Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Hamilton Lane INC | earningsrelease8-kq32018.htm |

HAMILTON LANE INCORPORATED REPORTS THIRD QUARTER FISCAL 2018 RESULTS

BALA CYNWYD, PENN. – February 6, 2018 – Leading private markets asset management firm Hamilton Lane Incorporated (NASDAQ: HLNE) today reported its results for the third quarter of fiscal year 2018, the period ended December 31, 2017.

Hamilton Lane CEO Mario Giannini commented: “2017 was a year of milestones for our firm. We continued to grow our global team, expanded our geographic presence and investment capabilities, and invested more in technology; all to better serve our clients around the world. We also successfully completed an initial public offering, welcoming new shareholders to the Hamilton Lane family.

As a result of our expanding client base, our asset footprint reached a new high of approximately $424 billion in the third quarter, and each of our offerings experienced year-over-year revenue growth. With that, we remain optimistic about the current business environment and our ability to execute on a strategy that will continue to meet clients’ private markets needs and drive shareholder value.”

Hamilton Lane issued a full detailed presentation of its third quarter fiscal 2018 results, which can be viewed at http://ir.hamiltonlane.com.

Dividend

Hamilton Lane has declared a quarterly dividend of $0.175 per share of Class A common stock to record holders at the close of business on March 15, 2018. This dividend will be paid on April 5, 2018.

Conference Call

Hamilton Lane will discuss third quarter fiscal 2018 results in a webcast and conference call today, Tuesday, February 6, 2018, at 11:00 a.m. Eastern Time. The call will be broadcast live via a webcast, which may be accessed on Hamilton Lane’s Investor Relations website. The call may also be accessed by dialing (844) 579-6824 inside the U.S., or (734) 385-2616 for international callers. The conference ID is 1497296.

A replay of the webcast will be available on Hamilton Lane’s Investor Relations website approximately two hours after the live broadcast for a period of one year and can be accessed in the same manner as the live webcast at the Hamilton Lane Investor Relations website.

About Hamilton Lane

Hamilton Lane (NASDAQ: HLNE) is a leading alternative investment management firm providing innovative private markets solutions to sophisticated investors around the world. Dedicated to private markets investing for 26 years, the firm currently employs approximately 340 professionals operating in offices throughout the U.S., Europe, Asia-Pacific, Latin America and the Middle East. With approximately $424 billion in total assets under management and supervision as of December 31, 2017, Hamilton Lane offers a full range of investment products and services that enable clients to participate in the private markets asset class on a global and customized basis. For more information, please visit www.hamiltonlane.com or follow Hamilton Lane on Twitter: @hamilton_lane.

Forward-Looking Statements

Some of the statements in this release may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Words such as “will,” “expect,” “believe” and similar expressions are used to identify these forward-looking statements. Forward-looking statements discuss management’s current expectations and projections relating to our financial position, results of operations,

plans, objectives, future performance and business. All forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different, including risks relating to our ability to manage growth, fund performance, risk, changes in our regulatory environment and tax status; market conditions generally; our ability to access suitable investment opportunities for our clients; our ability to maintain our fee structure; our ability to attract and retain key employees; our ability to manage our obligations under our debt agreements; defaults by clients and third-party investors on their obligations to us; our ability to comply with investment guidelines set by our clients; our ability to consummate planned acquisitions and successfully integrate the acquired business with ours; the time, expense and effort associated with being a newly public company; and our ability to receive distributions from Hamilton Lane Advisors, L.L.C. to fund our payment of dividends, taxes and other expenses.

The foregoing list of factors is not exhaustive. For more information regarding these risks and uncertainties as well as additional risks that we face, you should refer to the “Risk Factors” detailed in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended March 31, 2017 and in our subsequent reports filed from time to time with the Securities and Exchange Commission. The forward-looking statements included in this release are made only as of the date hereof. We undertake no obligation to update or revise any forward-looking statement as a result of new information or future events, except as otherwise required by law.

Investor Contact

Demetrius Sidberry

dsidberry@hamiltonlane.com

+1 610 617 6768

Media Contact

Kate McGann

kmcgann@hamiltonlane.com

+1 610 617 5841

Fiscal Year 2018 Third Quarter Results

Earnings Presentation - February 6, 2018

Page 2

Today’s Speakers

Hartley Rogers

Chairman

Randy Stilman

Chief Financial Officer

Demetrius Sidberry

Head of Investor Relations

Erik Hirsch

Vice Chairman

Page 3

Period Highlights

• Total asset footprint (assets under management/advisement) reached a record

amount of approximately $424 billion, growing 28% compared to December 31, 2016

• Assets under management and fee-earning assets under management were

approximately $50 billion and $30 billion, respectively, as of December 31, 2017,

increases of 25% and 13%, respectively, compared to December 31, 2016

• Declared a quarterly dividend of $0.175 per share of Class A common stock to record

holders at the close of business on March 15, 2018

Business

Performance

Financial

Results

Dividend

USD in millions except per share amounts Q3 FY18 QTD Q3 FY18 YTD vs. Q3 FY17 YTD

Management and advisory fees $48.3 $146.3 16%

GAAP net income $(6.3) $3.8 N/A1

GAAP EPS $(0.35) $0.21 N/A1

Non-GAAP EPS2 $0.46 $1.05 N/A1

Fee Related Earnings2 $19.4 $62.4 17%

Adjusted EBITDA2 $36.1 $85.1 37%

1 Figures not available as a result of the company going public after the stated period.

2 Non-GAAP earnings per share, Fee Related Earnings and Adjusted EBITDA are non-GAAP financial measures. For the reconciliations of our non-GAAP

financial measures to the most directly comparable GAAP financial measures, see pages 21 and 27 of this presentation.

Page 4

Growing Asset Footprint & Influence

$36 $51

$77 $79

$95 $81

$129

$147 $147

$189 $205

$292

$374

$6

$7

$11 $13

$16 $19

$22

$24 $30

$32

$35

$40

$50

$0

$50

$100

$150

$200

$250

$300

$350

$400

$450

$500

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Total AUA Total AUM

Total Assets Under Management/Advisement ($B)1

1 Data as of calendar year end 12/31 unless otherwise noted. Numbers may not tie due to rounding.

CAG

R: 21

%

$424B

AUM & AUAQ-o-Q Growth

AUA: 5%

AUM: 5%

Page 5

Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Dec-16 Dec-17

Customized Separate Accounts Specialized Funds

CAGR: 1

4%

Total Fee-Earning Assets Under Management ($B)1

$0

$5

$10

$15

$20

$25

$30

$35

$40

$11

$5

$16

$14

$5

$19

$16

$6

$22

$17

$7

$24

$18

$9

$27

$20

$9

$30

$18

$8

$26

13%

Y-o-Y Growth

0.58% 0.55% 0.56% 0.57% 0.58%0.56%

1 Data as of fiscal year end 3/31 unless otherwise noted. Numbers may not tie due to rounding.

Total Management Fee Revenues as a % of Average FEAUM

Fee-Earning AUM Driving Revenues

...and annual fee rates are stable

Fee-earning AUM growth continues...

* Customized Separate Accounts:

• New client wins

• Client re-ups

? ?c?uisition of ?eal ?ssets firm?

• Closed Q2 FY18

• ?3 re?ects ??3??? of incremental ?????

• ?????? of ????? in total ac?uired

Drivers of Growth

Page 6

Year in Review: Calendar 2017

Expanding Client Base and Asset Footprint

• New client adds and separate account re-ups continue

• Completed the raise of our latest flagship secondary fund, Hamilton Lane Secondary Fund IV, L.P., which

attracted $1.9 billion in commitments--our largest specialized product to date

• Closed our credit-focused annual series fund, Hamilton Lane Strategic Opportunities Fund 2017, on $435

million in commitments, which is more than twice the size of the prior year’s fund

Investment Performance

• 522 bps of realized outperformance vs. MSCI World PME over a 10 year span1

Growing Global Presence

• Continued expanding our global footprint with the addition of three new offices in Sydney, Australia

Munich, Germany and Portland, Oregon

• Approximately 340 professionals dedicated to private markets around the globe

Continuation of Data & Technology Initiatives

• Partnered with Ipreo to form Private Market Connect, a data collection and management initiative

Transacting in Areas of Growth

• Closed the acquisition of Real Asset Portfolio Management, LLC, which broadens the firm’s real

assets capabilities

Enhanced Governance

• Added two new independent board members

Driving Shareholder Returns

• Declared dividends in our first four quarters as a public company

• Meaningful share price appreciation since the IPO

1 As of June 30, 2017

Page 7

It All Comes Back to Our Culture

People matterKeeping clients in sight Award-winning culture

2012 -

2017

2017

Page 8

The investable universe of private companies continues to grow

Private Markets Opportunity Set

Public Markets Growth

Source: World Bank, Capital IQ (October 2017)

Growth in Number of Public Companies

Growth in Listed Equities Market Cap

+5%

+46%

0%

40%

80%

120%

160%

200%

2011 2016

Private Markets Growth

0%

40%

80%

120%

160%

200%

+180%

+42%

2011 2016

+29%

Source: Hamilton Lane Data via Cobalt, Pitchbook, Capital IQ (October 2017)

Growth in Number of U.S. Private Equity-Backed Companies

Growth in Private Markets NAV

Growth in Number of Private Companies Globally

Public vs. Private Company Valuations

$0

$200

$400

$600

$800

$1,000

$200

$849

Median 2017 US LBO Size Median US-Listed Company

Source: Pitchbook, Capital IQ (January 2018). Median 2017 LBO size as of 9/30/2017.

Median US-Listed company size as of 1/9/2018

U

SD in

M

ill

io

n

s

Page 9

FAQs

1

AUM Growth

2

Incentive Fee

Revenue

3

Tax Reform Impact

Page 10

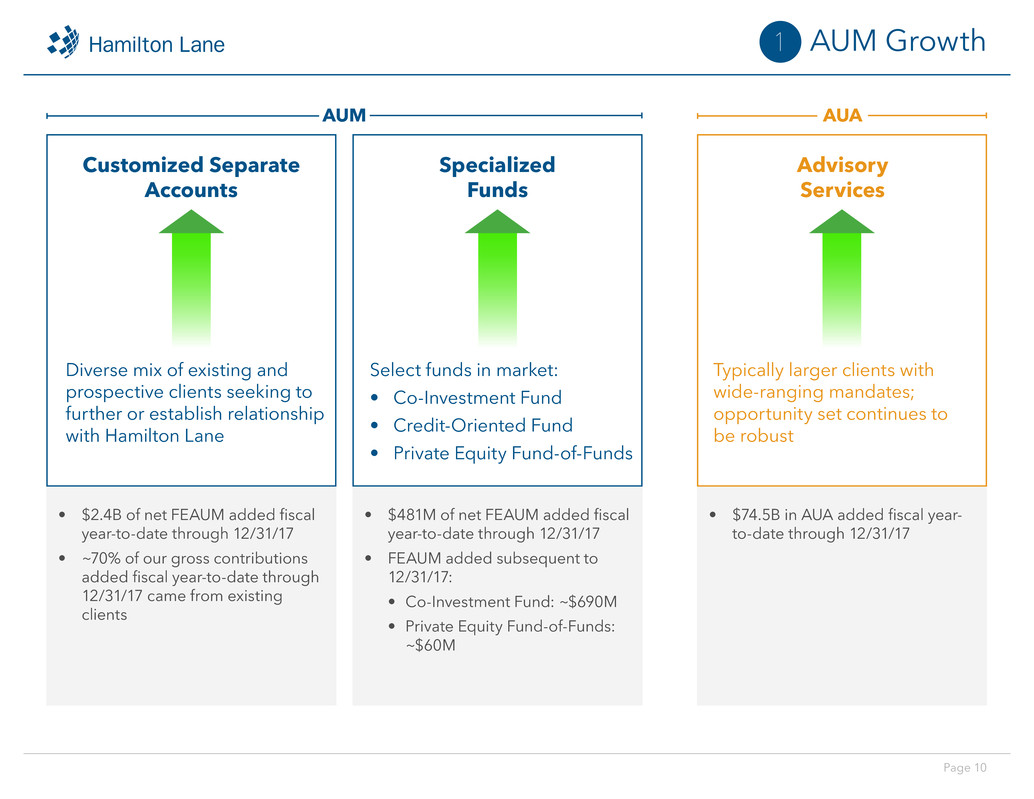

AUM Growth

Customized Separate

Accounts

Specialized

Funds

Advisory

Services

Diverse mix of existing and

prospective clients seeking to

further or establish relationship

with Hamilton Lane

Select funds in market:

• Co-Investment Fund

• Credit-Oriented Fund

• Private Equity Fund-of-Funds

Typically larger clients with

wide-ranging mandates;

opportunity set continues to

be robust

1

• $2.4B of net FEAUM added fiscal

year-to-date through 12/31/17

• ~70% of our gross contributions

added fiscal year-to-date through

12/31/17 came from existing

clients

• $481M of net FEAUM added fiscal

year-to-date through 12/31/17

• FEAUM added subsequent to

12/31/17:

• Co-Investment Fund: ~$690M

• Private Equity Fund-of-Funds:

~$60M

• $74.5B in AUA added fiscal year-

to-date through 12/31/17

AUM AUA

Page 11

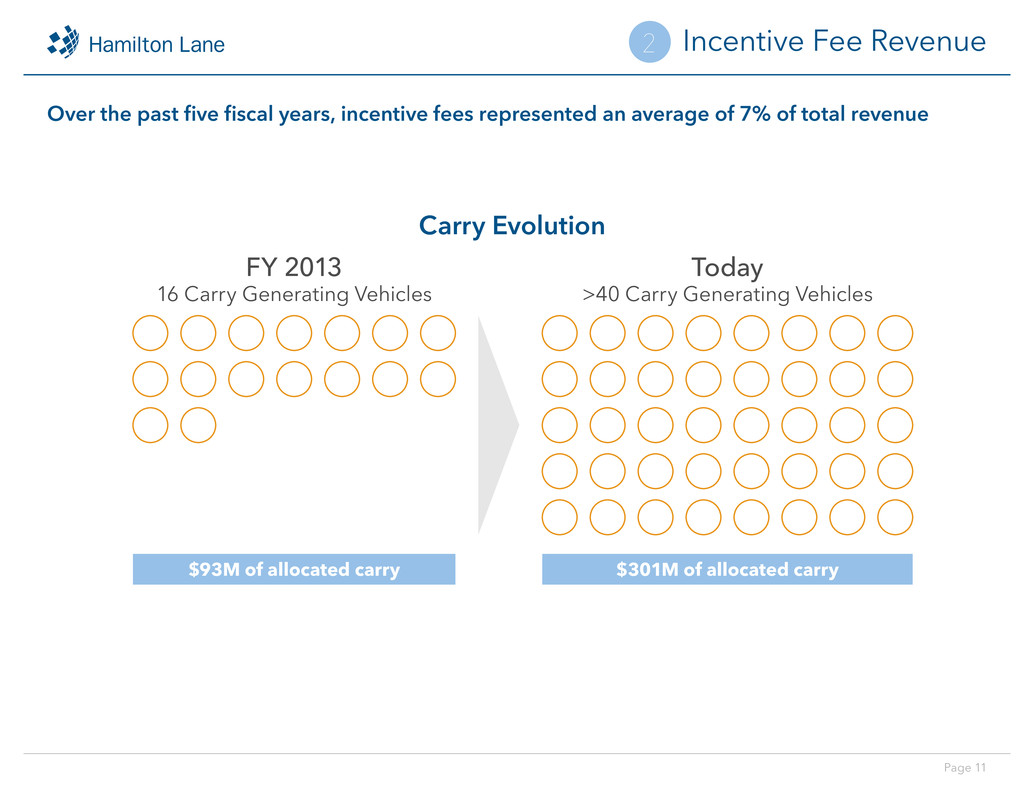

Over the past five fiscal years, incentive fees represented an average of 7% of total revenue

Incentive Fee Revenue2

FY 2013

16 Carry Generating Vehicles

Today

>40 Carry Generating Vehicles

$93M of allocated carry $301M of allocated carry

Carry Evolution

Page 12

Tax Reform - Impact on the Private Markets3

• Several items in the tax reform bill will significantly impact the profitability and cash flow of private deals. Some

will result in lower tax expenses while others might raise them. For domestically-focused U.S. companies we

expect the overall impact to be positive, but much depends on the level of debt relative to profitability and the

capital intensity of the business.

• Overall, we expect the improvements in the tax rate and expensing capital goods to more than outweigh the

cost of limiting interest deductibility. The largest gains accrue to those companies with little interest expense

relative to EBIT and those with high current capital spending.

• One area of concern would be companies with high interest expense to EBITDA.

These companies may already be experiencing stress, and with the tax reform

they would lose some interest deduction. The associated negative cash flow

impact only worsens their stress.

“Private equity is very much a big

winner out of the reform”

- The Wall Street Journal 1/24/18

Our analysis suggests

values of private-equity-

owned companies

will get a boost of 3%

to 17% on average

Page 13

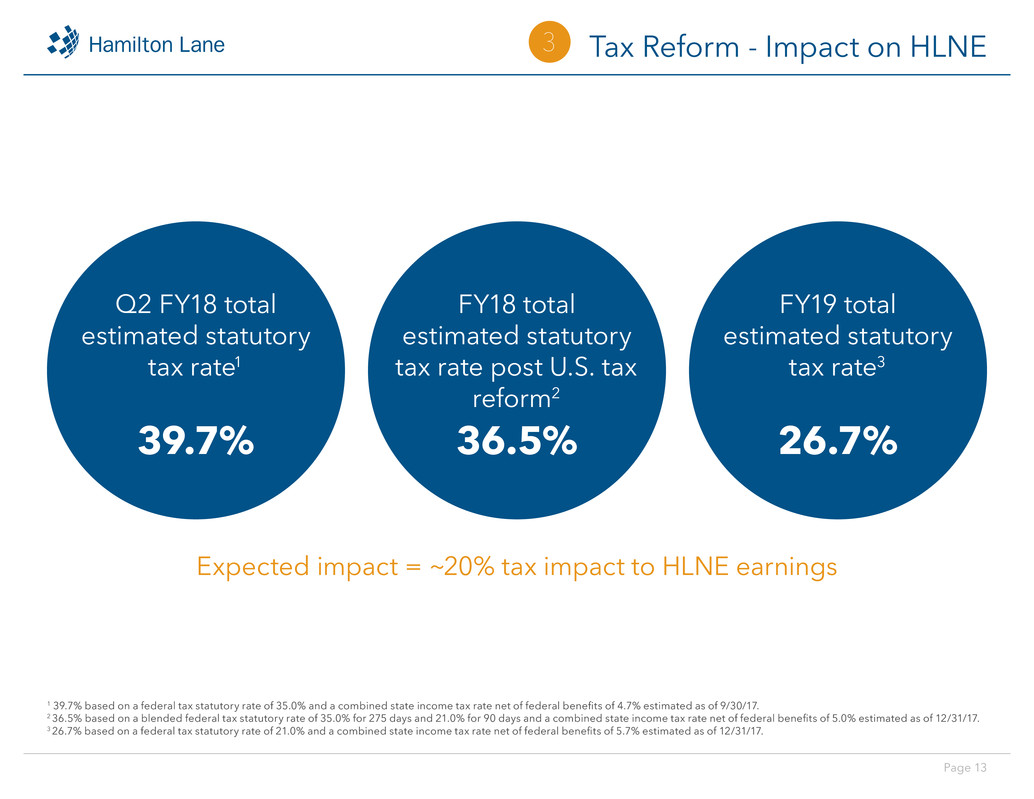

Tax Reform - Impact on HLNE3

Q2 FY18 total

estimated statutory

tax rate1

39.7%

FY18 total

estimated statutory

tax rate post U.S. tax

reform2

36.5%

FY19 total

estimated statutory

tax rate3

26.7%

Expected impact = ~20% tax impact to HLNE earnings

1 39.7% based on a federal tax statutory rate of 35.0% and a combined state income tax rate net of federal benefits of 4.7% estimated as of 9/30/17.

2 36.5% based on a blended federal tax statutory rate of 35.0% for 275 days and 21.0% for 90 days and a combined state income tax rate net of federal benefits of 5.0% estimated as of 12/31/17.

3 26.7% based on a federal tax statutory rate of 21.0% and a combined state income tax rate net of federal benefits of 5.7% estimated as of 12/31/17.

Financial Highlights

Page 15

Revenues continue to be driven primarily by management and advisory fees

Consolidated Revenues

• Represented an average of 93% of total revenues over the

past five fiscal years

• Y-o-Y growth of 16%

• Growth across all management and advisory fee offerings

• 19% Y-o-Y growth in specialized funds’ management fees

driven by $0.5B raised in Secondary Fund IV during the

nine months ended December 31, 2017

• Incentive fees derived from a highly diversified pool of

assets and funds

• Allocated carried interest of $301M as of 12/31/17

diversified across +3,000 assets and ~40 funds

• Y-o-Y growth in incentive fees driven by $14.6M recognition

of deferred carried interest from Co-Investment Fund II

• Recognition of deferred carried interest positively impacted

Q3’s EPS by $0.16

• Total revenues increased by 25%, driven by growth across

core offerings

0

50

100

150

200

FY13 FY17Q3 FY17 Q3 FY18

$113

$173

Management and Advisory Fees

Incentive Fees

Total Revenues

$126

$146

Y-o-Y Growth: 16% CAGR: 11%

0

50

100

150

200

FY13 FY17Q3 FY17 Q3 FY18

$6 $7$7

$20

Y-o-Y Growth: 193% CAGR: 4%

0

50

100

150

200

FY13 FY17Q3 FY17 Q3 FY18

$119

$180

$133

$166

Y-o-Y Growth: 25% CAGR: 11%

Long-Term GrowthYTD

Long-Term GrowthYTD

Long-Term GrowthYTD

U

SD in

M

ill

io

ns

U

SD in

M

ill

io

ns

U

SD in

M

ill

io

ns

Page 16

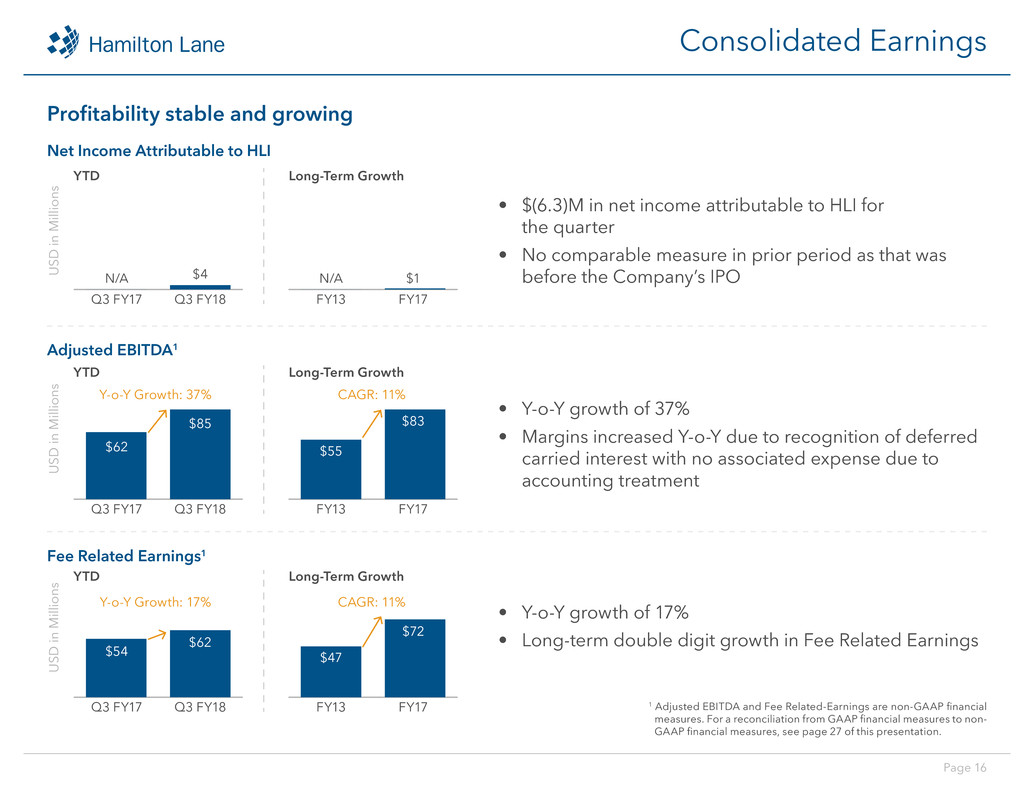

Profitability stable and growing

Consolidated Earnings

• Y-o-Y growth of 37%

• Margins increased Y-o-Y due to recognition of deferred

carried interest with no associated expense due to

accounting treatment

• $(6.3)M in net income attributable to HLI for

the quarter

• No comparable measure in prior period as that was

before the Company’s IPO

• Y-o-Y growth of 17%

• Long-term double digit growth in Fee Related Earnings

1 Adjusted EBITDA and Fee Related-Earnings are non-GAAP financial

measures. For a reconciliation from GAAP financial measures to non-

GAAP financial measures, see page 27 of this presentation.

Adjusted EBITDA1

Fee Related Earnings1

U

SD in

M

ill

io

ns

Long-Term GrowthYTD

U

SD in

M

ill

io

ns

FY13 FY17Q3 FY17 Q3 FY18

$55

$83

$62

$85

Y-o-Y Growth: 37% CAGR: 11%

Net Income Attributable to HLI

U

SD in

M

ill

io

ns

Long-Term GrowthYTD

FY13 FY17Q3 FY17 Q3 FY18

N/A N/A$4 $1

Long-Term GrowthYTD

FY13 FY17Q3 FY17 Q3 FY18

$47

$72

$54

$62

Y-o-Y Growth: 17% CAGR: 11%

Page 17

Strong balance sheet with investments in our own products and a modest amount

of leverage...

Other Key Items

• Vast majority of our investments are those made

alongside our clients

• For 12/31/17, the total investment balance consisted of

~$114M in equity method investments in our funds and

~$17M in technology-related investments

• Principal amount of debt outstanding of $85.0M

as of 12/31/17

$0

$30

$60

$90

$120

$150

Mar-13 Mar-14 Mar-15 Mar-16 Mar-17

$78

$92

$103 $103

$120

Dec-17

$131

Investments

$0

$1

$2

$3

$4

Dec-17

0.8x

Mar-17

1.0x

Gross Leverage Profile1

U

SD in

M

ill

io

ns

X T

TM

A

d

ju

st

ed

E

B

IT

D

A

1 Ratio of principal amount of debt outstanding to trailing twelve months Adjusted EBITDA. See page 28 for additional detail on calculation of gross leverage ratio.

Fiscal Year 2018 Third Quarter Results

Earnings Presentation - February 6, 2018

Appendix

Page 20

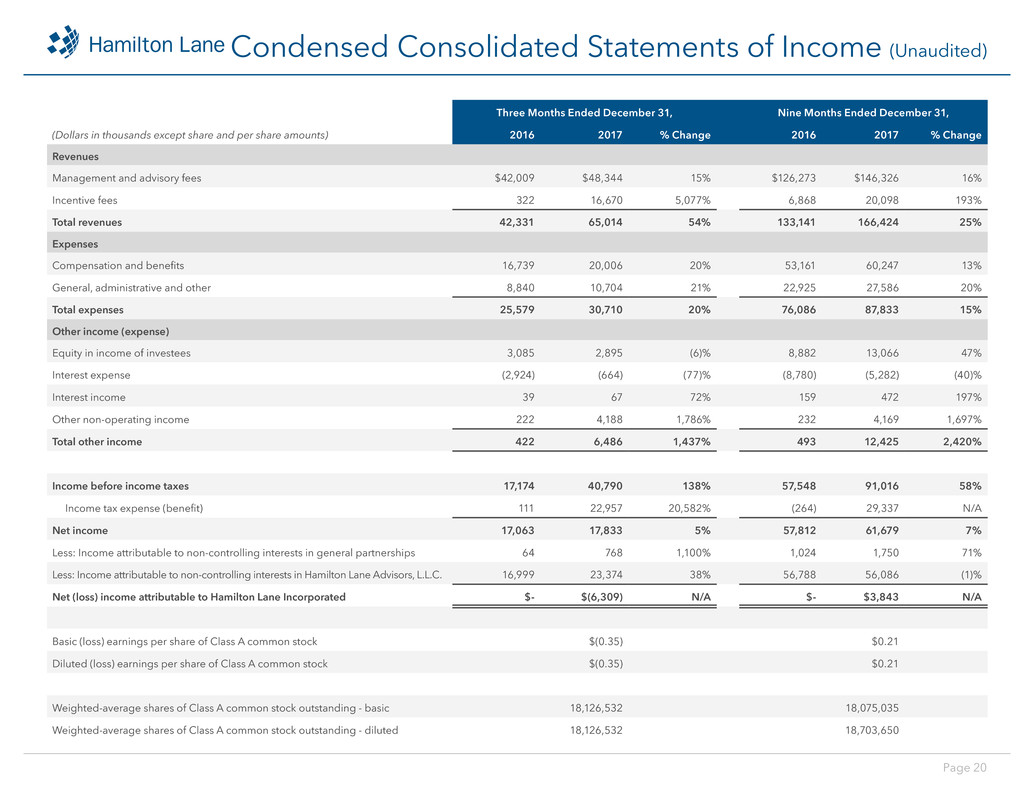

Condensed Consolidated Statements of Income (Unaudited)

Three Months Ended December 31, Nine Months Ended December 31,

(Dollars in thousands except share and per share amounts) 2016 2017 % Change 2016 2017 % Change

Revenues

Management and advisory fees $42,009 $48,344 15% $126,273 $146,326 16%

Incentive fees 322 16,670 5,077% 6,868 20,098 193%

Total revenues 42,331 65,014 54% 133,141 166,424 25%

Expenses

Compensation and benefits 16,739 20,006 20% 53,161 60,247 13%

General, administrative and other 8,840 10,704 21% 22,925 27,586 20%

Total expenses 25,579 30,710 20% 76,086 87,833 15%

Other income (expense)

Equity in income of investees 3,085 2,895 (6)% 8,882 13,066 47%

Interest expense (2,924) (664) (77)% (8,780) (5,282) (40)%

Interest income 39 67 72% 159 472 197%

Other non-operating income 222 4,188 1,786% 232 4,169 1,697%

Total other income 422 6,486 1,437% 493 12,425 2,420%

Income before income taxes 17,174 40,790 138% 57,548 91,016 58%

Income tax expense (benefit) 111 22,957 20,582% (264) 29,337 N/A

Net income 17,063 17,833 5% 57,812 61,679 7%

Less: Income attributable to non-controlling interests in general partnerships 64 768 1,100% 1,024 1,750 71%

Less: Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 16,999 23,374 38% 56,788 56,086 (1)%

Net (loss) income attributable to Hamilton Lane Incorporated $- $(6,309) N/A $- $3,843 N/A

Basic (loss) earnings per share of Class A common stock $(0.35) $0.21

Diluted (loss) earnings per share of Class A common stock $(0.35) $0.21

Weighted-average shares of Class A common stock outstanding - basic 18,126,532 18,075,035

Weighted-average shares of Class A common stock outstanding - diluted 18,126,532 18,703,650

Page 21

Non-GAAP Financial Measures

Three Months Ended December 31, Nine Months Ended December 31,

(Dollars in thousands except share and per share amounts) 2016 2017 % Change 2016 2017 % Change

Adjusted EBITDA

Management and advisory fees $42,009 $48,344 15% $126,273 $146,326 16%

Total expenses 25,579 30,710 20% 76,086 87,833 15%

Less:

Incentive fee related compensation1 (158) (1,027) 550% (3,370) (2,709) (20)%

Contingent compensation related to acquisition - (771) N/A - (1,198) N/A

Management fee related expenses 25,421 28,912 14% 72,716 83,926 15%

Fee Related Earnings $16,588 $19,432 17% $53,557 $62,400 17%

Incentive fees2 322 16,670 5,077% 6,868 20,098 193%

Incentive fees attributable to non-controlling interests2 - (834) N/A - (834) N/A

Incentive fee related compensation1 (158) (1,027) 550% (3,370) (2,709) (20)%

Interest income 39 67 72% 159 472 197%

Equity-based compensation 1,169 1,284 10% 3,506 4,272 22%

Depreciation and amortization 467 486 4% 1,440 1,396 (3)%

Adjusted EBITDA $18,427 $36,078 96% $62,160 $85,095 37%

Adjusted EBITDA margin 44% 55% 47% 51%

Non-GAAP earnings per share reconciliation

Net (loss) income attributable to Hamilton Lane Incorporated $(6,309) $3,843

Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 23,374 56,086

Income tax expense 22,957 29,337

Write-off of deferred financing costs3 - 2,544

Impact of Tax Act on TRA liability4 (4,186) (4,186)

Impact of Tax Act on IPO related compensation5 (669) (669)

Contingent compensation related to acquisition 771 1,198

Adjusted pre-tax net income 35,938 88,153

Adjusted income taxes6 (11,450) (32,185)

Adjusted net income $24,488 $55,968

Adjusted shares7 53,316,965 53,142,319

Non-GAAP earnings per share $0.46 $1.05

1 Incentive fee related compensation includes incentive fee compensation expense as well as bonus and other revenue sharing allocated to carried interest classified as base compensation.

2 Incentive fees for the three and nine months ended December 31, 2017 include $14.6 million of non-cash carry related to the $41.5 million of incentive fee payments received in fiscal 2016. Of the $14.6 million, $13.7 million is included in net income and

$0.8 million is attributable to non-controlling interests.

3 Represents write-off of debt issuance costs and realized loss on interest rate caps related to the payoff of our predecessor credit facility during the nine months ended December 31, 2017.

4 Represents change in payable to related parties pursuant to the TRA as a result of being re-measured due to the tax rate change. The change in liability was recorded to other non-operating income in the Condensed Consolidated Statements of Income.

5 Represents reduction in expense due to the impact of tax rate changes on the $1.9 million expense accrued in fiscal 2017 to induce members of HLA to exchange their HLA units for HLI common stock in the Reorganization.

6 Represents corporate income taxes at our estimated statutory tax rate of 36.51% for the nine months ended December 31, 2017 applied to adjusted pre-tax net income. The 36.51% is based on a federal tax statutory rate of 31.55% and a combined state

income tax rate net of federal benefits of 4.96%.

7 Assumes the full exchange of HLA Class B and Class C units for HLI Class A common stock.

Page 22

Management and Advisory Fees

Three Months Ended December 31, Nine Months Ended December 31,

(Dollars in thousands) 2016 2017 % Change 2016 2017 % Change

Management and advisory fees

Customized separate accounts $17,826 $19,860 11% $52,794 $58,253 10%

Specialized funds 17,124 19,132 12% 53,407 63,582 19%

Advisory and reporting 6,021 7,479 24% 17,680 20,958 19%

Distribution management 1,038 1,873 80% 2,392 3,533 48%

Total management and advisory fees $42,009 $48,344 15% $126,273 $146,326 16%

Specialized

funds

44%

Customized

separate

accounts

40%

Advisory

and reporting

14%

Distribution

management

2%

Nine Months Ended December 31, 2017

Page 23

Incentive Fees

(Dollars in thousands)

Three Months Ended December 31, Nine Months Ended December 31,

2016 2017 % Change 2016 2017 % Change

Incentive fees

Secondary Fund II $469 $1,124 140% $2,110 $2,239 6%

Co-investment Fund II - 14,579 N/A - 14,579 N/A

Other specialized funds 86 868 909% 4,174 862 (79)%

Customized separate accounts (233) 99 N/A 584 2,418 314%

Incentive fees $322 $16,670 5,077% $6,868 $20,098 193%

December 31,

2016

September 30,

2017

December 31,

2017

YoY % Change QoQ % Change

Allocated carried interest

Secondary Fund II $8,437 $7,145 $6,031 (29)% (16)%

Secondary Fund III 24,559 32,074 34,158 39% 6%

Secondary Fund IV 2,016 10,884 11,815 486% 9%

Co-investment Fund I 1,144 - - (100)% N/A

Co-investment Fund II 94,863 108,907 94,385 (1)% (13)%

Co-investment Fund III 11,243 28,775 29,978 167% 4%

Other specialized funds 10,769 24,576 26,641 147% 8%

Customized separate accounts 59,816 87,998 97,519 63% 11%

Total allocated carried interest $212,847 $300,359 $300,527 41% 0%

Page 24

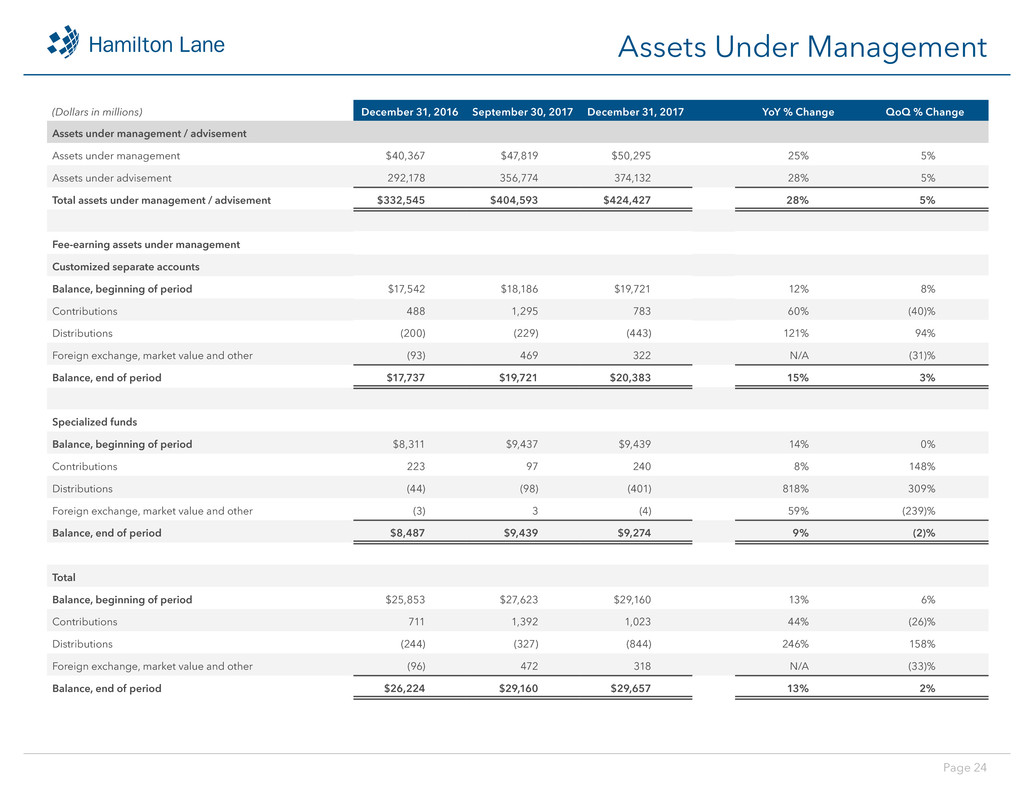

Assets Under Management

(Dollars in millions) December 31, 2016 September 30, 2017 December 31, 2017 YoY % Change QoQ % Change

Assets under management / advisement

Assets under management $40,367 $47,819 $50,295 25% 5%

Assets under advisement 292,178 356,774 374,132 28% 5%

Total assets under management / advisement $332,545 $404,593 $424,427 28% 5%

Fee-earning assets under management

Customized separate accounts

Balance, beginning of period $17,542 $18,186 $19,721 12% 8%

Contributions 488 1,295 783 60% (40)%

Distributions (200) (229) (443) 121% 94%

Foreign exchange, market value and other (93) 469 322 N/A (31)%

Balance, end of period $17,737 $19,721 $20,383 15% 3%

Specialized funds

Balance, beginning of period $8,311 $9,437 $9,439 14% 0%

Contributions 223 97 240 8% 148%

Distributions (44) (98) (401) 818% 309%

Foreign exchange, market value and other (3) 3 (4) 59% (239)%

Balance, end of period $8,487 $9,439 $9,274 9% (2)%

Total

Balance, beginning of period $25,853 $27,623 $29,160 13% 6%

Contributions 711 1,392 1,023 44% (26)%

Distributions (244) (327) (844) 246% 158%

Foreign exchange, market value and other (96) 472 318 N/A (33)%

Balance, end of period $26,224 $29,160 $29,657 13% 2%

Page 25

Condensed Consolidated Balance Sheets (Unaudited)

(Dollars in thousands except share and per share amounts) March 31, 2017 December 31, 2017

Assets

Cash and cash equivalents $32,286 $68,677

Restricted cash 1,849 1,787

Fees receivable 12,113 13,287

Prepaid expenses 2,593 1,584

Due from related parties 3,313 4,275

Furniture, fixtures and equipment, net 4,063 4,061

Investments 120,147 130,765

Deferred income taxes 61,223 39,766

Other assets 3,030 8,844

Total assets $240,617 $273,046

Liabilities and Equity

Accounts payable $1,366 $1,080

Accrued compensation and benefits 3,417 28,051

Deferred incentive fee revenue 45,166 31,422

Debt 84,310 84,617

Accrued members' distributions 2,385 4,520

Dividends payable - 3,172

Payable to related parties pursuant to tax receivable agreement 10,734 6,436

Other liabilities 6,612 5,730

Total liabilities 153,990 165,028

Preferred stock, $0.001 par value, 10,000,000 authorized, none issued - -

Class A common stock, $0.001 par value, 300,000,000 authorized; 19,287,882 and 19,151,033 issued and

19,287,882 and 19,036,504 outstanding as of December 31, 2017 and March 31, 2017, respectively

19 19

Class B common stock, $0.001 par value, 50,000,000 authorized; 27,935,255 issued and outstanding as of

December 31, 2017 and March 31, 2017

28 28

Additional paid-in-capital 61,845 62,853

Accumulated other comprehensive loss (311) -

(Accumulated deficit) retained earnings 612 (5,057)

Less: Treasury stock, at cost, 114,529 shares of class A common stock as of March 31, 2017 (2,151) -

Total Hamilton Lane Incorporated stockholders’ equity 60,042 57,843

Non-controlling interests in general partnerships 9,901 8,363

Non-controlling interests in Hamilton Lane Advisors, L.L.C. 16,684 41,812

Total equity 86,627 108,018

Total liabilities and equity $240,617 $273,046

Page 26

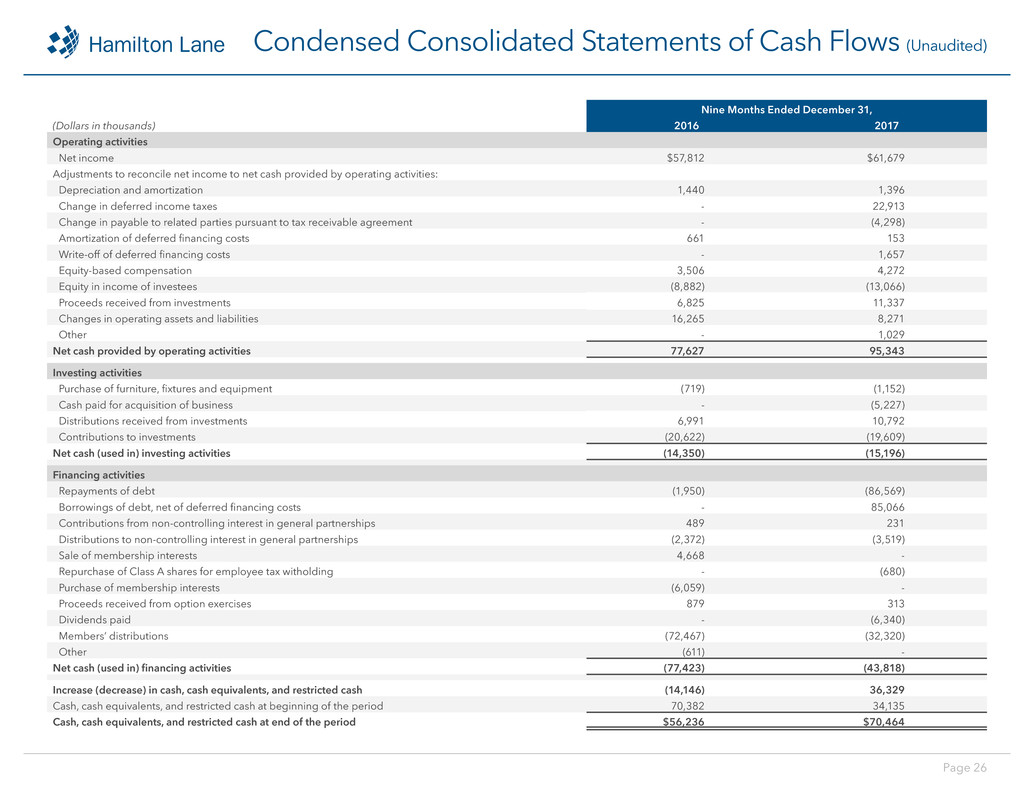

Condensed Consolidated Statements of Cash Flows (Unaudited)

Nine Months Ended December 31,

(Dollars in thousands) 2016 2017

Operating activities

Net income $57,812 $61,679

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization 1,440 1,396

Change in deferred income taxes - 22,913

Change in payable to related parties pursuant to tax receivable agreement - (4,298)

Amortization of deferred financing costs 661 153

Write-off of deferred financing costs - 1,657

Equity-based compensation 3,506 4,272

Equity in income of investees (8,882) (13,066)

Proceeds received from investments 6,825 11,337

Changes in operating assets and liabilities 16,265 8,271

Other - 1,029

Net cash provided by operating activities 77,627 95,343

Investing activities

Purchase of furniture, fixtures and equipment (719) (1,152)

Cash paid for acquisition of business - (5,227)

Distributions received from investments 6,991 10,792

Contributions to investments (20,622) (19,609)

Net cash (used in) investing activities (14,350) (15,196)

Financing activities

Repayments of debt (1,950) (86,569)

Borrowings of debt, net of deferred financing costs - 85,066

Contributions from non-controlling interest in general partnerships 489 231

Distributions to non-controlling interest in general partnerships (2,372) (3,519)

Sale of membership interests 4,668 -

Repurchase of Class A shares for employee tax witholding - (680)

Purchase of membership interests (6,059) -

Proceeds received from option exercises 879 313

Dividends paid - (6,340)

Members’ distributions (72,467) (32,320)

Other (611) -

Net cash (used in) financing activities (77,423) (43,818)

Increase (decrease) in cash, cash equivalents, and restricted cash (14,146) 36,329

Cash, cash equivalents, and restricted cash at beginning of the period 70,382 34,135

Cash, cash equivalents, and restricted cash at end of the period $56,236 $70,464

Page 27

Non-GAAP Reconciliation

Three Months Ended December 31, Nine Months Ended December 31,

(Dollars in thousands) 2016 2017 2016 2017

Net (loss) income attributable to Hamilton Lane Incorporated1 $- $(6,309) $- $3,843

Income attributable to non-controlling interests in general partnerships 64 768 1,024 1,750

Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 16,999 23,374 56,788 56,086

Incentive fees2 (322) (16,670) (6,868) (20,098)

Incentive fee related compensation3 158 1,027 3,370 2,709

Interest income (39) (67) (159) (472)

Interest expense 2,924 664 8,780 5,282

Income tax expense (benefit) 111 22,957 (264) 29,337

Equity in income of investees (3,085) (2,895) (8,882) (13,066)

Contingent compensation related to acquisition - 771 - 1,198

Other non-operating income (222) (4,188) (232) (4,169)

Fee Related Earnings $16,588 $19,432 $53,557 $62,400

Depreciation and amortization 467 486 1,440 1,396

Equity-based compensation 1,169 1,284 3,506 4,272

Incentive fees2 322 16,670 6,868 20,098

Incentive fees attributable to non-controlling interests2 - (834) - (834)

Incentive fee related compensation3 (158) (1,027) (3,370) (2,709)

Interest income 39 67 159 472

Adjusted EBITDA $18,427 $36,078 $62,160 $85,095

Non-GAAP earnings per share reconciliation

Net (loss) income attributable to Hamilton Lane Incorporated1 $(6,309) $3,843

Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 23,374 56,086

Income tax expense 22,957 29,337

Write-off of deferred financing costs4 - 2,544

Impact of Tax Act on TRA liability5 (4,186) (4,186)

Impact of Tax Act on IPO related compensation6 (669) (669)

Contingent compensation related to acquisition 771 1,198

Adjusted pre-tax net income 35,938 88,153

Adjusted income taxes7 (11,450) (32,185)

Adjusted net income $24,488 $55,968

Weighted-average shares of Class A common stock outstanding 18,126,532 18,703,650

Exchange of Class B and Class C units in HLA8 34,438,669 34,438,669

Assumed exercise and vesting of employee awards 751,764 -

Adjusted shares 53,316,965 52,142,319

Non-GAAP earnings per share $0.46 $1.05

1 Prior to our IPO, HLI was a wholly-owned subsidiary of HLA with no operations or assets.

2 Incentive fees for the three and nine months ended December 31, 2017 include $14.6 million of non-cash carry related to the $41.5 million of incentive fee payments received in fiscal 2016. Of the $14.6 million, $13.7 million is included in net income and

$0.8 million is attributable to non-controlling interests.

3 Incentive fee related compensation includes incentive fee compensation expense and bonus and other revenue sharing allocated to carried interest classified as base compensation.

4 Represents write-off of debt issuance costs and realized loss on interest rate caps related to the payoff of our predecessor credit facility during the nine months ended December 31, 2017.

5 Represents change in payable to related parties pursuant to the TRA as a result of being re-measured due to the tax rate change. The change in liability was recorded to other non-operating income in the Condensed Consolidated Statements of Income.

6 Represents reduction in expense due to the impact of tax rate changes on the $1.9 million expense accrued in fiscal 2017 to induce members of HLA to exchange their HLA units for HLI common stock in the Reorganization.

7 Represents corporate income taxes at our estimated statutory tax rate of 36.51% for the nine months ended December 31, 2017 applied to adjusted pre-tax net income. The 36.51% is based on a federal tax statutory rate of 31.55% and a combined state

income tax rate net of federal benefits of 4.96%.

8 Assumes the full exchange of HLA Class B and Class C units for HLI Class A common stock.

Reconciliation from Net Income

Page 28

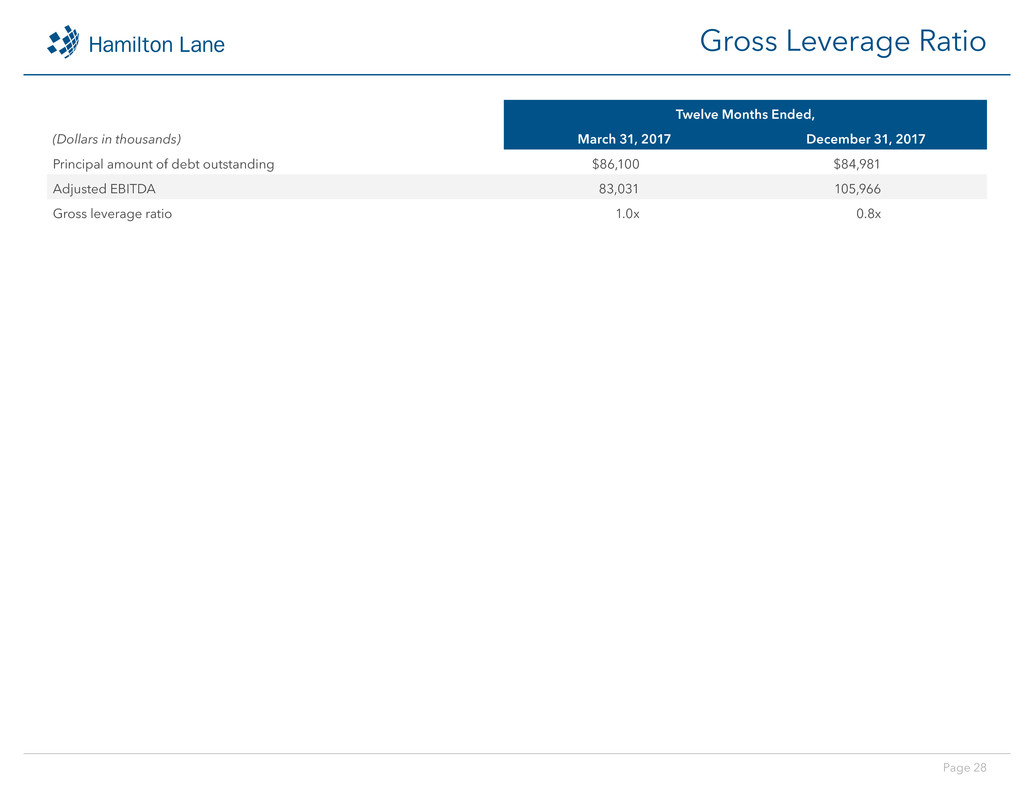

Gross Leverage Ratio

Twelve Months Ended,

(Dollars in thousands) March 31, 2017 December 31, 2017

Principal amount of debt outstanding $86,100 $84,981

Adjusted EBITDA 83,031 105,966

Gross leverage ratio 1.0x 0.8x

Page 29

Terms

Adjusted EBITDA is our primary internal measure of profitability. We believe Adjusted EBITDA is useful to investors because it enables them to better evaluate the performance of our core

business across reporting periods. Adjusted EBITDA represents net income excluding (a) interest expense on our loan agreements and predecessor credit facility, (b) income tax expense,

(c) depreciation and amortization expense, (d) equity-based compensation expense, (e) non-operating income (loss) and (f) certain other significant items that we believe are not indicative of our

core performance.

Fee Related Earnings (“FRE”) is used to highlight our earnings from recurring management fees. FRE represents net income excluding (a) incentive fees and related compensation, (b) interest

income and expense, (c) income tax expense, (d) equity in income of investees, (e) other non-operating income and (f) certain other significant items that we believe are not indicative of our core

performance. We believe FRE is useful to investors because it provides additional insight into the operating profitability of our business. FRE is presented before income taxes.

Non-GAAP earnings per share measures our per-share earnings assuming all Class B and Class C units in HLA were exchanged for Class A common stock in HLI. Non-GAAP earnings per share

is calculated as adjusted net income divided by adjusted shares outstanding. Adjusted net income is income before taxes fully taxed at our estimated statutory tax rate. We believe Non-GAAP

earnings per share is useful to investors because it enables them to better evaluate per-share operating performance across reporting periods.

Our assets under management (“AUM”) comprise primarily the assets associated with our customized separate accounts and specialized funds. We classify assets as AUM if we have full

discretion over the investment decisions in an account. We calculate our AUM as the sum of:

(1) the net asset value of our clients’ and funds’ underlying investments;

(2) the unfunded commitments to our clients’ and funds’ underlying investments; and

(3) the amounts authorized for us to invest on behalf of our clients and fund investors but not committed to an underlying investment.

Management fee revenue is based on a variety of factors and is not linearly correlated with AUM. However, we believe AUM is a useful metric for assessing the relative size and scope of our asset

management business.

Our assets under advisement (“AUA”) comprise assets from clients for which we do not have full discretion to make investments in their account. We generally earn revenue on a fixed fee

basis on our AUA client accounts for services including asset allocation, strategic planning, development of investment policies and guidelines, screening and recommending investments, legal

negotiations, monitoring and reporting on investments and investment manager review and due diligence. Advisory fees vary by client based on the amount of annual commitments, services

provided and other factors. Since we earn annual fixed fees from the majority of our AUA clients, the growth in AUA from existing accounts does not have a material impact on our revenues.

However, we view AUA growth as a meaningful benefit in terms of the amount of data we are able to collect and the degree of influence we have with fund managers.

Fee-earning assets under management, or fee-earning AUM, is a metric we use to measure the assets from which we earn management fees. Our fee-earning AUM comprise assets in our

customized separate accounts and specialized funds from which we derive management fees. We classify customized separate account revenue as management fees if the client is charged an

asset-based fee, which includes the majority of our discretionary AUM accounts but also includes certain non-discretionary AUA accounts. Our fee-earning AUM is equal to the amount of capital

commitments, net invested capital and net asset value of our customized separate accounts and specialized funds depending on the fee terms. Substantially all of our customized separate

accounts and specialized funds earn fees based on commitments or net invested capital, which are not affected by market appreciation or depreciation. Therefore, revenues and fee-earning AUM

are not significantly affected by changes in market value. Our calculations of fee-earning AUM may differ from the calculations of other asset managers, and as a result, this measure may not be

comparable to similar measures presented by other asset managers. Our definition of fee-earning AUM is not based on any definition that is set forth in the agreements governing the customized

separate accounts or specialized funds that we manage.

Hamilton Lane Incorporated (or “HLI”) was incorporated in the State of Delaware on December 31, 2007. The Company was formed for the purpose of completing an initial public offering

(“IPO”) and related transactions (“Reorganization”) in order to carry on the business of Hamilton Lane Advisors, L.L.C. (“HLA”) as a publicly-traded entity. As of March 6, 2017, HLI became the

sole managing member of HLA.

Page 30

Disclosures

As of February 2, 2018

Some of the statements in this presentation may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act

of 1934 and the Private Securities Litigation Reform Act of 1995. Words such as “will,” “expect,” “believe” and similar expressions are used to identify these forward-looking statements. Forward-

looking statements discuss management’s current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance and business. All

forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different, including risks relating to

our ability to manage growth, fund performance, risk, changes in our regulatory environment and tax status; market conditions generally; our ability to access suitable investment opportunities

for our clients; our ability to maintain our fee structure; our ability to attract and retain key employees; our ability to consummate planned acquisitions and successfully integrate the acquired

business with ours; our ability to manage our obligations under our debt agreements; defaults by clients and third-party investors on their obligations to us; our ability to comply with investment

guidelines set by our clients; the time, expense and effort associated with being a newly public company; and our ability to receive distributions from Hamilton Lane Advisors, L.L.C. to fund our

payment of dividends, taxes and other expenses.

The foregoing list of factors is not exhaustive. For more information regarding these risks and uncertainties as well as additional risks that we face, you should refer to the “Risk Factors” detailed

in Part I, Item 1A of our Annual Report on Form 10K for the fiscal year ended March 31, 2017, and in our subsequent reports filed from time to time with the Securities and Exchange Commission.

The forward-looking statements included in this presentation are made only as of the date presented. We undertake no obligation to update or revise any forward-looking statement as a result of

new information or future events, except as otherwise required by law.