Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CHESAPEAKE ENERGY CORP | ex9912018-02x02prfebruary2.htm |

| 8-K - 8-K - CHESAPEAKE ENERGY CORP | a8-k2018x02x02repreliminar.htm |

CHESAPEAKE ENERGY:

THE TRANSFORMATION AND THE FUTURE

Doug Lawler

President and Chief Executive Officer

Exhibit 99.2

FORWARD-LOOKING STATEMENTS

This presentation includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of

1934. Forward-looking statements are statements other than statements of historical fact. They include statements that give our current expectations, guidance or forecasts of

future events, production and well connection forecasts, estimates of operating costs, anticipated capital and operational efficiencies, planned development drilling and expected

drilling cost reductions, general and administrative expenses, capital expenditures, the timing of anticipated asset sales and proceeds to be received therefrom, projected cash

flow and liquidity, our ability to enhance our cash flow and financial flexibility, plans and objectives for future operations, and the assumptions on which such statements are

based. Although we believe the expectations and forecasts reflected in the forward-looking statements are reasonable, we can give no assurance they will prove to have been

correct. They can be affected by inaccurate or changed assumptions or by known or unknown risks and uncertainties.

Factors that could cause actual results to differ materially from expected results include those described under “Risk Factors” in Item 1A of our annual report on Form 10-K and

any updates to those factors set forth in Chesapeake’s subsequent quarterly reports on Form 10-Q or current reports on Form 8-K (available at http://www.chk.com/investors/

sec-filings). These risk factors include: the volatility of oil, natural gas and NGL prices; the limitations our level of indebtedness may have on our financial flexibility; our inability

to access the capital markets on favorable terms; the availability of cash flows from operations and other funds to finance reserve replacement costs or satisfy our debt

obligations; our credit rating requiring us to post more collateral under certain commercial arrangements; write-downs of our oil and natural gas asset carrying values due to low

commodity prices; our ability to replace reserves and sustain production; uncertainties inherent in estimating quantities of oil, natural gas and NGL reserves and projecting

future rates of production and the amount and timing of development expenditures; our ability to generate profits or achieve targeted results in drilling and well operations;

leasehold terms expiring before production can be established; commodity derivative activities resulting in lower prices real ized on oil, natural gas and NGL sales; the need to

secure derivative liabilities and the inability of counterparties to satisfy their obligations; adverse developments or losses from pending or future litigation and regulatory

proceedings, including royalty claims; charges incurred in response to market conditions and in connection with our ongoing actions to reduce financial leverage and complexity;

drilling and operating risks and resulting liabilities; effects of environmental protection laws and regulation on our business; legislative and regulatory initiatives further regulating

hydraulic fracturing; our need to secure adequate supplies of water for our drilling operations and to dispose of or recycle the water used; impacts of potential legislative and

regulatory actions addressing climate change; federal and state tax proposals affecting our industry; potential OTC derivatives regulation limiting our ability to hedge against

commodity price fluctuations; competition in the oil and gas exploration and production industry; a deterioration in general economic, business or industry conditions; negative

public perceptions of our industry; limited control over properties we do not operate; pipeline and gathering system capacity constraints and transportation interruptions; terrorist

activities and/or cyber-attacks adversely impacting our operations; potential challenges by SSE’s former creditors of our spin-off of in connection with SSE’s recently completed

bankruptcy under Chapter 11 of the U.S. Bankruptcy Code; an interruption in operations at our headquarters due to a catastrophic event; the continuation of suspended

dividend payments on our common stock; the effectiveness of our remediation plan for a material weakness; certain anti-takeover provisions that affect shareholder rights; and

our inability to increase or maintain our liquidity through debt repurchases, capital exchanges, asset sales, joint ventures, farmouts or other means.

In addition, disclosures concerning the estimated contribution of derivative contracts to our future results of operations are based upon market information as of a specific date.

These market prices are subject to significant volatility. Our production forecasts are also dependent upon many assumptions, including estimates of production decline rates

from existing wells and the outcome of future drilling activity. Expected asset sales may not be completed in the time frame anticipated or at all. We caution you not to place

undue reliance on our forward-looking statements, which speak only as of the date of this presentation, and we undertake no obligation to update any of the information

provided in this presentation, except as required by applicable law. In addition, this presentation contains time-sensitive information that reflects management’s best judgment

only as of the date of this presentation.

We use certain terms in this presentation such as “Resource Potential,” “Net Reserves” and similar terms that the SEC’s guide lines strictly prohibit us from including in filings

with the SEC. These terms include reserves with substantially less certainty, and no discount or other adjustment is included in the presentation of such reserve numbers. U.S.

investors are urged to consider closely the disclosure in our Form 10-K for the year ended December 31, 2016, File No. 1-13726 and in our other filings with the SEC, available

from us at 6100 North Western Avenue, Oklahoma City, Oklahoma 73118. These forms can also be obtained from the SEC by calling 1-800-SEC-0330.

2 CHK: The Transformation & The Future

UNCONVENTIONAL TRAILBLAZER

The Early Years

CHK: The Transformation & The Future 3

PRODUCTION AND DEBT

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

0

100

200

300

400

500

600

700

800

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017F 2018F

Deb

t

($

B

)

A

v

g.

Da

ily

P

ro

d

u

c

ti

o

n

(

m

b

o

e/

d

)

CHK Capital & Production

2017F/2018F as of 11+1

Avg. Daily Prod. (boe/d) Total Debt

CHK: The Transformation & The Future 4

Entered

Barnett

Entered

Haynesville

1989 – 2000

Oklahoma

focused E&P

Entered

Niobrara

Entered

Utica

Entered

Eagle Ford

Entered

Fayetteville

Entered

Marcellus

Entered

Permian

COMPLEXITY ACROSS ALL ASPECTS OF THE COMPANY

Companies CHK owned or invested in:

As of 12/31/2012

CHK: The Transformation & The Future 5

$21.25 billion

Total leverage

45,400 gross wells

Interests

7 joint ventures

With 5 different companies

10 VPPS

12,000 employees

Governance

challenges

Leads to activist investors

CHK: The Transformation & The Future

The Transformation

6

THE GREATEST CHALLENGE IN THE INDUSTRY

CHK: The Transformation & The Future 7

In 2013, by any measure, a bottom-quartile-performing company

HIGH CASH

COSTS

HIGH

DEBT

POOR

CAPITAL

EFFICIENCY

HIGH

TRANSPORTATION

COSTS

LOW

MARGINS

+ + + +

CHK: The Transformation & The Future 8

BUSINESS STRATEGIES

> Financial discipline

> Profitable and

efficient growth from

captured resources

> Exploration

> Business development

CORE VALUES

> Integrity and trust

> Respect

> Transparency and

open communication

> Commercial focus

> Change leadership

CHK: The Transformation & The Future 9

THE TRANSFORMATION BEGINS

CHK: The Transformation & The Future 10

Focused on Value

TRANSFORMATION TEAMS:

Organizational Structure

Financial & Corporate Planning

Capital Efficiency

Portfolio Characterization

Affiliated/Subsidiary Evaluation

Cash Costs

Marketing & GP&T

Performance Evaluation

Field Operations

Focused on Volume

#2 most active driller in the U.S.

Peak rig count = 180

#1 driller of horizontal shale wells

in the world

~11mm net acres under lease

(U.S. onshore)

23 years of production growth

BEST-IN-CLASS EH&S PERFORMANCE

CHK: The Transformation & The Future

(1) 2013 NOV count is 1,929 due to how NOVs were uploaded/managed in KMI database

11

80% improvement 97% improvement 98% improvement

PROTECTING THE

ENVIRONMENT

Reportable Spills

304

214

191

133

72

61

2012 2013 2014 2015 2016 2017

1.47

0.48

0.31

0.51

0.38

0.05

2012 2013 2014 2015 2016 2017

PROTECTING OUR

EMPLOYEES

Total Recordable

Incident Rate

1,929

371

184

126 29

2013 2014 2015 2016 2017

REGULATORY

COMPLIANCE LEADER

Notice of Regulatory Violations

Incident Count

(1)

$0.00

$2.00

$4.00

$6.00

$8.00

$10.00

$12.00

$14.00

$16.00

0

100

200

300

400

500

600

700

800

2012 2013 2014 2015 2016 2017E

C

a

p

ex

($

b

il

li

o

n

s

)

N

et

Pr

o

d

u

cti

o

n

(m

b

o

e/

d

)

Equivalent Production and Capex

CAPITAL EFFICIENCY DEFINED

(1) Absolute production that is not adjusted for asset sales

CHK: The Transformation & The Future 12

$0.00

$1.00

$2.00

$3.00

$4.00

$5.00

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

2012 2013 2014 2015 2016 2017E

L

OE

($

/b

o

e

)

L

OE

($

m

il

li

o

n

s

)

Production Expense

CASH COST LEADERSHIP

Sources: S&P Capital IQ, Company Filings, LOE defined as Oil, natural gas and NGL production expenses

Cash Costs: Not including GP&T costs

CHK: The Transformation & The Future 13

CASH COST LEADERSHIP

$-

$0.50

$1.00

$1.50

$2.00

$2.50

$-

$100

$200

$300

$400

$500

$600

2012 2013 2014 2015 2016 2017E

G

&

A

($

/b

o

e

)

G

&

A

($

m

il

li

o

n

s

)

G&A

CHK: The Transformation & The Future 14

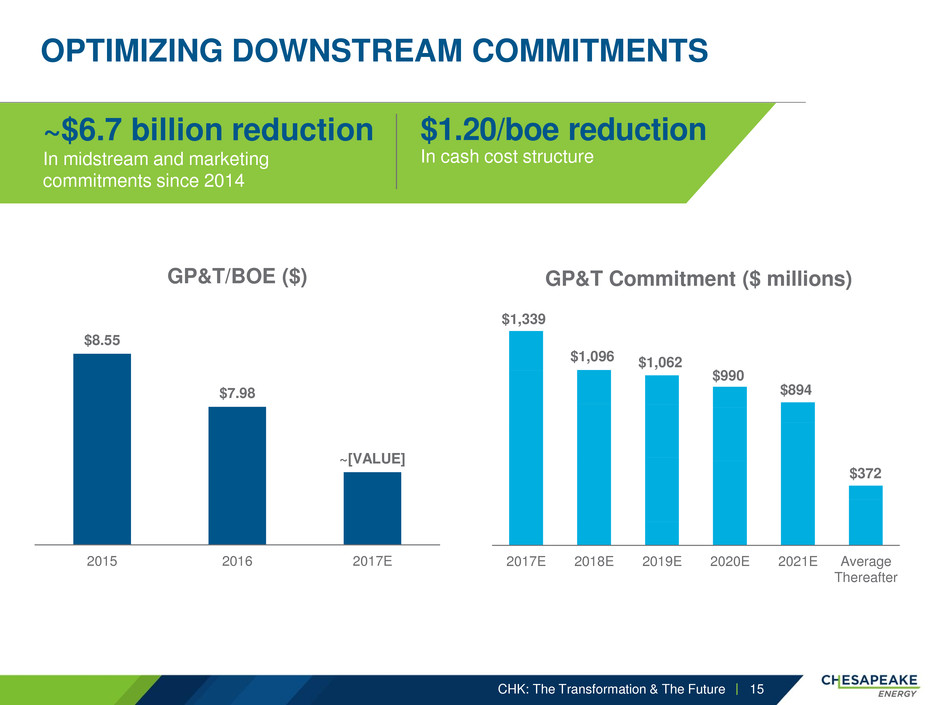

OPTIMIZING DOWNSTREAM COMMITMENTS

CHK: The Transformation & The Future 15

$8.55

$7.98

~[VALUE]

2015 2016 2017E

GP&T/BOE ($)

2017E 2018E 2019E 2020E 2021E Average

Thereafter

GP&T Commitment ($ millions)

$1,339

$1,096 $1,062

$990

$894

$372

$1.20/boe reduction

In cash cost structure

~$6.7 billion reduction

In midstream and marketing

commitments since 2014

[VALUE]

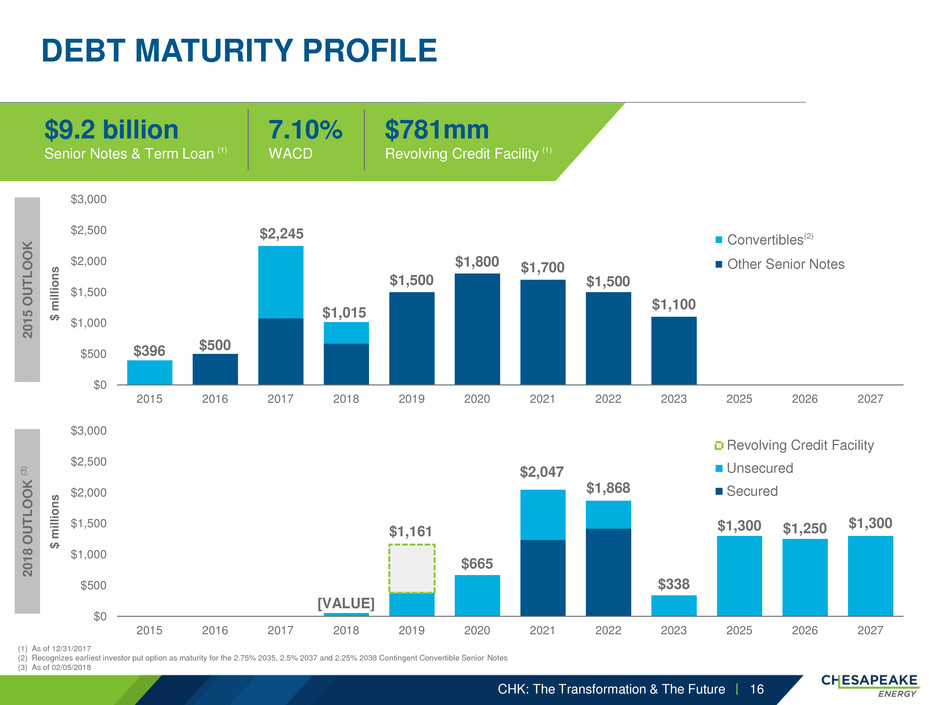

$665

$338

$1,300 $1,250 $1,300

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

2015 2016 2017 2018 2019 2020 2021 2022 2023 2025 2026 2027

Revolving Credit Facility

Unsecured

Secured

$2,047

$1,868

$1,161

$

m

il

li

o

n

s

ev l ing edit ilit

nsecure

ecure

2

0

1

8

O

U

T

L

O

O

K

(3

)

$500

$1,500

$1,800 $1,700

$1,500

$1,100

$396

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

2015 2016 2017 2018 2019 2020 2021 2022 2023 2025 2026 2027

#REF!

Convertibles

$2,245

$1,015

Convertibles(2)

Other Senior Notes

$

m

il

li

o

n

s

2

0

1

5

O

U

T

L

O

O

K

$781mm

Revolving Credit Facility (1)

DEBT MATURITY PROFILE

(1) As of 12/31/2017

(2) Recognizes earliest investor put option as maturity for the 2.75% 2035, 2.5% 2037 and 2.25% 2038 Contingent Convertible Senior Notes

(3) As of 02/05/2018

CHK: The Transformation & The Future 16

$9.2 billion

Senior Notes & Term Loan (1)

7.10%

WACD

EVOLUTION OF THE TRANSFORMATION

• Created best-in-class Code of Conduct

and Supplier Code of Conduct

• Established risk-based compliance

program

• A leader in cash cost structure and

capital efficiency

• Set the company on a path to achieve

production growth while aiming toward

cash flow neutrality in 2018

CHK: The Transformation & The Future 17

Where We Have Been

~$11.2 billion

Since 2012, reduced total

leverage (~50% decrease)

~$6.7 billion

Reduced midstream and

marketing commitments

since 2014 (~42% decrease)

~$3.2 billion

Reduced debt maturities

due between 2018 – 2020

(~75% decrease)

The Future

CHK: The Transformation & The Future 18

PREMIER, DIVERSIFIED ASSET BASE

CHK: The Transformation & The Future 19

World-class

gas assets

˃ Appalachia North

˃ Appalachia South

˃ Gulf Coast

PREMIER, DIVERSIFIED ASSET BASE

CHK: The Transformation & The Future 20

Emerging

oil-growth assets

˃ Eagle Ford

˃ Mid-Continent

˃ Powder River

DEPTH AND CAPABILITY OF THE PORTFOLIO

CHK: The Transformation & The Future 21

35%

65%

Locations

Average IP 60 BOE Production Per Well by First Prod Year

Drilled

Remaining

4,950,000

Net Acres

0

50,000

100,000

150,000

200,000

APPALACHIA NORTH

0

20,000

40,000

60,000

80,000

APPALACHIA SOUTH

0

100,000

200,000

300,000

GULF COAST

2017 2016 2015 2014 2013 2012

0

20,000

40,000

60,000

EAGLE FORD

0

10,000

20,000

30,000

40,000

MID-CONTINENT

0

20,000

40,000

60,000

POWDER RIVER

2017 2016 2015 2014 2013 2012

STRATEGIC PRIORITIES

Debt reduction

of $2 – $3 billion

ultimate goal of net debt

to EBITDA of 2X

Free cash flow neutrality

Margin enhancement

2

3

1

BUSINESS STRATEGIES

Our strategy remains unchanged –

resilient to commodity price volatility

> Financial discipline

> Profitable and efficient growth

from captured resources

> Exploration

> Business development

CHK: The Transformation & The Future 22

RECENT PROGRESS ON OUR PRIORITIES

CHK: The Transformation & The Future 23

593,000 boe

per day

Q4 2017 production

Achieved Q4 2017 goal of

100,000 barrels

of oil per day

Record EH&S

performance

In 2017

Signed three separate sales

agreements totaling

~$500mm

Expected to close mid-2018

Monetized a portion

of FTSI investment

Net proceeds of $78mm and

hold ~22mm additional shares

~$3 billion

In asset sales in 2016 and 2017

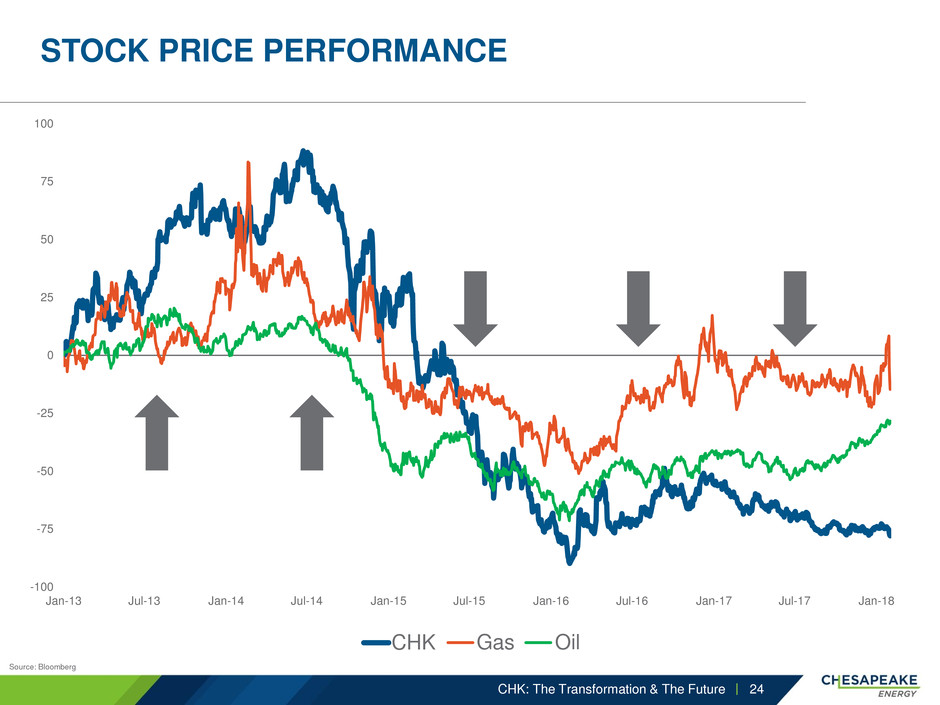

STOCK PRICE PERFORMANCE

CHK: The Transformation & The Future 24

Source: Bloomberg

-100

-75

-50

-25

0

25

50

75

100

Jan-13 Jul-13 Jan-14 Jul-14 Jan-15 Jul-15 Jan-16 Jul-16 Jan-17 Jul-17 Jan-18

CHK NG1 CL1Gas Oil

CHESAPEAKE ENERGY:

THE UNCONVENTIONAL LEADER

CHK: The Transformation & The Future 25

Leadership attributes

˃ Capital efficiency

˃ Operational excellence

˃ Portfolio depth

˃ Technology

˃ EH&S excellence

Undervalued currency

A Transformed Company

Appendix

CHK: The Transformation & The Future 26

REDUCING TOTAL LEVERAGE AND COMPLEXITY

• Chesapeake continues to simplify the business:

˃ Eliminated finance leases, subsidiary preferred equity

and eight VPPs

˃ Optimizing the capital structure

˃ Reduced interest expense by ~$100mm (2017E vs. 2016)

(1) Updated through 10/31/2017

(2) Includes $441 million legal settlement and $416 million in buyout of midstream obligations

(3) Using Moody’s valuation methodology

CHK: The Transformation & The Future

($mm) 2012 2013 2014 2015 2016 Q3’17 Pro Forma (1)

Credit Facility (1) $418 $405 $0 $0 $0 $643

Term Loan (1) $2,000 $2,000 $0 $0 $1,500 $1,263

Second-Lien Notes (1) $0 $0 $0 $2,425 $2,419 $1,417

Long-Term Bonds (1)

$10,647 $10,825 $11,756 $7,281 $6,070 $6,550

Less: Cash ($287) ($837) ($4,108) ($825) ($900) ($9)

Net Debt $12,778 $12,393 $7,648 $8,881 $9,089 $9,864 (2)

VPPs $3,186 $2,454 $1,702 $1,289 $273 $218

Operating and Finance Leases $1,255 $948 $0 $0 $0 $0

Subsidiary Preferred $2,500 $2,310 $1,250 $0 $0 $0

Corporate Preferred (3) $1,531 $1,531 $1,531 $1,531 $886 $835

Total Adjusted Net Leverage $21,250 $19,637 $12,131 $11,701 $10,248 $10,917

-23%

SINCE JAN 2013

~50% reduction

In total net leverage

= $10.3 billion

- 48%

27

Includes payments of $857mm for one-time obligations in 2017

$-

$2.00

$4.00

$6.00

$8.00

$10.00

$12.00

$14.00

$16.00

$18.00

A B C CHK D E F G H I J K L M N O P Q

Cash Costs/BOE ($)

as of Q3 2017

G&A LOE

LOW-COST OPERATOR

• CHK remains a cash cost leader after halving costs over the last five years

• 80% of its peers have higher cash cost than CHK

Sources: S&P Capital IQ, company filings. Cash costs include production expenses, G&A expenses and expenses associated with stock-based compensation, but exclude restructuring other termination costs,

gathering, processing and transportation expenses and interest expense. G&A expenses include expenses associated with stock-based compensation, but exclude restructuring and other termination costs.

CHK: The Transformation & The Future 28

CAPITAL EFFICIENCY

Source: 2016 10-K filings. Proved reserve F&D costs defined as the sum of the development and exploration costs divided by proved reserves added by extensions, additions and discoveries.

Peer Group includes: APA, AR, APC, COG, COP, CXO, DVN, ECA, EOG, HES, MRO, MUR, NBL, PE, PXD, RRC, SWN and XEC

CHK: The Transformation & The Future 29

0

5

10

15

20

25

30

$/b

o

e

2016 Proved F&D Costs

6 mcf to 1 boe

0

5

10

15

20

25

30

35

$/b

o

e

2016 Proved F&D Costs

15 mcf to 1 boe

~$2.35/boe ~$3.40/boe

Operational leadership and technical capabilities

provide peer-leading cost management