Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PINNACLE WEST CAPITAL CORP | pnw201712318-kearningsrele.htm |

| EX-99.1 - EXHIBIT 99.1 - PINNACLE WEST CAPITAL CORP | pnw20171231exhibit991.htm |

Fourth Quarter and Full-Year 2017

FOURTH QUARTER AND

FULL-YEAR 2017 RESULTS

February 23, 2018

Fourth Quarter and Full-Year 20172

FORWARD LOOKING STATEMENTS AND

NON-GAAP FINANCIAL MEASURES

This presentation contains forward-looking statements based on current expectations, including statements regarding our earnings guidance and

financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,”

“expect,” “require,” “intend,” “assume,” “project” and similar words. Because actual results may differ materially from expectations, we caution you

not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from

outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to: our ability to manage capital

expenditures and operations and maintenance costs while maintaining high reliability and customer service levels; variations in demand for

electricity, including those due to weather seasonality, the general economy, customer and sales growth (or decline), and the effects of energy

conservation measures and distributed generation; power plant and transmission system performance and outages; competition in retail and

wholesale power markets; regulatory and judicial decisions, developments and proceedings; new legislation, ballet initiatives and regulation,

including those relating to environmental requirements, regulatory policy, nuclear plant operations and potential deregulation of retail electric

markets; fuel and water supply availability; our ability to achieve timely and adequate rate recovery of our costs, including returns on and of debt

and equity capital investments; our ability to meet renewable energy and energy efficiency mandates and recover related costs; risks inherent in the

operation of nuclear facilities, including spent fuel disposal uncertainty; current and future economic conditions in Arizona, including in real estate

markets; the development of new technologies which may affect electric sales or delivery; the cost of debt and equity capital and the ability to

access capital markets when required; environmental, economic and other concerns surrounding coal-fired generation, including regulation of

greenhouse gas emissions; volatile fuel and purchased power costs; the investment performance of the assets of our nuclear decommissioning trust,

pension, and other postretirement benefit plans and the resulting impact on future funding requirements; the liquidity of wholesale power markets

and the use of derivative contracts in our business; potential shortfalls in insurance coverage; new accounting requirements or new interpretations

of existing requirements; generation, transmission and distribution facility and system conditions and operating costs; the ability to meet the

anticipated future need for additional generation and associated transmission facilities in our region; the willingness or ability of our counterparties,

power plant participants and power plant land owners to meet contractual or other obligations or extend the rights for continued power plant

operations; and restrictions on dividends or other provisions in our credit agreements and ACC orders. These and other factors are discussed in Risk

Factors described in Part I, Item 1A of the Pinnacle West/APS Annual Report on Form 10-K for the fiscal year ended December 31, 2017, which you

should review carefully before placing any reliance on our financial statements, disclosures or earnings outlook. Neither Pinnacle West nor APS

assumes any obligation to update these statements, even if our internal estimates change, except as required by law.

In this presentation, references to net income and earnings per share (EPS) refer to amounts attributable to common shareholders.

We present “electricity gross margin” per diluted share of common stock. Gross margin refers to operating revenues less fuel and purchased power

expenses. Gross margin is a “non-GAAP financial measure,” as defined in accordance with SEC rules. The appendix contains a reconciliation of this

non-GAAP financial measure to the referenced revenue and expense line items on our Consolidated Statements of Income, which are the most

directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles in the United States of

America (GAAP). We view gross margin as an important performance measure of the core profitability of our operations, and is used by our

management in analyzing the operations of our business. We believe that investors benefit from having access to the same financial measures that

management uses.

Fourth Quarter and Full-Year 20173

CONSOLIDATED EPS COMPARISON

2017 VS. 2016

$0.19

$0.47

2017 2016

4th Quarter

GAAP Net Income

$4.35

$3.95

2017 2016

Full-Year

GAAP Net Income

Fourth Quarter and Full-Year 20174

Adjusted

O&M(1)

$(0.27)

EPS VARIANCES

4TH QUARTER 2017 VS. 4TH QUARTER 2016

4Q 2016 4Q 2017

$0.47

$0.19

D&A

$(0.13)

Other, net

$(0.04)

Other

Taxes

$(0.06)

Adjusted

Gross Margin(1)

$0.29

Effective Tax

Rate

$(0.07)Gross Margin

Rate Increase $ 0.17

Sales / Usage $ 0.05

LFCR $ -

Transmission $ 0.06

Weather $ (0.03)

Other $ 0.04

(1) Excludes costs and offsetting operating revenues associated with renewable energy and demand side management programs.

See non-GAAP reconciliation in Appendix.

Fourth Quarter and Full-Year 20175

EPS VARIANCES

FULL YEAR 2017 VS. 2016

(1) Excludes costs and offsetting operating revenues associated with renewable energy and demand side management programs.

See non-GAAP reconciliation in Appendix.

Adjusted

Gross Margin(1)

$0.85

Adjusted

O&M(1)

$(0.03)

D&A

$(0.27)

Other, net

$(0.03)

Interest, net

of AFUDC

$(0.02)

$3.95

$4.35

2016 2017

Other

Taxes

$(0.10)

Gross Margin

Rate Increase $ 0.30

Sales / Usage $ 0.13

LFCR $ 0.08

Transmission $ 0.23

Weather $ 0.03

Other $ 0.08

Fourth Quarter and Full-Year 20176

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17

U.S. Phoenix

ECONOMIC

INDICATORS

Arizona and Metro Phoenix

remain attractive places to

live and do business

E

Year over Year Employment Growth1

Above-average job growth in tourism,

health care, manufacturing, financial

services, and construction

Maricopa County ranked #1 in U.S. for

population growth in 2016

- U.S. Census Bureau March 2017

Scottsdale ranked best place in the U.S.

to find a new job in 2017; 4 other valley

cities ranked in Top 20

- WalletHub January 2017

2017 housing construction at highest level

since 2007

Vacancy rates in office and retail space

have fallen to pre-recessionary levels

0

10,000

20,000

30,000

40,000

'07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18

Single Family Multifamily Projected

Single Family & Multifamily Housing Permits

Maricopa County

Arizona population surpassed 7 million in

2017

1 Employment data is based on CPS as of December 2017

Arizona #1 state in the country in 2017

for in-bound moves

- North American Moving Services January 2018

Fourth Quarter and Full-Year 20177

EPS GUIDANCE

AS OF FEBRUARY 23, 2018

2017 EPS 2018 Guidance

Raising 2018 Guidance Range 1

$4.35

$4.35 - $4.55 + Rate increase*

+ Adjustment mechanisms, primarily

Transmission Cost Adjustor (TCA)

and Lost Fixed Cost Recovery

(LFCR)

+ Selective Catalytic Reduction (SCR)

and Ocotillo deferrals*

+ Modest sales growth

– Higher D&A due to plant additions

and rates*

– Higher O&M, primarily planned fossil

outages

– Higher Taxes Other Than Income

Taxes, primarily higher property

taxes*

– Higher Interest

Key Drivers 2017 - 2018

1 Prior 2018 EPS Guidance: $4.25 - $4.45

* 2017 Rate Review Order specific items.

See key factors and assumptions in appendix.

Fourth Quarter and Full-Year 2017

APPENDIX

Fourth Quarter and Full-Year 20179

2018 EPS GUIDANCE Key Factors & Assumptions as of February 23, 2018

2018

Electricity gross margin* (operating revenues, net of fuel and

purchased power expenses) $2.47 - $2.52 billion

• Retail customer growth about 1.5–2.5%

• Weather-normalized retail electricity sales volume about 0.5-1.5% higher

compared to prior year

• Assumes normal weather

Operating and maintenance (O&M)* $860 – $880 million

Other operating expenses (depreciation and amortization, Four Corners SCRs and

Ocotillo deferrals, taxes other than income taxes, and other miscellaneous expenses) $790 – $810 million

Interest expense, net of allowance for borrowed and equity funds used during

construction (Total AFUDC $65 million) $180 – $190 million

Net income attributable to noncontrolling interests $20 million

Effective tax rate 18%

Average diluted common shares outstanding ~113 million

EPS Guidance $4.35 - $4.55

* Excludes O&M of $85 million, and offsetting revenues, associated with renewable energy and demand side management programs.

Fourth Quarter and Full-Year 201710

FINANCIAL OUTLOOK Key Factors & Assumptions as of February 23, 2018

Assumption Impact

Retail customer growth • Expected to average about 2-3% annually

• Modestly improving Arizona and U.S. economic conditions

Weather-normalized retail electricity sales

volume growth • About 0.5–1.5%

Assumption Impact

Lost Fixed Cost Recovery (LFCR) • Offsets 30-40% of revenues lost due to ACC-mandated energy efficiency and distributed

renewable generation initiatives

Environmental Improvement Surcharge

(EIS)

• Assumed to recover up to $14 million annually of carrying costs for government-mandated

environmental capital expenditures (cumulative per kWh cap rate of $0.00050)

Power Supply Adjustor (PSA) • 100% recovery

• Includes certain environmental chemical costs and third-party battery storage

Transmission Cost Adjustor (TCA) • TCA is filed each May and automatically goes into rates effective June 1

• Transmission revenue is accrued each month as it is earned.

APS Solar Communities • Additions to flow through RES until next base rate case

Four Corners Units 4 and 5 SCRs • 2019 step increase

Property Tax Rate Deferral: APS is allowed to defer for future recovery (or credit to customers) the Arizona property tax expense above

(or below) the 2015 test year caused by changes to the applicable composite property tax rate.

Gross Margin – Customer and Sales Growth (2018-2020)

Gross Margin – Related to 2017 Rate Review Order

Outlook Through 2019: Goal of earning more than 9.5% Return on Equity (earned Return on Equity based on average Total

Shareholder’s Equity for PNW consolidated, weather-normalized)

Fourth Quarter and Full-Year 201711

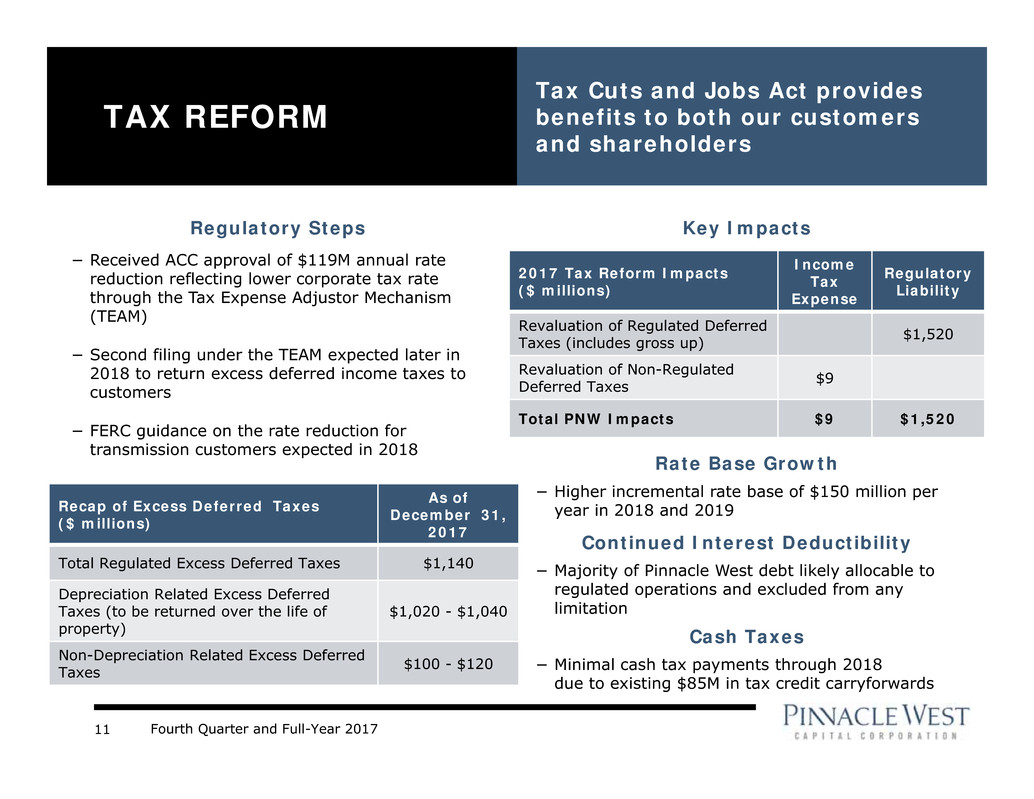

TAX REFORM

Tax Cuts and Jobs Act provides

benefits to both our customers

and shareholders

Regulatory Steps

− Received ACC approval of $119M annual rate

reduction reflecting lower corporate tax rate

through the Tax Expense Adjustor Mechanism

(TEAM)

− Second filing under the TEAM expected later in

2018 to return excess deferred income taxes to

customers

− FERC guidance on the rate reduction for

transmission customers expected in 2018

Key Impacts

Recap of Excess Deferred Taxes

($ millions)

As of

December 31,

2017

Total Regulated Excess Deferred Taxes $1,140

Depreciation Related Excess Deferred

Taxes (to be returned over the life of

property)

$1,020 - $1,040

Non-Depreciation Related Excess Deferred

Taxes $100 - $120

2017 Tax Reform Impacts

($ millions)

Income

Tax

Expense

Regulatory

Liability

Revaluation of Regulated Deferred

Taxes (includes gross up) $1,520

Revaluation of Non-Regulated

Deferred Taxes $9

Total PNW Impacts $9 $1,520

Rate Base Growth

− Higher incremental rate base of $150 million per

year in 2018 and 2019

Continued Interest Deductibility

− Majority of Pinnacle West debt likely allocable to

regulated operations and excluded from any

limitation

Cash Taxes

− Minimal cash tax payments through 2018

due to existing $85M in tax credit carryforwards

Fourth Quarter and Full-Year 201712

$218 $282 $241 $198

$235 $120

$9

$193

$91

$22

$46

$3

$16

$24 $17

$174

$148

$215

$180

$419

$444

$541 $617

$99

$80

$101 $153

2017 2018 2019 2020

APS CAPITAL

EXPENDITURES

Capital expenditures are funded

primarily through internally

generated cash flow

($ Millions)

$1,341

$1,181

Other

Distribution

Transmission

Renewable

Generation

Environmental(1)

Traditional

Generation

Projected

$1,153

New Gas

Generation(2)

• The chart does not include capital expenditures related to 4CA’s 7% interest in the Four Corners Power Plant Units 4 and 5 of

$29 million in 2017, $15 million in 2018, $7 million in 2019 and $6 million in 2020.

• 2018 – 2020 as disclosed in 2017 Form 10-K.

(1) Includes Selective Catalytic Reduction controls at Four Corners with in-service dates of Q4 2017 (Unit 5) and Q1 2018 (Unit 4)

(2) Ocotillo Modernization Project: 2 units scheduled for completion in Q4 2018, 3 units scheduled for completion in Q1 2019

$1,211

Fourth Quarter and Full-Year 201713

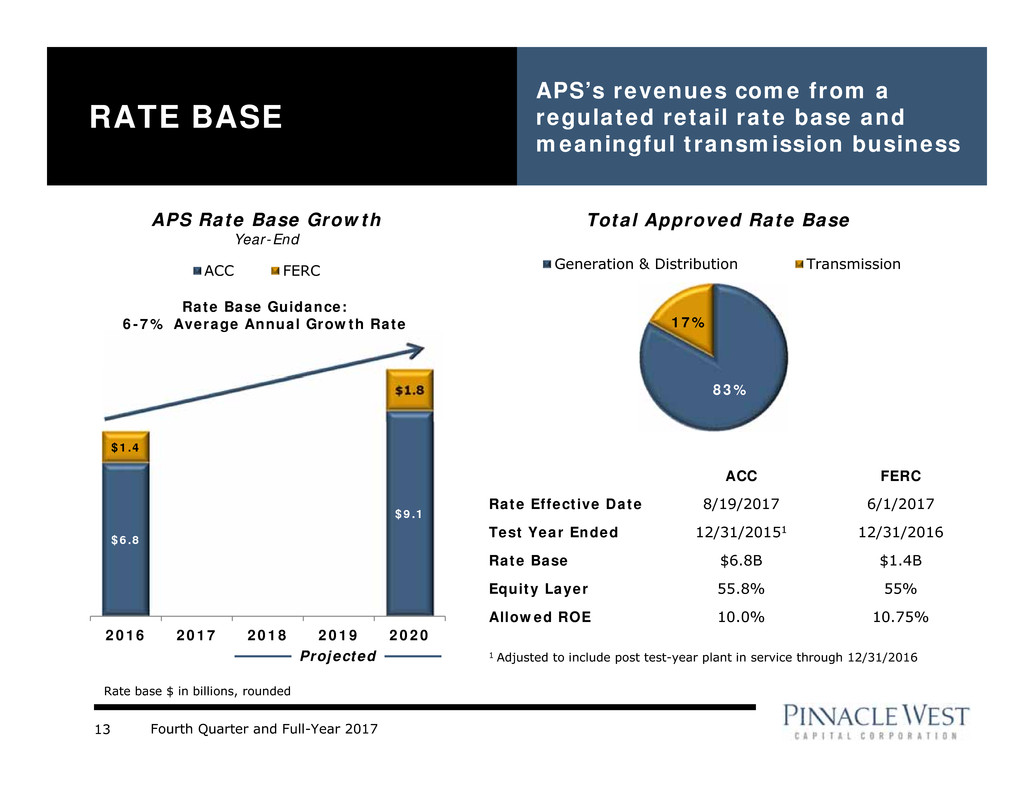

RATE BASE

APS’s revenues come from a

regulated retail rate base and

meaningful transmission business

$6.8

$9.1

$1.4

$1.8

2016 2017 2018 2019 2020

APS Rate Base Growth

Year-End

ACC FERC

Total Approved Rate Base

Projected

ACC FERC

Rate Effective Date 8/19/2017 6/1/2017

Test Year Ended 12/31/20151 12/31/2016

Rate Base $6.8B $1.4B

Equity Layer 55.8% 55%

Allowed ROE 10.0% 10.75%

1 Adjusted to include post test-year plant in service through 12/31/2016

83%

17%

Generation & Distribution Transmission

Rate base $ in billions, rounded

Rate Base Guidance:

6-7% Average Annual Growth Rate

Fourth Quarter and Full-Year 201714

OPERATIONS &

MAINTENANCE

Goal is to keep O&M per kWh flat,

adjusted for planned outages

751 753 734 756 770

785 - 795

37 52 38

72 63

75 - 85$788 $805 $772

$828 $833

$860 - $880

2013 2014 2015 2016 2017 2018E*

PNW Consolidated ex RES/DSM** Planned Fleet Outages

* 2018 excludes impacts related to the adoption of the new accounting standard regarding the presentation of pension and postretirement

benefit costs. See Notes 2 and 7 in the 2017 Form 10-K for additional information.

** Excludes RES/DSM of $137 million in 2013, $103 million in 2014, $96 million in 2015, $83 million in 2016, $91 million in 2017 and

$85 million in 2018E.

($ Millions)

Fourth Quarter and Full-Year 201715

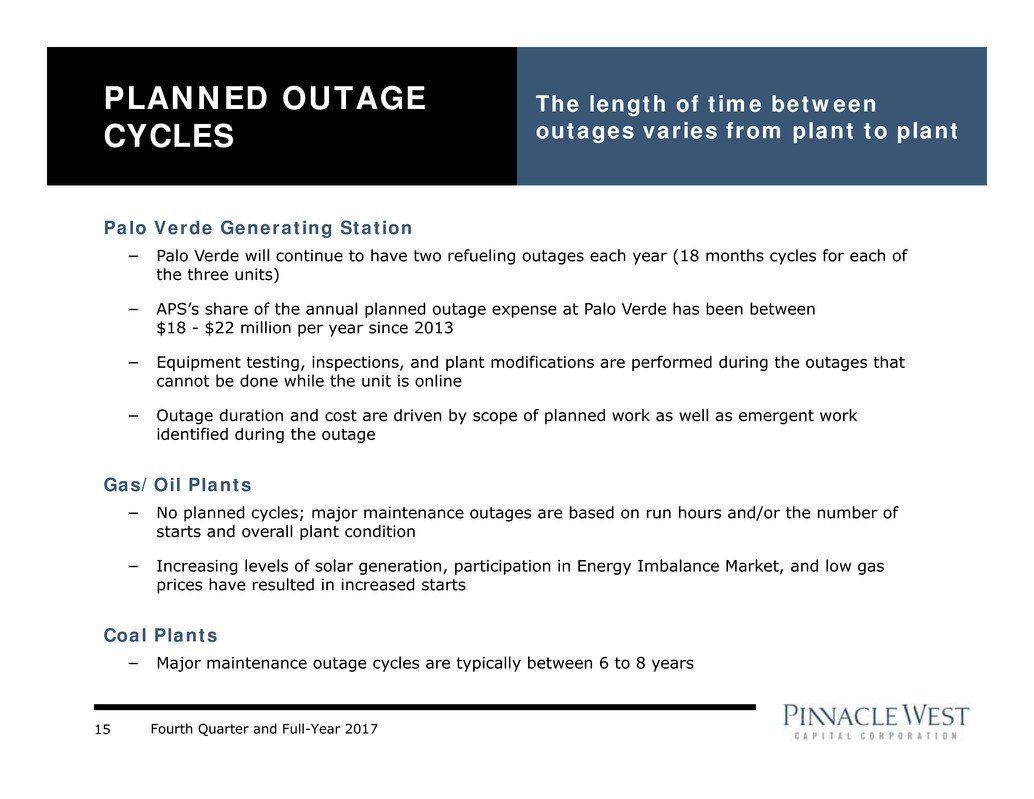

Palo Verde Generating Station

− Palo Verde will continue to have two refueling outages each year (18 months cycles for each of

the three units)

− APS’s share of the annual planned outage expense at Palo Verde has been between

$18 - $22 million per year since 2013

− Equipment testing, inspections, and plant modifications are performed during the outages that

cannot be done while the unit is online

− Outage duration and cost are driven by scope of planned work as well as emergent work

identified during the outage

Gas/Oil Plants

− No planned cycles; major maintenance outages are based on run hours and/or the number of

starts and overall plant condition

− Increasing levels of solar generation, participation in Energy Imbalance Market, and low gas

prices have resulted in increased starts

Coal Plants

− Major maintenance outage cycles are typically between 6 to 8 years

PLANNED OUTAGE

CYCLES

The length of time between

outages varies from plant to plant

Fourth Quarter and Full-Year 201716

Credit Ratings (1)

• A- or equivalent ratings or better at S&P, Moody’s

and Fitch

2017 Major Financing Activities

• $250 million re-opening in March of APS’s

outstanding 4.35% senior unsecured notes due

November 2045

• $300 million 10-year 2.95% APS senior unsecured

notes issued in September

• $300 million 3-year 2.25% PNW senior unsecured

notes issued in November

2018 Major Financing Activities

• Currently expect up to $600 million of long-term

debt issuance at APS

(1) We are disclosing credit ratings to enhance understanding of

our sources of liquidity and the effects of our ratings on our

costs of funds.

BALANCE SHEET STRENGTH

$82

$600

$250

$300

$-

$100

$200

$300

$400

$500

$600

2018 2019 2020

APS PNW

($Millions)

Long-Term Debt Maturity Schedule

Fourth Quarter and Full-Year 201717

2017 RATE REVIEW ORDER*

EFFECTIVE AUGUST 19, 2017

Key Financial Proposals – Base Rate Changes

Annualized Base Rate Revenue Changes ($ millions)

Non-fuel, Non-depreciation Base Rate Increase $ 87.2

Decrease fuel and Purchased Power over Base Rates (53.6)

Increase due to Changes in Depreciation Schedules 61.0

Total Base Rate Increase $ 94.6

Key Financial Assumptions

Allowed Return on Equity 10.0%

Capital Structure

Long-term debt 44.2%

Common equity 55.8%

Base Fuel Rate (¢/kWh) 3.0168

Post-test year plant period 12 months

*The ACC’s decision is subject to appeals.

Fourth Quarter and Full-Year 201718

Key Proposals – Revenue Requirement

Four Corners • Cost deferral order from in-service dates to incorporation of SCRs in rates using a step-increase no later than January 1, 2019

Ocotillo Modernization

Project • Cost deferral order from in-service dates to effective date in next rate case

Power Supply Adjustor (PSA) • Modified to include certain environmental chemical costs and third-party battery storage

Property Tax Deferral • Defer for future recovery the Arizona property tax expense above or below the test year rate

Key Proposals – Rate Design

Lost Fixed Cost Recovery

(LFCR)

• Modified to be applied as a capacity (demand) charge per kW for customer with a demand rate and

as a kWh charge for customers with a two-part rate without demand

Environmental Improvement

Surcharge (EIS)

• Increased cumulative per kWh cap rate from $0.00016 to a new rate of $0.00050 and include a

balancing account

Time-of-Use Rates (TOU)

• Modified on-peak period for residential, and extra small through large general service to

3:00 pm – 8:00 pm weekdays

• After September 1, 2018, a new TOU rate will be the standard rate for all new customers (except

small use)

Distributed Generation

• New DG customers eligible for TOU rate with Grid Access Charge or Demand rates

• Resource Comparison Proxy (RCP) for exported energy of $0.129/kWh in year one

APS Solar Communities

• New program for utility-owned solar distributed generation, recoverable through the Renewable

Energy Adjustment Clause (RES), to be no less than $10 million per year, and not more than $15

million per year

Other Considerations

Rate Case Moratorium • No new general rate case application before June 1, 2019 (3-year stay-out)

Self-Build Moratorium

• APS will not pursue any new self-build generation (with exceptions) having an in-service date prior

to January 1, 2022 (extended to December 31, 2027 for combined-cycle generating units) unless

expressly authorized by the ACC

2017 RATE REVIEW ORDER*

EFFECTIVE AUGUST 19, 2017

*The ACC’s decision is subject to appeals.

Fourth Quarter and Full-Year 201719

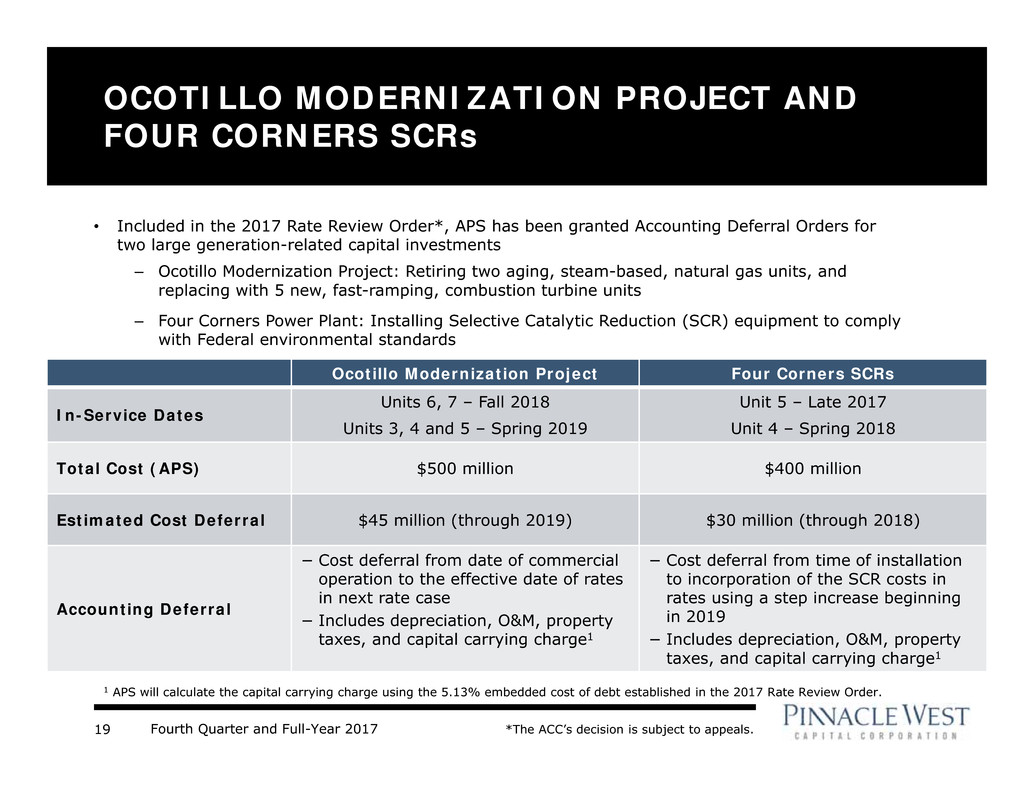

OCOTILLO MODERNIZATION PROJECT AND

FOUR CORNERS SCRs

Ocotillo Modernization Project Four Corners SCRs

In-Service Dates

Units 6, 7 – Fall 2018

Units 3, 4 and 5 – Spring 2019

Unit 5 – Late 2017

Unit 4 – Spring 2018

Total Cost (APS) $500 million $400 million

Estimated Cost Deferral $45 million (through 2019) $30 million (through 2018)

Accounting Deferral

− Cost deferral from date of commercial

operation to the effective date of rates

in next rate case

− Includes depreciation, O&M, property

taxes, and capital carrying charge1

− Cost deferral from time of installation

to incorporation of the SCR costs in

rates using a step increase beginning

in 2019

− Includes depreciation, O&M, property

taxes, and capital carrying charge1

• Included in the 2017 Rate Review Order*, APS has been granted Accounting Deferral Orders for

two large generation-related capital investments

– Ocotillo Modernization Project: Retiring two aging, steam-based, natural gas units, and

replacing with 5 new, fast-ramping, combustion turbine units

– Four Corners Power Plant: Installing Selective Catalytic Reduction (SCR) equipment to comply

with Federal environmental standards

1 APS will calculate the capital carrying charge using the 5.13% embedded cost of debt established in the 2017 Rate Review Order.

*The ACC’s decision is subject to appeals.

Fourth Quarter and Full-Year 201720

FOUR CORNERS SCR

RATE RIDER

APS will file for a rate increase

in April 2018

1 Estimate as of December 31, 2017

2 Based on 2017 Rate Review Order

Financial Cost of Capital Bill Impact

• Consistent with prior

disclosed estimates

• 7.85% Return on Rate

Base2

– Weighted Average Cost

of Capital (WACC)

• Rate rider applied as a

percentage of base rates

for all applicable customers

• $390 million1 direct costs

vs. $400 million2

contemplated in APS’s

recent rate case

• 5.13% Return on Deferral2

– Embedded Cost of Debt

• ~$65 million revenue

requirement

• $40 million1 in indirect

costs (overhead, AFUDC)

• 5% Depreciation Rate

– 20 year useful life

(2038-depreciation

study)

• ~2% bill impact

• 5 Year Deferral

Amortization

Key Components of APS’s Anticipated Request

Fourth Quarter and Full-Year 201721

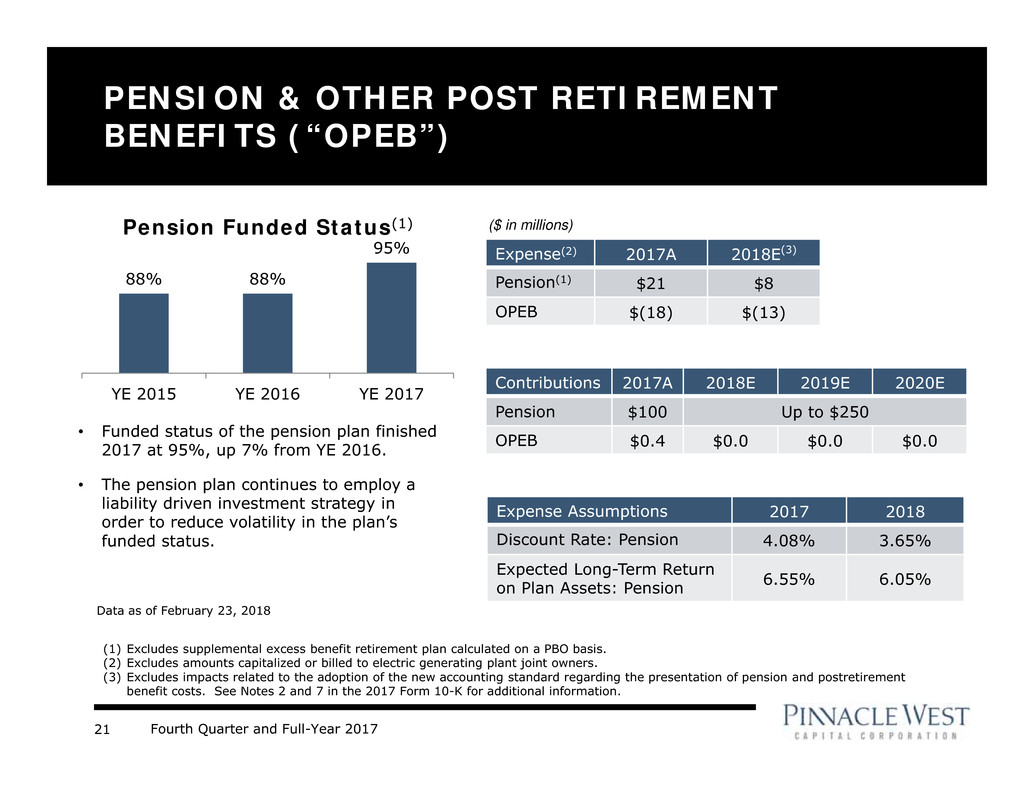

• Funded status of the pension plan finished

2017 at 95%, up 7% from YE 2016.

• The pension plan continues to employ a

liability driven investment strategy in

order to reduce volatility in the plan’s

funded status.

PENSION & OTHER POST RETIREMENT

BENEFITS (“OPEB”)

88% 88%

95%

YE 2015 YE 2016 YE 2017

Pension Funded Status(1)

Expense(2) 2017A 2018E(3)

Pension(1) $21 $8

OPEB $(18) $(13)

Contributions 2017A 2018E 2019E 2020E

Pension $100 Up to $250

OPEB $0.4 $0.0 $0.0 $0.0

Expense Assumptions 2017 2018

Discount Rate: Pension 4.08% 3.65%

Expected Long-Term Return

on Plan Assets: Pension 6.55% 6.05%

(1) Excludes supplemental excess benefit retirement plan calculated on a PBO basis.

(2) Excludes amounts capitalized or billed to electric generating plant joint owners.

(3) Excludes impacts related to the adoption of the new accounting standard regarding the presentation of pension and postretirement

benefit costs. See Notes 2 and 7 in the 2017 Form 10-K for additional information.

Data as of February 23, 2018

($ in millions)

Fourth Quarter and Full-Year 201722

484

680

832

715

1157 1158

1349

1141

1002

1189

1077 1168

1153

759

1267

1001

1291

1413 1364

2033

1603

1443

1283

14341463

1578

1843

1971

2495

3817

2210

3591

328

554

648 705

995

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

2015 Applications 2016 Applications 2017 Applications 2018 Applications

* Monthly data equals applications received minus cancelled applications. As of January 31, 2018, approximately 74,000

residential grid-tied solar photovoltaic (PV) systems have been installed in APS’s service territory, totaling approximately

581 MWdc of installed capacity. Excludes APS Solar Partner Program residential PV systems.

Note: www.arizonagoessolar.org logs total residential application volume, including cancellations. Solar water heaters can also be found

on the site, but are not included in the chart above.

RESIDENTIAL PV

APPLICATIONS* 10 18 22 44 51

57

74

133

150

2

2009 2012 2014 2016 2018

Residential DG (MWdc) Annual Additions

YTD

Fourth Quarter and Full-Year 201723

(4)

10

(13)

4 2

12

(10)

(2)

$(15)

$(10)

$(5)

$0

$5

$10

$15

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

GROSS MARGIN EFFECTS OF WEATHER

VARIANCES VS. NORMAL

Pretax

Millions

All periods recalculated to current 10-year rolling average (2005-2014)

2016

$(3) Million

2017

$2 Million

Fourth Quarter and Full-Year 201724

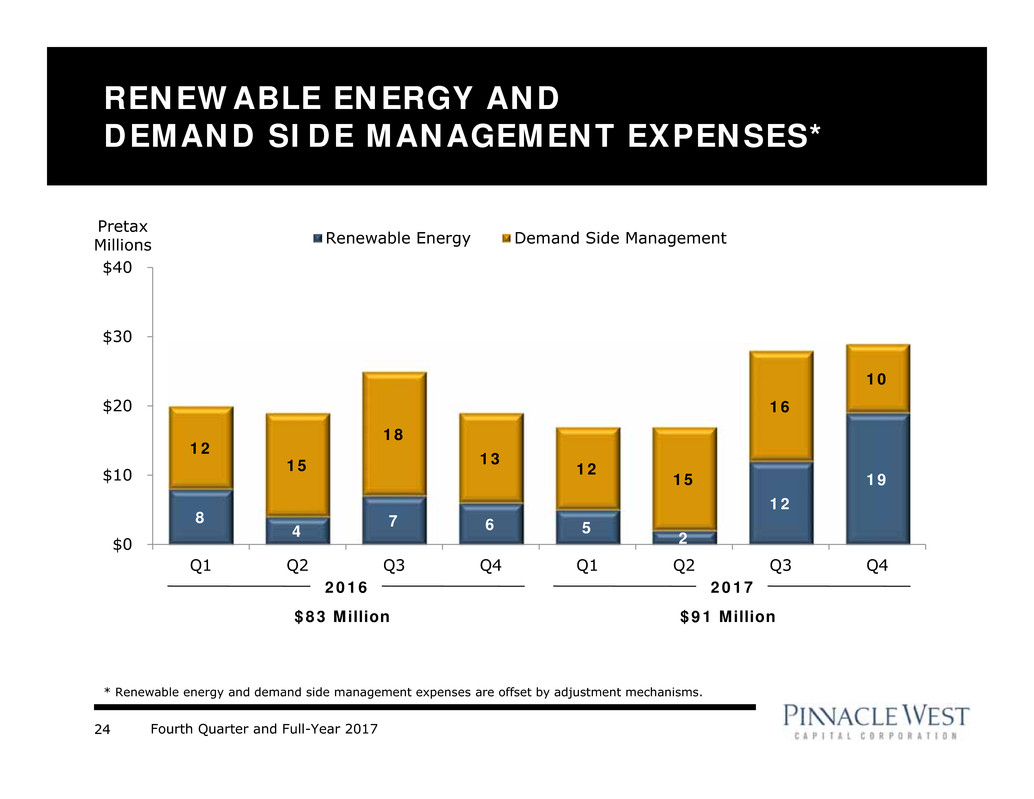

8

4

7 6 5

2

12

19

12

15

18

13

12

15

16

10

$0

$10

$20

$30

$40

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Renewable Energy Demand Side Management

RENEWABLE ENERGY AND

DEMAND SIDE MANAGEMENT EXPENSES*

* Renewable energy and demand side management expenses are offset by adjustment mechanisms.

Pretax

Millions

2016

$83 Million

2017

$91 Million

Fourth Quarter and Full-Year 201725

2018 KEY DATES

Other Key Dates Q1 Q2 Q3 Q4

Arizona State Legislature In session Jan 8 – End of Q2

Elections Aug 28: Primary Nov 6: General

ACC Key Dates / Docket # Q1 Q2 Q3 Q4

Key Recurring Regulatory Filings

Lost Fixed Cost Recovery

E-01345A-11-0224 File Feb 15

Implement

May 1

Transmission Cost Adjustor

E-01345A-11-0224

File May 15

Implement Jun 1

2019 DSM/EE Implementation Plan

TBD

2018 DSM Decision

Expected March 2018 Jun 1: File 2019 Plan

Decision expected by

end of 2018

2019 RES Implementation Plan

TBD

2018 RES Decision

Expected March 2018 Jul 1: File 2019 Plan

Decision expected by

end of 2018

APS Rate Review/

Four Corners SCR Step Increase

E-01345A-16-0036

Feb: Customer

Transition Begins

May 1: File Year Two

RCP Export Rate

Apr: File Four Corners

SCR Request

Sep 1: Year Two RCP

Export Rate

Implemented

Resource Planning and Procurement

E-00000V-15-0094

Decision expected in

March 2018

Workshops begin for

APS 2020 IRP

Review and Modification of Current

Net Metering Rules

RE-00000A-17-0260

Staff Draft Rules

Expected Q2

Modification of the Federal Tax Reform

Rate Adjustment

AU-00000A-17-0379

Jan 9: APS TEAM filing

Jan 31:Workshop

Arizona Energy Modernization Plan

E-00000Q-16-0289

Fourth Quarter and Full-Year 201726

NON-GAAP MEASURE RECONCILIATION

$ millions pretax, except per share amounts 2017 2016

Operating revenues* 760$ 739$

Fuel and purchased power expenses* (204) (243)

Gross margin 556 496 0.33$

Adjustments:

Renewable energy and demand

side management programs (31) (25) (0.04)

Adjusted gross margin 525$ 471$ 0.29$

Operations and maintenance* (266)$ (208)$ (0.32)$

Adjustments:

Renewable energy and demand

side management programs (29) (19) 0.05

Adjusted operations and maintenance (237)$ (189)$ (0.27)$

* Line items from Consolidated Statements of Income

Three Months Ended

December 31, EPS

Impact

Fourth Quarter and Full-Year 201727

NON-GAAP MEASURE RECONCILIATION

$ millions pretax, except per share amounts 2017 2016

Operating revenues* 3,565$ 3,499$

Fuel and purchased power expenses* (981) (1,076)

Gross margin 2,584 2,423 0.89$

Adjustments:

Renewable energy and demand

side management programs (112) (105) (0.04)

Adjusted gross margin 2,472$ 2,318$ 0.85$

Operations and maintenance* (924)$ (911)$ (0.07)$

Adjustments:

Renewable energy and demand

side management programs (91) (83) 0.04

Adjusted operations and maintenance (833)$ (828)$ (0.03)$

* Line items from Consolidated Statements of Income

Twelve Months Ended

December 31, EPS

Impact

Fourth Quarter and Full-Year 201728

NON-GAAP MEASURE RECONCILIATION

$ millions pretax

Operating revenues* 3,645$ - 3,705$

Fuel and purchased power expenses* (1,090) - (1,100)

Gross margin 2,555 - 2,605

Adjustments:

Renewable energy and demand

side management programs (85) - (85)

Adjusted gross margin 2,470$ - 2,520$

Operations and maintenance* 945$ - 965$

Adjustments:

Renewable energy and demand

side management programs (85) - (85)

Adjusted operations and maintenance 860$ - 880$

* Line items from Consolidated Statements of Income

2018 Guidance

Fourth Quarter and Full-Year 201729

CONSOLIDATED STATISTICS

2017 2016 Incr (Decr) 2017 2016 Incr (Decr)

ELECTRIC OPERATING REVENUES (Dollars in Millions)

Retail

Residential 353$ 332$ 21 1,792$ 1,730$ 62$

Business 370 362 8 1,615 1,605 10

Total Retail 723 694 29 3,407 3,335 72

Sales for Resale (Wholesale) 18 30 (12) 80 95 (15)

Transmission for Others 11 7 4 46 28 18

Other Miscellaneous Services 5 6 (1) 21 32 (11)

Total Electric Operating Revenues 757$ 737$ 20 3,554$ 3,490$ 64$

ELECTRIC SALES (GWH)

Retail

Residential 2,552 2,671 (119) 13,207 13,195 12

Business 3,390 3,460 (70) 14,811 14,827 (16)

Total Retail 5,942 6,131 (189) 28,018 28,022 (4)

Sales for Resale (Wholesale) 597 1,045 (448) 2,875 3,767 (892)

Total Electric Sales 6,539 7,176 (637) 30,893 31,789 (896)

RETAIL SALES (GWH) - WEATHER NORMALIZED

Residential 2,631 2,653 (22) 13,278 13,321 (43)

Business 3,353 3,440 (87) 14,727 14,772 (45)

Total Retail Sales 5,984 6,093 (108) 28,005 28,093 (88)

Retail sales (GWH) (% over prior year) (1.8)% (0.3)%

AVERAGE ELECTRIC CUSTOMERS

Retail Customers

Residential 1,086,642 1,066,711 19,931 1,080,665 1,061,814 18,851

Business 134,843 132,173 2,670 133,961 131,697 2,264

Total Retail 1,221,485 1,198,884 22,601 1,214,626 1,193,511 21,115

Wholesale Customers 35 46 (11) 40 46 (6)

Total Customers 1,221,520 1,198,930 22,590 1,214,666 1,193,557 21,109

Total Customer Growth (% over prior year) 1.9% 1.8%

RETAIL USAGE - WEATHER NORMALIZED (KWh/Average Customer)

Residential 2,421 2,487 (66) 12,287 12,545 (258)

Business 24,868 26,026 (1,158) 109,934 112,166 (2,232)

3 Months Ended December 31, 12 Months Ended December 31,

Numbers may not foot due to rounding.

Fourth Quarter and Full-Year 201730

CONSOLIDATED STATISTICS

2017 2016 Incr (Decr) 2017 2016 Incr (Decr)

WEATHER INDICATORS - RESIDENTIAL

Actual

Cooling Degree-Days 52 57 (5) 1,776 1,720 56

Heating Degree-Days 203 282 (79) 642 679 (37)

Average Humidity 22% 29% (7)% 24% 27% (3)%

10-Year Averages (2005 - 2014)

Cooling Degree-Days 44 44 - 1,766 1,766 -

Heating Degree-Days 344 344 - 836 836 -

Average Humidity 28% 28% - 25% 25% -

ENERGY SOURCES (GWH)

Generation Production

Nuclear 2,264 2,276 (12) 9,411 9,384 27

Coal 1,506 2,376 (870) 7,140 6,687 453

Gas, Oil and Other 2,234 1,508 726 7,916 8,270 (354)

Renewables 121 93 28 567 501 66

Total Generation Production 6,125 6,252 (127) 25,034 24,842 192

Purchased Power - -

Conventional 414 753 (339) 5,061 5,737 (676)

Resales 137 188 (51) 770 1,027 (257)

Renewables 430 431 (1) 1,897 1,828 69

Total Purchased Power 981 1,372 (390) 7,728 8,592 (864)

Total Energy Sources 7,106 7,624 (518) 32,762 33,433 (672)

POWER PLANT PERFORMANCE

Capacity Factors - Owned

Nuclear 90% 90% - 94% 93% 1%

Coal 41% 64% (23)% 49% 46% 3%

Gas, Oil and Other 32% 22% 10% 28% 30% (2)%

Solar 24% 22% 2% 28% 30% (2)%

System Average 44% 46% (2)% 46% 46% -

3 Months Ended December 31, 12 Months Ended December 31,

Numbers may not foot due to rounding.