Attached files

| file | filename |

|---|---|

| 8-K - 8-K - US BANCORP \DE\ | d517745d8k.htm |

Credit Suisse Financial Services Forum 2018 February 13, 2018 Gunjan Kedia Vice Chairman, Wealth Management & Investment Services Mark Jordahl President, Wealth Management Exhibit 99.1

Forward-looking Statements and Additional Information The following information appears in accordance with the Private Securities Litigation Reform Act of 1995: Today’s presentation contains forward-looking statements about U.S. Bancorp. Statements that are not historical or current facts, including statements about beliefs and expectations, are forward-looking statements and are based on the information available to, and assumptions and estimates made by, management as of the date hereof. These forward-looking statements cover, among other things, anticipated future revenue and expenses and the future plans and prospects of U.S. Bancorp. Forward-looking statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated. A reversal or slowing of the current economic recovery or another severe contraction could adversely affect U.S. Bancorp’s revenues and the values of its assets and liabilities. Global financial markets could experience a recurrence of significant turbulence, which could reduce the availability of funding to certain financial institutions and lead to a tightening of credit, a reduction of business activity, and increased market volatility. Stress in the commercial real estate markets, as well as a downturn in the residential real estate markets could cause credit losses and deterioration in asset values. In addition, changes to statutes, regulations, or regulatory policies or practices could affect U.S. Bancorp in substantial and unpredictable ways. U.S. Bancorp’s results could also be adversely affected by deterioration in general business and economic conditions; changes in interest rates; deterioration in the credit quality of its loan portfolios or in the value of the collateral securing those loans; deterioration in the value of securities held in its investment securities portfolio; legal and regulatory developments; litigation; increased competition from both banks and non-banks; changes in customer behavior and preferences; breaches in data security; effects of mergers and acquisitions and related integration; effects of critical accounting policies and judgments; and management’s ability to effectively manage credit risk, market risk, operational risk, compliance risk, strategic risk, interest rate risk, liquidity risk and reputational risk. For discussion of these and other risks that may cause actual results to differ from expectations, refer to U.S. Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2016, on file with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Corporate Risk Profile” contained in Exhibit 13, and all subsequent filings with the Securities and Exchange Commission under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934. However, factors other than these also could adversely affect U.S. Bancorp’s results, and the reader should not consider these factors to be a complete set of all potential risks or uncertainties. Forward-looking statements speak only as of the date hereof, and U.S. Bancorp undertakes no obligation to update them in light of new information or future events. This presentation includes non-GAAP financial measures to describe U.S. Bancorp’s performance. The calculations of these measures are provided in the Appendix. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

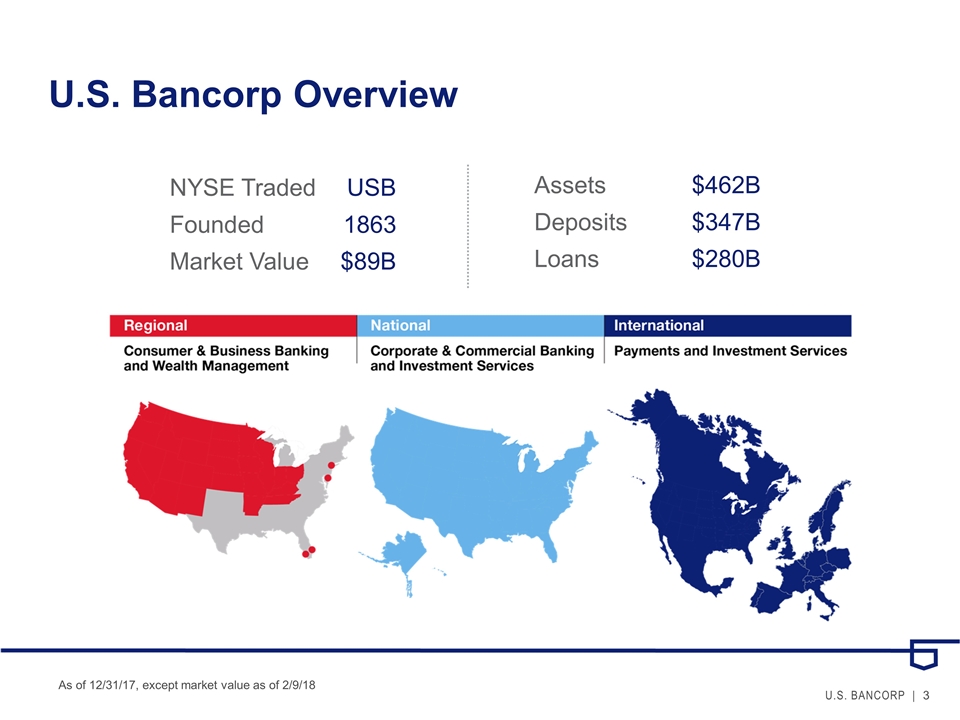

U.S. Bancorp Overview As of 12/31/17, except market value as of 2/9/18 NYSE TradedUSB Founded 1863 Market Value $89B Assets $462B Deposits $347B Loans $280B

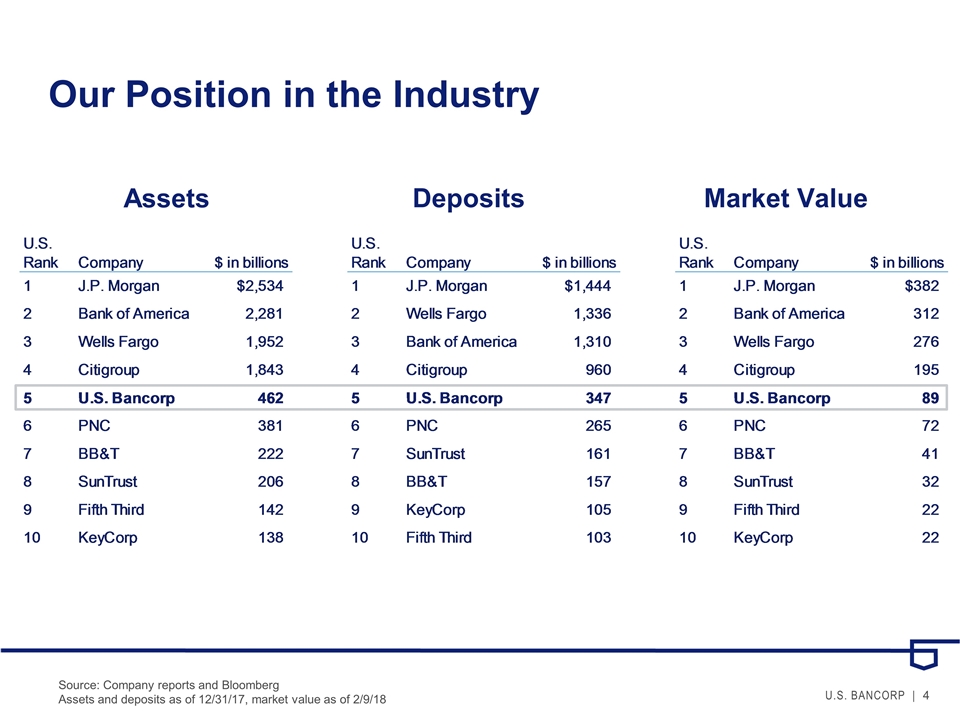

Our Position in the Industry Source: Company reports and Bloomberg Assets and deposits as of 12/31/17, market value as of 2/9/18 Assets Market Value Deposits

Our Key Priorities 1) One U.S. Bank initiative: putting the customer in the center 2) Leveraging technology and innovation to drive growth and efficiency 3) A relentless focus on optimization one U.S. Bank

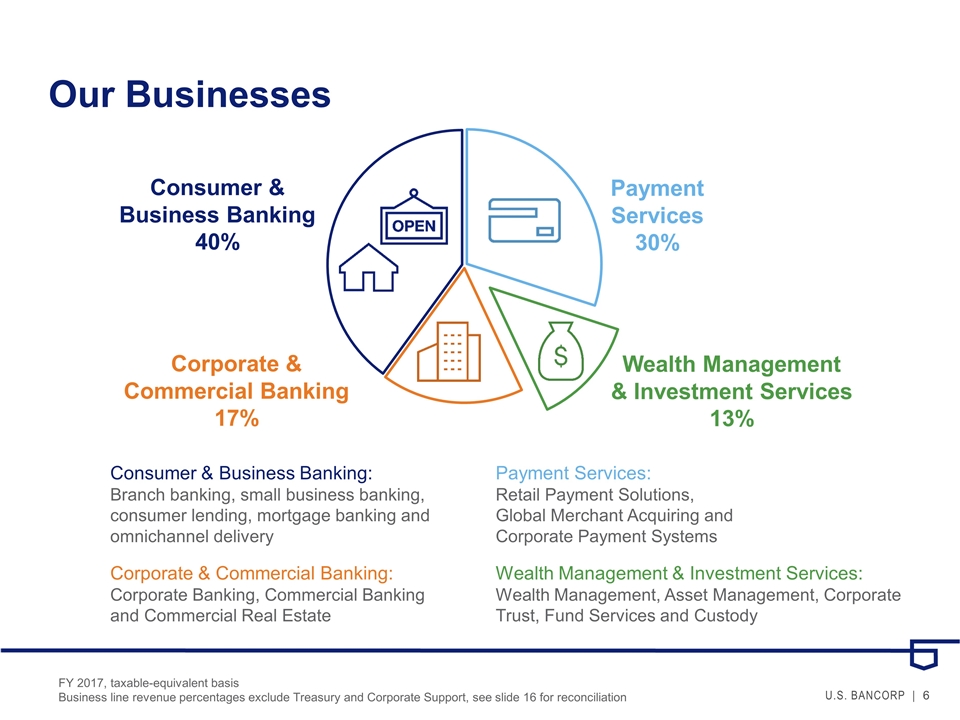

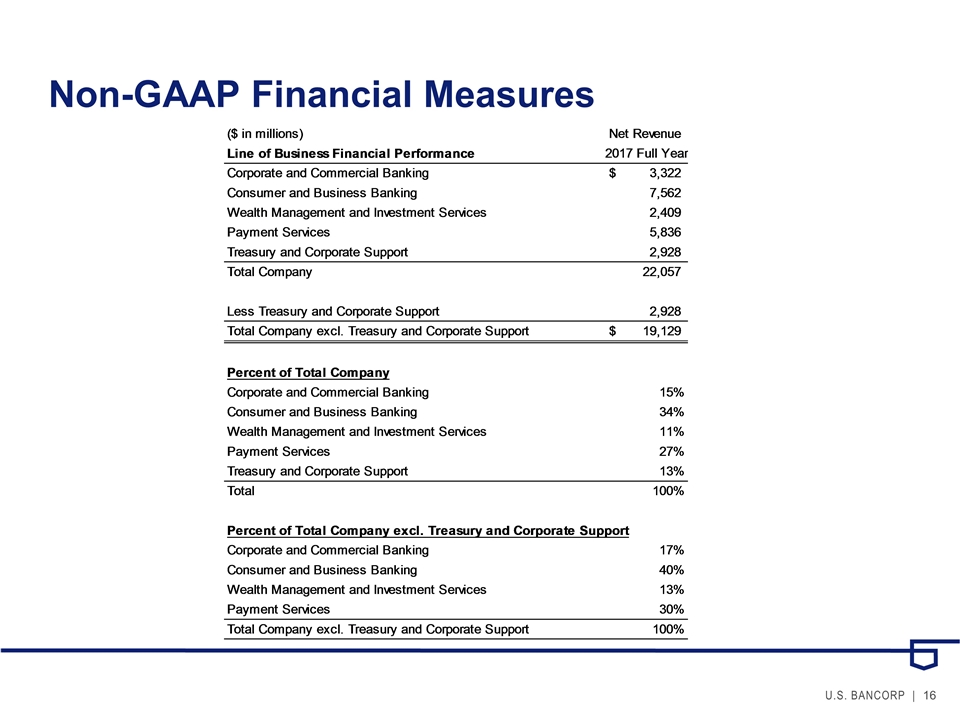

Our Businesses Payment Services 30% Wealth Management & Investment Services 13% Corporate & Commercial Banking 17% Consumer & Business Banking 40% Consumer & Business Banking: Branch banking, small business banking, consumer lending, mortgage banking and omnichannel delivery Payment Services: Retail Payment Solutions, Global Merchant Acquiring and Corporate Payment Systems Corporate & Commercial Banking: Corporate Banking, Commercial Banking and Commercial Real Estate Wealth Management & Investment Services: Wealth Management, Asset Management, Corporate Trust, Fund Services and Custody FY 2017, taxable-equivalent basis Business line revenue percentages exclude Treasury and Corporate Support, see slide 16 for reconciliation

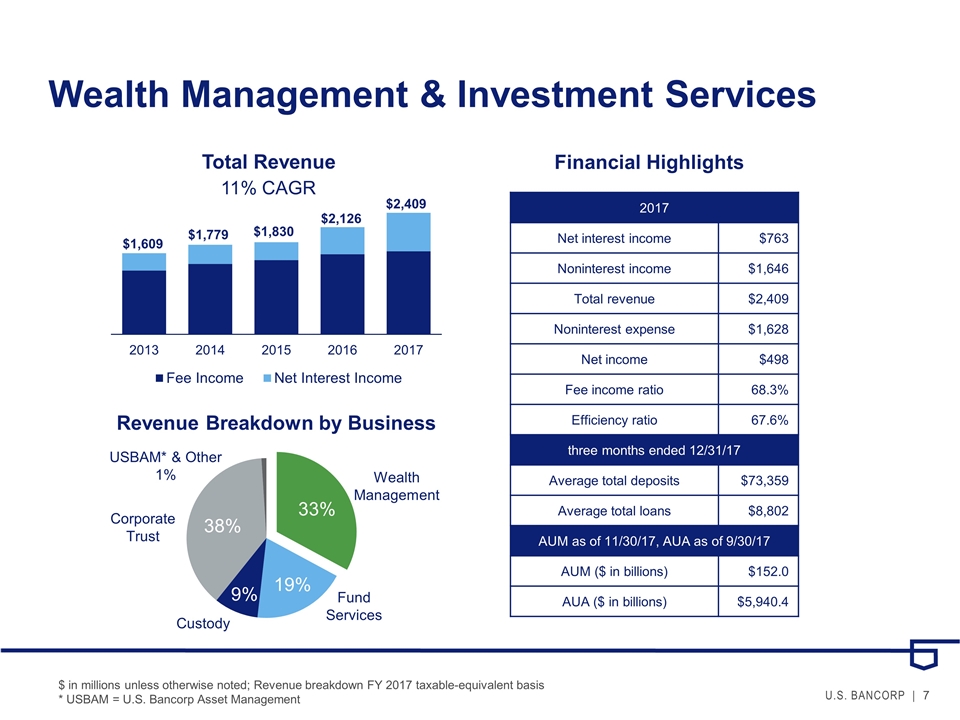

Wealth Management & Investment Services $ in millions unless otherwise noted; Revenue breakdown FY 2017 taxable-equivalent basis * USBAM = U.S. Bancorp Asset Management 2017 Net interest income $763 Noninterest income $1,646 Total revenue $2,409 Noninterest expense $1,628 Net income $498 Fee income ratio 68.3% Efficiency ratio 67.6% three months ended 12/31/17 Average total deposits $73,359 Average total loans $8,802 AUM as of 11/30/17, AUA as of 9/30/17 AUM ($ in billions) $152.0 AUA ($ in billions) $5,940.4 Financial Highlights $1,609 $1,779 $1,830 $2,126 $2,409 Total Revenue Revenue Breakdown by Business Wealth Management Fund Services Corporate Trust Custody USBAM* & Other 1% 11% CAGR

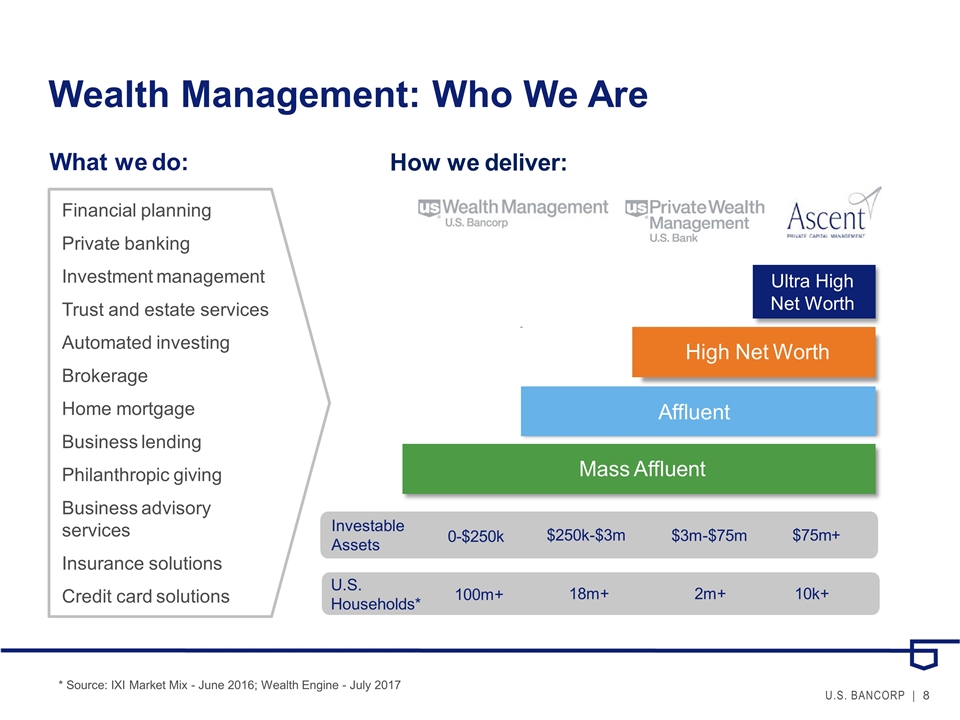

Wealth Management: Who We Are How we deliver: What we do: Financial planning Private banking Investment management Trust and estate services Automated investing Brokerage Home mortgage Business lending Philanthropic giving Business advisory services Insurance solutions Credit card solutions Mass Affluent Affluent High Net Worth Investable Assets 0-$250k $250k-$3m $3m-$75m $75m+ U.S. Households* 100m+ 18m+ 2m+ 10k+ Ultra High Net Worth * Source: IXI Market Mix - June 2016; Wealth Engine - July 2017

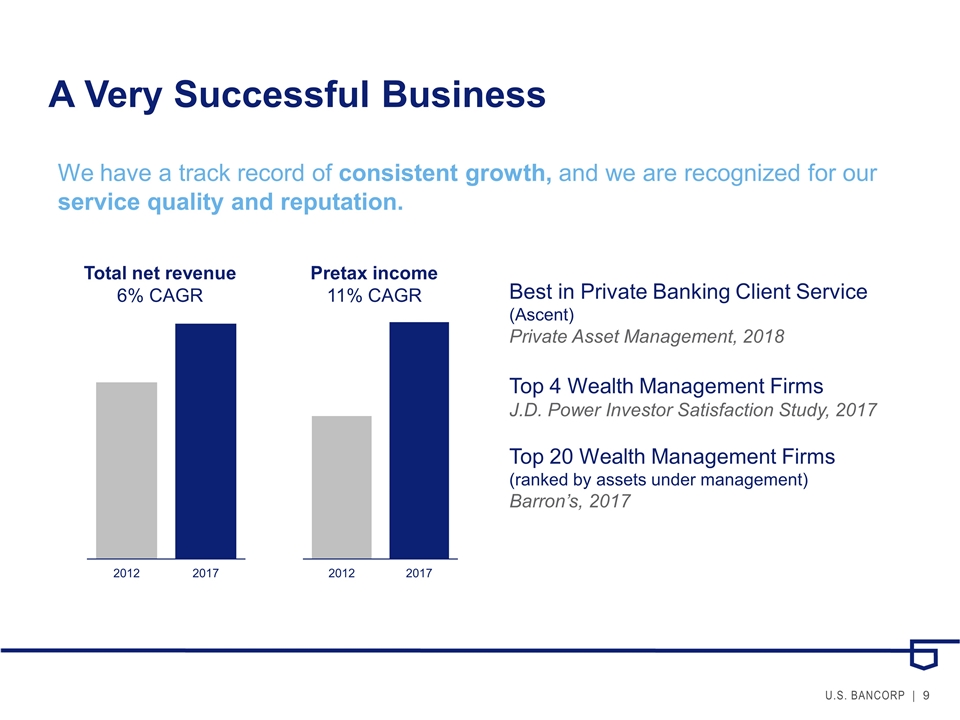

A Very Successful Business We have a track record of consistent growth, and we are recognized for our service quality and reputation. Total net revenue 6% CAGR Pretax income 11% CAGR Best in Private Banking Client Service (Ascent) Private Asset Management, 2018 Top 4 Wealth Management Firms J.D. Power Investor Satisfaction Study, 2017 Top 20 Wealth Management Firms (ranked by assets under management) Barron’s, 2017

Putting Our Key Priorities to Work Collectively position us to drive revenue growth and returns one U.S. Bank Technology and innovation Optimization

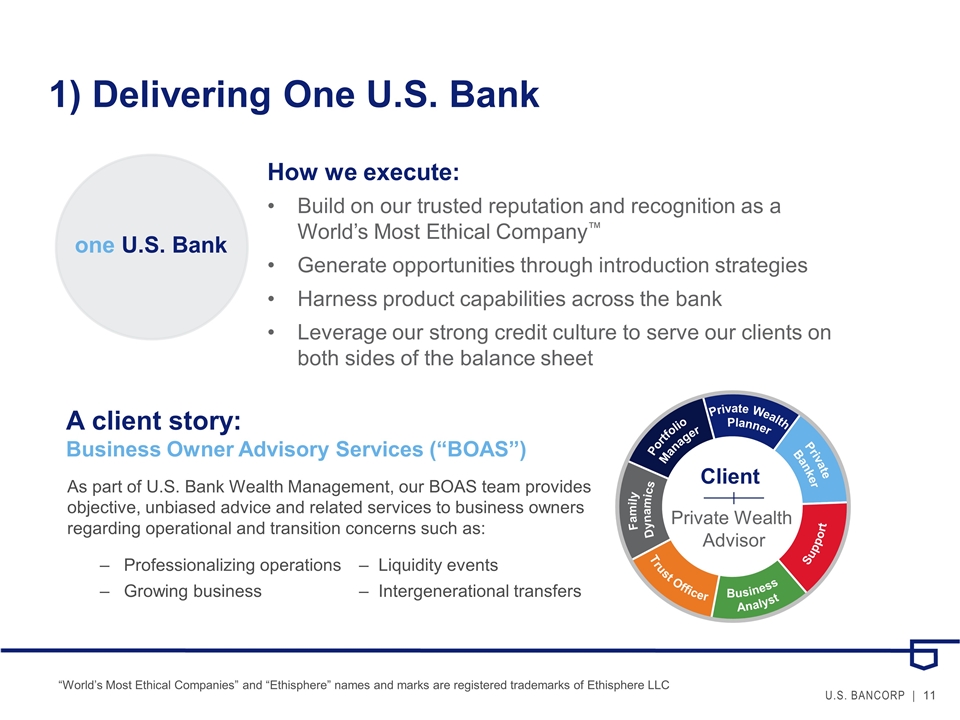

1) Delivering One U.S. Bank Build on our trusted reputation and recognition as a World’s Most Ethical Company™ Generate opportunities through introduction strategies Harness product capabilities across the bank Leverage our strong credit culture to serve our clients on both sides of the balance sheet How we execute: A client story: Business Owner Advisory Services (“BOAS”) one U.S. Bank Portfolio Manager Private Wealth Planner Private Banker Family Dynamics Trust Officer Business Analyst Support Client Private Wealth Advisor As part of U.S. Bank Wealth Management, our BOAS team provides objective, unbiased advice and related services to business owners regarding operational and transition concerns such as: Professionalizing operations – Liquidity events Growing business – Intergenerational transfers “World’s Most Ethical Companies” and “Ethisphere” names and marks are registered trademarks of Ethisphere LLC

2) Leveraging Technology and Innovation Develop new and enhanced client capabilities Enable our people to drive increased efficiency and productivity Adopt new technologies against a clear vision to ensure discipline and purpose How we execute: A client story: Digital solutions such as automated portfolios and financial planning software allow us to advise our clients wherever they are, whenever they need us.

3) Optimization of Our Model Offer our clients a distinctive value proposition Define our “sweet spot” and then double down on our efforts Win with our story and our brand How we execute: A client story: In our Ascent family offices, it’s about more than just money. We deliver custom service to our clients by surrounding them with professionals ranging from advisors and relationship managers to wealth psychologists and family historians.

Bringing It All Together Technology & innovation Optimization Increased revenue Greater efficiency Higher profits Higher returns We are well-positioned in an attractive industry, and we are committed to a strategy that will deliver improving returns. One U.S. Bank

Appendix

Non-GAAP Financial Measures