Attached files

| file | filename |

|---|---|

| EX-95 - EXHIBIT 95 - CONSOL Coal Resources LP | exhibit95-mshax12312017.htm |

| EX-32.2 - EXHIBIT 32.2 - CONSOL Coal Resources LP | exhibit322-12312017.htm |

| EX-32.1 - EXHIBIT 32.1 - CONSOL Coal Resources LP | exhibit321-12312017.htm |

| EX-31.2 - EXHIBIT 31.2 - CONSOL Coal Resources LP | exhibit312-12312017.htm |

| EX-31.1 - EXHIBIT 31.1 - CONSOL Coal Resources LP | exhibit311-12312017.htm |

| EX-23.1 - EXHIBIT 23.1 - CONSOL Coal Resources LP | exhibit231-12312017.htm |

| EX-21.1 - EXHIBIT 21.1 - CONSOL Coal Resources LP | exhibit211-12312017.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________________________________

FORM 10-K

_________________________________________________________________

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-14901

__________________________________________________

CONSOL Coal Resources LP

(Exact name of registrant as specified in its charter)

Delaware | 47-3445032 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

1000 CONSOL Energy Drive, Suite 100

Canonsburg, PA 15317-6506

(724) 485-3300

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

________________________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange On Which Registered | |

Common Units representing limited partner interests | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

__________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (check one):

Large accelerated filer o Accelerated filer x Non-accelerated filer o Smaller Reporting Company o Emerging Growth Company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate value of the common units held by non-affiliates of the registrant (treating all executive officers and directors of the registrant, for this purpose, as if they may be affiliates of the registrant) was approximately $146,858,493 as of June 30, 2017, the last business day of the registrant’s most recently completed second fiscal quarter, based on the reported closing price of the common units as reported on The New York Stock Exchange on such date.

CONSOL Coal Resources LP had 15,906,728 common units, 11,611,067 subordinated units, and a 1.7% general partner interest outstanding at February 8, 2018.

DOCUMENTS INCORPORATED BY REFERENCE:

None

TABLE OF CONTENTS

Page | ||

PART I | ||

Item 1. | Business | |

Item 1A. | Risk Factors | |

Item 1B. | Unresolved Staff Comments | |

Item 2. | Properties | |

Item 3. | Legal Proceedings | |

Item 4. | Mine Safety Disclosures | |

PART II | ||

Item 5. | Market for Registrant’s Common Units and Related Unitholder Matters and Issuer Purchases of Equity Securities | |

Item 6. | Selected Financial Data | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |

Item 8. | Financial Statements and Supplementary Data | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosures | |

Item 9A. | Controls and Procedures | |

Item 9B. | Other Information | |

PART III | ||

Item 10. | Directors, Executive Officers and Corporate Governance of Managing General Partner | |

Item 11. | Executive Compensation | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Unitholder Matters | |

Item 13. | Certain Relationships and Related Transactions and Director Independence | |

Item 14. | Principal Accounting Fees and Services | |

PART IV | ||

Item 15. | Exhibits and Financial Statement Schedules | |

Signatures | ||

2

PART I

Significant Relationships and Other Important Definitions Referenced in this Annual Report

• | “Affiliated Company Credit Agreement” refers to an agreement entered into on November 28, 2017 among the Partnership and certain of its subsidiaries (collectively, the “Credit Parties”), CONSOL Energy, as lender and administrative agent, and PNC Bank, National Association, as collateral agent (“PNC”). The Affiliated Company Credit Agreement provides for a revolving credit facility in an aggregate principal amount of up to $275 million to be provided by CONSOL Energy, as lender. |

• | “Class A Preferred Units” refers to the convertible preferred units representing limited partner interests in CONSOL Coal Resources LP. The Partnership issued 3,956,496 Class A Preferred Units to CNX on September 30, 2016. On October 2, 2017 the 3,956,496 Class A Preferred Units were converted to common units on a one-for-one basis, in accordance with our Partnership Agreement. The key terms of the Class A Preferred Units were described in our Annual Report on Form 10-K for the year ended December 31, 2016 (our “2016 Form 10-K”); |

• | “CONSOL Coal Finance” refers to CONSOL Coal Finance Corporation, a Delaware corporation and a direct, wholly owned subsidiary of the Partnership; |

• | “CONSOL Coal Resources LP,” the “Partnership,” “we,” “our,” “us” and similar terms, when used in a historical context, refer to CONSOL Coal Resources LP, a Delaware limited partnership, and its subsidiaries, with common units listed for trading on the New York Stock Exchange under the ticker “CCR.” Prior to November 28, 2017, we were called CNX Coal Resources LP and our common units traded on the New York Stock Exchange under the ticker “CNXC”; |

• | “CONSOL Operating” refers to CONSOL Operating LLC, a Delaware limited liability company and a direct, wholly owned subsidiary of the Partnership; |

• | “CONSOL Thermal Holdings” refers to CONSOL Thermal Holdings LLC, a Delaware limited liability company and a direct, wholly owned subsidiary of CONSOL Operating; following the PA Mining Acquisition, CONSOL Thermal Holdings owns a 25% undivided interest in the assets, liabilities, revenues and expenses comprising the Pennsylvania Mining Complex; |

• | “common units” refer to the limited partner interests in CONSOL Coal Resources LP. The holders of common units are entitled to participate in partnership distributions and are entitled to exercise the rights or privileges of limited partners under the Partnership Agreement. The common units are listed on the New York Stock Exchange under the symbol “CCR”; |

• | “Concurrent Private Placement” refers to the issuance (concurrent with the IPO) of 5,000,000 common units to Greenlight Capital pursuant to a common unit purchase agreement; |

• | “CONSOL Energy” and our “sponsor” refer to CONSOL Energy Inc., a Delaware corporation and the parent of our general partner, and its subsidiaries other than our general partner, us and our subsidiaries; |

• | “CPCC” refers to CONSOL Pennsylvania Coal Company LLC, a Delaware limited liability company and a wholly owned subsidiary of CONSOL Energy; |

• | “Conrhein” refers to Conrhein Coal Company, a Pennsylvania general partnership and a wholly-owned subsidiary of CONSOL Energy; |

• | “general partner” refers to CONSOL Coal Resources GP LLC, a Delaware limited liability company and our general partner; |

• | “Greenlight Capital” refers to certain funds managed by Greenlight Capital, Inc. and its affiliates; |

• | “IPO” refers to the completion of the Partnership’s initial public offering on July 7, 2015; |

3

• | “Omnibus Agreement” refers to the Omnibus Agreement dated July 7, 2015, as replaced by the First Amended and Restated Omnibus Agreement dated as of September 30, 2016, and as amended by the First Amendment to the First Amended and Restated Omnibus Agreement, dated November 28, 2017; |

• | “PA Mining Acquisition” refers to a transaction which closed on September 30, 2016, wherein the Partnership and its wholly owned subsidiary, CONSOL Thermal Holdings, entered into a Contribution Agreement with CNX, CPCC and Conrhein, under which CONSOL Thermal Holdings acquired an undivided 6.25% of the contributing parties’ right, title and interest in and to the Pennsylvania Mining Complex (which represents an aggregate 5% undivided interest in and to the Pennsylvania Mining Complex); |

• | “CNX” refers to CNX Resources Corporation and its consolidated subsidiaries on or after November 28, 2017 and to CONSOL Energy Inc. and its consolidated subsidiaries prior to November 28, 2017; |

• | “Partnership Agreement” refers to the First Amended and Restated Agreement of Limited Partnership of the Partnership, as replaced by the Second Amended and Restated Agreement of Limited Partnership of the Partnership dated as of September 30, 2016, as replaced by the Third Amended and Restated Partnership Agreement dated as of November 28, 2017; |

• | “Pennsylvania Mining Complex” refers to the coal mines, coal reserves and related assets and operations, located primarily in southwestern Pennsylvania. The Pennsylvania Mining complex was owned 80% by CNX and 20% by CONSOL Thermal Holdings from July 2015 until the closing of the PA Mining Acquisition in September 2016. Following the PA Mining Acquisition until November 28, 2017, the Pennsylvania Mining Complex was owned 75% by CNX and its subsidiaries and 25% by CONSOL Thermal Holdings. In connection with the separation on November 28, 2017, CNX’s undivided interest in the Pennsylvania Mining Complex was transferred to CONSOL Energy; |

• | “PNC Revolving Credit Facility” refers to a credit agreement that the Partnership entered into on July 7, 2015, as borrower, and certain subsidiaries of the Partnership, as guarantors, for a $400 million revolving credit facility with PNC, as administrative agent, and other lender parties. On November 28, 2017, in connection with the separation, the Partnership paid all fees and other amounts outstanding under the PNC Revolving Credit Facility and terminated the PNC Revolving Credit Facility and the related loan documents; |

• | “Predecessor” refers to CNX’s ownership of CPCC and the Conrhein assets and liabilities prior to the IPO on July 7, 2015; |

• | “preferred units” refer to any limited partnership interests, other than the common units and subordinated units, issued in accordance with the Partnership Agreement that, as determined by our general partner, have special voting rights to which our common units are not entitled. As of the date of this Annual Report on Form 10-K, there are no outstanding preferred units; |

• | “SEC” refers to the United States Securities and Exchange Commission; |

• | “separation” refers to the separation of the coal business from CNX’s other businesses and the creation, as a result of the distribution, of an independent, publicly traded company (CONSOL Energy) to hold the assets and liabilities associated with the coal business (including CNX’s interest in the general partner and in us) after the distribution; |

• | “sponsor” or “our sponsor” refers to CNX prior to the completion of the separation on November 28, 2017 and to |

CONSOL Energy following the completion of the separation; and

• | “subordinated units” refer to limited partner interests in CONSOL Coal Resources LP having the rights and obligations specified with respect to subordinated units in the Partnership Agreement. In connection with the completion of the IPO, we issued 11,611,067 subordinated units to CNX. In connection with the separation and the Affiliated Company Credit Agreement, all of the subordinated units were transferred directly to CONSOL Energy. |

4

FORWARD-LOOKING STATEMENTS

We are including the following cautionary statement in this Annual Report on Form 10-K to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for any forward-looking statements made by, or on behalf of us. With the exception of historical matters, the matters discussed in this Annual Report on Form 10-K are forward-looking statements (as defined in Section 21E of the Exchange Act) that involve risks and uncertainties that could cause actual results to differ materially from projected results. Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. The forward-looking statements may include projections and estimates concerning the timing and success of specific projects and our future production, revenues, income and capital spending. When we use the words “believe,” “continue,” “intend,” “expect,” “may,” “should,” “anticipate,” “could,” “estimate,” “plan,” “predict,” “project,” “will,” or their negatives, or other similar expressions, the statements which include those words are usually forward-looking statements. When we describe strategy that involves risks or uncertainties, we are making forward-looking statements. The forward-looking statements in this Annual Report on Form 10-K speak only as of the date of this Annual Report on Form 10-K; we disclaim any obligation to update these statements unless required by securities law, and we caution you not to rely on them unduly. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks, contingencies and uncertainties relate to, among other matters, the following:

• | changes in coal prices or the costs of mining or transporting coal; |

• | uncertainty in estimating economically recoverable coal reserves and replacement of reserves; |

• | our ability to develop our existing coal reserves, acquire additional reserves and successfully execute our mining plans; |

• | changes in general economic conditions, both domestically and globally; |

• | competitive conditions within the coal industry; |

• | changes in the consumption patterns of coal-fired power plants and steelmakers and other factors affecting the demand for coal by coal-fired power plants and steelmakers; |

• | the availability and price of coal to the consumer compared to the price of alternative and competing fuels; |

• | competition from the same and alternative energy sources; |

• | energy efficiency and technology trends; |

• | our ability to successfully implement our business plan; |

• | the price and availability of debt and equity financing; |

• | operating hazards and other risks incidental to coal mining; |

• | major equipment failures and difficulties in obtaining equipment, parts and raw materials; |

• | availability, reliability and costs of transporting coal; |

• | adverse or abnormal geologic conditions, which may be unforeseen; |

• | natural disasters, weather-related delays, casualty losses and other matters beyond our control; |

• | operating in a single geographic area; |

• | interest rates; |

• | our reliance on a few major customers; |

• | labor availability, relations and other workforce factors; |

• | defaults by CONSOL Energy under our operating agreement, employee services agreement and Affiliated Company Credit Agreement; |

• | restrictions in our Affiliated Company Credit Agreement that may adversely affect our business; |

• | changes in our tax status; |

• | delays in the receipt of, failure to receive or revocation of necessary governmental permits; |

• | the effect of existing and future laws and government regulations, including the enforcement and interpretation of environmental laws thereof; |

• | the effect of new or expanded greenhouse gas regulations; |

• | the effects of litigation; |

• | conflicts of interest that may cause our general partner or CONSOL Energy to favor their own interest to our detriment; |

• | the requirement that we distribute all of our available cash; and |

• | other factors discussed in this Annual Report Form 10-K under “Risk Factors,” as updated by any subsequent Forms 10-Q, which are on file at the SEC. |

5

ITEM 1. BUSINESS

General

We are a master limited partnership formed on March 16, 2015 by our then-sponsor, CNX Resources Corporation (formerly known as CONSOL Energy Inc.), to manage and further develop all of its active coal operations in Pennsylvania. As part of the separation, all of CNX’s ownership interest in our general partner and in us was transferred to CONSOL Energy as our new sponsor. All amounts except per unit or per ton are displayed in thousands.

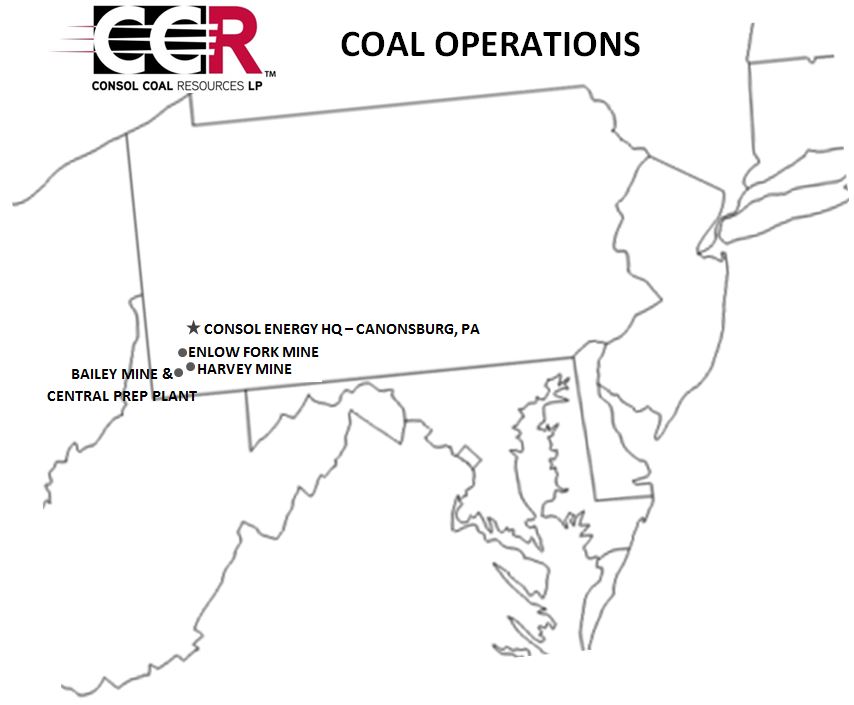

At December 31, 2017, our assets are comprised of a 25% undivided interest in, and operational control over, the Pennsylvania Mining Complex, which consists of three underground mines and related infrastructure that produce high-Btu bituminous thermal coal that is sold primarily to electric utilities in the eastern United States. We are a leading producer of high-Btu thermal coal in the Northern Appalachian Basin and the eastern United States due to our ability to efficiently produce and deliver large volumes of high-quality coal at competitive prices, the strategic location of our mines, the industry experience of our management team and our relationship with CONSOL Energy.

The Pennsylvania Mining Complex, which includes the Bailey Mine, the Enlow Fork Mine and the Harvey Mine, has extensive high-quality coal reserves. We mine our reserves from the Pittsburgh No. 8 Coal Seam, which is a large contiguous formation of uniform, high-Btu thermal coal that is ideal for high productivity, low-cost longwall operations. As of December 31, 2017, the Partnership’s portion of the Pennsylvania Mining Complex included 183,867 tons of proven and probable coal reserves with an average gross heat content of approximately 12,915 British thermal units (“Btu”) per pound and approximately 3.6 pounds of sulfur dioxide per million British thermal units (“lb SO2/mmBtu”). Based on our current production capacity, these reserves are sufficient to support approximately 26 years of production. In addition, our reserves currently exhibit thermoplastic behavior suitable for cokemaking and contain an average of approximately 39%-40% volatile matter (on a dry basis), which enables us, if market dynamics are favorable, to capture greater margins from selling our coal as a crossover product in the high-vol metallurgical market to cokemakers and steel manufacturers who utilize modern cokemaking technologies.

The design of the Pennsylvania Mining Complex is optimized to produce large quantities of coal on a cost-efficient basis. We are able to sustain high production volumes at comparatively low operating costs due to, among other things, the technologically advanced longwall mining systems, logistics infrastructure and safety. All of our mines utilize longwall mining, which is a highly automated underground mining technique that produces large volumes of coal at lower costs compared to other underground mining methods. Generally, we operate five longwalls and 15-17 continuous mining sections at the Pennsylvania Mining Complex. The current production capacity of the Partnership’s portion of the Pennsylvania Mining Complex’s five longwalls is 7,125 tons of coal per year. The preparation plant is connected via conveyor belts to each of our mines and cleans and processes up to 8,200 tons of coal per hour. Our on-site logistics infrastructure at the preparation plant includes a dual-batch train loadout facility capable of loading up to 9,000 tons of coal per hour and 19.3 miles of track linked to separate Class I rail lines owned by Norfolk Southern and CSX, which enables us to simultaneously accommodate multiple unit trains and significantly increases our efficiency in meeting our customers’ transportation needs. Our ability to accommodate multiple unit trains allows for the seamless transition from empty inbound trains to fully loaded outbound trains at our facility.

On July 1, 2015, the Partnership’s common units began trading on the New York Stock Exchange under the ticker symbol “CNXC”. On July 7, 2015, the Partnership completed the issuance of common units in connection with the IPO, a private placement of common units with Greenlight Capital, and entered into a $400,000 senior secured revolving credit facility. In connection with the IPO, CNX contributed to the Partnership a 20% undivided interest in the assets, liabilities, revenues and expenses comprising the Pennsylvania Mining Complex.

On September 30, 2016, we acquired an additional 5% undivided interest in the Pennsylvania Mining Complex from CNX and its affiliates for $21,500 in cash and the issuance of 3,956,496 Class A Preferred Units with a value of $67,300. All information (except distributable cash flow, which reflects the ownership percentage at the time) included within this filing has been recast to reflect the Partnership’s current 25% undivided interest in the assets, liabilities, revenues and expenses comprising the Pennsylvania Mining Complex. On October 2, 2017, all of the Class A Preferred Units were converted into common units on a one-for-one basis.

On November 28, 2017, CONSOL Energy was separated from CNX into an independent, publicly traded coal company via a pro rata distribution of all of CONSOL Energy’s common stock to CNX’s stockholders. CONSOL Energy was originally formed as CONSOL Mining Corporation in Delaware on June 21, 2017 to hold CNX’s coal business, including its interest in the Pennsylvania Mining Complex and certain related coal assets, including CNX’s ownership interest in the Partnership and our general partner, CNX’s terminal operations at the Port of Baltimore and undeveloped coal reserves located in the Northern

6

Appalachian, Central Appalachian and Illinois basins and certain related coal assets and liabilities. As part of the separation, CONSOL Mining Corporation changed its name to CONSOL Energy Inc. and its ticker to “CEIX”, CNX changed its name to CNX Resources Corporation and its ticker to “CNX”, the Partnership changed its name to CONSOL Coal Resources LP and its ticker to “CCR” and the general partner changed its name to CONSOL Coal Resources GP LLC.

Our primary strategy for growing our business and increasing distributions to our unitholders is to increase operating efficiencies to maximize realizations and make acquisitions that increase our distributable cash flow. The primary component of our growth strategy is based upon our expectation of future divestitures by CONSOL Energy to us of portions of its retained 75% undivided interest in the Pennsylvania Mining Complex.

Our principal executive offices are located at 1000 CONSOL Energy Drive, Suite 100, Canonsburg, Pennsylvania 15317-6506, and our telephone number is (724) 485-3300. Our website is located at www.ccrlp.com. Information on our website is not incorporated by reference into this Annual Report on Form 10-K and does not constitute a part of this Annual Report on Form 10-K.

7

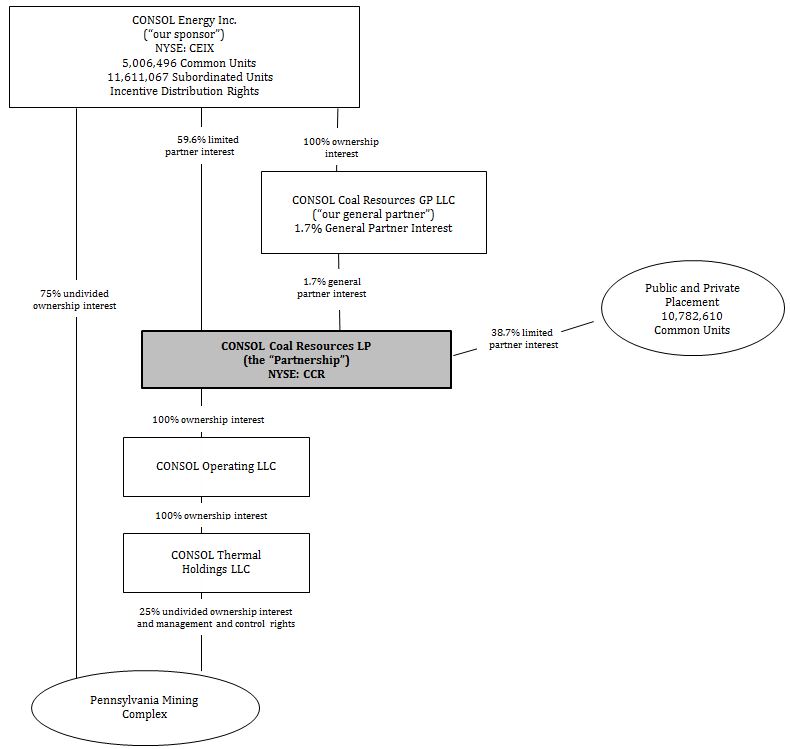

Organization Structure

The following simplified diagram depicts our organizational structure and our relationship with CONSOL Energy as of December 31, 2017:

Our Relationship with CONSOL Energy

One of our principal strengths is our relationship with CONSOL Energy. CONSOL Energy is a leading, low-cost producer of high-quality bituminous coal, headquartered in Canonsburg, Pennsylvania. CONSOL Energy and its predecessors have been mining coal, primarily in the Appalachian Basin, since 1864. CONSOL Energy deploys an organic growth strategy focused on efficiently developing its resource base. CONSOL Energy’s premium coal grades are sold to electricity generators, steel makers, coke producers and industrial consumers, both domestically and internationally. CONSOL Energy is listed on the NYSE under the symbol “CEIX” and had a market capitalization of approximately $1.1 billion as of December 31, 2017.

8

Our Assets

CONSOL Thermal Holdings owns a 25% undivided interest in the Pennsylvania Mining Complex. CONSOL Thermal Holdings entered into an operating agreement with CPCC and Conrhein under which CONSOL Thermal Holdings is named as operator and assumes management and control over the day-to-day operations of the Pennsylvania Mining Complex for the life of the mines. We are managed by the directors and executive officers of our general partner. As a result, the directors and executive officers of our general partner have the ultimate responsibility for managing and conducting all of our and our subsidiaries’ operations, including with respect to CONSOL Thermal Holdings’ rights and obligations under the operating agreement. Based on our current production capacity utilizing five longwall mining systems, our recoverable reserves are sufficient to support approximately 26 years of production.

Following the separation, CONSOL Energy owns a 75% undivided interest in the Pennsylvania Mining Complex, as well as 100% of our general partner, all of our incentive distribution rights and, indirectly through our general partner, our 1.7% general partner interest. In addition, CONSOL Energy owns 60.6% of the limited partner interest in us.

Our Operations

Bailey Mine

The Bailey Mine is located in Enon, Pennsylvania. As of December 31, 2017, the Partnership’s portion of the Bailey Mine’s assigned and accessible reserve base contained an aggregate of 61,296 tons of clean recoverable proven and probable coal. While operating two longwalls, the typical production capacity of our portion of the Bailey Mine is 2,875 tons (11,500 on a 100% basis) of coal per year. For the years ended December 31, 2017, 2016 and 2015, our portion of the Bailey Mine produced 3,031 tons, 3,014 tons and 2,547 tons of coal, respectively.

Enlow Fork Mine

The Enlow Fork Mine is located directly north of the Bailey Mine. As of December 31, 2017, the Partnership’s portion of the Enlow Fork Mine’s assigned and accessible reserve base contained an aggregate of 73,867 tons of clean recoverable proven and probable coal. While operating two longwalls, the typical production capacity of our portion of the Enlow Fork Mine is 2,875 tons (11,500 on a 100% basis) of coal per year. For the years ended December 31, 2017, 2016 and 2015, our portion of the Enlow Fork Mine produced 2,295 tons, 2,409 tons and 2,250 tons of coal, respectively.

Harvey Mine

The Harvey Mine is located directly east of the Bailey and Enlow Fork Mines. As of December 31, 2017, the Partnership’s portion of the Harvey Mine’s assigned and accessible reserve base contained an aggregate of 48,704 tons of clean recoverable proven and probable coal. While operating one longwall, the typical production capacity of our portion of the Harvey Mine is 1,375 tons (5,500 on a 100% basis) of coal per year. For the years ended December 31, 2017, 2016 and 2015, our portion of the Harvey Mine produced 1,201 tons, 743 tons and 901 tons of coal, respectively. Longwall production commenced in March 2014.

Capital Expenditures

In 2018, the Partnership expects to invest $31,000-$36,000 in maintenance capital expenditures. The Partnership is not expecting to invest in expansion projects in 2018, however, the Partnership continually evaluates potential acquisitions.

Our Customers and Contracts

We sell coal to an established customer base through opportunities as a result of strong business relationships or through a formalized bidding process. We refer to the contracts under which coal produced from the Pennsylvania Mining Complex is sold and which a wholly owned subsidiary of CONSOL Energy administers under the contract agency agreement at our direction as “our contracts”. We are greater than 95% contracted for 2018, 70% contracted for 2019 and 24% contracted for 2020, assuming an annual production rate of approximately 6,750 tons. With our planned coal production in 2018 largely sold out, our focus now has shifted to maximizing realizations for any additional production and booking additional sales for contract years 2019 and 2020. Our contracted position includes a mix of sales to our top domestic customers, to the export thermal market, and to the export metallurgical market, maintaining our diversified market exposure and providing a solid revenue base for meeting our long-term market strategy.

9

The sales commitments under contract are our expected sales tons and can fluctuate up or down due to provisions contained within our contracts. The contractual time commitments for customers to nominate future purchase volumes under our contracts are typically sufficient to allow us to balance our sales commitments with prospective production capacity or incremental sales volume. In addition, the commitments can change because of reopener provisions contained in certain of these long-term contracts. For the years ended December 31, 2017, 2016 and 2015, approximately 68%, 80% and 75%, respectively, of all the coal produced from the Pennsylvania Mining Complex was sold under contracts with terms of one year or more.

The provisions of our contracts are the results of both bidding procedures and extensive negotiations with each customer. As a result, the provisions of our contracts vary significantly in many respects, including, among other factors, price adjustment features, price and contract reopener terms, force majeure provisions, coal qualities and quantities. Our contracts typically stipulate procedures for transportation of coal, quality control, sampling and weighing. Most contain provisions requiring us to deliver coal within stated ranges for specific coal characteristics such as heat, sulfur, ash, moisture, grindability, volatile matter content and other qualities. Failure to meet these specifications can result in economic penalties, rejection or suspension of shipments or termination of the contracts. Although the volume to be delivered pursuant to a long-term contract is stipulated, the customers often have the option to vary the volume within specified limits.

Substantially all of our multi-year sales contracts contain base prices, subject only to pre-established adjustment mechanisms based primarily on (i) variances in the quality characteristics of coal delivered to the customer beyond threshold quality characteristics specified in the applicable sales contract, (ii) the actual calorific value of coal delivered to the customer, and/or (iii) changes in electric power prices in the markets in which our customers operate, as adjusted for any factors set forth in the applicable contract. The electric power price-related adjustments, if any, result only in positive monthly adjustments to the contracted base price that we receive for our coal. Price reopener provisions are present in several of our multi-year sales contracts. These price reopener provisions may automatically set a new price prospectively based on prevailing market price or, in some instances, require the parties to agree on a new price, sometimes within a specified range of prices. In a limited number of agreements, failure of the parties to agree on a price under a price reopener provision can lead to termination of the contract. Under some of our contracts, we have the right to match lower prices offered to our customers by other suppliers. Some of the long-term contracts also permit the contract to be reopened for renegotiation of terms and conditions other than pricing terms, and where a mutually acceptable agreement on terms and conditions cannot be concluded, either party may have the option to terminate the contract.

Of our 2017 sales tons, approximately 65% were sold to U.S. electric generators, 32% were priced on export markets and 3% were sold to other domestic customers. We derive a significant portion of our revenues from two customers: Duke Energy Corporation (“Duke Energy”) and Xcoal Energy & Resources (“Xcoal Energy”) from each of whom we derived at least 10% of our total coal sales for the year ended December 31, 2017. As of January 1, 2018, we had nine sales agreements with these customers that expire at various times in 2018 and 2019. As of February 16, 2018, CONSOL Energy has entered into an additional contract with Xcoal Energy. It is anticipated that these combined contracts with Xcoal Energy will account for more than 10% of the Partnership’s total revenue for the year ended December 31, 2018.

Transportation Logistics and Infrastructure

We have developed a transportation and logistics network with dual rail transportation options that we believe provides us with operational and marketing flexibility, reduces the cost to deliver coal to our core market and allows us to realize higher netback prices. Most of our coal is sold free on board, or FOB, at the Pennsylvania Mining Complex, which means that our customers bear the transportation costs from the mining complex, and essentially all of our coal transported to our domestic customers or to an export terminal facility originates by rail. We believe our proximity to our core markets, dual rail transportation options, rail-to-barge access and customized on-site logistics infrastructure contribute to lower overall delivered costs for power plants in the eastern United States as a result of shorter transportation distances, access to diversified rail route options, higher rail car utilization, more efficient use of locomotive power and more predictable movement of product between mine and destination. In addition, we have favorable access to international coal markets through coal export terminals located on the U.S. east coast.

Information About Geographic Areas

Our revenue is derived predominantly from sales to customers in the United States. Less than 1% of our revenue is derived from sales to Canada over the past 3 years. We have contractual relationships with certain United States-based coal exporters who distribute coal to international markets. For the year ended December 31, 2017, 2016, and 2015 approximately 31%, 16%, and 19% of our coal revenues were derived from these United States-based exporters, respectively, in which our coal was intended to be shipped to Asia, Europe, South America, and Africa.

10

All of the Partnership’s long-lived assets are located in the United States.

Seasonality

Our business has historically experienced limited variability in its results due to the effect of seasonal changes. Demand for coal-fired power can increase due to unusually hot or cold weather as power consumers use more air conditioning or heating, respectively. Conversely, mild weather can result in weaker demand for our coal. Adverse weather conditions, such as blizzards or floods, can impact our ability to transport coal over our overland conveyor systems and to transport our coal by rail.

Competition

The coal industry is highly competitive, with numerous producers selling into all markets that use coal. There are numerous large and small producers in all coal-producing basins of the United States, and we compete with many of these producers, including those who export coal abroad. Potential changes to international trade agreements, trade concessions or other political and economic arrangements may benefit coal producers operating in countries other than the United States. We may be adversely impacted on the basis of price or other factors with companies that in the future may benefit from favorable foreign trade policies or other arrangements. In addition, coal is sold internationally in U.S. dollars and, as a result, general economic conditions in foreign markets and changes in foreign currency exchange rates may provide our foreign competitors with a competitive advantage. If our competitors’ currencies decline against the U.S. dollar or against our foreign customers’ local currencies, those competitors may be able to offer lower prices for coal to our customers. Furthermore, if the currencies of our overseas customers were to significantly decline in value in comparison to the U.S. dollar, those customers may seek decreased prices for the coal we sell to them. Consequently, currency fluctuations could adversely affect the competitiveness of our coal in international markets, which could have a material adverse effect on our business, financial condition, results of operations, cash flows and ability to make cash distributions.

The most important factors on which we compete are coal price, coal quality and characteristics, transportation costs and reliability of supply. Demand for coal and the prices that we will be able to obtain for our coal are closely linked to coal consumption patterns of the domestic electric generation industry and foreign coal consumers. These coal consumption patterns are influenced by many factors that are beyond our control, including demand for electricity, which is significantly dependent upon economic activity and summer and winter temperatures in the United States, government regulation, technological developments and the location, quality, price and availability of competing sources of fuel.

Laws and Regulations

Overview

Our coal mining operations are subject to various federal, state and local environmental, health and safety regulations. Regulations relating to our operations require us to obtain permits and other licenses; reclaim and restore our properties after mining operations have been completed; store, transport and dispose of materials used or generated by our operations; manage surface subsidence from underground mining; control water and air emissions; protect wetlands and endangered plant and wildlife; and to ensure employee health and safety. Furthermore, the electric power generation industry is subject to extensive regulation regarding the environmental impact of its power generation activities, which could affect demand for our coal. Compliance with these laws has substantially increased the cost of coal mining, and the possibility exists that new legislation

or regulations may be adopted which would have a significant impact on our coal mining operations or our customers’ ability to use our coal and may require us or our customers to change their operations significantly or incur substantial costs.

The following is a summary of the more significant existing environmental and worker health and safety laws and regulations to which we and our customers’ business operations are subject and for which compliance may have a material adverse impact on our capital expenditures, results of operations and financial position.

Environmental Laws

Air Emissions. The Clean Air Act (“CAA”) and corresponding state and local laws and regulations affect all aspects of coal mining operations, both directly and indirectly. The CAA directly impacts our coal mining and processing operations by requiring us to obtain pre-approval for the construction or modification of certain facilities or to use specific equipment, technologies or best management practices to control emissions.

11

The CAA also indirectly and more significantly affects the U.S. coal industry by extensively regulating the air emissions of coal-fired electric power generating plants operated by our customers. Coal contains impurities, such as sulfur, mercury and other constituents, many of which are released into the air when coal is burned. Carbon dioxide (“CO2”), a regulated greenhouse gas (“GHG”), is also emitted when coal is burned. Environmental regulations governing emissions from coal-fired electric generating plants increase the costs to operate and could affect demand for coal as a fuel source and affect the volume of our sales. Moreover, additional environmental regulations increase the likelihood that existing coal-fired electric generating plants will be decommissioned, including plants to which the Partnership sells coal to, and reduce the likelihood that new coal-fired plants will be built in the future.

In early 2012, the United States Environmental Protection Agency (“EPA”) promulgated or finalized several rules for New Source Performance Standards (“NSPS”) for coal and oil fired power plants which also have a negative effect on coal-generating facilities. The Utility Maximum Control Technology (“UMACT”) rule requires more stringent NSPS for particulate matter (“PM”), Sulfur dioxide (“SO2”) and nitrogen oxides (“NOX”) and the Mercury and Air Toxics Standards (“MATS”) rule requires new mercury and air toxic standards. In November 2012, the EPA published a notice of reconsideration of certain aspects of the UMACT and MATS rules. Following reconsideration in April 2013 and again in April 2014, the EPA promulgated final UMACT and MATS rules in November 2014. The rule was rejected by the U.S. Supreme Court on June 29, 2015 and sent back to the D.C. Circuit Court to determine whether to remand and allow the EPA to address the rule’s deficiencies or to vacate and nullify the rule; nevertheless most coal-fired electric power generators have already taken steps to comply with the rule. On April 18, 2017 the EPA asked the Court to delay arguments over MATS to allow the Trump Administration time to fully review the findings. On April 27, 2017, the Court granted the requested stay.

The CAA requires the EPA to set National Ambient Air Quality Standards (“NAAQS”) for certain pollutants and the CAA identifies two types of NAAQS. Primary standards provide public health protection, including protecting the health of “sensitive” populations such as asthmatics, children, and the elderly. Secondary standards provide public welfare protection, including protection against decreased visibility and damage to animals, crops, vegetation, and buildings. On October 1, 2015, the EPA finalized the NAAQS for ozone pollution and reduced the limit to 70 parts per billion (ppb) from the previous 75 ppb standard. The final rule could have a large impact on the coal mining industry as states would be required to update their permitting standards to meet these potentially unachievable limits. Several states have filed a petition for review in the D.C. Circuit of Appeals. On April 7, 2017, the EPA advised the Court that it intended to reconsider the final rule. On April 11, 2017, the Court stayed the litigation pending further action by the EPA. On August 10, 2017, EPA withdrew a previously-announced one-year extension to the compliance deadline.

On July 6, 2011, the EPA finalized a rule known as the Cross-State Air Pollution Rule (“CSAPR”). CSAPR regulates cross-border emissions of criteria air pollutants such as SO2 and NOX, as well as byproducts, fine particulate matter (“PM2.5”) and ozone by requiring states to limit emissions from sources that “contribute significantly” to noncompliance with air quality standards for the criteria air pollutants. If the ambient levels of criteria air pollutants are above the thresholds set by the EPA, a region is considered to be in “nonattainment” for that pollutant and the EPA applies more stringent control standards for sources of air emissions located in the region. In April 2014, the Supreme Court reversed a decision of the D.C. Circuit Court of Appeals that vacated the rule. Following remand and briefing the D.C. Circuit Court, in October 2014, granted a motion to lift a stay of the rule and allow the EPA to modify the CSAPR compliance deadline by three years, setting the stage for issuance of the proposed rule. Implementation of CSAPR Phase 1 began in 2015, with Phase 2 scheduled to begin in 2017. On September 7, 2016, the EPA finalized an update to the CSAPR for the 2008 ozone NAAQS by issuing the final CSAPR Update. As of May 2017, this rule limits summertime (May - September) NOX emissions from power plants in 22 states in the eastern United States.

On March 27, 2012, the EPA published its proposed NSPS for CO2 emissions from new coal-powered electric generating units. The proposed rule would have applied to new power plants and to existing plants that make major modifications. If the rule had been adopted as proposed, only new coal-fired power plants with CO2 capture and storage (“CCS”) could have met the proposed emission limits. Commercial scale CCS is not likely to be available in the near future, and if available, it may make coal-fired electric generation units uneconomical compared to new gas-fired electric generation units. On January 8, 2014, the EPA re-proposed NSPS for CO2 for new fossil fuel fired power plants and rescinded the rules that were proposed on April 13, 2012.

On September 20, 2013, the EPA issued a new proposal, “Carbon Pollution Standard for New Power Plants”, to establish separate NSPS for CO2 emissions for natural gas-fired turbines and coal-fired units. On June 2, 2014, the EPA announced the Clean Power Plan (“CPP Rule”) rules intended to cut carbon emissions from existing power plants. Under this proposed rule, the EPA would create emission guidelines for states to follow in developing plans to address GHG emissions from existing fossil fuel-fired electric generating units. Specifically, the EPA proposed state-specific rate-based goals for CO2 emissions from

12

the power sector, as well as guidelines for states to follow in developing plans to achieve the state-specific goals. On August 3, 2015, the EPA finalized the CPP Rule and the Carbon Pollution Standards for New Power Plants.

Numerous petitions challenging the CPP Rule have been consolidated into one case, West Virginia v. EPA. While the

litigation is still ongoing at the circuit court level, a mid-litigation application to the Supreme Court resulted in a stay of the CPP Rule. On September 27, 2016, an en banc panel of the U.S. Court of Appeals for the D.C. Circuit heard oral arguments in the case. The decision, originally expected in early 2017, has been stayed as a result of a March 28, 2017 executive order directing the EPA to begin the process of reviewing and possibly rescinding the CPP Rule. The EPA filed a motion and the motion was granted by the U.S. Court of Appeals for the D.C. Circuit requesting the stay while the EPA conducts their review of the CPP Rule. If the review does not result in any rule changes, the U.S. Court of Appeals for the D.C. Circuit will rule on the legality of the CPP Rule. On October 16, 2017, the EPA formally proposed repeal of the CPP, which relies on a re-interpretation of Clean Air Act 111(d), on which the CPP was originally premised.

Similarly, various states and industry groups challenged the Carbon Pollution Standards for New Power Plants. That litigation has also been stayed following the March 28, 2017 executive order.

The current Administration’s executive order promoting energy independence and economic growth issued on March 28, 2017 requires the review of existing regulations that potentially burden the development or use of domestically produced energy resources. On October 25, 2017, the EPA issued a report in compliance with the March 28, 2017 executive order recommending changes to the NAAQS and NSPS programs. It also recommended that the EPA’s regulations consider employment impacts and that the EPA develop a database of industry-knowledgeable contacts. The review of existing regulations may not result in any changes and any changes made to existing regulations may not produce the intended favorable results desired by the new Administration. The executive order also directed the Council on Environmental Quality to rescind its final guidance entitled, “Final Guidance for Federal Departments and Agencies on Consideration of Greenhouse Gas Emissions and the Effects of Climate Change in National Environmental Policy Act Reviews.” The guidance previously directed agencies to consider proposed actions and their effects on climate change (GHG emissions would have been a key indicator being assessed under any NEPA review). Such review considerations may have created additional delays or costs in any NEPA review processes for energy producers and generators and may have prevented the acquisition of any necessary federal approvals for energy producers and generators.

Clean Water Act. The federal Clean Water Act (“CWA”) and corresponding state laws affect our coal operations by regulating discharges into surface waters. Permits requiring regular monitoring and compliance with effluent limitations and reporting requirements govern the discharge of pollutants into regulated waters. The CWA and corresponding state laws include requirements for: improvement of designated “impaired waters” (i.e., not meeting state water quality standards) through the use of effluent limitations; anti-degradation regulations which protect state designated “high quality/exceptional use” streams by restricting or prohibiting discharges; requirements to treat discharges from coal mining properties for non-traditional pollutants, such as chlorides, selenium and dissolved solids; requirements to minimize impacts and compensate for unavoidable impacts resulting from discharges of fill materials to regulated streams and wetlands; and requirements to dispose of produced wastes and other oil and gas wastes at approved disposal facilities. In addition, the Spill Prevention, Control and Countermeasure (“SPCC”) requirements of the CWA apply to all CONSOL Energy operations that use or produce fluids and require the implementation of plans to address any spills and the installation of secondary containment around all storage tanks. These requirements may cause us to incur significant additional costs that could adversely affect our operating results, financial condition and cash flows.

However, on June 29, 2015, the EPA issued a final rule effective August 28, 2015, clarifying which waterways are subject to federal jurisdiction under the Clean Water Act (“2015 Clean Water Rule”), which would impose additional permitting obligations on our operations. On August 27, 2015, the District Court for the District of North Dakota blocked implementation of the rule in 13 states. On October 9, 2015, the U.S. Circuit Court of Appeals for the Sixth Circuit blocked implementation of the rule nationwide. On February 28, 2017, Presidential Executive Order on “Restoring the Rule of Law, Federalism, and Economic Growth by reviewing the ‘Waters of the United States’ Rule” was issued. In response, on June 27, 2017, the U.S. Environmental Protection Agency, Department of the Army, and the Army Corps of Engineers issued a rule proposing to re-codify the definition of “waters of the United States” to the text that existed prior to the 2015 Clean Water Rule. The proposed rule provides certainty in the interim period until a subsequent rulemaking on the definition of “waters of the United States” can be finalized. On January 22, 2018, the U.S. Supreme Court ruled that challenges to the 2015 Clean Water Rule are properly decided in federal district courts and not federal courts of appeal. This decision implicates the nationwide injunction previously enacted by the Sixth Circuit, but has no impact on the current Administration’s efforts to replace the rulemaking. Additionally, on January 31, 2018, the EPA finalized a rule delaying the effective date of the 2015 Clean Water Rule for two years.

13

In order to obtain a permit for certain coal mining activities, including the construction of coal refuse areas and slurry impoundments, an operator must obtain a permit for the discharge of fill material from the ACOE and a discharge permit from the state regulatory authority under the state counterpart to the CWA. Beginning in early 2009, the EPA took a number of initiatives that have resulted in delays and obstruction of the issuance of such permits for surface mining operations in the Appalachian states, including Pennsylvania where the Pennsylvania Mining Complex is located. Increased oversight of delegated state programmatic authority, coupled with individual permit review and additional requirements imposed by the EPA, has resulted in delays in the review and issuance of permits.

Resource Conservation and Recovery Act. The federal Resource Conservation and Recovery Act (“RCRA”) and corresponding state laws and regulations affect coal mining by imposing requirements for the treatment, storage and disposal of hazardous wastes. Facilities at which hazardous wastes have been treated, stored or disposed of are subject to corrective action orders issued by the EPA that could adversely affect our results, financial condition and cash flows. In 2010, the EPA proposed options for the regulation of Coal Combustion Residuals from the electric power sector as either hazardous waste or non-hazardous waste. On December 19, 2014, the EPA announced the first national regulations for the disposal of Coal Combustion Receivables from electric utilities and independent power producers under RCRA. On April 17, 2015, the EPA finalized these regulations under the solid waste provisions (Subtitle D) of RCRA and not the hazardous waste provisions (Subtitle C) which became effective on October 19, 2015. The EPA affirms in the preamble to the final rule that “this rule does not apply to Coal Combustion Receivables placed in active or abandoned underground or surface mines.” Instead, “the U.S. Department of Interior (“DOI”) and the EPA will address the management of Coal Combustion Receivables in mine fills in a separate regulatory action(s).” On September 14, 2017, EPA stated its intention to reconsider certain Coal Combustion Receivables provisions. It is unclear whether this reconsideration will result in changes to the Coal Combustion Receivables regulations.

On November 3, 2015, the EPA published the final rule Effluent Limitations Guidelines and Standards (“ELG”), revising the regulations for the Steam Electric Power Generating category which became effective on January 4, 2016. The rule sets the first federal limits on the levels of toxic metals in wastewater that can be discharged from power plants, based on technology improvements in the steam electric power industry over the last three decades. On September 13, 2017, EPA finalized a rule postponing certain compliance dates for specific waste streams subject to the effluent limitations for a period of two years. The combined effect of the Coal Combustion Receivables and ELG regulations has forced power generating companies to close existing ash ponds and will likely force the closure of certain older existing coal burning power plants that cannot comply with the new standards.

Surface Mining Control and Reclamation Act. The federal Surface Mining Control and Reclamation Act (“SMCRA”) establishes minimum national operational and reclamation standards for all surface mines as well as most aspects of underground mines. SMCRA requires that comprehensive environmental protection and reclamation standards be met during the course of and following completion of mining activities. Permits for all mining operations must be obtained from the U.S. Office of Surface Mining (“OSM”) or, where state regulatory agencies have adopted federally approved state programs under SMCRA, the appropriate state regulatory authority. States that operate federally approved state programs may impose standards which are more stringent than the requirements of SMCRA and OSM’s regulations and in many instances have done so. The Pennsylvania Mining Complex is located in states which have achieved primary jurisdiction for enforcement of SMCRA through approved state programs. In addition, SMCRA imposes a reclamation fee on all current mining operations, the proceeds of which are deposited in the Abandoned Mine Reclamation Fund, which is used to restore unreclaimed and abandoned mine lands mined before 1977. The current per ton fee is $0.12 per ton for underground mined coal. This fee is currently scheduled to be in effect until September 30, 2021.

Federal and state laws require bonds to secure our obligations to reclaim lands used for mining and to satisfy other miscellaneous obligations. These bonds are provided by CONSOL Energy and are typically renewable on a yearly basis. Surety bond costs have increased while the market terms of surety bonds have generally become less favorable. It is possible that surety-bond issuers may refuse to renew bonds or may demand additional collateral therefor. Any failure by CONSOL Energy or us to maintain, or our inability to acquire, surety bonds that are required by state and federal laws or the related collateral required by the bond issuers therefor, would have a material adverse effect on our ability to produce coal, which could adversely affect our business, financial condition, liquidity, results of operations and cash flows.

Excess Spoil, Coal Mine Waste, Diversions, and Buffer Zones for Perennial and Intermittent Streams. The OSM has issued final amendments to regulations concerning stream buffer zones, stream channel diversions, excess spoil, and coal mine waste to comply with an order issued by the U.S. District Court for the District of Columbia on February 20, 2014, which vacated the stream buffer zone rule that was published December 12, 2008. On July 27, 2015, the OSM published the proposed Stream Protection Rule (SPR). After much debate and thousands of comments, the final SPR was published by the OSM in the Federal Register on December 20, 2016. The final SPR requires the restoration of the physical form, hydrologic function, and ecological

14

function of the segment of a perennial or intermittent stream that a permittee mines through. Additionally, it requires that the post-mining surface configuration of the reclaimed mine site include a drainage pattern, including ephemeral streams, similar to the pre-mining drainage pattern, with exceptions for stability, topographical changes, fish and wildlife habitat, etc. The rule also requires the establishment of a 100-foot-wide streamside vegetative corridor of native species (including riparian species, when appropriate) along each bank of any restored or permanently-diverted perennial, intermittent, or ephemeral stream. This rulemaking was nullified by Congress under the Congressional Review Act in February 2017.

Health and Safety Laws

Mine Safety. Legislative and regulatory changes have required us to purchase additional safety equipment, construct stronger seals to isolate mined out areas, and engage in additional training. We have also experienced more aggressive inspection protocols, and with new regulations the volume of civil penalties have increased. The actions taken thus far by federal and state governments include requiring:

• | the caching of additional supplies of self-contained self-rescuer (“SCSR”) devices underground; |

• | the purchase and installation of electronic communication and personal tracking devices underground; |

• | the purchase and installation of proximity detection devices on continuous miner machines; |

• | the placement of refuge chambers, which are structures designed to provide refuge for groups of miners during a mine emergency when evacuation from the mine is not possible, which will provide breathable air for 96 hours; |

• | the purchase of new fire resistant conveyor belting underground; |

• | additional training and testing that creates the need to hire additional employees; |

• | more stringent rock dusting requirements; and |

• | the purchase of personal dust monitors for collecting respirable dust samples from certain miners. |

On October 2, 2015, the Mine Safety and Health Administration (“MSHA”) published proposed rules for underground coal mining operations concerning proximity detection systems for coal hauling machines and scoops. The rulemaking record for this proposed rule was closed on December 15, 2016, but on January 9, 2017, MSHA published a notice reopening the record and extending the comment period for this proposed rule for 30 days. On January 15, 2015, MSHA published a final rule requiring underground coal mine operations to equip continuous mining machines, except full-face continuous mining machines, with proximity detection systems. The proximity detection system strengthens protection for miners by reducing the potential of pinning, crushing and striking hazards that result in accidents involving life-threatening injuries and death. The final rule became effective March 15, 2015 and included a phased in schedule for newly manufactured and in-service equipment.

In 2010, MSHA rolled out the “End Black Lung, Act Now” initiative. As a result, MSHA implemented a new final rule on August 1, 2014 to lower miners’ exposure to respirable coal mine dust including using the new Personal Dust Monitor technology. This final rule was implemented in three phases. The first phase began on August 1, 2014 and utilized the current gravimetric sampling device to take full shift dust samples from the current designated occupations and areas. It also required additional record keeping and immediate corrective action in the event of overexposure. The second phase began on February 1, 2016 and required additional sampling for designated and other occupations using the new continuous personal dust monitor (“CPDM”) technology, which provides real time dust exposure information to the miner. CPDM equipment was purchased and was placed into service which was required to meet compliance with the new rule. Dust Coordinators and Dust Technicians were hired in order to meet the staffing demand to manage compliance with the new rule. The final phase of the rule went into effect on August 1, 2016. The current respirable dust standard was reduced from 2.0 to 1.5mg/m3 for designated occupations and from 1.0 to 0.5mg/m3 for Part 90 Miners.

Black Lung Legislation. Under federal black lung benefits legislation, each coal mine operator is required to make payments of black lung benefits or contributions to:

• | current and former coal miners totally disabled from black lung disease; |

• | certain survivors of miners who have died from black lung disease; and |

• | a trust fund for the payment of benefits and medical expenses to claimants whose last mine employment was before January 1, 1970, where no responsible coal mine operator has been identified for claims (where a miner’s last coal employment was after December 31, 1969), or where the responsible coal mine operator has defaulted on the payment of such benefits. The trust fund is funded by an excise tax on U.S. production of up to $1.10 per ton for deep mined coal and up to $0.55 per ton for surface-mined coal, neither amount to exceed 4.4% of the gross sales price. |

The Patient Protection and Affordable Care Act (“PPACA”) made two changes to the Federal Black Lung Benefits Act. First, it provided changes to the legal criteria used to assess and award claims by creating a legal presumption that miners

15

are entitled to benefits if they have worked at least 15 years in underground coal mines, or in similar conditions, and suffer from a totally disabling lung disease. To rebut this presumption, a coal company would have to prove that a miner did not have black lung or that the disease was not caused by the miner’s work. Second, it changed the law so black lung benefits will continue to be paid to dependent survivors when the miner passes away, regardless of the cause of the miner’s death. The changes have increased the cost to us of complying with the Federal Black Lung Benefits Act. In addition to the federal legislation, we are also liable under various state statutes for our portion of black lung claims.

Other State and Local Laws

Ownership of Coal Rights. The Partnership’s coal business acquires ownership or leasehold rights to coal properties prior to conducting operations on those properties. As is customary in the coal industry, we have generally conducted only a summary review of the title to coal rights that are not in our development plans, but which we believe we control. This summary review is conducted at the time of acquisition or as part of a review of our land records to determine control of coal rights. Given our experience as a coal producer, we believe we have a well-developed ownership position relating to our coal control. Prior to the commencement of development operations on coal properties, we conduct a thorough title examination and perform curative work with respect to significant defects. We generally will not commence operations on a property until we have cured any material title defects on such property. We are typically responsible for the cost of curing any title defects. We have completed title work on substantially all of our coal producing properties and believe that we have satisfactory title to our producing properties in accordance with standards generally accepted in the industry.

Permits

Environmental Proceedings. On September 4, 2017, the Pennsylvania Department of Environmental Protection (the “DEP”) provided notice that it required additional time to review the technical merits of a prior permit submission (the “Application”) for continued longwall mining within the 4L panel under Polen Run at the Bailey Mine, in light of a recent Environmental Hearing Board (the “EHB”) decision, which is discussed further below. As a result, the longwall was idled at that time and workforce adjustments were made, pending further developments with the DEP and permit submission. This was the first time in the 35-year history of the Bailey Mine that a needed mining permit had not been received in a timely fashion.

As noted above, the DEP’s consideration of the Application related to part of an August 2017 EHB decision that impacts the application of DEP-required stream mitigation techniques, specifically the installation of synthetic stream-channel liner systems. The EHB is the quasi-judicial agency that hears appeals of DEP permitting decisions. The EHB decision held, in part, that the requirement to install a stream-channel liner system constituted impermissible pollution under applicable environmental laws. That determination had direct and specific implications for the Application with respect to undermining one particular stream, Polen Run in the 4L Panel, for which the DEP was proposing to require the installation of the stream-channel liner system as a mitigation measure. The DEP requested alternative mitigation measures for consideration, which our sponsor supplied. Given the potential for a protracted review, our sponsor felt it prudent to temporarily idle the longwall and dismantle and relocate it to another panel where it held an operating permit.

To that end, on September 18, 2017, we issued a press release stating that the DEP was requiring additional time to evaluate the approval of the Application and that, as a result of this ongoing evaluation, we determined to move the longwall to another permitted panel in order to resume operations. The longwall was moved and resumed operations the first week of October 2017. Our management implemented several measures to mitigate the production impact from this delay, including working additional unscheduled shifts as compared to the previous five and a half day schedule. Our management continued to take steps to mitigate the production impact from this delay and worked closely with the necessary agencies to obtain operating permits to allow for continuity of longwall mining operations. In November 2017, the DEP issued permitting authorizing revised longwall mining plans in the 5L Panel and longwall mining in Panels 6L through 8L.

The Application also sought authorization for continued longwall mining under the Polen Run stream in the Bailey Mine 5L Panel under Polen Run. Additionally, the Application has been revised to conform to the DEP’s interpretation of the August 2017 EHB decision. The Application proposes to conduct stream mitigation through techniques approved by the DEP under existing permits. The Application remains under the DEP’s review with respect to longwall mining under the Polen Run stream in the Baily Mine 5L Panel.

The Pennsylvania Mining Complex operates five total longwalls, with many of the approved permits as far out as ten years in advance.

16

Employees

Neither we nor our subsidiaries have any employees. Our general partner has the sole responsibility for procuring the employees and other personnel necessary to conduct our operations. The directors and executive officers of our general partner manage our and our subsidiaries’ operations and activities. The executive officers of our general partner are employed and compensated by CONSOL Energy or its affiliates, other than the general partner. Under our omnibus agreement (which CONSOL Energy assumed from CNX as part of the separation), we reimburse CONSOL Energy for compensation-related expenses (including salary, bonus, incentive compensation and other amounts) attributable to the portion of an executive’s compensation that is allocable to our general partner. Pursuant to the operating agreement (which CONSOL Energy assumed from CNX as part of the separation), CONSOL Thermal Holdings, our wholly owned subsidiary, manages and controls the day-to-day operations of the Pennsylvania Mining Complex. Under our employee services agreement (which CONSOL Energy assumed from CNX as part of the separation), employees of CONSOL Energy and its subsidiaries continue to mine, process and market coal from the Pennsylvania Mining Complex, subject to our direction and control under the operating agreement. All of the field-level employees required to conduct and support our operations are employed by CONSOL Energy or its subsidiaries and are subject to the employee services agreement. As of December 31, 2017, CONSOL Energy employed approximately 1,600 people who provide direct support to our operations pursuant to the employee services agreement. None of the employees who provide direct support to the Pennsylvania Mining Complex are represented by a labor union or collective bargaining agreement.

Jumpstart Our Business Startups Act (“JOBS Act”)

Under the JOBS Act, for as long as the Partnership remains an “emerging growth company” as defined in the JOBS Act, we may take advantage of certain exemptions from the SEC’s reporting requirements that are applicable to other public companies that are not emerging growth companies, including not being required to provide an auditor’s attestation report on management’s assessment of the effectiveness of its system of internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and seeking unitholder approval of any golden parachute payments not previously approved. We may take advantage of these reporting exemptions until we are no longer an emerging growth company.

The Partnership will remain an emerging growth company until December 31, 2020, although we will lose that status sooner if:

• | we have more than $1.07 billion of revenues in a fiscal year; |

• | limited partner interests held by non-affiliates have a market value of more than $700 million (large accelerated filer); or |

• | we issue more than $1 billion of non-convertible debt over a three-year period. |

The JOBS Act also provides that an emerging growth company can delay adopting new or revised accounting standards until such time as those standards apply to private companies. The Partnership has irrevocably elected to “opt out” of this exemption and, therefore, will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Available Information

The Partnership maintains a website at www.ccrlp.com. Information on our website is not incorporated by reference into this Annual Report on Form 10-K and does not constitute a part of this Annual Report on Form 10-K. We make available, free of charge, on our website, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after such reports are available, electronically filed with, or furnished to the SEC, and are also available at the SEC’s website www.sec.gov. Apart from SEC filings, we also use our website to publish information which may be important to investors.

ITEM 1A. RISK FACTORS

Risks Related to Our Business

We may not generate sufficient distributable cash flow to support the payment of the minimum quarterly distribution to our common and subordinated unitholders.

17

In order to support the payment of the minimum quarterly distribution of $0.5125 per common and subordinated unit per quarter, or $2.05 per common and subordinated unit on an annualized basis, we must generate distributable cash flow of approximately $14,285 per quarter, or approximately $57,142 per year, based on the number of common units, subordinated units and the general partner interest outstanding as of December 31, 2017.

The amount of available cash (as defined in the Partnership Agreement. See Item 5 - Market for Registrant’s Common Units and Related Unitholder Matters and Issuer Purchases of Equity Securities - “Definition of Available Cash”) that we can distribute on our common units principally depends upon the amount of cash we generate from our operations, which will fluctuate from quarter to quarter based on, among other things:

• | the amount of coal we are able to produce from our mines and the efficiency of our mining, preparation and transportation of coal, which could be adversely affected by, among other things, operating difficulties, unfavorable geologic conditions, inclement or hazardous weather conditions and natural disasters or other force majeure events; |

• | the levels of our operating expenses, general and administrative expenses and capital expenditures; |

• | the fees and expenses of our general partner and its affiliates (including CONSOL Energy) that we are required to reimburse; |

• | the amount of cash reserves established by our general partner; |

• | restrictions on distributions contained in our debt agreements; |

• | our ability to borrow under our debt agreements and/or to access the capital markets to fund our capital expenditures and operating expenditures and to pay distributions; |

• | our debt service requirements and other liabilities; |

• | the loss of, or significant reduction in, purchases by our largest customers; |

• | the level and timing of our capital expenditures; |

• | fluctuations in our working capital needs; |

• | the cost of acquisitions, if any; and |

• | other business risks affecting our cash levels. |

In addition, the actual amount of distributable cash flow that we generate will also depend on other factors, some of which are beyond our control, including:

• | overall domestic and global economic and industry conditions, including the market price of, supply of and demand for domestic and foreign coal; |

• | the consumption pattern of industrial consumers, electricity generators and residential users; |

• | the price and availability of alternative fuels for electricity generation, especially natural gas; |

• | competition from other coal suppliers; |

• | the impact of domestic and foreign governmental laws and regulations, including environmental and climate change regulations and regulations affecting the coal mining industry and coal-fired power plants, and delays in the receipt of, failure to receive, failure to maintain or revocation of necessary governmental permits; |

• | the costs associated with our compliance with domestic and foreign governmental laws and regulations, including environmental and climate change regulations; |

• | technological advances affecting energy consumption; |

• | the costs, availability and capacity of transportation infrastructure; |