Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Sabra Health Care REIT, Inc. | sbraex9922017q4.htm |

| EX-99.1 - EXHIBIT 99.1 - Sabra Health Care REIT, Inc. | sbraex9912017q4.htm |

| 8-K - 8-K - Sabra Health Care REIT, Inc. | sbra8-k2017q4.htm |

Reconciliations of

Non-GAAP Financial Measures

December 31, 2017

(Unaudited)

2

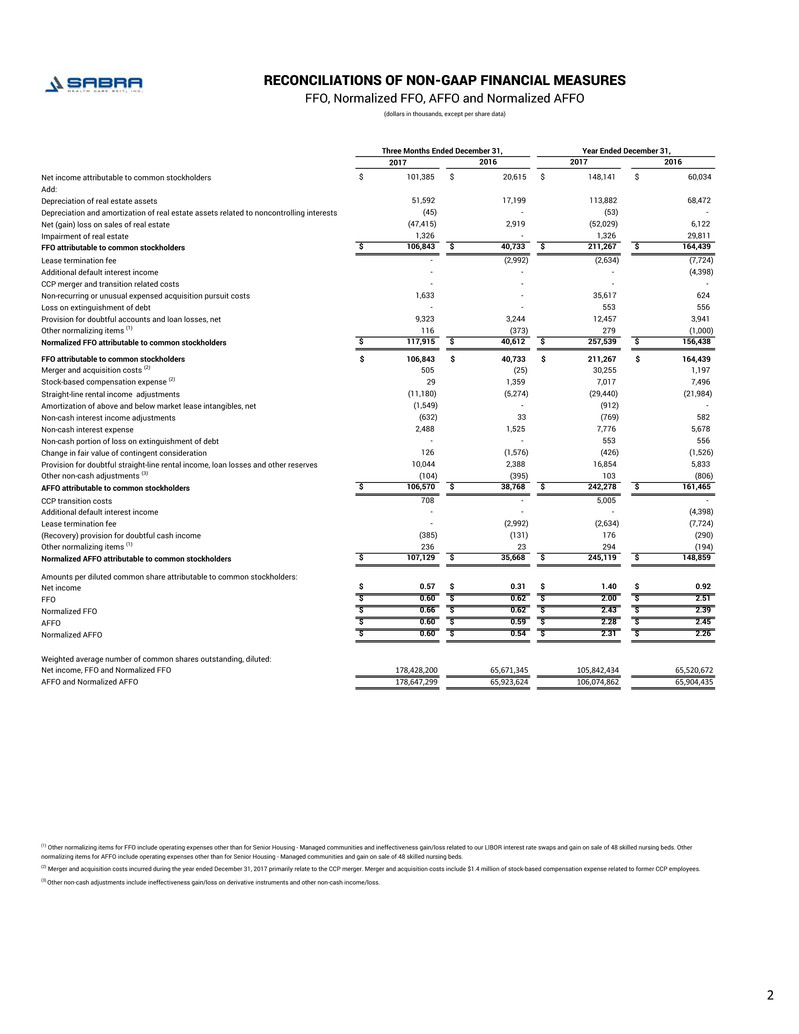

2017 2016 2017 2016

Net income attributable to common stockholders $ 101,385 $ 20,615 $ 148,141 $ 60,034

Add:

Depreciation of real estate assets 51,592 17,199 113,882 68,472

Depreciation and amortization of real estate assets related to noncontrolling interests (45) - (53) -

Net (gain) loss on sales of real estate (47,415) 2,919 (52,029) 6,122

Impairment of real estate 1,326 - 1,326 29,811

FFO attributable to common stockholders $ 106,843 $ 40,733 $ 211,267 $ 164,439

Lease termination fee - (2,992) (2,634) (7,724)

Additional default interest income - - - (4,398)

CCP merger and transition related costs - - - -

Non-recurring or unusual expensed acquisition pursuit costs 1,633 - 35,617 624

Loss on extinguishment of debt - - 553 556

Provision for doubtful accounts and loan losses, net 9,323 3,244 12,457 3,941

Other normalizing items (1) 116 (373) 279 (1,000)

Normalized FFO attributable to common stockholders $ 117,915 $ 40,612 $ 257,539 $ 156,438

FFO attributable to common stockholders 106,843$ 40,733$ 211,267$ 164,439$

Merger and acquisition costs (2) 505 (25) 30,255 1,197

Stock-based compensation expense (2) 29 1,359 7,017 7,496

Straight-line rental income adjustments (11,180) (5,274) (29,440) (21,984)

Amortization of above and below market lease intangibles, net (1,549) - (912) -

Non-cash interest income adjustments (632) 33 (769) 582

Non-cash interest expense 2,488 1,525 7,776 5,678

Non-cash portion of loss on extinguishment of debt - - 553 556

Change in fair value of contingent consideration 126 (1,576) (426) (1,526)

Provision for doubtful straight-line rental income, loan losses and other reserves 10,044 2,388 16,854 5,833

Other non-cash adjustments (3) (104) (395) 103 (806)

AFFO attributable to common stockholders $ 106,570 $ 38,768 $ 242,278 $ 161,465

CCP transition costs 708 - 5,005 -

Additional default interest income - - - (4,398)

Lease termination fee - (2,992) (2,634) (7,724)

(Recovery) provision for doubtful cash income (385) (131) 176 (290)

Other normalizing items (1) 236 23 294 (194)

Normalized AFFO attributable to common stockholders $ 107,129 $ 35,668 $ 245,119 $ 148,859

Amounts per diluted common share attributable to common stockholders:

Net income $ 0.57 $ 0.31 $ 1.40 $ 0.92

FFO $ 0.60 $ 0.62 $ 2.00 $ 2.51

Normalized FFO $ 0.66 $ 0.62 $ 2.43 $ 2.39

AFFO $ 0.60 $ 0.59 $ 2.28 $ 2.45

Normalized AFFO $ 0.60 $ 0.54 $ 2.31 $ 2.26

Weighted average number of common shares outstanding, diluted:

Net income, FFO and Normalized FFO 178,428,200 65,671,345 105,842,434 65,520,672

AFFO and Normalized AFFO 178,647,299 65,923,624 106,074,862 65,904,435

(2) Merger and acquisition costs incurred during the year ended December 31, 2017 primarily relate to the CCP merger. Merger and acquisition costs include $1.4 million of stock-based compensation expense related to former CCP employees.

(3) Other non-cash adjustments include ineffectiveness gain/loss on derivative instruments and other non-cash income/loss.

Year Ended December 31,Three Months Ended December 31,

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

FFO, Normalized FFO, AFFO and Normalized AFFO

(dollars in thousands, except per share data)

(1) Other normalizing items for FFO include operating expenses other than for Senior Housing - Managed communities and ineffectiveness gain/loss related to our LIBOR interest rate swaps and gain on sale of 48 skilled nursing beds. Other

normalizing items for AFFO include operating expenses other than for Senior Housing - Managed communities and gain on sale of 48 skilled nursing beds.

3

Year Ended

December 31, 2017

Net Income attributable to Sabra Health Care REIT, Inc. 158,383$

Interest 88,440

Income tax expense 651

Depreciation and amortization 113,882

EBTIDA 361,356$

Stock-based compensation expense 7,017

Merger and acquisition costs 30,255

CCP transition costs 5,005

Provision for loan losses and other reserves 6,367

Impairment of real estate 1,326

Loss on extinguishment of debt 553

Other income (2,876)

Net gain on sales of real estate (52,029)

Adjusted EBITDA (1) 356,974

Annualizing adjustments (2) 245,348

Annualized Adjusted EBITDA (3) 602,322$

Pro forma adjustments for:

Acquisitions (4) 40,011

Genesis and CCP rent reductions (24,983)

Facilities transitioned to new operator (5,530)

Pro Forma Annualized Adjusted EBITDA (5) 611,820$

Adjustment for:

Unconsolidated joint venture interest expense (6) 18,993

Pro Forma Annualized Adjusted EBITDA, as adjusted 630,813$

(2) Annualizing adjustments give effect to the acquisitions and dispositions completed during the year ended December 31, 2017 as though such acquisitions and dispositions were completed as of January 1, 2017.

(4) Includes the Enlivant and North American Healthcare acquisitions completed subsequent to December 31, 2017 as though such acquisitions were completed at the beginning of the period presented.

(6) Represents Sabra's pro rata share of unconsolidated joint venture interest expense as though our investment in the Enlivant joint venture was completed at the beginning of the period presented.

(5) Pro Forma Annualized Adjusted EBITDA is calculated as Annualized Adjusted EBITDA adjusted to give effect to acquisitions, dispositions and other transactions completed after the period presented as though

such acquisitions, dispositions and other transactions occurred at the beginning of the period.

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

Adjusted EBITDA, Annualized Adjusted EBITDA, Pro Forma Annualized

Adjusted EBITDA, and Pro Forma Annualized Adjusted EBITDA, As Adjusted

(in thousands)

(3) Annualized Adjusted EBITDA is calculated as Adjusted EBITDA as adjusted to give effect to the adjustments described in footnote 2 above.

(1) Adjusted EBITDA is calculated as earnings before interest, taxes, depreciation and amortization (“EBITDA”) excluding the impact of merger-related costs, stock-based compensation expense under the Company's

long-term equity award program and loan loss reserves.

4

Senior Care

Centers Enlivant

Genesis

Healthcare, Inc.

Avamere

Family of

Companies

Signature

Healthcare

Holiday AL

Holdings LP

North

American

Healthcare

Signature

Behavioral

Cadia

Healthcare

The McGuire

Group

All Other

Relationships Corporate Total

Net Income (loss) 19,211$ -$ 113,956$ 13,248$ 8,661$ 24,066$ 7,215$ 9,051$ 7,956$ 5,294$ 109,133$ (159,426)$ 158,365$

Adjustments:

Depreciation and amortization 4,986 - 16,036 4,092 5,042 15,184 2,444 3,223 2,622 2,376 57,010 867 113,882

Interest 1,140 - 4,875 - - - - - - - 1,669 80,756 88,440

General and administrative - - - - - - - - - - - 32,401 32,401

Merger and acquisition costs - - - - - - - - - - - 30,255 30,255

Provision for doubtful accounts and loan losses - - - - - - - - - - - 17,113 17,113

Impairment of real estate - - - - - - - - - - 1,326 - 1,326

Loss on extinguishment of debt - - - - - - - - - - - 553 553

Other income - - - - - - - - - - - (3,170) (3,170)

Net (gain) loss on sale of real estate - - (54,627) - 204 - - - - - 2,394 - (52,029)

Income tax expense - - - - - - - - - - - 651 651

Net Operating Income 25,337$ -$ 80,240$ 17,340$ 13,907$ 39,250$ 9,659$ 12,274$ 10,578$ 7,670$ 171,532$ -$ 387,787$

Non-cash rental income adjustments (2,541) - (1,884) (2,372) 371 (6,245) (1,090) (957) (564) (2,106) (12,964) - (30,352)

Cash Net Operating Income 22,796$ -$ 78,356$ 14,968$ 14,278$ 33,005$ 8,569$ 11,317$ 10,014$ 5,564$ 158,568$ -$ 357,435$

Annualizing adjustments 35,992 - (8,205) 25,101 24,256 859 21,675 18,971 173 9,327 85,860 - 214,009

Annualized Cash Net Operating Income 58,788$ -$ 70,151$ 40,069$ 38,534$ 33,864$ 30,244$ 30,288$ 10,187$ 14,891$ 244,428$ -$ 571,444$

Pro forma adjustments for:

Acquisitions - 54,968 - - - - 3,424 - - - - - 58,392

Genesis and CCP rent reductions - - (19,000) - (3,000) - - - - - (2,983) - (24,983)

Facilities transitioned to new operator - - - - - - - - 18,527 - (25,941) (7,414)

Pro forma Annualized Cash Net Operating Income 58,788$ 54,968$ 51,151$ 40,069$ 35,534$ 33,864$ 33,668$ 30,288$ 28,714$ 14,891$ 215,504$ -$ 597,439$

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

Annualized Cash NOI by Relationship

(in thousands)

Year Ended December 31, 2017

5

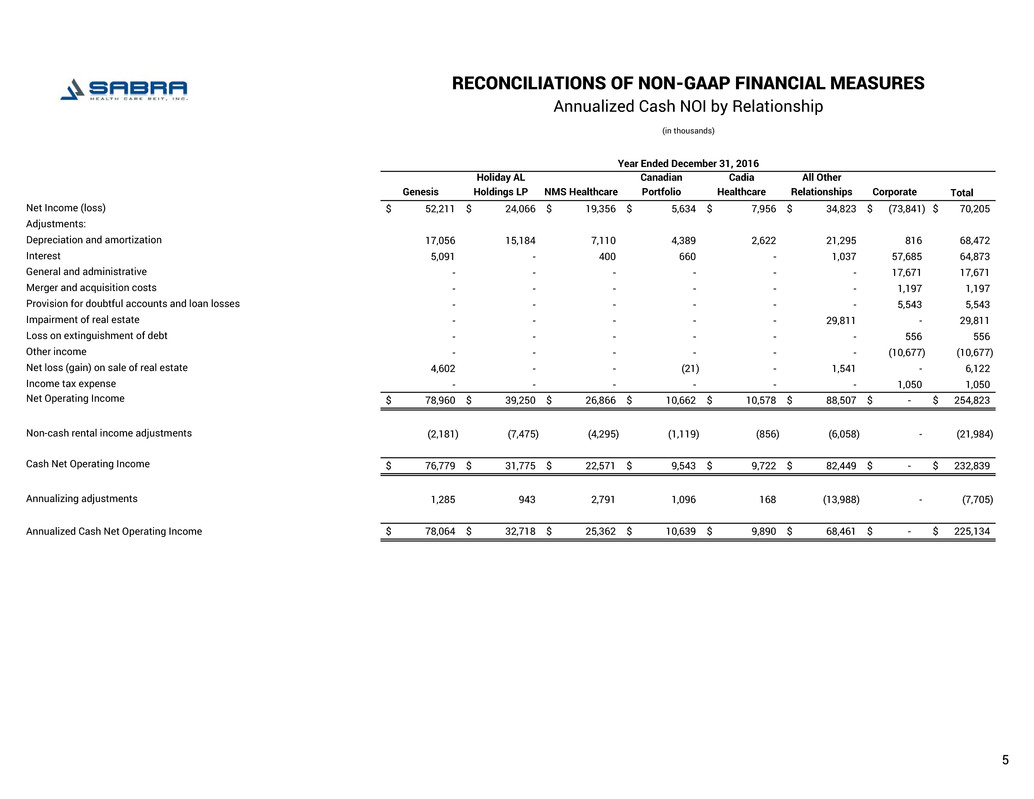

Genesis

Holiday AL

Holdings LP NMS Healthcare

Canadian

Portfolio

Cadia

Healthcare

All Other

Relationships Corporate Total

Net Income (loss) 52,211$ 24,066$ 19,356$ 5,634$ 7,956$ 34,823$ (73,841)$ 70,205$

Adjustments:

Depreciation and amortization 17,056 15,184 7,110 4,389 2,622 21,295 816 68,472

Interest 5,091 - 400 660 - 1,037 57,685 64,873

General and administrative - - - - - - 17,671 17,671

Merger and acquisition costs - - - - - - 1,197 1,197

Provision for doubtful accounts and loan losses - - - - - - 5,543 5,543

Impairment of real estate - - - - - 29,811 - 29,811

Loss on extinguishment of debt - - - - - - 556 556

Other income - - - - - - (10,677) (10,677)

Net loss (gain) on sale of real estate 4,602 - - (21) - 1,541 - 6,122

Income tax expense - - - - - - 1,050 1,050

Net Operating Income 78,960$ 39,250$ 26,866$ 10,662$ 10,578$ 88,507$ -$ 254,823$

Non-cash rental income adjustments (2,181) (7,475) (4,295) (1,119) (856) (6,058) - (21,984)

Cash Net Operating Income 76,779$ 31,775$ 22,571$ 9,543$ 9,722$ 82,449$ -$ 232,839$

Annualizing adjustments 1,285 943 2,791 1,096 168 (13,988) - (7,705)

Annualized Cash Net Operating Income 78,064$ 32,718$ 25,362$ 10,639$ 9,890$ 68,461$ -$ 225,134$

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

Annualized Cash NOI by Relationship

(in thousands)

Year Ended December 31, 2016

6

Skilled Nursing/

Transitional Care

Senior Housing -

Leased

Senior Housing -

Managed

Total Senior

Housing

Specialty

Hospitals and

Other

Interest and

Other Income Corporate Total

Net Income (loss) 120,147$ 15,225$ 1,236$ 16,461$ 9,292$ 6,964$ (48,895)$ 103,969$

Adjustments:

Depreciation and amortization 37,428 8,312 1,423 9,735 4,211 - 218 51,592

Interest 1,915 477 - 477 - - 29,830 32,222

General and administrative - - - - - - 8,242 8,242

Merger and acquisition costs - - - - - - 505 505

Provision for doubtful accounts and loan losses - - - - - - 9,659 9,659

Impairment of real estate 1,326 - - - - - - 1,326

Other income - - - - - - (49) (49)

Net gain on sale of real estate (46,762) (653) - (653) - - - (47,415)

Income tax expense - - - - - - 490 490

Net Operating Income 114,054$ 23,361$ 2,659$ 26,020$ 13,503$ 6,964$ -$ 160,541$

Non-cash rental income adjustments (8,114) (2,810) - (2,810) (1,804) - - (12,728)

Cash Net Operating Income 105,940$ 20,551$ 2,659$ 23,210$ 11,699$ 6,964$ -$ 147,813$

Cash Net Operating Income not included in same store (76,721) (3,902) (2,132) (6,034) (10,408)

Same store Cash Net Operating Income 29,219$ 16,649$ 527$ 17,176$ 1,291$

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

Annualized Cash NOI by Facility Type

(in thousands)

Three months Ended December 31, 2017

Senior Housing

7

Skilled Nursing/

Transitional Care

Senior Housing -

Leased

Senior Housing -

Managed

Total Senior

Housing

Specialty

Hospitals and

Other

Interest and

Other Income Corporate Total

Net Income (loss) 21,967$ 13,682$ 259$ 13,941$ 898$ 1,981$ (15,617)$ 23,170$

Adjustments:

Depreciation and amortization 8,202 8,030 271 8,301 475 - 221 17,199

Interest 1,176 484 - 484 - - 14,074 15,734

General and administrative - - - - - - 4,159 4,159

Merger and acquisition costs - - - - - - (25) (25)

Provision for doubtful accounts and loan losses - - - - - - 2,257 2,257

Other income - - - - - - (5,332) (5,332)

Net loss (gain) on sale of real estate 2,940 (21) - (21) - - - 2,919

Income tax expense - - - - - - 263 263

Net Operating Income 34,285$ 22,175$ 530$ 22,705$ 1,373$ 1,981$ -$ 60,344$

Non-cash rental income adjustments (2,282) (2,879) - (2,879) (113) - - (5,274)

Cash Net Operating Income 32,003$ 19,296$ 530$ 19,826$ 1,260$ 1,981$ -$ 55,070$

Cash Net Operating Income not included in same store (4,784) (2,329) - (2,329) -

Same store Cash Net Operating Income 27,219$ 16,967$ 530$ 17,497$ 1,260$

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

Annualized Cash NOI by Facility Type

(in thousands)

Three months Ended December 31, 2016

Senior Housing

8

Skilled Nursing/

Transitional Care

Senior Housing -

Leased

Senior Housing -

Managed

Total Senior

Housing

Specialty

Hospitals and

Other

Interest and

Other Income Corporate Total

Net Income (loss) 230,358$ 51,539$ 4,253$ 55,792$ 16,615$ 15,026$ (159,426)$ 158,365$

Adjustments:

Depreciation and amortization 68,638 33,253 4,317 37,570 6,807 - 867 113,882

Interest 5,772 1,912 - 1,912 - - 80,756 88,440

General and administrative - - - - - - 32,401 32,401

Merger and acquisition costs - - - - - - 30,255 30,255

Provision for doubtful accounts and loan losses - - - - - - 17,113 17,113

Impairment of real estate 1,326 - - - - - - 1,326

Loss on extinguishment of debt - - - - - - 553 553

Other income - - - - - - (3,170) (3,170)

Net gain on sale of real estate (51,370) (659) - (659) - - - (52,029)

Income tax expense - - - - - - 651 651

Net Operating Income 254,724$ 86,045$ 8,570$ 94,615$ 23,422$ 15,026$ -$ 387,787$

Non-cash rental income adjustments (17,254) (10,363) - (10,363) (2,735) - - (30,352)

Cash Net Operating Income 237,470$ 75,682$ 8,570$ 84,252$ 20,687$ 15,026$ -$ 357,435$

Annualizing adjustments 179,231 8,020 2,099 10,119 26,262 (1,603) - 214,009

Annualized Cash Net Operating Income 416,701$ 83,702$ 10,669$ 94,371$ 46,949$ 13,423$ -$ 571,444$

Pro forma adjustments for:

Acquisitions 3,424 - 54,968 54,968 - - - 58,392

Genesis and CCP rent reductions (24,983) - - - - - - (24,983)

Facilities transitioned to new operator (7,414) - - - - - - (7,414)

Pro forma Annualized Cash Net Operating Income 387,728$ 83,702$ 65,637$ 149,339$ 46,949$ 13,423$ -$ 597,439$

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

Annualized Cash NOI by Facility Type

(in thousands)

Year Ended December 31, 2017

Senior Housing

9

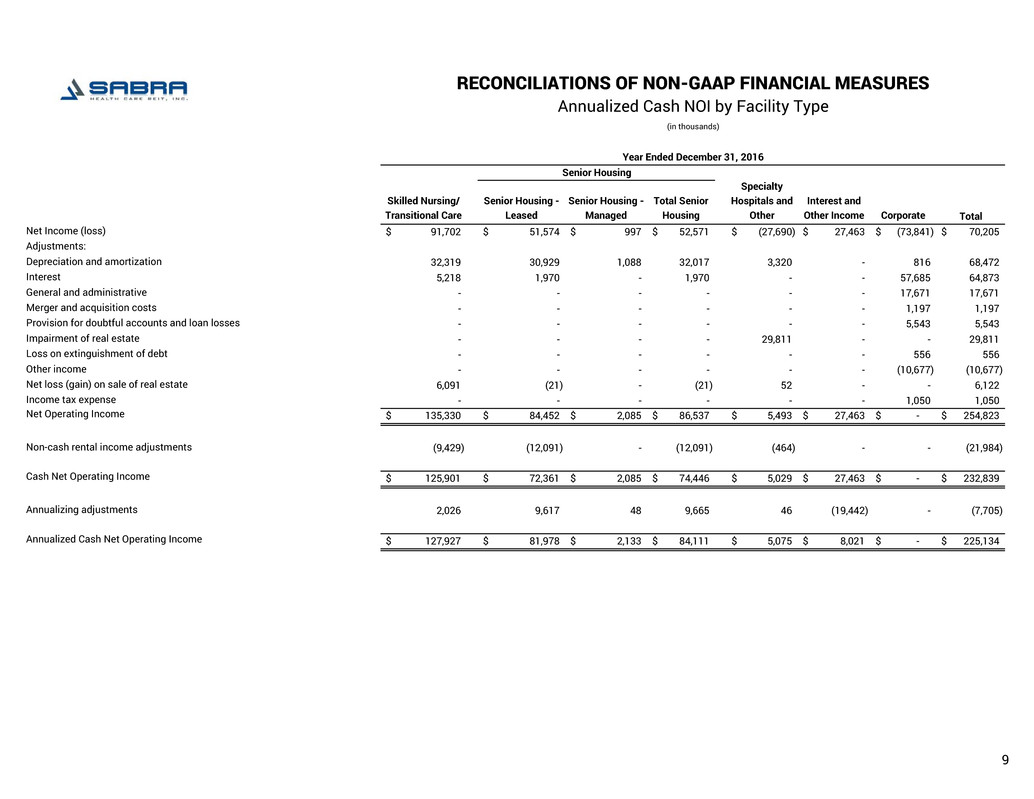

Skilled Nursing/

Transitional Care

Senior Housing -

Leased

Senior Housing -

Managed

Total Senior

Housing

Specialty

Hospitals and

Other

Interest and

Other Income Corporate Total

Net Income (loss) 91,702$ 51,574$ 997$ 52,571$ (27,690)$ 27,463$ (73,841)$ 70,205$

Adjustments:

Depreciation and amortization 32,319 30,929 1,088 32,017 3,320 - 816 68,472

Interest 5,218 1,970 - 1,970 - - 57,685 64,873

General and administrative - - - - - - 17,671 17,671

Merger and acquisition costs - - - - - - 1,197 1,197

Provision for doubtful accounts and loan losses - - - - - - 5,543 5,543

Impairment of real estate - - - - 29,811 - - 29,811

Loss on extinguishment of debt - - - - - - 556 556

Other income - - - - - - (10,677) (10,677)

Net loss (gain) on sale of real estate 6,091 (21) - (21) 52 - - 6,122

Income tax expense - - - - - - 1,050 1,050

Net Operating Income 135,330$ 84,452$ 2,085$ 86,537$ 5,493$ 27,463$ -$ 254,823$

Non-cash rental income adjustments (9,429) (12,091) - (12,091) (464) - - (21,984)

Cash Net Operating Income 125,901$ 72,361$ 2,085$ 74,446$ 5,029$ 27,463$ -$ 232,839$

Annualizing adjustments 2,026 9,617 48 9,665 46 (19,442) - (7,705)

Annualized Cash Net Operating Income 127,927$ 81,978$ 2,133$ 84,111$ 5,075$ 8,021$ -$ 225,134$

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

Annualized Cash NOI by Facility Type

(in thousands)

Year Ended December 31, 2016

Senior Housing

10

Private Payors Non-Private Payors Corporate Total

Net Income (loss) 111,187$ 206,604$ (159,426)$ 158,365$

Adjustments:

Depreciation and amortization 52,301 60,714 867 113,882

Interest 2,882 4,802 80,756 88,440

General and administrative - - 32,401 32,401

Merger and acquisition costs - - 30,255 30,255

Provision for doubtful accounts and loan losses - - 17,113 17,113

Impairment of real estate 133 1,193 - 1,326

Loss on extinguishment of debt - - 553 553

Other income - - (3,170) (3,170)

Net gain on sale of real estate (8,633) (43,396) - (52,029)

Income tax expense - - 651 651

Net Operating Income 157,870$ 229,917$ -$ 387,787$

Non-cash rental income adjustments (15,323) (15,029) - (30,352)

Cash Net Operating Income 142,547$ 214,888$ -$ 357,435$

Annualizing adjustments 50,391 163,618 - 214,009

Annualized Cash Net Operating Income 192,938$ 378,506$ -$ 571,444$

Pro forma adjustments for:

Acquisitions 55,532 2,860 - 58,392

Genesis and CCP rent reductions (4,831) (20,152) - (24,983)

Facilities transitioned to new operator (961) (6,453) - (7,414)

Pro forma Annualized Cash Net Operating Income 242,678$ 354,761$ -$ 597,439$

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

Annualized Cash NOI by Payor Type

(in thousands)

Year Ended December 31, 2017

11

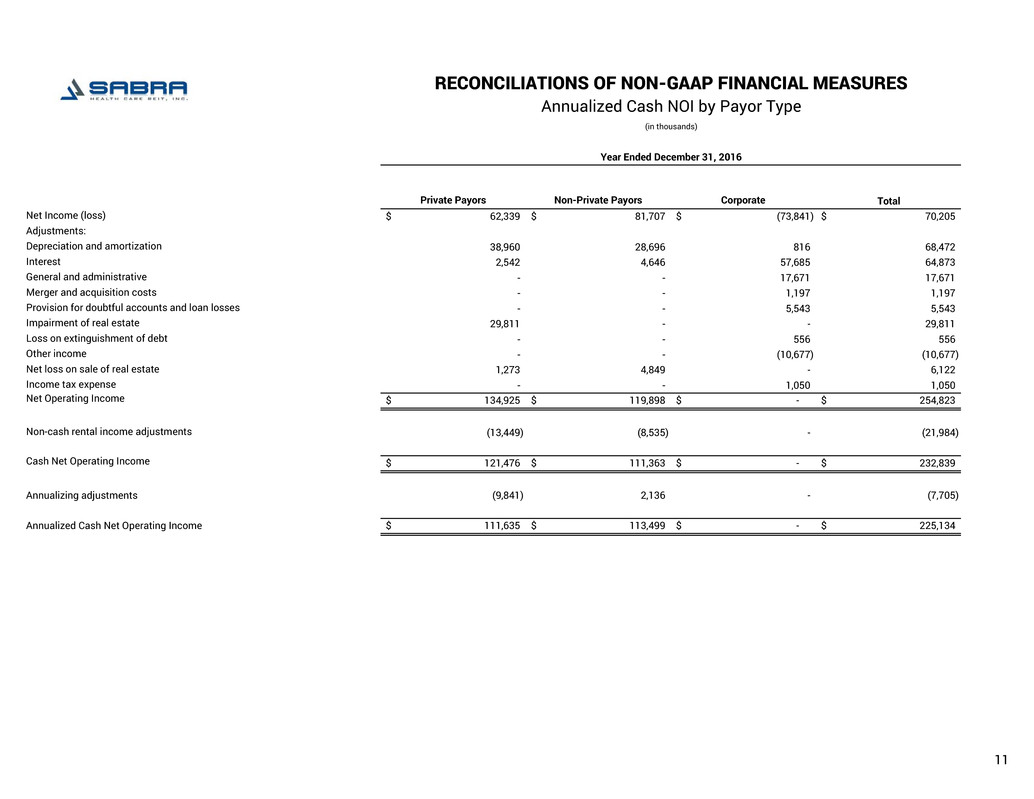

Private Payors Non-Private Payors Corporate Total

Net Income (loss) 62,339$ 81,707$ (73,841)$ 70,205$

Adjustments:

Depreciation and amortization 38,960 28,696 816 68,472

Interest 2,542 4,646 57,685 64,873

General and administrative - - 17,671 17,671

Merger and acquisition costs - - 1,197 1,197

Provision for doubtful accounts and loan losses - - 5,543 5,543

Impairment of real estate 29,811 - - 29,811

Loss on extinguishment of debt - - 556 556

Other income - - (10,677) (10,677)

Net loss on sale of real estate 1,273 4,849 - 6,122

Income tax expense - - 1,050 1,050

Net Operating Income 134,925$ 119,898$ -$ 254,823$

Non-cash rental income adjustments (13,449) (8,535) - (21,984)

Cash Net Operating Income 121,476$ 111,363$ -$ 232,839$

Annualizing adjustments (9,841) 2,136 - (7,705)

Annualized Cash Net Operating Income 111,635$ 113,499$ -$ 225,134$

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES

Annualized Cash NOI by Payor Type

(in thousands)

Year Ended December 31, 2016

12

NON-GAAP FINANCIAL MEASURES

DEFINITIONS

Adjusted EBITDA. Adjusted EBITDA is calculated as earnings before interest, taxes, depreciation and amortization (“EBITDA”) excluding the impact of merger-related costs, stock-based compensation expense under the

Company's long-term equity award program, and loan loss reserves. Adjusted EBITDA is an important non-GAAP supplemental measure of operating performance.

Annualized Cash Net Operating Income (“Annualized Cash NOI”). The Company believes that net income attributable to common stockholders as defined by GAAP is the most appropriate earnings measure. We consider

Annualized Cash NOI an important supplemental measure because it allows investors, analysts and our management to evaluate the operating performance of our investments. We define Annualized Cash NOI as

Annualized Revenues less operating expenses and non-cash revenues. Annualized Cash NOI excludes all other financial statement amounts included in net income.

Annualized Revenues. The annual straight-line rental revenues under leases and interest and other income generated by the Company's loans receivable and other investments based on amounts invested and

applicable terms as of the end of the period presented. Annualized Revenues do not include tenant recoveries or additional rents.

Cash Net Operating Income ("Cash NOI"). The Company believes that net income attributable to common stockholders as defined by GAAP is the most appropriate earnings measure. We consider Cash NOI an important

supplemental measure because it allows investors, analysts and our management to evaluate the operating performance of our investments. We define Cash NOI as total revenues less operating expenses and non-cash

revenues. Cash NOI excludes all other financial statement amounts included in net income.

Funds From Operations Attributable to Common Stockholders (“FFO”) and Adjusted Funds from Operations Attributable to Common Stockholders (“AFFO”). The Company believes that net income attributable to

common stockholders as defined by GAAP is the most appropriate earnings measure. The Company also believes that Funds From Operations, or FFO, as defined in accordance with the definition used by the National

Association of Real Estate Investment Trusts (“NAREIT”), and Adjusted Funds from Operations, or AFFO (and related per share amounts) are important non-GAAP supplemental measures of the Company's operating

performance. Because the historical cost accounting convention used for real estate assets requires straight-line depreciation (except on land), such accounting presentation implies that the value of real estate assets

diminishes predictably over time. However, since real estate values have historically risen or fallen with market and other conditions, presentations of operating results for a real estate investment trust that uses

historical cost accounting for depreciation could be less informative. Thus, NAREIT created FFO as a supplemental measure of operating performance for real estate investment trusts that excludes historical cost

depreciation and amortization, among other items, from net income attributable to common stockholders, as defined by GAAP. FFO is defined as net income attributable to common stockholders, computed in

accordance with GAAP, excluding gains or losses from real estate dispositions, plus real estate depreciation and amortization, net of amounts related to noncontrolling interests, and real estate impairment charges.

AFFO is defined as FFO excluding merger and acquisition costs, stock-based compensation expense, straight-line rental income adjustments, amortization of above and below market lease intangibles, net, non-cash

interest income adjustments, non-cash interest expense, as well as other non-cash revenue and expense items (including non-cash portion of loss on extinguishment of debt, change in fair value of contingent

consideration, provision for doubtful straight-line rental income, loan losses and other reserves, ineffectiveness gain/loss on derivative instruments, and non-cash revenue and expense amounts related to noncontrolling

interests). The Company believes that the use of FFO and AFFO (and the related per share amounts), combined with the required GAAP presentations, improves the understanding of the Company's operating results

among investors and makes comparisons of operating results among real estate investment trusts more meaningful. The Company considers FFO and AFFO to be useful measures for reviewing comparative operating

and financial performance because, by excluding the applicable items listed above, FFO and AFFO can help investors compare the operating performance of the Company between periods or as compared to other

companies. While FFO and AFFO are relevant and widely used measures of operating performance of real estate investment trusts, they do not represent cash flows from operations or net income attributable to

common stockholders as defined by GAAP and should not be considered an alternative to those measures in evaluating the Company’s liquidity or operating performance. FFO and AFFO also do not consider the costs

associated with capital expenditures related to the Company’s real estate assets nor do they purport to be indicative of cash available to fund the Company’s future cash requirements. Further, the Company’s

computation of FFO and AFFO may not be comparable to FFO and AFFO reported by other real estate investment trusts that do not define FFO in accordance with the current NAREIT definition or that interpret the

current NAREIT definition or define AFFO differently than the Company does.

Net Operating Income ("NOI"). The Company believes that net income attributable to common stockholders as defined by GAAP is the most appropriate earnings measure. We consider NOI an important supplemental

measure because it allows investors, analysts and our management to evaluate the operating performance of our investments. We define NOI as total revenues less operating expenses. NOI excludes all other financial

statement amounts included in net income.

Normalized FFO and Normalized AFFO. Normalized FFO and Normalized AFFO represent FFO and AFFO, respectively, adjusted for certain income and expense items that the Company does not believe are indicative of

its ongoing operating results. The Company considers Normalized FFO and Normalized AFFO to be useful measures to evaluate the Company’s operating results excluding these income and expense items to help

investors compare the operating performance of the Company between periods or as compared to other companies. Normalized FFO and Normalized AFFO do not represent cash flows from operations or net income as

defined by GAAP and should not be considered an alternative to those measures in evaluating the Company’s liquidity or operating performance. Normalized FFO and Normalized AFFO also do not consider the costs

associated with capital expenditures related to the Company’s real estate assets nor do they purport to be indicative of cash available to fund the Company’s future cash requirements. Further, the Company’s

computation of Normalized FFO and Normalized AFFO may not be comparable to Normalized FFO and Normalized AFFO reported by other REITs that do not define FFO in accordance with the current NAREIT definition

or that interpret the current NAREIT definition or define FFO and AFFO or Normalized FFO and Normalized AFFO differently than the Company does.