Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - Nationstar Mortgage Holdings Inc. | d484326dex994.htm |

| EX-99.3 - EX-99.3 - Nationstar Mortgage Holdings Inc. | d484326dex993.htm |

| EX-99.1 - EX-99.1 - Nationstar Mortgage Holdings Inc. | d484326dex991.htm |

| 8-K - FORM 8-K - Nationstar Mortgage Holdings Inc. | d484326d8k.htm |

| Exhibit 99.2

|

Nationstar SM MERGER PRESENTATION FEBRUARY 13, 2018

|

Forward Looking Statements

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, WMIH’s and

Nationstar’s expectations or predictions of future financial or business performance or conditions. All statements other than statements of historical or current fact included in this communication that address activities, events, conditions or

developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations,

plans, objectives, future performance and business and these statements are not guarantees of future performance. Forward-looking statements may include the words “anticipate,” “estimate,” “expect,” “project,”

“intend,” “plan,”

“believe,” “strategy,” “future,” “opportunity,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Such forward-looking statements involve risks and uncertainties that may cause actual events, results or

performance to differ materially from those indicated by such statements. Certain of these risks are identified and discussed in WMIH’s Form 10-K for the year ended December 31, 2016 under Risk

Factors in Part I, Item 1A and Nationstar’s Form 10-K for the year ended December 31, 2016 under Risk Factors in Part I, Item 1A. These risk factors will be important to consider in determining

future results and should be reviewed in their entirety. These forward-looking statements are expressed in good faith, and WMIH and Nationstar believe there is a reasonable basis for them. However, there can be no assurance that the events, results

or trends identified in these forward-looking statements will occur or be achieved. Forward-looking statements speak only as of the date they are made, and neither WMIH nor Nationstar is under any obligation, and expressly disclaim any obligation,

to update, alter or otherwise revise any forward-looking statement, except as required by law. Readers should carefully review the statements set forth in the reports, which WMIH and Nationstar have filed or will file from time to time with the SEC.

In addition to factors previously disclosed in WMIH’s and Nationstar’s reports filed with the SEC and those identified elsewhere in this communication,

the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: ability to meet the closing conditions to the merger, including approval by shareholders of WMIH and

Nationstar on the expected terms and schedule and the risk that regulatory approvals required for the merger are not obtained or are obtained subject to conditions that are not anticipated; delay in closing the merger; failure to realize the

benefits expected from the proposed transaction; the effects of pending and future legislation; risks associated with investing in real estate assets and changes in interest rates; risks related to disruption of management time from ongoing business

operations due to the proposed transaction; business disruption following the transaction; macroeconomic factors beyond WMIH’s or Nationstar’s control; risks related to WMIH’s or Nationstar’s indebtedness and other consequences

associated with mergers, acquisitions and divestitures and legislative and regulatory actions and reforms.

Annualized, pro forma, projected and estimated numbers

are used for illustrative purpose only, are not forecasts and may not reflect actual results.

2

|

Additional Information for Stockholders

This communication is being made in respect of the proposed merger transaction involving WMIH Corp. (“WMIH”) and Nationstar Mortgage Holdings Inc.

(“Nationstar”). WMIH intends to file a registration statement on Form S-4 with the SEC, which will include a joint proxy statement of WMIH and Nationstar and a prospectus of WMIH, and each party will

file other documents regarding the proposed transaction with the SEC. Any definitive proxy statement(s)/prospectus(es) will also be sent to the stockholders of WMIH and/or Nationstar, as applicable, seeking any required stockholder approval. This

communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Before making any voting or investment decision, investors and security holders of WMIH and

Nationstar are urged to carefully read the entire registration statement(s) and proxy statement(s)/prospectus(es), when they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these

documents, because they will contain important information about the proposed transaction. The documents filed by WMIH and Nationstar with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents

filed by WMIH may be obtained free of charge from WMIH at www.wmih-corp.com, and the documents filed by Nationstar may be obtained free of charge from Nationstar at www.nationstarholdings.com. Alternatively, these documents, when available, can be

obtained free of charge from WMIH upon written request to WMIH Corp., 800 Fifth Avenue, Suite 4100,

Seattle, Washington 98104, Attn: Secretary, or by calling (206)

922-2957, or from Nationstar upon written request to Nationstar Mortgage Holdings Inc., 8950 Cypress Waters Blvd, Dallas, TX 75019, Attention: Corporate Secretary, or by calling (469) 549-2000.

WMIH and Nationstar and certain of their respective directors and executive officers may be deemed to be participants

in the solicitation of proxies from the shareholders of WMIH and/or Nationstar, as applicable, in favor of the approval of the merger. Information regarding WMIH’s directors and executive officers is contained in WMIH’s Annual Report on

Form 10-K for the year ended December 31, 2016, its Quarterly Report on Form

10-Q for the quarterly periods ended March 31, 2017, June 30, 2017 and September 30, 2017 and its Proxy

Statement on Schedule 14A, dated April 18, 2017, which are filed with the SEC(1). Information regarding Nationstar’s directors and executive officers is contained in Nationstar’s Annual Report on Form

10-K for the year ended December 31, 2016, its Quarterly Report on Form 10-Q for the quarterly periods ended March 31, 2017, June 30, 2017 and

September 30, 2017, and its Proxy Statement on Schedule 14A, dated April 11, 2017, which are filed with the SEC. Additional information regarding the interests of those participants and other persons who may be deemed participants in the

transaction may be obtained by reading the registration statement(s) and the proxy statement(s)/prospectus(es) and other relevant documents filed with the SEC when they become available. Free copies of these documents may be obtained as described in

the preceding paragraph.

3

|

Today’s Presenters WMIH Corp. Jay Bray Bill Gallagher CEO & Chairman CEO Nationstar WMIH Amar Patel Thomas Fairfield CFO President & COO Nationstar WMIH 4

|

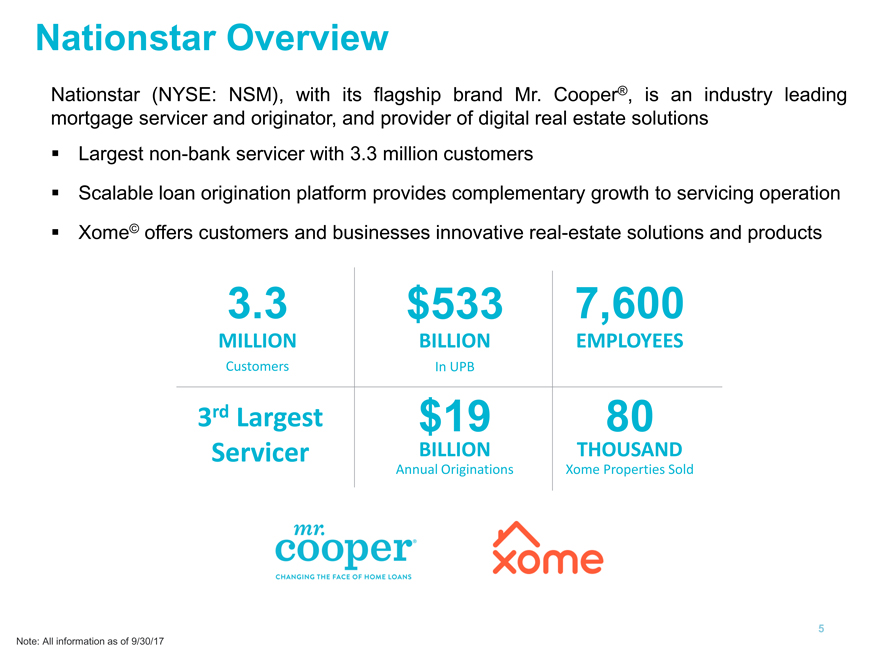

Nationstar Overview Nationstar (NYSE: NSM), with its flagship brand Mr. Cooper®, is an industry leading mortgage servicer and originator, and provider of digital real estate solutions Largest non-bank servicer with 3.3 million customers Scalable loan origination platform provides complementary growth to servicing operation Xome offers customers and businesses innovative real-estate solutions and products 3.3 $533 7,600 MILLION BILLION EMPLOYEES Customers In UPB 3rd Largest $19 80 Servicer BILLION THOUSAND Annual Originations Xome Properties Sold 5 Note: All information as of 9/30/17

|

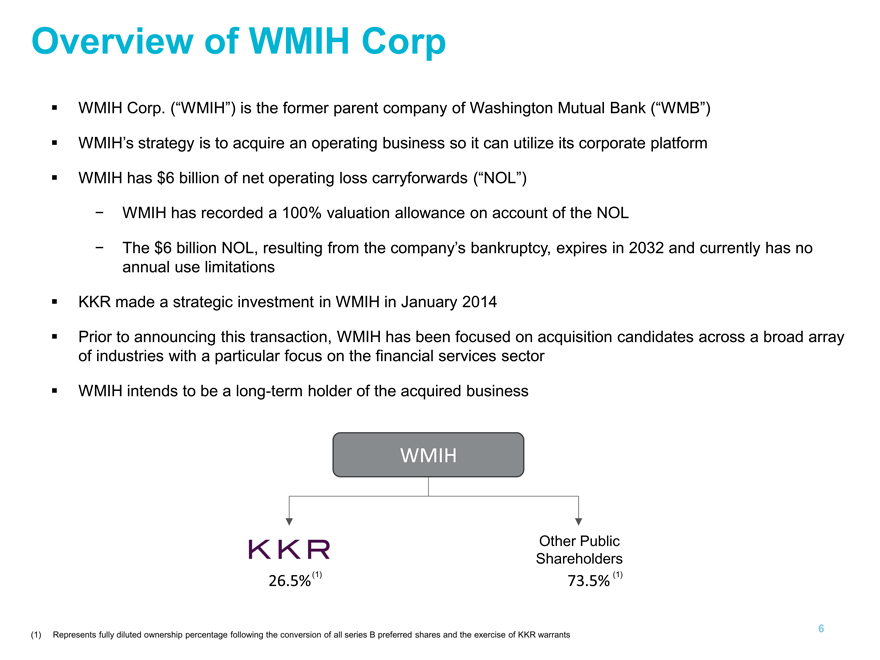

Overview of WMIH Corp WMIH Corp. (“WMIH”) is the former parent company of Washington Mutual Bank (“WMB”) WMIH’s strategy is to acquire an operating business so it can utilize its corporate platform WMIH has $6 billion of net operating loss carryforwards (“NOL”) —WMIH has recorded a 100% valuation allowance on account of the NOL —The $6 billion NOL, resulting from the company’s bankruptcy, expires in 2032 and currently has no annual use limitations KKR made a strategic investment in WMIH in January 2014 Prior to announcing this transaction, WMIH has been focused on acquisition candidates across a broad array of industries with a particular focus on the financial services sector WMIH intends to be a long-term holder of the acquired business WMIH Other Public Shareholders (1) (1) 26.5% 73.5% 6 (1) Represents fully diluted ownership percentage following the conversion of all series B preferred shares and the exercise of KKR warrants

|

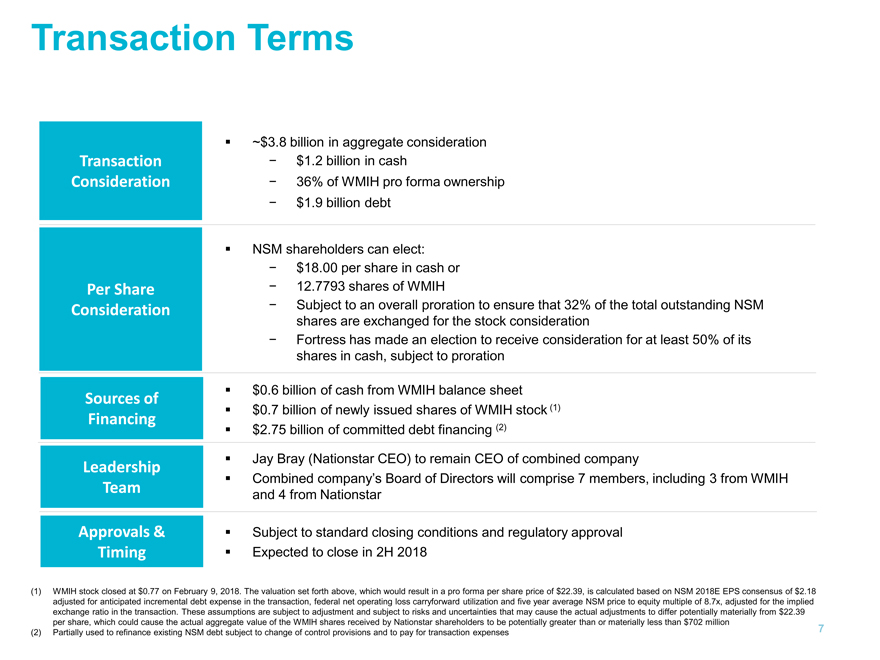

Transaction Terms ~$3.8 billion in aggregate consideration Transaction—$1.2 billion in cash Consideration—36% of WMIH pro forma ownership —$1.9 billion debt NSM shareholders can elect: —$18.00 per share in cash or Per Share—12.7793 shares of WMIH Consideration—Subject to an overall proration to ensure that 32% of the total outstanding NSM shares are exchanged for the stock consideration —Fortress has made an election to receive consideration for at least 50% of its shares in cash, subject to proration $0.6 billion of cash from WMIH balance sheet Sources of $0.7 billion of newly issued shares of WMIH stock (1) Financing $2.75 billion of committed debt financing (2) Jay Bray (Nationstar CEO) to remain CEO of combined company Leadership Combined company’s Board of Directors will comprise 7 members, including 3 from WMIH Team and 4 from Nationstar Approvals & Subject to standard closing conditions and regulatory approval Timing Expected to close in 2H 2018 (1) WMIH stock closed at $0.77 on February 9, 2018. The valuation set forth above, which would result in a pro forma per share price of $22.39, is calculated based on NSM 2018E EPS consensus of $2.18 adjusted for anticipated incremental debt expense in the transaction, federal net operating loss carryforward utilization and five year average NSM price to equity multiple of 8.7x, adjusted for the implied exchange ratio in the transaction. These assumptions are subject to adjustment and subject to risks and uncertainties that may cause the actual adjustments to differ potentially materially from $22.39 per share, which could cause the actual aggregate value of the WMIH shares received by Nationstar shareholders to be potentially greater than or materially less than $702 million (2) Partially used to refinance existing NSM debt subject to change of control provisions and to pay for transaction expenses 7

|

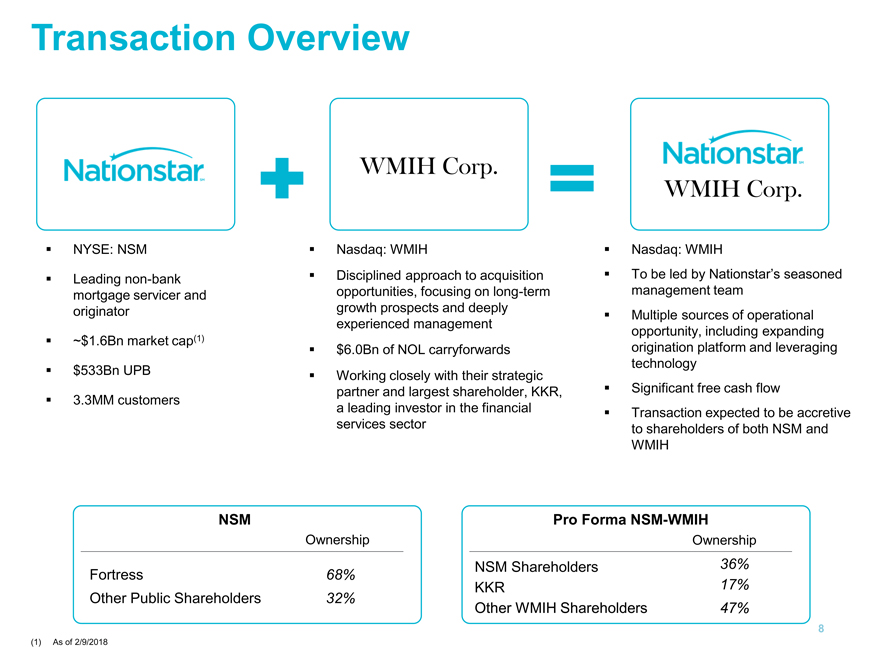

Transaction Overview WMIH Corp. WMIH Corp. NYSE: NSM Nasdaq: WMIH Nasdaq: WMIH Leading non-bank Disciplined approach to acquisition To be led by Nationstar’s seasoned mortgage servicer and opportunities, focusing on long-term management team originator growth prospects and deeply Multiple sources of operational experienced management opportunity, including expanding ~$1.6Bn market cap(1) $6.0Bn of NOL carryforwards origination platform and leveraging technology $533Bn UPB Working closely with their strategic 3.3MM customers partner and largest shareholder, KKR, Significant free cash flow a leading investor in the financial Transaction expected to be accretive services sector to shareholders of both NSM and WMIH NSM Pro Forma NSM-WMIH Ownership Ownership NSM Shareholders 36% Fortress 68% KKR 17% Other Public Shareholders 32% Other WMIH Shareholders 47% 8 (1) As of 2/9/2018

|

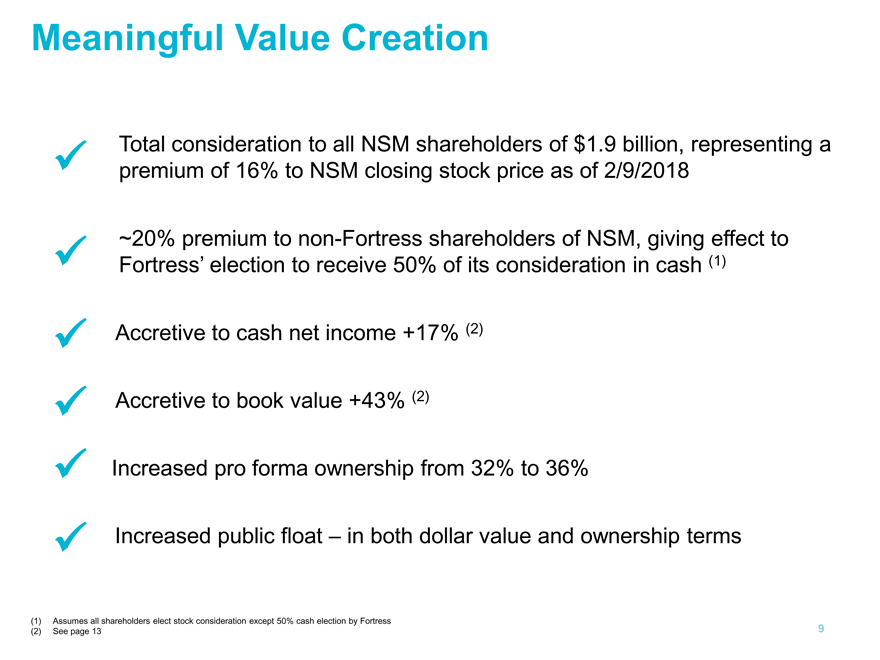

Meaningful Value Creation Total consideration to all NSM shareholders of $1.9 billion, representing a  premium of 16% to NSM closing stock price as of 2/9/2018 ~20% premium to non-Fortress shareholders of NSM, giving effect to  Fortress’ election to receive 50% of its consideration in cash (1)  Accretive to cash net income +17% (2)  Accretive to book value +43% (2)  Increased pro forma ownership from 32% to 36%  Increased public float – in both dollar value and ownership terms (1) Assumes all shareholders elect stock consideration except 50% cash election by Fortress (2) See page 13 9

|

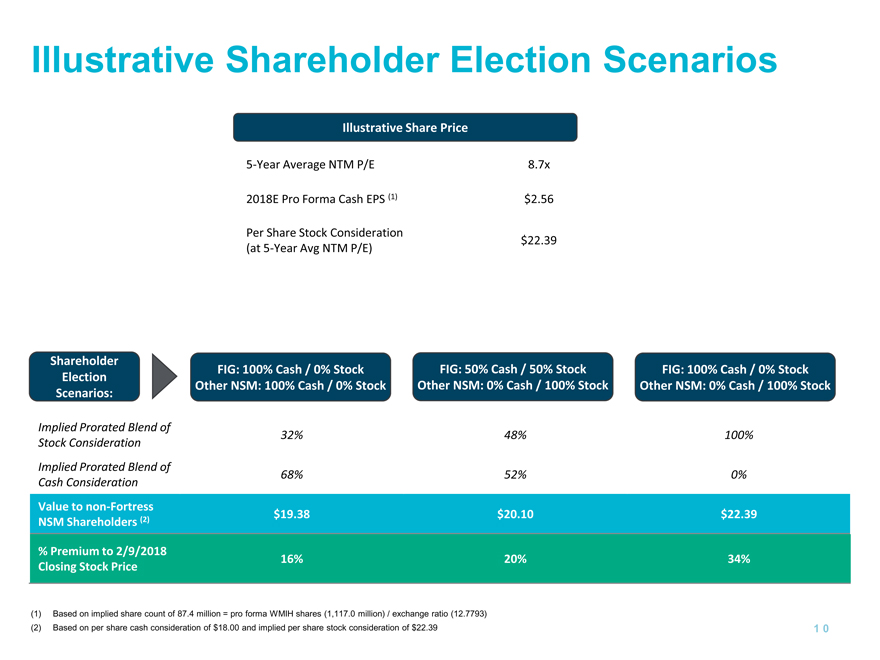

Illustrative Shareholder Election Scenarios Illustrative Share Price 5-Year Average NTM P/E 8.7x 2018E Pro Forma Cash EPS (1) $2.56 Per Share Stock Consideration $22.39 (at 5-Year Avg NTM P/E) Shareholder FIG: 100% Cash / 0% Stock FIG: 50% Cash / 50% Stock FIG: 100% Cash / 0% Stock Election Other NSM: 100% Cash / 0% Stock Other NSM: 0% Cash / 100% Stock Other NSM: 0% Cash / 100% Stock Scenarios: Implied Prorated Blend of 32% 48% 100% Stock Consideration Implied Prorated Blend of 68% 52% 0% Cash Consideration Value to non-Fortress $19.38 $20.10 $22.39 NSM Shareholders (2) % Premium to 2/9/2018 16% 20% 34% Closing Stock Price (1) Based on implied share count of 87.4 million = pro forma WMIH shares (1,117.0 million) / exchange ratio (12.7793) (2) Based on per share cash consideration of $18.00 and implied per share stock consideration of $22.39 1 0

|

Key Takeaways Publicly traded entity (Nasdaq: WMIH) with diversified ownership $6.0Bn of NOL carryforwards available for use through 2032 Significant free cash flow enables continued investment in business and deleveraging Meaningfully accretive to NSM and WMIH shareholders Remain committed to our 3.3 million customers Better positioned business with significantly increased cash flow 1 1

|

Appendix

|

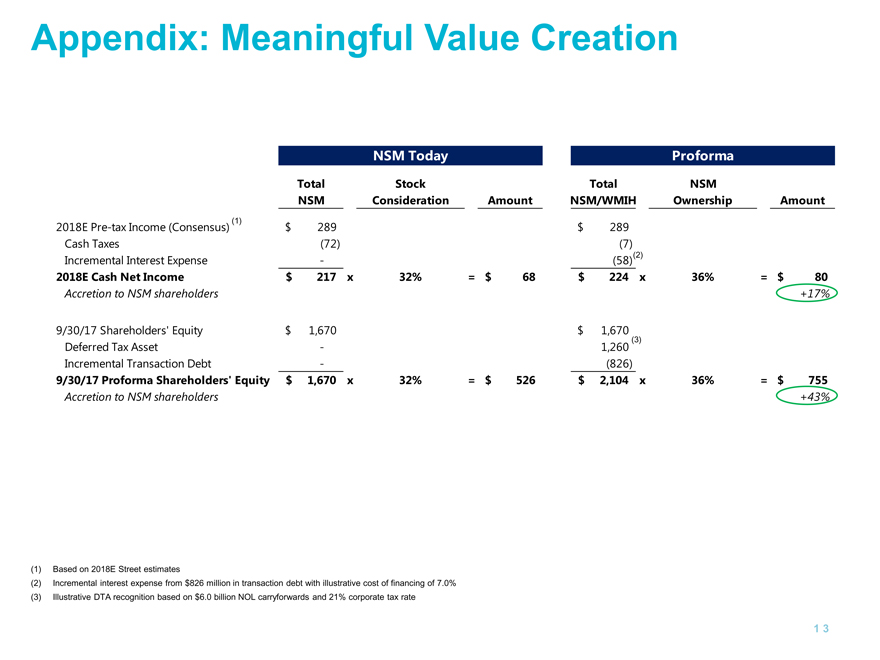

Appendix: Meaningful Value Creation NSM Today Proforma Total Stock Total NSM NSM Consideration Amount NSM/WMIH Ownership Amount (1) 2018E Pre-tax Income (Consensus) $ 289 $ 289 Cash Taxes (72) (7) (2) Incremental Interest Expense — (58) 2018E Cash Net Income $ 217 x 32% = $ 68 $ 224 x 36% = $ 80 Accretion to NSM shareholders +17% 9/30/17 Shareholders’ Equity $ 1,670 $ 1,670 (3) Deferred Tax Asset — 1,260 Incremental Transaction Debt — (826) 9/30/17 Proforma Shareholders’ Equity $ 1,670 x 32% = $ 526 $ 2,104 x 36% = $ 755 Accretion to NSM shareholders +43% (1) Based on 2018E Street estimates (2) Incremental interest expense from $826 million in transaction debt with illustrative cost of financing of 7.0% (3) Illustrative DTA recognition based on $6.0 billion NOL carryforwards and 21% corporate tax rate 1 3