Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FGL Holdings | fglholdings8-kinvestorpres.htm |

FGL Holdings January 31, 2018 1

January 31, 2018

FGL Holdings Investor Update

FGL Holdings January 31, 2018 2

Legal Disclosures

► All data in this presentation are as of 12/31/2017 and include unaudited 4Q17 estimated results, unless stated

otherwise

► As a result of the recent merger with CF Corp., the acquisition method of accounting (purchase accounting or

PGAAP) will be applied in 4Q17, including the initial recognition of most of the company’s assets and liabilities at fair

value and other merger related effects.

► Caution regarding forward-looking statements:

► This presentation contains forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements are subject to risks and uncertainties that could cause actual results, events

and developments to differ materially from those set forth in, or implied by, such statements. These statements are

based on the beliefs and assumptions of F&G’s management and the management of its subsidiaries.

► Generally, forward-looking statements include actions, events, results, strategies and expectations and are often

identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,”

“projects,” “may,” “will,” “could,” “might,” or “continues,” “outlook” or similar expressions. Factors that could cause

actual results, events and developments to differ from those set forth in, or implied by, the statements set forth

herein are discussed from time to time in F&G’s filings with the SEC, as well as those of its predecessor

companies—FGL and CFCO. You can find these filings on the SEC’s website, www.sec.gov.

► All forward-looking statements we describe herein are qualified by these cautionary statements and we can

provide no assurance that the actual results, events or developments referenced herein will occur or be realized.

F&G does not undertake any obligation to update or revise forward-looking statements to reflect changed

assumptions, the occurrence of unanticipated events or changes to future operating results.

► All estimates and forecasts for the effects of purchase accounting are preliminary and subject to change.

► Permission neither sought nor obtained with reference to third party sources

FGL Holdings January 31, 2018 3

Transaction Background

FGL Holdings January 31, 2018 4

Transaction Highlights

Conservative financial leverage with strong capitalization

Significant underlying cash and investable assets of $23B

Prudent Capital

Position with

Significant

Investable assets

4

Favorable demographic trends and growing retirement population drives

broader demand for FIA, MYGA and IUL products

F&G experienced ~10% annual sales growth from 2012-2016

Attractive

Sector and

Company Growth

3

Accelerated earnings momentum through enhanced asset management

performance through relationship with Blackstone and a tax-efficient

international platform

An enhanced ability to pursue ongoing strategic acquisitions by leveraging the

experience and professional network of CF Founders and Blackstone

Well Defined Value

Creation Levers

1

Primary insurance company with well-established Fixed Indexed Annuity (FIA),

Multi-Year Guaranty Annuity (MYGA) and Indexed Universal Life (IUL) platforms

Offers a comprehensive suite of underlying product offerings through its

longstanding and stable distribution relationships

Established Life &

Annuity Franchise

2

CF Corp. Founders Chinh Chu and Bill Foley bring significant investment and

operational expertise to F&G

Total investment of $900+ M from Chinh Chu, Bill Foley, FNF and Blackstone

demonstrates significant ongoing commitment to the franchise

Strong

Sponsorship with

Significant Capital

Investment

5

F&G

FGL Holdings January 31, 2018 5

Founders’ Background—World Class Sponsorship

CF Corporation (CFCO) was a publicly-listed company founded by Chinh Chu and William Foley which raised an

aggregate of $1.2 B of proceeds to acquire a high quality operating company; resulting in FGL Holdings (NYSE: FG)

Primary objective: build high quality, enduring business by using permanent capital

One of the largest U.S.-listed special purpose acquisition companies (SPAC)

Significant investment by co-founders aligns with shareholders’ interests

Capital raised from a broad base of blue-chip long-term investors

Well-

respected

reputations

Operational

expertise

Stewards of

stakeholders’

interests

History of

strategic

investments

with long-

term

horizon

CF

Corp.

Founders

Track

record of

delivering

stability and

value

Broad and

deep

insurance

industry

expertise

William P. Foley II

Founder and Co-Chairman (30+ Years Experience)

$54B of public market value creation

3 separate multi-billion dollar public market platforms, with over 100

acquisitions across all platforms

Chairman of the Board of Fidelity National Financial (“FNF”)

Vice-Chairman of the Board of Fidelity National Information Services (FIS)

Chinh E. Chu

Founder and Co-Chairman (25+ Years Experience)

Previously a Senior Managing Director at Blackstone and member of

Blackstone’s Executive Committee

- Longest tenured partner aside from Stephen Schwarzman

Served on Boards of Kronos, NCR, SunGard, London Financial Futures

Exchange, BankUnited, Stearns Mortgage, Celanese, Nalco, Catalent,

Nycomed, Stiefel, Allied Barton, and Graham Packaging

FGL Holdings January 31, 2018 6

Business Update

FGL Holdings January 31, 2018 7

Transaction Closing Overview

► Successfully closed transaction on

11/30/2017 for $1.84B

► New international entity structure in place

► Capitalized F&G Re with $750M

► Executed ~60% ModCo reinsurance

transaction between FGLIC and F&G Re

► Transitioned Investments team and $23B

portfolio management to Blackstone Group

► Established new Board of Directors

► Retained executive leadership team

FGL Holdings

(Cayman)

(NYSE: FG)

FGL US Holdings

Other

Non-Life

U.S. Entities

FGLIC (Iowa)

& Subsidiaries

Miscellaneous

Subsidiaries

F&G Re Ltd.

(Bermuda)

CF Bermuda

Holdings

(Bermuda)

FGL Holdings January 31, 2018 8

Sales Update

438 455 424 462

294

127 164 161

1Q17 2Q17 3Q17 4Q17E

F&G Annuity Sales Total $2.5B — F&G 6%; Industry 11% through 9/30/171

($M)

► Over past four years, F&G has consistently grown sales at greater than a 10% CAGR.

►2017 annuity sales of $2.5B are down 6% amidst industry-wide disruption from DOL ruling and

reduced appetite for safe money products given strong equity market gains

►Overall industry FIA sales are down 11% through 9/30/17

► Assets under management up 9% over 2016 with annuity volume + solid policyholder persistency

►~85% of FIA in-force protected by an average surrender charge of 9%

► Key distribution relationships remain strong and aligned for growth in 2018

AAUM ($B)

20.2 20.6 20.8 21.9

1Wink’s Report and LIMRA

► Achieved ~13% New

Business IRR for FIA’s

in 2017

► Post transaction target

is 15% with investment

and tax lift

FIA Other Annuities

732

582 588 623

FGL Holdings January 31, 2018 9

Portfolio Performing Well … Repositioning for Upside

247

257

261

265

1Q17 2Q17 3Q17 4Q17E

Portfolio Yield

2017 Net Investment Income (NII): $1.032B — +10% from prior year

($M)

4.90% 5.01% 5.02% 5.03%

► Investment portfolio has performed well throughout 2017 ... consistent improvement

in yield compared to prior year — up 8 bps overall

► No asset impairments in 4th quarter and just 4 bps on AAUM for full year, well below

pricing; <10 bps on average over last five years

► Net FIA spread consistently around 300bps … better than pricing

► Current portfolio is high-quality, well-matched and ready for upside repositioning

► NII $1,032B; 10%

► Portfolio 92% NAIC 1 & 2

► Fixed Maturities 96% IG

► Avg. ’17 Yield 5.00%

1 Results above do not reflect effects of transaction close at 11/30/17. Amounts and metrics for 4Q17E do not reflect impact of purchase accounting and

related fair value of investment portfolio, which are non-cash in nature.

1

FGL Holdings January 31, 2018 10

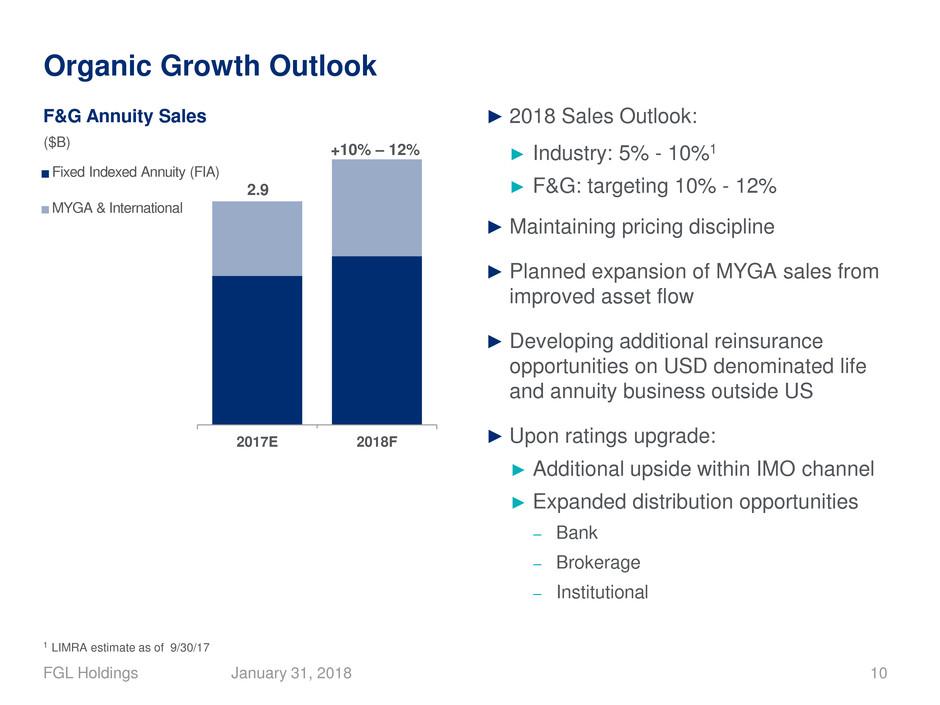

Organic Growth Outlook

2017E 2018F

Fixed Indexed Annuity (FIA)

MYGA & International

► 2018 Sales Outlook:

► Industry: 5% - 10%1

► F&G: targeting 10% - 12%

► Maintaining pricing discipline

► Planned expansion of MYGA sales from

improved asset flow

► Developing additional reinsurance

opportunities on USD denominated life

and annuity business outside US

► Upon ratings upgrade:

► Additional upside within IMO channel

► Expanded distribution opportunities

– Bank

– Brokerage

– Institutional

2.9

F&G Annuity Sales

($B)

+10% – 12%

1 LIMRA estimate as of 9/30/17

FGL Holdings January 31, 2018 11

U.S. Tax Reform Update

► Broad tax reform legislation signed into law and effective 1/1/2018; Corporate tax rate

reduced from 35% 21%

► Several provisions broadly impact insurance sector; F&G impact manageable

► timing of life insurance reserve deductibility

► timing of acquisition cost deductibility

► certain permanent adjustments regarding company treatment of dividends and tax-exempt interest

► Insurers with international operations are further impacted by provision to apply

alternative tax on affiliate reinsurance payments—base erosion alternative tax (BEAT)—

in addition to 1% federal excise tax

► industry analysis as to the method of alternative tax calculation is ongoing

► near-term, F&G is assuming a conservative onshore effective tax rate of 21% on all business

► working through restructuring scenarios to maintain flexibility while ensuring no exposure to BEAT

► Significant work continues to

► refine overall impact of tax reform legislation & BEAT implications for international platform

► explore further opportunities to leverage international platform

FGL Holdings January 31, 2018 12

U.S. Tax Reform Update (continued)

►Key assumptions looking ahead

► Clear benefits from lower overall corporate tax rate vs. historical ETR%

► Initial GAAP ETR projected to be at ~20% rate; though depending on final Treasury

guidance / regulations could be lower and in line with deal assumptions

►Add’l 3rd party options under evaluation can reduce ETR down to ~15% over time

► Lower corporate rate also reduces RBC ratios ...Industry range is 50-100 points1

►F&G estimate at the lower end of range; expect to offset with other actions as we

manage capital in support of desired ratings

►Estimated 2018 RBC ratio will be 425% - 450% for F&G

Historical GAAP Effective Tax

Rate

~35%

Current Assumption ETR%Assumed ETR % at Transaction

(based on 60% ModCo)

~10%-12%

~15% to ~20%

1CreditSights and industry estimates

FGL Holdings January 31, 2018 13

~4.9%

~5.0%

At Merger Signing Investment Lift Before

PGAAP

By Yearend '19

Repositioning Investment Portfolio

► $23B Investment Management Agreement executed at closing

► Newly formed “Blackstone Insurance Solutions Group” faces markets as part of ~$400B

Blackstone organization; immediate access to improved asset flows & expertise

► improved capital markets coverage;

► enhanced investment grade opportunities;

► access to Blackstone Funds (Private Equity, Real Estate, Credit, etc.)

►Actions well-underway to transform portfolio by year end 2019 and more than offset

estimated ~50 bps decrease to portfolio yield from initial purchase accounting impact

► Reposition low-earning

assets

► % structured assets

► 5% allocation to alternatives

Net Portfolio Yield

1 Estimated ~50 bps decrease to historical portfolio yield from fair value effects of purchase accounting (PGAAP), which are non-cash in nature.

2 Combined $80 - $90M+ increase to Net Income in 2019 from optimized asset management and assuming a 20% tax rate.

Investment

Actions ~5.5%

Purchase

accounting1

+20 - 30 bps

additional

40 bps

original lift

FGL Holdings January 31, 2018 14

Path to Value Creation—Levers to Increase Share Price

- $1.50

(1.0x - 3.0x

Multiple Uplift)

Reduction in tax rate to

~20% provides meaningful

earnings uplift, with potential

to reduce ETR to ~15% over

time with alternative

commercial solutions for

international platform

Tax Reform and

Reinsurance Structure

~60 - 70bps net yield uplift

targeted by YE19

Reposition actions

underway

Optimize Asset

Management

$2.5B of assets can yield

approximately 5-10%

incremental equity value

under new F&G structure

Leverage extensive

experience of FG Founders

and Board Co-Chairs

Accretive, Value-Add

Acquisitions

Structurally-improved ROE

results in higher

compounding and net

income growth

Selected industry

comparables trade at a

range of 10x to 13x P/E

Multiple Re-rating

Today ~2019: ~$13.00 to $14.501 Further Upside: ~$15.00+

Note: Assumes 214.4M ordinary shares and 70.9M warrants outstanding.

1Dilutive effect of warrants allocated pro rata across each Baseline item (except purchase accounting).

2$40 - $50M increase to Net Income in 2019 from Tax Reform and reinsurance.

3$80M - $90M+ increase to Net Income in 2019 from optimized asset management and reflecting a 20% tax rate.

4~$40M decrease to Net Income in 2019 from fair value effects of purchase accounting which are non-cash in nature. Estimated $65M decrease in after tax NII

(decrease of 50 bps portfolio yield).

partially offset by $25M increase from other items. FV effects to NII diminish beyond 2019 as in force portfolio matures or is repositioned.

5Range reflects acquisition of $2.5B - $10.0B of assets. Assumes target acquired at 1.0x P/BV and target standalone ROE of 10% improved pro forma to 15-19%.

Multiple

Re-Rating

Additional

Acquisitions5

Purchase

Accounting4$3.00 –

$3.50

$1.00 - $1.75

Tax Reform /

Reinsurance

Structure2

Asset

Management3

Before

Purchase

Accounting4

~$13.00

~$10.00

~$14.50

($1.50)

FGL Holdings January 31, 2018 15

Strong & Flexible Capital Base

► Debt to Capital at year-end 2017 ~25% … fixed charge coverage ratio >10x

► ~$100M cash at various holding companies

► New 3-year, $250M credit facility in place

► 400M1 capital available for general purposes; including M&A

► No common equity dividend assumed and preferred dividends assumed paid in kind (PIK)2

► 475% - 500% RBC in Iowa-based FGLIC

► >200% Bermuda Solvency Capital Requirement (BSCR) established

Current Ratings S&P A.M. Best Fitch Moody’s

Issuer Credit Rating3 BB+ / Positive bb+ / Under Review BB+ / Stable Ba35 / Stable

Financial Strength Rating4 BBB+ / Stable B++ / Under Review BBB / Stable Baa2 / Stable

1$400M capital at 15% ROE would equate to $600M value at 10x price-to-earnings (P/E) ratio.

2Payment of PIK dividends on preferred shares is subject to the terms of the preferred shares certificate of designation and investor agreement.

3Reflects issuer credit rating for holding companies and senior notes.

4Reflects financial strength rating for insurance operating subsidiaries.

5Reflects issuer credit rating for FGL Holdings. Issuer credit rating of Ba2 for CF Bermuda Holdings Limited and Fidelity & Guaranty Life Holdings, Inc.

Positioning for ratings upgrades to support expanded growth opportunities

FGL Holdings January 31, 2018 16

Looking Ahead to Upcoming Investor Day

Co-chairmen and executive management to cover the following topics

►Further insights to investment portfolio shifts

►Tax reform update

►Purchase accounting impacts

►2018 outlook and objectives