Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MATERION Corp | mtrn_2018221x8kinvestorpre.htm |

INVESTOR PRESENTATION

February 2018

These slides contain (and the accompanying oral discussion will contain, where applicable) “forward-

looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These

statements involve known and unknown risks, uncertainties and other factors that could cause the actual

results of the Company to differ materially from the results expressed or implied by these statements,

including health issues, litigation and regulation relating to our business, our ability to achieve and/or

maintain profitability, significant cyclical fluctuations in our customers’ businesses, competitive substitutes

for our products, risks associated with our international operations, including foreign currency rate

fluctuations, energy costs and the availability and prices of raw materials, and other factors disclosed in

periodic reports filed with the Securities and Exchange Commission. Consequently, these forward-

looking statements should be regarded as the Company’s current plans, estimates, and beliefs.

The Company does not undertake and specifically declines any obligation to publicly release the results

of any revisions to these forward-looking statements that may be made to reflect any future events or

circumstances after the date of such statements or to reflect the occurrence of anticipated or

unanticipated events.

These slides include certain non-GAAP financial measures as defined by the rules and regulations of the

Securities and Exchange Commission. A reconciliation of those measures to the most directly

comparable GAAP equivalent is provided in the Appendix to this presentation.

Forward-looking Statements

2

Materion Company Profile

3

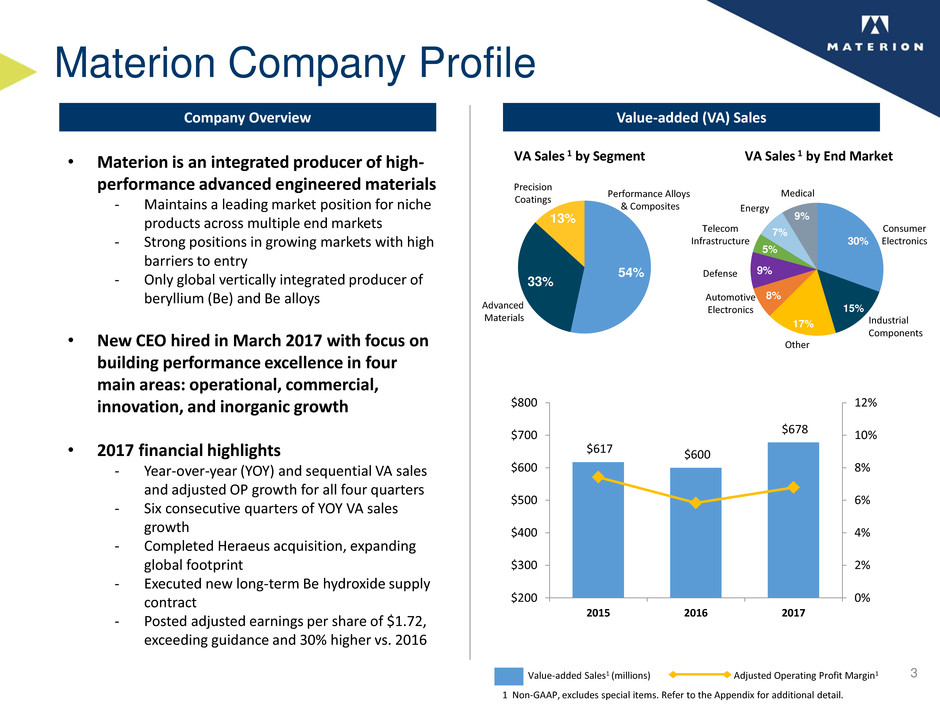

Company Overview Value-added (VA) Sales

• Materion is an integrated producer of high-

performance advanced engineered materials

- Maintains a leading market position for niche

products across multiple end markets

- Strong positions in growing markets with high

barriers to entry

- Only global vertically integrated producer of

beryllium (Be) and Be alloys

• New CEO hired in March 2017 with focus on

building performance excellence in four

main areas: operational, commercial,

innovation, and inorganic growth

• 2017 financial highlights

- Year-over-year (YOY) and sequential VA sales

and adjusted OP growth for all four quarters

- Six consecutive quarters of YOY VA sales

growth

- Completed Heraeus acquisition, expanding

global footprint

- Executed new long-term Be hydroxide supply

contract

- Posted adjusted earnings per share of $1.72,

exceeding guidance and 30% higher vs. 2016

$617 $600

$678

0%

2%

4%

6%

8%

10%

12%

$200

$300

$400

$500

$600

$700

$800

2015 2016 2017

Value-added Sales1 (millions)

1 Non-GAAP, excludes special items. Refer to the Appendix for additional detail.

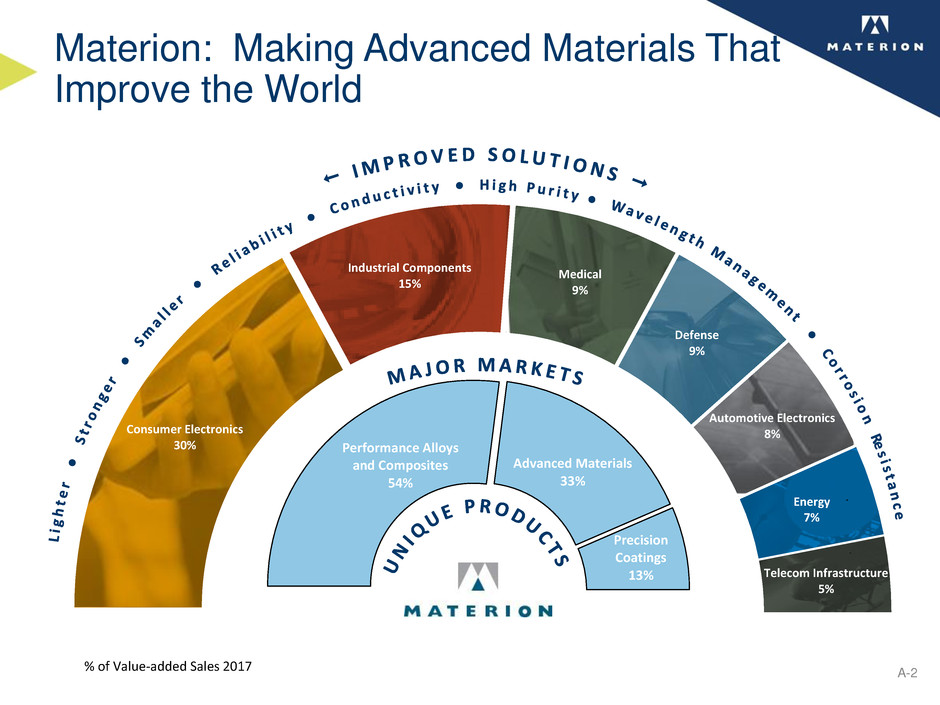

30%

15%

17%

8%

9%

5%

7%

9%

Telecom

Infrastructure

Automotive

Electronics

Defense

Industrial

Components

Medical

Other

Consumer

Electronics

Energy

54%

33%

13%

Performance Alloys

& Composites

Precision

Coatings

Advanced

Materials

VA Sales 1 by End Market VA Sales 1 by Segment

Adjusted Operating Profit Margin1

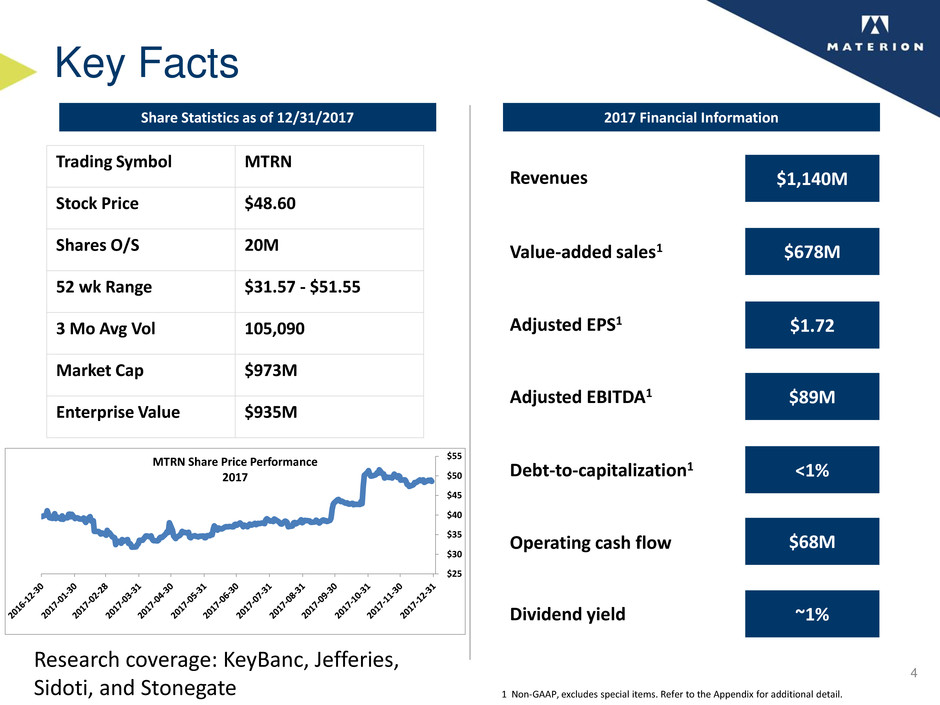

Key Facts

4

Share Statistics as of 12/31/2017 2017 Financial Information

Research coverage: KeyBanc, Jefferies,

Sidoti, and Stonegate

Adjusted EPS1

Adjusted EBITDA1

Debt-to-capitalization1

Operating cash flow

Revenues

Value-added sales1

$1.72

$89M

<1%

$68M

$1,140M

$678M

~1%

Trading Symbol MTRN

Stock Price $48.60

Shares O/S 20M

52 wk Range $31.57 - $51.55

3 Mo Avg Vol 105,090

Market Cap $973M

Enterprise Value $935M

1 Non-GAAP, excludes special items. Refer to the Appendix for additional detail.

Dividend yield

$25

$30

$35

$40

$45

$50

$55

MTRN Share Price Performance

2017

Performance Alloys and Composites

(PAC)

5

48%

12%

11%

17%

8%

4%

Clad Strip

ToughMet

CuBe

Be - Alloys

Be – High Purity

53%

26%

20%

1%

Europe

United States

Rest of World

Asia

21%

21%

20%

14%

9%

7%

6% 2%

Telecom

Infrastructure

Automotive

Electronics

Defense

Industrial

Components

Medical

Other

Consumer

Electronics

Energy

339.9

358.5

335.1 332.0

363.5

0%

2%

4%

6%

8%

10%

12%

14%

$100

$150

$200

$250

$300

$350

$400

2013 2014 2015 2016 2017

Product Mix1 Geographic Mix1 Value-added Sales by Market1

New product development

• New proprietary non-Be alloys with improved durability &

weight-to-strength ratio

• New heat dissipating clad material

• Improving customer yields with “near net shape” products

New application development

• Clad material serving the renewable energy market

• Precision rolling to thinner strips opening new application

opportunities

• ToughMet couplings serving the oil and gas production market

resist mechanical wear, thread damage, corrosion, and erosion

Beryllium market

• World’s only fully integrated producer

• Minimum of 75 years of proven mine reserves in Delta, Utah

• Primary Be competitor is consuming stockpiled ore

Growth Drivers Value-added Sales

O

P

%

o

f

V

A

Sa

le

s

V

A

S

al

es ($

m

ill

io

n

s)

Hydroxide

1 Reflects 2017 mix by market, geography, and product

59%

24%

17%

<1%

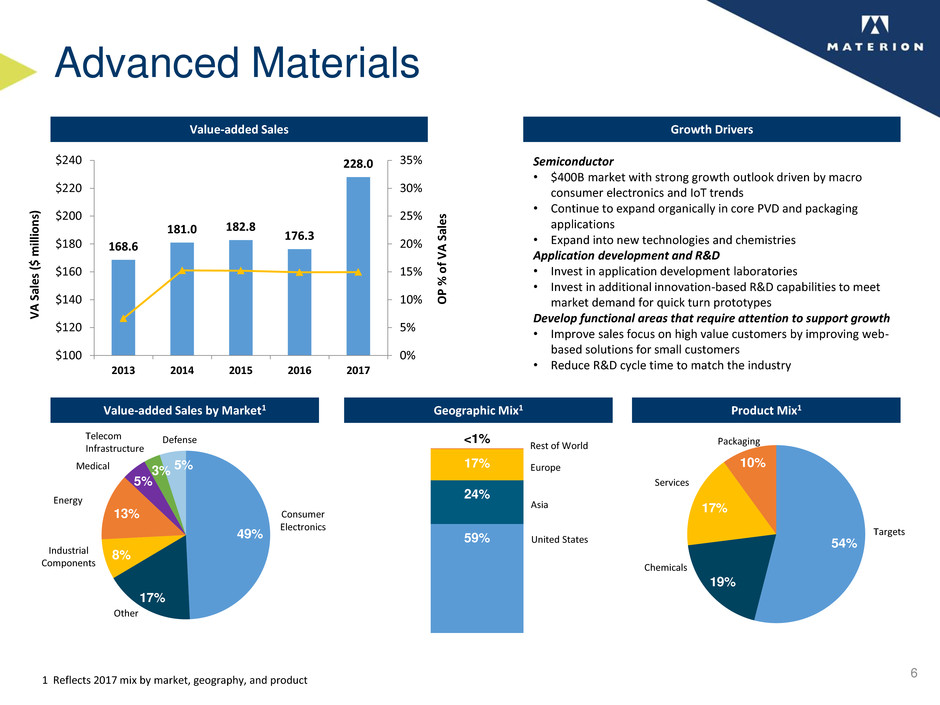

168.6

181.0 182.8

176.3

228.0

0%

5%

10%

15%

20%

25%

30%

35%

$100

$120

$140

$160

$180

$200

$220

$240

2013 2014 2015 2016 2017

Advanced Materials

54%

19%

17%

10%

Services

Packaging

Targets

Chemicals

Europe

United States

Rest of World

Asia

49%

17%

8%

13%

5%

3% 5%

Telecom

Infrastructure

Defense

Other

Medical

Consumer

Electronics

Industrial

Components

Energy

Product Mix1 Geographic Mix1 Value-added Sales by Market1

Growth Drivers Value-added Sales

O

P

%

o

f

V

A

Sa

le

s

V

A

S

al

es ($

m

ill

io

n

s)

1 Reflects 2017 mix by market, geography, and product

Semiconductor

• $400B market with strong growth outlook driven by macro

consumer electronics and IoT trends

• Continue to expand organically in core PVD and packaging

applications

• Expand into new technologies and chemistries

Application development and R&D

• Invest in application development laboratories

• Invest in additional innovation-based R&D capabilities to meet

market demand for quick turn prototypes

Develop functional areas that require attention to support growth

• Improve sales focus on high value customers by improving web-

based solutions for small customers

• Reduce R&D cycle time to match the industry

6

104.2 102.4 101.8

97.7

90.7

0%

4%

8%

12%

16%

20%

24%

$60

$70

$80

$90

$100

$110

$120

2013 2014 2015 2016 2017

Precision Coatings

7

36%

45%

19% Blood

Glucose

Test Strips

Projection Display

Components

Optical Filters

& Arrays

69%

15%

15%

1%

Europe

United States

Rest of World

Asia

45%

20%

17%

9%

7% 2%

Automotive

Electronics

Defense

Other

Medical

Consumer

Electronics

Industrial Components

Product Mix1 Geographic Mix1 Value-added Sales by Market1

Growth Drivers Value-added Sales

O

P

%

o

f

V

A

Sa

le

s

V

A

S

al

es ($

m

ill

io

n

s)

1 Reflects 2017 mix by market, geography, and product

New product development

• Novel electrode alloys

• Wafer level thermal imaging coatings

• Enhanced phosphor wheels

New market development

• New applications for medical sensing films

• Growing demand for optical filters in consumer electronics and

automotive sensors

Expanded product and service offerings

• Gettering capabilities for wafer level processing

• Laser patterning

• Precision film slitting & sheeting

• Expand array product line

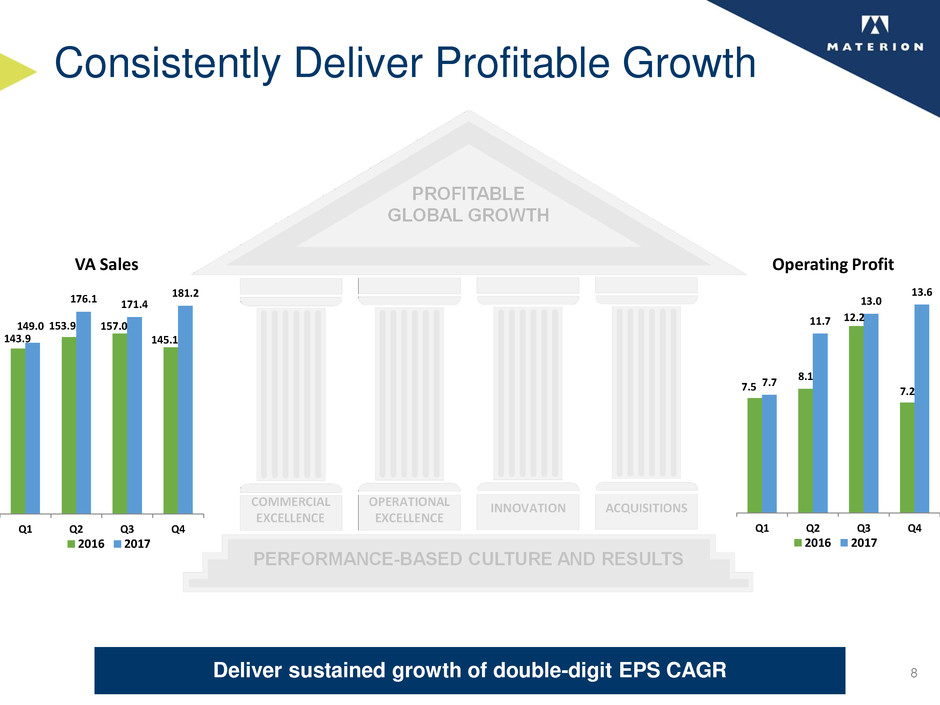

Consistently Deliver Profitable Growth

8 Deliver sustained growth of double-digit EPS CAGR

143.9

153.9 157.0

145.1

149.0

176.1 171.4

181.2

Q1 Q2 Q3 Q4

2016 2017

7.5

8.1

12.2

7.2

7.7

11.7

13.0

13.6

Q1 Q2 Q3 Q4

2016 2017

VA Sales Operating Profit

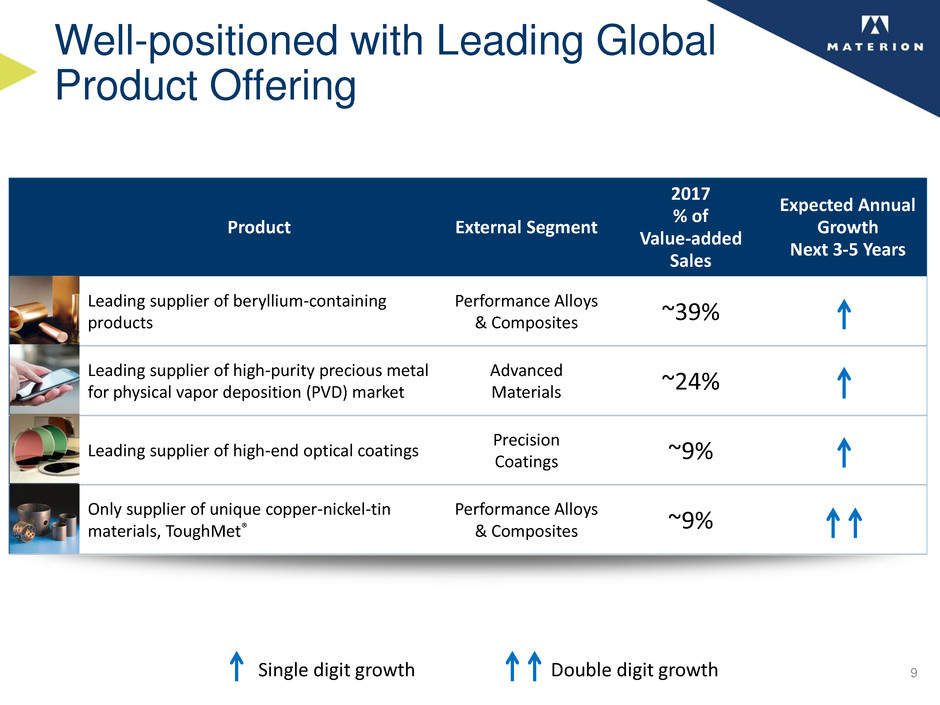

Well-positioned with Leading Global

Product Offering

9

Product External Segment

2017

% of

Value-added

Sales

Expected Annual

Growth

Next 3-5 Years

Leading supplier of beryllium-containing

products

Performance Alloys

& Composites ~39%

Leading supplier of high-purity precious metal

for physical vapor deposition (PVD) market

Advanced

Materials ~24%

Leading supplier of high-end optical coatings

Precision

Coatings ~9%

Only supplier of unique copper-nickel-tin

materials, ToughMet®

Performance Alloys

& Composites ~9%

Double digit growth Single digit growth

Global Megatrends Play to Our Strengths

10

Key Trends

• Miniaturization of electronics/IoT

• Additional electronic instruments for

autos, aircraft

• Expanding high performance

optical device opportunities

• Innovation in medical diagnostics and

sensors

• Extraction of oil and gas from

previously inaccessible locations

• Alternative energy

• New aircraft builds and retrofits

• Advancements in lighting (LED)

Characteristics of

our Materials

Conductivity

Corrosion resistance

Weight savings (lighter)

Purity

Wavelength management

Thermal management

Lubricity

Reliability

Durability

Miniaturization

Strength

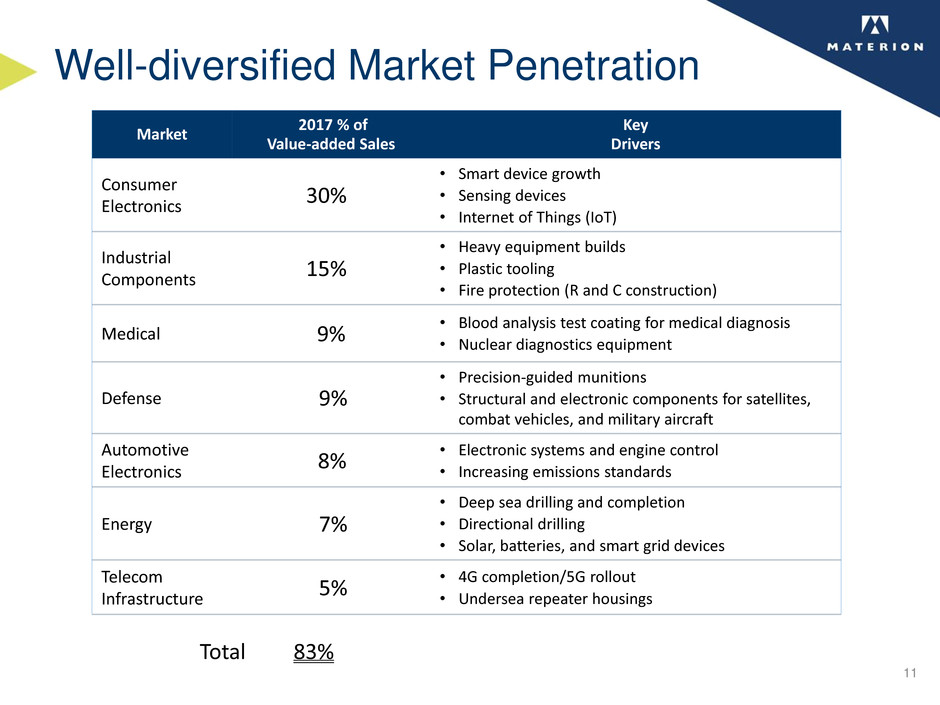

Market

2017 % of

Value-added Sales

Key

Drivers

Consumer

Electronics

30%

• Smart device growth

• Sensing devices

• Internet of Things (IoT)

Industrial

Components

15%

• Heavy equipment builds

• Plastic tooling

• Fire protection (R and C construction)

Medical 9%

• Blood analysis test coating for medical diagnosis

• Nuclear diagnostics equipment

Defense 9%

• Precision-guided munitions

• Structural and electronic components for satellites,

combat vehicles, and military aircraft

Automotive

Electronics

8%

• Electronic systems and engine control

• Increasing emissions standards

Energy 7%

• Deep sea drilling and completion

• Directional drilling

• Solar, batteries, and smart grid devices

Telecom

Infrastructure

5%

• 4G completion/5G rollout

• Undersea repeater housings

Well-diversified Market Penetration

11

Total 83%

9.7%

11.2%

11.6%

14.1%

16.0%

2013 2014 2015 2016 2017

Innovation Leading to Organic Growth

12

New Product Value-added Sales as % of Total Noteworthy New Products Offerings

Phosphor Wheel

• Provides high brightness, longer life

• Offers low noise characteristics,

individual precision balancing, and

stable colors

eStainless®

• Thermally conductive replacement for

conventional stainless steels

• Manages higher heat of today’s

processing technology

ToughMet® Bushings

• Copper-nickel-tin alloy that resists

mechanical wear, thread damage,

corrosion, and erosion

• Minimizes weight & maintenance cost

1 CAGR calculated from 2013 – 2017

Aluminum/Scandium Targets

• New mobile applications in MEMs

devices, including speakers in phone

• Offers superior performance to

alternative materials

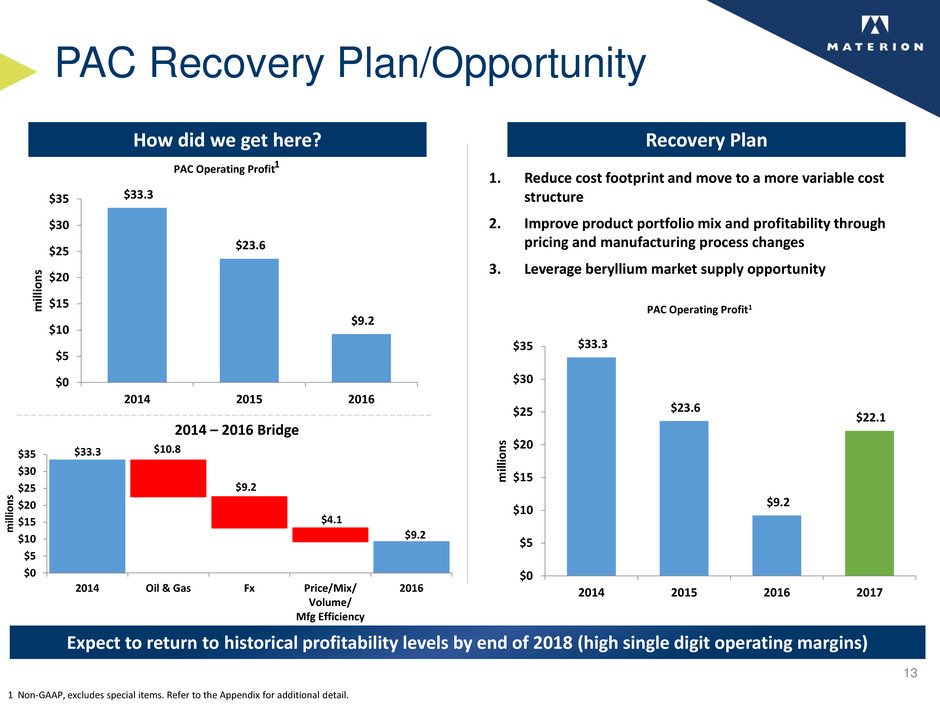

PAC Recovery Plan/Opportunity

13

$33.3

$23.6

$9.2

$0

$5

$10

$15

$20

$25

$30

$35

2014 2015 2016

m

ill

io

n

s

PAC Operating Profit

$33.3

$9.2

$10.8

$9.2

$4.1

$0

$5

$10

$15

$20

$25

$30

$35

2014 Oil & Gas Fx Price/Mix/

Volume/

Mfg Efficiency

2016

m

ill

io

n

s

1

How did we get here?

1 Non-GAAP, excludes special items. Refer to the Appendix for additional detail.

$33.3

$23.6

$9.2

$22.1

$0

$5

$10

$15

$20

$25

$30

$35

2014 2015 2016 2017

m

ill

io

n

s

PAC Operating Profit1

1. Reduce cost footprint and move to a more variable cost

structure

2. Improve product portfolio mix and profitability through

pricing and manufacturing process changes

3. Leverage beryllium market supply opportunity

Expect to return to historical profitability levels by end of 2018 (high single digit operating margins)

Recovery Plan

2014 – 2016 Bridge

2016 2018 (F)

<25%

28%

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

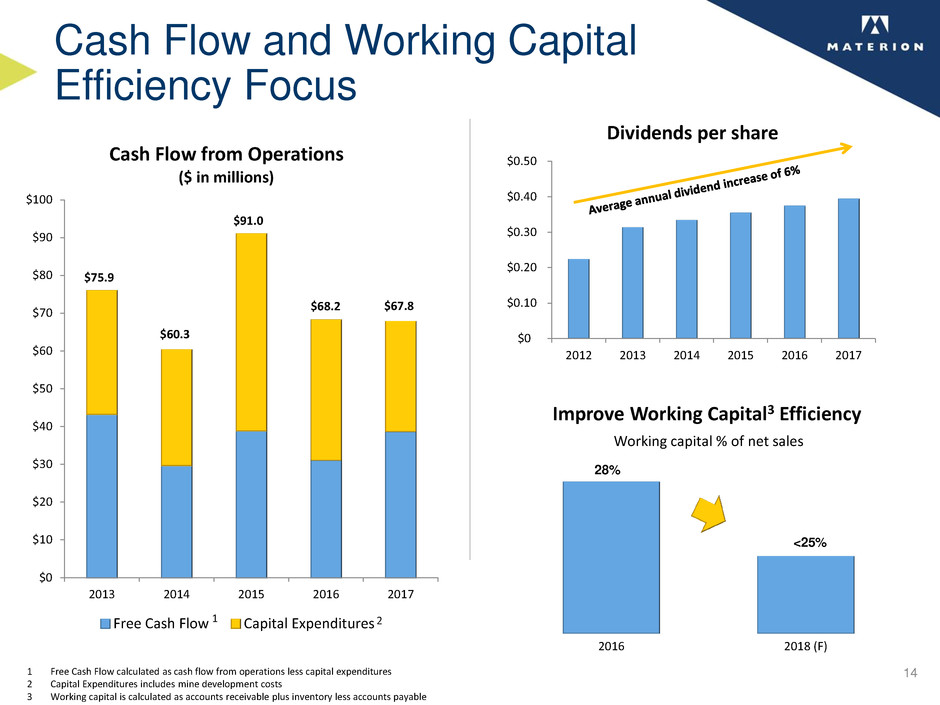

2013 2014 2015 2016 2017

Cash Flow from Operations

($ in millions)

Free Cash Flow Capital Expenditures

Cash Flow and Working Capital

Efficiency Focus

14

Improve Working Capital3 Efficiency

Working capital % of net sales

1 Free Cash Flow calculated as cash flow from operations less capital expenditures

2 Capital Expenditures includes mine development costs

3 Working capital is calculated as accounts receivable plus inventory less accounts payable

$0

$0.10

$0.20

$0.30

$0.40

$0.50

2012 2013 2014 2015 2016 2017

Dividends per share

$75.9

$60.3

$91.0

$68.2

1 2

$67.8

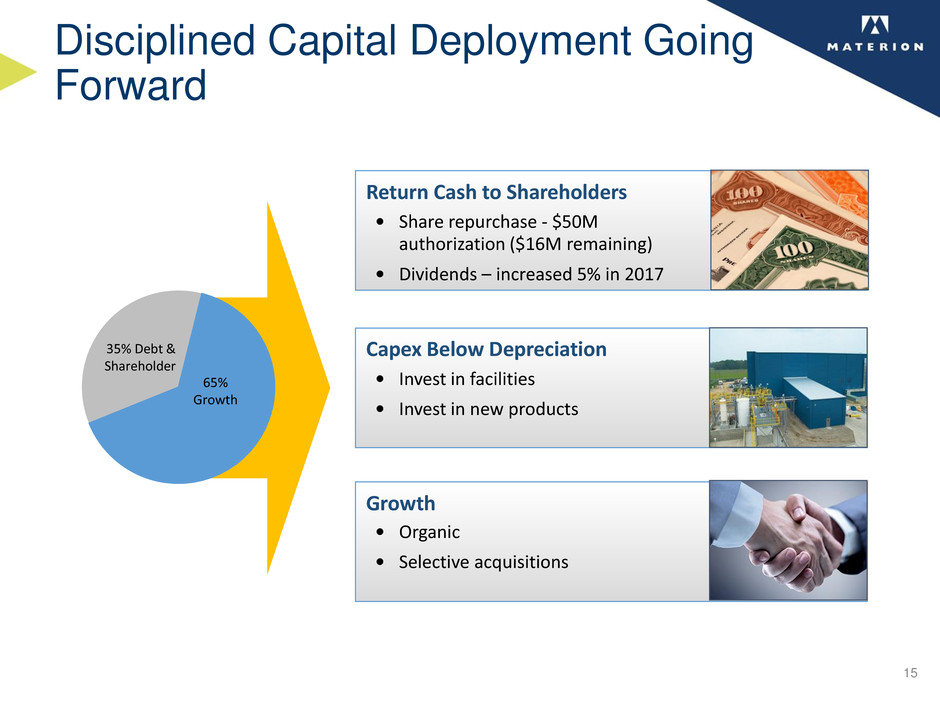

Disciplined Capital Deployment Going

Forward

15

Return Cash to Shareholders

• Share repurchase - $50M

authorization ($16M remaining)

• Dividends – increased 5% in 2017

Capex Below Depreciation

• Invest in facilities

• Invest in new products

Growth

• Organic

• Selective acquisitions

35% Debt &

Shareholder

65%

Growth

► Consistently delivering profitable growth

► Four consecutive quarters of year-over-year VA sales and OP

growth

► PAC profitability improvement plan on track

► Sequential operating profit margin improvement last 3 quarters

► Q4 2017 adjusted operating profit margin highest level in 2.5

years

► Global megatrends drive future growth opportunities

► Smaller, faster, more powerful, increased performance

► Strong cash flow and balance sheet

► Ended 2017 in a net cash position of $38M with average

operating cash flows of ~$75M over the last 3 years

Materion Investment Thesis

16

►Full-year guidance

► Adjusted EPS of $1.95 - $2.10

► Capex ~ $30M - $35M

► Mine development capital expenditures $5M - $10M

► Depreciation and amortization expense of ~$40M

► Effective tax rate excluding special items 16% – 18%

2018 Forecasted Financial Guidance

17

Appendix

Consumer Electronics

30%

Industrial Components

15%

Medical

9%

Defense

9%

Automotive Electronics

8%

Energy

7%

Telecom Infrastructure

5%

0

82%

Performance Alloys

and Composites

54%

Advanced Materials

33%

Precision

Coatings

13%

Materion: Making Advanced Materials That

Improve the World

% of Value-added Sales 2017

A-2

Beryllium Market Supply Opportunity

Materion – leading position in beryllium market

• Only global integrated producer

– Minimum of 75 years of proven reserves in Utah mine

– Supplies over 70% of world’s mined beryllium

• ~40% of company sales include beryllium in some form

• Global stockpiled sources depleting

• Only significant commercially active bertrandite ore mine

• Materion positioned to support world demand

• Significant incremental profit potential

A-3

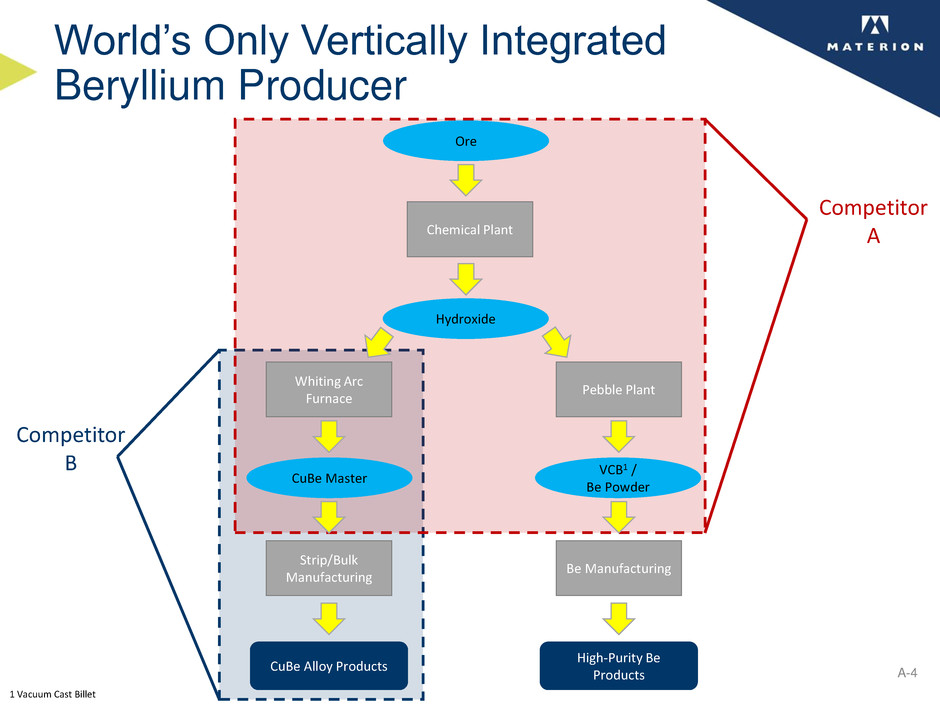

World’s Only Vertically Integrated

Beryllium Producer

Ore

Chemical Plant

Hydroxide

Whiting Arc

Furnace

Pebble Plant

CuBe Master

VCB1 /

Be Powder

CuBe Alloy Products

High-Purity Be

Products

Strip/Bulk

Manufacturing

Be Manufacturing

Competitor

B

Competitor

A

1 Vacuum Cast Billet

A-4

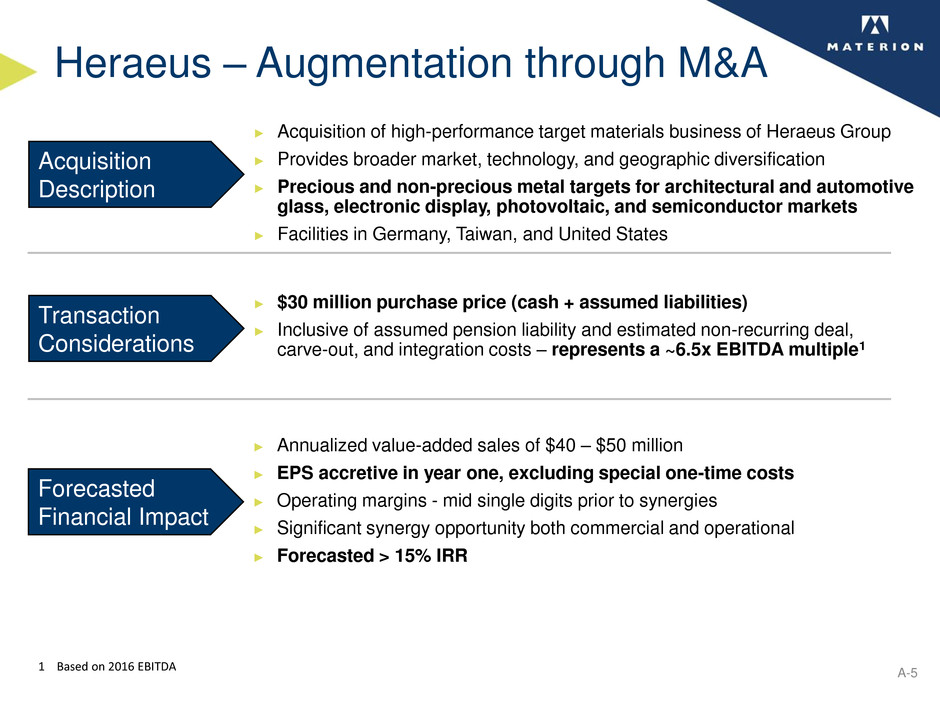

Heraeus – Augmentation through M&A

Acquisition

Description

► Acquisition of high-performance target materials business of Heraeus Group

► Provides broader market, technology, and geographic diversification

► Precious and non-precious metal targets for architectural and automotive

glass, electronic display, photovoltaic, and semiconductor markets

► Facilities in Germany, Taiwan, and United States

Transaction

Considerations

► $30 million purchase price (cash + assumed liabilities)

► Inclusive of assumed pension liability and estimated non-recurring deal,

carve-out, and integration costs – represents a ~6.5x EBITDA multiple1

Forecasted

Financial Impact

► Annualized value-added sales of $40 – $50 million

► EPS accretive in year one, excluding special one-time costs

► Operating margins - mid single digits prior to synergies

► Significant synergy opportunity both commercial and operational

► Forecasted > 15% IRR

1 Based on 2016 EBITDA

A-5

Financial

Information

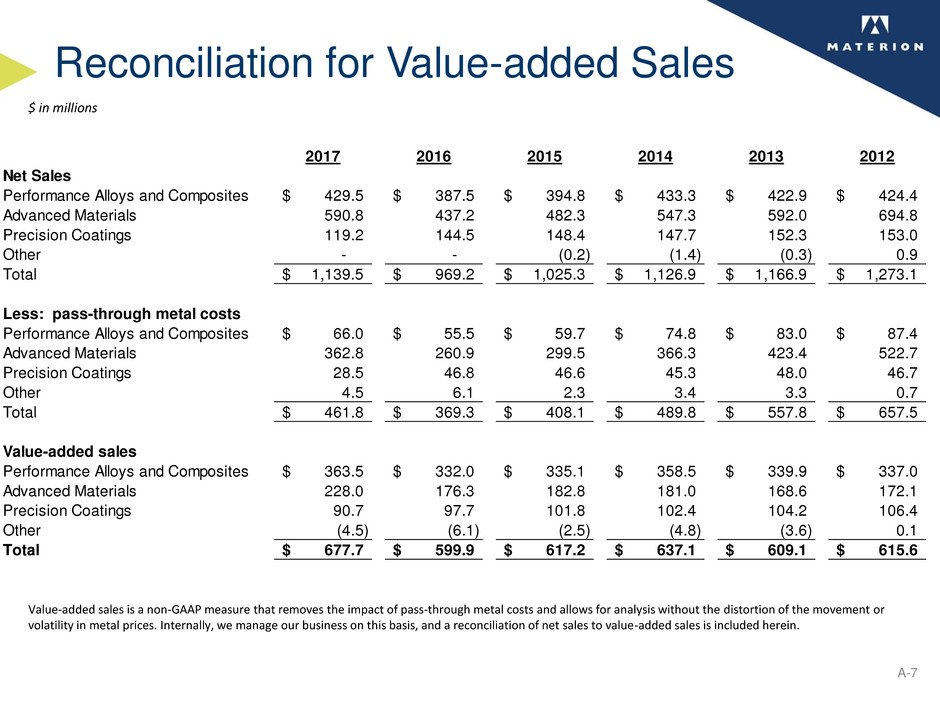

Reconciliation for Value-added Sales

A-7

$ in millions

Value-added sales is a non-GAAP measure that removes the impact of pass-through metal costs and allows for analysis without the distortion of the movement or

volatility in metal prices. Internally, we manage our business on this basis, and a reconciliation of net sales to value-added sales is included herein.

2017 2016 2015 2014 2013 2012

Net Sales

Performance Alloys and Composites 429.5$ 387.5$ 394.8$ 433.3$ 422.9$ 424.4$

Advanced Materials 590.8 437.2 482.3 547.3 592.0 694.8

Precision Coatings 119.2 144.5 148.4 147.7 152.3 153.0

Other - - (0.2) (1.4) (0.3) 0.9

Total 1,139.5$ 969.2$ 1,025.3$ 1,126.9$ 1,166.9$ 1,273.1$

Less: pass-through metal costs

Performance Alloys and Composites 66.0$ 55.5$ 59.7$ 74.8$ 83.0$ 87.4$

Advanced Materials 362.8 260.9 299.5 366.3 423.4 522.7

Precision Coatings 28.5 46.8 46.6 45.3 48.0 46.7

Other 4.5 6.1 2.3 3.4 3.3 0.7

Total 461.8$ 369.3$ 408.1$ 489.8$ 557.8$ 657.5$

Value-added sales

Performance Alloys and Composites 363.5$ 332.0$ 335.1$ 358.5$ 339.9$ 337.0$

Advanced Materials 228.0 176.3 182.8 181.0 168.6 172.1

Precision Coatings 90.7 97.7 101.8 102.4 104.2 106.4

Other (4.5) (6.1) (2.5) (4.8) (3.6) 0.1

Total 677.7$ 599.9$ 617.2$ 637.1$ 609.1$ 615.6$

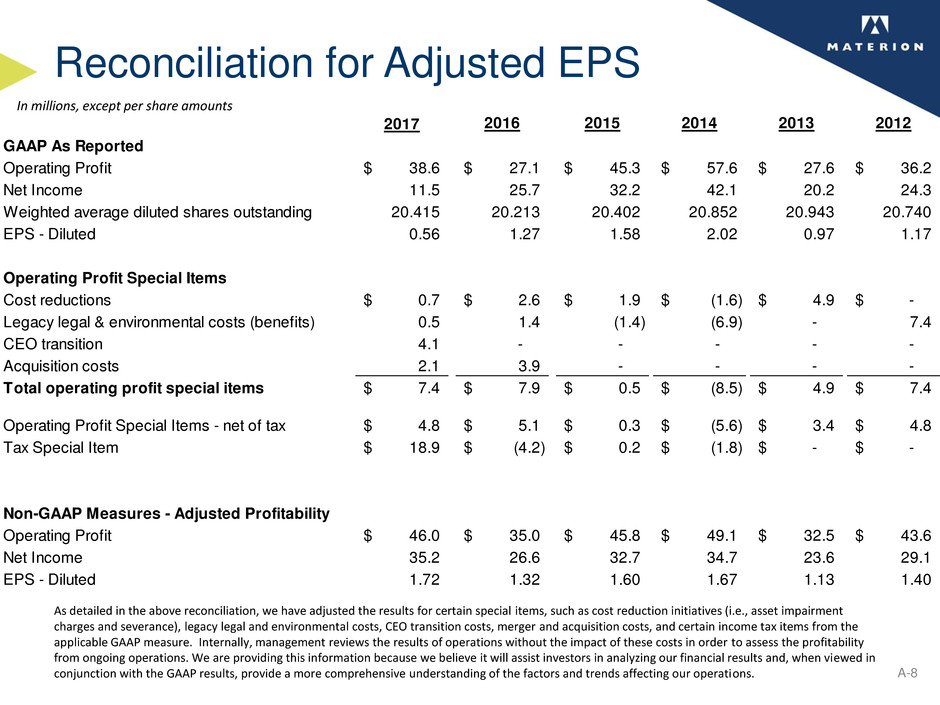

Reconciliation for Adjusted EPS

A-8

As detailed in the above reconciliation, we have adjusted the results for certain special items, such as cost reduction initiatives (i.e., asset impairment

charges and severance), legacy legal and environmental costs, CEO transition costs, merger and acquisition costs, and certain income tax items from the

applicable GAAP measure. Internally, management reviews the results of operations without the impact of these costs in order to assess the profitability

from ongoing operations. We are providing this information because we believe it will assist investors in analyzing our financial results and, when viewed in

conjunction with the GAAP results, provide a more comprehensive understanding of the factors and trends affecting our operations.

In millions, except per share amounts

2017 2016 2015 2014 2013 2012

GAAP As Reported

Operating Profit 38.6$ 27.1$ 45.3$ 57.6$ 27.6$ 36.2$

Net Income 11.5 25.7 32.2 42.1 20.2 24.3

Weighted average diluted shares outstanding 20.415 20.213 20.402 20.852 20.943 20.740

EPS - Diluted 0.56 1.27 1.58 2.02 0.97 1.17

Operating Profit Special Items

Cost reductions 0.7$ 2.6$ 1.9$ (1.6)$ 4.9$ -$

Legacy legal & environmental costs (benefits) 0.5 1.4 (1.4) (6.9) - 7.4

CEO transition 4.1 - - - - -

Acquisition costs 2.1 3.9 - - - -

Total operating profit special items 7.4$ 7.9$ 0.5$ (8.5)$ 4.9$ 7.4$

Operating Profit Special Items - net of tax 4.8$ 5.1$ 0.3$ (5.6)$ 3.4$ 4.8$

Tax Special Item 18.9$ (4.2)$ 0.2$ (1.8)$ -$ -$

Non-GAAP Measures - Adjusted Profitability

Operating Profit 46.0$ 35.0$ 45.8$ 49.1$ 32.5$ 43.6$

Net Income 35.2 26.6 32.7 34.7 23.6 29.1

EPS - Diluted 1.72 1.32 1.60 1.67 1.13 1.40

Other Non-GAAP Items

A-9

Adjusted EBITDA is calculated by adding depreciation, depletion, and amortization and certain special items such as cost reduction initiatives (i.e., asset

impairment charges and severance), legacy legal and environmental costs, CEO transition costs, merger and acquisition costs, and certain income tax items to our

operating profit. Internally, management reviews the results of operations without the impact of these costs in order to assess the profitability from ongoing

operations.

Debt-to-capitalization is our total debt divided by net debt plus shareholders’ equity. Net debt (cash) is a non-GAAP measure calculated by subtracting cash &

cash equivalents from our total outstanding debt. We are providing this information because we believe it is more indicative of our overall financial position. It is

also a measure our management uses to assess financing and other decisions.

$ in millions

2014 2013

Operating Profit 38.6$ 27.1$ 45.3$ 57.6$ 27.6$

Special Items 7.4 7.9 0.5 (8.5) 4.9

Adjusted Operating Profit 46.0$ 35.0$ 45.8$ 49.1$ 32.5$

Depreciation, depletion, and amortization 42.8 45.6 37.8 42.7 41.6

Adjusted EBITDA 88.8$ 80.6$ 83.6$ 91.8$ 74.1$

Total Debt 3.8$ 4.6$ 13.6$ 24.3$ 64.8$

Less: Cash & Cash Equivalents 41.8 31.5 24.2 13.1 22.8

Net Debt (Cash) (38.0)$ (26.9)$ (10.6)$ 11.2$ 42.0$

Total Shareholders' Equity 495.0$ 494.1$ 483.0$ 459.0$ 464.4$

Debt-to-Capitalization 1% 1% 3% 5% 13%

2016 20152017

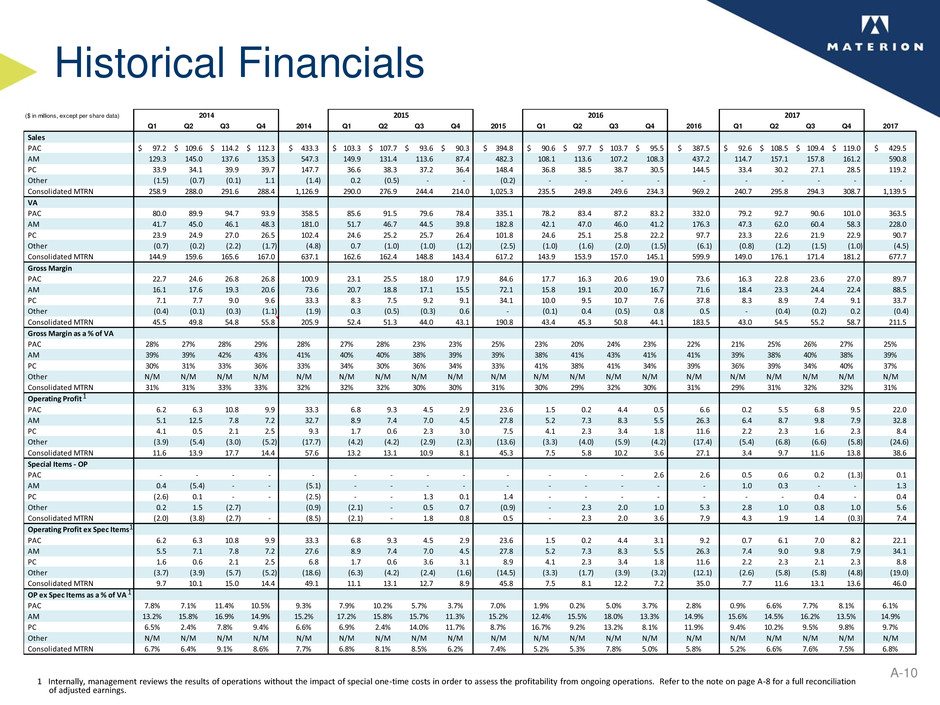

($ in millions, except per share data)

Q1 Q2 Q3 Q4 2014 Q1 Q2 Q3 Q4 2015 Q1 Q2 Q3 Q4 2016 Q1 Q2 Q3 Q4 2017

Sales

PAC 97.2$ 109.6$ 114.2$ 112.3$ 433.3$ 103.3$ 107.7$ 93.6$ 90.3$ 394.8$ 90.6$ 97.7$ 103.7$ 95.5$ 387.5$ 92.6$ 108.5$ 109.4$ 119.0$ 429.5$

AM 129.3 145.0 137.6 135.3 547.3 149.9 131.4 113.6 87.4 482.3 108.1 113.6 107.2 108.3 437.2 114.7 157.1 157.8 161.2 590.8

PC 33.9 34.1 39.9 39.7 147.7 36.6 38.3 37.2 36.4 148.4 36.8 38.5 38.7 30.5 144.5 33.4 30.2 27.1 28.5 119.2

Other (1.5) (0.7) (0.1) 1.1 (1.4) 0.2 (0.5) - - (0.2) - - - - - - - - - -

Consolidated MTRN 258.9 288.0 291.6 288.4 1,126.9 290.0 276.9 244.4 214.0 1,025.3 235.5 249.8 249.6 234.3 969.2 240.7 295.8 294.3 308.7 1,139.5

VA

PAC 80.0 89.9 94.7 93.9 358.5 85.6 91.5 79.6 78.4 335.1 78.2 83.4 87.2 83.2 332.0 79.2 92.7 90.6 101.0 363.5

AM 41.7 45.0 46.1 48.3 181.0 51.7 46.7 44.5 39.8 182.8 42.1 47.0 46.0 41.2 176.3 47.3 62.0 60.4 58.3 228.0

PC 23.9 24.9 27.0 26.5 102.4 24.6 25.2 25.7 26.4 101.8 24.6 25.1 25.8 22.2 97.7 23.3 22.6 21.9 22.9 90.7

Other (0.7) (0.2) (2.2) (1.7) (4.8) 0.7 (1.0) (1.0) (1.2) (2.5) (1.0) (1.6) (2.0) (1.5) (6.1) (0.8) (1.2) (1.5) (1.0) (4.5)

Consolidated MTRN 144.9 159.6 165.6 167.0 637.1 162.6 162.4 148.8 143.4 617.2 143.9 153.9 157.0 145.1 599.9 149.0 176.1 171.4 181.2 677.7

Gross Margin

PAC 22.7 24.6 26.8 26.8 100.9 23.1 25.5 18.0 17.9 84.6 17.7 16.3 20.6 19.0 73.6 16.3 22.8 23.6 27.0 89.7

AM 16.1 17.6 19.3 20.6 73.6 20.7 18.8 17.1 15.5 72.1 15.8 19.1 20.0 16.7 71.6 18.4 23.3 24.4 22.4 88.5

PC 7.1 7.7 9.0 9.6 33.3 8.3 7.5 9.2 9.1 34.1 10.0 9.5 10.7 7.6 37.8 8.3 8.9 7.4 9.1 33.7

Other (0.4) (0.1) (0.3) (1.1) (1.9) 0.3 (0.5) (0.3) 0.6 - (0.1) 0.4 (0.5) 0.8 0.5 - (0.4) (0.2) 0.2 (0.4)

Consolidated MTRN 45.5 49.8 54.8 55.8 205.9 52.4 51.3 44.0 43.1 190.8 43.4 45.3 50.8 44.1 183.5 43.0 54.5 55.2 58.7 211.5

Gross Margin as a % of VA

PAC 28% 27% 28% 29% 28% 27% 28% 23% 23% 25% 23% 20% 24% 23% 22% 21% 25% 26% 27% 25%

AM 39% 39% 42% 43% 41% 40% 40% 38% 39% 39% 38% 41% 43% 41% 41% 39% 38% 40% 38% 39%

PC 30% 31% 33% 36% 33% 34% 30% 36% 34% 33% 41% 38% 41% 34% 39% 36% 39% 34% 40% 37%

Other N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M

Consolidated MTRN 31% 31% 33% 33% 32% 32% 32% 30% 30% 31% 30% 29% 32% 30% 31% 29% 31% 32% 32% 31%

Operating Profit

PAC 6.2 6.3 10.8 9.9 33.3 6.8 9.3 4.5 2.9 23.6 1.5 0.2 4.4 0.5 6.6 0.2 5.5 6.8 9.5 22.0

AM 5.1 12.5 7.8 7.2 32.7 8.9 7.4 7.0 4.5 27.8 5.2 7.3 8.3 5.5 26.3 6.4 8.7 9.8 7.9 32.8

PC 4.1 0.5 2.1 2.5 9.3 1.7 0.6 2.3 3.0 7.5 4.1 2.3 3.4 1.8 11.6 2.2 2.3 1.6 2.3 8.4

Other (3.9) (5.4) (3.0) (5.2) (17.7) (4.2) (4.2) (2.9) (2.3) (13.6) (3.3) (4.0) (5.9) (4.2) (17.4) (5.4) (6.8) (6.6) (5.8) (24.6)

Consolidated MTRN 11.6 13.9 17.7 14.4 57.6 13.2 13.1 10.9 8.1 45.3 7.5 5.8 10.2 3.6 27.1 3.4 9.7 11.6 13.8 38.6

Special Items - OP

PAC - - - - - - - - - - - - - 2.6 2.6 0.5 0.6 0.2 (1.3) 0.1

AM 0.4 (5.4) - - (5.1) - - - - - - - - - - 1.0 0.3 - - 1.3

PC (2.6) 0.1 - - (2.5) - - 1.3 0.1 1.4 - - - - - - - 0.4 - 0.4

Other 0.2 1.5 (2.7) (0.9) (2.1) - 0.5 0.7 (0.9) - 2.3 2.0 1.0 5.3 2.8 1.0 0.8 1.0 5.6

Consolidated MTRN (2.0) (3.8) (2.7) - (8.5) (2.1) - 1.8 0.8 0.5 - 2.3 2.0 3.6 7.9 4.3 1.9 1.4 (0.3) 7.4

Operating Profit ex Spec Items

PAC 6.2 6.3 10.8 9.9 33.3 6.8 9.3 4.5 2.9 23.6 1.5 0.2 4.4 3.1 9.2 0.7 6.1 7.0 8.2 22.1

AM 5.5 7.1 7.8 7.2 27.6 8.9 7.4 7.0 4.5 27.8 5.2 7.3 8.3 5.5 26.3 7.4 9.0 9.8 7.9 34.1

PC 1.6 0.6 2.1 2.5 6.8 1.7 0.6 3.6 3.1 8.9 4.1 2.3 3.4 1.8 11.6 2.2 2.3 2.1 2.3 8.8

Other (3.7) (3.9) (5.7) (5.2) (18.6) (6.3) (4.2) (2.4) (1.6) (14.5) (3.3) (1.7) (3.9) (3.2) (12.1) (2.6) (5.8) (5.8) (4.8) (19.0)

Consolidated MTRN 9.7 10.1 15.0 14.4 49.1 11.1 13.1 12.7 8.9 45.8 7.5 8.1 12.2 7.2 35.0 7.7 11.6 13.1 13.6 46.0

OP ex Spec Items as a % of VA

PAC 7.8% 7.1% 11.4% 10.5% 9.3% 7.9% 10.2% 5.7% 3.7% 7.0% 1.9% 0.2% 5.0% 3.7% 2.8% 0.9% 6.6% 7.7% 8.1% 6.1%

AM 13.2% 15.8% 16.9% 14.9% 15.2% 17.2% 15.8% 15.7% 11.3% 15.2% 12.4% 15.5% 18.0% 13.3% 14.9% 15.6% 14.5% 16.2% 13.5% 14.9%

PC 6.5% 2.4% 7.8% 9.4% 6.6% 6.9% 2.4% 14.0% 11.7% 8.7% 16.7% 9.2% 13.2% 8.1% 11.9% 9.4% 10.2% 9.5% 9.8% 9.7%

Other N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M

Consolidated MTRN 6.7% 6.4% 9.1% 8.6% 7.7% 6.8% 8.1% 8.5% 6.2% 7.4% 5.2% 5.3% 7.8% 5.0% 5.8% 5.2% 6.6% 7.6% 7.5% 6.8%

2015 2016 20172014

1 Internally, management reviews the results of operations without the impact of special one-time costs in order to assess the profitability from ongoing operations. Refer to the note on page A-8 for a full reconciliation

of adjusted earnings.

Historical Financials

A-10

1

1

1