Attached files

| file | filename |

|---|---|

| 8-K - 8-K 1ST QUARTER FISCAL 2018 INVESTOR PRESENTATION - MATTHEWS INTERNATIONAL CORP | form8-k_1q2018xinvestorxpr.htm |

©2016 Matthews International Corporation. All Rights Reserved.

INVESTOR PRESENTATION

1st QUARTER FISCAL 2018

©2016 Matthews International Corporation. All Rights Reserved.

Business Overview

2

©2016 Matthews International Corporation. All Rights Reserved.

Disclaimer

Any forward-looking statements with respect to Matthews International Corporation (the ―Company‖) in connection with this presentation are being made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to be materially

different from management’s expectations. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations

will prove correct. Factors that could cause the Company’s results to differ from those presented herein are set forth in the Company’s Annual Report on Form 10-K and other periodic filings with the Securities

and Exchange Commission (―SEC‖).

The Company periodically provides information derived from financial data which is not presented in the consolidated financial statements prepared in accordance with U.S. generally accepted accounting

principles (―GAAP‖). Certain of this information are considered ―non-GAAP financial measures‖ under the SEC rules. The Company believes that this information provides management and investors with a

useful measure of the Company’s financial performance on a comparable basis. These non-GAAP financial measures are supplemental to the Company’s GAAP disclosures and should not be considered an

alternative to the GAAP financial information.

The Company uses non-GAAP financial measures to assist in comparing its performance on a consistent basis for purposes of business decision making by removing the impact of certain items that

management believes do not directly reflect the Company’s core operations including acquisition-related items, system-integration costs, adjustments related to intangible assets, litigation items, and strategic

initiative and other charges, which includes non-recurring charges related to operational initiatives and exit activities. Management believes that presenting non-GAAP financial measures is useful to investors

because it (i) provides investors with meaningful supplemental information regarding financial performance by excluding certain items, (ii) permits investors to view performance using the same tools that

management uses to budget, forecast, make operating and strategic decisions, and evaluate historical performance, and (iii) otherwise provides supplemental information that may be useful to investors in

evaluating the Company’s results. The Company believes that the presentation of these non-GAAP financial measures, when considered together with the corresponding GAAP financial measures and the

reconciliations to those measures, provided herein, provides investors with an additional understanding of the factors and trends affecting the Company’s business that could not be obtained absent these

disclosures.

The Company has presented free cash flow and free cash flow yield as supplemental measures of cash flow that are not required by, or presented in accordance with, GAAP. Management believes that these

measures provide relevant and useful information, which is widely used by analysts and investors as well as by our management. These measures provide management with insight on the cash generated by

operations, excluding certain expenses, above and beyond the annual capital expenditures. These measures allows management, as well as analysts and investors, to assess the Company’s ability to pursue

growth and investment opportunities designed to increase Shareholder value.

The Company also has presented adjusted operating profit and believes that it provides relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s

management in assessing both consolidated and segment performance. Adjusted operating profit provides the Company with an understanding of the results from the primary operations of its business by

excluding the effects of certain acquisition and system-integration costs, and items that do not reflect the ordinary earnings of the Company’s operations. This measure may be useful to an investor in evaluating

the underlying primary operating performance of the Company’s segments and business overall on a consistent basis.

Similarly, the Company believes that EBITDA and adjusted EBITDA provide relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s management in

assessing the performance of its business. Adjusted EBITDA provides the Company with an understanding of earnings before the impact of investing and financing charges and income taxes, and the effects of

certain acquisition and system-integration costs, and items that do not reflect the ordinary earnings of the Company’s operations. This measure may be useful to an investor in evaluating operating performance.

It is also useful as a financial measure for lenders and is used by the Company’s management to measure performance as well as strategic planning and forecasting.

The Company has also presented adjusted earnings per share and believes it provides relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s

management in assessing the performance of its business. Adjusted earnings per share provides the Company with an understanding of the results from the primary operations of our business by excluding the

per share effects of certain acquisition and system-integration costs, and items that do not reflect the ordinary earnings of our operations. This measure provides management with insight into the earning value

for shareholders excluding certain costs, not related to the Company’s primary operations. Likewise, this measure may be useful to an investor in evaluating the underlying operating performance of the

Company’s business overall, as well as performance trends, on a consistent basis.

Lastly, the Company has presented adjusted net income and believes it provides relevant and useful information, which is widely used by analysts and investors, as well as by the Company’s management in

assessing financial performance. Adjusted net income provides the Company with an understanding of the results from the primary operations of its business by excluding the effects of certain acquisition and

system-integration costs, and items that do not reflect the ordinary earnings of the Company’s operations. This measure may be useful to an investor in evaluating the underlying performance of the business.

3

©2016 Matthews International Corporation. All Rights Reserved.

Matthews

Founded in 1850 – headquartered in Pittsburgh, PA

Three business segments:

SGK Brand Solutions

Memorialization

Industrial Technologies

Approximately 11,000 employees

Over 25 countries

NASDAQ – 32.3 million shares outstanding, as of December 31, 2017

4

©2016 Matthews International Corporation. All Rights Reserved.

51%

8%

41%

Memorialization

SGK Brand Solutions

Industrial Technologies

5

Fiscal 2017 Sales

©2016 Matthews International Corporation. All Rights Reserved.

SGK BRAND SOLUTIONS

6

©2016 Matthews International Corporation. All Rights Reserved.

SGK Brand Solutions

7

Monoprix, a major city center retailer in France, teamed up with Brandimage to

launch its new Food To Go line.

Anthem developed a three-year ―Live Your Break‖ connected platform for

Nestlé KitKat. The activity combines connected packaging via a mobile digital

hub of user generated ―breaker‖ content with a real-world brand experience.

Roto-gravure cylinder by Saueressig

©2016 Matthews International Corporation. All Rights Reserved.

SGK Brand Solutions

8

Premedia / Tooling / Merchandising

= +

Marketing / Packaging Execution

Marketing / Packaging

Execution

SGK Brand Solutions Creative / Adaptive

©2016 Matthews International Corporation. All Rights Reserved.

SGK Brand Solutions

• SGK Brand Solutions has longstanding relationships with a large, blue chip customer base

consisting of many of the Fortune 100 and Fortune 50 companies

• Through brand development, SGK Brand Solutions has developed ―strategic‖ relationships rather

than ―vendor‖ relationships which enables more valued client engagement, with over 400

employees working onsite across 85+ client locations

• Brand solutions is a critical cog in the marketing programs of the top world-wide brands,

particularly where global consistency is highly valued

9

US Food / Beverage

Clients

Top Global

Pharmaceutical

Clients

Top Global Retailer

Clients

Other Key Partners

©2016 Matthews International Corporation. All Rights Reserved.

MEMORIALIZATION

10

©2016 Matthews International Corporation. All Rights Reserved. 11

Matthews

Architectural Products -

Building signs are an

example of the segment’s

architectural product

offerings.

Memorialization

Bronze Memorials

Forest Park West Cemetery

Cremation Garden

©2016 Matthews International Corporation. All Rights Reserved. 12

Memorialization

The Company is a leading manufacturer and distributor of caskets (wood, metal and

cremation) in North America.

The Super Power Pak III Plus cremation unit has some of the most advanced

features in combustion technology as well as industry leading performance, reliability

and support.

©2016 Matthews International Corporation. All Rights Reserved.

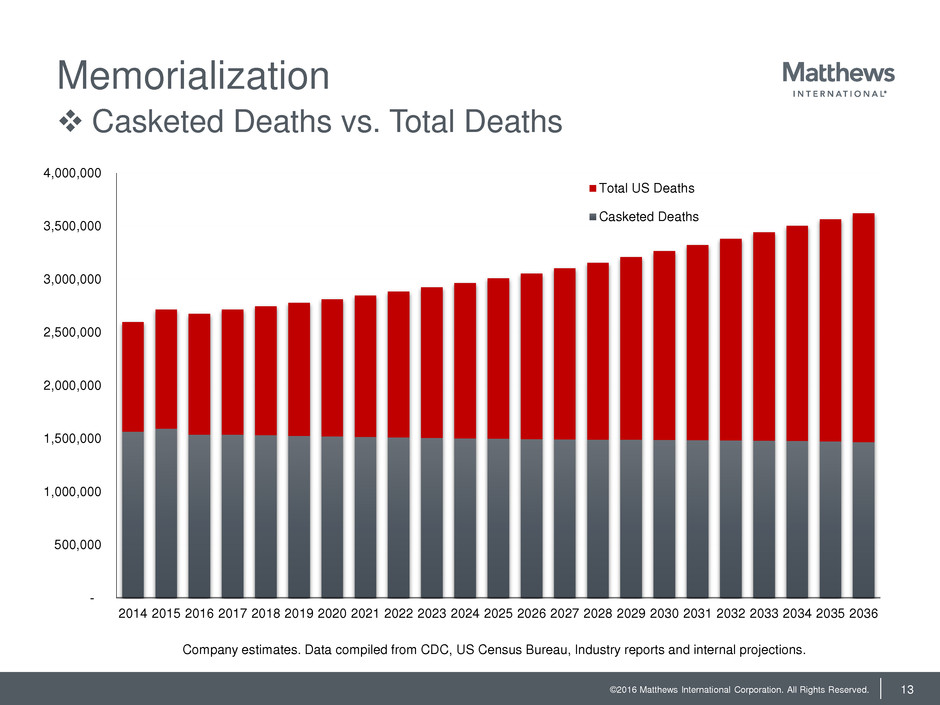

-

500,000

1,000,000

1,500,000

2,000,000

2,500,000

3,000,000

3,500,000

4,000,000

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036

Total US Deaths

Casketed Deaths

13

Memorialization

Casketed Deaths vs. Total Deaths

Company estimates. Data compiled from CDC, US Census Bureau, Industry reports and internal projections.

©2016 Matthews International Corporation. All Rights Reserved.

INDUSTRIAL TECHNOLOGIES

14

©2016 Matthews International Corporation. All Rights Reserved. 15

Industrial Technologies

Non-contact ink-jet printing units

apply print on products.

Multiple integrated distribution and fulfillment systems (including laser-based

identification and dimensioning technologies) communicate in a warehouse

to identify and route items and parcels through the facility and out to a

customer.

Pick-to-Light Systems utilizing light indicators for

sorting and control of merchandise.

Pyramid introduced a new warehouse execution solution, Continuous Intelligent Operations to

enhance automated distribution operations — from receiving to shipping.

©2016 Matthews International Corporation. All Rights Reserved.

Financial Overview

16

©2016 Matthews International Corporation. All Rights Reserved.

Key Elements of Long-Term EPS Growth

Internal Growth

Expand market presence of existing products

Manufacturing/cost structure improvements

New product development

Acquisitions

Primary objective to support strategic business plans

Leverage existing operating infrastructure

Achieve long-term annual return (EBITDA) of at least 15% on

invested capital

Share Repurchases

Repurchase in periods of excess cash flow

Current remaining authorization – 1.7 million shares

17

©2016 Matthews International Corporation. All Rights Reserved.

Consolidated Results

18

2015 2016 2017 2016 (a) 2017

(unaudited) (unaudited)

Sales 1,426,068$ 1,480,464$ 1,515,608$ 348,998$ 369,454$

Operating Profit 105,023$ 118,815$ 112,603$ 19,063$ 17,924$

Adj. Operating Profit (b) 141,906$ 154,872$ 151,062$ 27,713$ 22,597$

EBITDA (c) 173,043$ 185,646$ 191,074$ 34,118$ 34,992$

Adj. EBITDA (d) 215,974$ 239,586$ 238,683$ 50,635$ 46,496$

EPS - GAAP 1.91$ 2.03$ 2.28$ 0.32$ 1.10$

Adj. EPS (e) 3.03$ 3.38$ 3.60$ 0.66$ 0.64$

(Dollars in thousands,

except per share data)

Fiscal year ended September 30, QTD December 31,

(a) Fiscal 2017 first quarter information has been adjusted to reflect the adoption of ASU No. 2016-09. The Company early adopted this ASU in the

fourth quarter of fiscal 2017, which resulted in a reduction to income tax expense of $1,234, and a corresponding favorable impact on diluted

earnings per share of $0.04, both of which have been retroactively included in the first quarter results for fiscal 2017.

(b) Adjusted operating profit reflects certain adjustments to facilitate comparability. See reconciliation at Appendix A.

(c) EBITDA represents earnings before interest expense, income taxes, depreciation and amortization. See reconciliation at Appendix B.

(d) Adjusted EBITDA represents EBITDA plus stock compensation expense and the non-service cost portion of pension/post-retirement expense, and

also reflects certain adjustments to facilitate comparability. See reconciliation at Appendix B.

(e) Adjusted earnings per share reflects certain adjustments to facilitate comparability and excludes intangible amortization and the non-service cost

portion of pension/post-retirement expense. See reconciliation at Appendix C.

©2016 Matthews International Corporation. All Rights Reserved.

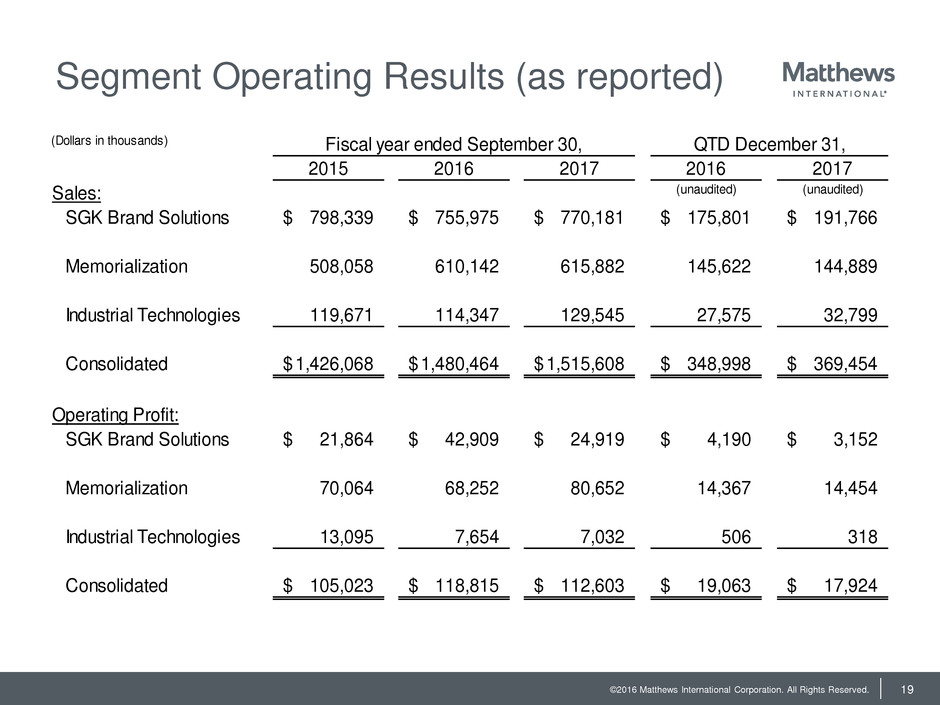

Segment Operating Results (as reported)

19

(Dollars in thousands)

2015 2016 2017 2016 2017

Sales: (unaudited) (unaudited)

SGK Brand Solutions 798,339$ 755,975$ 770,181$ 175,801$ 191,766$

Memorialization 508,058 610,142 615,882 145,622 144,889

Industrial Technologies 119,671 114,347 129,545 27,575 32,799

Consolidated 1,426,068$ 1,480,464$ 1,515,608$ 348,998$ 369,454$

Operating Profit:

SGK Brand Solutions 21,864$ 42,909$ 24,919$ 4,190$ 3,152$

Memorialization 70,064 68,252 80,652 14,367 14,454

Industrial Technologies 13,095 7,654 7,032 506 318

Consolidated 105,023$ 118,815$ 112,603$ 19,063$ 17,924$

Fiscal year ended September 30, QTD December 31,

©2016 Matthews International Corporation. All Rights Reserved. 20

(Dollars in thousands)

2015 2016 2017 2016 2017

Sales: (unaudited) (unaudited)

SGK Brand Solutions 798,339$ 755,975$ 770,181$ 175,801$ 191,766$

Memorialization 508,058 610,142 615,882 145,622 144,889

Industrial Technologies 119,671 114,347 129,545 27,575 32,799

Consolidated 1,426,068$ 1,480,464$ 1,515,608$ 348,998$ 369,454$

Adjusted EBITDA:*

SGK Brand Solutions 106,463$ 119,844$ 107,216$ 23,354$ 21,382$

Memorialization 92,416 107,061 118,880 25,301 23,061

Industrial Technologies 17,095 12,681 12,587 1,980 2,053

Consolidated 215,974$ 239,586$ 238,683$ 50,635$ 46,496$

Fiscal year ended September 30, QTD December 31,

* Adjusted EBITDA represents EBITDA plus stock compensation expense and the non-service cost portion of

pension/post-retirement expense, and also reflects certain adjustments to facilitate comparability. See reconciliations at

Appendix B and E.

.

Segment Results – Sales & Adjusted EBITDA

©2016 Matthews International Corporation. All Rights Reserved.

Free Cash Flow

21

(Dollars in thousands)

2015 2016 2017

Net Income 63,449$ 66,749$ 74,368$

Depreciation and Amortization 62,620 65,480 67,981

Stock-Based Compensation 9,097 10,612 14,562

Pension Cost (non-service portion) 5,677 8,413 8,773

Subtotal 140,843 151,254 165,684

Capital Expenditures (48,251) (41,682) (44,935)

Free Cash Flow

(1)

92,592$ 109,572$ 120,749$

Cash Provided from Operating Activities 141,064$ 140,274$ 149,299$

Fiscal year ended September 30,

(1) See Disclaimer (Page 3) for Management’s assessment of supplemental information related to free cash flow.

©2016 Matthews International Corporation. All Rights Reserved.

Free Cash Flow Yield

22

2015 2016 2017

Free Cash Flow (1) 92,592$ 109,572$ 120,749$

Market Capitalization 1,609,892$ 1,952,929$ 2,001,249$

Free Cash Flow Yield (1) 5.75% 5.61% 6.03%

Free Cash Flow Yield (based on 12/31/2017 Market Capitalization) 7.08%

(Dollars in thousands) Fiscal year ended September 30,

(1) See Disclaimer (Page 3) for Management’s assessment of supplemental information related to free cash flow, free cash

flow yield.

©2016 Matthews International Corporation. All Rights Reserved.

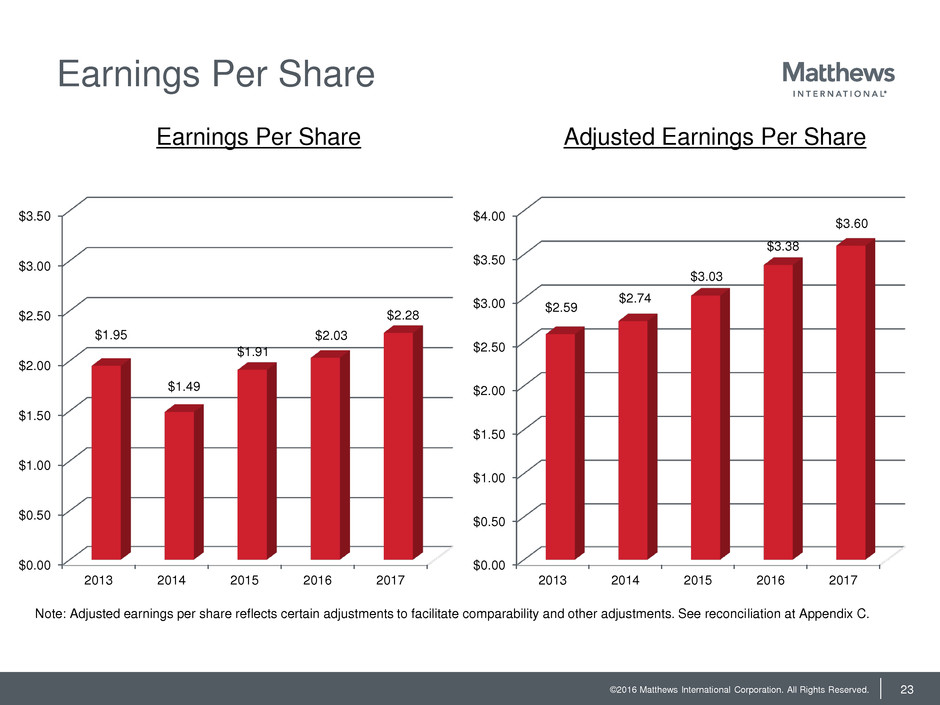

Earnings Per Share

23

Note: Adjusted earnings per share reflects certain adjustments to facilitate comparability and other adjustments. See reconciliation at Appendix C.

Earnings Per Share Adjusted Earnings Per Share

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

2013 2014 2015 2016 2017

$1.95

$1.49

$1.91

$2.03

$2.28

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

$4.00

2013 2014 2015 2016 2017

$2.59

$2.74

$3.03

$3.38

$3.60

©2016 Matthews International Corporation. All Rights Reserved.

EBITDA

(Dollars in millions)

24

Note: EBITDA represents earnings before interest expense, income taxes, depreciation and amortization. See reconciliation at Appendix B. Adjusted

EBITDA represents EBITDA plus certain expenses, and also reflects certain adjustments to facilitate comparability. See reconciliation at Appendix B.

EBITDA Adjusted EBITDA

$0.0

$50.0

$100.0

$150.0

$200.0

$250.0

2013 2014 2015 2016 2017

$131.1

$120.9

$173.0

$185.6 $191.1

$0.0

$50.0

$100.0

$150.0

$200.0

$250.0

2013 2014 2015 2016 2017

$160.6

$172.1

$216.0

$239.6 $238.7

©2016 Matthews International Corporation. All Rights Reserved.

Common Stock Price

25

Note: Stock price obtained from NASDAQ for each respective month-end period.

$0.00

$10.00

$20.00

$30.00

$40.00

$50.00

$60.00

$70.00

$50.74

$35.18 $35.36

$30.73 $29.82

$38.08

$43.89

$48.97

$60.76 $62.25

$52.80

©2016 Matthews International Corporation. All Rights Reserved.

Recent Highlights

Company raised fiscal 2018 non-GAAP earnings per share expectations to be

better than 10% over fiscal 2017

Reported record sales of $1.52 billion in fiscal 2017

Increased quarterly dividend 11.8% to 19.0 cents (November 2017)

23rd consecutive annual dividend increase since the Company’s IPO

Record operating cash flow of $149.3 million in fiscal 2017

Completed a $300 million 5.25% bond issuance in the 1st quarter of fiscal 2018

The U.S. Tax Cuts and Jobs Act reduces the U.S. federal corporate tax rate

Analyst coverage:

CJS Securities

FBR Capital Markets

Great Lakes Review

26

©2016 Matthews International Corporation. All Rights Reserved.

Institutional Shareholders

27

Shares

12/31/2017

BlackRock Institutional Trust Company, N.A. 4,166,858

The Vanguard Group, Inc. 3,217,078

Franklin Advisory Services, LLC 2,955,118

Wellington Management Company, LLP 1,465,646

Dimensional Fund Advisors, L.P. 1,275,732

Clarkston Capital Partners, LLC 1,137,592

State Street Global Advisors (US) 792,019

T. Rowe Price Associates, Inc. 565,150

Fidelity Management & Research Company 514,685

Bank of New York Mellon Corporation 494,651

Top Ten Institutions 16,584,529 51.4% of outstanding shares

Remaining Institutions 9,193,340

Total Institutional Ownership 25,777,869 79.8% of outstanding shares

Note: Institutional share information obtained from NASDAQ as of December 31,2017.

©2016 Matthews International Corporation. All Rights Reserved.

Appendices

28

©2016 Matthews International Corporation. All Rights Reserved.

Adjusted Operating Profit

Non-GAAP Reconciliation

29

Appendix A

(Dollars in thousands) 2015 2016 2017 2016 2017

SGK Brand Solutions

Operating Profit 21,864$ 42,909$ 24,919$ 4,190$ 3,152$

Acquisition-related items (1) 33,605 24,872 21,103 6,202 3,507

Intangible asset w rite-offs 4,842 - - - -

Strategic initiative and other charges (2) 1,016 120 8,620 - 269

Adjusted Operating Profit 61,327$ 67,901$ 54,642$ 10,392$ 6,928$

Memorialization

Operating Profit 70,064$ 68,252$ 80,652$ 14,367$ 14,454$

Acquisition-related items (1) 5,260 11,022 7,791 2,147 519

Litigation matter (8,996) - - - -

Strategic initiative and other charges (2) 1,156 (589) - - 288

Adjusted Operating Profit 67,484$ 78,685$ 88,443$ 16,514$ 15,261$

Industrial Technologies

Operating Profit 13,095$ 7,654$ 7,032$ 506$ 318$

Acquisition-related items (1) - - 356 301 -

Strategic initiative and other charges (2) - 632 589 - 90

Adjusted Operating Profit 13,095$ 8,286$ 7,977$ 807$ 408$

Consolidated

Operating Profit 105,023$ 118,815$ 112,603$ 19,063$ 17,924$

Acquisition-related items (1) 38,865 35,894 29,250 8,650 4,026

Intangible asset w rite-offs 4,842 - - - -

Litigation matter (8,996) - - - -

Strategic initiative and other charges (2) 2,172 163 9,209 - 647

Adjusted Operating Profit 141,906$ 154,872$ 151,062$ 27,713$ 22,597$

Fiscal year ended September 30, QTD December 31,

Note: See Disclaimer (Page 3) for Management’s assessment of supplemental information related to adjusted operating profit.

(1) Acquisition-related items also include one-time charges related to depreciation and amortization.

(2) See Disclosure (Page 3).

©2016 Matthews International Corporation. All Rights Reserved.

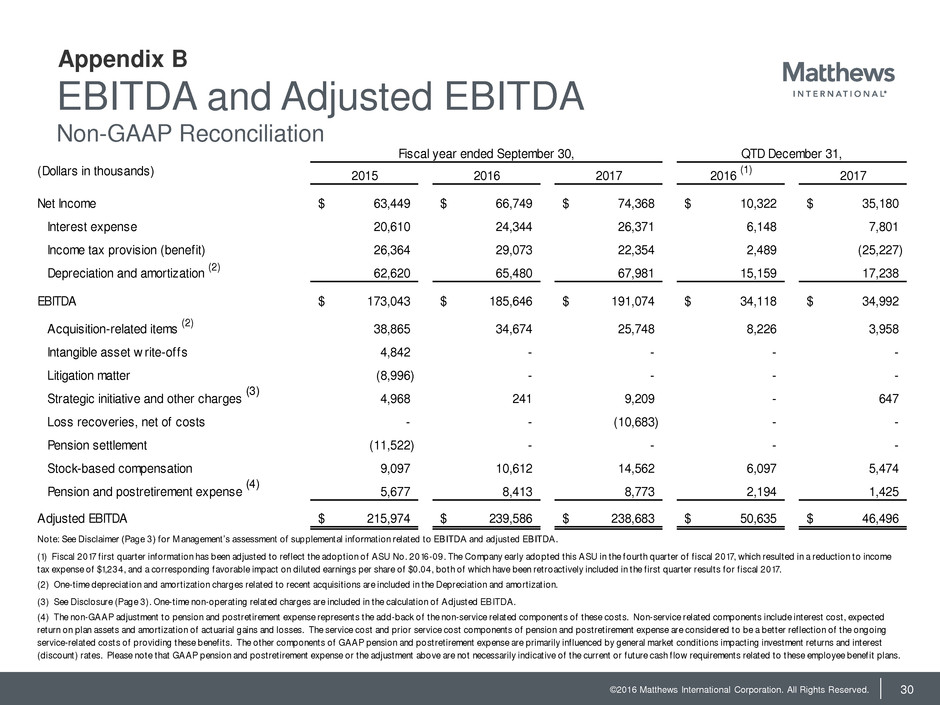

EBITDA and Adjusted EBITDA

Non-GAAP Reconciliation

30

Appendix B

(Dollars in thousands) 2015 2016 2017 2016

(1)

2017

Net Income 63,449$ 66,749$ 74,368$ 10,322$ 35,180$

Interest expense 20,610 24,344 26,371 6,148 7,801

Income tax provision (benefit) 26,364 29,073 22,354 2,489 (25,227)

Depreciation and amortization

(2)

62,620 65,480 67,981 15,159 17,238

EBITDA 173,043$ 185,646$ 191,074$ 34,118$ 34,992$

Acquisition-related items

(2)

38,865 34,674 25,748 8,226 3,958

Intangible asset w rite-offs 4,842 - - - -

Litigation matter (8,996) - - - -

Strategic initiative and other charges

(3)

4,968 241 9,209 - 647

Loss recoveries, net of costs - - (10,683) - -

Pension settlement (11,522) - - - -

Stock-based compensation 9,097 10,612 14,562 6,097 5,474

Pension and postretirement expense

(4)

5,677 8,413 8,773 2,194 1,425

Adjusted EBITDA 215,974$ 239,586$ 238,683$ 50,635$ 46,496$

(4) The non-GAAP adjustment to pension and postret irement expense represents the add-back of the non-service related components of these costs. Non-service related components include interest cost, expected

return on plan assets and amort izat ion of actuarial gains and losses. The service cost and prior service cost components of pension and postret irement expense are considered to be a better ref lect ion of the ongoing

service-related costs of providing these benefits. The other components of GAAP pension and postret irement expense are primarily inf luenced by general market condit ions impacting investment returns and interest

(discount) rates. Please note that GAAP pension and postret irement expense or the adjustment above are not necessarily indicat ive of the current or future cash f low requirements related to these employee benefit plans.

(2) One-t ime depreciat ion and amort izat ion charges related to recent acquisit ions are included in the Depreciat ion and amort izat ion.

Note: See Disclaimer (Page 3) for Management’s assessment of supplemental information related to EBITDA and adjusted EBITDA.

(3) See Disclosure (Page 3). One-t ime non-operat ing related charges are included in the calculat ion of Adjusted EBITDA.

Fiscal year ended September 30, QTD December 31,

(1) Fiscal 2017 f irst quarter information has been adjusted to ref lect the adoption of ASU No. 2016-09. The Company early adopted this ASU in the fourth quarter of f iscal 2017, which resulted in a reduction to income

tax expense of $1,234, and a corresponding favorable impact on diluted earnings per share of $0.04, both of which have been retroact ively included in the f irst quarter results for f iscal 2017.

©2016 Matthews International Corporation. All Rights Reserved.

Adjusted Earnings Per Share

Non-GAAP Reconciliation

31

Appendix C

2015 2016 2017 2016

(1)

2017

EPS - GAAP 1.91$ 2.03$ 2.28$ 0.32$ 1.10$

Acquisition-related items 0.79 0.74 0.65 0.19 0.09

Intangible asset w rite-offs 0.10 - - - -

Litigation matter (0.18) - - - -

Strategic initiative and other charges

(2)

0.14 0.01 0.21 - 0.02

Loss recoveries, net of costs - - (0.23) - -

Pension settlement (0.24) - - - -

Income tax regulation changes

(3)

- - - - (0.76)

Pension and postretirement expense

(4)

0.12 0.17 0.19 0.05 0.03

Intangible amortization expense 0.39 0.43 0.50 0.10 0.16

Adjusted EPS 3.03$ 3.38$ 3.60$ 0.66$ 0.64$

(2) See Disclosure (Page 3).

Fiscal year ended September 30, QTD December 31,

Note: See Disclaimer (Page 3) for Management’s assessment of supplemental information related to adjusted earnings per share. All per-share amounts are net of tax.

(4) The non-GAAP adjustment to pension and postret irement expense represents the add-back of the non-service related components of these costs. Non-service related components include interest cost,

expected return on plan assets and amort izat ion of actuarial gains and losses. The service cost and prior service cost components of pension and postret irement expense are considered to be a better

ref lect ion of the ongoing service-related costs of providing these benefits. The other components of GAAP pension and postret irement expense are primarily inf luenced by general market condit ions impacting

investment returns and interest (discount) rates. Please note that GAAP pension and postret irement expense or the adjustment above are not necessarily indicat ive of the current or future cash f low

requirements related to these employee benefit plans.

(3) The adjustment for income tax regulat ion changes consist of an estimated favorable tax benefit of approximately $38.0 million for the reduction in the Company’s net deferred tax liability principally

ref lect ing the lower U.S. Federal tax rate, offset part ially by an est imated repatriat ion transit ion tax charge of approximately $13.5 million.

(1) Fiscal 2017 f irst quarter information has been adjusted to ref lect the adoption of ASU No. 2016-09. The Company early adopted this ASU in the fourth quarter of f iscal 2017, which resulted in a reduction to

i come tax expense of $1,234, and a corresponding favorable impact on diluted earnings per share of $0.04, both of which have been retroact ively included in the f irst quarter results for f iscal 2017.

©2016 Matthews International Corporation. All Rights Reserved.

Adjusted Net Income

Non-GAAP Reconciliation

32

Appendix D

(Dollars in thousands)

Pretax After Tax Pretax After Tax Pretax After Tax

Net Income 89,652$ 63,449$ 95,234$ 66,749$ 96,287$ 74,368$

Acquisition-related items 38,865 26,428 34,674 23,578 29,449 20,615

Intangible asset w rite-offs 4,842 3,293 - - - -

Litigation matter (8,996) (6,117) - - - -

Loss recoveries, net of costs - - - - (10,683) (7,478)

Strategic initiative and other charges

(1)

4,968 3,378 241 164 9,209 6,722

Pension settlement (11,522) (7,835) - - - -

Tax related 1,334 - 485

Adjusted Net Income 83,930$ 90,491$ 94,712$

2017

Fiscal year ended September 30,

Note: See Disclaimer (Page 3) for Management’s assessment of supplemental information related to adjusted net income. Adjusted net

income reflects non-GAAP adjustments at an effective tax rate of approximately 32.0%.

2016

(1) See Disclosure (Page 3).

2015

©2016 Matthews International Corporation. All Rights Reserved.

Adjusted EBITDA by Segment

Non-GAAP Reconciliation

33

Appendix E

(Dollars in t housands) 2015 2016 2017 2016 (1) 2017

S GK Br a nd S ol ut i ons

Operat ing Prof it 21,864$ 42,909$ 24,919$ 4,190$ 3,152$

Depreciat ion and amort izat ion (2) 47,215 42,471 43,508 8,973 11,454

Ot her (3) 2,538 662 4,877 (48) (79)

EBITDA 71,617$ 86,042$ 73,304$ 13,114$ 14,527$

Acquisit ion-relat ed it ems (2) 33,605 24,380 19,541 6,402 3,507

Int angible asset writ e-of f s 4,842 - - - -

St rat egic init iat ive and ot her charges (4) 1,016 120 8,620 - 269

Loss recoveries, net of cost s - - (4,968) - -

Pension set t lement (11,522) - - - -

St ock-based compensat ion 4,236 5,180 6,639 2,817 2,416

Pension and post ret irement expense (5) 2,669 4,122 4,080 1,020 663

Adjust ed EBITDA 106,463$ 119,844$ 107,216$ 23,353$ 21,382$

M e mor i a l i z a t i on

Operat ing Prof it 70,064$ 68,252$ 80,652$ 14,367$ 14,454$

Depreciat ion and amort izat ion (2) 13,019 20,305 21,408 5,529 4,600

Ot her (3) 2,484 580 4,983 (49) (81)

EBITDA 85,567$ 89,137$ 107,043$ 19,847$ 18,974$

Acquisit ion-relat ed it ems (2) 5,260 10,294 5,851 1,523 451

Lit igat ion mat t er (8,996) - - - -

St rat egic init iat ive and ot her charges (4) 3,952 (511) - - 288

Loss recoveries, net of cost s - - (5,074) - -

St ock-based compensat ion 4,022 4,523 6,893 2,889 2,672

Pension and post ret irement expense (5) 2,611 3,618 4,167 1,042 677

Adjust ed EBITDA 92,416$ 107,061$ 118,880$ 25,301$ 23,061$

I ndust r i a l Te c hnol ogi e s

Operat ing Prof it 13,095$ 7,654$ 7,032$ 506$ 318$

Depreciat ion and amort izat ion (2) 2,386 2,704 3,065 657 1,184

Ot her (3) 378 109 630 (6) (10)

EBITDA 15,859$ 10,467$ 10,727$ 1,157$ 1,492$

Acquisit ion-relat ed it ems (2) - - 356 301 -

St rat egic init iat ive and ot her charges (4) - 632 589 - 90

Loss recoveries, net of cost s - - (641)

St ock-based compensat ion 839 909 1,030 391 386

Pension and post ret irement expense (5) 397 673 526 132 86

Adjust ed EBITDA 17,095$ 12,681$ 12,587$ 1,980$ 2,053$

Consol i da t e d

Operat ing Prof it 105,023$ 118,815$ 112,603$ 19,063$ 17,924$

Depreciat ion and amort izat ion (2) 62,620 65,480 67,981 15,159 17,238

Ot her (3) 5,400 1,351 10,490 (104) (170)

EBITDA 173,043$ 185,646$ 191,074$ 34,118$ 34,992$

Acquisit ion-relat ed it ems (2) 38,865 34,674 25,748 8,226 3,958

Int angible asset writ e-of f s 4,842 - - - -

Lit igat ion mat t er (8,996) - - - -

St rat egic init iat ive and ot her charges (4) 4,968 241 9,209 - 647

Loss recoveries, net of cost s - - (10,683) - -

Pension set t lement (11,522) - - - -

St ock-based compensat ion 9,097 10,612 14,562 6,097 5,474

Pension and post ret irement expense (5) 5,677 8,413 8,773 2,194 1,425

Adjust ed EBITDA 215,974$ 239,586$ 238,683$ 50,635$ 46,496$

Fiscal year ended Sept ember 30, QTD December 31,

Note: See Disclaimer (Page 3) for Management’s

assessment of supplemental information related to

EBITDA and adjusted EBITDA.

(1) - Fiscal 2017 first quarter information has

been adjusted to reflect the adoption of

ASU No. 2016-09. The Company early

adopted this ASU in the fourth quarter of

fiscal 2017, which resulted in a reduction to

income tax expense of $1,234, and a

corresponding favorable impact on diluted

earnings per share of $0.04, both of which

have been retroactively included in the first

quarter results for fiscal 2017

(2) One-time depreciation and amortization

charges related to recent acquisitions are

included in the Depreciation and

amortization.

(3) - Other represents Investment income,

Other income (deductions), net, and Net

loss (income) attributable to noncontrolling

interests

(4) - See Disclosure (Page 3). One-time non-

operating related charges are included in

the calculation of Adjusted EBITDA.

(5) - See FN 4 in Appendix C.

©2016 Matthews International Corporation. All Rights Reserved. 34

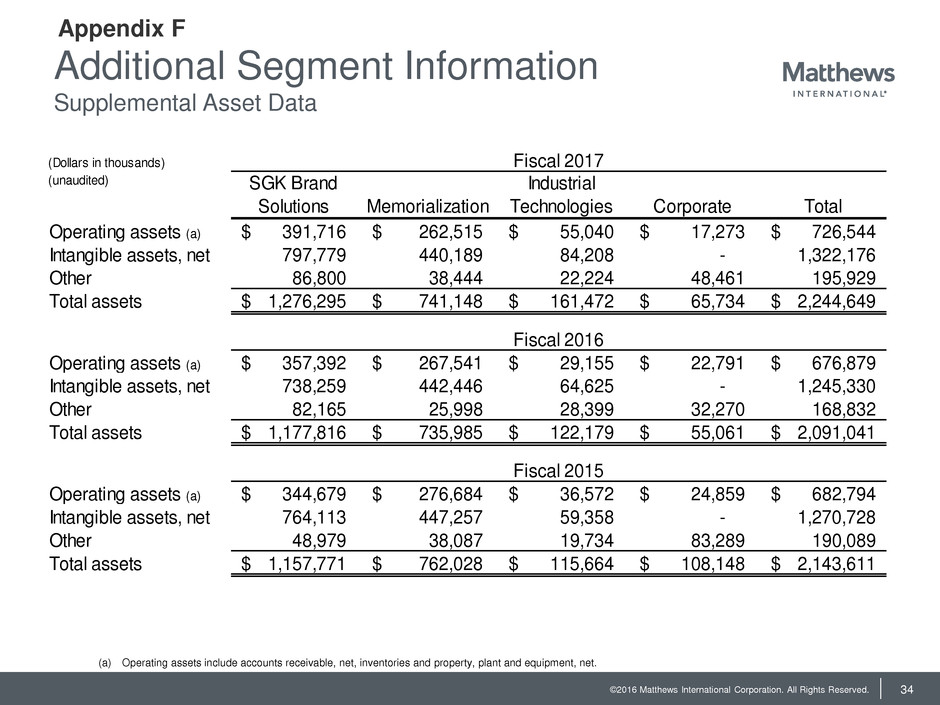

(a) Operating assets include accounts receivable, net, inventories and property, plant and equipment, net.

(Dollars in thousands)

(unaudited) SGK Brand

Solutions Memorialization

Industrial

Technologies Corporate Total

Operating assets (a) 391,716$ 262,515$ 55,040$ 17,273$ 726,544$

Intangible assets, net 797,779 440,189 84,208 - 1,322,176

Other 86,800 38,444 22,224 48,461 195,929

Total assets 1,276,295$ 741,148$ 161,472$ 65,734$ 2,244,649$

Operating assets (a) 357,392$ 267,541$ 29,155$ 22,791$ 676,879$

Intangible assets, net 738,259 442,446 64,625 - 1,245,330

Other 82,165 25,998 28,399 32,270 168,832

Total assets 1,177,816$ 735,985$ 122,179$ 55,061$ 2,091,041$

Operating assets (a) 344,679$ 276,684$ 36,572$ 24,859$ 682,794$

Intangible assets, net 764,113 447,257 59,358 - 1,270,728

Other 48,979 38,087 19,734 83,289 190,089

Total assets 1,157,771$ 762,028$ 115,664$ 108,148$ 2,143,611$

Fiscal 2017

Fiscal 2016

Fiscal 2015

Appendix F

Additional Segment Information

Supplemental Asset Data