Attached files

| file | filename |

|---|---|

| 8-K - 8-K INVESTOR PRESENTATION FEB 13, 2018 - PATTERSON UTI ENERGY INC | pten-8k_20180212.htm |

Credit Suisse February 12-14, 2018 23rd Annual Energy Summit

Forward-Looking Statements This material and any oral statements made in connection with this material include "forward-looking statements" within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. Statements made which provide the Company’s or management’s intentions, beliefs, expectations or predictions for the future are forward-looking statements and are inherently uncertain. The opinions, forecasts, projections or other statements other than statements of historical fact, including, without limitation, plans and objectives of management of the Company are forward-looking statements. It is important to note that actual results could differ materially from those discussed in such forward-looking statements. Important factors that could cause actual results to differ materially include the risk factors and other cautionary statements contained from time to time in the Company’s SEC filings, which may be obtained by contacting the Company or the SEC. These filings are also available through the Company’s web site at http://www.patenergy.com or through the SEC’s Electronic Data Gathering and Analysis Retrieval System (EDGAR) at http://www.sec.gov. We undertake no obligation to publicly update or revise any forward-looking statement. Statements made in this presentation include non-U.S. GAAP financial measures. The required reconciliation to U.S. GAAP financial measures are included on our website and/or at the end of this presentation.

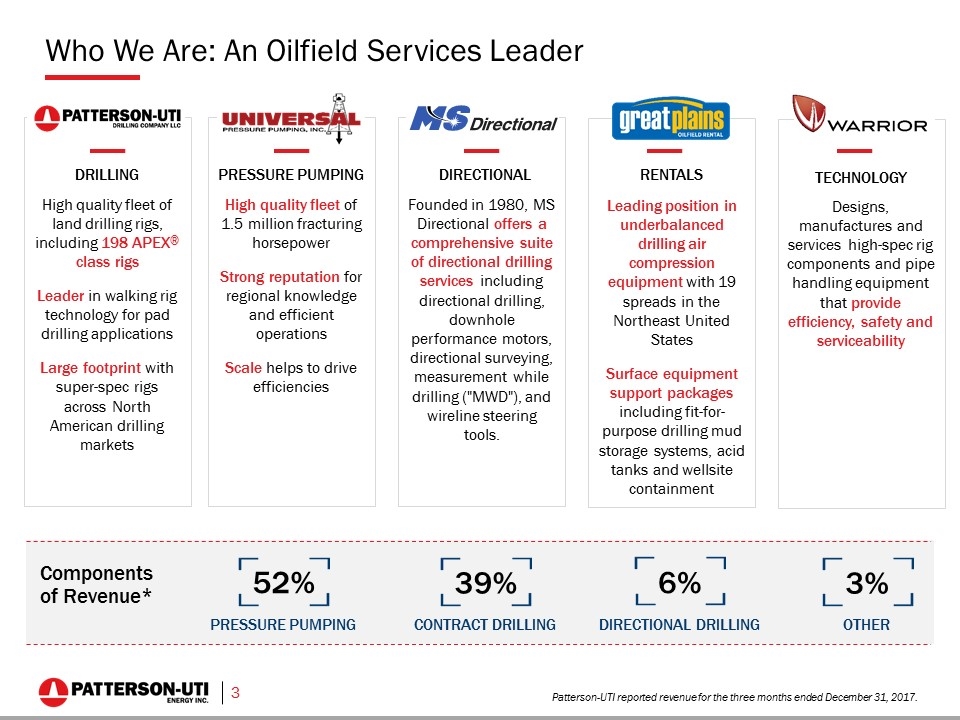

Who We Are: An Oilfield Services Leader Patterson-UTI reported revenue for the three months ended December 31, 2017. DRILLING PRESSURE PUMPING High quality fleet of land drilling rigs, including 198 APEX® class rigs Leader in walking rig technology for pad drilling applications Large footprint with super-spec rigs across North American drilling markets High quality fleet of 1.5 million fracturing horsepower Strong reputation for regional knowledge and efficient operations Scale helps to drive efficiencies Components of Revenue* 39% CONTRACT DRILLING 52% PRESSURE PUMPING 3% OTHER RENTALS TECHNOLOGY Leading position in underbalanced drilling air compression equipment with 19 spreads in the Northeast United States Surface equipment support packages including fit-for-purpose drilling mud storage systems, acid tanks and wellsite containment Designs, manufactures and services high-spec rig components and pipe handling equipment that provide efficiency, safety and serviceability DIRECTIONAL Founded in 1980, MS Directional offers a comprehensive suite of directional drilling services including directional drilling, downhole performance motors, directional surveying, measurement while drilling ("MWD"), and wireline steering tools. 6% DIRECTIONAL DRILLING

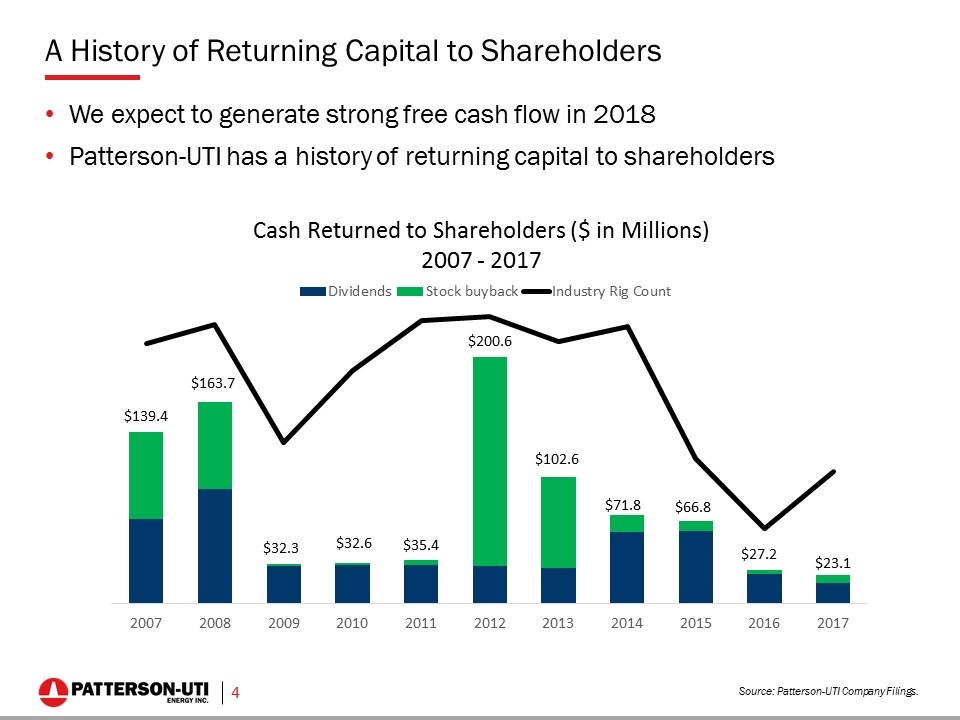

A History of Returning Capital to Shareholders We expect to generate strong free cash flow in 2018 Patterson-UTI has a history of returning capital to shareholders Source: Patterson-UTI Company Filings.

Q4 2017 Earnings Call Recap PTEN pressure pumping results in the first quarter are being impacted by transitory issues including weather Initiatives to improve pressure pumping results in 2018 include: Generating more cash with current active horsepower Relocating active spreads to more profitable markets Reactivating idle equipment Our view is that rig count and dayrates continue to increase in 2018 at current commodity prices Super-spec rig market remains tight and we require contracts to deliver rigs with major upgrades Increasing rig count drives increasing pressure pumping activity and improved pricing in 2018 We believe the pumping market remains tight in 2018, including new equipment entering the market, based on our rig count projections We expect to generate strong free cash flow in 2018

Additional References

Comprehensive Oilfield Services and Solutions Contract Drilling Hydraulic Fracturing Directional Drilling Cementing Acidizing Nitrogen Service Air Drilling Drilling Motor Rentals Water Transfer Drilling Top Drives Well Surveying Rental Equipment

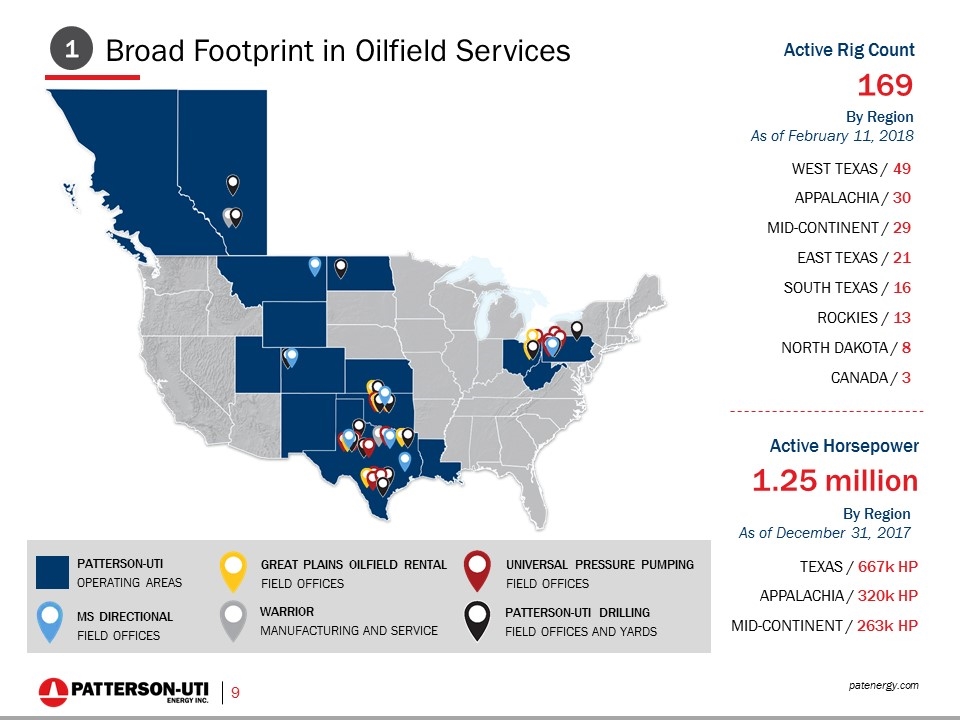

Broad Footprint in Oilfield Services patenergy.com WEST TEXAS / 49 APPALACHIA / 30 MID-CONTINENT / 29 EAST TEXAS / 21 SOUTH TEXAS / 16 ROCKIES / 13 NORTH DAKOTA / 8 CANADA / 3 By Region As of February 11, 2018 Active Rig Count 169 TEXAS / 667k HP APPALACHIA / 320k HP MID-CONTINENT / 263k HP Active Horsepower PATTERSON-UTI OPERATING AREAS UNIVERSAL PRESSURE PUMPING FIELD OFFICES GREAT PLAINS OILFIELD RENTAL FIELD OFFICES 1.25 million By Region As of December 31, 2017 WARRIOR MANUFACTURING AND SERVICE PATTERSON-UTI DRILLING FIELD OFFICES AND YARDS MS DIRECTIONAL FIELD OFFICES 1

Efficiency Efficiency improves well economics Patterson-UTI has the scale, processes, people and equipment necessary for efficient operations Technology Technology helps to improve efficiency Patterson-UTI is a technology leader in oilfield services U.S. Oilfield Services Scale Scale helps to improve efficiency Patterson-UTI is the only company in the U.S. unconventional market with scale in contract drilling, pressure pumping and directional drilling Financially Flexible Strong Balance Sheet Scalable business structure Patterson-UTI is a Leader: Why Invest in Patterson-UTI Energy?

Patterson-UTI: A Leader in Oilfield Services Efficiency Efficiency improves well economics. People Crews receive extensive onboarding and ongoing training to ensure competency and refine operating and safety procedures. Processes Patterson-UTI utilizes industry leading management systems and field audit processes to maximize reliability and provide continuous learning and feedback process. Innovation Patterson-UTI is a leader in the super-spec rig market. Super-spec rigs, modern pressure pumping fleets and comprehensive directional drilling provide critical path services for E&P companies.

People: Personnel Development Working incident free is not just a priority to us — it's our way of life. Operational excellence is our minimum standard — excellence is our way of life. Development of our people is a core value — continuous learning is our way of life.

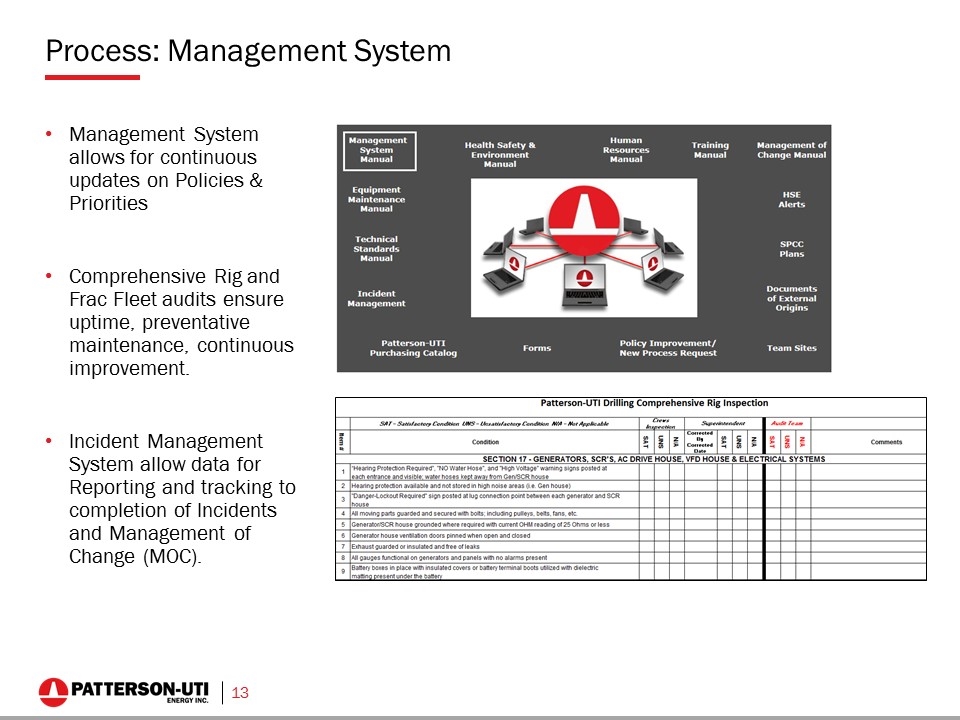

Process: Management System Management System allows for continuous updates on Policies & Priorities Comprehensive Rig and Frac Fleet audits ensure uptime, preventative maintenance, continuous improvement. Incident Management System allow data for Reporting and tracking to completion of Incidents and Management of Change (MOC).

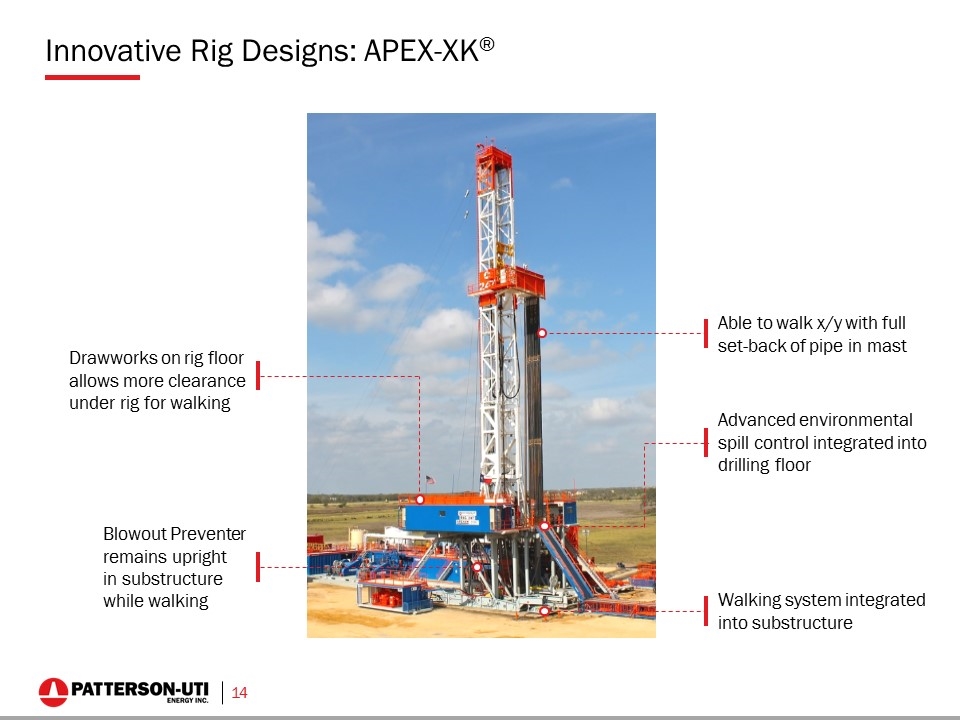

Innovative Rig Designs: APEX-XK® Able to walk x/y with full set-back of pipe in mast Walking system integrated into substructure Blowout Preventer remains upright in substructure while walking Drawworks on rig floor allows more clearance under rig for walking Advanced environmental spill control integrated into drilling floor

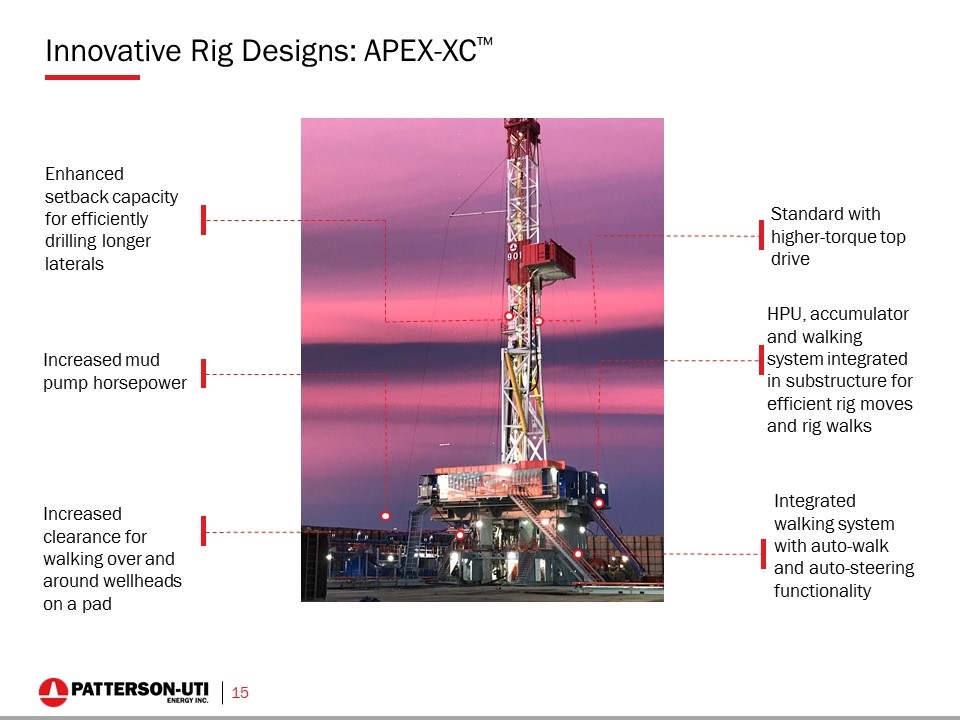

Innovative Rig Designs: APEX-XC™ Standard with higher-torque top drive Enhanced setback capacity for efficiently drilling longer laterals Increased clearance for walking over and around wellheads on a pad HPU, accumulator and walking system integrated in substructure for efficient rig moves and rig walks Integrated walking system with auto-walk and auto-steering functionality Increased mud pump horsepower

Innovative Rig Upgrades: Upgraded seven APEX 1000® rigs to APEX-XK® rigs, with an additional two planned for delivery in the first half of 2018. Upgrading three APEX® rigs to APEX-PK™ with a box-on-box substructure and integrated walking system for enhanced performance on multi-well pads. Upgraded rigs will have substantially all of the capabilities of a newbuild, but at a much lower upgrade cost than a newbuild.

Innovative Rig Technology: Warrior 500 Ton AC Top Drive HIGH PERFORMANCE - 50,000 ft-lbs continuous torque rating REDUNDANT POWER DELIVERY - Four independent power pathways from the AC bus to the top drive quill - No single-point sources of failure from generator to drill pipe REVOLUTIONARY POWER TRANSMISSION - No gear case - No power transmission lubrication SERVICEABILITY - Most major modules are interchangeable without specialized technicians - Comprehensive advanced diagnostics SAFETY AND EFFICIENCY - Comprehensive feedback of pipe-handler functions - Enhanced user interface and top drive control functions OPTIONAL INTEGRATED CASING DRIVE - Casing Running Tool not required

Innovative Pressure Pumping Technology: Bi-Fuel Engines can burn a fuel mix comprised of up to 70% natural gas Comparable torque and horsepower to an all diesel engine Reduces operating costs by lowering fuel costs Good for environmental sustainability

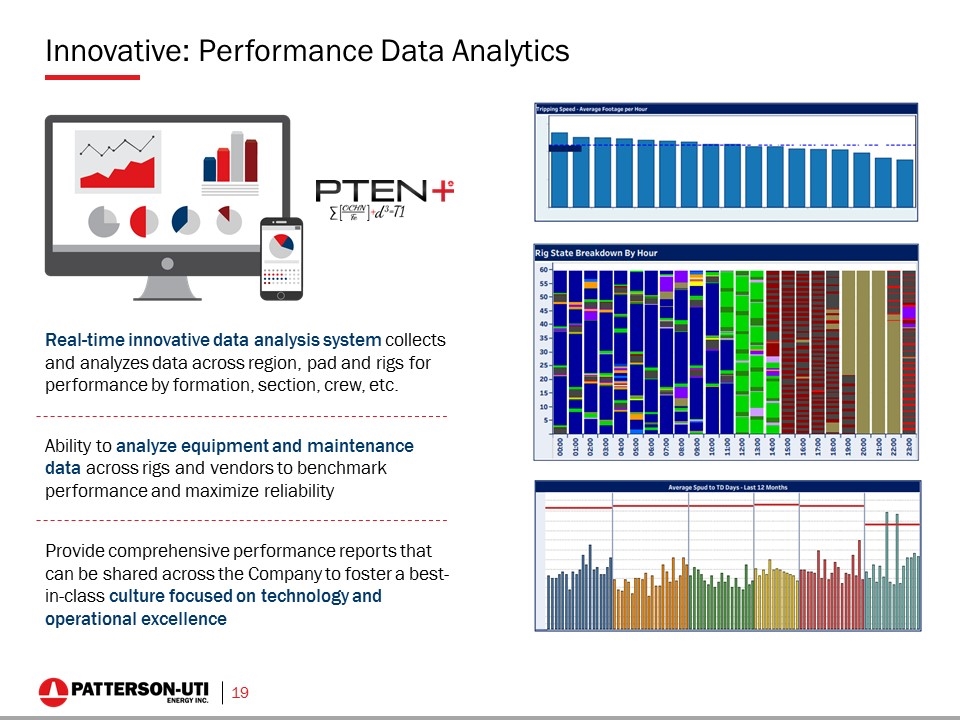

Innovative: Performance Data Analytics Real-time innovative data analysis system collects and analyzes data across region, pad and rigs for performance by formation, section, crew, etc. Ability to analyze equipment and maintenance data across rigs and vendors to benchmark performance and maximize reliability Provide comprehensive performance reports that can be shared across the Company to foster a best-in-class culture focused on technology and operational excellence

Innovative: Centralized Logistics Center Efficient procurement and logistics of sand and chemicals is important to being successful in hydraulic fracturing. Centralized logistics center includes: central scheduling and tracking software 24/7 dispatch personnel smart phone apps in the field Currently operational in Texas and Mid-Con and Expanding to Appalachia

Innovative: Directional Drilling MS Directional, a leading provider of directional drilling services in the United States MS Directional has a strong technology focus with proprietary mud motor, MWD and survey equipment Patented C2 technology enables high-speed electromagnetic telemetry independent of geological formation constraints, which reduces both drilling time and expense

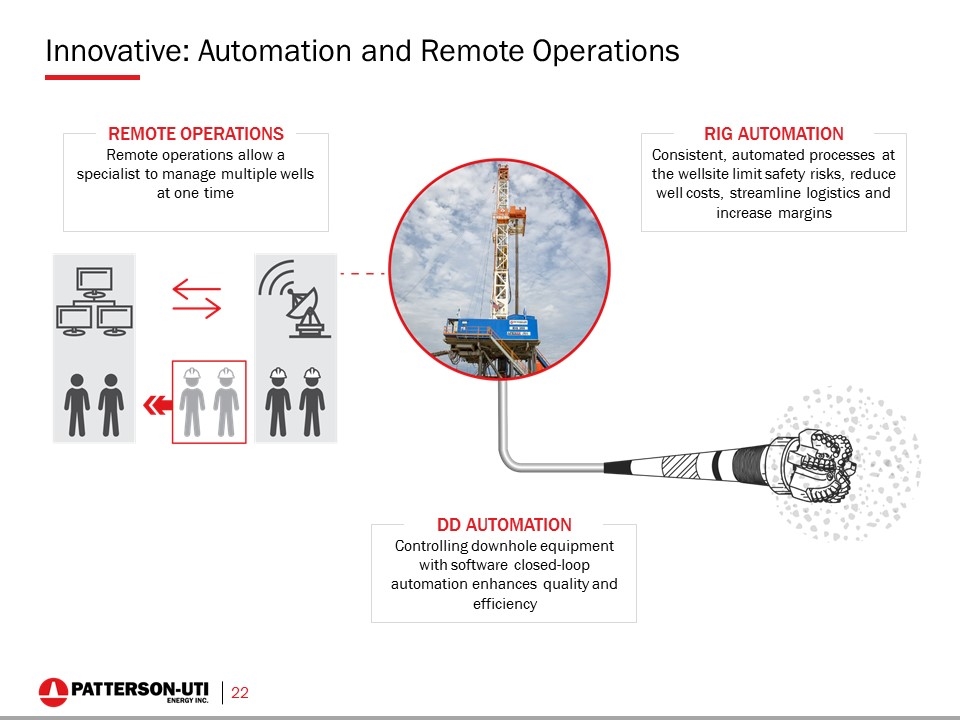

Innovative: Automation and Remote Operations REMOTE OPERATIONS Remote operations allow a specialist to manage multiple wells at one time RIG AUTOMATION Consistent, automated processes at the wellsite limit safety risks, reduce well costs, streamline logistics and increase margins DD AUTOMATION Controlling downhole equipment with software closed-loop automation enhances quality and efficiency

Strong Financial Position Substantial Liquidity $43 million cash as of December 31, 2017 $525 million of senior notes issued in January 2018 $500 million revolver through March 2019 17.2% Net Debt/Total Capital at December 31, 2017 (excluding $525 million debt issued in January 2018) $300 million term loan matures October 2020 $300 million term loan matures June 2022 $525 million 3.95% senior notes due 2028 No term debt maturities until October 2020 Investment Grade Credit Rating Moody’s – Baa2 Standard & Poor’s - BBB

Efficiency Efficiency improves well economics Patterson-UTI has the scale, processes, people and equipment necessary for efficient operations Technology Technology helps to improve efficiency Patterson-UTI is a technology leader in oilfield services U.S. Oilfield Services Scale Scale helps to improve efficiency Patterson-UTI is the only company in the U.S. unconventional market with scale in contract drilling, pressure pumping and directional drilling Financially Flexible Strong Balance Sheet Scalable business structure Patterson-UTI is a Leader: Why Invest in Patterson-UTI Energy?

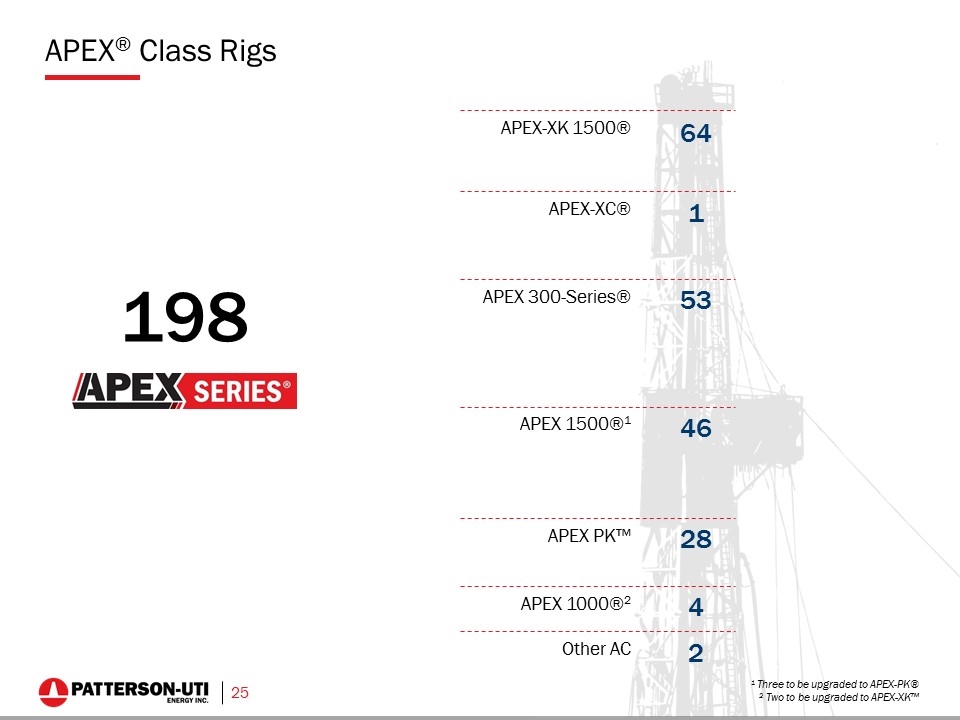

APEX® Class Rigs 1 Three to be upgraded to APEX-PK® 2 Two to be upgraded to APEX-XK™ 198 APEX-XK 1500® APEX 300-Series® APEX 1500®1 APEX PK™ APEX 1000®2 Other AC 64 53 46 28 4 2 APEX-XC® 1

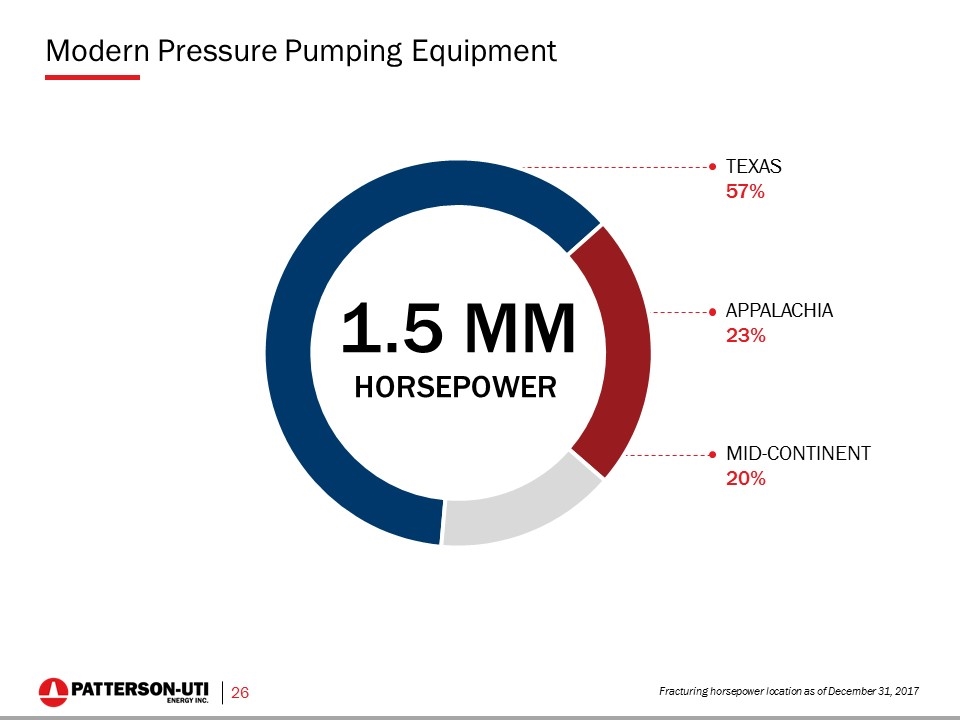

Modern Pressure Pumping Equipment Fracturing horsepower location as of December 31, 2017 APPALACHIA 23% 1.5 MM HORSEPOWER TEXAS 57% MID-CONTINENT 20%

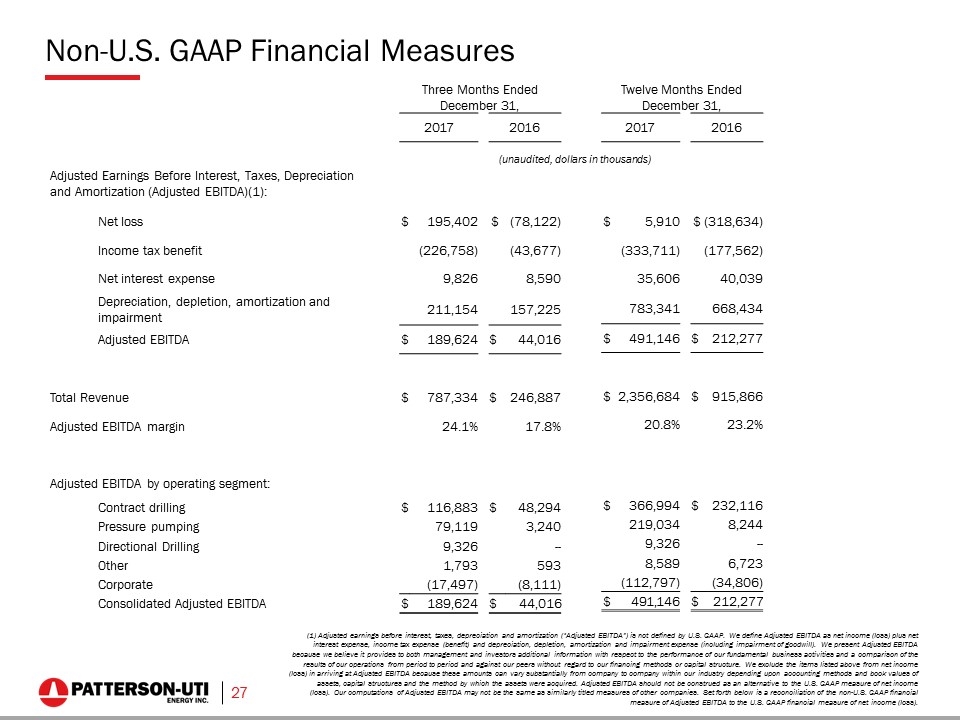

Non-U.S. GAAP Financial Measures (1) Adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) is not defined by U.S. GAAP. We define Adjusted EBITDA as net income (loss) plus net interest expense, income tax expense (benefit) and depreciation, depletion, amortization and impairment expense (including impairment of goodwill). We present Adjusted EBITDA because we believe it provides to both management and investors additional information with respect to the performance of our fundamental business activities and a comparison of the results of our operations from period to period and against our peers without regard to our financing methods or capital structure. We exclude the items listed above from net income (loss) in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDA should not be construed as an alternative to the U.S. GAAP measure of net income (loss). Our computations of Adjusted EBITDA may not be the same as similarly titled measures of other companies. Set forth below is a reconciliation of the non-U.S. GAAP financial measure of Adjusted EBITDA to the U.S. GAAP financial measure of net income (loss). Three Months Ended December 31, 2017 2016 Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA)(1): Net loss $ 195,402 $ (78,122) Income tax benefit (226,758) (43,677) Net interest expense 9,826 8,590 Depreciation, depletion, amortization and impairment 211,154 157,225 Adjusted EBITDA $ 189,624 $ 44,016 Total Revenue $ 787,334 $ 246,887 Adjusted EBITDA margin 24.1% 17.8% Adjusted EBITDA by operating segment: Contract drilling $ 116,883 $ 48,294 Pressure pumping 79,119 3,240 Directional Drilling 9,326 -- Other 1,793 593 Corporate (17,497) (8,111) Consolidated Adjusted EBITDA $ 189,624 $ 44,016 Twelve Months Ended December 31, 2017 2016 $ 5,910 $ (318,634) (333,711) (177,562) 35,606 40,039 783,341 668,434 $ 491,146 $ 212,277 $ 2,356,684 $ 915,866 20.8% 23.2% $ 366,994 $ 232,116 219,034 8,244 9,326 -- 8,589 6,723 (112,797) (34,806) $ 491,146 $ 212,277 (unaudited, dollars in thousands)