Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AMAG PHARMACEUTICALS, INC. | amag8-kxq417earningsrelease.htm |

| EX-99.1 - EXHIBIT 99.1 - AMAG PHARMACEUTICALS, INC. | ex991.htm |

AMAG Pharmaceuticals

2017 Financial Results

February 27, 2018

Forward-Looking Statements

2

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995 (PSLRA) and other federal securities laws. Any statements contained herein which do not describe historical facts,

including, among others, beliefs about the data for the new broad iron deficiency anemia Ferhamem label and the impact of

reports of hypophosphatemia; expectations regarding the market opportunity for Feraheme, including with the new broad

label; plans for the new Feraheme label’s launch strategy and growth drivers, including AMAG’s ability to expand access,

reinforce and enhance differentiation and expand patient types; beliefs about the importance patients place on the

attributes of the Makena auto-injector; expectations that the Makena auto-injector will be used in a majority of treated

patients assuming price parity; beliefs that the Makena auto-injector could become the new standard of care; attributes that

differentiate Intrarosa from other therapies; beliefs about the market opportunity for Intrarosa; plans for AMAG’s campaign

to educate and expand awareness of dyspareunia and treatment options; the key growth drivers for Intrarosa; beliefs that

AMAG has a strong liquidity profile; AMAG’s 2018 financial guidance, including total revenue, operating loss and adjusted

EBITDA; and AMAG’s 2018 key priorities are forward-looking statements which involve risks and uncertainties that could

cause actual results to differ materially from those discussed in such forward-looking statements.

Such risks and uncertainties include, among others, the possibility that AMAG’s expectations as to its 2018 plans will not be

realized, expectations for the recently approved Makena subcutaneous auto-injector and the Feraheme label expansion will

not be achievable, and that the entrance of generics to the Makena intramuscular formulation could happen more quickly

than anticipated in light of the loss of exclusivity in February 2018, and those other risks identified in AMAG’s filings with the

U.S. Securities and Exchange Commission (the “SEC”), including its Annual Report on Form 10-K for the year ended December

31, 2016 and subsequent filings with the SEC, including its upcoming Annual Report on Form 10-K for the year ended

December 31, 2017. Any such risks and uncertainties could materially and adversely affect AMAG’s results of operations, its

profitability and its cash flows, which would, in turn, have a significant and adverse impact on AMAG’s stock price. AMAG

cautions you not to place undue reliance on any forward-looking statements, which speak only as of the date they are made

AMAG disclaims any obligation to publicly update or revise any such statements to reflect any change in expectations or in

events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that

actual results will differ from those set forth in the forward-looking statements.

AMAG Pharmaceuticals® and Feraheme® are registered trademarks of AMAG Pharmaceuticals, Inc. MuGard® is a registered

trademark of Abeona Therapeutics, Inc. Makena® is a registered trademark of AMAG Pharma USA, Inc. Cord Blood Registry®

and CBR® are registered trademarks of CbrSystems, Inc. Intrarosa® is a trademark of Endoceutics, Inc.

Today’s Agenda

3

2017 Highlights and Recent Events1

4 Key Priorities and Closing Remarks

3 2017 Financial Overview

5 Q&A

2 Product Portfolio Update

2017 Highlights and

Recent Events

Solid Execution

Intrarosa

Launched Intrarosa; drove broad awareness and access

Phase 3 hypoactive sexual desire disorder (HSDD) study initiated by partner, Endoceutics

Bremelanotide

Completed clinical work with partner, Palatin, for planned NDA submission in Q1-2018

Launched HCP condition awareness campaign

Feraheme

Received FDA approval for broad IDA label (February 2, 2018)

Grew volume prior to FDA approval of expanded label

Makena

Received FDA approval for subcutaneous (SC) auto-injector (February 14, 2018)

Achieved record sales of $387.2 million, an increase of 16% over 2016

Cord Blood Registry

Increased storage revenue by $7.4 million, or 9%, over 2016

Grew new first-time enrollments by 4% over 2016

Business Development

Expanded product portfolio with Intrarosa and bremelanotide; established new

women’s health commercial team

Financial

Achieved record revenue of $610M, with revenue growth of every key AMAG product over 2016

Reduced debt by nearly 20%, ending 2017 with total debt of $816M and cash of $329M

5

Solid Execution

Intrarosa

Launched Intrarosa; drove broad awareness and access

Phase 3 hypoactive sexual desire disorder (HSDD) study initiated by partner, Endoceutics

Bremelanotide

Completed clinical work with partner, Palatin, for planned NDA submission in Q1-2018

Launched HCP condition awareness campaign

Feraheme

Received FDA approval for broad IDA label (February 2, 2018)

Grew volume prior to FDA approval of expanded label

Makena

Received FDA approval for subcutaneous (SC) auto-injector (February 14, 2018)

Achieved record sales of $387.2 million, an increase of 16% over 2016

Cord Blood Registry

Increased storage revenue by $7.4 million, or 9%, over 2016

Grew new first-time enrollments by 4% over 2016

Business Development

Expanded product portfolio with Intrarosa and bremelanotide; established new

women’s health commercial team

Financial

Achieved record revenue of $610M, with revenue growth of every key AMAG product over 2016

Reduced debt by nearly 20%, ending 2017 with total debt of $816M and cash of $329M

6

Strong 2017 Product Revenue Growth1

($M)

2016 2017

$531.8

$609.8

GAAP Product Revenue

14.7%

7

2016 2017

$548.8

$615.3

Non-GAAP Product Revenue2,3

12.1%

Makena revenue CBR revenueFeraheme/MuGard revenue Intrarosa revenue

1 Excludes “License fee, collaboration and other revenues” of $317,000 in 2016, and $124,000 in 2017.

2 Non-GAAP revenue includes purchase accounting adjustments related to CBR deferred revenue of $17M in 2016 and $5.5M in 2017.

3 See slide 34 for a reconciliation of GAAP to non-GAAP financials.

Treatment of iron

deficiency anemia (IDA)

in all eligible adult

patients

The only FDA-approved

therapy to reduce

recurrent preterm birth

in certain at-risk women

World’s largest umbilical

cord stem cell collection

and storage company

Candidate for the

treatment of severe

preeclampsia

An investigational

product for the

treatment of hypoactive

sexual desire disorder

(HSDD) in pre-

menopausal women

Management of oral

mucositis, a common

side effect of radiation or

chemotherapy

Maternal and Women’s HealthHematology /

Oncology Pregnancy

& Birth

Wellness

Post-Menopausal

Health

Velo

Option

Bremelanotide

FDA-approved locally

administered non-

estrogen1 product to

treat moderate to

severe dyspareunia

(pain during sex), a

symptom of vulvar and

vaginal atrophy (VVA),

due to menopause,

which does not carry a

boxed warning in its

label

81 Intrarosa is converted by enzymes in the body into androgens and estrogens, though the mechanism of action is not fully established.

AMAG’s Expanding Portfolio of Products

Product Portfolio Update

•Feraheme®

• Makena®

• Cord Blood Registry®

• Intrarosa®

9

FERAHEME® is the only IV

iron demonstrating effective

treatment for IDA in adult

patients with 1g of iron

across 2 fifteen-minute

infusions 3-8 days apart

10

Feraheme Broad IDA Label1 Approved February 2, 2018

Strong Data in New Broad

IDA Feraheme Label…

I V I R O N D E F I C I E N C Y A N E M I A : F E R A H E M E

1 Feraheme is indicated for the treatment of iron deficiency anemia (IDA) in adult patients who have intolerance to oral iron or have had

unsatisfactory response to oral iron or who have chronic kidney disease (CKD).

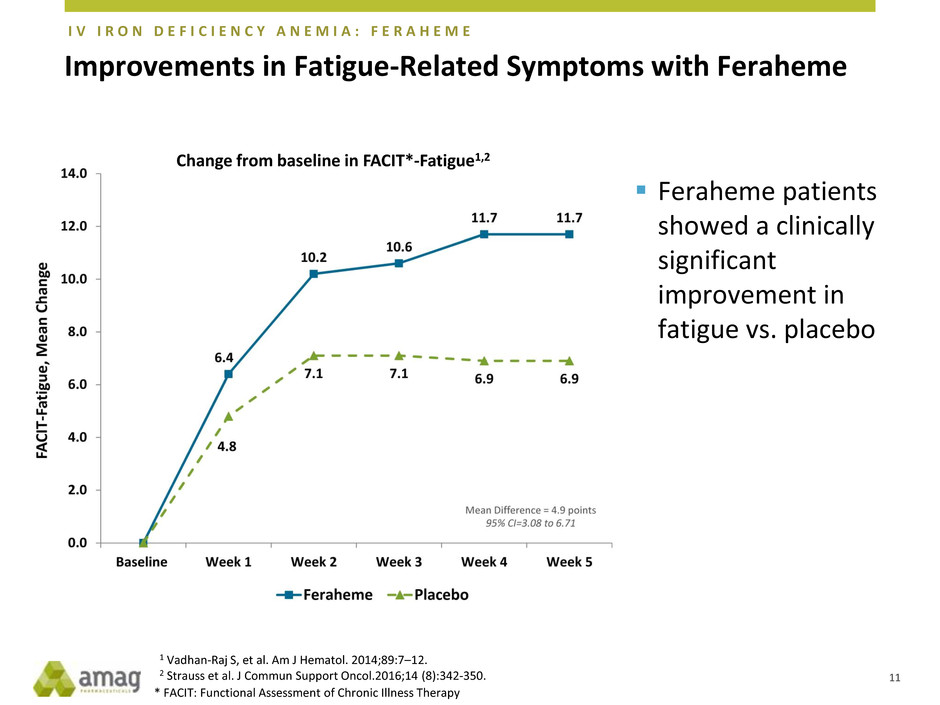

Improvements in Fatigue-Related Symptoms with Feraheme

11

I V I R O N D E F I C I E N C Y A N E M I A : F E R A H E M E

* FACIT: Functional Assessment of Chronic Illness Therapy

1 Vadhan-Raj S, et al. Am J Hematol. 2014;89:7–12.

2 Strauss et al. J Commun Support Oncol.2016;14 (8):342-350.

Change from baseline in FACIT*-Fatigue1,2

Feraheme patients

showed a clinically

significant

improvement in

fatigue vs. placebo

12

Lower Incidence of Severe Hypophosphatemia with Feraheme1

Hypophosphatemia can have important clinical implications2

– Acutely: muscle weakness and pain, fatigue

– Chronically: osteomalacia (impaired bone mineralization), bone pain, fractures, muscle weakness

I V I R O N D E F I C I E N C Y A N E M I A : F E R A H E M E

*** P<0.001, ANCOVA, Error bars represent 95% Confidence Interval

Shading represents lab normal reference range

Incidence of Serum Phosphate <0.6 mmol/L (2.0mg/dL) Mean Serum Phosphate (mg/dL)

1 Adkinson NF et al. Am J Hematol. 2018 Feb 8. doi: 10.1002/ajh.25060.

2 Blazevic A et al., The Netherlands Journal of Medicine, January 2014, Vol. 72, No. 1; Mani et al., Transplantation: October 15, 2010, Vol. 90, No. 7,

pp 804-805; Zoller H. et al, Curr Opin Nephrol Hypertens July 2017, Vol. 26, No. 4, pp.266-275.

Large Market Opportunity with New Broad Label

Feraheme

12%

Injectafer

29%

Other IV irons

59%

13

I V I R O N D E F I C I E N C Y A N E M I A : F E R A H E M E

Q4-2017 U.S. Non-dialysis IV Iron Market1

1 AMAG estimates current market using IQVIA data and internal analytics.

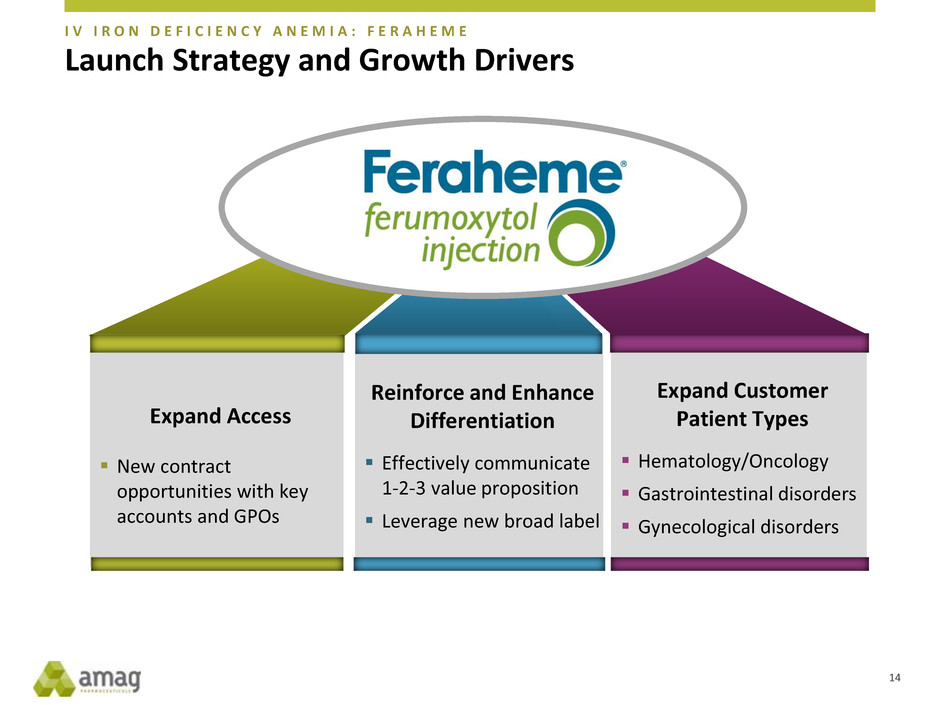

Launch Strategy and Growth Drivers

14

Expand Access

New contract

opportunities with key

accounts and GPOs

Expand Customer

Patient Types

Hematology/Oncology

Gastrointestinal disorders

Gynecological disorders

Reinforce and Enhance

Differentiation

Effectively communicate

1-2-3 value proposition

Leverage new broad label

I V I R O N D E F I C I E N C Y A N E M I A : F E R A H E M E

Product Portfolio Update

• Feraheme®

•Makena®

• Cord Blood Registry®

• Intrarosa®

15

Efficient

Discreet

Administration friendly

16

Makena SC Auto-injector Approved February 14, 2018

M A T E R N A L H E A L T H : M A K E N A

Subcutaneous injection Intramuscular injection

17

SC Attributes Important to Patients

1%

2%

10%

25%

28%

34%

0% 5% 10% 15% 20% 25% 30% 35% 40%

Site of injection

Needle thickness

Route of administration

Needle visibility

Needle length

Time for administration

Relative Importance

Statistically significant impact on overall preference

M A T E R N A L H E A L T H : M A K E N A

Top Drivers in Discreet Choice Analysis1

1 AMAG sponsored “Discrete Choice” patient survey conducted by Trinity Healthcare; n=183.

18

Makena SC Auto-injector Expected to be Used in

Majority of Treated Patients Assuming Price Parity1

M A T E R N A L H E A L T H : M A K E N A

6%

2%

2%

8%

83%

Future Prescribing3

(MDs, n=20)

Current Prescribing2

(HCPs, n=30)

8%

18%

67%

N/A

N/A Makena SC4

Makena IM

Generic HPC

single-dose vial4

Compounded

IM / HPC

Vaginal

Progesterone

Makena SC4

Makena IM

Generic HPC

single-dose vial4

Compounded

IM / HPC

Vaginal

Progesterone

Current and Future Use of Treatments to Reduce Risk of Preterm Birth

1 AMAG sponsored qualitative research conducted by Thinkgen.

2 Re-percentaged to exclude those patients who did not receive treatment. Respondents were asked “Of the at-risk patients you personally

managed in the past 12 months, what number received the following treatments? Your best estimate is fine.”

3 Respondents were asked to allocate their next 10 patients across treatments, adding the instruction after fielding began to assume that

Makena subcutaneous and a generic single-dose vial were available. Respondents were told not to consider product cost and coverage

when allocating future patients.

4 Included in the “Future Prescribing” allocation only.

19

Ensure SC Auto-injector Becomes the New Standard of Care

M A T E R N A L H E A L T H : M A K E N A

Expand use through

alternative treatment sites

(i.e. retail pharmacies)

Rapid and easy dispensing

of SC auto-injector

Key Imperatives Key Tactics

Manage access (price,

patient out-of-pocket,

reimbursement)

Easy access to SC auto-

injector with strong payer

value proposition

Effectively communicate the

benefits of SC auto-injector

~100 Makena sales reps,

Makena Care Connection

and distribution partners

Product Portfolio Update

• Feraheme®

• Makena®

•Cord Blood Registry®

• Intrarosa®

20

Returned to Growth

21

14,767

15,379

Q4-2016 Q4-2017

W O M E N ’ S H E A L T H : C O R D B L O O D R E G I S T R Y

Growth in First New EnrollmentsStrong commercial execution

driving new enrollments

2/3 of revenue driven by growing,

recurring annual storage fees

Product Portfolio Update

• Feraheme®

• Makena®

• Cord Blood Registry®

•Intrarosa®

22

Non-estrogen

treatment2

Unique safety profile

(no boxed warning)

Differentiated

MOA

23

Intrarosa is Differientiated1

W O M E N ’ S H E A L T H : I N T R A R O S A

1 Market research sponsored by AMAG and conducted by Roscow Market Research.

2 Intrarosa is converted by enzymes in the body into androgens and estrogens, though the mechanism of action is not fully established.

24

Dyspareunia: 90% of Affected Women Not on Rx Therapy

W O M E N ’ S H E A L T H : I N T R A R O S A

20M women in U.S. suffer from dyspareunia, a symptom of VVA1

+18 Million2

U.S. women with dyspareunia

not on prescription therapy

~1.7 Million2

U.S. women with dyspareunia

treated with prescription therapy

1 Intrarosa is a steroid indicated for the treatment of moderate to severe dyspareunia, a symptom of vulvar and vaginal atrophy, due to menopause.

2 AMAG estimate based on Wysocki et al. Management of Vaginal Atrophy: Implications from the REVIVE Survey. Clinical Medicine Insights: Reproductive

Health 2014:8 23–30; Kingsberg et al. Vulvar and Vaginal Atrophy in Postmenopausal Women: Findings from the REVIVE Survey. J Sex Med 2013;101790-

1799; and F. Palma et al: Vaginal atrophy of women in postmenopause. Results from a multicentric observational study: The AGATA study.

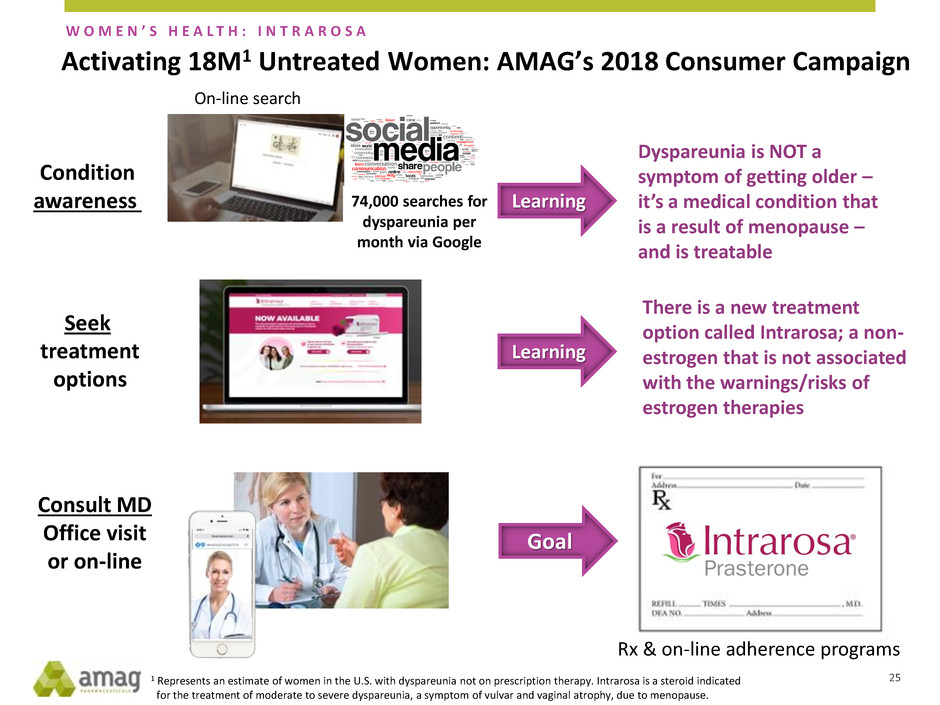

Activating 18M1 Untreated Women: AMAG’s 2018 Consumer Campaign

W O M E N ’ S H E A L T H : I N T R A R O S A

25

Seek

treatment

options

Consult MD

Office visit

or on-line

Condition

awareness

On-line search

74,000 searches for

dyspareunia per

month via Google

Dyspareunia is NOT a

symptom of getting older –

it’s a medical condition that

is a result of menopause –

and is treatable

Learning

There is a new treatment

option called Intrarosa; a non-

estrogen that is not associated

with the warnings/risks of

estrogen therapies

Learning

Goal

Rx & on-line adherence programs

1 Represents an estimate of women in the U.S. with dyspareunia not on prescription therapy. Intrarosa is a steroid indicated

for the treatment of moderate to severe dyspareunia, a symptom of vulvar and vaginal atrophy, due to menopause.

26

Key Intrarosa Growth Drivers

Launch

Priority

1

Launch

Priority

2

Launch

Priority

3

Create affordable access for all patients

Increase market awareness

Increase HCP prescribing

Launch

Priority

4

Launch

Priority

5

Make Intrarosa the 1st choice treatment among HCPs

Educate potential patients about condition

and Intrarosa as therapy

New in 2018

Intrarosa

Growth

Strategy

W O M E N ’ S H E A L T H : I N T R A R O S A

Financial Overview

27

$151.61 $158.3

1

$14.6

($7.1)

$531.81

$609.81

$78.9

($293.3)

Q4-2016 Q4-2017

4.4%

FY 2016 FY 2017

14.7%

3-months Ended December 31 12-months Ended December 31

1 Excludes “License fee, collaboration and other revenues” of $4,000 in Q4-2016, $70,000 in Q4-2017, $317,000 in 2016, and $124,000 in 2017.

Strong Financial Results While Investing in the Future

28

GAAP Product Revenue and Operating Income/Loss ($M)

Makena revenue CBR revenueFeraheme/MuGard revenue

GAAP operating income (loss)Intrarosa revenue

$153.02 $159.62

$77.4 $65.7

Strong Financial Results While Investing in the Future

$548.82

$230.1

$615.32

$265.7

FY 2016 FY 2017

12.1%

Q4-2016 Q4-2017

4.3%

1 See slide 34 for a reconciliation of GAAP to non-GAAP financials.

2 Excludes “License fee, collaboration and other revenues” of $4,000 in Q4-2016, $70,000 in Q4-2017, $317,000 in 2016, and $124,000 in 2017.

3 Includes purchase accounting adjustments related to CBR deferred revenue of $1.4M in Q4-2016 and Q4-2017, $17.0M in 2016, and $5.5M in 2017.

29

3-months Ended December 31 12-months Ended December 31

Non-GAAP Product Revenue and Adjusted EBITDA ($M)1

Makena revenue CBR revenue3Feraheme/MuGard revenue

Non-GAAP adjusted EBITDAIntrarosa revenue

Strong Liquidity Profile

($M) 12/31/17 12/31/16

Cash, cash equivalents and investments $329 $ 579

Principal debt outstanding

Convertible senior notes (2.5%) due 2019 $ 21 $ 200

Convertible senior notes (3.25%) due 2022 320 --

Term loan facility (4.75%) due 2021 (repaid in May 2017) -- 328

Senior notes (7.875%) due 2023 475 500

Total debt outstanding $816 $1,028

Balance sheet improved to align with evolving business strategy:

‒ De-levered by ~20%

‒ Extended maturities and repaid term loan

‒ Forward net leverage ratio ~4.2x1

30

1 Net leverage ratio derived from netting cash balance as of 12/31/17 from debt balance as of 12/31/17, divided by

mid-point of EBITDA guidance for 2018.

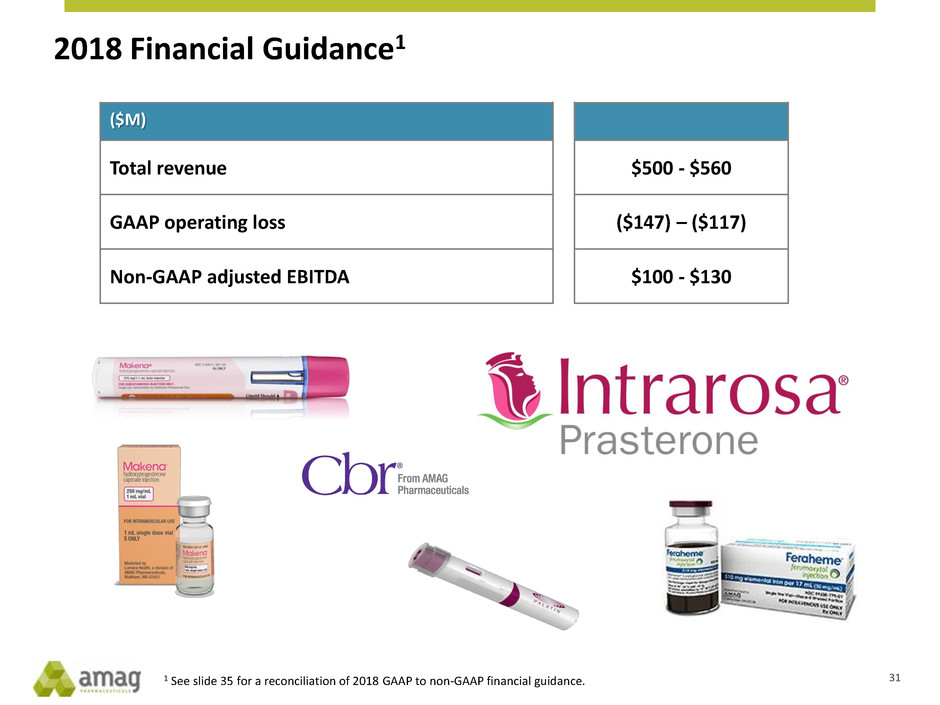

2018 Financial Guidance1

($M)

Total revenue $500 - $560

GAAP operating loss ($147) – ($117)

Non-GAAP adjusted EBITDA $100 - $130

1 See slide 35 for a reconciliation of 2018 GAAP to non-GAAP financial guidance. 31

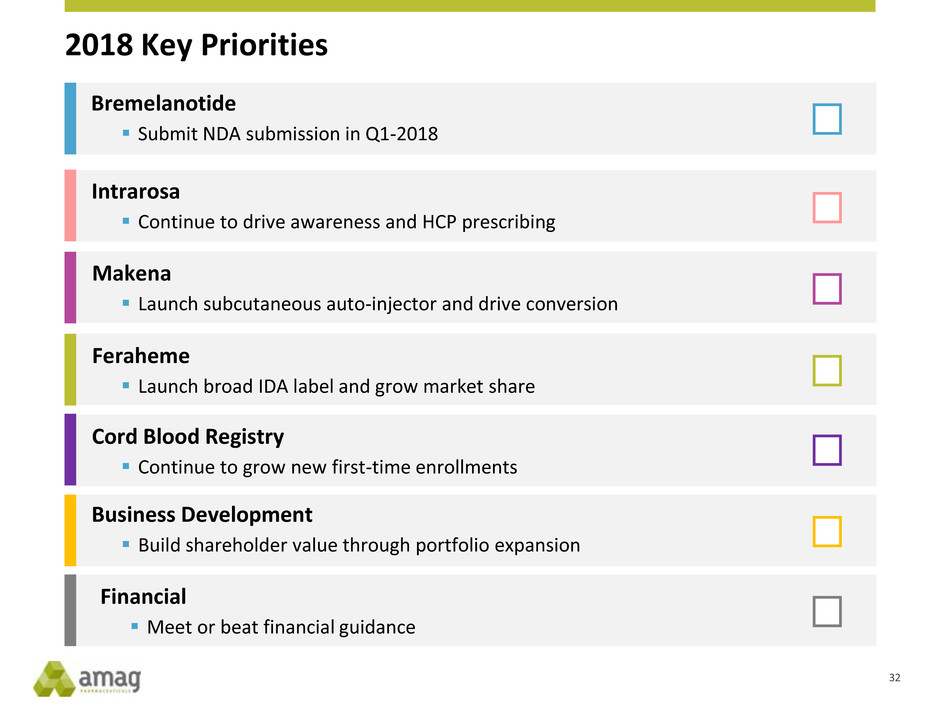

2018 Key Priorities

Intrarosa

Continue to drive awareness and HCP prescribing

Feraheme

Launch broad IDA label and grow market share

Makena

Launch subcutaneous auto-injector and drive conversion

Cord Blood Registry

Continue to grow new first-time enrollments

Business Development

Build shareholder value through portfolio expansion

Financial

Meet or beat financial guidance

Bremelanotide

Submit NDA submission in Q1-2018

32

AMAG Pharmaceuticals

Q&A

February 27, 2018

Appendix

Reconciliation of GAAP to Non-GAAP 2017 Financial Results

35

($M)

GAAP operating income (loss)

Purchase accounting adjustments related to CBR

deferred revenue

Depreciation and intangible asset amortization

Non-cash inventory step-up adjustments

Stock-based compensation

Adjustments to contingent consideration

Impairment charges of intangible assets

Acquisition related costs

Acquired IPR&D

Restructuring costs

Non-GAAP adjusted EBITDA

Q4-2017 Q4-2016 2017 2016

($7.1) $14.6 ($293.3) $78.9

1.4 1.4 5.5 17.0

65.6 29.1 153.3 94.2

0.9 1.0 2.3 5.7

5.4 5.7 23.5 22.5

(0.5) 20.6 (47.7) 25.7

-- 3.7 319.2 19.7

-- 1.3 1.5 1.3

-- -- 65.8 --

-- -- -- 0.7

$65.7 $77.4 $230.1 $265.7

Reconciliation of GAAP to Non-GAAP 2018 Financial Guidance

36

($M) 2018 Financial Guidance

Operating loss ($147) – ($117)

Depreciation & intangible asset amortization 200

Stock-based compensation 23

Non-cash inventory step up and adjustments to contingent consideration 4

Acquired IPR&D 20

Non-GAAP adjusted EBITDA $100 - $130

Share Count Reconciliation

37

(M)

Weighted average basic shares outstanding

Employee equity incentive awards

GAAP diluted shares outstanding

Employee equity incentive awards

Non-GAAP diluted shares outstanding

4Q-2017 4Q-2016

34.8 34.3

0.1 --1

34.9 34.3

-- 0.8

34.9 35.1

2017 2016

34.9 34.3

--1 --1

34.9 34.3

0.32 0.5

35.2 34.8

1 Employee equity incentive awards would be anti-dilutive in this period.

2 Reflects the non-GAAP dilutive impact of employee equity incentive awards.

22

AMAG Pharmaceuticals

2017 Financial Results

February 27, 2018