Attached files

Exhibit 10.42

ISLAMIC REPUBLIC OF MAURITANIA

Honor - Fraternity – Justice

EXPLORATION-PRODUCTION CONTRACT BETWEEN

THE ISLAMIC REPUBLIC OF MAURITANIA

and

TULLOW MAURITANIA LIMITED

C18

2012

(ENGLISH TRANSLATION)

TABLE OF CONTENTS

ARTICLE 1: DEFINITIONS | 4 | |

ARTICLE 2: SCOPE OF THE CONTRACT | 6 | |

ARTICLE 3: EXPLORATION AUTHORIZATION | 7 | |

ARTICLE 4: EXPLORATION WORK OBLIGATION | 8 | |

ARTICLE 5: PREPARATION AND APPROVAL OF ANNUAL WORK PROGRAMS | 10 | |

ARTICLE 6: CONTRACTOR OBLIGATIONS RELATING TO THE CONDUCT OF THE PETROLEUM OPERATIONS | 10 | |

ARTICLE 7: CONTRACTOR RIGHTS RELATING TO THE CONDUCT OF PETROLEUM OPERATIONS | 12 | |

ARTICLE 8: CONTROL OVER PETROLEUM OPERATIONS AND ACTIVITY REPORTS - CONFIDENTIALITY | 13 | |

ARTICLE 9: APPRAISAL OF A DISCOVERY AND GRANT OF AN EXPLOITATION AUTHORIZATION | 16 | |

ARTICLE 10: RECOVERY OF PETROLEUM COSTS AND PRODUCTION SHARING | 19 | |

ARTICLE 11: TAXATION | 20 | |

ARTICLE 12: PERSONNEL | 22 | |

ARTICLE 13: BONUSES | 22 | |

ARTICLE 14: PRICE OF HYDROCARBONS | 23 | |

ARTICLE 15: NATURAL GAS | 24 | |

ARTICLE 16: TRANSPORT OF HYDROCARBONS THROUGH PIPELINES | 26 | |

ARTICLE 17: OBLIGATIONS TO SUPPLY DOMESTIC MARKET WITH CRUDE OIL | 26 | |

ARTICLE 18: IMPORT AND EXPORT | 27 | |

ARTICLE 19: FOREIGN EXCHANGE | 27 | |

ARTICLE 20: BOOKKEEPING, MONETARY UNIT, ACCOUNTING | 27 | |

ARTICLE 21: GOVERNMENT PARTICIPATION. | 28 | |

ARTICLE 22: ASSIGNMENT | 30 | |

ARTICLE 23: OWNERSHIP, USE AND ABANDONMENT OF ASSETS | 30 | |

ARTICLE 24: LIABILITY AND INSURANCE | 32 | |

ARTICLE 25: TERMINATION OF THE CONTRACT | 33 | |

ARTICLE 26: APPLICABLE LAW AND STABILITY OF THE CONDITIONS | 33 | |

ARTICLE 27: FORCE MAJEURE | 34 | |

ARTICLE 28: ARBITRATION AND EXPERTISE | 34 | |

ARTICLE 29: CONDITIONS FOR APPLICATION OF THE CONTRACT | 35 | |

ARTICLE 30: EFFECTIVE DATE | 36 | |

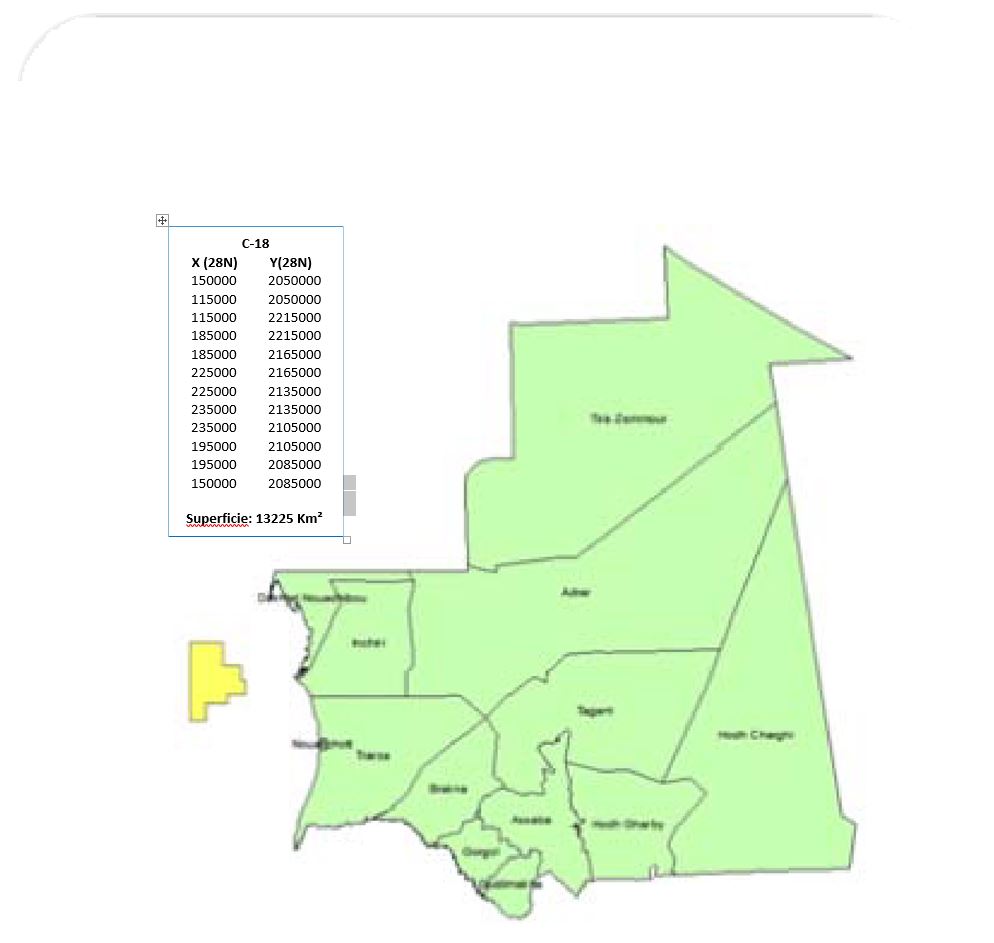

APPENDIX 1: EXPLORATION PERIMETER | 38 | |

APPENDIX 2: ACCOUNTING PROCEDURE | 40 | |

APPENDIX 3: MODEL FORM BANK GUARANTEE | 56 | |

CONTRACT

Between

The Islamic Republic of Mauritania (hereafter called "the State"), represented hereby by the Minister in charge of Petroleum, Energy and Mines

ON THE ONE HAND,

And

TULLOW MAURITANIA LIMITED a company incorporated under the laws of the Isle of Man (Registration No. 104570C) and having its registered office at Falcon Cliff, Palace Road, Douglas, Isle of Man, IM2 4LB represented hereby by Mr David Lawrie,

(hereinafter TULLOW MAURITANIA LIMITED is to be referred to as the "Contractor"),

ON THE OTHER HAND,

The State and the Contractor are hereafter collectively called "Parties" or individually "Party". THE FOLLOWING HAVING ALREADY BEEN STATED:

The State, owner of the deposits and natural hydrocarbons deposits contained in the ground and the sub- soil of the national territory, wishes to promote the discovery and production of hydrocarbons to support the economic expansion of the country within the framework instituted by law n° 2010-033 dated 20 July 2010 pertaining to the Crude Hydrocarbons Code as amended by law n° 2011-044 dated 25 October 2011;

The Contractor wishes to explore and exploit, within the framework of this exploration-production contract and in accordance with the Crude Hydrocarbons Code, the hydrocarbons which may be contained in the perimeter described in Appendix 1 of this Contract, and has provided evidence that it has the technical skills and financial means necessary for this purpose.

IT WAS AGREED WHAT FOLLOWS:

ARTICLE 1: DEFINITIONS

The terms used in the present document have the following significance:

1.1 | "Calendar Year" means a period of twelve (12) consecutive months beginning on the January first (1st) and ending on the following December thirty-first (31st). |

1.2 | "Contract Year" means a period of twelve (12) consecutive months starting as at the Effective Date or the anniversary of the aforesaid Effective Date. |

1.3 | "Appendices" mean the appendices of the present Contract consisting of: |

1.3.1 | Appendix 1 for the Exploration Perimeter |

1.3.2 | Appendix 2 for the Accounting Procedure |

1.3.3 | Appendix 3 for the model bank guarantee |

1.4 | "Exploration Authorization" means the authorization referred to under Article 3 of this Contract by which the State authorizes the Contractor to carry out, on an exclusive basis, all the hydrocarbon exploration and/or research work within the Exploration Perimeter. |

1.5 | "Exploitation Authorization" means the authorization granted to the Contractor to carry out, on an exclusive basis, all the development and exploitation of the Hydrocarbon deposits within the Exploitation Perimeter. |

1.6 | "Barrel" means "U.S. barrel", the equivalent of 42 American gallons (159 liters) measured at a temperature of 60°F (15.6 °C) and at atmospheric pressure. |

1.7 | "BTU" means the British energy unit, "British Thermal Unit" such that a million BTU (MMBTU) is equal to about 1055 joules. |

1.8 | "Annual Budget" means the detailed estimate of the cost of Petroleum Operations defined in an Annual Work Program. |

1.9 | "Crude Hydrocarbons Code" refers to law n° 2010-033 dated 20th July 2010 pertaining to the Code Crude Hydrocarbons, its amendments and its implementation provisions. |

1.10 | "Environment Code" refers to law n° 2000-045 dated 26th July 2000 pertaining to the Environmental Code, its amendments and the laws implementing it. |

1.11 | "Contractor" means collectively or individually the signatory company/companies of this Contract as well as any entity or company to which an interest would be transferred pursuant to articles 21 and 22 of this Contract. |

1.12 | "Contract" means this agreement, its appendices and its amendments. In the event of contradiction between the provisions of this agreement and the provision of its appendices, the provisions of this agreement shall prevail. |

1.13 | "Petroleum Costs" means all the costs and expenses incurred by the Contractor for Petroleum Operations provided for under this Contract and determined according to the Accounting Procedure, set out in Appendix 2 of this Contract. |

1.14 | "Effective Date" means the commencement date of this Contract as defined in article 30. |

1.15 | "Dollar'' means the dollar ($) of the United States of America. |

1.16 | "State" means the Islamic Republic of Mauritania. |

1.17 | "Gross Negligence" means carelessness or negligence of such gravity as to assume there was malicious intent on the part of the author. |

1.18 | "Wet Gas" means Natural Gas containing a fraction of elements becoming liquid at room pressure and temperature, and which justifies the installation of a recovery facility of such liquids. |

1.19 | "Natural Gas" means all gas hydrocarbons produced from a well including Wet Gas and Dry Gas which can be associated or not associated with liquid hydrocarbons, and waste gas which is obtained after extraction of natural gas liquids. |

1.20 | "Associated Natural Gas" means Natural Gas existing in a reservoir in solution with Crude Oil or in the form of "Gas Cap" in contact with Crude Oil, and which is produced or can be produced in association with Crude Oil. |

1.21 | "Non-associated Natural Gas" means Natural Gas other than Associated Natural Gas. |

1.22 | "Dry Gas" means Natural Gas containing mainly methane, ethane and inert gases. |

1.23 | "Hydrocarbons" means liquid and gas hydrocarbons or solid hydrocarbons such as bituminous sands and shales. |

1.24 | "LIBOR" means the annual interbank interest rate applicable for the Dollar as published by the Financial Times or the Wall Street Journal or any other publication of similar standing. |

1.25 | "Ministry" means the ministry for Crude Hydrocarbons. |

1.26 | "Minister" means the Minister in charge for Crude Hydrocarbons. |

1.27 | "Operator" means the company referred to in article 6.2 below responsible for the conduct and performance of Petroleum Operations, or any company which would be substituted to it later on, in accordance with the governing terms and conditions. |

1.28 | "Petroleum Operations" means all the research, exploitation, storage, transportation and marketing of hydrocarbons, including the evaluations/assessment, development, production, separation, processing operations up to the Point of Delivery, as well as the rehabilitation of the sites and, more generally, all other operations which are directly or indirectly related to the preceding ones and which carried out by the Contractor as part of this Contract, aside from the refining and distribution of petroleum products. |

1.29 | "Ouguiya" means the currency of the Islamic Republic of Mauritania. |

1.30 | "Exploitation Perimeter" means all or part of the Exploration Perimeter on which the State, in accordance with the terms of this Contract, grants to the Contractor an Exploitation Authorization in accordance with the provisions of article 9 below. |

1.31 | "Exploration Perimeter" means the surface defined in Appendix 1, reduced, if applicable, by the relinquished surface as provided for under article 3 and/or reduced by Exploitation Perimeters, on which the State, under the terms of this Contract, grants to the Contractor an Exploration Authorization in accordance with the provisions of article 2.1 below. |

1.32 | "Crude Oil" means all hydrocarbons which are liquid at a natural state or obtained from natural gas by condensation or separation from asphalt. |

1.33 | "Delivery Point" means: |

1.33.1 | For Crude Oil, the F.O.B point of loading of Crude Oil to the export terminal or any other point fixed by mutual agreement of the Parties; |

1.33.2 | For Natural Gas, the point of delivery fixed by mutual agreement of the Parties in accordance with article 15 of this Contract. |

1.34 | "Rehabilitation Plan" designates the program of works for the rehabilitation of the sites to be carried out by the Contractor at the expiration, renunciation or cancellation of an Exploitation Authorization in accordance with article 23.2. |

1.35 | "Annual Work Program" means the document setting out each element, of the Petroleum Operations to be carried out during a Calendar Year in accordance with the terms of this Contract and which is prepared in accordance with the provisions of articles 4 and 5 below. |

1.36 | "Affiliated Company" means |

1.36.1 | any company or any other entity which controls or is controlled, directly or indirectly, by a company or entity, or |

1.36.2 | any company or any other entity which controls or is controlled, directly or indirectly, by a company or an entity which controls directly or indirectly any company or entity party to this Contract. |

For purposes of this definition, the term "control" means the direct or indirect ownership by a company or any other entity of a percentage of company or partnership shares representing over fifty percent (50%) of the voting power at the general assembly of another company or entity.

1.37 | "Third Party" means any natural or legal person, other than the State, the Contractor and the Affiliated Companies of the Contractor. |

1.38 | "Quarter" means a period of three (3) consecutive months beginning on the first day of January, April, July or October of each Calendar Year. |

ARTICLE 2: SCOPE OF THE CONTRACT

In accordance with the Crude Hydrocarbons Code, the State hereby authorizes the Contractor to carry out on a purely exclusive basis in the Exploration Perimeter the Petroleum Operations which are useful and necessary in accordance with the terms of this Contract defined in Appendix 1.

2.1 | This Contract is entered into for the duration of the Exploration Authorization as provided for under article 3 of this Contract, including any of its renewal and possible extension periods and, in the event of commercial discovery, for the duration of the Exploitation Authorizations which would have been granted, as defined in article 9.11 below. |

2.2 | This Contract will end if, at the expiration of all the phases of the exploration provided for under article 3, the Contractor does not notify the State of its decision to develop a commercial Hydrocarbon reservoir and has not requested an Exploitation Authorization for this field in accordance with the provisions of article 9.5 below. |

In the event of a grant of several Exploitation Authorizations and save in the case of an early termination, this Contract shall end at the expiration of the last unexpired Exploitation Authorization in force.

2.3 | The expiration, revocation or termination of this Contract for whatever reason does not release the Contractor from its obligations under this Contract, arising before or at the time of the aforementioned expiration, renunciation or cancellation, which shall have to be carried out by the Contractor. |

2.4 | The Contractor will be responsible for carrying out the Petroleum Operations provided for under this Contract. It undertakes to carry them out in compliance with good international petroleum industry practice and to comply with the norms and standards developed by the Mauritanian regulation for industrial safety, environmental protection and operational techniques. |

2.5 | The Contractor shall provide all financial and technical means necessary for the smooth running of the Petroleum Operations and shall fully support all the risks related to the performance of the aforesaid Operations, subject to the provision of article 21 of this Contract. The Petroleum Costs borne by the Contractor shall be recoverable by the Contractor in accordance with the provisions of article 10 below. |

2.6 | During the validity period of the Contract, the production resulting from the Petroleum Operations shall be shared between the State and the Contractor in accordance with the provisions of article 10 below. |

ARTICLE 3: EXPLORATION AUTHORIZATION

3.1 | The Exploration Authorization inside the Exploration Perimeter defined in Appendix 1 is granted to the Contractor in accordance with the provisions of article 2.1 above for an initial phase of five (5) Contract Years. |

3.2 | The Contractor shall be entitled to two (2) renewals of the Exploration Authorization for a period of two (2) Contract Years for the first renewal and three (3) Contract Years for the second renewal, if it has fulfilled, as part of the preceding exploration phase, all the work obligations stipulated in article 4 below and has provided the bank guarantee for the renewal period in accordance with article 4.6 below. |

3.3 | If at the expiration of the phases of the exploration period defined in article 3.2 above, works are in fact being carried out, the Contractor shall be entitled, if it reasonably requests one, to an exceptional extension of that phase for a period not exceeding twelve (12) months. |

3.4 | If the Contractor discovers one or more Hydrocarbon reservoirs for which it cannot present a declaration of commerciality before the end of the third phase of the period of exploration in accordance with article 9.5 below, due to the distance of the reservoir from the possible points of delivery on the Mauritanian territory and the lack of pipeline transport infrastructures, or the lack of market for the production of Natural Gas, it can request an extension of the Exploration Authorization for a maximum duration of three (3) years for petroleum reservoirs and five (5) years for Natural Gas reservoirs, the Exploration Perimeter thus being reduced to the supposed limits of the reservoirs in question. |

3.5 | In the event an extension is granted, the Contractor shall submit to the Minister within sixty (60) days of the end of each Calendar Year of the extension period a report showing the commercial character, if any, of the reservoirs concerned, and, in the event of Natural Gas deposit, the results of the works and studies undertaken in accordance with article 15 below. |

3.6 | For each renewal or extension, the Contractor shall have to make a request to the Minister no later than two (2) months before the expiration of the ongoing exploration phase. The renewals shall be noted by Ministerial order whereas extensions shall be granted by a decree of the Council of Ministers: such acts shall take effect on the day following the expiration of the previous period. |

3.7 | The Contractor undertakes to return to the State at least twenty-five percent (25%) of the initial surface of the Exploration Perimeter at the time of each its renewal, in order to keep only seventy-five percent (75%) of the initial surface of the Exploration Perimeter during the second phase of the exploration period, and only fifty percent (50%) of the initial surface of the Exploration Perimeter during the third phase of the exploration period. |

3.8 | For the purposes of article 3.7 above: |

3.8.1 | Surfaces having previously been the subject of a voluntary return, in accordance with article 3.9, the surfaces already covered by Exploitation Authorizations shall be deducted from the surfaces to be returned; |

3.8.2 | The Contractor shall have the right to fix the scope, form and site of the portion of the Exploration Perimeter which it intends to keep. However, the returned portion shall have to be made up of a perimeter of simple geometrical form, delimited by North-South and East-West lines or by natural boundaries or borders, in accordance with Land Registry requirements. The surface area is based upon the cadastral apportionment from one of the initial or residual Exploration Perimeter limits and is calculated contiguously. |

3.8.3 | The request for renewal shall be accompanied by a plan indicating the Exploration Perimeter which is kept as well as report specifying the work carried out on the returned surfaces and the results obtained since the Effective Date. |

3.9 | The Contractor may at any time, subject to three (3) months' notice, notify to the Minister that it waives all or part of the Exploration Perimeter. In the event of a complete waiver, the Exploration Authorization shall be deemed terminated at the date of the aforesaid notification. |

In the event of a partial surrender, the provisions of article 3.8 above shall apply.

In any event, no voluntary renunciation during an exploration period phase shall reduce the exploration work obligations stipulated in article 4 below for the aforementioned period nor shall it put an end to the corresponding guarantee.

3.10 | Except in the event of an extension in accordance with articles 3.3 and 3.4 above, at the expiration of the third exploration period phase, the Contractor shall have to return the remaining surface of the Exploration Perimeter, save for the surfaces already covered by the Exploitation Perimeters. |

ARTICLE 4: EXPLORATION WORK OBLIGATION

4.1 | During the first phase of the exploration period of five (5) Contract Years defined in article 3.1 above, the Contractor undertakes to carry out the following works: |

• | The acquisition of one thousand two hundred (1200) km of 2D seismic; |

• | The acquisition of six hundred (600) km2 of 3D seismic. |

The aforementioned works shall commence within the twelve (12) months following the Effective Date.

4.2 | During the second phase of the exploration period of two (2) Contract Years defined in article |

3.2 above, the Contractor undertakes to carry out the following works:

• | Exploration well drilling: one (1) well to a minimum depth of 2000 meters (below sea level). |

The aforementioned works shall commence within six (6) months of the beginning of the phase in question.

4.3 | During the third phase of the exploration period of three (3) Contract Years defined in article 3.2, the Contractor undertakes to complete the following works: |

• | Exploration well drilling: one (1) well to a minimum depth of 2000 meters (below sea level). |

The aforementioned works shall commence within three (3) months of the beginning of the phase in question.

4.4 | Each exploration well drilling referred to above shall be carried out up to the minimal depth provided for above, or up to a lesser depth if the Minister authorizes it or if continuation of the drilling, carried out in accordance with good international practice in the petroleum industry, is excluded for any of the following reasons: |

4.4.1 | The basement is reached at a depth inferior to the minimal depth referred to above; |

4.4.2 | The continuation of the drilling presents an evident danger because of the existence of a pressure of an abnormal layer; |

4.4.3 | Rock formations are reached whose hardness does not allow, in practice, for the progress of the drilling carried out with the appropriate equipment facilities; |

4.4.4 | Oil-bearing formations are reached whose drilling through requires for their protection the installation of casings making it impossible to reach the minimal depth referred to above. |

In each of the above-mentioned cases, the Contractor shall inform the Minister and shall be authorized to suspend drilling, and the aforementioned drilling shall be deemed carried out at the minimal depth referred to above.

4.5 | If the Contractor, during either the first phase of the exploration period, or the second phase of the exploration period, respectively defined in articles 3.1 and 3.2 above, carries out a number of exploration drillings whose volume is higher than the minimal work obligations stipulated respectively in articles 4.1 and 4.2 above for the aforementioned phase, the surplus exploration drilling requirements can be carried over to the next phase(s) of the exploration shall be deducted from the minimal work obligations stipulated with regard to the aforementioned phases. |

For purposes of articles 4.1 to 4.5 above, the drilling carried out as part of the evaluation program of a discovery shall not be considered exploration drillings and, in the event of discovery of Hydrocarbons, only one well per discovery shall be deemed an exploration drilling.

4.6 | In the thirty (30) days following the Effective Date, the Contractor shall submit to the Minister a bank guarantee from a first ranking international bank, in accordance with Appendix 3 amounting to four million eight hundred thousand Dollars ($4,800,000) for the 2D seismic and three million Dollars ($3,000,000) for the 3D seismic referred to in article 4.1, for its minimal work obligations for the first phase of the exploration period defined in article 4.1 above. |

In the event of renewal of the Exploration Authorization, the Contractor shall also have to present to the Minister, within thirty (30) days following receipt of the Ministerial order noting the renewal, a bank guarantee from a first ranking international bank, in accordance with Appendix 3 amounting to

• | ten million Dollars ($10,000,000) per exploration drilling referred to in article 4.2 in respect of a renewal pursuant to Article 3.2 for a second phase of the exploration period covering its minimum work obligations for the phase concerned; and |

• | ten million Dollars ($10,000,000) per exploration drilling referred to in article 4.3 in respect of a renewal pursuant to Article 3.2 for a third phase of the exploration period covering its minimum work obligations for the phase concerned. |

If at the end of any phase of the exploration period or in the event of total waiver or termination of the Contract, the exploration works did not meet the minimum obligations under article 4, the Minister shall have the right to call in the guarantee for an amount equal to the amount of the guarantee after deduction of the estimated cost of minimum work possibly carried out.

This cost shall be on a lump sum basis using the following unit costs:

(a) | four thousand Dollars ($4,000) per kilometre of 2D seismic |

(b) | five thousand Dollars ($5,000) per kilometre square of 3D seismic. |

(c) | ten million Dollars ($10,000,000) per exploration drilling. |

Once the payment is made, the Contractor shall be deemed to have fulfilled its minimum exploration obligations in accordance with article 4 of this Contract; the Contractor shall be able, save in the event of a revocation of the Exploration Authorization due to a serious breach of this Contract, to continue to benefit from the provisions of the said Contract and, in the event of an admissible request, to obtain the renewal of the Exploration Authorization.

ARTICLE 5: PREPARATION AND APPROVAL OF ANNUAL WORK PROGRAMS

5.1 | No later than two (2) months after the Effective Date, the Contractor shall prepare and submit to the Ministry for approval a detailed Annual Work Program setting out each element of the works as well as the corresponding Annual Budget for the whole Exploration Perimeter by specifying the Petroleum Operations relating to the period from the Effective Date to the following 31st December. |

Then, no later than three (3) months before the beginning of each Calendar Year, the Contractor shall prepare and submit to the Ministry for approval a detailed Annual Work Program setting out each element of the works as well as the corresponding Annual Budget for the whole Exploration Perimeter then, if necessary, for the Exploitation Perimeter(s) by specifying the Petroleum Operations which he offers to carry out during the following Calendar Year.

Each Annual Work Program and the corresponding Annual Budget shall be subdivided between the different exploration activities, and if necessary, including the evaluation activities for each discovery, as well as the development and production activities for each commercial reservoir.

5.2 | If the Ministry deems that revisions or modifications of the Annual Work Program and the corresponding Annual Budget are necessary and useful, it must notify the Contractor in writing with all the justifications deemed useful within sixty (60) days following their receipt. In this case, the Ministry and the Contractor shall meet as soon as possible to study the requested revisions or modifications and to establish by mutual agreement the Annual Work Program and the corresponding Annual Budget in their final form, in accordance with good international petroleum industry practice. The date of adoption of the Annual Work Program and the corresponding Annual Budget shall be the date of the mutual agreement referred to above. |

In the absence of notification by the Ministry to the Contractor of its desire to make amendments or modifications within sixty (60) days referred to above, the aforementioned Annual Work Program and the corresponding Annual Budget shall be deemed accepted by the Ministry at the date of expiration of the said deadline.

In any case, each Annual Work Program operation for which the Ministry shall not have requested an amendment or modification shall have to be performed by the Contractor within the set deadlines.

5.3 | The Parties agree that the results achieved during the course of the work or that particular circumstances may justify changes to the Annual Work Program and to the corresponding Annual Budget. In this case, following notification to the Ministry, the Contractor shall be able to carry out such changes provided that the fundamental objectives of the said Annual Work Program are not modified. |

ARTICLE 6: CONTRACTOR OBLIGATIONS RELATING TO THE CONDUCT OF THE PETROLEUM OPERATIONS

6.1 | Without prejudice to the provisions of article 21.1 below, the Contractor shall have to provide all necessary funds and shall purchase or rent all the materials, equipment and material which are necessary for the performance of the Petroleum Operations. The Contractor is responsible for the preparation and execution of the Annual Work Programs which shall have to be performed in the most appropriate manner in compliance with good international petroleum industry practice. |

6.2 | At the Effective Date of this Contract, Tullow Mauritania Limited is designated as Operator and shall be responsible for the control and execution of the Petroleum Operations. The Operator, for and on behalf of the Contractor, shall provide the Minister with all the reports, information and data referred to in this Contract. Any change of Operator considered by the entities of the |

Contractor must have the prior approval of the Minister, which shall not be unreasonably withheld.

6.3 | The Operator must maintain for the duration of the Contract in Mauritania; a branch which shall have a person in charge and duly authorized to conduct the Petroleum Operations and to whom any notification could be presented under this Contract. |

6.4 | The Contractor shall have to take all the necessary measures for the protection of the environment during the Petroleum Operations. |

It shall in particular, for any Petroleum Operation requiring prior approval in accordance with the Environmental Code, to submit to the Minister, as applicable, environmental impact assessments or notes required for this type of operation, implement measures and to comply with the restrictions provided for under the environmental management plan, to provide the declarations and to comply with the audits under the Environmental Code.

Additionally, the Contractor shall take all reasonable steps based on good international petroleum industry practice to:

6.4.1 | make sure that all the installations and equipment used for the Petroleum Operations needs are at any time in good state in conformity with the applicable standards, including those resulting from international conventions ratified by the Islamic Republic of Mauritania and relating to the prevention of pollution; |

6.4.2 | avoid loss and discharges of: |

(A) | Hydrocarbons including Natural Gas flaring, (save as provided in Article 40 of Crude Hydrocarbons Code, under penalty of a fine of which the amount shall be further determined by decree taken by the Council of Ministers, and shall not exceed, under any circumstances, twenty (20) percent of the current market price of Natural Gas in Mauritania); |

(B) | muds; or |

(C) | any other products used in the Petroleum Operations, |

and deal with it in accordance with the environmental management plan referred to above.

The aforementioned fine shall not be considered either recoverable Petroleum Costs or a deductible expense;

6.4.3 | NOT APPLICABLE; |

6.4.4 | store Hydrocarbons products in installations and receptacles built for this purpose; |

6.4.5 | dismantle, without prejudice to the provisions of article 23.2 below, the installations which shall no longer be necessary to the Petroleum Operations and clean up the sites; and |

6.4.6 | generally prevent pollution of the ground and sub-soil, water and atmosphere, as well as degradations of the fauna and flora. |

6.5 | During the Petroleum Operations, the Contractor shall have to take all the necessary measures to protect the health and safety of people in accordance with good international petroleum industry practice and the existing regulation in Mauritania, and in particular to set up: |

6.5.1 | suitable means of prevention, quick response and management of risks including risks of blow-out; |

6.5.2 | measures for information, training and means adapted to the risks incurred, including personal protective equipment, equipment to control fire as well as means for first aid and prompt evacuation of victims. |

6.6 | All the works and installations set up by the Contractor under the terms of this Contract shall, according to their nature and the circumstances, be built, specified, set out and equipped so as to allow free and safe passage at all times within the Exploration Perimeter and the Exploitation Perimeter(s). |

6.7 | In the exercise of its right to build, carry out work and maintain all the installations necessary for the purposes of this Contract, the Contractor shall not occupy land located within five-hundred (500) meters of any structure whether religious, cultural or not, places of burial, walled enclosures, yards and gardens, dwellings, groups of dwellings, villages, agglomerations, wells, water points, tanks, streets, roads, railroads, water pipelines, piping systems, works of public utility, works of art, without the prior agreement of the Minister. The Contractor shall be liable for any damage that its work shall have caused. |

6.8 | The Contractor undertakes to grant his preference to Mauritanian companies and products, based on equivalent conditions in terms of price, quantity, quality, terms of payment and delivery lead time, and to require a similar commitment from its subcontractors. |

All procurement, construction or service contracts amounting to a value higher than one million (1,000,000) Dollars for exploration/assessment works and one million five hundred thousand (1,500,000) Dollars for development/exploitation works, will be subject to invitations to tender for Mauritanians and foreign bidders, save if otherwise agreed with the Minister.

Copies of such contracts entered into during each Quarter shall be submitted to the Minister within thirty (30) days of the end of the Quarter concerned.

6.9 | The Contractor undertakes to grant his preference, based on equivalent economic conditions, to the purchase of the goods necessary for Petroleum Operations, according to their lease or any other form of lease, and to require a similar commitment from its subcontractors. |

For this purpose, each Annual Budget referred to under article 5 shall specify all the draft lease contracts which exceed an annual value of four hundred thousand (400,000) Dollars.

ARTICLE 7: CONTRACTOR RIGHTS RELATING TO THE CONDUCT OF PETROLEUM OPERATIONS

7.1 | The Contractor has the exclusive right to carry out the Petroleum Operations inside the Exploration Perimeter and any Exploitation Perimeter derived from it, provided such operations are in conformity with the terms and conditions of this Contract, the Crude Hydrocarbons Code as well as the provisions of the existing laws and regulations in Mauritania, and that they are carried out according to good practice in the international petroleum industry. |

7.2 | For purposes of the execution of the Petroleum Operations, the Contractor shall bear the rights under article 54 of the Crude Hydrocarbons Code. |

7.3 | The expenses, allowances, and in general all charges arising from the use of property referred to in articles 55 to 57 of the Crude Hydrocarbons Code shall be borne by the Contractor and shall be recoverable as Petroleum Costs in accordance with the provisions of article 10.2 below. |

7.4 | The expiration of an Exploration Authorisation or an Exploitation Authorisation or the mandatory or voluntary, partial or total return of an Exploration Perimeter or an Exploitation Perimeter shall have no effect on the rights arising under article 7.2 above for the Contractor, with respect to the works and installations carried out pursuant to the provisions of this article 7 provided the aforementioned works and installations continue to be used as part of the |

Contractor's activities on the area retained or other exploration or exploitation perimeters in Mauritania.

7.5 | Subject to the provisions of articles 6.8 and 6.9 above, the Contractor has the freedom of choice of the suppliers and subcontractors and shall benefit from the customs procedure under article 18 of this Contract. |

7.6 | Unless otherwise provided, no restriction shall be made with regard to the entry, residence and freedom of circulation, employment, and repatriation of persons and their families as well as their property, concerning the employees of the Contractor and those of its subcontractors subject to compliance with the labor legislation and regulations as well as the existing social laws in force. |

The Ministry shall facilitate the grant to the Contractor as well as its agents, subcontractors and their families, of any administrative authorizations that may be necessary in relation to the Petroleum Operations carried out as part of the present Contract, including the entry and exit visas.

ARTICLE 8: CONTROL OVER PETROLEUM OPERATIONS AND ACTIVITY REPORTS - CONFIDENTIALITY

8.1 | The Petroleum Operations shall be subject to monitoring by the Ministry in accordance with the provisions of Title VIII of the Crude Hydrocarbons Code. The duly appointed representatives of the Ministry shall have the right to monitor the Petroleum Operations, to inspect the installations, equipment, and materials and to audit procedures, norms, recordings and books related to the Petroleum Operations. |

For the purposes of allowing the exercise of the aforementioned rights, the Contractor shall provide the Ministry and other agents of the State in charge of supervising the Petroleum Operations with reasonable assistance regarding transportation and accommodation. The transportation and accommodation expenditures which are directly linked to the monitoring and inspection shall be borne by the Contractor. The said expenditures shall be considered as Petroleum Costs recoverable under the provisions of article 10.2 of this Contract and as allowable expenses when determining the business profits tax industrial and commercial.

8.2 | The Contractor shall regularly inform the Ministry of the progress of the Petroleum Operations. It shall in particular submit to the Ministry the following programs and opinions: |

8.2.1 | A work program for any geological or geophysical survey at least thirty (30) days before the beginning of the survey in question and specify its precise location, objectives, techniques and equipment used, the name and address of the company which shall carry out the work, the commencement date and the projected duration, the number of kilometers of seismic lines, the estimated costs, and the safety arrangements if the use of explosives is proposed. |

8.2.2 | A work program for any drilling at least thirty (30) days before the beginning of the drilling in question and specify its precise location, a detailed description of the work proposed, including the drilling techniques and the associated operations, its depth, its geological objective, the commencement date and the projected duration, the estimated costs of the program, a summary of the geological and geophysical data having justified the decision of the Contractor, the name and address of the drilling company as well as the designation of the drilling platform, the name and address of all other subcontractors recruited for this operation, and the security measures considered. |

8.2.3 | Thirty (30) days’ notice concerning the abandonment of a producing well and seventy- two (72) hours for a non-producing well. |

8.2.4 | Seventy-two (72) hours notice concerning any suspension of drilling or any resumption of drilling suspended for more than thirty (30) days. |

Any accident occurring in the course of the Petroleum Operations shall be notified to the Minister immediately or within twenty-four (24) hours at the latest.

8.3 | The Minister may require that the Contractor finance and perform of all the works necessary to ensure the safety and hygiene in the context of the Petroleum Operations in accordance with article 6.5 above. |

8.4 | The Minister shall have access to all the original data resulting from the Petroleum Operations undertaken by the Contractor inside the Exploration Perimeter and Exploitation Perimeter(s) such as reports on geological, geophysics, petro-physics, drilling, and preliminary exploitation reports as well as any reports generally required to conduct such Petroleum Operations. |

8.5 | The Contractor undertakes to submit to the Ministry the following periodic reports: |

8.5.1 | Daily reports on drilling activities; |

8.5.2 | Weekly reports on geophysics works; |

8.5.3 | A detailed report on development activities starting from the granting of an Exploitation Authorization, within fifteen (15) days after the end of each Quarter; |

8.5.4 | Effective from the commencement of the production, and within fifteen (15) days after the end of each month, an exploitation report specifying each quantity of Hydrocarbons produced, used in the Petroleum Operations, stored, lost or burned, and sold, during the previous month as well as an estimate of each quantity in question for the current month. Concerning Hydrocarbons which are sold, the report shall specify the identity of the purchaser, the quantity sold and the price obtained for each sale. |

8.5.5 | Within fifteen (15) days after the end of each Quarter, a report relating to the Petroleum Operations carried out during the previous Quarter including, in particular, a description of the Petroleum Operations carried out and a detailed statement of the Petroleum Costs incurred, such costs being broken down by Exploration/Exploitation Perimeter and by nature; |

8.5.6 | Within three (3) months after the end of each Calendar Year, a report relating to the Petroleum Operations carried out during the previous Calendar Year, as well as a detailed statement of the Petroleum Costs incurred, such costs being broken down by Exploration/Exploitation Perimeter and by nature and a figures of the staff employed by the Contractor, indicating the number of employees, their nationality, their position, the total amount of the wages, the rate of mauritanisation employment as well as a report on medical care and instruction given to them. |

8.5.7 | Any other report generally required as part of the Petroleum Operations. |

8.6 | In addition, the following reports, data and documents shall be presented to the Ministry within a month of their preparation or their acquisition: |

8.6.1 | Two (2) copies of the geological reports created as part of the exploration; |

8.6.2 | Two (2) copies of the geophysics reports created as part of the exploration. The Ministry shall have access to the originals of all the records made (magnetic tapes or other support) and can obtain copies, upon request; |

8.6.3 | Two (2) copies of the reports for the implementation and establishment and end of drilling for each well drilled; |

8.6.4 | Two (2) copies of all measurements, tests, trials and surveys recorded during the drilling (end of drilling reports); |

8.6.5 | Two (2) copies of each analysis report (petrography, biostratigraphy, geochemistry or other) carried out on cores, cuttings or fluids collected from each well drilled including the negatives of the various related photographs; |

8.6.6 | A representative sample of cores taken, of drill cuttings taken from each well as well as samples of fluids produced during the tests or production tests shall also be submitted within a reasonable time; |

8.6.7 | Moreover, the Contractor shall be able to freely export samples of cores and cuttings taken and fluids produced; |

8.6.8 | And in general, two (2) copies of all other reports generally required to carry out the Petroleum Operations. |

The reports, studies and other results referred to in the present article 8.6, as well as those referred to in article 8.5 above, shall be provided on adequate supports, in digital and paper format.

8.7 | The Parties undertake to treat as confidential and not to communicate to a Third Party or to be published, save with the prior approval of the Minister, any data and information of technical nature related to the Petroleum Operations and which are not yet in the public domain, throughout the duration of the Contract. |

In the event of the surrender of an area or a waiver of its rights over an area, the Contractor shall treat as confidential and agrees not disclose to Third Parties or publish, without the prior approval of the Minister, any data and information relating to the perimeter in question and which is not yet in the public domain.

After the surrender, termination or expiry of the Contract, the Contractor shall treat as confidential and shall not disclose to Third Parties nor shall publish, without prior approval of the Minister, any data and information related to the Petroleum Operations which is not already available in the public domain.

8.8 | Notwithstanding the provisions of article 8.7, the State shall be authorized to communicate data and information: |

8.8.1 | To all service providers and professional consultants involved in the performance of the Petroleum Operations, after obtaining a similar commitment of confidentiality; |

8.8.2 | To any bank or financial institution from which an entity of the State requests or obtains funding, after obtaining a similar commitment of confidentiality; |

8.8.3 | As part of any contentious procedure of legal, administrative or arbitral nature. |

8.9 | Notwithstanding the provisions of article 8.7, the Contractor shall be authorized to communicate the data and information: |

8.9.1 | to any Affiliated Company bound by a similar commitment of confidentiality; |

8.9.2 | to all service providers and professional consultants involved in the performance of the Petroleum Operations, after obtaining a similar commitment of confidentiality; |

8.9.3 | to any company interested in good faith in taking a possible assignment, after obtaining from such company, a commitment to keep confidential this information and data and to use them only for the purposes of the aforesaid assignment; |

8.9.4 | to any bank, institution or financial entity from which an entity of the Contractor requests or obtains funding, after obtaining a similar commitment of confidentiality; |

8.9.5 | when and to the extent that the regulations of a recognized stock exchange requires it; |

8.9.6 | as part of any contentious procedure of legal, administrative or arbitral nature. |

8.10 | The Contractor shall report to the Minister as soon as possible about all information relating to mineral substances found during the performance of the Petroleum Operations. |

8.11 | The Contractor shall take part in the implementation of the Extractive Industry Transparency Initiative (EITI) in accordance with article 98 of the Crude Hydrocarbons Code. |

ARTICLE 9: APPRAISAL OF A DISCOVERY AND GRANT OF AN EXPLOITATION

AUTHORIZATION

9.1 | If the Contractor discovers Hydrocarbons in the Exploration Perimeter, it shall notify the Minister in writing as soon as possible and shall carry out, in accordance with good international petroleum industry practice, the necessary tests. In the thirty (30) days following the date of provisional closing or of abandonment of the discovery well, the Contractor shall submit to the Minister a report giving all information related to the aforementioned discovery and shall provide its recommendations in respect of the continuation of its evaluation. |

9.2 | If the Contractor wishes to undertake the appraisal of the discovery referred to above, it shall diligently submit to the Minister for approval the appraisal works programme, the timetable of the works and the corresponding budget estimate, no later than six (6) months following the date on which the discovery was notified as set out in article 9.1 above. |

The Contractor shall then undertake with all due diligence the appraisal works in accordance with the established program, it being understood that the provisions of articles 5.2 and 5.3 above will apply to said program.

9.3 | Within three (3) months of the completion of the appraisal works, and no later than thirty (30) days prior to the expiration of the third phase of the exploration period defined in article 3.2, including any extension thereof in accordance with the provisions of articles 3.3 and 3.4 above, the Contractor shall submit to the Minister a detailed report giving all the technical and economic information relating to the reservoir which was discovered and appraised, establishing whether, in the Contractor’s opinion, the aforementioned discovery is commercial or not. |

This report shall include inter alia the following information: the geological and petro-physical characteristics and the estimated delimitation of the reservoir; the results of the tests and production tests carried out; the nature, properties and volume of the Hydrocarbons that it contains, a preliminary techno-economic study of the exploitation of the reservoir.

9.4 | Any quantity of Hydrocarbons produced from a discovery before it is declared commercial shall be subject to the provisions of article 10 of this Contract, if it is not used for the performance of the Petroleum Operations or it is lost. |

9.5 | If a reservoir is considered by the Contractor to be commercial it shall be entitled to an Exploitation Authorization. In this case, the Contractor shall submit to the Minister an application for an Exploitation Authorization, within three (3) months after the submission of the report referred to in article 9.3 above, and no later than thirty (30) days before the expiration of the third phase of the exploration period defined in article 3.2, including any extension thereof in accordance with the provisions of articles 3.3 and 3.4 above. The aforementioned application shall specify the lateral and stratigraphic delimitation of the Exploitation Perimeter, which shall only cover the estimated limit(s) of the reservoir discovered and appraised inside the unexpired Exploration Perimeter and shall be supported with the technical justifications necessary for the aforementioned delimitation. The above-mentioned application for an Exploitation Authorization shall be accompanied by a detailed development and production program, including specifically with respect to the reservoir concerned: |

9.5.1 | An estimate of the proven and probable recoverable reserves and the corresponding production profile, as well as a study on the methods of recovery of Hydrocarbons and valorization of Natural Gas; |

9.5.2 | The description of works and installations required for the exploitation of the reservoir, such as the number of wells, the facilities necessary for the production, separation, processing, storage and transport of Hydrocarbons; |

9.5.3 | The program and schedule for performance of the aforesaid works and facilities, including the date of production start-up; |

9.5.4 | The estimate of the development investments and operating costs broken down by year, as well as an economic study confirming the commercial nature of the reservoir; |

9.5.5 | Methods of financing these investments by each entity constituting the Contractor; |

9.5.6 | The environmental impact assessment of the development project to be undertaken by the Contractor in accordance with the provisions of the Environmental Code; |

9.5.7 | An indicative diagram of Rehabilitation Plan to rehabilitate the sites at the end of operations. |

The Minister shall be entitled to propose amendments or modifications to the above-mentioned development and production program, by notifying them to the Contractor with all the justifications deemed useful within ninety (90) days of receipt of said program. The provisions of article 5.2 above shall apply to said program as regards the approval thereof within the ninety (90) day period referred to above.

If the results obtained during the development justify changes to the development and production program, the aforementioned program may be modified by using the same procedure as that referred to above for its initial adoption.

9.6 | The Exploitation Authorization shall be granted by the Minister within forty-five (45) days of the date of adoption of the development and production program by the Parties. The grant of an Exploitation Authorization entails the cancellation of the Exploration Authorization inside the Exploitation Perimeter, but lets it remain valid outside this area until its expiration date without modifying the minimum exploration work commitment provided for under article 4 above for the relevant phase of the exploration period. |

9.7 | If the Contractor makes several commercial discoveries in the Exploration Perimeter, each shall give rise, in accordance with article 9.5 and 9.6 above, to a separate Exploitation Authorization corresponding to an Exploitation Perimeter. |

9.8 | If during works performed after the grant of an Exploitation Authorization, it appears that the extent of the reservoir is larger than initially projected pursuant to article 9.5 above, the Minister shall grant to the Contractor under the framework of the Exploitation Authorization already granted, the additional portion provided that the extension forms an integral part of the unexpired Exploration Perimeter and the Contractor provides technical justifications for the extension requested. |

If it appears that the reservoir has a shorter extension than initially projected, the Minister may require the Contractor to return the portion(s) which are outside the limits of the reservoir.

9.9 | If a reservoir extends beyond the boundary of the unexpired Exploration Perimeter the Minister may require that the Contractor exploit the aforementioned reservoir in partnership with the permit-holder of adjacent perimeter in accordance with the provisions of article 53 of the Crude Hydrocarbons Code. Within twelve (12) months of the written request of the Minister, the Contractor shall put to him, for approval, a draft development and production program for the reservoir in question, prepared in agreement with the permit-holder of the rights to the adjacent perimeter. |

In the event that a reservoir extends over one or several other perimeters which are not subject to a contract, an extension of the contractual perimeter can be carried out under the provisions of the Crude Hydrocarbons Code.

9.10 | The Contractor shall start development operations including the necessary studies no later than six (6) months after the grant of the Exploitation Authorization referred to in article 9.6 above and shall monitor them with utmost diligence. The Contractor undertakes to carry out the development and production operations according to good international petroleum industry practice to ensure the optimal recovery of Hydrocarbons contained in the reservoir. The Contractor undertakes to start as soon as possible studies of enhanced recovery in consultation with the Ministry and to use such recovery procedures if, in the Contractor’s opinion, such procedures may result in an improvement in the rate of recovery under economic conditions. |

9.11 | The duration of the exploitation period during which the Contractor is authorized to produce from a reservoir declared commercial is fixed at twenty-five (25) years if the exploitation relates to reservoirs of Crude Oil and thirty (30) years if the exploitation relates to Natural Gas reservoirs, starting from the date of grant of the corresponding Exploitation Authorization. |

Upon expiry of the initial exploitation period defined above, the corresponding Exploitation Authorization may be renewed for an additional period of no more than ten (10) years upon reasoned request of the Contractor submitted to the Minister no later than one (1) year before the aforementioned expiration, provided that the Contractor has met all its contractual obligations under this Contract during the initial exploitation period and that it can demonstrate that commercial production from the Exploitation Perimeter remains possible during the requested additional period.

9.12 | For any reservoir having resulted in the grant of an Exploitation Authorization, the Contractor undertakes, subject to the provisions of article 21 below, to bear the costs of all the Petroleum Operations which are useful and necessary for the exploitation of the reservoir, in accordance with the development and production program adopted. |

However, if on the basis of technical knowledge acquired in respect of this reservoir, the Contractor deems and can provide accountable evidence, during the development and production program or in the course of exploitation, that production of the said reservoir cannot or can no longer be commercially profitable although the discovery well and the appraisal works resulted in the grant of an Exploitation Authorization in accordance with this Contract, the Minister undertakes not to oblige the Contractor to continue the works and to make technical-commercial arrangements, insofar as possible, with the Contractor which would make it possible for the Contractor to continue the profitable exploitation of the reservoir. If the Contractor decides not to continue exploitation works and if the Minister requires it, the Contractor shall relinquish the said Exploitation Authorization and any rights related thereto.

9.13 | The Contractor may at any time, subject to at least a six (6) month prior written notice to the Minister, relinquish all or part of an Exploitation Perimeter, provided it has met all the obligations under this Contract. |

9.14 | The Contractor undertakes throughout the duration of the Exploitation Authorization to produce annually quantities of Hydrocarbons from each reservoir in accordance with good international petroleum industry standards by principally taking into account the rules of good reservoir preservation and the optimal recovery of Hydrocarbon reserves under economic conditions throughout the duration of the Exploitation Authorizations in question. |

9.15 | Stoppage of production of a reservoir for a period of over six (6) consecutive months decided by the Contractor without the approval of the Minister, may result in the termination of this Contract under the conditions provided for in article 25 below. |

9.16 | The Minister may, on three (3) months notice, require the Contractor to relinquish immediately, and without compensation, all its rights over the supposed discovery limits, including |

Hydrocarbons which could be produced from the said discovery, if the Contractor, without duly justified reason:

9.16.1 | has not submitted an appraisal work program in respect of the said discovery within the timeframe referred to in article 9.2 above; |

9.16.2 | has not completed the appraisal work of the said discovery in accordance with the assessment program and within the timeframe referred to in article 9.2 above; |

9.16.3 | or has not submitted an application for an Exploitation Authorization within the time referred to in article 9.5 above. |

The State may then complete all the appraisal, development and production works in respect of this discovery provided that no damage is caused to the performance of Petroleum Operations by the Contractor in the Exploration Perimeter.

ARTICLE 10: RECOVERY OF PETROLEUM COSTS AND PRODUCTION SHARING

10.1 | From the start of a regular production of Hydrocarbons under an Exploitation Authorization or an anticipated production authorization, such production shall be shared and marketed in accordance with the provisions below. |

10.2 | For the purposes of recovery of Petroleum Costs, the Contractor may freely retain, during each Quarter, in respect of each Exploitation Authorization, a portion of the corresponding total production equal to sixty percent (60%) for Crude Oil and to sixty-five percent (65%) for Dry Gas of the total quantity produced which is neither used in the Petroleum Operations, nor lost, or only a lesser percentage which would be necessary and sufficient. |

The value of the portion of the total production allocated for recovery of the Petroleum Costs by the Contractor, as defined in the preceding paragraph, shall be calculated in accordance with the provisions of articles 14 and 15 below.

If during any Calendar Year the Petroleum Costs not yet recovered by the Contractor under the provisions of this article 10.2, exceed the equivalent in value of sixty percent (60%) in respect of Crude Oil or sixty-five percent (65%) in respect of Dry Gas of the total production calculated as indicated above, the excess of which cannot be recovered during the Calendar Year under consideration shall be carried forward the following Calendar Year(s) until full recovery of the Petroleum Costs or termination of this Contract.

The recovery of Petroleum Costs for any Quarter shall be made in accordance with the order set out in the Accounting Procedure.

10.3 | The quantity of Hydrocarbons, under each Exploitation Authorization, remaining during each Quarter after the Contractor has retained the portion necessary for the recovery of the Petroleum Costs under the provisions of article 10.2 above from the total production, shall be shared between the State and the Contractor as follows, according to the value of the ratio "R" defined below: |

Value of "R" | State Share | Contractor Share |

Lower than 1 | 30% | 70% |

Greater than or equal to 1 and lower than 1.5 | 32.5% | 67.5% |

Greater than or equal to 1.5 and lower than 2 | 35% | 65% |

Greater than or equal to 2 and lower than 2.5 | 37.5% | 62.5% |

Greater than or equal to 2.5 and lower than 3 | 40% | 60% |

Greater than or equal to 3 | 42.5% | 57.5%. |

For the purposes of this article, the ratio "R" indicates the ratio of "Net Cumulated Income" of the Contractor to "Cumulated Investments" within the relevant Exploitation Perimeter, where:

"Net Cumulated Income" indicates the sum, from the Effective Date until the end of the previous Quarter, of the value of Hydrocarbons obtained by the Contractor in accordance with the provisions of articles 10.2 and 10.3 above; reduced by the Exploitation Petroleum Costs incurred by the Contractor, as defined and determined under the provisions of the Accounting Procedure.

"Cumulated Investments" means the sum, from the Effective Date until the end of the previous Quarter, of the Exploration Petroleum Costs, and the Development Petroleum Costs incurred by the Contractor, as defined and determined according to the provisions of the Accounting Procedure.

10.4 | The State may receive its production defined in article 10.3 above, either in kind, or in cash. |

10.5 | If the State wishes to receive in kind all or part of its share of production as defined in article |

10.3 above, the Minister shall notify the Contractor of such wish in writing at least ninety (90) days before the beginning of the Quarter concerned, specifying the exact quantity that it wishes to receive in kind during the aforementioned Quarter and the conditions of delivery.

To this end, it is agreed that the Contractor shall not enter into any sales commitment relating to the State share of production for a period greater than one hundred and eighty (180) days without the written approval of the Minister.

10.6 | If the State wishes to receive in cash all or part of its share of production defined in article 10.3 above, or if the Minister has not notified the Contractor of its decision to receive in kind the State's share of production pursuant to article 10.5 above, the Contractor shall market the State's share of production to be taken in cash for the Quarter concerned, to lift this share during this Quarter, and to pay to the State, within the thirty (30) days following each lifting, an amount equal to the quantity corresponding to the State share of production multiplied by the F.O.B sales price less the inherent marketing expenses. |

The Minister shall have the right to require the payment for sales of the State share of production sold by the Contractor in Dollars or any other foreign currency in which the transaction has been made.

ARTICLE 11: TAXATION

11.1 | Each entity constituting the Contractor shall be subject to the business profits tax on their net profits generated in relation to the Petroleum Operations in accordance with articles 66 to 74 of the Crude Hydrocarbons Code and with the provisions of the Accounting Procedure defined in appendix 2 of this Contract. |

The rate of this tax is fixed at twenty-six percent (26 %) for the duration of the Contract as defined in article 2.2 above.

For the purposes of determining the business profits tax industrial and commercial, the value of the Hydrocarbons marketed by the Contractor in accordance with articles 10.2 and 10.3 above, to be integrated in the taxable net profit, shall be established in accordance with the provisions of article 14 below.

11.2 | Subject to the provisions of article 21 below, the Contractor shall pay to the State the following surface fees: |

11.2.1 | two Dollars ($2) per square kilometer and per annum during the first phase of the exploration period; |

11.2.2 | three Dollars ($3) per square kilometer and per annum during the second phase of the exploration period; |

11.2.3 | four Dollars ($4) per square kilometer and per annum during the third phase of the exploration period and during any extension provided for under articles 3.3 and 3.4 above; |

11.2.4 | one hundred and seventy Dollars ($170) per square kilometer and per annum for the effective duration of the Exploitation Authorization. |

The surface fees referred to in subsections 11.2.1, 11.2.2 and 11.2.3 above shall be paid annually in advance, no later than the first day of each Contract Year, for the whole Contract Year, according to the scope of the Exploration Perimeter held by the Contractor as at the expiration date of the aforesaid fees.

The surface fees relating to an Exploitation Authorization shall be paid annually in advance, at the beginning of each Calendar Year according to the grant of the Exploitation Authorization or for the Calendar Year of the said grant, within thirty (30) days of the date of the grant, pro rata temporis for the remainder of the current Calendar Year), according to the scope of the Exploitation Perimeter at the aforementioned date.

In the event of abandonment of a surface during a Calendar Year or resulting from a Force Majeure event, the Contractor shall not be entitled to any reimbursement of surface fees already paid.

The amounts referred to in this article 11.2 shall not be regarded as recoverable Petroleum Costs under the provisions of article 10.2 above, or be considered as deductible charges for the establishment of the business profits in accordance with article 76 of the Crude Hydrocarbons Code.

11.3 | The Contractor shall be liable for taxes and duties as well as deductions withheld and other tax obligations applicable to contractors in accordance with Title VI of the Crude Hydrocarbons Code. |

11.4 | The subcontractors of the Contractor as well as the personnel of the Contractor and of its subcontractors are subject to the existing tax provisions of common law in force, subject to the applicable provisions contained in Title VI of the Crude Hydrocarbons Code. |

11.5 | Subject to the provisions of article 83 of the Crude Hydrocarbons Code, the shareholders of the entities constituting the Contractor and their Affiliated Companies shall, in addition to the exemptions contained in article 86 of the aforementioned Code, also be exempt from all levies, duties, taxes and contributions relating to the dividends received, debts, loans and interest related to the Petroleum Operations. |

11.6 | Save for the taxes, contributions and duties provided for under Title VI of the Crude Hydrocarbons Code, surface fees provided for under article 11.2 above, bonuses under article 13 below, and the contribution referred in article 12.2 below, the Contractor shall be exempt from all levies, duties, taxes, fees or contributions of any nature, whether national, regional or communal, current or forthcoming, relating to the Petroleum Operations and any related income, or more generally, the properties, activities or acts of the Contractor, including its establishment, transfers of funds and its activities pursuant to the Contract, given that these exemptions apply only to Petroleum Operations. |

The exemptions referred to in the present article do not apply to the services actually rendered to the Contractor by the Mauritanian public administrations and communities. However, the tariffs

applied with respect to the Contractor, its subcontractors, carriers, clients and agents shall remain reasonable compared to the services rendered and shall not exceed the tariffs generally applied for these same services by the aforementioned public administrations and communities. The cost of these services shall be regarded as recoverable Petroleum Costs in accordance with the provisions of article 10.2 of this Contract.

ARTICLE 12: PERSONNEL

12.1 | The Contractor undertakes from the beginning of the Petroleum Operations to ensure priority employment based on equal qualifications for Mauritanian personnel and to contribute to the training of that personnel in order to allow their access to any position of skilled workers, foremen, executives, engineers and managers. |

For this purpose, the Contractor shall establish at the end of each Calendar Year, in agreement with the Ministry, a plan for the recruitment of Mauritanian personnel and a plan for training and development to achieve an increased participation of the Mauritanian personnel in the Petroleum Operations.

12.2 | The Contractor shall also contribute to the training and development of the agents from the Ministry and other entities referred to in article 80 of the Crude Hydrocarbons Code, in accordance with a plan established by the Ministry at the end of each Calendar Year. |

For this purpose, the Contractor shall pay to the State, for the said training and development, an amount equal to one hundred and fifty thousand Dollars ($150,000) per Calendar Year for the duration of the Exploration Authorisation and, from the date of grant of an Exploitation Authorisation, an amount equal to five hundred thousand Dollars ($500,000) per Calendar Year Contract. The payments referred to above shall be considered as non recoverable Petroleum Costs under the provisions of article 10.2 above but as charges deductible from the business profits in accordance with article 82 of the Crude Hydrocarbons Code.

ARTICLE 13: BONUSES

13.1 | The Contractor shall pay to the State a signature bonus of an amount of one million Dollars ($1,000,000) within thirty (30) days following the Effective Date. |

13.2 | In addition, the Contractor shall pay to the State the following production bonuses: |

13.2.1 | four million Dollars ($4,000,000) when the regular marketed production of Hydrocarbons extracted from the Exploitation Perimeters reaches for the first time the average rate of twenty-five thousand (25,000) Barrels of Crude Oil per day during a period of thirty (30) consecutive days; |

13.2.2 | six million Dollars ($6,000,000) when the regular marketed production of Hydrocarbons extracted from the Exploitation Perimeters reaches for the first time the average rate of fifty thousand (50,000) Barrels of Crude Oil per day during a period of thirty (30) consecutive days; |

13.2.3 | ten million Dollars ($10,000,000) when the regular marketed production of Hydrocarbons extracted from the Exploitation Perimeters reaches for the first time the average rate of one hundred thousand (100,000) Barrels of Crude Oil per day for a period of thirty (30) consecutive days; |

13.2.4 | eighteen million Dollars ($18,000,000) when the regular marketed production of Hydrocarbons extracted from the Exploitation Perimeters reaches for the first time the average rate of one hundred fifty thousand (150,000) Barrels of Crude Oil per day for a period of thirty (30) consecutive days. |

Each amount referred to in the paragraphs 13.2.1 to 13.2.4 above shall be paid within thirty (30) days following the aforementioned reference period of thirty (30) consecutive days.

13.3 | The amounts referred to in articles 13.1 and 13.2 above shall not be considered as recoverable Petroleum Costs under the provisions of article 10.2 above, nor considered as deductible charges for the purpose of calculating the business profits in accordance with article 79 of the Crude Hydrocarbons Code. |

ARTICLE 14: PRICE OF HYDROCARBONS

14.1 | The unit selling price of Crude Oil taken into consideration under articles 10 and 11 above shall be F.O.B. "Market Price" at the Delivery Point expressed in Dollars per Barrel such as below given for each Quarter. |

A Market Price shall be established for each type of Crude Oil or mixture of Crude Oils.

14.2 | The Market Price applicable to the liftings of Crude Oil carried out during a Quarter shall be calculated at the end of that Quarter, and shall be equal to the weighted average of the prices obtained by the Contractor and the State for sales of Crude Oil to Third Parties during the relevant Quarter, adjusted to reflect the differences in terms of quality and density as well as in terms of F.O.B delivery and terms of payment, provided that the quantities thus sold to Third Parties during the relevant Quarter represent at least thirty percent (30%) of the total quantities of Crude Oil obtained from all the granted Exploitation Perimeters under this Contract and sold during the said Quarter. |

14.3 | In the event that such sales to Third Parties are not made during the relevant Quarter, or do not represent at least thirty percent (30%) of the total quantities of Crude Oil obtained from the whole Exploitation Perimeters granted under this Contract and sold during the Quarter in question, the Market Price shall be established during the Quarter considered by comparison with the "Current International Market Price" of Crude Oil produced in Mauritania and in neighboring producing countries, taking into consideration the differences in terms of quality, density, transport and terms of payment. |

The term "Current International Market Price" means the price allowing the Crude Oil sold to reach, at the processing or consumption locations, a competitive price equivalent to that of Crude Oil of similar quality coming from other regions and delivered under comparable commercial conditions, both in terms of quantities and destination and utilization of such Crude Oil and taking into account the market conditions and the type of contracts.

14.4 | The following transactions shall, inter alia, be excluded from the calculation of the Market Price of Crude Oil: |

14.4.1 | sales in which the buyer is an Affiliated Company of the seller as well as sales between entities constituting the Contractor; |

14.4.2 | sales in exchange for payment other than payment in freely convertible currencies and sales driven, in whole or part, for reasons other than the usual economic incentives involved in Crude Oil sales on the international market (such as exchange contracts, sales from government to government or to government agencies). |

14.5 | A committee chaired by the Minister or his delegate and consisting of State representatives and those of the Contractor shall meet upon request of its chair, at the end of each Quarter, to establish, in accordance with the stipulations of this article 14 the Market Price of Crude Oil produced, which shall apply to the previous Quarter. The decisions of the committee shall be taken unanimously. |

In the event that no decision is taken by the committee within thirty (30) days from the end of the Quarter in question, the Market price of the Crude Oil produced shall be definitely determined by an internationally recognized expert appointed by mutual agreement between the Parties, or, failing such agreement, by the International Center for Technical Expertise from the

International Chamber of Commerce. The expert shall set the price in accordance with the provisions of this article 14 within twenty (20) days from his appointment. The expert’s costs shall be shared equally by the Parties.

14.6 | Pending the determination of the price, the Market price provisionally applicable to a Quarter shall be the Market price of the preceding Quarter. Any necessary adjustment shall be made no later than thirty (30) days after the determination of the Market Price for the relevant Quarter. |

14.7 | The Contractor shall measure all the Hydrocarbons produced after their extraction from water and the related substances, using, with the consent of the Ministry, the instruments and procedures in keeping with the international petroleum industry methods then in force. The Ministry shall have the right to examine these measurements and to control the instruments and procedures used. |

If during the exploitation, the Contactor wishes to change the said instruments and procedures, it shall obtain the prior consent of the Ministry.

If, during an inspection carried out by the Ministry, it is noted that the measuring instruments are inaccurate and exceed the permitted tolerances, and this situation is confirmed by an independent expert, the inaccuracy in question shall be regarded as having existed for half of the period since the preceding inspection, unless it can be demonstrated that this occurred in respect of a different length of time. The Petroleum Costs' account and the production and lifting shares of the Parties shall be subject of suitable adjustments within thirty (30) days following receipt of the expert's report.

14.8 | For Dry Gas, the provision of this article 14 shall apply mutatis mutandis without prejudice to the provisions of article 15 below. |

ARTICLE 15: NATURAL GAS

Non-associated Natural Gas

15.1 | If a discovery as referred to in article 9.1 above relates to a Non-associated Natural Gas reservoir that the Contractor has undertaken to appraise in accordance with article 9.2 above, the Minister and the Contractor shall carry out jointly, and concurrently with the appraisal works of the said discovery, a market research intended to evaluate the possible outlets for this Natural Gas, for the local market and exportation, as well as the necessary means for its marketing, and they shall consider the possibility of jointly marketing their shares of production. The study shall determine in particular the quantities which can definitely be shifted on the local market by virtue of their nature as combustible or as raw material, the installations and arrangements necessary for the movement of this Natural Gas to user companies or government agency responsible for its distribution, as well as the estimated selling price which shall be determined in accordance with the principles provided for under article 15.8 below. |