Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Atkore Inc. | atkr1q18exhibit991.htm |

| 8-K - 8-K - Atkore Inc. | atkr1q18form8-k.htm |

First Quarter 2018 Earnings Presentation

February 6, 2018

This presentation contains forward-looking statements that are subject to known and unknown risks and uncertainties, many of which are beyond our control. All statements other than statements of historical

fact included in this presentation are forward-looking statements. Forward-looking statements appearing throughout this presentation include, without limitation, statements regarding our intentions, beliefs,

assumptions or current expectations concerning, among other things, financial position; results of operations; cash flows; prospects; growth strategies or expectations; customer retention; the outcome (by

judgment or settlement) and costs of legal, administrative or regulatory proceedings, investigations or inspections, including, without limitation, collective, representative or any other litigation; and the impact of

prevailing economic conditions. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “believes,”

“expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “seeks,” “aims,” “projects,” “is optimistic,” “intends,” “plans,” “estimates,” “anticipates” and other comparable terms. We caution you that forward-looking

statements are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and

the development of the market in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this presentation. In addition, even if our results of

operations, financial condition and cash flows, and the development of the market in which we operate, are consistent with the forward-looking statements contained in this presentation, those results or

developments may not be indicative of results or developments in subsequent periods. A number of important factors, including, without limitation, the risks and uncertainties discussed under the captions “Risk

Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Quarterly Report on Form 10-Q for the fiscal quarter ended December 29, 2017, filed with the U.S.

Securities and Exchange Commission on February 6, 2017(File No. 001-37793), could cause actual results and outcomes to differ materially from those reflected in the forward-looking statements. Because of

these risks, we caution that you should not place undue reliance on any of our forward-looking statements. New risks and uncertainties arise from time to time, and it is impossible for us to predict those events

or how they may affect us. Further, any forward-looking statement speaks only as of the date on which it is made. We undertake no obligation to revise the forward-looking statements in this presentation after

the date of this presentation.

Market data and industry information used throughout this presentation are based on management’s knowledge of the industry and the good faith estimates of management. We also relied, to the extent

available, upon management’s review of independent industry surveys, forecasts and publications and other publicly available information prepared by a number of third party sources. All of the market data

and industry information used in this presentation involves a number of assumptions and limitations which we believe to be reasonable, and you are cautioned not to give undue weight to such estimates.

Although we believe that these sources are reliable, we cannot guarantee the accuracy or completeness of this information, and we have not independently verified this information. While we believe the

estimated market position, market opportunity and market size information included in this presentation are generally reliable, such information, which is derived in part from management’s estimates and

beliefs, is inherently uncertain and imprecise. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are subject to a high degree of

uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the

estimates prepared by independent parties.

We present Adjusted EBITDA, Adjusted EBITDA margin (Adjusted EBITDA over Net Sales), Net debt (total debt less cash and cash equivalents), Adjusted Net Income Per Share, and Leverage ratio (net debt

or total debt less cash and cash equivalents, over Adjusted EBITDA on trailing twelve month basis) to help us describe our operating and financial performance. Adjusted EBITDA, Adjusted EBITDA margin,

Net debt (total debt less cash and cash equivalents), Adjusted Net Income Per Share, and Leverage ratio are non-GAAP financial measures commonly used in our industry and have certain limitations and

should not be construed as alternatives to net income, net sales and other income data measures (as determined in accordance with generally accepted accounting principles in the United States, or GAAP), or

as better indicators of operating performance. Adjusted EBITDA, Adjusted EBITDA margin, Net debt, Adjusted Net Income Per Share, and Leverage ratio, as defined by us may not be comparable to similar

non-GAAP measures presented by other issuers. Our presentation of such measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. See

the appendix to this presentation for a reconciliation of Adjusted EBITDA to net income, Adjusted EBITDA Margin, Adjusted Net Income Per Share to Net Income Per Share, net debt to total debt, and Leverage

Ratio.

Fiscal Periods - The Company has a fiscal year that ends on September 30th. It is the Company's practice to establish quarterly closings using a 4-5-4 calendar. The Company's fiscal quarters end on the last

Friday in December, March and June.

Cautionary statements

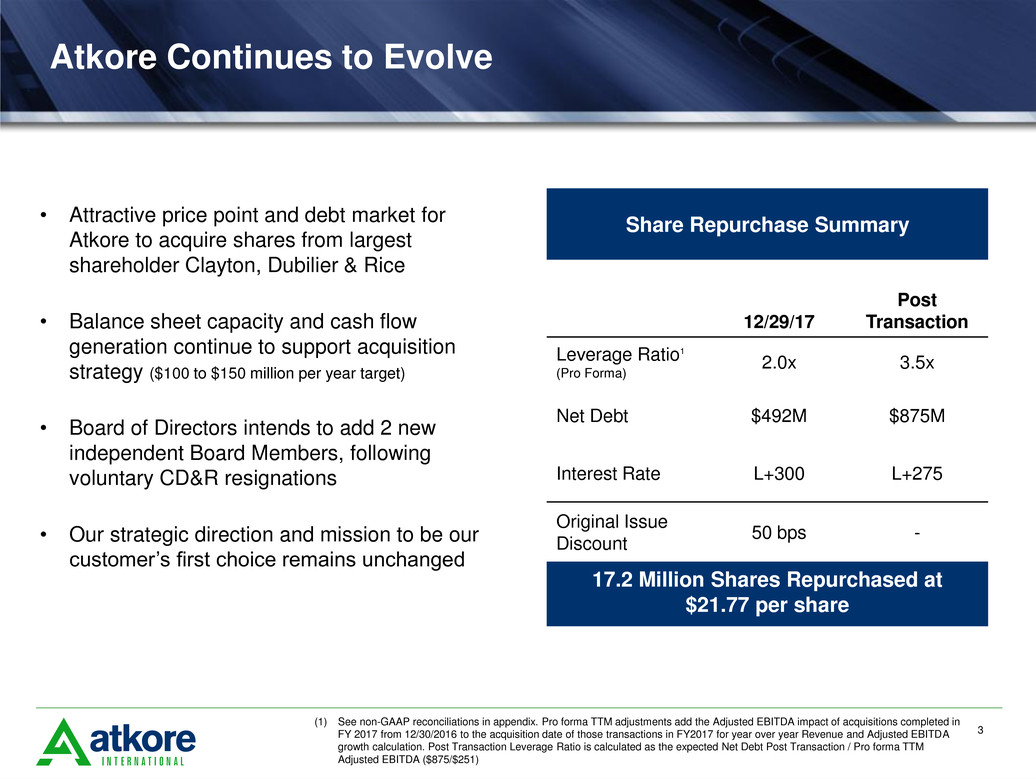

Atkore Continues to Evolve

• Attractive price point and debt market for

Atkore to acquire shares from largest

shareholder Clayton, Dubilier & Rice

• Balance sheet capacity and cash flow

generation continue to support acquisition

strategy ($100 to $150 million per year target)

• Board of Directors intends to add 2 new

independent Board Members, following

voluntary CD&R resignations

• Our strategic direction and mission to be our

customer’s first choice remains unchanged

1

3

Share Repurchase Summary

12/29/17

Post

Transaction

Leverage Ratio1

(Pro Forma)

2.0x 3.5x

Net Debt $492M $875M

Interest Rate L+300 L+275

Original Issue

Discount

50 bps -

17.2 Million Shares Repurchased at

$21.77 per share

(1) See non-GAAP reconciliations in appendix. Pro forma TTM adjustments add the Adjusted EBITDA impact of acquisitions completed in

FY 2017 from 12/30/2016 to the acquisition date of those transactions in FY2017 for year over year Revenue and Adjusted EBITDA

growth calculation. Post Transaction Leverage Ratio is calculated as the expected Net Debt Post Transaction / Pro forma TTM

Adjusted EBITDA ($875/$251)

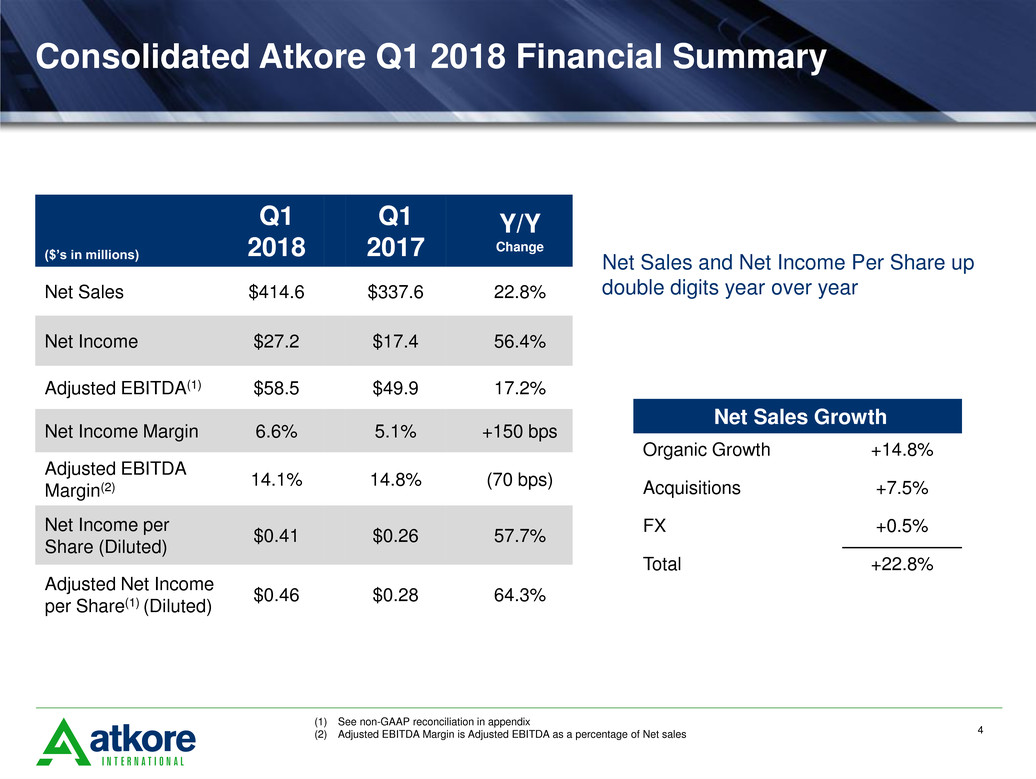

Consolidated Atkore Q1 2018 Financial Summary

($’s in millions)

Q1

2018

Q1

2017

Y/Y

Change

Net Sales $414.6 $337.6 22.8%

Net Income $27.2 $17.4 56.4%

Adjusted EBITDA(1) $58.5 $49.9 17.2%

Net Income Margin 6.6% 5.1% +150 bps

Adjusted EBITDA

Margin(2)

14.1% 14.8% (70 bps)

Net Income per

Share (Diluted)

$0.41 $0.26 57.7%

Adjusted Net Income

per Share(1) (Diluted)

$0.46 $0.28 64.3%

(1) See non-GAAP reconciliation in appendix

(2) Adjusted EBITDA Margin is Adjusted EBITDA as a percentage of Net sales

Net Sales Growth

Organic Growth +14.8%

Acquisitions +7.5%

FX +0.5%

Total +22.8%

Net Sales and Net Income Per Share up

double digits year over year

4

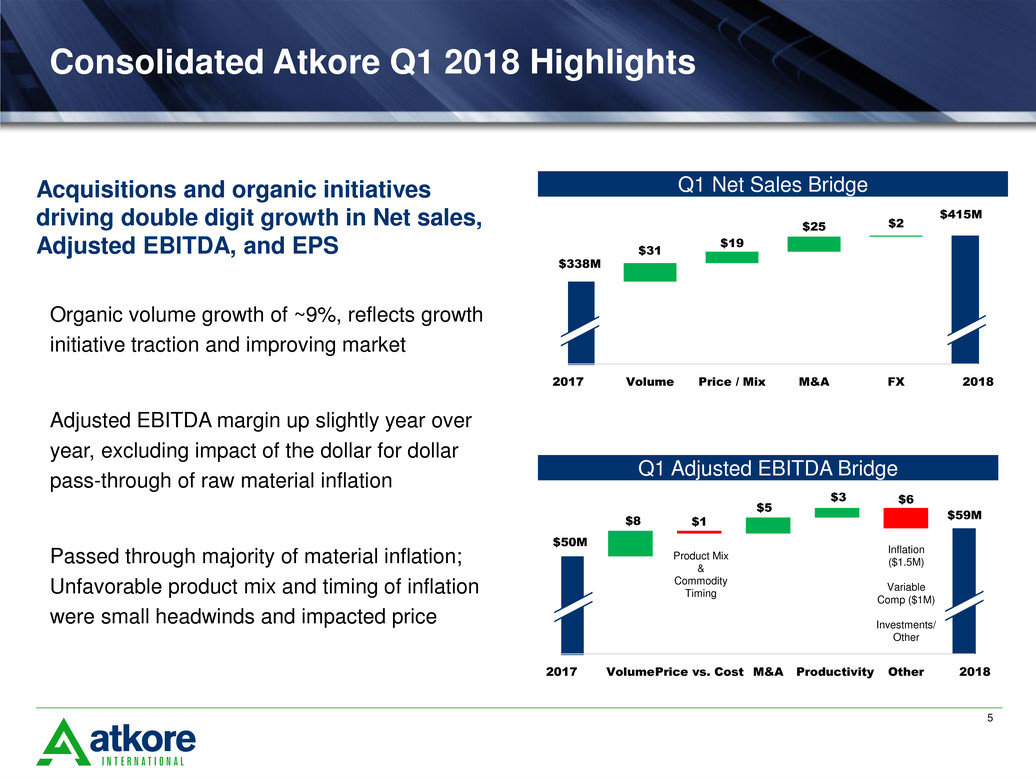

Consolidated Atkore Q1 2018 Highlights

$59M

$1

$6

$50M

$8

$5

$3

2017 VolumePrice vs. Cost M&A Productivity Other 2018

$415M

$338M

$31

$19

$25 $2

2017 Volume Price / Mix M&A FX 2018

Acquisitions and organic initiatives

driving double digit growth in Net sales,

Adjusted EBITDA, and EPS

Organic volume growth of ~9%, reflects growth

initiative traction and improving market

Adjusted EBITDA margin up slightly year over

year, excluding impact of the dollar for dollar

pass-through of raw material inflation

Passed through majority of material inflation;

Unfavorable product mix and timing of inflation

were small headwinds and impacted price

Q1 Net Sales Bridge

Q1 Adjusted EBITDA Bridge

Inflation

($1.5M)

Variable

Comp ($1M)

Investments/

Other

Product Mix

&

Commodity

Timing

5

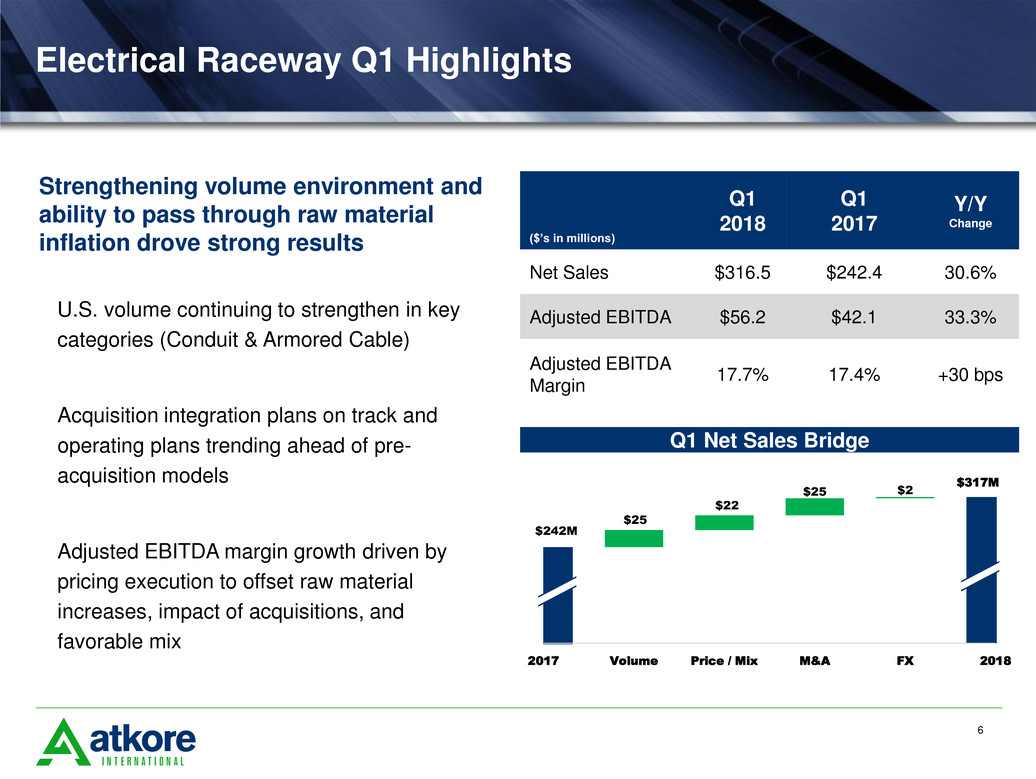

Electrical Raceway Q1 Highlights

U.S. volume continuing to strengthen in key

categories (Conduit & Armored Cable)

Acquisition integration plans on track and

operating plans trending ahead of pre-

acquisition models

Adjusted EBITDA margin growth driven by

pricing execution to offset raw material

increases, impact of acquisitions, and

favorable mix

$317M

$242M

$25

$22

$25 $2

2017 Volume Price / Mix M&A FX 2018

Q1 Net Sales Bridge

Strengthening volume environment and

ability to pass through raw material

inflation drove strong results ($’s in millions)

Q1

2018

Q1

2017

Y/Y

Change

Net Sales $316.5 $242.4 30.6%

Adjusted EBITDA $56.2 $42.1 33.3%

Adjusted EBITDA

Margin

17.7% 17.4% +30 bps

6

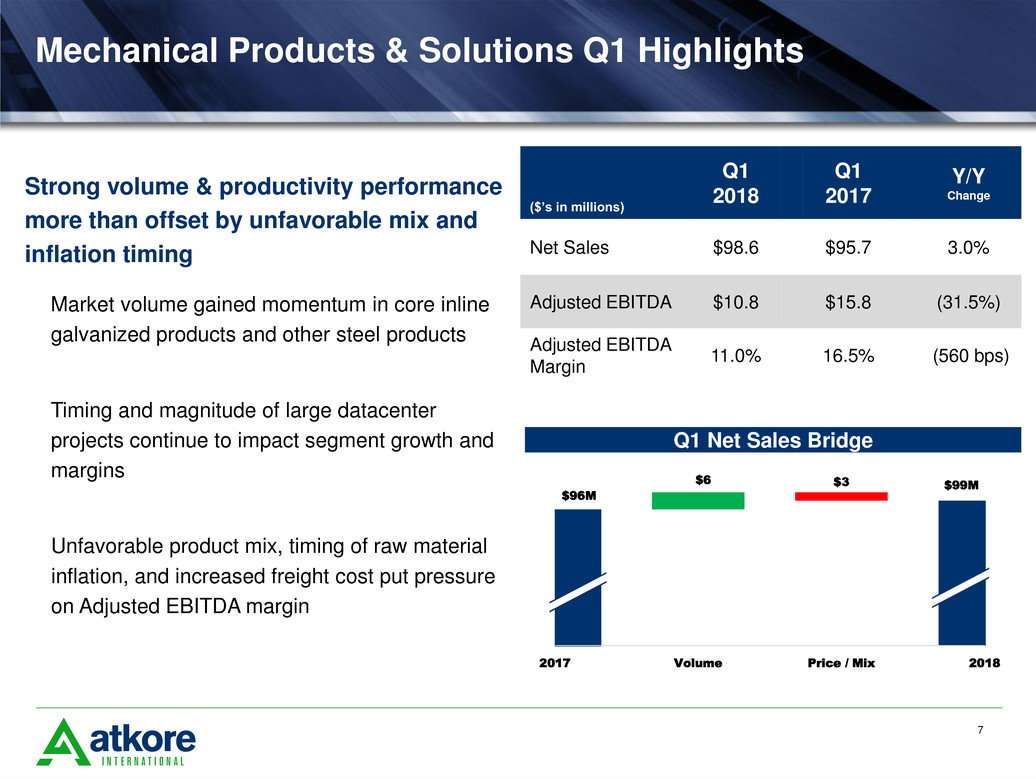

Mechanical Products & Solutions Q1 Highlights

Market volume gained momentum in core inline

galvanized products and other steel products

Timing and magnitude of large datacenter

projects continue to impact segment growth and

margins

Unfavorable product mix, timing of raw material

inflation, and increased freight cost put pressure

on Adjusted EBITDA margin

Strong volume & productivity performance

more than offset by unfavorable mix and

inflation timing

$99M$3

$96M

$6

2017 Volume Price / Mix 2018

($’s in millions)

Q1

2018

Q1

2017

Y/Y

Change

Net Sales $98.6 $95.7 3.0%

Adjusted EBITDA $10.8 $15.8 (31.5%)

Adjusted EBITDA

Margin

11.0% 16.5% (560 bps)

Q1 Net Sales Bridge

7

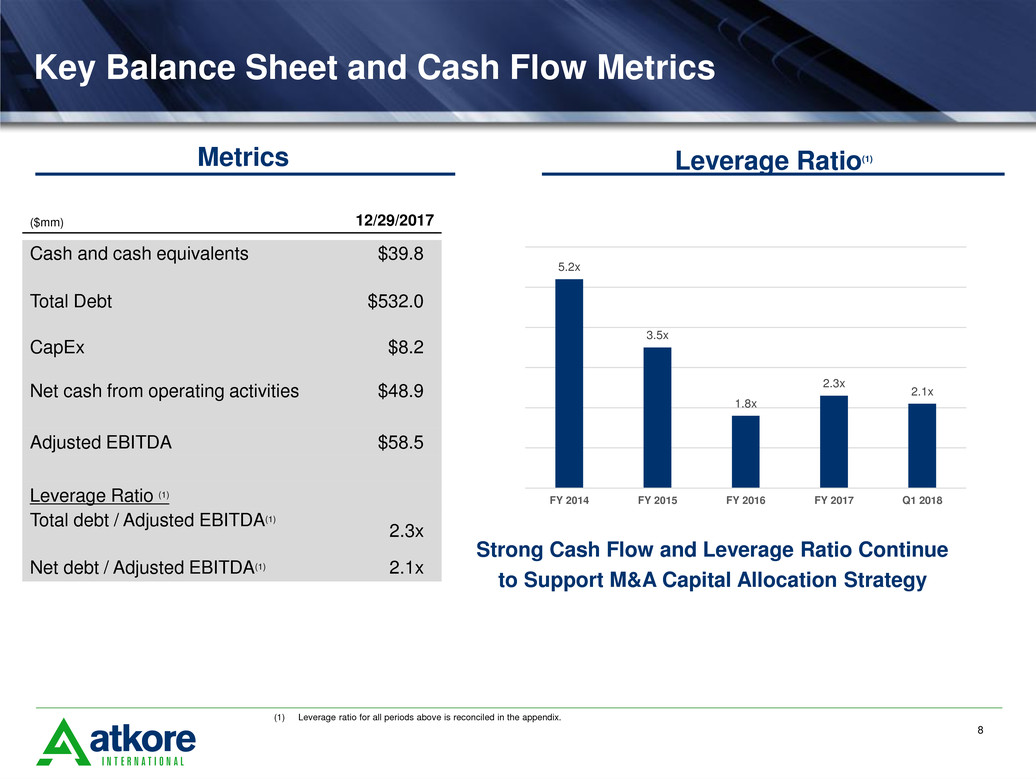

Key Balance Sheet and Cash Flow Metrics

($mm) 12/29/2017

Cash and cash equivalents $39.8

Total Debt $532.0

CapEx $8.2

Net cash from operating activities $48.9

Adjusted EBITDA $58.5

Leverage Ratio (1)

Total debt / Adjusted EBITDA(1)

2.3x

Net debt / Adjusted EBITDA(1) 2.1x

Metrics Leverage Ratio(1)

(1) Leverage ratio for all periods above is reconciled in the appendix.

5.2x

3.5x

1.8x

2.3x

2.1x

FY 2014 FY 2015 FY 2016 FY 2017 Q1 2018

Strong Cash Flow and Leverage Ratio Continue

to Support M&A Capital Allocation Strategy

8

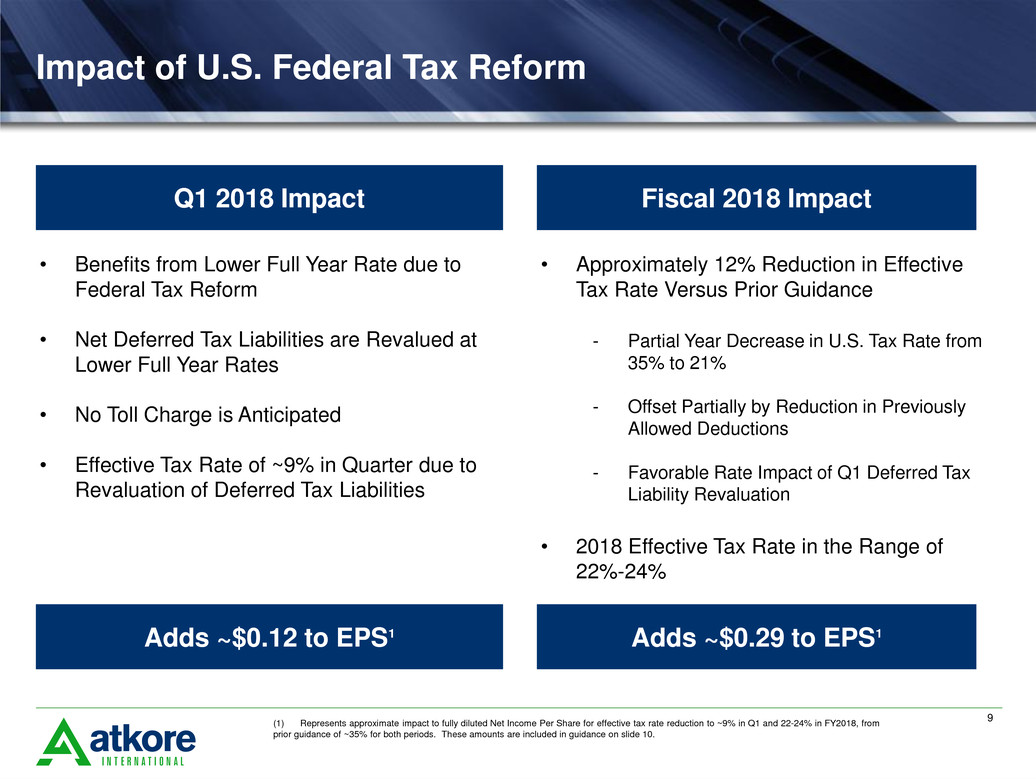

Impact of U.S. Federal Tax Reform

9

• Benefits from Lower Full Year Rate due to

Federal Tax Reform

• Net Deferred Tax Liabilities are Revalued at

Lower Full Year Rates

• No Toll Charge is Anticipated

• Effective Tax Rate of ~9% in Quarter due to

Revaluation of Deferred Tax Liabilities

Q1 2018 Impact Fiscal 2018 Impact

• Approximately 12% Reduction in Effective

Tax Rate Versus Prior Guidance

- Partial Year Decrease in U.S. Tax Rate from

35% to 21%

- Offset Partially by Reduction in Previously

Allowed Deductions

- Favorable Rate Impact of Q1 Deferred Tax

Liability Revaluation

• 2018 Effective Tax Rate in the Range of

22%-24%

Adds ~$0.12 to EPS1 Adds ~$0.29 to EPS1

(1) Represents approximate impact to fully diluted Net Income Per Share for effective tax rate reduction to ~9% in Q1 and 22-24% in FY2018, from

prior guidance of ~35% for both periods. These amounts are included in guidance on slide 10.

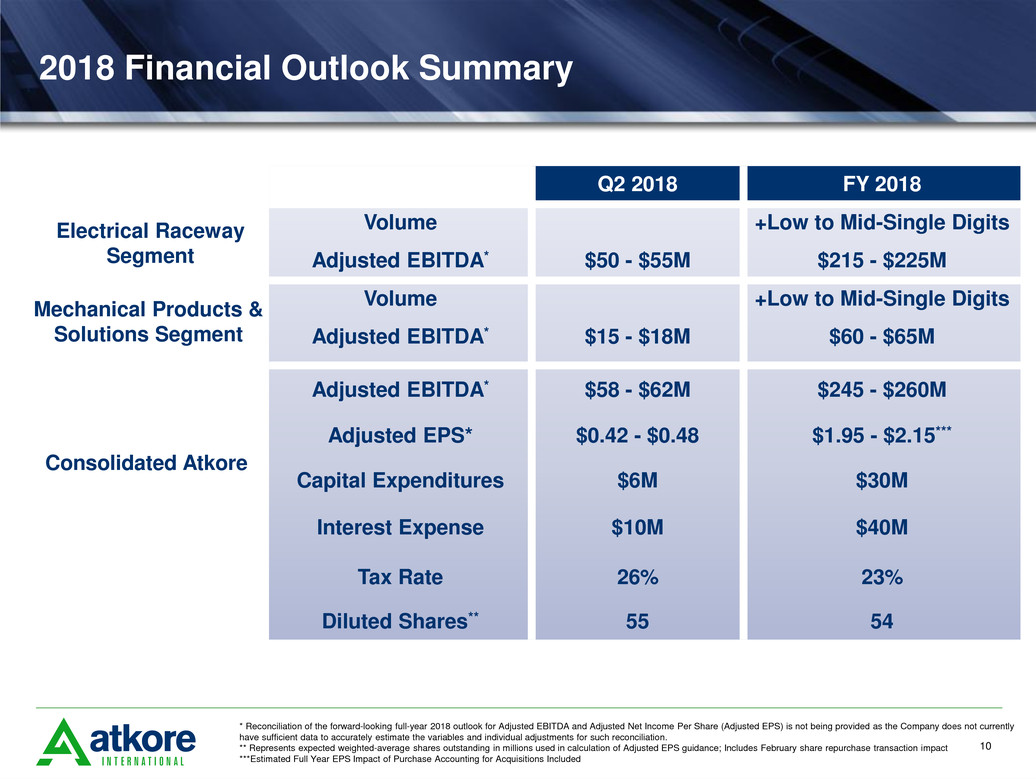

2018 Financial Outlook Summary

Electrical Raceway

Segment

Consolidated Atkore

Mechanical Products &

Solutions Segment

Q2 2018 FY 2018

Volume +Low to Mid-Single Digits

Adjusted EBITDA* $50 - $55M $215 - $225M

Volume +Low to Mid-Single Digits

Adjusted EBITDA* $15 - $18M $60 - $65M

Adjusted EBITDA* $58 - $62M $245 - $260M

Adjusted EPS* $0.42 - $0.48 $1.95 - $2.15***

Capital Expenditures $6M $30M

Interest Expense $10M $40M

Tax Rate 26% 23%

Diluted Shares** 55 54

* Reconciliation of the forward-looking full-year 2018 outlook for Adjusted EBITDA and Adjusted Net Income Per Share (Adjusted EPS) is not being provided as the Company does not currently

have sufficient data to accurately estimate the variables and individual adjustments for such reconciliation.

** Represents expected weighted-average shares outstanding in millions used in calculation of Adjusted EPS guidance; Includes February share repurchase transaction impact

***Estimated Full Year EPS Impact of Purchase Accounting for Acquisitions Included

10

Appendix

Segment Information

12

Three months ended

December 29, 2017 December 30, 2016

(in thousands) Net sales

Adjusted

EBITDA

Adjusted

EBITDA

Margin Net sales

Adjusted

EBITDA

Adjusted

EBITDA

Margin

Electrical Raceway

$ 316,523 $ 56,160 17.7% $ 242,385 $ 42,117 17.4%

Mechanical Products &

Solutions

98,574 $ 10,809 11.0% 95,681 $ 15,781 16.5%

Eliminations

(539) (475)

Consolidated operations

$ 414,558 $ 337,591

Adjusted earnings per share reconciliation

Consolidated Atkore International Group Inc.

13

Three months ended

(in thousands, except per share data) December 29, 2017 December 30, 2016

Net income $ 27,189 $ 17,382

Stock-based compensation 3,564 2,720

Loss on extinguishment of debt — 9,805

Other (a) 507 (10,930)

Pre-tax adjustments to net income 4,071 1,595

Tax effect (1,059) (571)

Adjusted net income $ 30,201 $ 18,406

Weighted-Average Common Shares Outstanding

Basic 63,316 62,642

Diluted 65,989 65,920

Net income per share

Basic $ 0.43 $ 0.28

Diluted $ 0.41 $ 0.26

Adjusted Net income per share

Basic $ 0.48 $ 0.29

Diluted $ 0.46 $ 0.28

(a) Represents other items, such as inventory reserves and adjustments, realized or unrealized gain (loss) on foreign currency transactions and

release of certain indemnified uncertain tax positions.

Net Income to Adjusted EBITDA reconciliation

Consolidated Atkore International Group Inc.

14

TTM Three months ended

(in thousands)

December 29,

2017

December 29,

2017

September 30,

2017 June 30, 2017 March 31, 2017

Net income $ 94,446 $ 27,189 $ 20,857 $ 27,465 $ 18,935

Interest expense, net 23,362 6,594 5,726 5,811 5,231

Income tax expense 38,495 2,516 12,173 11,431 12,375

Depreciation and amortization 58,309 17,210 14,485 13,341 13,273

Restructuring & impairments 1,129 262 556 (101) 412

Stock-based compensation 13,632 3,564 3,420 3,064 3,584

Legal matters 7,551 — 50 — 7,501

Transaction costs 3,863 645 2,235 845 138

Gain on sale of joint venture (5,774) — — — (5,774)

Other 1,191 507 60 177 447

Adjusted EBITDA $ 236,204 $ 58,487 $ 59,562 $ 62,033 $ 56,122

Acquisitions add-back1 14,881

Pro Forma Adjusted EBITDA $ 251,085

(1) Pro Forma adjustments add the Adjusted EBITDA for acquisitions completed in FY2017 not reported in the Adjusted EBITDA line due to

acquisition date

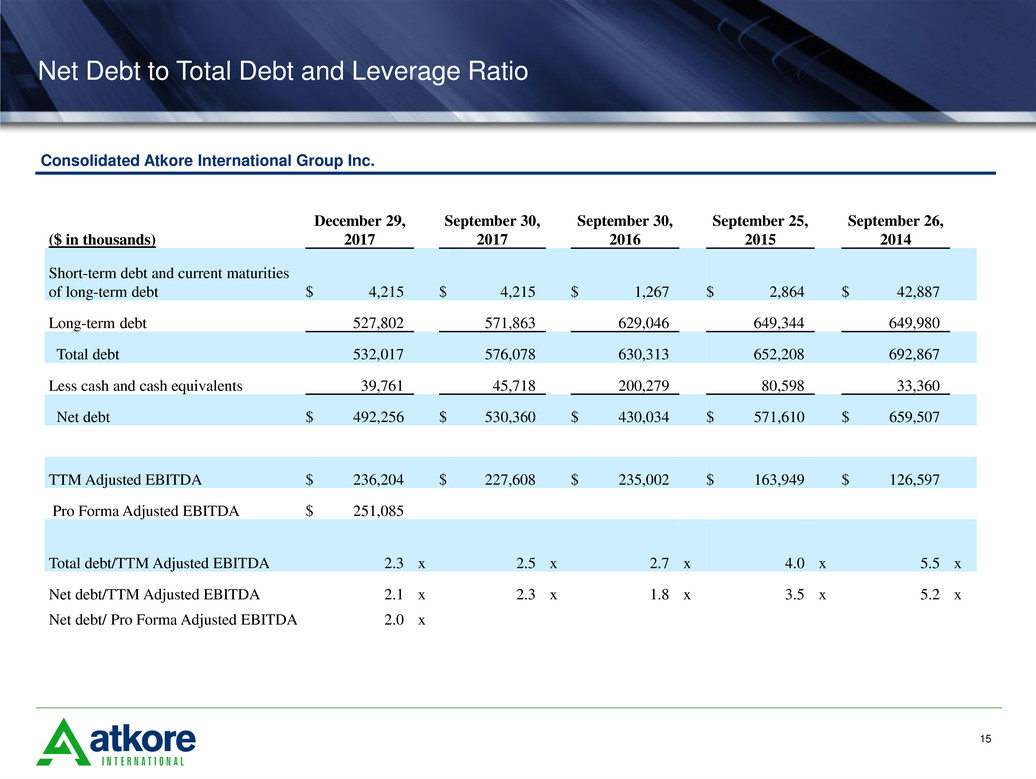

Net Debt to Total Debt and Leverage Ratio

Consolidated Atkore International Group Inc.

15

($ in thousands)

December 29,

2017

September 30,

2017

September 30,

2016

September 25,

2015

September 26,

2014

Short-term debt and current maturities

of long-term debt $ 4,215 $ 4,215 $ 1,267 $ 2,864 $ 42,887

Long-term debt 527,802 571,863 629,046 649,344 649,980

Total debt 532,017 576,078 630,313 652,208 692,867

Less cash and cash equivalents 39,761 45,718 200,279 80,598 33,360

Net debt $ 492,256 $ 530,360 $ 430,034 $ 571,610 $ 659,507

TTM Adjusted EBITDA $ 236,204 $ 227,608 $ 235,002 $ 163,949 $ 126,597

Pro Forma Adjusted EBITDA $ 251,085

Total debt/TTM Adjusted EBITDA 2.3 x 2.5 x 2.7 x 4.0 x 5.5 x

Net debt/TTM Adjusted EBITDA 2.1 x 2.3 x 1.8 x 3.5 x 5.2 x

Net debt/ Pro Forma Adjusted EBITDA 2.0 x