Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - RED ROBIN GOURMET BURGERS INC | exhibit991q4-2017.htm |

| 8-K - 8-K - RED ROBIN GOURMET BURGERS INC | a8-kq4x2017.htm |

CLASSIFIED – INTERNAL USE

Fourth Quarter 2017 Results

February 22, 2018

2CLASSIFIED – INTERNAL USE

Forward-Looking Statements

Forward-looking statements in this presentation regarding the Company’s future performance, revenues and

timing thereof, service model changes, new restaurant openings, tax rate, sensitivity of earnings per share

and other projected financial measures, statements under the heading “Outlook for 2018”, and all other

statements that are not historical facts, are made under the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These statements are based on assumptions believed by the Company to be

reasonable and speak only as of the date on which such statements are made. Without limiting the generality

of the foregoing, words such as “expect,” “believe,” “anticipate,” “intend,” “plan,” “project,” “will” or “estimate,”

or the negative or other variations thereof or comparable terminology are intended to identify forward-looking

statements. Except as required by law, the Company undertakes no obligation to update such statements to

reflect events or circumstances arising after such date, and cautions investors not to place undue reliance on

any such forward-looking statements. Forward-looking statements involve risks and uncertainties that could

cause actual results to differ materially from those described in the statements based on a number of factors,

including but not limited to the following: the effectiveness of the Company’s strategic initiatives; the ability to

fulfill planned, and realize the anticipated benefits of completed, expansion and restaurant remodeling; the

effectiveness of our marketing strategies and initiatives to achieve restaurant sales growth; the cost and

availability of key food products, labor, and energy; the ability to achieve anticipated revenue and cost

savings from anticipated new technology systems and tools in the restaurants and other initiatives; the ability

to develop, test, implement and increase online ordering, to-go services, catering and other off-premise sales;

the ability to increase labor productivity through alternative labor models; availability of capital or credit facility

borrowings; the adequacy of cash flows or available debt resources to fund operations and growth

opportunities; federal, state, and local regulation of the Company’s business; and other risk factors described

from time to time in the Company’s Form 10-K, Form 10-Q, and Form 8-K reports (including all amendments

to those reports) filed with the U.S. Securities and Exchange Commission.

This presentation may also contain non-GAAP financial information. Management uses this information in its

internal analysis of results and believes that this information may be informative to investors in gauging the

quality of the Company’s financial performance, identifying trends in results, and providing meaningful period-

to-period comparisons. For a reconciliation of non-GAAP measures presented in this document, see the

Appendix of this presentation or the Schedules to the Q4 press release posted on redrobin.com.

3CLASSIFIED – INTERNAL USE

Our Red Robin Values

4CLASSIFIED – INTERNAL USE

Red Robin Q4-2017 Results

• Total revenues increased 17.5%

• Comparable restaurant revenue increased

2.7% (using constant currency rates)

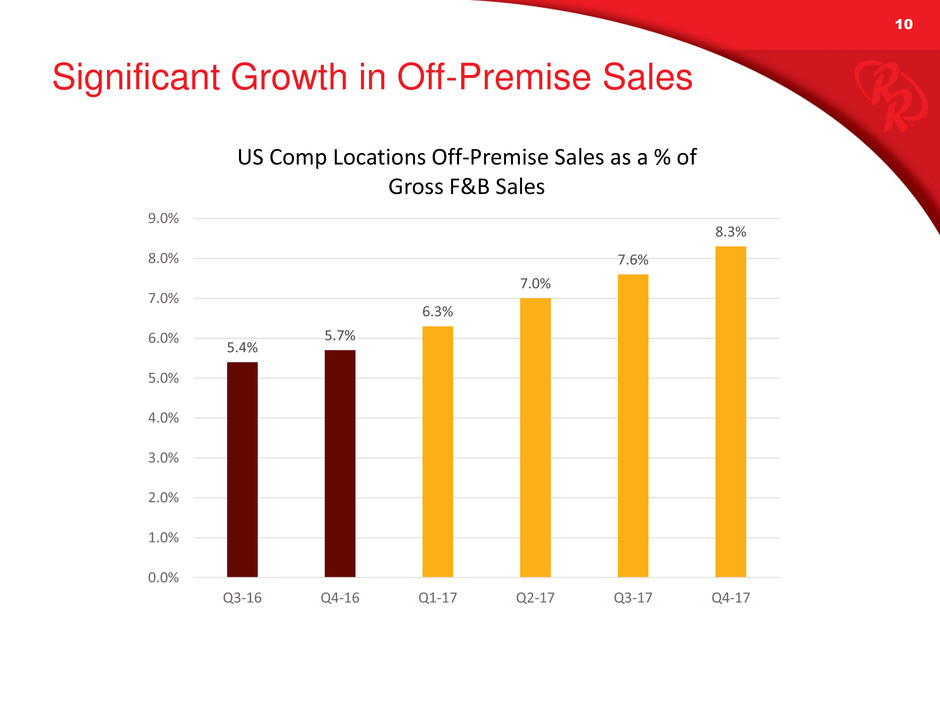

• Off-premise revenues increased to 8.3% of

total food and beverage sales

• Restaurant-level operating profit(1) was

20.5% compared to 19.8% in the prior year

• Adjusted EBITDA(1) was $35.8 million

• Earnings per diluted share were $0.68

compared to loss per diluted share of $0.68

in Q4 2016. Adjusted diluted EPS(1) were

$0.78 compared to $0.35 in the prior year

• Opened 1 new Red Robin® restaurants net

of 1 closure

(1) See reconciliations of non-GAAP financial measures to the most

comparable GAAP financial measures in Appendix.

5CLASSIFIED – INTERNAL USE

Six Consecutive Quarters of Traffic

Outperformance vs. Competitors

Source: Based on Black Box Intelligence Casual Dining (All Cuisine) peers as of 12/31/2017

-1.5%

-0.9%

-0.6%

1.2%

2.2%

1.2%

3.6%

4.0%

3.6%

-2.0%

-1.0%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17

6CLASSIFIED – INTERNAL USE

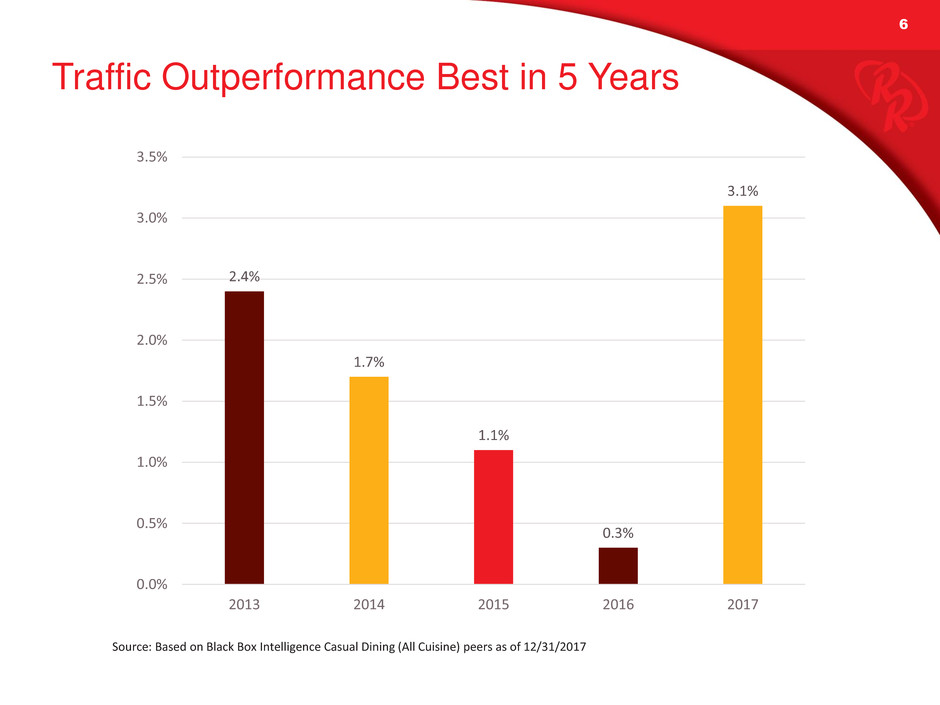

Traffic Outperformance Best in 5 Years

Source: Based on Black Box Intelligence Casual Dining (All Cuisine) peers as of 12/31/2017

2.4%

1.7%

1.1%

0.3%

3.1%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

2013 2014 2015 2016 2017

7CLASSIFIED – INTERNAL USE

Continued Improvement in

Net Promoter Scores

6.0%

6.5%

7.0%

7.5%

8.0%

8.5%

9.0%

9.5%

60

62

64

66

68

70

72

2016 Q1 2016 Q2 2016 Q3 2016 Q4 2017 Q1 2017 Q2 2017 Q3 2017 Q4

D

et

rac

to

rs

as

%

N

et

P

rom

o

te

r

Sc

o

re

Guest Voice In-Restaurant - RRGB USA

NPS Score Detractors (Score %)

8CLASSIFIED – INTERNAL USE

Everyday Value Matters to Our Guests…

9

…And We Are Making Progress

26

31

36

41

46

51

38 40 42 44 46 48 50 52 54 56 58

In

te

n

t

to

R

ec

o

m

m

en

d

T

o

p

B

o

x

%

Value Top Box %

Major Casual Dining Chains – Value vs. Intent to Recommend

Source: Technomic, 12 months ending Dec ‘17

2017

Q4 ‘15 – Q3 ’16

Baseline

10CLASSIFIED – INTERNAL USE

Significant Growth in Off-Premise Sales

5.4%

5.7%

6.3%

7.0%

7.6%

8.3%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

Q3-16 Q4-16 Q1-17 Q2-17 Q3-17 Q4-17

US Comp Locations Off-Premise Sales as a % of

Gross F&B Sales

11CLASSIFIED – INTERNAL USE

Our Strategic Priorities

• Maximize brand equities to ensure

a strong foundation

• Rapidly pilot and rollout

transformational changes

• Conceptualize and test

revolutionary new approaches

We will measure ourselves against

the best in class in our business!

CLASSIFIED – INTERNAL USE 12

Financial Update

13CLASSIFIED – INTERNAL USE

Comparable Restaurant Revenue

Trend(1)

3.1%

2.9%

3.5%

-2.0%

-2.6%

-3.2%

-3.6%

-4.3%

-1.2%

0.5%

-0.1%

2.7%

-4.5%

-2.5%

-0.5%

1.5%

3.5%

5.5%

Q1-15 Q2-15 Q3-15 Q4-15 Q1-16 Q2-16 Q3-16 Q4-16 Q1-17 Q2-17 Q3-17 Q4-17

(1) Calculated at constant currency rates

14CLASSIFIED – INTERNAL USE

Consistently Outperforming Peers

On Traffic…

Source: Based on Black Box Intelligence Casual Dining (All Cuisine) peers as of 12/31/2017

-1.5%

-0.9%

-0.6%

1.2%

2.2%

1.2%

3.6%

4.0%

3.6%

-2.0%

-1.0%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17

15CLASSIFIED – INTERNAL USE

…And Outperforming Peers on Sales

Source: Based on Black Box Intelligence Casual Dining (All Cuisine) peers as of 12/31/2017

-0.7%

-1.4%

-1.3%

0.0%

0.3%

1.9%

2.3%

2.1%

-2.0%

-1.5%

-1.0%

-0.5%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17

16CLASSIFIED – INTERNAL USE

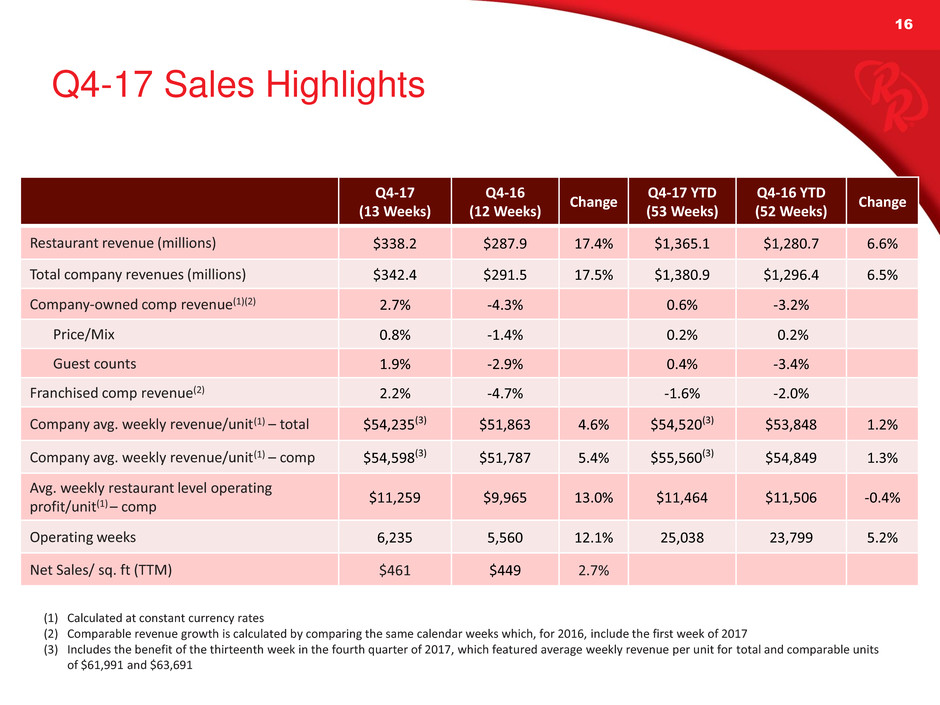

Q4-17 Sales Highlights

Q4-17

(13 Weeks)

Q4-16

(12 Weeks)

Change

Q4-17 YTD

(53 Weeks)

Q4-16 YTD

(52 Weeks)

Change

Restaurant revenue (millions) $338.2 $287.9 17.4% $1,365.1 $1,280.7 6.6%

Total company revenues (millions) $342.4 $291.5 17.5% $1,380.9 $1,296.4 6.5%

Company-owned comp revenue(1)(2) 2.7% -4.3% 0.6% -3.2%

Price/Mix 0.8% -1.4% 0.2% 0.2%

Guest counts 1.9% -2.9% 0.4% -3.4%

Franchised comp revenue(2) 2.2% -4.7% -1.6% -2.0%

Company avg. weekly revenue/unit(1) – total $54,235(3) $51,863 4.6% $54,520(3) $53,848 1.2%

Company avg. weekly revenue/unit(1) – comp $54,598(3) $51,787 5.4% $55,560(3) $54,849 1.3%

Avg. weekly restaurant level operating

profit/unit(1) – comp

$11,259 $9,965 13.0% $11,464 $11,506 -0.4%

Operating weeks 6,235 5,560 12.1% 25,038 23,799 5.2%

Net Sales/ sq. ft (TTM) $461 $449 2.7%

(1) Calculated at constant currency rates

(2) Comparable revenue growth is calculated by comparing the same calendar weeks which, for 2016, include the first week of 2017

(3) Includes the benefit of the thirteenth week in the fourth quarter of 2017, which featured average weekly revenue per unit for total and comparable units

of $61,991 and $63,691

17CLASSIFIED – INTERNAL USE

23.2%

22.6%

22.1% 22.2%

22.8%

21.4%

19.1%

19.8%

21.3%

20.8%

18.6%

20.5%

16.0%

17.0%

18.0%

19.0%

20.0%

21.0%

22.0%

23.0%

24.0%

25.0%

Q1 Q2 Q3 Q4

2015 2016 2017

Restaurant Level Operating Profit

(1)(2)

Margins

17

(1) See Appendix for reconciliation of non-GAAP restaurant-level operating profit to net income (loss)

(2) Prior period local marketing costs have been reclassified from Other operating to Selling to conform with the current

period presentation

YTD 2017: 20.4%

YTD 2016: 20.9%

YTD 2015: 22.6%

18CLASSIFIED – INTERNAL USE

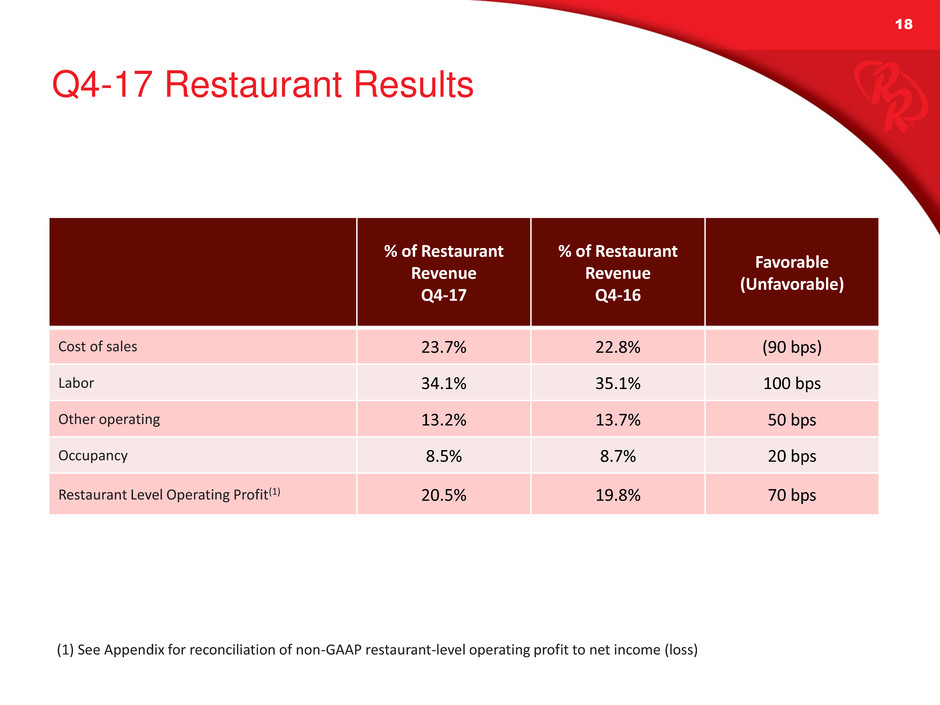

Q4-17 Restaurant Results

18

% of Restaurant

Revenue

Q4-17

% of Restaurant

Revenue

Q4-16

Favorable

(Unfavorable)

Cost of sales 23.7% 22.8% (90 bps)

Labor 34.1% 35.1% 100 bps

Other operating 13.2% 13.7% 50 bps

Occupancy 8.5% 8.7% 20 bps

Restaurant Level Operating Profit(1) 20.5% 19.8% 70 bps

(1) See Appendix for reconciliation of non-GAAP restaurant-level operating profit to net income (loss)

19CLASSIFIED – INTERNAL USE

$45.5

$33.6

$30.0

$34.3

$48.9

$33.5

$26.8

$29.2

$45.8

$32.3

$25.5

$35.8

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

$40.0

$45.0

$50.0

$55.0

Q1 Q2 Q3 Q4

2015 2016 2017

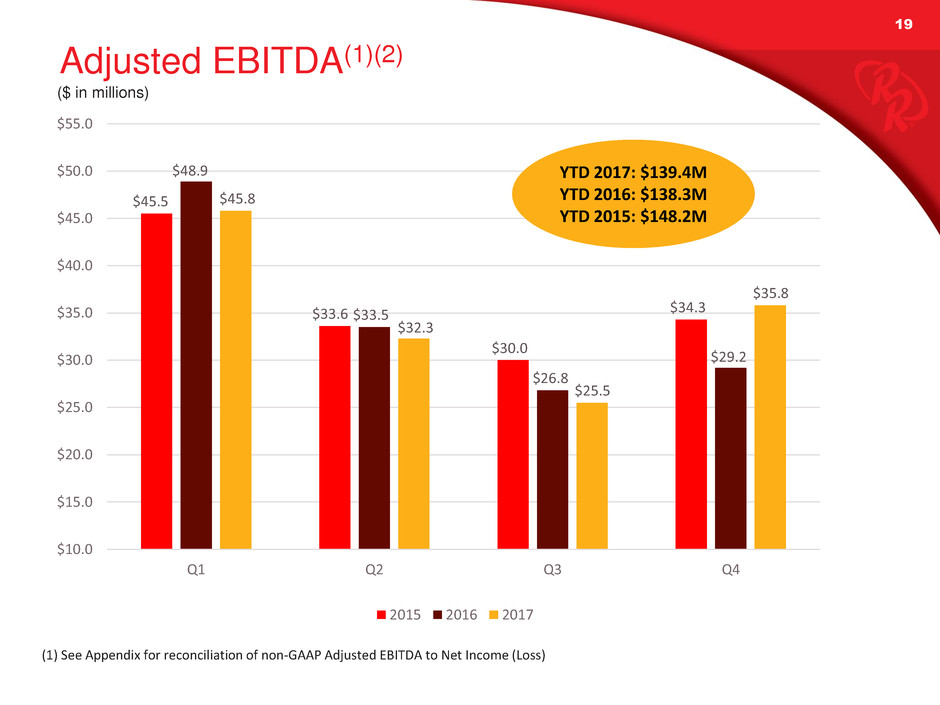

Adjusted EBITDA(1)(2)

($ in millions)

19

(1) See Appendix for reconciliation of non-GAAP Adjusted EBITDA to Net Income (Loss)

YTD 2017: $139.4M

YTD 2016: $138.3M

YTD 2015: $148.2M

20CLASSIFIED – INTERNAL USE

Adjusted Earnings Per Diluted Share

$1.10

$0.78

$0.58

$0.86

$1.27

$0.75

$0.38

$0.35

$0.89

$0.61

$0.21

$0.78

$0.15

$0.35

$0.55

$0.75

$0.95

$1.15

$1.35

Q1 Q2 Q3 Q4

2015 2016 2017

20

See Appendix for reconciliation of non-GAAP Adjusted Earnings Per Diluted Share to Earnings (Loss) Per Diluted Share

YTD 2017: $2.49

YTD 2016: $2.78

YTD 2015: $3.32

21CLASSIFIED – INTERNAL USE

Outlook for 2018

• Comparable restaurant sales growth of 50 to 150 basis points, with operating weeks

to decline 1% as a result of having only 52 weeks in 2018 compared to 53 weeks in

2017, offset by the impact of new unit growth in 2017 and 2018; total revenue

between a decline of 50 basis points and an increase of 50 basis points in 2018

• Cost of sales up by 50 to 100 bps

• Restaurant labor costs between an increase of 25 bps and a decrease of 25 bps

• Other operating expenses flat to down 50 bps

• Depreciation and amortization approximately $95 million

• General and administrative expense $85 to $90 million

• Selling expense up slightly as a percentage of revenue

• Pre-opening costs approximately $3 million

• Income tax rate between 0% and 5%

• Earnings per diluted share projected to range from $2.40 to $2.80, with Q1 earnings

per diluted share between $0.60 and $0.80

• Overall capital expenditures between $65 million and $75 million

• Approximately 3 to 5 new Red Robin locations net of closures

22CLASSIFIED – INTERNAL USE

Thank you to all of our Team Members!

17

CLASSIFIED – INTERNAL USE 23

Appendix

24CLASSIFIED – INTERNAL USE

Adjusted Net Income(1)

$15.6

$11.2

$8.3

$12.0

$17.6

$10.3

$5.0

$4.5

$11.6

$7.9

$2.7

$10.2

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

$16.0

$18.0

Q1 Q2 Q3 Q4

2015 2016 2017

($ in millions)

24

(1) See Appendix for reconciliation of non-GAAP Adjusted Net Income to Net Income (Loss)

YTD 2017: $32.3M

YTD 2016: $37.4M

YTD 2015: $47.1M

25CLASSIFIED – INTERNAL USE

$36.0

$31.3

$34.0

$39.6

$42.5

$24.6

$27.6

$4.3

$70.0

$34.7

$16.9

$35.0

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

$80.0

Q1 Q2 Q3 Q4

2015 2016 2017

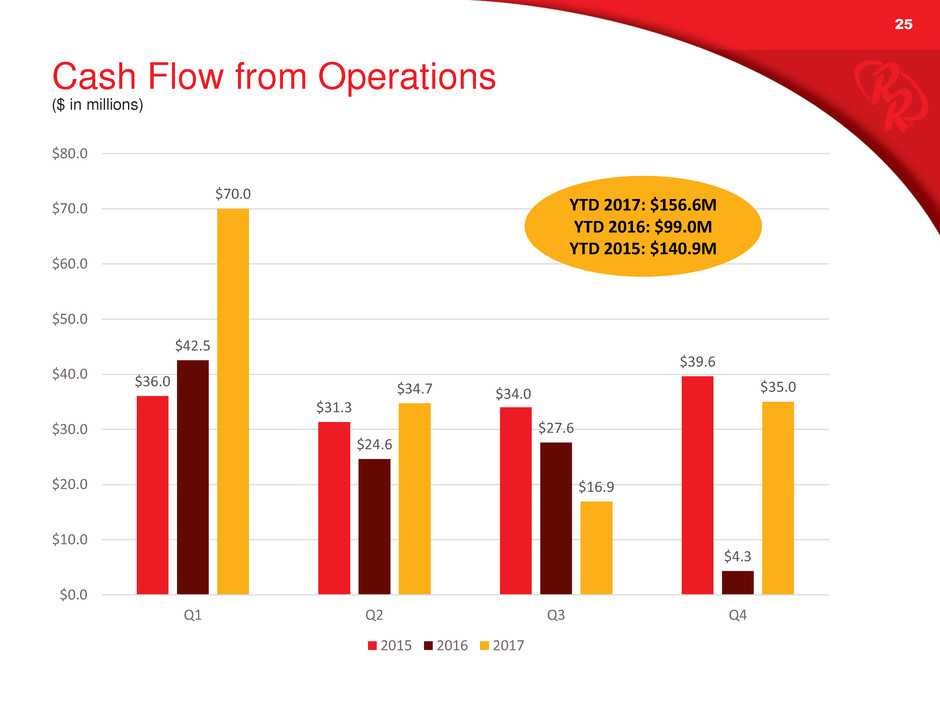

Cash Flow from Operations

($ in millions)

25

YTD 2017: $156.6M

YTD 2016: $99.0M

YTD 2015: $140.9M

26CLASSIFIED – INTERNAL USE

Q4-17 Commodity Update

26

% of Total

COGS in Q4-17

Market vs. Contract

Ground beef 13.3% Market

Steak fries 11.5% 100% contracted through 10/19

Poultry 9.5% 100% contracted though 12/18

Produce 8.0% 70% contracted through 10/18

Meat 7.6% Prime rib and bacon 100% contracted through 4/18

Bread 6.2% Frozen bread 100% contracted through 3/18

Seafood 3.1% Cod and Shrimp 100% contracted through 6/18

Fry oil 1.7% 100% contracted through 11/18

27CLASSIFIED – INTERNAL USE

Reconciliation of Adjusted Net Income to Net Income

(Loss) and Adjusted Earnings Per Diluted Share to

Earnings (Loss) Per Diluted Share

27

($ in thousands, except per share data)

2015 2016 2017

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Net income (loss) as reported $ 16,565 $ 11,166 $ 8,282 $ 11,691 $ 14,225 $ 7,552 $ (1,300) $ (8,752) $ 11,567 $ 6,931 $ 2,714 $ 8,807

Adjustments to net income (loss):

Asset impairment and restaurant

closure costs

- - - 581 825 3,860 9,321 20,420 - 1,584 - 5,330

Litigation contingencies - - - - 3,900 - - - - - -

Reorganization costs - - - - - - - 1,322 - - -

Change in estimate for gift card

breakage

(1,369) - - - - - - - - - -

Income tax (expense) benefit of adj. 439 - - (227) (1,356) (1,153) (2,993) (8,470) - (618) - (1,175)

Deferred tax liability remeasurement

due to Tax Cuts and Jobs Act

- - - - - - - - - - - (2,808)

Adjusted net income $ 15,635 $ 11,166 $ 8,282 $ 12,045 $ 17,594 $ 10,259 $ 5,028 $ 4,520 $ 11,567 $ 7,897 $ 2,714 $ 10,154

Diluted net income (loss) per share(1):

Net income (loss) as reported $ 1.16 $ 0.78 $ 0.58 $ 0.84 $ 1.03 $ 0.55 $ (0.10) $ (0.68) $ 0.89 $ 0.53 $ 0.21 $ 0.68

Adjustments to net income (loss):

Asset impairment and restaurant

closure costs

- - - 0.04 0.06 0.28 0.70 1.58 - 0.12 - 0.41

Litigation contingencies - - - - 0.28 - - - - - - -

Reorganization costs - - - - - - - 0.10 - - - -

Change in estimate for gift card

breakage

(0.09) - - - - - - - - - - -

Income tax (expense) benefit of adj. 0.03 - - (0.02) (0.10) (0.08) (0.22) (0.65) - (0.04) - (0.09)

Deferred tax liability remeasurement

due to Tax Cuts and Jobs Act

- - - - - - - - - - - (0.22)

Adjusted EPS - diluted $ 1.10 $ 0.78 $ 0.58 $ 0.86 $ 1.27 $ 0.75 $ 0.38 $ 0.35 $ 0.89 $ 0.61 $ 0.21 $ 0.78

(1) For the third and fourth quarters of 2016, the impact of dilutive shares is included in the calculations as the adjustments for the quarter resulted in adjusted net

income. In the fourth quarter of 2016, the calculation for Asset impairment and restaurant closure costs includes $0.01 related to the effect of the diluted shares on net

loss per share as reported.

28CLASSIFIED – INTERNAL USE

Restaurant Level Operating Profit Reconciliation

to Income from Operations and Net Income (Loss)

($ in thousands)

2015 2016 2017

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Restaurant revenue $ 388,509 $ 288,704 $ 279,496 $ 282,189 $ 396,770 $ 302,117 $ 293,858 $ 287,924 $ 413,451 $ 312,351 $ 301,100 $ 338,154

Restaurant operating costs(1):

Cost of sales 97,950 71,665 68,197 66,825 92,325 70,831 69,447 65,646 94,607 73,903 71,642 80,203

Labor 124,356 93,513 92,097 93,551 132,984 102,847 102,294 101,107 145,519 108,422 106,205 115,286

Other operating(2) 45,827 34,959 34,604 35,377 48,587 38,986 40,834 39,319 52,064 40,057 41,454 44,734

Occupancy 30,147 23,210 22,804 23,846 32,498 24,905 25,121 24,884 33,119 25,140 25,868 28,626

Restaurant-level operating profit 90,229 65,357 61,794 62,590 90,376 64,549 56,161 56,968 88,142 64,828 55,932 69,309

Add – Franchise royalties, fees,

and other revenue

6,392 4,275 3,916 4,111 5,356 3,432 3,449 3,535 5,106 3,420 3,148 4,195

Deduct – Other operating:

Depreciation and amortization 23,003 17,260 18,618 18,493 23,951 19,159 21,468 22,117 28,044 21,173 21,258 22,070

General and administrative

expenses

34,995 23,044 23,709 21,257 31,980 19,972 20,328 19,015 30,913 21,927 18,562 21,874

Selling(2) 13,825 11,478 9,439 8,910 12,529 12,337 10,345 11,381 14,978 12,822 13,701 15,243

Pre-opening and acquisition costs 955 1,369 2,239 2,445 2,372 2,238 2,382 1,033 1,855 1,377 1,503 835

Other charges(2) - - - 581 4,725 3,860 9,321 21,742 - 1,584 - 5,330

Total other operating 72,778 53,152 54,005 51,686 75,557 57,566 63,845 75,288 75,790 58,882 55,024 65,352

Income (loss) from operations 23,845 16,480 11,705 15,015 20,175 10,415 (4,235) (14,785) 17,458 9,366 4,056 8,152

Interest expense, net and other 1,060 904 1,098 747 1,638 1,486 1,612 2,046 2,984 2,453 2,032 2,543

Income tax expense (benefit) 6,220 4,410 2,325 2,577 4,312 1,377 (4,547) (8,079) 2,907 (18) (690) (3,198)

Total other 7,280 5,314 3,423 3,324 5,950 2,863 (2,935) (6,033) 5,891 2,435 1,342 (655)

Net income (loss) $ 16,565 $ 11,166 $ 8,282 $ 11,691 $ 14,225 $ 7,552 $ (1,300) $ (8,752) $ 11,567 $ 6,931 $ 2,714 $ 8,807

(1) Excluding depreciation and amortization, which is shown separately.

(2) Certain amounts presented in prior periods have been reclassified to conform with the current period presentation.

29CLASSIFIED – INTERNAL USE

EBITDA and Adjusted EBITDA

Reconciliation to Net Income (Loss)

29

2015 2016 2017

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Net income (loss) as

reported

$ 16,565 $ 11,166 $ 8,282 $11,691 $14,225 $ 7,552 $ (1,300) $ (8,752) $ 11,567 $ 6,931 $ 2,714 $ 8,807

Adjustments to net income

(loss):

Income tax expense (benefit) 6,220 4,410 2,325 2,577 4,312 1,377 (4,547) (8,079) 2,907 (18) (690) (3,198)

Interest expense, net 1,088 805 777 959 1,655 1,555 1,822 2,161 3,249 2,626 2,222 2,821

Depreciation and

amortization

23,003 17,260 18,618 18,493 23,951 19,159 21,468 22,117 28,044 21,173 21,258 22,070

EBITDA(1).. $ 48,322 $ 33,641 $ 30,002 $ 33,720 $ 44,143 $ 29,643 $ 17,443 $ 7,447 $ 45,767 $ 30,712 $ 25,504 $ 30,500

Asset impairment and

restaurant closure costs

- - - 581 825 3,860 9,321 20,420 - 1,584 - 5,330

Litigation contingencies - - - - 3,900 - - - - - - -

Reorganization costs - - - - - - - 1,322 - - - -

Change in estimate for gift

card breakage

(1,369) - - - - - - - - - - -

Adjusted EBITDA $ 45,507 $ 33,641 $ 30,002 $ 34,301 $ 48,868 $ 33,503 $ 26,764 $ 29,189 $ 45,767 $ 32,296 $ 25,504 $ 35,830

($ in thousands)

(1) To conform with current period presentation and to provide an EBITDA measure comparable to other companies in our industry,

stock-based compensation was excluded from EBITDA in all prior periods presented.