Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Avery Dennison Corp | a2234573zex-32_2.htm |

| EX-32.1 - EX-32.1 - Avery Dennison Corp | a2234573zex-32_1.htm |

| EX-31.2 - EX-31.2 - Avery Dennison Corp | a2234573zex-31_2.htm |

| EX-31.1 - EX-31.1 - Avery Dennison Corp | a2234573zex-31_1.htm |

| EX-23 - EX-23 - Avery Dennison Corp | a2234573zex-23.htm |

| EX-21 - EX-21 - Avery Dennison Corp | a2234573zex-21.htm |

| EX-12 - EX-12 - Avery Dennison Corp | a2234573zex-12.htm |

| EX-10.31 - EX-10.31 - Avery Dennison Corp | a2234573zex-10_31.htm |

| EX-10.30 - EX-10.30 - Avery Dennison Corp | a2234573zex-10_30.htm |

| EX-10.29 - EX-10.29 - Avery Dennison Corp | a2234573zex-10_29.htm |

| 10-K - 10-K - Avery Dennison Corp | a2234573z10-k.htm |

EXHIBIT 13

Businesses at a Glance

| |

Segment | Segment | Segment | |||

|---|---|---|---|---|---|---|

| Label and Graphic Materials | Retail Branding and Information Solutions | Industrial and Healthcare Materials | ||||

| | | | | | | |

| BUSINESSES | Label and Packaging Materials Graphics Solutions Reflective Solutions |

Retail Branding and Information Solutions Printer Solutions |

Performance Tapes Fastener Solutions Vancive Medical Technologies |

|||

| | | | | | | |

| 2017 SALES IN MILLIONS | $4,512 | $1,511 | $591 | |||

| | | | | | | |

| % OF SALES | 68% | 23% | 9% | |||

| | | | | | | |

| GLOBAL BRAND | Avery Dennison® Fasson® |

Avery Dennison® Monarch® |

Avery Dennison® Vancive Medical Technologies® |

|||

| | | | | | | |

| DESCRIPTION | The technologies and materials of our Label and Graphic Materials businesses enhance brands' shelf, store and street appeal; inform shoppers of ingredients; protect brand security; improve operational efficiency and customer product performance; and provide visual information that enhances safety. | Our Retail Branding and Information Solutions provide intelligent, creative, and sustainable solutions that elevate brands and accelerate performance through the global retail supply chain. | Our Industrial and Healthcare Materials businesses provide tapes products, including coated and adhesives transfer tapes; fasteners, primarily precision-extruded and injection-molded plastic devices; and wound care, ostomy, surgical and electromedical device applications for manufacturers, clinicians and patients. | |||

| | | | | | | |

| PRODUCTS/SOLUTIONS | Pressure-sensitive labeling materials; packaging materials and solutions; roll-fed sleeve; engineered films; graphic imaging media; reflective materials | Creative services; brand embellishments; graphic tickets; tags and labels; sustainable packaging; inventory visibility and loss prevention solutions; data management services; price tickets; printers and scanners; radio-frequency identification inlays and tags; brand protection and security solutions | Pressure-sensitive tapes for automotive, building and construction; electronics; general industrial; diaper tapes and closures; fasteners; skin-contact adhesives; surgical, wound care, ostomy and securement products; medical barrier films | |||

| | | | | | | |

| MARKET SEGMENTS | Food; beverage; wine and spirits; home and personal care products; pharmaceuticals; durables; fleet vehicle/automotive; architectural/ retail; promotional/advertising; traffic; safety; transportation | Apparel manufacturing and retail supply chain; food service and supply chain; hard goods and supply chain; pharmaceutical supply chain; logistics | Original equipment manufacturing; personal care; electronics; building and construction; retail supply chain; medical | |||

| | | | | | | |

| CUSTOMERS | Label converters; package designers; packaging engineers and manufacturers; industrial manufacturers; printers; distributors; designers; advertising agencies; government agencies; sign manufacturers; graphics vendors | Apparel and footwear brands; manufacturers and retailers; food service, grocery and pharmaceutical supply chains; consumer goods brands; automotive manufacturers; transportation companies | Tape converters; original equipment manufacturers; original design manufacturers; construction firms; personal care product manufacturers; manufacturers and retailers; medical device manufacturers | |||

| | | | | | | |

| WEBSITES | www.label.averydennison.com www.graphics.averydennison.com www.reflectives.averydennison.com |

www.rbis.averydennison.com www.rfid.averydennison.com |

www.tapes.averydennison.com www.vancive.averydennison.com |

|||

| | | | | | | |

| LEADERS | Georges Gravanis President Label and Graphic Materials |

Deon Stander Vice President and General Manager Retail Branding and Information Solutions |

Michael Johansen Vice President and General Manager Industrial and Healthcare Materials |

|||

| | | | | | | |

Safe Harbor Statement

The matters discussed in this Annual Report contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These statements, which are not statements of historical fact, contain estimates, assumptions, projections and/or expectations regarding future events, which may or may not occur. Words such as "aim," "anticipate," "assume," "believe," "continue," "could," "estimate," "expect," "foresee," "guidance," "intend," "may," "might," "objective," "plan," "potential," "project," "seek," "shall," "should," "target," "will," "would," or variations thereof, and other expressions that refer to future events and trends, identify forward-looking statements. These forward-looking statements, and financial or other business targets, are subject to certain risks and uncertainties, which could cause our actual results to differ materially from the expected results, performance or achievements expressed or implied by such forward-looking statements.

Certain risks and uncertainties are discussed in more detail under "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Annual Report on Form 10-K for the fiscal year ended December 30, 2017 and include, but are not limited to, risks and uncertainties relating to the following: fluctuations in demand affecting sales to customers; worldwide and local economic conditions; changes in political conditions; changes in governmental laws and regulations; fluctuations in foreign currency exchange rates and other risks associated with foreign operations, including in emerging markets; the financial condition and inventory strategies of customers; changes in customer preferences; fluctuations in cost and availability of raw materials; our ability to generate sustained productivity improvement; our ability to achieve and sustain targeted cost reductions; the impact of competitive products and pricing; loss of significant contracts or customers; collection of receivables from customers; selling prices; business mix shift; execution and integration of acquisitions; timely development and market acceptance of new products, including sustainable or sustainably-sourced products; investment in development activities and new production facilities; amounts of future dividends and share repurchases; customer and supplier concentrations; successful implementation of new manufacturing technologies and installation of manufacturing equipment; disruptions in information technology systems, including cyber-attacks or other intrusions to network security; successful installation of new or upgraded information technology systems; data security breaches; volatility of financial markets; impairment of capitalized assets, including goodwill and other intangibles; credit risks; our ability to obtain adequate financing arrangements and maintain access to capital; fluctuations in interest and tax rates; changes in tax laws and regulations including the Tax Cuts and Jobs Act, and uncertainties associated with interpretations of such laws and regulations; outcome of tax audits; fluctuations in pension, insurance, and employee benefit costs; the impact of legal and regulatory proceedings, including with respect to environmental, health and safety; protection and infringement of intellectual property; the impact of epidemiological events on the economy and our customers and suppliers; acts of war, terrorism, and natural disasters; and other factors.

We believe that the most significant risk factors that could affect our financial performance in the near-term include: (1) the impacts of global economic conditions and political uncertainty on underlying demand for our products and foreign currency fluctuations; (2) the degree to which higher costs can be offset with productivity measures and/or passed on to customers through selling price increases, without a significant loss of volume; (3) competitors' actions, including pricing, expansion in key markets, and product offerings; and (4) the execution and integration of acquisitions.

Our forward-looking statements are made only as of the date hereof. We assume no duty to update these forward-looking statements to reflect new, changed or unanticipated events or circumstances, other than as may be required by law.

| 1 Avery Dennison Corporation 2017 Annual Report | | |

Five-Year Summary

(Dollars in millions, except percentages |

2017 | 2016 | 2015 | 2014 | (1) | 2013 | |||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

and per share amounts) |

Dollars | % | Dollars | % | Dollars | % | Dollars | % | Dollars | % | |||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For the Year |

|||||||||||||||||||||||||||||||

Net sales |

$ | 6,613.8 | 100.0 | $ | 6,086.5 | 100.0 | $ | 5,966.9 | 100.0 | $ | 6,330.3 | 100.0 | $ | 6,140.0 | 100.0 | ||||||||||||||||

Gross profit |

1,812.2 | 27.4 | 1,699.7 | 27.9 | 1,645.8 | 27.6 | 1,651.2 | 26.1 | 1,637.7 | 26.7 | |||||||||||||||||||||

Marketing, general and administrative expense |

1,123.2 | 17.0 | 1,097.5 | 18.0 | 1,108.1 | 18.6 | 1,158.9 | 18.3 | 1,174.2 | 19.1 | |||||||||||||||||||||

Other expense, net (2) |

36.5 | .6 | 65.2 | 1.1 | 68.3 | 1.1 | 68.2 | 1.1 | 36.6 | .6 | |||||||||||||||||||||

Interest expense |

63.0 | 1.0 | 59.9 | 1.0 | 60.5 | 1.0 | 63.3 | 1.0 | 60.9 | 1.0 | |||||||||||||||||||||

Income from continuing operations before taxes |

589.5 | 8.9 | 477.1 | 7.8 | 408.9 | 6.9 | 360.8 | 5.7 | 366.0 | 6.0 | |||||||||||||||||||||

Provision for income taxes (5) |

307.7 | 4.7 | 156.4 | 2.6 | 134.5 | 2.3 | 113.5 | 1.8 | 124.3 | 2.0 | |||||||||||||||||||||

Income from continuing operations |

281.8 | 4.3 | 320.7 | 5.3 | 274.4 | 4.6 | 247.3 | 3.9 | 241.7 | 3.9 | |||||||||||||||||||||

Loss from discontinued operations, net of tax |

— | N/A | — | N/A | (.1 | ) | N/A | (2.2 | ) | N/A | (28.5 | ) | N/A | ||||||||||||||||||

Net income |

281.8 | 4.3 | 320.7 | 5.3 | 274.3 | 4.6 | 245.1 | 3.9 | 213.2 | 3.5 | |||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

2017 |

2016 |

2015 |

2014 |

2013 |

||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Per Share Information |

|||||||||||||||||||||||||||||||

Income per common share from continuing operations |

$ | 3.19 | $ | 3.60 | $ | 3.01 | $ | 2.64 | $ | 2.46 | |||||||||||||||||||||

Loss per common share from discontinued operations |

— | — | — | (.03 | ) | (.29 | ) | ||||||||||||||||||||||||

Net income per common share |

3.19 | 3.60 | 3.01 | 2.61 | 2.17 | ||||||||||||||||||||||||||

Income per common share from continuing operations, assuming dilution |

3.13 | 3.54 | 2.95 | 2.58 | 2.41 | ||||||||||||||||||||||||||

Loss per common share from discontinued operations, assuming dilution |

— | — | — | (.02 | ) | (.28 | ) | ||||||||||||||||||||||||

Net income per common share, assuming dilution |

3.13 | 3.54 | 2.95 | 2.56 | 2.13 | ||||||||||||||||||||||||||

Dividends per common share |

1.76 | 1.60 | 1.46 | 1.34 | 1.14 | ||||||||||||||||||||||||||

Weighted average number of common shares outstanding (in millions) |

88.3 | 89.1 | 91.0 | 93.8 | 98.4 | ||||||||||||||||||||||||||

Weighted average number of common shares outstanding, assuming dilution (in millions) |

90.1 | 90.7 | 92.9 | 95.7 | 100.1 | ||||||||||||||||||||||||||

Market price per share at fiscal year-end |

$ | 114.86 | $ | 70.22 | $ | 62.66 | $ | 51.79 | $ | 50.48 | |||||||||||||||||||||

Market price per share range |

70.14 to 117.10 |

58.16 to 78.84 |

51.07 to 66.18 |

41.28 to 52.67 |

34.92 to 50.65 |

||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

At End of Year |

|||||||||||||||||||||||||||||||

Property, plant and equipment, net (3) |

$ | 1,097.9 | $ | 915.2 | $ | 847.9 | $ | 875.3 | $ | 922.5 | |||||||||||||||||||||

Total assets (4) |

5,136.9 | 4,396.4 | 4,133.7 | 4,356.9 | 4,608.3 | ||||||||||||||||||||||||||

Long-term debt and capital leases |

1,316.3 | 713.4 | 963.6 | 940.1 | 944.6 | ||||||||||||||||||||||||||

Total debt |

1,581.7 | 1,292.5 | 1,058.9 | 1,144.4 | 1,021.5 | ||||||||||||||||||||||||||

Shareholders' equity (4) |

1,046.2 | 925.5 | 965.7 | 1,047.7 | 1,468.1 | ||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other Information |

|||||||||||||||||||||||||||||||

Depreciation and amortization expense (3) |

$ | 178.7 | $ | 180.1 | $ | 188.3 | $ | 201.6 | $ | 204.3 | |||||||||||||||||||||

Research and development expense (3) |

93.4 | 89.7 | 91.9 | 102.5 | 96.0 | ||||||||||||||||||||||||||

Effective tax rate (3)(5) |

52.2 | % | 32.8 | % | 32.9 | % | 31.5 | % | 34.0 | % | |||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- (1)

- Results for 2014 reflected a 53-week period.

- (2)

- Included pre-tax charges for severance and related costs, asset impairment charges, lease and other contract cancellation costs, loss from settlement of pension obligations, and other items.

- (3)

- Amounts are for continuing operations only.

- (4)

- Amounts are for continuing and discontinued operations.

- (5)

- "Provision for income taxes" for fiscal year 2017 includes the estimated impact of the Tax Cuts and Jobs Act ("TCJA") enacted in the U.S. on December 22, 2017. The TCJA significantly revises U.S. corporate income taxation, among other changes, lowering corporate income tax rates, implementing a modified territorial tax regime, and imposing a one-time transition tax through a deemed repatriation of accumulated untaxed earnings and profits of foreign subsidiaries. This provision includes a reasonable estimate ("provisional amount") of the impact of the TCJA on our tax provision following the guidance of SEC Staff Accounting Bulletin No. 118 ("SAB 118").

| | | 2 |

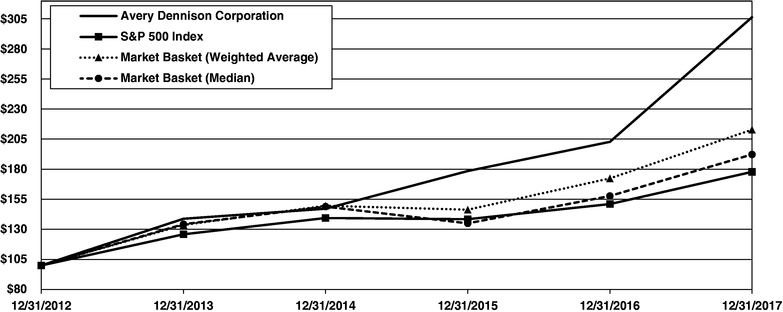

Stockholder Return Performance

The graph below compares the cumulative stockholder return on our common stock, including the reinvestment of dividends, with the return on the S&P 500® Stock Index, the average return (weighted by market capitalization) of the S&P 500® Materials and Industrials subsets (the "Market Basket"), and the median return of the Market Basket, in each case for the five-year period ending December 31, 2017.

Comparison of Five-Year Cumulative Total Return as of December 31, 2017

Total Return Analysis (1)

| |

12/31/2012 |

12/31/2013 |

12/31/2014 |

12/31/2015 |

12/31/2016 |

12/31/2017 |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | | | | |

Avery Dennison Corporation |

$ | 100.00 | $ | 138.87 | $ | 147.24 | $ | 178.63 | $ | 202.93 | $ | 306.70 | |||||||

S&P 500 Index |

100.00 | 125.93 | 139.51 | 138.50 | 151.11 | 177.93 | |||||||||||||

Market Basket (Weighted Average) (2) |

100.00 | 133.70 | 149.72 | 146.41 | 172.49 | 213.06 | |||||||||||||

Market Basket (Median) |

100.00 | 134.32 | 149.00 | 135.06 | 157.84 | 192.44 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

- (1)

- Assumes $100.00 invested on December 31, 2012 and the reinvestment of dividends.

- (2)

- Average weighted by market capitalization.

Historical stock price performance is not necessarily indicative of future stock price performance.

| 3 Avery Dennison Corporation 2017 Annual Report | | |

Management's Discussion and Analysis of Financial Condition and Results of Operations

ORGANIZATION OF INFORMATION

Management's Discussion and Analysis of Financial Condition and Results of Operations, or MD&A, provides management's views on our financial condition and results of operations, should be read in conjunction with the accompanying Consolidated Financial Statements and notes thereto, and includes the following sections:

Non-GAAP Financial Measures |

4 | |

Overview and Outlook |

4 | |

Analysis of Results of Operations |

6 | |

Results of Operations by Reportable Segment |

7 | |

Financial Condition |

9 | |

Critical Accounting Estimates |

14 | |

Recent Accounting Requirements |

16 | |

Market-Sensitive Instruments and Risk Management |

16 |

NON-GAAP FINANCIAL MEASURES

We report our financial results in conformity with accounting principles generally accepted in the United States of America, or GAAP, and also communicate with investors using certain non-GAAP financial measures. These non-GAAP financial measures are not in accordance with, nor are they a substitute for or superior to, the comparable GAAP financial measures. These non-GAAP financial measures are intended to supplement presentation of our financial results that are prepared in accordance with GAAP. Based on feedback from investors and financial analysts, we believe that the supplemental non-GAAP financial measures we provide are useful to their assessments of our performance and operating trends, as well as liquidity.

Our non-GAAP financial measures exclude the impact of certain events, activities or strategic decisions. The accounting effects of these events, activities or decisions, which are included in the GAAP financial measures, may make it difficult to assess our underlying performance in a single period. By excluding the accounting effects, both positive and negative, of certain items (e.g., restructuring charges, legal settlements, certain effects of strategic transactions and related costs, losses from debt extinguishments, gains and losses from curtailment and settlement of pension obligations, gains or losses on sales of certain assets, and other items), we believe that we are providing meaningful supplemental information that facilitates an understanding of our core operating results and liquidity measures. These non-GAAP financial measures are used internally to evaluate trends in our underlying performance, as well as to facilitate comparison to the results of competitors for a single period. While some of the items we exclude from GAAP financial measures recur, they tend to be disparate in amount, frequency, or timing.

We use the following non-GAAP financial measures in this MD&A:

- •

- Sales change ex. currency refers to the increase or decrease in sales excluding the estimated impact of foreign currency translation. The estimated impact of foreign currency translation is calculated on a constant currency basis, with prior period results translated at current period average exchange rates to exclude the effect of foreign currency fluctuations.

- •

- Organic sales change refers to the increase or decrease in sales excluding the estimated impact of foreign currency translation, product line exits, acquisitions and divestitures, and, where applicable, an extra week in our fiscal year.

We believe that sales change ex. currency and organic sales change assist investors in evaluating the sales growth from the ongoing activities of our businesses and provide greater ability to evaluate our results from period to period.

- •

- Free cash flow refers to cash flow from operations, less payments for property, plant and equipment, software and other deferred charges, plus proceeds from sales of property, plant and equipment, plus (minus) net proceeds from sales (purchases) of investments, plus (minus) free cash outflow (inflow) from discontinued operations. We believe that free cash flow assists investors by showing the amount of cash we have available for debt reductions, dividends, share repurchases, and acquisitions.

- •

- Operational working capital refers to trade accounts receivable and inventories, net of accounts payable, and excludes cash and cash equivalents, short-term borrowings, deferred taxes, other current assets and other current liabilities, as well as net current assets or liabilities held-for-sale. We believe that operational working capital assists investors in assessing our working capital requirements because it excludes the impact of fluctuations attributable to our financing and other activities (which affect cash and cash equivalents, deferred taxes, other current assets, and other current liabilities) that tend to be disparate in amount, frequency, or timing, and that may increase the volatility of working capital as a percentage of sales from period to period. The items excluded from this measure are not significantly influenced by our day-to-day activities managed at the operating level and do not necessarily reflect the underlying trends in our operations.

- •

- Net debt to EBITDA ratio refers to total debt (including capital leases) less cash and cash equivalents, divided by EBITDA, which refers to net income before interest, taxes, depreciation and amortization. We believe the net debt to EBITDA ratio is meaningful because investors view it as a useful measurement of our leverage position.

OVERVIEW AND OUTLOOK

Fiscal Year

Normally, our fiscal years consist of 52 weeks, but every fifth or sixth fiscal year consists of 53 weeks. Our 2017, 2016, and 2015 fiscal years consisted of 52-week periods ending December 30, 2017, December 31, 2016, and January 2, 2016, respectively.

| | | 4 |

Management's Discussion and Analysis of Financial Condition and Results of Operations

Net Sales

The factors impacting the reported sales change are shown in the table below:

| |

2017 |

2016 |

|||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

Reported sales change |

9 | % | 2 | % | |||

Foreign currency translation |

(1 | ) | 3 | ||||

| | | | | | | | |

Sales change ex. currency |

8 | % | 5 | % | |||

| | | | | | | | |

Acquisitions |

(4 | ) | (1 | ) | |||

| | | | | | | | |

Organic sales change |

4 | % | 4 | % | |||

| | | | | | | | |

In both years, net sales increased on an organic basis due to higher volume.

Income from Continuing Operations

Income from continuing operations decreased from approximately $321 million in 2016 to approximately $282 million in 2017. Major factors affecting the change in income from continuing operations in 2017 compared to 2016 included:

- •

- Higher income taxes primarily due to our provisional estimate of the impact resulting from the enactment of the Tax Cuts and Jobs Act ("TCJA")

- •

- Higher employee-related costs

- •

- Net impact of pricing and raw material costs

- •

- Higher restructuring charges

Offsetting factors:

- •

- Volume/mix

- •

- Benefits from productivity initiatives, including savings from restructuring actions, net of transition costs

- •

- Prior-year loss from settlement of pension obligations

Acquisitions

During 2017, we completed the stock acquisitions of Yongle Tape Ltd. and Finesse Medical Limited, and the net asset acquisition of Hanita Coatings Rural Cooperative Association Limited and stock acquisition of certain of its subsidiaries (collectively, the "2017 Acquisitions"), which were not material, individually or in the aggregate, to the Consolidated Financial Statements. In 2016, we completed the acquisition of the European business of Mactac ("Mactac"), which was not material to the Consolidated Financial Statements. Refer to Note 2, "Acquisitions," to the Consolidated Financial Statements for more information.

Cost Reduction Actions

2015/2016 Actions

During fiscal year 2017, we recorded $34.1 million in restructuring charges, net of reversals, related to restructuring actions initiated during the third quarter of 2015 ("2015/2016 Actions"). These charges consisted of severance and related costs for the reduction of approximately 920 positions, lease cancellation costs, and asset impairment charges.

During fiscal year 2016, we recorded $20.9 million in restructuring charges, net of reversals, related to our 2015/2016 Actions. These charges consisted of severance and related costs for the reduction of approximately 440 positions, lease cancellation costs, and asset impairment charges.

Impact of Cost Reduction Actions

During fiscal year 2017, we realized $59.5 million in savings, net of transition costs, primarily from our 2015/2016 Actions.

We anticipate incremental savings, net of transition costs, primarily from our 2015/2016 Actions of approximately $30 million to $35 million in 2018. We estimate cash restructuring costs of at least $15 million in 2018. However, we continue to assess restructuring options and may adjust our restructuring plans.

Restructuring charges were included in "Other expense, net" in the Consolidated Statements of Income. Refer to Note 13, "Cost Reduction Actions," to the Consolidated Financial Statements for more information.

Cash Flow

| (In millions) |

2017 |

2016 |

2015 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

Net cash provided by operating activities |

$ | 650.1 | $ | 585.3 | $ | 473.7 | ||||

Purchases of property, plant and equipment |

(190.5 | ) | (176.9 | ) | (135.8 | ) | ||||

Purchases of software and other deferred charges |

(35.6 | ) | (29.7 | ) | (15.7 | ) | ||||

Proceeds from sales of property, plant and equipment |

6.0 | 8.5 | 7.6 | |||||||

Purchases of investments, net |

(8.3 | ) | (.1 | ) | (.5 | ) | ||||

Plus: free cash outflow from discontinued operations |

– | – | .1 | |||||||

| | | | | | | | | | | |

Free cash flow |

$ | 421.7 | $ | 387.1 | $ | 329.4 | ||||

| | | | | | | | | | | |

In 2017, net cash provided by operating activities increased compared to 2016 primarily due to higher income from continuing operations before taxes, as well as lower pension plan contributions, partially offset by higher income tax payments, net of refunds. Net cash provided by operating activities in 2017 reflected the impact of our adoption of the accounting guidance update related to stock-based payments described in Note 1, "Summary of Significant Accounting Policies," to the Consolidated Financial Statements. Free cash flow increased due to higher net cash flow provided by operating activities, partially offset by higher net capital and software expenditures.

In 2016, net cash provided by operating activities increased compared to 2015 primarily due to higher net income, lower severance payments, benefits from changes in operational working capital, and lower income tax payments, net of refunds, partially offset by higher incentive compensation paid in 2016 for the 2015 performance year and higher pension plan contributions. Free cash flow increased due to higher net cash flow provided by operating activities, partially offset by higher capital and software expenditures.

Outlook

Certain factors that we believe may contribute to our 2018 results are described below:

- •

- We expect our net sales to increase by approximately 8%.

- •

- Assuming the continuation of foreign currency rates in effect at year-end 2017, we expect foreign currency translation to increase pre-tax operating income by approximately $20 million.

- •

- We expect our full year effective tax rate to be in the mid-twenty percent range.

- •

- We anticipate capital and software expenditures of approximately $250 million.

- •

- We estimate cash restructuring costs of at least $15 million.

| 5 Avery Dennison Corporation 2017 Annual Report | | |

Management's Discussion and Analysis of Financial Condition and Results of Operations

ANALYSIS OF RESULTS OF OPERATIONS

Income from Continuing Operations before Taxes

| (In millions, except percentages) |

2017 |

2016 |

2015 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

Net sales |

$ | 6,613.8 | $ | 6,086.5 | $ | 5,966.9 | ||||

Cost of products sold |

4,801.6 | 4,386.8 | 4,321.1 | |||||||

| | | | | | | | | | | |

Gross profit |

1,812.2 | 1,699.7 | 1,645.8 | |||||||

Marketing, general and administrative expense |

1,123.2 | 1,097.5 | 1,108.1 | |||||||

Other expense, net |

36.5 | 65.2 | 68.3 | |||||||

Interest expense |

63.0 | 59.9 | 60.5 | |||||||

| | | | | | | | | | | |

Income from continuing operations before taxes |

$ | 589.5 | $ | 477.1 | $ | 408.9 | ||||

| | | | | | | | | | | |

Gross profit margin |

27.4 |

% |

27.9 |

% |

27.6 |

% |

||||

| | | | | | | | | | | |

Gross Profit Margin

Gross profit margin in 2017 decreased compared to 2016 due to margin decline in the Industrial and Healthcare Materials reportable segment driven by the impact of acquisitions, growth investments, near-term operational challenges, and a program loss in personal care tapes, which began impacting results in mid-2016.

Gross profit margin in 2016 improved compared to 2015 primarily reflecting benefits from productivity initiatives, including savings from restructuring, net of transition costs, and higher volume, partially offset by higher employee-related costs, the net impact of pricing and raw material costs, and unfavorable geographic mix.

Marketing, General and Administrative Expense

Marketing, general and administrative expense increased in 2017 compared to 2016 due to acquisitions. Before the impact of acquisitions, the benefits from productivity initiatives, including savings from restructuring, net of transition costs, were partially offset by higher employee-related costs.

Marketing, general and administrative expense decreased in 2016 compared to 2015 reflecting benefits from productivity initiatives, including savings from restructuring, net of transition costs, and the favorable impact of foreign currency translation, partially offset by higher employee-related costs.

Other Expense, net

| (In millions) |

2017 |

2016 |

2015 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

Other expense, net by type |

||||||||||

Restructuring charges: |

||||||||||

Severance and related costs |

$ | 31.2 | $ | 14.7 | $ | 52.5 | ||||

Asset impairment charges and lease cancellation costs |

2.2 | 5.2 | 7.0 | |||||||

Other items: |

||||||||||

Transaction costs |

5.2 | 5.0 | – | |||||||

Net gains on sales of assets |

(2.1 | ) | (1.1 | ) | (1.7 | ) | ||||

Net loss from curtailment and settlement of pension obligations |

– | 41.4 | .3 | |||||||

Legal settlements |

– | – | (.3 | ) | ||||||

Loss on sale of a product line and related exit costs |

– | – | 10.5 | |||||||

| | | | | | | | | | | |

Other expense, net |

$ | 36.5 | $ | 65.2 | $ | 68.3 | ||||

| | | | | | | | | | | |

Refer to Note 13, "Cost Reduction Actions," and Note 6, "Pension and Other Postretirement Benefits," to the Consolidated Financial Statements for more information.

Interest Expense

Interest expense increased approximately $3 million in 2017 compared to 2016, primarily due to additional long-term borrowings made in 2017. Refer to Note 4, "Debt and Capital Leases," to the Consolidated Financial Statements for more information.

Net Income and Earnings per Share

| (In millions, except percentages and per share amounts) |

2017 |

2016 |

2015 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

Income from continuing operations before taxes |

$ | 589.5 | $ | 477.1 | $ | 408.9 | ||||

Provision for income taxes |

307.7 | 156.4 | 134.5 | |||||||

| | | | | | | | | | | |

Income from continuing operations |

281.8 | 320.7 | 274.4 | |||||||

Loss from discontinued operations, net of tax |

– | – | (.1 | ) | ||||||

| | | | | | | | | | | |

Net income |

$ | 281.8 | $ | 320.7 | $ | 274.3 | ||||

| | | | | | | | | | | |

Net income per common share |

$ | 3.19 | $ | 3.60 | $ | 3.01 | ||||

Net income per common share, assuming dilution |

3.13 | 3.54 | 2.95 | |||||||

| | | | | | | | | | | |

Effective tax rate for continuing operations |

52.2 |

% |

32.8 |

% |

32.9 |

% |

||||

| | | | | | | | | | | |

Provision for Income Taxes

The 2017 effective tax rate for continuing operations included a net tax charge of $172 million related to the enactment of the TCJA, $5.1 million of tax benefit from the release of valuation allowance on certain state deferred tax assets, $4.2 million of tax benefit, including previously accrued interest and penalties, from effective settlements and changes in our judgment about tax filing positions as a result of new information, and $4.4 million of tax benefit from decreases in certain tax reserves, including interest and penalties, as a result of closing tax years.

The 2017 effective tax rate also included a net benefit of $16 million related to our adoption of the accounting guidance update related to stock-based payments described in Note 1, "Summary of Significant Accounting Policies," to the Consolidated Financial Statements. This accounting guidance update required that the effect of excess tax benefits associated with stock-based payments be recognized in the income statement instead of in capital in excess of par value as was the case prior to our adoption of this update. Excess tax benefits are the effects of tax deductions in excess of compensation expense recognized for financial accounting purposes. These benefits related to stock-based awards generally are generated as a result of stock price appreciation during the vesting period or between the time of grant and the time of exercise. We expect future excess tax benefits to vary depending on our stock-based payments in future reporting periods. These excess tax benefits may cause variability in our future effective tax rate as they can fluctuate based on vesting and exercise activity, as well as our future stock price.

In 2017, as a result of intra-entity sales and transfers of assets other than inventory related to the recent integration of an acquisition, we recognized a total of approximately $14 million of tax-related deferred

| | | 6 |

Management's Discussion and Analysis of Financial Condition and Results of Operations

charges in "Other current assets" and "Other assets." However, we expect the tax-related deferred charges to be derecognized as an adjustment to retained earnings upon our adoption of the accounting guidance update described in Note 1, "Summary of Significant Accounting Policies," to the Consolidated Financial Statements.

The 2016 effective tax rate for continuing operations included $7.6 million of tax expense associated with the cost to repatriate current earnings of certain foreign subsidiaries and $46.3 million of tax expense related to U.S. income and foreign withholding taxes resulting from changes in indefinite reinvestment assertions on certain foreign earnings and profits; benefits from changes in certain tax reserves, including interest and penalties, of $16.8 million resulting from settlements of certain foreign audits and $5.4 million resulting from expirations of statutes of limitations; benefits of $6.7 million from the release of valuation allowances against certain deferred tax assets in a foreign jurisdiction associated with a structural simplification approved by the tax authority and $3.6 million from the release of valuation allowances on certain state deferred tax assets; and $8.4 million of tax expense from deferred tax adjustments resulting from tax rate changes in certain foreign jurisdictions.

The 2015 effective tax rate for continuing operations included tax expense of $20 million associated with the tax cost to repatriate current earnings of certain foreign subsidiaries; benefits from changes in certain tax reserves, including interest and penalties, of $5.8 million resulting from settlements of audits and $8.2 million resulting from expirations of statutes of limitations; and a tax benefit of $2.6 million from the extension of the federal research and development credit, as a result of the enactment of the Protecting Americans from Tax Hikes Act of 2015 ("PATH Act"), which included a provision making permanent the federal research and development tax credit for the tax years 2015 and beyond. The PATH Act also retroactively extended the controlled foreign corporation ("CFC") look-through rule that had expired on December 31, 2014.

Refer to Note 14, "Taxes Based on Income," to the Consolidated Financial Statements for more information.

RESULTS OF OPERATIONS BY REPORTABLE SEGMENT

Operating income refers to income from continuing operations before interest and taxes.

Label and Graphic Materials

| (In millions) |

2017 |

2016 |

2015 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

Net sales including intersegment sales |

$ | 4,575.8 | $ | 4,250.7 | $ | 4,093.4 | ||||

Less intersegment sales |

(64.1 | ) | (63.4 | ) | (61.3 | ) | ||||

| | | | | | | | | | | |

Net sales |

$ | 4,511.7 | $ | 4,187.3 | $ | 4,032.1 | ||||

Operating income (1) |

567.3 | 516.2 | 453.4 | |||||||

| | | | | | | | | | | |

(1) Included charges associated with restructuring in all years, transaction costs in 2017 and 2016, gains on sale of assets in 2017 and 2015, and losses from curtailment and settlement of pension obligations in 2015. |

$ | 14.5 | $ | 13.0 | $ | 12.1 | ||||

| | | | | | | | | | | |

Net Sales

The factors impacting reported sales change are shown in the table below:

| |

2017 |

2016 |

|||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

Reported sales change |

8 | % | 4 | % | |||

Foreign currency translation |

(1 | ) | 3 | ||||

| | | | | | | | |

Sales change ex. currency |

7 | 7 | |||||

Acquisitions |

(3 | ) | (1 | ) | |||

| | | | | | | | |

Organic sales change (1) |

4 | % | 5 | % | |||

| | | | | | | | |

- (1)

- Totals may not sum due to rounding.

In both years, net sales increased on an organic basis due to higher volume.

In 2017, net sales increased on an organic basis at mid-single digit rates in emerging markets and Western Europe and at a low-single digit rate in North America.

In 2016, net sales increased on an organic basis at a low-teen digit rate in emerging markets, at a mid-single digit rate in Western Europe, and at a low-single digit rate in North America.

Operating Income

Operating income increased in 2017 compared to 2016 primarily reflecting higher volume/mix and benefits from productivity initiatives, including savings from restructuring, net of transition costs, partially offset by higher employee-related costs and the net impact of pricing and raw material costs.

Operating income increased in 2016 compared to 2015 due to higher volume and benefits from productivity initiatives, including savings from restructuring, net of transition costs, partially offset by the net impact of pricing and raw material costs, unfavorable geographic mix, the unfavorable impact of foreign currency translation, and higher employee-related costs.

Retail Branding and Information Solutions

| (In millions) |

2017 |

2016 |

2015 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

Net sales including intersegment sales |

$ | 1,514.4 | $ | 1,448.3 | $ | 1,446.3 | ||||

Less intersegment sales |

(3.2 | ) | (2.9 | ) | (2.9 | ) | ||||

| | | | | | | | | | | |

Net sales |

$ | 1,511.2 | $ | 1,445.4 | $ | 1,443.4 | ||||

Operating income (1) |

122.9 | 102.6 | 51.6 | |||||||

| | | | | | | | | | | |

(1) Included charges associated with restructuring and transaction costs related to the sale of a product line in all years, gains on sales of assets in 2017 and 2016, and legal settlement in 2015. |

$ | 18.1 | $ | 9.8 | $ | 45.7 | ||||

| | | | | | | | | | | |

| 7 Avery Dennison Corporation 2017 Annual Report | | |

Management's Discussion and Analysis of Financial Condition and Results of Operations

Net Sales

The factors impacting reported sales change are shown in the table below:

| |

2017 |

2016 |

|||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

Reported sales change |

5 | % | – | % | |||

Foreign currency translation |

– | 2 | |||||

| | | | | | | | |

Sales change ex. currency |

5 | 2 | |||||

Product line divestiture |

– | 2 | |||||

| | | | | | | | |

Organic sales change (1) |

5 | % | 3 | % | |||

| | | | | | | | |

- (1)

- Totals may not sum due to rounding.

In 2017, net sales increased on an organic basis due to higher volume, reflecting growth in both base apparel tickets and tags and radio-frequency identification products.

In 2016, net sales increased on an organic basis primarily due to higher volume from sales of radio-frequency identification products.

Operating Income

Operating income increased in 2017 compared to 2016 due to benefits from productivity initiatives, including savings from restructuring actions, net of transition costs, and higher volume, partially offset by higher employee-related costs.

Operating income increased in 2016 compared to 2015 due to higher volume, lower restructuring charges, benefits from productivity initiatives, including savings from restructuring, net of transition costs, and the loss on sale of a product line and related transaction and exit costs in the prior year, partially offset by higher employee-related costs and the impact of strategic pricing actions.

Industrial and Healthcare Materials

| (In millions) |

2017 |

2016 |

2015 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

Net sales including intersegment sales |

$ | 598.6 | $ | 461.0 | $ | 506.2 | ||||

Less intersegment sales |

(7.7 | ) | (7.2 | ) | (14.8 | ) | ||||

| | | | | | | | | | | |

Net sales |

$ | 590.9 | $ | 453.8 | $ | 491.4 | ||||

Operating income (1) |

50.5 | 54.6 | 57.1 | |||||||

| | | | | | | | | | | |

(1) Included charges associated with restructuring in all years and transaction costs in 2017 and 2016. |

$ | 3.7 | $ | 1.9 | $ | 8.0 | ||||

| | | | | | | | | | | |

Net Sales

The factors impacting reported sales change are shown in the table below:

| |

2017 |

2016 |

|||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

Reported sales change |

30 | % | (8 | )% | |||

Foreign currency translation |

– | 2 | |||||

| | | | | | | | |

Sales change ex. currency |

30 | (6 | ) | ||||

Acquisitions |

(28 | ) | (2 | ) | |||

| | | | | | | | |

Organic sales change |

2 | % | (8 | )% | |||

| | | | | | | | |

In 2017, net sales increased on an organic basis due to higher volume, as growth in industrial categories more than offset the anticipated decline in healthcare categories.

In 2016, net sales decreased on an organic basis primarily due to lower volume in the Performance Tapes product group. Net sales decreased on an organic basis at a high-single digit rate for the Performance Tapes product group primarily due to a program loss in personal care tapes.

Operating Income

Operating income decreased in 2017 compared to 2016 due to the program loss in personal care tapes, which began impacting results in mid-2016, higher employee-related costs, and growth investments, partially offset by volume growth in the industrial categories and the impact of acquisitions.

Operating income decreased in 2016 compared to 2015 primarily due to lower volume, including the program loss in personal care tapes, partially offset by benefits from productivity initiatives, including savings from restructuring, net of transition costs, and lower restructuring charges.

| | | 8 |

Management's Discussion and Analysis of Financial Condition and Results of Operations

FINANCIAL CONDITION

Liquidity

Operating Activities

| (In millions) |

2017 |

2016 |

2015 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

Net income |

$ | 281.8 | $ | 320.7 | $ | 274.3 | ||||

Depreciation and amortization |

178.7 | 180.1 | 188.3 | |||||||

Provision for doubtful accounts and sales returns |

37.6 | 54.4 | 46.5 | |||||||

Net losses from asset impairments and sales/disposals of assets |

1.4 | 1.5 | 12.2 | |||||||

Stock-based compensation |

30.2 | 27.2 | 26.3 | |||||||

Loss from settlement of pension obligations |

– | 41.4 | – | |||||||

Deferred income taxes |

151.6 | 52.3 | 12.9 | |||||||

Other non-cash expense and loss |

53.9 | 46.2 | 50.1 | |||||||

Trade accounts receivable |

(141.2 | ) | (88.2 | ) | (135.9 | ) | ||||

Inventories |

(14.9 | ) | (19.6 | ) | (34.4 | ) | ||||

Other current assets |

(6.5 | ) | (7.6 | ) | 3.9 | |||||

Accounts payable |

83.4 | 31.6 | 65.5 | |||||||

Accrued liabilities |

(.6 | ) | 32.4 | 7.0 | ||||||

Taxes on income |

29.6 | (14.1 | ) | (23.7 | ) | |||||

Other assets |

(11.8 | ) | (1.2 | ) | (.3 | ) | ||||

Long-term retirement benefits and other liabilities |

(23.1 | ) | (71.8 | ) | (19.0 | ) | ||||

| | | | | | | | | | | |

Net cash provided by operating activities |

$ | 650.1 | $ | 585.3 | $ | 473.7 | ||||

| | | | | | | | | | | |

For cash flow purposes, changes in assets and liabilities and other adjustments exclude the impact of foreign currency translation (discussed below in "Analysis of Selected Balance Sheet Accounts").

In 2017, cash flow provided by operating activities increased compared to 2016 primarily due to higher income from continuing operations before taxes, as well as lower pension plan contributions, partially offset by higher income tax payments, net of refunds. In addition, operating activities reflected the impact of our adoption of the accounting guidance update related to stock-based payments described in Note 1, "Summary of Significant Accounting Policies," to the Consolidated Financial Statements.

In 2016, cash flow provided by operating activities increased compared to 2015 due to higher net income, lower severance payments, benefits from changes in operational working capital, and lower income tax payments, net of refunds, partially offset by higher incentive compensation paid in 2016 for the 2015 performance year and higher pension contributions.

Investing Activities

| (In millions) |

2017 |

2016 |

2015 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

Purchases of property, plant and equipment |

$ | (190.5 | ) | $ | (176.9 | ) | $ | (135.8 | ) | |

Purchases of software and other deferred charges |

(35.6 | ) | (29.7 | ) | (15.7 | ) | ||||

Proceeds from sales of property, plant and equipment |

6.0 | 8.5 | 7.6 | |||||||

Purchases of investments, net |

(8.3 | ) | (.1 | ) | (.5 | ) | ||||

Payments for acquisitions, net of cash acquired, and investments in businesses |

(319.3 | ) | (237.2 | ) | – | |||||

Other |

– | – | 1.5 | |||||||

| | | | | | | | | | | |

Net cash used in investing activities |

$ | (547.7 | ) | $ | (435.4 | ) | $ | (142.9 | ) | |

| | | | | | | | | | | |

Capital and Software Spending

In 2017 and 2016, we invested in new equipment to support growth in Asia, Europe and North America and to improve manufacturing productivity. In 2015, we invested in new equipment to support growth, primarily in Asia and Europe, and to improve manufacturing productivity.

In 2017, we invested in information technology primarily associated with enterprise resource planning system implementations in North America, Asia, and Europe. Information technology investments in 2016 and 2015 were primarily associated with standardization initiatives in Asia and North America.

Payments for Acquisitions and Investments in Businesses

In 2017 and 2016, the aggregate payments for acquisitions, net of cash acquired, and investments in businesses were approximately $319 million and $237 million, respectively, which we funded through cash and commercial paper borrowings. The 2017 Acquisitions were also partially funded through proceeds from the senior notes we issued in 2017.

Refer to Note 2, "Acquisitions," to the Consolidated Financial Statements for more information.

Other

In May 2015, we received $1.5 million from the sale of a product line in our RBIS reportable segment.

Financing Activities

| (In millions) |

2017 |

2016 |

2015 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

Net change in borrowings and repayments of debt |

$ | (343.0 | ) | $ | 232.2 | $ | (105.8 | ) | ||

Additional long-term borrowings |

542.9 | – | – | |||||||

Dividend payments |

(155.5 | ) | (142.5 | ) | (133.1 | ) | ||||

Share repurchases |

(129.7 | ) | (262.4 | ) | (232.3 | ) | ||||

Proceeds from exercises of stock options, net |

22.0 | 71.0 | 104.0 | |||||||

Tax withholding for and excess tax benefit from stock-based compensation, net |

(20.6 | ) | (4.5 | ) | (.1 | ) | ||||

| | | | | | | | | | | |

Net cash used in financing activities |

$ | (83.9 | ) | $ | (106.2 | ) | $ | (367.3 | ) | |

| | | | | | | | | | | |

| 9 Avery Dennison Corporation 2017 Annual Report | | |

Management's Discussion and Analysis of Financial Condition and Results of Operations

Borrowings and Repayment of Debt

In March 2016, we entered into an agreement to establish a Euro-Commercial Paper Program pursuant to which we may issue unsecured commercial paper notes up to a maximum aggregate amount outstanding of $500 million. As of December 31, 2016, $209 million was outstanding under this program, which reflected borrowings to fund a portion of our acquisition of Mactac. As of December 30, 2017, no balance was outstanding under this program.

In March 2017, we issued €500 million of senior notes, due March 2025. The senior notes bear an interest rate of 1.25% per year, payable annually in arrears. The net proceeds from the offering, after deducting underwriting discounts and estimated offering expenses, were $526.6 million (€495.5 million), a portion of which we used to repay commercial paper borrowings used to finance a portion of our acquisition of Mactac and the remainder of which we used for general corporate purposes and the 2017 Acquisitions.

Given the seasonality of our cash flow from operating activities, during 2017, 2016, and 2015, our commercial paper borrowings were also used to fund share repurchase activity, dividend payments, and capital expenditures. In October 2017, we repaid $250 million of senior notes at maturity using U.S. commercial paper borrowings.

Refer to Note 2, "Acquisitions," and Note 4, "Debt and Capital Leases," to the Consolidated Financial Statements for more information.

Dividend Payments

We paid dividends of $1.76 per share in 2017 compared to $1.60 per share in 2016. In April 2017, we increased our quarterly dividend to $.45 per share, representing an increase of approximately 10% from our previous dividend rate of $.41 per share.

Share Repurchases

From time to time, our Board of Directors ("Board") authorizes the repurchase of shares of our outstanding common stock. Repurchased shares may be reissued under our long-term incentive plan or used for other corporate purposes. In 2017, we repurchased approximately 1.5 million shares of our common stock at an aggregate cost of $129.7 million. In 2016, we repurchased approximately 3.8 million shares of our common stock at an aggregate cost of $262.4 million.

In April 2017, our Board authorized the repurchase of shares of our common stock with a fair market value of up to $650 million, exclusive of any fees, commissions or other expenses related to such purchases, in addition to the amount outstanding under our previous Board authorization. Board authorizations remain in effect until shares in the amount authorized thereunder have been repurchased. As of December 30, 2017, shares of our common stock in the aggregate amount of $625.2 million remained authorized for repurchase under this Board authorization. As of December 31, 2016, shares of our common stock in the aggregate amount of $104.9 million remained authorized under our previous Board authorization.

Proceeds from Exercises of Stock Options, net

The number of stock options exercised was approximately .6 million, 1.4 million, and 2.5 million in 2017, 2016, and 2015, respectively. Refer to Note 12, "Long-Term Incentive Compensation," to the Consolidated Financial Statements for more information.

Tax Withholding for and Excess Tax Benefit from Stock-Based Compensation, Net

In 2017, tax withholding for and excess tax benefit from stock-based compensation, net, reflected the impact of our adoption of the accounting guidance update related to stock-based payments described in Note 1, "Summary of Significant Accounting Policies," to the Consolidated Financial Statements.

Analysis of Selected Balance Sheet Accounts

Long-lived Assets

Property, plant and equipment, net, increased by approximately $183 million to $1.1 billion at year-end 2017, which primarily reflected purchases of property, plant and equipment, as well as the preliminary valuation of property, plant and equipment from the 2017 Acquisitions of approximately $66 million and the impact of foreign currency translation, partially offset by depreciation expense.

Goodwill increased by approximately $192 million to $985.1 million at year-end 2017, which primarily reflected the preliminary valuation of goodwill associated with the 2017 Acquisitions and the impact of foreign currency translation.

Other intangibles resulting from business acquisitions, net, increased by approximately $100 million to $166.3 million at year-end 2017, which primarily reflected the valuation of intangibles resulting from the 2017 Acquisitions and the impact of foreign currency translation, partially offset by amortization expense.

Refer to Note 3, "Goodwill and Other Intangibles Resulting from Business Acquisitions," to the Consolidated Financial Statements for more information.

Other assets increased by approximately $51 million to $453.4 million at year-end 2017, which primarily reflected an increase in the cash surrender value of our corporate-owned life insurance policies, an increase to tax-related deferred charges associated with the recent integration of an acquisition, and the impact of the 2017 Acquisitions, partially offset by amortization expense related to software and other deferred charges, net of purchases.

Shareholders' Equity Accounts

The balance of our shareholders' equity increased by approximately $121 million to $1.05 billion at year-end 2017, which reflected current year net income, the use of treasury shares to settle exercises of stock options and vesting of stock-based awards and fund contributions to our U.S. defined contribution plan, and the net decrease in "Accumulated other comprehensive loss." These increases were partially offset by dividend payments and share repurchases.

The balance of our treasury stock increased by approximately $85 million to $1.86 billion at year-end 2017, which primarily reflected share repurchase activity, partially offset by the use of treasury shares to settle exercises of stock options and vesting of stock-based awards and fund contributions to our U.S. defined contribution plan.

Accumulated other comprehensive loss decreased by approximately $71 million to $680.5 million at year-end 2017 primarily due to the favorable impact of foreign currency translation and amortization of net actuarial losses related to our pension plans.

Refer to Note 6, "Pension and Other Postretirement Benefits," to the Consolidated Financial Statements for more information.

| | | 10 |

Management's Discussion and Analysis of Financial Condition and Results of Operations

Impact of Foreign Currency Translation

| (In millions) |

2017 |

2016 |

|||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

Change in net sales |

$ | 29 | $ | (147 | ) | ||

Change in net income from continuing operations |

1 | (12 | ) | ||||

| | | | | | | | |

In 2017, international operations generated approximately 76% of our net sales. Our future results are subject to changes in political and economic conditions in the regions in which we operate and the impact of fluctuations in foreign currency exchange and interest rates.

The favorable impact of foreign currency translation on net sales in 2017 compared to 2016 was primarily related to euro-denominated sales and sales in Brazil, partially offset by the unfavorable impact of foreign currency translation on sales in China.

Effect of Foreign Currency Transactions

The impact on net income from transactions denominated in foreign currencies is largely mitigated because the costs of our products are generally denominated in the same currencies in which they are sold. In addition, to reduce our income and cash flow exposure to transactions in foreign currencies, we enter into foreign exchange forward, option and swap contracts where available and appropriate. We also utilize certain foreign-currency-denominated debt to mitigate our foreign currency translation exposure from our net investment in foreign operations.

Analysis of Selected Financial Ratios

We utilize the financial ratios discussed below to assess our financial condition and operating performance.

Working Capital (Deficit) and Operational Working Capital Ratios

Working capital (deficit) (current assets minus current liabilities), as a percentage of net sales, was 4% in 2017 compared to (1.6)% in 2016. The increase was primarily driven by increases in trade accounts receivable and inventories, as well as the decrease in short-term debt as a result of lower commercial paper borrowings, partially offset by an increase in accounts payable.

Operational working capital, as a percentage of net sales, is reconciled with working capital (deficit) below. Our objective is to minimize our investment in operational working capital, as a percentage of sales, to maximize our cash flow and return on investment.

| (In millions, except percentages) |

2017 |

2016 |

|||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

(A) Working capital (deficit) |

$ | 266.1 | $ | (99.5 | ) | ||

Reconciling items: |

|||||||

Cash and cash equivalents |

(224.4 | ) | (195.1 | ) | |||

Current refundable income taxes and other current assets |

(217.3 | ) | (182.8 | ) | |||

Assets held for sale |

(6.3 | ) | (6.8 | ) | |||

Short-term borrowings and current portion of long-term debt and capital leases |

265.4 | 579.1 | |||||

Current income taxes payable and other current accrued liabilities |

699.2 | 583.3 | |||||

| | | | | | | | |

(B) Operational working capital |

$ | 782.7 | $ | 678.2 | |||

| | | | | | | | |

(C) Net sales |

$ | 6,613.8 | $ | 6,086.5 | |||

| | | | | | | | |

Working capital (deficit), as a percentage of net sales (A) ÷ (C) |

4.0 | % | (1.6 | )% | |||

| | | | | | | | |

Operational working capital, as a percentage of net sales (B) ÷ (C) |

11.8 | % | 11.1 | % | |||

| | | | | | | | |

Accounts Receivable Ratio

The average number of days sales outstanding was 63 days in 2017 compared to 62 days in 2016, calculated using the four-quarter average accounts receivable balance divided by the average daily sales in 2017 and 2016, respectively. The increase in the average number of days sales outstanding reflected the impact of foreign currency translation and the timing of collections.

Inventory Ratio

Average inventory turnover was 7.9 in 2017 compared to 8.2 in 2016, calculated using the annual cost of sales in 2017 and 2016, respectively, and divided by the four-quarter average inventory balance. The decrease in the average inventory turnover primarily reflected the timing of inventory purchases.

Accounts Payable Ratio

The average number of days payable outstanding was 72 days in 2017 compared to 71 days in 2016, calculated using the four-quarter average accounts payable balance divided by the average daily cost of products sold in 2017 and 2016, respectively. The increase in average number of days payable outstanding primarily reflected the impact of foreign currency translation and the timing of vendor payments.

| 11 Avery Dennison Corporation 2017 Annual Report | | |

Management's Discussion and Analysis of Financial Condition and Results of Operations

Net Debt to EBITDA Ratio

| (In millions, except ratios) |

2017 |

2016 |

2015 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

Net income |

$ | 281.8 | $ | 320.7 | $ | 274.3 | ||||

Reconciling items: |

||||||||||

Interest expense |

63.0 | 59.9 | 60.5 | |||||||

Provision for income taxes |

307.7 | 156.4 | 134.5 | |||||||

Depreciation |

126.6 | 117.5 | 125.2 | |||||||

Amortization |

52.1 | 62.5 | 62.9 | |||||||

| | | | | | | | | | | |

EBITDA |

$ | 831.2 | $ | 717.0 | $ | 657.4 | ||||

| | | | | | | | | | | |

Total debt and capital leases |

$ | 1,581.7 | $ | 1,292.5 | $ | 1,058.9 | ||||

Less cash and cash equivalents |

(224.4 | ) | (195.1 | ) | (158.8 | ) | ||||

| | | | | | | | | | | |

Net debt |

$ | 1,357.3 | $ | 1,097.4 | $ | 900.1 | ||||

| | | | | | | | | | | |

Net debt to EBITDA ratio |

1.6 | 1.5 | 1.4 | |||||||

| | | | | | | | | | | |

The net debt to EBITDA ratio was higher in 2017 compared to 2016 primarily due to higher net debt as a result of the issuance of €500 million of senior notes, a portion of which was used to repay commercial paper borrowings that we used to finance a portion of our acquisition of Mactac and the remainder of which was used for general corporate purposes and the 2017 Acquisitions, partially offset by higher EBITDA.

The net debt to EBITDA ratio was higher in 2016 compared to 2015 primarily due to higher net debt as a result of higher commercial paper borrowings (primarily to fund the Mactac acquisition) and share repurchase activity, partially offset by higher EBITDA.

Financial Covenants

Our revolving credit facility (the "Revolver") contains financial covenants requiring that we maintain specified ratios of total debt and interest expense in relation to certain measures of income. As of December 30, 2017 and December 31, 2016, we were in compliance with our financial covenants.

Fair Value of Debt

The estimated fair value of our long-term debt is primarily based on the credit spread above U.S. Treasury securities on notes with similar rates, credit rating, and remaining maturities. The fair value of short-term borrowings, which includes commercial paper issuances and short-term lines of credit, approximates carrying value given the short duration of these obligations. The increase in the fair value of our total debt from $1.31 billion at December 31, 2016 to $1.6 billion at December 30, 2017 primarily reflected our issuance of €500 million of senior notes in 2017, partially offset by a reduction in commercial paper borrowings in that year. Fair value amounts were determined based primarily on Level 2 inputs. Refer to Note 1, "Summary of Significant Accounting Policies," to the Consolidated Financial Statements for more information.

Capital Resources

Capital resources include cash flows from operations, cash and cash equivalents and debt financing. At year-end 2017, we had cash and cash equivalents of $224.4 million held in accounts at third-party financial institutions.

Our cash balances are held in numerous locations throughout the world. At year-end 2017, the majority of our cash and cash equivalents was held by our foreign subsidiaries.

To meet U.S. cash requirements, we have several cost-effective liquidity options available. These options include borrowing funds at reasonable rates, including borrowings from foreign subsidiaries, and repatriating foreign earnings and profits. However, if we were to repatriate incremental foreign earnings and profits, we may be subject to withholding taxes imposed by foreign tax authorities and additional U.S. taxes due to the impact of foreign currency movements related to such earnings and profits.

In November 2017, we amended and restated the Revolver, increasing the amount available from certain domestic and foreign banks from $700 million to $800 million. The amendment also extended the Revolver's maturity date to November 8, 2022. The maturity date may be extended for additional one-year periods under certain circumstances. The commitments under the Revolver may be increased by up to $300 million, subject to lender approval and customary requirements. The Revolver is used as a back-up facility for our commercial paper program and can be used for other corporate purposes.

No balances were outstanding under the Revolver as of year-end 2017 or 2016. Commitment fees associated with the Revolver in 2017, 2016, and 2015 were $1.1 million, $1.1 million, and $1.9 million, respectively.

In addition to the Revolver, we have significant short-term lines of credit available in various countries totaling approximately $330 million at December 30, 2017. These lines may be cancelled at any time by us or the issuing banks. Short-term borrowings outstanding under our lines of credit were $76.1 million and $72.9 million at December 30, 2017 and December 31, 2016, respectively, with a weighted-average interest rate of 6.2% and 6.5%, respectively.

In March 2016, we entered into an agreement to establish a Euro-Commercial Paper Program pursuant to which we may issue unsecured commercial paper notes up to a maximum aggregate amount outstanding of $500 million. Proceeds from issuances under this program may be used for general corporate purposes. The maturities of the notes may vary, but may not exceed 364 days from the date of issuance. Our payment obligations with respect to any notes issued under this program are backed by the Revolver. There are no financial covenants under this program. As of December 30, 2017, no balance was outstanding under this program.

We had $183.8 million and $44.5 million of borrowings from U.S. commercial paper issuances outstanding at year-end 2017 and 2016, respectively, with a weighted-average interest rate of 1.8% and .9%, respectively.

We had medium-term notes of $45 million outstanding at year-end 2017 and 2016.

Refer to Note 4, "Debt and Capital Leases," to the Consolidated Financial Statements for more information.

We are exposed to financial market risk resulting from changes in interest and foreign currency rates, and to possible liquidity and credit risks of our counterparties.

Capital from Debt

Our total debt increased by approximately $289 million to $1.58 billion at year-end 2017 compared to $1.29 billion at year-end 2016, primarily reflecting the issuance of €500 million of senior notes, a portion of which we used to repay commercial paper borrowings used to finance a portion of our acquisition of Mactac and the remainder of which we used for general corporate purposes and to fund the 2017 Acquisitions.

| | | 12 |

Management's Discussion and Analysis of Financial Condition and Results of Operations

Credit ratings are a significant factor in our ability to raise short- and long-term financing. The credit ratings assigned to us also impact the interest rates paid and our access to commercial paper, credit facilities, and other borrowings. A downgrade of our short-term credit ratings could impact our ability to access the commercial paper markets. If our access to commercial paper markets were to become limited, the Revolver and our other credit facilities would be available to meet our short-term funding requirements, if necessary. When determining a credit rating, we believe that rating agencies primarily consider our competitive position, business outlook, consistency of cash flows, debt level and liquidity, geographic dispersion and management team. We remain committed to maintaining an investment grade rating.

Contractual Obligations, Commitments and Off-Balance Sheet Arrangements

Contractual Obligations at End of Year 2017

| |

Payments Due by Period | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (In millions) |

Total |

2018 |

2019 |

2020 |

2021 |

2022 |

Thereafter |

|||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Short-term borrowings |

$ | 259.9 | $ | 259.9 | $ | – | $ | – | $ | – | $ | – | $ | – | ||||||||

Long-term debt |

1,304.5 | 1.5 | 15.0 | 265.0 | – | – | 1,023.0 | |||||||||||||||

Payments related to long-term capital leases |

37.2 | 6.2 | 6.2 | 5.6 | 5.3 | 4.8 | 9.1 | |||||||||||||||

Interest on long-term debt |

283.2 | 41.6 | 41.6 | 31.5 | 27.1 | 27.1 | 114.3 | |||||||||||||||

Operating leases |

189.7 | 48.2 | 35.8 | 26.3 | 18.2 | 13.6 | 47.6 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Total contractual obligations |

$ | 2,074.5 | $ | 357.4 | $ | 98.6 | $ | 328.4 | $ | 50.6 | $ | 45.5 | $ | 1,194.0 | ||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

We enter into operating leases primarily for office and warehouse space and equipment for information technology, machinery, and transportation. The table above includes minimum annual rental commitments on operating leases having initial or remaining non-cancelable lease terms of one year or more.

The table above does not include:

- •

- Purchase obligations or open purchase orders at year-end – It is impracticable for us to obtain this information or provide a reasonable estimate thereof due to the decentralized nature of our purchasing systems. In addition, purchase orders are generally entered into at fair value and cancelable without penalty.

- •

- Cash funding requirements for pension benefits payable to certain eligible current and future retirees under our funded plans – Benefits under our funded pension plans are paid through a trust or trust equivalent. Cash funding requirements for our funded plans, which can be significantly impacted by earnings on investments, the discount rate, changes in the plans, and funding laws and regulations, are not included as we are not able to estimate required contributions to the trust or trust equivalent. Refer to Note 6, "Pension and Other Postretirement Benefits," to the Consolidated Financial Statements for information regarding expected contributions to these plans.

- •

- Pension and postretirement benefit payments – As of December 30, 2017, we had unfunded benefit obligations from certain defined benefit plans. Refer to Note 6, "Pension and Other Postretirement Benefits," to the Consolidated Financial Statements for more information, including expected benefit payments over the next 10 years.

- •

- Deferred compensation plan benefit payments – It is impracticable for us to obtain a reasonable estimate for 2017 and beyond due to the volatility of the payment amounts and certain events that could trigger immediate payment of benefits to participants. In addition, participant account balances are marked-to-market monthly and benefit payments are adjusted annually. Refer to Note 6, "Pension and Other Postretirement Benefits," to the Consolidated Financial Statements for more information.

- •

- Cash awards to employees under incentive compensation plans – The amounts to be paid to employees under these awards are based on our stock price and, if applicable, achievement of certain performance objectives as of the end of their respective performance periods, and, therefore, we cannot reasonably estimate the amounts to be paid on the vesting dates. Refer to Note 12, "Long-term Incentive Compensation," to the Consolidated Financial Statements for more information.

- •

- Unfunded termination indemnity benefits to certain employees outside of the U.S. – These benefits are subject to applicable agreements, local laws and regulations. We have not incurred significant costs related to these arrangements.

- •

- Unrecognized tax benefits of $108.7 million – The resolution of the balance, including the timing of payments, is contingent upon various unknown factors and cannot be reasonably estimated. Refer to Note 14, "Taxes Based on Income," to the Consolidated Financial Statements for more information.

- •

- The TCJA transition tax – We estimated a provisional cash tax impact related to the transition tax resulting from the TCJA to be approximately $27.8 million, which we will elect, to pay over a period of eight years, free of interest, with the first installment due in 2018 and the final installment due in 2025. This amount may materially change pending completion of the analysis related to the impact of the TCJA following the guidance of SEC Staff Accounting Bulletin No. 118 ("SAB 118"). Refer to Note 14, "Taxes Based on Income," to the Consolidated Financial Statements for more information.

- •

- Contingent consideration liabilities – The amounts to be paid for earn-out payments related to certain of the 2017 Acquisitions are subject to the acquired company's achievement of certain performance targets and may differ from the amounts accrued as of December 30, 2017. Refer to Note 2, "Acquisitions," to the Consolidated Financial Statements for more information.

| 13 Avery Dennison Corporation 2017 Annual Report | | |

Management's Discussion and Analysis of Financial Condition and Results of Operations

CRITICAL ACCOUNTING ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions for the reporting period and as of the financial statement date. These estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities and the reported amounts of revenue and expense. Actual results could differ from these estimates.

Critical accounting estimates are those that are important to our financial condition and results, and which require us to make difficult, subjective and/or complex judgments. Critical accounting estimates cover accounting matters that are inherently uncertain because their future resolution is unknown. We believe our critical accounting estimates include accounting for goodwill, pension and postretirement benefits, taxes based on income, long-term incentive compensation, litigation matters, and environmental expenditures.

Goodwill

Our reporting units are composed of either a discrete business or an aggregation of businesses with similar economic characteristics. In performing the required impairment tests, we perform a quantitative assessment, primarily consisting of a present value (discounted cash flow) method, to determine the fair value of the reporting units with goodwill. For certain reporting units the goodwill of which is acquired in the current period, we perform a qualitative assessment to determine whether a quantitative assessment was necessary. We perform our annual impairment test of goodwill during the fourth quarter.

Certain factors may result in the need to perform an impairment test prior to the fourth quarter, including significant underperformance of a business relative to expected operating results, significant adverse economic and industry trends, significant decline in our market capitalization for an extended period of time relative to net book value, or a decision to divest a portion of a reporting unit.