Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Kinder Morgan Canada Ltd | kml-2017x10kxexh322.htm |

| EX-32.1 - EXHIBIT 32.1 - Kinder Morgan Canada Ltd | kml-2017x10kxexh321.htm |

| EX-31.2 - EXHIBIT 31.2 - Kinder Morgan Canada Ltd | kml-2017x10kxexh312.htm |

| EX-31.1 - EXHIBIT 31.1 - Kinder Morgan Canada Ltd | kml-2017x10kxexh311.htm |

| EX-21.1 - EXHIBIT 21.1 - Kinder Morgan Canada Ltd | kml-2017x10kxexh211.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________

Form 10-K

[X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

or

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____to_____

Commission file number: 000-55864

Kinder Morgan Canada Limited

(Exact name of registrant as specified in its charter)

Alberta, Canada | N/A | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

Suite 2700, 300 - 5th Avenue S.W. Calgary, Alberta T2P 5J2

(Address of principal executive offices) (zip code)

Registrant’s telephone number, including area code: 403-514-6780

____________

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Restricted Voting Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No þ

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K(§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” (in Rule 12b-2 of the Exchange Act).

Large accelerated filer o Accelerated filer o Non-accelerated filer þ Smaller reporting company o Emerging growth company þ

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes o No þ

Aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based on closing prices in the daily composite list for transactions on the Toronto Stock Exchange on June 30, 2017 was approximately CAD$1,631,630,700. As of February 16, 2018, the registrant had 103,661,302 Restricted Voting Shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement for the 2018 Annual Meeting of Stockholders, which shall be filed no later than April 30, 2018, are incorporated into PART III, as specifically set forth in PART III.

KINDER MORGAN CANADA LIMITED TABLE OF CONTENTS | ||

Page Number | ||

KINDER MORGAN CANADA LIMITED TABLE OF CONTENTS (continued) | ||

EXPLANATORY NOTE

Capitalized terms used throughout this document are defined in "Glossary" below. References to "we," "us," "our" and the "Company" are to Kinder Morgan Canada Limited and, unless the context otherwise indicates, the Operating Entities. We state our financial statements in Canadian dollars. References in this document to "dollars," "$" or "CAD$" are to the currency of Canada, and references to "U.S.$" or “U.S. dollar” are to the currency of the United States. See "Conversions."

GLOSSARY | |||

Company Abbreviations | |||

Class A Units | = | the Class A limited partnership units of the Limited Partnership | |

Class B Units | = | the Class B limited partnership units of the Limited Partnership | |

Cochin | = | Canadian portion of the U.S. and Canadian Cochin pipeline system | |

Company Voting Shares | = | collectively, the Restricted Voting Shares and the Special Voting Shares | |

Cooperation Agreement | = | the cooperation agreement, between the Company, the General Partner, the Limited Partnership, KMCC, KMCT and Kinder Morgan (in respect to certain provisions only) entered into in connection with the IPO | |

General Partner | = | Kinder Morgan Canada GP Inc. | |

IPO | = | Initial Public Offering of KML’s Restricted Voting Shares in May 2017 | |

Jet Fuel | = | Jet Fuel pipeline system | |

KMCC | = | Kinder Morgan Canada Company | |

KMCI | = | Kinder Morgan Canada Inc. | |

KMCT | = | Kinder Morgan Canada Terminal ULC | |

KMCU | = | Kinder Morgan Cochin ULC | |

KML | = | Kinder Morgan Canada Limited and its majority-owned and/or controlled subsidiaries | |

Kinder Morgan | = | Kinder Morgan, Inc. | |

Kinder Morgan Canada Group | = | collectively, the Company, the General Partner, the Limited Partnership, and each person that any of the Company, the General Partner or the Limited Partnership controls from time to time | |

Kinder Morgan Group | = | Kinder Morgan and each person that Kinder Morgan directly or indirectly controls from time to time, other than any member of the Kinder Morgan Canada Group | |

Limited Partnership | = | Kinder Morgan Canada Limited Partnership | |

LP Units | = | collectively, the Class A Units and the Class B Units | |

Operating Entities | = | the companies, partnerships and joint ventures that own and operate the assets comprising our business, which are direct or indirect wholly owned subsidiaries or jointly-controlled investments of the Limited Partnership, with the principal operating entities being KMCU, KM Canada Marine Terminal Limited Partnership, KM Canada North 40 Limited Partnership, Kinder Morgan Canada Rail Holdings GP Limited, KMCI, Trans Mountain Pipeline L.P., Trans Mountain (Jet Fuel) Inc., Trans Mountain Pipeline (Puget Sound) LLC and Trans Mountain | |

Preferred LP Units | = | the preferred limited partnership units in the Limited Partnership | |

Puget Sound | = | Puget Sound pipeline system | |

Restricted Voting Shares | = | the restricted voting shares in the capital of KML | |

Series 1 Preferred Shares | = | the 12,000,000 cumulative redeemable minimum rate reset Preferred Shares, Series 1 in the capital of KML | |

Series 2 Preferred Shares | = | the cumulative redeemable floating rate Preferred Shares, Series 2 in the capital of KML | |

Series 3 Preferred Shares | = | the 10,000,000 cumulative redeemable minimum rate reset Preferred Shares, Series 3 in the capital of KML | |

Series 4 Preferred Shares | = | the cumulative redeemable floating rate Preferred Shares, Series 4 in the capital of KML | |

Preferred Shares | = | Collectively all outstanding Series 1 Preferred Shares, Series 2 Preferred Shares (if and when issued), Series 3 Preferred Shares and Series 4 Preferred Shares (if and when issued) | |

Special Voting Shares | = | the special voting shares in the capital of KML | |

TMEP | = | Trans Mountain Expansion Project | |

TMPL | = | Trans Mountain pipeline system | |

1

GLOSSARY (continued) | |||

Trans Mountain | = | Trans Mountain Pipeline ULC | |

Unless the context otherwise requires, references to “we,” “us,” “our,” “ours,” “the Company,” are intended to mean Kinder Morgan Canada Limited and its majority-owned and/or controlled subsidiaries. | |||

Common Industry and Other Terms | |||

/d | = | per day | |

Adjusted EBITDA | = | adjusted earnings before interest expense, taxes, depreciation and amortization | |

B.C. | = | British Columbia | |

BCUC | = | British Columbia Utilities Commission | |

bpd | = | barrels per day | |

DCF | = | distributable cash flow | |

DD&A | = | depreciation, depletion and amortization | |

EBDA | = | earnings before depreciation, depletion and amortization expenses | |

FASB | = | Financial Accounting Standards Board | |

FERC | = | Federal Energy Regulatory Commission | |

GAAP or U.S. GAAP | = | United States Generally Accepted Accounting Principles | |

LLC | = | limited liability company | |

MBbl | = | thousand barrels | |

MMBbl | = | million barrels | |

MMtonnes | = | million metric tonnes. | |

NEB | = | National Energy Board | |

SEC | = | United States Securities and Exchange Commission | |

TSX | = | Toronto Stock Exchange | |

U.S. | = | United States of America | |

WCSB | = | Western Canadian Sedimentary Basin | |

2

Information Regarding Forward-Looking Statements

This report includes forward-looking statements and forward-looking information, including forward-looking information and projections provided by third party sources (collectively “forward-looking statements”). These forward-looking statements are identified as any statement that does not relate strictly to historical or current facts. Forward-looking statements may be identified by words such as “anticipate,” “believe,” “intend,” “plan,” “projection,” “forecast,” “strategy,” “position,” “continue,” “estimate,” “expect,” “may,” or the negative of those terms or other variations of them or comparable terminology. In particular, but without limitation, this document contains forward-looking statements pertaining to the following:

• | the TMEP and Base Line Terminal project, including the possibility of mitigation to address project delays, the impact of cost increases (and the extent to which Trans Mountain is able to pass such costs through to shippers) and delays on project returns, and the cost structure, anticipated funding, construction plans, completion scheduling, in-service dates, future utilization, future revenue and costs and future impacts on our Adjusted EBITDA and DCF; |

• | expectations regarding our ability to generate certain targeted Adjusted EBITDA and DCF (including capitalized financing costs) and to declare dividends, including amounts thereof; |

• | the future commercial viability of our business; |

• | the realization of benefits deriving from future growth projects, including TMEP and Base Line Terminal; |

• | the potential growth opportunities and anticipated competitive position of our business segments; |

• | the anticipated results of our pipeline tolls and toll structure and our ability to recover certain cost overruns and earn returns as a result of such tolls; |

• | expectations respecting our ability to generate predictable and growing cash available for distribution and to support growing dividends; |

• | expectations and intentions respecting distributions from the Limited Partnership, the payout of DCF and our payment of quarterly dividends to our shareholders, as well as the amounts of those dividends; |

• | the extent of Kinder Morgan’s indirect participation in the Limited Partnership’s distribution reinvestment plan; |

• | the impact of commodity pricing; |

• | anticipated future capital and operating expenditures; |

• | expectations respecting the ongoing financing of our business and operations; |

• | anticipated decommissioning and abandonment costs; |

• | operational (including marine) safety levels and standards; |

• | future pipeline capacity and tolls; and |

• | future crude oil supply and demand and demand for the services we provide. |

Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Future actions, conditions or events and future results of operations may differ materially from those expressed in forward-looking statements. Many of the factors that will determine these results are beyond our ability to control or predict. Any “financial outlook” set out in this document has been included for the purpose of providing information relating to management’s current expectations and plans for the future, is based on a number of significant assumptions and may not be appropriate, and should not be used, for purposes other than those for which such forward-looking statements are disclosed herein.

Our business, financial condition and results of operations, including our ability to pay cash dividends, are substantially dependent on our financial condition and results of operations and our successful development of TMEP. As a result, factors or events that impact our business as well as the costs associated with and the time required to complete (if completed) TMEP are likely to have a commensurate impact on us, the market price and value of the Restricted Voting Shares and our ability to pay dividends. Similarly, given the nature of our relationship with Kinder Morgan, factors or events that impact Kinder Morgan may have consequences for us.

Specific factors that could cause actual results to differ from those in the forward-looking statements provided in this document include, but are not limited to:

• | issues, delays or stoppages associated with major expansion projects, including TMEP; |

• | our receipt, and the timing of receipt, of governmental and/or regulatory approvals and permits; |

• | changes in the level or nature of support or opposition from the federal government and various provincial governments (including the Alberta and B.C. provincial governments), municipal governments and/or applicable regulators (including the NEB); |

• | public opposition and concerns of individuals, special interest or Aboriginal groups, governmental organizations, non-governmental organizations and other third parties that may expose us to higher project or operating costs, project delays or even project cancellations; |

• | an increase in our indebtedness and/or significant unanticipated cost overruns or required capital expenditures; |

3

• | changes in public opinion or damage to our reputation; |

• | the resolution of issues relating to interested third party and/or Aboriginal rights, title and consultation; |

• | the level of shipper demand for spot utilization on the Trans Mountain pipeline; |

• | the breakdown or failure of equipment, pipelines and facilities; releases or spills; operational disruptions or service interruptions; and catastrophic events; |

• | volatility in prices for and resulting changes in demand for refined petroleum products, oil, steel and other bulk materials and chemicals and certain agricultural products; |

• | industry, market and economic conditions and demand for the services we provide; |

• | the availability of alternative energy sources and conservation and technological advances; |

• | changes in overall global demand for hydrocarbons; |

• | natural disasters, extreme weather events or power shortages; |

• | difficulties or delays experienced by railroads, barges, trucks, ships or pipelines in delivering products to or from our terminals, storage facilities or pipelines; |

• | conditions in the capital and credit markets, inflation and fluctuations in interest rates; |

• | our ability to access external sources of financing in sufficient amounts and on acceptable terms to the extent needed to fund expansions of our pipelines, terminals, storage and related facilities and the acquisition of operating businesses and assets; |

• | compliance with legislative or regulatory requirements or changes in laws, regulations, third-party relations, approvals and decisions of courts, regulators (including the NEB) and other applicable governmental bodies; |

• | changes to regulatory, environmental, political, legal, operational and geological considerations; |

• | changes in tariff rates set by the NEB or another regulatory agency; |

• | changes in our capital structure and credit ratings; |

• | changes in tax law and/or tax reassessments; |

• | national, international, regional and local economic, competitive and regulatory conditions and developments; |

• | abandonment costs that may be substantial and exceed the amounts held in abandonment trusts; |

• | risks related to Kinder Morgan holding the controlling voting interests in us and any changes in our relationship with Kinder Morgan; |

• | the ability of our customers and other counterparties to perform under their contracts with us, financial distress experienced by our customers and other counterparties and our ability to secure development efforts, including renewing long-term customer contracts and the terms of such renewal; |

• | our ability to recover indemnification from contractual counterparties; |

• | our ability to adequately maintain a skilled workforce; |

• | strikes, blockades, riots, terrorism (including cyber-attacks), war or other acts or accidents or catastrophic events; |

• | increased industry competition; |

• | volatility and wide fluctuations in the market price for the Restricted Voting Shares or our other outstanding securities; |

• | foreign exchange fluctuations; |

• | changes in accounting pronouncements and the timing of when such measurements are to be made and recorded; and |

• | our ability to obtain and maintain sufficient insurance coverage. |

The foregoing list should not be construed to be exhaustive. We believe the forward-looking statements in this document are reasonable. However, there is no assurance that any of the actions, events or results of the forward-looking statements will occur, or if any of them do, of their timing or what impact they will have on our results of operations or financial condition. Because of these uncertainties, investors should not put undue reliance on any forward-looking statements.

See Item 1A “Risk Factors” for a more detailed description of these and other factors that may affect the forward-looking statements in this document. When considering forward-looking statements, you should keep in mind the risk factors described in Item 1A “Risk Factors.” Such risk factors could cause actual results to differ materially from those contained in any forward-looking statement. We disclaim any obligation, other than as required by applicable law, to update the above list or to announce publicly the result of any revisions to any of the forward-looking statements to reflect future events or developments.

4

PART I

Items 1 and 2. Business and Properties.

Overview

KML owns an interest in and operates an integrated network of pipeline systems and terminal facilities in Canada. Our interest in the Limited Partnership is described below and the Limited Partnership holds our business, which is comprised of a portfolio of strategic energy infrastructure assets across Western Canada.

For over 60 years, TMPL has been the only Canadian crude oil and refined products export pipeline with North American West Coast tidewater access. Current transportation capacity on TMPL is approximately 300,000 bpd (based on throughput of 80% light oil and refined products and 20% heavy oil), and it is connected to 20 incoming pipelines near Edmonton, Alberta, one of North America’s most significant energy hubs. In Alberta, we have one of the largest integrated networks of crude tank storage and rail terminals in Western Canada and the largest merchant terminal storage facility in the Edmonton market. We also operate the largest origination crude by rail loading facility in North America. In B.C., we control the largest mineral concentrate export/import facility on the west coast of North America through our Vancouver Wharves Terminal, transferring over four million tons of bulk cargo and 1.5 MMBbl of liquids annually. In the state of Washington, we ship crude oil from the Sumas Terminal for delivery to the BP plc, Phillips 66, Shell Oil Products U.S. and Tesoro Corporation refineries in Anacortes and Ferndale. We also own Cochin, which is the Canadian portion of the U.S. and Canadian Cochin pipeline system that transports light condensate to Fort Saskatchewan, Alberta, traversing two provinces in Canada and four states in the U.S. Given the challenges faced by the energy sector looking to construct major infrastructure projects, particularly in environmentally sensitive regions, our asset base has many unique attributes that offer significant, sustainable competitive advantages that we believe would be challenging for competitors to replicate over the near to mid-term.

Reorganization and IPO

The Company was incorporated on April 7, 2017. On May 30, 2017, the Company completed an IPO of 102,942,000 Restricted Voting Shares on the TSX at a price to the public of $17.00 per Restricted Voting Share for total gross proceeds of approximately $1.75 billion. We used our IPO proceeds to indirectly acquire from Kinder Morgan an approximate 30% economic interest in the Limited Partnership, while Kinder Morgan indirectly retained the remaining approximate 70% economic interest.

Concurrent with the closing of our IPO, the Limited Partnership acquired an interest in the Operating Entities from KMCC and KMCT , each a wholly owned subsidiaries of Kinder Morgan, in exchange for the issuance to KMCC and KMCT of Class B Units of the Limited Partnership. In addition, KMCC and KMCT were issued Special Voting Shares in the Company for nominal consideration.

Immediately following the closing of our IPO, we used the proceeds from our IPO to indirectly subscribe for Class A Units representing an approximate 30% economic interest in the Limited Partnership while the Class B Units held by KMCC and KMCT represented, in the aggregate, an approximate 70% economic interest in the Limited Partnership. Following the issuance of the Series 1 Preferred Shares and Series 3 Preferred Shares, the Company’s and Kinder Morgan’s respective interests in the Limited Partnership are subject to the preferred shareholders’ priority on distributions and upon liquidation.

Currently, the issued and outstanding Restricted Voting Shares comprise approximately 30% of all outstanding Company Voting Shares, and the Kinder Morgan interest, which represents its indirect ownership of 100% of the Special Voting Shares, comprises approximately 70% of all outstanding Company Voting Shares.

For the description of our share capital and the limited partnership units of the Limited Partnership, which holds our business, see Item 5 “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities—Ownership Interests.”

Subsequent to our IPO, Kinder Morgan retained control of us and the Limited Partnership, and as a result we accounted for our acquisition of an approximate 30% economic interest in the Limited Partnership as a transfer of net assets among entities under common control. Therefore, our consolidated financial statements presented herein were derived from the consolidated financial statements and accounting records of Kinder Morgan. The assets and liabilities in these consolidated financial statements have been reflected at historical carrying value of the immediate parents within the Kinder Morgan organizational structure including goodwill and purchase price assigned amounts, as applicable. See Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

5

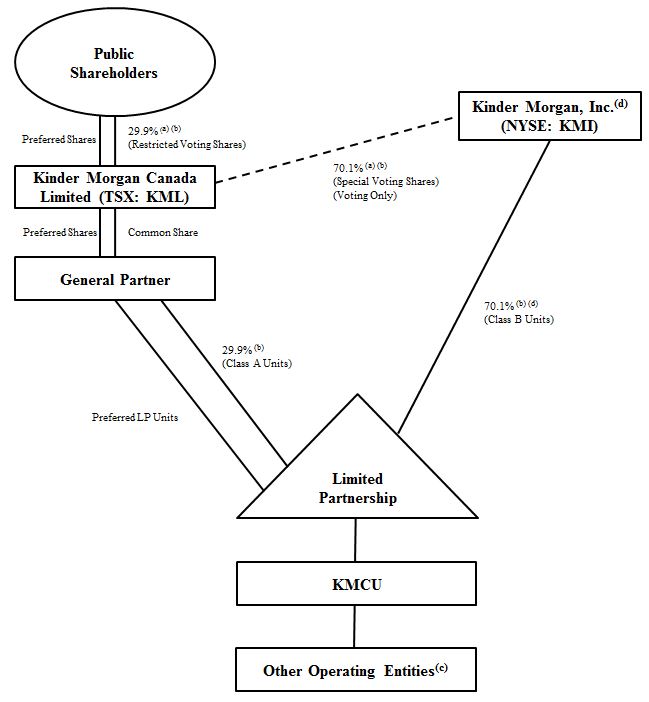

The intercorporate relationships of the Company, the Limited Partnership, and our Operating Entities as of December 31, 2017 are as follows:

_______________

(a) | Approximate percentages based on ownership of total outstanding Company Voting Shares as of December 31, 2017. |

(b) | Approximate percentages based on ownership of total outstanding Class A Units and Class B Units as of December 31, 2017. Distributions on the Preferred LP Units will be made prior to any distributions on the Class A Units and Class B Units. |

(c) | Other operating entities include the Operating Entities other than KMCU. |

(d) | Kinder Morgan owns (indirectly through KMCC and KMCT) 100% of our outstanding Special Voting Shares and 100% of the Class B Units. |

6

Business and Segments

We focus on providing fee-based services to customers from an asset portfolio consisting of energy-related pipelines and liquid and bulk terminaling facilities. Our two business segments are: (i) Pipelines, which is comprised of TMPL including the Westridge Marine Terminal and other related terminaling assets, TMEP, Puget Sound, Jet Fuel, and Canadian portion of Cochin and (ii) Terminals, which is comprised of the Vancouver Wharves Terminal and the terminals located in the Edmonton, Alberta area, including the Base Line Terminal joint venture project.

Our key strategies are to:

• | focus on stable, fee-based energy transportation and storage assets that are central to the energy infrastructure of Western Canada; |

• | increase utilization of our existing assets while controlling costs, operating safely, and employing environmentally sound operating practices; |

• | leverage economies of scale from expansions of existing assets and potential incremental acquisitions that fit within our strategy and are accretive to cash flow; and |

• | maintain a strong balance sheet and maximize value for our investors. |

Overview of Assets | ||||

Asset | Design [Storage] Capacity | Description | ||

Pipelines | ||||

TMPL | ~300 MBbl/d | Only pipeline in Canada transporting crude oil and refined products to the West Coast. | ||

TMEP | ~890 MBbl/d (~590 incr.) | Total capital cost estimated to be ~$7.4 billion, further described below under “ —Pipelines Business—TMEP”(a) | ||

Puget Sound | ~240 MBbl/d | Ships from Sumas Terminal to the state of Washington refineries via TMPL. | ||

Edmonton Terminal | [~8,000 MBbl] | 35 tanks in total, majority serving TMPL regulated service with 15 of 35 tanks leased to Terminal business (unregulated entity).(b) | ||

Westridge Marine Terminal | [395 MBbl] | Liquid export / import terminals in Burnaby, which can accommodate Aframax sized tankers. | ||

Kamloops/Sumas/Burnaby Terminals | [2,560 MBbl] | Kamloops: 2 tanks serving TMPL (160 MBbl), Sumas: 6 tanks all serving TMPL (715 MBbl), and Burnaby: 13 tanks serving TMPL (1,685 MBbl). | ||

Jet Fuel(c) | [45 MBbl] | Transport jet fuel from refinery in Burnaby and the Westridge Marine Terminal to Vancouver International Airport. | ||

Cochin(d) | ~110 MBbl/d | Transport condensate from the Canada/U.S. border near Maxbass, North Dakota to Fort Saskatchewan, Alberta. | ||

Terminals | ||||

Vancouver Wharves Terminal | 4.0 MMtonnes bulk + [250 MBbl] | Bulk commodity marine terminal provides handling, storage, loading and unloading services. | ||

Edmonton South Terminal | [5,100 MBbl] | 15 tanks currently leased from Trans Mountain(b); tanks sub-leased to third parties in unregulated service (merchant tanks). | ||

North 40 Terminal | [2,150 MBbl] | Merchant crude oil storage and blending services. | ||

Edmonton Rail Terminal | 210 MBbl/d | Operated 50/50 joint venture with Imperial Oil (largest origination crude-by-rail terminal in North America). | ||

Alberta Crude Terminal | 40 MBbl/d | Non-operated 50/50 joint venture with Keyera Corporation (Keyera) that is fully contracted. | ||

Base Line Terminal | [4,800 MBbl] | Operated 50/50 joint venture with Keyera (12 tanks planned to be placed in service throughout 2018), further described below. | ||

_________

(a) | Includes capitalized financing costs. |

(b) | We currently expect that TMPL will recall two of the 15 merchant tanks comprising the Edmonton South Terminal upon the completion of TMEP for use in its regulated service. |

7

(c) | Jet Fuel has a BCUC-approved negotiated settlement that ends in 2018. |

(d) | Cochin is part of the Cochin pipeline system, which transports condensate from Kankakee County, Illinois to Fort Saskatchewan, Alberta. Capacity on the U.S. portion of the Cochin pipeline system, which is not owned by us, is approximately 95 MBbl/d |

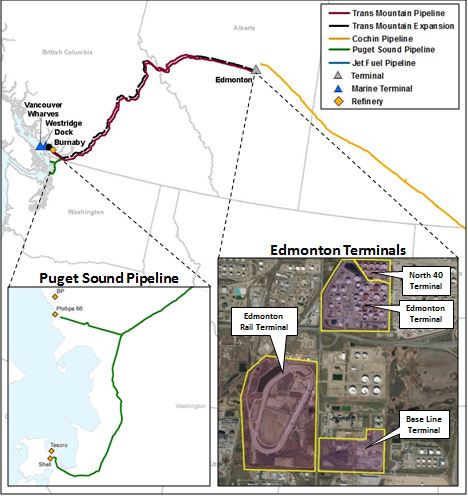

Overview Map of Our Business

For financial information on our two reportable business segments, see Note 18 “Reportable Segments” to our consolidated financial statements.

8

Pipelines Business

TMPL

Trans Mountain Oil Pipe Line Company was established on March 21, 1951. Construction of TMPL commenced in 1952 and the first shipment of oil reached TMPL’s Burnaby Terminal on October 17, 1953. The initial capacity of the pipeline system was 150,000 bpd. Since 1953, the capacity of TMPL has been increased a number of times by twinning parts of the line and adding associated facilities.

In 2008, the Anchor Loop project was completed, which involved the installation of a second pipeline adjacent to the existing TMPL on a 158 kilometer section of the system between Hinton, Alberta and Hargreaves, B.C., just west of Mount Robson Provincial Park. The Anchor Loop project increased the capacity of the pipeline system from 260,000 bpd to 300,000 bpd and involved the installation of two new pump stations.

TMPL is approximately 1,150 kilometers long, beginning in Edmonton, Alberta and terminating on the west coast of B.C. in Burnaby. Twenty-three active pump stations located along TMPL route maintain the 300,000 bpd capacity of the line, flowing at a speed of approximately eight kilometers per hour. In addition to the pump stations, four terminals located in Edmonton, Kamloops, Sumas and Burnaby and the Westridge Marine Terminal, house storage tanks and serve as locations for incoming pipelines. The 300,000 bpd nominal capacity of the pipeline has been determined based on a throughput mix of 20% heavy oil and 80% light oil. The actual delivery capacity on the TMPL mainline is based on the type of oil or refined product being transported. For example, when the pipeline is delivering only light oil, it can deliver an amount closer to approximately 350,000 bpd and if it is delivering only heavy oil, the system’s delivery capacity is closer to approximately 280,000 bpd.

TMPL regularly ships multiple products, including refined petroleum, synthetic crude oil, light crude oil and heavy crude oil, and it is the only pipeline in North America that carries both refined products and crude oil together in the same line. This process, known as “batching,” means that a series of products can follow one another through the pipeline in a “batch train.” A typical batch train in the TMPL mainline is made up of a variety of materials being transported for different shippers; however, any product moved in the pipeline must meet TMPL’s tariff requirements, which include technical specifications for any products accepted for transportation on TMPL. While products move next to each other in the pipeline mix, product interface is kept to a minimum by moving the products in a specific sequence. Products that mix are refined for use.

In order to optimize batches to achieve maximum throughput, TMPL has built tanks, pumps and other ancillary equipment which enable connection and staging of batches to be delivered to the TMPL mainline pipe. Tanks are used to accumulate enough of a particular type of product to make up an efficient batch. While shippers are permitted to deliver oil to the mainline at a rated throughput to avoid the use of tanks, the TMPL tanks can be used by shippers delivering at less than the 300,000 bpd capacity to accumulate their product and have it pumped at the throughput capacity 300,000 bpd so as not to slow the line down. In addition to maximizing throughput, the tanks are also used to minimize the mixing or product interfaces.

As at the date hereof, TMPL remains the only pipeline that transports liquid petroleum from the WCSB to the West Coast. It is also the only pipeline providing Canadian producers with direct access to world market pricing through a Canadian port.

Trans Mountain’s Terminals

Edmonton Terminal

TMPL begins in Sherwood Park, Alberta at the Edmonton Terminal. This facility is made up of 35 tanks with total storage capacity of approximately 8.0 MMBbl. All tanks at the Edmonton Terminal are in crude oil, condensate or refined product service and each tank has the flexibility to handle most products that are connected to the terminal, including in-tank mixing of multiple products. The Edmonton Terminal is connected to 20 incoming pipelines from oil and refinery production in Alberta and is adjacent, or in close proximity, to the starting point of the Enbridge Inc. cross-continent crude oil pipeline system, the North 40 Terminal, the Suncor Energy Inc. Edmonton refinery, the Keyera Edmonton terminal, the Keyera Alberta EnviroFuels plant, the Gibson Energy Inc. Edmonton terminal, the Plains Midstream Canada Edmonton Strathcona terminal and the Imperial Oil Strathcona refinery.

Twenty of the tanks at the Edmonton Terminal, ranging in size from 80,000 barrels to 220,000 barrels and comprising 2.9 MMBbl of total storage capacity, are currently used by Trans Mountain to serve TMPL’s regulated service. As noted above, these tanks are used by Trans Mountain to facilitate batching and maximize throughput on the TMPL mainline. The remaining 15 tanks at the Edmonton Terminal (referred to as the “Edmonton South Terminal”)), ranging in size from 250,000 barrels to 400,000 barrels and constituting approximately 5.1 MMBbl of the total storage capacity, are leased to KM Canada North 40’s Edmonton

9

South Terminal and are marketed on a merchant basis, subject to a 24 month right of recall, exercisable by Trans Mountain, in the event that the Edmonton Terminal is further expanded and Trans Mountain requires the tanks for its regulated service. This leasing arrangement is based on a Memorandum of Understanding with the Canadian Association of Petroleum Producers and has been sanctioned by the NEB. In connection with the completion of TMEP, Trans Mountain expects that it will exercise recall rights under the leasing arrangement with KM Canada North 40 in respect of two of the tanks at the Edmonton South Terminal. As a result, following this recall, the Edmonton South Terminal will be comprised of 13 merchant tanks and 22 of the existing tanks will be used by Trans Mountain to service the regulated TMPL. As the use of the recalled tanks will be included in the overall tolls charged on the expanded TMPL, such tanks will no longer generate the incremental revenue realized through leases to external customers. As such, the recall is expected to result in a decrease in the net cash earnings attributable to the Edmonton South Terminal. See “—Terminals Business—Edmonton South Terminal” below.

In addition to its service as a storage and terminaling facility, the Edmonton Terminal houses the primary control center for TMPL, Puget Sound, Jet Fuel, the North 40 Terminal, the Westridge Marine Terminal, the Base Line Terminal, and the line to the Edmonton Rail Terminal. The control center located at the Edmonton Terminal does not operate Cochin, which is controlled from the U.S. See “—Terminals Business” below.

Kamloops Terminal

In Kamloops, B.C., refined products from Edmonton, Alberta are delivered to a distribution terminal near Kamloops airport that we operate. The TMPL terminal in Kamloops contains two inactive crude oil storage tanks with a total storage capacity of approximately 160,000 barrels and also serves as a primary pump station for TMPL.

Sumas Pump Station and Sumas Terminal

The Sumas pump station and the Sumas Terminal are approximately three kilometers apart and are both located in Abbotsford, B.C. The terminal is used to stage oil for delivery further down TMPL and contains six storage tanks with total storage capacity of approximately 715,000 barrels. The pump station includes four pumps, two of which are used to route product from the TMPL mainline into the state of Washington via Puget Sound and two of which are used to route the product on the TMPL mainline to Burnaby, B.C.

Burnaby Terminal

The Burnaby Terminal, located in Burnaby, B.C., is the terminus of the TMPL mainline. It receives both crude oil and refined products for temporary storage and transportation through separate pipelines to a local distribution terminal, a local refinery and the Westridge Marine Terminal. The Burnaby Terminal has 13 storage tanks with total storage capacity of approximately 1.685 MMBbl.

The pump station used to operate Jet Fuel is also located within the Burnaby Terminal although Jet Fuel and TMPL are not connected and are operated as separate systems.

Westridge Marine Terminal

The Westridge Marine Terminal is located within the Burrard Inlet in Burnaby, B.C. Regulated by Transport Canada and the NEB, the dock at the terminal can accommodate up to Aframax class vessels (approximately 120,000 dead weight tons) and barges. The Westridge Marine Terminal is used to deliver crude oil from TMPL onto barges and tankers and to receive jet fuel into the three tanks at the terminal for delivery into Jet Fuel.

The Westridge Marine Terminal houses three storage tanks, that are currently being leased to a third party, with total storage capacity of approximately 395,000 barrels. The terminal is used to receive jet fuel for delivery into Jet Fuel. Significant modifications are planned for the Westridge Marine Terminal as part of TMEP. Limited construction activity on such modifications began in September 2017.

TMEP

Our estimated total capital cost for TMEP is approximately $7.4 billion,which includes capitalized financing costs ($6.7 billion excluding capitalized equity and debt financing costs). Construction related delays could result in increases to the estimated total costs. See Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Recent Business Developments— TMEP Permitting and Construction Progress.”

10

Upon completion, TMEP would provide western Canadian crude oil producers with an additional 590,000 bpd of crude oil transportation capacity and tidewater access to the western United States (most notably states of Washington, California and Hawaii) and global markets (most notably Asia). Over 70% of Canadian crude products are currently exported to U.S. markets, with the majority of the remaining products being consumed domestically (Source: CAPP 2016 Forecast, Markets and Transportation 2016-0007). This dependence on a single market, combined with the cost and limited availability of transportation options, has resulted in Canadian crude products producers receiving a material discount to global benchmark prices on the sale of similar quality products (Source: CAPP 2016 Crude Oil Forecast, Markets and Transportation 2016-0007).

Beginning in early 2011, through discussions with Trans Mountain and existing shippers and other interested parties, it became clear that there was significant interest in an expansion of TMPL for the purpose of improving access to the North American west coast and offshore markets. Between October 2011 and November 2012, Trans Mountain conducted an open season process to obtain commitments for TMEP. Trans Mountain advanced a firm service offering designed to provide shippers with long-term contractual certainty of shipping crude oil product volumes on the expanded system, while providing Trans Mountain with the financial certainty necessary to support the contemplated investment in the expansion. In total, at the conclusion of the open season process, Trans Mountain entered into firm transportation services agreements with 13 companies for a total of 707,500 bpd based on a capacity of 890,000 bpd (the maximum amount that Trans Mountain anticipated the NEB would authorize) following completion of TMEP.

Upon the completion of the proposed TMEP, throughput capacity of TMPL will increase from approximately 300,000 bpd to 890,000 bpd. The proposed expansion of TMPL is intended to comprise, among other things, the following:

• | approximately 980 kilometers of new, buried pipeline segments that twin (or “loop”) the existing pipeline in Alberta and B.C., including two 3.6 kilometer segments (7.2 kilometers in total) of new buried delivery lines from the Burnaby Terminal to the Westridge Marine Terminal; |

• | new and modified facilities, including pump stations and tanks; and |

• | a new dock complex with three new berths at the Westridge Marine Terminal, each capable of handling Aframax class vessels. |

The major components of the pipeline portion of TMEP will include:

• | using existing active 24-inch (610 mm) and 30-inch (762 mm) outside diameter buried pipeline segments; |

• | reactivating two 24-inch (610 mm) outside diameter buried pipeline segments that have been maintained in a deactivated state; |

• | constructing three new 36-inch (914 mm) and one new 42-inch (1,220 mm) outside diameter buried pipeline segments totaling approximately 860 kilometers and 120 kilometers, respectively; and |

• | constructing two parallel 3.6 kilometers long, 30-inch (762 mm) outside diameter buried delivery lines from the Burnaby Terminal to the Westridge Marine Terminal. |

TMEP will result in two continuous pipelines between Edmonton and Burnaby:

• | Line 1 is expected to have a capacity of 350,000 bpd of light crude oil and refined products; and |

• | Line 2 is expected to have a capacity of 540,000 bpd of heavy crude oil. |

The existing TMPL has been operating safely for more than 60 years and its location is known to local TMPL operations crews, landowners, surface management agencies, and local emergency responders. To minimize environmental and socio-economic effects and facilitate efficient pipeline operations, use of the existing TMPL right of way has been maximized in the TMEP design. Where it was not possible to align along the existing TMPL right of way, construction along other linear facilities was evaluated including other pipelines, power lines, highways and roads, railways, communication lines and other utilities. The result is that approximately 73% of the new pipeline corridor follows the existing TMPL right of way, approximately 17% follows other existing rights of way, and approximately 10% will be within a new corridor. The completion of the Anchor Loop project in 2008 also minimizes the need for additional construction in the highly sensitive Jasper National Park region.

Electrically powered pump stations located at regular intervals along the pipeline will be required for the expansion. The major components of the pump stations portion of TMEP that will support mainline operation include:

• | adding 12 new pump stations; and |

• | deactivating some elements of the existing Blue River, B.C. pump station. |

11

The major components of the associated facilities of TMEP include:

• | the addition of 20 new above-ground storage tanks, including the construction of four new tanks and inclusion of two existing tanks at the Edmonton Terminal, constructing one new tank at the Sumas Terminal and the construction of 14 new tanks and the demolition of one existing tank at the Burnaby Terminal; and |

• | constructing a new dock complex, with a total of three Aframax-capable berths, as well as a utility dock (for tugs, boom deployment vessels, and emergency response vessels and equipment), at the Westridge Marine Terminal, followed by the deactivation and demolition of the existing berth. |

Seventy-two new buried remote mainline block valves will be installed and complement existing mainline block valves, which will be located at the pump stations. These remote mainline block valves and existing mainline block valves work to limit the volume of and consequences associated with pipeline leaks or ruptures. A total of 25 new sending or receiving scraper traps for in-line inspection tools will also be installed at facility locations along the pipeline.

B.C. Hydro requires TMEP to build two connections, an approximately 24 kilometer line to connect to a power station in Kingsvale, B.C. and an approximately 1.5 kilometer connection to a power station in Black Pines, B.C., that will either be (i) turned over to B.C. Hydro for a minimal amount, (ii) owned, maintained and operated by us, or (iii) sold to a third party to maintain and operate.

Currently, up to approximately five vessels per month are loaded with heavy crude oil at the Westridge Marine Terminal. Upon completion of TMEP, it is anticipated that the Westridge Marine Terminal will be capable of serving up to 34 Aframax class vessels per month with actual demand to be influenced by market conditions. The maximum vessel size (Aframax class) served at the terminal will not change as a result of TMEP. Similarly, product moving over the dock at the Westridge Marine Terminal is expected to continue to be primarily heavy crude oil. Of the 890,000 bpd capacity of the expanded system, up to 630,000 bpd may be handled through the Westridge Marine Terminal for shipment. Currently, monthly barge traffic typically consists of loading two crude oil barges and receiving one jet fuel barge. This level of activity is not expected to be affected by TMEP.

We have signed a number of agreements with general construction contractors and are currently in negotiations with other construction contractors to construct the various pipeline spreads on TMEP, with the intention that general construction contracts will be entered into with respect to spreads one through six and engineering, procurement and construction contracts will be entered into with respect to spread seven, terminals and pump stations (including the Edmonton Terminal) and with respect to any work required in the Lower Mainland of B.C.

Upon completion, the newly constructed pipeline is expected to carry predominantly heavy crude volumes and the existing pipeline will carry predominantly light crude and refined products.

TMEP Expansion Shipping Agreements

Trans Mountain delivered the final cost estimate and tolls to shippers in February 2017. At that time some existing shippers gave up capacity, some increased capacity and some new shippers acquired capacity, the net result of which was the turn back of 22,000 bpd (or 3% of the previously committed barrels). These 22,000 bpd were subsequently recommitted during an additional supplemental open season process in March 2017. As a result of TMEP’s open season processes, 13 companies have entered into one 15-year and twelve 20-year transportation service agreements with Trans Mountain for a total of 707,500 bpd, representing approximately 80% of the expanded system’s capacity (the maximum amount under the regulated limit imposed by the NEB). These shippers represent or are affiliates of some of the largest producing companies in the WCSB and a significant majority of these committed shippers have, or are subsidiaries of a parent entity that has, an investment grade credit rating (however such parent entity may not be a guarantor). These companies have direct access to large volumes of supply, either through their own production, or through their position in the market as a large marketer and/or refiner of crude oil. This maximum level of recommitment highlights the strong market demand for the expanded system’s takeaway capacity and has better aligned TMEP shipper composition with the changing Canadian crude producer landscape.

Where a particular shipper is not investment grade or no support provider is available, Trans Mountain may obtain, in respect of such shipper, letters of credit from acceptable banks for an amount having the same value as up to 12 months of the shipper’s contract exposure, or such other amount as may be determined reasonable and appropriate.

The TMEP-related transportation service agreements provide for a sharing of risks between Trans Mountain and its shippers during the development stage, including the construction of TMEP and the long-term operation of the pipeline system. Each shipper is entitled to a certain amount of capacity each month, and the shippers are required to pay for the fixed cost of such capacity whether they use it or not.

12

The transportation service agreements also provide flexibility to the shippers that are parties to them, as such agreements enable the shippers to manage their capacity entitlements and associated financial obligations. Shippers can assign their shipping rights to third parties on a short-term or long-term basis, thereby reducing risk and ensuring that the firm capacity is fully utilized. There are also make-up provisions in the event that shippers cannot use their full capacity entitlements in any given month. Shippers also have the right to renew their contracts at the end of the initial term for an additional five-year period on rates to be determined at the time of renewal (if any).

The fixed toll to be paid by shippers under the TMEP-related transportation service agreements has been established according to a risk sharing formula that will be escalated during the lifetime of the contracts at a fixed rate. Under the agreements there is a variable toll component based on actual costs incurred for power, unanticipated costs related to changes in legislation or regulation and other costs as may be agreed to by Trans Mountain and shippers. As the vast majority of the toll will not be adjusted according to actual costs incurred, as would normally occur under a cost-of-service approach, this arrangement will provide greater toll certainty to shippers and reduce the risk of unanticipated increases in transportation costs over time.

Approximately 20% of the expanded TMPL’s nominal capacity (182,500 bpd), will be reserved for spot month-to-month shipments. The toll for spot shipments will be tied to the toll for long-term service and, as such, spot shippers will benefit from all of the contractual provisions that protect long-term shippers from cost escalation.

Puget Sound

In operation since 1954, Puget Sound ships crude oil products from the Sumas Terminal to state of Washington refineries in Anacortes and Ferndale.

Puget Sound is approximately 111 kilometers long, with one pump station and a diameter of 16 to 20 inches (406 to 508 mm) and two storage tanks with total storage capacity of approximately 200,000 barrels. The system has total throughput capacity of approximately 240,000 bpd (when transporting primarily light oil), with approximately 191,000 bpd transported in 2016. The transit time of products on Puget Sound is approximately one day. The pipeline is regulated by the FERC for tariffs and the U.S. Department of Transportation for safety and integrity. Approximately 80% of the 2016 revenue from Puget Sound originated from counterparties that have, or are subsidiaries of a parent entity that has, an investment grade credit rating (however such parent entity may not be a guarantor).

In addition to their access to the Westridge Marine Terminal, shippers on TMPL have, and following completion of TMEP will continue to have, the option to deliver their product to Puget Sound.

Jet Fuel

Jet Fuel transports jet fuel from a Burnaby refinery and the Westridge Marine Terminal to the Vancouver International Airport. The 41 kilometer pipeline system has been in operation since 1969. It includes five storage tanks at the Vancouver International Airport with aggregate storage capacity of 45,000 barrels. British Columbia Oil and Gas Commission (“BC OGC”) regulates the integrity and safety of the pipeline and BCUC regulates Jet Fuel’s tolls.

Cochin

The U.S. and Canadian Cochin pipeline system consists of a 12 inch (305 mm) diameter pipeline that spans from Kankakee County, Illinois to Fort Saskatchewan, Alberta, totaling approximately 2,452 kilometers. The U.S. and Canadian Cochin pipeline system, which transports light hydrocarbon liquids (primarily to be used as diluent to facilitate bitumen transportation), traverses two provinces in Canada and four states in the United States. The U.S. and Canadian Cochin pipeline system is comprised of approximately 1000 kilometers of pipeline and includes 38 block valves and ten pump stations. While we do not own or operate the U.S. portion of the U.S. and Canadian Cochin pipeline system, the U.S. and Canadian portions are interdependent (including with respect to volumes shipped and financial and contractual obligations) and, as the bulk of the tariffs on this pipeline system are governed by a joint international tariff, revenue is shared between the U.S. and Canadian portions. The U.S,. portion of this pipeline system is wholly owned by an indirect subsidiary of Kinder Morgan.

In 2014, Kinder Morgan reversed the western leg of the U.S. and Canadian Cochin pipeline system (which was previously used primarily to ship propane into the U.S) to begin moving light condensate westbound from the Kinder Morgan Cochin terminal in Kankakee County, Illinois, to terminal facilities near Fort Saskatchewan, Alberta (the “Cochin Reversal Project”). Cochin is currently capable of transporting approximately 95,000 bpd of light condensate (constrained by the U.S. portion of the Cochin pipeline system). If additional receipt points in Canada are established, and future demand supports it, throughput on the Cochin

13

pipeline has the potential to reach approximately 110,000 bpd. This additional volume would most likely come from the Bakken oil play in North Dakota.

KMCU is the operator of Cochin, which is operated and maintained by Canadian staff located at the KMCU regional and local offices in Wainwright, Alberta and Regina, Saskatchewan. KMCU is also the holder of the NEB certificates for Cochin.

Pipeline Segment - Potential Growth Opportunities

While we do not presently have any plans to expand TMPL outside of the current scope of TMEP, the combined capacity of the expanded pipeline could potentially be further increased by over 300,000 bpd to approximately 1.2 million bpd, with additional power and further capital enhancements.

The Puget Sound pipeline is capable of being expanded to increase its capacity to approximately 500,000 bpd from its current capacity of 240,000 bpd.

We will continue to monitor market and industry developments to determine which, if any, further expansion projects on TMPL may be appropriate.

With the projected continuing growth of Canadian bitumen production, U.S. diluent imports are expected to remain an integral part of bringing Canadian bitumen to market (Source: CAPP 2017 Crude Oil Forecast, Markets and Transportation 2017-0009). Cochin has an additional 15,000 bpd of capacity on its Canadian section of the pipeline system due to a higher pressure rating in Canada. While Cochin would need to loop its line to be in position to expand its capacity to greater than 110,000 bpd, we are currently evaluating a number of other opportunities to utilize the existing 15,000 bpd capacity through the addition of new connections to Cochin. In 2017, Cochin completed a new delivery point to the Plains Midstream Canada storage facility in Fort Saskatchewan, Alberta, as well as a new receipt point near Kankakee County, Illinois from Marathon Pipe Line LLC’s Wabash pipeline. Kinder Morgan is also currently constructing a new truck facility in Maxbass, North Dakota to allow for delivery of additional volumes onto the U.S. portion of the Cochin pipeline system from the Bakken region. Future projects that we may undertake, should conditions warrant, include, among others, the addition of a new delivery point to the Pembina Condensate Diluent Hub facility, as well as a connection to the Conway natural gas liquids market via Oneok’s North system. Other than as disclosed in this document, no definitive decisions have been made with respect to any material growth projects within the Pipelines segment.

See Item 1A “Risk Factors—Risks Relating to Our Business—Major projects, including TMEP, may be inhibited, delayed or stopped.”

Terminals Business

In addition to our pipeline assets, we are supported by a network of strategically located terminal facilities in Western Canada, including the largest merchant terminal position in the Edmonton, Alberta market. This merchant terminal position is underpinned predominantly by fee-based services without direct commodity price exposure, and is secured by superior market positions and contracts. See “—Major Customers and Contractual Relationships” and “—Competition” below.

Vancouver Wharves Terminal

Located in North Vancouver, B.C., the Vancouver Wharves Terminal is a 125-acre bulk marine terminal facility that annually transfers over 4.0 million tons of bulk cargo and 1.5 MMBbl of liquids predominantly to offshore export markets. The Vancouver Wharves Terminal, which has been in operation since 1959, was acquired by Kinder Morgan in 2007. This acquisition included securing a 40-year operating lease and asset ownership agreement with the B.C. Railway Company for the terminal uplands. Vancouver Wharves also holds a corresponding water lot lease agreement with Port Metro Vancouver to support the terminal vessel loading and unloading operations with the same 40-year term.

Since the acquisition of Vancouver Wharves, Kinder Morgan has undertaken a number of projects designed to improve and expand the terminal: in June 2013, it sanctioned the construction of a zinc concentrate truck load out facility; in April 2014, approval was received to expand the terminal’s lead concentrate interior shed walls; in March 2015, upgrading work commenced on the sulphur load out facility; and in June 2015, project approval was received to upgrade the terminal’s grain handling facility. The Vancouver Wharves Terminal currently has 1.0 million tons of bulk storage capacity, 250,000 barrels of petroleum storage and facilities that can house up to 325 rail cars. The terminal assets include four berths capable of handling Panamax-size vessels. The main export products at Vancouver Wharves are sulphur, copper concentrates, diesel, jet fuel, bio-diesel, wheat and canola seed, while the most significant import products at Vancouver Wharves are zinc and lead concentrate. With good connectivity

14

through the recently expanded Vancouver North Shore rail gateway corridor and connections with three Class 1 rail companies serving the area (the Canadian National Railway (“CN”), the Canadian Pacific Railway (“CP”) and the BNSF Railway) as well as all major highway routes in western Canada, Vancouver Wharves continues to provide a safe and efficient link for customers’ supply chain connectivity for water borne trade to global markets.

Edmonton South Terminal

The Edmonton South Terminal is a merchant tank terminal located in Sherwood Park, Alberta. As noted above, the assets currently making up the Edmonton South Terminal are embedded within the Edmonton Terminal, are owned by Trans Mountain and are operated by KMCI, for and on behalf of KM Canada North 40. A long-term leasing arrangement with Trans Mountain governs the merchant use of the tanks by KM Canada North 40. The first phase of the Edmonton South Terminal, comprised of nine merchant tanks, was put into service throughout 2013 and 2014. As part of a phase two expansion, an additional four tanks and associated infrastructure were constructed and placed in service in 2014. In connection with the Edmonton Rail Terminal project, a final two tanks were brought into service at the Edmonton South Terminal at the end of 2014. In total, the assets comprising this facility consist of 15 tanks with a total storage capacity of approximately 5.1 MMBbl along with associated outbound pumps, meters and pipe connections to other facilities. Trans Mountain currently expects to recall two of the tanks in merchant service at the Edmonton South Terminal upon the completion of TMEP for use in TMPL regulated service, comprising between approximately 700,000 and 800,000 barrels of total storage capacity. The NEB approved agreement specifies that if additional tanks are identified as needed for TMPL for regulated purposes, more tanks can be recalled upon 24-months’ notice. As the use of the recalled tanks will be included in the overall tolls charged on the expanded TMPL, such tanks will no longer generate the incremental revenue realized through leases to external customers. As such, the recall is expected to result in a decrease in the net cash earnings attributable to the Edmonton South Terminal.

The Edmonton South Terminal provides significant optionality for customers through its diverse suite of inbound and outbound pipeline connections, including access to the vast majority of crude types in Alberta. All tanks at the terminal are in crude oil service and each tank has the flexibility to handle all products that are connected to the terminal, including in-tank mixing and outbound blending of multiple products. In addition to its connection to the Edmonton Rail Terminal and the North 40 Terminal, the Edmonton South Terminal has significant pipeline connectivity. The Edmonton South Terminal has 14 major inbound pipeline connections from throughout Alberta and two major outbound pipeline connections, which allow customers to ship their products west, east or south. In addition to its position within the larger Trans Mountain Edmonton Terminal, the Edmonton South Terminal is, similarly, adjacent, or in close proximity, to the starting point of the Enbridge Inc. cross-continent crude oil pipeline system, the North 40 Terminal, the Suncor Energy Inc. Edmonton refinery, the Keyera Edmonton terminal, the Keyera Alberta EnviroFuels plant, the Gibson Energy Inc. Edmonton terminal, the Plains Midstream Canada Edmonton Strathcona terminal and the Imperial Oil Strathcona refinery. Customers utilizing the Edmonton South Terminal tanks have the option of direct injection into the TMPL mainline or utilizing any of the other outbound connections available at the terminal.

North 40 Terminal

Located in Sherwood Park, Alberta, immediately adjacent to the Edmonton South Terminal, the nine tank North 40 Terminal facility, in service since March 2008, provides merchant storage for crude oil products. This approximately 2.15 million barrel facility is comprised of eight 250,000 barrel tanks and one 150,000 barrel tank. The North 40 Terminal has a highly diverse suite of eight inbound pipeline connections (anticipated to increase to ten inbound pipeline connections by 2018), including access to the vast majority of crude types in Alberta, and five outbound connections. In addition to its pipeline connections which allow customers to ship their products west, east or south, the North 40 Terminal is connected to the Alberta Crude Terminal (as described below), the Base Line Terminal (as described below), TMPL, a local refinery and a third-party midstream facility. All tanks at the terminal are in crude oil service and have the flexibility to handle all products that are connected to the terminal, including in-tank mixing of multiple products. The North 40 Terminal is operated by KMCI, for and on behalf of KM Canada North 40.

Edmonton Rail Terminal

In December 2013, Kinder Morgan and Imperial Oil announced the formation of a 50-50 unincorporated joint venture to build the Edmonton Rail Terminal with an initial capacity of 100,000 bpd. By August 2014, the joint venture had entered into firm, take-or-pay agreements with strong, creditworthy major oil companies. These contracted commitments allowed for an expansion of the Edmonton Rail Terminal to add incremental capacity of 110,000 bpd, for a total of 210,000 bpd. The terminal was constructed by Kinder Morgan, placed in service in April 2015 and is currently operated by an affiliate of KM Canada North 40.

The Edmonton Rail Terminal capacity at start-up in 2015 was approximately 210,000 bpd, making the terminal the largest origination crude by rail loading facility in North America. The terminal is connected via pipeline to the Edmonton South Terminal

15

and is capable of sourcing all crude streams that are handled there for delivery by rail to North American markets and refineries. The terminal connects to both the CN and CP railway networks and can hold up to four unit trains on-site (two loading and two staged), load unit trains of up to 150 rail cars per train and load two trains with the same or differing products simultaneously. Trains are loaded at the Edmonton Rail Terminal through a 38-spot dual-sided rack (76 loading spots in total). Upon the completion of the construction of the Base Line Terminal, the Edmonton Rail Terminal, through its connections with the Edmonton South Terminal and the Base Line Terminal, will have access to the approximately 9.9 MMBbl of crude oil capable of being stored at such terminals.

Alberta Crude Terminal

An unincorporated 50-50 joint venture between an affiliate of KM Canada North 40 and Keyera, the Alberta Crude Terminal is a crude oil rail loading facility located in Sherwood Park, Alberta and operated by Keyera. The Alberta Crude Terminal construction project was sanctioned in July 2013 and placed in service in November 2014. The terminal is fully contracted and is served by the CN and CP railway networks. This terminal has approximately 40,000 bpd of manifest crude oil rail loading capacity as well as capacity for 250 rail car storage spots, which assist in the efficient manifest movement of the railcars loaded at the facility. Upon the completion of the construction of the Base Line Terminal, the Alberta Crude Terminal, through its connections with the North 40 Terminal and the Base Line Terminal, will have access to the approximately 7.0 MMBbl of crude oil capable of being stored at such terminals.

Base Line Terminal

Announced in March 2015, the Base Line Terminal is a second 50-50 unincorporated joint venture between an affiliate of KM Canada North 40 and Keyera. The Base Line Terminal is a merchant crude oil storage terminal located on land at the Keyera Alberta EnviroFuels facility in Sherwood Park, Alberta. Construction commenced on this project in the second half of 2015. The initial build will have 12 tanks with a total capacity of 4.8 MMBbl. This project is supported by multiple long-term customer contracts that will draw revenue streams and associated risks that are similar in nature to those for the existing terminals near Edmonton. See “—Major Customers and Contractual Relationships” and “—Competition” below.

Upon completion, the Base Line Terminal is expected to have some of the best tank terminal connectivity in Canada, with a diverse suite of ten inbound pipeline connections, including access to the vast majority of crude types in Alberta and six outbound connections, including both pipeline and rail. This terminal will leverage off of the existing North 40 Terminal by using transfer lines to facilitate product transfer between terminals via a pipeline bridge over a highway in Strathcona County. In addition to its pipeline access, the Base Line Terminal will also be connected to the Alberta Crude and Edmonton Rail Terminals. All tanks at the terminal will be in crude oil service and have the flexibility to handle all products that are connected to the terminal, including in-tank mixing and outbound blending of multiple products. We expect to have more than 14.9 MMBbl of total storage (including regulated tankage) capacity in the Edmonton area upon completion of the Base Line Terminal.

See Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Recent Business Developments—Base Line Terminals Construction Progress: and “—Outlook.”

Potential Growth Opportunities

The Terminals segment routinely explores opportunities for growth in its Terminals business. In addition to its growth projects currently underway, there is potential for the Base Line Terminal to expand its operations in the future to include up to six additional tanks and add additional inbound and outbound connections. Vancouver Wharves has one of the last remaining parcels of land available for development in Port Metro Vancouver and the Terminals segment is currently exploring potential opportunities for this available land. To date, we have identified approximately $250 million worth of potential capital projects predominantly at our Vancouver Wharves terminal (excluding projects that have been discussed elsewhere in this document), and those projects are in various stages of evaluation and/or development. Other than as disclosed in this document, no definitive decisions have been made with respect to any material growth projects within the Terminals segment. See Item 1A “Risk Factors—Risks Relating to Our Business—Major projects, including TMEP, may be inhibited, delayed or stopped.”

16

Major Customers and Contractual Relationships

Major Customers

For the year ended December 31, 2017, we had two customers that represented 20% and 11% of total revenue, respectively. For the year ended December 31, 2016, we had two customers that each represented 14% and 10% of total revenue, respectively. For the year ended December 31, 2015, we had two customers that each represented 12% of total revenue.

Contractual Relationships

TMPL is a common carrier pipeline, providing transportation services under a cost of service model that is negotiated with shippers and regulated by the NEB. Although TMPL takes custody of its shippers’ products, it does not own any of the product it ships. TMPL has posted tariff rates that are available to all shippers based on a monthly contract which varies according to the type of product being shipped as well as receipt and delivery points. As such, it provides service to producers, marketers, refineries and terminals who sell or resell products to domestic markets, oil marketers and international shippers moving oil to such places as Asia, and the states of California and Washington.

Since late 2010, TMPL has been meaningfully over-subscribed, resulting in pipeline apportionment (nominating less volumes for shipment than shippers request). Shippers on TMPL are generally large and well-capitalized. In 2017, the top ten shippers on TMPL accounted for approximately 85% of the revenue generated from the system, including its terminal assets. Of these shippers, as a percentage of such revenue generated, 96% have, or are subsidiaries of a parent entity that has, an investment grade credit rating (however, such parent entity may not be a guarantor), with approximately 66% being rated A− to AA+ by S&P and approximately 19% being rated BBB to BBB+ by S&P. Of the remaining 15%, 11% are non-investment grade and 4% of the shippers do not have a credit rating. In 2017, some of the shippers on TMPL , in alphabetical order, were the following entities or affiliates thereof: BP Canada Energy Trading Company, Cenovus Energy Inc., Chevron Canada Limited, Imperial Oil Limited, Nexen Energy ULC, Phillips 66 Canada Ltd, Shell Canada Products, Suncor Energy Inc., and Tesoro Canada Supply and Distribution Ltd.

Throughout the past 20 years, TMPL has entered into negotiated toll settlements with its shippers to establish final tolls on TMPL. We believe that negotiated settlements are advantageous from a cost perspective and may provide opportunities for additional returns.

In February 2016, the NEB approved TMPL’s 2016 to 2018 (inclusive) negotiated toll settlement. The toll settlement provides for a three-year term and includes a rollover provision and the TMEP transition provision. TMPL’s net regulated rate base is approximately $1 billion as of December 31, 2016 with sustaining capital automatically added in subsequent years. Under the NEB-approved negotiated toll settlement, the tolls on TMPL are based on a 9.5% return on equity, a 5% cost of debt and a deemed 45% equity and 55% debt structure. The toll settlement provides for the flow-through to shippers of certain operating costs, including power costs, property tax, income tax, integrity costs, environmental compliance and remediation costs and the cost of insurance and security. Labor and service-related costs are fixed costs in the toll settlement, and are escalated annually at a set index. These costs are allocated to TMPL by KMCI based on usage and are determined by the shared service model using a methodology approved by the NEB. In addition, the toll settlement agreement provides power and capacity incentives. Specifically, 50% of the B.C. power costs savings are allocated to the shipper and 50% are allocated to the pipeline system, and 75% of the transmission power costs savings are allocated to the shipper and 25% are allocated to pipeline sharing. The settlement agreement also provides for a capacity incentive which is allocated 50% to the shipper and 50% to the pipeline system above a formulaic 96% capacity target. Variances between toll proceeds and annual revenue requirement are adjusted through tolls in the following year. TMPL’s current negotiated toll settlement includes a provision for extension, if the extension is mutually acceptable to TMPL and the shipper, up until the TMEP in-service date.

In 2011, TMPL received approval from the NEB to implement firm service for 54,000 bpd of service to the Westridge Marine Terminal, and charge a premium on such barrels to fund expansion projects on TMPL. This service and the premiums associated with it will be in effect until the earlier of the in-service date of TMPL expansion and ten years from the date of implementation. The premiums are approved to be used by TMPL to offset the cost of projects designed to enhance existing and future operations including development costs relating to the TMEP and equate to a total of approximately $28.6 million per year. As of December 31, 2017, $34 million had been used to construct a 250,000 barrel tank and associated infrastructure at the Edmonton Terminal and $132.6 million had been used to offset the development costs of TMEP.

Rates charged on Puget Sound are regulated by the FERC and are based on a cost of service model that has been in place since prior to 1992 and, as such, have been grandfathered and escalated from time to time as permitted by the FERC. As a result of this grandfathering, the Puget Sound cost of service rates that were in place for the 365-day period prior to September 1992,

17

plus escalation, may continue to be charged to its shippers unless and until the rates are successfully challenged on the basis that a substantial change has occurred in the economic circumstances or nature of the services provided that were a basis for such rates. To date, no such complaints have been made. In 2017 approximately 100% of the revenue on the Puget Sound pipeline originated from customers that have, or from subsidiaries of a parent entity that has, an investment grade credit rating (however such parent entity may not be a guarantor).

Jet Fuel delivers jet fuel from the Westridge Marine Terminal and from a refinery in Burnaby to the Vancouver International Airport. With respect to the volume from the Westridge Marine Terminal, it has a contract with one of Canada’s largest airlines to unload jet fuel from barges at the Westridge Marine Terminal and store such volumes at the Westridge Marine Terminal. Jet Fuel then transports such jet fuel to the Vancouver International Airport. Through this arrangement and the jet fuel shipped from the Burnaby refinery, Jet Fuel has a BCUC-approved negotiated settlement that ends in 2018.

Cochin has three primary customers who, among them, have total contractual take-or-pay commitments of 85,000 bpd. These customers have investment grade credit ratings and financial capacity that support their long-term contractual commitments, which expire in 2024. The take-or-pay commitments obligate the committed shippers to make payments based on their contractual volume commitments, regardless of actual throughput. The joint international tariff rate is adjusted annually in accordance with the standard FERC methodology for escalating indexed rates for petroleum products pipelines. Cochin also offers transportation under: (i) a volumes incentive rate (available to certain committed shippers who ship above their contractual commitments in a calendar year), (ii) an uncommitted joint rate, as well as (iii) local uncommitted U.S. and Canadian rates.

The Terminals business services as many as 20 liquids customers, made up of a diverse mix of production, refining, marketing and integrated companies, and 9 bulk customers at any given point in time. Approximately 60% (by revenue dollar amount) of these customers have, or their parent entity has, an investment grade credit rating (however parent entities may not be guarantors). Our top three Terminal segment customers account for approximately 45% of total Terminal segment’s total revenue and the top ten Terminal segment customers account for approximately 75% of total Terminals segment revenue.