Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - S&T BANCORP INC | stba4q17investorsheet201.htm |

| 8-K - 8-K - S&T BANCORP INC | stba-4q2017investorpresx8k.htm |

MEMBER FDIC

Full Year 2017

2

This presentation contains or incorporates statements that we believe are forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to our financial condition, results of operations, plans,

objectives, outlook for earnings, revenues, expenses, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and

other matters regarding or affecting S&T and its future business and operations. Forward looking statements are typically identified by words

or phrases such as “will likely result”, “expect”, “anticipate”, “estimate”, “forecast”, “project”, “intend”, “ believe”, “assume”, “strategy”, “trend”,

“plan”, “outlook”, “outcome”, “continue”, “remain”, “potential”, “opportunity”, “believe”, “comfortable”, “current”, “position”, “maintain”, “sustain”,

“seek”, “achieve” and variations of such words and similar expressions, or future or conditional verbs such as will, would, should, could or

may. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these

assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters

discussed in these forward-looking statements are subject to various risks, uncertainties and other factors that could cause actual results and

trends to differ materially from those made, projected, or implied in or by the forward-looking statements depending on a variety of

uncertainties or other factors including, but not limited to: credit losses; cyber-security concerns; rapid technological developments and

changes; sensitivity to the interest rate environment including a prolonged period of low interest rates, a rapid increase in interest rates or a

change in the shape of the yield curve; a change in spreads on interest-earning assets and interest-bearing liabilities; regulatory supervision

and oversight; legislation affecting the financial services industry as a whole, and S&T, in particular; the outcome of pending and future

litigation and governmental proceedings; increasing price and product/service competition; the ability to continue to introduce competitive new

products and services on a timely, cost-effective basis; managing our internal growth and acquisitions; the possibility that the anticipated

benefits from acquisitions cannot be fully realized in a timely manner or at all, or that integrating the acquired operations will be more difficult,

disruptive or costly than anticipated; containing costs and expenses; reliance on significant customer relationships; general economic or

business conditions; deterioration of the housing market and reduced demand for mortgages; deterioration in the overall macroeconomic

conditions or the state of the banking industry that could warrant further analysis of the carrying value of goodwill and could result in an

adjustment to its carrying value resulting in a non-cash charge to net income; re-emergence of turbulence in significant portions of the global

financial and real estate markets that could impact our performance, both directly, by affecting our revenues and the value of our assets and

liabilities, and indirectly, by affecting the economy generally and access to capital in the amounts, at the times and on the terms required to

support our future businesses. Many of these factors, as well as other factors, are described in our filings with the SEC. Forward-looking

statements are based on beliefs and assumptions using information available at the time the statements are made. We caution you not to

unduly rely on forward-looking statements because the assumptions, beliefs, expectations and projections about future events may, and often

do, differ materially from actual results. Any forward-looking statement speaks only as to the date on which it is made, and we undertake no

obligation to update any forward-looking statement to reflect developments occurring after the statement is made.

Forward Looking Statement

and Risk Factors

3

Non-GAAP Financial Measures

In addition to the results of operations presented in accordance with Generally Accepted Accounting

Principles (GAAP), S&T management uses and this presentation contains or references certain non-

GAAP financial measures, such as net interest income on a fully taxable equivalent basis. S&T believes

these financial measures provide information useful to investors in understanding our operational

performance and business and performance trends which facilitate comparisons with the performance of

others in the financial services industry. Although S&T believes that these non-GAAP financial measures

enhance investors’ understanding of S&T’s business and performance, these non-GAAP financial

measures should not be considered an alternative to GAAP. The non-GAAP financial measures contained

therein should be read in conjunction with the audited financial statements and analysis as presented in

the Annual Report on Form 10-K as well as the unaudited financial statements and analyses as presented

in the respective Quarterly Reports on Forms 10-Q for S&T Bancorp, Inc. and subsidiaries.

4

Table of Contents

Corporate Profile 5

2017 Highlights 6

Performance Summary 7

STBA Investment Thesis 8

Performance 9

Expenses 12

Growth 14

Mergers and Expansion 15

Markets 16

Asset Quality 22

Rate Sensitivity 27

Senior Management 28

Lines of Business 29

Valuation 30

The Right Size 31

Financial Data 32

Appendix - Non-GAAP Measures 38

5

Corporate Profile

5

• Headquartered in Indiana, PA

• $7.1 billion in assets (as of 12.31.17)

• $1.4 billion market cap (as of 12.31.17)

• Locations in 5 regional markets

• Stock symbol: STBA

Corporate Profile

6

2017 Highlights

• Net income increased to $73.0 million compared to $71.4 million for 2016.

Excluding the net DTA re-measurement of $13.4 million, net income

increased 21% to $86.4 million(1) compared to 2016.

• ROA was 1.03%, ROE was 8.37% and ROTE(1) was 12.77%.

• Excluding the DTA re-measurement of $13.4 million, ROA was 1.22%(1),

ROE was 9.90%(1) and ROTE was 15.08%(1).

• Net interest income increased $22.5 million, or 11%, and net interest

margin (FTE)(1) increased 9 basis points to 3.56% compared to 3.47% in

2016.

• Asset quality metrics improved with a decrease in nonperforming loans of

$18.7 million, or 44%, compared to December 31, 2016.

(1)Refer to appendix for reconciliation of Non-GAAP financial measures

2017 Highlights

7

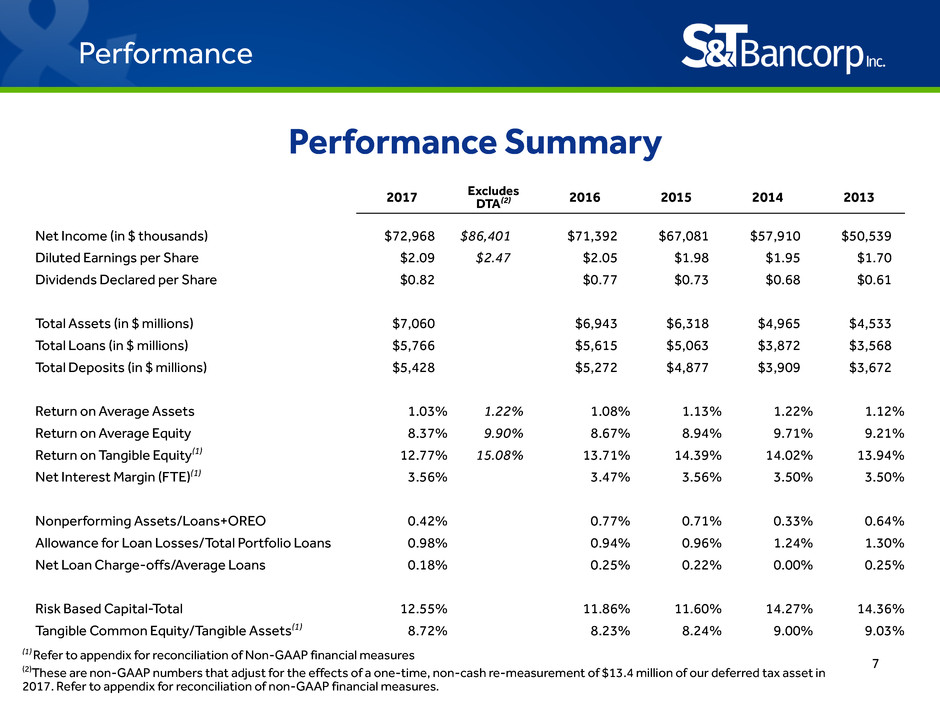

Performance Summary

(1) Refer to appendix for reconciliation of Non-GAAP financial measures

(2)These are non-GAAP numbers that adjust for the effects of a one-time, non-cash re-measurement of $13.4 million of our deferred tax asset in

2017. Refer to appendix for reconciliation of non-GAAP financial measures.

2017 ExcludesDTA(2) 2016 2015 2014 2013

Net Income (in $ thousands) $72,968 $86,401 $71,392 $67,081 $57,910 $50,539

Diluted Earnings per Share $2.09 $2.47 $2.05 $1.98 $1.95 $1.70

Dividends Declared per Share $0.82 $0.77 $0.73 $0.68 $0.61

Total Assets (in $ millions) $7,060 $6,943 $6,318 $4,965 $4,533

Total Loans (in $ millions) $5,766 $5,615 $5,063 $3,872 $3,568

Total Deposits (in $ millions) $5,428 $5,272 $4,877 $3,909 $3,672

Return on Average Assets 1.03% 1.22% 1.08% 1.13% 1.22% 1.12%

Return on Average Equity 8.37% 9.90% 8.67% 8.94% 9.71% 9.21%

Return on Tangible Equity(1) 12.77% 15.08% 13.71% 14.39% 14.02% 13.94%

Net Interest Margin (FTE)(1) 3.56% 3.47% 3.56% 3.50% 3.50%

Nonperforming Assets/Loans+OREO 0.42% 0.77% 0.71% 0.33% 0.64%

Allowance for Loan Losses/Total Portfolio Loans 0.98% 0.94% 0.96% 1.24% 1.30%

Net Loan Charge-offs/Average Loans 0.18% 0.25% 0.22% 0.00% 0.25%

Risk Based Capital-Total 12.55% 11.86% 11.60% 14.27% 14.36%

Tangible Common Equity/Tangible Assets(1) 8.72% 8.23% 8.24% 9.00% 9.03%

Performance

8

STBA Investment Thesis

• Above peer performance

• Demonstrated expense discipline and efficiency

• Organic growth

• Strategic and effective mergers and expansion

• Stable regional markets with long-term

oil and gas benefit

• Sound asset quality

STBA Investment Thesis

9

Return on Average Assets

1.4%

1.2%

1.0%

0.8%

0.6%

0.4%

0.2%

0.0%

2013 2014 2015 2016 2017

1.03%

(1) BHCPR Peer Group 2: Bank Holding Companies with $3-10 Billion of Assets through 3Q17

(2)This is a non-GAAP number that adjusts for the effects of a one-time, non-cash re-measurement of $13.4

million of our deferred tax asset in 2017. Refer to appendix for reconciliation of non-GAAP financial measures.

Performance

Peer(1)

1.12%

1.22%

1.13%

1.08%

1.22%(2)

10

Performance

Return on Average Equity

12.5%

10.0%

7.5%

5.0%

2.5%

0.0%

2013 2014 2015 2016 2017

8.37%

(1) BHCPR Peer Group 2: Bank Holding Companies with $3-10 Billion of Assets through 3Q17

(2)This is a non-GAAP number that adjusts for the effects of a one-time, non-cash re-measurement of $13.4

million of our deferred tax asset in 2017. Refer to appendix for reconciliation of non-GAAP financial measures.

Peer(1)9.21%

9.90%(2)

8.67%

8.94%

9.71%

11

Performance

Return on Average Tangible Equity

20.0%

15.0%

10.0%

5.0%

0.0%

2013 2014 2015 2016 2017

12.77%

(1) SNL Financial Custom Peer Group Holding Companies with $3-10 Billion of Assets through 3Q17.

(2) )Refer to appendix for reconciliation of non-GAAP financial measures

(3)This is a non-GAAP number that adjusts for the effects of a one-time, non-cash re-measurement of $13.4 million of

our deferred tax asset in 2017. Refer to appendix for reconciliation of non-GAAP financial measures.

Peer(1)

(2)

13.94% 14.02%

14.39%

13.71%

15.08%(3)

12

Non Interest Expense / Average Assets

3.5%

3.0%

2.5%

2.0%

1.5%

1.0%

0.5%

0.0%

2013 2014 2015 2016 2017

Expenses

(1) BHCPR Peer Group 2: Bank Holding Companies with $3-10 Billion of Assets through 3Q17.

Peer(1)2.61%

2.46%

2.30%

2.17%

2.10%

13

Expenses

Efficiency Ratio

70%

60%

50%

40%

2013 2014 2015 2016 2017

60.03%

58.67%

55.86%

54.06%

51.77%

Peer(1)

(1) BHCPR Peer Group 2: Bank Holding Companies with $3-10 Billion of Assets through 3Q17.

(2)Refer to appendix for reconciliation of Non-GAAP financial measures

(2)

14

Loan Growth

$6,000

$5,500

$5,000

$4,500

$4,000

$3,500

$3,000

$2,500

Lo

an

D

ol

la

rs

(in

m

ill

io

ns

)

2011 2012 2013 2014 2015 2016 2017

$3,133

$3,369

$3,568

$3,872

$5,063

$5,615

$5,766

Growth

CA

GR = 10.7

%

15

Mergers and expansion

S&T Bank Mainline Bank Gateway Bank Integrity Bank

$7,000

$6,000

$5,000

$4,000

$3,000

$

(M

ill

io

ns

)

2012 2013 2014 2015 2016 2017

4,159

4,533

$4,533

4,965

$4,965

5,452

6,943

$6,943

7,060

$7,060

242

126

$4,527

866

$6,318

North Shore Pittsburgh

LPO opened -

November 16, 2016

Mainline National Bank

acquired - March 9, 2012

Northeast Ohio

Loan Production Office

opened – August 27, 2012

Gateway Bank acquired

August 13, 2012

Western NY LPO

opened – March

23, 2015

Integrity Bank

acquired

March 4, 2015

Central Ohio LPO

opened – January 21, 2014

S&T Bank branch opens in

State College, PA

June 18, 2014

S&T Bank branch

opens in Akron, OH

December 21, 2015

16

Loan Growth by Market

2012 2017

Markets

Western NY Western NY

Central PA

Central PA

Southwestern PA Southwestern PA

Northeast OH

Northeast OH

Central OH Central OH

17

MSAs Locations Deposits(2) % Loans(2) %

Southwestern PA(1)

Pittsburgh

50 $3,849 70.9% $2,975 51.6%Altoona

Johnstown

Central PA

Lancaster

8 696 12.8% 838 14.5%Harrisburg

York

Other PA 123 2.3% 380 6.6%

Total PA 4,668 86.0% 4,193 72.7%

Northeast OH Akron 1 42 0.7% 314 5.4%

Cleveland

Central OH Columbus 1 31 0.6% 291 5.0%

Other OH 15 0.3% 159 2.8%

Total OH 88 1.6% 764 13.2%

Western NY Rochester 1 14 0.2% 373 6.5%

Buffalo

Other NY 19 0.4% 172 3.0%

Total NY 33 0.6% 545 9.5%

Total Other States 639 11.8% 264 4.6%

Total $5,428 100.0% $5,766 100.0%

S&T Operates in 5 Regional Markets

(1) Includes Pittsburgh, Altoona & Johnstown MSAs and Indiana, Clearfield & Jefferson Counties

(2) Based on customer residence

Dollars in millions

Markets

18

Projected Population Change 2018-2023

5%

4%

3%

2%

1%

0%

-1%

-2%

Southwestern PA Central PA Northeast OH Central OH Western NY

(0.66)%

1.99%

(0.14)%

4.01%

0.25%

3.50%

2,838 1,561 2,752 2,076 2,208

Source: SNL & Nielson 2017

Estimated

Population

2018

in 000s

Markets

U.S. Average

19

Median Household Income

$70,000

$60,000

$50,000

$40,000

$30,000

$20,000

$10,000

$0

Southwestern PA Central PA Northeast OH Central OH Western NY

$57,787

$64,246

$56,107

$63,009

$58,110

$61,045 U.S. Average

Source: SNL & Nielson 2017

Markets

20

Unemployment Rate

7%

6%

5%

4%

3%

2%

1%

Southwestern PA Central PA Northeast OH Central OH Western NY

4.37%

3.55%

4.55%

3.50%

5.20%

4.10%

Source: November 2017 Bureau of Labor Statistics; seasonally adjusted

U.S. Average

Markets

21

Stable regional markets with long-term oil & gas benefit

Markets

22

Asset quality

Nonperforming Loans / Total Loans

1.5%

1.0%

0.5%

0.0%

2013 2014 2015 2016 2017

0.63%

0.32%

0.70%

0.76%

(1) BHCPR Peer Group 2: Bank Holding Companies with $3-10 Billion of Assets through 3Q17

Peer(1) 0.42%

23

Asset quality

Net Charge Offs / Average Loans

0.50%

0.40%

0.30%

0.20%

0.10%

0.00%

2013 2014 2015 2016 2017

0.25%

0.00%

0.22%

0.25%

0.18%

(1) BHCPR Peer Group 2: Bank Holding Companies with $3-10 Billion of Assets through 3Q17

Peer(1)

24

Commercial

CRE

$2,686

60%

C&I

$1,433

32%

Asset quality

Loan Mix

As of 12.31.17

Total Portfolio Loans $5,761

Commercial

$4,504

78%

Consumer

$1,257

22%

Consumer

Mortgage/

Construction

$703

56%

Home Equity

$487

39%

Other

$67

5%

in $ Millions

Construction

$385

8%

25

Asset quality

Recreational

1%

Mobile Home Park

2%

Convenience Stores

2%

Restaurant

2%

Student Rentals

3% Dealerships

4%

Warehouse/Storage

4%

Other

5%

Manufacturing

6%

Retail Space

7%

Flex/Mixed Use

9%

Healthcare

9%

Strip Malls

9%

Hotels

10%

Multi-Family

12%

Offices

15%

Commercial Real Estate Diversification

As of 12.31.17

Total CRE $2,686 million

Pennsylvania

63%

Ohio

20%

New York

10%

West Virginia

2%

Other

5%

26

Asset quality

Commercial & Industrial Diversification

As of 12.31.17

Total C&I $1,433 million

Agriculture 1%

Arts, Enter. & Recr. 1%

Food Svs. 1%

Support Svs. 1%

Finance/Insurance 2%

Mining 3%

Transportation

3%

Professional Svs. 3%

Wholesale Trade 5%

Construction 5%

Other Svs. 5%

Educational Svs 7%

Health Care 11%

RE- Rent/Lease 11%

Public Admin. 12%

Manufacturing 13%

Retail Trade 15%

27

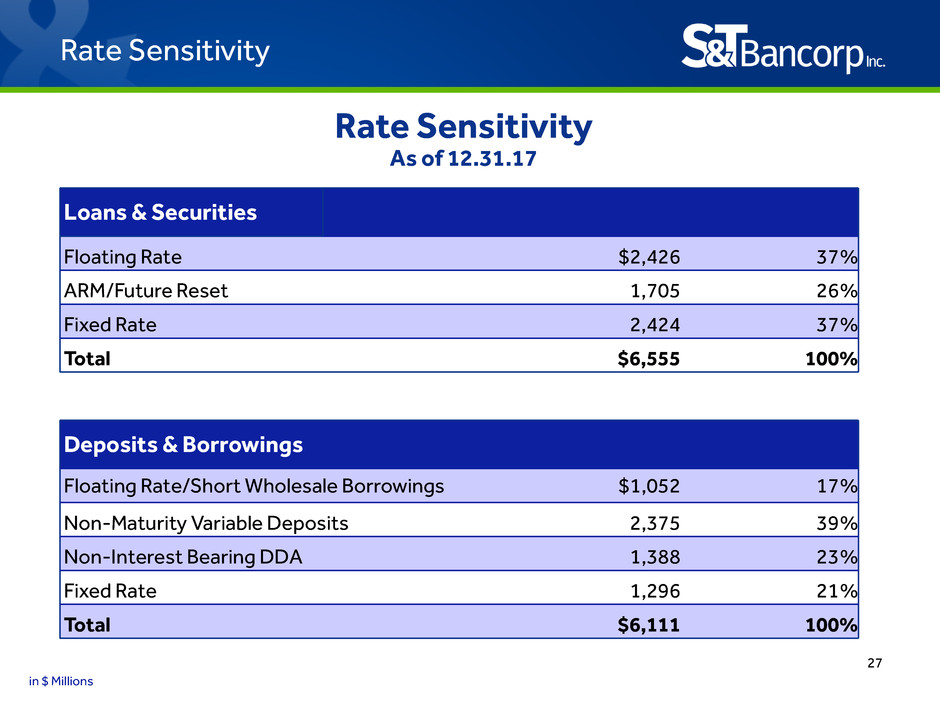

Loans & Securities

Floating Rate $2,426 37%

ARM/Future Reset 1,705 26%

Fixed Rate 2,424 37%

Total $6,555 100%

Deposits & Borrowings

Floating Rate/Short Wholesale Borrowings $1,052 17%

Non-Maturity Variable Deposits 2,375 39%

Non-Interest Bearing DDA 1,388 23%

Fixed Rate 1,296 21%

Total $6,111 100%

Rate Sensitivity

As of 12.31.17

in $ Millions

Rate Sensitivity

28

Senior Management

Name Title Years in Banking Years with S&T

Todd D. Brice President & CEO 32 32

Mark Kochvar Chief Financial Officer 31 25

David G. Antolik Chief Lending Officer 29 27

Ernest J. Draganza Chief Risk Officer 30 25

Patrick J. Haberfield Chief Credit Officer 30 7

David P. Ruddock Chief Operating Officer 32 32

Thomas J. Sposito, II Chief Corporate Develop Officer 32 5

Rebecca A. Stapleton Chief Banking Officer 29 29

Senior Management

29

Lines of Business

Commercial Banking

• 46 commercial bankers

• 19 business bankers

• C&I growth focused on privately held companies

with sales up to $150 million

• Regional team based approach to credit delivery

• Dedicated small business (B2B) delivery channel

• Dedicated treasury management team

Retail Banking

• Relationship driven

• Robust suite of deposit, loan, and digital products

• Over 132,000 households

• 60 locations; average deposit size of $90.5 million

• Technology driven with over 111,000 online banking

and over 65,000 mobile banking customers

• Solution center support

Wealth Management

• $2.0 billion AUA

• 4 divisions

• S&T Trust

• S&T Financial Services

• RIA/Stewart Capital Advisors

• Private Banking

• Annual revenue of $10.2 million

Lines of Business

30

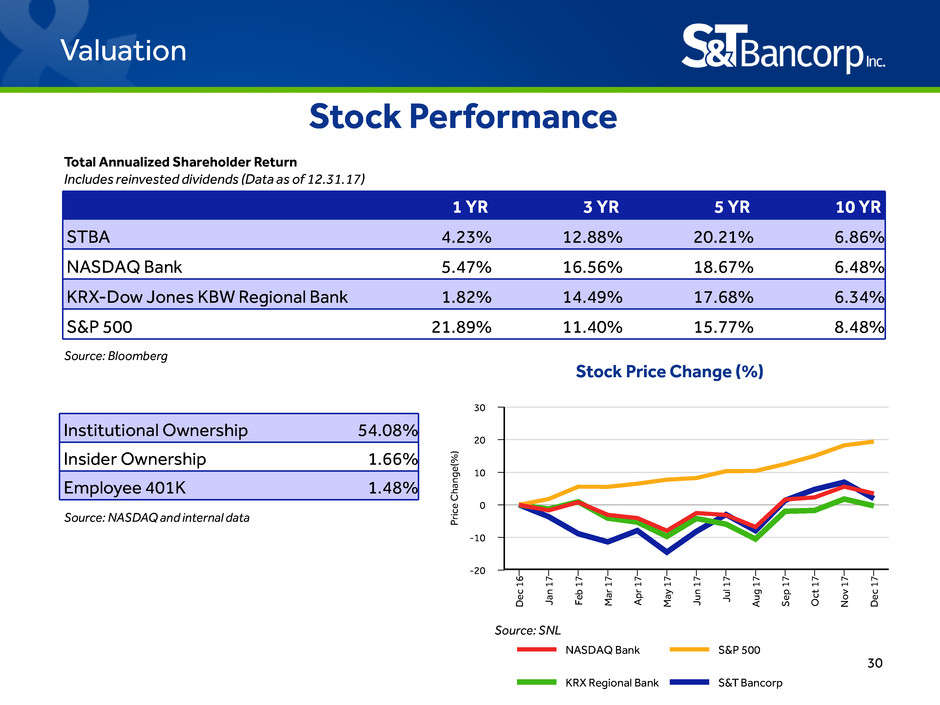

1 YR 3 YR 5 YR 10 YR

STBA 4.23% 12.88% 20.21% 6.86%

NASDAQ Bank 5.47% 16.56% 18.67% 6.48%

KRX-Dow Jones KBW Regional Bank 1.82% 14.49% 17.68% 6.34%

S&P 500 21.89% 11.40% 15.77% 8.48%

Valuation

NASDAQ Bank S&P 500

KRX Regional Bank S&T Bancorp

Stock Price Change (%)

30

20

10

0

-10

-20

Pr

ic

e

C

ha

ng

e(

%

)

D

ec

16

Ja

n

17

Fe

b

17

M

ar

17

Ap

r1

7

M

ay

17

Ju

n

17

Ju

l1

7

Au

g

17

Se

p

17

O

ct

17

N

ov

17

D

ec

17

Institutional Ownership 54.08%

Insider Ownership 1.66%

Employee 401K 1.48%

Source: NASDAQ and internal data

Source: Bloomberg

Total Annualized Shareholder Return

Includes reinvested dividends (Data as of 12.31.17)

Stock Performance

Source: SNL

31

The Right Size

• Big enough to:

• Provide full complement of products and services

• Access technology

• Access capital markets

• Attract talent

• Expand – mergers and acquisitions/de novo

• Small enough to:

• Stay close to our customers

• Understand our markets

• Be responsive

The Right Size

32

Income Statement

Dollars in thousands, except per share data

(1)These are non-GAAP numbers that adjust for the effects of a one-time, non-cash re-measurement of $13.4 million of our

deferred tax asset in 2017. Refer to appendix for reconciliation of non-GAAP financial measures.

2017

Excludes

DTA(1) 2016 2015 2014 2013

Net Interest Income $225,733 $203,259 $187,551 $148,042 $139,193

Noninterest Income 55,462 54,635 51,033 46,338 51,527

Total Revenue 281,195 257,894 238,584 194,380 190,720

Noninterest Expense 147,907 143,232 136,717 117,240 117,392

Provision for Loan Losses 13,883 17,965 10,388 1,715 8,311

Net Income Before Taxes 119,405 96,697 91,479 75,425 65,017

Taxes 46,437 33,004 25,305 24,398 17,515 14,478

Net Income $72,968 $86,401 $71,392 $67,081 $57,910 $50,539

Diluted Earnings per Share $2.09 $2.47 $2.05 $1.98 $1.95 $1.70

Financial Data

33

Balance Sheet

Dollars in thousands

2017 2016 2015 2014 2013

Securities $698,291 $693,487 $660,963 $640,273 $509,425

Interest-bearing Balances 61,965 87,201 41,639 57,048 53,594

Loans, Net 5,709,544 5,562,437 5,014,786 3,823,805 3,522,080

Other 590,455 599,928 600,966 443,560 448,091

Total Assets $7,060,255 $6,943,053 $6,318,354 $4,964,686 $4,533,190

Deposits $5,427,891 $5,272,377 $4,876,611 $3,908,842 $3,672,308

Borrowings 683,081 771,164 580,748 385,666 241,276

Other Liabilities 65,252 57,556 68,758 61,789 48,300

Equity 884,031 841,956 792,237 608,389 571,306

Total Liabilities & Equity $7,060,255 $6,943,053 $6,318,354 $4,964,686 $4,533,190

Financial Data

34

Net Interest Margin

(1)Refer to appendix for reconciliation of Non-GAAP financial measures

2017 2016 2015 2014 2013

Securities - FTE 2.48% 2.41% 2.48% 2.58% 2.64%

Loans - FTE 4.32% 4.08% 4.09% 4.06% 4.22%

Total Interest-earning Assets - FTE 4.09% 3.87% 3.86% 3.78% 3.86%

Deposits 0.62% 0.51% 0.37% 0.36% 0.42%

Borrowings 1.27% 0.86% 0.71% 0.91% 1.28%

Total Costing Liabilities 0.72% 0.55% 0.40% 0.41% 0.50%

Net Interest Margin – FTE(1) 3.56% 3.47% 3.56% 3.50% 3.50%

Purchase Accounting NIM – FTE(1) 3.53% 3.41% 3.44% 3.49% 3.49%

Financial Data

35

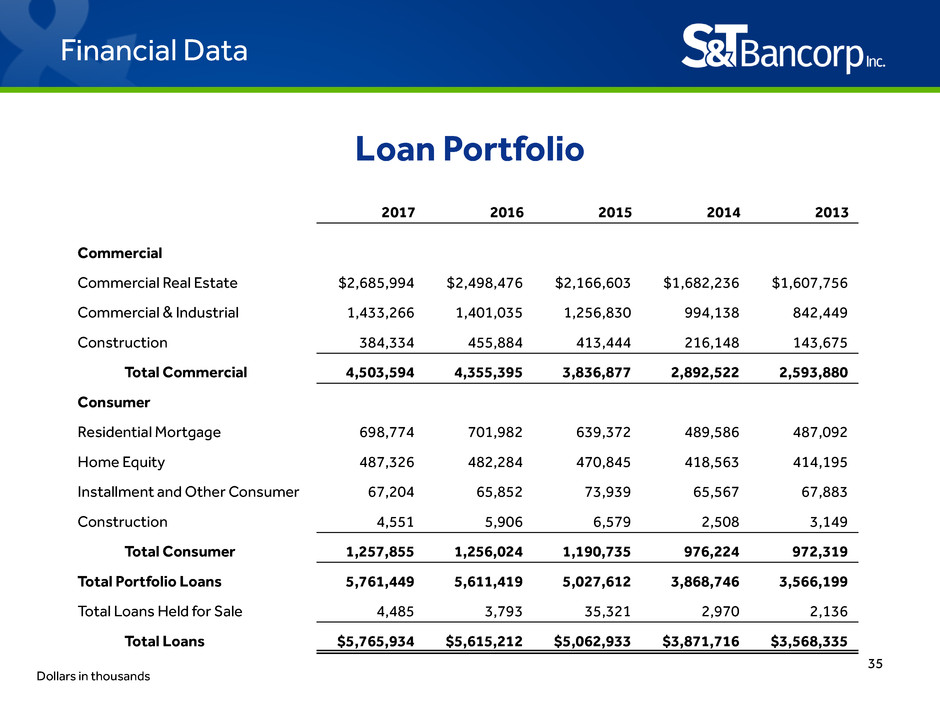

Loan Portfolio

Dollars in thousands

2017 2016 2015 2014 2013

Commercial

Commercial Real Estate $2,685,994 $2,498,476 $2,166,603 $1,682,236 $1,607,756

Commercial & Industrial 1,433,266 1,401,035 1,256,830 994,138 842,449

Construction 384,334 455,884 413,444 216,148 143,675

Total Commercial 4,503,594 4,355,395 3,836,877 2,892,522 2,593,880

Consumer

Residential Mortgage 698,774 701,982 639,372 489,586 487,092

Home Equity 487,326 482,284 470,845 418,563 414,195

Installment and Other Consumer 67,204 65,852 73,939 65,567 67,883

Construction 4,551 5,906 6,579 2,508 3,149

Total Consumer 1,257,855 1,256,024 1,190,735 976,224 972,319

Total Portfolio Loans 5,761,449 5,611,419 5,027,612 3,868,746 3,566,199

Total Loans Held for Sale 4,485 3,793 35,321 2,970 2,136

Total Loans $5,765,934 $5,615,212 $5,062,933 $3,871,716 $3,568,335

Financial Data

36

Asset Quality

Dollars in thousands

2017 2016 2015 2014 2013

Total Nonperforming Loans $23,938 $42,635 $35,382 $12,457 $22,454

Nonperforming Loans/Total Loans 0.42% 0.76% 0.70% 0.32% 0.63%

Nonperforming Assets/Total Loans + OREO 0.42% 0.77% 0.71% 0.33% 0.64%

Net Charge-offs (Recoveries)/Average Loans 0.18% 0.25% 0.22% 0.00% 0.25%

Allowance for Loan Losses/Total Portfolio Loans 0.98% 0.94% 0.96% 1.24% 1.30%

Allowance for Loan Losses/Nonperforming Loans 236% 124% 136% 385% 206%

Financial Data

37

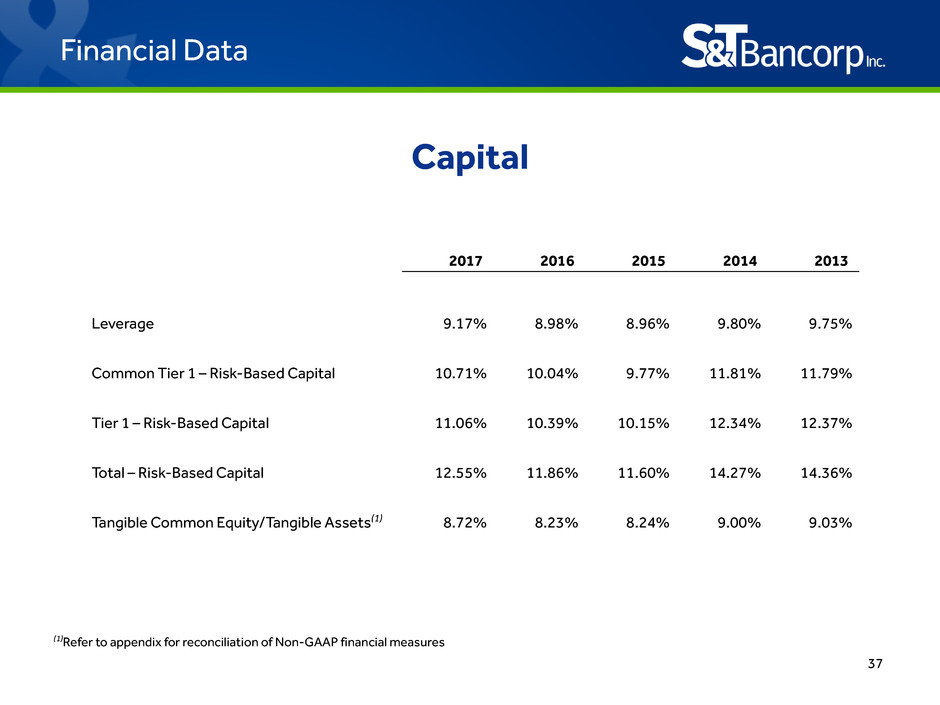

Capital

(1)Refer to appendix for reconciliation of Non-GAAP financial measures

2017 2016 2015 2014 2013

Leverage 9.17% 8.98% 8.96% 9.80% 9.75%

Common Tier 1 – Risk-Based Capital 10.71% 10.04% 9.77% 11.81% 11.79%

Tier 1 – Risk-Based Capital 11.06% 10.39% 10.15% 12.34% 12.37%

Total – Risk-Based Capital 12.55% 11.86% 11.60% 14.27% 14.36%

Tangible Common Equity/Tangible Assets(1) 8.72% 8.23% 8.24% 9.00% 9.03%

Financial Data

38

APPENDIX – Non-GAAP Measures

2017 2016 2015 2014 2013

Tangible shareholders' equity/tangible assets (non-GAAP)

Total Shareholders’ Equity (GAAP basis) $884,031 $841,956 $792,237 $608,389 $571,306

Less: goodwill and other intangible assets (295,347) (296,580) (298,289) (178,451) (179,580)

Tax effect of other intangible assets 1,287 1,719 2,284 921 1,316

Tangible shareholders' equity (non-GAAP) 589,971 547,095 496,232 430,859 393,042

Total assets (GAAP basis) 7,060,255 6,943,053 6,318,354 4,964,686 4,533,190

Less: goodwill and other intangible assets (295,347) (296,580) (298,289) (178,451) (179,580)

Tax effect of other intangible assets 1,287 1,719 2,284 921 1,316

Tangible assets (non-GAAP) $6,766,195 $6,648,192 $6,022,349 $4,787,156 $4,354,926

Tangible shareholders' equity/tangible assets (non-GAAP) 8.72% 8.23% 8.24% 9.00% 9.03%

Return on average tangible shareholders' equity (non-GAAP)

Net Income $72,968 $71,392 $67,081 $57,910 $50,539

Plus: amortization of intangibles 1,233 1,615 1,818 1,129 1,590

Tax effect of amortization of intangibles (432) (565) (636) (395) (556)

Net income before amortization of intangibles 73,769 72,442 68,263 58,644 51,573

Total average shareholders’ equity (GAAP Basis) 872,130 823,607 750,069 596,155 548,771

Less: average goodwill and other intangible assets (295,937) (297,377) (278,130) (178,990) (180,338)

Tax effect of other intangible assets 1,493 1,992 2,283 1,109 1,581

Tangible average shareholders' equity (non-GAAP) $577,686 $528,222 $474,222 $418,274 $370,014

Return on average tangible shareholders' equity (non-GAAP) 12.77% 13.71% 14.39% 14.02% 13.94%

Dollars in thousands

Appendix

39

APPENDIX – Non-GAAP Measures

2017 2016 2015 2014 2013

Efficiency ratio (non-GAAP)

Noninterest expense $147,907 $143,232 $136,717 $117,240 $117,392

Net interest income 225,733 203,259 187,551 148,042 139,193

Plus: taxable equivalent adjustment 7,493 7,043 6,123 5,461 4,850

Net interest income (FTE) (non-GAAP) 233,226 210,302 193,674 153,503 144,043

Noninterest income 55,462 54,635 51,033 46,338 51,527

Less: securities (gains) losses, net (3,000) — 34 (41) (5)

Net interest income (FTE) (non-GAAP) plus noninterest income $285,688 $264,937 $244,741 $199,800 $195,565

Efficiency ratio (non-GAAP) 51.77% 54.06% 55.86% 58.67% 60.03%

Appendix

40

APPENDIX – Non-GAAP Measures

2017 2016 2015 2014 2013

Net Interest Margin Rate (FTE) (Non-GAAP)

Total interest income $260,642 $227,774 $203,548 $160,523 $153,756

Less: interest expense (34,909) (24,515) (15,997) (12,481) (14,563)

Net interest income per consolidated statements of net income 225,733 203,259 187,551 148,042 139,193

Plus: taxable equivalent adjustment 7,493 7,043 6,123 5,461 4,850

Net interest income (FTE) (non-GAAP) 233,226 210,302 193,674 153,503 144,043

Purchase accounting adjustment (1,839) (2,952) (6,202) (109) (458)

Purchase accounting net interest income (FTE) (non-GAAP) $231,387 $207,350 $187,472 $153,394 $143,585

Average interest earning assets $6,549,821 $6,067,151 $5,432,862 $4,386,799 $4,111,281

Net Interest Margin 3.45 % 3.35 % 3.45 % 3.37 % 3.39 %

Adjustment to FTE Basis 0.11 % 0.12 % 0.11 % 0.13 % 0.11 %

Net Interest Margin (FTE) (non-GAAP) 3.56 % 3.47 % 3.56 % 3.50 % 3.50 %

Purchase accounting adjustment (0.03)% (0.06)% (0.12)% (0.01)% (0.01)%

Purchase accounting NIM – FTE (non-GAAP) 3.53 % 3.41 % 3.44 % 3.49 % 3.49 %

Dollars in thousands

Appendix

41

APPENDIX – Non-GAAP Measures

2017 2017

Return on Average Equity Return on Tangible Shareholders' Equity

Net Income $72,968 Net Income $72,968

Plus: DTA re-measurement 13,433 Plus: DTA re-measurement 13,433

Adjusted net income (non-GAAP) 86,401 Adjusted net income (non-GAAP) 86,401

Average assets 872,130 Plus: amortization of intangibles 1,233

Plus: DTA re-measurement 589 Tax effect of amortization of intangibles (432)

Average assets (non-GAAP) 872,719 Adjusted net income before amortization of intangibles 87,202

Return on average equity (non-GAAP) 9.90% Average total shareholders' equity 872,130

Plus: DTA re-measurement 589

Less: average goodwill and other intangible assets (295,937)

Return on Average Assets Tax effect of average goodwill and other intangible assets 1,493

Net Income $72,968 Average tangible equity (non-GAAP) $578,275

Plus: DTA re-measurement 13,433 Return on average tangible equity (non-GAAP) 15.08%

Adjusted net income (non-GAAP) 86,401

Diluted Earnings Per Share

Average assets $7,060,232 Net Income $72,968

Plus: DTA re-measurement 589 Plus: DTA re-measurement 13,433

Average assets (non-GAAP) 7,060,821 Adjusted net income (non-GAAP) 86,401

Return on average assets (non-GAAP) 1.22% Average shares outstanding - diluted 34,955

Diluted earnings per share (non-GAAP) $2.47

Dollars in thousands

Appendix

MEMBER FDIC

Full Year 2017