Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Tallgrass Energy, LP | exhibit9912018272.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 7, 2018

Tallgrass Energy GP, LP

(Exact name of registrant as specified in its charter)

Delaware | 001-37365 | 47-3159268 | ||

(State or Other Jurisdiction of Incorporation or Organization) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||

4200 W. 115th Street, Suite 350 Leawood, Kansas | 66211 | |

(Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (913) 928-6060

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. | Entry into a Material Definitive Agreement. |

Tallgrass Equity Acquisition of 25.01% Interest in REX and Additional Common Units of TEP

On February 7, 2018, Tallgrass Energy GP, LP, a Delaware limited partnership (the “Partnership”), Tallgrass Development, LP, a Delaware limited partnership (“Development”), Tallgrass Equity, LLC, a Delaware limited liability company (“TE”), Tallgrass Development Holdings, LLC, a Delaware limited liability company and wholly owned subsidiary of TE (“Merger Sub”), and, for certain limited purposes, Tallgrass Energy Holdings, LLC, a Delaware limited liability company (“Holdings”) entered into a definitive Agreement and Plan of Merger (the “Merger Agreement”), pursuant to which Development merged with and into Merger Sub, with Merger Sub remaining as the surviving company (the “Merger”), in exchange for (i) 27,554,785 units representing limited liability company interests in TE (“TE Units”), and (ii) 27,554,785 Class B Shares (as defined in the Partnership’s limited partnership agreement) (such TE Units and Class B Shares, together, the “Merger Consideration”). The Merger Consideration was paid to the limited partners of Development upon the closing of the Merger and such recipients were also granted certain registration rights with respect to the Merger Consideration under an existing registration rights agreement entered into by the Partnership and certain Class B shareholders. The Merger Agreement contains customary representations and warranties, indemnification obligations and covenants by the parties.

As a result of the Merger, Tallgrass Equity acquired a 25.01% membership interest in Rockies Express Pipeline LLC, a Delaware limited liability company (“REX”), and an additional 5,619,218 common units representing limited partner interests of Tallgrass Equity Partners, LP, a Delaware limited partnership (“TEP”). Including the 49.99% membership interest in REX held by TEP, TE now effectively controls an aggregate 75% membership interest in REX and owns an aggregate of 25,619,218 common units of TEP. The Partnership is the managing member of and therefore controls TE.

Prior to the Merger, Development entered into a Purchase and Sale Agreement with TEP effective as of February 1, 2018 whereby Development sold to TEP (i) a 2% membership interest in Tallgrass Pony Express Pipeline, LLC, a Delaware limited liability company, and (ii) a 100% membership interest in Tallgrass Operations, LLC, a Delaware limited liability company, in exchange for $59,610,975 in cash consideration (the “Pony Transaction”). As a result of the Pony Transaction, Pony Express and Operations are now indirect wholly-owned subsidiaries of TEP.

TEGP Management, LLC, a Delaware limited liability company (the “General Partner”), serves as the general partner of the Partnership. The Conflicts Committee of the Board of Directors of the General Partner recommended approval of the Merger to the Board of Directors, which then approved the Merger. The Conflicts Committee, which is composed entirely of independent directors, retained independent legal and financial advisors to assist in evaluating and negotiating the Merger.

The Merger Agreement and the above descriptions have been included to provide investors and security holders with information regarding the terms of the Merger Agreement. They are not intended to provide any other factual information about the Partnership, Development, TE, Merger Sub, Holdings or their respective subsidiaries or affiliates or equity holders. The representations, warranties and covenants contained in the Merger Agreement were made only for purposes of that agreement and as of specific dates; were solely for the benefit of the parties to the Merger Agreement; and may be subject to limitations agreed upon by the parties, including being qualified by confidential disclosures made by each contracting party to the other as a way of allocating contractual risk between them that differ from those applicable to investors. Investors should be aware that these representations, warranties and covenants or any description thereof alone may not describe the actual state of affairs of the Partnership, Development, TE, Merger Sub, Holdings or their respective subsidiaries, affiliates, businesses or equity holders as of the date they were made or at any other time.

The above description does not purport to be a complete description of the Merger Agreement and is qualified in its entirety by the contents of the Merger Agreement, a copy of which will be filed as an exhibit to the Partnership’s Current Report on Form 10-Q for the quarter ended March 31, 2018.

Merger Consideration

Pursuant to the terms of the Merger Agreement, the Merger Consideration was issued to the limited partners of Development as follows:

Holder | TE Units and Class B Shares |

Entities Affiliated with The Energy & Minerals Group | 10,497,067 |

Entities Affiliated with Kelso & Company | 11,646,401 |

Entities Affiliated with Magnetar Capital | 1,417,566 |

Entities Affiliated with Management | 3,725,519 |

Minority Investors | 268,232 |

TOTAL | 27,554,785 |

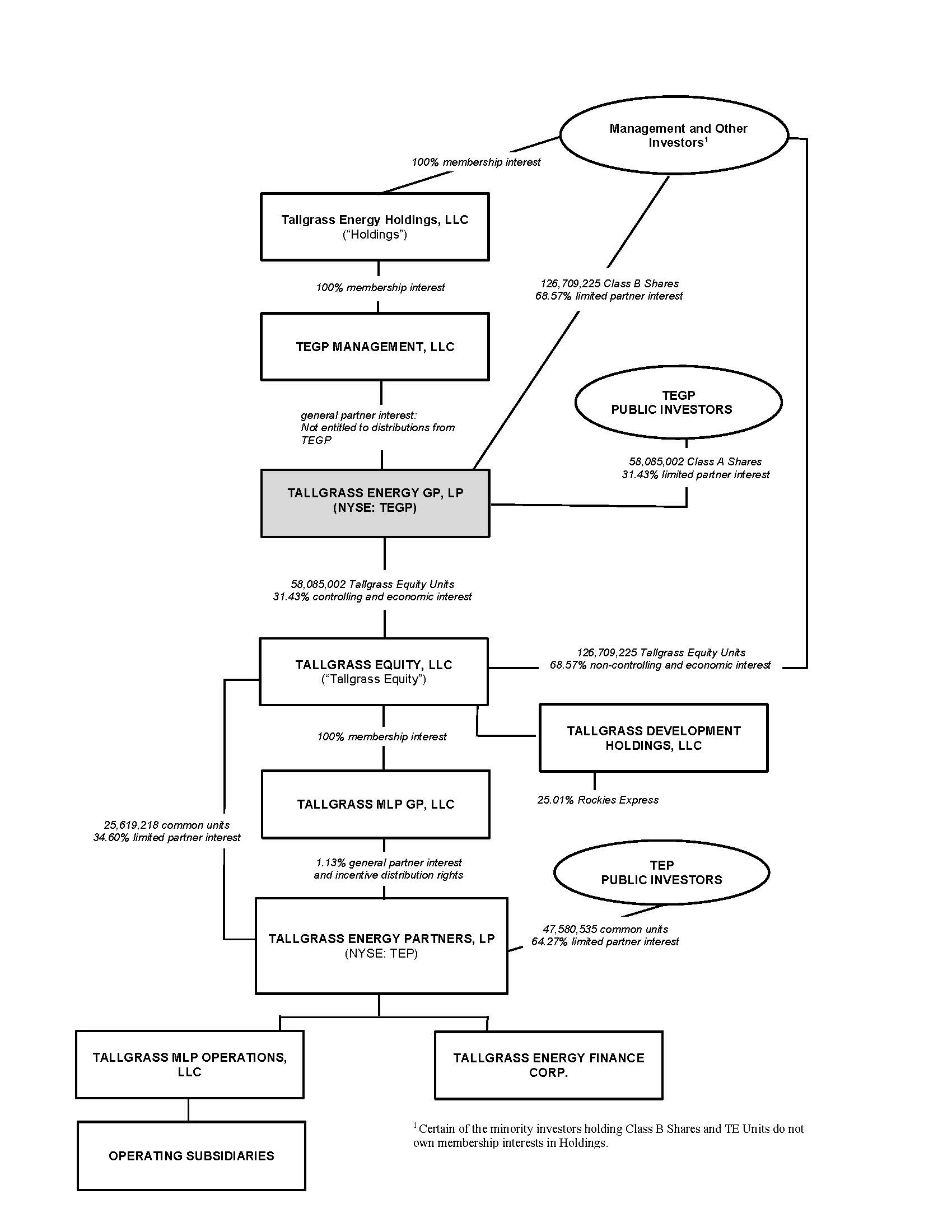

Pro Forma Organizational Structure

As a result of the transactions described herein, the organizational structure of the Partnership is as follows:

Item 2.01. | Completion of Acquisition or Disposition of Assets |

The information provided above under Item 1.01 is incorporated into this Item 2.01 by reference.

Item 7.01. | Regulation FD Disclosure. |

On February 7, 2018, the Partnership and TEP issued a joint press release announcing the Merger and the Pony Transaction. A copy of the press release is furnished with this Form 8-K as Exhibit 99.1 and incorporated into this Item 7.01 by reference.

In accordance with General Instruction B.2 to Form 8-K, the information provided in this Item 7.01 and attached to this Current Report on Form 8-K as Exhibit 99.1 shall be deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of the general incorporation language of such filing, except as expressly set forth by specific reference in such filing.

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

TALLGRASS ENERGY GP, LP | ||||

By: | TEGP Management, LLC | |||

its general partner | ||||

Date: | February 7, 2018 | By: | /s/ David G. Dehaemers, Jr. | |

David G. Dehaemers, Jr. | ||||

President and Chief Executive Officer | ||||