Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - SendGrid, Inc. | ex-32d2.htm |

| EX-32.1 - EX-32.1 - SendGrid, Inc. | ex-32d1.htm |

| EX-31.2 - EX-31.2 - SendGrid, Inc. | ex-31d2.htm |

| EX-31.1 - EX-31.1 - SendGrid, Inc. | ex-31d1.htm |

| EX-23.1 - EX-23.1 - SendGrid, Inc. | ex-23d1.htm |

| EX-3.2 - EX-3.2 - SendGrid, Inc. | ex-3d2.htm |

| EX-3.1 - EX-3.1 - SendGrid, Inc. | ex-3d1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☒ |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

||

|

For the fiscal year ended December 31, 2017 |

||

|

|

||

|

or |

||

|

☐ |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

||

|

For the transition period from to |

||

Commission File Number: 001-38275

SendGrid, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware (State or other jurisdiction of incorporation or organization) |

27-0554600 (I.R.S. Employer Identification Number) |

||

1801 California Street, Suite 500

Denver, Colorado 80202

(Address of principal executive offices) (Zip Code)

(888) 985-7363

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

(Name of each exchange on which registered) |

|

Common Stock, par value $0.001 per share |

|

The New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act: Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act: Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment to the Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

|

Accelerated filer ☐ |

|

Non-accelerated filer ☒ (Do not check if a smaller reporting company) |

|

Smaller reporting company ☐ |

|

Emerging Growth Company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The registrant’s common stock was not publicly traded as of the last business day of the registrant’s most recently completed second fiscal quarter.

On February 15, 2018, the registrant had 42,701,210 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its 2018 Annual Meeting of Stockholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K to the extent stated herein. Such Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2017.

SendGrid, Inc.

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2017

2

Unless the content otherwise requires, references in this Annual Report on Form 10-K to “SendGrid,” “company,” “our,” “us,” and “we” refer to SendGrid, Inc. and where appropriate its consolidated subsidiaries.

“SendGrid” and other trademarks or service marks of SendGrid appearing in this Annual Report on Form 10-K are our property. This Annual Report on Form 10-K contains additional trade names, trademarks, and service marks of other companies, which are the property of their respective owners. We do not intend our use or display of other companies’ trade names, trademarks, or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this Annual Report on Form 10-K, including statements regarding our future financial condition, results of operations, business strategy and plans and objectives of management for future operations, as well as statements regarding industry trends, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “believe,” “will,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “predict,” “could,” “potentially” or the negative of these terms or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions described under the section titled “Risk Factors” and elsewhere in this Annual Report on Form 10-K, regarding, among other things:

|

· |

our ability to effectively sustain and manage our growth and future expenses, and our ability to achieve and maintain future profitability; |

|

· |

our ability to attract new customers and to maintain and expand our existing customer base; |

|

· |

our dependence on our self-service model; |

|

· |

our ability to scale and update our platform to respond to customers’ needs and rapid technological change; |

|

· |

our reliance on third parties, including for strategic relationships to sell our services and for network connectivity, hosting and other services; |

|

· |

the effects of increased competition on our market and our ability to compete effectively; |

|

· |

our ability to expand our operations and increase adoption of our platform internationally; |

|

· |

our ability to maintain, protect and enhance our brand; |

|

· |

our customers’ and other platform users’ violation of our policies or misuse of our platform; |

|

· |

the sufficiency of our cash and cash equivalents to satisfy our liquidity needs; |

|

· |

our failure or the failure of our platform of services to comply with applicable industry standards, laws, and regulations; |

|

· |

our ability to maintain our corporate culture; |

|

· |

our ability to hire, retain and motivate qualified personnel; |

|

· |

our ability to identify targets for, execute on and realize the benefits of potential acquisitions; |

3

|

· |

our ability to estimate the size and potential growth of our target market; and |

|

· |

our ability to maintain proper and effective internal controls. |

These risks are not exhaustive. Other sections of this Annual Report on Form 10-K may include additional factors that could adversely impact our business and financial performance. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in, or implied by, any forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Annual Report on Form 10-K.

4

Overview

We are a leading digital communication platform, enabling businesses to engage with their customers via email reliably, effectively and at scale. Our cloud-based platform allows for frictionless adoption and immediate value creation for businesses, providing their developers and marketers with the tools to seamlessly and effectively reach their customers using email. Since our inception we have processed more than one trillion emails.

Increasingly, today’s transactions are digital. They happen online and are often automatic and recurring. Consumers want a seamless experience and have come to expect that their online activity will be recorded in their email inbox. Email serves as the system of record for a consumer’s digital life, delivering purchase receipts, shipping notifications, account information, social media updates, reservations, and website login data. Email is the primary communication channel in the digital world, with 125 billion commercial emails sent every day, according to a 2017 Radicati Group report. Email is also a trusted marketing tool for businesses. Businesses rely on email to send customers notifications, promotions, and personalized content because email is effective, searchable, and permanent. An email-based promotion can reach the right user at the right time, with a high degree of certainty that the user will see it. According to The Inbox Report 2017, in 2016 nearly 80% of Americans checked their email daily. According to a 2015 Direct Marketing Association report, email demonstrated the highest return on investment among all forms of digital communication, generating $38 in revenue for every $1 invested.

While email offers a compelling value proposition for businesses, effective email delivery at scale is complex and difficult. Inbox service providers, including Google Gmail, Microsoft Outlook, and Yahoo! Mail, evaluate incoming email and block the delivery of harmful or unwanted email. However, these filters can also prevent the delivery of wanted email. According to a 2017 Return Path report for the 12-month period ended June 30, 2017, only 80% of wanted email reached its intended recipient. To manage email delivery on their own, businesses must understand the complexities associated with both sending millions or billions of transactional and marketing emails and the unique dynamics of numerous inbox service providers. Dedicated servers and databases, domain expertise, continuous monitoring of email protocols and a team of people are all necessary to maintain a robust internally-developed email communications system. The use of developer resources in this effort can reduce businesses investment in product innovation and other priorities. Without an effective, easy to use system, marketers seeking to reach customers via email can also expend significant time and resources without accomplishing their marketing goals.

SendGrid was founded in 2009 by developers who were frustrated with their own experiences in managing email delivery. They wanted to build a system “that just worked” for developers and allowed them to focus on strategic business activities. They developed a robust technology platform incorporating their domain expertise and created an Application Programming Interface, or API, that allowed for easy integration by businesses. We built our business model around serving the developer, including self-service adoption and a frictionless user experience. We have extended this platform over time to serve the similar email delivery needs of marketers.

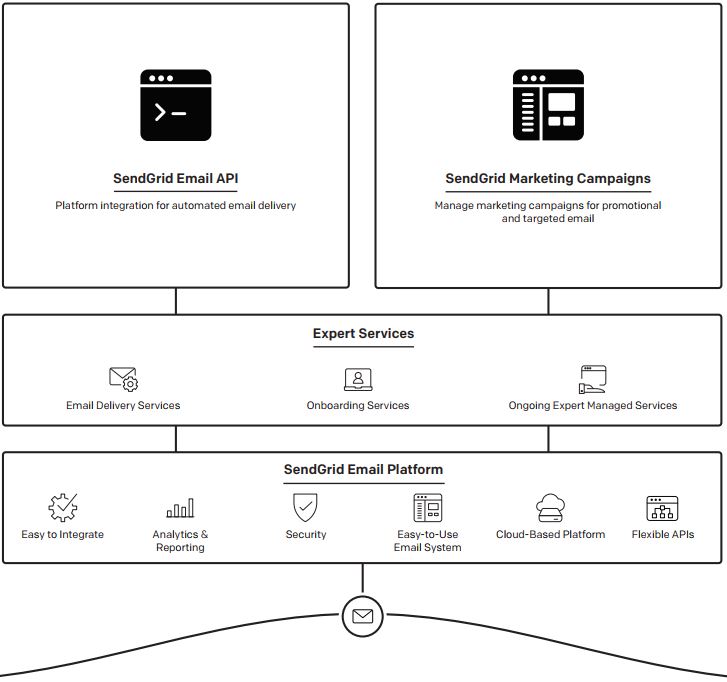

We offer our customers three services: our Email API; Marketing Campaigns; and Expert Services. Our Email API service allows developers to use our API in their preferred development framework to leverage our platform to add email functionality to their applications within minutes. This service enables businesses to send thousands or billions of emails, all with the same high level of service and reliability, and incorporates proprietary technology and domain expertise to significantly improve deliverability rates. Our Marketing Campaigns service allows marketers to upload and manage customer contact lists, create and test email templates, and then execute and analyze multi-faceted email campaigns that engage customers and drive growth. Our Expert Services help businesses further optimize their email delivery. With our platform, businesses can achieve industry leading email deliverability that translates into higher brand engagement with their customers. For 2017, 2016, and 2015, revenue from our Email API service and our Marketing Campaigns service represented 80%, 79%, and 79% and 13%, 9%, and 1% of our total revenue, respectively.

Our category leadership, self-service model, and company culture have enabled us to attract and retain customers and employees and continue to develop innovative solutions for email delivery. Our platform is designed to serve the

5

communication needs of small and midsize businesses, or SMBs, and large enterprises across industries. Our pricing model and extensive document library make our platform accessible to developers and marketers alike, irrespective of their expertise or the scale of their needs. We deliver our services through a self-service cloud-based subscription model, where businesses primarily sign up for our services through our website. We offer transparent and affordable pricing, generally on a per month basis by volume of email and typically paid by credit card. In addition, we have robust documentation for onboarding and ongoing usage. We have developed a broad user and partner community available for help and support. This self-service delivery model has enabled us to rapidly attract customers while operating our business efficiently.

Businesses of all sizes and across industries depend on our digital communication platform. As of December 31, 2017, we had over 63,000 customers globally, an increase of 39% year over year. While we serve large enterprises, we primarily serve SMBs that rely on email to power their businesses and are rapidly adopting cloud services. Our self-service model has allowed us to efficiently acquire SMB customers that historically have not been a focus for companies that depend on large enterprise sales forces. Our robust platform and the increasing breadth of our services allow us to scale with our customers as they grow.

Industry Trends

Email Is the Primary Commercial Communications Channel in the Digital World

Businesses increasingly interact with their customers through digital channels. Many emerging businesses are digital first. They primarily engage with customers through online and mobile channels. Customers of these businesses rarely interact with sales people, collect paper receipts, track orders over the phone or mail in their bills. Customers enjoy and increasingly demand one-click purchases, recurring home deliveries and automated online services and depend on email as their system of record for their transactions.

Businesses send emails to their customers daily because marketers know they can reach a wide audience and personalize interactions, while trusting emails will reach their target recipient. Digital channels allow businesses to engage with their customers in a more personalized way. Consumers leave a digital footprint of their transaction history and preferences, enabling businesses to analyze demographic information and buying behavior in order to deliver highly personalized digital experiences. The emergence of smart phones and other personal devices has enabled convenient online access by consumers, who as a result expect instant access to information and services. These dynamics have created the opportunity for frequent customer engagement and targeted marketing. Businesses must be able to react quickly and effectively in order to take advantage of this opportunity.

Email Is Used for Multiple Business Purposes

Businesses send email in three different forms to connect with customers:

Transactional (Recipient Initiated, One-to-One)

A transactional email is generated whenever an event occurs, such as a purchase, payment, password reset, account creation, shipping notification, and social media update. Nearly all websites and applications require a unique email address to sign up or login, establishing email as the system of record for the transaction.

Marketing (One-to-Many)

One-to-many marketing email is sent as a single message to a large distribution list, and includes promotions, newsletters, buy now, sign up now, and special offers.

Marketing (Personalized, One-to-One)

Personalized marketing email is based on unique data about the recipient and is the most difficult type of marketing email to produce but can be the most valuable to businesses. To generate a personalized marketing email, businesses can apply data analysis techniques to generate an email specific to that user at the right time.

6

Email Is Highly Effective at Driving Customer Engagement and Revenue

Email accounts are widespread, and each is personal to its owner and consistent across time, making email a highly effective method of communication between businesses and consumers. Individuals with email accounts check their email throughout the day, every day. The use of smartphones for always-on access has only increased this effectiveness.

Effective Email Delivery Is Difficult

While email offers a compelling value proposition, businesses struggle to achieve effective email delivery due to a number of factors.

The Email Recipient’s Side

Inbox service providers, including Google Gmail, Microsoft Outlook, and Yahoo! Mail, use sophisticated filters to analyze incoming email and prevent the delivery of harmful or unwanted email, often blocking wanted email as well. Recipient systems analyze factors such as sender reputation, email content, past spam or phishing complaints, invalid addresses, blacklists, and domain name reputation with the goal of verifying legitimate email. If an email does not pass one of these filters, the system will automatically block the email from the recipient’s inbox, with the addressee likely not even knowing it was blocked. The cost of delivery failure includes not only the infrastructure expense associated with processing the email, but more importantly, the lost revenue for a business from a new or existing customer. We estimate businesses lose tens of billions of dollars in revenue every year from failed email delivery.

The Email Sender’s Side

Maintaining an email delivery system is complex. Domain expertise, dedicated resources, and the need to satisfy complex technical requirements are all required to operate an effective email delivery system, particularly at scale.

To be effective, businesses must understand the complexities of building a sender reputation and how to maintain that reputation across inbox service providers, spam houses, blacklist managers and industry watchdogs. This effectiveness requires strong relationships with postmasters at major inbox service providers to understand their protocols and proprietary methods in order to optimize delivery and resolve sender reputation issues quickly. Businesses must also synthesize a vast array of rapidly changing regulations, including privacy laws, that differ significantly by country.

Building and managing an email delivery system is resource-intensive and costly. To deliver billions of emails to thousands of recipients, businesses need dedicated infrastructure, including servers and databases, as well as an understanding of protocols to communicate with the recipient servers, including Simple Mail Transfer Protocol, or SMTP, and APIs. Businesses also need to build, maintain, and manage distribution lists across various applications and integrate relevant information from disparate databases into the email system.

Businesses Are Adopting Cloud Services to Reduce Complexity and Focus on Core Functions

Technological innovation has enabled businesses to improve efficiency, but it has also lowered barriers to entry and raised customer expectations. Businesses of all sizes must adapt quickly to changing market needs in order to grow and compete. As a result, businesses are turning to cloud services to manage complex and costly parts of their IT infrastructure and operations. For example, more than one million companies use Amazon Web Services for computing, network and storage infrastructure, over $20 billion in online payments has been processed by Stripe, over 500,000 businesses are powered by Shopify, and billions of Short Message Service, or SMS, messages have been sent using Twilio. Cloud services can seamlessly provide many of the critical, but non-core, components for a business, allowing it to maximize the value of internal resources by focusing on its core differentiating competencies.

Frictionless, Self-Service Models Are Driving High Adoption of Cloud Services

The ease of cloud service delivery is driving a move from multi-million-dollar capital purchases of on-premises IT infrastructure to recurring lower-cost subscriptions for cloud services. Many cloud services providers are also making it easier for end users to experiment with and adopt their technologies by deploying self-service models. These services

7

enable easy integration with existing IT systems and business workflows. As a result, self-service models enable cloud services providers to broaden their customer reach to include SMBs that have not been well-served by traditional enterprise sales forces. This change has increased the influence of line of business owners, developers and marketers in technology purchasing decisions compared to a traditional Chief Information Officer led purchasing process. Developers at businesses of all sizes can now conduct research to find solutions to meet their needs and adopt cloud services on their own, often using credit cards for purchases instead of purchase orders. This enables developers and marketers to sign up for services on the Internet and be up and running in minutes. With cloud services, developers and marketers exert greater control over how they allocate their resources.

Businesses Need to Effectively and Efficiently Send Wanted Email at Scale

Email is critical to building and growing customer relationships, but it requires significant resources and expertise to manage the complex underlying infrastructure. Businesses are turning to cloud services providers to provide transactional and marketing email services. The developers and marketers who are driving purchasing decisions of cloud services need a transactional and marketing email solution that possesses the following characteristics:

|

· |

Reliability: continuous uptime to send secure emails at any time |

|

· |

Effectiveness: high delivery rates and high consumer engagement |

|

· |

Scalability: ability to send billions of emails across a range of customer use cases, with the same level of effectiveness |

|

· |

Ease of Adoption and Integration: self-service onboarding and integration |

|

· |

Affordability: lower, predictable cost versus an internal system and accessible to businesses of all sizes |

|

· |

Platform Extensibility: integrated transactional and marketing email capabilities |

|

· |

Services and Support: expert help to obtain desired outcomes and enhance email marketing capabilities |

Benefits of Our Solution

Key benefits of our solution include:

Platform Reliability

Businesses rely on our platform to power their customer email communications. We utilize a robust global infrastructure that includes multiple co-located data centers and public cloud resources to host our platform. In 2017, our platform was available for our customers to send email 99.995% of the time. We have invested and continue to invest to improve the reliability of our platform.

Proprietary Technology and Domain Expertise Enables Effective Email Delivery

We significantly improve email deliverability through embedded intellectual property in our platform and industry-leading domain expertise. Our platform is designed to operate at scale across multiple inbox service providers. We have over 180 domain experts in email communication supporting our technology. In 2017 we estimate that we achieved a delivery rate of 94%, as compared to a general delivery rate for wanted email of 80% (as reported by Return Path in 2017 for the 12-month period ended June 30, 2017). Our delivery rates for 2016 and 2015 were consistent with our delivery rate for 2017. We also offer Expert Services to help our customers achieve the best outcomes for their individual needs. We estimate customers who utilize our Expert Services achieve nearly 2% higher deliverability on average, compared to our standard offering.

8

Ability to Scale With Customers As They Grow

Our communication platform provides the same high-quality service to a wide range of businesses, from startups to large enterprises, that send significant email volumes. Our Email API service starts with entry-level pricing of $9.95 that supports up to 40,000 emails per month and scales up from there. Our largest customers send more than one billion emails per month. We recognize that as our customers scale, their needs evolve, and we provide services that help them manage the complexities that emerge.

Frictionless Adoption for Developers and Marketers

We make it easy for developers and marketers to adopt our platform using a self-service model. We provide a flexible API setup to easily add email functionality to their applications which allows developers to begin sending email through our API in minutes. We have comprehensive documentation to help developers write code in their preferred development framework. We also provide 24 x 7 support to help our customers integrate with our platform. We have a community of over 2.9 million active users that serves as a resource for questions about our platform. Marketers seek the same reliable service for marketing email as developers do for transactional email. Therefore, once a business is using our API for transactional email delivery, it is simple for that business to also use our platform for promotional and personalized email marketing.

Affordable and Accessible to Businesses of All Sizes

We offer our Email API service as a monthly subscription, with pricing based on email volume. Our Email API service pricing plans start at $9.95 per month for up to 40,000 emails, providing businesses of all sizes, especially SMBs, with an affordable option for digital customer communication. Businesses can tailor the use of our services for their individual needs, without the need to commit to expensive, multi-year contracts. Our cloud-based services generally provide significant cost savings compared to an internally developed system and free up internal resources for other tasks. Based on our internal estimates and analysis, we believe a typical high-volume customer located in a major metropolitan area could save up to one-third by using our Email API service as compared to the cost of implementing and maintaining an internally-developed email delivery system.

Extensible Communications Platform

Our platform incorporates extensible technology that allows our customers to expand their use cases to improve their customer communications. We introduced our Email API service in 2009, which allowed businesses to send both transactional and marketing emails. We continued to add functionality to our platform and in late 2015, we introduced our Marketing Campaigns service. Businesses that use our Marketing Campaigns service gain more insight about how their customers interact with email, which allows the business to improve deliverability and engagement. Our customers benefit from having a single platform for transactional and marketing email, enabling them to manage their customer contact data in a single place, leverage universal design templates and testing systems, and ensure high email deliverability.

Competitive Strengths

Our competitive strengths include:

Easy to Adopt, Self-Service Model

Our Email API and Marketing Campaigns services are designed to be accessed from our website and immediately useable. During 2017, approximately 99% of our new customers purchased our platform through our website, without engaging with our sales team. By reducing the friction that typically accompanies the purchase of business software and eliminating the need for complicated and costly implementation and training, we believe we attract more customers to try, buy and derive value from our platform. Customers find us through our marketing efforts and word-of-mouth. This self-service model has allowed us to grow our customer base while avoiding the expensive customer acquisition costs typical of high-touch enterprise sales models. We focus on the quality of our services, frictionless adoption, and customer support in lieu of a costly traditional sales infrastructure.

9

Market Leadership in Email Service with Strong Brand Association

We pioneered the market for a cloud-based email API service and continue to invest significant resources to extend our technology leadership and brand awareness in our industry. As a result of these initiatives and our involvement in the early development of commercialized email service, we believe that the SendGrid brand has become synonymous with email delivery and is recognized as the industry standard for scalability, reliability, and deliverability. Our brand recognition is central to the efficiency of our self-service sales model.

Significant Domain Expertise Around Email

We have processed over one trillion emails since inception, including over 450 billion emails in 2017. We sent email to more than 3.9 billion unique email addresses globally during 2017. We believe each of those figures is materially larger than our closest competitor. We have longstanding relationships and integrations with inbox service providers, including Google Gmail, Microsoft Outlook, and Yahoo! Mail. These relationships provide us with real-time intelligence and performance feedback that enables us to optimize the deliverability of the emails that we send. Additionally, our personnel hold leadership roles with numerous email industry organizations including the Messaging Malware Mobile Anti-Abuse Working Group, Data & Marketing Association, and Email Experience Council.

Large, Growing and Happy Global Customer Base

As of December 31, 2017, we had over 63,000 customers globally. Our broad customer base provides us with insight into digital communication trends and activity and results in word-of-mouth recognition that drives traffic to our website. We have minimal customer concentration with no customer accounting for more than 2% of revenue in any of the last three years, and a broad geographic reach with more than 36% of our revenue in the same periods coming from international regions, where we maintain limited infrastructure and no product localization.

Our Growth Strategies

Key components of our growth strategy include:

Continue to Add Customers to Our Platform

The market for our platform is large, underpenetrated, and growing. We believe that there is substantial opportunity to add additional customers both in the United States and internationally as the ubiquity of email and the digital transformation of businesses continue to drive market adoption of our services.

Expand Platform Features and Functionality and Grow Our Marketing Campaigns Service

Our ability to develop new applications and functionalities has been integral to our success and we intend to continue to invest to extend the functionality and range of our platform. An example of innovation includes our Marketing Campaigns service, which we launched in late 2015. Our Marketing Campaigns service has experienced strong customer receptivity, with more than 10,000 customers as of December 31, 2017. We intend to grow our Marketing Campaigns service by cross selling into our existing Email API service customer base, acquiring new customers and adding new capabilities and features. Many of our Email API service customers do not employ separate, dedicated marketing solutions and we believe that our Marketing Campaigns service offers them a highly attractive proposition. Furthermore, while we do not currently provide services in other emerging communications channels, such as messaging/chat platforms, in-app messages, online ads, browser and push notifications, and SMS, we believe that the proliferation of these channels creates further potential growth opportunities over time for us to help our customers optimize their communications across those channels.

Expand our Strategic Partner Channel

We have built and plan to continue investing in channel relationships with our strategic partners in order to broaden the reach of our internal marketing efforts. Our partner ecosystem includes strategic relationships with leading public cloud infrastructure providers and ecommerce platforms, such as Heroku, Amazon Web Services and Microsoft Azure, software vendors that offer complementary products and with which we co-sell our Email API and Marketing Campaigns services,

10

such as GitHub, New Relic and Twilio, and digital marketing agencies, such as Deloitte Digital, which resell our services to their clients.

Continue to Grow Internationally

We generated more than 36% of our revenue in each of the last three years from customers located in international geographies despite having limited international infrastructure and no product localization. We attribute this success to awareness of our services, our frictionless self-service onboarding process, and the ease-of-use of our services. Recently, we opened our first international sales and marketing office in London. In the future, we intend to add more physical infrastructure as well as localized platform content and currency, checkout, and support that will enhance our attractiveness to international customers.

Pursue Select Acquisitions to Augment Our Features and Functionality

We intend to continue pursuing acquisitions that we believe will be complementary. For example, we may pursue acquisitions that we believe will enhance our services, accelerate customer acquisition, introduce different distribution channels, and add talent and expertise to our organization. We have a track record of successfully completing acquisitions. For example, in 2015, we acquired certain assets from Message Bus, a transactional email company, and in 2017, we acquired JCKM, Inc., or Bizzy, a marketing automation company.

11

Our Platform and Services

Our offerings include:

Email API

Our Email API service enables businesses to programmatically send email via our API or an SMTP relay. We manage delivery of those emails and report on account statistics and recipient engagement. We take care of the details of making SMTP connections, bulk emailing, connection handling, and click- and open-tracking to help our customers get the right message to the right person at the right time.

|

· |

Integrations: Businesses can integrate our email API with multiple leading development frameworks and client libraries, including Node.js, Ruby, Python, Go, Hypertext Preprocessor, Java, and C#. |

|

· |

Documentation: Users can get answers and support from robust documentation, video tutorials and the SendGrid community on our website. |

12

|

· |

Internet Protocol, or IP, Management: Domains and links can be customized, whether sending from shared IP address pools or a dedicated IP address, for improved reputation management and delivery. |

|

· |

Deliverability: Our custom Sender Policy Framework and DomainKeys Identified Mail record creation is designed to eliminate domain spoofing and phishing. |

|

· |

Reporting & Analytics: Account statistics and engagement data can be accessed in real-time via our Advanced Statistics API and SendGrid Event Webhook. |

|

· |

Mobile support: Our deep linking functionality enables email engagement for mobile apps. |

|

· |

Security: Our two-factor authentication, API key permissions, and IP Address Access Management enables secure management of our email API by our customers. |

Marketing Campaigns

Our email marketing service, SendGrid Marketing Campaigns, allows marketers to upload and manage customer contact lists, create and test email templates, and then execute and analyze multi-faceted email campaigns that engage customers and drive growth. Our Marketing Campaigns service includes:

|

· |

Segmentation and Contact Management Tools: Enables users to upload and manage target recipient lists, create segments of recipients, and personalize messages to segments. |

|

· |

A/B testing: Campaign optimization tools to test changes to subject lines, images, links, copy and button placement to optimize email campaign performance. Users can run up to six variations simultaneously. |

|

· |

Email Template Editor: Enables marketers to design emails, drag and drop email components or existing Hyper Text Markup Language, or HTML, into the code editors, or write HTML directly, and personalize emails using customer fields to add recipient-specific data. |

|

· |

Analytics and Reporting: Our real time analytics provide instant feedback and customizable performance metrics to optimize engagement. |

Expert Services

Our Expert Services provide customers with a variety of service packages to ensure customers are able to maximize the value of their email programs.

|

· |

Expert Managed Services: Our in-house email experts proactively manage our customers’ sender reputations on an ongoing basis by using sophisticated monitoring tools, building custom delivery plans, and making recommendations to improve deliverability and email program return on investment. |

|

· |

One-time Services: Offerings range from one-time onboarding and email delivery consulting services to custom-designed service packages that include direct access to expert technical support and delivery services team members. |

The SendGrid Way

We create new services and functionality via a process called The SendGrid Way. We engage our customer base to gather extensive feedback on existing services and services in development, as well as to learn about other communications problems our customers need to solve. This iterative process is ideal in providing our development team with listening posts to help guide our development roadmap. Our SendGrid Labs team is focused on future innovation beyond currently offered services.

13

Our Technology

The technology that powers our digital communications platform combines IP and domain knowledge around email delivery, which enables us to deliver email reliably and at scale. Numerous and distinct technologies and processes go into email delivery, and it is our ability to apply these technologies across billions of daily emails and dozens of inbox service providers that truly differentiates our platform. Our technology balances the processes needed to keep bad actors who send harmful or unwanted emails off our platform with enabling reputable senders to deliver wanted mail to recipients. Constantly managing these two objectives, automatically and at scale, ensures a frictionless experience for users.

We describe our technology differentiation across five areas:

Ability to Process Email Efficiently

Using a mechanism in Domain Name Servers, we have designed our mail processors to automatically route mail sent by our customers to our platform to the nearest email processing facility for optimized response times. We lease co-location space from third-party data center providers to maintain email processing facilities in four locations spread across the United States, as well as in Asia, the United Kingdom and Europe.

Improving Deliverability for Reputable Senders

Our platform is designed to capture the continuous signal provided by inbox service providers, allowing us to understand their operational responses to our email delivery techniques. Our proprietary technology relies on this continuous feedback mechanism to adjust the timing, speed and volume of email sending to optimize delivery for our customers across inbox service providers. We employ a variety of techniques to preserve the sender reputation of our customers, including warming up new IP addresses, where we systematically increase the volume of email sent from new IP addresses at a measured pace, and exponential-backoff, where we decelerate email sending quickly if the messages being sent are not well received by the target inbox service provider. We also protect our customers from actions that may inadvertently damage their ability to reach their end users. For example, our platform blocks the sending of email to end users who have unsubscribed from an email distribution list. Our Expert Services team also provides customized advice to help businesses improve their sender reputation for better deliverability.

Keeping Bad Actors Off the System

We strive to ensure that our platform is used only for sending wanted email. We continuously monitor the behaviors of users to detect unwanted email patterns. Once identified, we can reduce, suspend, or eliminate the ability of bad actors to send emails by removing them from our platform. We utilize machine learning to analyze information gathered during the sign-up process and from third parties as well as email content to determine malicious intent. These controls help us to preserve the sender reputations of our customers.

Market Leading Security Architecture

We incorporate sophisticated layers of security into our platform. We offer encrypted email to the receiver’s inbox through a Transport Layer Security connection. Our services are System and Organization Controls 2 Type II compliant. Moreover, we have implemented a broad range of advanced security technologies designed to prevent external cyberattacks and keep our internal and customer-facing systems secure.

Managing Our Services at Scale

Our technology is designed to capture, process, and react to the unique and continuous signals provided by an array of inbox service providers. We helped create the notion of a transactional email service provider. We built a global, proprietary Message Transfer Agent, which is a set of sophisticated software components that manages the distribution and delivery of email to recipients through our co-located email processing facilities. We leverage scalable cloud resources to support continuous sending during high volume periods. We maintain a high level of reliability across our email processing facilities because they operate independently from one another. If we encounter an issue at one email processing facility, we can reroute mail to another to support continuous service for our customers. Our platform also uses fair queuing

14

to optimize the email flow through the system so that an important message such as a password reset email is prioritized over non-critical messages going to millions of recipients.

We intend to continue to invest in our research and development capabilities. Our research and development expense was $29.6 million, $21.2 million, and $19.0 million for 2017, 2016, and 2015, respectively.

Our Customers

Our scalable platform helps businesses solve some of their most important digital communications challenges. As of December 31, 2017, we had more than 63,000 customers globally using our services. We believe a relatively small number of businesses have more than one unique paying account with us, and we count each of these accounts as a separate customer. Our customers are comprised of SMBs and large global enterprises. We have a diverse customer base that spans industries. No customer accounted for more than 2% of revenue in any of the last three years.

Marketing and Sales

Marketing

We believe the SendGrid name is synonymous with email. We rely on our brand strength and self-service, go-to-market model to acquire customers with little direct sales involvement. Because of our self-service model, we depend on businesses finding us. We invest significantly in our marketing efforts to promote our brand, attract customers, and build a community around our platform. We focus our marketing efforts on:

|

· |

Self-Service Channel: We acquire new customers through direct response marketing, such as email marketing, search engine advertising, display advertising, social media advertising and digital sponsorships. These initiatives are designed to attract new customers to our website that will sign up for our service. We run our own demand-side platform, allowing us to directly manage our digital advertising spend and maximize the efficacy of our customer acquisition strategy. We devote significant attention to generating compelling and informative content, including an extensive library of how-to guides, best practices recommendations and comparable benchmarks. Our customer analytics supports all of these efforts, measuring the effectiveness of each component of our self-service strategy. |

|

· |

Strategic Partner Channel: We continue to expand our relationships with leading public cloud infrastructure providers, ecommerce platforms, software vendors and digital marketing agencies to acquire new customers. |

|

· |

Brand Strategy: Our marketing is focused on both creating awareness of SendGrid across the developer and marketer communities through advertising, content marketing, public relations, and events, and driving direct-response conversions via our self-service and partner channels. Our research and insights team continually gathers feedback from our customers to improve our targeting and ultimately the return-on-investment from our marketing activities. We established a customer advisory board to understand the changing needs of customers and to reflect those needs in our development roadmap. |

|

· |

Community Development: Through our Community Development team, we partner with startup accelerators, such as Techstars, incubators, and others in the startup ecosystem to provide mentorship and other support to emerging digital companies. |

15

Sales

Our inside sales team responds to inbound customer inquiries and pursues targeted outbound prospects. We have a strategic focus on cross-selling our Marketing Campaigns service and Expert Services to our existing customer base. We also have a dedicated customer success team that supports larger-volume accounts and helps them grow and expand.

Technical Support

Our platform is designed to be easy to adopt and use with little support. We provide 24 x 7 support for all of our customers through our Customer Support team. Our online support services enable our customers to access documentation and instruction for our services on the Docs section of our website. We offer troubleshooting and how-to tips for all of our services, with links to all our service-specific knowledge bases.

Our Competition

We provide cloud-based services that enable businesses to reach their customers using email for both transactional and marketing purposes. The market for providing these services is fragmented, with some vendors addressing transactional email services, some vendors addressing email marketing services and other vendors providing a broad array of services that include transactional and marketing services as part of a software suite or broader portfolio of software offerings. Notwithstanding the availability of third-party software services, some businesses rely on internally-developed solutions for their email communications needs. The market for digital communications services is also rapidly evolving, creating opportunity for new competitors to enter the market with point product solutions or addressing specific segments of the market. In addition, in some instances, we have strategic or other commercial relationships with companies with which we also compete, such as Amazon Web Services. Our competitors include:

|

· |

Companies that offer transactional email services, including Amazon, Mailgun, Oracle and SparkPost; and |

|

· |

Companies that offer email marketing services, including Adobe, Campaign Monitor, Endurance, IBM, MailChimp, Oracle, and Salesforce. |

We believe the principal competitive factors include: completeness of offering; credibility with developers and marketers; global reach; ease of adoption; features and functionality; platform scalability, reliability, security, and performance; brand awareness and reputation; integration with third-party applications and data sources; customer support; and the total cost of deployment and ownership. We believe that we compete favorably with respect to each of these factors. For additional information, see the section titled “Risk Factors—Risks Related to our Business—The market in which we participate is highly competitive and, if we do not compete effectively, our operating results could be harmed.”

Employees

As of December 31, 2017, we had 415 full-time employees.

Government Regulations

We are subject to a number of U.S. federal and state and foreign laws and regulations that involve matters central to our business. These laws and regulations may involve privacy, data protection, intellectual property, competition, consumer protection, taxation or other subjects. Many of the laws and regulations to which we are subject are still evolving and being tested in courts and could be interpreted in ways that could harm our business. In addition, the application and interpretation of these laws and regulations often are uncertain, particularly in the new and rapidly evolving industry in which we operate. Because global laws and regulations have continued to develop and evolve rapidly, it is possible that we may not be, or may not have been, compliant with each such applicable law or regulation.

Intellectual Property

We rely on a combination of intellectual property rights, including patent, trade secret, copyright, and trademark protections, as well as customary contractual protections to protect our proprietary technology.

16

As of December 31, 2017, in the United States, we had one issued patent, which expires in 2036. We have also registered “SendGrid” as a trademark and our pixel grid design in the United States and various foreign jurisdictions. In addition, we also enter into confidentiality and invention assignment agreements with our employees and contractors and sign confidentiality agreements with third parties. We restrict access to proprietary technology and confidential information through the use of internal controls.

Despite our efforts to protect our technology and proprietary rights through intellectual property rights and contractual protections, unauthorized parties may still copy or otherwise obtain and use our software and other technology. In addition, we intend to continue to expand our international operations, and effective intellectual property and trade secret protection may not be available or may be limited in foreign countries.

Segment and Geographic Information

We view our operations and manage our business as one operating segment. See our consolidated financial statements for a discussion of revenues, operating loss, net loss, and total assets.

For a description of our revenue and long-lived assets by geographic location, see Note 14 of the Notes to our Consolidated Financial Statements included in this Annual Report on Form 10-K.

Corporate Information

We were incorporated in Delaware in July 2009. Our principal executive offices are located at 1801 California Street, Suite 500, Denver, CO 80202, and our telephone number is (888) 985-7363.

Available Information

We maintain a website at https://sendgrid.com, including an investor relations section at https://investors.sendgrid.com in which we routinely post important information, such as webcasts of quarterly earnings calls and other investor events in which we participate or host, and any related materials. You may access our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports, as well as other reports relating to us that are filed with or furnished to the Securities or Exchange Commission, or SEC, free of charge in the investor relations section of our website as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. We are not, however, including the information contained on our website, or information that may be accessed through links on our website, as part of, or incorporating such information by reference into, this Annual Report on Form 10-K, and you should not consider any information contained on, or that can be accessed through, our website as part of this Annual Report on Form 10-K. The public may also read and copy materials we file with the SEC at the SEC’s Public Reference Room, which is located at 100 F Street, NE, Washington, DC 20549. You can obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov.

17

Our operations and financial results are subject to various risks and uncertainties including those described below. You should carefully consider the risks and uncertainties described below, together with all of the other information in this Annual Report on Form 10-K, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, as well as our other public filings with the SEC. Our business, operating results, financial condition, or prospects could be materially and adversely affected by any of these risks and uncertainties. In that case, the trading price of our common stock could decline. In addition, the risks and uncertainties discussed below are not the only ones we face. Our business, operating results, financial condition, or prospects could also be harmed by risks and uncertainties not currently known to us or that we currently do not believe are material, and these risks and uncertainties could result in a decrease in the market price of our common stock. In assessing the risks and uncertainties described below, you should also refer to the other information contained in this Annual Report on Form 10-K, including our consolidated financial statements and the related notes thereto.

Risks Related to our Business

Our recent growth may not be indicative of our future growth and, if we continue to grow, we may not be able to manage our growth effectively.

We have recently experienced a period of rapid growth in our headcount and operations. In particular, we grew from 58 employees as of December 31, 2011, to 415 fulltime employees as of December 31, 2017, and we have also significantly increased the number of emails processed by our platform over the last several years. We anticipate that we will continue to expand our operations and headcount in the near term. Our growth has placed, and future growth will place, a significant strain on our management, technical, administrative, operational, and financial infrastructure. Our success will depend in part on our ability to manage this growth effectively. To manage the expected growth of our operations and personnel, we will need to continue to improve our management, technical, administrative, operational, and financial controls and our reporting systems and procedures. Failure to effectively manage our growth could result in difficulty or delays in effectively scaling our platform to handle increased email volumes, declines in quality or customer satisfaction, increases in costs, difficulties in introducing new features or other operational difficulties. Any of these difficulties could adversely impact our business and results of operations.

If we are unable to sustain our revenue growth rate, we may not achieve or maintain profitability in the future.

We have experienced rapid revenue growth over recent years, with revenue of $111.9 million, $79.9 million, and $58.5 million in 2017, 2016, and 2015, respectively. Although we have experienced rapid revenue growth historically, we may not continue to grow as rapidly in the future and our revenue growth rates may decline. Any success that we may experience in the future will depend in large part on our ability to, among other things:

|

· |

maintain and expand our customer base; |

|

· |

increase revenue from existing customers through increased or broader use of our platform within their organizations; |

|

· |

improve the performance and capabilities of our platform through research and development; |

|

· |

continue to successfully expand our business domestically and internationally; |

|

· |

achieve the anticipated benefits from any businesses or technologies that we may acquire; and |

|

· |

successfully compete with other companies. |

If we are unable to maintain consistent revenue or revenue growth, our stock price could be volatile or decline, and we may not achieve or maintain profitability. You should not rely on our revenue for any prior quarterly or annual periods as any indication of our future revenue or revenue growth.

18

If we are unable to attract new customers, retain existing customers or increase sales both to new and existing customers, our business and results of operations will be affected adversely.

To succeed, we must continue to attract and retain customers and increase sales to new and existing customers. We price our services on a tiered subscription model based on the customer’s use of our services (principally, email volumes), and therefore the revenue we generate from our customers depends on their use of our services. We have only a limited salesforce and to date have relied primarily on our self-service model to generate our revenue. The amount that new and existing customers purchase, renew, and use our services depends on a number of factors, including those outside of our control.

We may fail to attract new customers, retain existing customers or increase sales to new or existing customers as a result of a number of factors, including: reductions in our current or potential customers’ spending levels; competitive factors affecting the cloud-based business software market, including the introduction of competing platforms, discount pricing and other strategies that may be implemented by our competitors; our ability to execute on our growth strategy and operating plans; a decline in our customers’ level of satisfaction with our platform and customers’ usage of our platform or an increased perception by our customers’ that they can manage their email distribution and marketing efforts internally or otherwise without use of our platform; reductions in the use of email as a digital communication channel; the difficulty and cost to switch to a competitor may not be significant for many of our customers; changes in our relationships with third parties, including our strategic partners and payment processors; the timeliness and success of new services and functionality we may offer now or in the future, including our Marketing Campaigns service that we introduced in late 2015; concerns relating to actual or perceived security breaches; the frequency and severity of any system outages; and technological changes or problems. In addition, we believe a relatively small number of businesses have more than one unique paying account with us, and we count each of these accounts as a separate customer. We believe our number of customers is an important measure for evaluating our business. Because some businesses have more than one unique paying account with us and we count each of these accounts as a separate customer, the number of our customers set forth in this Annual Report on Form 10-K for any period is not necessarily indicative of the number of unique businesses from which we received revenue during any such period. We rely on our reputation and recommendations from key customers in order to promote our platform. The loss of any of our key customers could have a significant impact on our business reputation and our ability to obtain new customers. In addition, acquisitions of our customers could lead to cancellation of our contracts with those customers or by the acquiring companies.

Failure to attract new customers, retain existing customers or increase sales to customers will harm our business and results of operations.

Our limited operating history in new and developing markets and our rapid growth make it difficult to evaluate our current business and future prospects.

We introduced our Email API service in 2009, our Marketing Campaigns service in late 2015, and our Expert Services in 2016. The majority of our revenue growth has occurred in the last few years and was derived from the sale of subscriptions to our Email API service. This short operating history and our rapid growth make it difficult to evaluate our future prospects. Our ability to forecast our future operating results is subject to a number of uncertainties, including our ability to plan for and model future growth, particularly with respect to our most recently introduced services. If our assumptions regarding these uncertainties are incorrect or change in reaction to changes in our markets, or if we do not address these risks successfully, our operating and financial results could differ materially from our historical and expected operating and financial results, our business could suffer, and the trading price of our stock may decline.

We also operate in new and developing markets that may not continue to develop as we expect. You should consider our future prospects in light of the challenges and uncertainties that we face, including the fact that our business has grown rapidly, and it may not be possible to discern fully the trends that we are subject to, that we operate in new and developing markets and that elements of our business strategy are new and subject to ongoing development. We have encountered and will continue to encounter risks and difficulties frequently experienced by growing companies in rapidly changing industries, including increasing and unforeseen expenses as we continue to grow our business. If we do not manage these risks successfully, our business and results of operations will be harmed.

19

If we are unable to increase adoption of our platform through our self-service model, our business, results of operations, and financial condition may be adversely affected.

Historically, we have relied on the adoption of our platform through our self-service model for a significant majority of our revenue. We have only a limited salesforce. Although we believe our business model can continue to scale without a significantly larger salesforce, our self-service model may not continue to be as effective as we anticipate, and the absence of a large direct sales function may impede our future growth.

As we continue to scale our business, we may choose to invest in a larger direct salesforce to reach additional customers and grow our revenue. Our ability to manage a larger direct salesforce is uncertain. Identifying and recruiting additional qualified sales personnel and managing and training them once hired would require significant time, expense and attention and would significantly impact our business model. In addition, adding additional salesforce would considerably change our cost structure and results of operations, and we may have to reduce other expenses, such as our research and development expense, in order to accommodate a corresponding increase in marketing and sales expense and attain and maintain profitability. If our lack of a large direct salesforce limits us from reaching additional customers and growing our revenue and we are unable to hire, develop and retain talented sales personnel in the future, our revenue growth and results of operations may be harmed.

Our growth depends in part on the success of our strategic relationships with third parties to sell our services.

We have established strategic relationships with a number of other companies, including public cloud infrastructure providers and ecommerce platforms, software vendors that offer complementary products and with which we co-sell our services and digital marketing agencies that resell our services to their clients. In order to grow our business, we anticipate that we will continue to establish and maintain these strategic relationships. Identifying strategic partners, and negotiating and documenting relationships with them, requires significant time and resources. Our competitors may be effective in providing incentives to third parties to favor their products or services over ours or to prevent or reduce subscriptions to our platform. In addition, acquisitions of our strategic partners by our competitors, or acquisition of our competitors by our strategic partners, could result in a decrease in the number of our current and potential customers, as our strategic partners may no longer facilitate the adoption of our platform by potential customers.

If we are unsuccessful in establishing or maintaining our strategic relationships with third parties, our ability to compete or to grow our revenues could be impaired and our operating results could suffer. Even if we are successful in our strategic relationships, we cannot assure you that these relationships will result in increased usage of our services or increased revenues.

Our future success depends in part on our ability to continue to drive adoption of our platform and services by international customers, and our international operations and sales to customers with international operations expose us to risks inherent in international sales.

We generated more than 36% of our revenue in each of the last three years from customers located outside the United States. The future success of our business will depend, in part, on our ability to continue to expand our customer base worldwide and to sell additional services to international customers.

If we are unable to successfully market our platform to or localize our services for international customers, then our business, results of operations, and financial condition may be adversely affected, and our growth may be constrained.

We have limited experience operating in international markets where the challenges of conducting our business can be significantly different from those we have faced in the United States and the existing markets in which we operate and where business practices may create internal control risks. We have only recently established operations outside of the United States, with the opening of an office in London. We may open additional non-U.S. offices in the future. There are a number of risks inherent in conducting international business, including:

|

· |

fluctuations in foreign currency exchange rates; |

20

|

· |

the burden of complying with a wide variety of laws and regulatory regimes, including those relating to labor matters, consumer and data protection, privacy, network security, encryption, and taxes; |

|

· |

tariffs, export and import restrictions, restrictions on foreign investments, sanctions, and other trade barriers or protection measures; |

|

· |

costs and difficulties of localizing our services; |

|

· |

lack of acceptance of our localized services; |

|

· |

difficulties in and costs of staffing, managing, and operating our international operations; |

|

· |

tax issues, including restrictions on repatriating earnings and with respect to our corporate operating structure and intercompany arrangements; |

|

· |

weaker intellectual property protection; |

|

· |

economic weakness or currency related crises; |

|

· |

limitations on the ability of our self-service sales model to attract international customers; |

|

· |

our limited historical sale experience outside the United States; |

|

· |

our ability to adapt to our marketing and selling efforts to different cultures and customer requirements; |

|

· |

common local business behaviors that are in direct conflict with our policies and codes of conduct and ethics; |

|

· |

corporate espionage; and |

|

· |

political instability and security risks in the countries where we are doing business. |

If we are unable to effectively manage these risks, our relationships with our existing and prospective customers, strategic partners and employees and our operations outside of the United States may be adversely affected.

If we are not able to maintain and enhance our brand and maintain and increase market awareness of our company and services, then our business, results of operations, and financial condition may be adversely affected.

We believe that maintaining and enhancing the “SendGrid” brand identity and maintaining and increasing market awareness of our company and services is critical to achieving widespread acceptance of our platform, to strengthen our relationships with our existing customers and to our ability to attract new customers. The successful promotion of our brand will depend largely on our continued marketing efforts, our ability to continue to offer high quality services, our ability to be thought leaders in our industry and our ability to successfully differentiate our platform and services from competing products and services. For example, we rely on both algorithmic and purchased listings displayed by search engines to attract a significant percentage of the customers. Algorithmic listings cannot be purchased, and instead are determined and displayed solely by a set of formulas designed by the search engine. Purchased listings can be purchased by advertisers in order to attract customers to their websites, but the cost of purchased search listing advertising may increase as demand for these channels grows. If search engines on which we rely for algorithmic listings modify their algorithms in an attempt to optimize their search listings, this could result in fewer potential customers clicking through to our website, requiring us to resort to additional purchased listings or other costly advertisements to attempt to replace this traffic. If one or more search engines on which we rely for purchased listings modifies or terminates its relationship with us, or increases the amounts it charges us, our expenses could rise. Any such increases could negatively affect market awareness of our brand and our business, results of operations, and financial condition.

In addition, independent industry analysts often provide reviews of our services and competing products and services, which may significantly influence the perception of our services in the marketplace. If these reviews are negative or not

21

as strong as reviews of our competitors’ products and services, then our brand may be harmed. This may cause us to lose existing customers, decrease the number of new customers that we are able to attract or lower our pricing model, each of which would likely harm our results of operations.

From time to time, our customers and other third parties have complained about our platform, such as complaints about our pricing and customer support or the use of our platform to transmit spam, phishing scams, website links to harmful applications or other harmful or illegal material. If we do not handle customer and other complaints effectively, then our brand and reputation may suffer, our customers may lose confidence in us and our customers may reduce or cease their use of our services. In addition, many of our customers post about and discuss Internet-based products and services, including our platform and services, on social media. Our success depends, in part, on our ability to generate positive customer feedback and minimize negative feedback on social media channels where existing and potential customers seek and share information. If actions we take or changes we make to our platform or services, particularly as our platform continues to scale, upset these customers then their online commentary could negatively affect our brand and reputation. Complaints or negative publicity about us, our platform or our services could materially and adversely impact our ability to attract and retain customers, our business, results of operations, and financial condition.

The promotion of our brand also requires us to make substantial expenditures, and we anticipate that these expenditures will increase as our market becomes more competitive and as we expand into new markets. To the extent that these activities increase revenue, this revenue still may not be enough to offset the increased expenses we incur. If we do not successfully maintain and enhance our brand, then our business may not grow, we may see our pricing power reduced relative to competitors and we may lose customers, all of which would adversely affect our business, results of operations, and financial condition.

The market in which we participate is highly competitive and, if we do not compete effectively, our operating results could be harmed.

We provide cloud-based services that enable businesses to reach their customers using email for both transactional and marketing purposes. The market for providing these services is fragmented, with some vendors addressing transactional email services, some vendors addressing email marketing services and other vendors providing a broad array of services that include transactional and marketing services as part of a software suite or broader portfolio of software offerings. Notwithstanding the availability of third-party software services, some businesses rely on internally-developed solutions for their email communications needs. The market for digital communications services is rapidly evolving, creating opportunity for new competitors to enter the market with point product solutions or addressing specific segments of the market. In addition, in some instances, we have strategic or other commercial relationships with companies with which we also compete, such as Amazon Web Services. Our competitors include:

|

· |

Companies that offer transactional email services, including Amazon, Mailgun, Oracle and SparkPost; and |

|

· |

Companies that offer email marketing services, including Adobe, Campaign Monitor, Endurance, IBM, MailChimp, Oracle and Salesforce. |

We believe the principal factors on which we compete include: completeness of offering; credibility with developers and marketers; global reach; ease of adoption; features and functionality; platform scalability, reliability, security, and performance; brand awareness and reputation; integration with third-party applications and data sources; customer support; and the total cost of deployment and ownership. Our current and potential competitors may develop and market new technologies with similar or superior functionality to our platform or at a cheaper price point that render our existing or future services less competitive or obsolete, and we may need to decrease the prices or accept less favorable terms for subscriptions for our services in order to remain competitive. If we are unable to maintain our pricing due to competitive pressures, our margins will be reduced, and our operating results will be negatively affected.

Our current and potential competitors also may have significantly more financial, technical, marketing, and other resources than we have, may be able to devote greater resources to the development, promotion, sale and support of their products and services, may have more extensive customer bases and broader customer relationships and may have longer operating histories and greater name recognition. As a result, these competitors may respond faster to new technologies and undertake more extensive marketing programs for their products or services. If these companies decide to further invest in

22