Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CHESAPEAKE ENERGY CORP | a8-k2018x02x13recreditsuis.htm |

CREDIT SUISSE

23RD ANNUAL ENERGY SUMMIT

Vail, Colorado | February 13, 2018

Nick Dell’Osso

Executive Vice President and Chief Financial Officer

Exhibit 99.1

FORWARD-LOOKING STATEMENTS

This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of

1934. Forward-looking statements are statements other than statements of historical fact. They include statements that give our current expectations, guidance or forecasts of

future events, production and well connection forecasts, estimates of operating costs, anticipated capital and operational efficiencies, planned development drilling and expected

drilling cost reductions, general and administrative expenses, capital expenditures, the timing of anticipated asset sales and proceeds to be received therefrom, projected cash

flow and liquidity, our ability to enhance our cash flow and financial flexibility, plans and objectives for future operations, and the assumptions on which such statements are

based. Although we believe the expectations and forecasts reflected in the forward-looking statements are reasonable, we can give no assurance they will prove to have been

correct. They can be affected by inaccurate or changed assumptions or by known or unknown risks and uncertainties.

Factors that could cause actual results to differ materially from expected results include those described under “Risk Factors” in Item 1A of our annual report on Form 10-K and

any updates to those factors set forth in Chesapeake‟s subsequent quarterly reports on Form 10-Q or current reports on Form 8-K (available at http://www.chk.com/investors/

sec-filings). These risk factors include: the volatility of oil, natural gas and NGL prices; the limitations our level of indebtedness may have on our financial flexibility; our inability

to access the capital markets on favorable terms; the availability of cash flows from operations and other funds to finance reserve replacement costs or satisfy our debt

obligations; our credit rating requiring us to post more collateral under certain commercial arrangements; write-downs of our oil and natural gas asset carrying values due to low

commodity prices; our ability to replace reserves and sustain production; uncertainties inherent in estimating quantities of oil, natural gas and NGL reserves and projecting

future rates of production and the amount and timing of development expenditures; our ability to generate profits or achieve targeted results in drilling and well operations;

leasehold terms expiring before production can be established; commodity derivative activities resulting in lower prices real ized on oil, natural gas and NGL sales; the need to

secure derivative liabilities and the inability of counterparties to satisfy their obligations; adverse developments or losses from pending or future litigation and regulatory

proceedings, including royalty claims; charges incurred in response to market conditions and in connection with our ongoing actions to reduce financial leverage and complexity;

drilling and operating risks and resulting liabilities; effects of environmental protection laws and regulation on our business; legislative and regulatory initiatives further regulating

hydraulic fracturing; our need to secure adequate supplies of water for our drilling operations and to dispose of or recycle the water used; impacts of potential legislative and

regulatory actions addressing climate change; federal and state tax proposals affecting our industry; potential OTC derivatives regulation limiting our ability to hedge against

commodity price fluctuations; competition in the oil and gas exploration and production industry; a deterioration in general economic, business or industry conditions; negative

public perceptions of our industry; limited control over properties we do not operate; pipeline and gathering system capacity constraints and transportation interruptions; terrorist

activities and/or cyber-attacks adversely impacting our operations; potential challenges by SSE‟s former creditors of our spin-off of in connection with SSE‟s recently completed

bankruptcy under Chapter 11 of the U.S. Bankruptcy Code; an interruption in operations at our headquarters due to a catastrophic event; the continuation of suspended

dividend payments on our common stock; the effectiveness of our remediation plan for a material weakness; certain anti-takeover provisions that affect shareholder rights; and

our inability to increase or maintain our liquidity through debt repurchases, capital exchanges, asset sales, joint ventures, farmouts or other means.

In addition, disclosures concerning the estimated contribution of derivative contracts to our future results of operations are based upon market information as of a specific date.

These market prices are subject to significant volatility. Our production forecasts are also dependent upon many assumptions, including estimates of production decline rates

from existing wells and the outcome of future drilling activity. Expected asset sales may not be completed in the time frame anticipated or at all. We caution you not to place

undue reliance on our forward-looking statements, which speak only as of the date of this presentation, and we undertake no obligation to update any of the information

provided in this presentation, except as required by applicable law. In addition, this presentation contains time-sensitive information that reflects management‟s best judgment

only as of the date of this presentation.

We use certain terms in this presentation such as “Resource Potential,” “Net Reserves” and similar terms that the SEC‟s guide lines strictly prohibit us from including in filings

with the SEC. These terms include reserves with substantially less certainty, and no discount or other adjustment is included in the presentation of such reserve numbers. U.S.

investors are urged to consider closely the disclosure in our Form 10-K for the year ended December 31, 2016, File No. 1-13726 and in our other filings with the SEC, available

from us at 6100 North Western Avenue, Oklahoma City, Oklahoma 73118. These forms can also be obtained from the SEC by calling 1-800-SEC-0330.

2 Credit Suisse 23rd Annual Energy Summit

STRATEGIC GOALS

Debt reduction

of $2 – $3 billion

ultimate goal of net debt

to EBITDA of 2X

Free cash flow neutrality

Margin enhancement

2

3

1

OUR STRATEGY AND GOALS

Our strategy remains unchanged –

resilient to commodity price volatility

> Financial discipline

> Profitable and efficient growth

from captured resources

> Exploration

> Business development

Credit Suisse 23rd Annual Energy Summit 3

2017 ACCOMPLISHMENTS

Credit Suisse 23rd Annual Energy Summit 4

(1) Includes production expenses, general and administrative expenses (including stock-based compensation) and gathering, processing and transportation expenses. Excludes restructuring and other termination costs and interest expense.

(2) Agency reportable spills

~$500 million

Reduced costs by ~18%(1)

Improved cost structure

by ~$0.58/boe

~$1.3 billion

Of net proceeds collected from

asset and property sales

~11% growth

In oil production 4Q16 to 4Q17,

exceeded goal of 10%

~$1.3 billion

Reduced term secured debt by 32%

Continued reduction

in legal complexity

Record EH&S

performance

~0.045 TRIR

15% reduction in reported spills(2)

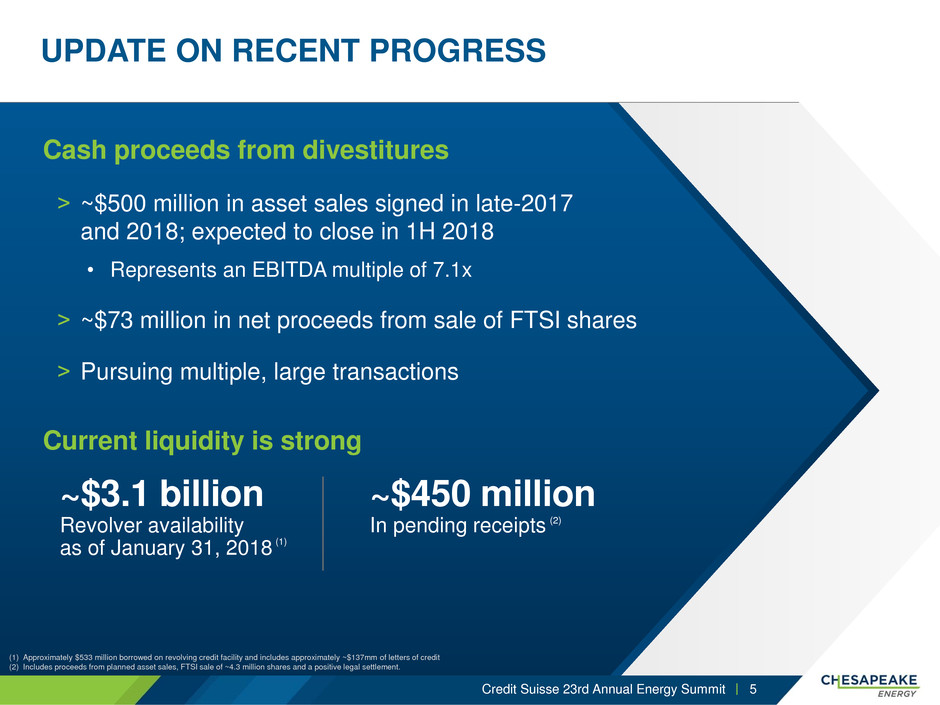

UPDATE ON RECENT PROGRESS

Credit Suisse 23rd Annual Energy Summit 5

(1) Approximately $533 million borrowed on revolving credit facility and includes approximately ~$137mm of letters of credit

(2) Includes proceeds from planned asset sales, FTSI sale of ~4.3 million shares and a positive legal settlement.

Cash proceeds from divestitures

˃ ~$500 million in asset sales signed in late-2017

and 2018; expected to close in 1H 2018

• Represents an EBITDA multiple of 7.1x

˃ ~$73 million in net proceeds from sale of FTSI shares

˃ Pursuing multiple, large transactions

Current liquidity is strong

~$3.1 billion

Revolver availability

as of January 31, 2018 (1)

~$450 million

In pending receipts (2)

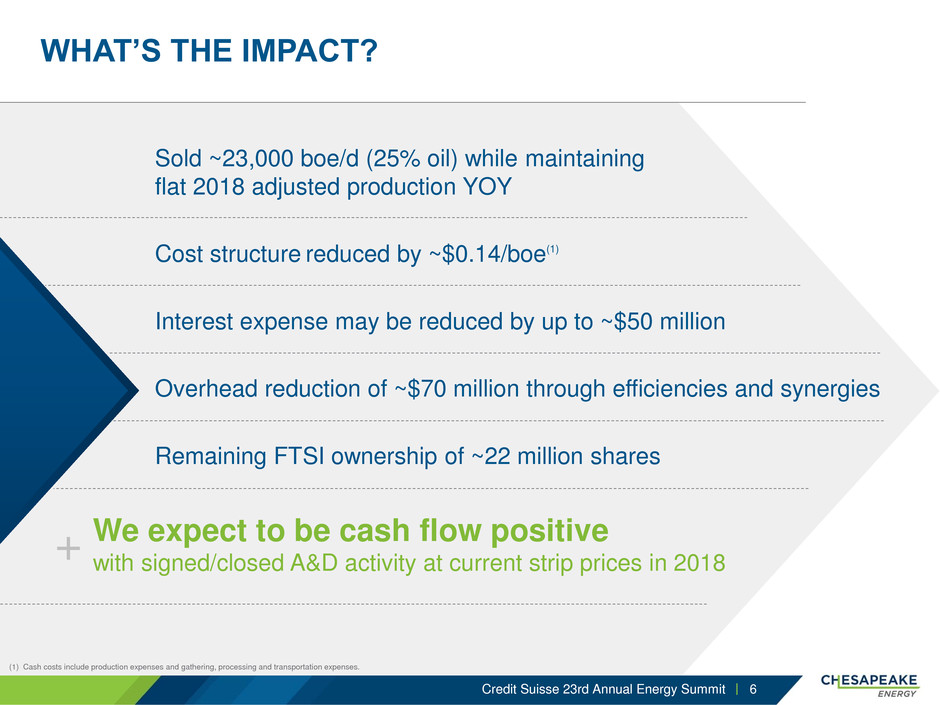

WHAT’S THE IMPACT?

(1) Cash costs include production expenses and gathering, processing and transportation expenses.

Sold ~23,000 boe/d (25% oil) while maintaining

flat 2018 adjusted production YOY

Cost structure

reduced by ~$0.14/boe(1)

Interest expense may be reduced by up to ~$50 million

Overhead reduction of ~$70 million through efficiencies and synergies

Remaining FTSI ownership of ~22 million shares

Credit Suisse 23rd Annual Energy Summit 6

+ We expect to be cash flow positive

with signed/closed A&D activity at current strip prices in 2018

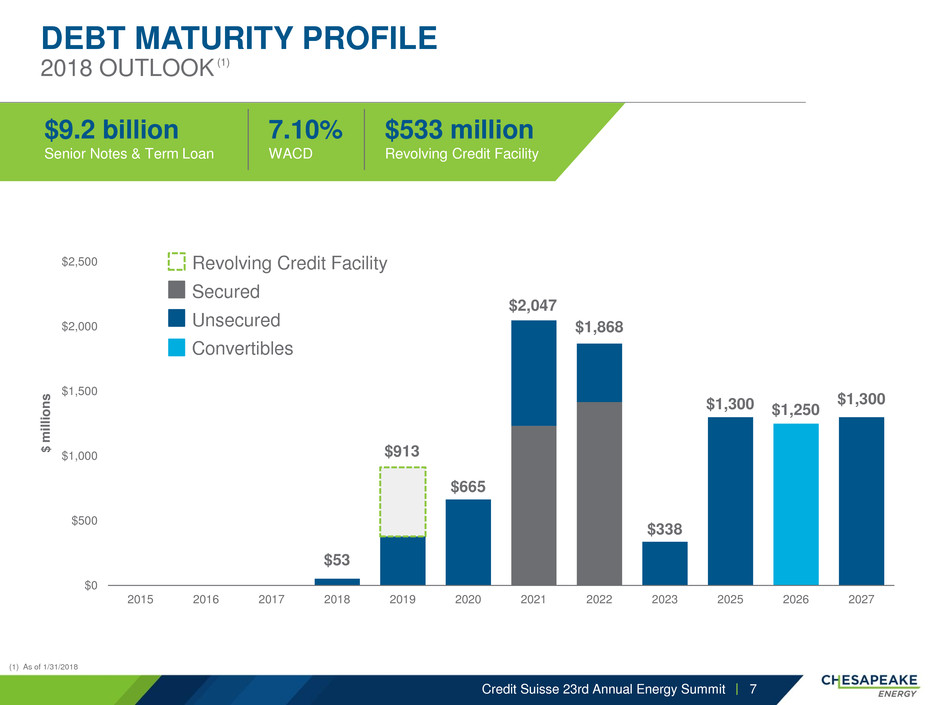

$53

$665

$338

$1,300 $1,250

$1,300

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

2015 2016 2017 2018 2019 2020 2021 2022 2023 2025 2026 2027

$2,047

$1,868

$913

Revolving Credit Facility

Secured

Unsecured

Convertibles

$

millio

n

s

$533 million

Revolving Credit Facility

DEBT MATURITY PROFILE

2018 OUTLOOK (1)

Credit Suisse 23rd Annual Energy Summit 7

(1) As of 1/31/2018

$9.2 billion

Senior Notes & Term Loan

7.10%

WACD

Credit Suisse 23rd Annual Energy Summit 8

˃ Portfolio depth

˃ Growing capital efficiency

˃ Operational scale

˃ Advancing technology

˃ EH&S excellence

Driving value across our portfolio

Credit Suisse 23rd Annual Energy Summit 9

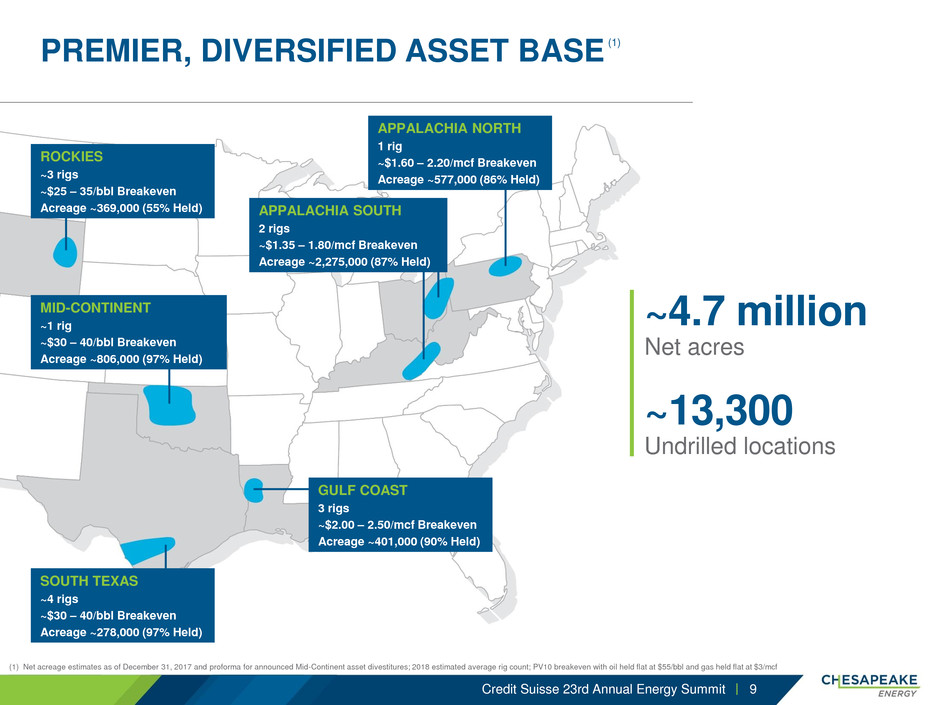

(1) Net acreage estimates as of December 31, 2017 and proforma for announced Mid-Continent asset divestitures; 2018 estimated average rig count; PV10 breakeven with oil held flat at $55/bbl and gas held flat at $3/mcf

APPALACHIA NORTH

1 rig

~$1.60 – 2.20/mcf Breakeven

Acreage ~577,000 (86% Held)

MID-CONTINENT

~1 rig

~$30 – 40/bbl Breakeven

Acreage ~806,000 (97% Held)

SOUTH TEXAS

~4 rigs

~$30 – 40/bbl Breakeven

Acreage ~278,000 (97% Held)

GULF COAST

3 rigs

~$2.00 – 2.50/mcf Breakeven

Acreage ~401,000 (90% Held)

ROCKIES

~3 rigs

~$25 – 35/bbl Breakeven

Acreage ~369,000 (55% Held) APPALACHIA SOUTH

2 rigs

~$1.35 – 1.80/mcf Breakeven

Acreage ~2,275,000 (87% Held)

~4.7 million

Net acres

~13,300

Undrilled locations

PREMIER, DIVERSIFIED ASSET BASE

(1)

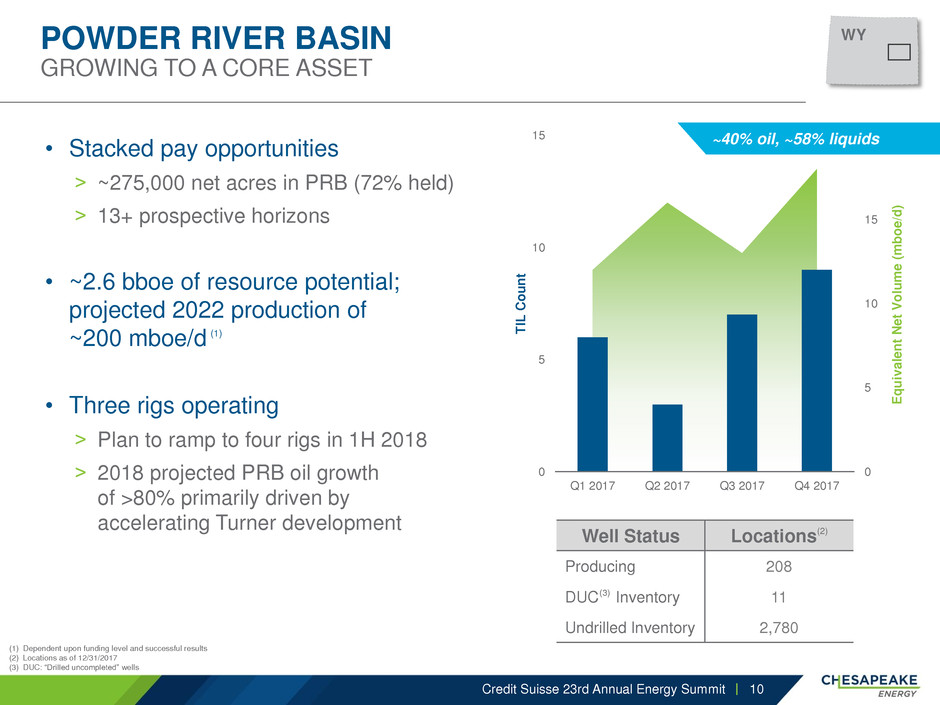

POWDER RIVER BASIN

GROWING TO A CORE ASSET

• Stacked pay opportunities

˃ ~275,000 net acres in PRB (72% held)

˃ 13+ prospective horizons

• ~2.6 bboe of resource potential;

projected 2022 production of

~200 mboe/d (1)

• Three rigs operating

˃ Plan to ramp to four rigs in 1H 2018

˃ 2018 projected PRB oil growth

of >80% primarily driven by

accelerating Turner development

Credit Suisse 23rd Annual Energy Summit 10

Well Status Locations(2)

Producing 208

DUC (3) Inventory 11

Undrilled Inventory 2,780

0

5

10

15

20

0

5

10

15

Q1 2017 Q2 2017 Q3 2017 Q4 2017

E

q

u

iv

al

e

n

t

Ne

t

V

o

lu

m

e

(

m

b

o

e/d

)

T

IL

C

o

u

n

t

WY

~40% oil, ~58% liquids

(1) Dependent upon funding level and successful results

(2) Locations as of 12/31/2017

(3) DUC: “Drilled uncompleted” wells

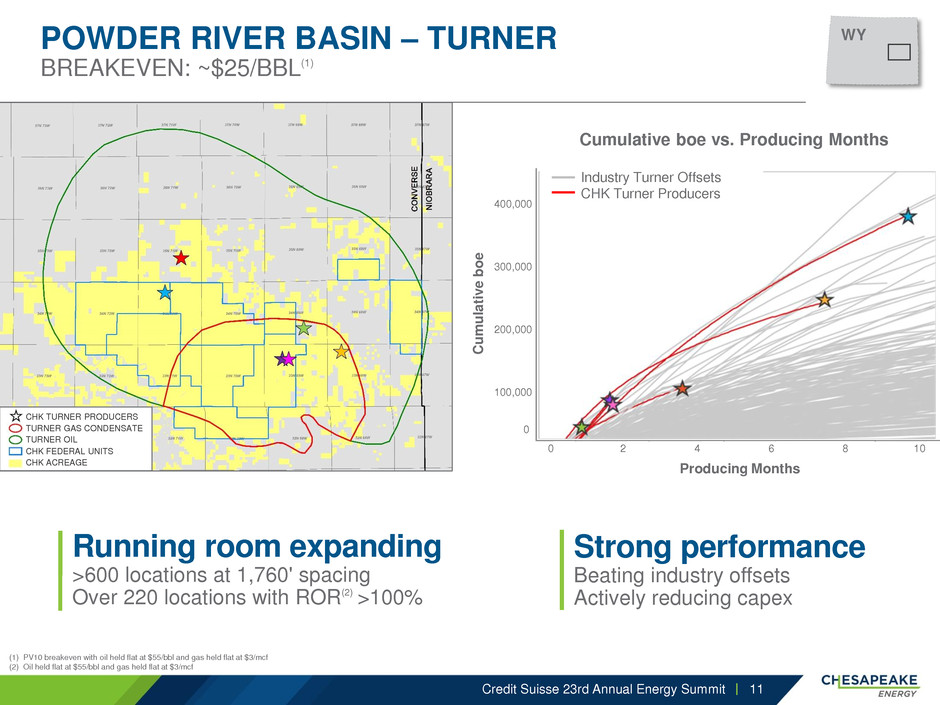

POWDER RIVER BASIN – TURNER

BREAKEVEN: ~$25/BBL(1)

Credit Suisse 23rd Annual Energy Summit

(1) PV10 breakeven with oil held flat at $55/bbl and gas held flat at $3/mcf

(2) Oil held flat at $55/bbl and gas held flat at $3/mcf

Running room expanding

>600 locations at 1,760' spacing

Over 220 locations with ROR(2)

>100%

Strong performance

Beating industry offsets

Actively reducing capex

11

WY

Cumulative boe vs. Producing Months

Producing Months

Industry Turner Offsets

CHK Turner Producers

400,000

300,000

200,000

100,000

0

C

umula

ti

v

e

b

o

e

2 4 6 8 10 0

CHK TURNER PRODUCERS

TURNER GAS CONDENSATE

TURNER OIL

CHK FEDERAL UNITS

CHK ACREAGE

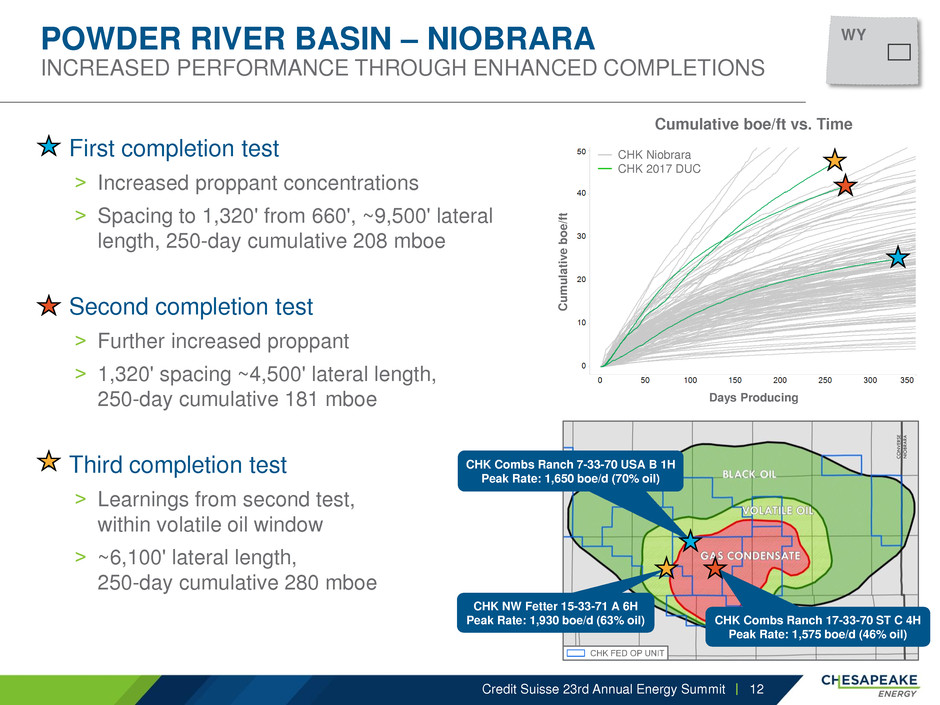

POWDER RIVER BASIN – NIOBRARA

INCREASED PERFORMANCE THROUGH ENHANCED COMPLETIONS

• First completion test

˃ Increased proppant concentrations

˃ Spacing to 1,320' from 660', ~9,500' lateral

length, 250-day cumulative 208 mboe

• Second completion test

˃ Further increased proppant

˃ 1,320' spacing ~4,500' lateral length,

250-day cumulative 181 mboe

• Third completion test

˃ Learnings from second test,

within volatile oil window

˃ ~6,100' lateral length,

250-day cumulative 280 mboe

Credit Suisse 23rd Annual Energy Summit 12

Cumulative boe/ft vs. Time

CHK Niobrara

CHK 2017 DUC

Days Producing

Cu

m

u

la

ti

v

e

b

o

e

/f

t

CHK Combs Ranch 7-33-70 USA B 1H

Peak Rate: 1,650 boe/d (70% oil)

CHK Combs Ranch 17-33-70 ST C 4H

Peak Rate: 1,575 boe/d (46% oil)

CHK NW Fetter 15-33-71 A 6H

Peak Rate: 1,930 boe/d (63% oil)

WY

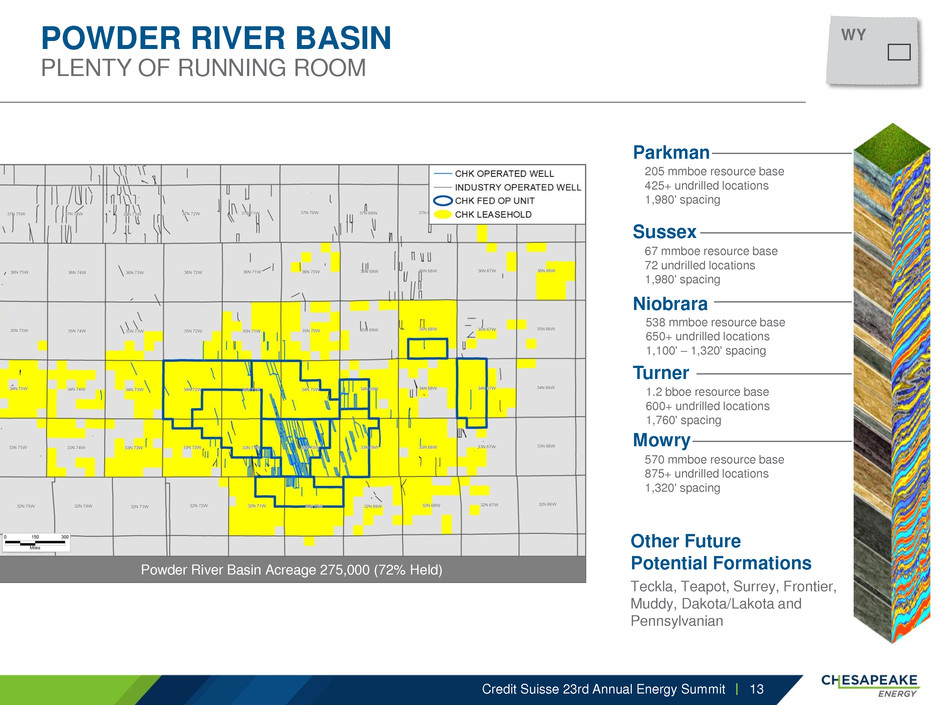

POWDER RIVER BASIN

PLENTY OF RUNNING ROOM

Credit Suisse 23rd Annual Energy Summit 13

205 mmboe resource base

425+ undrilled locations

1,980' spacing

1.2 bboe resource base

600+ undrilled locations

1,760' spacing

67 mmboe resource base

72 undrilled locations

1,980' spacing

538 mmboe resource base

650+ undrilled locations

1,100' – 1,320' spacing

570 mmboe resource base

875+ undrilled locations

1,320' spacing

Parkman

Sussex

Niobrara

Turner

Mowry

Other Future

Potential Formations

Teckla, Teapot, Surrey, Frontier,

Muddy, Dakota/Lakota and

Pennsylvanian

Powder River Basin Acreage 275,000 (72% Held)

WY

0

20

40

60

80

100

120

0

25

50

75

100

Q1 2017 Q2 2017 Q3 2017 Q4 2017

E

q

u

iv

al

e

n

t

Ne

t

V

o

lu

m

e

(

m

b

o

e/d

)

T

IL

C

o

u

n

t

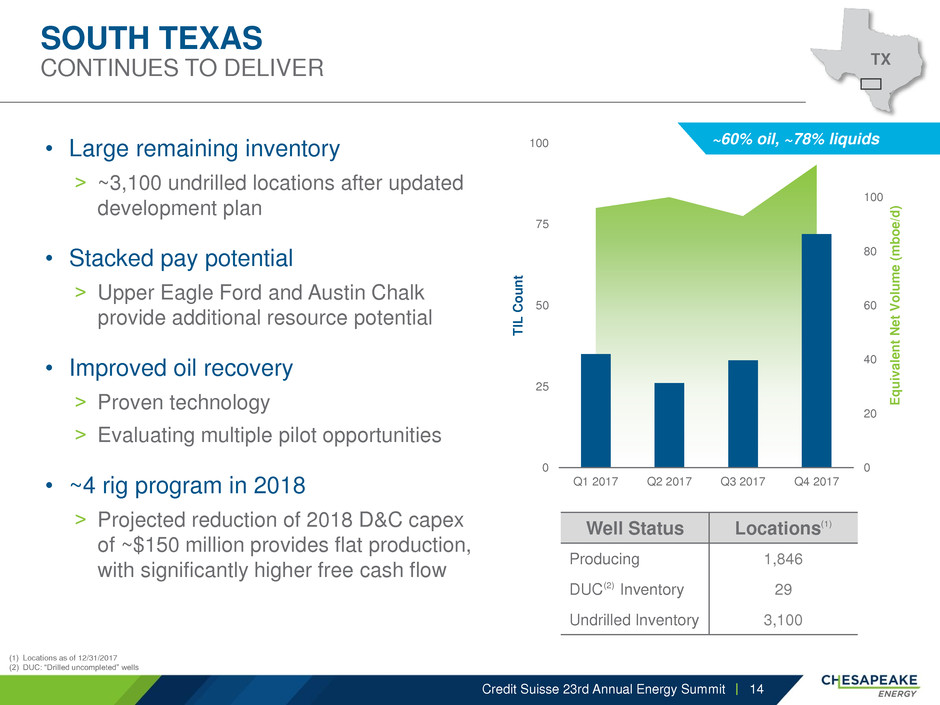

Well Status Locations(1)

Producing 1,846

DUC (2) Inventory 29

Undrilled Inventory 3,100

SOUTH TEXAS

CONTINUES TO DELIVER

• Large remaining inventory

˃ ~3,100 undrilled locations after updated

development plan

• Stacked pay potential

˃ Upper Eagle Ford and Austin Chalk

provide additional resource potential

• Improved oil recovery

˃ Proven technology

˃ Evaluating multiple pilot opportunities

• ~4 rig program in 2018

˃ Projected reduction of 2018 D&C capex

of ~$150 million provides flat production,

with significantly higher free cash flow

(1) Locations as of 12/31/2017

(2) DUC: “Drilled uncompleted” wells

Credit Suisse 23rd Annual Energy Summit 14

TX

~60% oil, ~78% liquids

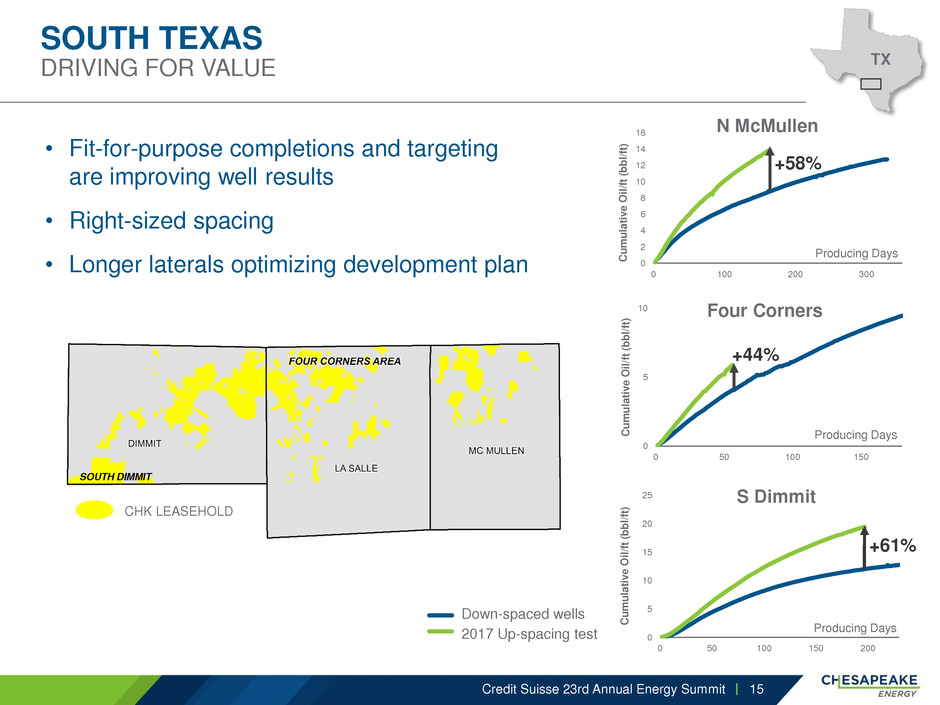

SOUTH TEXAS

DRIVING FOR VALUE

• Fit-for-purpose completions and targeting

are improving well results

• Right-sized spacing

• Longer laterals optimizing development plan

Credit Suisse 23rd Annual Energy Summit 15

Down-spaced wells

2017 Up-spacing test 0

5

10

15

20

25

0 50 100 150 200

C

u

m

u

la

ti

v

e

O

il

/f

t

(bb

l/

ft

)

Producing Days

S Dimmit

+61%

0

5

10

0 50 100 150

C

u

m

u

la

ti

v

e

O

il

/f

t

(bb

l/

ft

)

Producing Days

Four Corners

+44%

NORTH MCMULLEN

0

2

4

6

8

10

12

14

16

0 100 200 300

C

u

m

u

la

ti

v

e

O

il

/f

t

(bb

l/

ft

)

Producing Days

N McMullen

+58%

SOUTH DIMMIT

CHK LEASEHOLD

TX

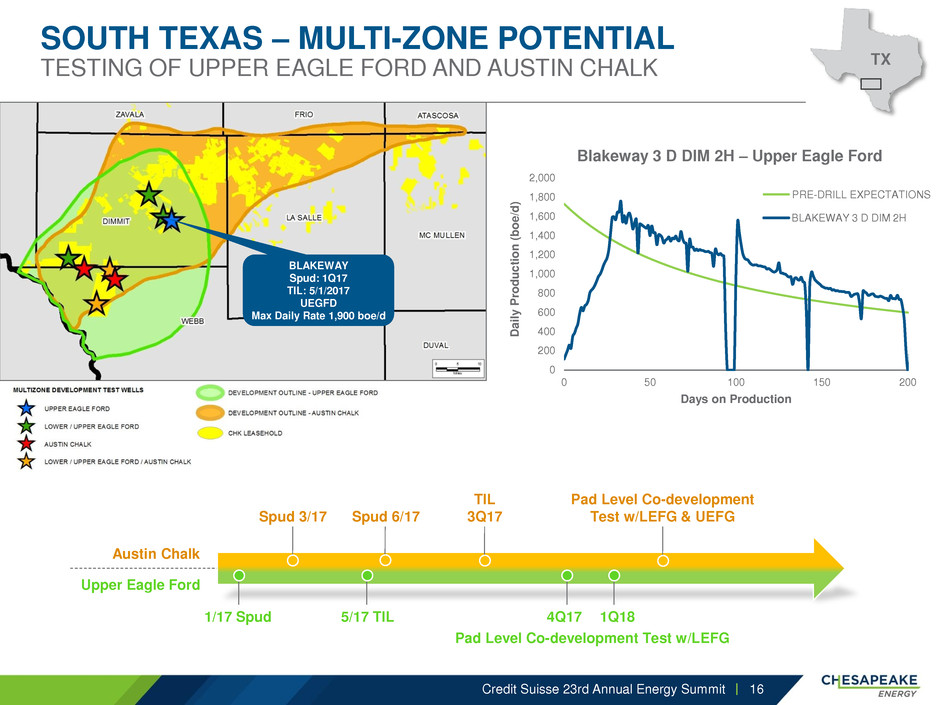

SOUTH TEXAS – MULTI-ZONE POTENTIAL

TESTING OF UPPER EAGLE FORD AND AUSTIN CHALK

Credit Suisse 23rd Annual Energy Summit 16

Austin Chalk

Upper Eagle Ford

Spud 3/17

Spud 6/17

5/17 TIL 4Q17

Pad Level Co-development

Test w/LEFG & UEFG

TIL

3Q17

Pad Level Co-development Test w/LEFG

1Q18 1/17 Spud

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

0 50 100 150 200

Da

il

y

Prod

u

c

ti

o

n

(b

o

e

/d

)

Days on Production

Blakeway 3 D DIM 2H – Upper Eagle Ford

SERIES2

BLAKEWAY 3 D DIM 2H

PRE-DRILL EXPECTATIONS

TX

BLAKEWAY

Spud: 1Q17

TIL: 5/1/2017

UEGFD

Max Daily Rate 1,900 boe/d

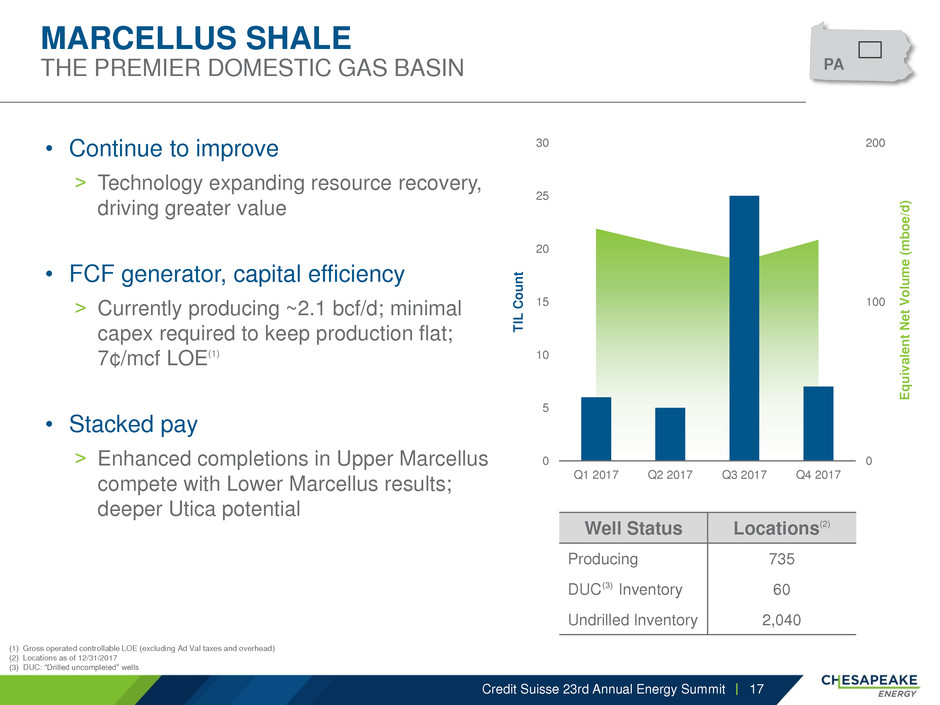

MARCELLUS SHALE

THE PREMIER DOMESTIC GAS BASIN

• Continue to improve

˃ Technology expanding resource recovery,

driving greater value

• FCF generator, capital efficiency

˃ Currently producing ~2.1 bcf/d; minimal

capex required to keep production flat;

7¢/mcf LOE(1)

• Stacked pay

˃ Enhanced completions in Upper Marcellus

compete with Lower Marcellus results;

deeper Utica potential

(1) Gross operated controllable LOE (excluding Ad Val taxes and overhead)

(2) Locations as of 12/31/2017

(3) DUC: “Drilled uncompleted” wells

Credit Suisse 23rd Annual Energy Summit 17

Well Status Locations(2)

Producing 735

DUC (3) Inventory 60

Undrilled Inventory 2,040

0

100

200

0

5

10

15

20

25

30

Q1 2017 Q2 2017 Q3 2017 Q4 2017

E

q

u

iv

al

e

n

t

Ne

t

V

o

lu

m

e

(

m

b

o

e/d

)

T

IL

C

o

u

n

t

PA

LOWER MARCELLUS

ENHANCED COMPLETIONS DRIVING MORE VALUE

Credit Suisse 23rd Annual Energy Summit

Operational leader

Breaking records and reducing maintance capital

Record McGavin 6H, IP30 55 mmcf/d

Core expansion

Longer laterals and enhanced completions

deliver greater resource

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

0 50 100 150 200 250 300 350 400

Cu

m

u

la

ti

v

e

Prod

u

c

ti

o

n

(

M

M

CF

)

Normalized Producing Days

Enhanced vs. Modern Completions

DPH SW WYO 3H MCGAVIN E WYO 6H

WOODMAC MARCELLUS TC

18

Industry Well

37 mmcf/d

CHK OFFSETS

PA

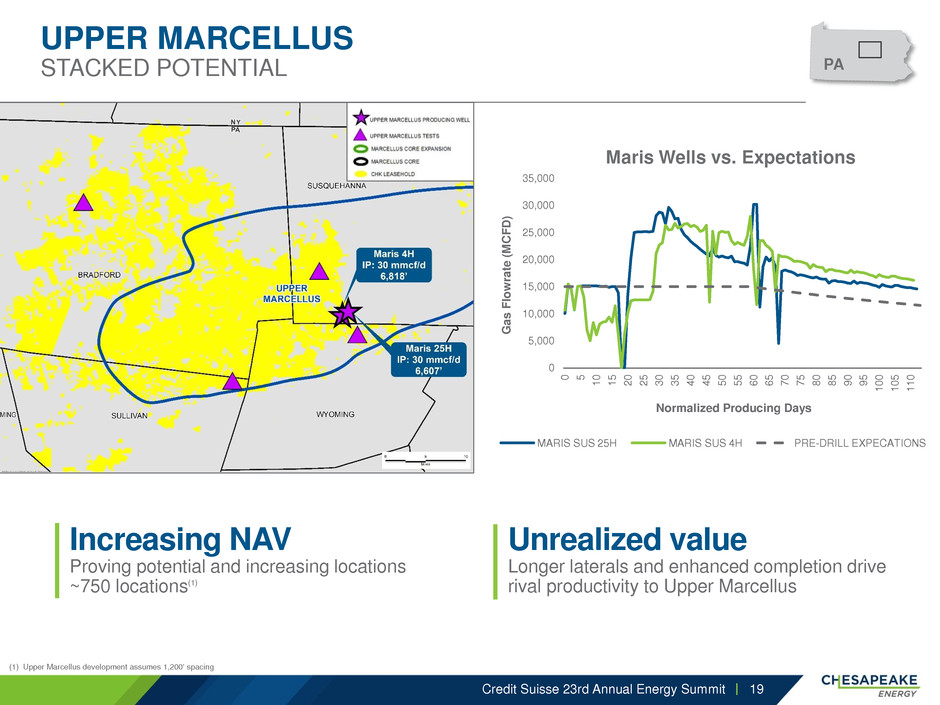

UPPER MARCELLUS

STACKED POTENTIAL

Credit Suisse 23rd Annual Energy Summit

(1) Upper Marcellus development assumes 1,200' spacing

Increasing NAV

Proving potential and increasing locations

~750 locations(1)

Unrealized value

Longer laterals and enhanced completion drive

rival productivity to Upper Marcellus

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

0 5

1

0

1

5

2

0

2

5

3

0

3

5

4

0

4

5

5

0

5

5

6

0

6

5

7

0

7

5

8

0

8

5

9

0

9

5

1

0

0

1

0

5

1

1

0

G

a

s

F

lo

w

rat

e

(

M

CFD

)

Normalized Producing Days

Maris Wells vs. Expectations

MARIS SUS 25H MARIS SUS 4H PRE-DRILL EXPECATIONS

19

PA

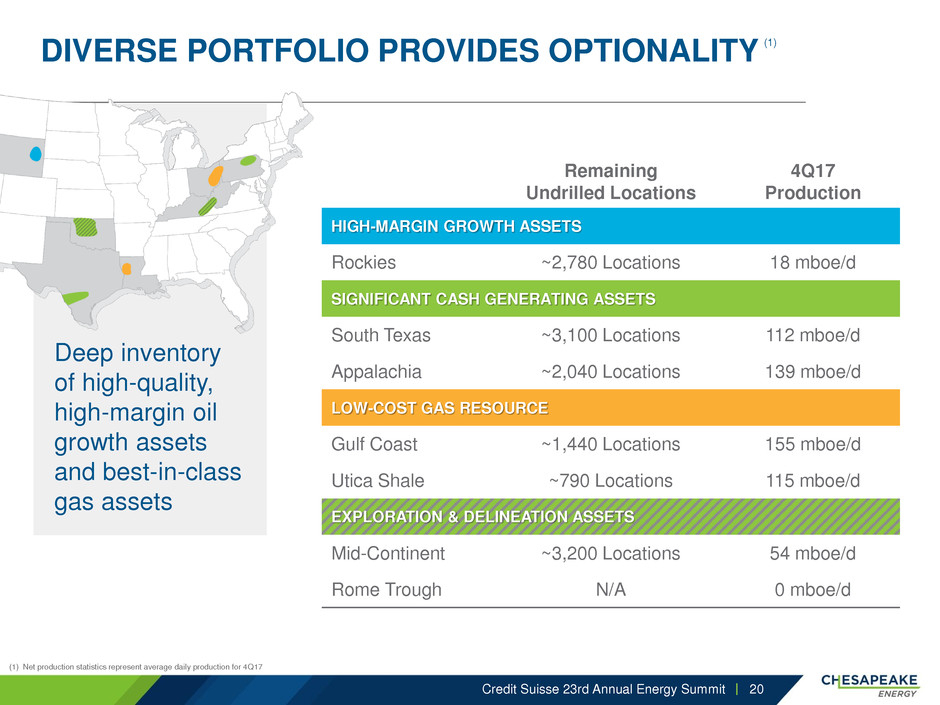

DIVERSE PORTFOLIO PROVIDES OPTIONALITY

(1)

Credit Suisse 23rd Annual Energy Summit 20

(1) Net production statistics represent average daily production for 4Q17

Remaining

Undrilled Locations

4Q17

Production

HIGH-MARGIN GROWTH ASSETS

Rockies ~2,780 Locations 18 mboe/d

SIGNIFICANT CASH GENERATING ASSETS

South Texas ~3,100 Locations 112 mboe/d

Appalachia ~2,040 Locations 139 mboe/d

LOW-COST GAS RESOURCE

Gulf Coast ~1,440 Locations 155 mboe/d

Utica Shale ~790 Locations 115 mboe/d

EXPLORATION & DELINEATION ASSETS

Mid-Continent ~3,200 Locations 54 mboe/d

Rome Trough N/A 0 mboe/d

Deep inventory

of high-quality,

high-margin oil

growth assets

and best-in-class

gas assets

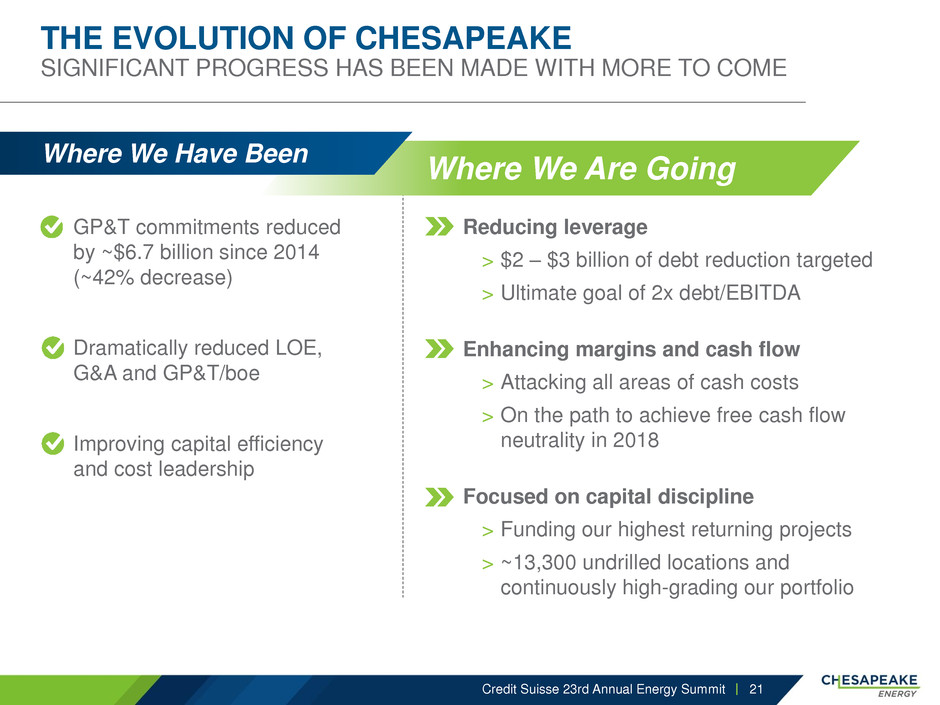

Where We Are Going

Reducing leverage

> $2 – $3 billion of debt reduction targeted

> Ultimate goal of 2x debt/EBITDA

Enhancing margins and cash flow

> Attacking all areas of cash costs

> On the path to achieve free cash flow

neutrality in 2018

Focused on capital discipline

> Funding our highest returning projects

> ~13,300 undrilled locations and

continuously high-grading our portfolio

THE EVOLUTION OF CHESAPEAKE

SIGNIFICANT PROGRESS HAS BEEN MADE WITH MORE TO COME

Where We Have Been

GP&T commitments reduced

by ~$6.7 billion since 2014

(~42% decrease)

Dramatically reduced LOE,

G&A and GP&T/boe

Improving capital efficiency

and cost leadership

Credit Suisse 23rd Annual Energy Summit 21

Appendix

Credit Suisse 23rd Annual Energy Summit 22

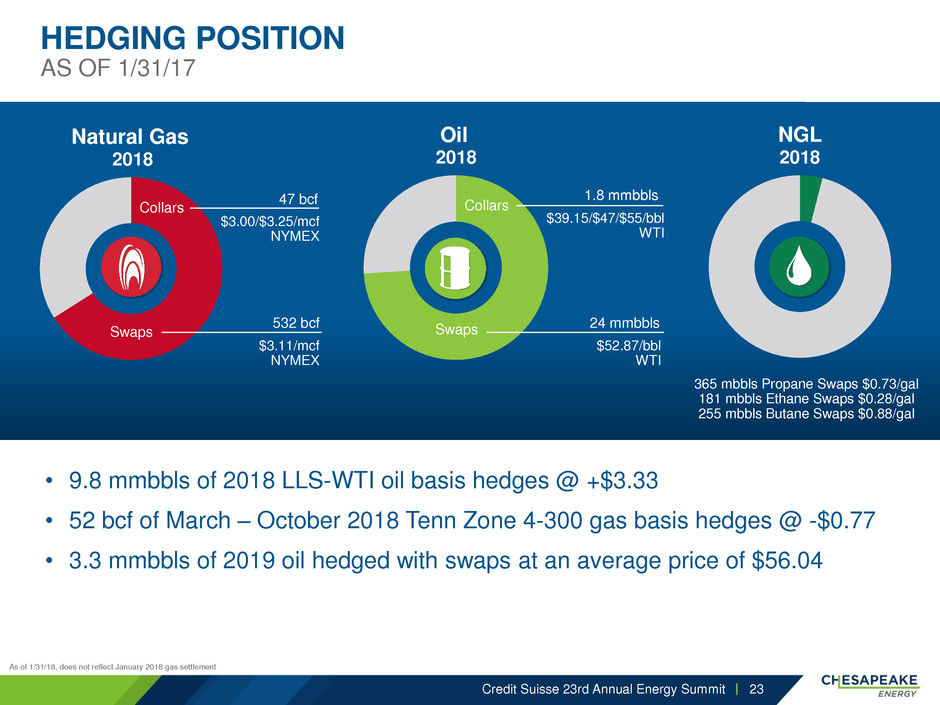

HEDGING POSITION

AS OF 1/31/17

Credit Suisse 23rd Annual Energy Summit 23

As of 1/31/18, does not reflect January 2018 gas settlement

NGL

2018

365 mbbls Propane Swaps $0.73/gal

181 mbbls Ethane Swaps $0.28/gal

255 mbbls Butane Swaps $0.88/gal

Natural Gas

2018

$3.11/mcf

NYMEX

Swaps

Collars

$3.00/$3.25/mcf

NYMEX

47 bcf

532 bcf

Oil

2018

$52.87/bbl

WTI

Swaps

$39.15/$47/$55/bbl

WTI

Collars

1.8 mmbbls

24 mmbbls

• 9.8 mmbbls of 2018 LLS-WTI oil basis hedges @ +$3.33

• 52 bcf of March – October 2018 Tenn Zone 4-300 gas basis hedges @ -$0.77

• 3.3 mmbbls of 2019 oil hedged with swaps at an average price of $56.04

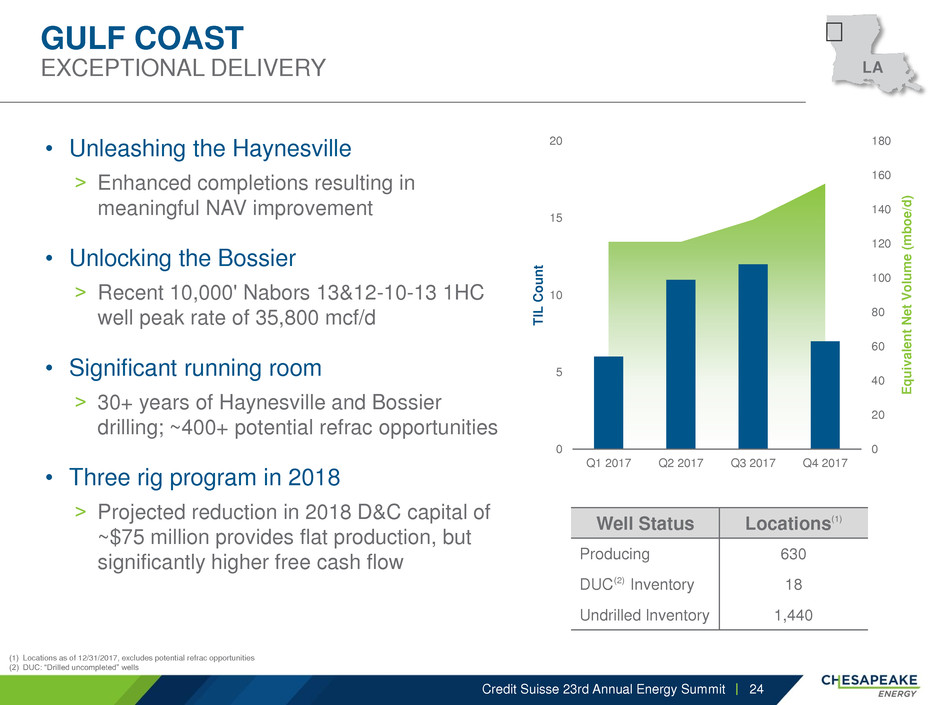

GULF COAST

EXCEPTIONAL DELIVERY

• Unleashing the Haynesville

˃ Enhanced completions resulting in

meaningful NAV improvement

• Unlocking the Bossier

˃ Recent 10,000' Nabors 13&12-10-13 1HC

well peak rate of 35,800 mcf/d

• Significant running room

˃ 30+ years of Haynesville and Bossier

drilling; ~400+ potential refrac opportunities

• Three rig program in 2018

˃ Projected reduction in 2018 D&C capital of

~$75 million provides flat production, but

significantly higher free cash flow

(1) Locations as of 12/31/2017, excludes potential refrac opportunities

(2) DUC: “Drilled uncompleted” wells

Credit Suisse 23rd Annual Energy Summit 24

Well Status Locations(1)

Producing 630

DUC (2) Inventory 18

Undrilled Inventory 1,440

0

20

40

60

80

100

120

140

160

180

0

5

10

15

20

Q1 2017 Q2 2017 Q3 2017 Q4 2017

E

q

u

iv

al

e

n

t

Ne

t

V

o

lu

m

e

(

m

b

o

e/d

)

T

IL

C

o

u

n

t

LA

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

0 2 4 6 8 10 12 14

A

v

e

rage

C

u

m

u

lati

v

e Gas

p

e

r

W

el

l

(b

cf

)

Month

Average Cumulative Gas per Well

„08 – „09

„10 – „13

„14 – „15

„16

„17

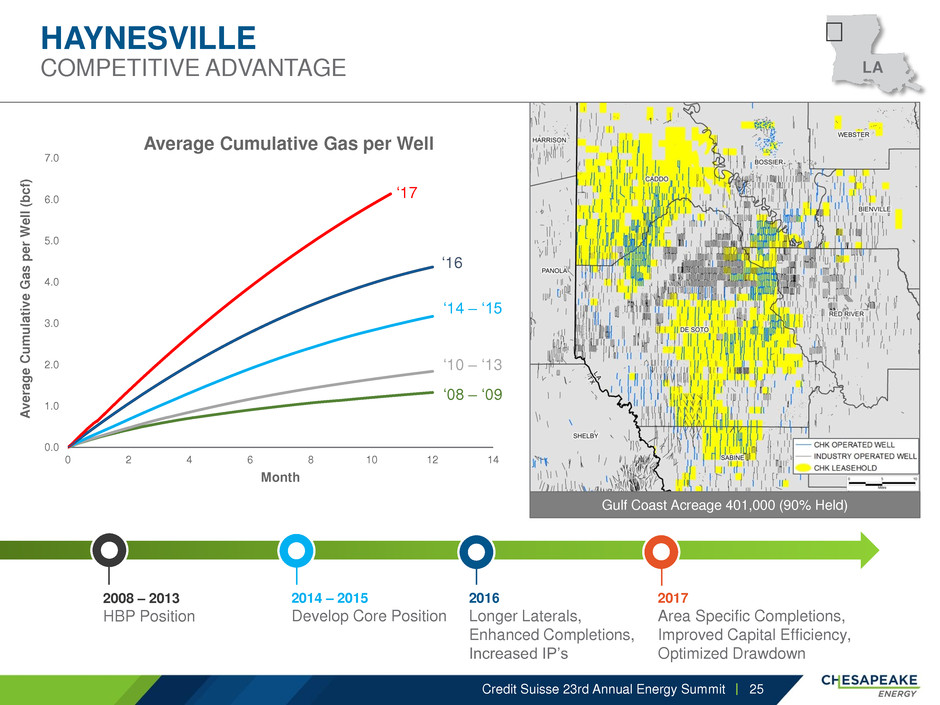

HAYNESVILLE

COMPETITIVE ADVANTAGE

Credit Suisse 23rd Annual Energy Summit

2008 – 2013

HBP Position

2014 – 2015

Develop Core Position

2016

Longer Laterals,

Enhanced Completions,

Increased IP‟s

2017

Area Specific Completions,

Improved Capital Efficiency,

Optimized Drawdown

25

LA

Gulf Coast Acreage 401,000 (90% Held)

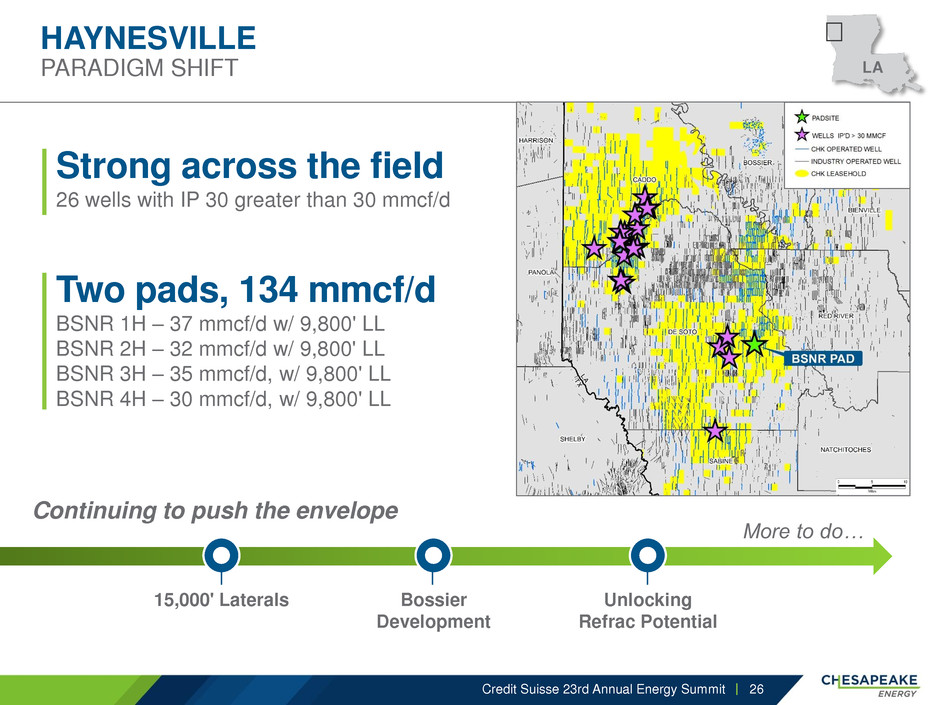

HAYNESVILLE

PARADIGM SHIFT

Credit Suisse 23rd Annual Energy Summit

Two pads, 134 mmcf/d

BSNR 1H – 37 mmcf/d w/ 9,800' LL

BSNR 2H – 32 mmcf/d w/ 9,800' LL

BSNR 3H – 35 mmcf/d, w/ 9,800' LL

BSNR 4H – 30 mmcf/d, w/ 9,800' LL

Continuing to push the envelope

More to do…

Strong across the field

26 wells with IP 30 greater than 30 mmcf/d

26

LA

15,000' Laterals Bossier

Development

Unlocking

Refrac Potential

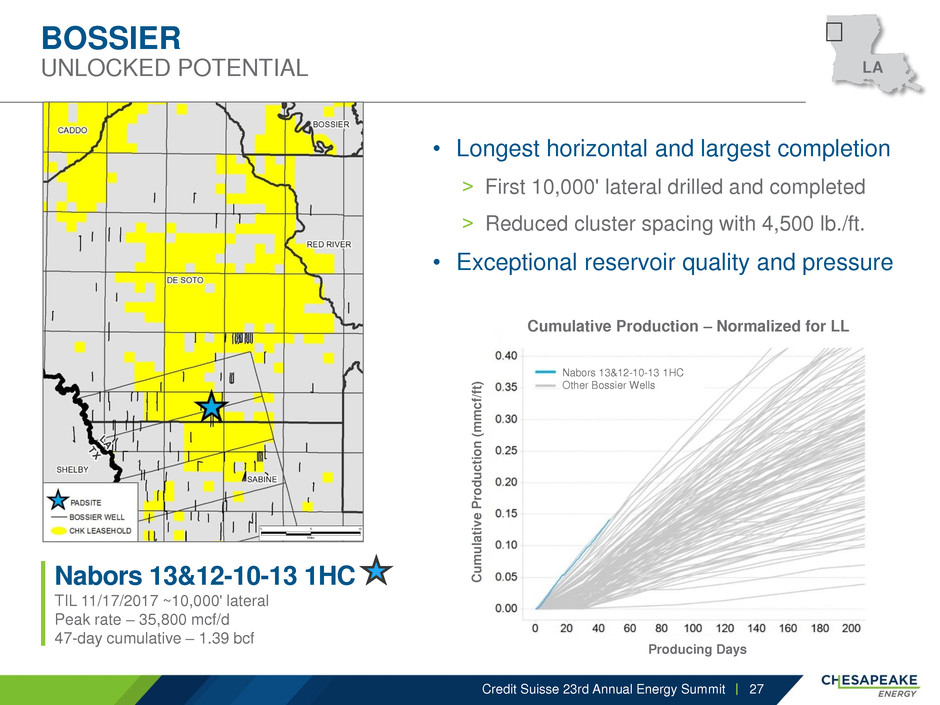

BOSSIER

UNLOCKED POTENTIAL

Credit Suisse 23rd Annual Energy Summit 27

Nabors 13&12-10-13 1HC

TIL 11/17/2017 ~10,000' lateral

Peak rate – 35,800 mcf/d

47-day cumulative – 1.39 bcf

• Longest horizontal and largest completion

˃ First 10,000' lateral drilled and completed

˃ Reduced cluster spacing with 4,500 lb./ft.

• Exceptional reservoir quality and pressure

LA

Cumulative Production – Normalized for LL

Producing Days

C

u

m

u

lati

v

e

P

ro

d

u

cti

o

n

(

m

m

cf/

ft

)

Nabors 13&12-10-13 1HC

Other Bossier Wells

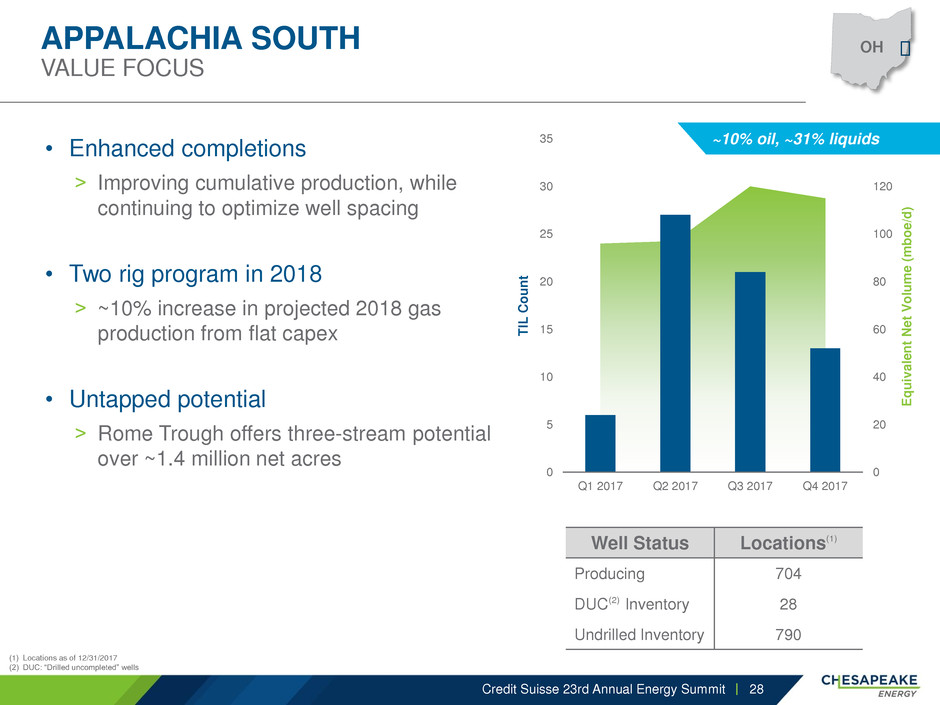

APPALACHIA SOUTH

VALUE FOCUS

• Enhanced completions

˃ Improving cumulative production, while

continuing to optimize well spacing

• Two rig program in 2018

˃ ~10% increase in projected 2018 gas

production from flat capex

• Untapped potential

˃ Rome Trough offers three-stream potential

over ~1.4 million net acres

(1) Locations as of 12/31/2017

(2) DUC: “Drilled uncompleted” wells

Credit Suisse 23rd Annual Energy Summit 28

Well Status Locations(1)

Producing 704

DUC (2) Inventory 28

Undrilled Inventory 790

0

20

40

60

80

100

120

140

0

5

10

15

20

25

30

35

Q1 2017 Q2 2017 Q3 2017 Q4 2017

E

q

u

iv

al

e

n

t

Ne

t

V

o

lu

m

e

(

m

b

o

e/d

)

T

IL

C

o

u

n

t

OH

~10% oil, ~31% liquids

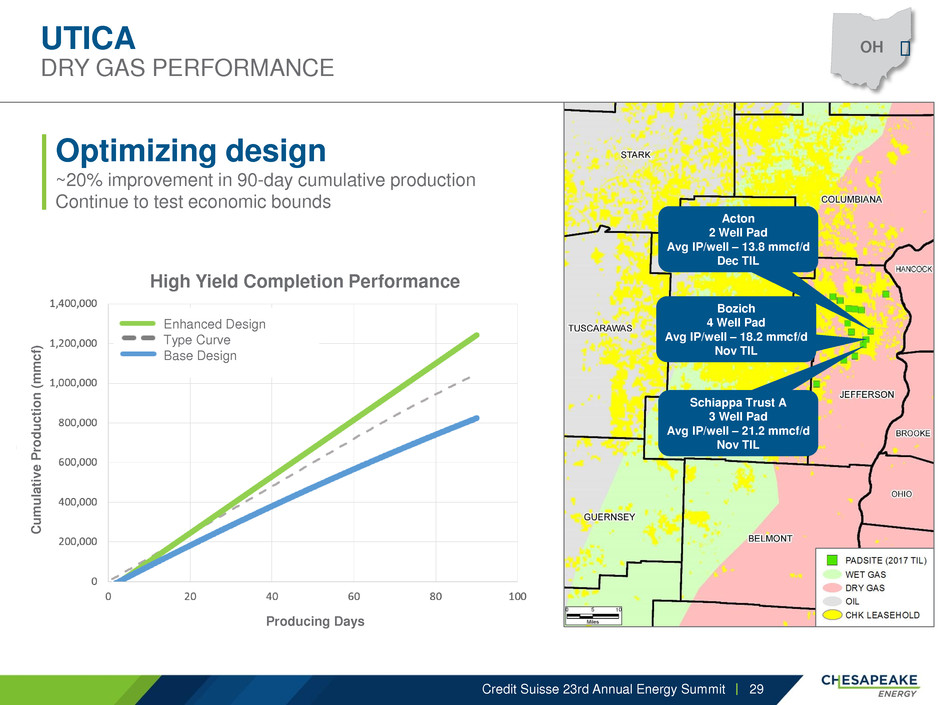

UTICA

DRY GAS PERFORMANCE

Credit Suisse 23rd Annual Energy Summit

Optimizing design

~20% improvement in 90-day cumulative production

Continue to test economic bounds

29

High Yield Completion Performance

Producing Days

C

u

m

u

lati

v

e

P

ro

d

u

cti

o

n

(

m

m

cf

)

Enhanced Design

Type Curve

Base Design

OH

Acton

2 Well Pad

Avg IP/well – 13.8 mmcf/d

Dec TIL

Schiappa Trust A

3 Well Pad

Avg IP/well – 21.2 mmcf/d

Nov TIL

Bozich

4 Well Pad

Avg IP/well – 18.2 mmcf/d

Nov TIL

High Yield Completion Performance

Producing Days

C

u

m

u

lati

v

e

P

ro

d

u

cti

o

n

(

b

o

e

)

Enhanced Completions

Type Curve

Base Design

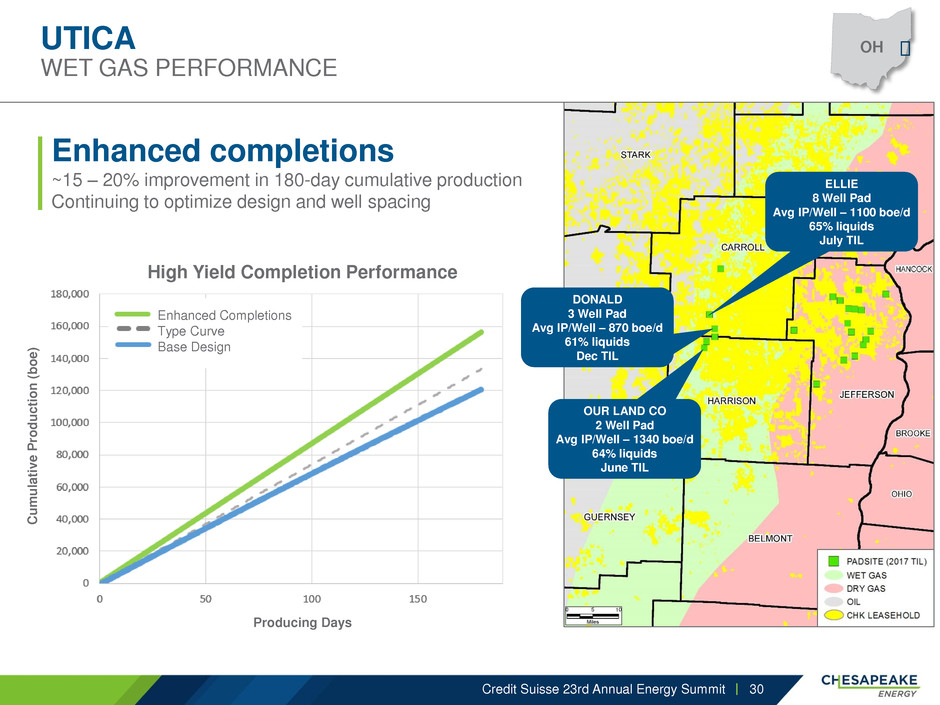

UTICA

WET GAS PERFORMANCE

Credit Suisse 23rd Annual Energy Summit

Enhanced completions

~15 – 20% improvement in 180-day cumulative production

Continuing to optimize design and well spacing

ELLIE

8 Well Pad

Avg IP/Well – 1100 boe/d

65% liquids

July TIL

DONALD

3 Well Pad

Avg IP/Well – 870 boe/d

61% liquids

Dec TIL

OUR LAND CO

2 Well Pad

Avg IP/Well – 1340 boe/d

64% liquids

June TIL

30

OH

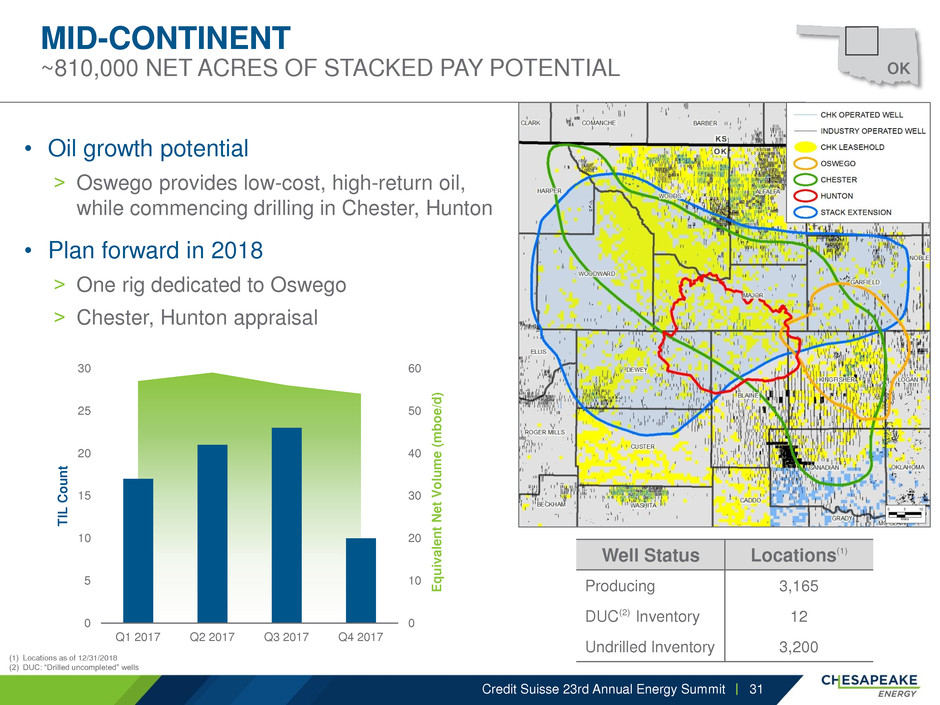

MID-CONTINENT

~810,000 NET ACRES OF STACKED PAY POTENTIAL

• Oil growth potential

˃ Oswego provides low-cost, high-return oil,

while commencing drilling in Chester, Hunton

• Plan forward in 2018

˃ One rig dedicated to Oswego

˃ Chester, Hunton appraisal

(1) Locations as of 12/31/2018

(2) DUC: “Drilled uncompleted” wells

Credit Suisse 23rd Annual Energy Summit 31

Well Status Locations(1)

Producing 3,165

DUC (2) Inventory 12

Undrilled Inventory 3,200

0

10

20

30

40

50

60

0

5

10

15

20

25

30

Q1 2017 Q2 2017 Q3 2017 Q4 2017

E

q

u

iv

al

e

n

t

Ne

t

V

o

lu

m

e

(

m

b

o

e

/d

)

T

IL

C

o

u

n

t

OK

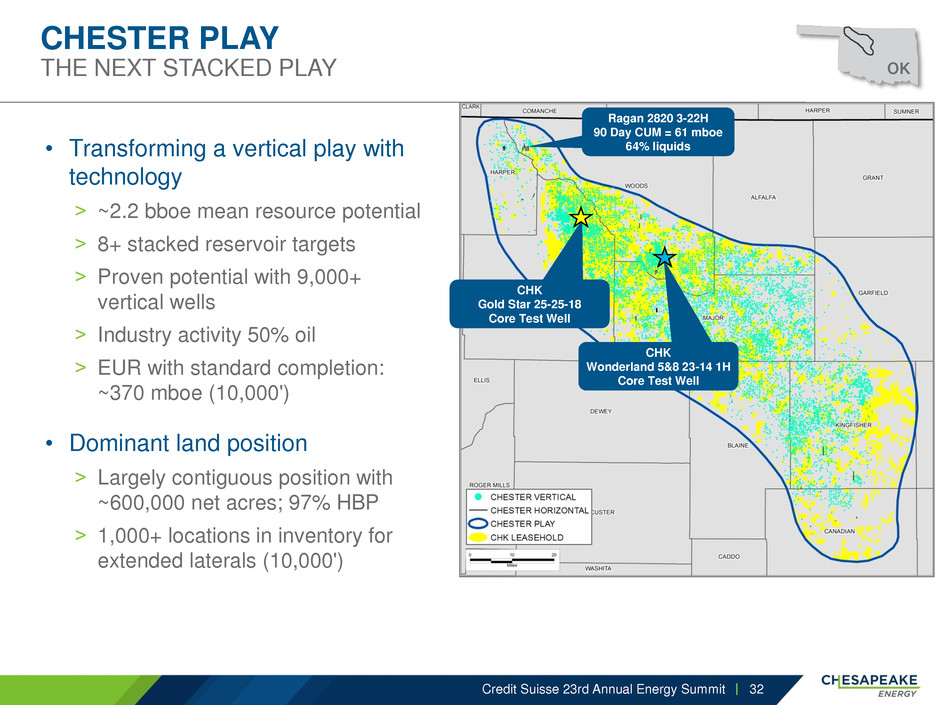

CHESTER PLAY

THE NEXT STACKED PLAY

• Transforming a vertical play with

technology

˃ ~2.2 bboe mean resource potential

˃ 8+ stacked reservoir targets

˃ Proven potential with 9,000+

vertical wells

˃ Industry activity 50% oil

˃ EUR with standard completion:

~370 mboe (10,000')

• Dominant land position

˃ Largely contiguous position with

~600,000 net acres; 97% HBP

˃ 1,000+ locations in inventory for

extended laterals (10,000')

Credit Suisse 23rd Annual Energy Summit 32

OK

Ragan 2820 3-22H

90 Day CUM = 61 mboe

64% liquids

CHK

Wonderland 5&8 23-14 1H

Core Test Well

CHK

Gold Star 25-25-18

Core Test Well

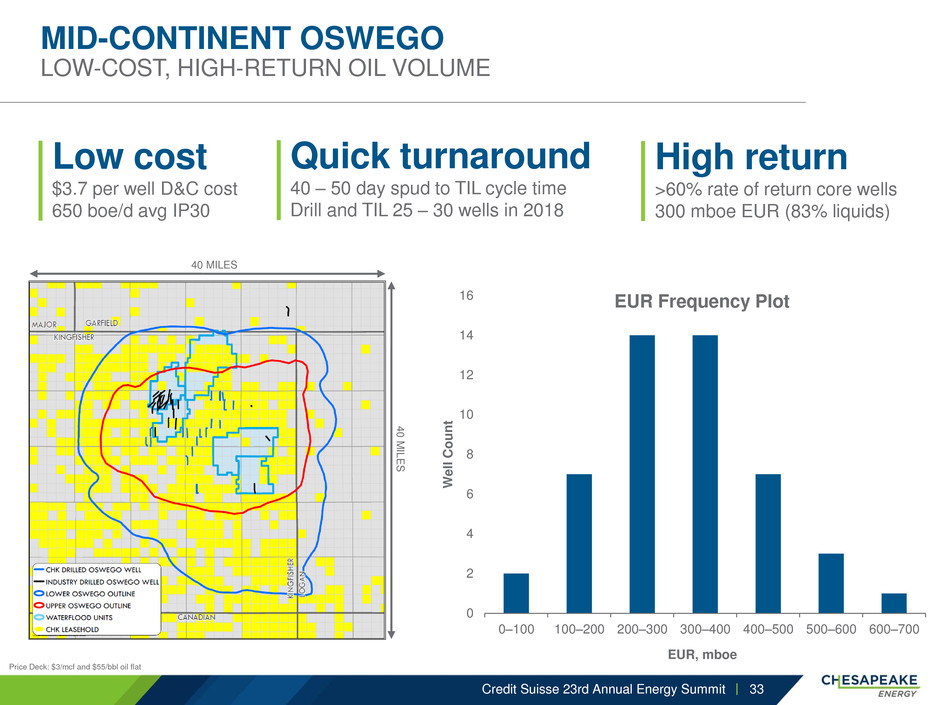

MID-CONTINENT OSWEGO

LOW-COST, HIGH-RETURN OIL VOLUME

Credit Suisse 23rd Annual Energy Summit

Price Deck: $3/mcf and $55/bbl oil flat

Quick turnaround

40 – 50 day spud to TIL cycle time

Drill and TIL 25 – 30 wells in 2018

40 MILES

4

0

M

IL

E

S

33

0

2

4

6

8

10

12

14

16

0–100 100–200 200–300 300–400 400–500 500–600 600–700

W

el

l C

o

u

n

t

EUR, mboe

EUR Frequency Plot

Low cost

$3.7 per well D&C cost

650 boe/d avg IP30

High return

>60% rate of return core wells

300 mboe EUR (83% liquids)

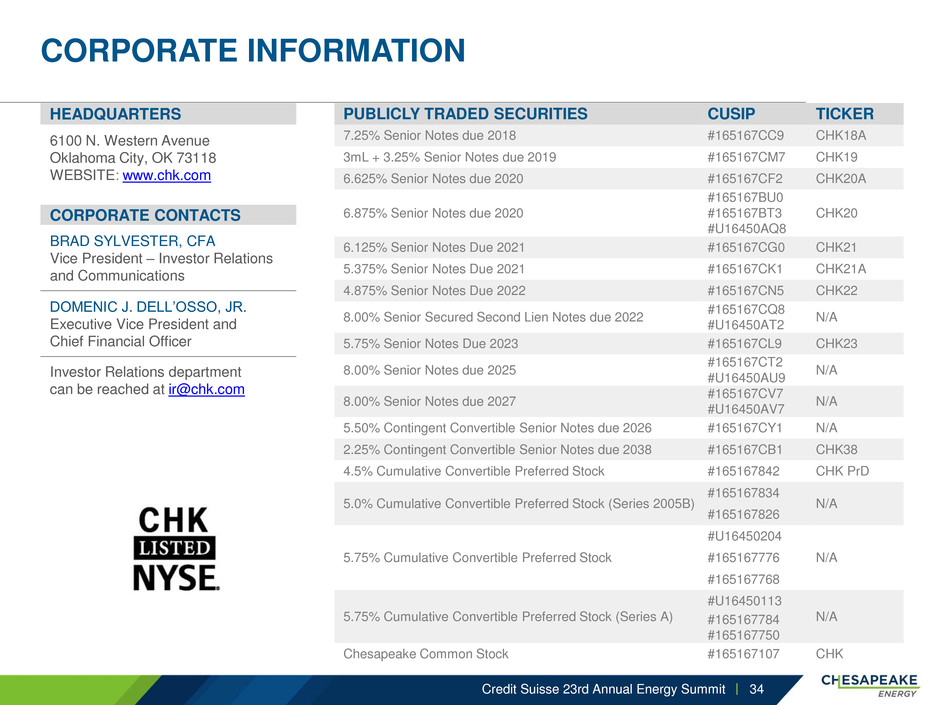

CORPORATE INFORMATION

Credit Suisse 23rd Annual Energy Summit

HEADQUARTERS

6100 N. Western Avenue

Oklahoma City, OK 73118

WEBSITE: www.chk.com

CORPORATE CONTACTS

BRAD SYLVESTER, CFA

Vice President – Investor Relations

and Communications

DOMENIC J. DELL‟OSSO, JR.

Executive Vice President and

Chief Financial Officer

Investor Relations department

can be reached at ir@chk.com

34

PUBLICLY TRADED SECURITIES CUSIP TICKER

7.25% Senior Notes due 2018 #165167CC9 CHK18A

3mL + 3.25% Senior Notes due 2019 #165167CM7 CHK19

6.625% Senior Notes due 2020 #165167CF2 CHK20A

6.875% Senior Notes due 2020

#165167BU0

#165167BT3

#U16450AQ8

CHK20

6.125% Senior Notes Due 2021 #165167CG0 CHK21

5.375% Senior Notes Due 2021 #165167CK1 CHK21A

4.875% Senior Notes Due 2022 #165167CN5 CHK22

8.00% Senior Secured Second Lien Notes due 2022

#165167CQ8

#U16450AT2

N/A

5.75% Senior Notes Due 2023 #165167CL9 CHK23

8.00% Senior Notes due 2025

#165167CT2

#U16450AU9

N/A

8.00% Senior Notes due 2027

#165167CV7

#U16450AV7

N/A

5.50% Contingent Convertible Senior Notes due 2026 #165167CY1 N/A

2.25% Contingent Convertible Senior Notes due 2038 #165167CB1 CHK38

4.5% Cumulative Convertible Preferred Stock #165167842 CHK PrD

5.0% Cumulative Convertible Preferred Stock (Series 2005B)

#165167834

N/A

#165167826

5.75% Cumulative Convertible Preferred Stock

#U16450204

N/A #165167776

#165167768

5.75% Cumulative Convertible Preferred Stock (Series A)

#U16450113

N/A #165167784

#165167750

Chesapeake Common Stock #165167107 CHK