Attached files

| file | filename |

|---|---|

| EX-23.2 - VIVOS INC | ex23-2.htm |

| EX-23.1 - VIVOS INC | ex23-1.htm |

As filed with the Securities and Exchange Commission on February 8 , 2018

Registration No. 333- 216588

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

(Amendment No. 1)

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

VIVOS INC

(Exact name of registrant as specified in its charter)

| Delaware | 2810 | 80-0138937 | ||

| (State

or other jurisdiction of incorporation or organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S.

Employer Identification Number) |

719 Jadwin Avenue,

Richland, WA 99352

(509) 736-4000

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Dr. Michael Korenko, Chief Executive Officer

Vivos Inc

719 Jadwin Avenue,

Richland , WA 99352

(509) 736-4000

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies of all communications to:

Daniel W. Rumsey, Esq. Jessica R. Sudweeks, Esq. Disclosure Law Group, a Professional Corporation 600 W. Broadway, Suite 700 San Diego, CA 92101 619-272-7050

|

Ralph V. De Martino, Esq. Cavas Pavri, Esq. Schiff Hardin LLP 901 K Street, NW #700 Washington, DC 20001 202-778-6400 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] |

| (Do not check if a smaller reporting company) | Emerging growth company | [ ] | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

CALCULATION OF REGISTRATION FEE

| Title Of Each Class Of Securities To Be Registered | Proposed

Maximum Aggregate Offering Price (1) | Amount

Of Registration Fee | ||||||

| Common stock, $0.001 par value per share | $ | 6,9000,000.00 | $ | 859.05 | ||||

| Warrants to purchase shares of common stock (2)( 3 ) | - | - | ||||||

| Shares of common stock issuable upon exercise of warrants ( 4 ) | $ | 8,625,000.00 | 1,073.81 | |||||

| Underwriter unit purchase option | ||||||||

| Shares of common stock included in Underwriter unit purchase option | $ | 660,000 | 82.17 | |||||

| Shares of common stock issuable upon exercise of warrants included in Underwriter unit purchase option | 825,000.00 | 102.71 | ||||||

| Total | $ | 17,010,000.00 | $ | 2,117.75 | (5) | |||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (“Securities Act”). |

| (2) | Represents warrants to purchase a number of shares of common stock equal to 100% of the common stock sold in this offering at an exercise price of 125% of the public offering price of the shares of common stock. |

| (3) | Pursuant to Rule 457(g) of the Securities Act, no separate registration fee is required for the warrants. |

| (4) | Pursuant to Rule 416, there is also being registered such indeterminable additional securities as may be issued to prevent dilution as a result of stock splits, stock dividends or similar transactions. |

| (5) | $1,159 previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

| The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted. | ||

Subject to completion, dated February 8 , 2018

PRELIMINARY PROSPECTUS

VIVOS INC

[______] Shares of Common Stock

and

Warrants to Purchase up to [_______] Shares of Common Stock

We are offering (i) [____] shares of common stock and (ii) warrants to purchase up to [______] shares of common stock. Each share of common stock we sell will be accompanied by a warrant to purchase up to [__] share[s] of common stock. The warrants are exercisable immediately at an exercise price per share equal to 125% of the public offering price per share of common stock in this offering, and expire five years from the date of issuance. The common stock and warrants are immediately separable but can only be purchased together in this offering.

Our common stock is quoted on the OTC PINK Marketplace under the symbol “RDGL.” We intend to apply to list our common stock on a national securities exchange, such as the NASDAQ Capital Market or the NYSE American, LLC under the symbol “RDGL,” although no assurances can be given that such listing will be achieved in a timely manner or at all. There is no established public trading market for the warrants, and we do not intend to apply to list the warrants on any securities exchange or automated quotation system.

On February 8 , 2018, the closing price for our common stock, as quoted on the OTC Pink Marketplace, was $0.06 per share.

Investing in our securities involves risks. See “Risk Factors” beginning on page 7 of this prospectus.

| Per Share | Per Warrant | Total | ||||||||||

| Public Offering Price | $ | $ | $ | |||||||||

| Underwriting discount (1)(2) | $ | $ | $ | |||||||||

| Offering Proceeds, Before Expenses | $ | $ | $ | |||||||||

| (1) | The public offering price and underwriting discount correspond to an assumed public offering price per share of $[___] and an assumed public offering price per full warrant of $0.001. |

| (2) | We have also agreed to issue to the underwriter warrants to purchase common shares in an amount equal to 10% of the aggregate number of shares sold in this offering and to reimburse the underwriter for certain of their expenses. Please see “Underwriting” for a complete description of the compensation payable to the underwriter. |

We have granted the underwriter an option to purchase up to an additional [___] shares of common stock and/or warrants to purchase up to an aggregate of shares of common stock, in any combinations thereof, to cover over-allotments, if any. The underwriter can exercise this option at any time within 45 days after the date of this prospectus.

The report of our independent auditors contains an explanatory paragraph as to our ability to continue as a going concern, which could prevent us from obtaining new financing on reasonable terms or at all.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the common stock and the warrants against payment on or about [______], 2018.

VIEWTRADE SECURITIES, INC.

The date of this prospectus is [______], 2018.

TABLE OF CONTENTS

| -i- |

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus and any prospectus supplement or free writing prospectus authorized by us. To the extent the information contained in this prospectus differs or varies from the information contained in any document filed prior to the date of this prospectus and incorporated by reference, the information in this prospectus will control. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The information in this prospectus is accurate only as of the date it is presented. You should read this prospectus, and any prospectus supplement or free writing prospectus that we have authorized for use in connection with this offering, in their entirety before investing in our securities.

We are offering to sell, and seeking offers to buy, the securities offered by this prospectus only in jurisdictions where offers and sales are permitted. The distribution of this prospectus and the offering of the securities offered by this prospectus in certain jurisdictions may be restricted by law. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

This prospectus contains company names, product names, trade names, trademarks and service marks of Vivos Inc and other organizations, all of which are the property of their respective owners. We own or have rights to trademarks, service marks or trade names that we use in connection with the operation of our business. In addition, our name, logo and website names and addresses are our service marks or trademarks. Although we have applied for a trademark covering “Vivos Inc,” the application is currently pending; to date, RadioGel™ is currently our only registered trademark. The other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners. Solely for convenience, the trademarks, service marks, tradenames and copyrights referred to in this prospectus are listed without the ©, ® and TM symbols, but we will assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and tradenames.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to the registration statement of which this prospectus forms a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We anticipate affecting a reverse split of our authorized, and issued and outstanding shares of common stock prior to consummation of the offering at a ratio of one-for-fifty (the “Reverse Split”), pending review and acceptance of the Reverse Split from the Financial Industry Regulatory Authority (“FINRA”). Unless otherwise specifically indicated, reference to shares of common stock in this prospectus is pre-Reverse Split, and does not reflect the one-for-fifty adjustment that will occur as a result of the Reverse Split. See also “Risk Factors” beginning on page 7.

| -ii- |

The following summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision in our securities. Before investing in our securities, you should carefully read this entire prospectus, including our financial statements and the related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Business Summary

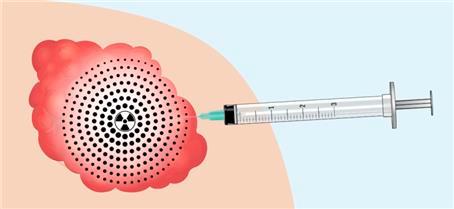

We are a development stage radiation oncology medical device company engaged in the development of our yttrium-90 based brachytherapy device, RadioGel™ , for the treatment of non-resectable tumors. A prominent team of radiochemists, scientists and engineers, collaborating with strategic partners, including national laboratories, universities and private corporations, lead our development efforts. Unless the context otherwise requires, the words “Vivos Inc,” “Vivos,” “we,” “the Company,” “us” and “our” refer to Vivos Inc, a Delaware corporation.

Our current focus is on the development of our RadioGel™ device candidate, including obtaining approval from the Food and Drug Administration (“FDA”) to market and sell RadioGel™ as a Class II medical device. RadioGel™ is an injectable particle-gel for brachytherapy radiation treatment of cancerous tumors in people and animals. RadioGel™ is comprised of a hydrogel, or a substance that is liquid at room temperature and then gels when reaching body temperature after injection into a tumor. In the gel are small, one micron, yttrium-90 phosphate particles (“Y-90”). Once injected, these inert particles are locked in place inside the tumor by the gel, delivering a very high local radiation dose. The radiation is beta, consisting of high-speed electrons. These electrons only travel a short distance so the device can deliver high radiation to the tumor with minimal dose to the surrounding tissue. Optimally, patients can go home immediately following treatment without the risk of radiation exposure to family members. Since Y-90 has a half-life of 2.7 days, the radioactively drops to 5% of its original value after ten days.

RadioGel™ incorporates patented technology developed for Battelle Memorial Institute (“Battelle”) at Pacific Northwest National Laboratory, a leading research institute for government and commercial customers. Battelle has granted us an exclusive license to patents covering the manufacturing, processing and applications of RadioGel™ (the “Battelle License”). Other intellectual property protection for RadioGel™ includes proprietary production processes and trademark protection in 17 countries. We plan to continue efforts to develop new refinements on the production process, and the product and application hardware, as a basis for future patents.

We are working towards obtaining approval from the FDA to market and sell RadioGel™ as a Class II medical device. We first requested FDA approval of RadioGel™ in June 2013, at which time the FDA classified RadioGel™ as a medical device. The Company then followed with a 510(k) submission which the FDA responded, in turn, with a request for a physician letter of substantial equivalence and a reformatted 510(k) summary, which the Company provided in January 2014. In February 2014, the FDA ruled the device as not substantially equivalent due to a lack of a predicate device and it was therefore classified as a Class III device. Class III devices are generally the highest risk devices and are therefore subject to the highest level of regulatory review, control and oversight. Class III devices must typically be approved by FDA before they are marketed. Class II devices represent lower risk devices than Class III and require fewer regulatory controls to provide reasonable assurance of the device’s safety and effectiveness. In contrast, Class I devices are deemed to be lower risk than Class II or III, and are therefore subject to the least regulatory controls.

We are currently developing test plans to address issues raised by the FDA in connection with our previous submissions regarding RadioGel™, including developing specific test plans and specific indication of use. We intend to request that the FDA grant approval to re-apply for de novo classification of RadioGel™, which would reclassify the device from a Class III device to a Class II device, further simplifying the path to FDA approval. In the event the FDA denies our application and subsequently determines during the de novo review that RadioGel™ cannot be classified as a Class I or Class I1 device, we will then need to submit a pre-market approval application to obtain the necessary regulatory approval as a Class III device. See also Business – Regulatory History for a discussion regarding the Company’s application for FDA approval of RadioGel™.

| -1- |

Our IsoPet Solutions division was established in May 2016 to focus on the veterinary oncology market, namely engagement of university veterinarian hospitals to develop the detailed therapy procedures to treat animal tumors and ultimately use of the technology in private clinics. In January 2018, we received notification from the FDA that the Center for Veterinary Medicine Product Classification Group ruled that RadioGel™ is classified as a device for animal therapy of feline sarcomas and canine soft tissue sarcomas, which is the most common type of cancer in animals. In addition, the FDA also reviewed and approved our label, which is a requirement for any device used in animals.

We have worked with four different university veterinarian hospitals on RadioGel™ testing and therapy. Colorado State University demonstrated the procedures and the CT and PET-CT imaging of RadioGel. Washington State University treated four cats for feline sarcoma. They concluded that the product was safe and effective in killing cancer cells. A contract was signed with University of Missouri to treat canine sarcomas and equine sarcoids starting early in 2019. The safety review at UC Davis is almost completed. They will be treating prostate and liver cancer in dogs in 2019.

These animal therapies will focus on creating labels that describe the procedures in detail as a guide to future veterinarians. The labels will be voluntarily submitted to the FDA for review. They will then be used as data for future FDA applications in the medical sector and as key intellectual property for licensing to private veterinary clinics.

We anticipate that future profit will be derived from direct sales of RadioGel™ and related services, and from licensing to private medical and veterinary clinics in the U.S. and internationally.

Exchange Listing and Reverse Stock Split

On June 26, 2017, our board of directors (the “Board”) approved the Reverse Split at an exchange ratio of between one-for-ten and one-for-fifty, with our Board retaining the discretion as to whether to implement the Reverse Split and which exchange ratio to implement. The Reverse Split is intended to allow us to meet the minimum share price requirement of a national securities exchange, such as the Nasdaq Capital Market or the NYSE American, LLC. On February 5, 2018, our Board determined that, following the effectiveness of the registration statement, of which this prospectus is a part, and prior to the closing of this offering, we will affect the Reverse Split at a ratio of one-for-fifty.

Risk Factors

Our business is subject to substantial risk. Please carefully consider the section titled “Risk Factors” on page 7 of this prospectus for a discussion of the factors you should carefully consider before deciding to purchase the securities offered by this prospectus. These risks include, among others:

| ● | we are a development stage company with no current revenues, and limited experience developing medical devices, including those intended for use in the radiation oncology field, which makes it difficult to assess our future viability; |

| ● | we depend heavily on the success of RadioGel™, and we cannot be certain that we will be able to obtain regulatory approval for, or successfully commercialize, RadioGel™, or any other future product candidates; |

| ● | failures or delays in the commencement or business plan could delay, prevent or limit our ability to generate revenue and continue our business; |

| ● | we face significant competition, and if we are unable to compete effectively, we may not be able to achieve or maintain significant market penetration or improve our results of operations; |

| ● | if we are unable to adequately protect our proprietary technology, or obtain and maintain issued patents that are sufficient to protect our product candidates, others could compete against us more directly, which would have a material adverse impact on our business, results of operations, financial condition and prospects; and |

| ● | we have incurred significant net losses since inception and we will continue to incur substantial operating losses for the foreseeable future. |

| -2- |

Corporate Information

Vivos Inc was incorporated under the laws of Delaware on December 23, 1994 as Savage Mountain Sports Corporation (“SMSC”). On September 6, 2006, we changed our corporate name to Advanced Medical Isotope Corporation, and on December 29, 2017, we changed our corporate name once again to Vivos Inc Our principal executive offices are located at 719 Jadwin Avenue, Richland, Washington 99352, and our telephone number is (509) 736-4000. Our website address is www.radiogel.com. The information contained on our website is not part of this prospectus. We have included our website address as a factual reference and do not intend it to be an active link to our website.

| The Offering | ||

| Common stock we are offering | [___] shares of our common stock. | |

| Common stock outstanding immediately after this offering | [______] shares (assuming no exercise of the warrants offered hereby). | |

| Warrants we are offering | Warrants to purchase up to [_______] shares of common stock. Each share of common stock sold in this offering will be accompanied by a warrant to purchase [__] share[s] of our common stock, at an exercise price per share equal to 125% of the public offering price of our common stock in this offering. The warrants will be immediately exercisable, and may be exercised for a period of five years following the date of issuance. | |

| Over-allotment option | We have granted the underwriters an option for a period of up to 45 days from the date of this prospectus to purchase up to an additional [_____] shares of common stock and/or warrants to purchase up to an aggregate of shares of common stock, in any combinations thereof, solely to cover over-allotments, if any, at the public offering price less the underwriting discounts and commissions.

Because the warrants are not listed on a national securities exchange or other nationally recognized trading market, the underwriters will be unable to satisfy any overallotment of shares and warrants without exercising the underwriters’ overallotment option with respect to the warrants. As a result, the underwriters will exercise their overallotment option for all of the warrants which are over-allotted, if any, at the time of the initial offering of the shares and the warrants. However, because our common stock is publicly traded, the underwriters may satisfy some or all of the overallotment of shares of our common stock, if any, by purchasing shares in the open market and will have no obligation to exercise the overallotment option with respect to our common stock. | |

| Use of proceeds | We estimate that the net proceeds to us from this offering, after deducting the estimated offering expenses payable by us, will be approximately $[___] million, excluding any proceeds we may receive upon exercise of the warrants, if any. We intend to use the net proceeds of this offering for research and development, primarily related to obtaining FDA approval for RadioGel™ as a Class II medical device, ordinary course working capital needs and other general corporate purposes. See “Use of Proceeds” beginning on page 19 for a more complete description of the intended use of proceeds from this offering. |

| -3- |

| Reverse Stock Split | We intend to affect the Reverse Split of our authorized and issued and outstanding shares of common stock prior to consummation of the offering at a ratio of one-for-fifty, pending review and acceptance of the Reverse Split from the Financial Industry Regulatory Authority (“FINRA”). Unless otherwise specifically stated, each reference to shares of common stock in this prospectus is pre-Reverse Split, and does not reflect the one-for-fifty adjustment anticipated as a result of the Reverse Split. | |

| Risk factors | You should read the “Risk Factors” section beginning on page 7 of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. | |

| OTC PINK symbol | “RDGL.” | |

| Proposed Listing | We intend to list our common stock on a national securities exchange, such as the NASDAQ Capital Market or the NYSE American, LLC, under the symbol “RDGL.” No assurances can be given that we will be successful. |

The number of shares of our common stock to be outstanding after this offering is based on 65,695,213 shares of our common stock outstanding as of January 31, 2018, prior to giving effect to the Reverse Split. The number of shares outstanding excludes the following, in each case as of such date, before giving effect to the Reverse Split:

| ● | 1,097,623 shares of common stock issuable upon the exercise of stock options outstanding as of January 31, 2018, at a weighted average exercise price of $1.14 per share; |

| ● | 304,201 shares of common stock issuable upon the exercise of warrants outstanding as of January 31, 2018, at a weighted average exercise price of $2.63 per share; |

| ● | 18,155,788 shares of common stock issuable upon conversion of convertible promissory notes outstanding as of January 31, 2018; |

| ● | 37,786,2 3 0 shares of common stock issuable upon the conversion of Series A Convertible Preferred Stock (“Series A Preferred”) as of January 31, 2018; and |

| ● | [____] shares of common stock issuable upon exercise of warrants to be issued in connection with this offering, and [____] shares of common stock issuable to the underwriter in connection with this offering. |

Except as otherwise indicated, all information in this prospectus assumes: (i) no exercise of the outstanding options and warrants or the conversion of any outstanding convertible promissory notes or shares of Series A Preferred into common shares described above; and (ii) no exercise of the underwriters’ option to purchase additional shares of common stock and/or warrants.

| -4- |

SUMMARY CONSOLIDATED FINANCIAL DATA

The summary consolidated statements of operations data presented below is derived from our unaudited financial statements for the quarters ended September 30, 2017 and 2016 and our audited financial statements for the years ended December 31, 2016 and 2015 included elsewhere in this prospectus. The following summary consolidated financial data should be read with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in any future period. The summary financial data in this section are not intended to replace the financial statements and are qualified in their entirety by the financial statements and related notes included elsewhere in this prospectus.

| Three

months ended September 30, | Year

ended December 31, | |||||||||||||||

| 2017 | 2016 | 2016 | 2015 | |||||||||||||

| Consulting Revenues | $ | - | $ | 4,054 | $ | 8,108 | $ | 24,108 | ||||||||

| Operating expenses | ||||||||||||||||

| Cost of materials | - | - | - | 474 | ||||||||||||

| Sales and marketing expenses | 52,620 | 65,995 | 284,138 | - | ||||||||||||

| Depreciation and amortization expense | - | 738 | 2,947 | 5,672 | ||||||||||||

| Professional fees | 211,954 | 265,497 | 2,068,796 | 741,375 | ||||||||||||

| Stock based compensation | 24,283 | 27,427 | 675,324 | 80,635 | ||||||||||||

| Payroll expenses | 436,319 | 160,500 | 652,877 | 679,259 | ||||||||||||

| Research and development | - | - | 328,026 | 149,650 | ||||||||||||

| Loan fees | - | 8,664 | - | - | ||||||||||||

| General and administrative expenses | 66,973 | 137,593 | 432,470 | 408,306 | ||||||||||||

| Total operating expenses | 961,799 | 666,414 | 4,444,578 | 2,065,371 | ||||||||||||

| Operating loss | (961,799 | ) | (666,414 | ) | (4,436,470 | ) | (2,041,263 | ) | ||||||||

| Non-operating income (expense): | ||||||||||||||||

| Interest expense | (527,188 | ) | (85,830 | ) | (6,259,467 | ) | (3,196,153 | ) | ||||||||

| Net gain (loss) on settlement of debt | - | (111,328 | ) | 3,108,342 | 3,562,067 | |||||||||||

| Loss on sale of stock | - | (54,561 | ) | |||||||||||||

| Net gain (loss) on debt extinguishment | (369,428 | ) | - | |||||||||||||

| Net gain (loss) on derivative liability | 9 | 762,151 | (2,244,353 | ) | 7,887,025 | |||||||||||

| Grant income | 21,010 | 21,010 | ||||||||||||||

| Loss on impaired assets | - | - | (43,957 | ) | - | |||||||||||

| Non-operating income (expense), net | (896,607 | ) | 510,432 | ) | (5,418,425 | ) | 8,273,949 | |||||||||

| Income (loss) before Income Taxes | (1,858,406 | ) | (155,982 | ) | (9,854,895 | ) | 6,232,686 | |||||||||

| Income tax provision | - | - | - | - | ||||||||||||

| Net income (loss) | $ | (1,858,406 | ) | (155,982 | ) | $ | (9,854,895 | ) | $ | 6,232,686 | ||||||

| Earnings (loss) per common share | $ | (0.04 | ) | (0.01 | ) | $ | (0.46 | ) | $ | 0.34 | ||||||

| Weighted average number of common shares outstanding | 52,471,896 | 19,999,985 | 21,497,069 | 18,505,467 | ||||||||||||

| -5- |

| (1) | See Note 2 to our audited consolidated financial statements for an explanation of the method used to calculate basic and diluted net loss per common share and the weighted-average number of shares used in the computation of the per share amounts. |

| Consolidated Balance Sheet Data(1): | At September 30, 2017 | At

December 31, 2016 |

||||||||||

| Actual | Pro Forma (2) | |||||||||||

| Cash and cash equivalents | $ | 22,110 | $ | 27,889 | ||||||||

| Total assets | 29,546 | 41,996 | ||||||||||

| Accounts payable and accrued expenses | 794,627 | 1,137,086 | ||||||||||

| Related party accounts payable | 71,297 | 109,718 | ||||||||||

| Accrued interest payable | 319,372 | 114,755 | ||||||||||

| Payroll liabilities payable | 44,441 | 499,502 | ||||||||||

| Convertible notes payable, net | 1,959,276 | 544,508 | ||||||||||

| Derivative liability | - | 324,532 | ||||||||||

| Related party promissory note | 383,771 | 332,195 | ||||||||||

| Total stockholders’ equity (deficit) | (3,543,238 | ) | (13,020,300 | ) | ||||||||

| (1) | The as adjusted balance sheet data gives effect to the assumed sale and issuance by us of [______] shares of common stock warrants to purchase up to [______] shares of our common stock in this offering, at an assumed public offering price of $[__] per share and assumed public offering price of $[__] per warrant, and after deducting the estimated underwriting discounts and estimated offering expenses payable by us assuming no value is attributed to the warrants, and the warrants are accounted for and classified as equity. |

| (2) | Each $0.10 increase (decrease) in the assumed public offering price of $[__ ] per share of common stock would increase (decrease) each of our as adjusted cash and cash equivalents, total assets and total stockholders’ equity (deficit) by approximately $[__], assuming the public offering price per warrant remains at $[__] and we sell the maximum amount of common stock and warrants set forth on the cover page of this prospectus and after deducting the estimated underwriting discounts and estimated offering expenses payable by us. |

| -6- |

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, as well as the other information in this prospectus, including our consolidated financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before deciding whether to invest in our securities. The occurrence of any of the events or developments described below could harm our business, financial condition, operating results, and growth prospects. In such an event, the market price of our common stock could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

RISKS ASSOCIATED WITH THE COMPANY’S BUSINESS

Our independent registered public accounting firms’ reports on its financial statements questions our ability to continue as a going concern.

Our independent registered public accounting firms’ reports on our financial statements for the years ended December 31, 2016 and 2015 express doubt about our ability to continue as a going concern. The reports include an explanatory paragraph stating that we suffered recurring losses, used significant cash in support of our operating activities and, based on our current operating levels, require additional capital or significant restructuring to sustain our operation for the foreseeable future. There is no assurance that we will be able to obtain sufficient additional capital to continue our operations and to alleviate doubt about our ability to continue as a going concern. If we obtain additional financing, such funds may not be available on favorable terms and likely would entail considerable dilution to existing shareholders. Any debt financing, if available, may involve restrictive covenants that restrict our ability to conduct our business. It is extremely remote that we could obtain any financing on any basis that did not result in considerable dilution for shareholders. Inclusion of a “going concern qualification” in the report of our independent accountants or in any future report may have a negative impact on our ability to obtain debt or equity financing and may adversely impact its stock price.

A combination of our current financial condition and the FDA’s determinations to date regarding our brachytherapy products raise material concerns about ability to continue as a going concern.

We will not be able to continue as a going concern unless we obtain financing. Depending upon the amount of financing, if any, we are able to obtain, we may not receive adequate funds to continue the approval process for RadioGelTM or other brachytherapy products with the FDA.

We have generated operating losses since inception, which are expected to continue, and have increasing cash requirements, which we may be unable to satisfy.

We have generated material operating losses since inception. We had an accumulated deficit of $61,663,407 as of September 30, 2017, including a net loss of $3,793,967 and $10,144,168 for the nine months ended September 30, 2017 and 2016, respectively, and an accumulated deficit of $57,869,440 as of December 31, 2016, including a net loss of $9,854,895 for the year ended December 31, 2016 and a net income of $6,232,686 for the year ended December 31, 2015. Historically, we have relied upon investor funds to maintain our operations and develop our business. We anticipate raising additional capital within the next twelve months from investors for working capital and to execute our business plans, although we can provide no assurance that additional investor funds will be available on terms acceptable to us. If we are unable to obtain additional financing to meet our working capital requirements, we may have to cease operations.

| -7- |

We require at least $1.5 million per year to maintain current operating activities. Over the next 12-24 months, we believe it will cost approximately $5 million to $10 million to fund: (1) the FDA approval process and initial deployment of the brachytherapy products and (2) initiate regulatory approval processes outside of the United States. The continued deployment of the brachytherapy products and a worldwide regulatory approval effort will require additional resources and personnel. The principal variables in the timing and amount of spending for the brachytherapy products in the next 12-24 months will be the FDA’s classification of our brachytherapy products as Class II or Class III devices (or otherwise) and any requirements for additional studies which may possibly include clinical studies. Thereafter, the principal variables in the amount of our spending and our financing requirements would be the timing of any approvals and the nature of our arrangements with third parties for manufacturing, sales, distribution and licensing of those products and the products’ success in the U.S. and elsewhere. We intend to fund our activities through strategic transactions such as licensing and partnership agreements or additional capital raises.

The recent economic events, including the inherent instability and volatility in global capital markets, as well as the lack of liquidity in the capital markets, could impact our ability to obtain financing and our ability to execute our business plan.

We have a limited operating history, which may make it difficult to evaluate our business and prospects.

We have a limited operating history upon which one can base an evaluation of our business and prospects. As a company in the development stage, there are substantial risks, uncertainties, expenses and difficulties to which our business is subject. To address these risks and uncertainties, we must do the following:

| ● | successfully develop and execute the business strategy; |

| ● | respond to competitive developments; and |

| ● | attract, integrate, retain and motivate qualified personnel. |

There is no assurance that we will achieve or maintain profitable operations or that we will obtain or maintain adequate working capital to meet our obligations as they become due. We cannot be certain that our business strategy will be successfully developed and implemented or that we will successfully address the risks that face our business. In the event that we do not successfully address these risks, our business, prospects, financial condition, and results of operations could be materially and adversely affected.

Our new products are regulated and require appropriate clearances and approvals to be marketed in the U.S. and globally.

There is no assurance the FDA or other global regulatory authorities will grant us permission to market our brachytherapy Y-90 RadioGelTM device.

We have been working with the FDA to obtain clearance for our brachytherapy Y-90 RadioGelTM device, but no assurances have been received. On December 23, 2014, we announced that we submitted a de novo to the FDA for marketing clearance for our patented Y-90 RadioGelTM device pursuant to Section 513(f)(2) of the U.S. Food, Drug and Cosmetic Act (the “Act”). In June 2015, the FDA notified us that the de novo was not granted. In February 2014, the FDA found the same device under Section 510(k) of the Act not substantially equivalent, and concluded that the device is classified by statute as a Class III medical device, unless the device is reclassified. We are seeking reclassification of the product to Class II. If we are successful in seeking reconsideration of our de novo application, as a regulatory matter, the device could be on an easier and faster path to market in the United States. However, there would still be the requirements to complete the in vitro and in vivo testing, and then some human clinical trials. That testing date is submitted in a de novo pre-market application and if accepted we could then go to market. As a practical matter, we would still need to secure funding and commercial arrangements before marketing could commence. If the de novo is declined and if we obtain funding to permit us to continue operations, we will explore steps toward seeking approval for the device as a Class III medical device. Generally, the time period and cost of seeking approval as a Class III medical device is materially greater than the time period and cost of seeking approval as a Class II medical device. If we seek approval as a Class III device, human clinical trials will be necessary. Generally, human trials for Class III products are larger, of longer duration and costlier than those for Class II devices. If human clinical trials are necessary, there will be additional cost and time to reach marketing clearance or approval. Unless we obtain sufficient funding, we will be unable to do the foregoing activities. There can be no assurance that the product will be approved as either a Class II or Class III device by the FDA even if additional data is provided. There can be no assurance that we will receive FDA approval, or if we do , the timing thereof.

| -8- |

If we are successful in increasing the size of our organization, we may experience difficulties in managing growth.

We are a small organization with a minimal number of employees. If we are successful, we may experience a period of significant expansion in headcount, facilities, infrastructure and overhead and further expansion may be required to address potential growth and market opportunities. Any such future growth will impose significant added responsibilities on members of management, including the need to improve our operational and financial systems and to identify, recruit, maintain and integrate additional managers. Our future financial performance and our ability to compete effectively will depend, in part, on the ability to manage any future growth effectively.

Our business is dependent upon the continued services of our Chief Executive Officer, Michael Korenko. Should we lose the services of Mr. Korenko, our operations will be negatively impacted.

Our business is dependent upon the expertise of our Chief Executive Officer, Michael Korenko. Mr. Korenko is essential to our operations. Accordingly, an investor must rely on Mr. Korenko’s management decisions and his willingness to continue as the Company’s Chief Executive Officer. We do not maintain key man insurance on Mr. Korenko’s life. The loss of the services of Mr. Korenko would have a material adverse effect upon our business.

We are heavily dependent on consultants for many of the services necessary to continue operations. The loss of any of these consultants could have a material adverse effect on our business, results of operations and financial condition.

Our success is heavily dependent on the continued active participation of certain consultants and collaborating scientists. Certain key employees and consultants have no written employment contracts. Loss of the services of any one or more of our consultants could have a material adverse effect upon our business, results of operations and financial condition.

If we are unable to hire and retain additional qualified personnel, the business and financial condition may suffer.

Our success and achievement of our growth plans depend on our ability to recruit, hire, train and retain highly qualified technical, scientific, regulatory and managerial employees, consultants and advisors. Competition for qualified personnel among pharmaceutical and biotechnology companies is intense, and an inability to attract and motivate additional highly skilled personnel required for the expansion of our activities, or the loss of any such persons, could have a material adverse effect on our business, results of operations and financial condition.

Our revenues have historically been derived from sales made to a small number of customers. We have discontinued prior operations related to our core business. To succeed, we will need to recommence our operations and achieve sales to a materially larger number of customers.

During 2014, we ceased all previous manufacturing and sales activities. Our sales for the nine months ended September 30, 2017 and year ended December 31, 2016 and 2015 consisted of consulting revenue only. Our consulting revenues for the nine months ended September 30, 2017 and years ended December 31, 2016 and 2015 were made to one customer, and those sales constituted 100% of total revenues for those years. At such time as we re-commence active operations, no assurances can be given that we will be successful in commercializing our products or expanding the number of customers purchasing our products and services.

Many of our competitors have greater resources and experience than we have.

Many of our competitors have greater financial resources, longer history, broader experience, greater name recognition, and more substantial operations than hawse have , and they represent substantial long-term competition for us. Our competitors may be able to devote more financial and human resources than we can towards research, new product development, regulatory approvals, and marketing and sales. Our competitors may develop or market products that are viewed by customers as more effective or more economical than our products. There is no assurance that we will be able to compete effectively against current and future competitors, and such competitive pressures may adversely affect our business and results of operations.

| -9- |

Our future revenues depend upon acceptance of our current and future products in the markets in which we compete.

Our future revenues depend upon receipt of financing, regulatory approval and the successful production, marketing, and sales of the various isotopes we might market in the future. The rate and level of market acceptance of each of these products, if any, may vary depending on the perception by physicians and other members of the healthcare community of their safety and efficacy as compared to that of any competing products; the clinical outcomes of any patients treated; the effectiveness of our sales and marketing efforts in the United States, Europe, Far East, Middle East, and Russia; any unfavorable publicity concerning our products or similar products; the price of our products relative to other products or competing treatments; any decrease in current reimbursement rates from the Centers for Medicare and Medicaid Services or third-party payers; regulatory developments related to the manufacture or continued use of our products; availability of sufficient supplies to either purchase or manufacture our products; our ability to produce sufficient quantities of our products; and the ability of physicians to properly utilize our products and avoid excessive levels of radiation to patients. Any material adverse developments with respect to the commercialization of any such products may adversely affect revenues and may cause us to continue to incur losses in the future.

In the future, we will rely heavily on a limited number of suppliers.

Some of the products we might market and components thereof are currently available only from a limited number of suppliers, several of which are international suppliers. Failure to obtain deliveries from these sources could have a material adverse effect on our ability to operate.

We may incur material losses and costs as a result of product liability claims that may be brought against us.

We face an inherent business risk of exposure to product liability claims in the event that products supplied by us fail to perform as expected or such products result, or are alleged to result, in bodily injury. Any such claims may also result in adverse publicity, which could damage our reputation by raising questions about the safety and efficacy of our products, and could interfere with our efforts to market our products. A successful product liability claim against us in excess of our available insurance coverage or established reserves may have a material adverse effect on our business. Although we currently maintain liability insurance in amounts we believes are commercially reasonable, any product liability we may incur may exceed our insurance coverage.

We are subject to the risk that certain third parties may mishandle our products.

If we market products, we will likely rely on third parties, such as commercial air courier companies, to deliver the products, and on other third parties to package the products in certain specialized packaging forms requested by customers. Thus, we would be subject to the risk that these third parties may mishandle our products , which could result in material adverse effects, particularly given the radioactive nature of some of the products.

Our operations expose us to the risk of material environmental liabilities.

We are subject to potentially material liabilities related to the remediation of environmental hazards and to personal injuries or property damages that may be caused by hazardous substance releases and exposures. We are subject to various federal, state, local and foreign government requirements regulating the discharge of materials into the environment or otherwise relating to the protection of the environment. These laws and regulations can impose substantial fines and criminal sanctions for violations, and can require installation of costly equipment or operational changes to limit emissions and/or decrease the likelihood of accidental hazardous substance releases. We expect to incur capital and operating costs to comply with these laws and regulations. In addition, changes in laws, regulations and enforcement of policies, the discovery of previously unknown contamination or new technology or information related to individual sites, or the imposition of new clean-up requirements or remedial techniques may require us to incur costs in the future that would have a negative effect on our financial condition or results of operations. Operational hazards could result in the spread of contamination within our facility and require additional funding to correct.

| -10- |

We are subject to uncertainties regarding reimbursement for use of our products.

Hospitals and freestanding clinics may be less likely to purchase our products if they cannot be assured of receiving favorable reimbursement for treatments using our products from third-party payers, such as Medicare and private health insurance plans. Third-party payers are increasingly challenging the pricing of certain medical services or devices, and there is no assurance that they will reimburse our customers at levels sufficient for us to maintain favorable sales and price levels for our products. There is no uniform policy on reimbursement among third-party payers, and there is no assurance that our products will continue to qualify for reimbursement from all third-party payers or that reimbursement rates will not be reduced. A reduction in or elimination of third-party reimbursement for treatments using our products would likely have a material adverse effect on our revenues.

Our future growth is largely dependent upon our ability to develop new technologies that achieve market acceptance with appropriate margins.

Our business operates in global markets that are characterized by rapidly changing technologies and evolving industry standards. Accordingly, future growth rates depend upon a number of factors, including our ability to (i) identify emerging technological trends in our target end-markets, (ii) develop and maintain competitive products, (iii) enhance our products by adding innovative features that differentiate our products from those of our competitors, and (iv) develop, manufacture and bring products to market quickly and cost-effectively. Our ability to develop new products based on technological innovation can affect our competitive position and requires the investment of significant resources. These development efforts divert resources from other potential investments in our business, and they may not lead to the development of new technologies or products on a timely basis or that meet the needs of our customers as fully as competitive offerings. In addition, the markets for our products may not develop or grow as we currently anticipate . The failure of our technologies or products to gain market acceptance due to more attractive offerings by our competitors could significantly reduce our revenues and adversely affect our competitive standing and prospects.

We may rely on third parties to represent us locally in the marketing and sales of our products in international markets and our revenue may depend on the efforts and results of those third parties.

Our future success may depend, in part, on our ability to enter into and maintain collaborative relationships with one or more third parties, the collaborator’s strategic interest in our products and our products under development, and the collaborator’s ability to successfully market and sell any such products. We intend to pursue collaborative arrangements regarding the marketing and sales of our products; however, we may not be able to establish or maintain such collaborative arrangements, or if we are able to do so, our collaborators may not be effective in marketing and selling our products. To the extent that we decide not to, or are unable to, enter into collaborative arrangements with respect to the sales and marketing of our products, significant capital expenditures, management resources and time will be required to establish and develop an in-house marketing and sales force with technical expertise. To the extent that we depend on third parties for marketing and distribution, any revenues received by us will depend upon the efforts and results of such third parties, which may or may not be successful.

We may pursue strategic acquisitions that may have an adverse impact on our business.

Executing our business strategy may involve pursuing and consummating strategic transactions to acquire complementary businesses or technologies. In pursuing these strategic transactions, even if we do not consummate them, or in consummating such transactions and integrating the acquired business or technology, we may expend significant financial and management resources and incur other significant costs and expenses. There is no assurance that any strategic transactions will result in additional revenues or other strategic benefits for our business. We may issue our stock as consideration for acquisitions, joint ventures or other strategic transactions, and the use of stock as purchase consideration could dilute the interests of our current stockholders. In addition, we may obtain debt financing in connection with an acquisition. Any such debt financing may involve restrictive covenants relating to capital-raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and pursue business opportunities, including potential acquisitions. In addition, such debt financing may impair our ability to obtain future additional financing for working capital, capital expenditures, acquisitions, general corporate or other purposes, and a substantial portion of cash flows, if any, from our operations may be dedicated to interest payments and debt repayment, thereby reducing the funds available to us for other purposes.

| -11- |

We will need to hire additional qualified accounting personnel in order to remediate a material weakness in our internal control over financial accounting, and we will need to expend any additional resources and efforts that may be necessary to establish and to maintain the effectiveness of our internal control over financial reporting and our disclosure controls and procedures.

As a public company, we are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Sarbanes-Oxley Act of 2002. Our management is required to evaluate and disclose its assessment of the effectiveness of our internal control over financial reporting as of each year-end, including disclosing any “material weakness” in our internal control over financial reporting. A material weakness is a control deficiency, or combination of control deficiencies, that results in more than a remote likelihood that a material misstatement of the annual or interim financial statements will not be prevented or detected. As a result of its assessment, management has determined that there is a material weakness due to the lack of segregation of duties and, due to this material weakness, management concluded that, as of December 31, 2016 and 2015, our internal control over financial reporting was ineffective. This material weakness was first identified in our Form 10-K/A amended annual report for the year ended December 31, 2008. This material weakness has the potential of adversely impacting our financial reporting process and our financial reports. Because of this material weakness, management also concluded that our disclosure controls and procedures were ineffective as of December 31, 2016 and 2015. We need to hire additional qualified accounting personnel in order to resolve this material weakness. We will also need to expend any additional resources and efforts that may be necessary to establish and to maintain the effectiveness of our internal control over financial reporting and disclosure controls and procedures.

We may be unable to make timely license and patent payments.

Patent costs associated with existing and new technology are significant. Existing patent and license fees must be paid for us to maintain rights to certain technology. We would forfeit our exclusive rights to licensed technologies if we failed to pay patent and rights fees in a timely fashion. There is no assurance of sufficient capital to meet ongoing legal costs associated with the patent costs for our technology.

Our patented or other technologies may infringe on other patents, which may expose us to costly litigation.

It is possible that our patented or other technologies may infringe on patents or other rights owned by others. We may have to alter our products or processes, pay licensing fees, defend infringement actions or challenge the validity of the patents in court, or cease activities altogether because of patent rights of third parties, thereby causing additional unexpected costs and delays to us . Patent litigation is costly and time consuming, and we may not have sufficient resources to pursue such litigation. If we do not obtain a license under such patents, if we are found liable for infringement, or if we are not able to have such patents declared invalid, we may be liable for significant money damages, may encounter significant delays in bringing products to market or may be precluded from participating in the manufacture, use or sale of products or methods of treatment requiring such licenses.

Protecting our intellectual property is critical to our innovation efforts.

We own or have a license to use several U.S. and foreign patents and patent applications, trademarks and copyrights. Our intellectual property rights may be challenged, invalidated or infringed upon by third parties, or we may be unable to maintain, renew or enter into new licenses of third party proprietary intellectual property on commercially reasonable terms. In some non-U.S. countries, laws affecting intellectual property are uncertain in their application, which can adversely affect the scope or enforceability of our patents and other intellectual property rights. Any of these events or factors could diminish or cause us to lose the competitive advantages associated with our intellectual property, subject us to judgments, penalties and significant litigation costs, or temporarily or permanently disrupt our sales and marketing of the affected products or services.

| -12- |

We may not be able to protect our trade secrets and other unpatented proprietary technology, which could give competitors an advantage.

We rely upon trade secrets and other unpatented proprietary technology. We may not be able to adequately protect our rights with regard to such unpatented proprietary technology, or competitors may independently develop substantially equivalent technology. We seek to protect trade secrets and proprietary knowledge, in part through confidentiality agreements with our employees, consultants, advisors and collaborators. Nevertheless, these agreements may not effectively prevent disclosure of our confidential information and may not provide us with an adequate remedy in the event of unauthorized disclosure of such information, and as a result our competitors could gain a competitive advantage.

General economic conditions in markets in which we do business can impact the demand for our goods and services. Decreased demand for our products and services could have a negative impact on our financial performance and cash flow.

Demand for our products and services, in part, depends on the general economic conditions affecting the countries and industries in which we do business. A downturn in economic conditions in a country or industry that we serve may adversely affect the demand for our products and services, in turn negatively impacting our operations and financial results. Further, changes in demand for our products and services can magnify the impact of economic cycles on our businesses. Unanticipated contract terminations by current customers can negatively impact operations, financial results and cash flow. Our earnings, cash flow and financial position are exposed to financial market risks worldwide, including interest rate and currency exchange rate fluctuations and exchange rate controls. Fluctuations in domestic and world financial markets could adversely affect interest rates and impact our ability to obtain credit or attract investors.

We are subject to extensive government regulation in jurisdictions around the world in which we do business. Regulations address, among other things, environmental compliance, import/export restrictions, healthcare services, taxes and financial reporting, and those regulations can significantly increase the cost of doing business, which in turn can negatively impact our operations, financial results and cash flow.

If we are successful in developing manufacturing capability, we will be subject to extensive government regulation and intervention both in the U.S. and in all foreign jurisdictions in which we conduct business. Compliance with applicable laws and regulations will result in higher capital expenditures and operating costs, and changes to current regulations with which we comply can necessitate further capital expenditures and increases in operating costs to enable continued compliance. Additionally, from time to time, we may be involved in proceedings under certain of these laws and regulations. Foreign operations are subject to political instabilities, restrictions on funds transfers, import/export restrictions, and currency fluctuation.

Volatility in raw material and energy costs, interruption in ordinary sources of supply, and an inability to recover from unanticipated increases in energy and raw material costs could result in lost sales or could significantly increase the cost of doing business.

Market and economic conditions affecting the costs of raw materials, utilities, energy costs, and infrastructure required to provide for the delivery of our products and services are beyond our control. Any disruption or halt in supplies, or rapid escalations in costs, could adversely affect our ability to manufacture products or to competitively price our products in the marketplace. To date, the ultimate impact of energy costs increases has been mitigated through price increases or offset through improved process efficiencies; however, continuing escalation of energy costs could have a negative impact upon our business and financial performance.

RISKS RELATED TO OUR COMMON STOCK

Our common stock is currently quoted on the OTC Pink Marketplace . Failure to develop or maintain a more active trading market may negatively affect the value of our common stock, may deter some potential investors from purchasing our common stock or other equity securities, and may make it difficult or impossible for stockholders to sell their shares of common stock.

| -13- |

Our average daily volume of shares traded was 223,500 for the period January 1, 2017 through December 31, 2017, and 113,034 and 403,927 for years ended December 31, 2016 and 2015, respectively. Failure to develop or maintain an active trading market may negatively affect the value of our common stock, may make some potential investors unwilling to purchase our common stock or equity securities that are convertible into or exercisable for our common stock, and may make it difficult or impossible for our stockholders to sell their shares of common stock and recover any part of their investment.

Our outstanding securities, the stock or securities that we may become obligated to issue under existing agreements, and certain provisions of those securities, may cause immediate and substantial dilution to existing stockholders and may make it more difficult to raise additional equity capital.

We had 65,695,213 shares of common stock issued and outstanding on January 31, 2018. We also had outstanding on that date derivative securities consisting of options, warrants, shares of preferred stock and convertible notes that if they had been exercised and/or converted in full on January 31, 2018, would have resulted in the issuance of up to 57,343,842 additional shares of common stock. The issuance of shares upon the exercise of options or the conversion of convertible notes may result in substantial dilution to each stockholder by reducing that stockholder’s percentage ownership of our total outstanding common stock. Additionally, we have outstanding notes that if not prepaid by specific dates entitle the holder to convert the principal and accrued interest into common stock at 60% of the lowest trading price during the previous thirty-day trading period of our common stock prior to conversion as provided in the notes. See Note 11 of the footnotes to the Consolidated Financial Statements for the years ended December 31, 2016 and 2015 beginning on page F-34 of this prospectus regarding the equity issuable upon conversion. The issuance of some or all of those warrants and any exercise of those warrants will have the effect of further diluting the percentage ownership of our other stockholders. The existence and terms of these derivative securities and other obligations may make it more difficult for us to raise additional capital through the sale of stock or other equity securities.

Future sales of our common stock, including sales following exercise or conversion of derivative securities, or the perception that such sales may occur, may depress the price of common stock and could encourage short sales.

The sale or availability for sale of substantial amounts of our shares in the public market, including shares issuable upon exercise of options or warrants or upon the conversion of convertible securities, or the perception that such sales may occur, may adversely affect the market price of our common stock. Any decline in the price of our common stock may encourage short sales, which could place further downward pressure on the price of our common stock.

Our stock price is likely to be volatile.

For the year ended December 31, 2017, the reported low closing price for our common stock was $0.02, and the reported high closing price was $0.18. For the year ended December 31, 2016, the reported low closing price for our common stock was $0.07 per share, and the reported high closing price was $0.96 per share. For the year ended December 31, 2015, the reported low closing price for our common stock was $0.03 per share, and the reported high closing price was $0.49 per share. There is generally significant volatility in the market prices, as well as limited liquidity, of securities of early stage companies, particularly early stage medical product companies. Contributing to this volatility are various events that can affect our stock price in a positive or negative manner. These events include, but are not limited to: governmental approvals, refusals to approve, regulations or other actions; market acceptance and sales growth of our products; litigation involving us or our industry; developments or disputes concerning our patents or other proprietary rights; changes in the structure of healthcare payment systems; departure of key personnel; future sales of our securities; fluctuations in our financial results or those of companies that are perceived to be similar to us; investors’ general perception of us; and general economic, industry and market conditions. If any of these events occur, it could cause our stock price to fall, and any of these events may cause our stock price to be volatile.

| -14- |

Our common stock is subject to the “Penny Stock” rules of the SEC and the trading market in our securities is limited, which makes transactions in our common stock cumbersome and may reduce the value of an investment in our stock.

The Securities and Exchange Commission ( “SEC” ) has adopted Rule 3a51-1, which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, Rule 15g-9 requires that a broker or dealer approve a person’s account for transactions in penny stocks and that the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience and objectives of the person and must make a reasonable determination that the transactions in penny stocks are suitable for that person and that the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which sets forth the basis on which the broker or dealer made the suitability determination, and that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and may cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

As a result of us issuing preferred stock, the rights of holders of our common stock and the value of our common stock may be adversely affected.

Our board of directors is authorized to issue classes or series of preferred stock, without any action on the part of the stockholders. Our board of directors also has the power, without stockholder approval, to set the terms of any such classes or series of preferred stock, including voting rights, dividend rights and preferences over the common stock with respect to dividends or upon the liquidation, dissolution or winding-up of its business, and other terms. We have issued preferred stock that has a preference over the common stock with respect to the payment of dividends or upon liquidation, dissolution or winding-up, and with respect to voting rights. In accordance with that and with the issuance of preferred stock, the common stockholders voting rights have been diluted and it is possible that the rights of holders of the common stock or the value of the common stock have been adversely affected.

We do not expect to pay any dividends on common stock for the foreseeable future.

We have not paid any cash dividends on our common stock to date and do not anticipate we will pay cash dividends on our common stock in the foreseeable future. Accordingly, stockholders must be prepared to rely on sales of their common stock after price appreciation to earn an investment return, which may never occur. Any determination to pay dividends in the future will be made at the discretion of our board of directors and will depend on our results of operations, financial conditions, contractual restrictions, restrictions imposed by applicable law, and other factors that our board deems relevant.

FINRA sales practice requirements may also limit your ability to buy and sell our common stock, which could depress the price of our shares.

FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

| -15- |

RISKS RELATED TO THIS OFFERING

Purchasers in this offering will experience immediate and substantial dilution in the book value of their investment.

Because the public offering price per share and related warrant is substantially higher than the book value per share of our common stock, you will incur immediate and substantial dilution in the net tangible book value of the common stock you purchase in this offering. After giving effect to the assumed sale by us of [___] shares of our common stock and warrants to purchase up to [_____] shares of common stock at an assumed public offering price of $[__] per share and assumed public offering price of $[__] per warrant, and after deducting the estimated underwriting discounts and estimated offering expenses payable by us, you will suffer immediate and substantial dilution of $[___] per share in the pro forma net tangible book value of the common stock you purchase in this offering, assuming no value is attributed to the warrants, and the warrants are accounted for and classified as equity. To the extent outstanding options, warrants or other derivative securities are ultimately exercised or converted, or if we issue restricted stock to our employees under our 2015 Omnibus Securities and Incentive Plan, there will be further dilution to investors who purchase shares in this offering. In addition, if we issue additional equity securities or derivative securities, investors purchasing shares in this offering will experience additional dilution. For a further description of the dilution that you will experience immediately after this offering, see “Dilution” on page 22.

We may allocate the net proceeds from this offering in ways that differ from our estimates based on our current plans and assumptions discussed in the section titled “Use of Proceeds” and with which you may not agree.

The allocation of net proceeds of the offering set forth in the “Use of Proceeds” section of this prospectus represents our estimates based upon our current plans and assumptions regarding industry and general economic conditions, our future revenues and expenditures. The amounts and timing of our actual expenditures will depend on numerous factors, including market conditions, cash generated by our operations, business developments and related rate of growth. We may find it necessary or advisable to use portions of the proceeds from this offering for other purposes. Circumstances that may give rise to a change in the use of proceeds and the alternate purposes for which the proceeds may be used are discussed in the section in this prospectus entitled “Use of Proceeds.” You may not have an opportunity to evaluate the economic, financial or other information on which we base our decisions on how to use our proceeds. As a result, you and other stockholders may not agree with our decisions. See “Use of Proceeds” on page 19 for additional information.