Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FTI CONSULTING, INC | d510879d8k.htm |

FTI Consulting, Inc. Fourth Quarter and Full Year 2017 Earnings Conference Call Exhibit 99.1

Cautionary Note about Forward-Looking Statements This presentation includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve uncertainties and risks. Forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events, future revenues, future results and performance, future capital allocations and expenditures, expectations, plans or intentions relating to acquisitions, share repurchases and other matters, business trends, new, or changes to, laws and regulations, including the 2017 U.S. Tax Cuts and Jobs Act (the “2017 Tax Act”), and other information that is not historical, including statements regarding estimates of our future financial results. When used in this presentation, words such as "anticipates," "estimates," "expects," “goals,” "intends," "believes,” "forecasts,” “objectives” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking statements, including, without limitation, estimates of our future financial results, are based upon our expectations at the time we make them and various assumptions. Our expectations, beliefs and projections are expressed in good faith, and we believe there is a reasonable basis for them. However, there can be no assurance that management's expectations, beliefs or estimates will be achieved, and the Company's actual results may differ materially from our expectations, beliefs and estimates. The Company has experienced fluctuating revenues, operating income and cash flow in prior periods and expects that this will occur from time to time in the future. Other factors that could cause such differences include declines in demand for, or changes in, the mix of services and products that we offer, the mix of the geographic locations where our clients are located or where services are performed, fluctuations in the price per share of our common stock, adverse financial, real estate or other market and general economic conditions, and other future events, which could impact each of our segments differently and could be outside our control, the pace and timing of the consummation and integration of past and future acquisitions, the Company's ability to realize cost savings and efficiencies, competitive and general economic conditions, retention of staff and clients, new laws and regulations, or changes thereto, including the 2017 U.S. Tax Cuts and Jobs Act ("2017 Tax Act"), and other risks described under the heading "Part I, Item 1A Risk Factors" in the Company's Annual Report on Form 10-K for the year ended December 31, 2017, filed with the Securities and Exchange Commission (“SEC”) and in the Company's other filings with the SEC, including the risks set forth under "Risks Related to Our Reportable Segments" and "Risks Related to Our Operations.” We are under no duty to update any of the forward-looking statements to conform such statements to actual results or events and do not intend to do so.

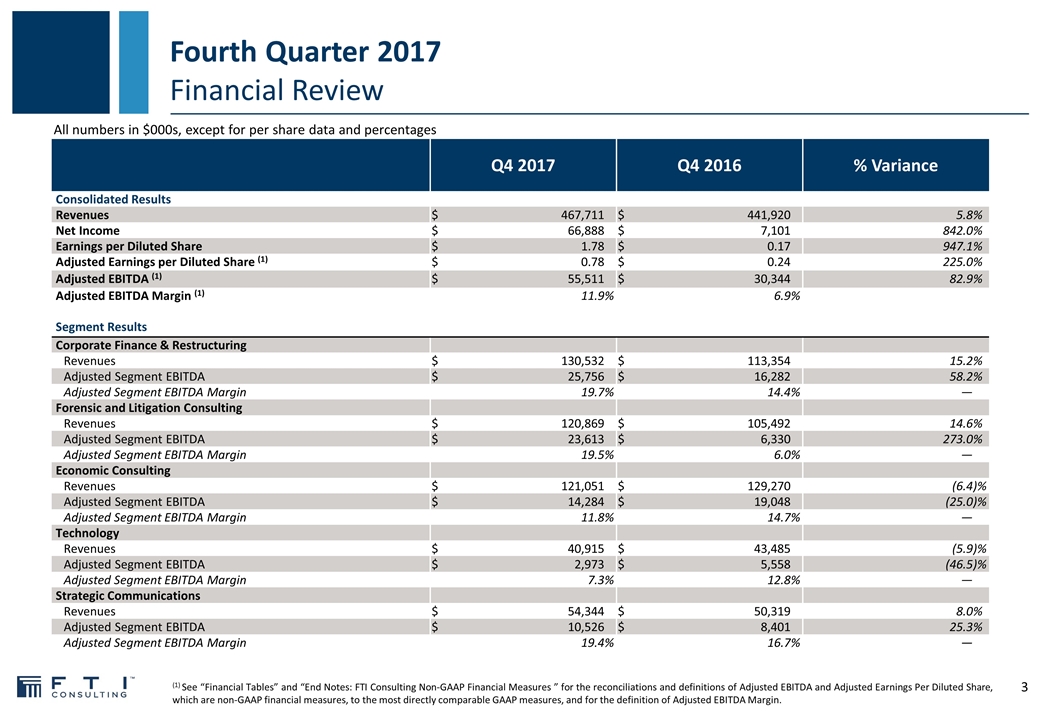

Fourth Quarter 2017Financial Review All numbers in $000s, except for per share data and percentages (1) See “Financial Tables” and “End Notes: FTI Consulting Non-GAAP Financial Measures ” for the reconciliations and definitions of Adjusted EBITDA and Adjusted Earnings Per Diluted Share, which are non-GAAP financial measures, to the most directly comparable GAAP measures, and for the definition of Adjusted EBITDA Margin. Q4 2017 Q4 2017 Q4 2016 Q4 2016 % Variance Consolidated Results Revenues $ 467,711 $ 441,920 5.8 % Net Income $ 66,888 $ 7,101 842.0 % Earnings per Diluted Share $ 1.78 $ 0.17 947.1 % Adjusted Earnings per Diluted Share (1) $ 0.78 $ 0.24 225.0 % Adjusted EBITDA (1) $ 55,511 $ 30,344 82.9 % Adjusted EBITDA Margin (1) 11.9 % 6.9 % Segment Results Corporate Finance & Restructuring Revenues $ 130,532 $ 113,354 15.2 % Adjusted Segment EBITDA $ 25,756 $ 16,282 58.2 % Adjusted Segment EBITDA Margin 19.7 % 14.4 % — Forensic and Litigation Consulting Revenues $ 120,869 $ 105,492 14.6 % Adjusted Segment EBITDA $ 23,613 $ 6,330 273.0 % Adjusted Segment EBITDA Margin 19.5 % 6.0 % — Economic Consulting Revenues $ 121,051 $ 129,270 (6.4 )% Adjusted Segment EBITDA $ 14,284 $ 19,048 (25.0 )% Adjusted Segment EBITDA Margin 11.8 % 14.7 % — Technology Revenues $ 40,915 $ 43,485 (5.9 )% Adjusted Segment EBITDA $ 2,973 $ 5,558 (46.5 )% Adjusted Segment EBITDA Margin 7.3 % 12.8 % — Strategic Communications Revenues $ 54,344 $ 50,319 8.0 % Adjusted Segment EBITDA $ 10,526 $ 8,401 25.3 % Adjusted Segment EBITDA Margin 19.4 % 16.7 % —

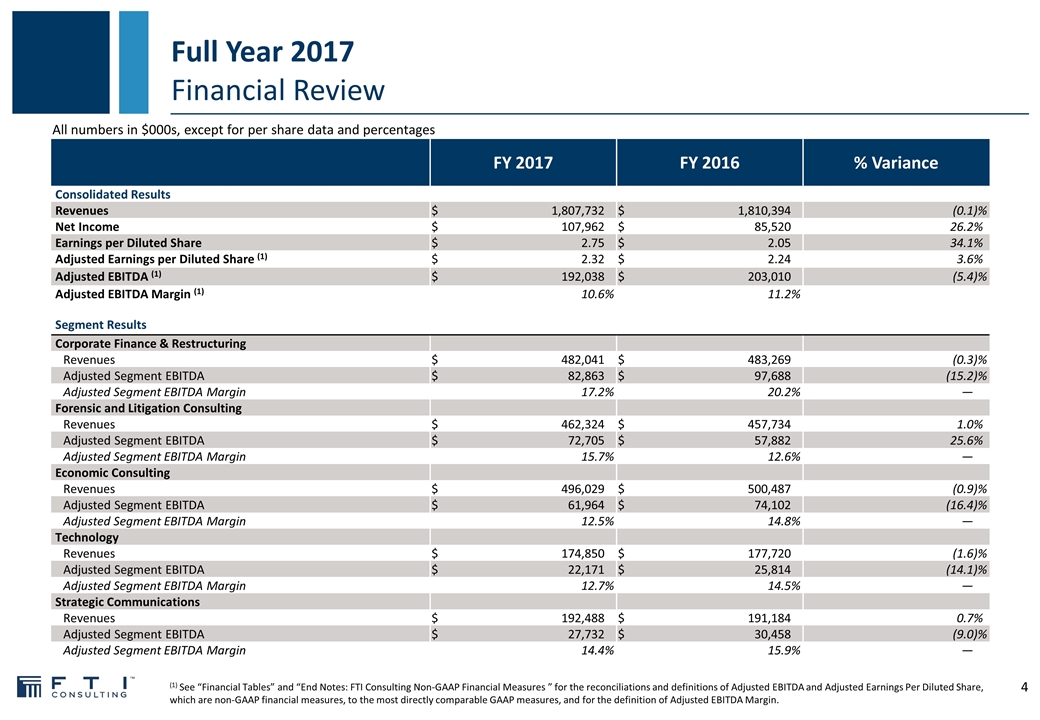

Full Year 2017Financial Review (1) See “Financial Tables” and “End Notes: FTI Consulting Non-GAAP Financial Measures ” for the reconciliations and definitions of Adjusted EBITDA and Adjusted Earnings Per Diluted Share, which are non-GAAP financial measures, to the most directly comparable GAAP measures, and for the definition of Adjusted EBITDA Margin. FY 2017 FY 2017 FY 2016 FY 2016 % Variance Consolidated Results Revenues $ 1,807,732 $ 1,810,394 (0.1 )% Net Income $ 107,962 $ 85,520 26.2 % Earnings per Diluted Share $ 2.75 $ 2.05 34.1 % Adjusted Earnings per Diluted Share (1) $ 2.32 $ 2.24 3.6 % Adjusted EBITDA (1) $ 192,038 $ 203,010 (5.4 )% Adjusted EBITDA Margin (1) 10.6 % 11.2 % Segment Results Corporate Finance & Restructuring Revenues $ 482,041 $ 483,269 (0.3 )% Adjusted Segment EBITDA $ 82,863 $ 97,688 (15.2 )% Adjusted Segment EBITDA Margin 17.2 % 20.2 % — Forensic and Litigation Consulting Revenues $ 462,324 $ 457,734 1.0 % Adjusted Segment EBITDA $ 72,705 $ 57,882 25.6 % Adjusted Segment EBITDA Margin 15.7 % 12.6 % — Economic Consulting Revenues $ 496,029 $ 500,487 (0.9 )% Adjusted Segment EBITDA $ 61,964 $ 74,102 (16.4 )% Adjusted Segment EBITDA Margin 12.5 % 14.8 % — Technology Revenues $ 174,850 $ 177,720 (1.6 )% Adjusted Segment EBITDA $ 22,171 $ 25,814 (14.1 )% Adjusted Segment EBITDA Margin 12.7 % 14.5 % — Strategic Communications Revenues $ 192,488 $ 191,184 0.7 % Adjusted Segment EBITDA $ 27,732 $ 30,458 (9.0 )% Adjusted Segment EBITDA Margin 14.4 % 15.9 % — All numbers in $000s, except for per share data and percentages

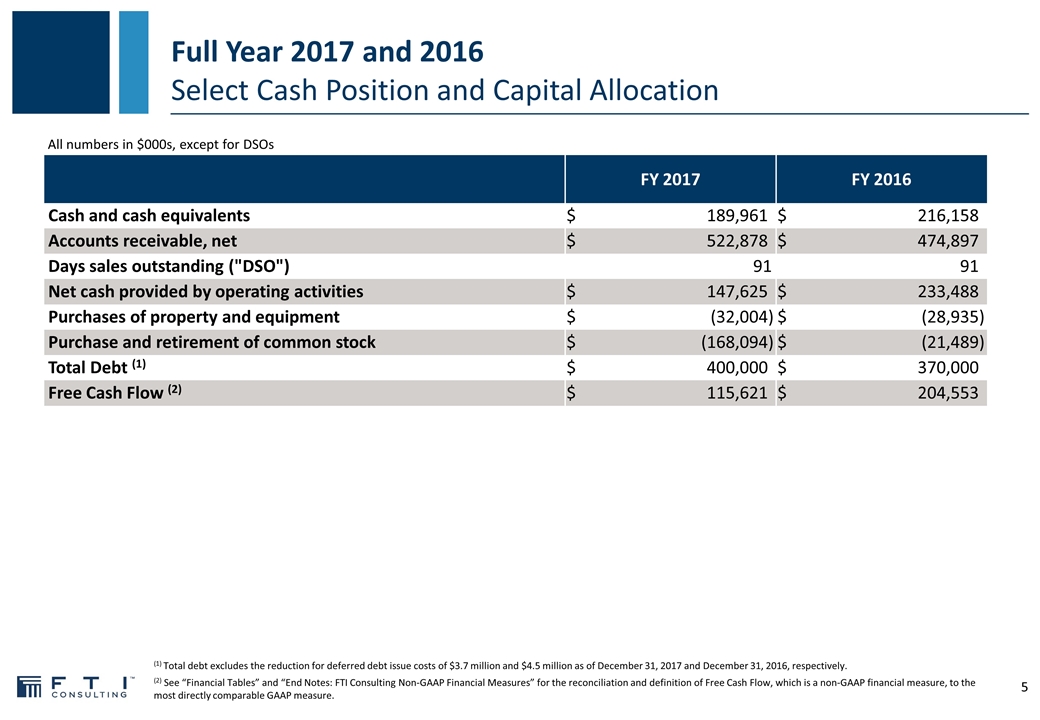

Full Year 2017 and 2016 Select Cash Position and Capital Allocation (1) Total debt excludes the reduction for deferred debt issue costs of $3.7 million and $4.5 million as of December 31, 2017 and December 31, 2016, respectively. (2) See “Financial Tables” and “End Notes: FTI Consulting Non-GAAP Financial Measures” for the reconciliation and definition of Free Cash Flow, which is a non-GAAP financial measure, to the most directly comparable GAAP measure. All numbers in $000s, except for DSOs FY 2017 FY 2017 FY 2016 FY 2016 Cash and cash equivalents $ 189,961 $ 216,158 Accounts receivable, net $ 522,878 $ 474,897 Days sales outstanding ("DSO") 91 91 91 Net cash provided by operating activities $ 147,625 $ 233,488 Purchases of property and equipment $ (32,004 ) $ (28,935 ) Purchase and retirement of common stock $ (168,094 ) $ (21,489 ) Total Debt (1) $ 400,000 $ 370,000 Free Cash Flow (2) $ 115,621 $ 204,553

Financial Tables

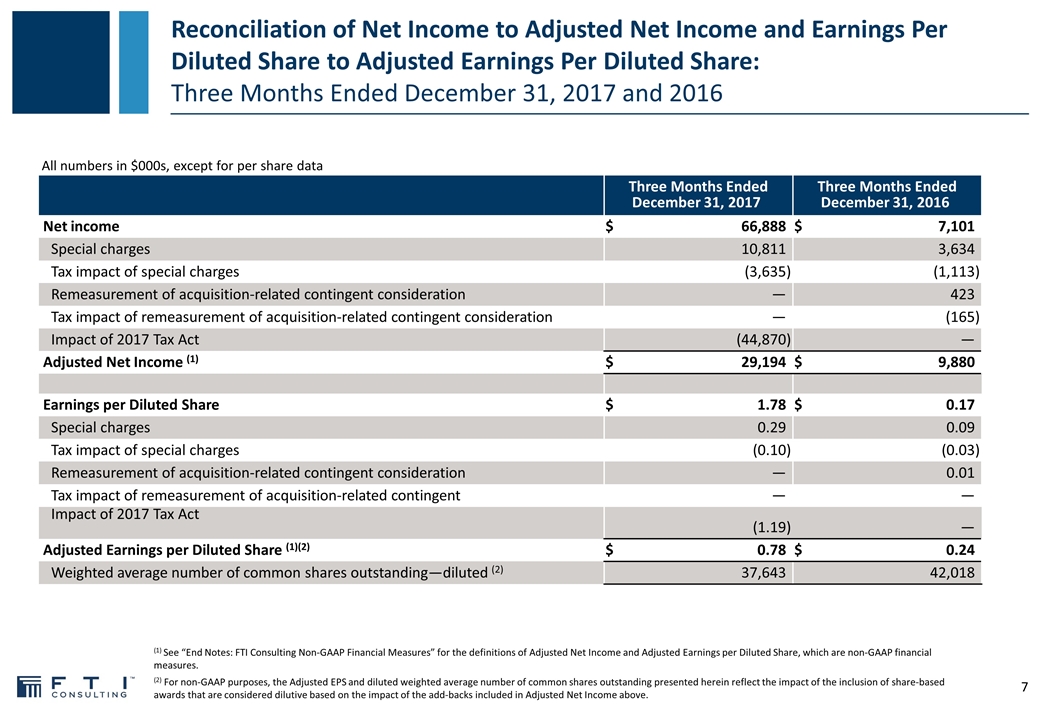

Reconciliation of Net Income to Adjusted Net Income and Earnings Per Diluted Share to Adjusted Earnings Per Diluted Share: Three Months Ended December 31, 2017 and 2016 (1) See “End Notes: FTI Consulting Non-GAAP Financial Measures” for the definitions of Adjusted Net Income and Adjusted Earnings per Diluted Share, which are non-GAAP financial measures. (2) For non-GAAP purposes, the Adjusted EPS and diluted weighted average number of common shares outstanding presented herein reflect the impact of the inclusion of share-based awards that are considered dilutive based on the impact of the add-backs included in Adjusted Net Income above. All numbers in $000s, except for per share data Three Months Ended December 31, 2017 Three Months Ended December 31, 2017 Three Months Ended December 31, 2016 Three Months Ended December 31, 2016 Net income $ 66,888 $ 7,101 Special charges 10,811 3,634 Tax impact of special charges (3,635 ) (1,113 ) Remeasurement of acquisition-related contingent consideration — 423 Tax impact of remeasurement of acquisition-related contingent consideration — (165 ) Impact of 2017 Tax Act (44,870 ) — Adjusted Net Income (1) $ 29,194 $ 9,880 Earnings per Diluted Share $ 1.78 $ 0.17 Special charges 0.29 0.09 Tax impact of special charges (0.10 ) (0.03 ) Remeasurement of acquisition-related contingent consideration — 0.01 Tax impact of remeasurement of acquisition-related contingent — — Impact of 2017 Tax Act (1.19 ) — Adjusted Earnings per Diluted Share (1)(2) $ 0.78 $ 0.24 Weighted average number of common shares outstanding—diluted (2) 37,643 42,018

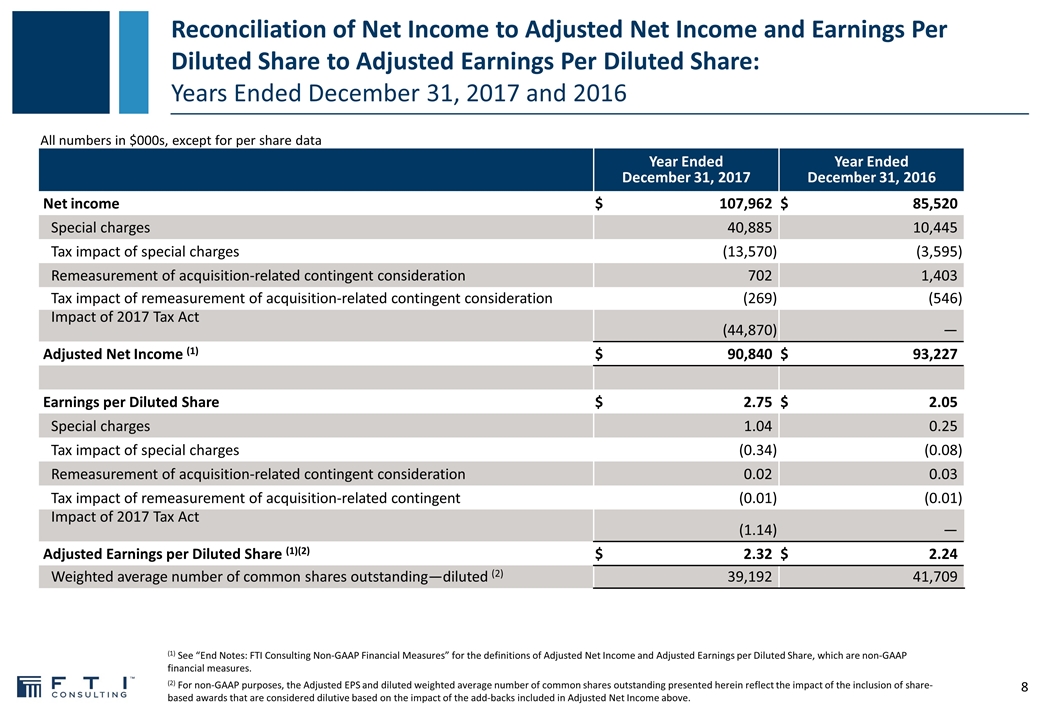

Reconciliation of Net Income to Adjusted Net Income and Earnings Per Diluted Share to Adjusted Earnings Per Diluted Share: Years Ended December 31, 2017 and 2016 (1) See “End Notes: FTI Consulting Non-GAAP Financial Measures” for the definitions of Adjusted Net Income and Adjusted Earnings per Diluted Share, which are non-GAAP financial measures. (2) For non-GAAP purposes, the Adjusted EPS and diluted weighted average number of common shares outstanding presented herein reflect the impact of the inclusion of share-based awards that are considered dilutive based on the impact of the add-backs included in Adjusted Net Income above. All numbers in $000s, except for per share data Year Ended December 31, 2017 Year Ended December 31, 2017 Year Ended December 31, 2016 Year Ended December 31, 2016 Net income $ 107,962 $ 85,520 Special charges 40,885 10,445 Tax impact of special charges (13,570 ) (3,595 ) Remeasurement of acquisition-related contingent consideration 702 1,403 Tax impact of remeasurement of acquisition-related contingent consideration (269 ) (546 ) Impact of 2017 Tax Act (44,870 ) — Adjusted Net Income (1) $ 90,840 $ 93,227 Earnings per Diluted Share $ 2.75 $ 2.05 Special charges 1.04 0.25 Tax impact of special charges (0.34 ) (0.08 ) Remeasurement of acquisition-related contingent consideration 0.02 0.03 Tax impact of remeasurement of acquisition-related contingent (0.01 ) (0.01 ) Impact of 2017 Tax Act (1.14 ) — Adjusted Earnings per Diluted Share (1)(2) $ 2.32 $ 2.24 Weighted average number of common shares outstanding—diluted (2) 39,192 41,709

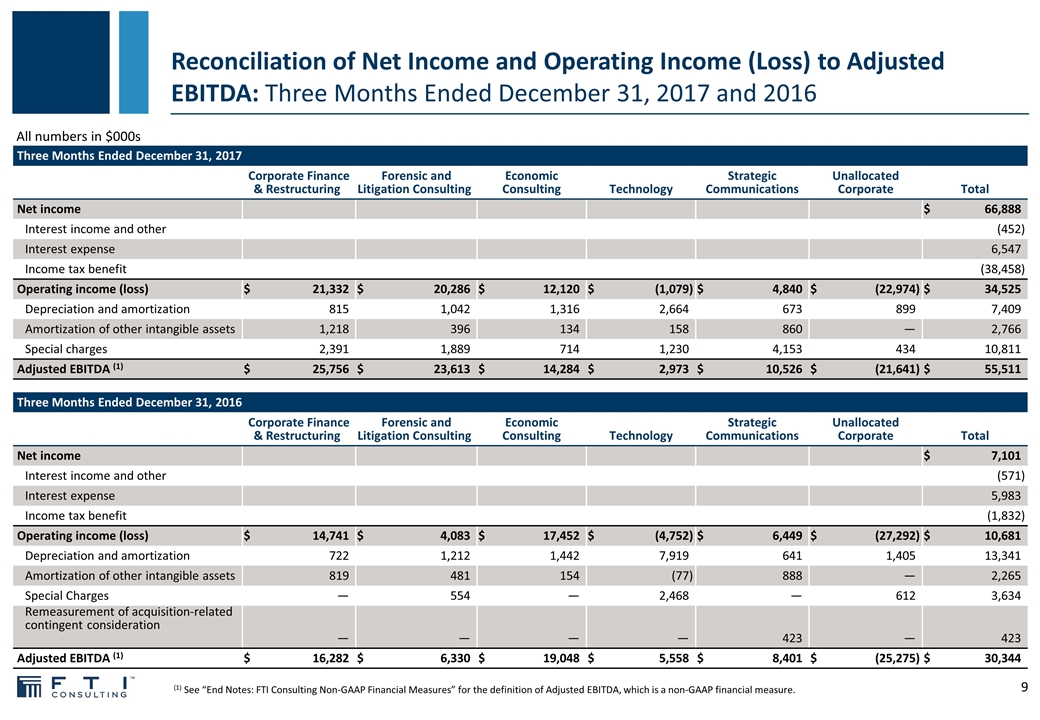

Reconciliation of Net Income and Operating Income (Loss) to Adjusted EBITDA: Three Months Ended December 31, 2017 and 2016 (1) See “End Notes: FTI Consulting Non-GAAP Financial Measures” for the definition of Adjusted EBITDA, which is a non-GAAP financial measure. All numbers in $000s Three Months Ended December 31, 2016 Corporate Finance & Restructuring Corporate Finance & Restructuring Forensic and Litigation Consulting Forensic and Litigation Consulting Economic Consulting Economic Consulting Technology Technology Strategic Communications Strategic Communications Unallocated Corporate Unallocated Corporate Total Total Net income $ 7,101 Interest income and other (571 ) Interest expense 5,983 Income tax benefit (1,832 ) Operating income (loss) $ 14,741 $ 4,083 $ 17,452 $ (4,752 ) $ 6,449 $ (27,292 ) $ 10,681 Depreciation and amortization 722 1,212 1,442 7,919 641 1,405 13,341 Amortization of other intangible assets 819 481 154 (77 ) 888 — 2,265 Special Charges — 554 — 2,468 — 612 3,634 Remeasurement of acquisition-relatedcontingent consideration — — — — 423 — 423 Adjusted EBITDA (1) $ 16,282 $ 6,330 $ 19,048 $ 5,558 $ 8,401 $ (25,275 ) $ 30,344 Three Months Ended December 31, 2017 Corporate Finance & Restructuring Corporate Finance & Restructuring Forensic and Litigation Consulting Forensic and Litigation Consulting Economic Consulting Economic Consulting Technology Technology Strategic Communications Strategic Communications Unallocated Corporate Unallocated Corporate Total Total Net income $ 66,888 Interest income and other (452 ) Interest expense 6,547 Income tax benefit (38,458 ) Operating income (loss) $ 21,332 $ 20,286 $ 12,120 $ (1,079 ) $ 4,840 $ (22,974 ) $ 34,525 Depreciation and amortization 815 1,042 1,316 2,664 673 899 7,409 Amortization of other intangible assets 1,218 396 134 158 860 — 2,766 Special charges 2,391 1,889 714 1,230 4,153 434 10,811 Adjusted EBITDA (1) $ 25,756 $ 23,613 $ 14,284 $ 2,973 $ 10,526 $ (21,641 ) $ 55,511

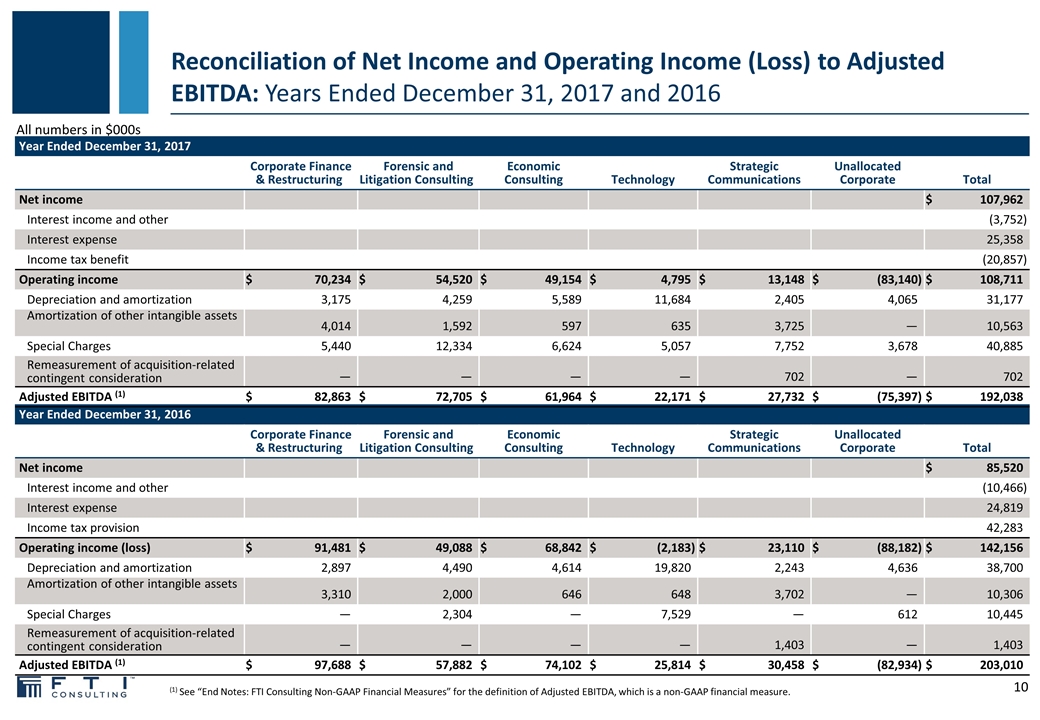

Reconciliation of Net Income and Operating Income (Loss) to Adjusted EBITDA: Years Ended December 31, 2017 and 2016 All numbers in $000s (1) See “End Notes: FTI Consulting Non-GAAP Financial Measures” for the definition of Adjusted EBITDA, which is a non-GAAP financial measure. Year Ended December 31, 2016 Corporate Finance & Restructuring Corporate Finance & Restructuring Forensic and Litigation Consulting Forensic and Litigation Consulting Economic Consulting Economic Consulting Technology Technology Strategic Communications Strategic Communications Unallocated Corporate Unallocated Corporate Total Total Net income $ 85,520 Interest income and other (10,466 ) Interest expense 24,819 Income tax provision 42,283 Operating income (loss) $ 91,481 $ 49,088 $ 68,842 $ (2,183 ) $ 23,110 $ (88,182 ) $ 142,156 Depreciation and amortization 2,897 4,490 4,614 19,820 2,243 4,636 38,700 Amortization of other intangible assets 3,310 2,000 646 648 3,702 — 10,306 Special Charges — 2,304 — 7,529 — 612 10,445 Remeasurement of acquisition-related contingent consideration — — — — 1,403 — 1,403 Adjusted EBITDA (1) $ 97,688 $ 57,882 $ 74,102 $ 25,814 $ 30,458 $ (82,934 ) $ 203,010 Year Ended December 31, 2017 Corporate Finance & Restructuring Corporate Finance & Restructuring Forensic and Litigation Consulting Forensic and Litigation Consulting Economic Consulting Economic Consulting Technology Technology Strategic Communications Strategic Communications Unallocated Corporate Unallocated Corporate Total Total Net income $ 107,962 Interest income and other (3,752 ) Interest expense 25,358 Income tax benefit (20,857 ) Operating income $ 70,234 $ 54,520 $ 49,154 $ 4,795 $ 13,148 $ (83,140 ) $ 108,711 Depreciation and amortization 3,175 4,259 5,589 11,684 2,405 4,065 31,177 Amortization of other intangible assets 4,014 1,592 597 635 3,725 — 10,563 Special Charges 5,440 12,334 6,624 5,057 7,752 3,678 40,885 Remeasurement of acquisition-related contingent consideration — — — — 702 — 702 Adjusted EBITDA (1) $ 82,863 $ 72,705 $ 61,964 $ 22,171 $ 27,732 $ (75,397 ) $ 192,038

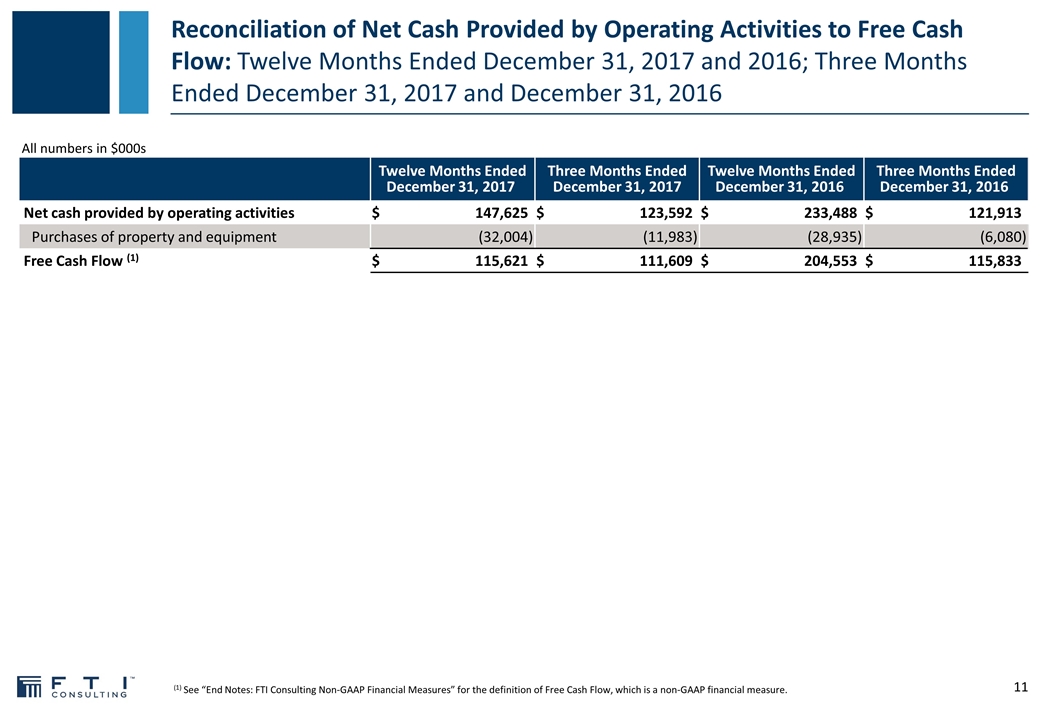

Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow: Twelve Months Ended December 31, 2017 and 2016; Three Months Ended December 31, 2017 and December 31, 2016 All numbers in $000s (1) See “End Notes: FTI Consulting Non-GAAP Financial Measures” for the definition of Free Cash Flow, which is a non-GAAP financial measure. Twelve Months Ended December 31, 2017 Twelve Months Ended December 31, 2017 Three Months Ended December 31, 2017 Three Months Ended December 31, 2017 Twelve Months Ended December 31, 2016 Twelve Months Ended December 31, 2016 Three Months Ended December 31, 2016 Three Months Ended December 31, 2016 Net cash provided by operating activities $ 147,625 $ 123,592 $ 233,488 $ 121,913 Purchases of property and equipment (32,004 ) (11,983 ) (28,935 ) (6,080 ) Free Cash Flow (1) $ 115,621 $ 111,609 $ 204,553 $ 115,833

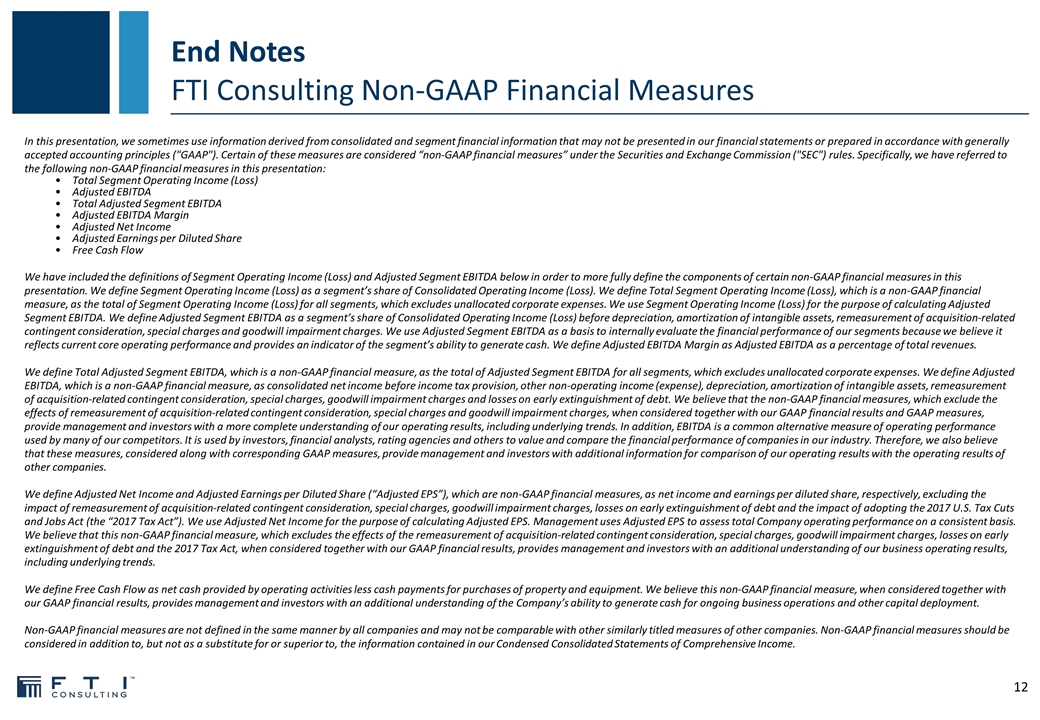

End NotesFTI Consulting Non-GAAP Financial Measures In this presentation, we sometimes use information derived from consolidated and segment financial information that may not be presented in our financial statements or prepared in accordance with generally accepted accounting principles ("GAAP"). Certain of these measures are considered “non-GAAP financial measures” under the Securities and Exchange Commission ("SEC") rules. Specifically, we have referred to the following non-GAAP financial measures in this presentation: Total Segment Operating Income (Loss) Adjusted EBITDA Total Adjusted Segment EBITDA Adjusted EBITDA Margin Adjusted Net Income Adjusted Earnings per Diluted Share Free Cash Flow We have included the definitions of Segment Operating Income (Loss) and Adjusted Segment EBITDA below in order to more fully define the components of certain non-GAAP financial measures in this presentation. We define Segment Operating Income (Loss) as a segment’s share of Consolidated Operating Income (Loss). We define Total Segment Operating Income (Loss), which is a non-GAAP financial measure, as the total of Segment Operating Income (Loss) for all segments, which excludes unallocated corporate expenses. We use Segment Operating Income (Loss) for the purpose of calculating Adjusted Segment EBITDA. We define Adjusted Segment EBITDA as a segment’s share of Consolidated Operating Income (Loss) before depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges and goodwill impairment charges. We use Adjusted Segment EBITDA as a basis to internally evaluate the financial performance of our segments because we believe it reflects current core operating performance and provides an indicator of the segment’s ability to generate cash. We define Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of total revenues. We define Total Adjusted Segment EBITDA, which is a non-GAAP financial measure, as the total of Adjusted Segment EBITDA for all segments, which excludes unallocated corporate expenses. We define Adjusted EBITDA, which is a non-GAAP financial measure, as consolidated net income before income tax provision, other non-operating income (expense), depreciation, amortization of intangible assets, remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges and losses on early extinguishment of debt. We believe that the non-GAAP financial measures, which exclude the effects of remeasurement of acquisition-related contingent consideration, special charges and goodwill impairment charges, when considered together with our GAAP financial results and GAAP measures, provide management and investors with a more complete understanding of our operating results, including underlying trends. In addition, EBITDA is a common alternative measure of operating performance used by many of our competitors. It is used by investors, financial analysts, rating agencies and others to value and compare the financial performance of companies in our industry. Therefore, we also believe that these measures, considered along with corresponding GAAP measures, provide management and investors with additional information for comparison of our operating results with the operating results of other companies. We define Adjusted Net Income and Adjusted Earnings per Diluted Share (“Adjusted EPS”), which are non-GAAP financial measures, as net income and earnings per diluted share, respectively, excluding the impact of remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges, losses on early extinguishment of debt and the impact of adopting the 2017 U.S. Tax Cuts and Jobs Act (the “2017 Tax Act”). We use Adjusted Net Income for the purpose of calculating Adjusted EPS. Management uses Adjusted EPS to assess total Company operating performance on a consistent basis. We believe that this non-GAAP financial measure, which excludes the effects of the remeasurement of acquisition-related contingent consideration, special charges, goodwill impairment charges, losses on early extinguishment of debt and the 2017 Tax Act, when considered together with our GAAP financial results, provides management and investors with an additional understanding of our business operating results, including underlying trends. We define Free Cash Flow as net cash provided by operating activities less cash payments for purchases of property and equipment. We believe this non-GAAP financial measure, when considered together with our GAAP financial results, provides management and investors with an additional understanding of the Company’s ability to generate cash for ongoing business operations and other capital deployment. Non-GAAP financial measures are not defined in the same manner by all companies and may not be comparable with other similarly titled measures of other companies. Non-GAAP financial measures should be considered in addition to, but not as a substitute for or superior to, the information contained in our Condensed Consolidated Statements of Comprehensive Income.

Appendix

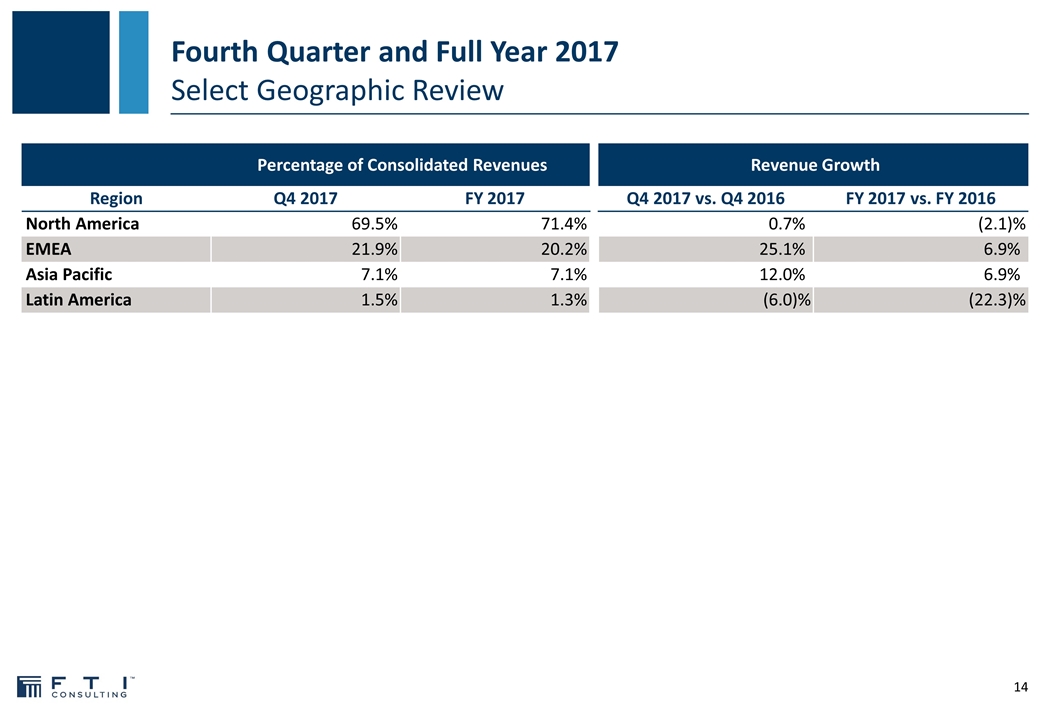

Fourth Quarter and Full Year 2017Select Geographic Review Percentage of Consolidated Revenues Revenue Growth Region Q4 2017 FY 2017 Q4 2017 vs. Q4 2016 FY 2017 vs. FY 2016 North America 69.5 % 71.4 % 0.7 % (2.1 )% EMEA 21.9 % 20.2 % 25.1 % 6.9 % Asia Pacific 7.1 % 7.1 % 12.0 % 6.9 % Latin America 1.5 % 1.3 % (6.0 )% (22.3 )%

FTI Consulting named to Forbes magazine list of America’s Best Management Consulting Firms for the second consecutive year — recognized in 20 sectors and functional areas Corporate Finance & Restructuring ranked the #1 U.S. Restructuring Advisor according to The Deal for the last ten years Forensic and Litigation Consulting recognized as the #1 Global Risk & Investigations Services Provider by the National Law Journal FTI Consulting and Compass Lexecon had the most experts (129) recognized in the Who’s Who Legal Consulting Experts Guide for the second consecutive year FTI Technology named a Leader in Worldwide E-Discovery Services Vendor by IDC MarketScape’s Vendor Assessment Report Strategic Communications named EMEA PR Consultancy of the Year by The Holmes Report Full Year 2017Awards & Accolades