Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FEB 2018 INVESTOR PRESENTATION - SCHWEITZER MAUDUIT INTERNATIONAL INC | feb18investorpre8-k.htm |

© 2018 Schweitzer-Mauduit International, Inc. Confidential

SWM INVESTOR PRESENTATION

February 2018

© 2018 Schweitzer-Mauduit International, Inc. Confidential 2

Forward Looking Statements, Non-

GAAP Disclosure, & Definitions

This presentation may contain “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995 and other federal securities laws that are subject to the safe harbor created by such laws and other legal

protections. Caution should be taken not to place undue reliance on any such forward-looking statements because actual results may differ

materially from the results suggested by these statements. These forward-looking statements are made only as of the date of this presentation.

We undertake no obligation, except as may be required by law, to publicly update or revise any forward-looking statements, whether as a result

of new information, future events or otherwise. In addition, forward-looking statements are subject to certain risks and uncertainties that could

cause actual results to differ materially from our historical experience and present expectations or projections. These risks and uncertainties

include, but are not limited to, those described in Part I, “Item 1A. Risk Factors” and elsewhere in our Annual Report on Form 10-K for the

period ended December 31, 2016 and those described from time to time in our periodic and other reports filed with the Securities and Exchange

Commission

Certain financial measures and comments contained in this presentation are “non-

GAAP” financial measures, specifically measures which exclude one or more of the following: restructuring and impairment

expenses, depreciation and amortization, interest expense, tax provision (benefit), capital spending, capitalized software expenditures,

purchase accounting adjustments, and tax valuation adjustments. We believe that investors’ understanding is enhanced by disclosing these

non-GAAP financial measures as a reasonable basis for comparison of our ongoing results of operations. All non-GAAP (Adjusted) figures are

reconciled to closest GAAP measure in the appendix. All financial metrics are presented on a continuing operations basis unless noted

otherwise; all per share metrics are on a diluted basis

The following terms/abbreviations are used throughout the presentation and are defined as follows:

EP - Engineered Papers segment, AMS - Advanced Materials & Structures segment, OCF – operating cash flow, FCF - free cash flow, OP -

operating profit, EBITDA - earnings before interest taxes depreciation and amortization, LIP - low ignition propensity, RTL - reconstituted

tobacco leaf, W&B - wrapper and binder, RO - reverse osmosis, TPU - thermoplastic polyurethane

© 2018 Schweitzer-Mauduit International, Inc. Confidential 3

Overview

Engineered Papers (EP)

Advanced Materials & Structures (AMS)

Financial Overview, Outlook

© 2018 Schweitzer-Mauduit International, Inc. Confidential 4

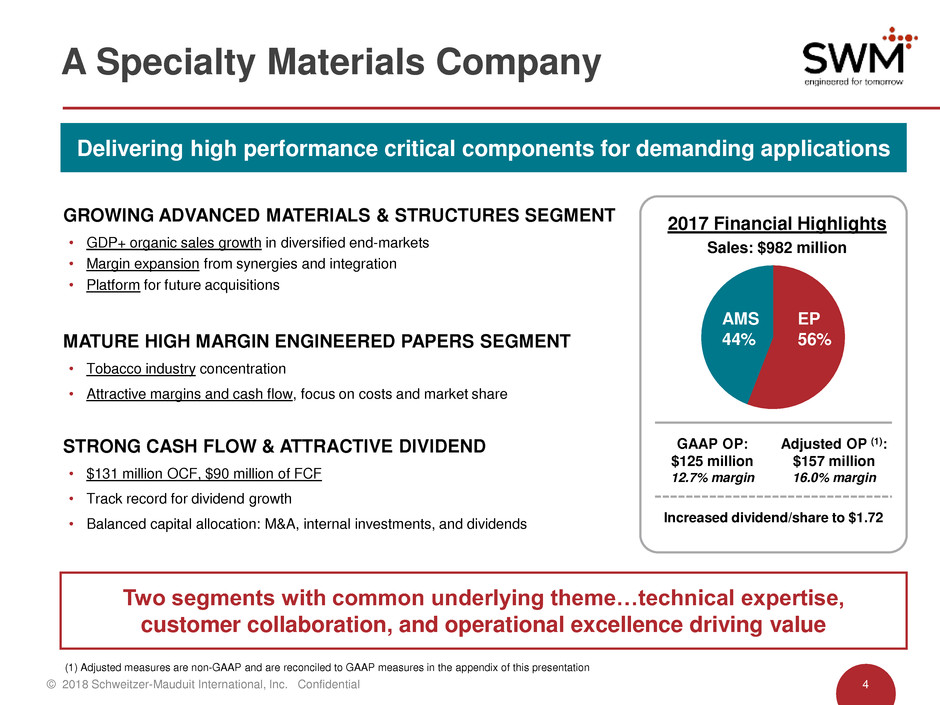

A Specialty Materials Company

Delivering high performance critical components for demanding applications

GROWING ADVANCED MATERIALS & STRUCTURES SEGMENT

• GDP+ organic sales growth in diversified end-markets

• Margin expansion from synergies and integration

• Platform for future acquisitions

MATURE HIGH MARGIN ENGINEERED PAPERS SEGMENT

• Tobacco industry concentration

• Attractive margins and cash flow, focus on costs and market share

STRONG CASH FLOW & ATTRACTIVE DIVIDEND

• $131 million OCF, $90 million of FCF

• Track record for dividend growth

• Balanced capital allocation: M&A, internal investments, and dividends

2017 Financial Highlights

Sales: $982 million

AMS

44%

EP

56%

GAAP OP:

$125 million

12.7% margin

(1) Adjusted measures are non-GAAP and are reconciled to GAAP measures in the appendix of this presentation

Increased dividend/share to $1.72

Adjusted OP (1):

$157 million

16.0% margin

Two segments with common underlying theme…technical expertise,

customer collaboration, and operational excellence driving value

© 2018 Schweitzer-Mauduit International, Inc. Confidential 5

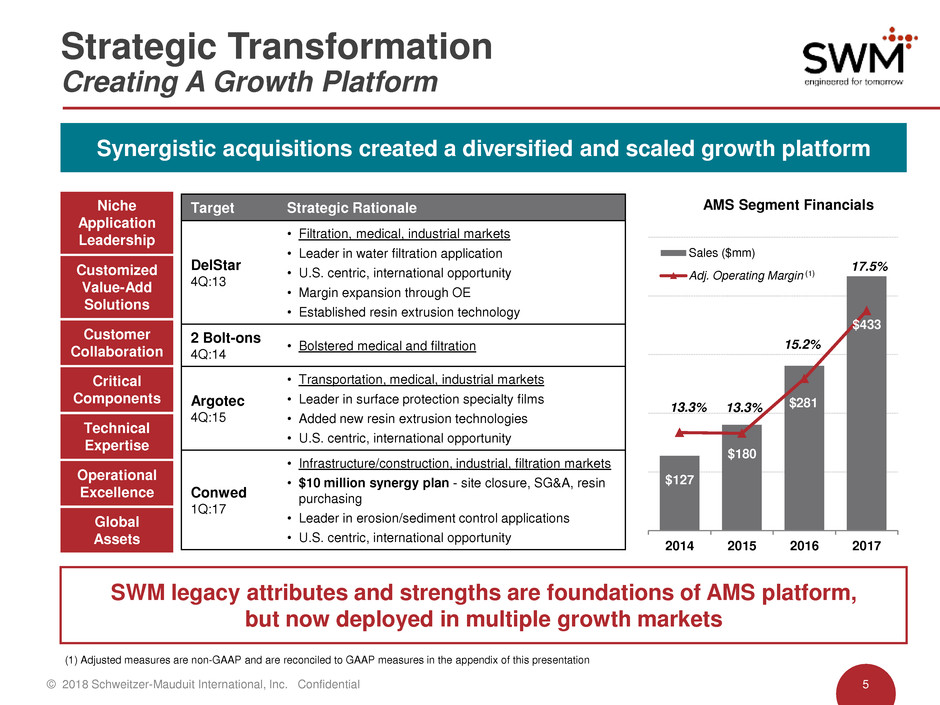

SWM legacy attributes and strengths are foundations of AMS platform,

but now deployed in multiple growth markets

Strategic Transformation

Creating A Growth Platform

Synergistic acquisitions created a diversified and scaled growth platform

$127

$180

$281

$433

13.3% 13.3%

15.2%

17.5%

10%

12%

14%

16%

18%

20%

$0

$100

$200

$300

$400

$500

2014 2015 2016 2017

Sales ($mm)

Adj. Operating MarginCustomized

Value-Add

Solutions

Customer

Collaboration

Operational

Excellence

Technical

Expertise

Niche

Application

Leadership

Global

Assets

Critical

Components

Target Strategic Rationale

DelStar

4Q:13

• Filtration, medical, industrial markets

• Leader in water filtration application

• U.S. centric, international opportunity

• Margin expansion through OE

• Established resin extrusion technology

2 Bolt-ons

4Q:14

• Bolstered medical and filtration

Argotec

4Q:15

• Transportation, medical, industrial markets

• Leader in surface protection specialty films

• Added new resin extrusion technologies

• U.S. centric, international opportunity

Conwed

1Q:17

• Infrastructure/construction, industrial, filtration markets

• $10 million synergy plan - site closure, SG&A, resin

purchasing

• Leader in erosion/sediment control applications

• U.S. centric, international opportunity

AMS Segment Financials

(1) Adjusted measures are non-GAAP and are reconciled to GAAP measures in the appendix of this presentation

(1)

© 2018 Schweitzer-Mauduit International, Inc. Confidential 6

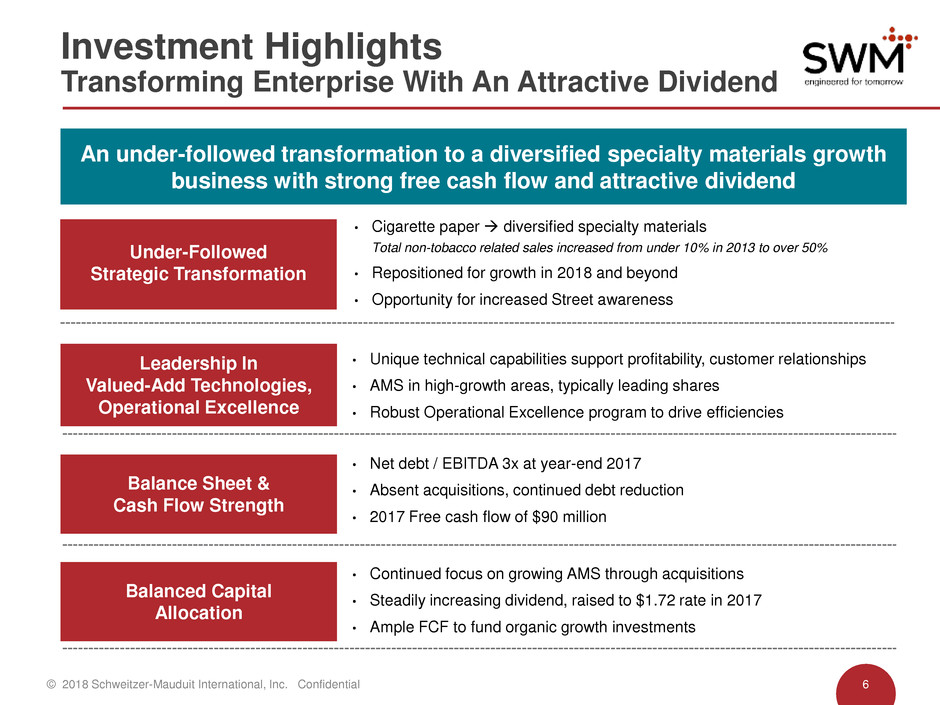

Investment Highlights

Transforming Enterprise With An Attractive Dividend

An under-followed transformation to a diversified specialty materials growth

business with strong free cash flow and attractive dividend

Under-Followed

Strategic Transformation

• Cigarette paper diversified specialty materials

Total non-tobacco related sales increased from under 10% in 2013 to over 50%

• Repositioned for growth in 2018 and beyond

• Opportunity for increased Street awareness

Balanced Capital

Allocation

Leadership In

Valued-Add Technologies,

Operational Excellence

Balance Sheet &

Cash Flow Strength

• Unique technical capabilities support profitability, customer relationships

• AMS in high-growth areas, typically leading shares

• Robust Operational Excellence program to drive efficiencies

• Net debt / EBITDA 3x at year-end 2017

• Absent acquisitions, continued debt reduction

• 2017 Free cash flow of $90 million

• Continued focus on growing AMS through acquisitions

• Steadily increasing dividend, raised to $1.72 rate in 2017

• Ample FCF to fund organic growth investments

© 2018 Schweitzer-Mauduit International, Inc. Confidential 7

Overview

Engineered Papers (EP)

Advanced Materials & Structures (AMS)

Financial Overview, Outlook

© 2018 Schweitzer-Mauduit International, Inc. Confidential 8

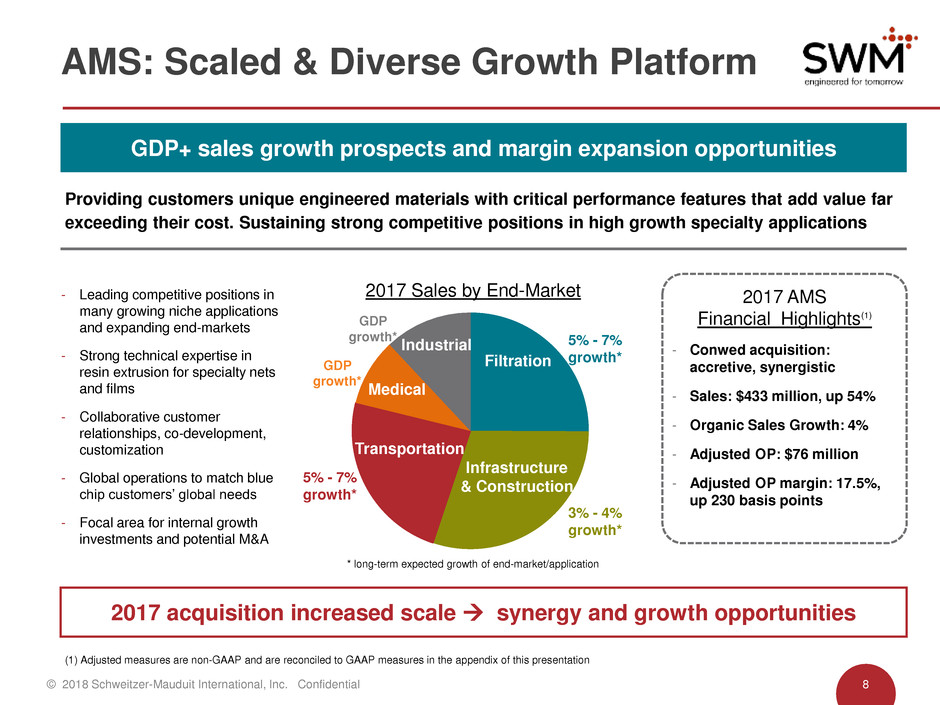

AMS: Scaled & Diverse Growth Platform

Providing customers unique engineered materials with critical performance features that add value far

exceeding their cost. Sustaining strong competitive positions in high growth specialty applications

GDP+ sales growth prospects and margin expansion opportunities

Infrastructure

& Construction

Transportation

5% - 7%

growth*

3% - 4%

growth*

5% - 7%

growth*

GDP

growth*

* long-term expected growth of end-market/application

GDP

growth*

Medical

Industrial

Filtration

2017 AMS

Financial Highlights(1)

- Conwed acquisition:

accretive, synergistic

- Sales: $433 million, up 54%

- Organic Sales Growth: 4%

- Adjusted OP: $76 million

- Adjusted OP margin: 17.5%,

up 230 basis points

2017 acquisition increased scale synergy and growth opportunities

2017 Sales by End-Market

(1) Adjusted measures are non-GAAP and are reconciled to GAAP measures in the appendix of this presentation

- Leading competitive positions in

many growing niche applications

and expanding end-markets

- Strong technical expertise in

resin extrusion for specialty nets

and films

- Collaborative customer

relationships, co-development,

customization

- Global operations to match blue

chip customers’ global needs

- Focal area for internal growth

investments and potential M&A

© 2018 Schweitzer-Mauduit International, Inc. Confidential 9

Key Technologies

Precision Engineered To Meet Customer Demands

Designed to spec…thickness, clarity, durability, UV resistance, flow-through,

water resistance, strength, breathability, puncture resistance, heat tolerance

• Typical resins: polypropylene, polyethylene

• Spacer in RO filtration devices

• Pleat support in filtration cartridges

• Blankets and socks for erosion/sediment control

• Protective pipeline casings for oil & gas

• Food packaging

• TPU specialty resins deliver unique performance attributes

• Surface protection and glass lamination

• Finger bandages and woundcare

• Specialty textiles/apparel

• Architectural glass

Film Netting

© 2018 Schweitzer-Mauduit International, Inc. Confidential 10

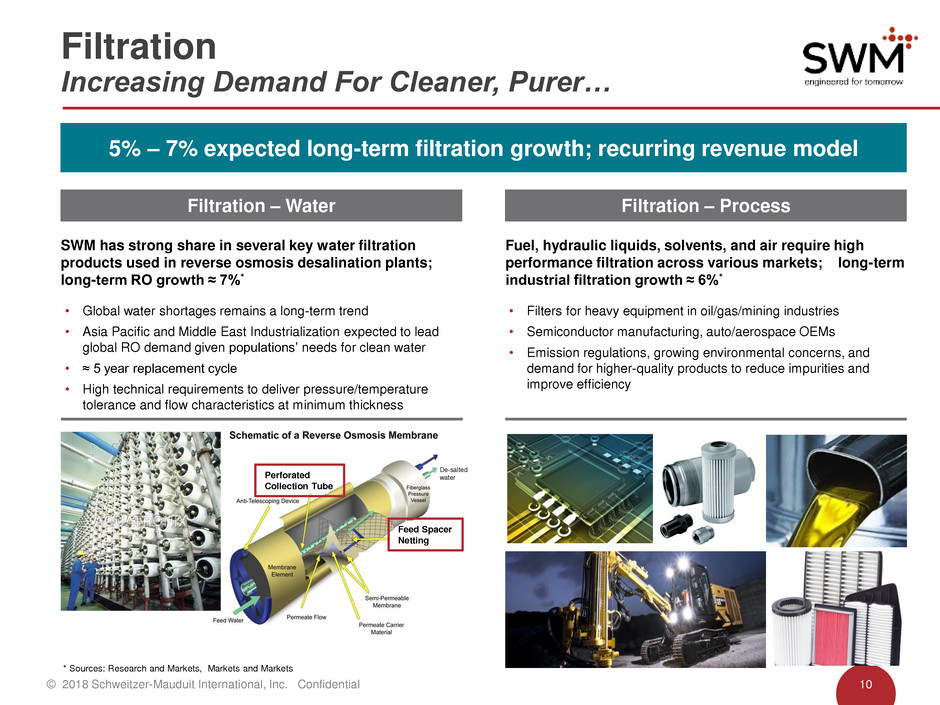

Filtration

Increasing Demand For Cleaner, Purer…

Fuel, hydraulic liquids, solvents, and air require high

performance filtration across various markets; long-term

industrial filtration growth ≈ 6%*

• Filters for heavy equipment in oil/gas/mining industries

• Semiconductor manufacturing, auto/aerospace OEMs

• Emission regulations, growing environmental concerns, and

demand for higher-quality products to reduce impurities and

improve efficiency

* Sources: Research and Markets, Markets and Markets

Filtration – Process

5% – 7% expected long-term filtration growth; recurring revenue model

SWM has strong share in several key water filtration

products used in reverse osmosis desalination plants;

long-term RO growth ≈ 7%*

• Global water shortages remains a long-term trend

• Asia Pacific and Middle East Industrialization expected to lead

global RO demand given populations’ needs for clean water

• ≈ 5 year replacement cycle

• High technical requirements to deliver pressure/temperature

tolerance and flow characteristics at minimum thickness

Filtration – Water

De-salted

water

Feed Spacer

Netting

Perforated

Collection Tube

© 2018 Schweitzer-Mauduit International, Inc. Confidential 11

Infrastructure & Construction

Increasing Needs For Erosion/Sediment Control

Leader in erosion/sediment control applications for

highway development and oil & gas industry

• Erosion control “blankets” used in highway development; recent

strong growth, further infrastructure spending supports outlook

• Technical leadership at delivering high strength yet ultra-

lightweight netting

• Filled “socks” for high performance barriers used in oil & gas site

development (i.e., Marcellus Shale), significant adoption potential

• Opportunity in handling stormwater to mitigate environmental risks

Niche flooring and other home construction products;

glass films for commercial buildings

• Carpet cushion support netting for residential construction

• Netting for sod roll backing to drive production efficiencies;

driven by residential construction and landscaping

• Other netting applications: house wraps, materials protection

• Films for laminated/reinforced glass in global high-rise

construction, ballistic resistant, and privacy glass

3% – 4% expected long-term growth; U.S infrastructure and construction play

Construction Infrastructure

© 2018 Schweitzer-Mauduit International, Inc. Confidential 12

Transportation

Global Expansion Of Surface Protection Films

5% – 7% expected long-term growth in niche applications; strength in Asia

Increasing paint protection adoption in Asia driving

strong recent growth

• Aftermarket automotive customers; penetration relatively low at

≈5% in US

• New Asian distribution channels cross-selling to a rising middle

class seeking to protect their personal auto investment

• Technical leadership in TPU film technology with best-in-class

quality to deliver ultra-clear, defect free, installer-friendly material

Stable growth in security glass for military applications;

emerging demand for automotive glass protection films

• Highly durable products for ballistic resistant glass and other

high impact applications, aerospace glass

• Auto cabin safety applications to reinforce glass, alter lighting

• Industry leader in both TPU and EVA (ethylene vinyl acetate);

films are interlayer between glass sheets

• Printed films for vehicle graphics/marketing

Transportation – Lamination & Graphics Transportation – Auto Paint Protection

© 2018 Schweitzer-Mauduit International, Inc. Confidential 13

• Finger bandages

• Advanced woundcare

• Facemasks/gowns

• Pipeline protection

• Wind turbine blades

• Food packaging

• Performance textiles

• Wipes

• Parts protection

Industrial & Medical

Innovative Solutions Using Core AMS Technologies

Core film and netting capabilities applied in various niche applications

to meet unique performance requirements; GDP growth

© 2018 Schweitzer-Mauduit International, Inc. Confidential 14

Overview

Engineered Papers (EP)

Advanced Materials & Structures (AMS)

Financial Overview, Outlook

© 2018 Schweitzer-Mauduit International, Inc. Confidential 15

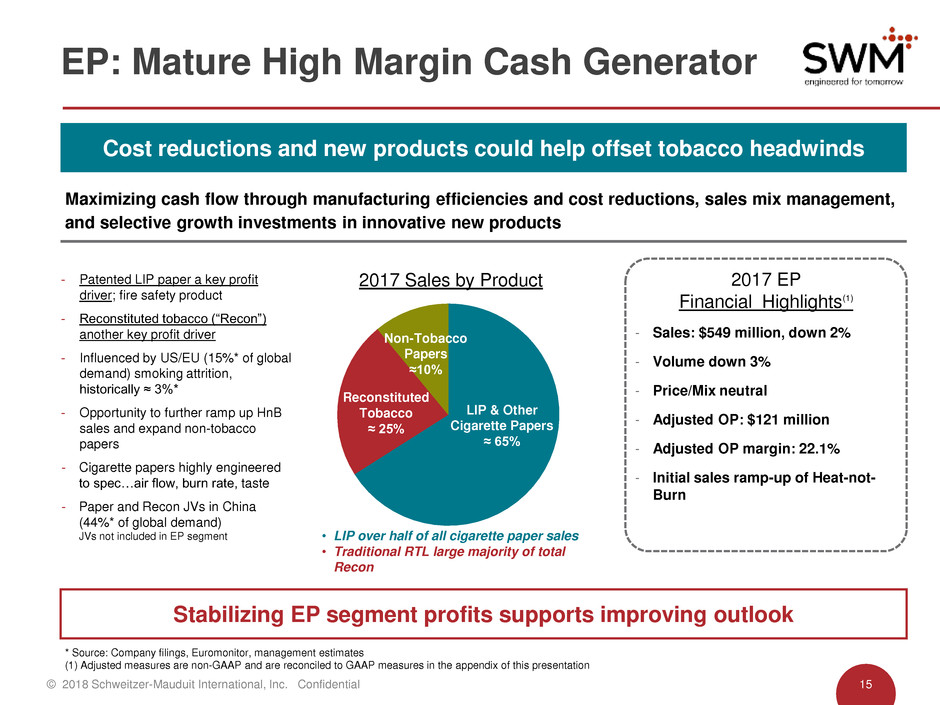

- Patented LIP paper a key profit

driver; fire safety product

- Reconstituted tobacco (“Recon”)

another key profit driver

- Influenced by US/EU (15%* of global

demand) smoking attrition,

historically ≈ 3%*

- Opportunity to further ramp up HnB

sales and expand non-tobacco

papers

- Cigarette papers highly engineered

to spec…air flow, burn rate, taste

- Paper and Recon JVs in China

(44%* of global demand)

JVs not included in EP segment

EP: Mature High Margin Cash Generator

Cost reductions and new products could help offset tobacco headwinds

Stabilizing EP segment profits supports improving outlook

2017 EP

Financial Highlights(1)

- Sales: $549 million, down 2%

- Volume down 3%

- Price/Mix neutral

- Adjusted OP: $121 million

- Adjusted OP margin: 22.1%

- Initial sales ramp-up of Heat-not-

Burn

Maximizing cash flow through manufacturing efficiencies and cost reductions, sales mix management,

and selective growth investments in innovative new products

* Source: Company filings, Euromonitor, management estimates

(1) Adjusted measures are non-GAAP and are reconciled to GAAP measures in the appendix of this presentation

2017 Sales by Product

• LIP over half of all cigarette paper sales

• Traditional RTL large majority of total

Recon

Reconstituted

Tobacco

≈ 25%

Non-Tobacco

Papers

≈10%

LIP & Other

Cigarette Papers

≈ 65%

© 2018 Schweitzer-Mauduit International, Inc. Confidential 16

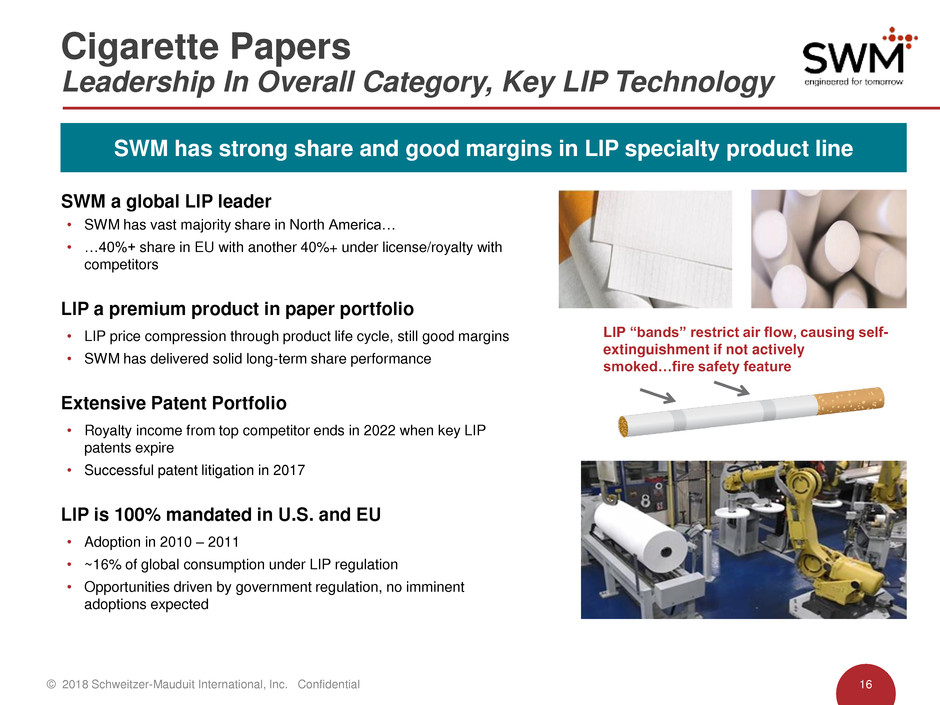

SWM a global LIP leader

• SWM has vast majority share in North America…

• …40%+ share in EU with another 40%+ under license/royalty with

competitors

LIP a premium product in paper portfolio

• LIP price compression through product life cycle, still good margins

• SWM has delivered solid long-term share performance

Extensive Patent Portfolio

• Royalty income from top competitor ends in 2022 when key LIP

patents expire

• Successful patent litigation in 2017

LIP is 100% mandated in U.S. and EU

• Adoption in 2010 – 2011

• ~16% of global consumption under LIP regulation

• Opportunities driven by government regulation, no imminent

adoptions expected

LIP “bands” restrict air flow, causing self-

extinguishment if not actively

smoked…fire safety feature

Cigarette Papers

Leadership In Overall Category, Key LIP Technology

SWM has strong share and good margins in LIP specialty product line

© 2018 Schweitzer-Mauduit International, Inc. Confidential 17

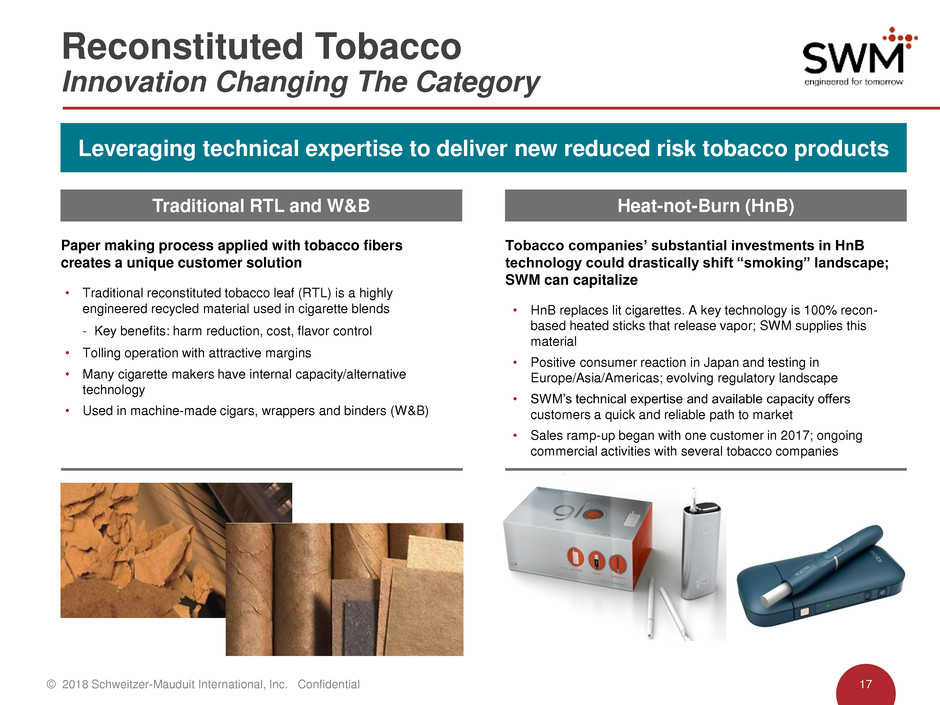

Reconstituted Tobacco

Innovation Changing The Category

Heat-not-Burn (HnB) Traditional RTL and W&B

• Traditional reconstituted tobacco leaf (RTL) is a highly

engineered recycled material used in cigarette blends

- Key benefits: harm reduction, cost, flavor control

• Tolling operation with attractive margins

• Many cigarette makers have internal capacity/alternative

technology

• Used in machine-made cigars, wrappers and binders (W&B)

• HnB replaces lit cigarettes. A key technology is 100% recon-

based heated sticks that release vapor; SWM supplies this

material

• Positive consumer reaction in Japan and testing in

Europe/Asia/Americas; evolving regulatory landscape

• SWM’s technical expertise and available capacity offers

customers a quick and reliable path to market

• Sales ramp-up began with one customer in 2017; ongoing

commercial activities with several tobacco companies

Paper making process applied with tobacco fibers

creates a unique customer solution

Tobacco companies’ substantial investments in HnB

technology could drastically shift “smoking” landscape;

SWM can capitalize

Leveraging technical expertise to deliver new reduced risk tobacco products

© 2018 Schweitzer-Mauduit International, Inc. Confidential 18

Overview

Engineered Papers (EP)

Advanced Materials & Structures (AMS)

Financial Overview, Outlook

© 2018 Schweitzer-Mauduit International, Inc. Confidential 19

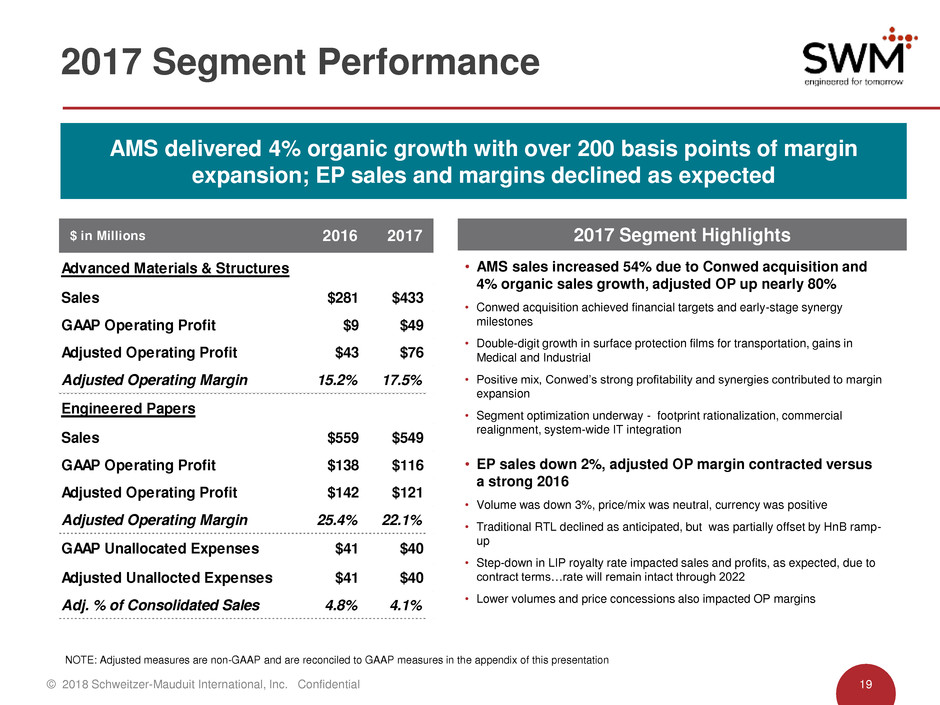

2017 Segment Performance

AMS delivered 4% organic growth with over 200 basis points of margin

expansion; EP sales and margins declined as expected

$ in Millions 2016 2017

Sales $281 $433

GAAP Operating Profit $9 $49

Adjusted Operating Profit $43 $76

Adjusted Operating Margin 15.2% 17.5%

Engineered Papers

Sales $559 $549

GAAP Operating Profit $138 $116

Adjusted Operating Profit $142 $121

Adjusted Operating Margin 25.4% 22.1%

GAAP Unallocated Expenses $41 $40

Adjusted Unallocted Expenses $41 $40

Adj. % of Consolidated Sales 4.8% 4.1%

Advanced Materials & Structures

• AMS sales increased 54% due to Conwed acquisition and

4% organic sales growth, adjusted OP up nearly 80%

• Conwed acquisition achieved financial targets and early-stage synergy

milestones

• Double-digit growth in surface protection films for transportation, gains in

Medical and Industrial

• Positive mix, Conwed’s strong profitability and synergies contributed to margin

expansion

• Segment optimization underway - footprint rationalization, commercial

realignment, system-wide IT integration

• EP sales down 2%, adjusted OP margin contracted versus

a strong 2016

• Volume was down 3%, price/mix was neutral, currency was positive

• Traditional RTL declined as anticipated, but was partially offset by HnB ramp-

up

• Step-down in LIP royalty rate impacted sales and profits, as expected, due to

contract terms…rate will remain intact through 2022

• Lower volumes and price concessions also impacted OP margins

2017 Segment Highlights

NOTE: Adjusted measures are non-GAAP and are reconciled to GAAP measures in the appendix of this presentation

© 2018 Schweitzer-Mauduit International, Inc. Confidential 20

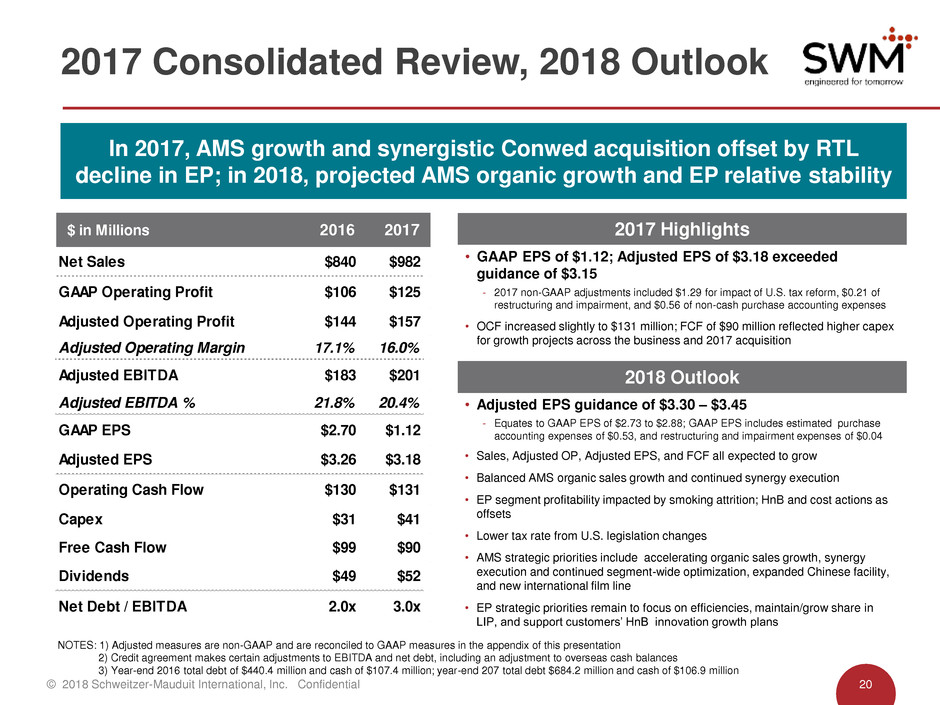

2017 Consolidated Review, 2018 Outlook

$ in Millions 2016 2017

Net Sales $840 $982

GAAP Operating Profit $106 $125

Adjusted Operating Profit $144 $157

Adjusted Operating Margin 17.1% 16.0%

Adjusted EBITDA $183 $201

Adjusted EBITDA % 21.8% 20.4%

GAAP EPS $2.70 $1.12

Adjusted EPS $3.26 $3.18

Operating Cash Flow $130 $131

Capex $31 $41

Free Cash Flow $99 $90

Dividends $49 $52

Net Debt / EBITDA 2.0x 3.0x

2017 Highlights

• GAAP EPS of $1.12; Adjusted EPS of $3.18 exceeded

guidance of $3.15

- 2017 non-GAAP adjustments included $1.29 for impact of U.S. tax reform, $0.21 of

restructuring and impairment, and $0.56 of non-cash purchase accounting expenses

• OCF increased slightly to $131 million; FCF of $90 million reflected higher capex

for growth projects across the business and 2017 acquisition

In 2017, AMS growth and synergistic Conwed acquisition offset by RTL

decline in EP; in 2018, projected AMS organic growth and EP relative stability

2018 Outlook

• Adjusted EPS guidance of $3.30 – $3.45

- Equates to GAAP EPS of $2.73 to $2.88; GAAP EPS includes estimated purchase

accounting expenses of $0.53, and restructuring and impairment expenses of $0.04

• Sales, Adjusted OP, Adjusted EPS, and FCF all expected to grow

• Balanced AMS organic sales growth and continued synergy execution

• EP segment profitability impacted by smoking attrition; HnB and cost actions as

offsets

• Lower tax rate from U.S. legislation changes

• AMS strategic priorities include accelerating organic sales growth, synergy

execution and continued segment-wide optimization, expanded Chinese facility,

and new international film line

• EP strategic priorities remain to focus on efficiencies, maintain/grow share in

LIP, and support customers’ HnB innovation growth plans

NOTES: 1) Adjusted measures are non-GAAP and are reconciled to GAAP measures in the appendix of this presentation

2) Credit agreement makes certain adjustments to EBITDA and net debt, including an adjustment to overseas cash balances

3) Year-end 2016 total debt of $440.4 million and cash of $107.4 million; year-end 207 total debt $684.2 million and cash of $106.9 million

© 2018 Schweitzer-Mauduit International, Inc. Confidential 21

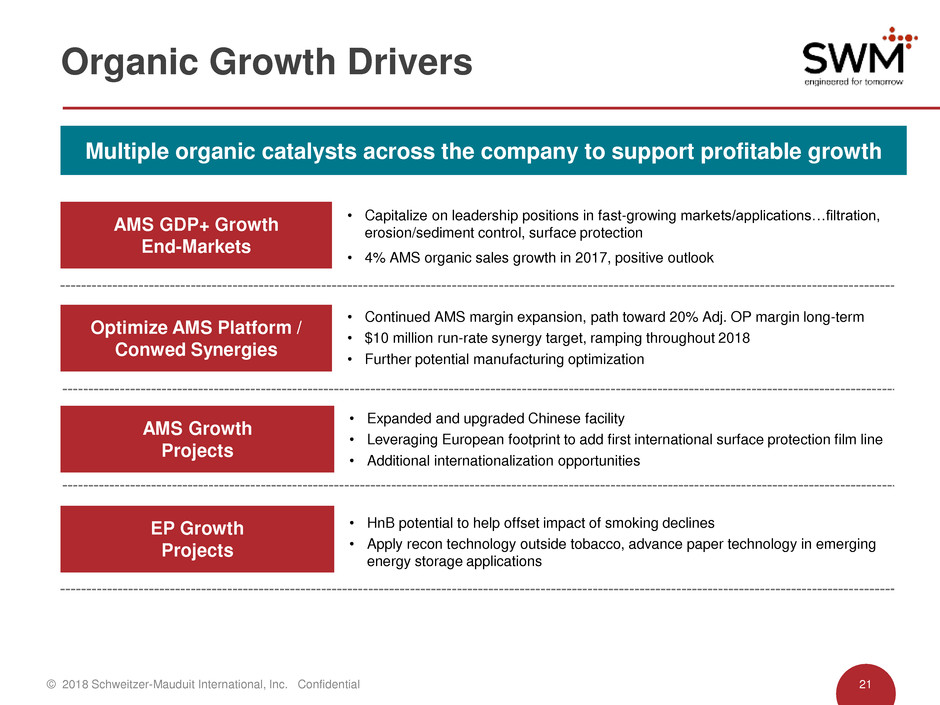

Multiple organic catalysts across the company to support profitable growth

Organic Growth Drivers

• Continued AMS margin expansion, path toward 20% Adj. OP margin long-term

• $10 million run-rate synergy target, ramping throughout 2018

• Further potential manufacturing optimization

Optimize AMS Platform /

Conwed Synergies

• Capitalize on leadership positions in fast-growing markets/applications…filtration,

erosion/sediment control, surface protection

• 4% AMS organic sales growth in 2017, positive outlook

AMS GDP+ Growth

End-Markets

• Expanded and upgraded Chinese facility

• Leveraging European footprint to add first international surface protection film line

• Additional internationalization opportunities

AMS Growth

Projects

• HnB potential to help offset impact of smoking declines

• Apply recon technology outside tobacco, advance paper technology in emerging

energy storage applications

EP Growth

Projects

© 2018 Schweitzer-Mauduit International, Inc. Confidential 22

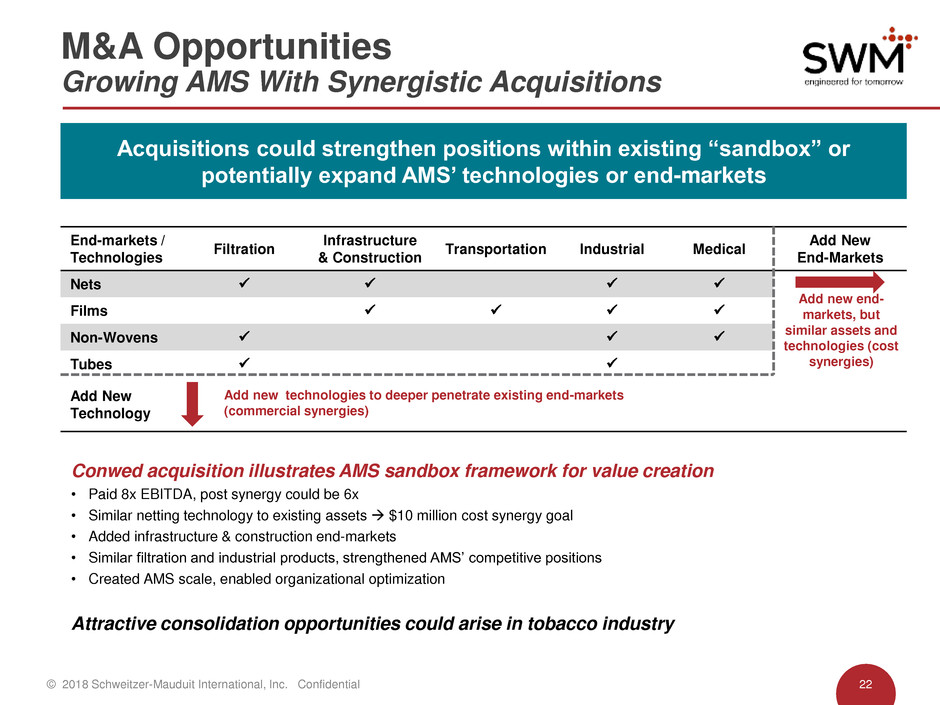

Acquisitions could strengthen positions within existing “sandbox” or

potentially expand AMS’ technologies or end-markets

M&A Opportunities

Growing AMS With Synergistic Acquisitions

End-markets /

Technologies

Filtration

Infrastructure

& Construction

Transportation Industrial Medical

Add New

End-Markets

Nets

Films

Non-Wovens

Tubes

Add New

Technology

Add new end-

markets, but

similar assets and

technologies (cost

synergies)

Add new technologies to deeper penetrate existing end-markets

(commercial synergies)

Conwed acquisition illustrates AMS sandbox framework for value creation

• Paid 8x EBITDA, post synergy could be 6x

• Similar netting technology to existing assets $10 million cost synergy goal

• Added infrastructure & construction end-markets

• Similar filtration and industrial products, strengthened AMS’ competitive positions

• Created AMS scale, enabled organizational optimization

Attractive consolidation opportunities could arise in tobacco industry

© 2018 Schweitzer-Mauduit International, Inc. Confidential 23

APPENDIX

Non-GAAP Reconciliations & Supplemental Data

Historical Segment Financials

© 2018 Schweitzer-Mauduit International, Inc. Confidential 24

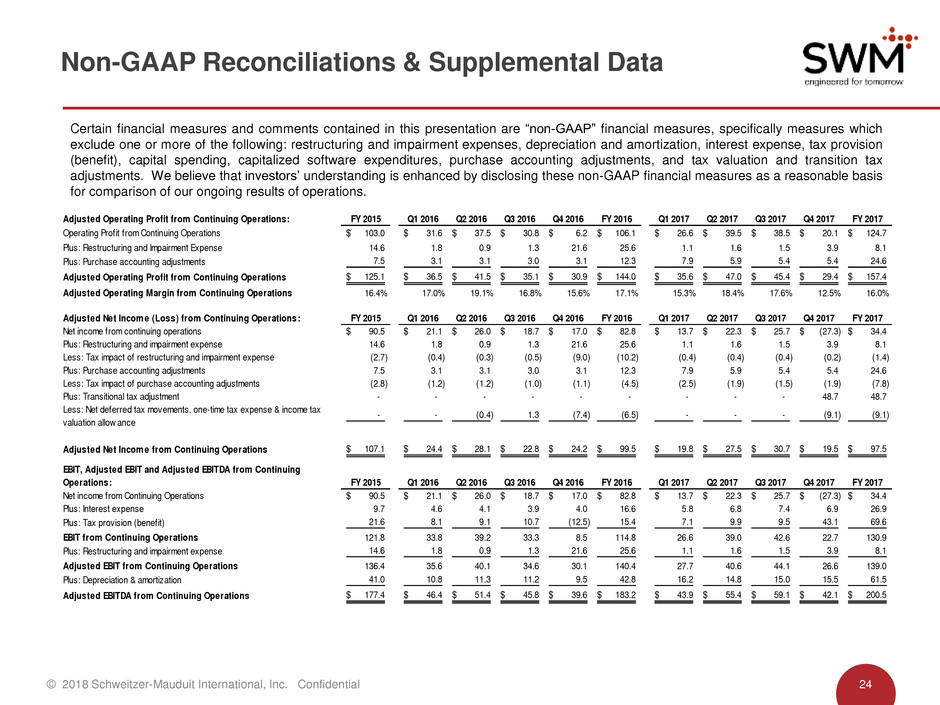

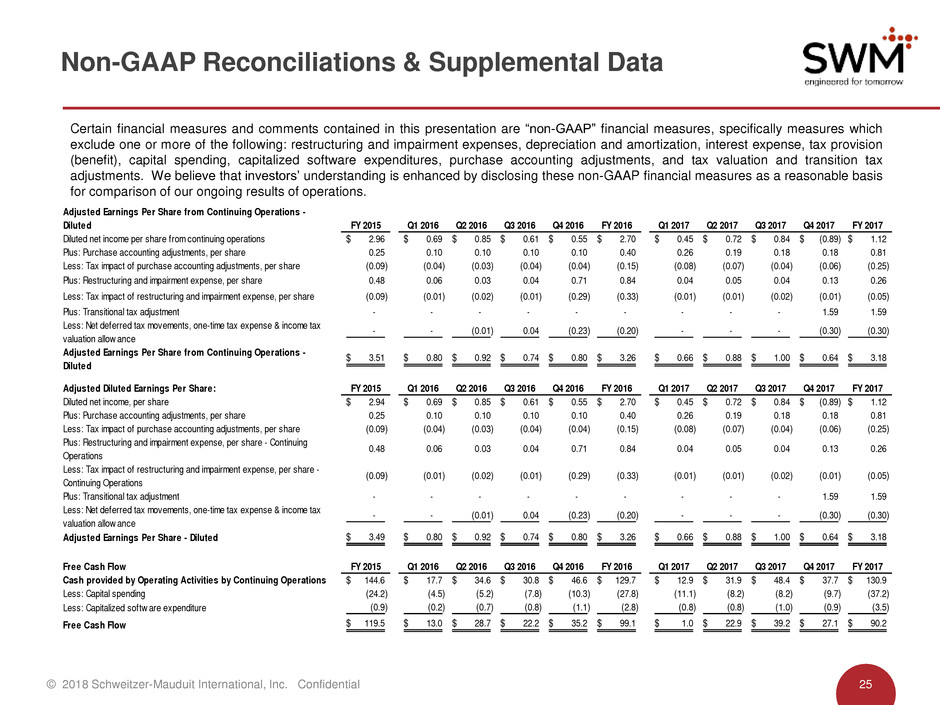

Non-GAAP Reconciliations & Supplemental Data

Certain financial measures and comments contained in this presentation are “non-GAAP” financial measures, specifically measures which

exclude one or more of the following: restructuring and impairment expenses, depreciation and amortization, interest expense, tax provision

(benefit), capital spending, capitalized software expenditures, purchase accounting adjustments, and tax valuation and transition tax

adjustments. We believe that investors’ understanding is enhanced by disclosing these non-GAAP financial measures as a reasonable basis

for comparison of our ongoing results of operations.

Adjusted Operating Profit from Continuing Operations: FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 FY 2017

Operating Profit from Continuing Operations 103.0$ 31.6$ 37.5$ 30.8$ 6.2$ 106.1$ 26.6$ 39.5$ 38.5$ 20.1$ 124.7$

Plus: Restructuring and Impairment Expense 14.6 1.8 0.9 1.3 21.6 25.6 1.1 1.6 1.5 3.9 8.1

Plus: Purchase accounting adjustments 7.5 3.1 3.1 3.0 3.1 12.3 7.9 5.9 5.4 5.4 24.6

Adjusted Operating Profit from Continuing Operations 125.1$ 36.5$ 41.5$ 35.1$ 30.9$ 144.0$ 35.6$ 47.0$ 45.4$ 29.4$ 157.4$

Adjusted Operating Margin from Continuing Operations 16.4% 17.0% 19.1% 16.8% 15.6% 17.1% 15.3% 18.4% 17.6% 12.5% 16.0%

Adjusted Net Income (Loss) from Continuing Operations: FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 FY 2017

Net income from continuing operations 90.5$ 21.1$ 26.0$ 18.7$ 17.0$ 82.8$ 13.7$ 22.3$ 25.7$ (27.3)$ 34.4$

Plus: Restructuring and impairment expense 14.6 1.8 0.9 1.3 21.6 25.6 1.1 1.6 1.5 3.9 8.1

Less: Tax impact of restructuring and impairment expense (2.7) (0.4) (0.3) (0.5) (9.0) (10.2) (0.4) (0.4) (0.4) (0.2) (1.4)

Plus: Purchase accounting adjustments 7.5 3.1 3.1 3.0 3.1 12.3 7.9 5.9 5.4 5.4 24.6

Less: Tax impact of purchase accounting adjustments (2.8) (1.2) (1.2) (1.0) (1.1) (4.5) (2.5) (1.9) (1.5) (1.9) (7.8)

Plus: Transitional tax adjustment - - - - - - - - - 48.7 48.7

Less: Net deferred tax movements, one-time tax expense & income tax

valuation allow ance

- - (0.4) 1.3 (7.4) (6.5) - - - (9.1) (9.1)

Adjusted Net Income from Continuing Operations 107.1$ 24.4$ 28.1$ 22.8$ 24.2$ 99.5$ 19.8$ 27.5$ 30.7$ 19.5$ 97.5$

EBIT, Adjusted EBIT and Adjusted EBITDA from Continuing

Operations: FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 FY 2017

Net income from Continuing Operations 90.5$ 21.1$ 26.0$ 18.7$ 17.0$ 82.8$ 13.7$ 22.3$ 25.7$ (27.3)$ 34.4$

Plus: Int t e p se 9.7 4.6 4.1 3.9 4.0 16.6 5.8 6.8 7.4 6.9 26.9

Plus: Tax provision (benefit) 21.6 8.1 9.1 10.7 (12.5) 15.4 7.1 9.9 9.5 43.1 69.6

EBIT from Continuing Operations 121.8 33.8 39.2 33.3 8.5 114.8 26.6 39.0 42.6 22.7 130.9

Plus: Restructuring and impairment expense 14.6 1.8 0.9 1.3 21.6 25.6 1.1 1.6 1.5 3.9 8.1

Adjusted EBIT from Continuing Operations 136.4 35.6 40.1 34.6 30.1 140.4 27.7 40.6 44.1 26.6 139.0

Plus: Depreciation & amortization 41.0 10.8 11.3 11.2 9.5 42.8 16.2 14.8 15.0 15.5 61.5

Adjusted EBITDA from Continuing Operations 177.4$ 46.4$ 51.4$ 45.8$ 39.6$ 183.2$ 43.9$ 55.4$ 59.1$ 42.1$ 200.5$

© 2018 Schweitzer-Mauduit International, Inc. Confidential 25

Non-GAAP Reconciliations & Supplemental Data

Certain financial measures and comments contained in this presentation are “non-GAAP” financial measures, specifically measures which

exclude one or more of the following: restructuring and impairment expenses, depreciation and amortization, interest expense, tax provision

(benefit), capital spending, capitalized software expenditures, purchase accounting adjustments, and tax valuation and transition tax

adjustments. We believe that investors’ understanding is enhanced by disclosing these non-GAAP financial measures as a reasonable basis

for comparison of our ongoing results of operations.

Adjusted Earnings Per Share from Continuing Operations -

Diluted FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 FY 2017

Diluted net income per share from continuing operations 2.96$ 0.69$ 0.85$ 0.61$ 0.55$ 2.70$ 0.45$ 0.72$ 0.84$ (0.89)$ 1.12$

Plus: Purchase accounting adjustments, per share 0.25 0.10 0.10 0.10 0.10 0.40 0.26 0.19 0.18 0.18 0.81

Less: Tax impact of purchase accounting adjustments, per share (0.09) (0.04) (0.03) (0.04) (0.04) (0.15) (0.08) (0.07) (0.04) (0.06) (0.25)

Plus: Restructuring and impairment expense, per share 0.48 0.06 0.03 0.04 0.71 0.84 0.04 0.05 0.04 0.13 0.26

Less: Tax impact of restructuring and impairment expense, per share (0.09) (0.01) (0.02) (0.01) (0.29) (0.33) (0.01) (0.01) (0.02) (0.01) (0.05)

Plus: Transitional tax adjustment - - - - - - - - - 1.59 1.59

Less: Net deferred tax movements, one-time tax expense & income tax

valuation allow ance

- - (0.01) 0.04 (0.23) (0.20) - - - (0.30) (0.30)

Adjusted Earnings Per Share from Continuing Operations -

Diluted

3.51$ 0.80$ 0.92$ 0.74$ 0.80$ 3.26$ 0.66$ 0.88$ 1.00$ 0.64$ 3.18$

Adjusted Diluted Earnings Per Share: FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 FY 2017

Diluted net income, per share 2.94$ 0.69$ 0.85$ 0.61$ 0.55$ 2.70$ 0.45$ 0.72$ 0.84$ (0.89)$ 1.12$

Plus: Purchase accounting adjustments, per share 0.25 0.10 0.10 0.10 0.10 0.40 0.26 0.19 0.18 0.18 0.81

Less: Tax impact of purchase accounting adjustments, per share (0.09) (0.04) (0.03) (0.04) (0.04) (0.15) (0.08) (0.07) (0.04) (0.06) (0.25)

Plus: Restructuring and impairment expense, per share - Continuing

Operations

0.48 0.06 0.03 0.04 0.71 0.84 0.04 0.05 0.04 0.13 0.26

Less: Tax impact of restructuring and impairment expense, per share -

Continuing Operations

(0.09) (0.01) (0.02) (0.01) (0.29) (0.33) (0.01) (0.01) (0.02) (0.01) (0.05)

Plus: Transitional tax adjustment - - - - - - - - - 1.59 1.59

Less: Net deferred tax movements, one-time tax expense & income tax

valuation allow ance

- - (0.01) 0.04 (0.23) (0.20) - - - (0.30) (0.30)

Adju t E rn gs Per Share - Diluted 3.49$ 0.80$ 0.92$ 0.74$ 0.80$ 3.26$ 0.66$ 0.88$ 1.00$ 0.64$ 3.18$

Free Cash Flow FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 FY 2017

Cash provided by Operating Activities by Continuing Operations 144.6$ 17.7$ 34.6$ 30.8$ 46.6$ 129.7$ 12.9$ 31.9$ 48.4$ 37.7$ 130.9$

Less: Capital spending (24.2) (4.5) (5.2) (7.8) (10.3) (27.8) (11.1) (8.2) (8.2) (9.7) (37.2)

Less: Capitalized softw are expenditure (0.9) (0.2) (0.7) (0.8) (1.1) (2.8) (0.8) (0.8) (1.0) (0.9) (3.5)

Free Cash Flow 119.5$ 13.0$ 28.7$ 22.2$ 35.2$ 99.1$ 1.0$ 22.9$ 39.2$ 27.1$ 90.2$

© 2018 Schweitzer-Mauduit International, Inc. Confidential 26

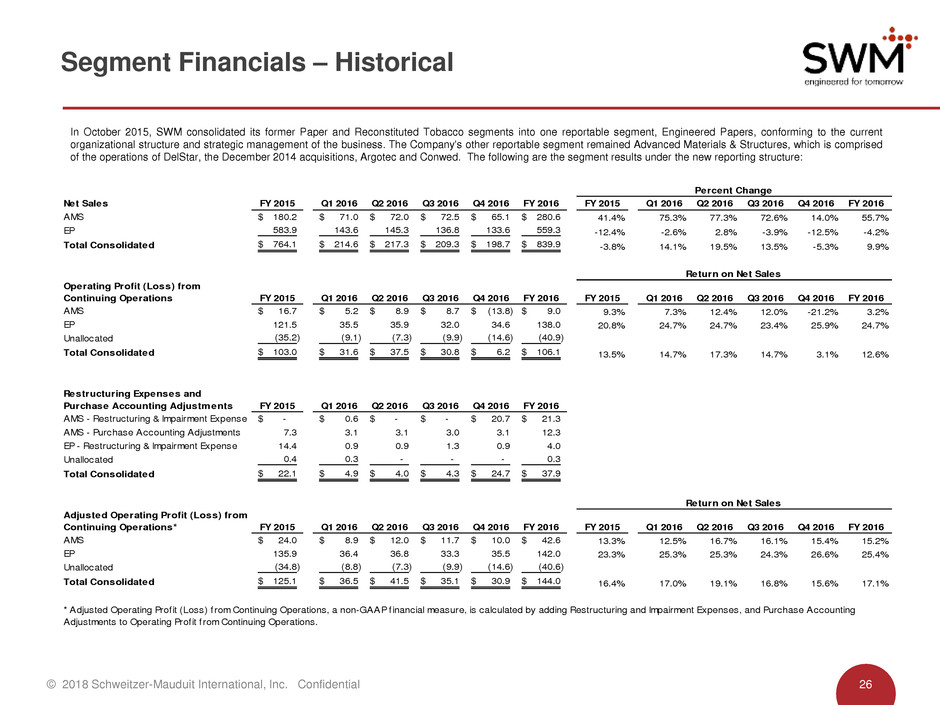

Segment Financials – Historical

In October 2015, SWM consolidated its former Paper and Reconstituted Tobacco segments into one reportable segment, Engineered Papers, conforming to the current

organizational structure and strategic management of the business. The Company's other reportable segment remained Advanced Materials & Structures, which is comprised

of the operations of DelStar, the December 2014 acquisitions, Argotec and Conwed. The following are the segment results under the new reporting structure:

Net Sales FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016

AMS 180.2$ 71.0$ 72.0$ 72.5$ 65.1$ 280.6$ 41.4% 75.3% 77.3% 72.6% 14.0% 55.7%

EP 583.9 143.6 145.3 136.8 133.6 559.3 -12.4% -2.6% 2.8% -3.9% -12.5% -4.2%

Total Consolidated 764.1$ 214.6$ 217.3$ 209.3$ 198.7$ 839.9$ -3.8% 14.1% 19.5% 13.5% -5.3% 9.9%

Operating Profit (Loss) from

Continuing Operations FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016

AMS 16.7$ 5.2$ 8.9$ 8.7$ (13.8)$ 9.0$ 9.3% 7.3% 12.4% 12.0% -21.2% 3.2%

EP 121.5 35.5 35.9 32.0 34.6 138.0 20.8% 24.7% 24.7% 23.4% 25.9% 24.7%

Unallocated (35.2) (9.1) (7.3) (9.9) (14.6) (40.9)

Total Consolidated 103.0$ 31.6$ 37.5$ 30.8$ 6.2$ 106.1$ 13.5% 14.7% 17.3% 14.7% 3.1% 12.6%

Restructuring Expenses and

Purchase Accounting Adjustments FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016

AMS - Restructuring & Impairment Expense -$ 0.6$ -$ -$ 20.7$ 21.3$

AMS - Purchase Accounting Adjustments 7.3 3.1 3.1 3.0 3.1 12.3

EP - Restructuring & Impairment Expense 14.4 0.9 0.9 1.3 0.9 4.0

Unallocated 0.4 0.3 - - - 0.3

Total Consolidated 22.1$ 4.9$ 4.0$ 4.3$ 24.7$ 37.9$

Adjusted Operating Profit (Loss) from

Continuing Operations* FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016 FY 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 FY 2016

AMS 24.0$ 8.9$ 12.0$ 11.7$ 10.0$ 42.6$ 13.3% 12.5% 16.7% 16.1% 15.4% 15.2%

EP 135.9 36.4 36.8 33.3 35.5 142.0 23.3% 25.3% 25.3% 24.3% 26.6% 25.4%

Unallocated (34.8) (8.8) (7.3) (9.9) (14.6) (40.6)

Total Consolidated 125.1$ 36.5$ 41.5$ 35.1$ 30.9$ 144.0$ 16.4% 17.0% 19.1% 16.8% 15.6% 17.1%

Percent Change

Return on Net Sales

* Adjusted Operating Profit (Loss) from Continuing Operations, a non-GAAP financial measure, is calculated by adding Restructuring and Impairment Expenses, and Purchase Accounting

Adjustments to Operating Profit from Continuing Operations.

Return on Net Sales

© 2018 Schweitzer-Mauduit International, Inc. Confidential 27

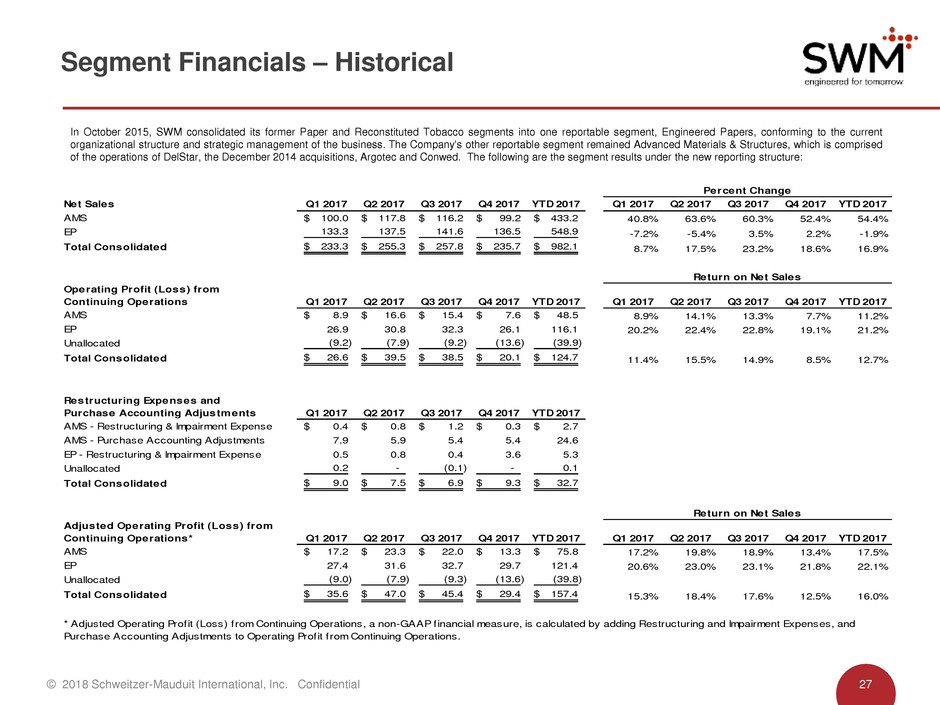

Segment Financials – Historical

In October 2015, SWM consolidated its former Paper and Reconstituted Tobacco segments into one reportable segment, Engineered Papers, conforming to the current

organizational structure and strategic management of the business. The Company's other reportable segment remained Advanced Materials & Structures, which is comprised

of the operations of DelStar, the December 2014 acquisitions, Argotec and Conwed. The following are the segment results under the new reporting structure:

Net Sales Q1 2017 Q2 2017 Q3 2017 Q4 2017 YTD 2017 Q1 2017 Q2 2017 Q3 2017 Q4 2017 YTD 2017

AMS 100.0$ 117.8$ 116.2$ 99.2$ 433.2$ 40.8% 63.6% 60.3% 52.4% 54.4%

EP 133.3 137.5 141.6 136.5 548.9 -7.2% -5.4% 3.5% 2.2% -1.9%

Total Consolidated 233.3$ 255.3$ 257.8$ 235.7$ 982.1$ 8.7% 17.5% 23.2% 18.6% 16.9%

Operating Profit (Loss) from

Continuing Operations Q1 2017 Q2 2017 Q3 2017 Q4 2017 YTD 2017 Q1 2017 Q2 2017 Q3 2017 Q4 2017 YTD 2017

AMS 8.9$ 16.6$ 15.4$ 7.6$ 48.5$ 8.9% 14.1% 13.3% 7.7% 11.2%

EP 26.9 30.8 32.3 26.1 116.1 20.2% 22.4% 22.8% 19.1% 21.2%

Unallocated (9.2) (7.9) (9.2) (13.6) (39.9)

Total Consolidated 26.6$ 39.5$ 38.5$ 20.1$ 124.7$ 11.4% 15.5% 14.9% 8.5% 12.7%

Restructuring Expenses and

Purchase Accounting Adjustments Q1 2017 Q2 2017 Q3 2017 Q4 2017 YTD 2017

AMS - Restructuring & Impairment Expense 0.4$ 0.8$ 1.2$ 0.3$ 2.7$

AMS - Purchase Accounting Adjustments 7.9 5.9 5.4 5.4 24.6

EP - Restructuring & Impairment Expense 0.5 0.8 0.4 3.6 5.3

Unallocated 0.2 - (0.1) - 0.1

Total Consolidated 9.0$ 7.5$ 6.9$ 9.3$ 32.7$

Adjusted Operating Profit (Loss) from

Continuing Operations* Q1 2017 Q2 2017 Q3 2017 Q4 2017 YTD 2017 Q1 2017 Q2 2017 Q3 2017 Q4 2017 YTD 2017

AMS 17.2$ 23.3$ 22.0$ 13.3$ 75.8$ 17.2% 19.8% 18.9% 13.4% 17.5%

EP 27.4 31.6 32.7 29.7 121.4 20.6% 23.0% 23.1% 21.8% 22.1%

Unallocated (9.0) (7.9) (9.3) (13.6) (39.8)

Total Consolidated 35.6$ 47.0$ 45.4$ 29.4$ 157.4$ 15.3% 18.4% 17.6% 12.5% 16.0%

Percent Change

Return on Net Sales

Return on Net Sales

* Adjusted Operating Profit (Loss) from Continuing Operations, a non-GAAP financial measure, is calculated by adding Restructuring and Impairment Expenses, and

Purchase Accounting Adjustments to Operating Profit from Continuing Operations.