Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Western Union CO | a991earningsrelease123117.htm |

| 8-K - 8-K - Western Union CO | a2017q4earningsrelease8-k.htm |

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

Mike Salop

Senior Vice President, Investor Relations

2

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

Safe Harbor

This presentation contains certain statements that are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are not guarantees of future

performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Actual outcomes and results may differ materially from those expressed in, or implied by, our forward-

looking statements. Words such as "expects," "intends," "anticipates," "believes," "estimates," "guides," "provides guidance," "provides outlook" and other similar expressions or future or conditional

verbs such as "may," "will," "should," "would," "could," and "might" are intended to identify such forward-looking statements. Readers of this presentation of The Western Union Company (the

"Company," "Western Union," "we," "our" or "us") should not rely solely on the forward-looking statements and should consider all uncertainties and risks discussed in the "Risk Factors" section and

throughout the Annual Report on Form 10-K for the year ended December 31, 2016. The statements are only as of the date they are made, and the Company undertakes no obligation to update any

forward-looking statement.

Possible events or factors that could cause results or performance to differ materially from those expressed in our forward-looking statements include the following: (i) events related to our business and

industry, such as: changes in general economic conditions and economic conditions in the regions and industries in which we operate, including global economic and trade downturns, or significantly

slower growth or declines in the money transfer, payment service, and other markets in which we operate, including downturns or declines related to interruptions in migration patterns, or non-

performance by our banks, lenders, insurers, or other financial services providers; failure to compete effectively in the money transfer and payment service industry, including among other things, with

respect to price, with global and niche or corridor money transfer providers, banks and other money transfer and payment service providers, including electronic, mobile and Internet-based services,

card associations, and card-based payment providers, and with digital currencies and related protocols, and other innovations in technology and business models; political conditions and related actions

in the United States and abroad which may adversely affect our business and economic conditions as a whole, including interruptions of United States or other government relations with countries in

which we have or are implementing significant business relationships with agents or clients; deterioration in customer confidence in our business, or in money transfer and payment service providers

generally; our ability to adopt new technology and develop and gain market acceptance of new and enhanced services in response to changing industry and consumer needs or trends; changes in, and

failure to manage effectively, exposure to foreign exchange rates, including the impact of the regulation of foreign exchange spreads on money transfers and payment transactions; any material breach

of security, including cybersecurity, or safeguards of or interruptions in any of our systems or those of our vendors or other third parties; cessation of or defects in various services provided to us by third-

party vendors; mergers, acquisitions and integration of acquired businesses and technologies into our Company, and the failure to realize anticipated financial benefits from these acquisitions, and

events requiring us to write down our goodwill; failure to manage credit and fraud risks presented by our agents, clients and consumers; failure to maintain our agent network and business relationships

under terms consistent with or more advantageous to us than those currently in place, including due to increased costs or loss of business as a result of increased compliance requirements or difficulty

for us, our agents or their subagents in establishing or maintaining relationships with banks needed to conduct our services; decisions to change our business mix; changes in tax laws, or their

interpretation, including with respect to the Tax Act and potential related state income tax impacts, and unfavorable resolution of tax contingencies; adverse rating actions by credit rating agencies; our

ability to realize the anticipated benefits from business transformation, productivity and cost-savings, and other related initiatives, which may include decisions to downsize or to transition operating

activities from one location to another, and to minimize any disruptions in our workforce that may result from those initiatives; our ability to protect our brands and our other intellectual property rights

and to defend ourselves against potential intellectual property infringement claims; our ability to attract and retain qualified key employees and to manage our workforce successfully; material changes

in the market value or liquidity of securities that we hold; restrictions imposed by our debt obligations; (ii) events related to our regulatory and litigation environment, such as: liabilities or loss of

business resulting from a failure by us, our agents or their subagents to comply with laws and regulations and regulatory or judicial interpretations thereof, including laws and regulations designed to

protect consumers, or detect and prevent money laundering, terrorist financing, fraud and other illicit activity; increased costs or loss of business due to regulatory initiatives and changes in laws,

regulations and industry practices and standards, including changes in interpretations in the United States, the European Union and globally, affecting us, our agents or their subagents, or the banks with

which we or our agents maintain bank accounts needed to provide our services, including related to anti-money laundering regulations, anti-fraud measures, our licensing arrangements, customer due

diligence, agent and subagent due diligence, registration and monitoring requirements, consumer protection requirements, remittances, and immigration; liabilities, increased costs or loss of business

and unanticipated developments resulting from governmental investigations and consent agreements with or enforcement actions by regulators, including those associated with the settlement

agreements with the United States Department of Justice, certain United States Attorney's Offices, the United States Federal Trade Commission, the Financial Crimes Enforcement Network of the United

States Department of Treasury, and various state attorneys general, and those associated with the January 4, 2018 consent order which resolved a matter with the New York State Department of

Financial Services; liabilities resulting from litigation, including class-action lawsuits and similar matters, and regulatory actions, including costs, expenses, settlements and judgments; failure to comply

with regulations and evolving industry standards regarding consumer privacy and data use and security, including with respect to the General Data Protection Regulation approved by the European

Union; the ongoing impact on our business from the Dodd-Frank Wall Street Reform and Consumer Protection Act, as well as regulations issued pursuant to it and the actions of the Consumer Financial

Protection Bureau and similar legislation and regulations enacted by other governmental authorities in the United States and abroad related to consumer protection; effects of unclaimed property laws

or their interpretation or the enforcement thereof; failure to maintain sufficient amounts or types of regulatory capital or other restrictions on the use of our working capital to meet the changing

requirements of our regulators worldwide; changes in accounting standards, rules and interpretations or industry standards affecting our business; and (iii) other events, such as: adverse tax

consequences from our spin-off from First Data Corporation; catastrophic events; and management's ability to identify and manage these and other risks.

3

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

Hikmet Ersek

President & Chief Executive Officer

4

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

Solid business performance in the fourth quarter

• Revenue growth accelerated to 5%, or 4% on a

constant currency basis*

• Improved trends in consumer money transfer

• Westernunion.com money transfer revenues increased 22%

• Strong growth from bill payments businesses

• Declines in Business Solutions

Overview

5

*Note: See appendix for reconciliation of Non-GAAP to GAAP financial measures.

Returned more than $800 million to shareholders in 2017

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

2018 strategic plans

• Drive digital expansion in consumer money transfer

• Optimize customer experience in retail money transfer

• Implement new go-to-market strategies in payments

businesses and leverage digital platforms

Overview

6

Generate operating efficiencies to fuel long-term growth

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

Raj Agrawal

Executive Vice President & Chief Financial Officer

7

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

Consolidated revenues of $1.4 billion increased 5% compared

to the prior year period, or 4% constant currency*

*Note: See appendix for reconciliation of Non-GAAP to GAAP financial measures.

Revenue

8

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

80% of Company revenue

Revenue increased 5% on a reported

basis and 4% constant currency*

Total transactions increased 3%

Cross-border principal increased 6%, or

4% constant currency*

*Note: See appendix for reconciliation of Non-GAAP to GAAP financial measures.

Consumer-to-Consumer Q4

9

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

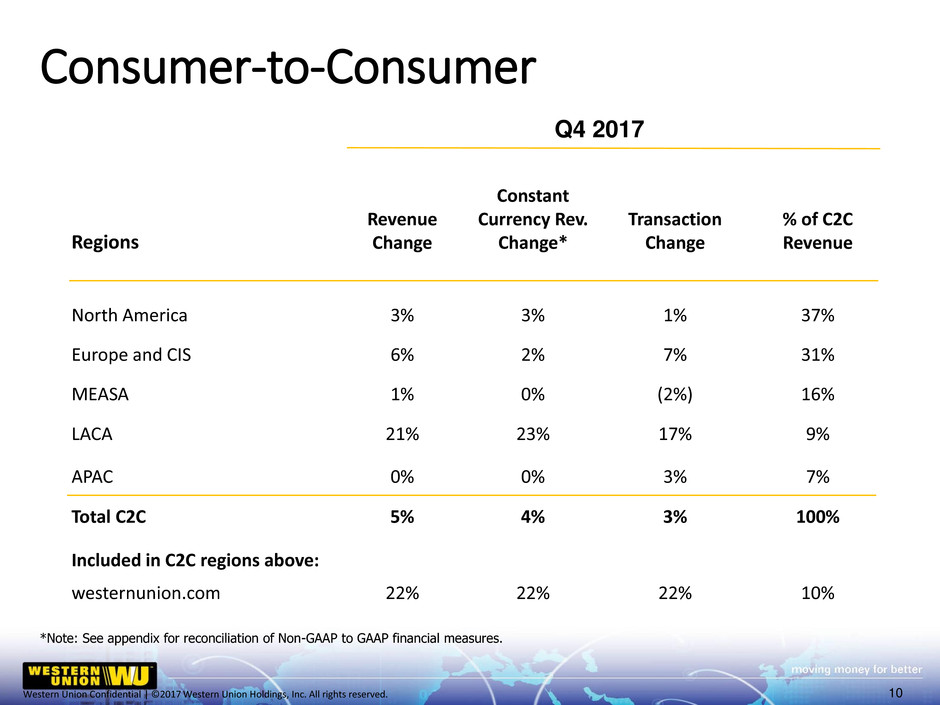

Regions

Revenue

Change

Constant

Currency Rev.

Change*

Transaction

Change

% of C2C

Revenue

North America 3% 3% 1% 37%

Europe and CIS 6% 2% 7% 31%

MEASA 1% 0% (2%) 16%

LACA 21% 23% 17% 9%

APAC 0% 0% 3% 7%

Total C2C 5% 4% 3% 100%

Included in C2C regions above:

westernunion.com 22% 22% 22% 10%

Q4 2017

Consumer-to-Consumer

*Note: See appendix for reconciliation of Non-GAAP to GAAP financial measures.

10

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

Business Solutions (B2B)

6% of Company revenue

Revenue decreased 4%, or declined

8% constant currency*

Other (primarily bill payments

businesses in the U.S. & Argentina)

14% of Company revenue

Revenue increased 11%, or 14%

constant currency*

*Note: See appendix for reconciliation of Non-GAAP to GAAP financial measures.

Business Solutions and Other Q4

11

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

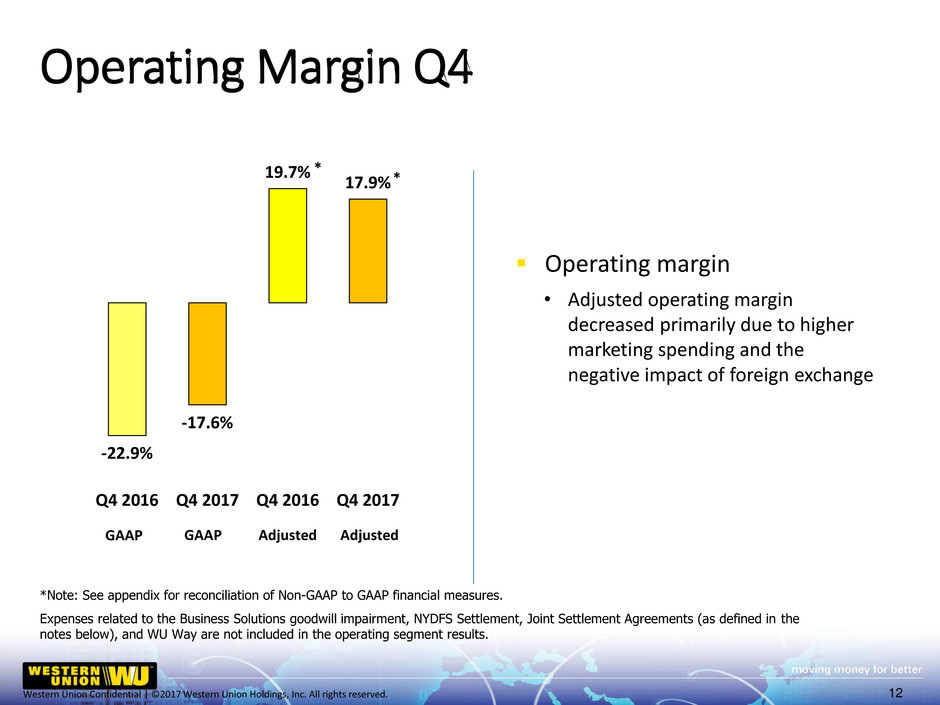

Operating Margin Q4

Operating margin

• Adjusted operating margin

decreased primarily due to higher

marketing spending and the

negative impact of foreign exchange

*Note: See appendix for reconciliation of Non-GAAP to GAAP financial measures.

Expenses related to the Business Solutions goodwill impairment, NYDFS Settlement, Joint Settlement Agreements (as defined in the

notes below), and WU Way are not included in the operating segment results.

12

-22.9%

-17.6%

19.7%

17.9%

-30.0%

-25.0%

-20.0%

-15.0%

-10.0%

-5.0%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

Q4 2016 Q4 2017 Q4 2016 Q4 2017

Adjusted GAAP

*

*

Adjusted GAAP

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

C2C Operating Margin Q4

13

Operating margin

• Decreased due to higher marketing

spending and the negative impact

of foreign exchange, partially offset

by a lower average commission

rate and decreased technology

expenses

22.8%

21.4%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

Q4 2016 Q4 2017

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

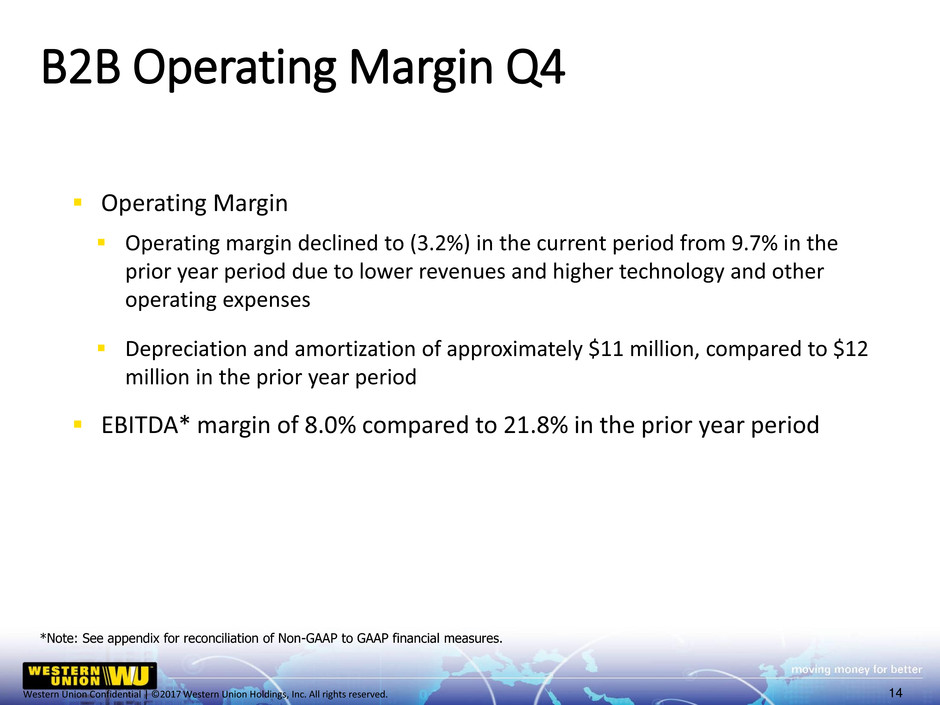

Operating Margin

Operating margin declined to (3.2%) in the current period from 9.7% in the

prior year period due to lower revenues and higher technology and other

operating expenses

Depreciation and amortization of approximately $11 million, compared to $12

million in the prior year period

EBITDA* margin of 8.0% compared to 21.8% in the prior year period

*Note: See appendix for reconciliation of Non-GAAP to GAAP financial measures.

B2B Operating Margin Q4

14

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

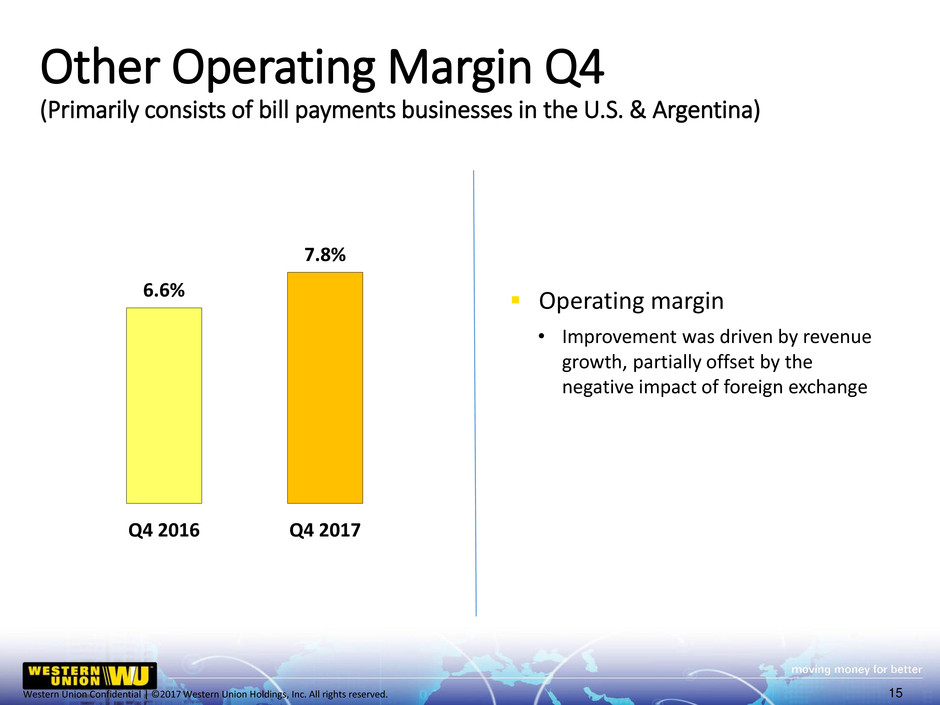

Operating margin

• Improvement was driven by revenue

growth, partially offset by the

negative impact of foreign exchange

Other Operating Margin Q4

(Primarily consists of bill payments businesses in the U.S. & Argentina)

15

6.6%

7.8%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

Q4 2016 Q4 2017

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

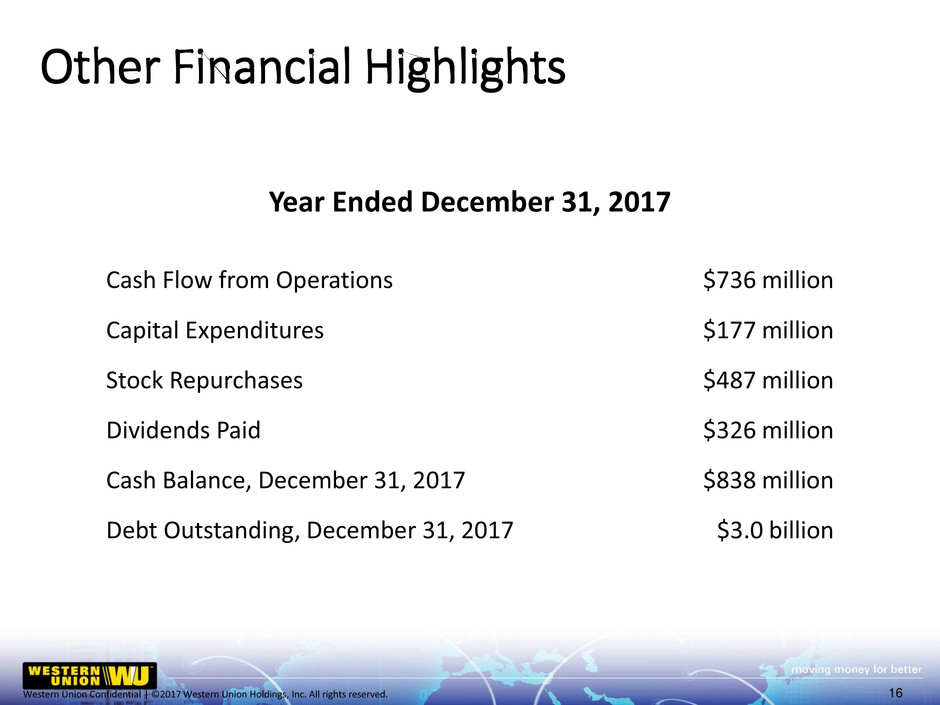

Year Ended December 31, 2017

Cash Flow from Operations $736 million

Capital Expenditures $177 million

Stock Repurchases $487 million

Dividends Paid $326 million

Cash Balance, December 31, 2017 $838 million

Debt Outstanding, December 31, 2017 $3.0 billion

Other Financial Highlights

16

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

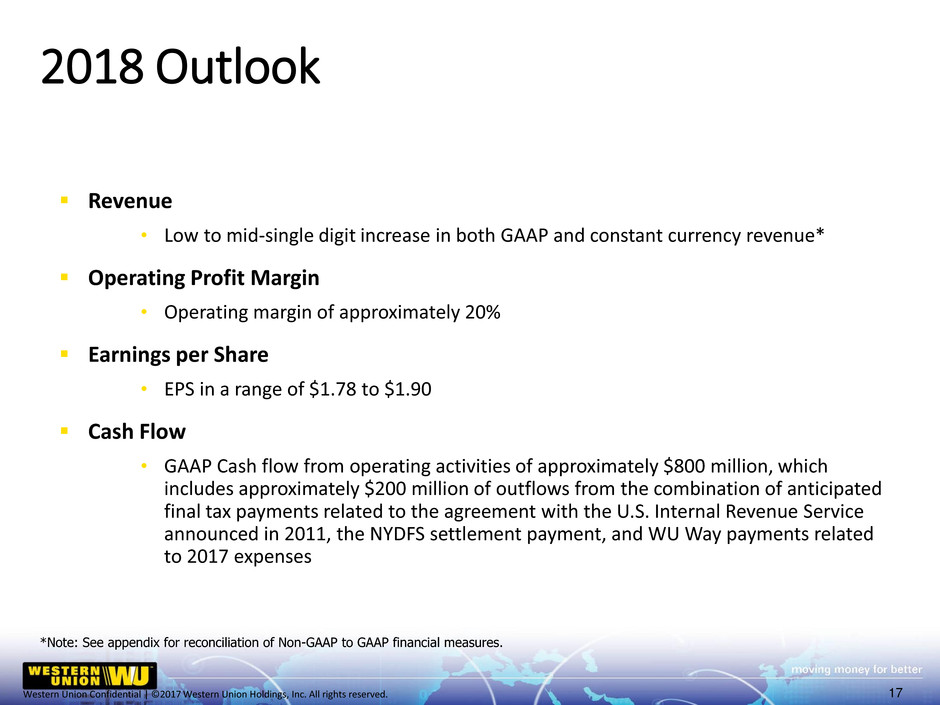

Revenue

• Low to mid-single digit increase in both GAAP and constant currency revenue*

Operating Profit Margin

• Operating margin of approximately 20%

Earnings per Share

• EPS in a range of $1.78 to $1.90

Cash Flow

• GAAP Cash flow from operating activities of approximately $800 million, which

includes approximately $200 million of outflows from the combination of anticipated

final tax payments related to the agreement with the U.S. Internal Revenue Service

announced in 2011, the NYDFS settlement payment, and WU Way payments related

to 2017 expenses

2018 Outlook

17

*Note: See appendix for reconciliation of Non-GAAP to GAAP financial measures.

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

Questions & Answers

18

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

Fourth Quarter 2017 Earnings

Webcast & Conference Call

Appendix

19

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved. Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved.

Non-GAAP Measures

20

Western Union's management believes the non-GAAP financial measures presented provide meaningful supplemental information regarding our

operating results to assist management, investors, analysts, and others in understanding our financial results and to better analyze trends in our

underlying business, because they provide consistency and comparability to prior periods.

These non-GAAP financial measures include revenue change constant currency adjusted; operating margin, excluding the Goodwill impairment,

NYDFS Settlement (as defined in the notes below), Joint Settlement Agreements (as defined in the notes below) and WU Way business transformation

expenses; EBITDA margin; adjusted EBITDA margin, excluding the Goodwill impairment, NYDFS Settlement, Joint Settlement Agreements and WU

Way business transformation expenses; diluted EPS, excluding the Goodwill impairment, NYDFS Settlement, Joint Settlement Agreements, WU Way

business transformation expenses and Tax Act (as defined in the notes below); effective tax rate, excluding the Goodwill impairment, NYDFS

Settlement, Joint Settlement Agreements, WU Way business transformation expenses and Tax Act; Consumer-to-Consumer segment revenue change,

constant currency adjusted; Consumer-to-Consumer segment principal per transaction change, constant currency adjusted; Consumer-to-Consumer

segment cross-border principal change, constant currency adjusted; Consumer-to-Consumer segment region and westernunion.com revenue change,

constant currency adjusted; Business Solutions segment revenue change, constant currency adjusted; Business Solutions segment EBITDA margin; and

Other revenue change, constant currency adjusted. Although the expenses related to the WU Way are specific to that initiative, the types of expenses

related to the WU Way initiative are similar to expenses that the Company has previously incurred and can reasonably be expected to incur in the

future. Constant currency results assume foreign revenues are translated from foreign currencies to the U.S. dollar, net of the effect of foreign currency

hedges, at rates consistent with those in the prior year.

A non-GAAP financial measure should not be considered in isolation or as a substitute for the most comparable GAAP financial measure. A non-

GAAP financial measure reflects an additional way of viewing aspects of our operations that, when viewed with our GAAP results and the

reconciliation to the corresponding GAAP financial measure, provide a more complete understanding of our business. Users of the financial statements

are encouraged to review our financial statements and publicly-filed reports in their entirety and not to rely on any single financial measure. A

reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures is included below.

All adjusted year-over-year changes were calculated using prior year amounts, which have been adjusted for changes in our reporting segments and

geographic regions, as described in our earnings press release. Amounts included below are in millions, unless indicated otherwise.

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved. Western Union Confidential |©2017 Western Union Holdings, Inc. All rights reserved.

Reconciliation of Non-GAAP Measures

21

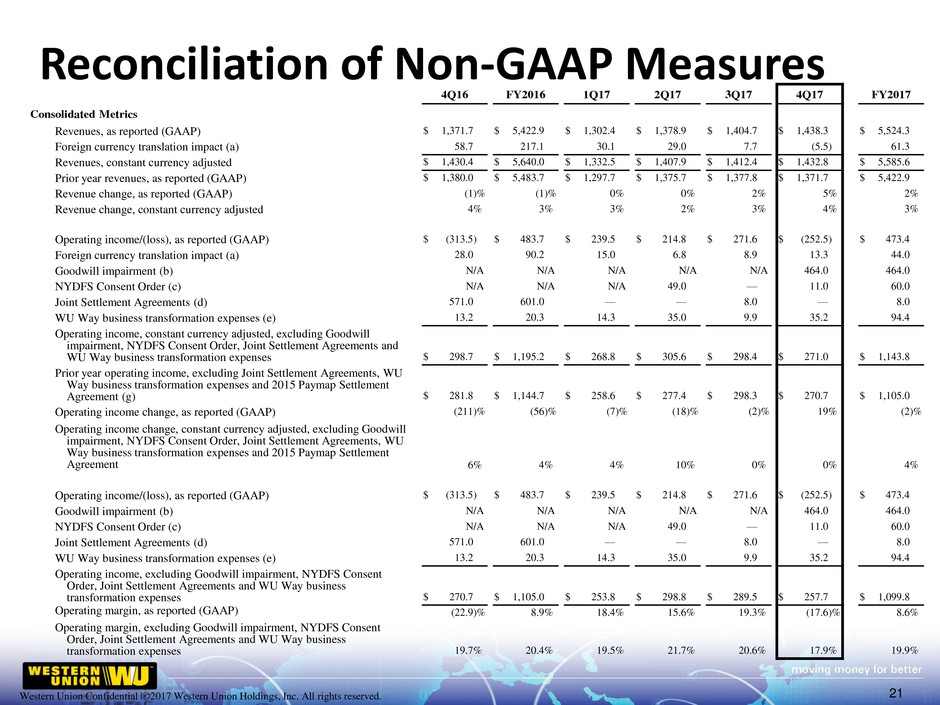

4Q16 FY2016 1Q17 2Q17 3Q17 4Q17 FY2017

Consolidated Metrics

Revenues, as reported (GAAP) $ 1,371.7 $ 5,422.9 $ 1,302.4 $ 1,378.9 $ 1,404.7 $ 1,438.3 $ 5,524.3

Foreign currency translation impact (a) 58.7 217.1 30.1 29.0 7.7 (5.5 ) 61.3

Revenues, constant currency adjusted $ 1,430.4 $ 5,640.0 $ 1,332.5 $ 1,407.9 $ 1,412.4 $ 1,432.8 $ 5,585.6

Prior year revenues, as reported (GAAP) $ 1,380.0 $ 5,483.7 $ 1,297.7 $ 1,375.7 $ 1,377.8 $ 1,371.7 $ 5,422.9

Revenue change, as reported (GAAP) (1 )% (1 )% 0 % 0 % 2 % 5 % 2 %

Revenue change, constant currency adjusted 4 % 3 % 3 % 2 % 3 % 4 % 3 %

Operating income/(loss), as reported (GAAP) $ (313.5 ) $ 483.7 $ 239.5 $ 214.8 $ 271.6 $ (252.5 ) $ 473.4

Foreign currency translation impact (a) 28.0 90.2 15.0 6.8 8.9 13.3 44.0

Goodwill impairment (b) N/A N/A N/A N/A N/A 464.0 464.0

NYDFS Consent Order (c) N/A N/A N/A 49.0 — 11.0 60.0

Joint Settlement Agreements (d) 571.0 601.0 — — 8.0 — 8.0

WU Way business transformation expenses (e) 13.2 20.3 14.3 35.0 9.9 35.2 94.4

Operating income, constant currency adjusted, excluding Goodwill

impairment, NYDFS Consent Order, Joint Settlement Agreements and

WU Way business transformation expenses $ 298.7 $ 1,195.2 $ 268.8 $ 305.6 $ 298.4 $ 271.0 $ 1,143.8

Prior year operating income, excluding Joint Settlement Agreements, WU

Way business transformation expenses and 2015 Paymap Settlement

Agreement (g) $ 281.8 $ 1,144.7 $ 258.6 $ 277.4 $ 298.3 $ 270.7 $ 1,105.0

Operating income change, as reported (GAAP) (211 )% (56 )% (7 )% (18 )% (2 )% 19 % (2 )%

Operating income change, constant currency adjusted, excluding Goodwill

impairment, NYDFS Consent Order, Joint Settlement Agreements, WU

Way business transformation expenses and 2015 Paymap Settlement

Agreement 6 % 4 % 4 % 10 % 0 % 0 % 4 %

Operating income/(loss), as reported (GAAP) $ (313.5 ) $ 483.7 $ 239.5 $ 214.8 $ 271.6 $ (252.5 ) $ 473.4

Goodwill impairment (b) N/A N/A N/A N/A N/A 464.0 464.0

NYDFS Consent Order (c) N/A N/A N/A 49.0 — 11.0 60.0

Joint Settlement Agreements (d) 571.0 601.0 — — 8.0 — 8.0

WU Way business transformation expenses (e) 13.2 20.3 14.3 35.0 9.9 35.2 94.4

Operating income, excluding Goodwill impairment, NYDFS Consent

Order, Joint Settlement Agreements and WU Way business

transformation expenses $ 270.7 $ 1,105.0 $ 253.8 $ 298.8 $ 289.5 $ 257.7 $ 1,099.8

Operating margin, as reported (GAAP) (22.9 )% 8.9 % 18.4 % 15.6 % 19.3 % (17.6 )% 8.6 %

Operating margin, excluding Goodwill impairment, NYDFS Consent

Order, Joint Settlement Agreements and WU Way business

transformation expenses 19.7 % 20.4 % 19.5 % 21.7 % 20.6 % 17.9 % 19.9 %

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved. Western Union Confidential |©2017 Western Union Holdings, Inc. All rights reserved.

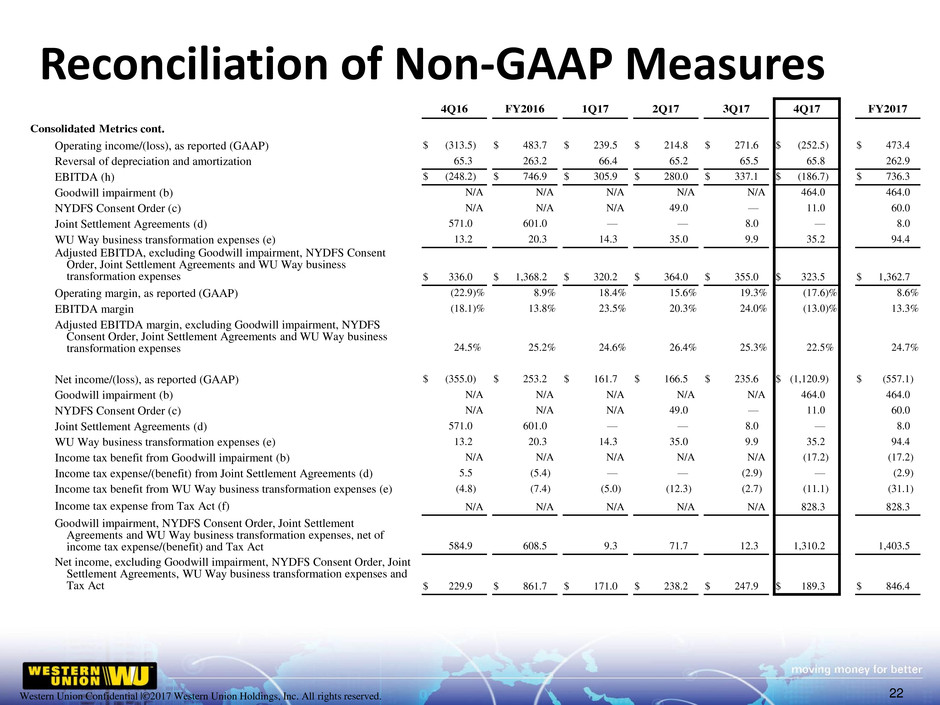

Reconciliation of Non-GAAP Measures

22

4Q16 FY2016 1Q17 2Q17 3Q17 4Q17 FY2017

Consolidated Metrics cont.

Operating income/(loss), as reported (GAAP) $ (313.5 ) $ 483.7 $ 239.5 $ 214.8 $ 271.6 $ (252.5 ) $ 473.4

Reversal of depreciation and amortization 65.3 263.2 66.4 65.2 65.5 65.8 262.9

EBITDA (h) $ (248.2 ) $ 746.9 $ 305.9 $ 280.0 $ 337.1 $ (186.7 ) $ 736.3

Goodwill impairment (b) N/A N/A N/A N/A N/A 464.0 464.0

NYDFS Consent Order (c) N/A N/A N/A 49.0 — 11.0 60.0

Joint Settlement Agreements (d) 571.0 601.0 — — 8.0 — 8.0

WU Way business transformation expenses (e) 13.2 20.3 14.3 35.0 9.9 35.2 94.4

Adjusted EBITDA, excluding Goodwill impairment, NYDFS Consent

Order, Joint Settlement Agreements and WU Way business

transformation expenses $ 336.0 $ 1,368.2 $ 320.2 $ 364.0 $ 355.0 $ 323.5 $ 1,362.7

Operating margin, as reported (GAAP) (22.9 )% 8.9 % 18.4 % 15.6 % 19.3 % (17.6 )% 8.6 %

EBITDA margin (18.1 )% 13.8 % 23.5 % 20.3 % 24.0 % (13.0 )% 13.3 %

Adjusted EBITDA margin, excluding Goodwill impairment, NYDFS

Consent Order, Joint Settlement Agreements and WU Way business

transformation expenses 24.5 % 25.2 % 24.6 % 26.4 % 25.3 % 22.5 % 24.7 %

Net income/(loss), as reported (GAAP) $ (355.0 ) $ 253.2 $ 161.7 $ 166.5 $ 235.6 $ (1,120.9 ) $ (557.1 )

Goodwill impairment (b) N/A N/A N/A N/A N/A 464.0 464.0

NYDFS Consent Order (c) N/A N/A N/A 49.0 — 11.0 60.0

Joint Settlement Agreements (d) 571.0 601.0 — — 8.0 — 8.0

WU Way business transformation expenses (e) 13.2 20.3 14.3 35.0 9.9 35.2 94.4

Income tax benefit from Goodwill impairment (b) N/A N/A N/A N/A N/A (17.2 ) (17.2 )

Income tax expense/(benefit) from Joint Settlement Agreements (d) 5.5 (5.4 ) — — (2.9 ) — (2.9 )

Income tax benefit from WU Way business transformation expenses (e) (4.8 ) (7.4 ) (5.0 ) (12.3 ) (2.7 ) (11.1 ) (31.1 )

Income tax expense from Tax Act (f) N/A N/A N/A N/A N/A 828.3 828.3

Goodwill impairment, NYDFS Consent Order, Joint Settlement

Agreements and WU Way business transformation expenses, net of

income tax expense/(benefit) and Tax Act 584.9 608.5 9.3 71.7 12.3 1,310.2 1,403.5

Net income, excluding Goodwill impairment, NYDFS Consent Order, Joint

Settlement Agreements, WU Way business transformation expenses and

Tax Act $ 229.9 $ 861.7 $ 171.0 $ 238.2 $ 247.9 $ 189.3 $ 846.4

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved. Western Union Confidential |©2017 Western Union Holdings, Inc. All rights reserved.

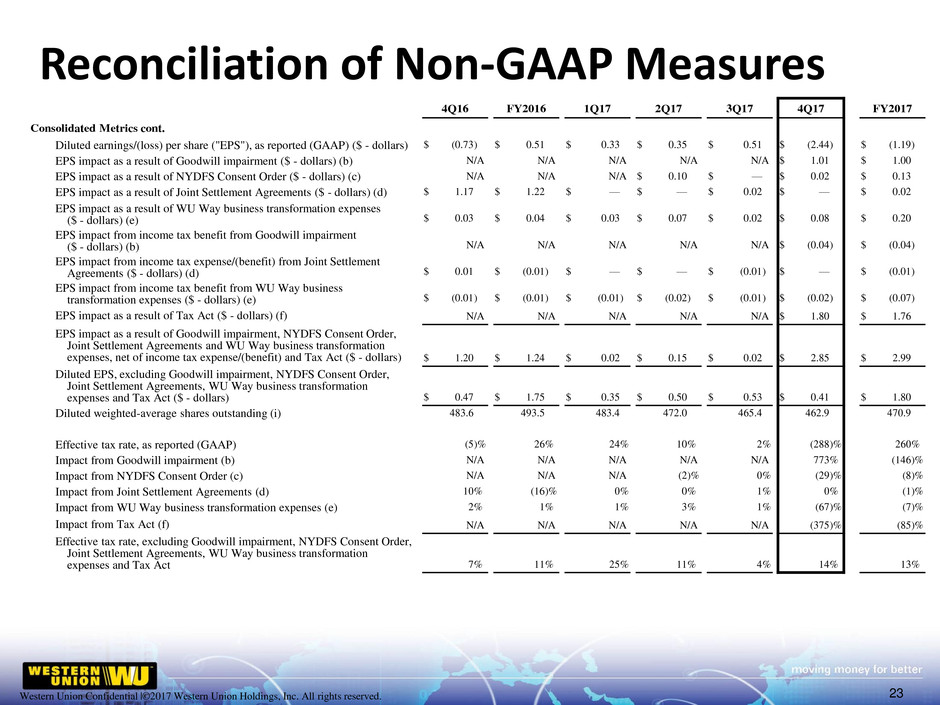

Reconciliation of Non-GAAP Measures

23

4Q16 FY2016 1Q17 2Q17 3Q17 4Q17 FY2017

Consolidated Metrics cont.

Diluted earnings/(loss) per share ("EPS"), as reported (GAAP) ($ - dollars) $ (0.73 ) $ 0.51 $ 0.33 $ 0.35 $ 0.51 $ (2.44 ) $ (1.19 )

EPS impact as a result of Goodwill impairment ($ - dollars) (b) N/A N/A N/A N/A N/A $ 1.01 $ 1.00

EPS impact as a result of NYDFS Consent Order ($ - dollars) (c) N/A N/A N/A $ 0.10 $ — $ 0.02 $ 0.13

EPS impact as a result of Joint Settlement Agreements ($ - dollars) (d) $ 1.17 $ 1.22 $ — $ — $ 0.02 $ — $ 0.02

EPS impact as a result of WU Way business transformation expenses

($ - dollars) (e) $ 0.03 $ 0.04 $ 0.03 $ 0.07 $ 0.02 $ 0.08 $ 0.20

EPS impact from income tax benefit from Goodwill impairment

($ - dollars) (b) N/A N/A N/A N/A N/A $ (0.04 ) $ (0.04 )

EPS impact from income tax expense/(benefit) from Joint Settlement

Agreements ($ - dollars) (d) $ 0.01 $ (0.01 ) $ — $ — $ (0.01 ) $ — $ (0.01 )

EPS impact from income tax benefit from WU Way business

transformation expenses ($ - dollars) (e) $ (0.01 ) $ (0.01 ) $ (0.01 ) $ (0.02 ) $ (0.01 ) $ (0.02 ) $ (0.07 )

EPS impact as a result of Tax Act ($ - dollars) (f) N/A N/A N/A N/A N/A $ 1.80 $ 1.76

EPS impact as a result of Goodwill impairment, NYDFS Consent Order,

Joint Settlement Agreements and WU Way business transformation

expenses, net of income tax expense/(benefit) and Tax Act ($ - dollars) $ 1.20 $ 1.24 $ 0.02 $ 0.15 $ 0.02 $ 2.85 $ 2.99

Diluted EPS, excluding Goodwill impairment, NYDFS Consent Order,

Joint Settlement Agreements, WU Way business transformation

expenses and Tax Act ($ - dollars) $ 0.47 $ 1.75 $ 0.35 $ 0.50 $ 0.53 $ 0.41 $ 1.80

Diluted weighted-average shares outstanding (i) 483.6 493.5 483.4 472.0 465.4 462.9 470.9

Effective tax rate, as reported (GAAP) (5 )% 26 % 24 % 10 % 2 % (288 )% 260 %

Impact from Goodwill impairment (b) N/A N/A N/A N/A N/A 773 % (146 )%

Impact from NYDFS Consent Order (c) N/A N/A N/A (2 )% 0 % (29 )% (8 )%

Impact from Joint Settlement Agreements (d) 10 % (16 )% 0 % 0 % 1 % 0 % (1 )%

Impact from WU Way business transformation expenses (e) 2 % 1 % 1 % 3 % 1 % (67 )% (7 )%

Impact from Tax Act (f) N/A N/A N/A N/A N/A (375 )% (85 )%

Effective tax rate, excluding Goodwill impairment, NYDFS Consent Order,

Joint Settlement Agreements, WU Way business transformation

expenses and Tax Act 7 % 11 % 25 % 11 % 4 % 14 % 13 %

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved. Western Union Confidential |©2017 Western Union Holdings, Inc. All rights reserved.

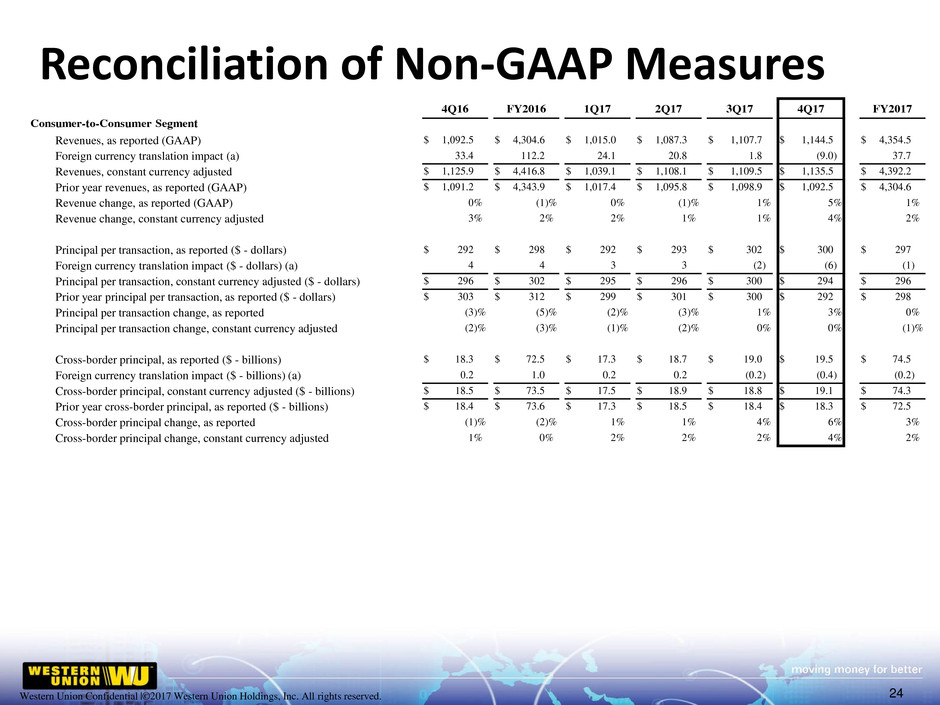

Reconciliation of Non-GAAP Measures

24

4Q16 FY2016 1Q17 2Q17 3Q17 4Q17 FY2017

Consumer-to-Consumer Segment

Revenues, as reported (GAAP) $ 1,092.5 $ 4,304.6 $ 1,015.0 $ 1,087.3 $ 1,107.7 $ 1,144.5 $ 4,354.5

Foreign currency translation impact (a) 33.4 112.2 24.1 20.8 1.8 (9.0 ) 37.7

Revenues, constant currency adjusted $ 1,125.9 $ 4,416.8 $ 1,039.1 $ 1,108.1 $ 1,109.5 $ 1,135.5 $ 4,392.2

Prior year revenues, as reported (GAAP) $ 1,091.2 $ 4,343.9 $ 1,017.4 $ 1,095.8 $ 1,098.9 $ 1,092.5 $ 4,304.6

Revenue change, as reported (GAAP) 0 % (1 )% 0 % (1 )% 1 % 5 % 1 %

Revenue change, constant currency adjusted 3 % 2 % 2 % 1 % 1 % 4 % 2 %

Principal per transaction, as reported ($ - dollars) $ 292 $ 298 $ 292 $ 293 $ 302 $ 300 $ 297

Foreign currency translation impact ($ - dollars) (a) 4 4 3 3 (2 ) (6 ) (1 )

Principal per transaction, constant currency adjusted ($ - dollars) $ 296 $ 302 $ 295 $ 296 $ 300 $ 294 $ 296

Prior year principal per transaction, as reported ($ - dollars) $ 303 $ 312 $ 299 $ 301 $ 300 $ 292 $ 298

Principal per transaction change, as reported (3 )% (5 )% (2 )% (3 )% 1 % 3 % 0 %

Principal per transaction change, constant currency adjusted (2 )% (3 )% (1 )% (2 )% 0 % 0 % (1 )%

Cross-border principal, as reported ($ - billions) $ 18.3 $ 72.5 $ 17.3 $ 18.7 $ 19.0 $ 19.5 $ 74.5

Foreign currency translation impact ($ - billions) (a) 0.2 1.0 0.2 0.2 (0.2 ) (0.4 ) (0.2 )

Cross-border principal, constant currency adjusted ($ - billions) $ 18.5 $ 73.5 $ 17.5 $ 18.9 $ 18.8 $ 19.1 $ 74.3

Prior year cross-border principal, as reported ($ - billions) $ 18.4 $ 73.6 $ 17.3 $ 18.5 $ 18.4 $ 18.3 $ 72.5

Cross-border principal change, as reported (1 )% (2 )% 1 % 1 % 4 % 6 % 3 %

Cross-border principal change, constant currency adjusted 1 % 0 % 2 % 2 % 2 % 4 % 2 %

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved. Western Union Confidential |©2017 Western Union Holdings, Inc. All rights reserved.

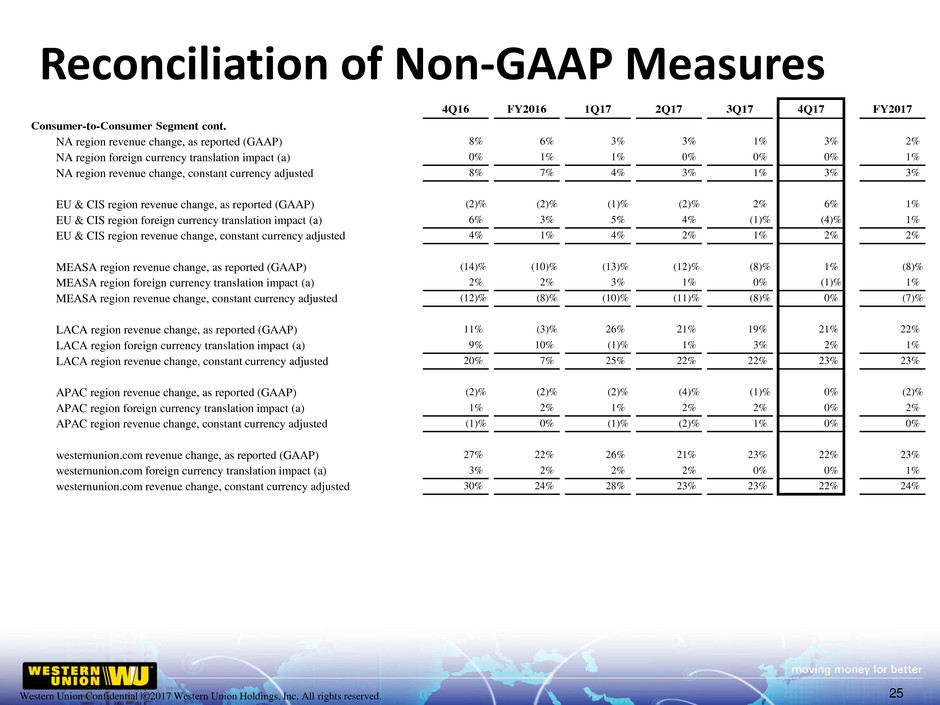

Reconciliation of Non-GAAP Measures

25

4Q16 FY2016 1Q17 2Q17 3Q17 4Q17 FY2017

Consumer-to-Consumer Segment cont.

NA region revenue change, as reported (GAAP) 8 % 6 % 3 % 3 % 1 % 3 % 2 %

NA region foreign currency translation impact (a) 0 % 1 % 1 % 0 % 0 % 0 % 1 %

NA region revenue change, constant currency adjusted 8 % 7 % 4 % 3 % 1 % 3 % 3 %

EU & CIS region revenue change, as reported (GAAP) (2 )% (2 )% (1 )% (2 )% 2 % 6 % 1 %

EU & CIS region foreign currency translation impact (a) 6 % 3 % 5 % 4 % (1 )% (4 )% 1 %

EU & CIS region revenue change, constant currency adjusted 4 % 1 % 4 % 2 % 1 % 2 % 2 %

MEASA region revenue change, as reported (GAAP) (14 )% (10 )% (13 )% (12 )% (8 )% 1 % (8 )%

MEASA region foreign currency translation impact (a) 2 % 2 % 3 % 1 % 0 % (1 )% 1 %

MEASA region revenue change, constant currency adjusted (12 )% (8 )% (10 )% (11 )% (8 )% 0 % (7 )%

LACA region revenue change, as reported (GAAP) 11 % (3 )% 26 % 21 % 19 % 21 % 22 %

LACA region foreign currency translation impact (a) 9 % 10 % (1 )% 1 % 3 % 2 % 1 %

LACA region revenue change, constant currency adjusted 20 % 7 % 25 % 22 % 22 % 23 % 23 %

APAC region revenue change, as reported (GAAP) (2 )% (2 )% (2 )% (4 )% (1 )% 0 % (2 )%

APAC region foreign currency translation impact (a) 1 % 2 % 1 % 2 % 2 % 0 % 2 %

APAC region revenue change, constant currency adjusted (1 )% 0 % (1 )% (2 )% 1 % 0 % 0 %

westernunion.com revenue change, as reported (GAAP) 27 % 22 % 26 % 21 % 23 % 22 % 23 %

westernunion.com foreign currency translation impact (a) 3 % 2 % 2 % 2 % 0 % 0 % 1 %

westernunion.com revenue change, constant currency adjusted 30 % 24 % 28 % 23 % 23 % 22 % 24 %

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved. Western Union Confidential |©2017 Western Union Holdings, Inc. All rights reserved.

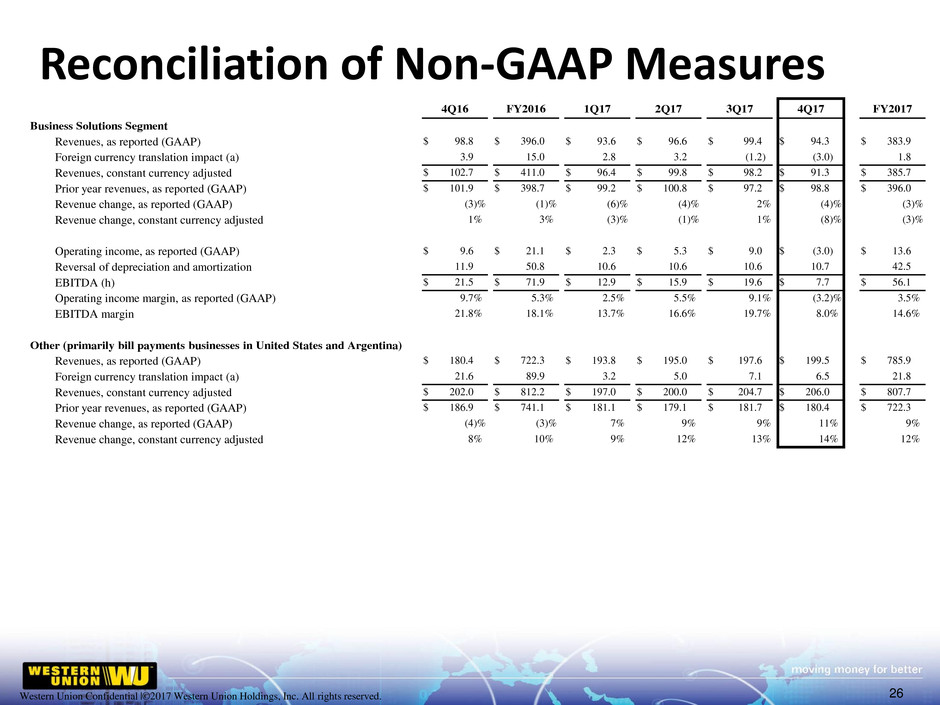

Reconciliation of Non-GAAP Measures

26

4Q16 FY2016 1Q17 2Q17 3Q17 4Q17 FY2017

Business Solutions Segment

Revenues, as reported (GAAP) $ 98.8 $ 396.0 $ 93.6 $ 96.6 $ 99.4 $ 94.3 $ 383.9

Foreign currency translation impact (a) 3.9 15.0 2.8 3.2 (1.2 ) (3.0 ) 1.8

Revenues, constant currency adjusted $ 102.7 $ 411.0 $ 96.4 $ 99.8 $ 98.2 $ 91.3 $ 385.7

Prior year revenues, as reported (GAAP) $ 101.9 $ 398.7 $ 99.2 $ 100.8 $ 97.2 $ 98.8 $ 396.0

Revenue change, as reported (GAAP) (3 )% (1 )% (6 )% (4 )% 2 % (4 )% (3 )%

Revenue change, constant currency adjusted 1 % 3 % (3 )% (1 )% 1 % (8 )% (3 )%

Operating income, as reported (GAAP) $ 9.6 $ 21.1 $ 2.3 $ 5.3 $ 9.0 $ (3.0 ) $ 13.6

Reversal of depreciation and amortization 11.9 50.8 10.6 10.6 10.6 10.7 42.5

EBITDA (h) $ 21.5 $ 71.9 $ 12.9 $ 15.9 $ 19.6 $ 7.7 $ 56.1

Operating income margin, as reported (GAAP) 9.7 % 5.3 % 2.5 % 5.5 % 9.1 % (3.2 )% 3.5 %

EBITDA margin 21.8 % 18.1 % 13.7 % 16.6 % 19.7 % 8.0 % 14.6 %

Other (primarily bill payments businesses in United States and Argentina)

Revenues, as reported (GAAP) $ 180.4 $ 722.3 $ 193.8 $ 195.0 $ 197.6 $ 199.5 $ 785.9

Foreign currency translation impact (a) 21.6 89.9 3.2 5.0 7.1 6.5 21.8

Revenues, constant currency adjusted $ 202.0 $ 812.2 $ 197.0 $ 200.0 $ 204.7 $ 206.0 $ 807.7

Prior year revenues, as reported (GAAP) $ 186.9 $ 741.1 $ 181.1 $ 179.1 $ 181.7 $ 180.4 $ 722.3

Revenue change, as reported (GAAP) (4 )% (3 )% 7 % 9 % 9 % 11 % 9 %

Revenue change, constant currency adjusted 8 % 10 % 9 % 12 % 13 % 14 % 12 %

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved. Western Union Confidential |©2017 Western Union Holdings, Inc. All rights reserved.

Reconciliation of Non-GAAP Measures

27

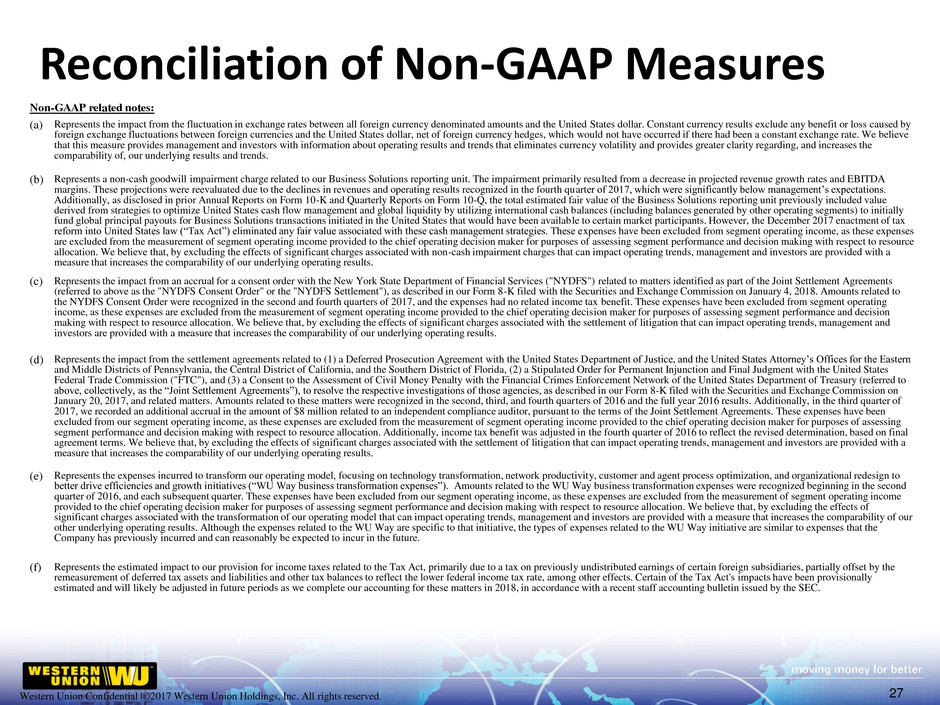

Non-GAAP related notes:

(a) Represents the impact from the fluctuation in exchange rates between all foreign currency denominated amounts and the United States dollar. Constant currency results exclude any benefit or loss caused by

foreign exchange fluctuations between foreign currencies and the United States dollar, net of foreign currency hedges, which would not have occurred if there had been a constant exchange rate. We believe

that this measure provides management and investors with information about operating results and trends that eliminates currency volatility and provides greater clarity regarding, and increases the

comparability of, our underlying results and trends.

(b) Represents a non-cash goodwill impairment charge related to our Business Solutions reporting unit. The impairment primarily resulted from a decrease in projected revenue growth rates and EBITDA

margins. These projections were reevaluated due to the declines in revenues and operating results recognized in the fourth quarter of 2017, which were significantly below management’s expectations.

Additionally, as disclosed in prior Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, the total estimated fair value of the Business Solutions reporting unit previously included value

derived from strategies to optimize United States cash flow management and global liquidity by utilizing international cash balances (including balances generated by other operating segments) to initially

fund global principal payouts for Business Solutions transactions initiated in the United States that would have been available to certain market participants. However, the December 2017 enactment of tax

reform into United States law (“Tax Act”) eliminated any fair value associated with these cash management strategies. These expenses have been excluded from segment operating income, as these expenses

are excluded from the measurement of segment operating income provided to the chief operating decision maker for purposes of assessing segment performance and decision making with respect to resource

allocation. We believe that, by excluding the effects of significant charges associated with non-cash impairment charges that can impact operating trends, management and investors are provided with a

measure that increases the comparability of our underlying operating results.

(c) Represents the impact from an accrual for a consent order with the New York State Department of Financial Services ("NYDFS") related to matters identified as part of the Joint Settlement Agreements

(referred to above as the "NYDFS Consent Order" or the "NYDFS Settlement"), as described in our Form 8-K filed with the Securities and Exchange Commission on January 4, 2018. Amounts related to

the NYDFS Consent Order were recognized in the second and fourth quarters of 2017, and the expenses had no related income tax benefit. These expenses have been excluded from segment operating

income, as these expenses are excluded from the measurement of segment operating income provided to the chief operating decision maker for purposes of assessing segment performance and decision

making with respect to resource allocation. We believe that, by excluding the effects of significant charges associated with the settlement of litigation that can impact operating trends, management and

investors are provided with a measure that increases the comparability of our underlying operating results.

(d) Represents the impact from the settlement agreements related to (1) a Deferred Prosecution Agreement with the United States Department of Justice, and the United States Attorney’s Offices for the Eastern

and Middle Districts of Pennsylvania, the Central District of California, and the Southern District of Florida, (2) a Stipulated Order for Permanent Injunction and Final Judgment with the United States

Federal Trade Commission ("FTC"), and (3) a Consent to the Assessment of Civil Money Penalty with the Financial Crimes Enforcement Network of the United States Department of Treasury (referred to

above, collectively, as the “Joint Settlement Agreements”), to resolve the respective investigations of those agencies, as described in our Form 8-K filed with the Securities and Exchange Commission on

January 20, 2017, and related matters. Amounts related to these matters were recognized in the second, third, and fourth quarters of 2016 and the full year 2016 results. Additionally, in the third quarter of

2017, we recorded an additional accrual in the amount of $8 million related to an independent compliance auditor, pursuant to the terms of the Joint Settlement Agreements. These expenses have been

excluded from our segment operating income, as these expenses are excluded from the measurement of segment operating income provided to the chief operating decision maker for purposes of assessing

segment performance and decision making with respect to resource allocation. Additionally, income tax benefit was adjusted in the fourth quarter of 2016 to reflect the revised determination, based on final

agreement terms. We believe that, by excluding the effects of significant charges associated with the settlement of litigation that can impact operating trends, management and investors are provided with a

measure that increases the comparability of our underlying operating results.

(e) Represents the expenses incurred to transform our operating model, focusing on technology transformation, network productivity, customer and agent process optimization, and organizational redesign to

better drive efficiencies and growth initiatives (“WU Way business transformation expenses”). Amounts related to the WU Way business transformation expenses were recognized beginning in the second

quarter of 2016, and each subsequent quarter. These expenses have been excluded from our segment operating income, as these expenses are excluded from the measurement of segment operating income

provided to the chief operating decision maker for purposes of assessing segment performance and decision making with respect to resource allocation. We believe that, by excluding the effects of

significant charges associated with the transformation of our operating model that can impact operating trends, management and investors are provided with a measure that increases the comparability of our

other underlying operating results. Although the expenses related to the WU Way are specific to that initiative, the types of expenses related to the WU Way initiative are similar to expenses that the

Company has previously incurred and can reasonably be expected to incur in the future.

(f) Represents the estimated impact to our provision for income taxes related to the Tax Act, primarily due to a tax on previously undistributed earnings of certain foreign subsidiaries, partially offset by the

remeasurement of deferred tax assets and liabilities and other tax balances to reflect the lower federal income tax rate, among other effects. Certain of the Tax Act's impacts have been provisionally

estimated and will likely be adjusted in future periods as we complete our accounting for these matters in 2018, in accordance with a recent staff accounting bulletin issued by the SEC.

Western Union Confidential | ©2017 Western Union Holdings, Inc. All rights reserved. Western Union Confidential |©2017 Western Union Holdings, Inc. All rights reserved.

Reconciliation of Non-GAAP Measures

28

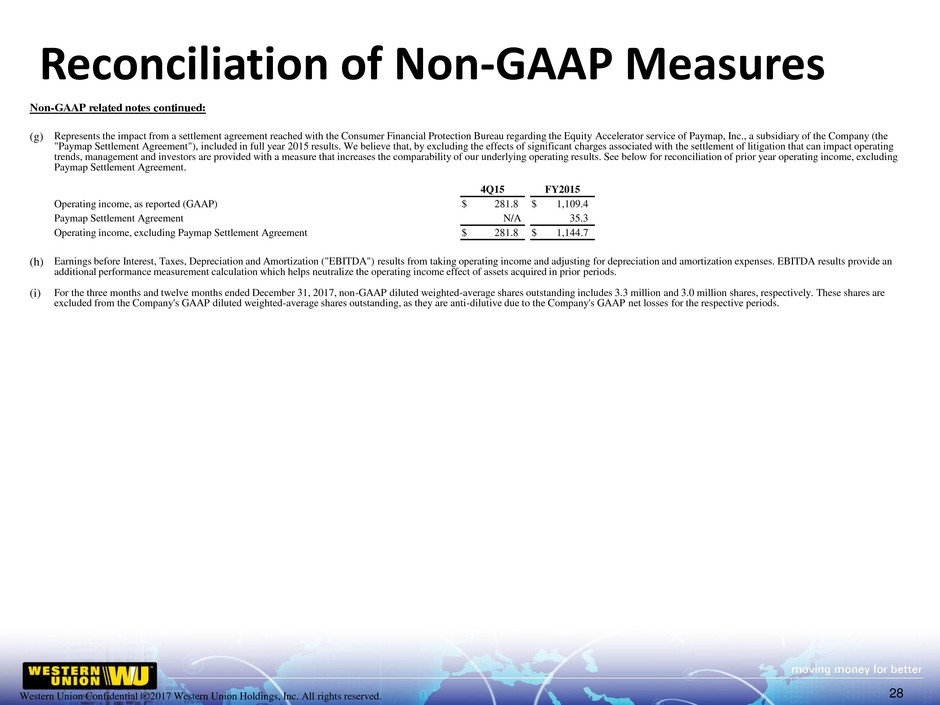

Non-GAAP related notes continued:

(g) Represents the impact from a settlement agreement reached with the Consumer Financial Protection Bureau regarding the Equity Accelerator service of Paymap, Inc., a subsidiary of the Company (the

"Paymap Settlement Agreement"), included in full year 2015 results. We believe that, by excluding the effects of significant charges associated with the settlement of litigation that can impact operating

trends, management and investors are provided with a measure that increases the comparability of our underlying operating results. See below for reconciliation of prior year operating income, excluding

Paymap Settlement Agreement.

4Q15 FY2015

Operating income, as reported (GAAP) $ 281.8 $ 1,109.4

Paymap Settlement Agreement N/A 35.3

Operating income, excluding Paymap Settlement Agreement $ 281.8 $ 1,144.7

(h) Earnings before Interest, Taxes, Depreciation and Amortization ("EBITDA") results from taking operating income and adjusting for depreciation and amortization expenses. EBITDA results provide an

additional performance measurement calculation which helps neutralize the operating income effect of assets acquired in prior periods.

(i) For the three months and twelve months ended December 31, 2017, non-GAAP diluted weighted-average shares outstanding includes 3.3 million and 3.0 million shares, respectively. These shares are

excluded from the Company's GAAP diluted weighted-average shares outstanding, as they are anti-dilutive due to the Company's GAAP net losses for the respective periods.