Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K FEB 26 2018 - CREE, INC. | form8k022618.htm |

© 2018 Cree, Inc. All rights reserved

© 2018 Cree, Inc. All rights reserved

RAIFORD GARRABRANT, DIRECTOR

FEBRUARY 26TH, 2018

Investor Relations

© 2018 Cree, Inc. All rights reserved 3

Welcome

Raiford Garrabrant Investor Relations

Corporate Strategy

Gregg Lowe Chief Executive Officer

Wolfspeed

Cengiz Balkas SVP / GM Wolfspeed

Break

LED Products

Dave Emerson EVP / GM LED Products

Agenda

Lighting Products

Craig Atwater SVP / GM Lighting Products

Financial Overview

Mike McDevitt Chief Financial Officer

Group Q&A

Presentation Adjourns

© 2018 Cree, Inc. All rights reserved 4

Note on Forward-Looking Statements

This presentation includes forward-looking statements about Cree’s business outlook, future financial results and targets, product markets, plans and objectives for future

operations, and product development programs and goals. These statements are subject to risks and uncertainties, both known and unknown, that may cause actual results to

differ materially, as discussed in our most recent annual report and other reports filed with the U.S. Securities and Exchange Commission.

Important factors that could cause actual results to differ materially include the risk that we may not obtain sufficient orders to achieve our targeted revenues; price competition in

key markets; our ability to lower costs; the risk that our results will suffer if we are unable to balance fluctuations in customer demand and capacity; product mix; risks associated

with our ability to complete development and commercialization of products under development; risks associated with the ramp-up of production of our new products and our

entry into new business channels; the rapid development of new technology and competing products that may impair demand or render our products obsolete; the potential lack

of customer acceptance for our products; risks associated with acquisitions, divestitures, joint ventures or investments generally; and the risk that we or our channel partners are

not able to develop and expand customer bases and accurately anticipate demand from end customers, which can result in increased inventory and reduced orders as we

experience wide fluctuations in supply and demand.

The forward-looking statements in this presentation were based on management’s analysis of information available at the time the presentation was prepared and on

assumptions deemed reasonable by management. Our industry and business are constantly evolving, and Cree undertakes no obligation to update such forward-looking

statements to reflect new information, subsequent developments or otherwise, except as may be required by applicable U.S. federal securities laws and regulations.

Note Regarding Non-GAAP Financial Measures

This presentation includes certain non-GAAP financial measures and targets. Cree's management evaluates results and makes operating decisions using both GAAP and non-

GAAP measures included in this presentation. Non-GAAP results exclude certain costs, charges and expenses which are included in GAAP results. By including these non-

GAAP measures, management intends to provide investors with additional information to further analyze the Company's performance, core results and underlying trends. Non-

GAAP results are not prepared in accordance with GAAP and non-GAAP information should be considered a supplement to, and not a substitute for, financial statements

prepared in accordance with GAAP. Investors and potential investors are encouraged to review the reconciliation of non-GAAP financial measures to their most directly

comparable GAAP measures attached to this presentation. Please see the Appendix at the end of this presentation.

Forward-Looking Statements & Non-GAAP Measures

© 2018 Cree, Inc. All rights reserved

GREGG LOWE, CEO

FEBRUARY 26TH, 2018

© 2018 Cree, Inc. All rights reserved 6

WOLFSPEED

A Powerhouse Semiconductor company focused on Silicon Carbide (SiC)

and Gallium Nitride (GaN)

• Large multi-decade growth opportunities with SiC and GaN in Electric Vehicles, Solar energy,

Telecommunications, Industrial, and Mil/Aero

• Invest to expand scale and to accelerate growth of SiC Materials, Power Devices and GaN

RF Devices where SiC and GaN have distinct advantage

• Objectives: High growth, strong gross margins with good fall through to the bottom line

Cree’s Transformation Path

© 2018 Cree, Inc. All rights reserved 7

LED

Focus where our best-in-class technology and application-optimized solutions are differentiated

and valued

• High-power technology provides the only solution

• High-power general lighting

• Automotive lighting

• Application-optimized solutions solve the most difficult system-level problems

• Next-generation video

• Specialty lighting

• Cree Venture JV accesses additional SAM

• Broader mid-power markets

• Objectives: Modest growth and gross margin expansion

OPEX lean, CAPEX light

Cree’s Transformation Path

© 2018 Cree, Inc. All rights reserved 8

LIGHTING

Fix the Business

• Fix quality through improved processes and new product developments

• Improve channel position and relationships

• New product innovations to better position the portfolio--focused on higher specification and

smart intelligent features improving customer satisfaction

• Objectives: Modest growth, gross margin in line with the industry and operating margin

expansion

Cree’s Transformation Path

© 2018 Cree, Inc. All rights reserved 9

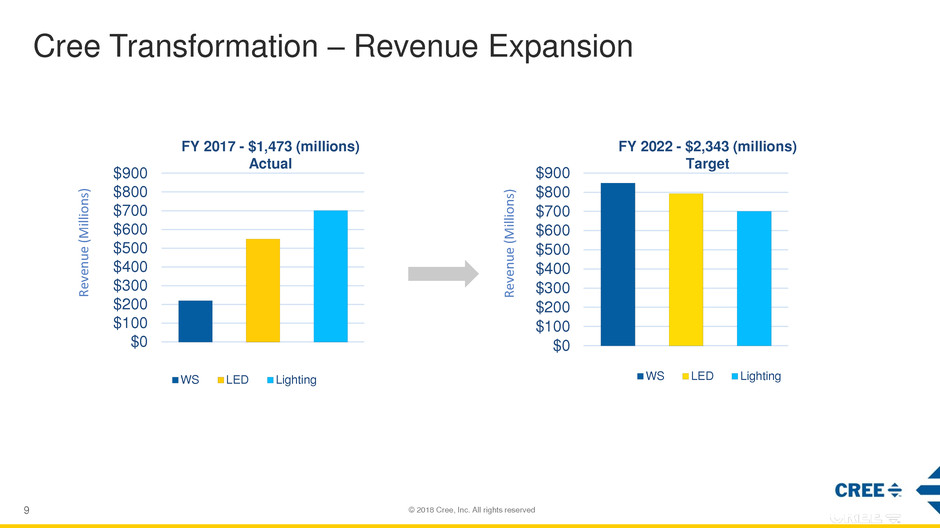

Cree Transformation – Revenue Expansion

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

WS LED Lighting

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

WS LED Lighting

FY 2017 - $1,473 (millions)

Actual

FY 2022 - $2,343 (millions)

Target

Re

ven

u

e

(M

ill

io

n

s)

Re

ven

u

e

(M

ill

io

n

s)

© 2018 Cree, Inc. All rights reserved 10

Gross Margin and Earnings Power Expansion 25.7%

40.0%

-0.7%

20.0%

-5%

0%

5%

10%

15%

20%

25%

30%

35%

40%

F18Q2 FY22

%

to

Re

ven

ue

Gross and Operating Margin (non-GAAP)

GM% OM%

Long Range Model (non-GAAP)

• GM 40+%

• OM 20+%

Target

Actual

© 2018 Cree, Inc. All rights reserved 11

WOLFSPEED

A Powerhouse Semiconductor company focused on Silicon Carbide (SiC) and Gallium

Nitride (GaN)

LED

Focus where our best-in-class technology and application-optimized solutions are

differentiated and valued

LIGHTING

Fix the Business

Cree’s Transformation Path

© 2018 Cree, Inc. All rights reserved

© 2018 Cree, Inc. All rights reserved

CREE CONFIDENTIAL & PROPRIETARY © 2017 Cree, Inc. All rights

reserved

Wolfspeed

Cengiz Balkas, SVP and GM

February 26, 2018

© 2018 Cree, Inc. All rights reserved 14

WOLFSPEED

A Powerhouse Semiconductor company focused on Silicon Carbide (SiC)

and Gallium Nitride (GaN)

• Large multi-decade growth opportunities with SiC and GaN in Electric Vehicles, Solar energy,

Telecommunications, Industrial, and Mil/Aero

• Invest to expand scale and to accelerate growth of SiC Materials, Power Devices and GaN

RF Devices where SiC and GaN have distinct advantage

• Objectives: High growth, strong gross margins with good fall through to the bottom line

Cree’s Transformation Path

© 2018 Cree, Inc. All rights reserved 15

Silicon Carbide and GaN: Fundamental Advantages

Silicon Carbide Solar Inverters

and On-Board Chargers are:

• 5X lighter

• 3X smaller

• 25% lower semiconductor losses

GaN-Based Antennas:

• Increased capacity and

coverage

• 2X the users/tower

• 10X the data rate/user

4G LTE antenna 5G active antenna

0

5

10

15

Switching Efficiency Power Density

Silicon Carbide vs Silicon

SiC Si

0

20

40

60

Max Frequency Power Density

GaN vs Silicon LDMOS

GaN Si

© 2018 Cree, Inc. All rights reserved 16

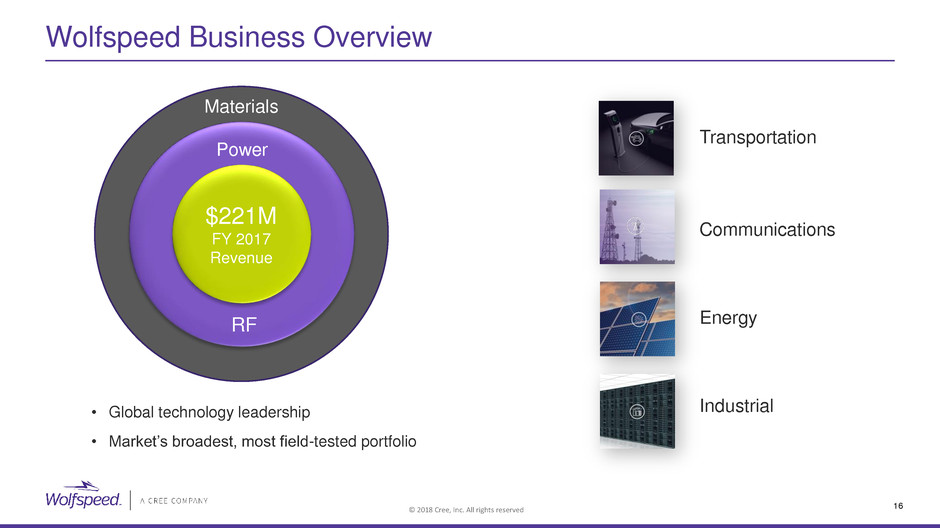

Wolfspeed Business Overview

$xxB

$221M

FY 2017

Revenue

RF

Power

Materials

• Global technology leadership

• Market’s broadest, most field-tested portfolio

Transportation

Communications

Energy

Industrial

© 2018 Cree, Inc. All rights reserved 17

30 Years of Global Silicon Carbide and GaN Leadership

1991

Released world’s

first commercial SiC

wafers

1998

Created industry’s

first GaN HEMT on

SiC

2000

Demonstrated first

ever GaN MMIC

with record power

density

2002

Released first 600V

commercial SiC JBS

Schottky diode

2011

Released industry’s

first SiC MOSFET

2016

Leading 150mm SiC

wafer market;

introduced 200mm

© 2018 Cree, Inc. All rights reserved 18

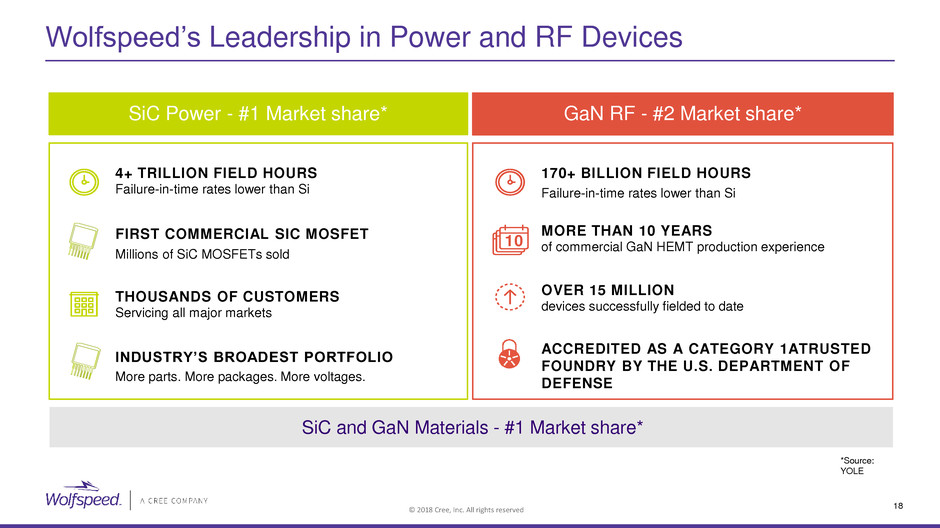

Wolfspeed’s Leadership in Power and RF Devices

SiC Power - #1 Market share*

GaN RF - #2 Market share*

4+ TRILLION FIELD HOURS

Failure-in-time rates lower than Si

FIRST COMMERCIAL SIC MOSFET

THOUSANDS OF CUSTOMERS

Servicing all major markets

170+ BILLION FIELD HOURS

MORE THAN 10 YEARS

of commercial GaN HEMT production experience

OVER 15 MILLION

devices successfully fielded to date

ACCREDITED AS A CATEGORY 1ATRUSTED

FOUNDRY BY THE U.S. DEPARTMENT OF

DEFENSE

10

INDUSTRY’S BROADEST PORTFOLIO

Millions of SiC MOSFETs sold

More parts. More packages. More voltages.

Failure-in-time rates lower than Si

*Source:

YOLE

SiC and GaN Materials - #1 Market share*

© 2018 Cree, Inc. All rights reserved 19

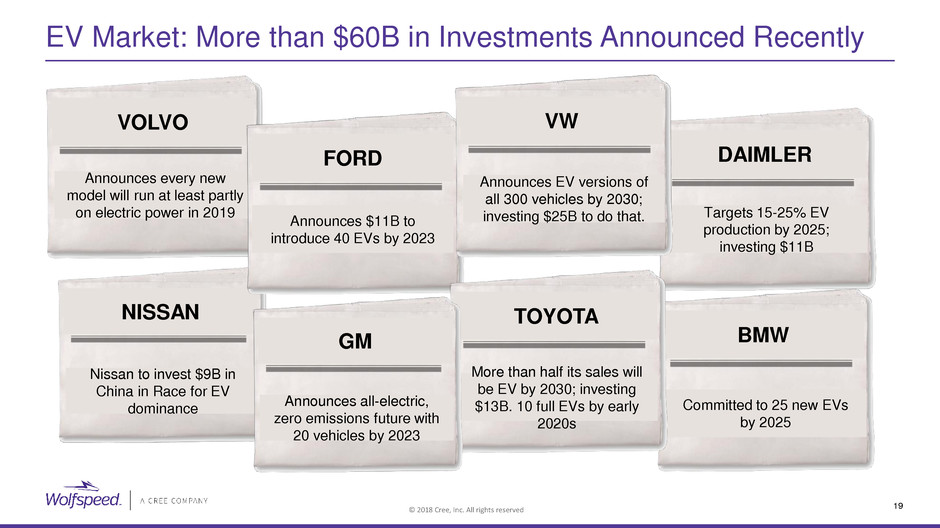

EV Market: More than $60B in Investments Announced Recently

BMW

Committed to 25 new EVs

by 2025

NISSAN

Nissan to invest $9B in

China in Race for EV

dominance

VOLVO

Announces every new

model will run at least partly

on electric power in 2019

FORD

Announces $11B to

introduce 40 EVs by 2023

DAIMLER

Targets 15-25% EV

production by 2025;

investing $11B

TOYOTA

More than half its sales will

be EV by 2030; investing

$13B. 10 full EVs by early

2020s

VW

Announces EV versions of

all 300 vehicles by 2030;

investing $25B to do that.

GM

Announces all-electric,

zero emissions future with

20 vehicles by 2023

© 2018 Cree, Inc. All rights reserved 20

Even Modest EV Adoption Drives Significant Opportunity

• SiC at the heart of EV

and EV infrastructure

• Multi-decade

opportunity

$15B

$-

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

0

20

40

60

80

100

120

140

2017 2022 2027 2032

S

iC

O

p

p

ortun

it

y

in

M

ill

io

n

s

V

e

h

ic

le

s

P

ro

d

u

c

e

d

i

n

M

ill

io

n

s

Total Vehicles Electric SiC Opportunity

*Source: Bloomberg New Energy Finance and Cree Estimates

$6B

$2.4B

© 2018 Cree, Inc. All rights reserved 21

Power

© 2018 Cree, Inc. All rights reserved 22

Key Markets Driving SiC Power Market Expansion

Drivers

≈30% of all vehicles made will be electric

by 2032

Faster charging and long-term reliability

High efficiency and power density for commercial

and industrial equipment

Legislation and social awareness for renewables

Worldwide SiC

Revenue 2017

(Source: YOLE estimates )

$5.0B

SAM 2022

Solar

Electric

Vehicles

$280M

Fast Charging

SiC Power Market

(Source: YOLE and company estimates)

© 2018 Cree, Inc. All rights reserved 23

On-Vehicle SiC has Unprecedented Potential for Growth

Drivers

Within ten years half of all model types

manufactured will be EVs

Policy tailwinds – emission standards

are tightening

Increasing Range

Decreasing cost

Worldwide SiC

Revenue 2017

$2.4B

SAM 2022

Solar

$7M

SiC EV Market

(Source: YOLE and company estimates)

(Source:

YOLE )

© 2018 Cree, Inc. All rights reserved 24

Fast Chargers Could Drive a $500 Million SAM by 2022

Drivers

Asia leading the field for charger installations

On-the-go demand for fast charging

Efficiency and size key to installation

Worldwide SiC

Revenue 2017

$522M

SAM 2022

Solar

Electric

Vehicles

$2M

Fast Charging

SiC Fast

Charging Market

(Source: YOLE and company estimates)

(Source: YOLE estimates)

© 2018 Cree, Inc. All rights reserved 25

Solar Silicon Carbide Adoption Accelerating

Drivers

Energy efficiency and cost

Legislation and global incentives

Social awareness for renewables

Worldwide SiC Solar

Revenue 2017

$2.1B

SAM 2022

Solar

Electric

Vehicles

$85M

Solar SiC Market

(Source: YOLE and company estimates)

(Source: YOLE estimates)

© 2018 Cree, Inc. All rights reserved 26

10 MW

saved

per year

• SiC enables lighter, smaller, quieter and more efficient solar inverters

• SiC saves 10 megawatts for each gigawatt installed per year vs silicon; saves 500 watts for every

second in operation

© 2018 Cree, Inc. All rights reserved 27

RF

© 2018 Cree, Inc. All rights reserved 28

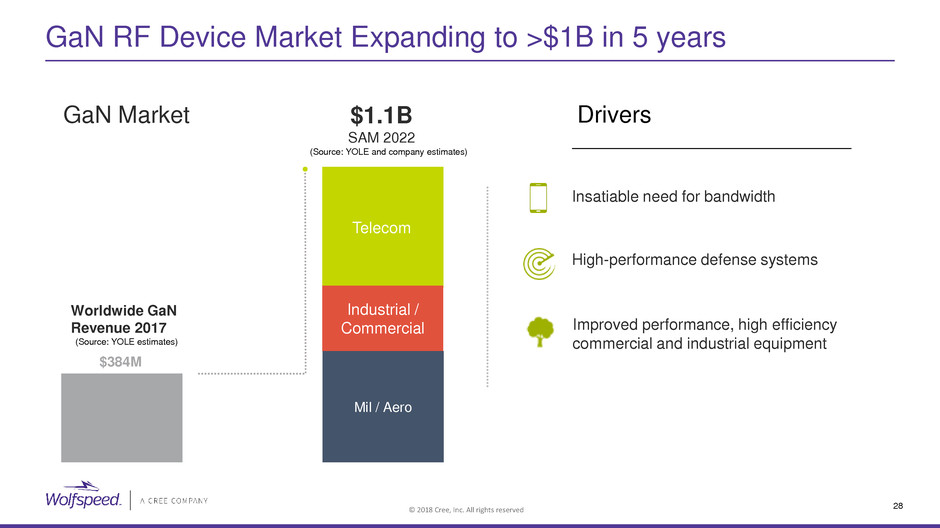

GaN RF Device Market Expanding to >$1B in 5 years

Drivers

Insatiable need for bandwidth

High-performance defense systems

Improved performance, high efficiency

commercial and industrial equipment

Worldwide GaN

Revenue 2017

$1.1B

SAM 2022

Telecom

Industrial /

Commercial

$384M

Mil / Aero

GaN Market

(Source: YOLE and company estimates)

(Source: YOLE estimates)

© 2018 Cree, Inc. All rights reserved 29

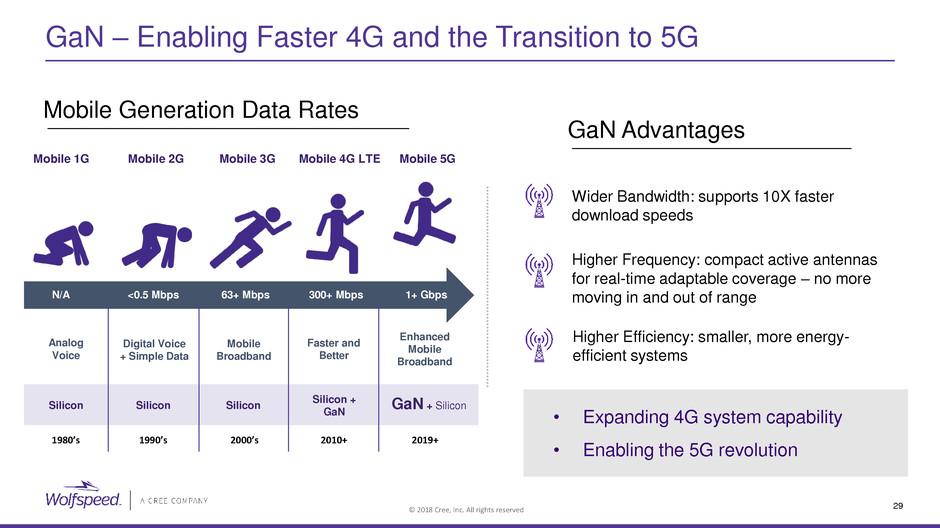

GaN – Enabling Faster 4G and the Transition to 5G

GaN Advantages

Wider Bandwidth: supports 10X faster

download speeds

Higher Frequency: compact active antennas

for real-time adaptable coverage – no more

moving in and out of range

Higher Efficiency: smaller, more energy-

efficient systems

Mobile Generation Data Rates

Mobile 1G Mobile 2G Mobile 3G Mobile 4G LTE Mobile 5G

N/A <0.5 Mbps 63+ Mbps 300+ Mbps 1+ Gbps

Silicon Silicon Silicon

Silicon +

GaN

1980’s 1990’s 2000’s 2010+ 2019+

GaN + Silicon

Enhanced

Mobile

Broadband

• Expanding 4G system capability

• Enabling the 5G revolution

Faster and

Better

Mobile

Broadband

Digital Voice

+ Simple Data

Analog

Voice

© 2018 Cree, Inc. All rights reserved 30

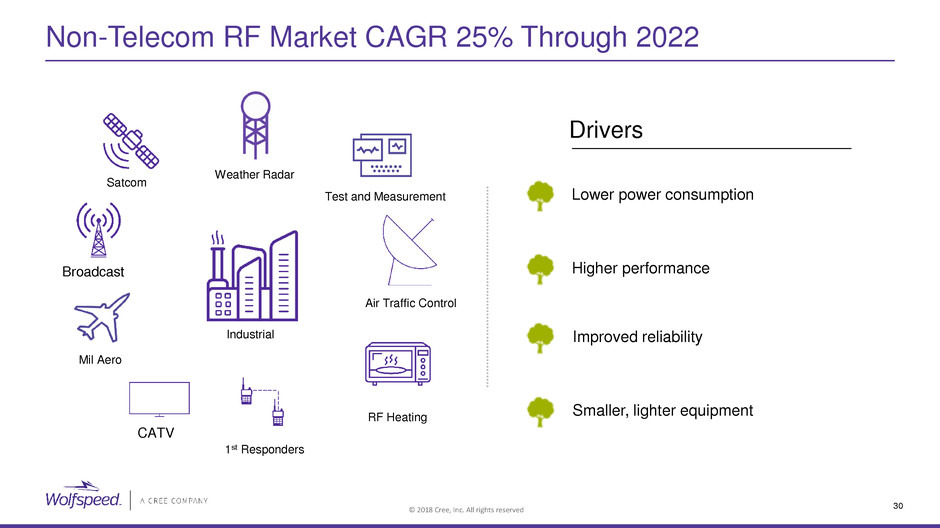

Non-Telecom RF Market CAGR 25% Through 2022

Drivers

Lower power consumption

Higher performance

Improved reliability

Smaller, lighter equipment

Weather Radar

Air Traffic Control

1st Responders

CATV

RF Heating

Industrial

Test and Measurement

Mil Aero

Broadcast

Satcom

© 2018 Cree, Inc. All rights reserved 31

Materials

© 2018 Cree, Inc. All rights reserved 32

A More Powerful, Efficient World Enabled by SiC and GaN

• #1 supply position at major power and RF

semi companies globally

• Over three decades of global technology

leadership

• Continued innovation through device

performance feedback

• Unrivaled scale; significantly ramping capacity

to meet demand

30

YEA

RS

© 2018 Cree, Inc. All rights reserved 33

SiC Materials Innovation Leadership

• Released the world’s first commercial SiC wafers in 1991

• Led every subsequent wafer diameter increase

1991

Unrivaled scale and market share leader

Initiated Commercial SiC Wafer Market

Led commercial scale SiC production

© 2018 Cree, Inc. All rights reserved 34

SiC Materials Market Expanding To >$1B by 2022

Drivers

EV applications driving significant volume

steps in power wafer market

Significant adoption in broad

industrial market applications

Telecom/5G commercial growth with

major RF players

Worldwide SiC Materials

Revenue 2017

$1.2B

SAM 2022

Solar

Electric

Vehicles

$56M

Value proposition for SiC validated in

applications that are driving significant growth

SiC Materials

Market

(Source: YOLE and company estimates)

(Source: YOLE estimates)

© 2018 Cree, Inc. All rights reserved 35

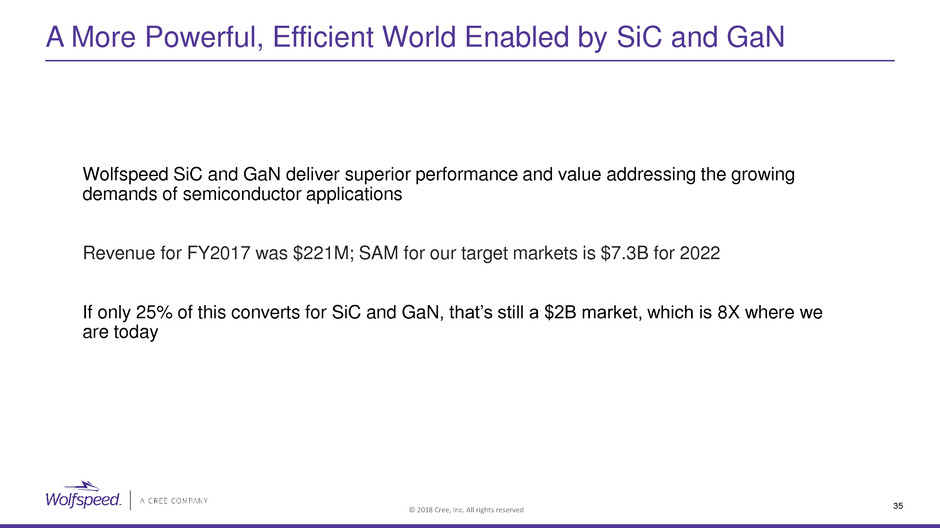

A More Powerful, Efficient World Enabled by SiC and GaN

Wolfspeed SiC and GaN deliver superior performance and value addressing the growing

demands of semiconductor applications

Revenue for FY2017 was $221M; SAM for our target markets is $7.3B for 2022

If only 25% of this converts for SiC and GaN, that’s still a $2B market, which is 8X where we

are today

© 2018 Cree, Inc. All rights reserved 36

WOLFSPEED

A Powerhouse Semiconductor company focused on Silicon Carbide (SiC)

and Gallium Nitride (GaN)

• Large multi-decade growth opportunities with SiC and GaN in Electric Vehicles, Solar energy,

Telecommunications, Industrial, and Mil/Aero

• Invest to expand scale and to accelerate growth of SiC Materials, Power Devices and GaN

RF Devices where SiC and GaN have distinct advantage

• Objectives: High growth, strong gross margins with good fall through to the bottom line

Cree’s Transformation Path

© 2018 Cree, Inc. All rights reserved

© 2018 Cree, Inc. All rights reserved

DAVE EMERSON, EVP AND GM

FEBRUARY 26TH, 2018

LED BUSINESS

© 2018 Cree, Inc. All rights reserved 39

LED

Focus where our best-in-class technology and application-optimized solutions are differentiated

and valued

• High-power technology provides the only solution

• High-power general lighting

• Automotive lighting

• Application-optimized solutions solve the most difficult system-level problems

• Next-generation video

• Specialty lighting

• Cree Venture JV accesses additional SAM

• Broader mid-power markets

• Objectives: Modest growth and gross margin expansion

OPEX lean, CAPEX light

Cree’s Transformation Path

© 2018 Cree, Inc. All rights reserved 40

LEDs

$550M

GM – 27%

(2017)

$793M

GM – 31%

(2022)

Stickier applications

High-power Lighting, Automotive Lighting,

Next-generation Video Screen, Specialty Lighting

Broader SAM

Cree Venture JV

Modest revenue growth with good gross margin expansion

OpEx Lean, CapEx Light

© 2018 Cree, Inc. All rights reserved 41

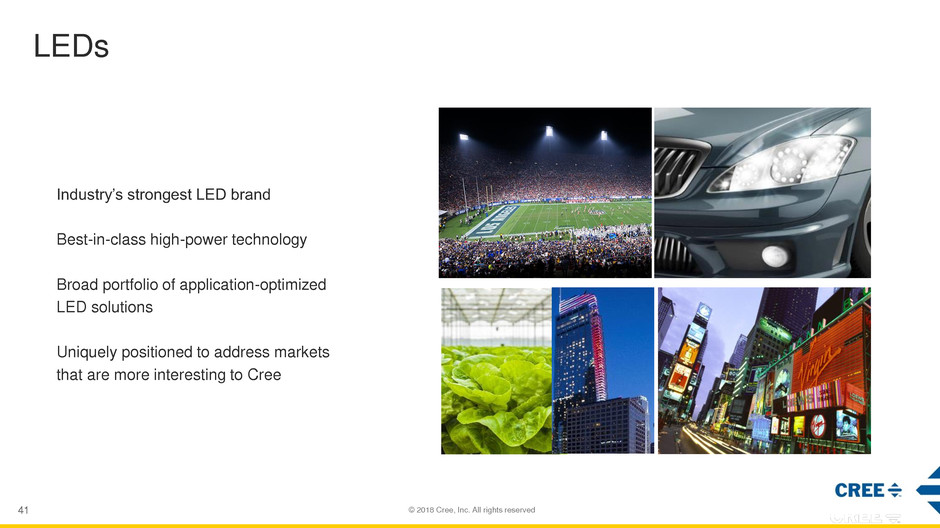

LEDs

Industry’s strongest LED brand

Best-in-class high-power technology

Broad portfolio of application-optimized

LED solutions

Uniquely positioned to address markets

that are more interesting to Cree

© 2018 Cree, Inc. All rights reserved 42

Focus in Differentiated Market Segments

HIGH

P

O

W

E

R

A

P

P

LIC

A

TIO

N

O

P

TIMIZE

D

Automotive Lighting

$1.6B

Next-Generation

Video

$1.1B

Specialty Lighting

$0.7B

New focus provides access to $4.6B SAM by 2022 in differentiated applications

* Sources: IHS Packaged LEDs 2017, Strategies Unlimited 2017, LEDInside 2017 & Cree internal analysis

General Lighting

$1.2B

© 2018 Cree, Inc. All rights reserved 43

Cree Venture: Synergy for Growth

Expanded portfolio to address larger mid-power opportunity

IP, Brand & Channel

High Volume / Cost Optimized

Low cost, Large Scale Manufacturing

Increase General Lighting SAM 5X - Low OpEx, No CapEx

+

© 2018 Cree, Inc. All rights reserved 44

New Strategic Focus Drives Profits

G

ros

s

Ma

rgi

n

Time

New focus combined with OpEx Lean/CapEx Light approach increases cash flow

New focus

Differentiate

• High-power General Lighting

• Automotive

• Next-Generation Video

Screen

• Specialty Lighting

Broader MP Market

• Cree Venture JV

© 2018 Cree, Inc. All rights reserved 45

LED

Focus where our best-in-class technology and application-optimized solutions are differentiated

and valued

• High-power technology provides the only solution

• High-power general lighting

• Automotive lighting

• Application-optimized solutions solve the most difficult system-level problems

• Next-generation video

• Specialty lighting

• Cree Venture JV accesses additional SAM

• Broader mid-power markets

• Objectives: Modest growth and gross margin expansion

OPEX lean, CAPEX light

Cree’s Transformation Path

© 2018 Cree, Inc. All rights reserved

© 2018 Cree, Inc. All rights reserved

CRAIG ATWATER, SVP AND GM

FEBRUARY 26TH, 2018

LIGHTING BUSINESS

© 2018 Cree, Inc. All rights reserved 48

LIGHTING

Fix the Business

• Fix quality through improved processes and new product developments

• Improve channel position and relationships

• New product innovations to better position the portfolio--focused on higher specification and

smart intelligent features improving customer satisfaction

• Objectives: Modest growth, gross margin in line with the industry and operating margin

expansion

Cree’s Transformation Path

© 2018 Cree, Inc. All rights reserved 49

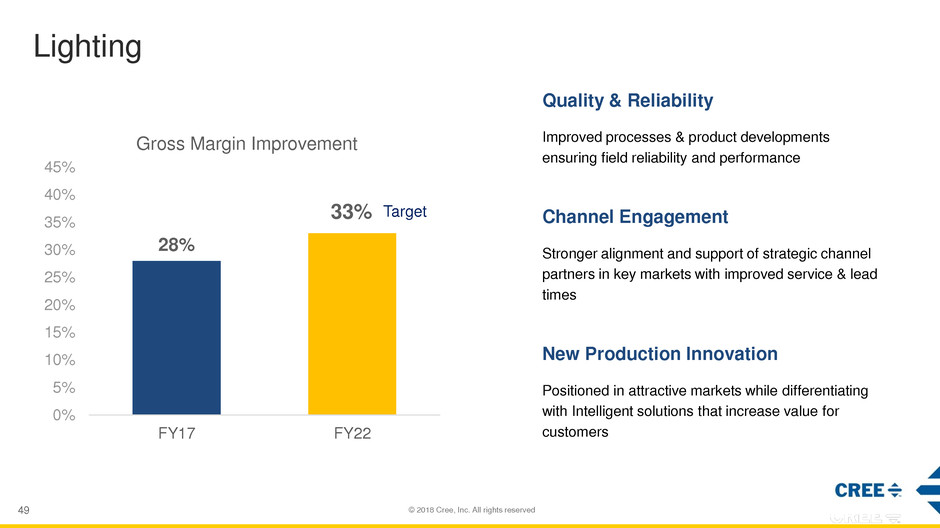

Lighting

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

FY17 FY22

Gross Margin Improvement

28%

Quality & Reliability

Improved processes & product developments

ensuring field reliability and performance

Channel Engagement

Stronger alignment and support of strategic channel

partners in key markets with improved service & lead

times

New Production Innovation

Positioned in attractive markets while differentiating

with Intelligent solutions that increase value for

customers

33% Target

© 2018 Cree, Inc. All rights reserved 50

$701M

FY2017

Intelligent

Indoor Outdoor

Lighting

Office / Education / Retail

Healthcare

Industrial

Area/Site

© 2018 Cree, Inc. All rights reserved 51

Quality & Reliability

Key Drivers:

• Improved process controls resulting in quality product

developments

• State-of-the art reliability lab

• Resolution & reduction of field claims

Early Indications:

• Design & process improvements preventing new issues

from being sent into the market

• Recent product launches performing well

© 2018 Cree, Inc. All rights reserved 52

Channel Engagement

Key Drivers:

• Stronger agent alignment & support

• Distributor partnerships & growth programs

• Stock & Flow penetration

• Service enhancements & Lead Time Optimization

Early Indications:

• Increased field selling resources by >75%

• Aligning w/ partners to drive mutual growth

© 2018 Cree, Inc. All rights reserved 53

New Product Innovation

Key Drivers:

• Engineering teams refocused on product development

• Complete portfolio optionality to increase specification

strength & margin opportunity

• Intelligent product solutions that delight customers and

solve new problems

Early Indications:

• Reprioritized NPI pipeline to position portfolio in more

attractive markets

• Recent NPI GM low 30’s

© 2018 Cree, Inc. All rights reserved 54

Lighting

Recognized leader in indoor and outdoor LED

lighting—delivering better light experiences without

compromise

Lighting technologies delivering brilliantly efficient,

radically simple and exceptional high quality

products

Built on a foundation of relentless innovation, we

are committed to delivering value beyond light

Outdoor

Indoor

© 2018 Cree, Inc. All rights reserved 55

LIGHTING

Fix the Business

• Fix quality through improved processes and new product developments

• Improve channel position and relationships

• New product innovations to better position the portfolio--focused on higher specification and

smart intelligent features improving customer satisfaction

• Objectives: Modest growth, gross margin in line with the industry and operating margin

expansion

Cree’s Transformation Path

© 2018 Cree, Inc. All rights reserved

© 2018 Cree, Inc. All rights reserved

MIKE McDEVITT, CFO

FEBRUARY 26TH, 2018

BUSINESS MODEL

© 2018 Cree, Inc. All rights reserved 58

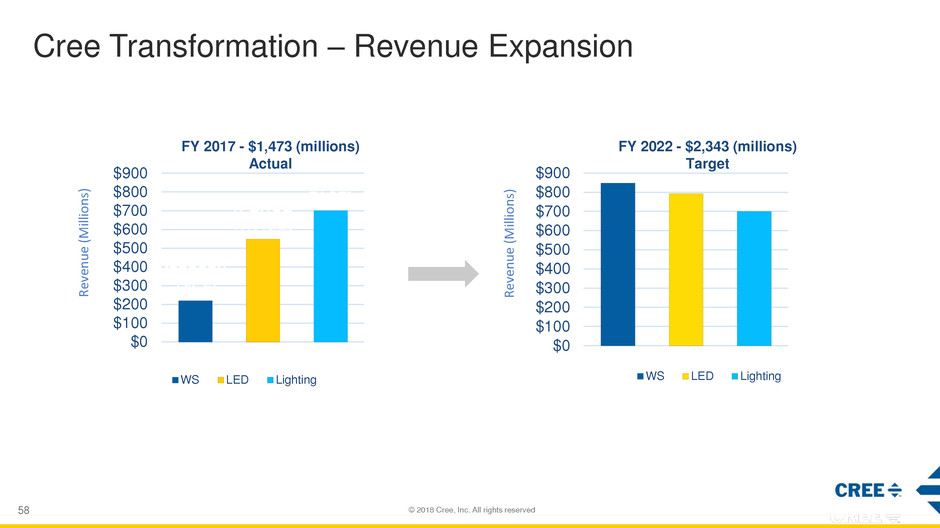

Cree Transformation – Revenue Expansion

[PERCEN

TAGE]

[PERCE

NTAGE]

[PERCEN

TAGE]

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

WS LED Lighting

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

WS LED Lighting

FY 2017 - $1,473 (millions)

Actual

FY 2022 - $2,343 (millions)

Target

Re

ven

u

e

(M

ill

io

n

s)

Re

ven

u

e

(M

ill

io

n

s)

© 2018 Cree, Inc. All rights reserved 59

Gross Margin and Earnings Power Expansion

Long Range Model (non-GAAP)

• GM 40+%

• OM 20+%

• Wolfspeed targets high revenue growth, strong gross margins with good fall through to bottom line

• LED targets modest revenue growth and gross margin expansion, OPEX lean and CAPEX light

• Lighting targets modest growth, gross margin in line with the industry, operating margin expansion

25.7%

40.0%

-0.7%

20.0%

-5%

0%

5%

10%

15%

20%

25%

30%

35%

40%

F18Q2 FY22

%

to

Re

ven

ue

Gross and Operating Margin (non-GAAP)

GM% OM%

Actual

Target

© 2018 Cree, Inc. All rights reserved 60

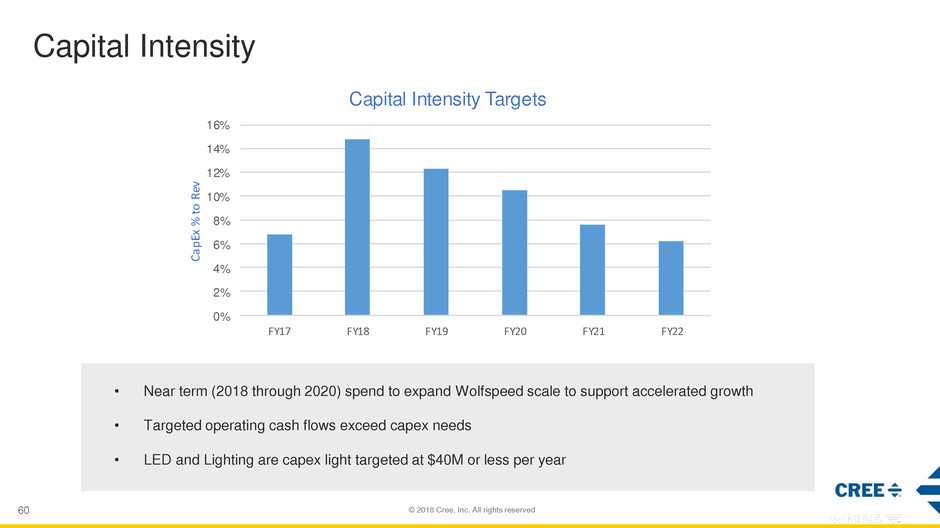

Capital Intensity

0%

2%

4%

6%

8%

10%

12%

14%

16%

FY17 FY18 FY19 FY20 FY21 FY22

Ca

pEx

%

to

Rev

Capital Intensity Targets

• Near term (2018 through 2020) spend to expand Wolfspeed scale to support accelerated growth

• Targeted operating cash flows exceed capex needs

• LED and Lighting are capex light targeted at $40M or less per year

© 2018 Cree, Inc. All rights reserved 61

Powering Earnings Growth

8%

26%

0%

5%

10%

15%

20%

25%

30%

F18Q2 FY22

EB

ITD

A

%

to

Re

ven

ue

EBITDA

$-

$250

$500

$750

$1,000

$1,250

$1,500

F18Q2 FY22

C&

I ($

's i

n M

's)

Cash & Investments

Organic growth in segments that reward value

• Provides profit expansion

• Increases cash position

• Enables access to other forms of capital to pursue other strategic opportunities

Actual

Target

Actual

Target

© 2018 Cree, Inc. All rights reserved

GREGG LOWE, CEO

FEBRUARY 26TH, 2018

© 2018 Cree, Inc. All rights reserved 63

WOLFSPEED

A Powerhouse Semiconductor company focused on Silicon Carbide (SiC) and Gallium

Nitride (GaN)

LED

Focus where our best-in-class technology and application-optimized solutions are

differentiated and valued

LIGHTING

Fix the Business

Cree’s Transformation Path

© 2018 Cree, Inc. All rights reserved

© 2018 Cree, Inc. All rights reserved

Appendix 1

© 2018 Cree, Inc. All rights reserved 66

Non-GAAP Financial Measures

This presentation includes certain non-GAAP financial measures and targets. Cree's management evaluates results and makes operating decisions using both GAAP and non-

GAAP measures included in this presentation. Non-GAAP results exclude certain costs, charges and expenses which are included in GAAP results. By including these non-

GAAP measures, management intends to provide investors with additional information to further analyze the Company's performance, core results and underlying trends. Non-

GAAP results are not prepared in accordance with GAAP and non-GAAP information should be considered a supplement to, and not a substitute for, financial statements

prepared in accordance with GAAP. Investors and potential investors are encouraged to review the reconciliation of non-GAAP financial measures to their most directly

comparable GAAP measures included in this Appendix.

We present three non-GAAP financial measures in this presentation – Non-GAAP Gross Margin, Non-GAAP Operating Margin and EBITDA. For the presentation of historical

non-GAAP financial measures and results, the reconciliation to their most directly comparable GAAP measures are on the next page.

For forward-looking non-GAAP financial measures, we are unable to provide a reconciliation to the most directly comparable GAAP financial measure because certain information

needed to project these future measures is difficult to estimate and is dependent on future events which are uncertain or outside of our control. Nonetheless, we note that the

items that we expect to exclude from our non-GAAP measures (when applicable) include stock-based compensation expense; amortization or impairment of acquisition-related

intangibles; business restructuring charges or gains; net changes with equity investments; and income tax effects of the foregoing non-GAAP items. Cree management currently

believes that the Company’s long term non-GAAP tax rate should approximate the GAAP tax rate, subject to the composition on a jurisdiction by jurisdiction basis of revenue,

expense and income.

Appendix -- Non-GAAP Measures Reconciliation

© 2018 Cree, Inc. All rights reserved 67

Appendix -- Non-GAAP Measures Reconciliation

Non-GAAP Gross Margin Reconciliation FY18Q2 Non-GAAP Operating Margin Reconciliation FY18Q2 EBITDA Reconciliation FY18Q2

Revenue $ 367.9 Revenue $ 367.9 Revenue $ 367.9

GAAP Gross Profit $ 92.6 GAAP Operating (loss) income $ (26.3) GAAP Income before income taxes $ 0.4

GAAP Gross Margin % 25.2% GAAP Operating (loss) income % -7.2% Adjustments:

Adjustment: Adjustments: Depreciation and amortization 37.2

Stock-based compensation expense 1.9 Stock-based compensation expense 12.0 Stock-based compensation 12.0

Non-GAAP Gross Profit $ 94.5

Amortization or impairment of

acquisition related intangibles 6.8

Loss on Disposal or impairment

of long lived assets 4.3

Non-GAAP Gross Margin % 25.7% Executive Severance 4.9 (Gain) loss on equity investment (25.2)

Adjustment Total 23.7 Interest Expense 1.1

Non-GAAP Operating (loss) income $ (2.6) Adjustment Total 29.4

Non-GAAP Operating (loss) income % -0.7% EBITDA $ 29.8

EBITDA % 8%