Attached files

| file | filename |

|---|---|

| EX-10.01 - EXHIBIT 10.01 EXCLUSIVE LICENSE AND DISTRIBUTION AGREEMENT - ALPHACOM HOLDINGS INC | f8k020918_ex10z01.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 7, 2018

MITU RESOURCES INC.

(Exact name of registrant as specified in its charter)

Nevada |

| 000-55315 |

| N/A |

(State or other jurisdiction |

| (Commission File Number) |

| (IRS Employer |

of Incorporation) |

|

|

| Identification Number) |

Gregorio Luperón #7 Puerto Plata, Dominican Republic 829-876-4960 |

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices) |

Cll 62B 32c-60 Bogota, 11011, Colombia +57 22 587 2251 |

(Former Address) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

_____________

Explanatory Note

This Current Report on Form 8-K is being filed to amend the Company’s Form 8-K/A that was filed with the SEC on February 8, 2018 (the “Original Filing”). The Original Filing was inadvertently filed as an amended Form 8-K as opposed to simply a Form 8-K, otherwise no other changes have been made to the Original Filing.

______________

Page 1 of 21

Form 8-K

Current Report

FORWARD LOOKING STATEMENTS

The following discussion, in addition to the other information contained in this Current Report (“Report”), should be considered carefully in evaluating our prospects. This Report (including without limitation the following factors that may affect operating results) contains forward-looking statements regarding us and our business, financial condition, results of operations and prospects. Words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this Report. Additionally, statements concerning future matters such as revenue projections, projected profitability, growth strategies, possible changes in legislation and other statements regarding matters that are not historical are forward-looking statements.

Forward-looking statements in this Report reflect the good faith judgment of our management and the statements are based on facts and factors as we currently know them. Forward-looking statements are subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, but are not limited to, those discussed in this Report. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Report.

As referred to hereinafter in this Report and unless otherwise indicated, the terms “we”, “us”, “our”, the “Company” refer to Mitu Resources Inc.

ITEM 1.01ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

On February 7, 2018, we entered into and executed an Exclusive License and Distribution Agreement (“License Agreement”) with HeadWind Technologies Ltd. (“HeadWind”) whereby we were granted various Intellectual Property Rights related to owner, inventor, and creator of the “Wind Shark” a new type of self-starting, vertical axis wind turbine created to change the way low wind turbines are defined (the “Product”). Pursuant to the terms of the License Agreement, we acquired the rights to further develop, commercialize, market and distribute certain proprietary inventions and know-how related to the Products. In exchange there shall be licensee fee of four hundred thousand dollars ($400,000), paid in tranches as set forth in the Licensee Agreement, and continuing royalty (the "Royalty") equal to three percent (3%) of the gross sales price for sales of all Products.

The foregoing summary of the terms of the Exclusive License and Distribution Agreement, is qualified in its entirety by the complete copy of the Exclusive License and Distribution Agreement which is attached hereto as Exhibit 10.01 and is incorporated by reference herein.

ITEM 2.01COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

The information provided in Item 1.01 of this Current Report on Form 8-K related to the aforementioned Exclusive License and Distribution Agreement is incorporated by reference into this Item 2.01. We have included the information that would be required if the registrant were filing a general form for registration of securities on Form 10, including a complete description of the business and operations of the Company, such information can be found under Item 5.06 of this Current Report.

ITEM 5.01CHANGES IN CONTROL OF REGISTRANT

On February 7, 2018, Simeon Leonardo Reyes Francisco acquired control of fifteen million (15,000,000) shares (the “Purchased Shares”) of the Company’s issued and outstanding common stock, representing approximately 50.00% of the Company’s total issued and outstanding common stock, from Juan Perez and Nelson Rincon in accordance with a stock purchase agreement by and among, on the one hand, Mr. Simeon Leonardo Reyes Francisco and, on the other hand, Mr. Perez and Mr. Rincon (the “Stock Purchase Agreement”). Pursuant to the Stock Purchase Agreement, Mr. Simeon Leonardo Reyes Francisco paid an purchase price of fifteen thousand dollars ($15,000) to Mr. Perez and Mr. Rincon in exchange for the Purchased Shares.

Page 2 of 21

ITEM 5.02 DEPARTURE OF DIRECTORS OR PRINCIPAL OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF PRINCIPAL OFFICERS

Ms. Juan Perez resigned from all positions with the Company effective as of February 7, 2018, including President, Chief Executive Officer, and Sole-Director. The resignation was not the result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

Ms. Nelson Rincon resigned from all positions with the Company effective as of February 7, 2018, including Treasurer and Secretary. The resignation was not the result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

On February 7, 2018, Mr. Simeon Leonardo Reyes Francisco was appointed as the sole member of the Company’s Board of Directors and as the Company’s President, Chief Executive Officer, Chief Financial Officer, Treasurer, and Secretary.

The biography for Simeon Leonardo Reyes Francisco is set forth below:

Professional Appointments

Galaxia Computers Founder – 2001- Present Owner Software and hardware distribution company

Actual Inversiones Imperial Founder – Manager Investment – Financing Group Actual

Member of ANGE (Association of Business Entrepreneurs of the Dominican Republic)

Punta Cana Group Managing engineer – In charge of Pueblo Bavaro development 1996 -2001

Education

Graduate of System Engineering & Civil Engineer Utesa – Santiago, Dominican Republic. 1994

Graduate of Business Administration Pontificia Universidad Católica Madre & Maestra 2002

ITEM 5.06CHANGE IN SHELL COMPANY STATUS

Upon entering into the Exclusive License and Distribution Agreement, we believe we are now able to fully exploit our intended business model. Item 2.01(f) of Form 8-K states that if the registrant was a “shell” company, such as the Company was immediately before Exclusive License and Distribution Agreement, then the registrant must disclose in a Current Report on Form 8-K the information that would be required if the registrant were filing a general form for registration of securities on Form 10.

Accordingly, this Report includes all of the information that would be included in a Form 10. Please note that unless indicated otherwise, the information provided below relates to us after the closing of the Exclusive License and Distribution Agreement. Information relating to periods prior to the date of the Exclusive License and Distribution Agreement only relate to the party specifically indicated. The following information is being provided with respect to the Company after giving effect to the Exclusive License and Distribution Agreement pursuant to the requirements of Item 2.01 of Form 8-K and Form 10.

FORM 10 DISCLOSURE

ITEM 1. BUSINESS

Our Corporate History and Background

MITU Resources Inc. was incorporated under the laws of the State of Nevada April 17, 2013. We were incorporated as an exploration stage mining company with one mineral claim (the MITU Gold claim) in the Republic of Colombia. Our goal was to generate revenues through the sale of gold found and extracted from this claim. We acquired the MITU Gold Claim from Alvarez Explorations Inc. ("Alvarez") located in the Republic of the Colombia on April 17, 2013 for the sum of $5,000. The only terms between the Company and Alvarez are the payment of the purchase price by the Company to Alvarez, and the transfer of the MITU Gold Claim from Alvarez to the Company. The MITU Gold Claim is our only mineral claim and only material asset. There are no operations underway, no facilities other than the principal executive offices and no employees other than the two executive officers.

Page 3 of 21

On February 7, 2018, we entered into and executed an Exclusive License and Distribution Agreement (“License Agreement”) with HeadWind Technologies Ltd. (“HeadWind”) whereby we were granted various Intellectual Property Rights related to owner, inventor, and creator of the “Wind Shark” a new type of self-starting, vertical axis wind turbine created to change the way low wind turbines are defined (the “Product”). Pursuant to the terms of the License Agreement, we acquired the rights to further develop, commercialize, market and distribute certain proprietary inventions and know-how related to the Products. In exchange there shall be licensee fee of four hundred thousand dollars ($400,000), paid in tranches as set forth in the Licensee Agreement, and continuing royalty (the "Royalty") equal to three percent (3%) of the gross sales price for sales of all Products.

Following the Closing of the Exclusive License and Distribution Agreement, we believe we are now able to fully implement our intended business plan and plan of operations.

Our Business

Wind and Solar are two of the most prolific types of renewable energy available. However, most conventional solar systems are able to produce energy for about eight hours a day. When it is dark, the sun is low on the horizon, or even in daylight with cloud cover, energy production can be limited. Wind turbines are capable of producing energy when solar is not, during darkness and on cloudy days. Large wind turbines are costly, expensive to maintain and thus limited in deployment, but generally spin slowly so they are safe for birds and bats. Micro wind turbines are reasonably cost effective, in the $500 to $1500 range, but most don’t start producing power until wind speeds reach about 7 mph, and don’t hit peak power until over 30 mph. They generally quite noisy, so they are not desirable in residential areas, and they usually spin fast, so are not safe for birds and bats.

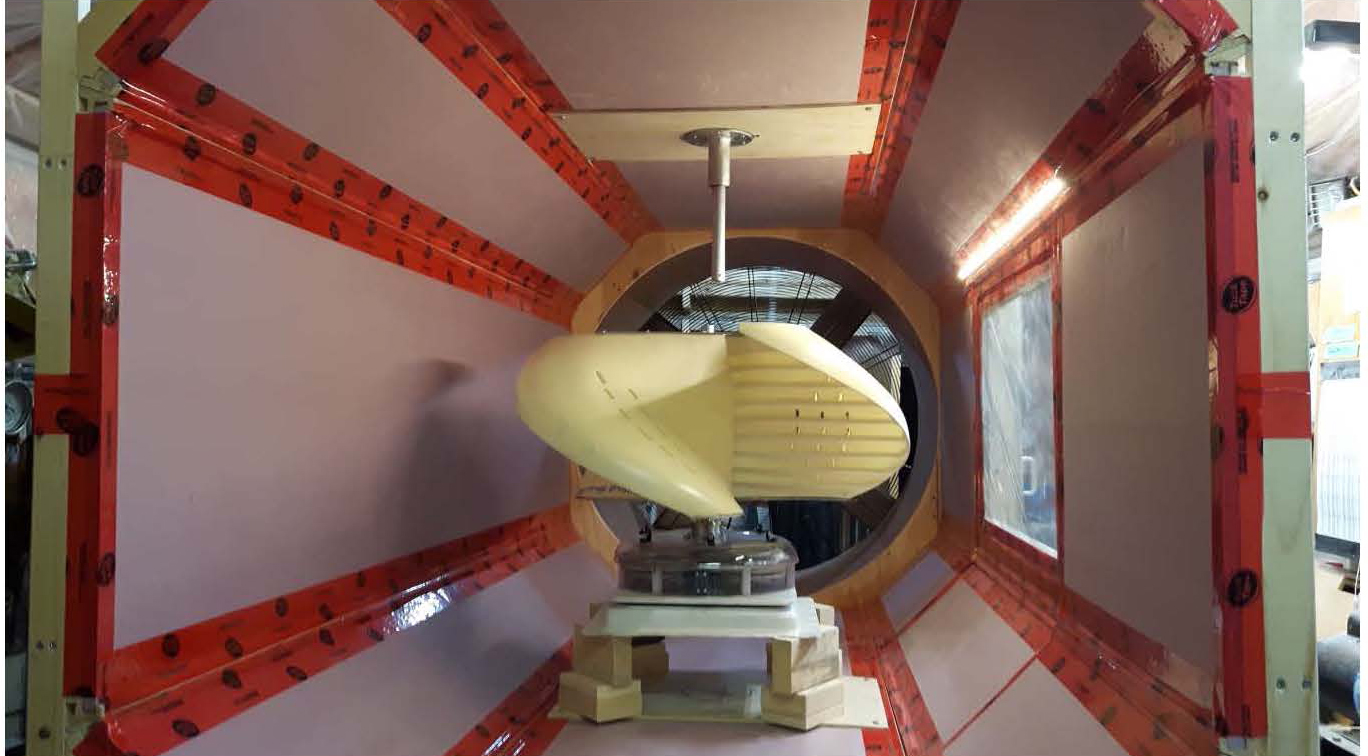

Introducing the WindShark: Faced with the limitations of existing windmills and inspired by sacred geometry and the operational dynamics of shark’s gills, WindShark was developed and wind tunnel tested. These efforts resulted in a novel vertical axis windmill design that met all of the required design criteria, and demonstrated that the technology could be scaled for various application and power generating scenarios.

WindShark is a proprietary vertical axis windmill with three curved helical blades that capture airflow from any wind direction. Each blade has scallops and slots that channel the airflow to energize both the front and back of the blade surfaces depending on its angle relative to the wind. This means that WindShark blades can produce energy when both moving into and away from the wind as they rotate around their central vertical axis. Another function of this design is that the lateral loads on the vertical axis are negligent, which should contribute to lower maintenance costs. Betz’s Law dictates the maximum energy that can be extracted from the wind, regardless of wind turbine design. Most utility scale units peak at about 75% of Betz’s limits. WindShark appears to come very close to these limits, though this is subject to further testing. The high efficiency of the WindShark design allows the turbine to start up at wind speeds below 2 mph and reach peak efficiencies between 6 to 10 mph.

Page 4 of 21

Less than a quarter of the United States has sustained winds adequate enough to make conventional small wind turbines economically viable. Due to its ability to harvest energy from lower speed winds, WindShark is able to deploy economically as much as three times more than that of conventional small wind turbines.

Due to WindSharks complex turbine blade shape, considerable effort has been invested to determine that it can be consistently manufactured. Initial prototypes have been 3-D printed and Roto-molded, with injection molding being considered for future production. Initial testing has commenced with a sourced 100 W generator, and will be further developed and tested with similar 200W, 500W, 1000W and 1500W generators in the near future. A proprietary generator is also in development as well as alternate materials and applications. This will include collapsing and stow-able field-deployable turbines, as well as turbines designed with the WindShark technology for deployment in moving-water scenarios.

THE MARKET

International

Internationally, the Product is a natural fit for developing countries such throughout South America, Africa, and a perfect component for the winning combination of wind plus solar.

California Cannabis Market.

We believe that there is a tremendous potential in California’s emerging cannabis market place for the WindShark. One of the major factors effecting gross margins in the cannabis marketplace is the cost of electricity to run a greenhouse or indoor grow facility. We believe there is huge potential to deploy the WindShark throughout California and other states where cannabis has become legal, offering substantial savings to the grower.

Recreational and “Off the Grid” Market.

We believe a significant market for the WindShark turbine exists in both the Recreation Market (inclusive of cabins, cottages, recreational vehicles and boats etc.) and for permanent homes and structures in remote areas where people are attempting to live without connecting to community services of any kind – if they even exist. Due to the ability of the WindShark turbine to produce consistent power at very low wind speeds compared to existing competing products, its relatively lightweight construction and the future ability to be collapsible for storage and transport, make it the ideal product for these uses.

Some 9 million RVs are on the road in the United States, the highest number ever according to the Recreational Vehicle Industry Association as at June 2016. In addition, more than 355,000 travel trailers, motorhomes, and folding camping trailers are being sold each year, or a record $15.4 billion worth.

Page 5 of 21

COMPETITION

We currently do not compete with wind turbine manufacturers, such as GE and Siemens, who sell large 100 foot to 300 foot wind turbine structures commonly utilized on new commercial wind farm applications. We will compete against small to medium wind turbine manufacturers, such as Bergey, Eocycle, Endurance and Kingspan, who manufacture wind turbines for residential and commercial markets. We believe that the Products will be delivered to the end consumer at a price-point that will allow us to be highly competitive.

Emerging Growth Company Status

We are an “emerging growth company” as defined under the Jumpstart our Business Startups Act (the “JOBS Act”). We expect to remain an “emerging growth company” for up to five years. As an “emerging growth company”, we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies”, including, but not limited to:

not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes- Oxley Act (we also will not be subject to the auditor attestation requirements of Section 404(b) as long as we are a “smaller reporting company”, which includes issuers that had a public float of less than $75 million as of the last business day of their most recently completed second fiscal quarter);

reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements; and

exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

ITEM 1A.RISK FACTORS

You should carefully consider each of the risks and uncertainties described below and elsewhere in this Current Report on Form 8-K, as well as any amendments or updates reflected in subsequent filings with the SEC. We believe these risks and uncertainties, individually or in the aggregate, could cause our actual results to differ materially from expected and historical results and could materially and adversely affect our business operations, results of operations, financial condition and liquidity. Further, additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our results and business operations.

Risks Associated with Our Business

The Company has no revenues to date.

The Company has generated no revenues to date. Most of management’s time, and the Company’s limited resources have been spent on R&D, and developing its business strategy. Most of the activity has been centered in the following areas; researching potential opportunities, contacting prospective partners, exploring marketing contacts, establishing operations, preparing a business plan, selecting professional advisors and consultants, and seeking capital for the Company.

The Company has a small financial and accounting organization. Being a public company may strain the Company's resources, divert management’s attention and affect its ability to attract and retain qualified officers and directors.

The Company is an early-stage company with no developed finance and accounting organization and the rigorous demands of being a public company require a structured and developed finance and accounting group. Once it becomes a public reporting company, the Company will become subject to the reporting requirements of the Securities Exchange Act of 1934. However, the requirements of these laws and the rules and regulations promulgated thereunder entail significant accounting, legal and financial compliance costs which may be prohibitive to the Company as it develops its business plan, services and scope. These costs have made, and will continue to make, some activities more difficult, time consuming or costly and may place significant strain on its personnel, systems and resources.

The Securities Exchange Act requires, among other things, that companies maintain effective disclosure controls and procedures and internal control over financial reporting. In order to maintain the requisite disclosure controls and procedures and internal control over financial reporting, significant resources and management oversight are required. As a result, management’s attention may be diverted from other business concerns, which could have a material adverse effect on the development of the Company's business, financial condition and results of operations.

Page 6 of 21

These rules and regulations may also make it difficult and expensive for the Company to obtain director and officer liability insurance. If the Company is unable to obtain adequate director and officer insurance, its ability to recruit and retain qualified officers and directors, especially those directors who may be deemed independent, will be significantly curtailed.

The Company expects to incur additional expenses and may ultimately never be profitable.

The Company has only recently emerged from its status as a development-stage company, and it has limited operations to date. The Company will need to continue to generate revenue to achieve and maintain profitability. To become profitable, the Company must successfully develop and operate its product sales and marketing business. These processes involve many factors that are beyond the Company’s control, including the type of competition that the Company may encounter. Ultimately, in spite of the Company’s best or reasonable efforts, the Company may never actually generate revenues sufficient to cover operating expenses or become profitable.

No assurance of market acceptance.

Even if the Company successfully markets, sells and distributes Product, there can be no assurance that the market reception will be positive for the Company or its ventures. The widespread adoption and use of the Products will represent fundamental change in the energy industry. As with any new technology, there is a substantial risk that potential customers may not accept the potential benefits of the Product. Market acceptance of Product will depend, in large part, upon the ability of Company to demonstrate the performance advantages and cost-effectiveness of its products over competing products. There can be no assurance that Company will be able to market its technology successfully on a widespread basis or that any of Company’s current or future products or services will be accepted in the marketplace. Furthermore, Company intends to develop products and systems and sell them at a price assumed by Company sufficient to generate a profit. Even if Company’s products and services are accepted in the industry, the market for its products may not be able to support Company’s pricing structure.

Reliance on third party agreements and relationships is necessary for development of the Company's business.

The Company will need strong third party relationships and partnerships in order to develop and grow its business. The Company will be substantially dependent on these strategic partners and third party relationships to commercialize its business.

The proposed operations of the Company are speculative.

The success of the proposed business plan of the Company will depend to a great extent on the operations, financial condition and management of the Company. Although the Company has a business plan and intends to execute its overall business strategy, limited operations have been conducted to date and the proposed operations of the Company remain speculative.

Executive officers, directors and 5% shareholders of the Company will retain voting control after the offering, which will allow them to exert substantial influence over major corporate decisions.

The Company anticipates that its executive officers and directors (together with 5% shareholders) will, in the aggregate, beneficially own enough of its issued and outstanding capital stock following the completion of this offering, assuming the sale of all Shares hereby offered, to exert voting control. Accordingly, the present shareholders, by virtue of their percentage share ownership and certain procedures established by the certificate of incorporation and by-laws of the Company for the election of its directors, may effectively control the board of directors and the policies of the Company. As a result, these stockholders will retain substantial control over matters requiring approval by the Company’s stockholders, such as (without limitation) the election of directors and approval of significant corporate transactions. This concentration of ownership may also have the effect of delaying or preventing a change in control, which in turn could have a material adverse effect on the market price of the Company’s common stock or prevent stockholders from realizing a premium over the market price for their Shares.

Government regulation could negatively impact the business.

The Company’s business segments may be subject to various government regulations in the jurisdictions in which they operate. Due to the potential wide scope of the Company’s operations, the Company could be subject to regulation by various political and regulatory entities, including various local and municipal agencies and government sub-divisions. The Company may incur increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure to comply. The Company’s operations could be adversely affected, directly or indirectly, by existing or future laws and regulations relating to its business or industry.

Page 7 of 21

The Company's election not to opt out of JOBS Act extended accounting transition period may not make its financial statements easily comparable to other companies.

Pursuant to the JOBS Act of 2012, as an emerging growth company the Company can elect to opt out of the extended transition period for any new or revised accounting standards that may be issued by the PCAOB or the SEC. The Company has elected not to opt out of such extended transition period which means that when a standard is issued or revised and it has different application dates for public or private companies, the Company, as an emerging growth company, can adopt the standard for the private company. This may make comparison of the Company's financial statements with any other public company which is not either an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible as possible different or revised standards may be used.

The recently enacted JOBS Act will also allow the Company to postpone the date by which it must comply with certain laws and regulations intended to protect investors and to reduce the amount of information provided in reports filed with the SEC.

The recently enacted JOBS Act is intended to reduce the regulatory burden on “emerging growth companies. The Company meets the definition of an emerging growth company and so long as it qualifies as an “emerging growth company,” it will, among other things:

-be exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that its independent registered public accounting firm provide an attestation report on the effectiveness of its internal control over financial reporting;

-be exempt from the “say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the “say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of the Dodd-Frank Act and certain disclosure requirements of the Dodd- Frank Act relating to compensation of its chief executive officer;

-be permitted to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Securities Exchange Act of 1934 and instead provide a reduced level of disclosure concerning executive compensation; and

-be exempt from any rules that may be adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report on the financial statements.

Although the Company is still evaluating the JOBS Act, it currently intends to take advantage of some or all of the reduced regulatory and reporting requirements that will be available to it so long as it qualifies as an “emerging growth company”. The Company has elected not to opt out of the extension of time to comply with new or revised financial accounting standards available under Section 102(b) of the JOBS Act. Among other things, this means that the Company's independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of the Company's internal control over financial reporting so long as it qualifies as an emerging growth company, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an emerging growth company, the Company may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers that would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate the Company. As a result, investor confidence in the Company and the market price of its common stock may be adversely affected.

The Company may face significant competition from companies that serve its industries.

The Company’s business is highly competitive with respect to price, quality, assortment and presentation, and customer service. This competitive market creates the risk of adverse impact to the Company’s revenues due to the potential need to reduce prices, and thus reduce margins, in order to stay competitive. If the Company fails to timely and effectively respond to competitive pressures and changes in the markets, it could adversely affect the Company’s financial performance.

Furthermore, the Company competes with firms who may have greater financial, distribution, marketing and other resources than the Company and may be able to secure better arrangements with suppliers and employees and more successfully attract and retain customers. The Company may be vulnerable to the marketing power and degree of consumer recognition of these larger competitors. The Company is susceptible to the risk that its competitors could effectively venture into the Company’s areas of expertise, in which case, the Company may not be able to compete successfully, and competitive pressures may adversely affect its business, results of operations and financial condition.

Page 8 of 21

Pricing pressures may be significant in the Company’s industry.

Because the market that the Company intends to target is competitive and large in volume, customers routinely ask for lower pricing to make their products more competitive. This phenomenon can put pricing pressure on the Products and reduce profit margin over time.

The Company is subject to the potential factors of market and customer changes.

The business of the Company is susceptible to rapidly changing preferences of the marketplace and its customers. The needs of customers are subject to constant change. Although the Company intends to carry out its plan of developing and selling products and solutions to satisfy changing customer demands in the marketplace, there can be no assurance that funds for such expenditures will be available or that the Company's competition will not develop similar or superior capabilities or that the Company will be successful in its internal efforts.

The future success of the Company will depend in part on its ability to respond effectively to rapidly changing trends, industry standards and customer requirements.

The development of new technology is a significant risk. Even though the Company plans to invest in marketing and sales of leading technology products and services, new technology may come to market that makes the Company’s products obsolete and less attractive to customers.

General economic factors may adversely affect the Company’s financial performance.

Economic conditions beyond the Company’s control, such as increased unemployment levels, inflation, increases in fuel, other energy costs and interest rates, lack of available credit, erosion in consumer confidence and other factors affecting disposable consumer income may adversely affect the Company’s business. Many of those factors, as well as commodity rates, transportation costs, costs of labor, insurance and healthcare, foreign exchange rate fluctuations, lease costs, changes in other laws and regulations and other economic factors, also affect the Company’s cost of goods sold as well as its general and administrative expenses, which may adversely affect sales or profitability.

The Company does not maintain certain insurance, including errors and omissions and indemnification insurance.

The Company has limited capital and, therefore, does not currently have a policy of insurance against liabilities arising out of the negligence of its officers and directors and/or deficiencies in any of its business operations. Even assuming that the Company obtained insurance, there is no assurance that such insurance coverage would be adequate to satisfy any potential claims made against the Company, its officers and directors, or its business operations. Any such liability which might arise could be substantial and may exceed the assets of the Company. The certificate of incorporation and by-laws of the Company provide for indemnification of officers and directors to the fullest extent permitted under applicable law. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons, it is the opinion of the Securities and Exchange Commission that such indemnification is against public policy, as expressed in the Act, and is therefore, unenforceable.

The Company may not be able to attract new customers or fuel its growth.

The Company hopes to grow its business by increasing sales and developing new products. There can be no assurance, however, that the Company will be able to successfully implement any of its growth strategies. To successfully achieve growth, the Company must continually evaluate the adequacy of its existing systems and find new uses for its unique turbine. There can be no assurance that the Company will adequately anticipate all of the changing demands that growth, should it occur, will impose on the Company’s systems, procedures, and structure. Any failure to adequately anticipate and respond to such changing demands is likely to have a material adverse effect on the Company.

Page 9 of 21

Risks Relating to Ownership of Our Securities

Our stock price may be volatile, which may result in losses to our shareholders.

The stock markets have experienced significant price and trading volume fluctuations, and the market prices of companies listed on the OTC Markets quotation system in which shares of our common stock are listed, have been volatile in the past and have experienced sharp share price and trading volume changes. The trading price of our common stock is likely to be volatile and could fluctuate widely in response to many factors, including the following, some of which are beyond our control:

variations in our operating results;

changes in expectations of our future financial performance, including financial estimates by securities analysts and investors;

changes in operating and stock price performance of other companies in our industry;

additions or departures of key personnel; and

future sales of our common stock.

Domestic and international stock markets often experience significant price and volume fluctuations. These fluctuations, as well as general economic and political conditions unrelated to our performance, may adversely affect the price of our common stock.

Our common shares may become thinly traded and you may be unable to sell at or near ask prices, or at all.

We cannot predict the extent to which an active public market for trading our common stock will be sustained. Although the trading price of our common shares increased significantly recently, it has historically been sporadically or “thinly-traded” meaning that the number of persons interested in purchasing our common shares at or near bid prices at certain given time may be relatively small or non-existent.

This situation is attributable to a number of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community who generate or influence sales volume. Even if we came to the attention of such persons, those persons tend to be risk-averse and may be reluctant to follow, purchase, or recommend the purchase of shares of an unproven company such as ours until such time as we become more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels will be sustained.

The market price for our common stock is particularly volatile given our status as a relatively small company, which could lead to wide fluctuations in our share price. You may be unable to sell your common stock at or above your purchase price if at all, which may result in substantial losses to you.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

We do not anticipate paying any cash dividends to our common shareholders.

We presently do not anticipate that we will pay dividends on any of our common stock in the foreseeable future. If payment of dividends does occur at some point in the future, it would be contingent upon our revenues and earnings, if any, capital requirements, and general financial condition. The payment of any common stock dividends will be within the discretion of our Board of Directors. We presently intend to retain all earnings after paying the interest for the preferred stock, if any, to implement our business plan; accordingly, we do not anticipate the declaration of any dividends for common stock in the foreseeable future.

Page 10 of 21

Volatility in our common share price may subject us to securities litigation.

The market for our common stock is characterized by significant price volatility as compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management’s attention and resources.

The elimination of monetary liability against our directors, officers and employees under Nevada law and the existence of indemnification rights of our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against our directors, officers and employees.

Our Articles of Incorporation contains a specific provision that eliminates the liability of our directors and officers for monetary damages to our company and shareholders. Further, we are prepared to give such indemnification to our directors and officers to the extent provided for by Nevada law. The foregoing indemnification obligations could result in our company incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which we may be unable to recoup. These provisions and resultant costs may also discourage our company from bringing a lawsuit against directors and officers for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors and officers even though such actions, if successful, might otherwise benefit our company and shareholders.

Our business is subject to changing regulations related to corporate governance and public disclosure that have increased both our costs and the risk of noncompliance.

Because our common stock is publicly traded, we are subject to certain rules and regulations of federal, state and financial market exchange entities charged with the protection of investors and the oversight of companies whose securities are publicly traded. These entities, including the Public Company Accounting Oversight Board, the SEC and FINRA, have issued requirements and regulations and continue to develop additional regulations and requirements in response to corporate scandals and laws enacted by Congress, most notably the Sarbanes-Oxley Act of 2002. Our efforts to comply with these regulations have resulted in, and are likely to continue resulting in, increased general and administrative expenses and diversion of management time and attention from revenue-generating activities to compliance activities. Because new and modified laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This evolution may result in continuing uncertainty regarding compliance matters and additional costs necessitated by ongoing revisions to our disclosure and governance practices.

ITEM 2.FINANCIAL INFORMATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

The following discussion should be read in conjunction with our audited annual financial statements and the related notes thereto for the year ended March 31, 2017. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. See “Risk Factors”. Our audited financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

We have a limited operating history and have not yet generated or realized any revenues from our activities. To implement our business plan and to stay in business, we must raise additional cash – particularly over the next 12 months. If we cannot raise additional funds we will not have sufficient funds to satisfy our cash requirements and would have to go out of business.

Page 11 of 21

Liquidity and Capital Resources

Since inception to the present, we have raised capital through private placements of common stock aggregating $30,000 with our only two shareholders and officers. As at March 31, 2017, we had $1,015 in cash.

Our capital commitments for the coming 12 months consist of administrative expenses together with expenses associated with the completion of our planned exploration program. Including this exploration work, we estimate that we will have to incur the following expenses during the next 12 months:

Expenses |

|

| Amount |

| Description |

Accounting |

| $ | 4,650 |

| Fees to the independent accountant for preparing the quarterly and annual financial statements. |

Legal |

|

| 10,000 |

| Legal fees in connection with miscellaneous matters. |

Audit |

|

| 10,000 |

| Review of the quarterly financial statements and audit of the annual financial statements |

Exploration |

|

| 6,712 |

| for Phase I |

Filing Fees |

|

| 475 |

| Annual fee to the Secretary of State for Nevada |

Office |

|

| 1,000 |

| Photocopying, delivery and fax expenses |

Transfer agent’s fees |

|

| 1,500 |

| Annual fee of $500 and estimated miscellaneous charges of $1,000 |

|

|

|

|

|

|

Estimated Expenses |

| $ | 34,337 |

|

|

In the future, the Company may be forced to rely upon cash advances from its officers to meet current and future liabilities.

We have no plant or significant equipment to sell, nor are we going to buy any plant or significant equipment during the next 12 months. We will not buy any equipment unless we locate a body of ore and determine that it is economical to extract the ore from the land. We may attempt to interest other companies to undertake exploration work on the MITU Gold Claim through joint venture arrangement or even the sale of part of the MITU Gold Claim. Neither of these avenues has been pursued as of the date of this prospectus. Our geologist has recommended an exploration program for the MITU Gold Claim. However, even if the results of this work suggest further exploration work is warranted, we do not presently have the requisite funds and so will be unable to complete anything beyond the exploration work on Phase I recommended in the Report until we raise more money or find a joint venture partner to complete the exploration work. If we cannot find a joint venture partner and do not raise more money, we will be unable to complete any work beyond the exploration program recommended by our geologist. If we are unable to finance additional exploration activities, we do not know what we will do and we do not have any plans to do anything else. We do not intend to hire any employees at this time. All of the work on the MITU Gold Claim will be conducted by our two officers. They will be responsible for supervision, surveying, exploration, and excavation and will be capable of evaluating the information derived from the exploration and excavation including advising MITU on the economic feasibility of removing any mineralized material we may discover. Of all the possibilities of financing to meet current and future liabilities, the most likely is cash advances from our officers. However, we have no agreements with our officers for them to make such advances, and they have no obligation to do so.

The Company will require additional financing to continue with its operations, as its current cash balance is less than one month of average cash burn for the Company’s operations.

Limited Operating History; Need for Additional Capital

There is no historical financial information about us upon which to base an evaluation of our performance as an exploration corporation. We are an exploration stage company and have not generated any revenues from our exploration activities. We cannot guarantee we will be successful in our exploration activities. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the exploration of our properties, and possible cost overruns due to price and cost increases in services.

To become profitable and competitive, we must invest in the exploration of our property before we start production of any minerals we may find. We must obtain equity or debt financing to provide the capital required to fully implement our phased exploration program. We have no assurance that financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to commence, continue, develop or expand our exploration activities. Even if available, equity financing could result in additional dilution to existing shareholder.

Page 12 of 21

During the year ended March 31, 2017, we incurred a net loss of $48,501 comprised of $32,180 of professional fees related to our accounting, audit, and legal fees incurred as part of our SEC filing requirements, and $16,321 of transfer agent fees and other expenses. During the year ended March 31, 2016, we incurred a net loss of $40,953 which included $25,200 of professional fees related to our accounting, audit, and legal fees, $10,753 of transfer agent fees and other expenses, and $5,000 for the impairment on the MITU gold claim. The overall increase in net loss for fiscal 2017 was due to increased costs of professional fees incurred for legal and audit fees.

For the years ended March 31, 2017 and 2016, we incurred a loss per share of $nil.

Our Planned Exploration Program

We must conduct exploration to determine what, if any, amounts of minerals exist on the MITU Gold Claim and if such minerals can be economically extracted and profitably processed.

Our planned exploration program is designed to explore and evaluate our property efficiently.

Our anticipated exploration costs for Phase I work on the MITU Gold Claim are approximately $6,712. This figure represents the anticipated cost to us of completing only Phase I work recommended by the Report. However, should the results of this work be sufficiently encouraging to justify our undertaking Phase II work recommended in the Report at an estimated cost of $13,000, we will have to raise additional investment capital. Regardless, we will have to raise additional funds within the next 12 months in order to satisfy our ongoing cash requirements and finance anything beyond Phase I work on the MITU Gold Claim.

Balance Sheets

As at March 31, 2017, we had cash and total assets of $1,015 compared to cash and total assets of $5,842 as at March 31, 2016. The decrease in cash and total assets was attributed to the use of cash for operating activities that was greater than the amount of financing received from management during the year.

We had liabilities of $105,180 at March 31, 2017 compared to $61,506 at March 31, 2016. The increase in liabilities is due to an additional $45,000 of debt owing to the President and Director of the Company for financing of our day-to-day operations. The amount owing is unsecured, non-interest bearing, and due on demand. The increase is offset by a decrease of $1,326 in accounts payable and accrued liabilities as we repaid outstanding obligations as they became due.

During the years ended March 31, 2017 and 2016, we did not have any capital transactions.

Cash Flows

Cash Flows from Operating Activities

During the year ended March 31, 2017, we used $49,827 of cash in operating activities compared to $40,342 during the year ended March 31, 2016. The increase in the use of cash for operating activities was attributed to an increase in overall operating activities during the year.

Cash Flows from Investing Activities

During the years ended March 31, 2017 and 2016, the Company has not had any investing activities.

Cash Flows from Financing Activities

During the year ended March 31, 2017, we received $45,000 from our President and Director for funding of our day-to-day operations compared to $40,000 during the year ended March 31, 2016. The amounts owing are unsecured, non-interest bearing, and due on demand.

Trends

We are in the exploration stage, have not generated any revenue and have no prospects of generating any revenue in the foreseeable future. We are unaware of any known trends, events or uncertainties that have had, or are reasonably likely to have, a material impact on our business or income, either in the long term of short term, other than as described in this section or in “Risk Factors”.

Page 13 of 21

Critical Accounting Policies

Our discussion and analysis of our financial condition and results of operations, including the discussion on liquidity and capital resources, are based upon our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an ongoing basis, management re-evaluates its estimates and judgments.

The going concern basis of presentation assumes we will continue in operation throughout the next fiscal year and into the foreseeable future and will be able to realize our assets and discharge our liabilities and commitments in the normal course of business. Certain conditions, discussed below, are currently present that raise substantial doubt upon the validity of this assumption. The financial statements do not include any adjustments that might result from the outcome of the uncertainty.

Our intended exploration activities depend upon our ability to obtain financing in the form of debt and equity and ultimately to generate future profitable exploration activity or income from its investments. As of the date hereof we have not generated revenues, and have experienced negative cash flow from minimal exploration activities. We may look to secure additional funds through future debt or equity financings. Such financings may not be available or may not be available on reasonable terms.

ITEM 3.PROPERTIES

We lease our principal executive offices at Gregorio Luperón #7, Puerto Plata, Dominican Republic. We believe our current premises are adequate for our current limited operations and we do not anticipate that we will require any additional premises in the foreseeable future. We anticipate that we will continue to utilize these premises so long as the space requirements of our company do not require a larger facility. We do not own any real property.

ITEM 4.SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of February 7, 2018, the total number of shares owned beneficially by each of our directors, named executive officers, individually and as a group, and the present owners of 5% or more of our total outstanding shares. The stockholder listed below has direct ownership of his shares and possesses sole voting and dispositive power with respect to the shares.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) (2) | Percentage of Class%(1) (2) |

Simeon Leonardo Reyes Francisco Gregorio Luperón #7, Puerto Plata, Dominican Republic | 15,000,000 | 50.0% |

Directors and Executive Officers as a Group(1) | 15,000,000 | 50.00% |

(1) Under Rule 13d-3, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (i) voting power, which includes the power to vote, or to direct the voting of shares; and (ii) investment power, which includes the power to dispose or direct the disposition of shares. Certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire the shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares outstanding is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of these acquisition rights. As a result, the percentage of outstanding shares of any person as shown in this table does not necessarily reflect the person’s actual ownership or voting power with respect to the number of shares of common stock actually outstanding on February 1, 2018. As of February 7, 2018, there were 30,000,000 shares of our company’s common stock issued and outstanding.

(2)As of February 7, 2018, Mr. Perez and Mr. Rincon the former officers and director sold their shares to Mr. Simeon Leonardo Reyes Francisco and concurrently resigned from all positions with the Company.

Changes in Control

We do not currently have any arrangements which if consummated may result in a change of control of our company.

Page 14 of 21

ITEM 5.DIRECTORS AND EXECUTIVE OFFICERS

Identification of Executive Officers and Directors of the Company

The following individuals serve as the directors and executive officers of our company as of the date of this Annual Report. All directors of our company hold office until the next annual meeting of our shareholders or until their successors have been elected and qualified. The executive officers of our company are appointed by our board of directors and hold office until their death, resignation or removal from office.

Name | Age | Position Held with the Company |

Simeon Leonardo Reyes Francisco

|

| Chief Executive Officer, President, Chief Financial Officer, Secretary and Director |

Business Experience

The following is a brief account of the education and business experience during at least the past five years of our director and executive officer, indicating his principal occupation during that period, and the name and principal business of the organization in which such occupation and employment were carried out.

Involvement in Certain Legal Proceedings

During the past ten years no director, executive officer, promoter or control person of the Company has been involved in the following:

(1)A petition under the Federal bankruptcy laws or any state insolvency law which was filed by or against, or a receiver, fiscal agent or similar officer was appointed by a court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such filing;

(2)Such person was convicted in a criminal proceeding or is a named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses);

(3)Such person was the subject of any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from, or otherwise limiting, the following activities:

i.Acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity;

ii.Engaging in any type of business practice; or

iii.Engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of Federal or State securities laws or Federal commodities laws;

(4)Such person was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any Federal or State authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described in paragraph (f)(3)(i) of this section, or to be associated with persons engaged in any such activity;

(5)Such person was found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated;

(6)Such person was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated;

Page 15 of 21

(7)Such person was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:

i.Any Federal or State securities or commodities law or regulation; or

ii.Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or

iii.Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

(8)Such person was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

Code of Ethics

We have not yet adopted a Code of Business Conduct and Ethics. Once we do, we will file a copy of it as an exhibit to a Current Report on Form 8-K.

Committees of the Board

All proceedings of our board of directors were conducted by resolutions consented to in writing by all the directors and filed with the minutes of the proceedings of the directors. Such resolutions consented to in writing by the directors entitled to vote on that resolution at a meeting of the directors are, according to the corporate laws of the state of Nevada and the bylaws of our company, as valid and effective as if they had been passed at a meeting of the directors duly called and held.

Our audit committee consists of our entire board of directors.

Our company currently does not have nominating, compensation committees or committees performing similar functions nor does our company have a written nominating, compensation or audit committee charter. Our board of directors does not believe that it is necessary to have such committees because it believes that the functions of such committees can be adequately performed by our directors.

Our company does not have any defined policy or procedure requirements for shareholders to submit recommendations or nominations for directors. The directors believe that, given the early stage of our development, a specific nominating policy would be premature and of little assistance until our business operations develop to a more advanced level. Our company does not currently have any specific or minimum criteria for the election of nominees to the board of directors and we do not have any specific process or procedure for evaluating such nominees. Our directors assess all candidates, whether submitted by management or shareholders, and make recommendations for election or appointment.

A shareholder who wishes to communicate with our board of directors may do so by directing a written request addressed to our president, at the address appearing on the first page of this annual report.

Audit Committee and Audit Committee Financial Expert

Our board of directors has determined that it does not have a member of our audit committee that qualifies as an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K, and is “independent” as the term is used in Item 7(d)(3)(iv) of Schedule 14A under the Securities Exchange Act of 1934, as amended.

We believe that the members of our board of directors, who act as our audit committee in fulfilling that function, are collectively capable of analyzing and evaluating our financial statements and understanding internal controls and procedures for financial reporting. We believe that retaining an independent director who would qualify as an “audit committee financial expert” would be overly costly and burdensome and is not warranted in our circumstances given the early stages of our development and the fact that we have not generated any material revenues to date. In addition, we currently do not have nominating, compensation or audit committees or committees performing similar functions nor do we have a written nominating, compensation or audit committee charter. Our board of directors does not believe that it is necessary to have such committees because it believes the functions of such committees can be adequately performed by our board of directors.

Page 16 of 21

ITEM 6.EXECUTIVE COMPENSATION

We have no standard arrangement to compensate our director or officers for their services in their respective capacity as directors or officers. The director and officers are not paid for meetings attended. All travel and lodging expenses associated with corporate matters are reimbursed by us, if and when incurred. Currently, the director and officers receive and have received no funds or other cash considerations. There are no financial agreements with our executive officers at this time although we will reimburse them for reasonable expenses incurred during their performance. We will not pay compensation for attendance at meetings. The table below summarizes compensation:

Summary Compensation Table

Name and Principal Position (a) | Fiscal Year (b) | Salary ($) (c) | Bonus ($) (d) | Stock Awards ($) (e) | Options Awards (Number) (f) | Non-Equity Incentive Plan Compensation ($) (g) | All Other Compensation $) (h) | Total ($) |

Mr. | 2018

| - | -

| -

| -

| -

| -

| - |

Mr. Simeon Leonardo Reyes Francisco, President, CEO, CFO, Secretary and Director

| 2018 | - | - | - | - | - | - | - |

Juan Perez, President and Director (2)

| 2015 2016 2017 | - - - | - - - | - - - | - - - | - - - | - - - | - - - |

Nelson Rincon , Secretary and Treasurer (2)

| 2015 2016 2017 | - - - | - - - | - - - | - - - | - - - | - - - | - - - |

(1) As of February 7, 2018, Mr. Simeon Leonardo Reyes Francisco was appointed as the sole officer and director of the Company.

(2) As of February 7, 2018, Mr. Perez and Mr. Rincon the former officers and director sold their shares to Mr. Simeon Leonardo Reyes Francisco and concurrently resigned from all positions with the Company.

Long-Term Incentive Plan Awards

We do not have any long-term incentive plans that provide compensation intended to serve as incentive for performance.

Compensation of Directors

Our directors do not receive any compensation for serving on the board of directors.

We have determined that none of our directors are independent directors, as that term is used in Item 7(d)(3)(iv)(B) of Schedule 14A under the Securities Exchange Act of 1934, as amended, and as defined by Rule 4200(a)(15) of the NASDAQ Marketplace Rules.

Stock Option Plans

During our fiscal year ended March 31, 2017, we did not institute any stock option plans.

Stock Options/SAR Grants

During our fiscal year ended March 31, 2017, there were no options granted to our named officers or directors.

Page 17 of 21

Outstanding Equity Awards at Fiscal Year End

No equity awards were outstanding as of the year ended March 31, 2017.

Pension, Retirement or Similar Benefit Plans

There are no arrangements or plans in which we provide pension, retirement or similar benefits for directors or executive officers. We have no material bonus or profit sharing plans pursuant to which cash or non-cash compensation is or may be paid to our directors or executive officers, except that stock options may be granted at the discretion of the board of directors or a committee thereof.

Indebtedness of Directors, Senior Officers, Executive Officers and Other Management

None of our directors or executive officers or any associate or affiliate of our company during the last two fiscal years, is or has been indebted to our company by way of guarantee, support agreement, letter of credit or other similar agreement or understanding currently outstanding.

Indemnification

Under our Bylaws, we may indemnify our officers or directors who are made a party to any proceeding, including a lawsuit, because of their position, if they acted in good faith and in a manner, they reasonably believed to be in our best interest. We may advance expenses incurred in defending a proceeding. To the extent that our officers or directors are successful on the merits in a proceeding as to which they are to be indemnified, we must indemnify them against all expenses incurred, including attorney’s fees. With respect to a derivative action, indemnity may be made only for expenses actually and reasonably incurred in defending the proceeding, and if the officers or directors are judged liable, only by a court order. The indemnification is intended to be to the fullest extent permitted by the laws of the State of Nevada.

Regarding indemnification for liabilities arising under the Securities Act of 1933, which may be permitted to directors or officers under Nevada law, we are informed that, in the opinion of the SEC, indemnification is against public policy, as expressed in the Act and is, therefore, unenforceable.

ITEM 7.CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Related Party Transactions

Other than as disclosed below, none of the following parties has, since incorporation, had any material interest, direct or indirect, in any transaction with us or in any presently proposed transaction that has or will materially affect us:

| (i) | any of our directors or officers; |

|

|

|

| (ii) | any person proposed as a nominee for election as a director; |

|

|

|

| (iii) | any person who beneficially owns, directly or indirectly, shares carrying more than 5% of the voting rights attached to our outstanding shares of common stock; |

|

|

|

| (iv) | any of our promoters; and |

|

|

|

| (v) | any member of the immediate family (including spouse, parents, children, siblings and in- laws) of any of the foregoing persons. |

Director Independence

For purposes of determining director independence, we have applied the definitions set out in NASDAQ Rule 5605(a)(2). The OTCBB on which shares of the Company’s Common Stock are quoted does not have any director independence requirements. The NASDAQ definition of “Independent Director” means a person other than an Executive Officer or employee or any other individual having a relationship, which, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

According to the NASDAQ definition, we have no independent directors.

Page 18 of 21

Review, Approval or Ratification of Transactions with Related Persons

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 8. LEGAL PROCEEDINGS

We know of no material, existing or pending legal proceedings against the Company, nor is the Company involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which directors, officers or any affiliates, or any registered or beneficial shareholders, of the Company is an adverse party or has a material interest adverse to the interests of the Company.

ITEM 9.MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Price and Dividends

Our common stock is currently quoted on the OTC Bulletin Board, under the symbol “MTUU.” Because we are quoted on the OTC Bulletin Board, our securities may be less liquid, receive less coverage by security analysts and news media, and generate lower prices than might otherwise be obtained if they were listed on a national securities exchange.

To date, very little trading has occurred in our stock. We have never declared or paid any cash dividends on our common stock nor do we intend to do so in the foreseeable future. Any future determination to pay cash dividends will be at the discretion of our board of directors and will depend upon our financial condition, operating results, capital requirements, any applicable contractual restrictions and such other factors as our board of directors deems relevant.

Re-Purchase of Equity Securities

None.

Securities Authorized for Issuance under Equity Compensation Plan

None.

ITEM 10.RECENT SALES OF UNREGISTERED SECURITIES

None.

ITEM 11.DESCRIPTION OF THE REGISTRANT’S SECURITIES

Common Stock

Our Articles of Incorporation authorize us to issue 70,000,000 shares of common stock, par value $0.001. As of the date of this Current Report 30,000,000 shares of our common stock were issued and outstanding and we have zero shares of our common stock reserved for options, warrants and other commitments.

Preferred Stock

Our Articles of Incorporation authorize us to issue no shares of preferred stock.

Voting Rights

Except as otherwise required by law or as may be provided by the resolutions of the Board of Directors authorizing the issuance of common stock, all rights to vote and all voting power shall be vested in the holders of common stock. Each share of common stock shall entitle the holder thereof to one vote.

No Cumulative Voting

Except as may be provided by the resolutions of the Board of Directors authorizing the issuance of common stock, cumulative voting by any shareholder is expressly denied.

Page 19 of 21

Rights upon Liquidation, Dissolution or Winding-Up of the Company

Upon any liquidation, dissolution or winding-up of the corporation, whether voluntary or involuntary, the remaining net assets of the Company shall be distributed pro rata to the holders of the common stock.

We refer you to our Articles of Incorporation, any amendments thereto, Bylaws, and the applicable provisions of the Nevada Revised Statutes for a more complete description of the rights and liabilities of holders of our securities.

ITEM 12.INDEMNIFICATION OF DIRECTORS AND OFFICERS

Section 78.138 of the NRS provides that a director or officer will not be individually liable unless it is proven that (i) the director’s or officer’s acts or omissions constituted a breach of his or her fiduciary duties, and (ii) such breach involved intentional misconduct, fraud or a knowing violation of the law.

Section 78.7502 of NRS permits a company to indemnify its directors and officers against expenses, judgments, fines and amounts paid in settlement actually and reasonably incurred in connection with a threatened, pending or completed action, suit or proceeding if the officer or director (i) is not liable pursuant to NRS 78.138 or (ii) acted in good faith and in a manner the officer or director reasonably believed to be in or not opposed to the best interests of the corporation and, if a criminal action or proceeding, had no reasonable cause to believe the conduct of the officer or director was unlawful.

Section 78.751 of NRS permits a Nevada company to indemnify its officers and directors against expenses incurred by them in defending a civil or criminal action, suit or proceeding as they are incurred and in advance of final disposition thereof, upon receipt of an undertaking by or on behalf of the officer or director to repay the amount if it is ultimately determined by a court of competent jurisdiction that such officer or director is not entitled to be indemnified by the company. Section 78.751 of NRS further permits the company to grant its directors and officers additional rights of indemnification under its articles of incorporation or bylaws or otherwise.

Section 78.752 of NRS provides that a Nevada company may purchase and maintain insurance or make other financial arrangements on behalf of any person who is or was a director, officer, employee or agent of the company, or is or was serving at the request of the company as a director, officer, employee or agent of another company, partnership, joint venture, trust or other enterprise, for any liability asserted against him and liability and expenses incurred by him in his capacity as a director, officer, employee or agent, or arising out of his status as such, whether or not the company has the authority to indemnify him against such liability and expenses.