Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ABRAXAS PETROLEUM CORP | a8kfebruaryupdate.htm |

Abraxas Petroleum

Corporate Update

February 2018

Raven Rig #1; McKenzie County, ND

Exhibit 99.1

2

The information presented herein may contain predictions, estimates and other forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Although the Company believes that its expectations are based on

reasonable assumptions, it can give no assurance that its goals will be achieved.

Important factors that could cause actual results to differ materially from those included in the forward-looking statements include the timing and

extent of changes in commodity prices for oil and gas, availability of capital, the need to develop and replace reserves, environmental risks, competition,

government regulation and the ability of the Company to meet its stated business goals.

Oil and Gas Reserves. The SEC permits oil and natural gas companies, in their SEC filings, to disclose only reserves anticipated to be economically

producible, as of a given date, by application of development projects to known accumulations. We use certain terms in this presentation, such as total

potential, de-risked, and EUR (expected ultimate recovery), that the SEC’s guidelines strictly prohibit us from using in our SEC filings. These terms

represent our internal estimates of volumes of oil and natural gas that are not proved reserves but are potentially recoverable through exploratory

drilling or additional drilling or recovery techniques and are not intended to correspond to probable or possible reserves as defined by SEC regulations.

By their nature these estimates are more speculative than proved, probable or possible reserves and subject to greater risk they will not be realized.

Non-GAAP Measures. Included in this presentation are certain non-GAAP financial measures as defined under SEC Regulation G. Investors are urged to

consider closely the disclosure in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and its subsequently filed

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and the reconciliation to GAAP measures provided in this presentation.

Initial production, or IP, rates, for both our wells and for those wells that are located near our properties, are limited data points in each well’s

productive history. These rates are sometimes actual rates and sometimes extrapolated or normalized rates. As such, the rates for a particular well may

change as additional data becomes available. Peak production rates are not necessarily indicative or predictive of future production rates, expected

ultimate recovery, or EUR, or economic rates of return from such wells and should not be relied upon for such purpose. Equally, the way we calculate

and report peak IP rates and the methodologies employed by others may not be consistent, and thus the values reported may not be directly and

meaningfully comparable. Lateral lengths described are indicative only. Actual completed lateral lengths depend on various considerations such as lease-

line offsets. Standard length laterals, sometimes referred to as 5,000 foot laterals, are laterals with completed length generally between 4,000 feet and

5,500 feet. Mid-length laterals, sometimes referred to as 7,500 foot laterals, are laterals with completed length generally between 6,500 feet and 8,000

feet. Long laterals, sometimes referred to as 10,000 foot laterals, are laterals with completed length generally longer than 8,000 feet.

Forward-Looking Statements

3

Headquarters......................... . San Antonio

Shares outstanding(1)……......... 165.9 mm

Market cap(1) …………………….... $355.0 mm

Net debt(1)……………………………. $86.0 mm

2018E CAPEX……………………….. $140 mm

(1) Shares outstanding as of December 31, 2017. Market cap using share price as of February 16, 2018. Total debt including RBL facility and building mortgage less cash as of December 31, 2017

(2) Enterprise value includes working capital deficit (excluding current hedging assets and liabilities) as of September 30, 2017, but does not include building mortgage. Includes RBL facility and building mortgage less cash as of December 31, 2017.

(3) Proved reserves as of December 31, 2017. See appendix for reconciliation of PV-10 to standardized measure.

(4) Net book value of other assets as of September 30, 2017.

(5) Average production for the quarter ended December 31, 2017

(6) PV-10 calculated using SEC pricing of $51.34/bbl of oil and $2.99/mcf of natural gas. Please see appendix for reconciliation to standardized measure.

EV/BOE(1,2)…………………………… $7.01

Proved Reserves(3)………………. . 65.9 mmboe

NBV Non-Oil & Gas Assets(4)… $21.3 mm

Production(5).……………………….. 8,785 boepd

PV-10(6)…………………………………. $425.9

NASDAQ: AXAS

Corporate Profile

4

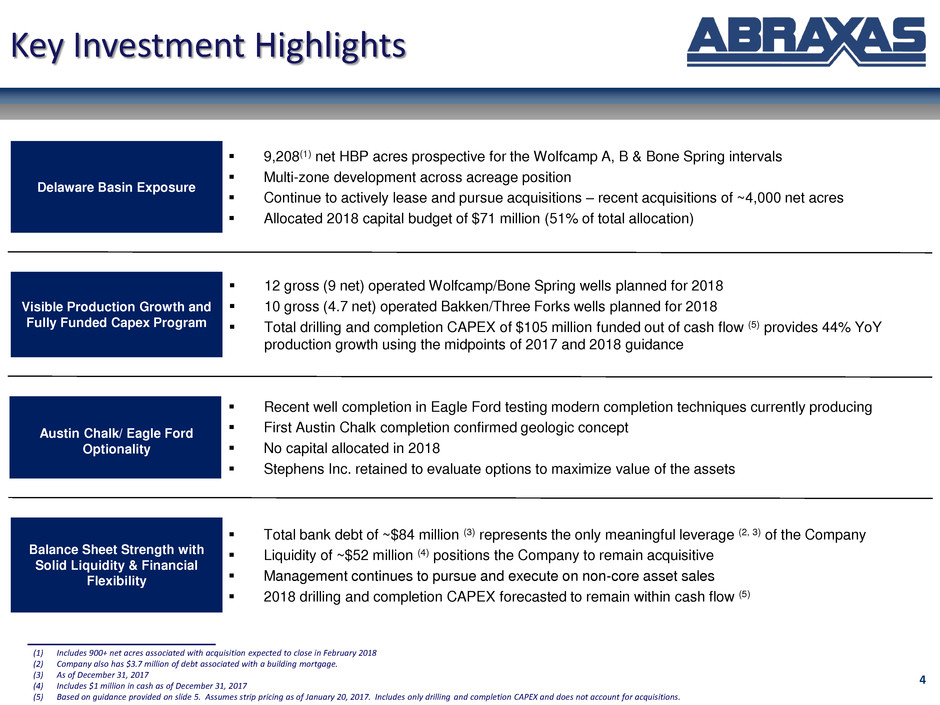

Key Investment Highlights

Recent well completion in Eagle Ford testing modern completion techniques currently producing

First Austin Chalk completion confirmed geologic concept

No capital allocated in 2018

Stephens Inc. retained to evaluate options to maximize value of the assets

Austin Chalk/ Eagle Ford

Optionality

Total bank debt of ~$84 million (3) represents the only meaningful leverage (2, 3) of the Company

Liquidity of ~$52 million (4) positions the Company to remain acquisitive

Management continues to pursue and execute on non-core asset sales

2018 drilling and completion CAPEX forecasted to remain within cash flow (5)

Balance Sheet Strength with

Solid Liquidity & Financial

Flexibility

12 gross (9 net) operated Wolfcamp/Bone Spring wells planned for 2018

10 gross (4.7 net) operated Bakken/Three Forks wells planned for 2018

Total drilling and completion CAPEX of $105 million funded out of cash flow (5) provides 44% YoY

production growth using the midpoints of 2017 and 2018 guidance

Visible Production Growth and

Fully Funded Capex Program

(1) Includes 900+ net acres associated with acquisition expected to close in February 2018

(2) Company also has $3.7 million of debt associated with a building mortgage.

(3) As of December 31, 2017

(4) Includes $1 million in cash as of December 31, 2017

(5) Based on guidance provided on slide 5. Assumes strip pricing as of January 20, 2017. Includes only drilling and completion CAPEX and does not account for acquisitions.

9,208(1) net HBP acres prospective for the Wolfcamp A, B & Bone Spring intervals

Multi-zone development across acreage position

Continue to actively lease and pursue acquisitions – recent acquisitions of ~4,000 net acres

Allocated 2018 capital budget of $71 million (51% of total allocation)

Delaware Basin Exposure

5

2018 Operating and Financial Guidance

2018 Capex Budget Allocation 2018 Operating Guidance

Operating Costs

Low

Case

High

Case

LOE ($/BOE) $4.00 $6.00

Production Tax (% Rev) 8.0% 9.0%

Cash G&A ($mm) $8.5 $12.5

Production (boepd) 10,000 12,000

(1) Yearly CAPEX for each year ending December 31, 2013, 2014, 2015, 2016 and 2017. 2018 based on midpoint of management guidance.

(2) Average estimated production for 2018 based on the midpoint of management guidance.

66%

22%

12%

2018 Expected Production Mix

Oil Gas NGL

Area

Capital

($MM)

% of

Total

Gross

Wells

Net

Wells

Permian - Delaware $71.2 50.9% 12.0 9.0

Bakken/Three Forks 33.8 24.1% 10.0 4.7

Eagle Ford/Austin Chalk 0.0 0.0% 0.0 0.0

Acquisitions/Facilities/Other 35.0 25.0% 0.0 0.0

Total $140.0 100% 22.0 13.7

$0

$50,000

$100,000

$150,000

$200,000

$250,000

0

2,000

4,000

6,000

8,000

10,000

12,000

20

13

A

20

14

A

20

15

A

20

16

A

20

17

A

20

18

E (

2)

Daily Production vs Yearly CAPEX (1)

6

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

Bakken/Three Forks Wolfcamp

Abraxas D&C CAPEX & Production Outlook(1)

2017-2019 in Boepd

Assumes one rig in the Bakken/Three Forks and one rig in the Delaware

D&C CAPEX(3) $100mm $105mm $100mm

PDP (2)

Incremental Bakken/

Three Forks (2)

Incremental

Wolfcamp (2)

B

ar

re

ls

o

f

Eq

u

iv

al

e

n

t

p

e

r

D

ay

(

B

o

e

p

d

)

(1) Production and CAPEX guidance based on internal management estimates. The 2017, 2018 and 2019 production and capital expenditure guidance is subject to change depending upon a number of factors, including the availability of drilling equipment and

personnel, economic and industry conditions at the time of drilling, prevailing and anticipated prices for oil and gas, the availability of sufficient capital resources for drilling prospects, the Company’s financial results, the availability of leases on reasonable

terms and the ability of the Company to obtain permits for drilling locations.

(2) Projected PDP volumes are based on management’s internal estimates and account for all recent completions and acquisitions. The rates of decline are estimates and actual production declines could be materially higher. Incremental Bakken/Three Forks,

Wolfcamp and Eagle Ford/Austin Chalk projections are based on the Company’s type curves.

(3) D&C CAPEX includes only capital expenditures associated with drilling, completions and facilities. Excludes approximately $30 million and $35 associated with acquisitions consummated or planned during 2017 and 2018, respectively.

7

Implied Value Per Acre(1,2)

(1) Calculated as Enterprise Value less reserve/production value divided by net acres. Enterprise value calculated using market cap as of January 26, 2018 and net debt as of September 30, 2017. Production/reserve value calculated as $35,000/Boepd multiplied by

quarter end September 30, 2017 average daily production.

(2) Peers include: Callon Petroleum, Centennial Development, Diamondback, Halcon, Jagged Peak, Lillis Energy, Parsley Energy, Rosehill Resources, RSP Permian. Halcon numbers are pro forma for recent divestitures and tender offers. Lillis Energy and Rosehill

Resources numbers are pro forma for recent transactions.

(3) Enterprise value of Abraxas calculated as market cap as of January 26, 2018 and net debt as of December 31, 2017. Includes $14.2 million and 900+ net acres associated with acquisition expected to close in February 2018. Abraxas production value

calculated as $35,000/Boepd multiplied by midpoint of Abraxas 1Q18 production guidance of 10,000-11,000 Boepd.

$0

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

Peer 1 (1) Peer 2 (1) Peer 3 (1) Peer 4 (1) Peer 5 (1) Peer 6 (1) Peer 7 (1) Peer 8 (1) Peer 9 (1) Peer 10 (1) Average AXAS (3)

8

Asset Base Overview

9

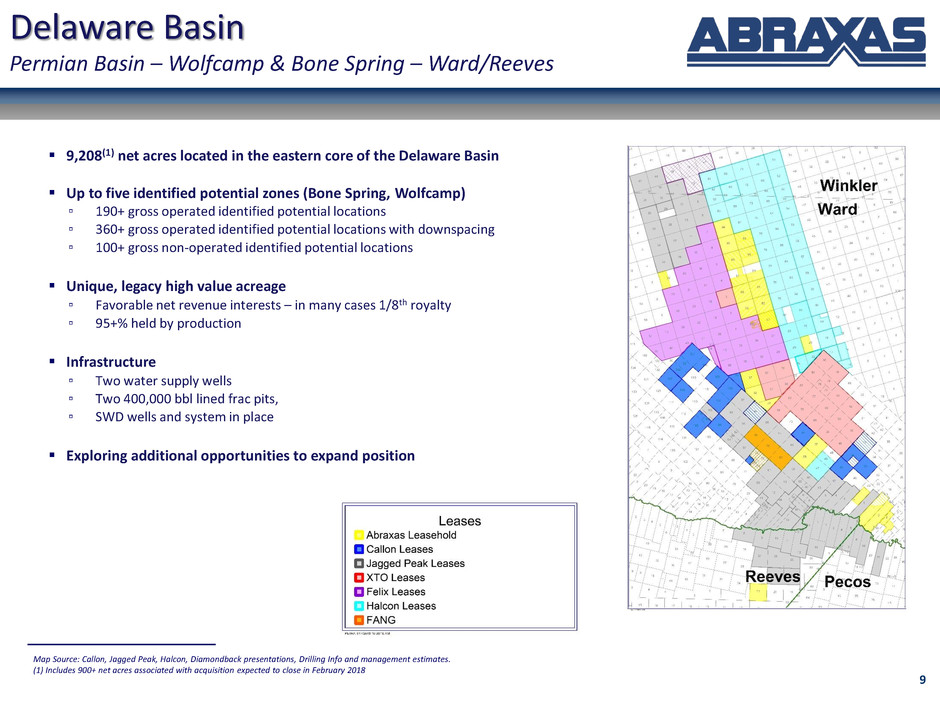

9,208(1) net acres located in the eastern core of the Delaware Basin

Up to five identified potential zones (Bone Spring, Wolfcamp)

▫ 190+ gross operated identified potential locations

▫ 360+ gross operated identified potential locations with downspacing

▫ 100+ gross non-operated identified potential locations

Unique, legacy high value acreage

▫ Favorable net revenue interests – in many cases 1/8th royalty

▫ 95+% held by production

Infrastructure

▫ Two water supply wells

▫ Two 400,000 bbl lined frac pits,

▫ SWD wells and system in place

Exploring additional opportunities to expand position

Delaware Basin

Permian Basin – Wolfcamp & Bone Spring – Ward/Reeves

Map Source: Callon, Jagged Peak, Halcon, Diamondback presentations, Drilling Info and management estimates.

(1) Includes 900+ net acres associated with acquisition expected to close in February 2018

10

1

2

3 4

5 6

7 8

9

10

11 12

13

14

16

17

18

19

15

20

21

22

9

Univ Lands Beldin 3H

Jagged Peak

IP24: 1,415 BOEPD (81% Oil)

LL: 9,561’

Surrounding Delaware Activity

1

Sealy Ranch 9301H

Halcon

LL: 10,000’

2

Univ Lands Beldin 4H

Jagged Peak

LL: 10,000’

3 & 4

Caprito 82 101H & 202H

Abraxas

LL: 4,820’

5 & 6

Sealy Ranch 7902H & 7903H

Halcon

LL: 10,000’

10

Caprito 99 302H

Abraxas

IP: 997 BOEPD (83% Oil)

LL: 4,529’

17

State Whiskey River 4-8-2H

Jagged Peak

IP 24: 2,260 BOEPD

LL:10,000’

18 & 19

Sealy Ranch 7701H & 7703H

Halcon

LL: 10,000’

15

Whiskey River 7374A&B

Jagged Peak

IP24: 2,504 BOEPD

LL: 9,000’

7 & 8

Caprito 83 304H (WC A2)

& 404 (WC B)

304H IP30: 1,014 BOEPD

(77% Oil) LL: 4,820’

14

St. Quadricorn 1617A 1H

Jagged Peak

Flowback Test: 1,500 BOEPD

LL: 10,000’

13

CRMWD-79 1H

Halcon

IP30: 1,343 BOEPD (80% Oil)

LL: 3,477’

11

Caprito 98 301HR

Abraxas

IP30: 999 BOEPD (84% Oil)

LL: 4,880’ (Wolfcamp A2)

12

Caprito 98 201H

Abraxas

IP30: 1,036 BOEPD (84% Oil)

LL: 4,880’ (Wolfcamp A1)

16

State 5913A 2H

Jagged Peak

IP24: 1,179 BOEPD (83% Oil)

LL: 6,662’ (Wolfcamp C)

20

UL Willow 3836-16 1H

Felix

LL: 10,000’

21

University Land 1H, 3H, & 4H

Felix

LL: 10,000’

22

Sealy Ranch

7 Permitted Wells

Halcon

LL: 10,000’

11

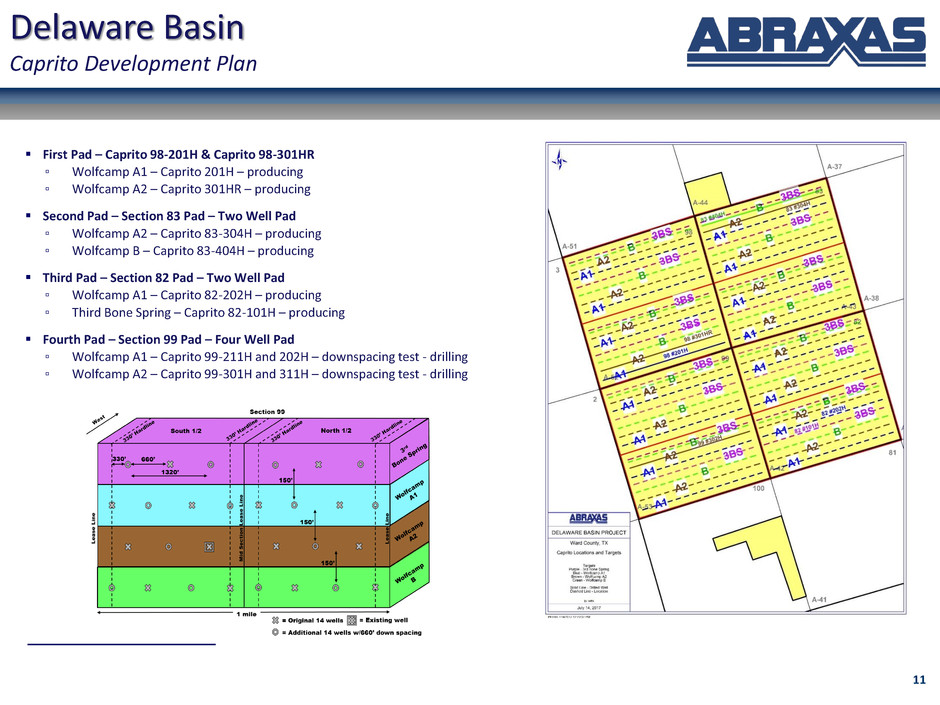

Delaware Basin

Caprito Development Plan

(1)

(1)

First Pad – Caprito 98-201H & Caprito 98-301HR

▫ Wolfcamp A1 – Caprito 201H – producing

▫ Wolfcamp A2 – Caprito 301HR – producing

Second Pad – Section 83 Pad – Two Well Pad

▫ Wolfcamp A2 – Caprito 83-304H – producing

▫ Wolfcamp B – Caprito 83-404H – producing

Third Pad – Section 82 Pad – Two Well Pad

▫ Wolfcamp A1 – Caprito 82-202H – producing

▫ Third Bone Spring – Caprito 82-101H – producing

Fourth Pad – Section 99 Pad – Four Well Pad

▫ Wolfcamp A1 – Caprito 99-211H and 202H – downspacing test - drilling

▫ Wolfcamp A2 – Caprito 99-301H and 311H – downspacing test - drilling

Delaware Wolfcamp

Wolfcamp A1 & A2 Well Economics

Wolfcamp: ROR vs WTI

Abraxas EOY16 Assumptions

604 MBOE gross type curve

▫ 77% Oil

▫ Initial rate: 1266 boepd

▫ di: 99.95%

▫ dm: 6.0%

▫ b-factor: 1.3

Assumed CWC: $7.3 million

Wolfcamp: Type Curve Assumptions

12

0

200

400

600

800

1000

1200

1400

0 20 40 60 80 100 120 140 160 180

B

O

EP

D

DAYS

NORMALIZED AVERAGE PRODUCTION BY WELL GROUP

WARD COUNTY - WOLFCAMP

WOLFCAMP A1 COMPLETIONS; WOLFCAMP A2 COMPLETIONS; LINE = EOY16 TYPE

13

Bakken/Three Forks

Bakken / Three Forks

4,013 net HBP acres located in the core of the Williston Basin

in McKenzie County, ND – de-risked Bakken and Three Forks

▫ 44 operated completed wells

▫ Est. 28 gross additional operated Bakken/ First Bench Three

Forks locations remaining

▫ Est. 20 gross additional Second Bench Three Forks locations

remaining

▫ 3 operated wells waiting on completion

▫ 4 operated wells drilling

▫ Est. 37 gross/3 net additional non-operated locations remaining

Yellowstone 2H-4HR

▫ 42.7% net revenue interest

▫ 30-day MB average rate(1) 1,777 boepd

▫ 30-day TF average rate(1) 1,371 boepd

Yellowstone 5H-7H

▫ Three well pad waiting on completion

▫ 42.7% net revenue interest

Lillibridge 9H-12H

▫ Four well pad drilling

(1) The 30-day average rates represent the highest 30 days of production and do not include the impact of natural gas liquids and shrinkage at the processing plant and include flared gas.

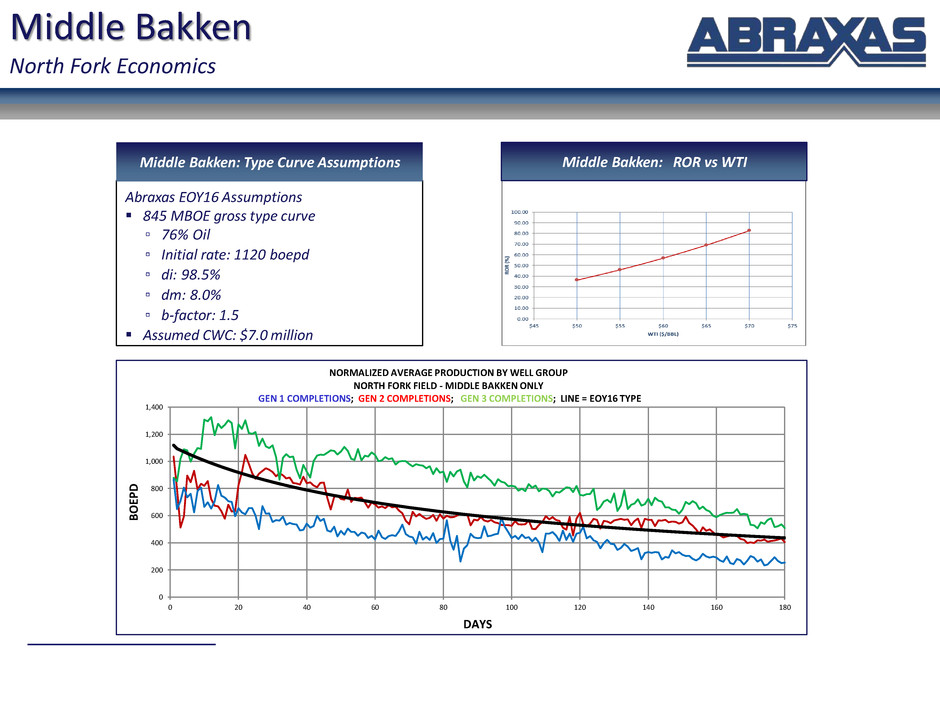

Middle Bakken

North Fork Economics

0

200

400

600

800

1,000

1,200

1,400

0 20 40 60 80 100 120 140 160 180

B

O

EP

D

DAYS

NORMALIZED AVERAGE PRODUCTION BY WELL GROUP

NORTH FORK FIELD - MIDDLE BAKKEN ONLY

GEN 1 COMPLETIONS; GEN 2 COMPLETIONS; GEN 3 COMPLETIONS; LINE = EOY16 TYPE

Middle Bakken: ROR vs WTI

Abraxas EOY16 Assumptions

845 MBOE gross type curve

▫ 76% Oil

▫ Initial rate: 1120 boepd

▫ di: 98.5%

▫ dm: 8.0%

▫ b-factor: 1.5

Assumed CWC: $7.0 million

Middle Bakken: Type Curve Assumptions

Three Forks

North Fork Economics

0

200

400

600

800

1000

1200

1400

0 20 40 60 80 100 120 140 160 180

B

O

EP

D

DAYS

NORMALIZED AVERAGE PRODUCTION BY WELL GROUP

NORTH FORK FIELD - THREE FORKS ONLY

GEN 1 COMPLETIONS; GEN 2 COMPLETIONS; GEN 3 COMPLETIONS; LINE=EOY16 TYPE

Three Forks: ROR vs WTI

Abraxas EOY16 Assumptions

723 MBOE gross type curve

▫ 73% Oil

▫ Initial rate: 1000 boepd

▫ di: 98.5%

▫ dm: 8.0%

▫ b-factor: 1.5

Assumed CWC: $7.0 million

Three Forks: Type Curve Assumptions

16

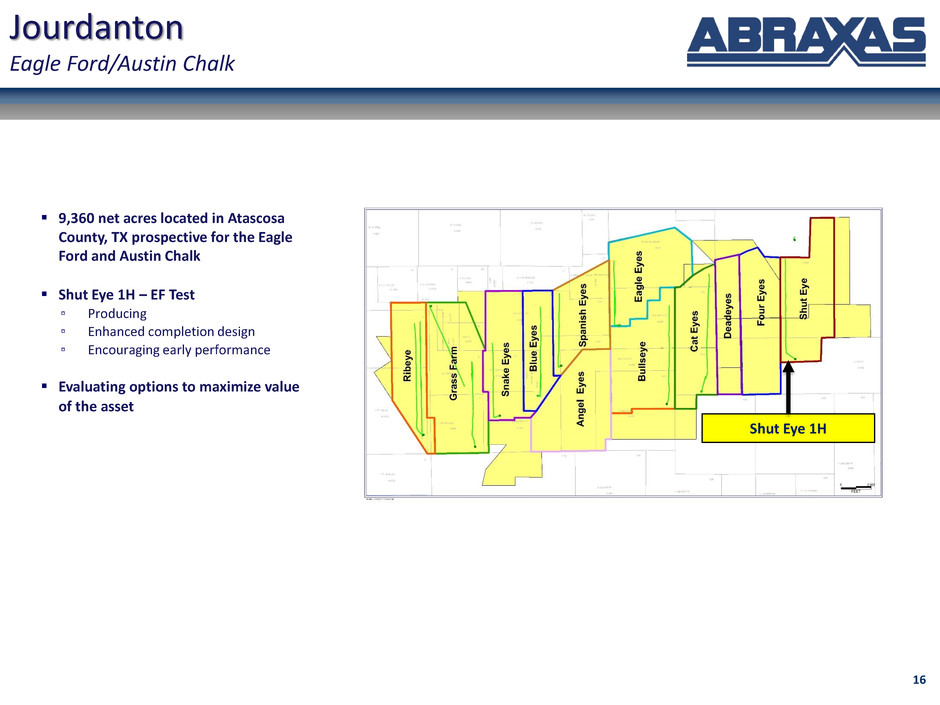

Shut Eye 1H

9,360 net acres located in Atascosa

County, TX prospective for the Eagle

Ford and Austin Chalk

Shut Eye 1H – EF Test

▫ Producing

▫ Enhanced completion design

▫ Encouraging early performance

Evaluating options to maximize value

of the asset

Jourdanton

Eagle Ford/Austin Chalk

17

Appendix

18

(1) 2018 daily volumes indicated for February – December 2018. January 2018 volumes equate to 3,050 Bopd hedged at $50.43.

(2) Straight line average price. Includes 2,651 and 1,200 of WTI swaps in 2018 and 2019, respectively. Includes 500 Bopd and 1,000 Bopd of LLS swaps in 2018 and 2019, respectively.

Abraxas Hedging Profile

2018 (1) 2019 2020

Oil Swaps (bbls/day) 3,885 2,383 1,200

NYMEX (1) $52.51 $55.44 $54.33

19

Adjusted EBITDA Reconciliation

Adjusted EBITDA is defined as net income plus interest expense, depreciation, depletion and amortization expenses, deferred income taxes and other non-cash

items. The following table provides a reconciliation of Adjusted EBITDA to net income for the periods presented.

(In thousands) Year End

2014 2015 2016

Net income $63,268.73 ($119,055) ($96,378)

Net interest expense 2,009 3,340 $3,827

Income tax expense (287) (37) $0

Depreciation, depletion and amortization 43,139 38,548 $24,431

Amortization of deferred financing fees 934 1,130 $1,019

Stock-based compensation 2,703 3,912 $3,194

Impairment 0 128,573 $67,626

Unrealized (gain) loss on derivative contracts (24,876) (18,417) $19,818

Realized (Gain) loss on interest derivative contract 0 0 $0

Realized (Gain) loss on monetized derivative contracts 0 5,061 $14,370

Earnings from equity method investment 0 0 $0

(Gai ) loss o discontinued operations (1,318) 20 $0

Expenses incurred with offerings and execution of loan agreement $1,747

Other non-cash items 0 883 $494

EBITDA $85,572 $43,957 $40,149

Credit facility borrowings $70,000 $134,000 $93,250

Debt/EBITDA 0.82x 3.05x 2.32x

20

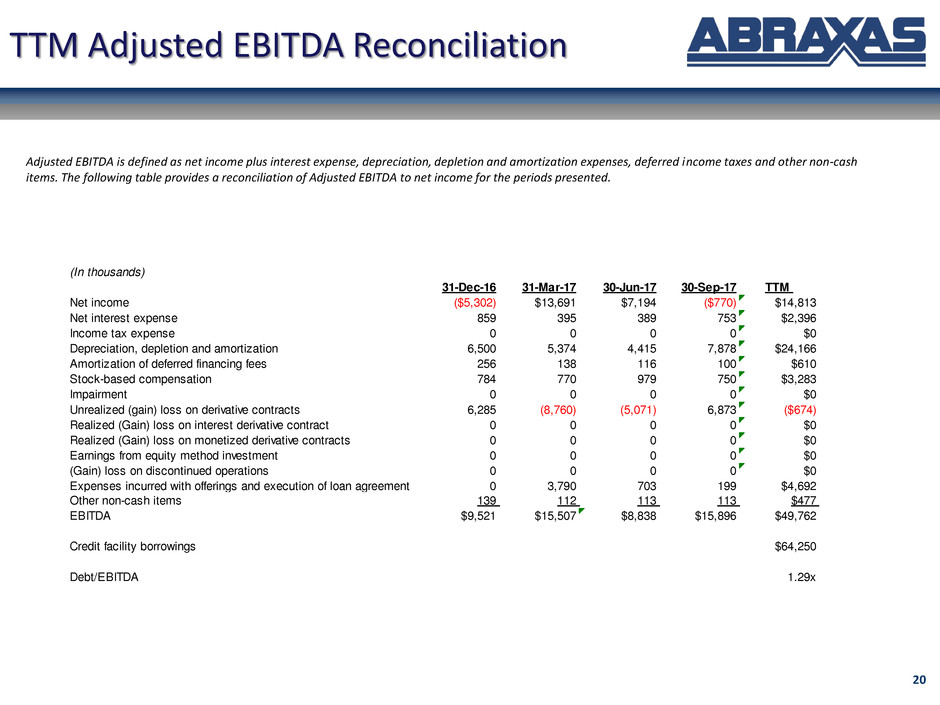

TTM Adjusted EBITDA Reconciliation

Adjusted EBITDA is defined as net income plus interest expense, depreciation, depletion and amortization expenses, deferred income taxes and other non-cash

items. The following table provides a reconciliation of Adjusted EBITDA to net income for the periods presented.

(In thousands)

31-Dec-16 31-Mar-17 30-Jun-17 30-Sep-17 TTM

Net income ($5,302) $13,691 $7,194 ($770) $14,813

Net interest expense 859 395 389 753 $2,396

Income tax expense 0 0 0 0 $0

Depreciation, depletion and amortization 6,500 5,374 4,415 7,878 $24,166

Amortization of deferred financing fees 256 138 116 100 $610

Stock-based compensation 784 770 979 750 $3,283

Impairment 0 0 0 0 $0

Unrealized (gain) loss on derivative contracts 6,285 (8,760) (5,071) 6,873 ($674)

Realized (Gain) loss on interest derivative contract 0 0 0 0 $0

Realiz d (Gain) loss on monetized derivative contracts 0 0 0 0 $0

Earnings from equity method investment 0 0 0 0 $0

(G i ) l ss o i continued operations 0 0 0 0 $0

Expenses incurred with offerings and execution of loan agreement 0 3,790 703 199 $4,692

Other non-cash items 139 112 113 113 $477

EBITDA $9,521 $15,507 $8,838 $15,896 $49,762

Credit facility borrowings $64,250

Debt/EBITDA 1.29x

21

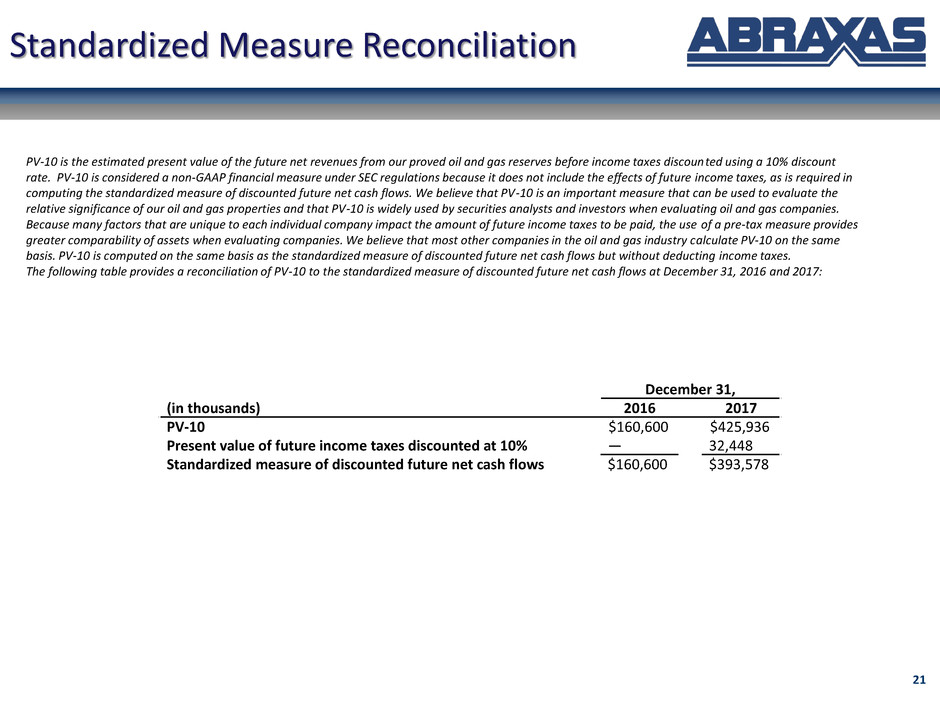

Standardized Measure Reconciliation

PV-10 is the estimated present value of the future net revenues from our proved oil and gas reserves before income taxes discounted using a 10% discount

rate. PV-10 is considered a non-GAAP financial measure under SEC regulations because it does not include the effects of future income taxes, as is required in

computing the standardized measure of discounted future net cash flows. We believe that PV-10 is an important measure that can be used to evaluate the

relative significance of our oil and gas properties and that PV-10 is widely used by securities analysts and investors when evaluating oil and gas companies.

Because many factors that are unique to each individual company impact the amount of future income taxes to be paid, the use of a pre-tax measure provides

greater comparability of assets when evaluating companies. We believe that most other companies in the oil and gas industry calculate PV-10 on the same

basis. PV-10 is computed on the same basis as the standardized measure of discounted future net cash flows but without deducting income taxes.

The following table provides a reconciliation of PV-10 to the standardized measure of discounted future net cash flows at December 31, 2016 and 2017:

December 31,

(in thousands) 2016 2017

PV-10 $160,600 $425,936

Present value of future income taxes discounted at 10% — 32,448

Standardized measure of discounted future net cash flows $160,600 $393,578

22

NASDAQ: AXAS