Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Dova Pharmaceuticals Inc. | a2234415zex-23_1.htm |

| EX-5.1 - EX-5.1 - Dova Pharmaceuticals Inc. | a2234415zex-5_1.htm |

| EX-1.1 - EX-1.1 - Dova Pharmaceuticals Inc. | a2234415zex-1_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on February 20, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Dova Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

2834 (Primary Standard Industrial Classification Code Number) |

81-3858961 (I.R.S. Employer Identification Number) |

240 Leigh Farm Road, Suite 245

Durham, North Carolina 27707

(919) 748-5975

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Alex Sapir

President and Chief Executive Officer

Dova Pharmaceuticals, Inc.

240 Leigh Farm Road

Suite 245

Durham, NC 27707

(919) 748-5975

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

Divakar Gupta Darren DeStefano Mark Ballantyne Cooley LLP 1114 Avenue of the Americas New York, New York 10036 (212) 479-6000 |

Deanna Kirkpatrick Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o Emerging growth company ý |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ý

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of each class of securities to be registered |

Amount to be registered(1) |

Proposed maximum offering price per share |

Proposed maximum aggregate offering price(2) |

Amount of registration fee |

||||

|---|---|---|---|---|---|---|---|---|

Common Stock, $0.001 par value per share |

2,875,000 | $31.15 | $89,556,250 | $11,149.76 | ||||

|

||||||||

(1) Includes shares the underwriters have the option to purchase.

(2) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act on the basis of the average of the high and low prices of the Registrant's common stock as reported on the NASDAQ Global Market on February 14, 2018.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Subject to completion, dated February 20, 2018

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

2,500,000 Shares

Common Stock

We are offering 2,500,000 shares of our common stock. Our common stock is listed on The NASDAQ Global Market under the symbol "DOVA." The last reported sales price of our common stock on The NASDAQ Global Market on February 16, 2018 was $34.68 per share. The final public offering price will be determined through negotiation between us and the lead underwriters in the offering and the recent market price used throughout the prospectus may not be indicative of the final offering price.

We are an "emerging growth company" as defined under the federal securities laws and will be subject to reduced public company reporting requirements.

| | | | | | | | |

| |

Per share |

Total |

|||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

Public offering price |

$ | $ | |||||

Underwriting discounts and commissions(1) |

$ |

$ |

|||||

Proceeds to Dova Pharmaceuticals, Inc., before expenses |

$ |

$ |

|||||

| | | | | | | | |

(1) We have also agreed to reimburse the underwriters for certain FINRA-related expenses. See "Underwriting" in this prospectus for a description of compensation payable to the underwriters.

We have granted the underwriters an option for a period of 30 days to purchase up to 375,000 additional shares of common stock on the same terms and conditions set forth above.

Investing in our common stock involves a high degree of risk. See "Risk factors" beginning on page 13 of this prospectus, as well as in the documents incorporated or deemed to be incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares in New York, New York against payment to investors on or about , 2018.

| J.P. Morgan | Jefferies | Evercore ISI |

Prospectus dated , 2018

Neither we nor the underwriters have authorized anyone to provide you with information other than that contained or incorporated by reference in this prospectus or any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to sell, and seeking offers to buy, common stock only in jurisdictions where offers and sales are permitted. The information contained or incorporated by reference in this prospectus is accurate only as of the date on the front cover page of this prospectus or the date of the applicable document incorporated by reference, or other earlier date stated in this prospectus or in the applicable document incorporated by reference, regardless of the time of delivery of this prospectus or of any sale of our common stock.

To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference filed with the Securities and Exchange Commission before the date of this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in a document incorporated by reference is inconsistent with a statement in another document incorporated by reference having a later date, the statement in the document having the later date modifies or supersedes the earlier statement.

No action is being taken in any jurisdiction outside the United States to permit a public offering of our common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that jurisdiction.

This summary highlights information contained elsewhere in this prospectus and in the documents incorporated by reference. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus and the documents incorporated by reference in this prospectus carefully, especially the "Risk factors" section beginning on page 13 of this prospectus and in the documents incorporated by reference into this prospectus and our consolidated financial statements and the related notes incorporated by reference in this prospectus, before making an investment decision.

As used in this prospectus and in the documents incorporated by reference, unless the context otherwise requires, references to "we," "us," "our," "the company" and "Dova Pharmaceuticals" refer to Dova Pharmaceuticals, Inc. and our wholly-owned subsidiary, AkaRx, Inc.

Overview

We are a pharmaceutical company focused on acquiring, developing and commercializing drug candidates for diseases that are treated by specialist physicians, with an initial focus on addressing thrombocytopenia, a disorder characterized by a low blood platelet count. Our drug candidate, avatrombopag, which we acquired from Eisai, Inc., or Eisai, in March 2016, is an orally administered thrombopoietin receptor agonist, or TPO-RA, that we are developing for the treatment of thrombocytopenia. On September 21, 2017, we submitted a new drug application, or NDA, to the U.S. Food and Drug Administration, or FDA, for the treatment of thrombocytopenia in patients with chronic liver disease, or CLD, scheduled to undergo a procedure. The NDA submission was supported by two identically designed pivotal Phase 3 clinical trials, both of which met the primary and secondary endpoints with high statistical significance. The NDA was granted Priority Review by the FDA in November 2017 and the Prescription Drug User Fee Act goal date for an FDA decision is May 21, 2018. We intend to build a hepatology-focused sales organization in the United States and have initiated commercial activities to support the launch of avatrombopag.

We also plan to submit a Supplemental New Drug Application, or sNDA, in the second half of 2018 for the treatment of patients with immune thrombocytopenic purpura, or ITP, which is chronic thrombocytopenia that requires continuous treatment. To date, avatrombopag has been evaluated in one Phase 3 clinical trial and two Phase 2 clinical trials for the treatment of adults with chronic ITP. In the Phase 3 trial, the primary efficacy endpoint was achieved with high statistical significance (p<0.0001). Additionally, during the first quarter of 2018, we are initiating a Phase 3 trial in pre-surgery thrombocytopenia, or PST, and in the second quarter of 2018 we plan to initiate a Phase 3 clinical trial for the treatment of patients with chemotherapy-induced thrombocytopenia, or CIT.

We believe that avatrombopag's efficacy and safety profile in combination with its convenient oral dosing could provide advantages over other treatments for thrombocytopenia. To date, avatrombopag has been evaluated in more than 20 clinical trials involving more than 1,100 subjects and has been observed to be generally well tolerated. We believe that avatrombopag may have the potential to be used more broadly for patients with thrombocytopenia.

Thrombocytopenia and current treatments

Thrombocytopenia is characterized by a deficiency of platelets that impairs blood clot formation and increases bleeding risk. Thrombocytopenia is defined as having less than 150,000 platelets per microliter of circulating blood and is diagnosed with a routine blood test. Thrombocytopenia can result in significant

1

bleeding risk even in cases of minor injury and increases the risk of excessive, uncontrolled bleeding during or after a medical procedure. Physicians determine how to treat thrombocytopenia, either in the acute setting or chronically, based on a number of factors, including the patient's platelet count, etiology of the underlying cause of thrombocytopenia, duration of required platelet count elevation and the patient's overall health profile.

Acute setting

We have initially focused on developing avatrombopag for the treatment of thrombocytopenia in CLD patients scheduled to undergo a procedure. CLD involves the progressive destruction and regeneration of the liver over a period of more than six months. Patients with CLD have reduced platelet production when liver cell mass becomes severely damaged. In addition, these patients also have increased trapping of platelets in the spleen and thus even fewer platelets are present in circulating blood. For multiple reasons, these patients often develop thrombocytopenia, which often worsens with the severity of the liver disease. Approximately 1.1 million CLD patients in the United States are affected by thrombocytopenia.

Patients with CLD undergo numerous non-emergent medical procedures for diagnosis and treatment of their disease, including liver biopsies, fluid removal, liver transplantation and endoscopy. Multiple medical professional associations have guidelines that recommend that patients have at least 50,000 platelets per microliter of circulating blood prior to minimally to moderately invasive medical procedures. Approximately 70,000 CLD patients in the United States have a platelet count less than 50,000 platelets per microliter of circulating blood.

We estimate that approximately 60% of these 70,000 CLD patients are treated with platelet transfusions in order to raise platelet counts in advance of medical procedures. These patients generally undergo one to three medical procedures per year.

More broadly outside of this CLD patient population, approximately 125,000 platelet transfusions are administered annually for more invasive planned surgical procedures for thrombocytopenia patients irrespective of disease etiology. Additionally, approximately 125,000 platelet transfusions are administered for patients with chemotherapy-induced thrombocytopenia, or CIT. These are two follow-on indications we are pursuing.

Despite being the standard of care, platelet transfusions are associated with limitations that impact their use including variable efficacy, risk of transfusion reactions, antibody development in up to 50% of patients, short duration of effect of transfused platelets, limited supply and inconvenience of administration. There is no drug treatment approved by the FDA or the European Medicines Agency, or EMA, for thrombocytopenia in patients with CLD in the acute setting prior to a medical procedure.

Chronic setting

Chronic treatment of thrombocytopenia involves continuous treatment of the disorder. The substantial majority of patients who require chronic treatment suffer from immune thrombocytopenic purpura, or ITP. First-line therapy for ITP consists of corticosteroids or intravenous immunoglobulin, or IVIG. In addition to off-label rituximab and splenectomy, currently marketed TPO-RAs are used as a second-line treatment of ITP.

We estimate that chronic ITP affects approximately 60,000 adults in the United States, of which up to 27,000 may require continuous treatment beyond corticosteroids and IVIG. However, we believe these available treatments have limitations that impact their use, such as limited efficacy, risk to patient safety, patient non-compliance or inconvenience.

2

Because of the limitations of current therapies used for thrombocytopenia in the acute and chronic setting, we believe there remains a significant unmet need for a treatment that demonstrates reliable and durable effectiveness and a favorable safety profile, that can be conveniently administered and potentially reduce the burden on patients.

Our drug candidate

We believe our drug candidate, avatrombopag, has the potential to be a first-in-class drug treatment of thrombocytopenia in the acute setting and a best-in-class treatment of thrombocytopenia in the chronic setting. Avatrombopag is an orally administered, small molecule TPO-RA, which is intended to address the limitations of other existing treatments for thrombocytopenia.

Avatrombopag is designed to mimic the effects of thrombopoietin, or TPO, in vitro and in vivo. TPO is a hormone produced in the liver and kidneys that binds to its receptor, c-Mpl (myeloproliferative leukemia protein). Following TPO receptor binding, intracellular signaling leads to megakaryocyte growth and maturation, which results in increased platelet production. TPO-RAs, like TPO, stimulate the activation, proliferation and maturation of megakaryocytes, resulting in an increase in circulating platelets. Avatrombopag is a highly specific TPO-RA as it binds to the TPO receptor at a distinct site from native TPO, leaving the TPO receptor accessible to native TPO, enabling avatrombopag to have an additive effect on platelet production.

While TPO-RAs are a validated class of therapy for the chronic treatment of thrombocytopenia, they have not been approved for the acute treatment of thrombocytopenia due, in part, to the risk of side effects, including portal vein thrombosis, or PVT. In CLD patients, who often have excessive accumulation of scar tissue in the liver, portal blood flow may be significantly lower than normal putting the patient at an increased risk of developing PVT. Further, the use of some TPO-RAs may lead to an even greater risk of PVT in these patients as large increases in platelet counts can give rise to platelet accumulation and cause further blockage of the portal vein.

We believe avatrombopag's pharmacokinetic/pharmacodynamic, or PK/PD, profile and metabolic characteristics are the attributes that differentiate it from the currently marketed TPO-RAs and could make it a compelling treatment option for patients with thrombocytopenia in the acute setting. In clinical trials, avatrombopag has been observed to have a less variable PK/PD profile than other TPO-RAs. In addition, avatrombopag is not extensively metabolized—approximately 40% to 50% is metabolized and is mostly eliminated away from the biliary route. We believe these metabolic characteristics and this PK/PD profile further reduce the risk of adverse effects, including thromboembolic events such as PVTs, in patient populations that are liver compromised, such as those with CLD.

In the chronic setting, we believe that approved TPO-RAs suffer from limitations impacting their broader use such as the risk of severe hepatotoxicity, need for subcutaneous administration, and impact of food on drug absorption. We believe avatrombopag has the potential to provide an effective, predictable, convenient and safe alternative to currently available TPO-RAs.

Clinical trials

In the first quarter of 2017, we completed two identically designed Phase 3 pivotal clinical trials, ADAPT 1 and ADAPT 2, in which all primary and secondary endpoints were met with high statistical significance. The primary endpoint for both studies was the percentage of CLD patients with thrombocytopenia scheduled to undergo a procedure, who did not require a platelet transfusion or any rescue procedure for bleeding at each of two doses of avatrombopag compared to placebo. In each trial, the percentage of subjects in each

3

of the two avatrombopag dosing cohorts requiring a platelet transfusion or a rescue procedure for bleeding was statistically significantly lower compared to placebo (across all cohorts, p-values ranging from p<0.0001 to p=0.0006). We also observed a larger percentage of avatrombopag-treated subjects who achieved the target platelet count of greater than or equal to 50,000 platelets per microliter of circulating blood on the procedure day and greater changes in platelet counts from baseline to procedure day, which were statistically significant improvements over placebo. We are initially developing avatrombopag for the acute treatment of thrombocytopenia in this population of patients with CLD scheduled to undergo a procedure.

In addition to ADAPT 1 and ADAPT 2, avatrombopag has also been evaluated in one Phase 3 trial in adults with chronic ITP, five Phase 2 trials in various thrombocytopenia patient populations, 15 Phase 1 trials and numerous preclinical studies, and has been observed to be generally well tolerated in over 1,100 patients. Based on the safety and efficacy profile observed in these trials and studies, we believe avatrombopag has the potential for use in the following acute settings: a broader population of thrombocytopenia patients regardless of disease etiology undergoing a broader set of medical procedures, including, for example, joint replacements, for which we are initiating a Phase 3 clinical trial in the first quarter of 2018, and patients who develop thrombocytopenia after receiving chemotherapy, for which we plan to initiate a Phase 3 clinical trial in the second quarter of 2018. In the chronic setting, we believe avatrombopag has the potential to treat adult patients with chronic ITP based on the results from a completed Phase 3 trial, and we plan to submit a sNDA to the FDA in the second half of 2018 for the treatment of patients with ITP.

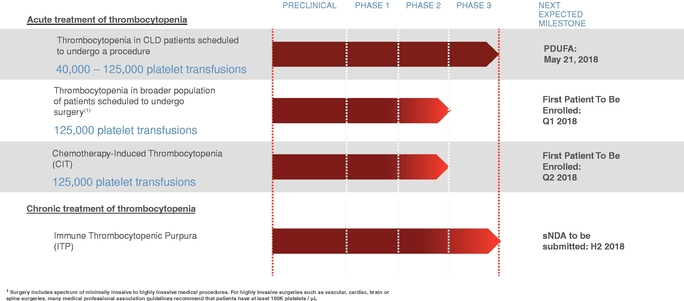

Pipeline summary and addressable market

The following table summarizes our lead development programs. We hold the worldwide rights to avatrombopag for these indications.

We believe that the total addressable market for avatrombopag is approximately $2.5 billion in the United States, with an approximately $800 million addressable market for our first indication, the acute treatment of thrombocytopenia in patients with CLD scheduled to undergo a procedure, and an approximately $1.7 billion addressable market for our follow-on indications depicted in the table. Furthermore, we believe that avatrombopag for the treatment of patients with chronic ITP alone has an approximately $600 million addressable market in the United States and an approximately $1.2 billion worldwide addressable market.

4

Management

Our management team has extensive experience ranging from identifying and acquiring drug candidates, drug development and global registrations through global commercial launches. Further, we are being supported by a leading group of biotech investors including PBM Capital Investments, LLC and Perceptive Advisors.

Our strategy

We are a pharmaceutical company focused on acquiring, developing and commercializing drug candidates for diseases that are treated by specialist physicians, with an initial focus on addressing thrombocytopenia. To achieve our goals, we are pursuing the following strategies:

- •

- Advance the development of our late-stage drug candidate, avatrombopag, for regulatory approval in the United States

and Europe. In the first quarter of 2017, we completed two identically designed pivotal Phase 3 clinical trials for avatrombopag in patients with CLD undergoing a

procedure. Based on these results, a NDA was submitted to the FDA for this initial indication on September 21, 2017. The NDA was granted Priority Review by the FDA in November 2017 and the

Prescription Drug User Fee Act goal date for an FDA decision is May 21, 2018. In addition, as our Phase 3 trials were also designed to be pivotal trials in Europe, we intend to submit a

Marketing Authorization Application, or MAA, to the European's Medicine's Agency, or EMA, in the first half of 2018.

- •

- Maximize the commercial potential of

avatrombopag. Our intent is to initially build a hepatology-focused sales organization in the United States. We have begun to execute this

strategy by hiring key executives with extensive U.S. commercial launch experience. In addition to the sales force, we intend to support the launch of avatrombopag with a dedicated team of

reimbursement support case managers as well as a network of specialty pharmacy service providers that will distribute the drug directly to the patient's home. In the future, we also may selectively

partner with leading companies that we believe can contribute additional resources and know-how for the development and commercialization of avatrombopag for additional indications and geographic

regions, further enhancing the value of our drug candidate.

- •

- Expand the breadth of indications for avatrombopag in other patient populations with

thrombocytopenia. We believe avatrombopag has the potential to be used more broadly for patients with thrombocytopenia in other acute settings

and chronically. During the first quarter of 2018, we are initiating a Phase 3 trial in PST, which will include patients with thrombocytopenia regardless of disease etiology undergoing

surgeries that require a platelet count of more than 100,000 platelets per microliter of circulating blood prior to surgery. Additionally, based on the results of one completed Phase 3 trial

and two Phase 2 trials evaluating the use of avatrombopag for the treatment of adults with chronic ITP and recent discussions with the FDA, we anticipate submitting a sNDA for avatrombopag in

the second half of 2018 for this indication. We also plan to initiate a Phase 3 clinical trial in the second quarter of 2018 for the treatment of patients with CIT.

- •

- Employ a value-driven approach to build a pipeline of drug

candidates. Using a similar approach to our identification and acquisition of avatrombopag, we intend to employ a value-driven strategy to

identify, acquire, develop and commercialize drug candidates for diseases that are treated by specialist physicians.

- •

- Maintain and strengthen our intellectual property portfolio. Our intellectual property strategy aims to protect and control the development and commercialization of our drug candidates. Our owned and

5

in-licensed patents for avatrombopag provide us with composition of matter and method of use exclusivity with respect to avatrombopag in the United States, including a composition of matter patent that expires in 2025, with possible patent term extension up to 2029. We also hold patents and applications in major world markets with respect to avatrombopag, which are projected to expire between 2023 and 2029, including available patent term adjustment and patent term extension. We will seek to broaden the scope of and increase the geographic reach of our patent protection throughout the world.

Risks associated with our business

Our ability to implement our business strategy is subject to numerous risks that you should be aware of before making an investment decision. See the "Risk Factors" section of this prospectus and in the documents incorporated by reference herein for a discussion of factors you should consider carefully before deciding to invest in our common stock. These risks include the following, among others:

- •

- We have a limited operating history and have never generated any product revenues. We expect to incur losses over the next several years and

may never achieve or maintain profitability.

- •

- We may require additional capital to fund our operations, and if we fail to obtain necessary financing, we may not be able to complete the

development and commercialization of our only current drug candidate, avatrombopag and any other potential drug candidates in the future.

- •

- We may be required to make significant payments in connection with our acquisition of avatrombopag from Eisai and our failure to make these

payments may adversely affect our ability to progress our development programs.

- •

- Our consolidated financial statements have been prepared assuming that we will continue as a going concern.

- •

- We are heavily dependent on the success of avatrombopag and if avatrombopag does not receive regulatory approval or is not successfully

commercialized, our business will be harmed.

- •

- If we are not able to obtain required regulatory approvals, we will not be able to commercialize avatrombopag, and our ability to generate

revenue will be materially impaired.

- •

- Even if we obtain FDA approval for avatrombopag in the United States, we may never obtain approval for or commercialize it in any other

jurisdiction, which would limit our ability to realize its full market potential.

- •

- Even if avatrombopag receives marketing approval, it may fail to achieve market acceptance by physicians, patients, third-party payors or

others in the medical community necessary for commercial success.

- •

- We do not have our own manufacturing capabilities and will rely on third parties to produce clinical and commercial supplies of avatrombopag

and any future drug candidate.

- •

- We rely on our license agreement with Astellas to provide rights to the core intellectual property relating to avatrombopag. Any termination or

loss of rights under that license agreement would have a material adverse effect on our development and commercialization of avatrombopag.

- •

- We currently have a limited number of employees, and we rely on Eisai and PBM Capital Group, LLC to provide various administrative, research and development and other services.

6

- •

- If we are unable to obtain and maintain patent protection for avatrombopag or any future drug candidate, or if the scope of the patent

protection obtained is not sufficiently broad, our competitors could develop and commercialize technology and products similar or identical to ours, which could have a material adverse effect on our

ability to successfully commercialize our technology and drug candidates.

- •

- Concentration of ownership of our common stock among our existing executive officers, directors and principal stockholders may prevent new investors from influencing significant corporate decisions.

Implications of being an emerging growth company

We qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of relief from certain reporting requirements and other burdens that are otherwise applicable generally to public companies. These provisions include:

- •

- an exception from compliance with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or

the Sarbanes-Oxley Act;

- •

- reduced disclosure about our executive compensation arrangements in our periodic reports, proxy statements and registration statements; and

- •

- exemptions from the requirements of holding non-binding advisory votes on executive compensation or golden parachute arrangements.

We may take advantage of these provisions until the earlier of December 31, 2022 or such time that we no longer qualify as an emerging growth company. We would cease to qualify as an emerging growth company if we have more than $1.07 billion in annual revenue, we are deemed to be a "large accelerated filer" under the rules of the U.S. Securities and Exchange Commission, or SEC, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the prior June 30th, or we issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some but not all of these reduced reporting burdens. For example, we may take advantage of the exemption from auditor attestation on the effectiveness of our internal control over financial reporting. To the extent that we take advantage of these reduced reporting burdens, the information that we provide stockholders may be different than you might obtain from other public companies in which you hold equity interests.

In addition, under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Our corporate information

We were originally formed as a limited liability company under the laws of the state of Delaware in March 2016 under the name PBM AKX Holdings, LLC. In June 2016, we amended our certificate of formation to change our name to Dova Pharmaceuticals, LLC. In September 2016, we converted from a limited liability company to a corporation, Dova Pharmaceuticals, Inc. Our principal executive offices are located at 240 Leigh Farm Road, Suite 245, Durham, NC 27707, and our telephone number is (919) 748-5975. Our

7

website address is www.dova.com. The information contained in, or accessible through, our website is not incorporated by reference into this prospectus, and you should not consider any information contained in, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our common stock.

We own various U.S. federal trademark applications and unregistered trademarks, including our company name. All other trademarks or trade names referred to in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus are referred to without the symbols ® and ™, but such references should not be construed as any indication that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

8

| Common stock offered by us | 2,500,000 shares | |

Common stock to be outstanding immediately after this offering |

28,152,457 shares |

|

Option to purchase additional shares |

We have granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase a maximum of 375,000 additional shares of common stock. |

|

Use of proceeds |

We estimate that the net proceeds to us from this offering, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, will be $80.9 million, or $93.1 million if the underwriters exercise their option to purchase additional shares in full, based on an assumed public offering price of $34.68 per share, the last reported sales price of our common stock on The NASDAQ Global Market on February 16, 2018. |

|

We anticipate that the majority of the net proceeds from this offering will be used to fund the commercial launch of avatrombopag, if approved, to fund the initiation of the Phase 3 clinical trial of avatrombopag for the treatment of a broader population of patients with thrombocytopenia undergoing surgery, to fund the initiation of the Phase 3 clinical trial of avatrombopag for the treatment of patients with CIT, to fund the sNDA submission for avatrombopag for the treatment of patients with ITP, and to repay a portion of our obligations under the Eisai note. The remainder may be used for other general corporate purposes, including general and administrative expenses and working capital. See "Use of proceeds" on page 17. |

||

Risk factors |

You should read the "Risk factors" section of this prospectus and in the documents incorporated by reference herein for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

|

NASDAQ Global Market symbol |

DOVA |

The number of shares of our common stock that will be outstanding after this offering is based on 25,652,457 shares of common stock outstanding as of December 31, 2017 and excludes:

- •

- 2,128,641 shares of common stock issuable upon exercise of stock options awarded as of December 31, 2017 at a weighted average exercise

price of $7.90 per share;

- •

- 2,156,609 shares of our common stock reserved for future issuance under our equity incentive plans following this offering as of

December 31, 2017; and

- •

- 1,027,170 additional shares of our common stock reserved for future issuance under our equity incentive plans on January 1, 2018 as a result of an automatic annual increase in the share reserve.

9

Except as otherwise indicated herein, all information in this prospectus, including the number of shares that will be outstanding after this offering, assumes:

- •

- no exercise of outstanding options outstanding as of December 31, 2017; and

- •

- no exercise of the underwriters' option to purchase additional shares of common stock.

10

Summary consolidated financial data

The following tables set forth, for the periods and as of the dates indicated, our summary financial data. The consolidated statement of operations data for the period from March 24, 2016 (inception) through December 31, 2016 and for the year ended December 31, 2017 are derived from our audited consolidated financial statements incorporated by reference in this prospectus. The consolidated balance sheet as of December 31, 2017 is derived from our audited consolidated financial statements incorporated by reference in this prospectus. You should read this data together with our consolidated financial statements and related notes incorporated by reference in this prospectus and the information under the captions "Selected consolidated financial data" and "Management's discussion and analysis of financial condition and results of operations" included elsewhere in this prospectus or incorporated by reference herein. Our historical results are not necessarily indicative of our future results.

| |

|

|

|||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

| |

March 24, 2016 (inception) to December 31, 2016 |

Year ended December 31, 2017 |

|||||

| | | | | | | | |

|

(in thousands, except share and per share amounts) | ||||||

Statement of Operations Data: |

|||||||

Operating expenses: |

|||||||

Research and development |

$ | 20,842 | $ | 14,710 | |||

Research and development—licenses acquired |

5,000 | 1,000 | |||||

General and administrative |

1,201 | 13,499 | |||||

| | | | | | | | |

Total operating expenses |

27,043 | 29,209 | |||||

| | | | | | | | |

Loss from operations |

(27,043 | ) | (29,209 | ) | |||

| | | | | | | | |

Other income (expense): |

|||||||

Other income, net |

9 | 486 | |||||

Interest expense—related party |

(4 | ) | (1 | ) | |||

Interest expense |

(152 | ) | (1,231 | ) | |||

| | | | | | | | |

Total other expense |

(147 | ) | (746 | ) | |||

| | | | | | | | |

Net loss |

$ | (27,190 | ) | $ | (29,955 | ) | |

| | | | | | | | |

Net loss per share of common stock—basic and diluted(1) |

$ | (1.57 | ) | $ | (1.40 | ) | |

| | | | | | | | |

Weighted average common shares outstanding—basic and diluted(1) |

17,332,257 | 21,435,369 | |||||

| | | | | | | | |

(1) See Note 2 to our consolidated financial statements incorporated by reference in this prospectus for an explanation of the method used to calculate basic and diluted net loss per common share.

The following table presents our summary balance sheet data as of December 31, 2017:

- •

- on an actual basis; and

- •

- on an as adjusted basis to give effect to the sale of 2,500,000 shares of common stock in this offering at the assumed public offering price of $34.68 per share, the last reported sale price of our common

11

stock on The NASDAQ Global Market on February 16, 2018, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

| |

|

|

|||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

|

As of December 31, 2017 |

||||||

| |

Actual |

As adjusted |

|||||

| | | | | | | | |

|

(in thousands) | ||||||

Balance Sheet Data: |

|||||||

Cash and cash equivalents |

$ | 94,846 | $ | 175,744 | |||

Working capital |

61,120 | 142,018 | |||||

Total assets |

96,379 | 177,277 | |||||

Note payable, short-term |

30,212 | 30,212 | |||||

Total liabilities |

35,197 | 35,197 | |||||

Total stockholders' equity |

61,182 | 142,080 | |||||

| | | | | | | | |

The as adjusted information discussed above is illustrative only and will be revised based on the actual public offering price and other terms of our public offering determined at pricing. Each $1.00 increase (decrease) in the assumed public offering price of $34.68 per share would increase (decrease) the as adjusted amount of each of cash and cash equivalents, working capital, total assets and total stockholders' equity by $2.4 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase (decrease) of 100,000 shares in the number of shares offered by us at the assumed public offering price would increase (decrease) each of cash and cash equivalents, working capital, total assets and total stockholders' equity by $3.3 million.

12

Investing in our common stock involves a high degree of risk. Before you invest in our common stock, you should carefully consider the following risks, as well as general economic and business risks, including those set forth under the heading "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 incorporated by reference herein, and all of the other information contained in this prospectus and in the documents incorporated by reference herein. Any of the following risks, including those discussed in the documents incorporated by reference herein, could have a material adverse effect on our business, operating results and financial condition and cause the trading price of our common stock to decline, which would cause you to lose all or part of your investment. When determining whether to invest, you should also refer to the other information contained or incorporated by reference in this prospectus, including our financial statements and the related notes thereto. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us may also adversely affect our business.

Risks related to this offering and ownership of our common stock

If you purchase shares of our common stock in this offering, you will suffer immediate dilution of your investment.

The assumed public offering price of our common stock is substantially higher than the net tangible book value per share of our common stock. Therefore, if you purchase shares of our common stock in this offering, you will pay a price per share that substantially exceeds our net tangible book value per share after this offering. Based on an assumed public offering price of $34.68 per share, you will experience immediate dilution of $29.63 per share, representing the difference between our as-adjusted net tangible book value per share after giving effect to this offering and the assumed public offering price.

In addition, as of December 31, 2017, we had outstanding stock options to purchase an aggregate of 2,128,641 shares of common stock at a weighted average exercise price of $7.90 per share. To the extent these outstanding options are exercised, there will be further dilution to investors in this offering.

A significant portion of our total outstanding shares are restricted from immediate resale but may be sold into the market in the near future. This could cause the market price of our common stock to drop significantly, even if our business is doing well.

Sales of a substantial number of shares of our common stock in the public market could occur at any time, subject to the restrictions and limitations described below. If our stockholders sell, or the market perceives that our stockholders intend to sell, substantial amounts of our common stock in the public market, the market price of our common stock could decline significantly.

Upon the closing of this offering, based upon the number of shares outstanding as of December 31, 2017, we will have 28,152,457 outstanding shares of common stock. Of these shares, approximately 13.3 million shares are, including the 2,500,000 shares sold in this offering will be, freely tradable, subject, in the case of our affiliates, to the conditions of Rule 144 under the Securities Act. An additional 14.9 million shares are subject to a contractual lock-up with the underwriters for this offering for 90 days following this offering. J.P. Morgan Securities LLC and Jefferies LLC may release these stockholders from their lock-up agreements at any time and without notice, which would allow for earlier sales of shares in the public market subject to the conditions of Rule 144 under the Securities Act.

13

In addition, we have filed a registration statement on Form S-8 registering the issuance of approximately 6.0 million shares of common stock subject to options or other equity awards issued or reserved for future issuance under our equity incentive plans. Shares registered under this registration statement on Form S-8 are available for sale in the public market subject to vesting arrangements and exercise of options, the lock-up agreements described above and, in the case of our affiliates, the restrictions of Rule 144.

Additionally, the holders of an aggregate of approximately 21 million shares of our common stock, or their transferees, have rights, subject to some conditions, to require us to file one or more registration statements covering their shares or to include their shares in registration statements that we may file for ourselves or other stockholders. If we were to register the resale of these shares, they could be freely sold in the public market without limitation. If these additional shares are sold, or if it is perceived that they will be sold, in the public market, the trading price of our common stock could decline.

We will have broad discretion in the use of our existing cash and cash equivalents, including the proceeds from this offering, and may invest or spend our cash in ways with which you do not agree and in ways that may not increase the value of your investment.

We will have broad discretion over the use of our cash and cash equivalents, including the proceeds from this offering. You may not agree with our decisions, and our use of cash and cash equivalents may not yield any return on your investment. We expect to use the net proceeds to us from this offering, together with our existing cash and cash equivalents, to fund the commercialization of avatrombopag, if approved, to fund clinical trials of avatrombopag for additional indications beyond its initial indication, to repay a portion of our obligations under the Eisai note and for working capital and general corporate purposes. In addition, we may use a portion of the proceeds from this offering to pursue our strategy to in-license or acquire additional drug candidates. Our failure to apply the net proceeds from this offering effectively could compromise our ability to pursue our growth strategy and we might not be able to yield a significant return, if any, on our investment of these net proceeds. You will not have the opportunity to influence our decisions on how to use our net proceeds from this offering.

14

Special note regarding forward-looking statements

This prospectus and the documents incorporated by reference in this prospectus contain forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, that involve substantial risks and uncertainties. In some cases, you can identify forward-looking statements by terms such as "may," "will," "should," "expect," "plan," "anticipate," "could," "intend," "target," "project," "estimate," "believe," "estimate," "predict," "potential" or "continue" or the negative of these terms or other similar expressions intended to identify statements about the future. These statements speak only as of the date of this prospectus or as of any such date stated in the applicable document incorporated by reference in this prospectus and involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements include, without limitation, statements about the following:

- •

- the timing, progress and results of clinical trials of avatrombopag and any other drug candidates, including statements regarding the timing of

initiation and completion of studies or trials and related preparatory work, the period during which the results of the trials will become available and our research and development programs;

- •

- the timing of any submission of filings for regulatory approval of avatrombopag, and the timing of and our ability to obtain and maintain

regulatory approval of avatrombopag for any indication;

- •

- our expectations regarding the scope of any approved indication for avatrombopag;

- •

- our ability to expand the indications for which avatrombopag may be approved;

- •

- our expectations regarding the size of the patient populations for, market acceptance and opportunity for and clinical utility of avatrombopag

or any other drug candidates, if approved for commercial use;

- •

- our ability to rely on Eisai for transition services under the TSA, including with respect to the development of avatrombopag;

- •

- our manufacturing capabilities and strategy, including the scalability and commercial viability of our manufacturing methods and processes,

including our ability to maintain our supply agreement with Eisai;

- •

- our ability to successfully commercialize avatrombopag;

- •

- our estimates of our expenses, ongoing losses, future revenue, capital requirements and our needs for or ability to obtain additional

financing;

- •

- our strategic plans and expectations for, and our ability to identify, develop and obtain regulatory approval for, new drug candidates;

- •

- the implementation of our strategic plan to identify and develop treatments for diseases treated by specialist physicians;

- •

- our ability to establish or maintain collaborations or strategic relationships;

- •

- our ability to identify, recruit and retain key personnel;

15

- •

- our ability to protect and enforce our intellectual property protection for avatrombopag, and the scope of such protection;

- •

- our expected use of proceeds from this offering;

- •

- our financial performance and expectation regarding future funding sources;

- •

- our competitive position and the development of and projections relating to our competitors or our industry;

- •

- the impact of laws and regulations; and

- •

- our expectations regarding the time during which we will be an emerging growth company under the JOBS Act.

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. You should refer to the "Risk factors" section of this prospectus and in our Annual Report on Form 10-K for the year ended December 31, 2017, which is incorporated by reference in this prospectus, for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. As a result of these factors, we cannot assure you that the forward-looking statements in this prospectus and in the documents incorporated by reference in this prospectus will prove to be accurate. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. You should, however, review the factors and risks and other information we describe in the reports we will file from time to time with the SEC after the date of this prospectus.

You should read this prospectus, the documents that we incorporate by reference in this prospectus and those documents we have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

We obtained the industry, statistical and market data in this prospectus and the documents incorporated by reference in this prospectus from our own internal estimates and research as well as from industry and general publications and research, surveys and studies conducted by third parties. All of the market data used in this prospectus and the documents incorporated by reference in this prospectus involve a number of assumptions and limitations. While we believe that the information from these industry publications, surveys and studies is reliable, the industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of important factors, including those described in the section titled "Risk factors" in this prospectus and in the documents incorporated by reference herein. These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us.

16

We estimate that the net proceeds from our issuance and sale of 2,500,000 shares of our common stock in this offering will be approximately $80.9 million (or $93.1 million if the underwriters exercise in full their option to purchase additional shares), based upon an assumed public offering price of $34.68 per share, which is the last reported sales price of our common stock on the NASDAQ Global Market on February 16, 2018, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

Each $1.00 increase (decrease) in the assumed public offering price of $34.68 per share would increase (decrease) the net proceeds to us from this offering by approximately $2.4 million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. Each increase (decrease) of 100,000 in the number of shares we are offering would increase (decrease) the net proceeds to us from this offering, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, by approximately $3.3 million, assuming the assumed public offering price stays the same.

As of December 31, 2017, we had cash and cash equivalents of approximately $94.8 million. We anticipate that the majority of the net proceeds from this offering will be used to fund the commercial launch of avatrombopag, if approved, to fund the initiation of the Phase 3 clinical trial of avatrombopag for the treatment of a broader population of patients with thrombocytopenia undergoing surgery, to fund the initiation of the Phase 3 clinical trial of avatrombopag for the treatment of patients with CIT, to fund the sNDA submission for avatrombopag for the treatment of patients with ITP, and to repay a portion of our obligations under the Eisai note. The remainder may be used for other general corporate purposes, including general and administrative expenses and working capital. For a description of the terms of the Eisai note, see the section titled "Management's discussion and analysis of financial condition and results of operations—Eisai note and security agreement" in our Annual Report on Form 10-K for the year ended December 31, 2017, which is incorporated by reference herein.

Our expected use of net proceeds from this offering represents our current intentions based upon our present plans and business condition. As of the date of this prospectus, we cannot predict with complete certainty all of the particular uses for the net proceeds to be received upon the completion of this offering or the actual amounts that we will spend on the uses set forth above. We believe opportunities may exist from time to time to expand our current business through the acquisition or in-license of complementary drug candidates. While we have no current agreements for any specific acquisitions or in-licenses at this time, we may use a portion of the net proceeds for these purposes.

The amounts and timing of our actual expenditures will depend on numerous factors, including the progress of our clinical trials and other development and commercialization efforts for avatrombopag, as well as the amount of cash used in our operations. Based on our current operational plans and assumptions, we expect our cash and cash equivalents, together with the net proceeds from this offering, will be sufficient to enable us to commence the commercialization of avatrombopag, if approved. With respect to conducting clinical trials of avatrombopag for additional indications beyond its initial indication, we expect that we may require additional funds as these programs progress, the amounts of which will depend on the ultimate clinical development paths we pursue. However, we cannot estimate with certainty the amount of net proceeds to be used for the purposes described above. We may find it necessary or advisable to use the net proceeds for other purposes, and we will have broad discretion in the application of the net proceeds. Pending the uses described above, we plan to invest the net proceeds from this offering in short- and intermediate-term, interest-bearing obligations, investment-grade instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government.

17

Market price of common stock

Our common stock has been quoted on the NASDAQ Global Market since June 29, 2017, under the symbol "DOVA." Prior to our IPO, there was no public market for our common stock.

The following table sets forth the high and low sales prices of our common stock for the period indicated.

| |

|

|

|||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

| |

High |

Low |

|||||

| | | | | | | | |

2017 |

|||||||

Second quarter (beginning June 29, 2017) |

$ | 22.40 | $ | 18.18 | |||

Third quarter |

$ | 28.59 | $ | 16.98 | |||

Fourth quarter |

$ | 32.75 | $ | 22.00 | |||

2018 |

|||||||

First quarter (through February 16, 2018) |

$ | 35.00 | $ | 25.63 | |||

| | | | | | | | |

As of February 16, 2018, there were 25,679,266 shares of common stock outstanding held by 31 record stockholders. The actual number of stockholders is greater than this number of record holders and includes stockholders who are beneficial owners but whose shares are held in street name by brokers and other nominees. This number of holders of record also does not include stockholders whose shares may be held in trust by other entities. The last reported sale price of our common stock on The NASDAQ Global Market on February 16, 2018 was $34.68 per share.

We have never declared or paid, and do not anticipate declaring or paying, in the foreseeable future, any cash dividends on our capital stock. We currently intend to retain all available funds and any future earnings to support our operations and finance the growth and development of our business. Any future determination related to our dividend policy will be made at the discretion of our board of directors and will depend upon, among other factors, our results of operations, financial condition, capital requirements, contractual restrictions, business prospects and other factors our board of directors may deem relevant.

18

The following table sets forth our cash and cash equivalents and our capitalization as of December 31, 2017:

- •

- on an actual basis; and

- •

- on an as adjusted basis to give effect to our sale of 2,500,000 shares of common stock in this offering at an assumed public offering price of $34.68 per share, the last reported sale price of our common stock on The NASDAQ Global Market on February 16, 2018, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

The following information is illustrative only of our cash and cash equivalents and capitalization following the completion of this offering and will change based on the actual public offering price and other terms of this offering determined at pricing. You should read this table together with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our financial statements and the related notes incorporated by reference in this prospectus.

| |

|

|

|||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

| |

As of December 31, 2017 |

||||||

| |

Actual |

As adjusted |

|||||

| | | | | | | | |

| |

(in thousands, except share and per share data) |

||||||

Cash and cash equivalents |

$ | 94,846 | $ | 175,744 | |||

| | | | | | | | |

Note payable, short-term |

30,212 | 30,212 | |||||

Stockholders' equity: |

|||||||

Common stock, $0.001 par value; 100,000,000 shares authorized and 25,652,457 shares issued and outstanding, actual; 100,000,000 shares authorized and 28,152,457 shares issued and outstanding, as adjusted |

26 | 28 | |||||

Additional paid-in capital |

118,301 | 199,197 | |||||

Accumulated deficit |

(57,145 | ) | (57,145 | ) | |||

| | | | | | | | |

Total stockholders' equity |

61,182 | 142,080 | |||||

| | | | | | | | |

Total capitalization |

$ | 91,394 | $ | 172,292 | |||

| | | | | | | | |

The number of shares of common stock outstanding in the table above assumes, with respect to the number of shares of common stock issued and outstanding after the offering, the issuance and sale in this offering of 2,500,000 shares of our common stock and does not include:

- •

- 2,128,641 shares of common stock issuable upon exercise of stock options awarded as of December 31, 2017 at a weighted average exercise

price of $7.90 per share; and

- •

- 2,156,609 shares of our common stock reserved for future issuance under our equity incentive plans following this offering as of

December 31, 2017; and

- •

- 1,027,170 additional shares of our common stock reserved for future issuance under our equity incentive plans on January 1, 2018 as a result of an automatic annual increase in the share reserve.

19

If you invest in our common stock in this offering, your interest will be diluted to the extent of the difference between the public offering price per share and the as adjusted net tangible book value per share of our common stock immediately after this offering. Net tangible book value per share is determined by dividing our total tangible assets less total liabilities by the number of outstanding shares of our common stock.

As of December 31, 2017, our net tangible book value was $61.2 million, or $2.39 per share of common stock.

Investors participating in this offering will incur immediate and substantial dilution. After giving effect to the issuance and sale of 2,500,000 shares of our common stock in this offering at an assumed public offering price of $34.68 per share, which is the last reported sales price of our common stock on The NASDAQ Global Market on February 16, 2018, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, our as adjusted net tangible book value as of December 31, 2017 would have been approximately $142.1 million, or approximately $5.05 per share of common stock. This represents an immediate increase in the net tangible book value of $2.66 per share to existing stockholders, and an immediate dilution in the net tangible book value of $29.63 per share to investors purchasing shares of our common stock in this offering. The following table illustrates this per share dilution:

| | | | | | | | |

Assumed public offering price per share |

$ | 34.68 | |||||

Actual net tangible book value per share as of December 31, 2017 |

$ | 2.39 | |||||

Increase in net tangible book value per share attributable to new investors participating in this offering |

2.66 | ||||||

| | | | | | | | |

As adjusted net tangible book value per share after this offering |

$ | 5.05 | |||||

| | | | | | | | |

Dilution per share to investors participating in this offering |

$ | 29.63 | |||||

| | | | | | | | |

The dilution information discussed above is illustrative only and will change based on the actual public offering price and other terms of this offering determined at pricing. Each $1.00 increase or decrease in the assumed public offering price of $34.68 per share would increase or decrease our as adjusted net tangible book value by $0.08 per share, and the dilution per share to investors participating in this offering by $0.92 per share, assuming that the number of shares offered by us, as set forth on the cover of this prospectus, remains the same. An increase of 100,000 shares offered by us at the assumed public offering price of $34.68 per share would increase our as adjusted net tangible book value by $0.10 per share and decrease the dilution to investors participating in this offering by $0.10 per share. A decrease of 100,000 shares offered by us at the assumed public offering price of $34.68 per share would decrease our as adjusted net tangible book value by $0.10 per share and increase the dilution to investors participating in this offering by $0.10 per share.

If the underwriters exercise their option in full to purchase 375,000 additional shares of common stock in this offering, the as adjusted net tangible book value per share after the offering would be $5.41 per share, the increase in the as adjusted net tangible book value per share to existing stockholders would be $3.02 per share and the dilution to investors purchasing common stock in this offering would be $29.27 per share.

20

The shares of our common stock reserved for future issuance under our equity benefit plans are subject to automatic annual increases in accordance with the terms of the plans. To the extent that options are exercised, new options or other equity awards are issued under our equity incentive plans, or we issue additional shares of common stock in the future, there will be further dilution to investors participating in this offering. In addition, we may choose to raise additional capital because of market conditions or strategic considerations, even if we believe that we have sufficient funds for our current or future operating plans. If we raise additional capital through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

21

Selected consolidated financial data

The following tables set forth, for the periods and as of the dates indicated, our selected consolidated financial data. The balance sheet data as of December 31, 2016 and 2017 and the statement of operations data for the period from March 24, 2016 (inception) through December 31, 2016 and for the year ended December 31, 2017 are derived from our audited consolidated financial statements incorporated by reference in this prospectus. You should read this data together with our consolidated financial statements and related notes incorporated by reference in this prospectus and the information under the captions "Management's discussion and analysis of financial condition and results of operations" incorporated by reference herein. Our historical results are not necessarily indicative of our future results.

| |

|

|

|||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

| |

March 24, 2016 (Inception) to December 31, 2016 |

Year ended December 31, 2017 |

|||||

| | | | | | | | |

| |

(in thousands, except share and per share data) |

||||||

Statement of Operations Data: |

|||||||

Operating expenses: |

|||||||

Research and development |

$ | 20,842 | $ | 14,170 | |||

Research and development—licenses acquired |

5,000 | 1,000 | |||||

General and administrative |

1,201 | 13,499 | |||||

| | | | | | | | |

Total operating expenses |

27,043 | 29,209 | |||||

| | | | | | | | |

Loss from operations |

(27,043 | ) | (29,209 | ) | |||

| | | | | | | | |

Other income (expense): |

|||||||

Other income, net |

9 | 486 | |||||

Interest expense—related party |

(4 | ) | (1 | ) | |||

Interest expense |

(152 | ) | (1,231 | ) | |||

| | | | | | | | |

Total other expense |

(147 | ) | (746 | ) | |||

| | | | | | | | |

Net loss |

$ | (27,190 | ) | $ | (29,955 | ) | |

| | | | | | | | |

Net loss per share of common stock—basic and diluted(1) |

$ | (1.57 | ) | $ | (1.40 | ) | |

| | | | | | | | |

Weighted average common shares outstanding—basic and diluted(1) |

17,332,257 | 21,435,369 | |||||

| | | | | | | | |

(1) See Note 2 to our consolidated financial statements incorporated by reference in this prospectus for an explanation of the method used to calculate basic and diluted net loss per common share.

| |

|

|

|||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

| |

As of December 31, 2016 |

As of December 31, 2017 |

|||||

| | | | | | | | |

| |

(in thousands) |

||||||

Balance Sheet Data: |

|||||||

Cash and cash equivalents |

$ | 28,709 | $ | 94,846 | |||

Working capital |

20,435 | 61,120 | |||||

Total assets |

28,746 | 96,379 | |||||

Note payable, long-term and short-term |

13,640 | 30,212 | |||||

Total liabilities |

21,951 | 35,197 | |||||

Total stockholders' equity |

6,795 | 61,182 | |||||

| | | | | | | | |

22

Certain relationships and related party transactions

The following includes a summary of transactions since March 24, 2016 to which we have been a party, in which the amount involved in the transaction exceeded $120,000, and in which any of our directors, executive officers or, to our knowledge, beneficial owners of more than 5% of our voting securities or any member of the immediate family of any of the foregoing persons had or will have a direct or indirect material interest. Other than described below, there have not been, nor are there currently any proposed, transactions or series of similar transactions to which we have been or will be a party other than compensation arrangements, which include equity and other compensation, termination, change in control and other arrangements, which are described under "Executive compensation" in our Annual Report on Form 10-K for the year ended December 31, 2017, which is incorporated by reference herein.

Participation in initial public offering

In our initial public offering, certain of our directors, executive officers and 5% stockholders and their affiliates purchased an aggregate of 841,435 shares of our common stock. Each of those purchases was made through the underwriters at the initial public offering price. The following table sets forth the aggregate number of shares of our common stock that these 5% stockholders and their affiliates purchased in our initial public offering:

| | | | | |

| Purchaser |

Shares of common stock |

|||

|---|---|---|---|---|

| | | | | |

Perceptive Life Sciences Master Fund, Ltd. |

588,235 | |||

Entities affiliated with Paul Manning(1) |

150,000 | |||

Alex Sapir |

20,100 | |||

Steven M. Goldman |

42,000 | |||

Roger A. Jeffs |

31,400 | |||

Lee F. Allen |

3,500 | |||

Kevin Laliberte |

6,200 | |||

| | | | | |

(1) Consists of 100,000 shares purchased by Paul B. Manning together with his spouse as Joint Tenants with Right of Survivorship and 50,000 shares purchased by BKB Growth Investments, LLC, of which Mr. Manning is a co-manager.

Conversion from limited liability company to corporation

In September 2016, we converted from a Delaware limited liability company named Dova Pharmaceuticals, LLC (formerly known as PBM AKX Holdings, LLC), or the LLC, to Dova Pharmaceuticals, Inc., a Delaware corporation. We refer to this activity as the Conversion. The Conversion was effected pursuant to a plan of conversion whereby each unit of membership of the LLC was converted into 330 shares of our common stock. Additionally, we terminated the LLC's operating agreement in connection with the Conversion. As part of the Conversion, the members of the LLC became our stockholders in the same ownership proportions as immediately prior to the Conversion. Effective upon the Conversion, our stockholders entered into a stockholders agreement which contained provisions similar to those set forth in the LLC's operating agreement immediately prior to the Conversion.

Services agreements with PBM Capital Group, LLC

In April 2016, we entered into the Dova services agreement with PBM Capital Group, LLC, an affiliate of PBM Capital Investments, LLC, a beneficial owner of more than 5% of our common stock and an entity

23

controlled by Paul B. Manning, one of our directors, to engage PBM Capital Group, LLC for certain scientific and technical, accounting, operations and back office support services. We agreed to pay PBM Capital Group, LLC a flat fee of $25,000 per month for these services. The Dova services agreement had an initial term of 12 months and was extended on April 1, 2017 for an additional one-year term. Pursuant to the Dova services agreement, we paid $0.2 million and $0.3 million to PBM Capital Group, LLC during the period from March 24, 2016 through December 31, 2016 and for the year ended December 31, 2017, respectively.

In April 2016, our wholly-owned subsidiary, AkaRx, Inc., or AkaRx, entered into the AkaRx services agreement with PBM Capital Group, LLC to engage PBM Capital Group, LLC for certain scientific and technical, accounting, operations and back office support services. AkaRx agreed to pay PBM Capital Group, LLC a flat fee of $25,000 per month for these services. The AkaRx services agreement had an initial term of 12 months and was extended on April 1, 2017 for an additional one-year term. Pursuant to the AkaRx services agreement, we paid $0.2 million and $0.3 million to PBM Capital Group, LLC during the period from March 24, 2016 through December 31, 2016 and for the year ended December 31, 2017, respectively.

Guarantee by PBM Capital Investments, LLC

In March 2016, we entered into a transition services agreement with Eisai, or the TSA. In connection with the TSA, AkaRx issued Eisai note, which enables us to finance payments due to Eisai under the TSA. The principal amount of the Eisai note will be increased by the amount of unpaid service fees and out-of-pocket expenses due and owed to Eisai under the TSA. Principal and interest under the Eisai note can be prepaid at any time without penalty. Payments due pursuant to the Eisai note are currently guaranteed by PBM Capital Investments, LLC.

Private placements of our securities