Attached files

| file | filename |

|---|---|

| EX-99.6 - EX-99.6 - GRANITE CONSTRUCTION INC | d542847dex996.htm |

| EX-99.5 - EX-99.5 - GRANITE CONSTRUCTION INC | d542847dex995.htm |

| EX-99.4 - EX-99.4 - GRANITE CONSTRUCTION INC | d542847dex994.htm |

| EX-99.3 - EX-99.3 - GRANITE CONSTRUCTION INC | d542847dex993.htm |

| EX-99.2 - EX-99.2 - GRANITE CONSTRUCTION INC | d542847dex992.htm |

| EX-99.1 - EX-99.1 - GRANITE CONSTRUCTION INC | d542847dex991.htm |

| EX-10.1 - EX-10.1 - GRANITE CONSTRUCTION INC | d542847dex101.htm |

| EX-2.1 - EX-2.1 - GRANITE CONSTRUCTION INC | d542847dex21.htm |

| 8-K - 8-K - GRANITE CONSTRUCTION INC | d542847d8k.htm |

Exhibit 99.7

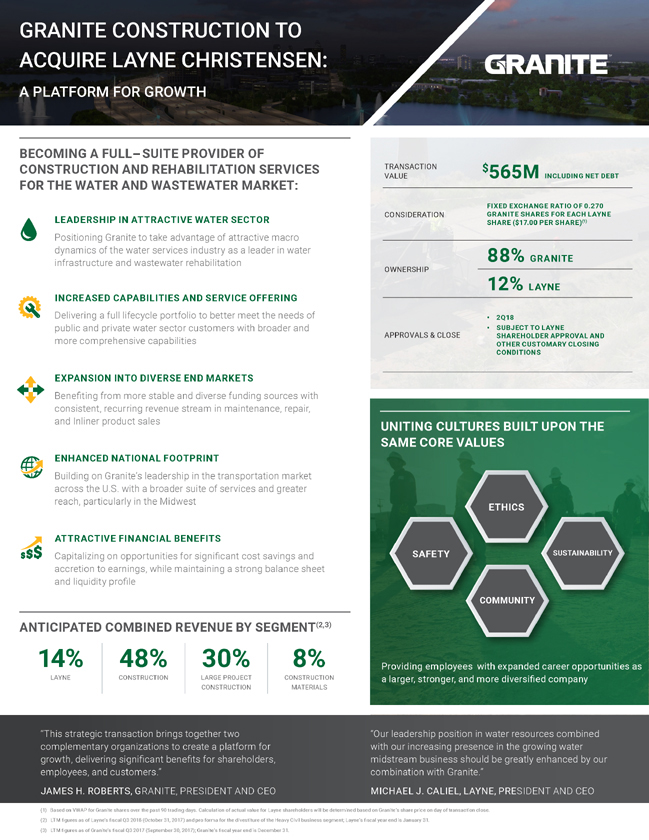

GRANITE CONSTRUCTION TO ACQUIRE LAYNE CHRISTENSEN: A PLATFORM FOR GROWTH BECOMING A FULL-SUITE PROVIDER OF CONSTRUCTION AND REHABILITATION SERVICES FOR THE WATER AND WASTEWATER MARKET: LEADERSHIP IN ATTRACTIVE WATER SECTOR Positioning Granite to take advantage of attractive macro dynamics of the water services industry as a leader in water infrastructure and wastewater rehabilitation INCREASED CAPABILITIES AND SERVICE OFFERING Delivering a full lifecycle portfolio to better meet the needs of public and private water sector customers with broader and more comprehensive capabilities EXPANSION INTO DIVERSE END MARKETS Benefiting from more stable and diverse funding sources with consistent, recurring revenue stream in maintenance, repair, and Inliner product sales ENHANCED NATIONAL FOOTPRINT Building on Granite’s leadership in the transportation market across the U.S. with a broader suite of services and greater reach, particularly in the Midwest ATTRACTIVE FINANCIAL BENEFITS Capitalizing on opportunities for significant cost savings and accretion to earnings, while maintaining a strong balance sheet and liquidity profile ANTICIPATED COMBINED REVENUE BY SEGMENT(2,3) 14% LAYNE 48% CONSTRUCTION 30% LARGE PROJECT CONSTRUCTION 8% CONSTRUCTION MATERIALS TRANSACTION VALUE $565M INCLUDING NET DEBT CONSIDERATION FIXED EXCHANGE RATIO OF 0.270 GRANITE SHARES FOR EACH LAYNE SHARE ($17.00 PER SHARE)(1) OWNERSHIP 88% GRANITE 12% LAYNE APPROVALS & CLOSE • 2Q18 • SUBJECT TO LAYNE SHAREHOLDER APPROVAL AND OTHER CUSTOMARY CLOSING CONDITIONS UNITING CULTURES BUILT UPON THE SAME CORE VALUES Providing employees with expanded career opportunities as a larger, stronger, and more diversified company “This strategic transaction brings together two complementary organizations to create a platform for growth, delivering significant benefits for shareholders, employees, and customers.” JAMES H. ROBERTS, GRANITE, PRESIDENT AND CEO “Our leadership position in water resources combined with our increasing presence in the growing water midstream business should be greatly enhanced by our combination with Granite.” MICHAEL J. CALIEL, LAYNE, PRESIDENT AND CEO (1) Based on VWAP for Granite shares over the past 90 trading days. Calculation of actual value for Layne shareholders will be determined based on Granite’s share price on day of transaction close. (2) LTM figures as of Layne’s fiscal Q3 2018 (October 31, 2017) and pro forma for the divestiture of the Heavy Civil business segment; Layne’s fiscal year end is January 31. (3) LTM figures as of Granite’s fiscal Q3 2017 (September 30, 2017); Granite’s fiscal year end is December 31.

FORWARD-LOOKING STATEMENTS

All statements included

or incorporated by reference in this communication, other than statements or characterizations of historical fact, are forward-looking statements within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on Granite’s current expectations, estimates and projections about its business and industry, management’s beliefs,

and certain assumptions made by Granite and Layne, all of which are subject to change. Forward-looking statements can often be identified by words such as “anticipates,” “expects,” “intends,” “plans,”

“predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,” “could,” “potential,” “continue,” “ongoing,”

similar expressions, and variations or negatives of these words. Examples of such forward-looking statements include, but are not limited to: (1) references to the anticipated benefits of the proposed transaction; (2) the expected future

capabilities and served markets of the individual and/or combined companies; (3) projections of financial results, whether by specific market segment, or as a whole, and whether for each individual company or the combined company; (4) market

expansion opportunities and segments that may benefit from sales growth as a result of changes in market share or existing markets; (5) the financing components of the proposed transaction; (6) potential credit scenarios, together with sources and

uses of cash; and (7) the expected date of closing of the transaction.

These forward-looking statements are not guarantees of future results and are subject to

risks, uncertainties and assumptions that could cause actual results to differ materially and adversely from those expressed in any forward-looking statement. Important risk factors that may cause such a difference in connection with the proposed

transaction include, but are not limited to, the following factors: (1) the risk that the conditions to the closing of the transaction are not satisfied, including the risk that required approvals for the transaction from governmental authorities or

the stockholders of Layne are not obtained; (2) litigation relating to the transaction; (3) uncertainties as to the timing of the consummation of the transaction and the ability of each party to consummate the transaction; (4) risks that the

proposed transaction disrupts the current plans and operations of Granite or Layne; (5) the ability of Granite or Layne to retain and hire key personnel; (6) competitive responses to the proposed transaction and the impact of competitive products;

(7) unexpected costs, charges or expenses resulting from the transaction; (8) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; (9) the combined companies’ ability

to achieve the growth prospects and synergies expected from the transaction, as well as delays, challenges and expenses associated with integrating the combined companies’ existing businesses; (1 0) the terms and availability of the

indebtedness planned to be incurred in connection with the transaction; and (11) legislative, regulatory and economic developments, including changing business conditions in the construction industry and overall economy as well as the financial

performance and expectations of Granite and Layne’s existing and prospective customers. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the proxy statement/prospectus that will be

included in the Registration Statement on Form S-4 that Granite will file with the Securities and Exchange Commission (“SEC”) in connection with the proposed transaction. Investors and potential investors are urged not to place undue

reliance on forward-looking statements in this document, which speak only as of this date. Neither Granite nor Layne undertakes any obligation to revise or update publicly any forward-looking statement to reflect future events or circumstances.

Nothing contained herein constitutes or will be deemed to constitute a forecast, projection or estimate of the future financial performance of Granite, Layne, or the combined company, following the implementation of the proposed transaction or

otherwise.

In addition, actual results are subject to other risks and uncertainties that relate more broadly to Granite’s overall business, including those

more fully described in Granite’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended December 31, 2016, and Layne’s overall business and financial condition, including those more fully described in

Layne’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended January 31, 2017.

No Offer or Solicitation

This document does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval nor shall there be any sale of

securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Additional Information and Where to Find It

n connection with the proposed transaction,

Granite will file a registration statement on Form S-4, which will include a preliminary prospectus of Granite and a preliminary proxy statement of Layne (the “proxy statement/prospectus”), and each party will file other documents

regarding the proposed transaction with the SEC. The registration statement has not yet become effective and the proxy statement/prospectus included therein is in preliminary form. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY

STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A definitive proxy statement/prospectus will be sent to Layne’s stockholders.

You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). In addition, investors and

stockholders will be able to obtain free copies of the proxy statement/prospectus and other documents filed with the SEC by Granite on Granite’s Investor Relations website (investor.Granite.com) or by writing to Granite, Investor Relations, 585

West Beach Street, Watsonville, CA 95076 (for documents filed with the SEC by Granite), or by Layne on Layne’s Investor Relations website (investor.laynechristensen.com) or by writing to Layne Company, Investor Relations, 1800 Hughes Landing

Boulevard, Suite 800, The Woodlands, TX 77380 (for documents filed with the SEC by Layne).

Participants in the Solicitation

Granite, Layne, and certain of their respective directors, executive officers, other members of management and employees and agents retained, may, under SEC rules, be deemed to be

participants in the solicitation of proxies from Layne stockholders in connection with the proposed transaction. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of Layne stockholders in

connection with the proposed transaction will be set forth in the proxy statement/prospectus when it is filed with the SEC. You can find more detailed information about Granite’s executive officers and directors in its definitive proxy

statement filed with the SEC on April 25, 2017. You can find more detailed information about Layne’s executive officers and directors in its definitive proxy statement filed with the SEC on April 28, 2017. Additional information about

Granite’s executive officers and directors and Layne’s executive officers and directors will be provided in the above-referenced Registration Statement on Form S-4 when it becomes available.