliates (as defined in Rule 405 under the Securities Act of 1933) of the registrant based upon the closing sale price of the Common Stock on the NASDAQ Global Select Market on June 30, 2017, the last business day of the registrant’s most recently completed second quarter, was approximately $1.1 billion.

As of February 23, 2018, the number of common shares outstanding was: 31,748,874

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Definitive Proxy Statement to be filed for its Annual Meeting of Shareholders

are incorporated by reference into Part III of this Annual Report on Form 10-K.

Form 10-K Index

Page Number | ||

Item 1 | ||

Item 1A | ||

Item 1B | ||

Item 2 | ||

Item 3 | ||

Item 4 | ||

Item 5 | ||

Item 6 | ||

Item 7 | ||

Item 7A | ||

Item 8 | ||

Item 9 | ||

Item 9A | ||

Item 10 | ||

Item 11 | ||

Item 12 | ||

Item 13 | ||

Item 14 | ||

Item 15 | ||

2

Safe Harbor Statement

Certain information set forth herein includes statements that express our opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results and, therefore, are, or may be deemed to be, “forward-looking statements.” These forward-looking statements can generally be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “seeks,” “projects,” “intends,” “plans,” “may,” “will” or “should” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, competition, strategies and the industries in which we operate. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We believe that these risks and uncertainties include, but are not limited to, those described in Item 1A “Risk Factors.” Those factors should not be construed as exhaustive and should be read with the other cautionary statements in Item 1A “Risk Factors.” Although we base these forward-looking statements on assumptions that we believe are reasonable when made, we caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity and the development of the industries in which we operate may differ materially from those made in or suggested by the forward-looking statements contained herein. In addition, even if our results of operations, financial condition and liquidity and the development of the industries in which we operate are consistent with the forward-looking statements contained in this document, those results or developments may not be indicative of results or developments in subsequent periods. Given these risks and uncertainties, you are cautioned not to place undue reliance on these forward-looking statements. Any forward-looking statements that we make herein speak only as of the date of those statements, and we undertake no obligation to update those statements or to publicly announce the results of any revisions to any of those statements to reflect future events or developments. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

PART I

Item 1. | Business |

The Company

Gibraltar Industries, Inc. (the "Company") is a leading manufacturer and distributor of building products for residential, industrial, infrastructure, renewable energy and conservation markets. Our business strategy focuses on significantly elevating and accelerating the growth and financial returns of the Company. We strive to deliver best-in-class, sustainable value creation for our shareholders for the long-term. We believe this can be achieved from a transformational change in the Company’s portfolio and its financial results. Our business strategy has four key elements, or "pillars," which are: operational excellence, product innovation, portfolio management, and acquisitions as a strategic accelerator.

Operational excellence is our first pillar in this strategy. 80/20 simplification ("80/20") is a core part of the operational excellence pillar and is based on the analysis that 25% of the customers typically generate 89% of the revenue in a business, and 150% of the profitability. Through the application of data analysis generated by 80/20 practice, we are focusing on our largest and best opportunities (the “80”) and eliminating complexity associated with less profitable opportunities (the “20”) in order to generate more earnings year over year, at a higher rate of return with a more efficient use of capital.

We have recently completed the third year of our multi-year simplification initiative. Since initiation of 80/20 in 2015, we have generated operating margin improvements from 80/20 simplification initiatives and have exceeded our initial five-year target ending 2019 of $25 million of pre-tax savings. We are currently in the middle innings of this 80/20 initiative, which means that there is both more work and more opportunity ahead. We are targeting greater structural changes affecting the balance sheet. We are starting the follow-on management tools of in-lining our manufacturing processes linked with market-rate-of-demand replenishment tools. These follow-on tools are focused on process manufacturing the highest-volume products for our largest customers, and on a much higher level of capacity utilization. We expect these methods will yield additional benefits including lower manufacturing costs, lower inventories and fixed assets, and an even higher level of service to customers.

Product innovation is our second strategic pillar. Innovation is centered on the allocation of new and existing resources to opportunities that we believe will produce sustainable returns. Our focus is on driving top line growth with new and innovative products. We are focused on those products and technologies that have relevance to the end-user and can be differentiated from our competition. Our initiatives will be tailored toward reallocating sales and marketing talent to target specific end user groups in order to better understand their needs and the various market opportunities that may be available. This effort is

3

expected to produce ideas and opportunities that generate profitable growth. Our focus on innovation is centered on four markets: postal and parcel products, residential air management, infrastructure and renewable energy. These respective markets are expected to grow based on demand for: centralized mail and parcel delivery systems; zero carbon footprint homes; the need for repairs to elevated bridges that are deficient or functionally obsolete; and energy sources not dependent on fossil fuels.

The third pillar of our strategy is portfolio management, which is a natural adjunct to the 80/20 initiative. Using the 80/20 process, we conduct strategic reviews of our customers and end markets, and allocate leadership time, capital and resources to the highest-potential platforms and businesses. During 2016, we sold our European industrial manufacturing business to a third party and initiated the divestitures of our small European residential solar racking business and U.S. bar grating product line, both of which proceeded as planned and are essentially complete. These portfolio changes have helped contribute to the Company's realization of a higher rate of return on invested capital in both 2017 and 2016. We have now acted on all near-term portfolio assessments. While we do not have any planned activities in the near future, we view portfolio management as a continuous process that will remain an important part of our strategy as we look to improve Gibraltar's long-term financial performance.

The fourth pillar of our strategy is acquisitions. We have targeted four key markets in which to make strategic acquisitions which are served by existing platforms within the Company. The existing platforms include the same areas in which we are targeting the development of innovative products: postal, parcel and storage solutions; infrastructure; residential air management; and renewable energy. These platforms are all in large markets in which the underlying trends for customer convenience and safety, energy-savings and resource conservation are of increasing importance and are expected to drive long-term demand. We believe these markets also offer the opportunity for higher returns on our investments than those we have generated in the past. The acquisitions of Rough Brothers Manufacturing, Inc., RBI Solar, Inc., and affiliates, collectively known as "RBI" in June 2015 and more recently, Nexus Corporation ("Nexus") in October 2016 and Package Concierge in February 2017, were the direct result of this fourth pillar strategy. We also consider businesses outside of these four markets, as we continually search out opportunities to grow our business in large markets with expected growth in demand for the foreseeable future, where we can add value through our manufacturing expertise, 80/20 process and purchasing synergies.

The Company serves customers primarily throughout North America and, to a lesser extent, Asia. Our customers include major home improvement retailers, wholesalers, industrial distributors, contractors, solar developers and institutional and commercial growers of plants. As of December 31, 2017, we operated 42 facilities, comprised of 30 manufacturing facilities, six distribution centers, and six offices, which are located in 17 states, Canada, China, and Japan. These facilities give us a base of operations to provide customer support, delivery, service and quality to a number of regional and national customers and providing us with manufacturing and distribution efficiencies in North America, as well as a presence in the Asian markets.

The Company operates and reports its results in the following three reporting segments:

• | Residential Products; |

• | Industrial and Infrastructure Products; and |

• | Renewable Energy and Conservation |

The following table sets forth the primary products, applications, and end markets for each segment:

Residential Products Segment

Product | Applications | End Market | ||||

Roof and foundation ventilation products | Ventilation and whole-house air flow |  | Residential: new construction and repair and remodeling | |||

Centralized mail systems and electronic package solutions | Secure storage for mail and package deliveries | |||||

Rain dispersion, trims and flashings, other accessories | Water protection; sun protection | |||||

4

Industrial and Infrastructure Products Segment

Product | Applications | End Market | ||

Fabricated expanded metal and perforated metal products | Perimeter security barriers; walkways / catwalks; filtration; architectural facades |  | Industrial and commercial construction, automotive, energy and power generation | |

Structural bearings, expansion joints and pavement sealant for bridges and roadways | Preserve functionality under varying weight, wind, temperature and seismic conditions | Bridge and elevated highway construction, airport pavements | ||

Renewable Energy and Conservation Segment

Product | Applications | End Users | ||

Solar racking systems: design, engineer, manufacture and installation | Small scale commercial solar installations |  | Solar developers; power companies; solar energy EPC contractors | |

Greenhouses: design, engineer, manufacture and installation | Retail, commercial, institutional and conservatories | Retail garden centers; conservatories and botanical gardens; commercial growers; public and private agricultural research | ||

We believe our operating segments have established reputations as industry leaders with respect to quality, service and innovation and have achieved strong competitive positions in our markets. We attribute their competitive standing in the markets primarily to the following strengths:

Leading market share. We have a leading market position in many of the products and services we offer, and we estimate that a majority of our net sales for the year ended December 31, 2017 were derived from the sale of products in which we had one of the leading U.S. market shares. We believe we have leading market shares in five distinct product families: roof-related ventilation; postal and parcel storage; structural bearings and expansion joints for bridges and other structures; institutional and retail greenhouses; and fixed-tilt ground mount racking for photovoltaic (PV) solar systems.

Provider of value-added products and related services. We increasingly focus on providing innovative value-added products and related services, such as centralized mail systems and electronic package solutions, expansion joints and structural bearings for roadways and bridges, roof and foundation ventilation products, solar racking systems, and greenhouses which can solve end customer needs while also helping to improve our margins and profitability. Our products use complex and demanding production and treatment processes that require advanced production equipment, sophisticated technology and exacting quality control measures, along with specialized design and engineering skills. We also focus our acquisition strategy on manufacturers offering engineered products and services in key growth markets.

Commitment to quality. Gibraltar’s quality management systems are designed to ensure that we meet the needs and desired level of excellence, of our customers and other stakeholders, while meeting statutory and regulatory requirements related to our products or services. Our policies, processes and procedures required for planning and execution, are based on the principles of: customer focus, leadership, engagement of people, process approach, improvement, evidence-based decision-making and relationship management.

Strong liquidity profile. We strive to manage our cash resources to ensure we have sufficient liquidity to support the seasonality of our businesses, potential downturns in economic activity, and to fund growth initiatives. During the years ended December 31, 2017 and 2016, we purchased Package Concierge for approximately $19 million and Nexus for approximately $24 million, respectively, funded by our cash on hand. Our liquidity as of December 31, 2017 was $511 million, including $222 million of cash and $289 million of availability under our revolving credit facility. We believe that our current low leverage and ample liquidity allow us to successfully manage our business, meet the demands of our customers, weather the cyclicality of certain end markets and take advantage of growth opportunities.

5

Recent developments

On February 22, 2017, the Company acquired all of the outstanding stock of Package Concierge for $19 million. The acquisition was financed through cash on hand. Package Concierge is a leading provider of multifamily electronic package delivery locker systems in the United States. The results of operations of Package Concierge have been included within the Company's Residential Products segment of the Company's consolidated financial statements from the date of acquisition.

On December 2, 2016, as part of its portfolio management initiative, the Company announced its intentions to exit its U.S. bar grating product line and its European residential solar racking business, within the Company’s Industrial and Infrastructure Products, and Renewable Energy and Conservation, segments, respectively. On February 6, 2017, the Company completed the sale of substantially all of its U.S. bar grating product line assets to a third party. In addition, the Company shut down the operations of its European residential solar racking business during the first quarter of 2017. These businesses contributed a combined $75 million in revenue and pre-tax operating losses of $6 million in 2016. This initiative resulted in the sale and closing of 3 facilities in 2017.

On October 11, 2016, the Company acquired all of the outstanding stock of Nexus for $24 million. The acquisition was financed through cash on hand. Nexus is a leading provider of commercial-scale greenhouses to customers in the United States. The results of operations of Nexus have been included within the Renewable Energy and Conservation segment of the Company's consolidated financial statements from the date of acquisition.

On April 15, 2016, the Company sold its European industrial manufacturing business to a third party for net of cash proceeds of $8 million. This business, which supplied expanded metal products for filtration and other applications, contributed $36 million in revenue to the Company's Industrial & Infrastructure Products segment in 2015 and had nearly break-even operating results. The divestiture of this business is in alignment with the Company's portfolio management assessments.

On June 9, 2015, the Company acquired RBI for $148 million. RBI is one of North America’s fastest-growing providers of solar racking solutions and is also one of the largest manufacturers of commercial greenhouses in the United States. RBI is a full service provider that designs, engineers, manufactures and installs solar racking systems for solar developers and power companies. In addition, RBI designs, engineers, manufactures and erects greenhouses for commercial, institutional and retail customers. The acquisition of RBI has enabled the Company to leverage its expertise in structural metals manufacturing, materials sourcing and logistics to help meet the growing demand for solar racking solutions. The results of RBI have been included in the Company’s consolidated financial results since the date of the acquisition. The acquisition was financed through cash on hand and short-term borrowings under our revolving credit facility.

Customers and Products

Our customers are located primarily throughout North America and, to a lesser extent, Asia. One customer, a home improvement retailer which purchases from both the Residential Products segment and Renewable Energy and Conservation segment, represented 12% of our consolidated net sales for 2017 and 11% for both 2016 and 2015. No other customer in any segment accounted for more than 10% of our consolidated net sales.

Our products are primarily distributed to our customers using common carriers. We maintain distribution centers that complement our manufacturing plants from which we ship products and ensure on-time delivery while maintaining efficiency within our distribution process. Our customers and product offerings by segment are described below.

Residential Products

Our Residential Products segment services the residential repair and remodeling and the housing construction markets in North America with products including roof and foundation ventilation products, centralized mail systems and electronic package solutions, out-door living products (retractable sun-shades), rain dispersion products and other roofing and related accessories. Our residential product offerings are sold through a number of sales channels including major retail home centers, building material wholesalers, building product distributors, buying groups, roofing distributors, residential contractors, and postal services distributors and providers. This segment operates 12 manufacturing facilities throughout the United States giving it a base of operations to provide manufacturing capability of high quality products, customer service, delivery and technical support to a broad network of regional and national customers across North America.

Our roof and foundation ventilation products and accessories include solar powered units. Our centralized mail and electronic package solutions include single mailboxes, cluster style mail and parcel boxes for single and multi-family housing and electronic package locker systems. Our remaining residential product offerings consist of roof edging and flashing, soffits and trim, drywall corner bead, metal roofing and accessories, rain dispersion products, including gutters and accessories, and exterior retractable awnings. Each of these product offerings can be sold separately or as part of a system solution.

6

Within our Residential Products businesses, we are constantly striving to improve our product/solution offerings by introducing new products, enhancing existing products, adapting to building code and regulatory changes, and providing new and innovative solutions to homeowners and contractors. New products introduced in recent years include adhesive roofing applications, electronic parcel lockers, roof top safety kits, chimney caps, heat trace coils, exterior, remote-controlled deck awnings for sun protection, and high-efficiency and solar-powered ventilation products. Our electronic parcel lockers and parcel room systems provide residents in multi-family communities a secure storage receptacle to handle both package deliveries and receipt of other delivered goods. Our ventilation and roof flashing products provide protection and extend the life of structures while providing a safer, healthier environment for residents. Our cluster box mail delivery products provide delivery cost savings to the postal service while offering secure storage for delivered mail and packages. Our building products are manufactured primarily from galvanized and painted steel, anodized and painted aluminum, and various resins.

Within our manufacturing facilities, we leverage significant production capabilities which allow us to process a wide range of metals and plastics for our residential products. Most of our production is completed using automatic roll forming machines, stamping presses, welding, paint lines, and injection molding equipment. We maintain our equipment according to a thorough preventive maintenance program allowing us to meet the demanding quality and delivery requirements of our customers. In some cases, the Company sources products from third-party vendors to optimize cost and quality in order to provide the very best and affordable solution for our customers.

Industrial and Infrastructure Products

Our Industrial and Infrastructure Products segment serves a variety of end markets such as industrial and commercial construction, highway and bridge construction, automotive, airports and energy and power generation through a number of sales channels including discrete and process manufacturers, steel fabricators and distributors, commercial and transportation contractors, and power generating utilities. Our Industrial and Infrastructure product offerings include perimeter security, expanded and perforated metal, plank grating, as well as, expansion joints and structural bearings for roadways and bridges. We operate 11 manufacturing facilities and 4 distribution centers throughout the United States and Canada giving us a base of operations to provide customer support, delivery, service, and quality to a number of regional and national customers, and providing us with manufacturing and distribution efficiencies in North America.

Our expanded and perforated metal and plank grating is used in walkways, catwalks, architectural facades, perimeter security barriers, shelving, and other applications where both visibility and security are necessary. Our fiberglass grating is used by our customers where high strength, light weight, low maintenance, corrosion resistance and non-conductivity are required. Our remaining product offerings in this segment includes expansion joint systems, bearing assemblies, and pavement sealing systems used in bridges, elevated highways, airport runways, and rail crossings.

We strive to improve our offerings of industrial and infrastructure products by introducing new products, enhancing existing products, adjusting product specifications to respond to commercial building code and regulatory changes, and providing additional solutions to original equipment manufacturers and contractors. New products introduced in recent years include customized perforated and expanded metal to penetrate a range of new markets such as architectural facades for buildings (museums, sports stadiums and retail outlets) and perimeter security barriers for protecting critical infrastructure. In addition, we have extended our transportation infrastructure products into new markets. For example, long-lasting pavement sealants for roadways are now being installed on airport runways, structural bearings for elevated highways and bridges have been installed on an offshore oil production platform, and corrosion-protection products for cable-suspension bridges are now marketed and sold internationally.

Our production capabilities allow us to process a wide range of metals necessary for manufacturing industrial products. Most of our production is completed using computer numerical control ("CNC") machines, shears, slitters, press brakes, milling, welding, and numerous automated assembly machines. We maintain our equipment according to a thorough preventive maintenance program, including in-house tool and die shops, allowing us to meet the demanding service requirements of many of our customers.

7

Renewable Energy and Conservation

The Renewable Energy and Conservation segment is primarily a designer and manufacturer of fully-engineered solutions for solar mounting systems and greenhouse structures. This segment offers a fully integrated approach to the design, engineering, manufacturing and installation of solar racking systems and commercial, institutional, and retail greenhouse structures servicing customers, such as solar owners and developers, retail garden centers, conservatories and botanical gardens, commercial growers, and schools and universities. We have 7 manufacturing facilities and 2 distribution centers and operate in the United States, China and Japan.

An integral part of each customer project is the fabrication of specifically designed metal structures for highly-engineered applications including: racking for ground-mounted solar arrays; carports that integrate solar PV panels; as well as commercial-scale greenhouses and other glass structures. Both the solar racking and greenhouse projects involve holding glass and plastic to metal and use the same raw materials including steel and aluminum. Most of our production is completed using CNC machines, roll forming machines, laser cutters and other fabrication tools. The structural metal components are designed, engineered, fabricated and installed in accordance with applicable structural steel and aluminum guidelines.

We strive to improve our offerings of products by introducing new products, enhancing existing products, adjusting product specifications to respond to commercial building codes and regulatory changes, and providing solutions to contractors and end users. New products introduced in recent years include metal framed canopy structures for car washes and pool enclosures, and solar racking systems for carports and canopies. Our car washes and canopy structures serve a market preference for light- transparent structures. Solar racking systems for carports serve as protection for cars from the effects of the sun and intense heat while providing a renewable energy resource. Similarly, solar racking systems installed on idle land, such as solid waste landfills, converts such land into a useful property by providing power generating capabilities.

Engineering and Technical Services

Our businesses employ engineers and other technical personnel to perform a variety of key tasks. These personnel staff fully-equipped, modern laboratories to support our operations. These laboratories enable us to verify, analyze, and document the physical, chemical, metallurgical, and mechanical properties of our raw materials and products. In addition, our engineering staff employs a range of drafting software to design highly specialized and technically precise products. In our Renewable Energy and Conservation segment, drawings are designed, signed and sealed by licensed engineers. Technical service personnel also work in conjunction with our sales force to determine the types of products and services that suit the particular needs of our customers.

Suppliers and Raw Materials

Our business is required to maintain sufficient quantities of raw material inventory in order to accommodate our customers’ short lead times. Accordingly, we plan our purchases to maintain raw materials at sufficient levels to satisfy the anticipated needs of our customers. We have implemented enterprise resource planning systems to better manage our inventory, forecast customer orders, enable efficient supply chain management, and allow for more timely counter-measures to changing customer demand and market conditions.

The primary raw materials we purchase are flat-rolled and plate steel, aluminum, and resins. We purchase flat-rolled and plate steel and aluminum at regular intervals on an as-needed basis, primarily from the major North American mills, as well as, a limited amount from domestic service centers and foreign steel importers. Substantially all of our resins are purchased from domestic vendors, primarily through distributors, with a small amount direct from manufacturers. Supply has historically been adequate from these sources to fulfill our needs. Because of our strategy to develop longstanding relationships in our supply chain, we have been able to adjust our deliveries of raw materials to match our required inventory positions to support our on-time deliveries to customers while allowing us to manage our investment in inventory and working capital. Management continually examines and improves our purchasing practices across our geographically dispersed facilities in order to streamline purchasing across similar commodities.

We purchase natural gas and electricity from suppliers in proximity to our operations.

Intellectual Property

We actively protect our proprietary rights by the use of trademark, copyright, and patent registrations. While we do not believe that any individual item of our intellectual property is material, we believe our trademarks, copyrights, and patents provide us with a competitive advantage when marketing our products to customers. We also believe our brands are well recognized in the markets we serve and we believe they stand for high-quality manufactured goods at a competitive price. These trademarks, copyrights, and patent registrations allow us to help maintain product leadership positions for the goods we offer.

8

Sales and Marketing

Our products and services are sold primarily by channel partners who are called on by our sales personnel and outside sales representatives located throughout the United States, Canada and Asia. We have organized sales teams to focus on specific customers and national accounts through which we provide enhanced supply solutions and improve our ability to increase the number of products that we sell. Our sales staff works with certain retail customers to optimize shelf space for our products which is expected to increase sales at these locations. Our sales regularly involve competitive bidding processes, and our reputation for meeting delivery time lines and strict specifications make us a preferred provider for many customers.

We focus on providing our customers with industry leading customer service. Our retail customers are provided with point-of-sale marketing aids to encourage consumer spending on our products in their stores. Continual communication with our customers allows us to understand their concerns and provides us with the opportunity to identify solutions that will meet their needs. We are able to meet our customers’ demand requirements due to our efficient manufacturing processes and extensive distribution network.

Backlog

While the majority of our products have short lead time order cycles, we have aggregated approximately $153 million of backlog at December 31, 2017. The backlog primarily relates to certain business units in our Industrial and Infrastructure Products and our Renewable Energy and Conservation segments. We believe that the majority of our backlog will be shipped, completed and installed during 2018.

Competition

The Company operates in highly competitive markets. We compete against several competitors in all three of our segments with different competitors in each major product category. We compete with competitors based on the range of products offered, quality, price, and delivery, as well as, serving as a full service provider for project management in certain segments. Although some of our competitors are large companies, the majority are small to medium-sized and do not offer the large range of building products that we offer.

We believe our broad range of products, high quality, and sustained ability to meet exacting customer delivery requirements gives us a competitive advantage over many of our competitors. We also believe that execution of our business strategy further differentiates us from many of our competitors and allows us to capitalize on those areas that give us a competitive advantage over many of our competitors.

Seasonality

The Company’s business has historically been subjected to seasonal influences, with higher sales typically realized in the second and third quarters. General economic forces, such as tax credit expirations and pending tariffs, along with changes in the Company’s customer mix have shifted traditional seasonal fluctuations in revenue over the past few years.

Governmental Regulation

Our production processes involve the use of environmentally sensitive materials. We believe that we operate our business in material compliance with all federal, state and local environmental laws and regulations, and do not anticipate any material adverse effect on our financial condition or results of operations to maintain compliance with such laws and regulations. However, we could incur operating costs or capital expenditures in complying with new or more stringent environmental requirements in the future or with current requirements if they are applied to our manufacturing facilities or distribution centers in a way we do not anticipate. In addition, new or more stringent regulation of our energy suppliers could cause them to increase the price of energy.

Our operations are also governed by many other laws and regulations covering our labor relationships, the import and export of goods, the zoning of our facilities, taxes, our general business practices, and other matters. We believe that we are in material compliance with these laws and regulations and do not believe that future compliance with such laws and regulations will have a material adverse effect on our financial condition or results of operations.

9

Internet Information

Copies of the Company’s Proxy Statements on Schedule 14A filed pursuant to Section 14 of the Securities Exchange Act of 1934 and Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge through the Company’s website (www.gibraltar1.com) as soon as reasonably practicable after the Company electronically files the material with, or furnishes it to, the Securities and Exchange Commission.

Employees

At December 31, 2017 and 2016, we employed 2,022 and 2,311 employees, respectively.

Senior Management Team

Our senior management team is composed of talented and experienced managers possessing broad experience in operational excellence, new product development, and driving profitable growth gained over multiple business cycles:

Frank Heard - Chief Executive Officer (CEO) and a member of the Board of Directors. Mr. Heard was appointed CEO and a member of the Board of Directors effective January 1, 2015. Mr. Heard was first hired in May 2014 as President and Chief Operating Officer. Mr. Heard joined our Company with extensive experience in the building products industry, including his 32 years of employment at Illinois Tool Works, Inc.

Timothy Murphy - Chief Financial Officer (CFO) and Senior Vice President (SVP). Mr. Murphy was appointed CFO and SVP of the Company on April 1, 2017. Mr. Murphy joined the Company in 2004 as Director of Financial Reporting, and subsequently served as the Company's Vice President, Treasurer and Secretary. Mr. Murphy was appointed as successor to the former CFO and SVP , Kenneth Smith. Mr. Smith's retirement in May of 2017 was announced by the Company in November 2016.

Cherri Syvrud - SVP of Human Resources and Organizational Development. Ms. Syvrud was appointed SVP of Human Resources and Organizational Development on April 1, 2016. Ms. Syvrud joined the Company with significant experience in human resources and organization development, including her 25 years of employment at Illinois Tool Works, Inc. Ms. Syvrud was appointed as successor to the former SVP of Human Resources and Organizational Development, Paul Murray. Mr. Murray's retirement in March of 2017 was announced by the Company in March 2016.

Jeffrey Watorek - Vice President, Treasurer and Secretary. Mr. Watorek was appointed as Vice President, Treasurer and Secretary on April 1, 2017. Mr. Watorek joined the Company in 2008 as Manager of Financial Reporting, and subsequently served as the Company's Director of Financial Performance and Analysis. Mr. Watorek was appointed as successor to the former Vice President, Treasurer and Secretary, Mr. Murphy, upon his appointment to CFO and SVP.

The Company conducted other recent senior leadership changes in 2017. The Company hired John Mehltretter as successor to David McCartney as Vice President of Information Services upon announcement of Mr. McCartney’s retirement in 2017; and William Vietas was promoted as successor to Richard Reilly as Group President of Renewable Energy and Conservation upon announcement of Mr. Reilly's retirement in 2017.

Item 1A. | Risk Factors |

Our business, financial condition and results of operations, and the market price for the Company's common shares are subject to numerous risks, many of which are driven by factors that cannot be controlled or predicted. The following discussion, as well as, other sections of this Annual Report on Form 10-K, including “Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations,” describe certain business and other risks affecting the Company. Consideration should be given to the risk factors described below as well as those in the Safe Harbor Statement at the beginning of this Annual Report on Form 10-K, in conjunction with reviewing the forward-looking statements and other information contained in this Annual Report on Form 10-K. These risks are not the only risks we face. Our business operations and market for our securities could also be adversely affected by additional factors that are not presently known to us or that we currently consider to be immaterial in our operations.

10

Macroeconomic factors outside of our control may adversely affect our business, our industry, and the businesses and industries of many of our customer and suppliers.

Macroeconomic factors have a significant impact on our business, customer demand and the availability of credit and other capital, affecting our ability to generate profitable margins. Our operations are subject to the effects of domestic and international economic conditions including government monetary and trade policies, tax laws and regulations, as well as, the relative debt levels of the U.S. and the other countries where we sell our products. Significant fluctuations in energy costs have, and may continue to, negatively impact demand for our expanded metal products. Tariffs placed on imported products used by our customers, such as solar panels, may negatively impact demand for our solar racking systems. In addition, fluctuations in the U.S. dollar impacts the prices we charge and costs we incur to export and import products.

We are unable to predict the impact on our business of changes in domestic and international economic conditions. The markets in which we operate have been challenging in the past, and the possibility remains that the domestic or global economies, or certain industry sectors of those economies that are key to our sales, may deteriorate, which could result in a corresponding decrease in demand for our products and negatively impact our results of operations and financial condition.

Our amount of leverage and debt service obligations could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry, and prevent us from meeting our obligations.

We had total indebtedness of $212.4 million, before unamortized debt issuance costs, as of December 31, 2017, of which $209.6 million is long-term debt. Our current level of indebtedness and the debt we may need to incur in the future to fund strategic acquisitions, investments or for other purposes could have significant adverse consequences to our business, including the following:

• | A significant level of outstanding debt could make us more vulnerable to changes in economic conditions and subject us to increases in prevailing interest rates; |

• | Increases in interest rates could increase our interest expense; |

• | A substantial portion of our cash flow from operations could be restricted to paying principal, premium, if any, and interest on our indebtedness; |

• | Limiting our ability to use cash flow from operations or to obtain additional debt or equity financing to execute on business strategy; and |

• | Limiting our ability to adjust to changing market conditions and place us at a competitive disadvantage compared to our competitors which have less debt. |

Our debt instruments impose operational and financial restrictive covenants which may limit our operational and financial prospects.

The Senior Credit Agreement and the indenture governing our 6.25% Notes contain several financial and other restrictive covenants. A significant decline in our operating income could cause us to violate these covenants, which could result in incurring additional financing fees that would be costly and adversely affect our profitability and cash flows. We may also incur additional debt for acquisitions, operations and capital expenditures that could adversely impact our ability to meet these covenants.

We apply judgments and make estimates in accounting for contracts, and changes in these judgments or estimates may have significant impacts on our earnings.

Changes in judgments or required estimates and any subsequent adjustments to those judgments or estimates (such as performance incentives, penalties, contract claims and contract modifications) could have a material adverse effect on sales and profits. Due to the substantial judgments applied and estimations involved with this process, our actual results could differ materially or could be settled unfavorably from our estimates. Revenue representing approximately 28% and 26% of 2017 and 2016 sales, respectively, were accounted for using the percentage of completion, cost-to-cost method of accounting. Refer to “Critical Accounting Estimates” within Item 7 of this Form 10-K for more detail of how our financial statements can be affected by accounting for revenue from contracts with customers.

A significant portion of our net sales are concentrated with a few customers. The loss of those customers would adversely affect our business, results of operations, and cash flows.

A loss of sales, whether due to decreased demand from the end markets we serve or from any significant customer in these markets, a decrease in the prices that we can realize from sales of our products to customers in these markets, or a loss, bankruptcy, or significant decrease in business from any of our major customers, could have a significant adverse effect on our profitability and cash flows. Our ten largest customers accounted for approximately 36%, 30%, and 34%, of our net sales

11

during 2017, 2016, and 2015, respectively, with our largest customer, a retail home improvement center, accounting for approximately 12% of our consolidated net sales during 2017 and 11% of our consolidated net sales for both 2016 and 2015.

The volatility of the commodity market on our pricing of our principal raw materials, and the highly competitive market environment in which we do business could significantly impact our gross profit, net income, and cash flow.

Our principal raw materials are commodity products consisting of steel, aluminum, and resins, for which, at times, availability and pricing can be volatile due to a number of factors beyond our control, including general economic conditions, domestic and worldwide demand, labor costs, competition, import duties, tariffs, and currency exchange rates. Commodity price fluctuations and increased competition could force us to lower our prices or to offer additional services or enhanced products at a higher cost to us, which could reduce our gross profit, net income, and cash flow and cause us to lose market share.

Our business is highly competitive and increased competition could reduce our gross profit, net income, and cash flow.

The principal markets that we serve are highly competitive. Competition is based primarily on product functionality, quality, price, raw material and inventory availability, and the ability to meet delivery schedules dictated by customers. We compete in our principal markets with companies of various sizes, some of which have greater financial and other resources than we do and some of which have better established brand names in the markets we serve. Increased competition could force us to lower our prices or to offer additional services or enhanced products at a higher cost to us, which could reduce our gross profit, net income, and cash flow and cause us to lose market share.

Our business and financial performance may be adversely affected by information systems interruptions, cybersecurity attacks, equipment failures, and technology integration.

Our business may be impacted by disruptions to our own or third-party information technology (“IT”) infrastructure, which could result from (among other causes) cyber-attacks on, or failures of, such infrastructure or compromises to its physical security, as well as from damaging weather or other acts of nature. Cyber-based risks, in particular, are evolving and include, but are not limited to, both attacks on our IT infrastructure and attacks on the IT infrastructure of third parties (both on premises and in the cloud) attempting to gain unauthorized access to our confidential or other proprietary information, classified information, or information relating to our employees, customers and other third parties.

Due to the evolving threat landscape, cyber-based attacks will continue and we may experience them going forward, potentially

with more frequency. We continue to make investments and adopt measures designed to enhance our protection, detection, response, and recovery capabilities, and to mitigate potential risks to our technology, products, services and operations from potential cyber-attacks. However, given the unpredictability, nature and scope of cyber-attacks, it is possible that potential vulnerabilities could go undetected for an extended period. We could potentially be subject to production downtimes, operational delays, other detrimental impacts on our operations or ability to provide products and services to our customers, the compromise of confidential or otherwise protected information, misappropriation, destruction or corruption of data, security breaches, other manipulation or improper use of our or third-party systems, networks or products, financial losses from remedial actions, loss of business or potential liability, and/or damage to our reputation, any of which could have a material adverse effect on our competitive position, results of operations, cash flows or financial condition. Due to the evolving nature of such risks, the impact of any potential incident cannot be predicted.

If the subcontractors and suppliers we rely upon do not perform to their contractual obligations, our revenues and cash flows would be adversely affected.

Some of our contracts with customers involve subcontracts with other companies that perform a portion of the services we provide to our customers. There is a risk that our subcontractors may not perform to their contractual obligations and therefore may cause disputes regarding the quality and timeliness of work performed by our subcontractors or customer concerns with the subcontractor. Any such disputes or concerns could materially and adversely impact our ability to perform our obligations as the prime contractor. Similarly, the failure by our suppliers to deliver raw materials, components or equipment parts according to schedule, or at all, may affect our ability to meet our customers' needs and may have an adverse effect upon our profitability. Failure of our raw materials or components to conform to our specification could also result in delays in our ability to timely deliver and may have an adverse impact on our relationships with our customers, and our ability to fully realize the revenue expected from sales to those customers.

12

Our strategy depends on identification, management and successful integration of future acquisitions.

Historically, we have grown through a combination of internal growth plus external expansion through acquisitions. Although we intend to continue to seek additional acquisition opportunities in accordance with our business strategy, we cannot provide any assurance that we will be able to identify appropriate acquisition candidates, or, if we do, that we will be able to negotiate successfully the terms of an acquisition, finance the acquisition or integrate the acquisition into our existing operations. Failure to integrate any acquisition successfully may cause significant operating inefficiencies, result in the incurring of unforeseen obligations or loss of customers and could adversely affect our profitability. Consummating an acquisition could require us to raise additional funds through additional equity or debt financing, which could increase our interest expense and reduce our cash flows and available funds.

Systems integration and implementation issues could disrupt our internal operations.

In connection with the acquisitions we make, we customarily must integrate legacy information technology systems of the acquired business with our information technology infrastructure, and in some cases, implement new information technology systems for the business. In addition, as the functionality of available information systems increases, we may need to implement significant upgrades or even replace some of our primary information technology systems across significant parts of our businesses and operations. The implementation of new information technology solutions could lead to interruptions of information flow internally and to our customers and suppliers while the implementation project is being completed. Any failure to integrate legacy systems of acquisitions or to implement new systems properly could negatively impact our operations and financial results.

We depend on our senior management team, and the unexpected loss of any member could adversely affect our operations.

Our success is dependent on the management and leadership skills of our senior executive and divisional management teams. The unexpected loss of any of these individuals, or our inability to attract and retain additional personnel could prevent us from successfully executing our business strategy. We cannot assure you that we will be able to retain our existing senior management personnel or to attract additional qualified personnel when needed. We have not entered into employment agreements with any of our senior management personnel other than Frank G. Heard, our President and Chief Executive Officer.

We could incur substantial costs in order to comply with, or to address any violations of, environmental, health and safety laws.

Our operations and facilities are subject to a variety of stringent federal, state, local, and foreign laws and regulations relating to the protection of the environment and human health and safety. Compliance with these laws and regulations sometimes involves substantial operating costs and capital expenditures, and failure to maintain or achieve compliance with these laws and regulations or with the permits required for our operations could result in substantial costs, such as fines and civil or criminal sanctions, third-party claims for property damage or personal injury, cleanup costs or temporary or permanent discontinuance of operations, including claims arising from the businesses and facilities that we have sold. For certain businesses we have divested, we have provided limited indemnifications for environmental contamination to the successor owners. We have also acquired and continue to acquire businesses and facilities to add to our operations. While we sometimes receive indemnification for pre-existing environmental contamination, the party providing the indemnification may not have sufficient resources to cover the cost of any required measures. Certain facilities of ours have been in operation for many years and we may be liable for remediation of any contamination at our current or former facilities; or at off-site locations where wastes have been sent for disposal, regardless of fault or whether we, our predecessors or others are responsible for such contamination. We have been responsible for remediation of contamination at some of our locations and, while such costs have not been material to date, the cost of remediation of any of these and any newly-discovered contamination cannot be quantified, and we cannot assure you that it will not materially affect our profits or cash flows. Changes in environmental laws, regulations or enforcement policies, including without limitation new or additional regulations affecting disposal of hazardous substances and waste, greenhouse gas emissions or use of fossil fuels, could have a material adverse effect on our business, financial condition, or results of operations.

Our operations are subject to seasonal fluctuations that may impact our cash flow.

Our net sales are generally lower in the first and fourth quarters primarily as a result of reduced activity in the building industry due to inclement weather. In addition, quarterly results may be affected by the timing of shipments of large customer orders. Therefore, our cash flow from operations may vary from quarter to quarter. If, as a result of any such fluctuation, our quarterly cash flows were significantly reduced, we may not be able to service our indebtedness or maintain covenant compliance.

13

Economic, political, and other risks associated with foreign operations could adversely affect our financial results and cash flows.

Although the large majority of our business activity takes place in the United States, we derive a portion of our revenues and earnings from operations in Canada, China and Japan, and are subject to risks associated with doing business internationally. Our sales originating outside the United States represented approximately 4% of our consolidated net sales during the year ended December 31, 2017. We believe that our business activities outside of the United States involve a higher degree of risk than our domestic activities, such as the possibility of unfavorable circumstances arising from host country laws or regulations, changes in tariff and trade barriers and import or export licensing requirements. In addition, any local or global health issue or uncertain political climates, international hostilities, natural disasters, or any terrorist activities could adversely affect customer demand, our operations and our ability to source and deliver products and services to our customers.

Future terror attacks, war, natural disasters or other catastrophic events beyond our control could negatively impact our operations and financial results.

Terror attacks, war, or other civil disturbances, natural disasters and other catastrophic events could lead to economic instability, decreased capacity to produce our products and decreased demand for our products. From time to time, terrorist attacks worldwide have caused instability in global financial markets. Concerns over global climate changes and environmental sustainability over time may influence the Company's strategic direction, supply chain, or delivery channels. Also, our facilities could be subject to damage from fires, floods, earthquakes or other natural or man-made disasters. Such interruptions could have an adverse effect on our operations, cash flows and financial results.

The nature of our business exposes us to product liability, product warranty and other claims, and other legal proceedings.

We are involved in product liability, product warranty and other claims relating to the products we manufacture and distribute. Although we currently maintain what we believe to be suitable and adequate insurance in excess of our self-insured amounts, there can be no assurance that we will be able to maintain such insurance on acceptable terms or that such insurance will provide adequate protection against potential liabilities. Product liability claims can be expensive to defend and can divert the attention of management and other personnel for significant periods, regardless of the ultimate outcome. Claims of this nature could also have a negative impact on customer confidence in our products and our Company. We cannot assure you that any current or future claims will not adversely affect our reputation, financial condition, operating results, and cash flows.

If events occur or indicators of impairment are present that may cause the carrying value of long-lived and indefinite-lived assets to no longer be recoverable, to exceed the fair value of the asset, or may lead to a reduction in the fair value of the asset, significant non-cash impairment charges to earnings may be taken that have a material impact on our results of operations.

In prior years, we have recorded significant non-cash impairment charges for goodwill and other intangible assets as a result of reductions in the estimated fair values of certain businesses. It is possible that we will be required to record additional non-cash impairment charges to our earnings in the future, which could be significant and have a material impact on our results of operations. Refer to “Critical Accounting Estimates” within Item 7 of this Form 10-K for more detail of how our financial statements can be affected by asset impairment.

The expiration, elimination or reduction of solar rebates, credits and incentives may adversely impact our business.

A variety of federal, state and local government agencies provide incentives to promote electricity generation from renewable sources such as solar power. These incentives are in the form of rebates, tax credits and other financial incentives which help to motivate end users, distributors, system integrators and others to install solar powered generating systems. Any changes to reduce, shorten or eliminate the scope and availability of these incentive programs could materially impact the demand for our related products, our financial condition and results of operations.

Item 1B. | Unresolved Staff Comments |

None.

Item 2. | Properties |

Our principal executive office and headquarters is located in Buffalo, New York, in a leased facility. As of December 31, 2017, we operated 34 domestic facilities and 8 foreign facilities, of which 29 were leased and 13 were owned. We believe the facilities we operate and their equipment are effectively utilized, well maintained, in good condition, and will be able to accommodate our capacity needs to meet current levels of demand. Our North American and Asian manufacturing sites are located to optimize customer service, market requirements, distribution capability and freight costs. We continuously review

14

our anticipated requirements for facilities and, on the basis of that review, may from time to time acquire additional facilities and/or dispose of existing facilities. Most recently, our operational excellence initiatives and portfolio changes have enabled us to reduce, and may further reduce in the future, the number of facilities necessary to meet our customer needs.

Item 3. | Legal Proceedings |

From time to time, the Company is named a defendant in legal actions arising out of the normal course of business. The Company is not a party to any material pending legal proceedings. The Company is also not a party to any other pending legal proceedings other than ordinary, routine litigation incidental to its business. The Company maintains liability insurance against risks arising out of the normal course of business.

Item 4. | Mine Safety Disclosures |

Not applicable.

15

PART II

Item 5. | Market for Common Equity and Related Stockholder Matters |

As of December 31, 2017, there were 69 shareholders of record of the Company’s common stock. However, the Company believes that it has a significantly higher number of shareholders because of the number of shares that are held by nominees.

The Company’s common stock is traded in the over-the-counter market and quoted on the NASDAQ Global Select Market (“NASDAQ”) under the symbol “ROCK.” The following table sets forth the high and low sale prices per share for the Company’s common stock for each quarter of 2017 and 2016 as reported on the NASDAQ Stock Exchange.

2017 | 2016 | ||||||||||||||

High | Low | High | Low | ||||||||||||

Fourth Quarter | $ | 33.25 | $ | 29.85 | $ | 47.85 | $ | 34.65 | |||||||

Third Quarter | $ | 35.85 | $ | 26.85 | $ | 39.28 | $ | 31.92 | |||||||

Second Quarter | $ | 40.45 | $ | 30.90 | $ | 32.10 | $ | 25.12 | |||||||

First Quarter | $ | 44.60 | $ | 38.70 | $ | 28.60 | $ | 18.78 | |||||||

The Company did not declare cash dividends during the years ended December 31, 2017 and 2016. Cash dividends are declared at the discretion of the Company’s Board of Directors. The Board of Directors determines to pay dividends based upon such factors as the Company’s cash flow, financial condition, capital requirements, debt covenant requirements, and other relevant conditions.

Equity Compensation Plan Information

The following table summarizes information as of December 31, 2017 concerning securities authorized for issuance under the Company’s equity based incentive compensation plans:

Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options | Weighted- Average Exercise Price of Outstanding Options | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (1) | ||||||

Equity Compensation Plans Approved by Security Holders | 247,666 | $ | 17.01 | 427,007 | |||||

1 | Consists of the Gibraltar Industries, Inc. 2016 Stock Plan for Non-Employee Directors and the 2015 Equity Incentive Plan (the Plans). Note 12 of the Company’s audited consolidated financial statements included in Item 8 of this Annual Report on Form 10-K provides additional information regarding the Plans and securities issuable upon exercise of options. All currently effective equity compensation plans have been approved by the Company’s shareholders. |

16

Performance Graph

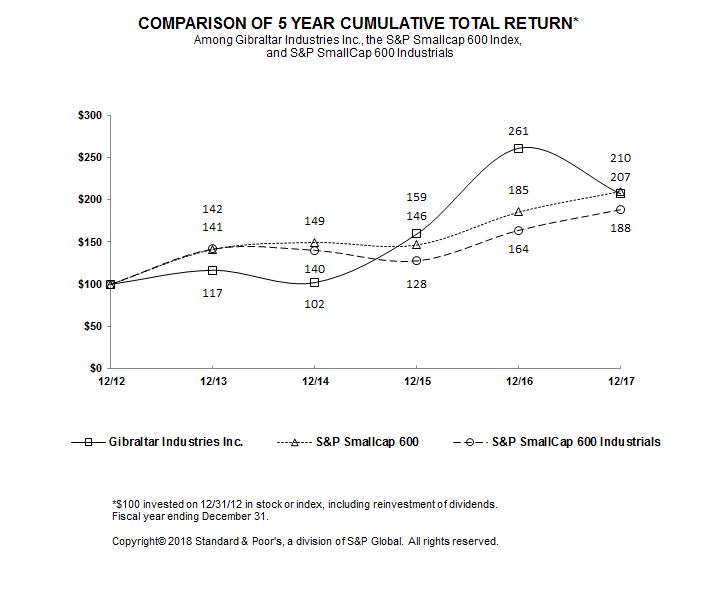

The performance graph shown below compares the cumulative total shareholder return on the Company’s common stock, based on the market price of the common stock, with the total return of the S&P SmallCap 600 Index and the S&P SmallCap 600 Industrials Index for the five-year period ended December 31, 2017. The comparison of total return assumes that a fixed investment of $100 was invested on December 31, 2012 in common stock and in each of the foregoing indices and further assumes the reinvestment of dividends. The stock price performance shown on the graph is not necessarily indicative of future price performance.

17

Item 6. | Selected Financial Data |

The selected historical consolidated financial data for each of the five years presented ended December 31 (in thousands, except per share data) are derived from the Company’s audited financial statements as reclassified for discontinued operations. The selected historical consolidated financial data should be read in conjunction with the Company’s audited consolidated financial statements and notes thereto contained in Item 8 and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” set forth in Item 7 of this Annual Report on Form 10-K.

Years Ended December 31, | |||||||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

Net sales | $ | 986,918 | $ | 1,007,981 | $ | 1,040,873 | $ | 862,087 | $ | 827,567 | |||||||||

Intangible asset impairment | $ | 247 | $ | 10,175 | $ | 4,863 | $ | 107,970 | $ | 23,160 | |||||||||

Income (loss) from operations | $ | 92,849 | $ | 73,488 | $ | 48,732 | $ | (70,417 | ) | $ | 21,480 | ||||||||

Interest expense | $ | 14,032 | $ | 14,577 | $ | 15,003 | $ | 14,421 | $ | 22,489 | |||||||||

Income (loss) before taxes | $ | 77,908 | $ | 49,983 | $ | 37,100 | $ | (84,750 | ) | $ | (832 | ) | |||||||

Provision for (benefit of) income taxes | $ | 14,943 | $ | 16,264 | $ | 13,624 | $ | (2,958 | ) | $ | 4,797 | ||||||||

Income (loss) from continuing operations | $ | 62,965 | $ | 33,719 | $ | 23,476 | $ | (81,792 | ) | $ | (5,629 | ) | |||||||

Income (loss) from continuing operations per share – Basic | $ | 1.98 | $ | 1.07 | $ | 0.75 | $ | (2.63 | ) | $ | (0.18 | ) | |||||||

Weighted average shares outstanding – Basic | 31,701 | 31,536 | 31,233 | 31,066 | 30,930 | ||||||||||||||

Income (loss) from continuing operations per share – Diluted | $ | 1.95 | $ | 1.05 | $ | 0.74 | $ | (2.63 | ) | $ | (0.18 | ) | |||||||

Weighted average shares outstanding – Diluted | 32,250 | 32,069 | 31,545 | 31,066 | 30,930 | ||||||||||||||

Current assets | $ | 462,764 | $ | 391,197 | $ | 351,422 | $ | 360,431 | $ | 322,400 | |||||||||

Current liabilities | $ | 171,033 | $ | 152,088 | $ | 185,395 | $ | 134,085 | $ | 119,913 | |||||||||

Total assets | $ | 991,385 | $ | 918,245 | $ | 889,772 | $ | 810,471 | $ | 889,571 | |||||||||

Total debt | $ | 210,021 | $ | 209,637 | $ | 209,282 | $ | 209,911 | $ | 209,416 | |||||||||

Total shareholders’ equity | $ | 531,719 | $ | 460,880 | $ | 410,086 | $ | 387,229 | $ | 471,749 | |||||||||

Capital expenditures | $ | 11,399 | $ | 10,779 | $ | 12,373 | $ | 23,291 | $ | 14,940 | |||||||||

Depreciation | $ | 12,929 | $ | 14,477 | $ | 17,869 | $ | 19,712 | $ | 20,478 | |||||||||

Amortization | $ | 8,761 | $ | 9,637 | $ | 12,679 | $ | 5,720 | $ | 6,572 | |||||||||

18

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with the Company’s risk factors and its consolidated financial statements and notes thereto included in Item 1A and Item 8, respectively, of this Annual Report on Form 10-K. Certain information set forth herein Item 7 constitutes “forward-looking statements” as that term is used in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based, in whole or in part, on management’s beliefs, estimates, assumptions, and currently available information. For a more detailed discussion of what constitutes a forward-looking statement and of some of the factors that could cause actual results to differ materially from such forward-looking statements, please refer to the “Safe Harbor Statement” on page 3 of this Annual Report on Form 10-K.

Company Overview

Gibraltar Industries, Inc. (the "Company") is a leading manufacturer and distributor of building products for residential, industrial, infrastructure, renewable energy and conservation markets. Our business strategy focuses on significantly elevating and accelerating the growth and financial returns of the Company. We strive to deliver best-in-class, sustainable value creation for our shareholders for the long-term. This strategy is intended to drive a transformational change in the Company’s portfolio and its financial results. It has four key elements which are: operational excellence, product innovation, portfolio management, and acquisitions as a strategic accelerator.

The Company serves customers primarily throughout North America and, to a lesser extent, Asia. Our customers include major home improvement retailers, wholesalers, industrial distributors, contractors, solar developers and institutional and commercial growers of plants. As of December 31, 2017, we operated 42 facilities in 17 states, Canada, China and Japan which includes 30 manufacturing facilities and six distribution centers, giving us a base of operations to provide customer support, delivery, service and quality to a number of regional and national customers and providing us with manufacturing and distribution efficiencies in North America, as well as a presence in Asian markets.

The Company operates and reports its results in the following three reporting segments:

• | Residential Products; |

• | Industrial and Infrastructure Products; and |

• | Renewable Energy and Conservation |

The end markets our businesses serve include residential housing, industrial manufacturing, transportation infrastructure, and renewable energy and conservation. These end markets are subject to economic conditions that are influenced by various factors. These factors include but are not limited to changes in general economic conditions, interest rates, exchange rates, commodity costs, demand for residential construction, demand for repair and remodeling, governmental policies and funding, tax policies and incentives, the level of non-residential construction and infrastructure projects, need for protection of high value assets, demand for renewable energy sources and climate change.

Residential construction markets remain relatively steady with U.S. new housing starts of 1.2 million up modestly from 2016. Residential repair, remodeling and re-roofing related activity increased impacting demand for our roof-related products. Demand for safe, secure and convenient delivery of packages in a fast-growing on-line consumer sales environment drove demand for our electronic package solutions.

Increased levels of state matching-funds for infrastructure projects increased bridge repair and maintenance projects. This growing demand is reflected in the growth of our infrastructure backlog. Protection standards created to secure high value power utility sites and transportation infrastructure impacts demand for perimeter security products.

The long-term attractiveness of renewable energy continues to drive additional investment in solar electricity generation, while governmental policy changes have created uncertainty in the industry. Concerns around climate change are increasing demand for locally sourced food and need for seed development which impacts demand for greenhouses.

Commodity prices for materials such as steel and aluminum rose steadily during 2017. These fluctuations impact the cost of raw materials we purchase and the pricing we offer to our customers.

We believe the key elements of our strategy will allow us to respond timely to changes in these factors. We have and expect to continue to examine the need for restructuring of our operations, including consolidation of facilities, reducing overhead costs, curtailing investments in inventory, and managing our business to generate incremental cash. Additionally, we believe our

19

current strategy has enabled us to better react to fluctuations in commodity costs and customer demand, and has helped in improving margins. We have used the improved cash flows generated by these initiatives to maintain low levels of debt, improve our liquidity position, and invest in growth initiatives. Overall, we are striving to achieve stronger financial results, make more efficient use of capital, and deliver higher shareholder returns.

Results of Operations

Year Ended December 31, 2017 Compared to Year Ended December 31, 2016

The following table sets forth selected results of operations data (in thousands) and its percentages of net sales for the years ended December 31:

2017 | 2016 | ||||||||||||

Net sales | $ | 986,918 | 100.0 | % | $ | 1,007,981 | 100.0 | % | |||||

Cost of sales | 750,374 | 76.0 | % | 763,219 | 75.7 | % | |||||||

Gross profit | 236,544 | 24.0 | % | 244,762 | 24.3 | % | |||||||

Selling, general, and administrative expense | 143,448 | 14.6 | % | 161,099 | 16.0 | % | |||||||

Intangible asset impairment | 247 | — | % | 10,175 | 1.0 | % | |||||||

Income from operations | 92,849 | 9.4 | % | 73,488 | 7.3 | % | |||||||

Interest expense | 14,032 | 1.4 | % | 14,577 | 1.4 | % | |||||||

Other expense | 909 | 0.1 | % | 8,928 | 0.9 | % | |||||||

Income before taxes | 77,908 | 7.9 | % | 49,983 | 5.0 | % | |||||||

Provision for income taxes | 14,943 | 1.5 | % | 16,264 | 1.7 | % | |||||||

Income from continuing operations | 62,965 | 6.4 | % | 33,719 | 3.3 | % | |||||||

Loss from discontinued operations | (405 | ) | (0.1 | )% | (44 | ) | — | % | |||||

Net income | $ | 62,560 | 6.3 | % | $ | 33,675 | 3.3 | % | |||||

The following table sets forth the Company’s net sales by reportable segment for the years ended December 31 (in thousands):

Change due to | |||||||||||||||||||||||