Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VALLEY NATIONAL BANCORP | vly8-k20180207analystprese.htm |

1Q18 Investor Presentation

Exhibit 99.1

Forward Looking Statements

The foregoing contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are not historical facts and include expressions

about management’s confidence and strategies and management’s expectations about new and existing programs and products, acquisitions, relationships, opportunities, taxation,

technology, market conditions and economic expectations. These statements may be identified by such forward-looking terminology as “should,” “expect,” “believe,” “view,” “opportunity,”

“allow,” “continues,” “reflects,” “typically,” “usually,” “anticipate,” or similar statements or variations of such terms. Such forward-looking statements involve certain risks and uncertainties.

Actual results may differ materially from such forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking

statements include, but are not limited to: weakness or a decline in the economy, mainly in New Jersey, New York and Florida, as well as an unexpected decline in commercial real estate

values within our market areas; less than expected cost reductions and revenue enhancement from Valley's cost reduction plans including its earnings enhancement program called "LIFT";

higher or lower than expected income tax expense or tax rates, including increases or decreases resulting from the impact of the Tax Act and other changes in tax laws, regulations and case

law; damage verdicts or settlements or restrictions related to existing or potential litigations arising from claims of breach of fiduciary responsibility, negligence, fraud, contractual claims,

environmental laws, patent or trade mark infringement, employment related claims, and other matters; the loss of or decrease in lower-cost funding sources within our deposit base may

adversely impact our net interest income and net income; cyber attacks, computer viruses or other malware that may breach the security of our websites or other systems to obtain

unauthorized access to confidential information, destroy data, disable or degrade service, or sabotage our systems; results of examinations by the OCC, the FRB, the CFPB and other

regulatory authorities, including the possibility that any such regulatory authority may, among other things, require us to increase our allowance for credit losses, write-down assets, require us

to reimburse customers, change the way we do business, or limit or eliminate certain other banking activities; changes in accounting policies or accounting standards, including the new

authoritative accounting guidance (known as the current expected credit loss (CECL) model) which may increase the required level of our allowance for credit losses after adoption on

January 1, 2020; our inability or determination not to pay dividends at current levels, or at all, because of inadequate future earnings, regulatory restrictions or limitations, changes in our

capital requirements or a decision to increase capital by retaining more earnings; higher than expected loan losses within one or more segments of our loan portfolio; unanticipated loan

delinquencies, loss of collateral, decreased service revenues, and other potential negative effects on our business caused by severe weather or other external events; unexpected significant

declines in the loan portfolio due to the lack of economic expansion, increased competition, large prepayments, changes in regulatory lending guidance or other factors; the failure of other

financial institutions with whom we have trading, clearing, counterparty and other financial relationships; the risk that the businesses of Valley and USAB may not be combined successfully, or

such combination may take longer or be more difficult, time-consuming or costly to accomplish than expected; the diversion of management's time on issues relating to merger integration;

the inability to realize expected cost savings and synergies from the merger of USAB with Valley in the amounts or in the timeframe anticipated; and the inability to retain USAB’s customers

and employees. A detailed discussion of factors that could affect our results is included in our SEC filings, including the “Risk Factors” section of our Annual Report on Form 10-K for the year

ended December 31, 2016 and Quarterly Report on Form 10-Q for the period ended September 30, 2017. We undertake no duty to update any forward-looking statement to conform the

statement to actual results or changes in our expectations. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future

results, levels of activity, performance or achievements.

2

The New Valley

Human Capital

• Recent CEO succession

• 7 out of our 13 Executives are new to Valley within the past 2

years

• One VLY, One Culture

Technology

• The Valley Roadmap is a 3 year (2017-2019) ~$50 million

infrastructure plan aimed at improving the Bank’s process

across all segments

• We expect greater efficiency and revenues a result

• Salesforce, nCino, Encompass

• Enterprise Data Hub (EDH)

Customer Enhancements

• Building a new suite of offerings tailored to retail and

commercial clients

• Back-office Modernization - Focused on increasing speed to

market and decisions times

• Branch Transformation

People

Products Process

3

Ira Robbins

President & CEO

Alan Eskow

SEVP & CFO

Dianne Grenz

SEVP & CCBO

Tom Iadanza

SEVP & CLO

Ron Janis

SEVP & General Counsel

Bob Bardusch

EVP & COO

Kevin Chittenden

EVP & CRLO

Bernadette Mueller

EVP & ECRAO

Andrea Onorato

EVP & CAO

Melissa Scofield

EVP & CRO

Yvonne Surowiec

EVP & CHRO

Joseph V. Chillura

EVP & Regional

President

Mark Saeger

EVP & CCO

The New Valley: Leadership Team

4

▪ Delivering robust customer and employee experiences through

frictionless interaction

Modernize

& Empower

Customer

Centric

Digitally

Powered

Data Driven

▪ Enhancing customer touch points to drive improved customer

capabilities

▪ Improving operating efficiency and agility by investing in continuous

modernization

▪ Harnessing data more intuitively to drive deep customer insights and

data centric decisioning

The New Valley: Technology Roadmap

5

The New Valley: Technology Roadmap Milestones

6

2018

Cloud/Streamlined Loan

Origination

Innovation Culture & Fintech

Enhanced Treasury & Branch

Transformation

New Website

Salesforce, nCino, Encompass

Instant Issue Debit

2017

New Web/Social Media

Storefront

Journey to Cloud Architecture

Modernize Employee

Technology

Data Hub and Big Data

Touch ID, E-signature, E-

contracting, ServiceNow

2019

Data Center

Transformation

Core Banking

Transformation

Interactive Teller & branch

transformation

P2P

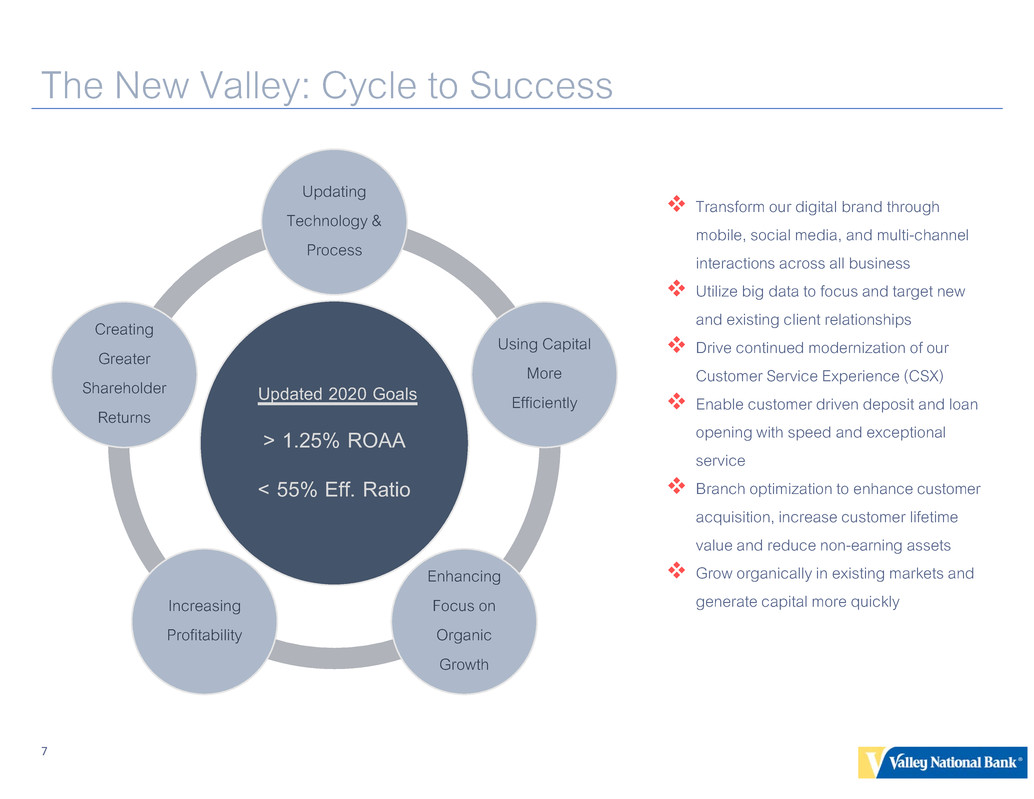

The New Valley: Cycle to Success

7

Updated 2020 Goals

> 1.25% ROAA

< 55% Eff. Ratio

Updating

Technology &

Process

Using Capital

More

Efficiently

Enhancing

Focus on

Organic

Growth

Increasing

Profitability

Creating

Greater

Shareholder

Returns

Transform our digital brand through

mobile, social media, and multi-channel

interactions across all business

Utilize big data to focus and target new

and existing client relationships

Drive continued modernization of our

Customer Service Experience (CSX)

Enable customer driven deposit and loan

opening with speed and exceptional

service

Branch optimization to enhance customer

acquisition, increase customer lifetime

value and reduce non-earning assets

Grow organically in existing markets and

generate capital more quickly

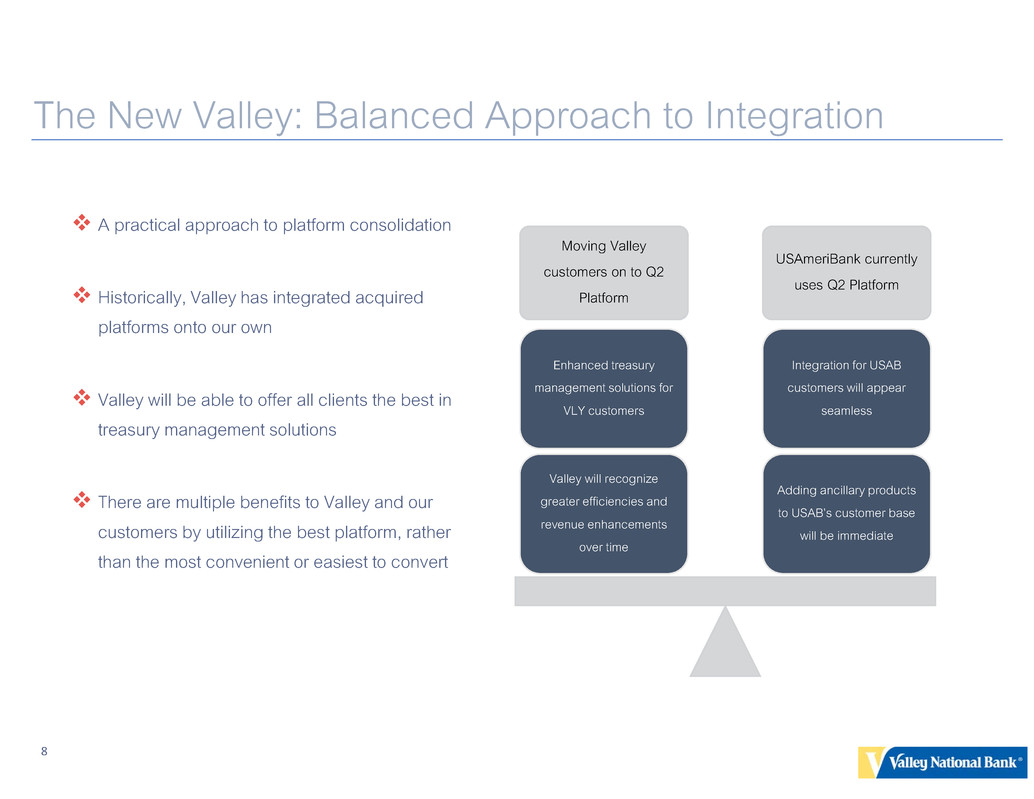

The New Valley: Balanced Approach to Integration

A practical approach to platform consolidation

Historically, Valley has integrated acquired

platforms onto our own

Valley will be able to offer all clients the best in

treasury management solutions

There are multiple benefits to Valley and our

customers by utilizing the best platform, rather

than the most convenient or easiest to convert

Moving Valley

customers on to Q2

Platform

USAmeriBank currently

uses Q2 Platform

Adding ancillary products

to USAB’s customer base

will be immediate

Integration for USAB

customers will appear

seamless

Valley will recognize

greater efficiencies and

revenue enhancements

over time

Enhanced treasury

management solutions for

VLY customers

8

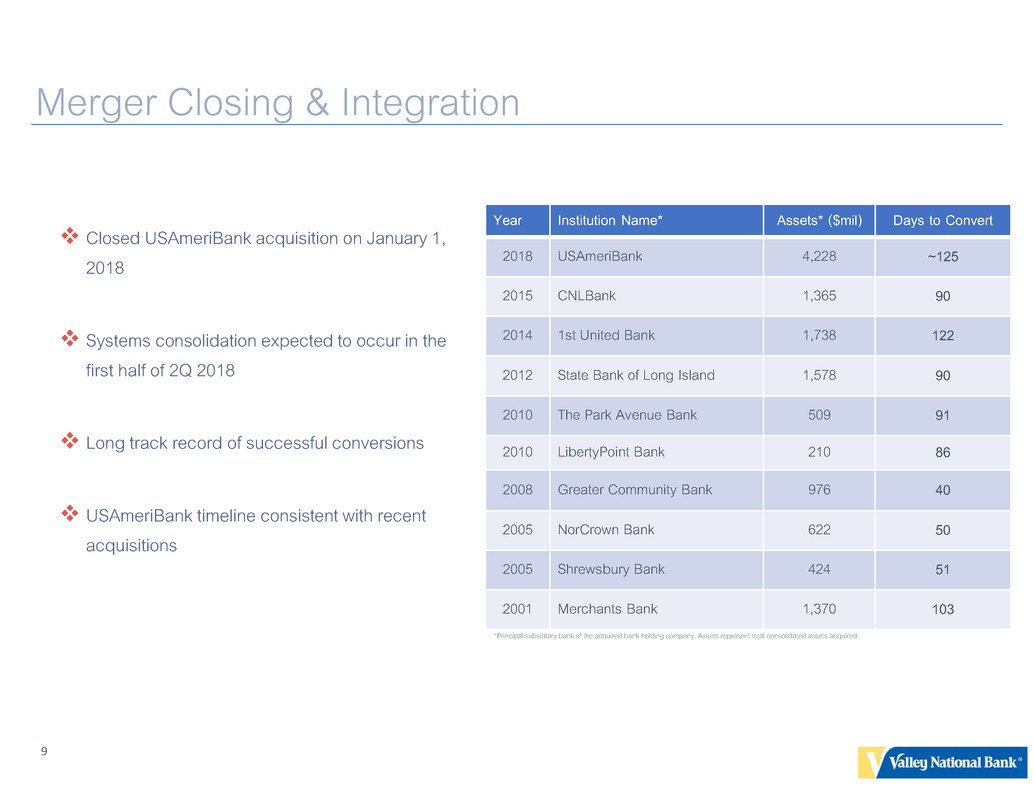

Closed USAmeriBank acquisition on January 1,

2018

Systems consolidation expected to occur in the

first half of 2Q 2018

Long track record of successful conversions

USAmeriBank timeline consistent with recent

acquisitions

Year Institution Name* Assets* ($mil) Days to Convert

2018 USAmeriBank 4,228 ~125

2015 CNLBank 1,365 90

2014 1st United Bank 1,738 122

2012 State Bank of Long Island 1,578 90

2010 The Park Avenue Bank 509 91

2010 LibertyPoint Bank 210 86

2008 Greater Community Bank 976 40

2005 NorCrown Bank 622 50

2005 Shrewsbury Bank 424 51

2001 Merchants Bank 1,370 103

Merger Closing & Integration

*Principal subsidiary bank of the acquired bank holding company. Assets represent total consolidated assets acquired.

9

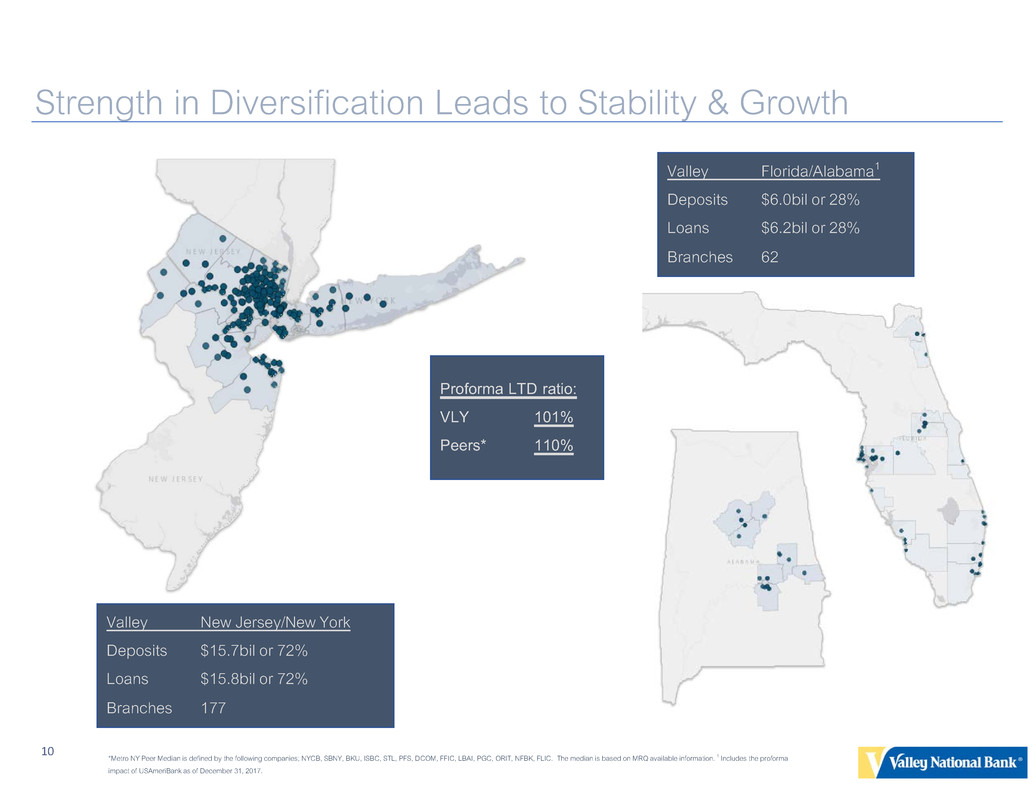

Strength in Diversification Leads to Stability & Growth

*Metro NY Peer Median is defined by the following companies; NYCB, SBNY, BKU, ISBC, STL, PFS, DCOM, FFIC, LBAI, PGC, ORIT, NFBK, FLIC. The median is based on MRQ available information. 1 Includes the proforma

impact of USAmeriBank as of December 31, 2017.

10

Valley Florida/Alabama1

Deposits $6.0bil or 28%

Loans $6.2bil or 28%

Branches 62

Proforma LTD ratio:

VLY 101%

Peers* 110%

Valley New Jersey/New York

Deposits $15.7bil or 72%

Loans $15.8bil or 72%

Branches 177

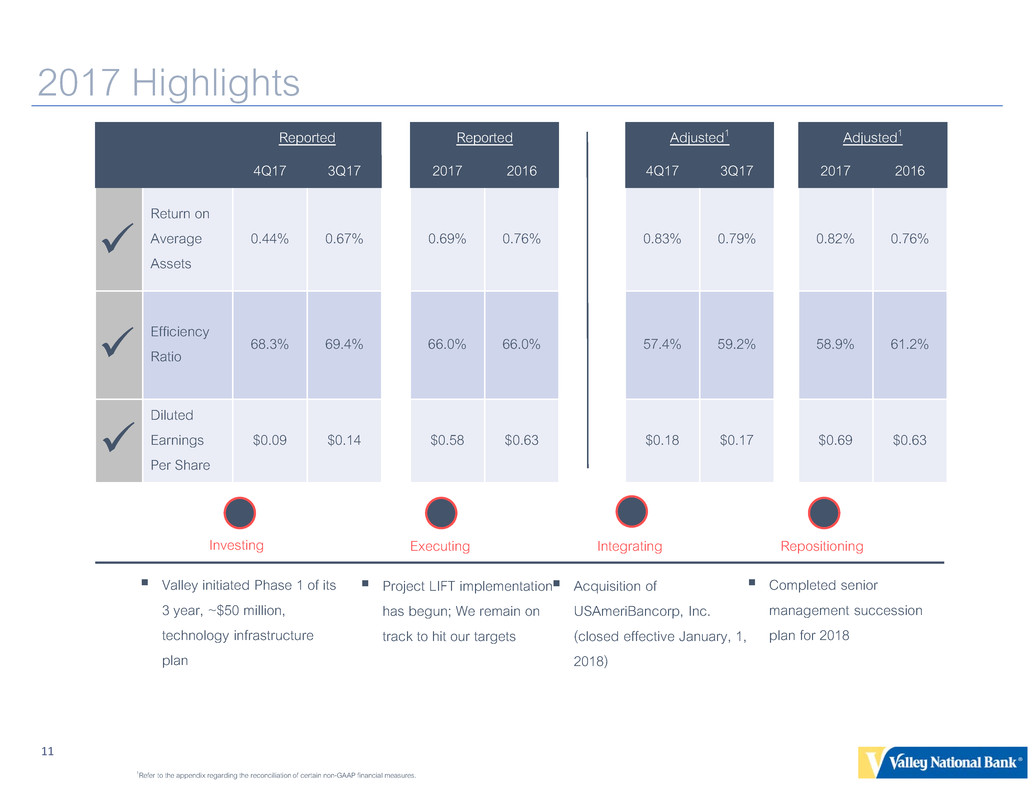

2017 Highlights

1Refer to the appendix regarding the reconciliation of certain non-GAAP financial measures.

Reported Reported Adjusted1 Adjusted1

4Q17 3Q17 2017 2016 4Q17 3Q17 2017 2016

Return on

Average

Assets

0.44% 0.67% 0.69% 0.76% 0.83% 0.79% 0.82% 0.76%

Efficiency

Ratio

68.3% 69.4% 66.0% 66.0% 57.4% 59.2% 58.9% 61.2%

Diluted

Earnings

Per Share

$0.09 $0.14 $0.58 $0.63 $0.18 $0.17 $0.69 $0.63

Valley initiated Phase 1 of its

3 year, ~$50 million,

technology infrastructure

plan

Project LIFT implementation

has begun; We remain on

track to hit our targets

Acquisition of

USAmeriBancorp, Inc.

(closed effective January, 1,

2018)

Completed senior

management succession

plan for 2018

Investing Executing Integrating Repositioning

11

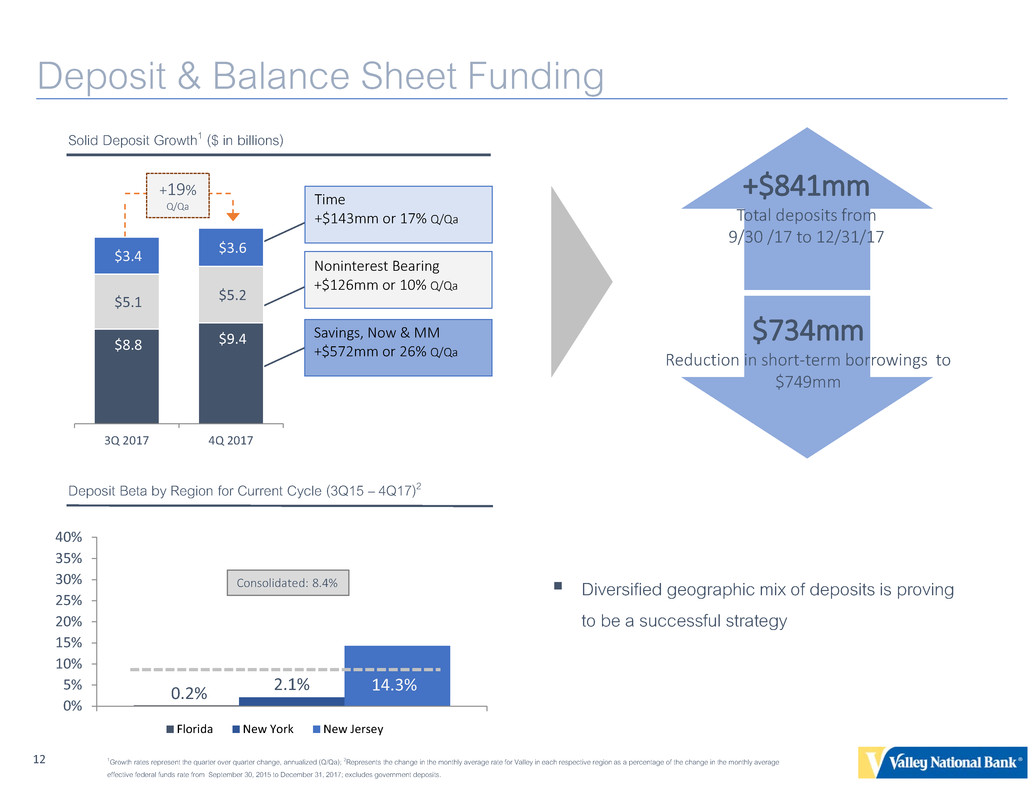

$8.8 $9.4

$5.1 $5.2

$3.4 $3.6

3Q 2017 4Q 2017

0.2% 2.1% 14.3%

0%

5%

10%

15%

20%

25%

30%

35%

40%

2017Florida New York New Jersey

$734mm

Reduction in short-term borrowings to

$749mm

Deposit & Balance Sheet Funding

Solid Deposit Growth1 ($ in billions)

Deposit Beta by Region for Current Cycle (3Q15 – 4Q17)2

+$841mm

Total deposits from

9/30 /17 to 12/31/17

+19%

Q/Qa

1Growth rates represent the quarter over quarter change, annualized (Q/Qa); 2Represents the change in the monthly average rate for Valley in each respective region as a percentage of the change in the monthly average

effective federal funds rate from September 30, 2015 to December 31, 2017; excludes government deposits.

Noninterest Bearing

+$126mm or 10% Q/Qa

Savings, Now & MM

+$572mm or 26% Q/Qa

Time

+$143mm or 17% Q/Qa

Diversified geographic mix of deposits is proving

to be a successful strategy

Consolidated: 8.4%

12

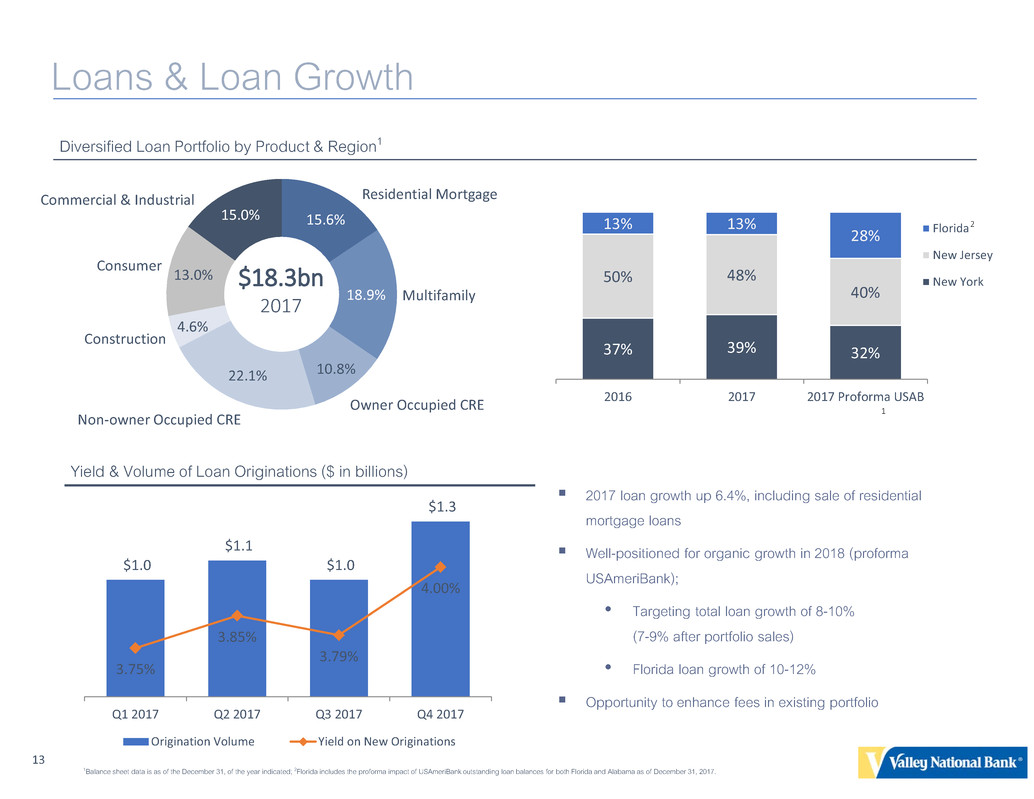

$1.0

$1.1

$1.0

$1.3

3.75%

3.85%

3.79%

4.00%

Q1 2017 Q2 2017 Q3 2017 Q4 2017

Origination Volume Yield on New Originations

Loans & Loan Growth

Yield & Volume of Loan Originations ($ in billions)

Diversified Loan Portfolio by Product & Region1

2017 loan growth up 6.4%, including sale of residential

mortgage loans

Well-positioned for organic growth in 2018 (proforma

USAmeriBank);

• Targeting total loan growth of 8-10%

(7-9% after portfolio sales)

• Florida loan growth of 10-12%

Opportunity to enhance fees in existing portfolio

1Balance sheet data is as of the December 31, of the year indicated; 2Florida includes the proforma impact of USAmeriBank outstanding loan balances for both Florida and Alabama as of December 31, 2017.

15.6%

18.9%

10.8% 22.1%

13.0%

15.0%

4.6%

Construction

Owner Occupied CRE

Residential Mortgage Commercial & Industrial

Multifamily

Non-owner Occupied CRE

Consumer

$18.3bn

2017

37% 39% 32%

50% 48%

40%

13% 13%

28%

2016 2017 2017 Proforma USAB

Florida

New Jersey

New York

2

1

13

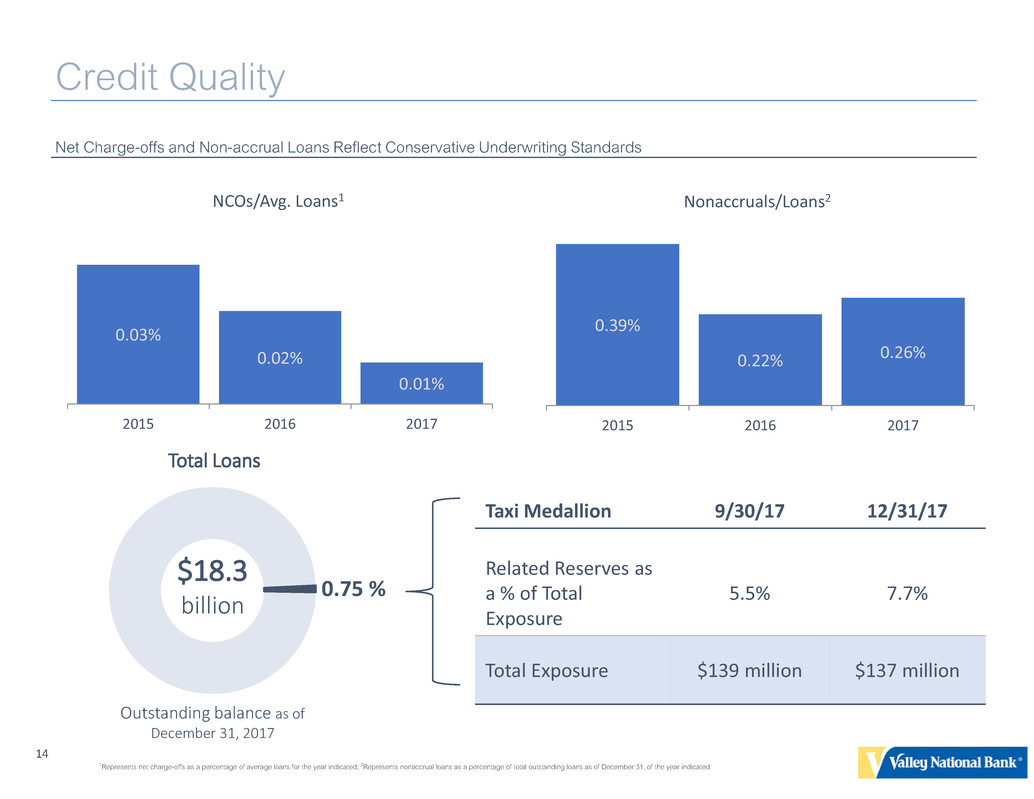

Taxi Medallion 9/30/17 12/31/17

Related Reserves as

a % of Total

Exposure

5.5% 7.7%

Total Exposure $139 million $137 million

0.75 %

$18.3

billion

Total Loans

Credit Quality

Net Charge-offs and Non-accrual Loans Reflect Conservative Underwriting Standards

Outstanding balance as of

December 31, 2017

0.03%

0.02%

0.01%

2015 2016 2017

NCOs/Avg. Loans1

0.39%

0.22% 0.26%

2015 2016 2017

Nonaccruals/Loans2

1Represents net charge-offs as a percentage of average loans for the year indicated; 2Represents nonaccrual loans as a percentage of total outstanding loans as of December 31, of the year indicated

14

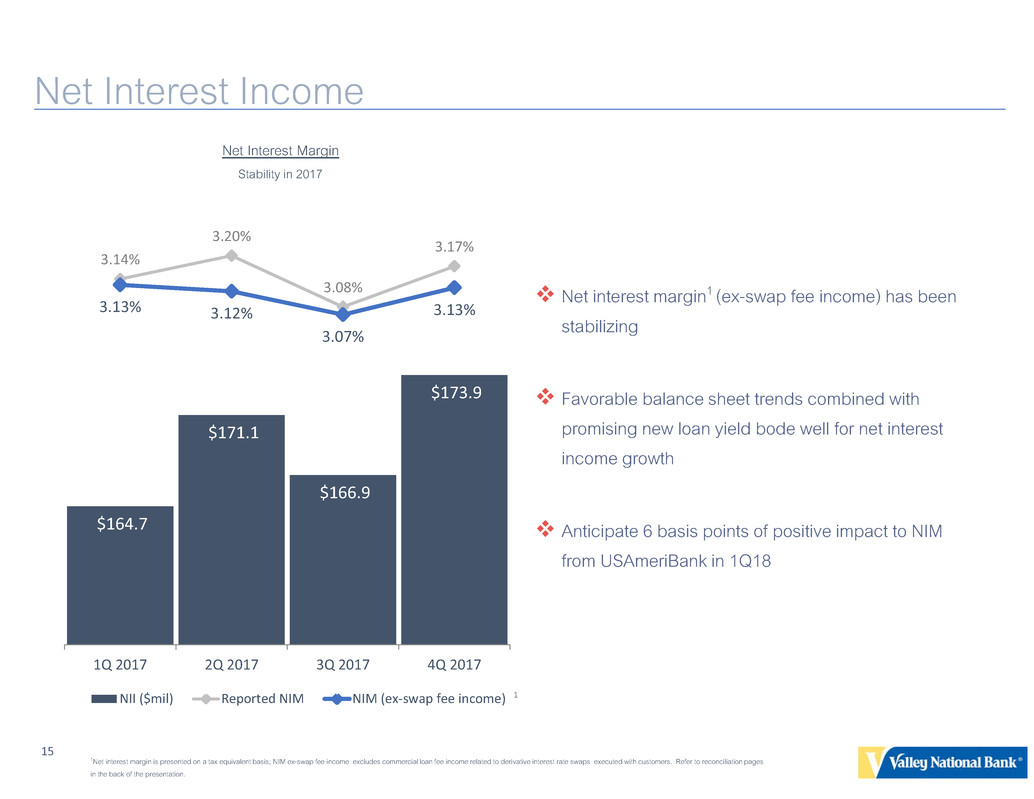

Net interest margin1 (ex-swap fee income) has been

stabilizing

Favorable balance sheet trends combined with

promising new loan yield bode well for net interest

income growth

Anticipate 6 basis points of positive impact to NIM

from USAmeriBank in 1Q18

Net Interest Income

$164.7

$171.1

$166.9

$173.9

3.14%

3.20%

3.08%

3.17%

3.13% 3.12%

3.07%

3.13%

1Q 2017 2Q 2017 3Q 2017 4Q 2017

NII ($mil) Reported NIM NIM (ex-swap fee income)

Net Interest Margin

Stability in 2017

1Net interest margin is presented on a tax equivalent basis; NIM ex-swap fee income excludes commercial loan fee income related to derivative interest rate swaps executed with customers. Refer to reconciliation pages

in the back of the presentation.

1

15

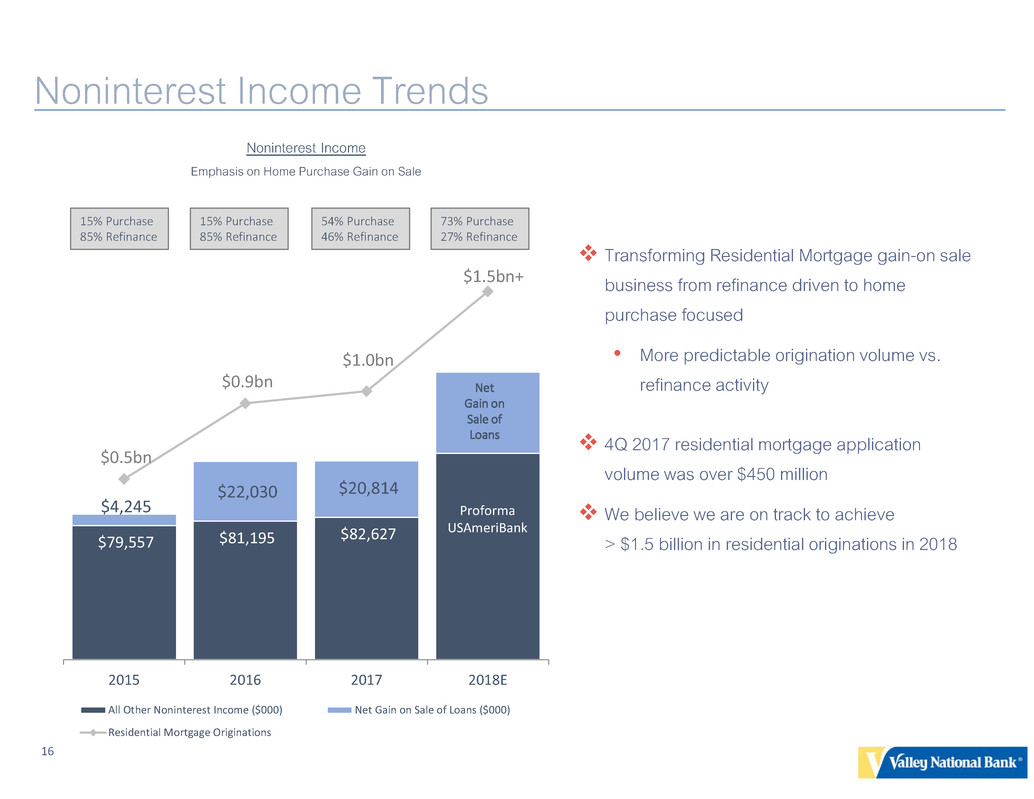

Transforming Residential Mortgage gain-on sale

business from refinance driven to home

purchase focused

• More predictable origination volume vs.

refinance activity

4Q 2017 residential mortgage application

volume was over $450 million

We believe we are on track to achieve

> $1.5 billion in residential originations in 2018

Noninterest Income Trends

$79,557 $81,195 $82,627

$4,245

$22,030 $20,814

$0.5bn

$0.9bn

$1.0bn

$1.5bn+

2015 2016 2017 2018E

All Other Noninterest Income ($000) Net Gain on Sale of Loans ($000)

Residential Mortgage Originations

Net

Gain on

Sale of

Loans

Proforma

USAmeriBank

Noninterest Income

Emphasis on Home Purchase Gain on Sale

15% Purchase

85% Refinance

54% Purchase

46% Refinance

15% Purchase

85% Refinance

73% Purchase

27% Refinance

16

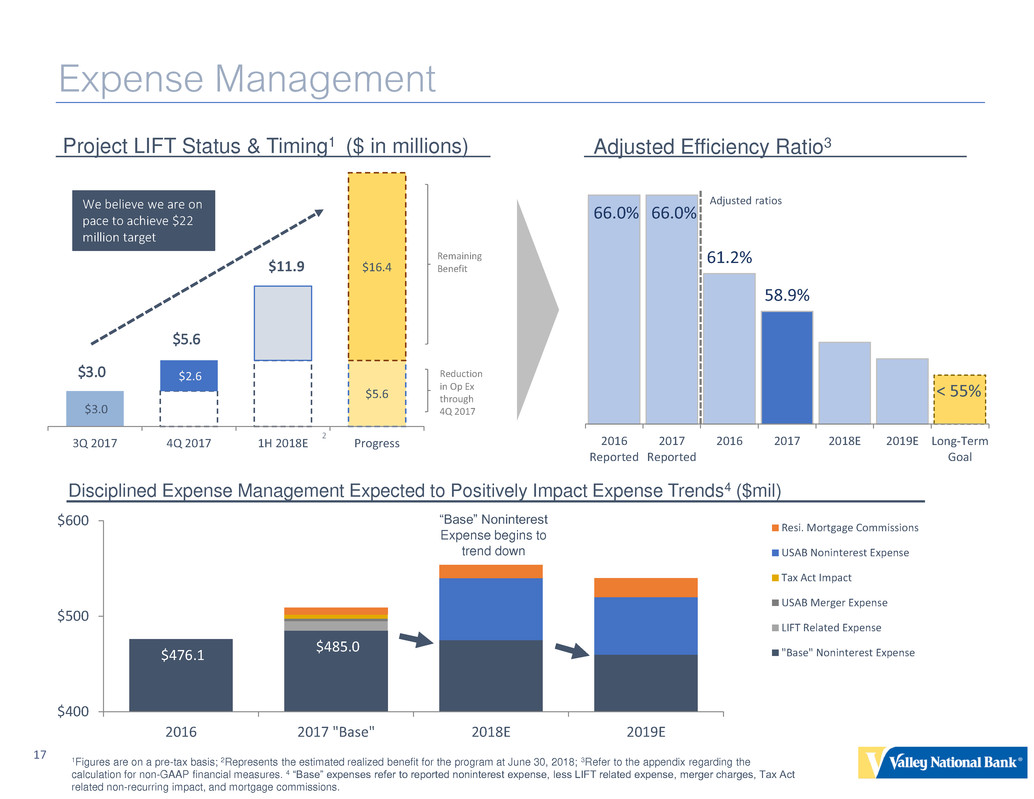

$476.1

$485.0

$400

$500

$600

2016 2017 "Base" 2018E 2019E

Resi. Mortgage Commissions

USAB Noninterest Expense

Tax Act Impact

USAB Merger Expense

LIFT Related Expense

"Base" Noninterest Expense

Expense Management

66.0% 66.0%

61.2%

58.9%

2016

Reported

2017

Reported

2016 2017 2018E 2019E Long-Term

Goal

Project LIFT Status & Timing1 ($ in millions) Adjusted Efficiency Ratio3

Disciplined Expense Management Expected to Positively Impact Expense Trends4 ($mil)

1Figures are on a pre-tax basis; 2Represents the estimated realized benefit for the program at June 30, 2018; 3Refer to the appendix regarding the

calculation for non-GAAP financial measures. 4 “Base” expenses refer to reported noninterest expense, less LIFT related expense, merger charges, Tax Act

related non-recurring impact, and mortgage commissions.

$3.0

$2.6

$11.9

$5.6

$16.4

3Q 2017 4Q 2017 1H 2018E Progress

Remaining

Benefit

Reduction

in Op Ex

through

4Q 2017

We believe we are on

pace to achieve $22

million target

$5.6

$3.0

“Base” Noninterest

Expense begins to

trend down

2

< 55%

17

Adjusted ratios

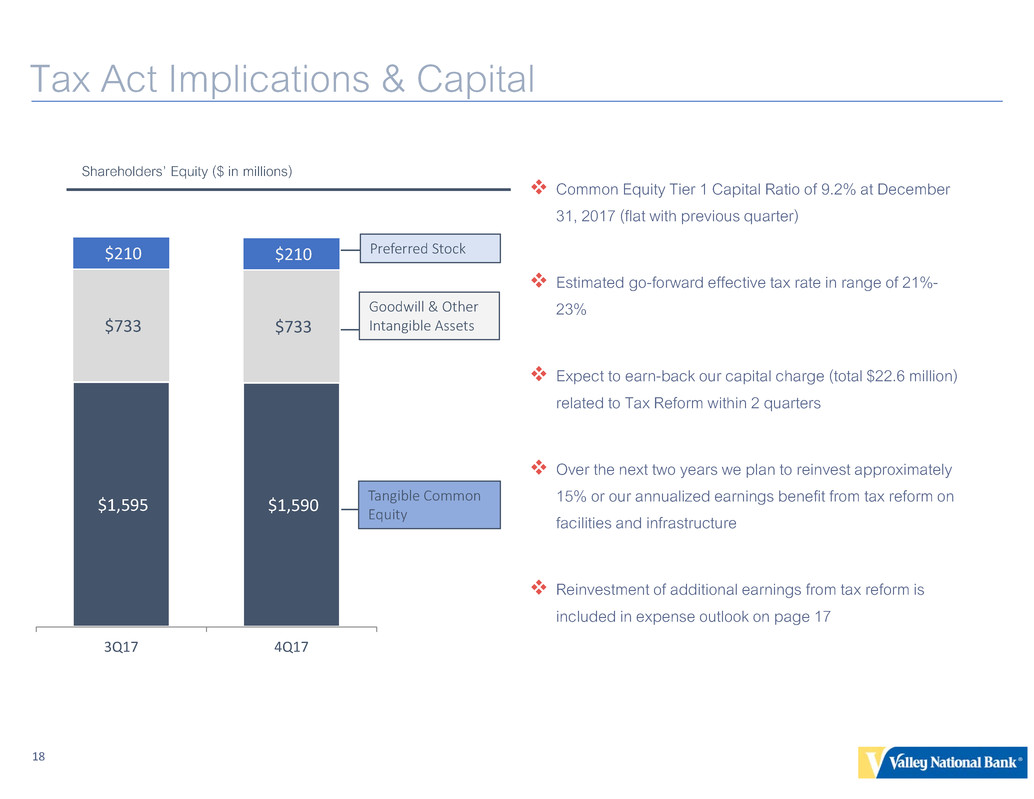

$1,595 $1,590

$733 $733

$210 $210

3Q17 4Q17

Common Equity Tier 1 Capital Ratio of 9.2% at December

31, 2017 (flat with previous quarter)

Estimated go-forward effective tax rate in range of 21%-

23%

Expect to earn-back our capital charge (total $22.6 million)

related to Tax Reform within 2 quarters

Over the next two years we plan to reinvest approximately

15% or our annualized earnings benefit from tax reform on

facilities and infrastructure

Reinvestment of additional earnings from tax reform is

included in expense outlook on page 17

Tax Act Implications & Capital

Preferred Stock

Goodwill & Other

Intangible Assets

Tangible Common

Equity

Shareholders’ Equity ($ in millions)

18

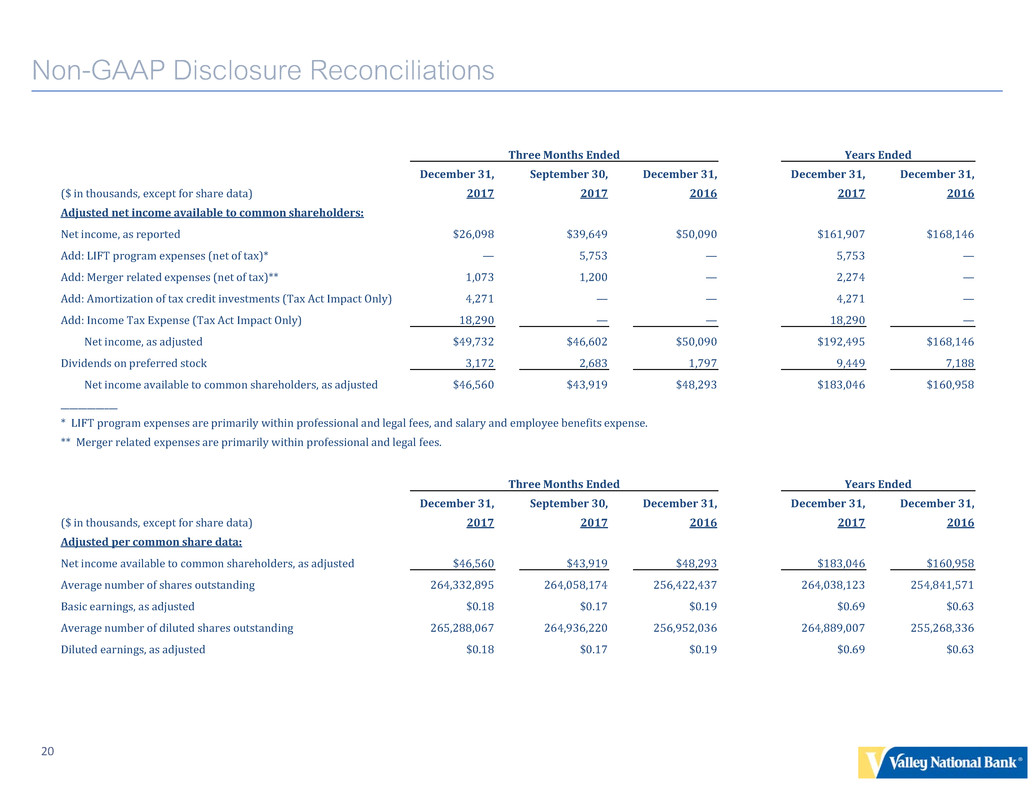

Non-GAAP Disclosure Reconciliations

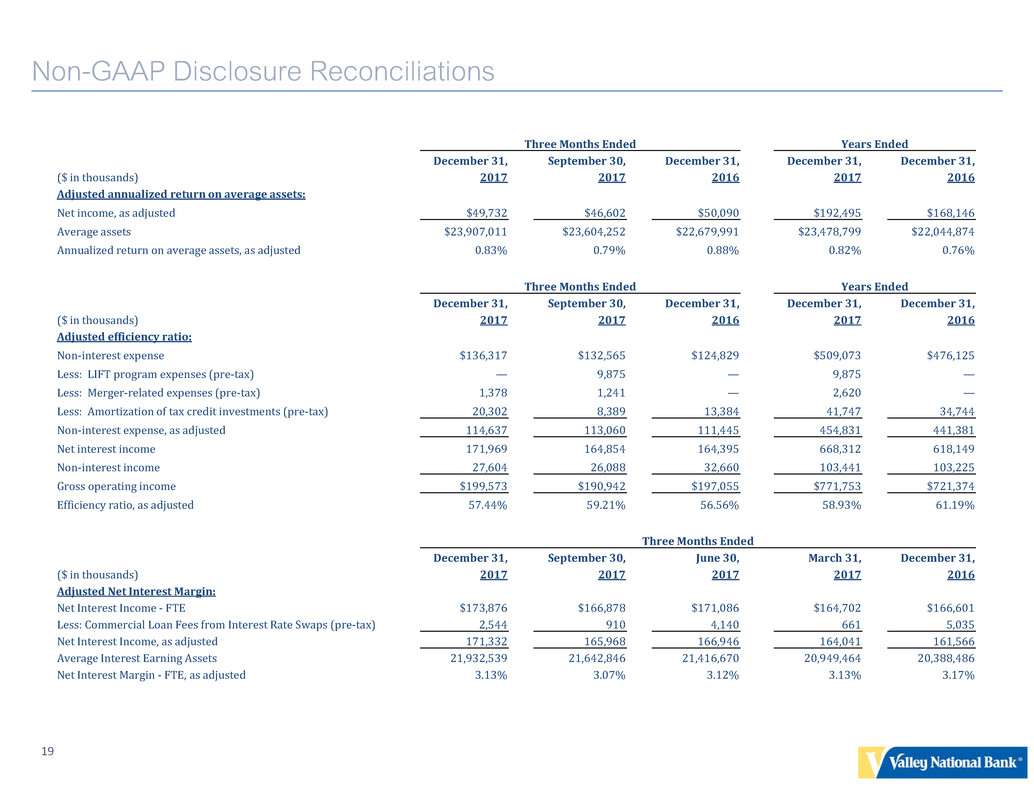

Three Months Ended Years Ended

December 31, September 30, December 31, December 31, December 31,

($ in thousands) 2017 2017 2016 2017 2016

Adjusted annualized return on average assets:

Net income, as adjusted $49,732 $46,602 $50,090 $192,495 $168,146

Average assets $23,907,011 $23,604,252 $22,679,991 $23,478,799 $22,044,874

Annualized return on average assets, as adjusted 0.83% 0.79% 0.88% 0.82% 0.76%

Three Months Ended Years Ended

December 31, September 30, December 31, December 31, December 31,

($ in thousands) 2017 2017 2016 2017 2016

Adjusted efficiency ratio:

Non-interest expense $136,317 $132,565 $124,829 $509,073 $476,125

Less: LIFT program expenses (pre-tax) — 9,875 — 9,875 —

Less: Merger-related expenses (pre-tax) 1,378 1,241 — 2,620 —

Less: Amortization of tax credit investments (pre-tax) 20,302 8,389 13,384 41,747 34,744

Non-interest expense, as adjusted 114,637 113,060 111,445 454,831 441,381

Net interest income 171,969 164,854 164,395 668,312 618,149

Non-interest income 27,604 26,088 32,660 103,441 103,225

Gross operating income $199,573 $190,942 $197,055 $771,753 $721,374

Efficiency ratio, as adjusted 57.44% 59.21% 56.56% 58.93% 61.19%

Three Months Ended

December 31, September 30, June 30, March 31, December 31,

($ in thousands) 2017 2017 2017 2017 2016

Adjusted Net Interest Margin:

Net Interest Income - FTE $173,876 $166,878 $171,086 $164,702 $166,601

Less: Commercial Loan Fees from Interest Rate Swaps (pre-tax) 2,544 910 4,140 661 5,035

Net Interest Income, as adjusted 171,332 165,968 166,946 164,041 161,566

Average Interest Earning Assets 21,932,539 21,642,846 21,416,670 20,949,464 20,388,486

Net Interest Margin - FTE, as adjusted 3.13% 3.07% 3.12% 3.13% 3.17%

19

Non-GAAP Disclosure Reconciliations

Three Months Ended Years Ended

December 31, September 30, December 31, December 31, December 31,

($ in thousands, except for share data) 2017 2017 2016 2017 2016

Adjusted net income available to common shareholders:

Net income, as reported $26,098 $39,649 $50,090 $161,907 $168,146

Add: LIFT program expenses (net of tax)* — 5,753 — 5,753 —

Add: Merger related expenses (net of tax)** 1,073 1,200 — 2,274 —

Add: Amortization of tax credit investments (Tax Act Impact Only) 4,271 — — 4,271 —

Add: Income Tax Expense (Tax Act Impact Only) 18,290 — — 18,290 —

Net income, as adjusted $49,732 $46,602 $50,090 $192,495 $168,146

Dividends on preferred stock 3,172 2,683 1,797 9,449 7,188

Net income available to common shareholders, as adjusted $46,560 $43,919 $48,293 $183,046 $160,958

_____________

* LIFT program expenses are primarily within professional and legal fees, and salary and employee benefits expense.

** Merger related expenses are primarily within professional and legal fees.

Three Months Ended Years Ended

December 31, September 30, December 31, December 31, December 31,

($ in thousands, except for share data) 2017 2017 2016 2017 2016

Adjusted per common share data:

Net income available to common shareholders, as adjusted $46,560 $43,919 $48,293 $183,046 $160,958

Average number of shares outstanding 264,332,895 264,058,174 256,422,437 264,038,123 254,841,571

Basic earnings, as adjusted $0.18 $0.17 $0.19 $0.69 $0.63

Average number of diluted shares outstanding 265,288,067 264,936,220 256,952,036 264,889,007 255,268,336

Diluted earnings, as adjusted $0.18 $0.17 $0.19 $0.69 $0.63

20

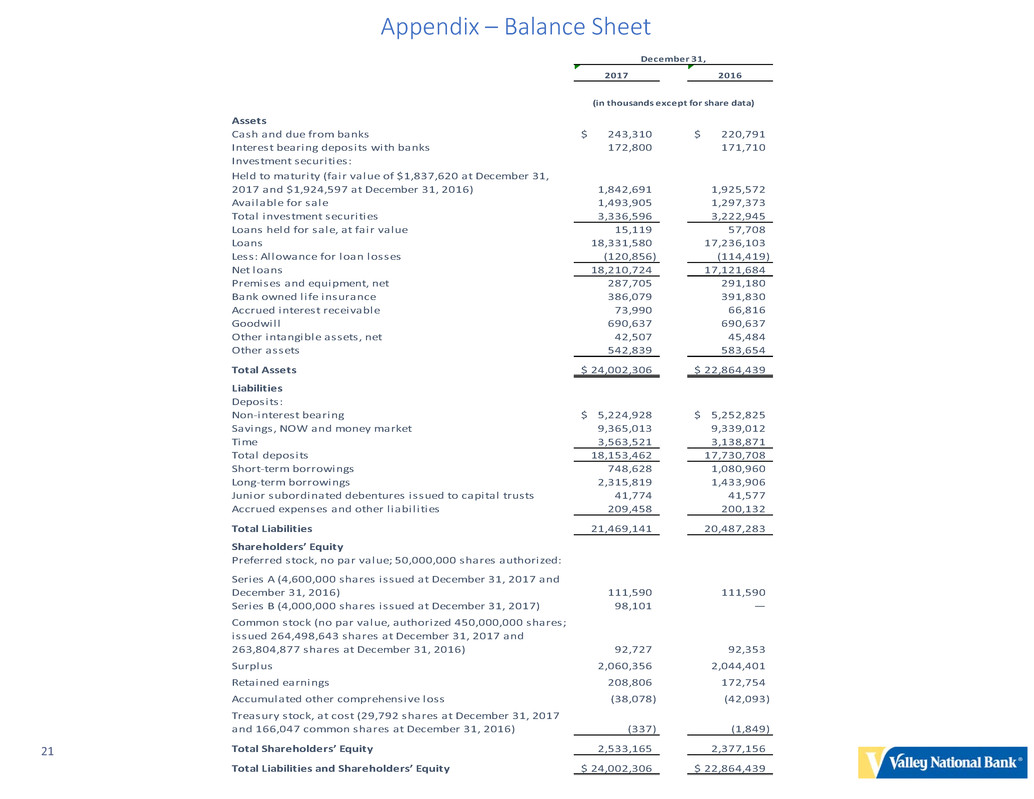

Appendix – Balance Sheet

21

2017 2016

Assets

Cash and due from banks 243,310$ 220,791$

Interest bearing deposits with banks 172,800 171,710

Investment securities:

Held to maturity (fair value of $1,837,620 at December 31,

2017 and $1,924,597 at December 31, 2016) 1,842,691 1,925,572

Available for sale 1,493,905 1,297,373

Total investment securities 3,336,596 3,222,945

Loans held for sale, at fair value 15,119 57,708

Loans 18,331,580 17,236,103

Less: Allowance for loan losses (120,856) (114,419)

Net loans 18,210,724 17,121,684

Premises and equipment, net 287,705 291,180

Bank owned life insurance 386,079 391,830

Accrued interest receivable 73,990 66,816

Goodwill 690,637 690,637

Other intangible assets, net 42,507 45,484

Other assets 542,839 583,654

Total Assets 24,002,306$ 22,864,439$

Liabilities

Deposits:

Non-interest bearing 5,224,928$ 5,252,825$

Savings, NOW and money market 9,365,013 9,339,012

Time 3,563,521 3,138,871

Total deposits 18,153,462 17,730,708

Short-term borrowings 748,628 1,080,960

Long-term borrowings 2,315,819 1,433,906

Junior subordinated debentures issued to capital trusts 41,774 41,577

Accrued expenses and other l iabil ities 209,458 200,132

Total Liabilities 21,469,141 20,487,283

Shareholders’ Equity

Preferred stock, no par value; 50,000,000 shares authorized:

Series A (4,600,000 shares issued at December 31, 2017 and

December 31, 2016) 111,590 111,590

Series B (4,000,000 shares issued at December 31, 2017) 98,101 —

Common stock (no par value, authorized 450,000,000 shares;

issued 264,498,643 shares at December 31, 2017 and

263,804,877 shares at December 31, 2016) 92,727 92,353

Surplus 2,060,356 2,044,401

Retained earnings 208,806 172,754

Accumulated other comprehensive loss (38,078) (42,093)

Treasury stock, at cost (29,792 shares at December 31, 2017

and 166,047 common shares at December 31, 2016) (337) (1,849)

Total Shareholders’ Equity 2,533,165 2,377,156

Total Liabilities and Shareholders’ Equity 24,002,306$ 22,864,439$

December 31,

(in thousands except for share data)

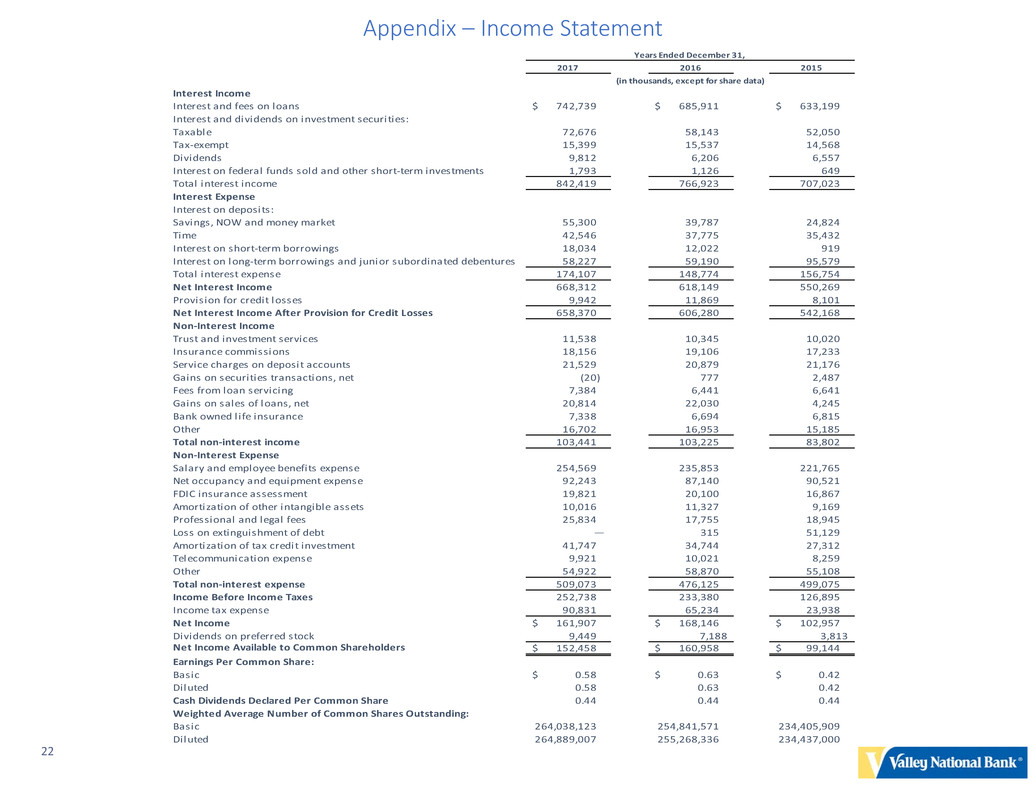

Appendix – Income Statement

22

2017 2016 2015

Interest Income

Interest and fees on loans 742,739$ 685,911$ 633,199$

Interest and dividends on investment securities:

Taxable 72,676 58,143 52,050

Tax-exempt 15,399 15,537 14,568

Dividends 9,812 6,206 6,557

Interest on federal funds sold and other short-term investments 1,793 1,126 649

Total interest income 842,419 766,923 707,023

Interest Expense

Interest on deposits:

Savings, NOW and money market 55,300 39,787 24,824

Time 42,546 37,775 35,432

Interest on short-term borrowings 18,034 12,022 919

Interest on long-term borrowings and junior subordinated debentures 58,227 59,190 95,579

Total interest expense 174,107 148,774 156,754

Net Interest Income 668,312 618,149 550,269

Provision for credit losses 9,942 11,869 8,101

Net Interest Income After Provision for Credit Losses 658,370 606,280 542,168

Non-Interest Income

Trust and investment services 11,538 10,345 10,020

Insurance commissions 18,156 19,106 17,233

Service charges on deposit accounts 21,529 20,879 21,176

Gains on securities transactions, net (20) 777 2,487

Fees from loan servicing 7,384 6,441 6,641

Gains on sales of loans, net 20,814 22,030 4,245

Bank owned life insurance 7,338 6,694 6,815

Other 16,702 16,953 15,185

Total non-interest income 103,441 103,225 83,802

Non-Interest Expense

Salary and employee benefits expense 254,569 235,853 221,765

Net occupancy and equipment expense 92,243 87,140 90,521

FDIC insurance assessment 19,821 20,100 16,867

Amortization of other intangible assets 10,016 11,327 9,169

Professional and legal fees 25,834 17,755 18,945

Loss on extinguishment of debt — 315 51,129

Amortization of tax credit investment 41,747 34,744 27,312

Telecommunication expense 9,921 10,021 8,259

Other 54,922 58,870 55,108

Total non-interest expense 509,073 476,125 499,075

Income Before Income Taxes 252,738 233,380 126,895

Income tax expense 90,831 65,234 23,938

Net Income 161,907$ 168,146$ 102,957$

Dividends on preferred stock 9,449 7,188 3,813

Net Income Available to Common Shareholders 152,458$ 160,958$ 99,144$

Earnings Per Common Share:

Basic 0.58$ 0.63$ 0.42$

Diluted 0.58 0.63 0.42

Cash Dividends Declared Per Common Share 0.44 0.44 0.44

Weighted Average Number of Common Shares Outstanding:

Basic 264,038,123 254,841,571 234,405,909

Diluted 264,889,007 255,268,336 234,437,000

Years Ended December 31,

(in thousands, except for share data)

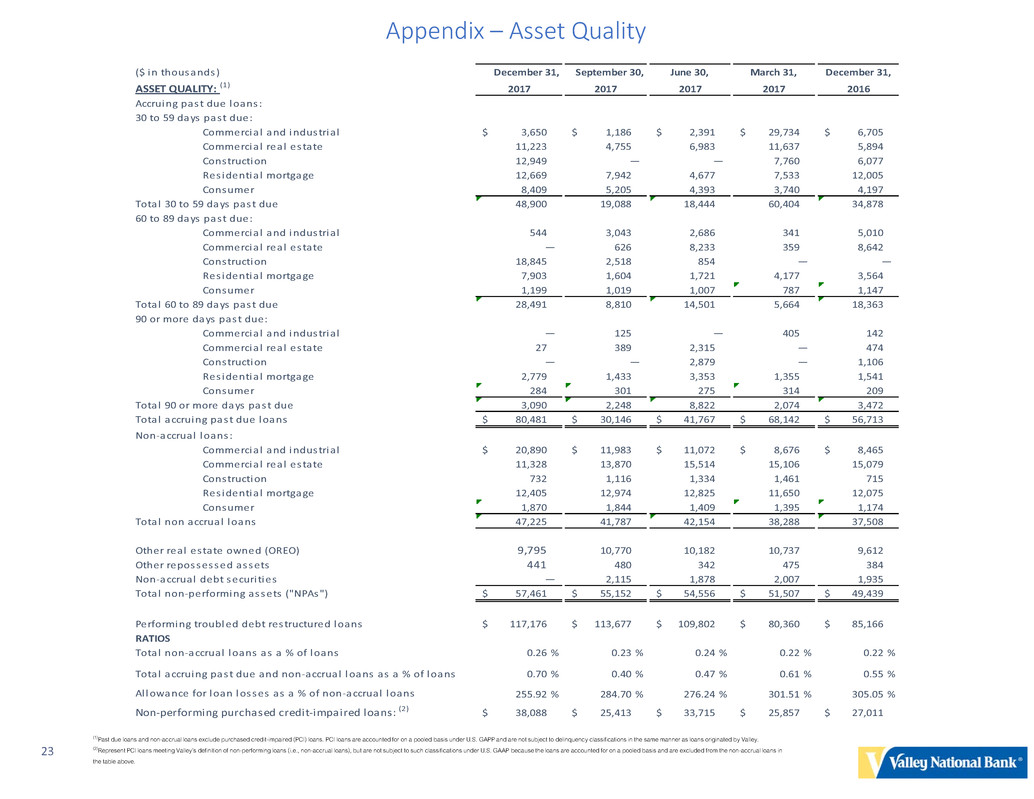

Appendix – Asset Quality

(1)Past due loans and non-accrual loans exclude purchased credit-impaired (PCI) loans. PCI loans are accounted for on a pooled basis under U.S. GAPP and are not subject to delinquency classifications in the same manner as loans originated by Valley.

(2)Represent PCI loans meeting Valley’s definition of non-performing loans (i.e., non-accrual loans), but are not subject to such classifications under U.S. GAAP because the loans are accounted for on a pooled basis and are excluded from the non-accrual loans in

the table above.

23

December 31, September 30, June 30, March 31, December 31,

2017 2017 2017 2017 2016

Commercia l and industria l 3,650$ 1,186$ 2,391$ 29,734$ 6,705$

Commercia l rea l es tate 11,223 4,755 6,983 11,637 5,894

Construction 12,949 — — 7,760 6,077

Res identia l mortgage 12,669 7,942 4,677 7,533 12,005

Consumer 8,409 5,205 4,393 3,740 4,197

48,900 19,088 18,444 60,404 34,878

Commercia l and industria l 544 3,043 2,686 341 5,010

Commercia l rea l es tate — 626 8,233 359 8,642

Construction 18,845 2,518 854 — —

Res identia l mortgage 7,903 1,604 1,721 4,177 3,564

Consumer 1,199 1,019 1,007 787 1,147

28,491 8,810 14,501 5,664 18,363

Commercia l and industria l — 125 — 405 142

Commercia l rea l es tate 27 389 2,315 — 474

Construction — — 2,879 — 1,106

Res identia l mortgage 2,779 1,433 3,353 1,355 1,541

Consumer 284 301 275 314 209

3,090 2,248 8,822 2,074 3,472

80,481$ 30,146$ 41,767$ 68,142$ 56,713$

Commercia l and industria l 20,890$ 11,983$ 11,072$ 8,676$ 8,465$

Commercia l rea l es tate 11,328 13,870 15,514 15,106 15,079

Construction 732 1,116 1,334 1,461 715

Res identia l mortgage 12,405 12,974 12,825 11,650 12,075

Consumer 1,870 1,844 1,409 1,395 1,174

47,225 41,787 42,154 38,288 37,508

9,795 10,770 10,182 10,737 9,612

441 480 342 475 384

— 2,115 1,878 2,007 1,935

57,461$ 55,152$ 54,556$ 51,507$ 49,439$

117,176$ 113,677$ 109,802$ 80,360$ 85,166$

0.26 % 0.23 % 0.24 % 0.22 % 0.22 %

0.70 % 0.40 % 0.47 % 0.61 % 0.55 %

255.92 % 284.70 % 276.24 % 301.51 % 305.05 %

38,088$ 25,413$ 33,715$ 25,857$ 27,011$

Tota l accruing past due and non-accrual loans as a % of loans

Non-performing purchased credit-impaired loans: (2)

Al lowance for loan losses as a % of non-accrual loans

Performing troubled debt restructured loans

RATIOS

Tota l non-accrual loans as a % of loans

Other rea l es tate owned (OREO)

Other repossessed assets

Non-accrual debt securi ties

Tota l non-performing assets ("NPAs")

Non-accrual loans :

Tota l non accrual loans

60 to 89 days past due:

Tota l 60 to 89 days past due

90 or more days past due:

Tota l 90 or more days past due

Tota l accruing past due loans

($ in thousands)

ASSET QUALITY: (1)

Accruing past due loans :

30 to 59 days past due:

Tota l 30 to 59 days past due

For More Information

Log onto our web site: www.valleynationalbank.com

E-mail requests to: rkraemer@valleynationalbank.com

Call Rick Kraemer, Investor Relations Officer, at: (973) 686-4817

Write to: Valley National Bank

1455 Valley Road

Wayne, New Jersey 07470

Attn: Rick Kraemer, Investor Relations Officer

Log onto our website above or www.sec.gov to obtain free copies of documents filed by Valley with

the SEC

24