Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - ROPER TECHNOLOGIES INC | a201710-kex321.htm |

| EX-31.2 - EXHIBIT 31.2 - ROPER TECHNOLOGIES INC | a201710-kex312.htm |

| EX-31.1 - EXHIBIT 31.1 - ROPER TECHNOLOGIES INC | a201710-kex311.htm |

| EX-23.1 - EXHIBIT 23.1 - ROPER TECHNOLOGIES INC | a201710-kex231.htm |

| EX-21.1 - EXHIBIT 21.1 - ROPER TECHNOLOGIES INC | a201710-kex211.htm |

| EX-10.23 - EXHIBIT 10.23 - ROPER TECHNOLOGIES INC | a201710-kex1023.htm |

| EX-10.22 - EXHIBIT 10.22 - ROPER TECHNOLOGIES INC | a201710-kex1022.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

--------------------------

FORM 10-K

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___ to ___

Commission File Number 1-12273

ROPER TECHNOLOGIES, INC.

(Exact name of Registrant as specified in its charter)

----------------

Delaware | 51-0263969 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

----------------

6901 Professional Parkway East, Suite 200

Sarasota, Florida 34240

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (941) 556-2601

----------------

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

Title of Each Class | Name of Each Exchange On Which Registered | |

Common Stock, $0.01 Par Value | New York Stock Exchange | |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

----------------

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. þ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§223.405) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act). þ Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark if the registrant is a shell company (as defined in Rule 12-b2 of the Act). ☐ Yes þ No

Based on the closing sale price on the New York Stock Exchange on June 30, 2017, the aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant was: $23,224,859,776.

Number of shares of registrant's Common Stock outstanding as of February 16, 2018: 102,826,454.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Proxy Statement to be furnished to Stockholders in connection with its Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

ROPER TECHNOLOGIES, INC.

FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017

Table of Contents

Page | ||

2

Information About Forward-Looking Statements

This Annual Report on Form 10-K ("Annual Report") includes and incorporates by reference "forward-looking statements" within the meaning of the federal securities laws. In addition, we, or our executive officers on our behalf, may from time to time make forward-looking statements in reports and other documents we file with the U.S. Securities and Exchange Commission ("SEC") or in connection with oral statements made to the press, potential investors or others. All statements that are not historical facts are "forward-looking statements." Forward-looking statements may be indicated by words or phrases such as "anticipate," "estimate," "plans," "expects," "projects," "should," "will," "believes" or "intends" and similar words and phrases. These statements reflect management's current beliefs and are not guarantees of future performance. They involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied in any forward-looking statement.

Examples of forward-looking statements in this report include but are not limited to statements regarding operating results, the success of our operating plans, our expectations regarding our ability to generate cash and reduce debt and associated interest expense, profit and cash flow expectations, the prospects for newly acquired businesses to be integrated and contribute to future growth and our expectations regarding growth through acquisitions. Important assumptions relating to the forward-looking statements include, among others, demand for our products, the cost, timing and success of product upgrades and new product introductions, raw material costs, expected pricing levels, expected outcomes of pending litigation, competitive conditions and general economic conditions. These assumptions could prove inaccurate. Although we believe that the estimates and projections reflected in the forward-looking statements are reasonable, our expectations may prove to be incorrect. Important factors that could cause actual results to differ materially from estimates or projections contained in the forward-looking statements include, but are not limited to:

• | general economic conditions; |

• | difficulty making acquisitions and successfully integrating acquired businesses; |

• | any unforeseen liabilities associated with future acquisitions; |

• | limitations on our business imposed by our indebtedness; |

• | unfavorable changes in foreign exchange rates; |

• | difficulties associated with exports; |

• | risks and costs associated with our international sales and operations; |

• | rising interest rates; |

• | product liability and insurance risks; |

• | increased warranty exposure; |

• | future competition; |

• | the cyclical nature of some of our markets; |

• | reduction of business with large customers; |

• | risks associated with government contracts; |

• | changes in the supply of, or price for, raw materials, parts and components; |

• | environmental compliance costs and liabilities; |

• | risks and costs associated with asbestos-related litigation; |

• | potential write-offs of our goodwill and other intangible assets; |

• | our ability to successfully develop new products; |

• | failure to protect our intellectual property; |

• | the effect of, or change in, government regulations (including tax); |

• | economic disruption caused by terrorist attacks, including cybersecurity threats, health crises or other unforeseen events; and |

• | the factors discussed in Item 1A to this Annual Report under the heading "Risk Factors." |

We believe these forward-looking statements are reasonable. However, you should not place undue reliance on any forward-looking statements, which are based on current expectations. Further, forward-looking statements speak only as of the date they are made, and we undertake no obligation to publicly update any of them in light of new information or future events.

3

PART I

ITEM 1. | BUSINESS |

Our Business

Roper Technologies, Inc. ("Roper," the "Company," "we," "our" or "us") is a diversified technology company. We operate businesses that design and develop software (both license and software-as-a-service) and engineered products and solutions for a variety of niche end markets.

We pursue consistent and sustainable growth in earnings and cash flow by emphasizing continuous improvement in the operating performance of our existing businesses and by acquiring other businesses that offer high value-added software, services, engineered products and solutions that we believe are capable of achieving growth and maintaining high margins. We compete in many niche markets and believe we are the market leader or a competitive alternative to the market leader in most of these markets.

We were incorporated on December 17, 1981 under the laws of the State of Delaware.

Market Share, Market Expansion, and Product Development

Leadership with Engineered Content for Niche Markets - We maintain a leading position in many of our markets. We believe our market positions are attributable to the technical sophistication of our products and software, the applications expertise used to create our advanced products and systems, and our distribution and service capabilities. Our operating units grow their businesses through new product development and development of new applications and services to satisfy customer needs. In addition, our operating units grow our customer base by expanding our access to customers and entering adjacent markets.

Diversified End Markets and Geographic Reach - We have a global presence, with sales to customers outside the U.S. totaling $1.3 billion in 2017. Information regarding our international operations is set forth in Note 13 of the Notes to Consolidated Financial Statements included in this Annual Report.

Research and Development - We conduct applied research and development to improve the quality and performance of our products and to develop new technologies and products. Our research and development spending was $281 million in 2017 as compared to $195 million and $164 million in 2016 and 2015, respectively.

Our Business Segments

Our operations are reported in four segments based upon common customers, markets, sales channels, technologies and common cost opportunities. The segments are: RF Technology, Medical & Scientific Imaging, Industrial Technology and Energy Systems & Controls. Financial information about our business segments is presented in Note 13 of the Notes to Consolidated Financial Statements included in this Annual Report.

RF Technology

Our RF Technology segment provides radio frequency identification ("RFID") communication technology and software solutions. This segment had net revenues of $1.86 billion for the year ended December 31, 2017, representing 40.4% of our total net revenues.

Comprehensive Application Management Software - We provide 1) enterprise software and information solutions for government contractors, professional services firms and other project-based businesses, 2) comprehensive management software solutions for law and other professional services firms, including business development, calendar/docket matter management, time and billing and case management and 3) preconstruction project management solutions for construction industry professionals.

Software-as-a-Service - We maintain electronic marketplaces that connect 1) available capacity of trucking units with the available loads of freight to be moved from location to location throughout North America, 2) food suppliers, distributors and vendors, primarily in the perishable food sector and 3) construction industry professionals.

Card Systems/Integrated Security Solutions - We provide software, card systems and integrated security solutions primarily to education and health care markets. We also provide an integrated nutrition management solution used by food service customers.

4

Toll and Traffic Systems - We manufacture and sell toll tags and monitoring systems as well as provide transaction and violation processing services for toll and traffic systems to both governmental and private sector entities. In addition, we provide intelligent traffic systems that assist customers in improving traffic flow and infrastructure utilization.

RFID Card Readers - We design, develop and manufacture RFID card readers that support most smart cards worldwide. The readers are used in numerous applications and OEM solutions including secure printing and single sign-on across several vertical markets including healthcare, manufacturing and government.

Metering and Remote Monitoring - We manufacture and sell meter reading, data logging and pressure control products for use primarily in water and gas applications. We also provide network monitoring, leakage reduction and pressure control services in water and gas distribution networks.

Medical and Scientific Imaging

Our Medical & Scientific Imaging segment offers products and software in medical applications, and high performance digital imaging products. For 2017, this segment had net revenues of $1.41 billion, representing 30.6% of our total net revenues.

Medical Products and Software - We provide diagnostic and laboratory software solutions to healthcare providers and services and technologies to support the diverse and complex needs of alternate site health care providers who deliver services outside of an acute care hospital setting. We also manufacture and sell patient positioning devices and related software for use in radiation oncology and 3-D measurement technology in computer-assisted surgery, and we supply diagnostic and therapeutic disposable products used in ultrasound imaging for minimally invasive medical procedures. We design and manufacture a non-invasive instrument for portable ultrasound bladder volume measurement and a video laryngoscope designed to enable rapid intubation in difficult situations. In addition, we provide a cloud-based financial analytics and performance software platform to healthcare providers.

Digital Imaging Products and Software - We manufacture and sell extremely sensitive, high-performance electron filters, charged couple device ("CCD") and complementary metal oxide semiconductor ("CMOS") cameras, detectors and related software for a variety of scientific and industrial uses, which require high resolution and/or high speed digital video, including electron microscopy and spectroscopy applications. We sell these products for use within academic, government research, semiconductor, security and other end-user markets such as biological and material science. They are frequently incorporated into products by original equipment manufacturers ("OEMs").

Industrial Technology

Our Industrial Technology segment produces primarily water meter and meter reading technology, fluid handling pumps, and materials analysis solutions. For 2017, this segment had net revenues of $784 million, representing 17.0% of our total net revenues.

Water Meter and Automatic Meter Reading Products and Systems - We manufacture and distribute water meter products serving the residential, commercial and industrial water management markets, and several lines of automatic meter reading products and systems serving these markets.

Fluid Handling Pumps - We manufacture and sell a wide variety of pumps. These pumps vary significantly in complexity and in pumping method employed, which allows for the movement and application of a diverse range of low and high viscosity liquids, high solids content slurries and chemicals. Our pumps are used in end markets such as oil and gas, agricultural, water and wastewater, chemical and general industrial.

Materials Analysis Equipment and Consumables - We manufacture and sell equipment and supply consumables necessary to prepare material samples for testing and analysis. These products are used mostly within the material science, steel, automotive, electronics, mining and research end-user markets.

The Industrial Technology segment companies' revenues reflect a combination of standard products and specially engineered, application-specific products. Standard products are typically shipped within two weeks of receipt of order. Application-specific products typically ship within 6 to 12 weeks following receipt of order. However, larger project orders and blanket purchase orders for certain OEMs may extend shipment for longer periods.

5

Energy Systems & Controls

Our Energy Systems & Controls segment principally produces control systems, testing equipment, valves and sensors. For 2017, this segment had net revenues of $551 million, representing 12.0% of our total net revenues.

Control Systems - We manufacture control systems and provide related engineering and commissioning services for turbomachinery applications, primarily in energy markets.

Fluid Properties Testing Equipment - We manufacture and sell test equipment to determine physical and elemental properties, such as sulfur and nitrogen content, flash point, viscosity, freeze point and distillation range of liquids and gases primarily for the petroleum industry.

Sensors, Controls and Valves - We manufacture sensors and control equipment including pressure sensors, temperature sensors, measurement instruments and control software for global rubber, plastics and process industries. We also manufacture and distribute valves, sensors, switches and control products used on engines, compressors, turbines and other powered equipment for the oil and gas, pipeline, power generation, marine engine and general industrial markets. Many of these products are designed for use in hazardous environments.

Non-destructive Inspection and Measurement Instrumentation - We manufacture non-destructive inspection and measurement solutions including measurement probes, robotics, vibration sensors, switches and transmitters. These solutions are applied principally in nuclear energy markets. Many of these products are designed for use in hazardous environments.

The Energy Systems & Controls segment companies' revenues reflect a combination of standard products and large engineered projects. Standard products generally ship within two weeks of receipt of order, and large engineered projects may have lead times of several months. As such, backlog may fluctuate depending upon the timing of large project awards.

Materials and Suppliers

We believe most materials and supplies we use are readily available from numerous sources and suppliers throughout the world. However, some components and sub-assemblies are currently available from a limited number of suppliers. Some high-performance components for digital imaging products can be in short supply and/or suppliers have occasional difficulty manufacturing such components to our specifications. We regularly investigate and identify alternative sources where possible, and we believe these conditions equally affect our competitors. Supply shortages have not had a material adverse effect on our revenues although delays in shipments have occurred following such supply interruptions.

Backlog

Our backlog includes only firm unfilled orders expected to be recognized as revenue within twelve months. Backlog was $1.7 billion at December 31, 2017, and $1.6 billion at December 31, 2016.

Distribution and Sales

Distribution and sales occur through direct sales offices, manufacturers' representatives and distributors. In addition, our Medical & Scientific Imaging segment also sells through value added resellers ("VARs") and OEMs.

Environmental Matters and Other Governmental Regulation

Our operations and properties are subject to laws and regulations relating to environmental protection, including those governing air emissions, water discharges, waste management and workplace safety. We use, generate and dispose of hazardous substances and waste in our operations and could be subject to material liabilities relating to the investigation and clean-up of contaminated properties and related claims. We are required to conform our operations and properties to these laws and adapt to regulatory requirements in all countries as these requirements change. In connection with our acquisitions, we may assume significant environmental liabilities, some of which we may not be aware of, or may not be quantifiable, at the time of acquisition. In addition, new laws and regulations, the discovery of previously unknown contamination or the imposition of new requirements could increase our costs or subject us to new or increased liabilities.

Customers

No customer accounted for 10% or more of net revenues for 2017 for any of our segments or for our company as a whole.

6

Competition

Generally, our products and solutions face significant competition, usually from a limited number of competitors. We believe that we are a leader in most of our markets, and no single company competes with us over a significant number of product lines. Competitors might be large or small in size, often depending on the size of the niche market we serve. We compete primarily on product quality, performance, innovation, technology, price, applications expertise, system and service flexibility, distribution channel access and customer service capabilities.

Patents and Trademarks

In addition to trade secrets, unpatented know-how, and other intellectual property rights, we own or license the rights under a number of patents, trademarks and copyrights relating to certain of our products and businesses. We also employ various methods, including confidentiality and non-disclosure agreements with individuals and companies we do business with, employees, distributors, representatives and customers to protect our trade secrets and know-how. We believe our operating units are not substantially dependent on any single patent, trademark, copyright, or other item of intellectual property or group of patents, trademarks or copyrights.

Employees

As of December 31, 2017, we had 14,236 employees, with 9,425 located in the United States. We have 187 employees who are subject to collective bargaining agreements. We have not experienced any work stoppages and consider our relations with our employees to be good.

Available Information

All reports we file electronically with the SEC, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and our annual proxy statements, as well as any amendments to those reports, are accessible at no cost on our website at www.ropertech.com as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. These filings are also accessible on the SEC's website at www.sec.gov. You may also read and copy any material we file with the SEC at the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Our Corporate Governance Guidelines; the charters of our Audit Committee, Compensation Committee, and Nominating and Governance Committee; and our Business Code of Ethics and Standards of Conduct are also available on our website. Any amendment to the Business Code of Ethics and Standards of Conduct and any waiver applicable to our directors, executive officers or senior financial officers will be posted on our website within the time period required by the SEC and the New York Stock Exchange (the "NYSE"). The information posted on our website is not incorporated into this Annual Report.

We have included the Chief Executive Officer and the Chief Financial Officer certifications regarding our public disclosure required by Section 302 of the Sarbanes-Oxley Act of 2002 as Exhibits 31.1 and 31.2 of this report. Additionally, we filed with the NYSE the Chief Executive Officer certification regarding our compliance with the NYSE's Corporate Governance Listing Standards (the "Listing Standards") pursuant to Section 303A.12(a) of the Listing Standards. We filed the certification with the NYSE on June 29, 2017 and our Chief Executive Officer indicated that he was not aware of any violations of the Listing Standards by us.

7

ITEM 1A. | RISK FACTORS |

Risks Relating to Our Business

Our indebtedness may affect our business and may restrict our operating flexibility.

As of December 31, 2017, we had $5.2 billion in total consolidated indebtedness. In addition, we had $1.2 billion undrawn availability under our senior unsecured credit facility. Subject to restrictions contained in our credit facility, we may incur additional indebtedness in the future, including indebtedness incurred to finance acquisitions.

Our level of indebtedness and the debt servicing costs associated with that indebtedness could have important effects on our operations and business strategy. For example, our indebtedness could:

• | limit our ability to borrow additional funds; |

• | limit our ability to complete future acquisitions; |

• | limit our ability to pay dividends; |

• | limit our ability to make capital expenditures; |

• | place us at a competitive disadvantage relative to our competitors, some of which have lower debt service obligations and greater financial resources; and |

• | increase our vulnerability to general adverse economic and industry conditions. |

Our ability to make scheduled principal payments of, to pay interest on, or to refinance our indebtedness and to satisfy our other debt obligations will depend upon our future operating performance, which may be affected by factors beyond our control. In addition, there can be no assurance that future borrowings or equity financing will be available to us on favorable terms for the payment or refinancing of our indebtedness. If we are unable to service our indebtedness, our business, financial condition and results of operations would be materially adversely affected.

Our credit facility contains covenants requiring us to achieve certain financial and operating results and maintain compliance with specified financial ratios. Our ability to meet the financial covenants or requirements in our credit facility may be affected by events beyond our control, and we may not be able to satisfy such covenants and requirements. A breach of these covenants or our inability to comply with the financial ratios, tests or other restrictions contained in our facility could result in an event of default under this facility. Upon the occurrence of an event of default under our credit facility, and the expiration of any grace periods, the lenders could elect to declare all amounts outstanding under the facility, together with accrued interest, to be immediately due and payable. If this were to occur, our assets may not be sufficient to fully repay the amounts due under this facility or our other indebtedness.

Unfavorable changes in foreign exchange rates may harm our business.

Several of our operating companies have transactions and balances denominated in currencies other than the U.S. dollar. Most of these transactions and balances are denominated in euros, Canadian dollars, British pounds or Danish kroner. Sales by our operating companies whose functional currency is not the U.S. dollar represented 17% and 20% of our total net revenues for the years ended December 31, 2017 and 2016, respectively. Unfavorable changes in exchange rates between the U.S. dollar and those currencies could significantly reduce our reported revenues and earnings.

8

We export a significant portion of our products. Difficulties associated with the export of our products could harm our business.

Sales to customers outside the U.S. by our businesses located in the U.S. account for a significant portion of our net revenues. These sales accounted for 11% of our net revenues for the year ended December 31, 2017 and 12% for the year ended December 31, 2016. We are subject to risks that could limit our ability to export our products or otherwise reduce the demand for these products in our foreign markets. Such risks include, without limitation, the following:

• | unfavorable changes in or noncompliance with U.S. and other jurisdictions' export requirements; |

• | restrictions on the export of technology and related products; |

• | unfavorable changes in or noncompliance with U.S. and other jurisdictions' export policies to certain countries; |

• | unfavorable changes in the import policies of our foreign markets; and |

• | a general economic downturn in our foreign markets. |

The occurrence of any of these events could reduce the foreign demand for our products or could limit our ability to export our products and, therefore, could have a material negative effect on our future sales and earnings.

Economic, political and other risks associated with our international operations could adversely affect our business.

As of and for the year ended December 31, 2017, 20% of our net revenues and 18% of our long-lived assets, excluding goodwill and intangibles, were attributable to operations outside the U.S. We expect our international operations to contribute materially to our business for the foreseeable future. Our international operations are subject to varying degrees of risk inherent in doing business outside the U.S. including, without limitation, the following:

• | adverse changes in a specific country's or region's political or economic conditions, particularly in emerging markets; |

• | oil price volatility; |

• | trade protection measures and import or export requirements; |

• | subsidies or increased access to capital for firms that are currently, or may emerge as, competitors in countries in which we have operations; |

• | partial or total expropriation; |

• | potentially negative consequences from changes in tax laws; |

• | difficulty in staffing and managing widespread operations; |

• | differing labor regulations; |

• | differing protection of intellectual property; and |

• | differing and unexpected changes in regulatory requirements. |

Our growth strategy includes acquisitions. We may not be able to identify suitable acquisition candidates, complete acquisitions or integrate acquisitions successfully.

Our future growth is likely to depend to some degree on our ability to acquire and successfully integrate new businesses. We intend to seek additional acquisition opportunities, both to expand into new markets and to enhance our position in existing markets. There are no assurances, however, that we will be able to successfully identify suitable candidates, negotiate appropriate terms, obtain financing on acceptable terms, complete proposed acquisitions, successfully integrate acquired businesses or expand into new markets. Once acquired, operations may not achieve anticipated levels of revenues or profitability.

Acquisitions involve risks, including difficulties in the integration of the operations, technologies, services and products of the acquired companies and the diversion of management's attention from other business concerns. Although our management will endeavor to evaluate the risks inherent in any particular transaction, there are no assurances that we will properly ascertain all such risks. In addition, prior acquisitions have resulted, and future acquisitions could result, in the incurrence of substantial additional indebtedness and other expenses. Future acquisitions may also result in potentially dilutive issuances of equity securities. Difficulties encountered with acquisitions may have a material adverse effect on our business, financial condition and results of operations.

9

Our technology is important to our success and our failure to protect this technology could put us at a competitive disadvantage.

Many of our products rely on proprietary technology; therefore we believe that the development and protection of intellectual property rights through patents, copyrights, trade secrets, trademarks, confidentiality agreements and other contractual provisions are important to the future success of our business. Despite our efforts to protect proprietary rights, unauthorized parties or competitors may copy or otherwise obtain and use our products or technology. Actions to enforce these rights may result in substantial costs and diversion of resources, and we make no assurances that any such actions will be successful.

Product liability, insurance risks and increased insurance costs could harm our operating results.

Our business exposes us to product liability risks in the design, manufacturing and distribution of our products. In addition, certain of our products are used in hazardous environments. We currently have product liability insurance; however, we may not be able to maintain our insurance at a reasonable cost or in sufficient amounts to adequately protect us against losses. We also maintain other insurance policies, including directors' and officers' liability insurance. We believe we have adequately accrued estimated losses, principally related to deductible amounts under our insurance policies, with respect to all product liability and other claims, based upon our past experience and available facts. However, a successful product liability or other claim or series of claims brought against us could have a material adverse effect on our business, financial condition and results of operations. In addition, a significant increase in our insurance costs could have an adverse impact on our operating results.

Our operating results could be adversely affected by a reduction of business with our large customers.

In some of our businesses, we derive a significant amount of revenue from large customers. The loss or reduction of any significant contracts with any of these customers could reduce our revenues and cash flows. Additionally, many of our customers are government entities. In many situations, government entities can unilaterally terminate or modify our existing contracts without cause and without penalty to the government agency.

We face intense competition. If we do not compete effectively, our business may suffer.

We face intense competition from numerous competitors. Our products compete primarily on the basis of product quality, performance, innovation, technology, price, applications expertise, system and service flexibility, distribution channel access and established customer service capabilities. We may not be able to compete effectively on all of these fronts or with all of our competitors. In addition, new competitors may emerge, and product lines may be threatened by new technologies or market trends that reduce the value of these product lines. To remain competitive, we must develop new products, respond to new technologies and enhance our existing products in a timely manner. We anticipate that we may have to adjust prices to stay competitive.

Changes in the supply of, or price for, raw materials, parts and components used in our products could affect our business.

The availability and prices of raw materials, parts and components are subject to curtailment or change due to, among other things, suppliers' allocations to other purchasers, interruptions in production by suppliers, changes in exchange rates and prevailing price levels. Some high-performance components for digital imaging products may be in short supply and/or suppliers may have occasional difficulty manufacturing these components to meet our specifications. In addition, some of our products are provided by sole source suppliers. Any change in the supply of, or price for, these parts and components, as well as any increases in commodity prices, particularly copper, could affect our business, financial condition and results of operations.

Environmental compliance costs and liabilities could increase our expenses and adversely affect our financial condition.

Our operations and properties are subject to laws and regulations relating to environmental protection, including air emissions, water discharges, waste management and workplace safety. These laws and regulations can result in the imposition of substantial fines and sanctions for violations and could, in certain instances, require the installation of pollution control equipment or operational changes to limit pollution emissions and/or decrease the likelihood of accidental hazardous substance releases. We must conform our operations and properties to these laws and adapt to regulatory requirements in the countries in which we operate as these requirements change.

We use and generate hazardous substances and wastes in some of our operations and, as a result, could be subject to potentially material liabilities relating to the investigation and clean-up of contaminated properties and to claims alleging personal injury. We have experienced, and expect to continue to experience, costs relating to compliance with environmental laws and regulations. In connection with our acquisitions, we may assume significant environmental liabilities, some of which we may not be aware of at the time of acquisition. In addition, new laws and regulations, stricter enforcement of existing laws and regulations, the discovery of previously unknown contamination or the imposition of new clean-up requirements could require us to incur costs or become

10

the basis for new or increased liabilities that could have a material adverse effect on our business, financial condition and results of operations.

Some of the industries in which we operate are cyclical, and, accordingly, our business is subject to changes in the economy.

Some of the business areas in which we operate are subject to specific industry and general economic cycles. Certain businesses are subject to industry cycles, including but not limited to, the industrial and energy markets. Accordingly, a downturn in these or other markets in which we participate could materially adversely affect us. If demand changes and we fail to respond accordingly, our results of operations could be materially adversely affected. The business cycles of our different operations may occur contemporaneously. Consequently, the effect of an economic downturn may have a magnified negative effect on our business.

Our goodwill and intangible assets are a significant amount of our total assets, and any write-off of our intangible assets would negatively affect our results of operations.

Our total assets reflect substantial intangible assets, primarily goodwill. At December 31, 2017, goodwill totaled $8.8 billion compared to $6.9 billion of stockholders' equity, and represented 62% of our total assets of $14.3 billion. The goodwill results from our acquisitions, representing the excess of cost over the fair value of the net assets we have acquired. We assess at least annually whether there has been an impairment in the value of our goodwill and indefinite economic life intangible assets. If future operating performance at one or more of our business units were to fall significantly below current levels, if competing or alternative technologies emerge, if interest rates rise or if business valuations decline, we could incur a non-cash charge to operating earnings. Any determination requiring the write-off of a significant portion of goodwill or unamortized intangible assets would negatively affect our results of operations, the effect of which could be material.

We depend on our ability to develop new products, and any failure to develop or market new products could adversely affect our business.

The future success of our business will depend, in part, on our ability to design and manufacture new competitive products and to enhance existing products so that we maintain our margin profile. This product development may require substantial internal investment. There can be no assurance that unforeseen problems will not occur with respect to the development, performance or market acceptance of new technologies or products or that we will otherwise be able to successfully develop and market new products. Failure of our products to gain market acceptance or our failure to successfully develop and market new products could reduce our margins, which would have an adverse effect on our business, financial condition and results of operations.

We rely on information and technology for many of our business operations which could fail and cause disruption to our business operations.

Our business operations are dependent upon information technology networks and systems to securely transmit, process and store electronic information and to communicate among our locations around the world and with clients and vendors. A shutdown of, or inability to access, one or more of our facilities, a power outage or a failure of one or more of our information technology, telecommunications or other systems could significantly impair our ability to perform such functions on a timely basis. Computer viruses, cyber-attacks, other external hazards and human error could result in the misappropriation of assets or sensitive information, corruption of data or operational disruption. If sustained or repeated, such a business interruption, system failure, service denial or data loss and damage could result in a deterioration of our ability to perform necessary business functions.

A breach in the security of our software could harm our reputation, result in a loss of current and potential customers, and subject us to material claims, which could materially harm our operating results and financial condition.

If our security measures are breached, an unauthorized party may obtain access to our data or our users' or customers' data. In addition, cyber-attacks and similar acts could lead to interruptions and delays in customer processing or a loss or breach of customers' data. Because the techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently and often are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. The risk that these types of events could seriously harm our business is likely to increase as we expand the number of web-based products and services we offer, and operate in more countries.

Regulatory authorities around the world have adopted and are considering further adoptions of legislative and regulatory proposals concerning data protection. In addition the interpretation and application of consumer and data protection laws in the United States, Europe and elsewhere are often uncertain and in flux. It is possible that these laws may be interpreted and applied in a manner

11

that is inconsistent with our data practices. If so, in addition to the possibility of fines, this could result in an order requiring that we change our data practices, which could have an adverse effect on our business and results of operations.

Any security breaches for which we are, or are perceived to be, responsible, in whole or in part, could subject us to legal claims or legal proceedings, including regulatory investigations, which could harm our reputation and result in significant litigation costs and damage awards or settlement amounts. Any imposition of liability, particularly liability that is not covered by insurance or is in excess of insurance coverage, could materially harm our operating results and financial condition. Security breaches also could cause us to lose current and potential customers, which could have an adverse effect on our business. Moreover, we might be required to expend significant financial and other resources to protect further against security breaches or to rectify problems caused by any security breach.

Any business disruptions due to political instability, armed hostilities, incidents of terrorism or natural disasters could adversely impact our financial performance.

If terrorist activity, armed conflict, political instability or natural disasters occur in the U.S. or other locations, such events may negatively impact our operations, cause general economic conditions to deteriorate or cause demand for our products to decline. A prolonged economic slowdown or recession could reduce the demand for our products, and therefore, negatively affect our future sales and profits. Any of these events could have a significant impact on our business, financial condition or results of operations.

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None

12

ITEM 2. | PROPERTIES |

Our corporate offices, consisting of 29,000 square feet of leased space, are located at 6901 Professional Parkway East, Sarasota, Florida. We have 128 principal locations around the world to support our operations, of which 49 are manufacturing, assembly and testing facilities, and the remaining 79 locations provide sales, programming, service and administrative support functions. We consider our facilities to be in good operating condition and adequate for their present use and believe we have sufficient capacity to meet our anticipated operating requirements.

The following table summarizes the size, location and usage of our principal properties as of December 31, 2017 (amounts in thousands of square feet).

Office | Office & Manufacturing | |||

Segment | Region | Leased | Leased | Owned |

RF Technology | ||||

U.S. | 1,163 | 108 | — | |

Canada | 30 | — | — | |

Europe | 82 | — | 16 | |

Asia-Pacific | 116 | — | — | |

Medical & Scientific Imaging | ||||

U.S. | 325 | 275 | 120 | |

Canada | — | 140 | — | |

Europe | 68 | 28 | — | |

Asia-Pacific | 21 | — | — | |

Mexico | — | 43 | — | |

Industrial Technology | ||||

U.S. | 18 | 260 | 478 | |

Canada | 36 | — | — | |

Europe | 13 | 136 | 43 | |

Asia-Pacific | 21 | — | — | |

Mexico | — | 60 | — | |

Energy Systems & Controls | ||||

U.S. | — | 322 | — | |

Canada | — | 56 | — | |

Europe | 29 | 20 | 128 | |

Asia-Pacific | — | 28 | 33 | |

13

ITEM 3. | LEGAL PROCEEDINGS |

Information pertaining to legal proceedings can be found in Note 12 to the Consolidated Financial Statements included in this Annual Report, and is incorporated by reference herein.

ITEM 4. | MINE SAFETY DISCLOSURES |

None

14

PART II

ITEM 5. | MARKET FOR REGISTRANT'S COMMON EQUITY RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common stock trades on the NYSE under the symbol "ROP". The table below sets forth the range of high and low sales prices for our common stock as reported by the NYSE as well as cash dividends declared during each of our 2017 and 2016 quarters.

High | Low | Cash Dividends Declared | ||||||||||

2017 | 4th Quarter | $ | 267.83 | $ | 243.45 | $ | 0.4125 | |||||

3rd Quarter | 247.54 | 226.81 | 0.35 | |||||||||

2nd Quarter | 235.50 | 204.62 | 0.35 | |||||||||

1st Quarter | 214.44 | 183.74 | 0.35 | |||||||||

2016 | 4th Quarter | $ | 188.04 | $ | 167.91 | $ | 0.35 | |||||

3rd Quarter | 182.84 | 163.33 | 0.30 | |||||||||

2nd Quarter | 184.66 | 164.77 | 0.30 | |||||||||

1st Quarter | 187.56 | 158.89 | 0.30 | |||||||||

Based on information available to us and our transfer agent, we believe that as of February 16, 2018 there were 136 record holders of our common stock.

Dividends – We have declared a cash dividend in each quarter since our February 1992 initial public offering and we have annually increased our dividend rate since our initial public offering. In December 2017, our Board of Directors increased the quarterly dividend paid January 23, 2018 to $0.4125 per share from $0.35 per share, an increase of 18%. This is the twenty-fifth consecutive year in which Roper has increased its dividend. The timing, declaration and payment of future dividends will be at the sole discretion of our Board of Directors and will depend upon our profitability, financial condition, capital needs, future prospects and other factors deemed relevant by our Board of Directors.

Recent Sales of Unregistered Securities - In 2017, there were no sales of unregistered securities.

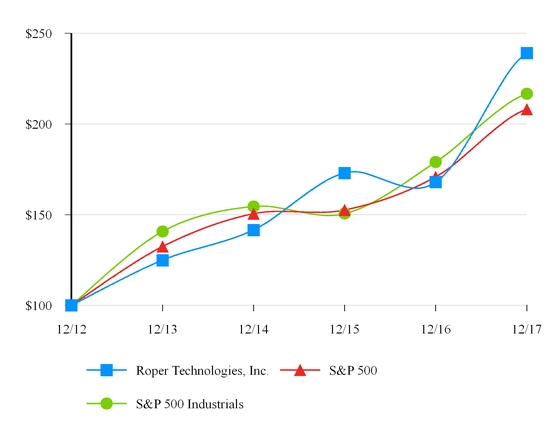

Performance Graph - This performance graph shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act") or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any of our filings under the Securities Act of 1933, as amended, or under the Exchange Act.

15

The following graph compares, for the five year period ended December 31, 2017, the cumulative total stockholder return for our common stock, the Standard and Poor's 500 Stock Index (the "S&P 500") and the Standard and Poor's 500 Industrials Index (the "S&P 500 Industrials"). Measurement points are the last trading day of each of our fiscal years ended December 31, 2012, 2013, 2014, 2015, 2016 and 2017. The graph assumes that $100 was invested on December 31, 2012 in our common stock, the S&P 500 and the S&P 500 Industrials and assumes reinvestment of any dividends. The stock price performance on the following graph is not necessarily indicative of future stock price performance.

12/31/2012 | 12/31/2013 | 12/31/2014 | 12/31/2015 | 12/31/2016 | 12/31/2017 | ||||||||||||||||||

Roper Technologies, Inc. | $ | 100.00 | $ | 124.89 | $ | 141.61 | $ | 172.94 | $ | 167.96 | $ | 239.15 | |||||||||||

S&P 500 | 100.00 | 132.39 | 150.51 | 152.59 | 170.84 | 208.14 | |||||||||||||||||

S&P 500 Industrials | 100.00 | 140.68 | 154.50 | 150.59 | 178.99 | 216.64 | |||||||||||||||||

The information set forth in Item 12 under the heading "Securities Authorized for Issuance under Equity Compensation Plans" is incorporated herein by reference.

16

ITEM 6. | SELECTED FINANCIAL DATA |

You should read the table below in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our Consolidated Financial Statements and related notes included in this Annual Report (amounts in thousands, except per share data).

As of and for the Years ended December 31, | |||||||||||||||||||

2017 (1) | 2016 (2) | 2015 (3) | 2014 (4) | 2013 (5) | |||||||||||||||

Operations data: | |||||||||||||||||||

Net revenues | $ | 4,607,471 | $ | 3,789,925 | $ | 3,582,395 | $ | 3,549,494 | $ | 3,238,128 | |||||||||

Gross profit | 2,864,796 | 2,332,410 | 2,164,646 | 2,101,899 | 1,882,928 | ||||||||||||||

Income from operations | 1,210,244 | 1,054,563 | 1,027,918 | 999,473 | 842,361 | ||||||||||||||

Net earnings (6) | 971,772 | 658,645 | 696,067 | 646,033 | 538,293 | ||||||||||||||

Per share data: | |||||||||||||||||||

Basic earnings per share | $ | 9.51 | $ | 6.50 | $ | 6.92 | $ | 6.47 | $ | 5.43 | |||||||||

Diluted earnings per share | $ | 9.39 | $ | 6.43 | $ | 6.85 | $ | 6.40 | $ | 5.37 | |||||||||

Dividends declared per share | $ | 1.4625 | $ | 1.2500 | $ | 1.0500 | $ | 0.8500 | $ | 0.6950 | |||||||||

Balance sheet data: | |||||||||||||||||||

Working capital (7) | $ | (270,007 | ) | $ | 331,229 | $ | 897,919 | $ | 884,158 | $ | 730,246 | ||||||||

Total assets (8) | 14,316,413 | 14,324,927 | 10,168,365 | 8,400,185 | 8,169,120 | ||||||||||||||

Long-term debt, net of current portion (8) | 4,354,611 | 5,808,561 | 3,264,417 | 2,190,282 | 2,437,975 | ||||||||||||||

Stockholders' equity | 6,863,564 | 5,788,865 | 5,298,947 | 4,755,360 | 4,213,050 | ||||||||||||||

(1) | Includes results from the acquisitions of Phase Technology from June 21, 2017, Handshake Software, Inc. from August 4, 2017, Workbook Software A/S from September 15, 2017 and Onvia, Inc. from November 17, 2017. |

(2) | Includes results from the acquisitions of CliniSys Group Ltd. from January 7, 2016, PCI Medical Inc. from March 17, 2016, GeneInsight Inc. from April 1, 2016, iSqFt Holdings Inc. (d/b/a ConstructConnect) from October 31, 2016, UNIConnect LC from November 10, 2016 and Deltek, Inc. from December 28, 2016. |

(3) | Includes results from the acquisitions of Strata Decision Technologies LLC from January 21, 2015, SoftWriters Inc. from February 9, 2015, Data Innovations LLC from March 4, 2015, On Center Software LLC from July 20, 2015, RF IDeas Inc. from September 1, 2015, Atlantic Health Partners LLC from September 4, 2015, Aderant Holdings Inc. from October 21, 2015, Atlas Database Software Corp. from October 26, 2015, Black Diamond Advanced Technologies through March 20, 2015 and Abel Pumps through October 2, 2015. |

(4) | Includes results from the acquisitions of Foodlink Holdings Inc. from July 2, 2014, Innovative Product Achievements LLC from August 5, 2014, Strategic Healthcare Programs Holdings LLC from August 14, 2014. |

(5) | Includes results from the acquisitions of Managed Health Care Associates Inc. from May 1, 2013 and Advanced Sensors Ltd. from October 4, 2013. |

(6) | The Tax Cuts and Jobs Act of 2017 (“the Tax Act”) was signed into U.S. law on December 22, 2017, which was prior to the end of the Company’s 2017 reporting period and resulted in a one-time net income tax benefit of $215.4 million. |

(7) | At December 31, 2017, there were $799 million of senior notes, net of debt issuance costs, due October 1, 2018, and at December 31, 2016, there were $399 million of senior notes, net of debt issuance costs, due November 15, 2017, thus requiring classification as short-term debt, included in working capital. |

(8) | Total assets and Long-term debt, net of current portion for 2013 and 2014 have been adjusted due to the retrospective adoption of an accounting standard update which requires that our senior notes be shown net of debt issuance costs. The adjustment amounts were $12,749 and $15,861 for the years ended December 31, 2014 and 2013, respectively. |

17

ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

You should read the following discussion in conjunction with "Selected Financial Data" and our Consolidated Financial Statements and related notes included in this Annual Report.

Overview

We are a diversified technology company. We operate businesses that design and develop software (both license and software-as-a-service) and engineered products and solutions for a variety of niche end markets.

We pursue consistent and sustainable growth in earnings and cash flow by emphasizing continuous improvement in the operating performance of our existing businesses and by acquiring other carefully selected businesses. Our acquisitions have represented both additions to existing businesses and new strategic platforms.

Application of Critical Accounting Policies

Our Consolidated Financial Statements are prepared in conformity with generally accepted accounting principles in the United States ("GAAP"). A discussion of our significant accounting policies can also be found in the notes to our Consolidated Financial Statements for the year ended December 31, 2017 included in this Annual Report.

GAAP offers acceptable alternative methods for accounting for certain issues affecting our financial results, such as determining inventory cost, depreciating long-lived assets and recognizing revenue. We have not changed the application of acceptable accounting methods or the significant estimates affecting the application of these principles in the last three years in a manner that had a material effect on our financial statements.

The preparation of financial statements in accordance with GAAP requires the use of estimates, assumptions, judgments and interpretations that can affect the reported amounts of assets, liabilities, revenues and expenses, the disclosure of contingent assets and liabilities and other supplemental disclosures.

The development of accounting estimates is the responsibility of our management. Our management discusses those areas that require significant judgments with the Audit Committee of our Board of Directors. The Audit Committee has reviewed all financial disclosures in our annual filings with the SEC. Although we believe the positions we have taken with regard to uncertainties are reasonable, others might reach different conclusions and our positions can change over time as more information becomes available. If an accounting estimate changes, its effects are accounted for prospectively or through a cumulative catch up adjustment.

Our most significant accounting uncertainties are encountered in the areas of accounts receivable collectibility, inventory valuation, future warranty obligations, revenue recognition (percentage-of-completion), income taxes and goodwill and indefinite-lived impairment analyses. These issues affect each of our business segments and are evaluated using a combination of historical experience, current conditions and relatively short-term forecasting.

Accounts receivable collectibility is based on the economic circumstances of customers and credits given to customers after shipment of products, including in certain cases credits for returned products. Accounts receivable are regularly reviewed to determine customers who have not paid within agreed upon terms, whether these amounts are consistent with past experiences, what historical experience has been with amounts deemed uncollectible and the impact that economic conditions might have on collection efforts in general and with specific customers. The returns and other sales credit allowance is an estimate of customer returns, exchanges, discounts or other forms of anticipated concessions and is treated as a reduction in revenue. The returns and other sales credits histories are analyzed to determine likely future rates for such credits. At December 31, 2017, our allowance for doubtful accounts receivable was $10.3 million and our allowance for sales returns and sales credits was $2.4 million, for a total of $12.7 million, or 1.9% of total gross accounts receivable, as compared to a total of $14.5 million, or 2.3% of total gross accounts receivable, at December 31, 2016. This percentage is influenced by the risk profile of the underlying receivables, and the timing of write-offs of accounts deemed uncollectible.

We regularly compare inventory quantities on hand against anticipated future usage, which we determine as a function of historical usage or forecasts related to specific items in order to evaluate obsolescence and excessive quantities. When we use historical usage, this information is also qualitatively compared to business trends to evaluate the reasonableness of using historical information as an estimate of future usage. At December 31, 2017, inventory reserves for excess and obsolete inventory were $38.1 million, or 15.7% of gross inventory cost, as compared to $37.2 million, or 17.0% of gross inventory cost, at December 31,

18

2016. The inventory reserve as a percent of gross inventory cost will continue to fluctuate based upon specific identification of reserves needed based upon changes in our business as well as the physical disposal of obsolete inventory.

Most of our product-based revenues are covered by warranty provisions that generally provide for the repair or replacement of qualifying defective items for a specified period after the time of sale, typically 12 to 24 months. Future warranty obligations are evaluated using, among other factors, historical cost experience, product evolution and customer feedback. Our expense for warranty obligations was less than 1% of net revenues for each of the years ended December 31, 2017, 2016 and 2015.

Revenues related to the use of the percentage-of-completion method of accounting are dependent on total costs incurred compared with total estimated costs for a project. During the years ended December 31, 2017, 2016 and 2015 we recognized revenue of $249 million, $241 million and $253 million, respectively, using this method. Percentage-of-completion is used primarily for major turn-key, longer term toll and traffic and energy projects and installations of large software application projects. At December 31, 2017, $253 million of revenue related to unfinished percentage-of-completion contracts had yet to be recognized.

Income taxes can be affected by estimates of whether and within which jurisdictions future earnings will occur and if, how and when cash is repatriated to the U.S., combined with other aspects of an overall income tax strategy. Additionally, taxing jurisdictions could retroactively disagree with our tax treatment of certain items, and some historical transactions have income tax effects going forward. Accounting rules require these future effects to be evaluated using current laws, rules and regulations, each of which can change at any time and in an unpredictable manner. During 2017, our effective income tax rate was 6.1%, as compared to the 2016 rate of 30.0%. The decrease was due primarily to the recognition of a $215 million net income tax benefit related to the Tax Act as well as increased excess tax benefits related to equity compensation in 2017 as compared to 2016. We expect the effective tax rate for 2018 to be between 21% and 23%.

We account for goodwill in a purchase business combination as the excess of the cost over the estimated fair value of net assets acquired. Goodwill, which is not amortized, is tested for impairment on an annual basis in conjunction with our annual forecast process during the fourth quarter (or an interim basis if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying value).

When testing goodwill for impairment, we have the option to first assess qualitative factors to determine whether the existence of events or circumstances leads to a determination that it is more likely than not that the estimated fair value of a reporting unit is less than its carrying amount. If we elect to perform a qualitative assessment and determine that an impairment is more likely than not, we are then required to perform the quantitative impairment test; otherwise, no further analysis is required. Under the qualitative assessment, we consider various qualitative factors, including macroeconomic conditions, relevant industry and market trends, cost factors, overall financial performance, other entity-specific events and events affecting the reporting unit that could indicate a potential change in the fair value of our reporting unit or the composition of its carrying values. We also consider the specific future outlook for the reporting unit.

We also may elect not to perform the qualitative assessment and, instead, proceed directly to the quantitative impairment test. The quantitative assessment utilizes both an income approach (discounted cash flows) and a market approach consisting of a comparable company earnings multiples methodology to estimate the fair value of a reporting unit. To determine the reasonableness of the estimated fair values, we review the assumptions to ensure that neither the income approach nor the market approach provides significantly different valuations. If the estimated fair value exceeds the carrying value, no further work is required and no impairment loss is recognized. If the carrying value exceeds the estimated fair value, a non-cash impairment loss is recognized in the amount of that excess.

Key assumptions used in the income and market approaches are updated when the analysis is performed for each reporting unit. Various assumptions are utilized including forecasted operating results, strategic plans, economic projections, anticipated future cash flows, the weighted-average cost of capital, comparable transactions, market data and earnings multiples. While we use reasonable and timely information to prepare our cash flow and discount rate assumptions, actual future cash flows or market conditions could differ significantly and could result in future non-cash impairment charges related to recorded goodwill balances.

Recently acquired reporting units generally represent a higher inherent risk of impairment, which typically decreases as the businesses are integrated into our enterprise. Negative industry or economic trends, disruptions to our business, actual results significantly below projections, unexpected significant changes or planned changes in the use of the assets, divestitures and market capitalization declines may have a negative effect on the fair value of our reporting units.

We have 33 reporting units with individual goodwill amounts ranging from zero to $2.3 billion. In 2017, we performed our annual impairment test in the fourth quarter for all reporting units. We conducted our analysis qualitatively and assessed whether it was more likely than not that the respective fair value of these reporting units was less than the carrying amount. We determined that

19

impairment of goodwill was not likely in 31 of our reporting units and thus we were not required to perform a quantitative analysis for these reporting units. For the remaining two reporting units, the Company performed its quantitative analysis and concluded that the fair value of each of these two reporting units was substantially in excess of its carrying value, with no impairment indicated as of October 1, 2017.

Business combinations can also result in other intangible assets being recognized. Amortization of intangible assets, if applicable, occurs over their estimated useful lives. Trade names that are determined to have an indefinite useful economic life are not amortized, but separately tested for impairment during the fourth quarter of the fiscal year or on an interim basis if an event occurs that indicates the fair value is more likely than not below the carrying value. We first qualitatively assess whether the existence of events or circumstances leads to a determination that it is more likely than not that the estimated fair value of the indefinite-lived trade name is less than its carrying amount. If necessary, we conduct a quantitative review using the relief-from-royalty method, which we believe to be an acceptable methodology due to its common use by valuation specialists in determining the fair value of intangible assets. This methodology assumes that, in lieu of ownership, a third-party would be willing to pay a royalty in order to exploit the related benefits of these assets. The fair value of each trade name is determined by applying a royalty rate to a projection of net revenues discounted using a risk-adjusted rate of capital. Each royalty rate is determined based on the profitability of the trade name to which it relates and observed market royalty rates. Revenue growth rates are determined after considering current and future economic conditions, recent sales trends, discussions with customers, planned timing of new product launches or other variables. Trade names resulting from recent acquisitions generally represent the highest risk of impairment, which typically decreases as the businesses are integrated into our enterprise and positioned for improved future sales growth.

The assessment of fair value for impairment purposes requires significant judgments to be made by management. Although our forecasts are based on assumptions that are considered reasonable by management and consistent with the plans and estimates management uses to operate the underlying businesses, there is significant judgment in determining the expected results attributable to the reporting units. Changes in estimates or the application of alternative assumptions could produce significantly different results. No impairment resulted from the annual reviews performed in 2017.

We evaluate whether there has been an impairment of identifiable intangible assets with definite useful economic lives, or of the remaining life of such assets, when certain indicators of impairment are present. In the event that facts and circumstances indicate that the cost or remaining period of amortization of any asset may be impaired, an evaluation of recoverability would be performed. If an evaluation is required, the estimated future gross, undiscounted cash flows associated with the asset would be compared to the asset's carrying amount to determine if a write-down to fair value or a revision in the remaining amortization period is required.

20

Results of Operations

The following table sets forth selected information for the years indicated. Dollar amounts are in thousands and percentages are of net revenues. Percentages may not foot due to rounding.

Years ended December 31, | |||||||||||

2017 | 2016 | 2015 | |||||||||

Net revenues: | |||||||||||

RF Technology (1) | $ | 1,862,126 | $ | 1,210,264 | $ | 1,033,951 | |||||

Medical & Scientific Imaging (2) | 1,410,349 | 1,362,813 | 1,215,318 | ||||||||

Industrial Technology (3) | 783,707 | 706,625 | 745,381 | ||||||||

Energy Systems & Controls (4) | 551,289 | 510,223 | 587,745 | ||||||||

Total | $ | 4,607,471 | $ | 3,789,925 | $ | 3,582,395 | |||||

Gross margin: | |||||||||||

RF Technology | 61.1 | % | 56.7 | % | 53.4 | % | |||||

Medical & Scientific Imaging | 72.0 | 73.2 | 74.0 | ||||||||

Industrial Technology | 50.6 | 50.6 | 49.8 | ||||||||

Energy Systems & Controls | 57.4 | 57.1 | 58.1 | ||||||||

Total | 62.2 | % | 61.5 | % | 60.4 | % | |||||

Segment operating margin: | |||||||||||

RF Technology | 25.7 | % | 30.8 | % | 30.2 | % | |||||

Medical & Scientific Imaging | 34.5 | 35.0 | 36.4 | ||||||||

Industrial Technology | 30.0 | 28.7 | 28.8 | ||||||||

Energy Systems & Controls | 27.4 | 25.4 | 27.6 | ||||||||

Total | 29.3 | % | 31.2 | % | 31.6 | % | |||||

Corporate administrative expenses | (3.1 | )% | (3.4 | )% | (2.9 | )% | |||||

Income from continuing operations | 26.3 | 27.8 | 28.7 | ||||||||

Interest expense, net | (3.9 | ) | (2.9 | ) | (2.4 | ) | |||||

Other income/(expense) | 0.1 | (0.1 | ) | 1.6 | |||||||

Income from continuing operations before taxes | 22.5 | 24.8 | 28.0 | ||||||||

Income taxes | (1.4 | ) | (7.4 | ) | (8.5 | ) | |||||

Net earnings | 21.1 | % | 17.4 | % | 19.4 | % | |||||

(1) | Includes results from the acquisitions of Foodlink Holdings Inc. from July 2, 2014, On Center Software LLC from July 20, 2015, RF Ideas Inc. from September 1, 2015, Aderant Holdings Inc. from October 21, 2015, Black Diamond Advanced Technologies through March 20, 2015, ConstructConnect from October 31, 2016, Deltek, Inc. from December 28, 2016, Handshake Software, Inc. from August 4, 2017, Workbook Software A/S from September 15, 2017 and Onvia, Inc. from November 17, 2017. |

(2) | Includes results from the acquisitions of Strata Decision Technologies LLC from January 21, 2015, SoftWriters Inc. from February 9, 2015, Data Innovations LLC from March 4, 2015, Atlantic Health Partners LLC from September 4, 2015, Atlas Database Software Corp. from October 26, 2015, CliniSys from January 7, 2016, PCI Medical from March 17, 2016, GeneInsight from April 1, 2016 and UNIConnect from November 10, 2016. |

(3) | Includes results from Abel Pumps through October 2, 2015. |

(4) | Includes results from the acquisition of Phase Technology from June 21, 2017. |

21

Year Ended December 31, 2017 Compared to Year Ended December 31, 2016

Net revenues for the year ended December 31, 2017 were $4.61 billion as compared to $3.79 billion for the year ended December 31, 2016, an increase of 21.6%. The increase was the result of contributions from acquisitions of 16.3%, organic growth of 5.3% and no impact from foreign exchange.

In our RF Technology segment, net revenues for the year ended December 31, 2017 increased by $651.9 million or 54% over the year ended December 31, 2016. Acquisitions accounted for 51% and organic revenues increased by 3%. The increase in organic revenues was due primarily to growth in our software businesses. Gross margin was 61.1% for the year ended December 31, 2017 as compared to 56.7% for the year ended December 31, 2016, due primarily to an increased percentage of revenues from our software businesses, which have a higher gross margin. Selling, general and administrative ("SG&A") expenses as a percentage of revenues in the year ended December 31, 2017 increased to 35.3%, as compared to 25.9% in the year ended December 31, 2016, due primarily to an increased percentage of revenues from our software businesses, which have a higher SG&A structure, including amortization of acquired intangibles. The resulting operating margin was 25.7% in 2017 as compared to 30.8% in 2016.

Our Medical & Scientific Imaging segment reported a $47.5 million or 3% increase in net revenues for the year ended December 31, 2017 over the year ended December 31, 2016, all of which was attributable to organic growth. The growth in organic revenues was due primarily to increased sales in our medical products businesses, led by NDI, and our alternate site healthcare businesses. Gross margin decreased to 72.0% for the year ended December 31, 2017 from 73.2% for the year ended December 31, 2016, due primarily to an unfavorable sales mix at both our software and medical products businesses. SG&A expenses as a percentage of net revenues decreased to 37.5% in the year ended December 31, 2017, as compared to 38.2% in the year ended December 31, 2016, due primarily to operating leverage on higher sales. The resulting operating margin was 34.5% in the year ended December 31, 2017 as compared to 35.0% in the year ended December 31, 2016.

Net revenues for our Industrial Technology segment increased by $77.1 million or 11% for the year ended December 31, 2017 from the year ended December 31, 2016, all of which was attributable to organic growth. The growth in organic revenues was broad-based, due primarily to our fluid handling, water meter technology and materials testing businesses. Gross margin was consistent at 50.6% for the years ended December 31, 2017 and 2016. SG&A expenses as a percentage of net revenues were 20.6% in the year ended December 31, 2017, as compared to 21.9% in the year ended December 31, 2016, due primarily to operating leverage on higher sales volume. The resulting operating margin was 30.0% in the year ended December 31, 2017 as compared to 28.7% in the year ended December 31, 2016.

In our Energy Systems & Controls segment, net revenues for the year ended December 31, 2017 increased by $41.1 million or 8% from the year ended December 31, 2016. Organic sales increased by 7% and the benefit from foreign exchange and acquisitions totaled 1%. The growth in organic revenues was due primarily to increased sales in pressure sensors and valves businesses serving energy markets as well as businesses serving industrial end markets. Gross margin increased to 57.4% in the year ended December 31, 2017 as compared to 57.1% in the year ended December 31, 2016 and SG&A expenses as a percentage of net revenues decreased to 30.0% in the year ended December 31, 2017, as compared to 31.7% in the year ended December 31, 2016, both of which were due to operating leverage on higher sales volume. As a result, operating margin was 27.4% in the year ended December 31, 2017 as compared to 25.4% in the year ended December 31, 2016.

Corporate expenses increased by $14.3 million to $141.8 million, or 3.1% of revenues, in 2017 as compared to $127.5 million, or 3.4% of revenues, in 2016. The dollar increase was due primarily to increased incentive compensation and professional services.

Interest expense increased $69.0 million, or 61.9%, for the year ended December 31, 2017 as compared to the year ended December 31, 2016. The increase was due primarily to higher average debt balances to fund acquisitions at the end of 2016.

Other income, net, of $5.0 million for the year ended December 31, 2017 was composed primarily of a $9.4 million gain on sale of a product line in our Energy Systems & Controls segment, offset in part by a $1.8 million charge on a minority investment and foreign exchange losses at our non-U.S. based companies. Other expense of $1.5 million for the year ended December 31, 2016 was composed primarily of foreign exchange losses at our non-U.S. based companies, offset in part by royalty income.

During 2017, our effective income tax rate was 6.1% as compared to our 2016 rate of 30.0%. The decrease was due primarily to the recognition of a $215 million net income tax benefit related to the Tax Act as well as increased excess tax benefits related to equity compensation in 2017 as compared to 2016.

The following table summarizes order backlog information at December 31, 2017 and 2016 (dollar amounts in thousands). We include in backlog only orders that are expected to be recognized as revenue within twelve months.

22

2017 | 2016 | change | ||||||||

RF Technology | $ | 991,382 | $ | 991,212 | — | % | ||||

Medical & Scientific Imaging | 467,836 | 423,616 | 10.4 | |||||||

Industrial Technology | 110,841 | 65,259 | 69.8 | |||||||

Energy Systems & Controls | 102,293 | 92,309 | 10.8 | |||||||

Total | $ | 1,672,352 | $ | 1,572,396 | 6.4 | % | ||||

Year Ended December 31, 2016 Compared to Year Ended December 31, 2015

Net revenues for the year ended December 31, 2016 were $3.79 billion as compared to $3.58 billion for the year ended December 31, 2015, an increase of 5.8%. The increase was the result of contributions from acquisitions of 6.8%, negative organic growth of 0.3% and a negative foreign exchange impact of 0.7%.