Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Golub Capital BDC 3, Inc. | gbdc3fy18q1investorpresent.htm |

GOLUB CAPITAL BDC 3, INC.

INVESTOR

PRESENTATION

QUARTER ENDED DECEMBER 31, 2017

Disclaimer

2

Some of the statements in this presentation constitute forward-looking statements,

which relate to future events or our future performance or financial condition. The

forward-looking statements contained in this presentation involve risks and

uncertainties, including statements as to: our future operating results; our business

prospects and the prospects of our portfolio companies; the effect of investments

that we expect to make and the competition for those investments; our contractual

arrangements and relationships with third parties; actual and potential conflicts of

interest with GC Advisors LLC ("GC Advisors"), our investment adviser, and other

affiliates of Golub Capital LLC (collectively, "Golub Capital"); the dependence of our

future success on the general economy and its effect on the industries in which we

invest; the ability of our portfolio companies to achieve their objectives; the use of

borrowed money to finance a portion of our investments; the adequacy of our

financing sources and working capital; the timing of cash flows, if any, from the

operations of our portfolio companies; general economic trends and other external

factors; the ability of GC Advisors to locate suitable investments for us and to

monitor and administer our investments; the ability of GC Advisors or its affiliates to

attract and retain highly talented professionals; our ability to qualify and maintain

our qualification as a regulated investment company and as a business

development company; general price and volume fluctuations in the stock markets;

the impact on our business of the Dodd-Frank Wall Street Reform and Consumer

Protection Act and the rules and regulations issued thereunder; and the effect of

changes to tax legislation and our tax position.

Such forward-looking statements may include statements preceded by, followed by

or that otherwise include the words “may,” “might,” “will,” “intend,” “should,” “could,”

“can,” “would,” “expect,” “believe,” “estimate,” “anticipate,” “predict,” “potential,” “plan”

or similar words.

We have based the forward-looking statements included in this presentation on

information available to us on the date of this presentation. Actual results could differ

materially from those anticipated in our forward-looking statements and future

results could differ materially from historical performance. We undertake no

obligation to revise or update any forward-looking statements made herein, whether

as a result of new information, future events or otherwise. You are advised to

consult any additional disclosures that we may make directly to you or through

reports that we have filed or in the future may file with the Securities and Exchange

Commission (“SEC”).

This presentation contains statistics and other data that have been obtained from or

compiled from information made available by third-party service providers. We have

not independently verified such statistics or data.

1. Investment income yield is calculated as (a) the actual amount earned on earning investments, including interest, fee income and amortization of capitalized fees and discounts, divided by the (b) daily average of total

earning investments at fair value.

2. Per share returns are calculated based on the daily weighted average shares outstanding during the period presented.

3. Return on equity calculations are based on daily weighted average of total net assets during the period presented.

Summary of Quarterly Results

3

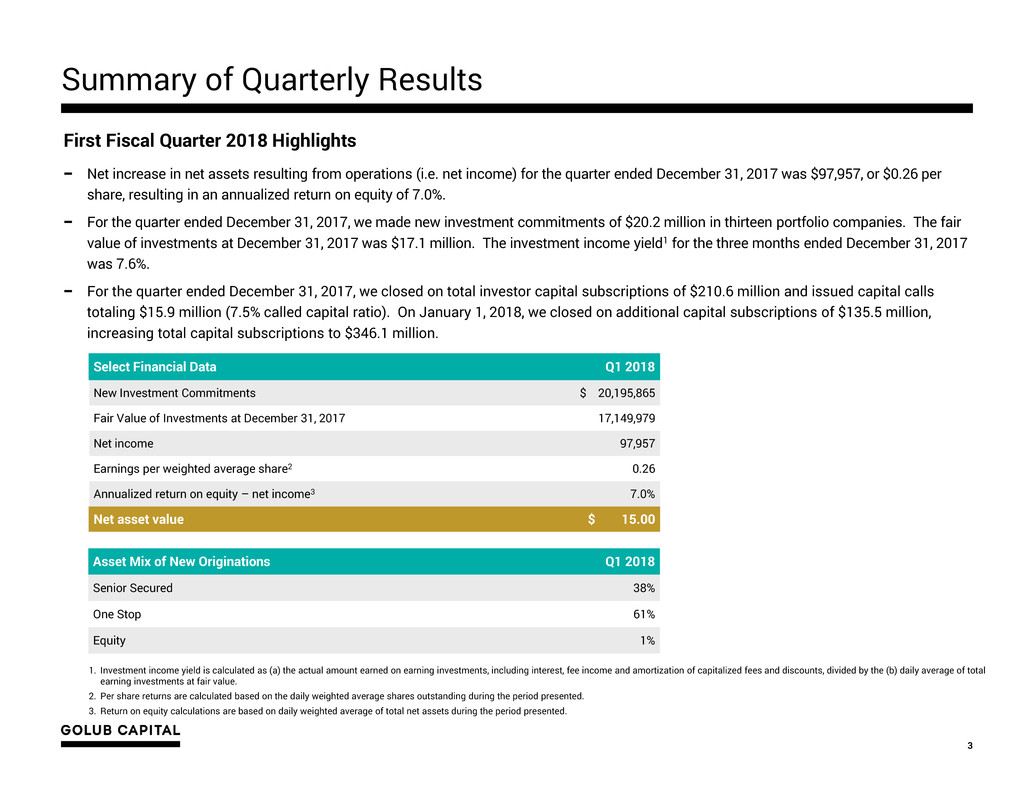

First Fiscal Quarter 2018 Highlights

− Net increase in net assets resulting from operations (i.e. net income) for the quarter ended December 31, 2017 was $97,957, or $0.26 per

share, resulting in an annualized return on equity of 7.0%.

− For the quarter ended December 31, 2017, we made new investment commitments of $20.2 million in thirteen portfolio companies. The fair

value of investments at December 31, 2017 was $17.1 million. The investment income yield1 for the three months ended December 31, 2017

was 7.6%.

− For the quarter ended December 31, 2017, we closed on total investor capital subscriptions of $210.6 million and issued capital calls

totaling $15.9 million (7.5% called capital ratio). On January 1, 2018, we closed on additional capital subscriptions of $135.5 million,

increasing total capital subscriptions to $346.1 million.

Select Financial Data Q1 2018

New Investment Commitments $ 20,195,865

Fair Value of Investments at December 31, 2017 17,149,979

Net income 97,957

Earnings per weighted average share2 0.26

Annualized return on equity – net income3 7.0%

Net asset value $ 15.00

Asset Mix of New Originations Q1 2018

Senior Secured 38%

One Stop 61%

Equity 1%

Quarterly Statements of Financial Condition

4

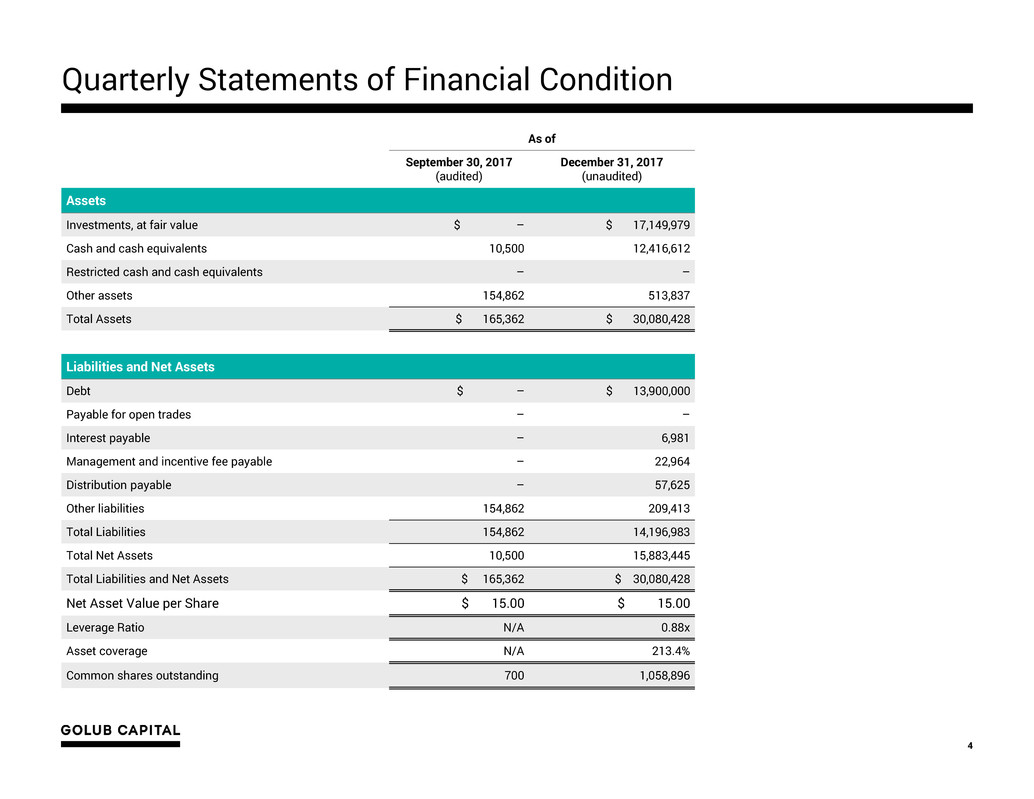

As of

September 30, 2017

(audited)

December 31, 2017

(unaudited)

Assets

Investments, at fair value $ – $ 17,149,979

Cash and cash equivalents 10,500 12,416,612

Restricted cash and cash equivalents – –

Other assets 154,862 513,837

Total Assets $ 165,362 $ 30,080,428

Liabilities and Net Assets

Debt $ – $ 13,900,000

Payable for open trades – –

Interest payable – 6,981

Management and incentive fee payable – 22,964

Distribution payable – 57,625

Other liabilities 154,862 209,413

Total Liabilities 154,862 14,196,983

Total Net Assets 10,500 15,883,445

Total Liabilities and Net Assets $ 165,362 $ 30,080,428

Net Asset Value per Share $ 15.00 $ 15.00

Leverage Ratio N/A 0.88x

Asset coverage N/A 213.4%

Common shares outstanding 700 1,058,896

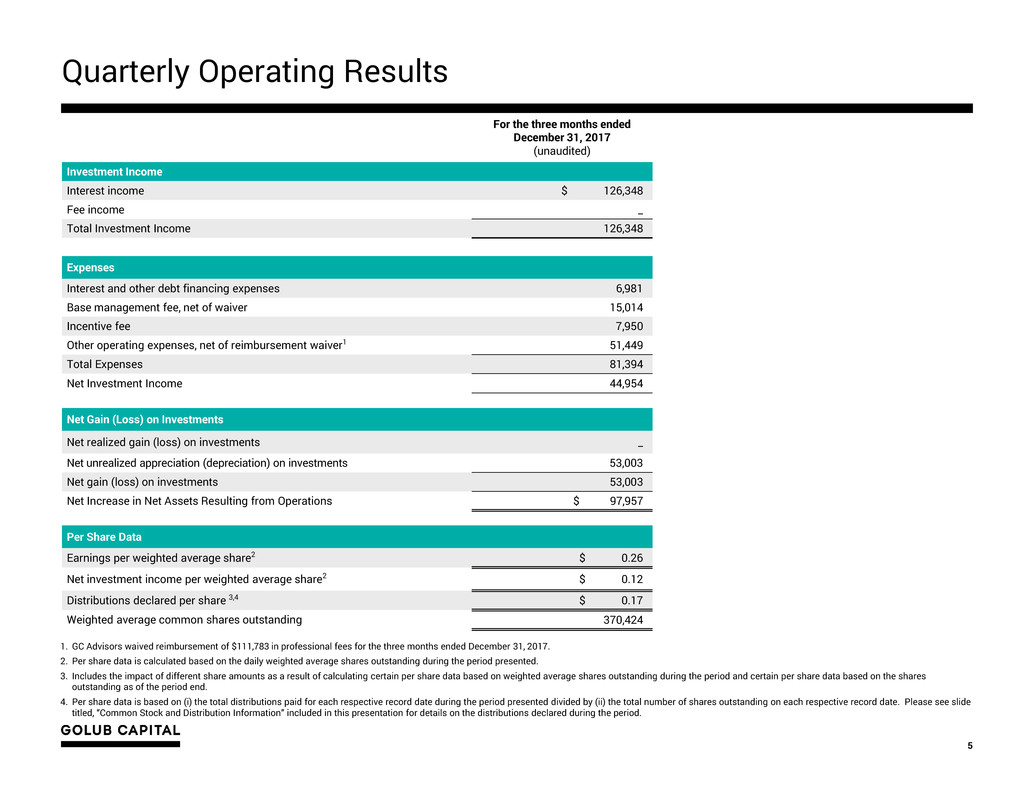

Quarterly Operating Results

5

1. GC Advisors waived reimbursement of $111,783 in professional fees for the three months ended December 31, 2017.

2. Per share data is calculated based on the daily weighted average shares outstanding during the period presented.

3. Includes the impact of different share amounts as a result of calculating certain per share data based on weighted average shares outstanding during the period and certain per share data based on the shares

outstanding as of the period end.

4. Per share data is based on (i) the total distributions paid for each respective record date during the period presented divided by (ii) the total number of shares outstanding on each respective record date. Please see slide

titled, “Common Stock and Distribution Information” included in this presentation for details on the distributions declared during the period.

For the three months ended

December 31, 2017

(unaudited)

Investment Income

Interest income $ 126,348

Fee income _

Total Investment Income 126,348

Expenses

Interest and other debt financing expenses 6,981

Base management fee, net of waiver 15,014

Incentive fee 7,950

Other operating expenses, net of reimbursement waiver1 51,449

Total Expenses 81,394

Net Investment Income 44,954

Net Gain (Loss) on Investments

Net realized gain (loss) on investments _

Net unrealized appreciation (depreciation) on investments 53,003

Net gain (loss) on investments 53,003

Net Increase in Net Assets Resulting from Operations $ 97,957

Per Share Data

Earnings per weighted average share2 $ 0.26

Net investment income per weighted average share2 $ 0.12

Distributions declared per share 3,4 $ 0.17

Weighted average common shares outstanding 370,424

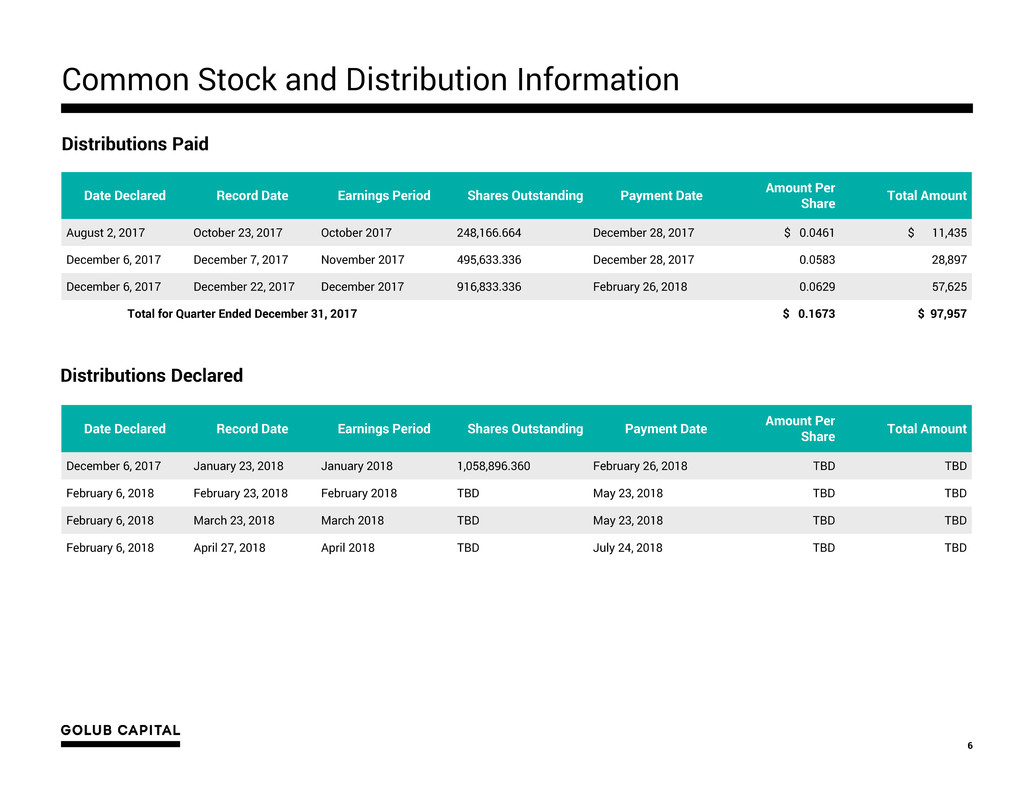

Common Stock and Distribution Information

6

Distributions Paid

Distributions Declared

Date Declared Record Date Earnings Period Shares Outstanding Payment Date Amount Per Share Total Amount

August 2, 2017 October 23, 2017 October 2017 248,166.664 December 28, 2017 $ 0.0461 $ 11,435

December 6, 2017 December 7, 2017 November 2017 495,633.336 December 28, 2017 0.0583 28,897

December 6, 2017 December 22, 2017 December 2017 916,833.336 February 26, 2018 0.0629 57,625

Total for Quarter Ended December 31, 2017 $ 0.1673 $ 97,957

Date Declared Record Date Earnings Period Shares Outstanding Payment Date Amount Per Share Total Amount

December 6, 2017 January 23, 2018 January 2018 1,058,896.360 February 26, 2018 TBD TBD

February 6, 2018 February 23, 2018 February 2018 TBD May 23, 2018 TBD TBD

February 6, 2018 March 23, 2018 March 2018 TBD May 23, 2018 TBD TBD

February 6, 2018 April 27, 2018 April 2018 TBD July 24, 2018 TBD TBD