Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Global Eagle Entertainment Inc. | d435282d8k.htm |

Business Update February 1, 2018 Exhibit 99.1

We make forward-looking statements in this presentation within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may include, without limitation, statements regarding our cash-flow generation, revenue growth and margin expansion in future periods, SEC reporting compliance, continued financial-covenant compliance under our credit agreement, the cessation of Nasdaq’s delisting proceedings, M&A integration activities, our systems and process implementation activities, business outlook, industry, business strategy, plans, goals and expectations concerning our market position, international expansion, future technologies, future operations, margins, profitability, future efficiencies, capital expenditures, liquidity and capital resources and other financial and operating information. These statements may be preceded by, followed by or include the words “anticipate,” “assume,” “believe,” “budget,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “future” and the negative of these or similar terms and phrases or similar expressions. These forward-looking statements are based on information available to us as of the date they were made (which is February 1, 2018), and involve a number of risks and uncertainties which may cause them to turn out to be wrong. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Please refer to our most recently filed Annual Report on Form 10-K and subsequently filed Quarterly Reports on Form 10-Q, and in particular any discussion of risk factors or forward-looking statements therein, which are available on the SEC’s website (www.sec.gov), for a full discussion of the risks and other factors that may impact any forward-looking statements in this presentation or that you may hear today. Forward-Looking Statements

MEDIA & CONTENT

Content for Mobility We curate, manage and distribute wholly-owned and licensed media Content licensing Content services Digital media UX/UI Design Portal Design APIs and SDKs Seatback Apps Games Advertising Content editing, integration and metadata Movie and television licensing & distribution Delivering 10 petabytes of movies viewed by 1 billion airline & maritime passengers annually Identifying, programming and licensing movies, television and live event content for mobility Portfolio of digital advertising, games, mobile applications and content development Video/audio customization, media delivery, management services & creative services Provides content edits required for local cultural, religious and political views Metadata and rights management Movie, TV & event acquisition and distribution for aviation, maritime & non-theatrical Rights owner for some independent studios Exclusive & preferred deals with major studios Advertising partner for airlines covering lounge, software portal, and IFE systems Games and applications for seatback systems including partnerships with Disney & EA Studio development (safety videos, GUIs) 3

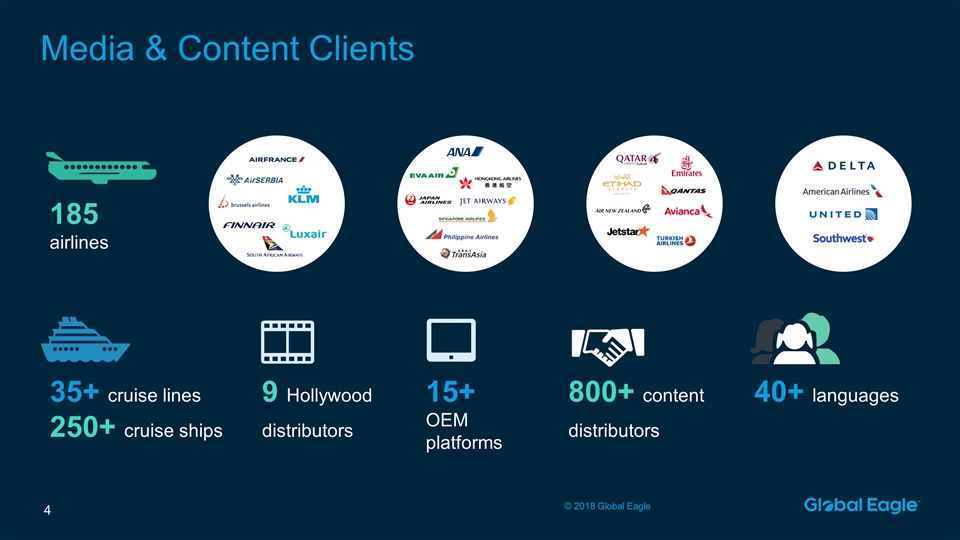

Media & Content Clients 35+ cruise lines 250+ cruise ships 9 Hollywood distributors 15+ OEM platforms 185 airlines 800+ content distributors 40+ languages 4

Media & Content Business Update Renewal of key customers Recent new wins High quality content line-up Operational transformation to fully digital workflow Margin improvement Scalability 5

Digital Transformation New digital mobile products creating growth & long term value Develop next-generation Travel Entertainment with enhanced Digital Media capabilities OTT and social media platforms have disrupted the market and permanently changed how audiences consume media Global Eagle will capitalize on this disruption in travel: We are developing next-gen, mobile-centric travel entertainment services Our mobility platforms are data-enabled to reach this audience in the right place, at the right time to maximize commercial value for our customers and our partners

CONNECTIVITY

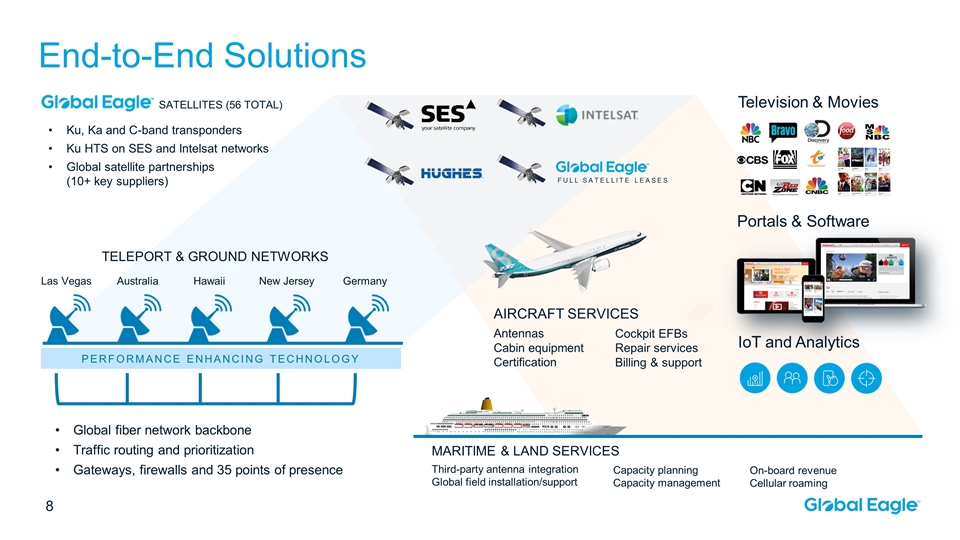

End-to-End Solutions FULL SATELLITE LEASES Hawaii New Jersey Germany Australia TELEPORT & GROUND NETWORKS Las Vegas Global fiber network backbone Traffic routing and prioritization Gateways, firewalls and 35 points of presence SATELLITES (56 TOTAL) Ku, Ka and C-band transponders Ku HTS on SES and Intelsat networks Global satellite partnerships (10+ key suppliers) Television & Movies Portals & Software AIRCRAFT SERVICES Antennas Cabin equipment Certification MARITIME & LAND SERVICES Third-party antenna integration Global field installation/support Cockpit EFBs Repair services Billing & support Capacity planning Capacity management On-board revenue Cellular roaming PERFORMANCE ENHANCING TECHNOLOGY IoT and Analytics

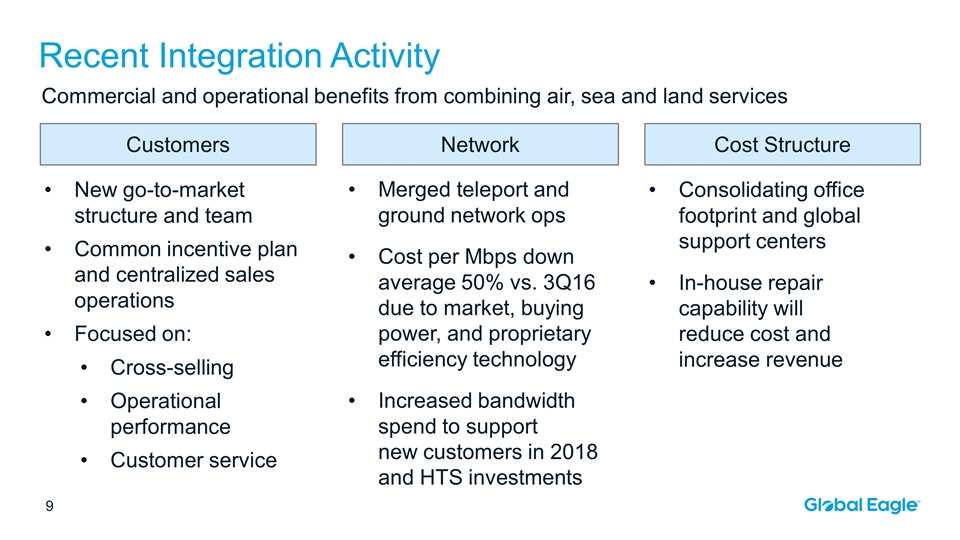

Recent Integration Activity Commercial and operational benefits from combining air, sea and land services Customers Network Cost Structure New go-to-market structure and team Common incentive plan and centralized sales operations Focused on: Cross-selling Operational performance Customer service Merged teleport and ground network ops Cost per Mbps down average 50% vs. 3Q16 due to market, buying power, and proprietary efficiency technology Increased bandwidth spend to support new customers in 2018 and HTS investments Consolidating office footprint and global support centers In-house repair capability will reduce cost and increase revenue

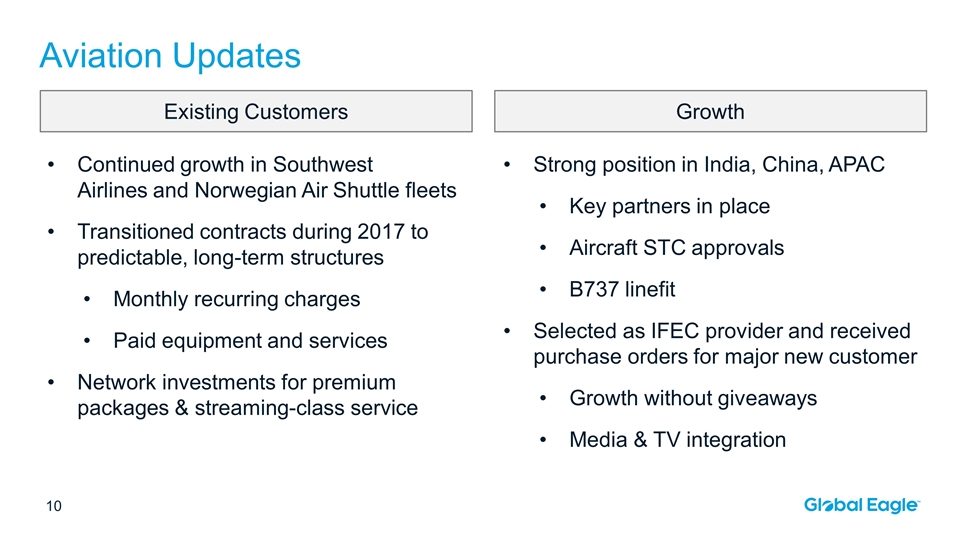

Aviation Updates Existing Customers Growth Continued growth in Southwest Airlines and Norwegian Air Shuttle fleets Transitioned contracts during 2017 to predictable, long-term structures Monthly recurring charges Paid equipment and services Network investments for premium packages & streaming-class service Strong position in India, China, APAC Key partners in place Aircraft STC approvals B737 linefit Selected as IFEC provider and received purchase orders for major new customer Growth without giveaways Media & TV integration

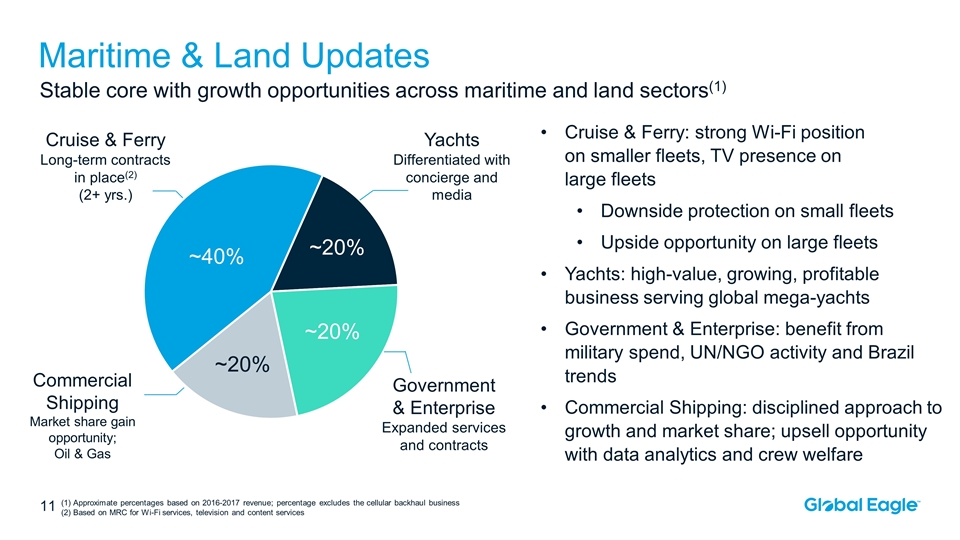

Maritime & Land Updates Stable core with growth opportunities across maritime and land sectors(1) Cruise & Ferry: strong Wi-Fi position on smaller fleets, TV presence on large fleets Downside protection on small fleets Upside opportunity on large fleets Yachts: high-value, growing, profitable business serving global mega-yachts Government & Enterprise: benefit from military spend, UN/NGO activity and Brazil trends Commercial Shipping: disciplined approach to growth and market share; upsell opportunity with data analytics and crew welfare Cruise & Ferry Long-term contracts in place(2) (2+ yrs.) Yachts Differentiated with concierge and media Government & Enterprise Expanded services and contracts Commercial Shipping Market share gain opportunity; Oil & Gas ~40% ~20% ~20% ~20% (1) Approximate percentages based on 2016-2017 revenue; percentage excludes the cellular backhaul business (2) Based on MRC for Wi-Fi services, television and content services

FINANCE

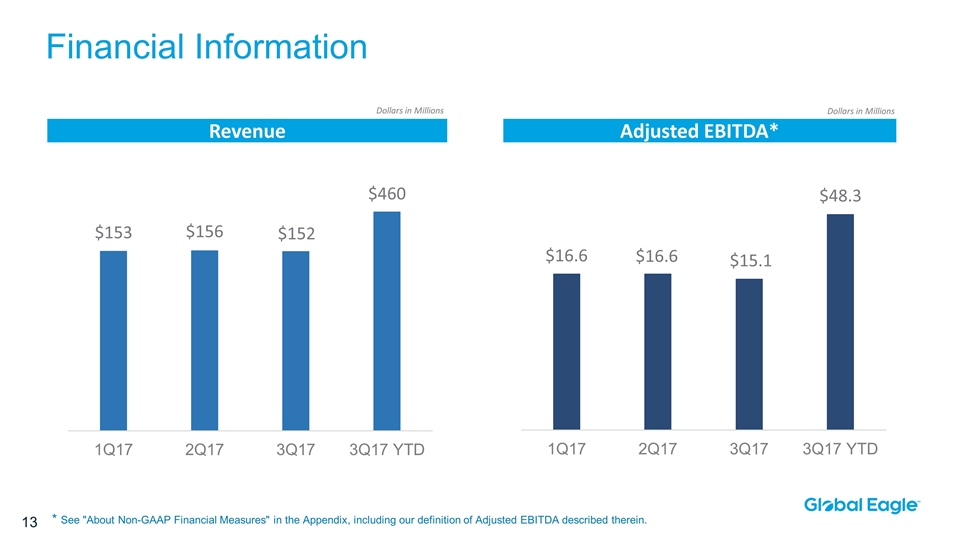

Revenue Adjusted EBITDA* Dollars in Millions Dollars in Millions $16.6 $16.6 $15.1 $48.3 $153 $156 $152 $460 Financial Information * See "About Non-GAAP Financial Measures" in the Appendix, including our definition of Adjusted EBITDA described therein.

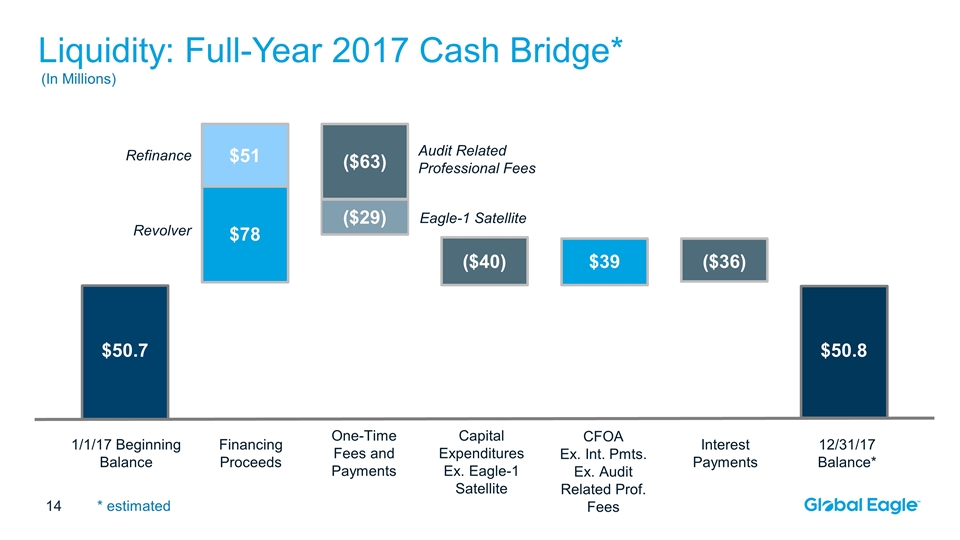

Liquidity: Full-Year 2017 Cash Bridge* 1/1/17 Beginning Balance Financing Proceeds One-Time Fees and Payments Capital Expenditures Ex. Eagle-1 Satellite CFOA Ex. Int. Pmts. Ex. Audit Related Prof. Fees Interest Payments 12/31/17 Balance* $78 $51 ($63) ($29) ($40) $39 ($36) Revolver Refinance Eagle-1 Satellite Audit Related Professional Fees $50.7 $50.8 * estimated (In Millions)

APPENDIX

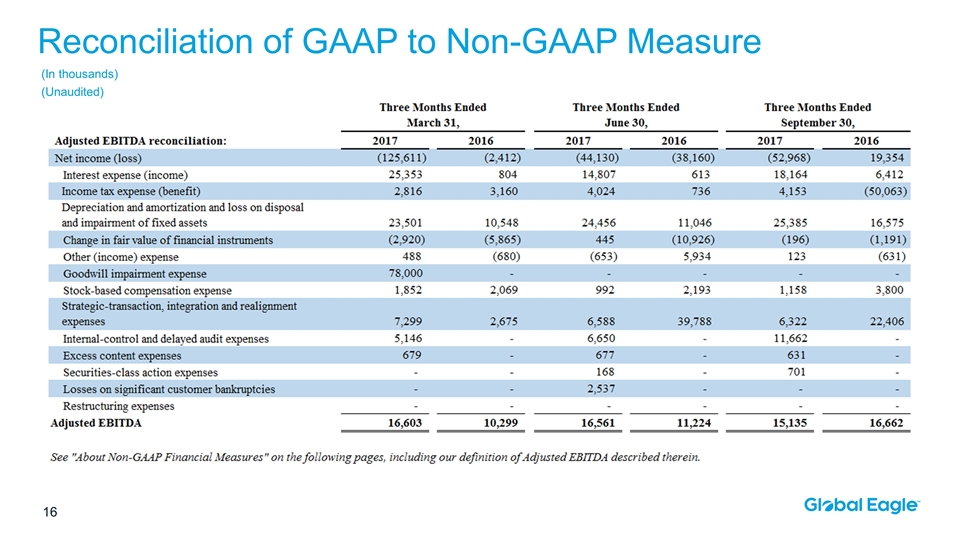

(In thousands) (Unaudited) Reconciliation of GAAP to Non-GAAP Measure 16

About Non-GAAP Financial Measures To supplement our consolidated financial statements, which were prepared and presented in accordance with accounting principles generally accepted in the United States, or GAAP, we present Adjusted EBITDA, which is a non-GAAP financial measure, as a measure of our performance. The presentation of Adjusted EBITDA is not intended to be considered in isolation from, or as a substitute for, or superior to, net income (loss) or any other performance measures derived in accordance with GAAP or as an alternative to net cash provided by operating activities or any other measures of our cash flows or liquidity. Further, we note that Adjusted EBITDA as presented herein is defined and calculated differently than the “Consolidated EBITDA” definition in our senior-secured credit agreement, which Consolidated EBITDA definition we use for financial-covenant-compliance purposes thereunder and as a measure of our liquidity. Adjusted EBITDA is one of the primary measures used by our management and Board of Directors to understand and evaluate our financial performance and operating trends, including period to period comparisons, to prepare and approve our annual budget and to develop short and long term operational plans. Additionally, Adjusted EBITDA is one of the primary measures used by our Compensation Committee to establish the funding targets for (and subsequent funding of) our Annual Incentive Plan bonuses for our employees and executives. We believe our presentation of Adjusted EBITDA is useful to investors both because it allows for greater transparency with respect to key metrics used by management in its financial and operational decision-making and because our management frequently uses it in discussions with investors, commercial bankers, securities analysts and other users of our financial statements. We define Adjusted EBITDA as net income (loss) before (a) interest expense (income), (b) income tax expense (benefit) and (c) depreciation and amortization (including relating to equity-method investments) and loss on disposal and impairment of fixed assets, and we then further adjust that result to exclude (1) change in fair value of financial instruments, (2) other (income) expense, including primarily, when applicable, (gains) losses from investments and foreign-currency-transaction (gains) losses, (3) goodwill impairment expense, (4) stock-based compensation expense, (5) strategic-transaction, integration and realignment expenses (as described below), (6) auditor and related third-party professional fees and expenses related to our internal-control deficiencies (and the remediation thereof) and delays in our 2016 audit process, (7) excess content expenses (as described below), (8) securities class-action expenses (as described below), (9) losses on significant customer bankruptcies (as described below) and (10) restructuring expenses pursuant to our September 2014 integration plan (when applicable in the period). Management does not consider these items to be indicative of our core operating results.

“Excess content expenses” includes the additional purchasing costs that we incurred in 2017 to procure movie content for our customers, notwithstanding that we could have procured equivalent content under our (preferential-pricing) output arrangements with major studios. We incurred these additional costs because we could not timely identify and measure our movie-content expenditures and procurement during the period due to weaknesses in our control environment. “Losses on significant customer bankruptcies” includes (1) our provision for bad debt associated with the bankruptcies of Air Berlin and Alitalia (two of our Media & Content customers) in 2017, together with (2) the costs (e.g., content acquisition fees) that we incurred to maintain service to those customers during their bankruptcy proceedings in order to preserve the customer relationship. “Securities class-action expenses” includes third-party professional fees and expenses associated with the securities class-action lawsuits filed against us in 2017. “Strategic-transaction, integration and realignment expenses” includes (1) transaction-related expenses and costs (including third-party professional fees) attributable to acquisition, financing, investment and other strategic-transaction activities, (2) integration and realignment expenses and allowances, (3) employee-severance, retention and relocation expenses, (4) purchase-accounting adjustments for deferred revenue, costs and credits associated with companies and businesses that we have acquired through our M&A activities, (5) service-level-agreement penalties incurred during our Eagle-1 migration and setup in its new orbital slot in 2017, and (6) claims at companies or businesses that we acquired through our M&A activities for underlying liabilities that pre-dated our acquisition of those companies or businesses. In respect of clause (6) in this definition, we include (i.e., exclude from net income (loss)) any estimated loss contingencies and provisions for legal settlements relating to those liabilities. About Non-GAAP Financial Measures (Continued)