Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PEAPACK GLADSTONE FINANCIAL CORP | form8k-19356_pgfc.htm |

Exhibit 99.1

Investor Presentation “Expanding Our Reach” Strategic Update and Year End Review 12/31/2017 P EAPACK - G LADSTONE B ANK

The foregoing contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are not historical facts but rather may include expressions about Management’s view of future financial condition and results of operations, Management’s confidence and strategies and Management’s expectations about new and existing programs and products , investments, relationships, opportunities and market conditions. These statements may be identified by such forward - looking term inology as “expect”, “look”, “believe”, “anticipate”, “may”, or similar statements or variations of such terms. Actual results may diffe r m aterially from such forward - looking statements. Factors that may cause actual results to differ materially from those contemplated by such forw ard - looking statements include, but are not limited to those risk factors identified in the Company’s Form 10 - K for the year ended December 31, 2016, in addition to: a) an inability to successfully grow our business and implement our strategic plan, including an inability to ge ner ate revenues to offset the increased personnel and other costs related to the strategic plan; b) the impact of anticipated higher operating e xpe nses in 2017 and beyond; c) an inability to manage our growth; d) an inability to successfully integrate our expanded employee base; e) an un expected decline in the economy, in particular in our New Jersey and New York market areas; f) declines in our net interest margin cau sed by the low interest rate environment and highly competitive market; g) declines in value in our investment portfolio; h) higher than exp ect ed increases in our allowance for loan losses; i ) higher than expected increases in loan losses or in the level of nonperforming loans; j) unexpected changes in interest rates; k) an unexpected decline in real estate values within our market areas; l) legislative and regulatory actions (i ncluding the impact of the Dodd - Frank Wall Street Reform and Consumer Protection Act, Basel III and related regulations) subject us to additional re gulatory oversight which may result in increased compliance costs; m) successful cyberattacks against our IT infrastructure and that o f o ur IT providers; n) higher than expected FDIC insurance premiums; o) adverse weather conditions; p) inability to successfully generate new bus ine ss in new geographic markets; q) inability to execute upon new business initiatives; r) lack of liquidity to fund our various cash obli gat ions; s) reduction in our lower - cost funding sources; t) our inability to adapt to technological changes; u) claims and litigation pertaining to fi duciary responsibility, environmental laws and other matters; and v) other unexpected material adverse changes in our operations or e arn ings. The Company assumes no responsibility to update such forward - looking statements in the future. Although we believe that the expe ctations reflected in the forward - looking statements are reasonable, the Company cannot guarantee future results, levels of activity, per formance, or achievements. Statement Regarding Forward - Looking Information 2

Stock Price Performance 2012 - 2017 Note: Market data as of December 31, 2017 Source: S&P Global Market Intelligence Five Year Comparative Stock Price Performance: 12/31/2012 – 12/31/2017 (20%) 0% 20% 40% 60% 80% 100% 120% 140% 160% 12/31/12 06/30/13 12/31/13 06/30/14 12/31/14 06/30/15 12/31/15 06/30/16 12/31/16 06/30/17 12/31/17 PGC +148.7% NASDAQ Bank +112.9% KBW Nasdaq Bank +108.1% 3

Stock Price Performance 2017 Note: Market data as of December 31, 2017 Source: S&P Global Market Intelligence One Year Comparative Stock Price Performance: 12/31/2016 – 12/31/2017 (15%) (10%) (5%) 0% 5% 10% 15% 20% 12/31/16 01/31/17 02/28/17 03/31/17 04/30/17 05/31/17 06/30/17 07/31/17 08/31/17 09/30/17 10/31/17 11/30/17 12/31/17 PGC +13.4% NASDAQ Bank +3.5% KBW Nasdaq Bank +16.3% 4

People Market Efficiency, Growth, and Profitability • Shared common vision • Very talented team with ties to the market • High levels of motivation and engagement • Act as a single team • Entrepreneurial culture • We operate in three of the top ten most affluent counties nationwide • New York MSA offers considerable growth opportunity • Large and small banks underserving the wealth related needs in this market • Improved operating leverage is delivering positive earnings momentum • People, products, market - depth and superior delivery ensure future growth • Eye toward capitalizing on emerging market opportunities • Nimble and flexible • Enviable revenue mix Unique Business Model • Holistic, “wealth centric”, advice - led approach • Private Banker acts as a lead point of contact • “Brand of One” • Fee income growth a key area of focus • Sophisticated processes to Enterprise Risk, CRE, and balance sheet management • Excellent risk leadership team • Solid governance including Firm and Board Risk Committees Risk Management Drivers for Creating Sustainable Long - Term Shareholder Value People Market Efficiency, Growth, and Profitability • Shared common vision • Very talented team with ties to the market • High levels of motivation and engagement • Act as a single team • Entrepreneurial culture • We operate in three of the top ten most affluent counties nationwide • New York MSA offers considerable growth opportunity • Large and small banks underserving the wealth related needs in this market Unique Business Model • Holistic, “wealth centric”, advice - led approach • Private Banker acts as a lead point of contact • “Brand of One” • Fee income growth a key area of focus • Sophisticated processes to Enterprise Risk, CRE, and balance sheet management • Excellent risk leadership team • Solid governance including Firm and Board Risk Committees Risk Management People Market • Shared common vision • Very talented team with ties to the market • High levels of motivation and engagement • Act as a single team • Entrepreneurial culture • We operate in three of the top ten most affluent counties nationwide • New York MSA offers considerable growth opportunity • Large and small banks underserving the wealth related needs in this market Unique Business Model • Holistic, “wealth centric”, advice - led approach • Private Banker acts as a lead point of contact • “Brand of One” • Fee income growth a key area of focus Risk Management 5

1. Non - GAAP financial measure; refer to reconciliation on page 36. • Wealth led, relationship - based commercial bank headquartered in the “wealth belt” of New Jersey delivering private bank level service, with over 95 years of operating history • Strong leadership team • Headquartered in Bedminster, NJ • Four Private Banking locations: Bedminster, Morristown, Princeton, Teaneck • 20 Branches in four affluent New Jersey counties: Somerset, Morris, Hunterdon, Union • Trust subsidiary: PGB Trust & Investments of Delaware, located in Greenville, DE Overview Financial Highlights Branch Map Franchise Overview (Dollars in Millions) 12/31/2016 12/31/2017 Total Assets $3,879 $4,261 Net Loans (inc HFS) $3,282 $3,669 Total Deposits $3,412 $3,698 Total Shareholders' Equity $324 $404 Tier 1 Leverage Ratio 8.35% 9.04% Tier 1 Risk-Based Capital Ratio 10.60% 11.31% Total Risk-Based Capital Ratio 13.25% 14.84% Tang. Common Equity / Tang. Assets 1 8.28% 8.97% As of the Period Ended: 6

New Jersey Market Overview 1. Rank reflects ranking amongst all New Jersey counties. Note: Weighted average is calculated as the sum of (percent of state/national franchise * demographic item) within each marke t; banks, thrifts, and savings banks included (retail branches only). Source: S&P Global Market Intelligence, FDIC Population Household Income Median HHI Total Projected $100K - $199K > $200K Projected Branches Population Change Change % of % of HHI Change in Market 2018 2010-2018 2018-2023 Number Total Number Total 2018 2018-2023 NJ Market (County) Total PGC (Actual) (%) (%) (Actual) Market (Actual) Market ($) (%)Rank¹ Markets with PGC Branches Hunterdon, NJ 45 4 123,886 (3.48%) (0.93%) 15,089 32% 10,614 23% $111,743 4.51% 1 Morris, NJ 220 6 498,852 1.34% 0.95% 58,501 32% 42,357 23% $110,971 8.07% 2 Somerset, NJ 124 9 335,447 3.71% 1.98% 37,328 31% 27,557 23% $107,717 7.96% 3 Union, NJ 185 1 559,707 4.33% 2.37% 49,035 25% 26,037 13% $76,739 9.59% 11 PGC Branch Markets 574 20 1,517,892 2.52% 1.55% 159,953 29% 106,565 19% Weighted Avg.: PGC Branch Markets 2.50% 1.48% $107,573 7.73% Markets with PGC Private Banking Office Only Bergen, NJ 449 - 945,893 4.51% 2.38% 104,074 30% 65,331 19% $96,670 9.36% 4 Mercer, NJ 139 - 371,183 1.27% 0.82% 33,953 25% 18,674 14% $77,984 6.36% 10 Aggregate: State of NJ 2,946 20 8,968,348 2.01% 1.30% 872,229 27% 427,066 13% $78,317 8.08% Aggregate: National 326,533,070 5.76% 3.50% $61,045 8.86% 7

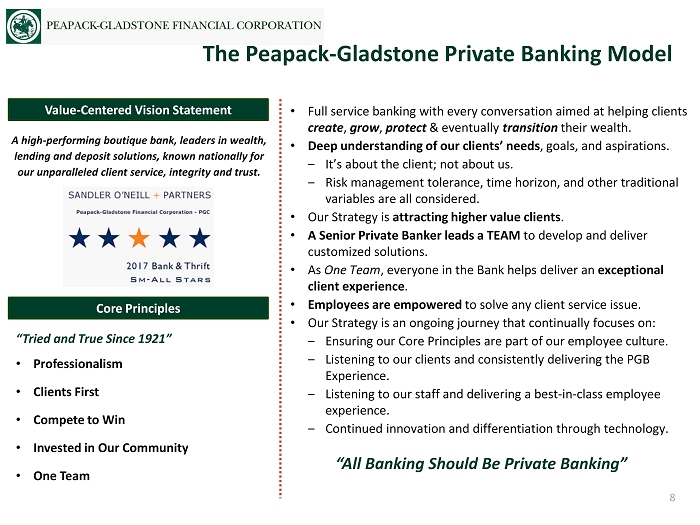

• Full service banking with every conversation aimed at helping clients create , grow , protect & eventually transition their wealth. • Deep understanding of our clients’ needs , goals, and aspirations. ‒ It’s about the client; not about us. ‒ Risk management tolerance, time horizon, and other traditional variables are all considered. • Our Strategy is attracting higher value clients . • A Senior Private Banker leads a TEAM to develop and deliver customized solutions. • As One Team , everyone in the Bank helps deliver an exceptional client experience . • Employees are empowered to solve any client service issue. • Our Strategy is an ongoing journey that continually focuses on: ‒ Ensuring our Core Principles are part of our employee culture. ‒ Listening to our clients and consistently delivering the PGB Experience. ‒ Listening to our staff and delivering a best - in - class employee experience. ‒ Continued innovation and differentiation through technology. Core Principles Value - Centered Vision Statement A high - performing boutique bank, leaders in wealth, lending and deposit solutions, known nationally for our unparalleled client service, integrity and trust. “Tried and True Since 1921” • Professionalism • Clients First • Compete to Win • Invested in Our Community • One Team The Peapack - Gladstone Private Banking Model “All Banking Should Be Private Banking” 8

• $5.5 billion in AUM/AUA. • 2017 Managed AUM inflows of $466 million vs. $322 million for 2016. • 2017 recurring fees increased 11% from 2016 (29% including recent MCM and QCM acquisitions). • Successfully completed two acquisitions. – August 2017: Murphy Capital Management (“MCM”); over $900 million of AUM as of September 30, 2017. – November 2017: Quadrant Capital Management (“QCM”); over $400 million of AUM. • Well positioned for additional strategic wealth management acquisitions. Our focus going forward: • Redesign of front - middle - back office of all wealth management units with an eye toward driving future efficiencies and scale. • Growing internal referrals from Commercial and Retail segments. • Continued strong referrals from legal/CPA professionals. Central to Our Strategy: Wealth Management 2017 Recap 9

Wealth Management AUM/AUA Wealth Management Fee Income Wealth Management Performance $8.00 $10.00 $12.00 $14.00 $16.00 $18.00 $20.00 $22.00 $24.00 2013 2014 2015 2016 2017 (Dollars in Millions) $2.0 $2.3 $2.5 $2.8 $3.0 $3.3 $3.5 $3.8 $4.0 $4.3 $4.5 $4.8 $5.0 $5.3 $5.5 $5.8 $6.0 2012 2013 2014 2015 2016 2017 (Dollars in Billions) $13.84 $15.24 $17.04 $2.3 $2.7 $3.0 $3.7 $3.3 $18.24 10 $23.18 $5.5 YOY Growth +27% YOY Growth +49%

1. Includes SBA Income, SWAP Income, Deposit & Loan Fees, Mortgage Banking, and BOLI Wealth Management Contributes Significantly to Our Enviable Revenue Mix 76.2% 15.9% 7.9% For Twelve Months Ended December 31, 2017 Total Non - Interest Income: 23.8% of Total Revenue Net Interest Income before Provision Wealth Fee Income Fees & Other Income 1 Total Non - Interest Income Target 30% - 40% 11

Steady Earnings Growth (Net Income) $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00 2012 2013 2014 2015 2016 2017 $19.97 $14.89 $9.26 $9.22 $26.48 (Dollars in Millions) 12 $36.50 YOY Growth +38%

ROACE ROAA Efficiency Ratio 1 Net Interest Margin Improved Returns and Efficiency 0.30% 0.40% 0.50% 0.60% 0.70% 0.80% 0.90% 1.00% 2012 2013 2014 2015 2016 2017 5.00% 7.00% 9.00% 11.00% 2012 2013 2014 2015 2016 2017 50.0% 55.0% 60.0% 65.0% 70.0% 75.0% 80.0% 2012 2013 2014 2015 2016 2017 13 2.25% 2.50% 2.75% 3.00% 3.25% 3.50% 3.75% 2012 2013 2014 2015 2016 2017 1. Efficiency Ratio calculated by dividing total noninterest expenses by revenue. 66.5% 75.2% 67.1% 63.7% 59.9% 58.7% 3.50% 3.26% 3.01% 2.80% 2.74% 2.80% 0.61% 0.54% 0.63% 0.64% 0.72% 0.89% 8.03% 7.37% 7.96% 7.71% 8.92% 10.12%

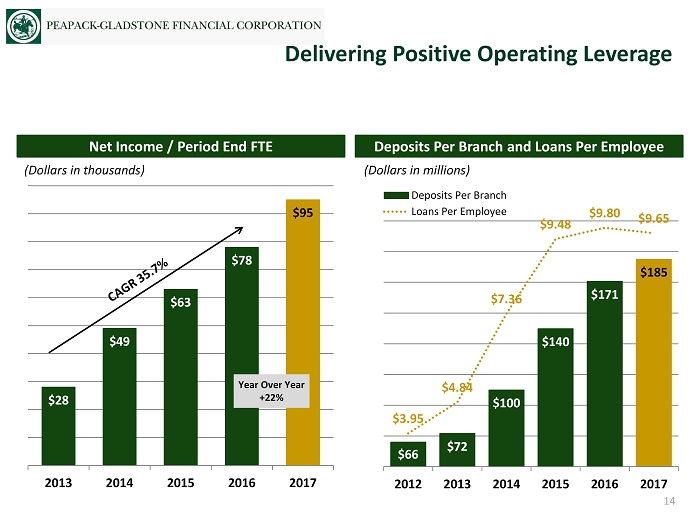

$28 $49 $63 $78 $95 2013 2014 2015 2016 2017 Year Over Year +22% Deposits Per Branch and Loans Per Employee Net Income / Period End FTE (Dollars in thousands) $66 $72 $100 $140 $171 $185 $3.95 $4.84 $7.36 $9.48 $9.80 $9.65 2012 2013 2014 2015 2016 2017 Deposits Per Branch Loans Per Employee (Dollars in millions) Delivering Positive Operating Leverage 14

Asset Growth $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 2012 2013 2014 2015 2016 2017 $3,365 $2,702 $1,967 $1,668 $3,879 (Dollars in Millions) 15 $4,261 YOY Growth +10%

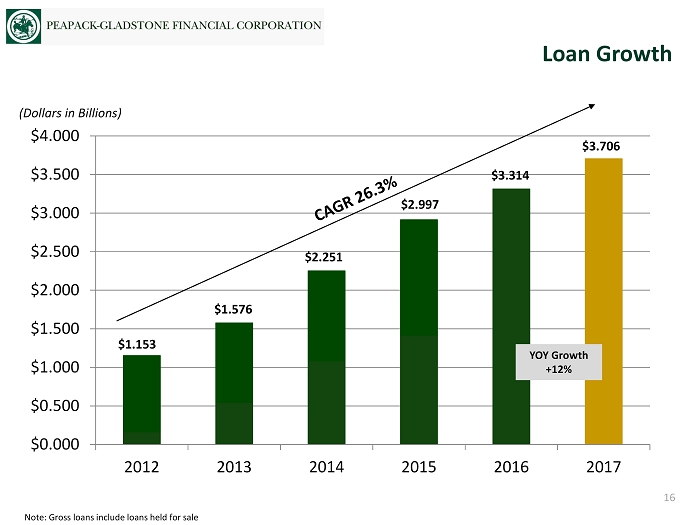

Note: Gross loans include loans held for sale Loan Growth $0.000 $0.500 $1.000 $1.500 $2.000 $2.500 $3.000 $3.500 $4.000 2012 2013 2014 2015 2016 2017 $2.997 $2.251 $1.576 $1.153 $3.314 (Dollars in Billions) 16 $3.706 YOY Growth +12%

Note: Gross loans include loans held for sale. Loan Composition: A Transformational Change 17 37.5% Long - Term Target 25% - 35% 16.9% Long Term Target 15% - 20% 25.9% Long Term Target 30% - 40% 4.1% 15.6% Long - Term Target 15% - 20% 44.7% 7.9% 10.0% 22.4% 14.0% As of December 31, 2017 As of December 31, 2012 Long - Term Target: 15% - 20% Gross Loans: $1,153 million Gross Loans: $3,706 million No construction & development loans as of 12/31/2017. 1 - 4 Family Multifamily CRE Commercial & Industrial Consumer and Oth er

Multifamily Loans / Bank’s Risk - Based Capital Bank’s CRE Concentration Ratio C&I Loans Portfolio Diversification and Decreasing CRE Concentration 250% 350% 450% 550% 650% 750% 2015 2016 2017 18 $300 $400 $500 $600 $700 $800 $900 2015 2016 2017 Steadily increasing C&I portfolio • C&I grew by $321MM or 50% during 2017. • Equipment Finance business launched May 2017: ‒ Offers a range of leasing and equipment finance term loans in transportation, manufacturing, heavy construction and utilities industries. ‒ Outstandings total $148MM (included in C&I Loans) as of 12/31/2017. ‒ 4 th Quarter lease activity created a tax benefit for the company under the new prospective tax rates included in the tax reform. $1,250 $1,350 $1,450 $1,550 2015 2016 2017 504% RBC 372% RBC 286% RBC $1,499 $1,389 $1,460 $513 $958 $637 695% 564% 466%

Proven track record of exceptional asset quality and a source of liquidity on an as needed basis. Geographically diversified portfolio – as of December 31, 2017: • New York – 53%; Top Markets – Bronx and Manhattan • New Jersey – 35%; Top Markets – Essex, Hudson, Passaic • Pennsylvania – 12%; Top Markets – Suburban Philadelphia and Bucks County As of December 31, 2017 • Current balance: $1.39 billion • Active loan participations and loan sales to generate liquidity, margin, and fee income; to date, $567 million sold or participated to approximately 9 institutions • Number of multifamily loans in portfolio: 472 • Average loan size: $3.3 million • Weighted average LTV: approximately 62% • Average debt yield of 9.86% • Weighted average DSCR (after underwriting stress): approximately 1.45x • No nonaccruals; no 30 day delinquencies • Generally all “workforce housing” – average rent just over $1,000 • 68% of the $1.39 billion portfolio is rent regulated • Data warehouse captures over 60 data points per loan Our Multifamily Portfolio 19

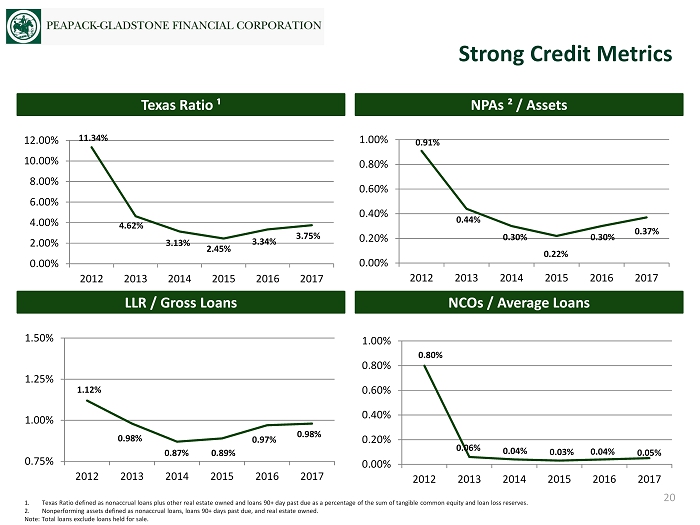

NPAs ² / Assets Texas Ratio ¹ NCOs / Average Loans LLR / Gross Loans Strong Credit Metrics 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 2012 2013 2014 2015 2016 2017 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 2012 2013 2014 2015 2016 2017 0.75% 1.00% 1.25% 1.50% 2012 2013 2014 2015 2016 2017 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 2012 2013 2014 2015 2016 2017 4.62% 3.13% 2.45% 3.34% 11.34% 0.91% 0.44% 0.30% 0.22% 0.30% 1.12% 0.98% 0.87% 0.89% 0.97% 0.04% 0.80% 0.06% 0.03% 0.04% 20 3.75% 0.37% 0.98% 0.05% 1. Texas Ratio defined as nonaccrual loans plus other real estate owned and loans 90+ day past due as a percentage of the sum of ta ngible common equity and loan loss reserves. 2. Nonperforming assets defined as nonaccrual loans, loans 90+ days past due, and real estate owned. Note: Total loans exclude loans held for sale.

Deposit Growth $0.000 $0.500 $1.000 $1.500 $2.000 $2.500 $3.000 $3.500 $4.000 2012 2013 2014 2015 2016 2017 $2.935 $2.299 $1.647 $1.516 $3.412 (Dollars in Billions) 21 $3.698 YOY Growth +8%

1. Core deposits defined as total deposits less time deposits. Total Deposits: $3,698 million Over 83% Core 1 Deposits Low - Cost Core Deposit Base Interest - bearing Demand 36.0% Savings & MMDA 32.8% Noninterest - bearing Demand 14.6% Jumbo Time 13.0% Time 3.6% As of December 31, 2017 22

Balance sheet risk management includes stress testing: • Capital – Quarterly stress testing (top down/bottom up). – Remain well - capitalized under our stress scenarios. • Liquidity (as of December 31, 2017) – $441 million in cash and cash equivalents and securities designated as available for sale. – Additional borrowing capacity of $1.3 billion available at the FHLB and $786 million at the FRB. – Quarterly stress testing. • Interest Rate – Quarterly stress testing. – In an immediate and sustained 200 basis point increase in market rates at December 31, 2017, modeling results show that net interest income for year 1 would increase approximately 3%, when compared to a flat interest rate scenario. Capital, Liquidity, & Interest Rate Risk Management 23

• Unique and proven business model. • Quality, depth, and experience of Senior Leadership Team. • Enviable market demographics. • Diversified revenue mix; high level of focus on growing non - interest income. • Proven track record of strong EPS growth. • Growing, advice - led commercial business. We Remain Optimistic 24

• EPS Growth – Low double digit EPS growth for 2018; high single/low double digit EPS growth thereafter. • Return on Equity – Target 10%+ run rate. • Efficiency Ratio – Mid to high 50’s. • Loan Growth – 8% to 12% annual loan growth. (Pricing discipline through our proprietary relationship - based loan profitability model. Future loan growth will be governed by our ability to acquire economical core deposits.) • Loan Mix – Continued diversification into Commercial & Industrial including Equipment Finance. Portfolio targets: » C&I (loans and leases): 30% - 40% (26% as of 12/31/2017) » CRE: 15% - 20% (17% as of 12/31/2017) » Multifamily: 25% - 35% (37% as of 12/31/2017) » Residential/Consumer: 15% - 20% (20% as of 12/31/2017) • Non - Interest Income / Revenue Mix – Non - interest income target of 30% - 40% of revenue. Wealth Management fees (from organic growth and Wealth M&A), Treasury Management, SWAP, SBA, and loan sale gains will drive this growth. • Funding – Continued funding from diversified sources. • Capital – Remain well - capitalized; rigorous capital management supported through quarterly stress testing. Financial Targets: 2018 and Beyond 25

Appendix P EAPACK - G LADSTONE B ANK

Douglas L. Kennedy President & Chief Executive Officer 908.719.6554 38 years experience; Before joining in 2012 , he served as President of the NJ Market for Capital One Bank . He has held key executive level positions and had great success building formidable regional and national specialty banking business at Fleet Bank, Summit Bancorp and Bank of America . He is a current Member of the NJ Chamber of Commerce Board of Directors, Montclair State University Board of Trustees, and Sacred Heart University Board of Trustees . He has served as President of NJ After 3 and as a Board Member of the NJ Bankers Association . John P. Babcock Senior EVP & President of Wealth Management 908.719.3301 35 years experience; Prior to joining, he was the managing director in charge of the Northeast Mid - Atlantic region for the HSBC Private Bank and, prior to that, he was the New York Metro Market Executive for U . S . Trust - the largest of U . S . Trust’s 53 markets in the U . S . In these and previous roles over the last 34 years, he has led commercial and wealth management/private bank businesses in New York City and regional markets through mergers, expansions, rapid growth and periods of significant organizational change . Jeffrey J. Carfora, CPA Senior EVP & Chief Financial Officer 908.719.4308 37 years experience; Joining as Executive Vice President and CFO in March 2009 , he was promoted to Senior Executive Vice President in August 2013 . Previously, he was affiliated with Penn Federal Savings Bank (where he joined as CFO and was later promoted to COO), Carteret Bank, and Marine Midland Bank . He began his career in 1980 with PriceWaterhouseCoopers . Robert A. Plante Executive Vice President Chief Operating Officer 908.470.3329 32 years experience; Before joining in 2017 , served as executive vice president and chief operations officer/chief information officer at IDB New York, a $ 9 . 8 billion commercial bank, where he was a member of the credit risk, market risk and asset liability committees, r esponsible for all back - office support functions including payments, deposits, commercial and residential lending, treasury, custody, commercial cash management and information technology . Experienced Leadership Team 27

Anthony V. Bilotta , Jr. Executive Vice President, Head of Retail Banking 908.306.4266 30 years experience; Prior to joining in 2013 , he served as SVP and Director of Retail Banking & Corporate Marketing at Oritani Bank, and prior to that, he was EVP, Director of Retail Banking at New York Community Bank (former Penn Federal Savings Bank) . He held similar impressive roles at PNC Bank and TD Banknorth , N . A . (former Hudson United Bank) . Lisa P. Chalkan Executive Vice President, Chief Credit Officer 908.719.6552 29 years experience; Before joining in 2015 , she held executive positions as SVP, Head of Commercial Credit Policy, Director of Loan Administration/Commercial Banking, and Manager of Middle Market Underwriting at Capital One N . A . , and also held key roles at Fleet Boston Financial/Bank of America and HSBC Bank USA/HSBC Securities, Inc . She is a key contributor to the Board of Trustees of the Union County Economic Development Corporation, serving as Secretary of the Board, and past honoree as a Woman of Influence in Finance by the Women’s Fund of NJ . Robert R. Cobleigh Executive Vice President, Peapack Capital 201.285.6201 30 years experience; Prior to joining in 2017 , he served as Regional VP and Credit Officer for Santander Corporate Equipment Finance, Inc . He was the VP of Credit for structured and specialty finance for MUFG - Union Bank/The Bank of Tokyo - Mitsubishi . He held senior positions at RBS/Citizens Asset Finance, Inc . , Siemens Financial Services, Inc . , Volvo Finance North America, Inc . , and International Proteins Corporation . Robert earned his Bachelor of Business Administration degree – Finance and MBA – Investment Management from Pace University . Thomas J. Ross, Jr. Executive Vice President, President Wealth Management Consultants 973.401.1500 35 years experience; Prior to joining in 2015 and before forming Wealth Management Consultants, he was the Partner - In - Charge of Coopers & Lybrand’s Personal Financial Services Group, serving on the firm’s National PFS Steering Committee . He helped found C&L’s Registered Investment Advisory subsidiary, serving on its Investment Policy Committee . He has an expertise in planning for senior corporate executives, optimization of compensation and benefits programs and the financial aspects of employment contracts . He has worked with current or retired Chairmen, CEOs and Presidents of major American corporations, written technical articles, instructed at professional education programs, and has been quoted in national financial press . Tom is a CPA (Inactive) with a BA in English from Boston College and an MBA in Finance from the Wharton School . Experienced Leadership Team 28

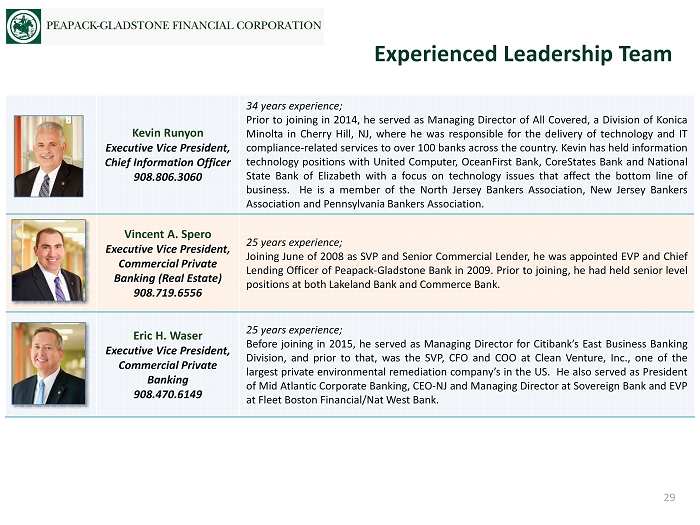

Kevin Runyon Executive Vice President, Chief Information Officer 908.806.3060 34 years experience; Prior to joining in 2014 , he served as Managing Director of All Covered, a Division of Konica Minolta in Cherry Hill, NJ, where he was responsible for the delivery of technology and IT compliance - related services to over 100 banks across the country . Kevin has held information technology positions with United Computer, OceanFirst Bank, CoreStates Bank and National State Bank of Elizabeth with a focus on technology issues that affect the bottom line of business . He is a member of the North Jersey Bankers Association, New Jersey Bankers Association and Pennsylvania Bankers Association . Vincent A. Spero Executive Vice President, Commercial Private Banking (Real Estate) 908.719.6556 25 years experience; Joining June of 2008 as SVP and Senior Commercial Lender, he was appointed EVP and Chief Lending Officer of Peapack - Gladstone Bank in 2009 . Prior to joining, he had held senior level positions at both Lakeland Bank and Commerce Bank . Eric H. Waser Executive Vice President, Commercial Private Banking 908.470.6149 25 years experience; Before joining in 2015 , he served as Managing Director for Citibank’s East Business Banking Division, and prior to that, was the SVP, CFO and COO at Clean Venture, Inc . , one of the largest private environmental remediation company’s in the US . He also served as President of Mid Atlantic Corporate Banking, CEO - NJ and Managing Director at Sovereign Bank and EVP at Fleet Boston Financial/Nat West Bank . Experienced Leadership Team 29

Tony Spinelli Tony Spinelli was named to the Board of Directors in May of 2017. Mr. Spinelli maintains Certified Information Systems Security Professional (CISSP) accreditation and serves on the boards of Per Scholas , the US Department of Defense and Georgia Tech Institute for Information Security and Privacy. Tony has also served on the board of advisors for Cisco, Cylance, Kudelski Security, and IBM. He holds multiple patents in such areas as data loss prevention and methods of network risk reduction and internet browsing habits. Mr. Spinelli serves as COO and President, Cyberdivision for Fractal Industries, Inc., a venture - backed artificial intelligence and machine learning decision - platform focused on advancing digital analytics in both cybersecurity and risk management. He has served as SVP and Chief Information Security Officer at Capital One Financial, as well as Tyco International, Equifax and First Data Corporation, where he led global teams responsible for security engineering, security operations, security compliance and policy and cybersecurity threat management. Carmen M. Bowser Carmen Bowser was named to the Board of Directors in September 2017. Ms. Bowser is a graduate of William Smith College with an MBA in Finance from Rutgers Graduate School of Management. She is a National Association of Corporate Directors Fellow and a member of Women Corporate Directors, the Urban Land Institute and WX, Inc. Ms. Bowser is an Independent Board Member and Member of the Audit and Nominating and Governance Committees for Columbia Property Trust, and is a Board Member for the 42nd Street Development Corporation. She served as Managing Vice President, Commercial Real Estate Division, at Capital One Bank, N.A., responsible for a 100 - person team which provided the “first line of defense” for new loan originations and asset management. Ms. Bowser was a Principal/Managing Director for Prudential Mortgage Capital Company, where she led the commercial mortgage origination teams in McLean, Virginia, Boston, Massachusetts and New York City, overseeing annual team loan production of approximately $800 million across an expansive platform of FNMA, General Account, conduit, bridge, interim and mezzanine loans. She has held similar positions at Teachers Insurance and Annuity Association, Arbor National Commercial Corp, and The Prudential Insurance Company of America. Steven A. Kass Steven A. Kass was named to the Board of Directors in January of 2018. He is the retired CEO of Rothstein Kass and former senior partner of KPMG, the firm that acquired Rothstein Kass in 2016. As CEO of Rothstein Kass , he developed and implemented corporate strategy, championed organizational culture, core values, business purpose, guiding principles, diversity and women’s initiatives. Kass was responsible for the oversight of the firm’s financial performance and risk management, crisis response and corporate governance. He negotiated the sale of Rothstein Kass firm assets to KPMG and as senior partner at KPMG, he facilitated the integration and assimilation of the two firms. Kass served as Co - Chairman of the Board at Rothstein Kass from 2005 – 2014. He was a member of the Executive Committee from 1995 - 2014, serving as Chair from 2005 - 2014. He is a member of the National Association of Corporate Directors, the American College of Corporate Directors, the Association of Audit Committee Members, the KPMG Audit Committee Institute and the Private Directors Association. He is a former board member of Sun Bancorp and AGN International, is a member of the Whitman School of Management and the Lubin School of Accounting Advisory Boards for Syracuse University. Recent Additions to the Board of Directors 30

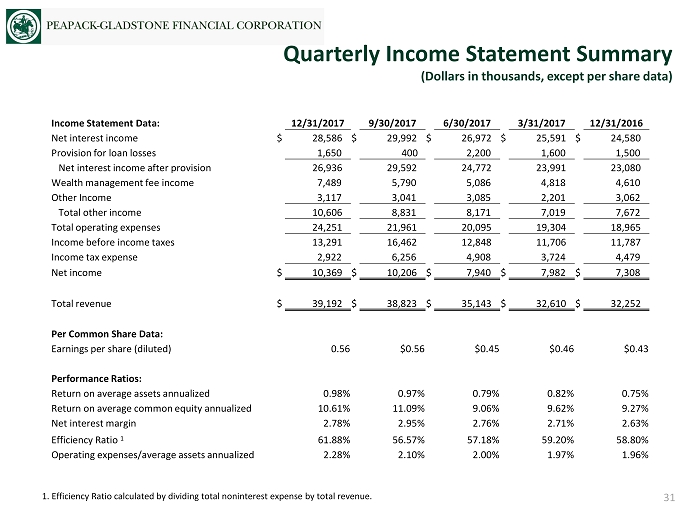

Quarterly Income Statement Summary (Dollars in thousands, except per share data) 31 1. Efficiency Ratio calculated by dividing total noninterest expense by total revenue. Income Statement Data: 12/31/2017 9/30/2017 6/30/2017 3/31/2017 12/31/2016 Net interest income $ 28,586 $ 29,992 $ 26,972 $ 25,591 $ 24,580 Provision for loan losses 1,650 400 2,200 1,600 1,500 Net interest income after provision 26,936 29,592 24,772 23,991 23,080 Wealth management fee income 7,489 5,790 5,086 4,818 4,610 Other Income 3,117 3,041 3,085 2,201 3,062 Total other income 10,606 8,831 8,171 7,019 7,672 Total operating expenses 24,251 21,961 20,095 19,304 18,965 Income before income taxes 13,291 16,462 12,848 11,706 11,787 Income tax expense 2,922 6,256 4,908 3,724 4,479 Net income $ 10,369 $ 10,206 $ 7,940 $ 7,982 $ 7,308 Total revenue $ 39,192 $ 38,823 $ 35,143 $ 32,610 $ 32,252 Per Common Share Data: Earnings per share (diluted) 0.56 $0.56 $0.45 $0.46 $0.43 Performance Ratios: Return on average assets annualized 0.98% 0.97% 0.79% 0.82% 0.75% Return on average common equity annualized 10.61% 11.09% 9.06% 9.62% 9.27% Net interest margin 2.78% 2.95% 2.76% 2.71% 2.63% Efficiency Ratio 1 61.88% 56.57% 57.18% 59.20% 58.80% Operating expenses/average assets annualized 2.28% 2.10% 2.00% 1.97% 1.96%

Year Over Year Income Statement Comparison 32 Year Year Increase/ 2017 (1) 2016 (Decrease) Net Interest Income $ 111.14 (2) $ 96.44 $ 14.70 15% Provision for loan and lease losses $ 5.85 $ 7.50 $ (1.65) - 22% Net Interest Income after provision $ 105.29 $ 88.94 $ 16.35 18% Wealth management fee income $ 23.18 $ 18.24 $ 4.94 27% Other income $ 11.45 (3) $ 10.68 (4) $ 0.77 7% Total other income $ 34.63 $ 28.92 $ 5.71 20% Operating expenses $ 85.61 (5) $ 75.12 $ 10.49 14% Pretax income $ 54.31 $ 42.74 $ 11.57 27% Income tax expense $ 17.81 (6) $ 16.26 $ 1.55 10% Net income $ 36.50 $ 26.48 $ 10.02 38% Diluted EPS $ 2.03 $ 1.60 $ 0.43 27% Return on average assets 0.89 % 0.72 % 0.17 Return on average equity 10.12 % 8.92 % 1.20 (1) 2017 included results of operations from Murphy Capital Management, acquired effective August 1, 2017, and from Quadrant Cap ital Management, acquired effective November 1, 2017. (2) 2017 included $1.2 million of recognition of deferred fees and prepayment income on two C&I credits. (3) 2017 included $412 thousand of gains on sales of loans held for sale at lower of cost or fair value. (4) 2016 included $1.23 million of gains on sales of loans held for sale at lower of cost or fair value . (5) 2017 included $660 thousand of investment banking expenses related to the Murphy Capital Management and the Quadrant Capi tal Management acquisitions, and also included $1.3 million of separation expenses related to two senior officers. (6) 2017 included a $1.60 million tax benefit from the reduction of the Company’s deferred tax liability due to the new tax l aw, and also included a $662 thousand tax benefit related to the adoption of ASU 2016 - 09, Compensation – Stock Compensation.

December 2017 Quarter Compared to Prior Year Quarter 33 Qtr Ended Qtr Ended December December Increase/ 2017 (1) 2016 (Decrease) Net Interest Income $ 28.59 $ 24.58 $ 4.01 16% Provision for loan and lease losses $ 1.65 $ 1.50 $ 0.15 10% Net Interest Income after provision $ 26.94 $ 23.08 $ 3.86 17% Wealth management fee income $ 7.49 $ 4.61 $ 2.88 62% Other income $ 3.11 (2) $ 3.07 (3) $ 0.04 1% Total other income $ 10.60 $ 7.68 $ 2.92 38% Operating expenses $ 24.25 (4) $ 18.97 $ 5.28 28% Pretax income $ 13.29 $ 11.79 $ 1.50 13% Income tax expense $ 2.92 (5) $ 4.48 $ (1.56) - 35% Net income $ 10.37 $ 7.31 $ 3.06 42% Diluted EPS $ 0.56 $ 0.43 $ 0.13 30% Return on average assets 0.98 % 0.75 % 0.23 Return on average equity 10.61 % 9.27 % 1.34 (1) The December 2017 quarter included results of operations from Murphy Capital Management, acquired effective August 1, 201 7, and from Quadrant Capital Management, acquired effective November 1, 2017. (2) The December 2017 quarter included $378 thousand of gains on sales of loans held for sale at lower of cost or fair value. (3) The December 2016 quarter included $353 thousand of gains on sales of loans held for sale at lower of cost or fair value. (4) The December 2017 quarter included $300 thousand of investment banking expenses related to the Quadrant Capital Managemen t a cquisition, and also included $1.3 million of separation expenses related to two senior officers. (5) The December 2017 quarter included a $1.60 million tax benefit from the reduction of the Company’s deferred tax liability du e to the new tax law.

December 2017 Quarter Compared to Linked Quarter 34 Qtr Ended Qtr Ended December September Increase/ 2017 (1) 2017 (1) (Decrease) Net Interest Income $ 28.59 $ 29.99 (2) $ (1.40) - 5% Provision for loan and lease losses $ 1.65 $ 0.40 $ 1.25 313% Net Interest Income after provision $ 26.94 $ 29.59 $ (2.65) - 9% Wealth management fee income $ 7.49 $ 5.79 $ 1.70 29% Other income $ 3.11 (3) $ 3.05 (3) $ 0.06 2% Total other income $ 10.60 $ 8.84 $ 1.76 20% Operating expenses $ 24.25 (4) $ 21.96 (5) $ 2.29 10% Pretax income $ 13.29 $ 16.47 $ (3.18) - 19% Income tax expense $ 2.92 (6) $ 6.26 $ (3.34) - 53% Net income $ 10.37 $ 10.21 $ 0.16 2% Diluted EPS $ 0.56 $ 0.56 $ - 0% Return on average assets 0.98 % 0.97 % 0.01 Return on average equity 10.61 % 11.09 % (0.48) (1) The 2017 periods shown included results of operations from Murphy Capital Management, acquired effective August 1, 2017, and from Quadrant Capital Management, acquired effective November 1, 2017. (2) The September 2017 quarter included $1.2 million of recognition of deferred fees and prepayment income on two C&I credits . (3) 2017 included $412 thousand of gains on sales of loans held for sale at lower of cost or fair value (specifically $378 th ous and in the December 2017 quarter and $34 thousand in the September 2017 quarter). (4) The December 2017 quarter included $300 thousand of investment banking expenses related to the Quadrant Capital Managemen t a cquisition, and also included $1.3 million of separation expenses related to two senior officers. (5) The September 2017 quarter included $360 thousand of investment banking expenses related to the Murphy Capital Management ac quisition. (6) The December 2017 quarter included a $1.60 million tax benefit from the reduction of the Company’s deferred tax liability du e to the new tax law.

Capital Summary (Dollars in thousands, except per share data) 35 1 Tangible equity as a percentage of tangible assets at period end is calculated by dividing tangible equity by tangible ass et s at period end. See non - GAAP financial measures reconciliation on page 36. 2 Tangible book value per share is calculated by dividing tangible equity by period end common shares outstanding. See non - GAAP financial measures reconciliation on page 36. 12/31/2017 12/31/2016 Equity to total assets 9.47% 8.36% Tangible equity to tangible assets 1 8.97% 8.28% Book value per share $21.68 $18.79 Tangible book value per share 2 $20.40 $18.60 Regulatory Capital - Holding Company Tier I leverage 9.04 % 8.35 % Tier I capital to risk weighted assets 11.31 10.60 Common Equity tier I capital ratio to risk - weighted assets 11.31 10.60 Tier I & II capital ratio to risk - weighted assets 14.84 13.25 Regulatory Capital - Bank Company Tier I leverage 10.61 % 9.31 % Tier I capital to risk weighted assets 13.27 11.82 Common Equity tier I capital ratio to risk - weighted assets 13.27 11.82 Tier I & II capital ratio to risk - weighted assets 14.34 12.87

Non - GAAP Financial Measures Reconciliation (Dollars in thousands, except per share data) 36 We believe that these non - GAAP financial measures provide information that is important to investors and that is useful in under standing our financial position, results and ratios. Our management internally assesses our performance based, in part, on these measures. However, these non - GAAP financ ial measures are supplemental and are not a substitute for an analysis based on GAAP measures. 12/31/2017 12/31/2016 Tangible Book Value Per share Shareholders Equity 403,678 324,210 Less Intangible assets, net 23,836 3,157 Tangible equity 379,842 321,053 Period end shares outstanding 18,619,634 17,257,995 Tangible book value per share 20.40 18.60 Book value per share 21.68 18.79 Tangible Equity to Tangible Assets Total assets 4,260,547 3,878,633 Less: Intangible assets, net 23,836 3,157 Tangible assets 4,236,711 3,875,476 Tangible equity to tangible assets 8.97% 8.28% Equity to assets 9.47% 8.36%

Peapack - Gladstone Financial Corporation 500 Hills Drive, Suite 300 P.O. Box 700 Bedminster, New Jersey 07921 (908) 234 - 0700 www.pgbank.com Douglas L. Kennedy President & Chief Executive Officer (908) 719 - 6554 dkennedy@pgbank.com Jeffrey J. Carfora Senior EVP & Chief Financial Officer (908) 719 - 4308 jcarfora@pgbank.com Contacts Corporate Headquarters Contact 37