Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Bioverativ Inc. | bivv-20171231ex321e3749c.htm |

| EX-31.2 - EX-31.2 - Bioverativ Inc. | bivv-20171231ex31236a75e.htm |

| EX-31.1 - EX-31.1 - Bioverativ Inc. | bivv-20171231ex311bd94bc.htm |

| EX-23.1 - EX-23.1 - Bioverativ Inc. | bivv-20171231ex2318c9749.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10‑K

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2017 |

|

|

or |

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

|

Commission file number: 001‑37859

Bioverativ Inc.

(Exact name of Registrant as Specified in its Charter)

|

Delaware |

81‑3461310 |

|

|

|

|

225 Second Avenue, Waltham, Massachusetts |

02451 |

(781) 663‑4400

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange on which registered |

|

Common Stock, par value $0.001 per share |

|

The Nasdaq Stock Market |

Securities to be registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well‑known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S‑T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files): Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S‑K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10‑K or any amendment to this Form 10‑K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b‑2 of the Exchange Act. (Check one):

|

Large accelerated filer ☒ |

Accelerated filer ☐ |

Non‑accelerated filer ☐ |

Smaller reporting company ☐ |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b‑2) of the Act. Yes ☐ No ☒

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) computed by reference to the price at which the common stock was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was $6,433.3 million.

The number of shares of the registrant’s common stock, $0.001 par value, outstanding as of February 9, 2018 was 108,223,644.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the registrant’s 2018 annual meeting of stockholders to be filed within 120 days of the end of its fiscal year ended December 31, 2017 are incorporated into Part III (Items 10, 11, 12, 13 and 14) of this Annual Report on Form 10-K where indicated.

BIOVERATIV INC.

ANNUAL REPORT ON FORM 10‑K

For the Year Ended December 31, 2017

2

NOTE REGARDING FORWARD‑LOOKING STATEMENTS

This report contains forward‑looking statements that are being made pursuant to the provisions of the Private Securities Litigation Reform Act of 1995 (the Act) with the intention of obtaining the benefits of the "Safe Harbor" provisions of the Act. Use by Bioverativ of the words “may,” “will,” “would,” “could,” “should,” “believes,” “estimates,” “projects,” “potential,” “expects,” “plans,” “seeks,” “intends,” “evaluates,” “pursues,” “anticipates,” “continues,” “designs,” “impacts,” “affects,” “forecasts,” “target,” “outlook,” “initiative,” “objective,” “designed,” “priorities,” or the negative of those words or other similar expressions is intended to identify forward‑looking statements.

These forward‑looking statements may include statements with respect to:

|

· |

the pending acquisition by Sanofi and our ability to satisfy all of the conditions under the merger agreement we entered into with Sanofi in the anticipated timeframe or at all; |

|

· |

accounting estimates, assumptions and policies, and the expected impact of the adoption of new accounting standards; |

|

· |

estimates of liabilities; |

|

· |

separation related adjustments and ongoing costs of certain services provided by Biogen post-separation; |

|

· |

expected timing of the completion of certain transition and other services provided by Biogen to us; |

|

· |

purchase price allocation determinations in connection with acquisitions, including accounting assumptions, judgments and estimates used in connection such determinations; |

|

· |

anticipated contingent payments, including milestone and royalty payment obligations, and the timing thereof; |

|

· |

our exposure to market volatility and foreign currency and interest rate risks, and the anticipated impact of actions taken to mitigate such risks; |

|

· |

revenue growth and associated costs, discounts or rebates in connection with our products; |

|

· |

tax rates; |

|

· |

future cash flows, working capital needs, capital expenditures, inventory purchases, strategic investments and access to capital markets; |

|

· |

future transactions in our securities and debt issuances; |

|

· |

dividends; |

|

· |

litigation related matters, including outcomes and expenses relating thereto; |

|

· |

the impact of healthcare reform, including any repeal, substantial modification or invalidation of the U.S. Patient Protection and Affordable Care Act; |

|

· |

business and strategic objectives; |

|

· |

business development activities; |

|

· |

our anticipated investments in infrastructure and personnel; |

|

· |

our expectation to invest in research and development activities; |

|

· |

expected clinical trials and timing thereof; |

|

· |

receipt of necessary regulatory authorization and approvals; |

|

· |

our anticipated geographic expansion; |

|

· |

our growth, including patient share growth; |

|

· |

our manufacturing, supply and distribution arrangements; |

|

· |

the sufficiency of our facilities; |

|

· |

our relationships with third parties, collaborators and our employees; and |

|

· |

our ability to operate as a standalone company. |

These forward‑looking statements involve risks and uncertainties, including those that are described in Item 1A. Risk Factors and elsewhere in this report, that could cause actual results to differ materially from those reflected in such statements. You should not place undue reliance on these statements. Forward‑looking statements speak only as of the date of this report. Except as required by law, we do not undertake any obligation to publicly update any forward‑looking statements, whether as a result of new information, future developments or otherwise.

3

NOTE REGARDING PRESENTATION OF INFORMATION

Unless the context otherwise requires, references in this report to the following terms shall have the following respective meanings:

|

· |

“Biogen” refers to Biogen Inc., a Delaware corporation, and its consolidated subsidiaries; |

|

· |

“distribution” refers to the distribution by Biogen to Biogen stockholders of all of the outstanding shares of Bioverativ, as further described in this report; |

|

· |

“hemophilia business” includes Biogen’s hemophilia business and certain additional assets and liabilities associated with Biogen’s pipeline programs related to hemophilia and other blood disorders; |

|

· |

“separation” refers to the separation of Biogen’s hemophilia business from Biogen’s other businesses and the creation, as a result of the distribution, of an independent, publicly traded company, Bioverativ Inc., that holds the hemophilia business, as further described in this report; |

|

· |

“separation date” is February 1, 2017; and |

|

· |

“Bioverativ,” “we,” “us,” “our,” “our company” and “the company” refer to Bioverativ Inc., a Delaware corporation, or Bioverativ Inc., together with its consolidated subsidiaries, as the context requires. |

See “Glossary of Scientific Terms” starting on page 62 of this report for definitions of certain additional terms as they are used in this report.

This report describes the business transferred to Bioverativ by Biogen in the separation as if the transferred business was Bioverativ’s business for all historical periods described. References in this report to Bioverativ’s historical assets, liabilities, products, businesses or activities of Bioverativ’s business are generally intended to refer to the historical assets, liabilities, products, businesses or activities of the transferred business as the business was conducted as part of Biogen prior to the separation. Since the separation date, Bioverativ has operated as a standalone company.

NOTE REGARDING TRADEMARKS, TRADE NAMES AND SERVICE MARKS

Bioverativ owns or has rights to use the trademarks, service marks and trade names that it uses in conjunction with the operation of its business. Some of the trademarks that Bioverativ owns or has rights to use that appear in this report include: ALPROLIX® and ELOCTATE®, which may be registered or trademarked in the United States and other jurisdictions. Bioverativ’s rights to some of its trademarks may be limited to select markets. Each trademark, trade name or service mark of any other company appearing in this report is, to Bioverativ’s knowledge, owned by such other company. References to ELOCTATE in this report shall also refer to ELOCTA, the approved trade name for ELOCTATE in the European Union, as the context may require.

4

Merger Agreement with Sanofi

On January 21, 2018, we entered into an Agreement and Plan of Merger (the “Merger Agreement”), with Sanofi (“Parent” or “Sanofi”), a French société anonyme, and Blink Acquisition Corp. (“Merger Sub”), a Delaware corporation and indirect wholly-owned subsidiary of Parent. See Note 21, Subsequent Events to our audited consolidated financial statements included in this Form 10-K.

Pursuant to the terms of Merger Agreement, upon the terms and subject to the conditions thereof, Merger Sub commenced a tender offer on February 7, 2018 (the “Offer”), to acquire all of the outstanding shares of common stock of the Company, par value $0.001 per share (the “Shares”), at a purchase price of $105.0 per Share in cash, net of applicable withholding taxes and without interest (the “Offer Price”). Unless extended by Merger Sub in accordance with the Merger Agreement, the offering period for the Offer will expire at 11:59 p.m. (New York City time), on March 7, 2018.

As soon as practicable following (but on the same day as) the consummation of the Offer and subject to the satisfaction or waiver of the conditions set forth in the Merger Agreement, Merger Sub will be merged with and into the Company (the “Merger”), with the Company surviving the Merger as an indirect wholly-owned subsidiary of Parent. The Merger will be governed by Section 251(h) of the Delaware General Corporation Law (“DGCL”) and effected without a vote of the Company’s stockholders.

The Merger Agreement includes representations and warranties, and covenants of the parties customary for a transaction of this nature.

We have prepared this Form 10-K and the forward-looking statements contained in this Form 10-K as if we were going to remain an independent company. If the Offer and Merger are consummated, many of the forward-looking statements contained in this Form 10-K will no longer be applicable.

Business Overview

Bioverativ Inc., a Delaware corporation, was formed to hold the hemophilia business of Biogen Inc. On February 1, 2017, we separated from Biogen and became an independent public company.

Bioverativ is a global biopharmaceutical company focused on the discovery, research, development and commercialization of innovative therapies for the treatment of rare blood diseases including hemophilia.

Our strategy is to lead in hemophilia, build a complement disease franchise, and transform the treatment of hemoglobinopathies. We aim to raise the standards of care and improve outcomes for patients as we pursue our vision to become the leading rare blood disease company.

Lead in Hemophilia. We have two marketed products, ELOCTATE [Antihemophilic Factor (Recombinant), Fc Fusion Protein] and ALPROLIX [Coagulation Factor IX (Recombinant), Fc Fusion Protein], extended half‑life clotting‑factor therapies for the treatment of hemophilia A and hemophilia B, respectively. These therapies, when originally introduced in 2014, were the first major advancements in the treatment of hemophilia A and B in nearly two decades. We continue to research and explore the potential benefits and science behind these therapies to address areas of serious need, including long-term joint health and immune tolerance induction in people with hemophilia who develop inhibitors. We currently market our products primarily in the United States, Japan, Canada and Australia, and our collaboration partner, Swedish Orphan Biovitrum AB (publ) (Sobi), markets the products primarily in the European Union. Geographic expansion in additional markets is a priority, with a primary focus on certain countries in Latin America.

5

Our new product development for the treatment of hemophilia includes discovery, preclinical and clinical programs studying next generation extended half-life hemophilia product candidates, gene therapies for both hemophilia A and B, and non-factor products to treat hemophilia leveraging mimetic bi-specific antibody technology and a novel bicyclic peptide product platform.

Build a Complement Disease Franchise. We plan to build a complement disease franchise with our initial focus on developing a treatment for cold agglutinin disease. Cold agglutinin disease is a global, chronic rare blood disease characterized by hemolytic anemia, with a significant portion of patients requiring transfusions and having crippling fatigue, poor quality of life and the potential for life-threatening complications such as thrombotic events, including pulmonary embolism and stroke. Our efforts in this therapeutic area are initially focused on advancing the development of BIVV009, a first-in-class monoclonal antibody for cold agglutinin disease in Phase 3 trials, which we obtained through the acquisition of True North Therapeutics in June 2017.

Transform Treatment of Hemoglobinopathies. We have early and research-stage programs for the treatment of hemoglobinopathies, including gene-edited cell therapies for the treatment of transfusion-dependent beta-thalassemia and sickle cell disease and several discovery programs seeking to target the root cause of sickle cell disease. We believe there is a significant unmet need for therapies to treat beta-thalassemia and sickle cell disease, which are life-long rare blood disorders linked to shorter life expectancies and with few treatment options.

2017 Highlights

In 2017, we focused on three key business priorities: maximizing our potential in hemophilia, advancing our pipeline, and executing on strategic business development.

Maximizing Our Potential In Hemophilia

|

· |

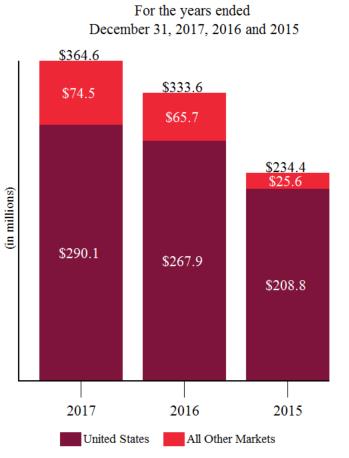

Revenue Growth – We delivered 31.7% revenue growth from 2016 to 2017. This growth was due primarily to strong commercial execution and differentiation of our Fc fusion technology and our extended half-life products. |

|

· |

Focus on Patient Outcomes – We aim to raise the standard of care and improve outcomes for patients with hemophilia through our extended half-life products. In particular, we are focused on better outcomes for patients based on improvement in joint health and prophylaxis usage of our products as evidenced by our growing body of data. |

|

· |

In October 2017, interim results from a longitudinal study of joint health in patients treated prophylactically with ELOCTATE were published in Haemophilia. These interim results show that participants enrolled in the ASPIRE extension study demonstrated continuous improvement in joint health over a nearly three-year period with prophylactic dosing of ELOCTATE, regardless of prior treatment regimen, severity of joint damage or target joints. Joint health improvements were most notable in hemophilia A patients with poor joint health. |

|

· |

In July 2017, we presented data at the International Society on Thrombosis and Haemostasis conference, which showed that long-term prophylactic use of ALPROLIX resolved target joints in 100% of adults and adolescents with severe hemophilia B in the extension study B-YOND. |

Advancing Our Pipeline

|

· |

Phase 3 Cold Agglutinin Disease Trials – In the fourth quarter of 2017, we initiated site start-up for two parallel Phase 3 trials, Cardinal and Cadenza, to investigate BIVV009 in primary cold agglutinin disease. |

|

· |

BIVV001 in Phase 1/2a Trial – In the fourth quarter of 2017, we enrolled the first patient in the Phase 1/2a trial of BIVV001 (also known as rFVIIIFc-VWF-XTEN), an investigational factor VIII therapy designed to |

6

potentially extend protection from bleeds with prophylactic dosing of once weekly or longer for people with hemophilia A. |

|

· |

IND for ST-400 – In October 2017, we and Sangamo Therapeutics, Inc. (Sangamo) announced that the U.S. Food and Drug Administration (FDA) accepted the Investigational New Drug (IND) application for ST-400, a gene-edited cell therapy candidate for people with transfusion-dependent beta-thalassemia. The IND enables Sangamo to initiate a Phase 1/2 clinical trial to assess the safety, tolerability and efficacy of ST-400 in adults with transfusion-dependent beta-thalassemia. |

Executing on Strategic Business Development

|

· |

True North Acquisition – In June 2017, we acquired True North, a clinical-stage biopharmaceutical company focused on the discovery, development and commercialization of first-in-class product candidates for complement-mediated diseases. With the acquisition, we added BIVV009 to our pipeline. BIVV009 has received breakthrough therapy designation from the FDA for the treatment of hemolysis in patients with primary cold agglutinin disease, and orphan drug designation from the FDA and the European Medicines Agency (EMA). |

|

· |

Bicycle Therapeutics Research Collaboration – In August 2017, we entered into a research collaboration with Bicycle Therapeutics (Bicycle), a biotechnology company that is pioneering a new class of medicines based on its novel bicyclic peptide (Bicycle®) product platform. The collaboration focuses on the discovery, development and commercialization of therapies for hemophilia and sickle cell disease. Under our agreement, Bicycle is responsible for leading initial discovery activities through lead optimization to candidate selection for two programs, and we will lead preclinical and clinical development, as well as subsequent marketing and commercialization efforts. |

Background on Hemophilia A and B

Hemophilia A and hemophilia B are rare, x‑linked genetic disorders that impair the ability of a person’s blood to clot due to reduced levels of a protein known as factor VIII or factor IX, respectively. This impairment can lead to recurrent and extended bleeding episodes that may cause pain, irreversible joint damage and life‑threatening hemorrhages. In its Annual Global Survey 2016, the World Federation of Hemophilia (WFH) estimated that nearly 150,000 people worldwide were identified as living with hemophilia A and nearly 30,000 people were diagnosed with hemophilia B.

Hemophilia is usually diagnosed at birth or at a very young age, and predominantly affects males. An individual’s hemophilia is classified as mild, moderate or severe and is based on the level of factor activity in the blood. Although hemophilia care varies widely across the globe, in the United States a majority of patients receive care from specialized hemophilia treatment centers.

Joint disease, which is caused by frequent bleeds into joints over time, is the leading cause of morbidity for people with hemophilia, often resulting in chronic pain and disability. The ability to minimize joint damage over the long term is a critical unmet need that could have a positive impact on patient outcomes.

Hemophilia is treated by injecting the missing clotting factor directly into the patient’s bloodstream. Therapies can be administered either on a schedule to help prevent or reduce bleeding episodes (prophylaxis) or to control bleeding when it occurs (on‑demand). Over time, regimens have shifted from on‑demand treatment to routine prophylaxis due to observed improvements in long‑term clinical outcomes, such as joint damage. In the United States, the February 2016 guidelines of the Medical and Scientific Advisory Council of the National Hemophilia Foundation recommend routine prophylaxis as optimal for the treatment of people with severe hemophilia.

Historically, hemophilia treatments were derived from factors taken from human blood plasma. In the early 1990s, recombinant factor products, developed in a lab through the use of recombinant DNA technology, became available. In 2016, use of recombinant factor product accounted for over 75% of sales globally. In 2014, ELOCTATE

7

and ALPROLIX became the first available extended half‑life recombinant factor therapies in the United States with the benefit of an effective treatment even with less frequent, more convenient dosing requirements.

Patients may experience complications with factor therapies. In some cases, patients may develop inhibitors that recognize the infused factor as a foreign protein and create antibodies to it. Inhibitor antibodies occur when a person with hemophilia has an immune response to treatment with clotting factor concentrates. According to the WFH, an inhibitor usually occurs within the first 75 exposures to factor concentrates and thus is most often seen in children with severe hemophilia. In 2014, the WFH estimated that approximately 25% to 30% of children with severe hemophilia A and approximately 1% to 6% of individuals with hemophilia B will develop inhibitors. A common treatment to eradicate inhibitors is immune tolerance induction. Immune tolerance induction involves exposure to frequent and higher doses of recombinant factor until the body can tolerate the factor. While this treatment can be effective, the treatment burden is high as it can take months or even years for the inhibitor antibodies to be removed.

Our Marketed Products

Our marketed products, ELOCTATE and ALPROLIX, leverage expertise in Fc fusion technology that was originally acquired by Biogen from Syntonix Pharmaceuticals (Syntonix, and now known as Bioverativ Therapeutics Inc., our wholly owned subsidiary) in 2007. Fc fusion is a proprietary technology used to link recombinant factor VIII and factor IX in the case of ELOCTATE and ALPROLIX, respectively, to a protein fragment in the body known as Fc. The fusion with Fc uses a naturally occurring pathway and is designed to extend the half‑life of the factor, thereby making the product last longer in a patient’s blood than traditional factor therapies. ELOCTATE consists of the Coagulation Factor VIII molecule (historically known as Antihemophilic Factor) linked to Fc and ALPROLIX consists of the Coagulation Factor IX molecule linked to Fc.

We collaborate with Sobi to develop and commercialize ELOCTATE and ALPROLIX globally. Under the collaboration, we have rights to commercialize ELOCTATE and ALPROLIX in the United States, Japan, Canada, Australia, Latin American countries and all other markets excluding Sobi’s commercialization territory. Sobi’s commercialization territory includes Europe, Russia and certain countries in Northern Africa and the Middle East. ELOCTATE and ALPROLIX were approved in the United States, Canada and Japan in 2014, and in the European Union in 2015 and 2016, respectively. For a further description of our development and collaboration agreement with Sobi, see “—Our Development and Commercialization Arrangements with Sobi” below.

|

Product |

|

General Description |

|

|

|

ELOCTATE is approved in the United States, Japan, Canada, Australia, Brazil, Colombia, the European Union and certain other countries for the treatment of adults and children with hemophilia A to control and prevent bleeding episodes. In the United States, it is indicated for use in adults and children with hemophilia A for on‑demand treatment and control of bleeding episodes, perioperative management of bleeding and routine prophylaxis to reduce the frequency of bleeding episodes. ELOCTATE has received orphan designation in the United States. |

8

|

|

|

ALPROLIX is approved in the United States, Japan, Canada, Australia, Brazil, Colombia, the European Union and certain other countries for the treatment of adults and children with hemophilia B to control and prevent bleeding episodes. In the United States, it is indicated for use in adults and children with hemophilia B for control and prevention of bleeding episodes, perioperative management and routine prophylaxis to reduce the frequency of bleeding episodes. ALPROLIX has received orphan designation in the United States and the European Union.

|

Product sales for ELOCTATE and ALPROLIX each accounted for approximately 62% and 31%, respectively, of our total revenue for the year ended December 31, 2017, 58% and 38%, respectively of our total revenue for the year ended December 31, 2016, and approximately 57% and 42%, respectively of our total revenue for the year ended December 31, 2015. For additional financial information about our product and other revenues, long lived assets and geographic areas in which we operate, please read Note 19, Segment Information to our audited consolidated financial statements, Item 6. Selected Financial Data and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations included in this report. A discussion of the risks attendant to our global operations is set forth in this report under Item 1A. Risk Factors.

Our research activities relating to ELOCTATE and ALPROLIX include ongoing and planned post‑marketing studies exploring the potential impact of the Fc fusion technology on long‑term joint health, immunogenicity and immune tolerance induction in hemophilia patients who develop inhibitors.

Research and Development Activities

We are engaged in discovery, preclinical, and clinical programs focused on advancing new technologies for the treatment of hemophilia and other blood disorders, such as cold agglutinin disease, sickle cell disease, and beta‑thalassemia. Our scientific and medical leaders are focused on advancing large and small molecules and cell and gene therapy in the hopes of developing treatments for these diseases.

A brief description of certain of our research and development programs, together with certain related business relationships and collaborations, is described below.

BIVV009

We have initiated site start-up for two parallel BIVV009 Phase 3 clinical trials for primary cold agglutinin disease, CARDINAL and CADENZA. BIVV009 is designed to selectively target C1s, the proximal initiator of the classical complement cascade, while leaving other complement cascade pathways intact.

Cold agglutinin disease is a global, chronic rare blood disease characterized by hemolytic anemia, with a significant portion of patients requiring transfusions and having crippling fatigue, poor quality of life and the potential for life-threatening complications such as thrombotic events, including pulmonary embolism and stroke. People living with cold agglutinin disease currently have no approved treatment options, and risk chronic iron overload from frequent blood transfusions to normalize hemoglobin levels. In addition, natural history data we published at the 2017 Annual Meeting for the American Society of Hematology (ASH) show a statistically significant increase in risk of thromboembolic events, like stroke, for people living with cold agglutinin disease. According to Berensten et al 2006, the diagnosed prevalence is approximately 16 people per million globally, leading to an estimated 10,000 people in the United States and Europe.

Cold agglutinin disease is caused by auto-immune mediated destruction of red blood cells. It is triggered by IgM auto-antibodies that bind to the surface of red blood cells and activate the classical complement pathway, leading to

9

red blood cell destruction. The classical complement pathway is a normal component of the innate immune system. However, when dysregulated, it is associated with multiple disease processes, including cold agglutinin disease.

We also have an ongoing Phase 1b clinical trial of BIVV009 for refractory immune thrombocytopenia.

Hemophilia Programs

BIVV001 (rFVIIIFc‑VWF‑XTEN). A Phase 1/2a clinical program of the combination of recombinant factor VIII‑Fc fusion protein with part of Von Willebrand factor, another component of the clotting cascade, attached with proprietary XTEN technology. The product candidate is being developed with the objective of achieving once weekly or less frequent dosing by intravenous administration in patients with hemophilia A.

BIVV002 (rFIXFc‑XTEN). A preclinical program for a next generation recombinant factor IX replacement product using XTEN technology exploring the use of subcutaneous dosing for patients with hemophilia B with the objective of achieving once weekly or less frequent dosing, which we believe would simplify the administration process for patients with hemophilia B.

Gene Therapy Programs. We are collaborating with Fondazione Telethon and Ospedale San Raffaele S.r.l. in preclinical programs to develop gene therapies for hemophilia A and B. This collaboration centers on advanced lentiviral gene transfer technology of the San Raffaele Telethon Institute for Gene Therapy.

Bi‑specific Antibody Program. A preclinical program to develop a non‑factor bi‑specific antibody for the treatment of patients with hemophilia A with inhibitors and the general hemophilia A population.

Beta Thalassemia and Sickle Cell Disease

ST-400. A Phase 1/2 clinical trial is planned to assess the safety, tolerability and efficacy of ST-400, a gene-edited cell therapy candidate, in adults with transfusion-dependent beta-thalassemia. This program is being developed pursuant to an exclusive worldwide research, development and commercialization collaboration and license agreement with Sangamo under which both companies are working to develop and commercialize product candidates for the treatment of sickle cell disease and beta‑thalassemia. For more information on our collaboration with Sangamo, refer to Item 7. Management’s Discussion and Analysis and of Financial Condition and Results of Operations—Contractual Obligations—Funding Commitments—Sangamo Therapeutics, Inc.

We are also building a clinical-stage pipeline in sickle cell disease by developing programs that intersect at all points of the biology, and these include a gene-edited cell therapy program and multiple small molecule programs.

Our expenses for research and development activities were $224.6 million in 2017, $210.1 million in 2016, and $236.9 million in 2015. For the periods prior to separation, these expenses include costs associated with research and development activities performed while part of Biogen. These expenses include allocations from Biogen to us for depreciation and other facility‑based expenses, regulatory affairs function, pharmacovigilance, other infrastructure and management costs supporting multiple projects. As a result, these expenses are not necessarily indicative of Bioverativ’s expenses for research and development activities as a standalone company.

Investment in research and development is critical to our future growth and our ability to remain competitive in the markets in which we participate. We intend to continue to make significant investment in research and development programs in addition to seeking to enhance future growth through internal efforts, acquisitions and collaborations with third parties.

Our Development and Commercialization Arrangements with Sobi

Bioverativ Therapeutics Inc., our wholly owned subsidiary, is a party to a development and commercialization agreement with Sobi. Under this agreement, the parties develop and commercialize in defined territories ELOCTATE, ALPROLIX and certain compound constructs that Sobi elects to designate as subject to the parties’ collaboration.

10

Generally, these compound constructs include fusion proteins containing both a recombinant factor and the Fc portion of an immunoglobulin, including certain constructs that may be developed using technology we obtained from Amunix.

The agreement generally defines Bioverativ’s commercialization territory as the United States, Japan, Canada, Australia, Latin American countries and all other markets excluding Sobi’s commercialization territory, and Sobi’s commercialization territory as Europe, Russia and certain countries in Northern Africa and the Middle East.

Under the agreement, prior to May 5, 2024, either Bioverativ or Sobi may present a compound construct as a potential product candidate that the parties may consider developing and commercializing under the collaboration. Upon Sobi’s election to treat a compound construct as a product, and in the case of a novel compound construct Sobi’s payment of an upfront fee to us, Sobi is granted the right to opt‑in to such compound construct and become responsible for final development and commercialization of that compound construct in Sobi’s commercialization territory. Generally, upon opt‑in, Sobi becomes obligated to make an advance payment and reimburse Bioverativ for certain development expenses incurred with respect to the compound construct. Until Sobi’s portion of the development expenses are fully paid, Sobi’s royalty rate payable to Bioverativ is increased, and the royalty payment payable by Bioverativ to Sobi for the sale of products in Bioverativ’s territory is decreased.

In 2016, Sobi assumed final development and commercialization activities and became the marketing authorization holder for ELOCTA and ALPROLIX in the European Union. Sobi has also elected to treat BIVV001 (rFVIIIFc-VWF-XTEN) and BIVV002 (rFIXFc‑XTEN), each compound constructs developed using the XTEN technology we obtained from Amunix, as subject to the collaboration.

The agreement provides for royalty payments between the parties for sales of collaboration products, including ELOCTATE and ALPROLIX, that vary based upon, among other things, the territory in which the sale was made and how the product is commercialized.

The agreement is terminable in its entirety or with respect to a product developed under the collaboration by either party upon six months’ written notice. The agreement is also terminable in its entirety under certain conditions and subject to certain dispute resolution procedures following a party’s uncured material breach of a material obligation of the agreement. Unless earlier terminated, the duration of the agreement continues with respect to each product, for so long as such product is being sold anywhere in the world.

Bioverativ and Sobi are also parties to ancillary agreements, including manufacturing and supply agreements for ELOCTATE and ALPROLIX pursuant to which Sobi forecasts, orders and purchases drug substance and drug product that is supplied to Sobi by Bioverativ.

For more information on our collaboration with Sobi, see Note 4, Collaborations, to the audited consolidated financial statements included elsewhere in this report.

Our International Operations

Outside of the United States, Japan remains a significant near term focus for growth of ELOCTATE and ALPROLIX. We have conducted research and development activities for hemophilia treatments in Japan since 2010. Through our dedicated Japanese sales force and marketing team, we have sold ELOCTATE and ALPROLIX in Japan since receipt of marketing approval in December 2014 and June 2014, respectively. For the years ended December 31, 2017 and 2016, we generated revenue of approximately $138.8 and $105.7 million, respectively, from our sales of ELOCTATE and ALPROLIX in Japan. In addition to Japan, we continue to make progress in other geographic areas, including Canada, Australia and countries in Latin America.

Intellectual Property

We rely on patents and other proprietary rights to develop, maintain and strengthen our competitive position. We own a number of patents and trademarks throughout the world and have entered into license arrangements relating to various third party patents and technologies.

11

Patents

Patents are important to obtaining and protecting exclusivity in our products and product candidates. We regularly seek patent protection in the U.S. and in selected countries outside of the U.S. for inventions originating from our research and development efforts. In addition, we license rights from others to various patents and patent applications.

U.S. patents, as well as most non‑U.S. patents, are generally effective for 20 years from the date the earliest application was filed; however, U.S. patents that issue on applications filed before June 8, 1995 may be effective until 17 years from the issue date, if that is later than the 20 year date. In some cases, the patent term may be extended to recapture a portion of the term lost during regulatory review of the claimed therapeutic, and in the case of the United States, also because of U.S. Patent and Trademark Office (USPTO) delays in prosecuting the application. Specifically, in the U.S., under the Drug Price Competition and Patent Term Restoration Act of 1984, commonly known as the Hatch‑Waxman Act, a patent that covers a U.S. Food and Drug Administration (FDA) approved drug may be eligible for patent term extension (for up to five years, but not beyond a total of 14 years from the date of product approval) as compensation for patent term lost during the FDA regulatory review process, but only one patent per approved drug product may be so extended. The duration and extension of the term of foreign patents varies, in accordance with local law.

Our patent portfolio includes issued patents and pending applications relating to our marketed products and our product pipeline. We hold patents for ELOCTATE and ALPROLIX that cover the composition of matter and methods of treatment of those therapies. Patents of primary importance to ELOCTATE and ALPROLIX have issued in the United States, Europe and Japan, and based on the applicable patent statutes and in the ordinary course, generally expire between 2024 and 2032. We also continue to pursue additional patents and patent term extensions in the United States and other territories covering various aspects of our products that may, if issued, extend exclusivity beyond the expiration of these patents.

The existence of patents does not guarantee our right to practice the patented technology or commercialize the patented product. Patents relating to biopharmaceutical and biotechnology products, compounds and processes, such as those that cover our existing compounds, products and processes and those that we will likely file in the future, do not always provide complete or adequate protection. Our patents may be invalidated earlier based on a competitor’s challenge in an applicable patent office or court proceeding.

Regulatory Exclusivity

In addition to patent protection, certain of our products are entitled to regulatory exclusivity which may consist of regulatory data protection and market protection. The expected expiration of this regulatory exclusivity in the United States and the European Union is set forth below:

|

|

|

|

|

Expected |

|

Product |

|

Territory |

|

Expiration |

|

ELOCTATE |

|

United States |

|

2026 |

|

ELOCTA(1) |

|

European Union |

|

2025 |

|

ALPROLIX |

|

United States |

|

2026 |

|

ALPROLIX(1) |

|

European Union |

|

2026(2) |

|

(1) |

Sobi has assumed responsibility for commercializing ELOCTA and ALPROLIX in Sobi’s commercialization territory pursuant to our development and commercialization agreement with Sobi. |

|

(2) |

This date has the potential to be extended by two years subject to EMA review and certification of activities conducted under our pediatric investigational plan. |

Regulatory data protection provides to the holder of a drug or biologic marketing authorization, for a set period of time, the exclusive use of the proprietary preclinical and clinical data that it created at significant cost and submitted

12

to the applicable regulatory authority to obtain approval of its product. After the applicable set period of time, third parties are then permitted to rely upon our data to file for approval of their abbreviated applications for, and to market (subject to any applicable market protection), their generic drugs and biosimilars referencing our data. Market protection provides to the holder of a drug or biologic marketing authorization the exclusive right to commercialize its product for a set period of time, thereby preventing the commercialization of another product containing the same active ingredient(s) during that period. Although the World Trade Organization’s agreement on trade‑related aspects of intellectual property rights requires signatory countries to provide regulatory exclusivity to innovative pharmaceutical products, implementation and enforcement varies widely from country to country. In the United States, biologics, such as ELOCTATE and ALPROLIX, are entitled to exclusivity under the Biologics Price Competition and Innovation Act, which was passed on March 23, 2010 as Title VII to the Patient Protection and Affordable Care Act (PPACA). PPACA provides a pathway for approval of biosimilars following the expiration of 12 years of exclusivity for the innovator biologic and a potential additional 180 day‑extension term for conducting pediatric studies. Under this framework, FDA cannot make a product approval effective for any biosimilar application until at least 12 years after the reference product’s date of first licensure. The PPACA also includes an extensive process for the innovator biologic and biosimilar manufacturer to litigate patent infringement, validity, and enforceability prior to the approval of the biosimilar. The PPACA does not, however, change the duration of patents granted on biologic products.

Japan also provides for market exclusivity through a re‑examination system, which prevents the entry of generics and biosimilars until the end of the re‑examination period (REP), which can be up to eight years from marketing approval. ELOCTATE and ALPROLIX are expected to have REPs ending in 2022.

Other Proprietary Rights

We also rely upon other forms of unpatented confidential information to remain competitive. We protect such information principally through confidentiality and non‑use agreements with our employees, consultants, outside scientific collaborators and scientists whose research we sponsor and other advisers. In the case of our employees, these agreements also provide, in compliance with relevant law, that inventions and other intellectual property conceived by such employees during their employment shall be our exclusive property.

Our trademarks are important to us and are generally covered by trademark applications or registrations in the USPTO and the patent or trademark offices of other countries. Trademark protection varies in accordance with local law, and continues in some countries as long as the trademark is used and in other countries as long as the trademark is registered. Trademark registrations generally are for fixed but renewable terms.

Litigation, interferences, oppositions, inter partes reviews or other proceedings are, have been and may in the future be necessary in some instances to determine the validity and scope of certain of our patents, regulatory exclusivities or other proprietary rights, and in other instances to determine the validity, scope or non‑infringement of certain patent rights claimed by others to be pertinent to the manufacture, use or sale of our products. We may also face challenges to our patents, regulatory exclusivities and other proprietary rights covering our products by manufacturers of generic drugs and biosimilars. A discussion of certain risks and uncertainties that may affect our patent position, regulatory exclusivities and other proprietary rights is set forth in Item 1A. Risk Factors.

Manufacturing and Facilities

ELOCTATE and ALPROLIX are currently manufactured at Biogen‑owned facilities located in North Carolina. The manufacturing process for bulk drug substance includes protein production, purification and viral clearance. Manufacture and supply of drug product, which includes fill finish, labeling and packaging, are provided primarily through third party contract manufacturing organizations.

In connection with our separation from Biogen, we entered into a manufacturing and supply agreement with Biogen for hemophilia products, pursuant to which Biogen manufactures and supplies, exclusively for us, drug substance, drug product and finished goods with respect to ELOCTATE and ALPROLIX, as well as for certain of our pipeline product candidates. Fill finish, label and packaging, distribution and logistics services for ELOCTATE and ALPROLIX drug product are being provided by Biogen directly or through third party contract manufacturing

13

organizations. Additionally, we have increased and continue to increase our level of direct contractual responsibility with other third party contract manufacturing organizations, logistics providers and distributors as we scale up our internal supply management capabilities.

Our properties include facilities which, in our opinion, are suitable and adequate for development and distribution of our products. For additional information regarding our properties, see Item 2. Properties.

Raw Materials

We rely on Biogen for all supplies and raw materials used in the production of ELOCTATE and ALPROLIX drug substance. We also rely on third party contract manufacturers and suppliers for the materials we require for our clinical trials. A discussion of certain risks and uncertainties that may affect the availability of sufficient quantities of supplies and raw materials is set forth in Item 1A. Risk Factors.

Sales, Marketing and Distribution

We have our own direct sales force. Our products are distributed to and through specialty pharmacies, hemophilia treatment centers, public and private hospitals and independent distributors. For the year ended December 31, 2017, ASD Specialty Healthcare, a specialty distributor, and CVS Health Corporation, a specialty pharmacy, individually represent 16% and 13%, respectively, of total revenues. Our sales, particularly to specialty pharmacies and hemophilia treatment centers, are subject to discounted pricing. See “—Regulatory Matters—Pricing and Reimbursement” below. We review our sales channels from time to time, and from time to time will make changes in our sales and distribution model as we believe necessary to best implement our business plan and strategies.

In the United States, third parties warehouse and ship our products through their distribution centers. These centers are generally stocked with adequate inventories to facilitate prompt customer service. Sales and distribution methods include frequent contact by sales and customer service representatives, automated communications via various electronic purchasing systems, circulation of catalogs and merchandising bulletins, direct‑mail campaigns, trade publication presence and advertising. Our Japanese sales and product distributions are made on a direct basis.

We use and expect to continue to use a variety of collaboration, distribution and other marketing arrangements with one or more third parties to commercialize our products in certain other markets outside of the United States. Under our development and commercialization arrangement with Sobi, for example, Sobi has assumed responsibility for commercializing ELOCTATE and ALPROLIX in its territory. See “—Our Development and Commercialization Arrangements with Sobi” above.

Competition

We face substantial competition from biotechnology, biopharmaceutical and other companies of all sizes, in the United States and other countries, as such competitors continue to expand their manufacturing capacity and sales and marketing channels related to our hemophilia products. Many of our competitors are working to develop products similar to those we are developing or those that we already market. Competition is primarily focused on cost‑effectiveness, price, service, product effectiveness and quality, patient convenience and technological innovation. The introduction of new products by competitors and changes in medical practices and procedures can impact our products. The principal sources of competition for Bioverativ’s marketed products globally are as follows:

|

· |

ELOCTATE: ELOCTATE competes with recombinant Factor VIII products including: |

|

· |

ADVATE® (Antihemophilic Factor (Recombinant))—Shire |

|

· |

ADYNOVATE (Antihemophilic Factor (Recombinant), PEGylated)—Shire |

|

· |

AFSTYLA ® [Antihemophilic Factor (Recombinant) Single Chain]—CSL Behring |

|

· |

HELIXATE® FS (Antihemophilic Factor (Recombinant))—CSL Behring |

|

· |

HEMLIBRA® (emicizumab-kxwh) (for inhibitor patients)—Genentech |

14

|

· |

KOGENATE® FS (Antihemophilic Factor (Recombinant))—Bayer |

|

· |

KOVALTRY® Antihemophilic Factor (Recombinant)—Bayer |

|

· |

NovoEight® (Antihemophilic Factor (Recombinant))—Novo Nordisk |

|

· |

Nuwiq® Recombinant Factor VIII—Octapharma |

|

· |

RECOMBINATE™ (Antihemophilic Factor (Recombinant))—Shire |

|

· |

XYNTHA®/ReFacto AF® (Antihemophilic Factor (Recombinant), Plasma/Albumin‑Free)—Pfizer and Sobi |

|

· |

ALPROLIX: competes with recombinant Factor IX products including: |

|

· |

BENEFIX® (Coagulation Factor IX (Recombinant))—Pfizer |

|

· |

IDELVION® (Coagulation Factor IX (Recombinant), Albumin Fusion Protein)—CSL Behring |

|

· |

IXINITY® (Coagulation Factor IX (Recombinant))—Aptevo |

|

· |

REBINYN® (Coagulation Factor IX (Recombinant), GlycoPEGylated)—Novo Nordisk |

|

· |

RIXUBIS® (Coagulation Factor IX (Recombinant))—Shire |

Our products also compete with a number of plasma derived Factor VIII and IX products. We are also aware of other longer‑acting products and non-factor technologies, such as bi-specific antibodies and gene therapies that are in development and, if successfully developed and approved, would compete with our hemophilia products. New therapies and technologies have the potential to transform the standard of care for hemophilia patients, and our products may be unable to compete successfully with such new therapies and technologies that may be developed and marketed by other companies.

There are additional competitive products or alternative therapy regimens available on a more limited geographic basis throughout the world. For additional information regarding competition, see the discussion of such matters in Item 1A. Risk Factors, including the following: “Risk Factors—Risks Related to Our Business—If our hemophilia products fail to compete effectively, our business and market position would suffer.”

Regulatory Matters

Our operations and products are subject to extensive regulation by numerous government agencies, both within and outside of the United States. The FDA, the EMA, the Ministry of Health, Labour and Welfare in Japan (the MHLW) and other government agencies both inside and outside of the United States, regulate the testing, safety, effectiveness, manufacturing, labeling, promotion and advertising, distribution and post‑market surveillance of our products. We must obtain specific approval from the FDA and non‑U.S. regulatory authorities before we can market and sell our products in a particular country. The requirements and process governing the conduct of clinical trials, product licensing, pricing and reimbursement vary from country to country.

Clinical Trial and Approval Process

The FDA, the EMA and other regulatory agencies promulgate regulations and standards for designing, conducting, monitoring, auditing and reporting the results of clinical trials to ensure that the data and results are accurate and that the rights and welfare of trial participants are adequately protected commonly referred to as current good clinical practices (cGCPs). Regulatory agencies enforce cGCPs through inspections of trial sponsors, principal investigators and trial sites, contract research organizations (CROs), and institutional review boards. If studies fail to comply with applicable cGCPs, the clinical data generated may be deemed unreliable and relevant regulatory agencies may conduct additional audits or require additional clinical trials before approving a marketing application. Noncompliance can also result in civil or criminal sanctions. We rely on third parties, including CROs, to carry out many of our clinical trial‑related activities. Failure of such third parties to comply with cGCPs can likewise result in rejection of our clinical trial data or other sanctions.

Before new products may be sold in the United States, preclinical studies and clinical trials of the products must be conducted and the results submitted to the FDA for approval. With limited exceptions, the FDA requires companies

15

to register both pre‑approval and post‑approval clinical trials and disclose clinical trial results in public databases. Failure to register a trial or disclose study results within the required time periods could result in penalties, including civil monetary penalties. To support marketing approval, clinical trial programs must establish a product candidate’s efficacy, determine an appropriate dose and dosing regimen and define the conditions for safe use. This is a high‑risk process that requires stepwise clinical studies, usually conducted in three phases, in which the candidate product must successfully meet predetermined endpoints. The results of the preclinical and clinical testing of a product are then submitted to the FDA in the form of a marketing application. In response to a marketing application, the FDA may grant marketing approval, request additional information or deny the application if it determines the application does not provide an adequate basis for approval.

Product development and receipt of regulatory approval takes a number of years, involves the expenditure of substantial resources and depends on a number of factors, including the severity of the disease in question, the availability of alternative treatments, potential safety signals observed in preclinical or clinical tests and the risks and benefits of the product as demonstrated in clinical trials. Many research and development programs do not result in the commercialization of a product. The FDA has substantial discretion in the product approval process, and it is impossible to predict with any certainty whether and when the FDA will grant marketing approval, or whether an approval, if granted, will be subject to limitations based on the FDA’s interpretation of the relevant pre‑clinical or clinical data. The agency also may require the sponsor of a marketing application to conduct additional clinical studies or to provide other scientific or technical information about the product, and these additional requirements may lead to unanticipated delay or expense.

Most non‑U.S. jurisdictions have product approval and post‑approval regulatory processes that are similar in principle to those in the United States. In Europe, for example, there are several tracks for marketing approval, depending on the type of product for which approval is sought. Under the centralized procedure in Europe, a company submits a single application to the EMA that is similar to the marketing application in the United States. A marketing application approved by the EC is valid in all member states. In addition to the centralized procedure, Europe also has various other methods for submitting applications and receiving approvals. Regardless of the approval process employed, various parties share responsibilities for the monitoring, detection and evaluation of adverse events post‑approval, including national authorities, the EMA, the EC and the marketing authorization holder. In some regions, it is possible to receive an “accelerated” review whereby the national regulatory authority will commit to truncated review timelines for products that meet specific medical needs.

Under the U.S. Orphan Drug Act, the FDA may grant orphan drug designation to biologics intended to treat a “rare disease or condition,” which generally is a disease or condition that affects fewer than 200,000 individuals in the United States. If a product which has an orphan drug designation subsequently receives the first FDA approval for the indication for which it has such designation, the product is entitled to orphan exclusivity. This means that the FDA may not approve any other applications to market the same drug for the same indication for a period of seven years following marketing approval, except in certain very limited circumstances, such as if the later product is shown to be clinically superior to the orphan product. Legislation similar to the U.S. Orphan Drug Act has been enacted in other countries to encourage the research, development and marketing of medicines to treat, prevent or diagnose rare diseases. In the European Union, medicinal products intended for diagnosis, prevention or treatment of life‑threatening or very serious diseases affecting less than five in 10,000 people receive 10‑year market exclusivity, protocol assistance, and access to the centralized procedure for marketing authorization. ELOCTATE and ALPROLIX have each received an orphan drug designation in the United States and have received orphan exclusivity through June 2021 and March 2021, respectively. ALPROLIX has also received an orphan drug designation in the European Union.

Biologic products may be subject to increased competition from biosimilar formulations of reference biologic products in the future. The complex nature of biologic products has warranted the creation of biosimilar regulatory approval pathways with strict, science‑based approval standards that take into account patient safety considerations. These biosimilar approval pathways are considered to be more abbreviated than for new biologics, although they are significantly different from the abbreviated approval pathways available for “generic drugs” (small‑molecule drugs that are the same as, and bioequivalent to, an already‑approved small molecule drug). The European Union has created a pathway for the approval of biosimilars, and has published guidance for approval of certain biosimilar products. More recently, in 2010, the PPACA authorized the FDA to approve biosimilars, but only a small number of biosimilars have

16

been approved by the FDA to date and the U.S. approval pathway for biosimilars remains subject to ongoing guidance from the FDA. While mature pathways for regulatory approval of generic drugs and healthcare systems exist around the globe that support and promote the substitutability of generic drugs, the approval pathways for biosimilar products remain in various stages of development, as do private and public initiatives or actions supporting the substitutability of biosimilar products. Thus, the extent to which biosimilars will be viewed as readily substitutable, and in practice readily substituted, for the reference biologic product is largely yet to be determined.

Post‑Approval Requirements

The FDA may require a sponsor to conduct additional post‑marketing studies as a condition of approval to provide data on safety and effectiveness. If a sponsor fails to conduct the required studies, the agency may withdraw its approval. In addition, if the FDA concludes that a product that has been shown to be effective can be safely used only if distribution or use is restricted, it can mandate post‑marketing restrictions as necessary to assure safe use. These may include requiring the sponsor to establish rigorous systems, such as risk evaluation and mitigation strategies (REMS), to assure use of the product under safe conditions. The FDA can impose financial penalties for failing to comply with certain post‑marketing commitments, including REMS. In addition, any changes to approved REMS must be reviewed and approved by the FDA prior to implementation.

Changes to approved products, such as adding an indication, making certain manufacturing changes, or changing manufacturers or suppliers of certain ingredients or components, may be subject to rigorous review, including multiple regulatory submissions, and approvals are not certain. For example, to obtain a new indication, a company must demonstrate with additional clinical data that the product is safe and effective for the new use. FDA regulatory review may result in denial or modification of the planned changes, or requirements to conduct additional tests or evaluations that can substantially delay or increase the cost of the planned changes.

Even after a company obtains regulatory approval to market a product, the product and the company’s manufacturing processes and quality systems are subject to continued review by the FDA and other regulatory authorities globally. We and our contract manufacturers also must adhere to current good manufacturing practices (cGMPs) and product‑specific regulations enforced by regulatory agencies both before and after product approval. Regulatory agencies regulate and inspect equipment, facilities and processes used in the manufacturing and testing of products prior to approving a product, as well as periodically following the initial approval of a product. If, as a result of these inspections, it is determined that our equipment, facilities or processes or that of our manufacturers do not comply with applicable regulations and conditions of product approval, we may face civil, criminal or administrative sanctions or remedies, including significant financial penalties and the suspension of our manufacturing operations.

Manufacturers are also required to monitor information on side effects and adverse events reported during clinical studies and after marketing approval and report such information and events to regulatory agencies. Non‑compliance with the FDA’s safety reporting requirements may result in civil or criminal penalties. Side effects or adverse events that are reported during clinical trials can delay, impede or prevent marketing approval. Based on new safety information that emerges after approval, the FDA can mandate product labeling changes, impose a new REMS or the addition of elements to an existing REMS, require new post‑marketing studies (including additional clinical trials) or suspend or withdraw approval of the product. These requirements may affect a company’s ability to maintain marketing approval of its products or require a company to make significant expenditures to obtain or maintain such approvals.

Pricing and Reimbursement

In both U.S. and non‑U.S. markets, sales of our products depend, in part, on the availability and amount of reimbursement by third party payors, including governments, private health plans and other organizations. Substantial uncertainty exists regarding the coverage, pricing and reimbursement of our products. Governments may regulate coverage, reimbursement and pricing of our products to control healthcare cost or affect utilization of the products. The U.S. and non‑U.S. governments have enacted and regularly consider additional reform measures that affect health care and drug coverage and costs. Private health plans may also seek to manage cost and utilization by implementing coverage and reimbursement limitations. Other payors, including managed care organizations, health insurers, pharmacy benefit managers, government health administration authorities and private health insurers, seek price discounts or

17

rebates in connection with the placement of our products on their formularies and, in some cases, the imposition of restrictions on access or coverage of particular drugs or pricing determined based on perceived value.

Within the United States

|

· |

Medicaid: Medicaid is a joint federal and state program that is administered by the states for low‑income and disabled beneficiaries. Under the Medicaid Drug Rebate Program, we are required to pay a rebate for each unit of product reimbursed by the state Medicaid programs. For most brand name drugs, the amount of the basic rebate for each product is set by law as 17.1% for clotting factors and certain other products of the average manufacturer price (AMP) or the difference between AMP and the best price available from us to any customer (with limited exceptions). The rebate amount must be adjusted upward if AMP increases more than inflation (measured by the Consumer Price Index—Urban) from launch of the product. This adjustment can cause the total rebate amount to exceed the minimum 17.1% basic rebate amount. The rebate amount is calculated each quarter based on our report of current AMP and best price for each of our products to the Centers for Medicare & Medicaid Services (CMS). The requirements for calculating AMP and best price are complex. We are required to report any revisions to AMP or best price previously reported within a certain period, which revisions could affect our rebate liability for prior quarters. In addition, if we fail to provide information timely or are found to have knowingly submitted false information to the government, the statute governing the Medicaid Drug Rebate Program provides for civil monetary penalties. |

|

· |

Medicare: Medicare is a federal program that is administered by the federal government and covers individuals age 65 and over, as well as those with certain disabilities. Medicare Part B generally covers drugs that must be administered by physicians or other health care practitioners; are provided in connection with certain durable medical equipment; or certain oral anti‑cancer drugs and certain oral immunosuppressive drugs. Clotting factors for hemophilia are typically paid under Medicare Part B. Medicare Part B pays for such drugs under a payment methodology based on the average sales price (ASP) of the drugs. Manufacturers, including us, are required to provide ASP information to the CMS on a quarterly basis. The manufacturer‑submitted information is used to calculate Medicare payment rates. For drugs administered outside the hospital outpatient setting, the current payment rate for Medicare Part B drugs is ASP plus six percent (4.3% after sequestration). The payment rates for drugs in the hospital outpatient setting are subject to periodic adjustment. If a manufacturer is found to have made a misrepresentation in the reporting of ASP, the governing statute provides for civil monetary penalties. |

Medicare Part D provides coverage to enrolled Medicare patients for self‑administered drugs (i.e., drugs that are not administered by a physician). Medicare Part D is administered by private prescription drug plans approved by the U.S. government and each drug plan establishes its own Medicare Part D formulary for prescription drug coverage and pricing, which the drug plan may modify from time‑to‑time. The prescription drug plans negotiate pricing with manufacturers and may condition formulary placement on the availability of manufacturer discounts. In addition, manufacturers, including us, are required to provide to CMS a 50% discount on brand name prescription drugs utilized by Medicare Part D beneficiaries when those beneficiaries reach the coverage gap in their drug benefits.

|

· |

Federal Agency Discounted Pricing: Our products are subject to discounted pricing when purchased by federal agencies via the Federal Supply Schedule (FSS). FSS participation is required for our products to be covered and reimbursed by the Veterans Administration (VA), Department of Defense, Coast Guard and the U.S. Public Health Service (PHS). Coverage under Medicaid, Medicare and the PHS pharmaceutical pricing program is also conditioned upon FSS participation. FSS pricing is intended not to exceed the price that we charge our most‑favored non‑federal customer for a product. In addition, prices for drugs purchased by the VA, Department of Defense (including drugs purchased by military personnel and dependents through the TriCare retail pharmacy program), Coast Guard and PHS are subject to a cap on pricing equal to 76% of the non‑federal average manufacturer price (non‑FAMP). An additional discount applies if non‑FAMP increases more than inflation (measured by the Consumer Price Index—Urban). In addition, if we fail to provide information timely or are found to have knowingly submitted false information to the government, the governing statute provides for civil monetary penalties. |

18

|

· |

340B Discounted Pricing: To maintain coverage of our products under the Medicaid Drug Rebate Program and Medicare Part B, we are required to extend significant discounts to certain covered entities that purchase products under Section 340B of the PHS pharmaceutical pricing program. Purchasers eligible for discounts include hospitals that serve a disproportionate share of financially needy patients, community health clinics, hemophilia treatment centers and other entities that receive certain types of grants under the Public Health Service Act. For all of our products, we must agree to charge a price that will not exceed the amount determined under statute (the “ceiling price”) when we sell outpatient drugs to these covered entities. In addition, we may, but are not required to, offer these covered entities a price lower than the 340B ceiling price. The 340B discount formula is based on AMP and is generally similar to the level of rebates calculated under the Medicaid Drug Rebate Program. |

Outside of the United States

Outside of the United States, products are paid for by a variety of payors, with governments being the primary source of payment. Governments may determine or influence reimbursement of products. Governments may also set prices or otherwise regulate pricing. Negotiating prices with governmental authorities can delay commercialization of our products. Governments may use a variety of cost‑containment measures to control the cost of products, including price cuts, mandatory rebates, “value‑based pricing” and reference pricing (i.e., referencing prices in other countries and using those reference prices to set a price). Budgetary pressures in many countries, including in the European Union, are continuing to cause governments to consider or implement various cost‑containment measures, such as price freezes, increased price cuts and rebates and expanded generic substitution and patient cost‑sharing.

Japanese Regulatory Matters

In Japan, the MHLW is responsible for regulating biological and pharmaceutical products under the Pharmaceuticals and Medical Devices Law, which provides a regulatory framework similar to that of the United States. Specifically, with regard to the clinical trial and approval process, before a new biological product may be sold in Japan, clinical trials must be conducted for the product of which the MHLW and the Pharmaceuticals and Medical Devices Agency (PMDA), a governmental organization authorized by the MHLW, must be notified. For the product to be approved, the results of such clinical trials must then be submitted to the PMDA. Approved products are subject to regulatory requirements similar to those of the United States, including (i) the possibility of the MHLW requiring post‑marketing studies to gather data on a product’s safety and efficacy as a condition for approval, (ii) re‑examination of the approved product within a specific time period following approval (e.g., 8 years for a new product) to verify its safety and efficacy and (iii) the reporting of any adverse event to the PMDA. With regard to pricing and reimbursement, Japan has a single health insurance system (National Health Insurance), under which drugs are provided to patients at a price designated by the MHLW in its discretion after negotiations between the applicable biopharmaceutical company and the MHLW under the National Health Insurance Act.

Other Laws

We and our products are also subject to various other regulatory regimes both inside and outside of the United States. Various laws, regulations and recommendations relating to data privacy and protection, safe working conditions, laboratory practices, the experimental use of animals, and the purchase, storage, movement, import, export and use and disposal of hazardous or potentially hazardous substances, including radioactive compounds and infectious disease agents, used in connection with our research work are or may be applicable to our activities. In the United States alone, we are subject to the oversight of the FDA, the Office of the Inspector General within the Department of Health and Human Services, the CMS, the Department of Justice, the Environmental Protection Agency, the Department of Defense and Customs and Border Protection, in addition to others. In jurisdictions outside of the United States, our activities are subject to regulation by government agencies including the EMA in Europe, and other agencies in other jurisdictions. Many of the agencies enforcing these laws have increased their enforcement activities with respect to healthcare companies in recent years. These actions appear to be part of a general trend toward increased enforcement activity globally. In addition, certain agreements entered into by us involving exclusive license rights may be subject to national or international antitrust regulatory control, the effect of which cannot be predicted. The extent of government regulation, which might result from future legislation or administrative action, cannot accurately be predicted.

19

Patient Engagement, Patient Access and Humanitarian Aid

We interact with patients, advocacy organizations and healthcare societies in order to gain insights into unmet needs, particularly in the hemophilia treatment community. The insights gained from these engagements help develop services, programs and applications that are designed to help patients lead better lives.

We are dedicated to helping patients obtain access to our therapies. For example, we provide charitable contributions that may assist eligible patients to receive our products. We have also continued our commitment, together with Sobi, to donate up to one billion international units (IUs) of clotting factor therapy for humanitarian use over a ten-year period, of which up to 500 million IUs will be donated to the WFH over a period of five years. We are responsible for half of the committed donation. Through the end of 2017, we have donated over 262 million of IUs, treating over 15,000 people in the developing world.

Employees

We employ approximately 460 persons as of December 31, 2017. We believe that we have good relations with our employees.

Environmental Matters

Our environmental policies require compliance with all applicable environmental regulations and contemplate, among other things, appropriate capital expenditures for environmental protection. While it is impossible to predict accurately the future costs associated with environmental compliance and potential remediation activities, compliance with environmental laws is not expected to require significant capital expenditures and has not had, and is not expected to have, a material adverse effect on our operations or competitive position.

Available Information