Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SHUTTERFLY INC | d373710d8k.htm |

Exhibit 99.1

Lenders’ Presentation “Helping people share life’s joy” February 2018 CONFIDENTIAL

Safe Harbor Disclaimer This presentation contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve risks and uncertainties. These forward-looking statements include statements regarding our expectations of being able to retire all acquisition-related debt by 2021. You can identify these statements by the use of terminology such as “guidance”, “believe”, “expect”, “will”, “should,” “could”, “estimate”, “anticipate” or similar forward-looking terms. You should not rely on these forward-looking statements as they involve risks and uncertainties that may cause actual results to vary materially from the forward-looking statements. Factors that might contribute to such differences include, among others, decreased consumer discretionary spending as a result of general economic conditions; our ability to expand our customer base and increase sales to existing customers; our ability to meet production requirements; our ability to retain and hire necessary employees, including seasonal personnel, and appropriately staff our operations; the impact of seasonality on our business; our ability to develop innovative, new products and services on a timely and cost-effective basis; consumer acceptance of our products and services; our ability to develop additional adjacent lines of business; unforeseen changes in expense levels; competition and the pricing strategies of our competitors, which could lead to pricing pressure; the possibility that the closing conditions to the proposed Lifetouch acquisition may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant a regulatory approval; delay in closing the Lifetouch acquisition or the possibility of non-consummation of the transaction; the risk of stockholder litigation in connection with contemplated Lifetouch acquisition; the retention of Lifetouch employees and our ability to successfully integrate the Lifetouch businesses; risks inherent in the achievement of anticipated synergies and the timing thereof; and general economic conditions and changes in laws and regulations. For more information regarding the risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements, as well as risks relating to our business in general, we refer you to the “Risk Factors” section of our SEC filings, including our most recent Form 10-K and 10-Q, which are available on the Securities and Exchange Commission’s Web site at www.sec.gov. These forward-looking statements are based on current expectations and the company assumes no obligation to update this information. This presentation includes non-GAAP financial measures, including Adjusted EBITDA, non-GAAP profits/margins, non-GAAP net loss, and non-GAAP net loss per share. We define Adjusted EBITDA as earnings before interest, taxes, depreciation, amortization and stock-based compensation. We define Adjusted EBITDA minus Capital Expenditures as Adjusted EBITDA less purchases of property, plant and equipment and capitalization of software and website development costs. The method we use to produce non-GAAP financial measures is not computed according to GAAP and may differ from the methods used by other companies. To supplement our consolidated financial statements presented on a GAAP basis, we believe that these non-GAAP measures provide useful information about our core operating results and thus are appropriate to enhance the overall understanding of our past financial performance and our prospects for the future. These adjustments to our GAAP results are made with the intent of providing both management and investors a more complete understanding of our underlying operational results and trends and performance. Management uses these non-GAAP measures to evaluate our financial results, develop budgets, manage expenditures, and determine employee compensation. The presentation of additional information is not meant to be considered in isolation or as a substitute for, or superior to, gross profit, net income (loss) or net income (loss) per share determined in accordance with GAAP. Management strongly encourages review of our financial statements and publicly-filed reports in their entirety and to not rely on any single financial measure. CONFIDENTIAL 2

Today’s Presenters Christopher North Mike Pope Shawn Tabak President and CEO Senior Vice President and CFO Vice President IR and Treasury CONFIDENTIAL 3

Agenda 1 Transaction Rationale 2 Shutterfly at a Glance 3 Lifetouch Overview 4 Credit Highlights 5 Historical Financials 6 Appendix CONFIDENTIAL 4

Transaction Rationale CONFIDENTIAL

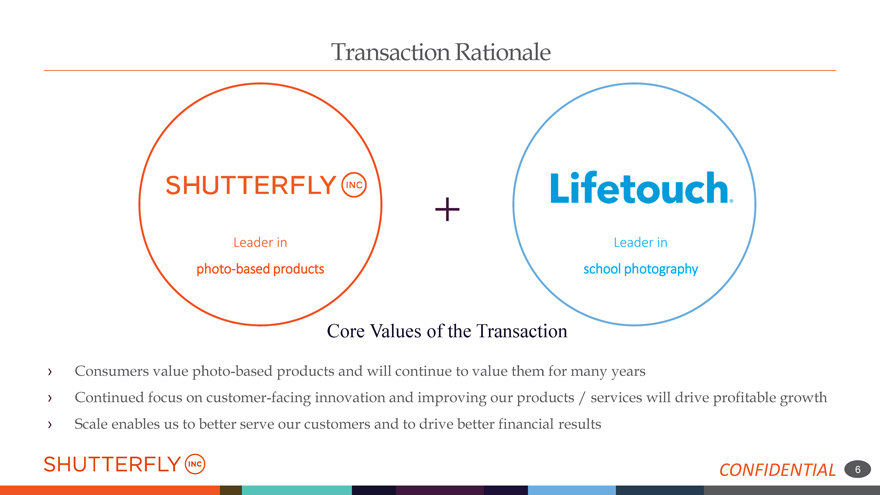

Transaction Rationale Leader in Leader in photo-based products school photography Core Values of the Transaction Consumers value photo-based products and will continue to value them for many years Continued focus on customer-facing innovation and improving our products / services will drive profitable growth Scale enables us to better serve our customers and to drive better financial results CONFIDENTIAL 6

Combining Shared Mission to Better Serve Customers Helping people share life’s joy Providing lifelong memories for all Leader in personalized photo-based products Leader in school photography $1.2 billion LTM Revenue $954 million LTM Revenue $234 million LTM Adjusted EBITDA $141 million LTM pro-forma Adjusted EBITDA 10 million active customers 10+ million households 26 million orders per year 50+ thousand schools served; 25+ million children photographed Vertically integrated manufacturing, specializing in four-color digital Vertically integrated manufacturing , specializing in traditional prints Peak demand in November/December Peak demand in September/October 40+ billion photos hosted on platform 1+ million new kindergarten households per year CONFIDENTIAL7

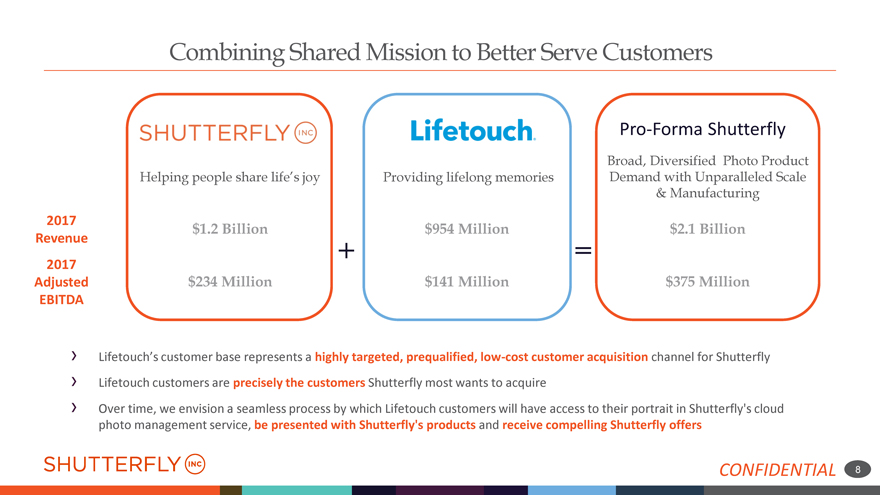

Combining Shared Mission to Better Serve Customers Pro-Forma Shutterfly Broad, Diversified Photo Product Helping people share life’s joyProviding lifelong memoriesDemand with Unparalleled Scale & Manufacturing 2017$1.2 Billion$954 Million$2.1 Billion Revenue + = 2017 Adjusted$234 Million$141 Million$375 Million EBITDA Lifetouch’s customer base represents a highly targeted, prequalified, low-cost customer acquisition channel for Shutterfly Lifetouch customers are precisely the customers Shutterfly most wants to acquire Over time, we envision a seamless process by which Lifetouch customers will have access to their portrait in Shutterfly’s cloud photo management service, be presented with Shutterfly’s products and receive compelling Shutterfly offers CONFIDENTIAL8

Compelling Strategic and Financial Rationale Combine shared mission and cultures focused on sharing life’s joy through photos Uniquely complementary asset (customers, revenue diversity, seasonality, manufacturing) Leverage shared manufacturing platform, and benefit from increased scale and complementary peak periods Adds significant, predictable revenue, adjusted EBITDA and free cash flow Increased diversification across segments and improved seasonality for manufacturing and labor demands Opportunity for revenue synergies from cross sell of products across the customer base CONFIDENTIAL 9

Shutterfly at a Glance CONFIDENTIAL

Today $1.2B Revenues 40B+ $190M+ 10.0M Hosted Photos Enterprise Revenue Customers 26.3M ~$38 ~75% Annual Orders Average Returning Customers (2) Order Value Notes: 1. Numerical statistics for the fiscal year ended December 31, 2017 2. Customers who purchased from Shutterfly in the fiscal year ended December 31, 2017, and were also prior customers 3. For the fiscal year ended December 31, 2017 CONFIDENTIAL 11

Breadth of Shutterfly Products and Brands Consumer Shutterfly Business Solutions Variable Print-on-Demand Personalized Gifts / Home DecorSolutions for Large Enterprises The leader in personalized photo products and services Examples include: Gather and organize your photos and videos so you can easily find, Targeted Direct MailPlan Books share and transform them into personalized photo books, cards, home decor and gifts Cards and Photo StationeryProductBooks CategoriesPersonalized Communications The leading online cards and stationery boutique, offering stylish announcements, invitations and personal stationery for every occasionPrintsCalendars CONFIDENTIAL12

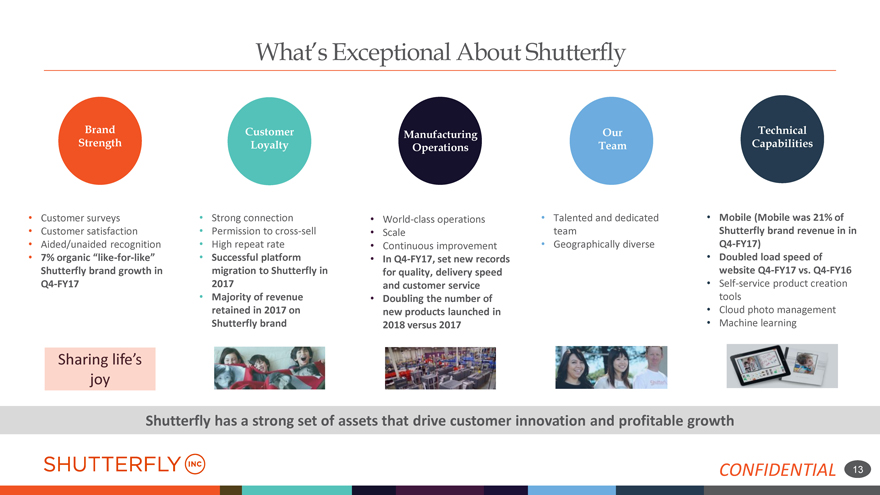

What’s Exceptional About Shutterfly Brand Customer ManufacturingOurTechnical Strength LoyaltyOperationsTeamCapabilities Customer surveys Strong connection World-class operations Talented and dedicated Mobile (Mobile was 21% of Customer satisfaction Permission to cross-sell ScaleteamShutterfly brand revenue in in Aided/unaided recognition High repeat rate Continuous improvement Geographically diverseQ4-FY17) 7% organic “like-for-like” Successful platform In Q4-FY17, set new records Doubled load speed of Shutterfly brand growth in migration to Shutterfly infor quality, delivery speed website Q4-FY17 vs. Q4-FY16 Q4-FY17 2017and customer service Self-service product creation Majority of revenue Doubling the number of tools retained in 2017 onnew products launched in Cloud photo management Shutterfly brand2018 versus 2017 Machine learning Shutterfly has a strong set of assets that drive customer innovation and profitable growth CONFIDENTIAL 13

Success of our Q4-FY2017 Quarter Platform Consolidation Product Segments Technology and Manufacturing Platform migration exceeded expectations New Cards formats and features resonated Benefits from platform consolidation, process Retained majority of revenue and with customers improvements, and equipment upgrades customers from the migrating brands Double-digit growth in Personalized Gifts Significant year-over-year improvement in Premium features in Tiny Prints Boutique and Home Decor speed and availability of sites, apps and resonated with customers Mobile revenue 21% of Shutterfly brand upload Cross-purchase of products revenue; increase of 465 basis points over Manufacturing quality, delivery speed, Q4’16 accuracy, and customer service Cards & Stationery and Personalized Gifts and Home Décor over 60% of App revenue Strong performance in Cards & Stationery, Successful platform consolidation significant Strong execution in technology and Personalized Gifts and Home Décor, and contributor to Q4 success. manufacturing. mobile. CONFIDENTIAL14

Lifetouch Overview CONFIDENTIAL

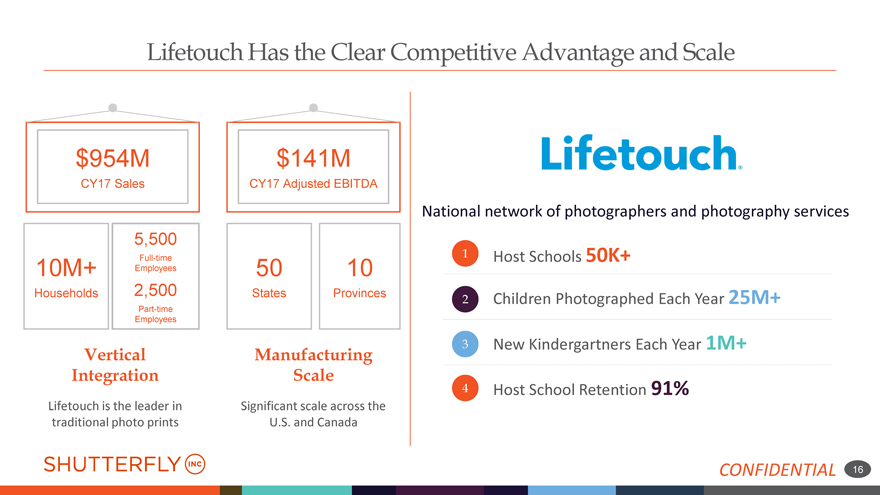

Lifetouch Has the Clear Competitive Advantage and Scale $954M $141M CY17 Sales CY17 Adjusted EBITDA National network of photographers and photography services 5,500 Full-time 1Host Schools 50K+ 10M+Employees5010 Households2,500StatesProvinces2Children Photographed Each Year 25M+ Part-time Employees VerticalManufacturing3New Kindergartners Each Year 1M+ Integration Scale 4Host School Retention 91% Lifetouch is the leader inSignificant scale across the traditional photo printsU.S. and Canada CONFIDENTIAL 16

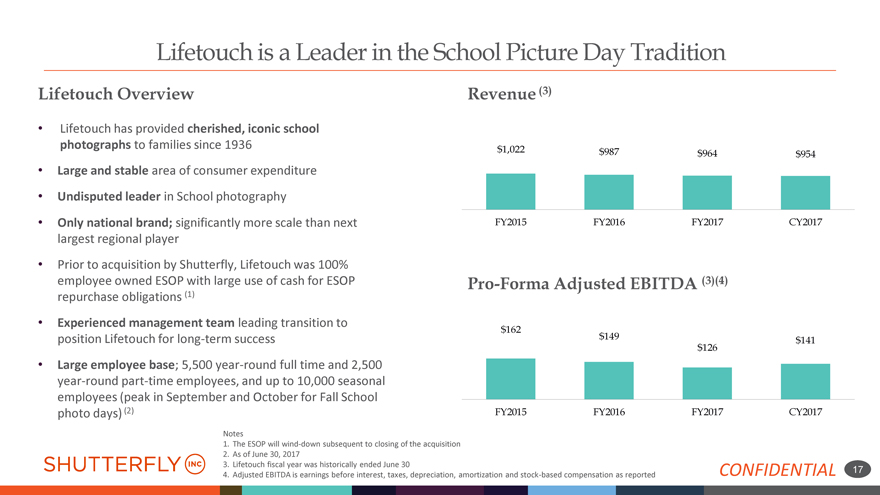

Lifetouch is a Leader in the School Picture Day Tradition Lifetouch Overview Lifetouch has provided cherished, iconic school photographs to families since 1936 Large and stable area of consumer expenditure Undisputed leader in School photography Only national brand; significantly more scale than next largest regional player Prior to acquisition by Shutterfly, Lifetouch was 100% employee owned ESOP with large use of cash for ESOP repurchase obligations (1) Experienced management team leading transition to position Lifetouch for long-term success Large employee base; 5,500 year-round full time and 2,500 year-round part-time employees, and up to 10,000 seasonal employees (peak in September and October for Fall School photo days) (2) Notes 1. The ESOP will wind-down subsequent to closing of the acquisition 2. As of June 30, 2017 3. Lifetouch fiscal year was historically ended June 30 4. Adjusted EBITDA is earnings before interest, taxes, depreciation, amortization and stock-based compensation as reported Revenue (3) $1,022 $987$964$954 FY2015FY2016FY2017CY2017 Pro-Forma Adjusted EBITDA (3)(4) $162 $149 $141 $126 FY2015FY2016FY2017CY2017 CONFIDENTIAL 17

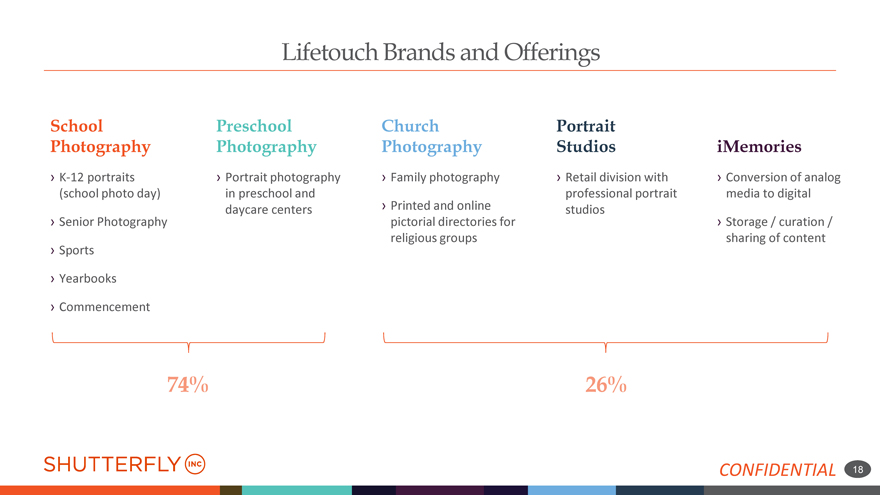

Lifetouch Brands and Offerings School Preschool ChurchPortrait PhotographyPhotographyPhotographyStudiosiMemories K-12 portraits Portrait photography Family photography Retail division with Conversion of analog (school photo day)in preschool and professional portraitmedia to digital daycare centers Printed and onlinestudios Senior Photography pictorial directories for Storage / curation / religious groups sharing of content Sports Yearbooks Commencement 74% 26% CONFIDENTIAL18

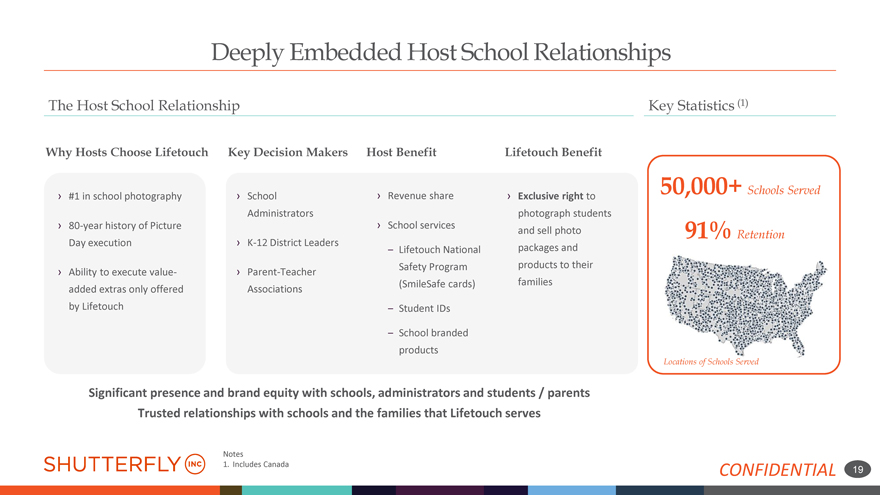

Deeply Embedded Host School Relationships The Host School Relationship Key Statistics (1) Why Hosts Choose LifetouchKey Decision MakersHost BenefitLifetouch Benefit #1 in school photography School Revenue share Exclusive right to50,000+ Schools Served Administrators photograph students 80-year history of Picture School servicesand sell photo91% Retention Day execution K-12 District Leaders ’Lifetouch Nationalpackages and Ability to execute value- Parent-Teacher Safety Programproducts to their added extras only offered Associations (SmileSafe cards)families by Lifetouch ’Student IDs ’School branded products Locations of Schools Served Significant presence and brand equity with schools, administrators and students / parents Trusted relationships with schools and the families that Lifetouch serves Notes 1. Includes Canada CONFIDENTIAL19

Credit Highlights CONFIDENTIAL

Key Credit Highlights Industry Leader with Best-in-Class Brand and Manufacturing Robust, Proven Go-To-Market Strategy with Multiple Customer Touchpoints Multiple Loyal, Attractive Customer Demographics with High Predictability Leading Share in Multiple Segments with Significant Scale and Profitability Disciplined Financial Policy with Focus on Free Cash Flow Generation Improved Seasonality of the Combined Business Strong Management Team with Proven Track Record CONFIDENTIAL 21

Shutterfly and Lifetouch are Industry Leaders with Best-in-Class Brand Strong Brand RecognitionWell Known and Highly Respected Brand 17 years as a leader in e-commerce80 years of School Photo Day Powerful secondary brand in Tiny Prints since 2011Large and Stable Consumer Expenditure Consistent >75% repeat revenue for Shutterfly91% Host School Retention CONFIDENTIAL22

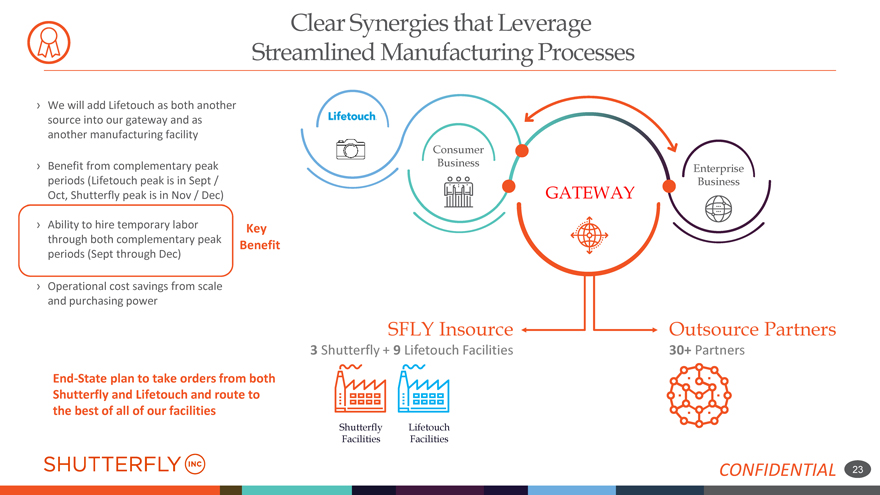

Clear Synergies that Leverage Streamlined Manufacturing Processes We will add Lifetouch as both another source into our gateway and as another manufacturing facility Consumer Benefit from complementary peak Business Enterprise periods (Lifetouch peak is in Sept / Business Oct, Shutterfly peak is in Nov / Dec) GATEWAY Ability to hire temporary laborKey through both complementary peakBenefit periods (Sept through Dec) Operational cost savings from scale and purchasing power SFLY Insource Outsource Partners 3 Shutterfly + 9 Lifetouch Facilities 30+ Partners End-State plan to take orders from both Shutterfly and Lifetouch and route to the best of all of our facilities ShutterflyLifetouch FacilitiesFacilities CONFIDENTIAL23

Robust, Proven Go-To-Market Strategy: Consumer Multi-Channel Model Direct Response and Awareness Marketing to Consumers And Natural Yearly and Milestone Touchpoints 1. Combined we can be present for every TVCatalog SEMSEO important milestone and celebration Radio Add all student photos Direct to Shutterfly Photos PR PrintDisplaySocial K-12 Mail and use Shutterfly platform for purchasing PRESCHOOLGRADUATION PartnerMobileAffiliateVideoEmail+ Present Shutterfly’s HOLIDAY &personalized products BIRTHSEASONALto parents in addition to current student Combined with Field Sales and Host-Enabled Marketing WEDDINGphoto packages Field Sales Photographers Parent Fliers Photo OperationsService Team Online Site2.Combined we can offer a wide variety of cherished photography products year-round Engage customers throughout the year across multiple touch points CONFIDENTIAL 24

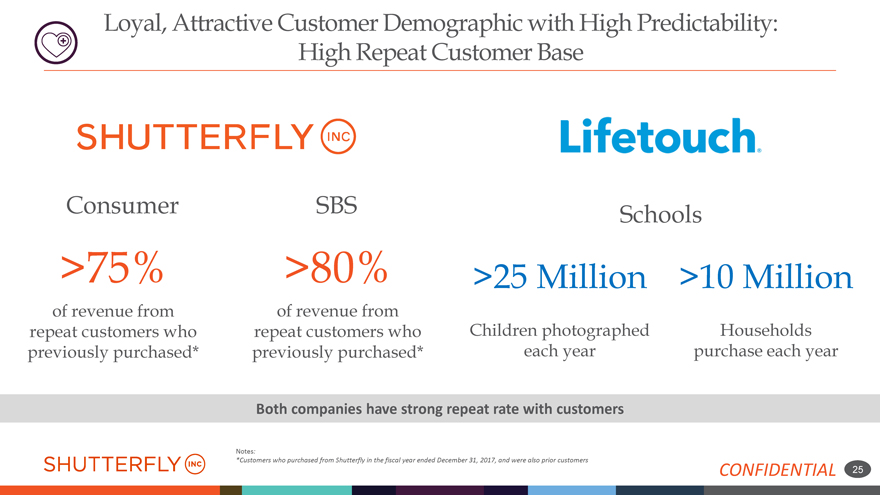

Loyal, Attractive Customer Demographic with High Predictability: High Repeat Customer Base ConsumerSBSSchools >75%>80%>25 Million>10 Million of revenue fromof revenue from repeat customers whorepeat customers whoChildren photographedHouseholds previously purchased*previously purchased*each yearpurchase each year Both companies have strong repeat rate with customers Notes: *Customers who purchased from Shutterfly in the fiscal year ended December 31, 2017, and were also prior customers CONFIDENTIAL 25

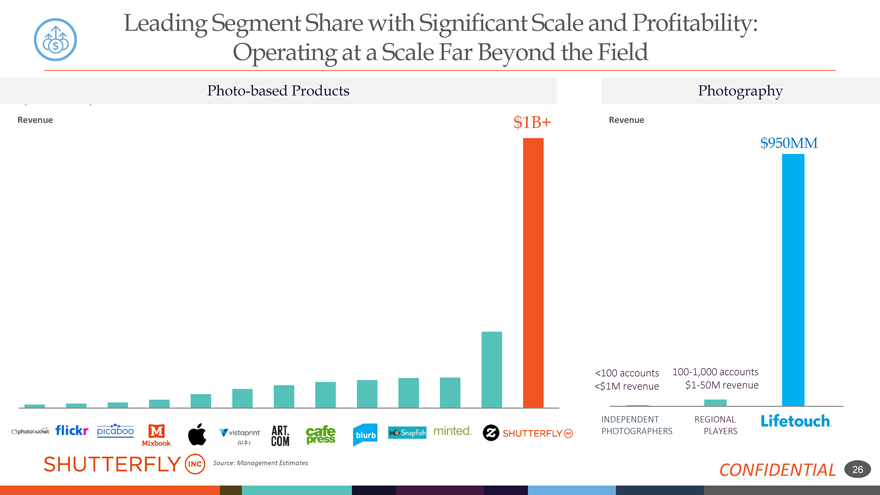

Leading Segment Share with Significant Scale and Profitability: Operating at a Scale Far Beyond the Field Photo-based Products Photography Revenue$1B+Revenue $950MM <100 accounts100-1,000 accounts <$1M revenue$1-50M revenue INDEPENDENTREGIONAL PHOTOGRAPHERS PLAYERS (U.S.) Source: Management Estimates CONFIDENTIAL26

Disciplined Financial Policy with Focus on Free Cash Flow Generation and Deleveraging 1. Returns-Based Capital Allocation All investments—organic and inorganic—evaluated against an estimated cost of capital hurdle rate Focus on value creating growth 2. Efficient, Prudent Cash and Liquidity Profile Carry sufficient cash to cover operational needs, taking into account seasonality with a cushion for contingencies 3. Managing to “Ba/BB” Rating Profile Public commitment to maintain “Ba/BB” credit rating profile and return to target leverage Anticipate being able to retire all acquisition-related debt by 2021 4. Return of Capital with FCF We have publicly suspended return of capital in favor of delevering CONFIDENTIAL 27

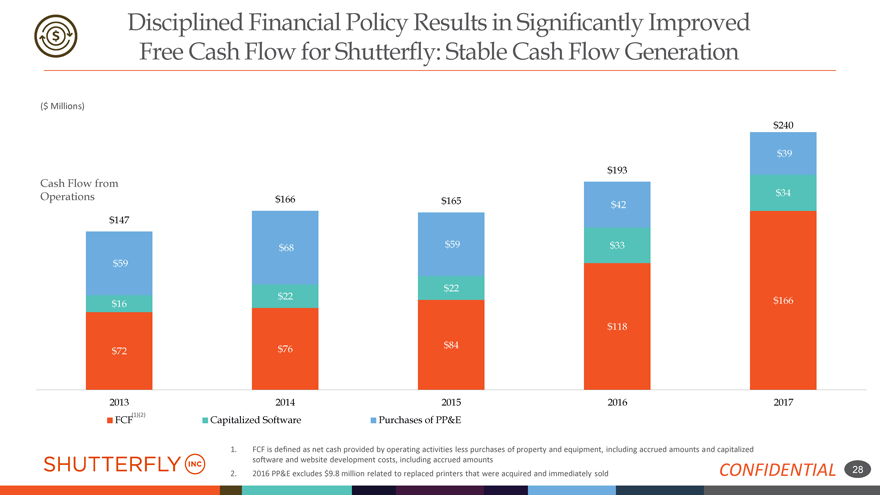

Disciplined Financial Policy Results in Significantly Improved Free Cash Flow for Shutterfly: Stable Cash Flow Generation ($ Millions) $240 $39 $193 Cash Flow from Operations $166$165 $34 $42 $147 $68$59$33 $59 $22 $22 $16 $166 $118 $72 $76$84 2013 2014201520162017 FCF(1)(2)Capitalized SoftwarePurchases of PP&E 1.FCF is defined as net cash provided by operating activities less purchases of property and equipment, including accrued amounts and capitalized software and website development costs, including accrued amounts 2.2016 PP&E excludes $9.8 million related to replaced printers that were acquired and immediately soldCONFIDENTIAL28

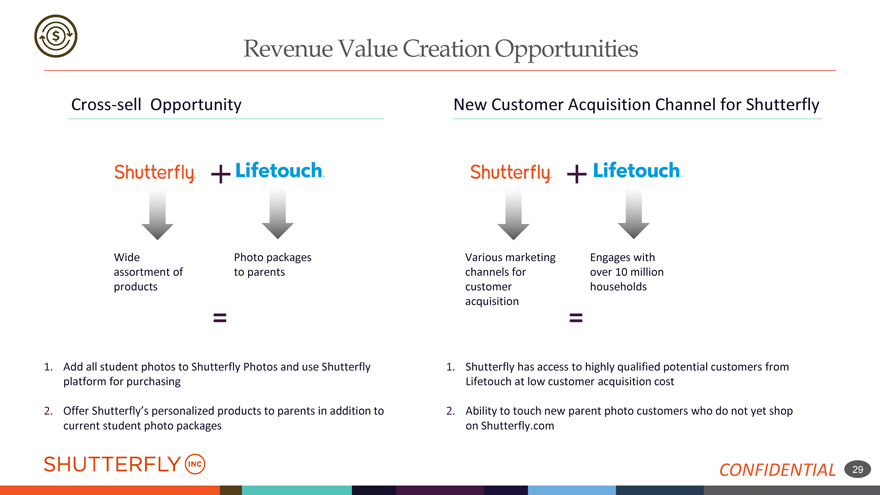

Revenue Value Creation Opportunities Cross-sell OpportunityNew Customer Acquisition Channel for Shutterfly WidePhoto packages Various marketingEngages with assortment ofto parents channels forover 10 million products customerhouseholds acquisition = = 1.Add all student photos to Shutterfly Photos and use Shutterfly1.Shutterfly has access to highly qualified potential customers from platform for purchasing Lifetouch at low customer acquisition cost 2.Offer Shutterfly’s personalized products to parents in addition to2.Ability to touch new parent photo customers who do not yet shop current student photo packages on Shutterfly.com CONFIDENTIAL29

The Combination Improves Our Seasonality Across Multiple Aspects of our Business RevenueManufacturingLabor Uniquely complementaryMore efficient use of CapEx and improvedSeasonal labor demand for ~2x as long capacity / utilization Lifetouch peak of Sept / Oct diversifies from Ability to hire through contiguous Lifetouch Shutterfly peak in Nov / DecSignificant cost synergiesand Shutterfly peak seasons Ongoing source of customer acquisition corresponding to Shutterfly target customer profile CONFIDENTIAL30

We are Done with Our Restructuring and Are Prepared and Ready to Apply the Same Expertise to Lifetouch Integration What We Did:Focused resources for Lifetouch integration Focused all of our resources on our largest opportunities Simpler manufacturing Consolidated to a singleplatform for integration consumer platform so all customers / all brands benefit from technology investmentsIncreased cash flow to Success of platform migrationreinvest and pay down debt seen in Q4 results Significant cost savings allowShutterfly & both reinvestment andLifetouch improved bottom lineOpportunity CONFIDENTIAL31

Strong Management Team with Proven Track Record Christopher North President & CEOAmazon UK, Phaidon Press, HarperCollins Michael MeekLifetouch President & CEONordstrom, Dayton’s, Macy’s, Target Mike PopeSVP, Chief Financial OfficerClean Power Finance, MarketTools, Dionex Michele AndersonSVP, RetailActivate, Australian Vintage Limited, iVillage Dwayne BlackSVP, Operations and SBSBanta Corporation, RR Donnelley John BorisSVP, Chief Marketing OfficerLonely Planet, Zagat Survey, 1-800 Flowers.com Tracy LayneySVP, Chief Human Resources OfficerGap Inc., Levi Strauss, PwC Ishantha LokugeSVP, Chief Product OfficereBay, Urbanpixel, Netscape Satish MenonSVP, Chief Technology OfficerUV Labs, Apollo Education Group, Yahoo Inc. CONFIDENTIAL32

Historical Financials CONFIDENTIAL

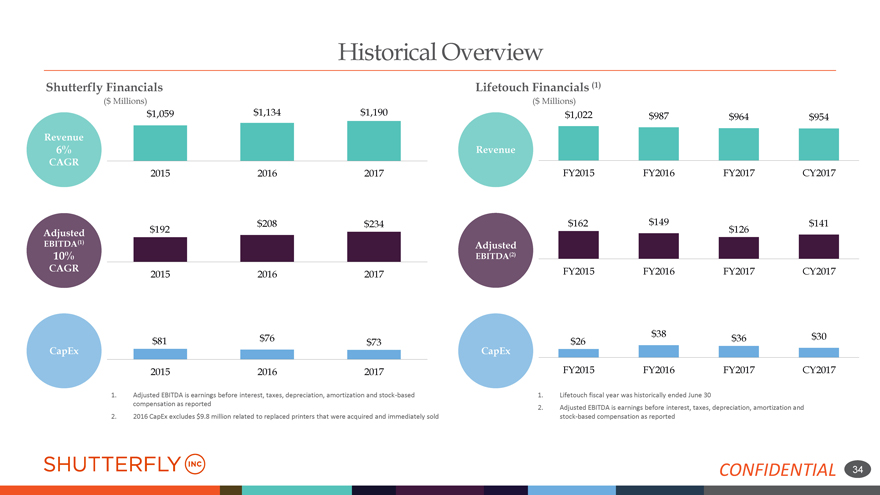

Historical Overview Shutterfly Financials Lifetouch Financials (1) ($ Millions) ($ Millions) $1,059$1,134$1,190 $1,022$987$964$954 Revenue 6% Revenue CAGR 201520162017 FY2015FY2016FY2017CY2017 $208$234 $162$149 $141 Adjusted$192 $126 EBITDA(1) Adjusted 10% EBITDA(2) CAGR201520162017 FY2015FY2016FY2017CY2017 $81$76$73 $26$38$36$30 CapEx CapEx 201520162017 FY2015FY2016FY2017CY2017 1.Adjusted EBITDA is earnings before interest, taxes, depreciation, amortization and stock-based1.Lifetouch fiscal year was historically ended June 30 compensation as reported 2.Adjusted EBITDA is earnings before interest, taxes, depreciation, amortization and 2.2016 CapEx excludes $9.8 million related to replaced printers that were acquired and immediately sold stock-based compensation as reported CONFIDENTIAL34

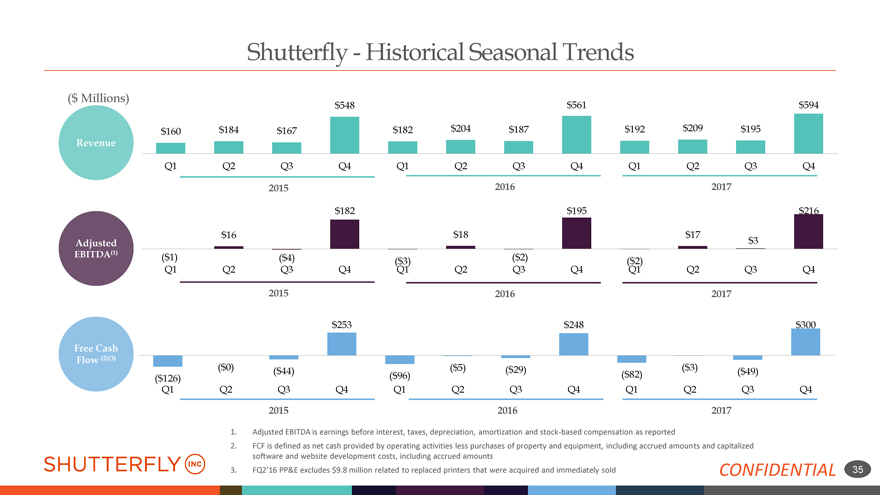

Shutterfly—Historical Seasonal Trends ($ Millions) $548 $561 $594 $160$184$167 $182$204$187 $192$209$195 Revenue Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4 2015 2016 2017 $182 $195 $216 $16 $18 $17 Adjusted $3 EBITDA(1)($1) ($4) ($2) ($3) ($2) Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4 2015 2016 2017 $253 $248 $300 Free Cash Flow (2)(3) ($126)($0)($44) ($96)($5)($29) ($82)($3)($49) Q1Q2Q3Q4Q1Q2Q3Q4Q1Q2Q3Q4 2015 2016 2017 1.Adjusted EBITDA is earnings before interest, taxes, depreciation, amortization and stock-based compensation as reported 2.FCF is defined as net cash provided by operating activities less purchases of property and equipment, including accrued amounts and capitalized software and website development costs, including accrued amounts 3.FQ2’16 PP&E excludes $9.8 million related to replaced printers that were acquired and immediately sold CONFIDENTIAL35

Appendix CONFIDENTIAL

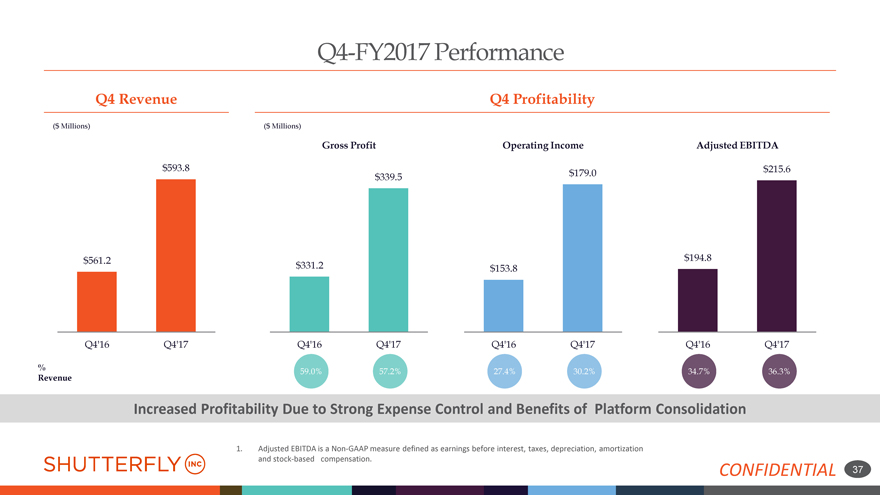

Q4-FY2017 Performance Q4 Revenue Q4 Profitability ($ Millions) ($ Millions) Gross ProfitOperating IncomeAdjusted EBITDA $593.8 $179.0 $215.6 $339.5 $561.2 $194.8 $331.2 $153.8 Q4’16Q4’17Q4’16Q4’17Q4’16Q4’17Q4’16Q4’17 % 59.0%57.2%27.4%30.2%34.7%36.3% Revenue Increased Profitability Due to Strong Expense Control and Benefits of Platform Consolidation 1.Adjusted EBITDA is a Non-GAAP measure defined as earnings before interest, taxes, depreciation, amortization and stock-based compensation. CONFIDENTIAL37

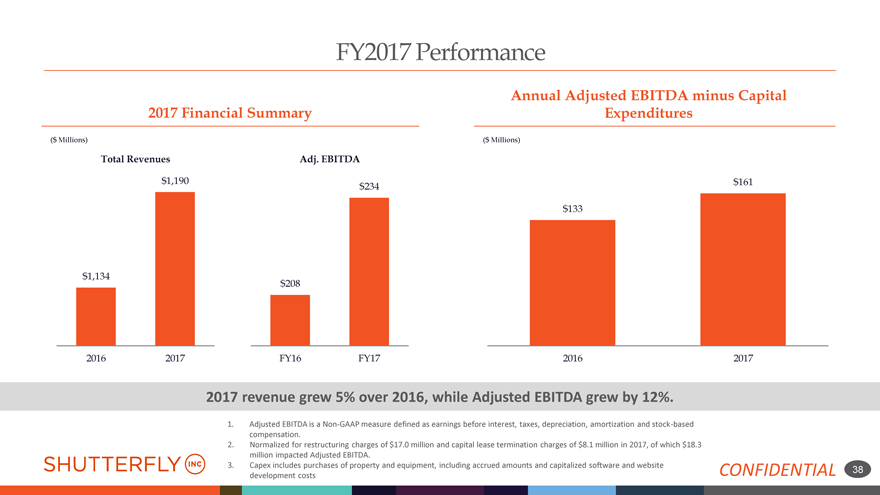

FY2017 Performance Annual Adjusted EBITDA minus Capital 2017 Financial Summary Expenditures ($ Millions) ($ Millions) Total RevenuesAdj. EBITDA $1,190 $234 $161 $133 $1,134 $208 20162017FY16FY1720162017 2017 revenue grew 5% over 2016, while Adjusted EBITDA grew by 12%. 1.Adjusted EBITDA is a Non-GAAP measure defined as earnings before interest, taxes, depreciation, amortization and stock-based compensation. 2.Normalized for restructuring charges of $17.0 million and capital lease termination charges of $8.1 million in 2017, of which $18.3 million impacted Adjusted EBITDA. 3.Capex includes purchases of property and equipment, including accrued amounts and capitalized software and websiteCONFIDENTIAL38 development costs

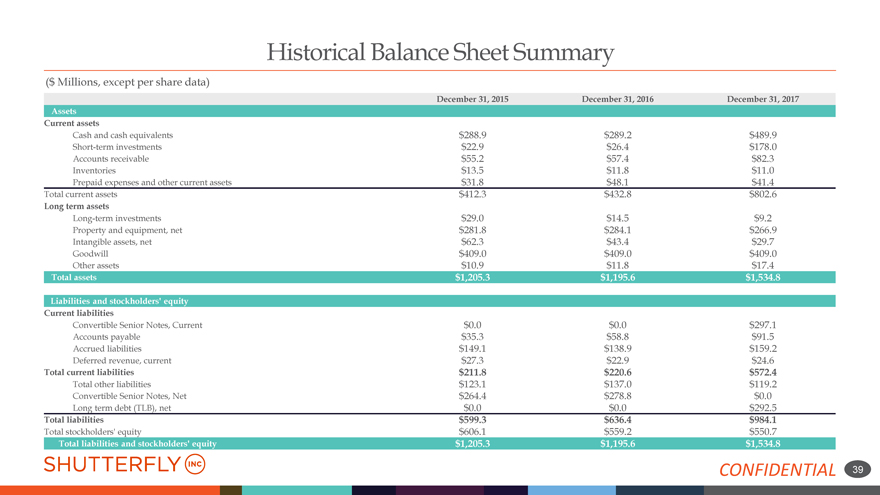

Historical Balance Sheet Summary ($ Millions, except per share data) December 31, 2015 December 31, 2016December 31, 2017 Assets Current assets Cash and cash equivalents$288.9$289.2$489.9 Short-term investments$22.9$26.4$178.0 Accounts receivable$55.2$57.4$82.3 Inventories$13.5$11.8$11.0 Prepaid expenses and other current assets$31.8$48.1$41.4 Total current assets$412.3$432.8$802.6 Long term assets Long-term investments$29.0$14.5$9.2 Property and equipment, net$281.8$284.1$266.9 Intangible assets, net$62.3$43.4$29.7 Goodwill$409.0$409.0$409.0 Other assets$10.9$11.8$17.4 Total assets$1,205.3$1,195.6$1,534.8 Liabilities and stockholders’ equity Current liabilities Convertible Senior Notes, Current$0.0$0.0$297.1 Accounts payable$35.3$58.8$91.5 Accrued liabilities$149.1$138.9$159.2 Deferred revenue, current$27.3$22.9$24.6 Total current liabilities$211.8$220.6$572.4 Total other liabilities$123.1$137.0$119.2 Convertible Senior Notes, Net$264.4$278.8$0.0 Long term debt (TLB), net$0.0$0.0$292.5 Total liabilities$599.3$636.4$984.1 Total stockholders’ equity$606.1$559.2$550.7 Total liabilities and stockholders’ equity$1,205.3$1,195.6$1,534.8 CONFIDENTIAL39

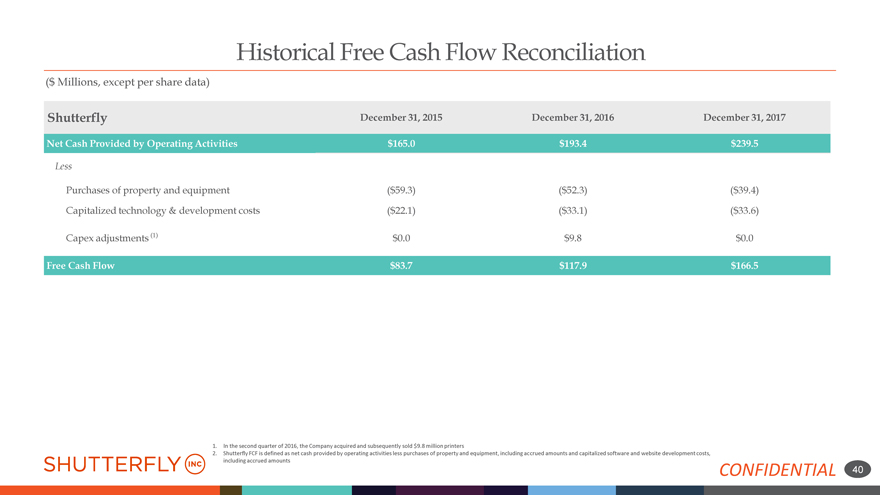

Historical Free Cash Flow Reconciliation ($ Millions, except per share data) Shutterfly December 31, 2015 December 31, 2016December 31, 2017 Net Cash Provided by Operating Activities$165.0$193.4$239.5 Less Purchases of property and equipment($59.3)($52.3)($39.4) Capitalized technology & development costs($22.1)($33.1)($33.6) Capex adjustments (1) $0.0$9.8$0.0 Free Cash Flow $83.7$117.9$166.5 1.In the second quarter of 2016, the Company acquired and subsequently sold $9.8 million printers 2.Shutterfly FCF is defined as net cash provided by operating activities less purchases of property and equipment, including accrued amounts and capitalized software and website development costs, including accrued amounts CONFIDENTIAL40

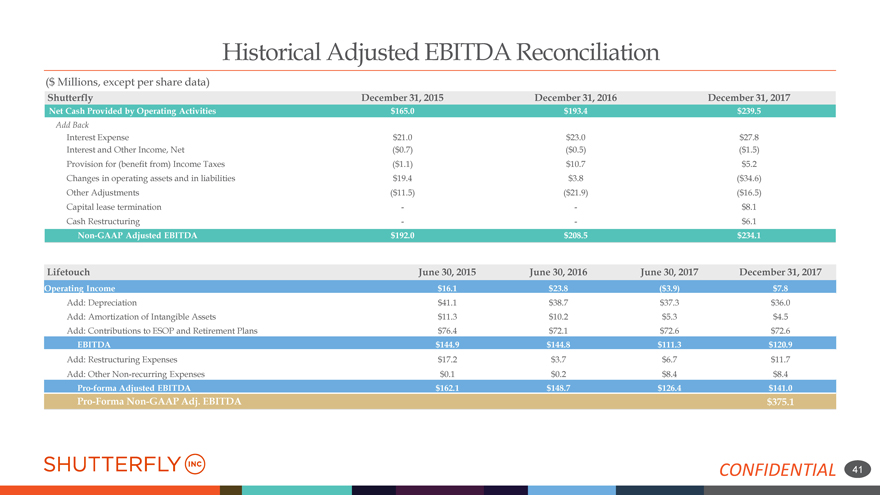

Historical Adjusted EBITDA Reconciliation ($ Millions, except per share data) Shutterfly December 31, 2015December 31, 2016 December 31, 2017 Net Cash Provided by Operating Activities$165.0$193.4 $239.5 Add Back Interest Expense$21.0$23.0 $27.8 Interest and Other Income, Net($0.7)($0.5) ($1.5) Provision for (benefit from) Income Taxes($1.1)$10.7 $5.2 Changes in operating assets and in liabilities$19.4$3.8 ($34.6) Other Adjustments($11.5)($21.9) ($16.5) Capital lease termination-- $8.1 Cash Restructuring-- $6.1 Non-GAAP Adjusted EBITDA$192.0$208.5 $234.1 LifetouchJune 30, 2015June 30, 2016June 30, 2017December 31, 2017 Operating Income$16.1$23.8($3.9)$7.8 Add: Depreciation$41.1$38.7$37.3$36.0 Add: Amortization of Intangible Assets$11.3$10.2$5.3$4.5 Add: Contributions to ESOP and Retirement Plans$76.4$72.1$72.6$72.6 EBITDA$144.9$144.8$111.3$120.9 Add: Restructuring Expenses$17.2$3.7$6.7$11.7 Add: Other Non-recurring Expenses$0.1$0.2$8.4$8.4 Pro-forma Adjusted EBITDA$162.1$148.7$126.4$141.0 Pro-Forma Non-GAAP Adj. EBITDA $375.1CONFIDENTIAL41

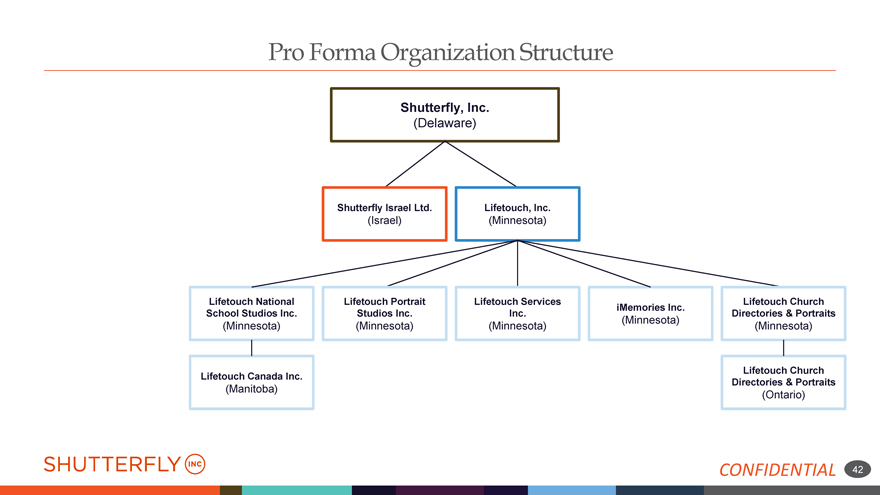

Pro Forma Organization Structure Shutterfly, Inc. (Delaware) Shutterfly Israel Ltd.Lifetouch, Inc. (Israel)(Minnesota) Lifetouch NationalLifetouch PortraitLifetouch Services Lifetouch Church iMemories Inc. School Studios Inc.Studios Inc.Inc. Directories & Portraits (Minnesota) (Minnesota)(Minnesota)(Minnesota) (Minnesota) Lifetouch Canada Inc. Lifetouch Church Directories & Portraits (Manitoba) (Ontario) CONFIDENTIAL42

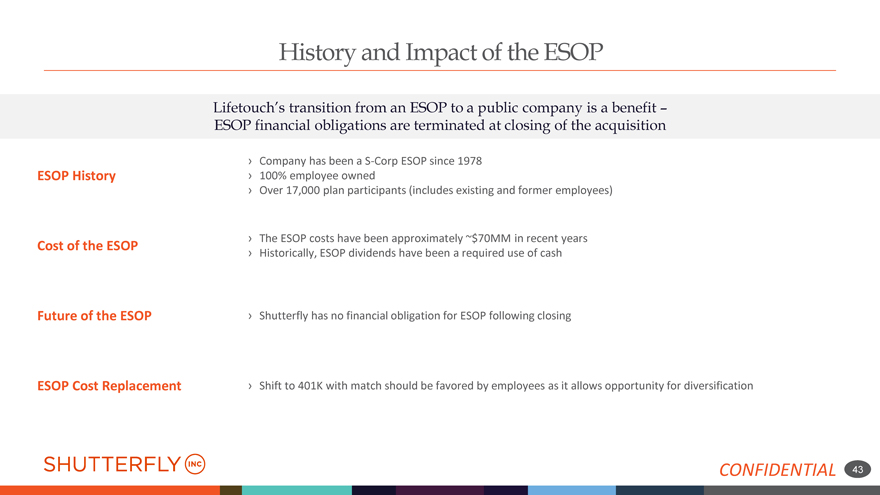

History and Impact of the ESOP Lifetouch’s transition from an ESOP to a public company is a benefit – ESOP financial obligations are terminated at closing of the acquisition Company has been a S-Corp ESOP since 1978 ESOP History 100% employee owned Over 17,000 plan participants (includes existing and former employees) The ESOP costs have been approximately ~$70MM in recent years Cost of the ESOP Historically, ESOP dividends have been a required use of cash Future of the ESOP Shutterfly has no financial obligation for ESOP following closing ESOP Cost Replacement Shift to 401K with match should be favored by employees as it allows opportunity for diversification CONFIDENTIAL43