Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AK STEEL HOLDING CORP | form8-kinvestorpresent.htm |

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

Fourth Quarter and Full Year 2017

Earnings Call

January 30, 2018

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

January 2018 2

AK Steel Executive Management Team

Roger Newport Chief Executive Officer

Kirk Reich President and Chief Operating Officer

Jaime Vasquez Vice President – Finance and Chief Financial Officer

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

January 2018 3

Forward-Looking Statements

We have made forward-looking statements in this presentation that are based on our management’s beliefs and assumptions and on information available to our management at the time such

statements were made and hereby are identified as “forward-looking statements” for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking

statements include information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential

operating performance improvements, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and

can be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “should” or the

negative of these terms or similar expressions.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in our forward-looking statements. You should not rely on any

forward-looking statements. Factors that could cause our actual results to differ materially from the results contemplated by such forward-looking statements include: reduced selling prices; shipments

and profits associated with a highly competitive and cyclical industry; domestic and global steel overcapacity; changes in the cost of raw materials and energy; our significant amount of debt and other

obligations; severe financial hardship or bankruptcy of one or more of our major customers or key suppliers; our significant proportion of sales to the automotive market; reduced demand in key product

markets due to competition from aluminum and other alternatives to steel; excess inventory of raw materials; supply chain disruptions or poor quality of raw materials; production disruption or reduced

production levels; our healthcare and pension obligations; not reaching new labor agreements on a timely basis; major litigation, arbitrations, environmental issues and other contingencies; regulatory

compliance and changes; climate change and greenhouse gas emission limitations; conditions in the financial, credit, capital and banking markets; our use of derivative contracts to hedge commodity

pricing volatility; potential permanent idling of facilities; inability to fully realize benefits of margin enhancement initiatives; information technology security threats and cybercrime; failure to achieve

expected benefits of the Precision Acquisition and/or to integrate Precision Partners successfully.

The risk factors discussed in this presentation and under “Item 1A.—Risk Factors” in AK Holding’s Annual Report on Form 10-K for the year ended December 31, 2016 and under similar headings in AK

Holding’s subsequently filed quarterly reports on Form 10-Q, as well as the other risks that could cause our results to differ materially from those expressed in forward-looking statements. There may be

other risks and uncertainties that we are unable to predict at this time or that we currently do not expect to have a material adverse effect on our business. We expressly disclaim any obligation to

update our forward-looking statements other than as required by law.

Non-GAAP financial measures

Included in this presentation are certain non-GAAP financial measures designed to complement the financial information presented in accordance with generally accepted accounting principles in the

United States of America because management believes such measures are useful to investors. These non-GAAP financial measures include EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted

Net Income (Loss), and Adjusted Earnings Per Share. Because our calculations of these measures may differ from similar measures used by other companies, you should be careful when comparing our

non-GAAP financial measures to those of other companies. A reconciliation of non-GAAP financial measures to GAAP financial measures is included in the Appendix to this presentation.

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

Roger Newport

Chief Executive Officer

January 2018

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

January 2018 5

2017 Highlights

$680 million of debt refinanced and maturities extended

Lowered annual interest cost by $18 million

Enhanced and lowered cost of revolving credit facility

Strengthened

Capital

Structure

Major investment completed at Middletown Works hot-end

New tanks installed on Middletown Works electrogalvanizing line

Mansfield melt shop upgrade and new technology at caster

Enhanced

Core Business

Launched new NEXMET™ AHSS coated products

Collaboration with the DOE to develop more efficient electrical steel for motors

Acquired Precision Partners – tool design and build / hot stamping / cold stamping

Expanded

Growth

Platform

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

January 2018 6

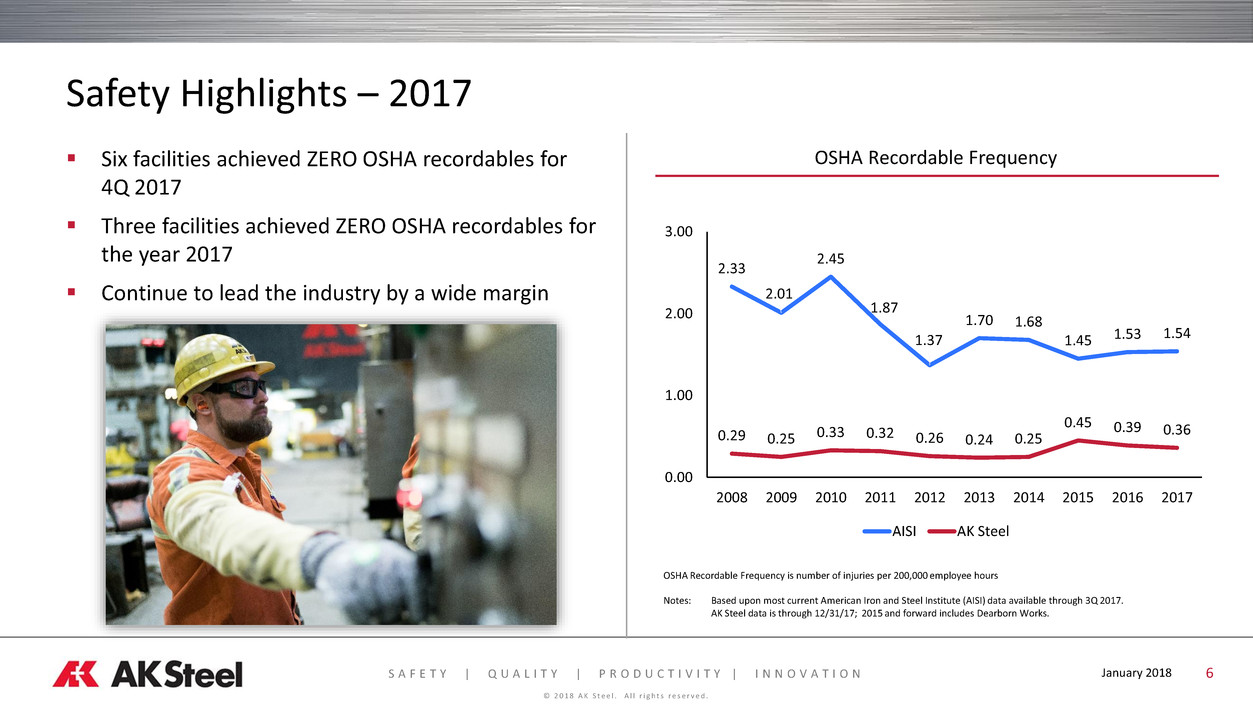

Safety Highlights – 2017

Six facilities achieved ZERO OSHA recordables for

4Q 2017

Three facilities achieved ZERO OSHA recordables for

the year 2017

Continue to lead the industry by a wide margin

2.33

2.01

2.45

1.87

1.37

1.70 1.68

1.45 1.53 1.54

0.29 0.25 0.33 0.32 0.26 0.24 0.25

0.45 0.39 0.36

0.00

1.00

2.00

3.00

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

AISI AK Steel

OSHA Recordable Frequency is number of injuries per 200,000 employee hours

Notes: Based upon most current American Iron and Steel Institute (AISI) data available through 3Q 2017.

AK Steel data is through 12/31/17; 2015 and forward includes Dearborn Works.

OSHA Recordable Frequency

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

550

1,550

2,550

3,550

4,550

2010 2011 2012 2013 2014 2015 2016 2017

0

20

40

60

80

2014 2015 2016 YTD Nov. 2017

20%

22%

24%

26%

28%

30%

2010 2011 2012 2013 2014 2015 2016 2017

January 2018 7

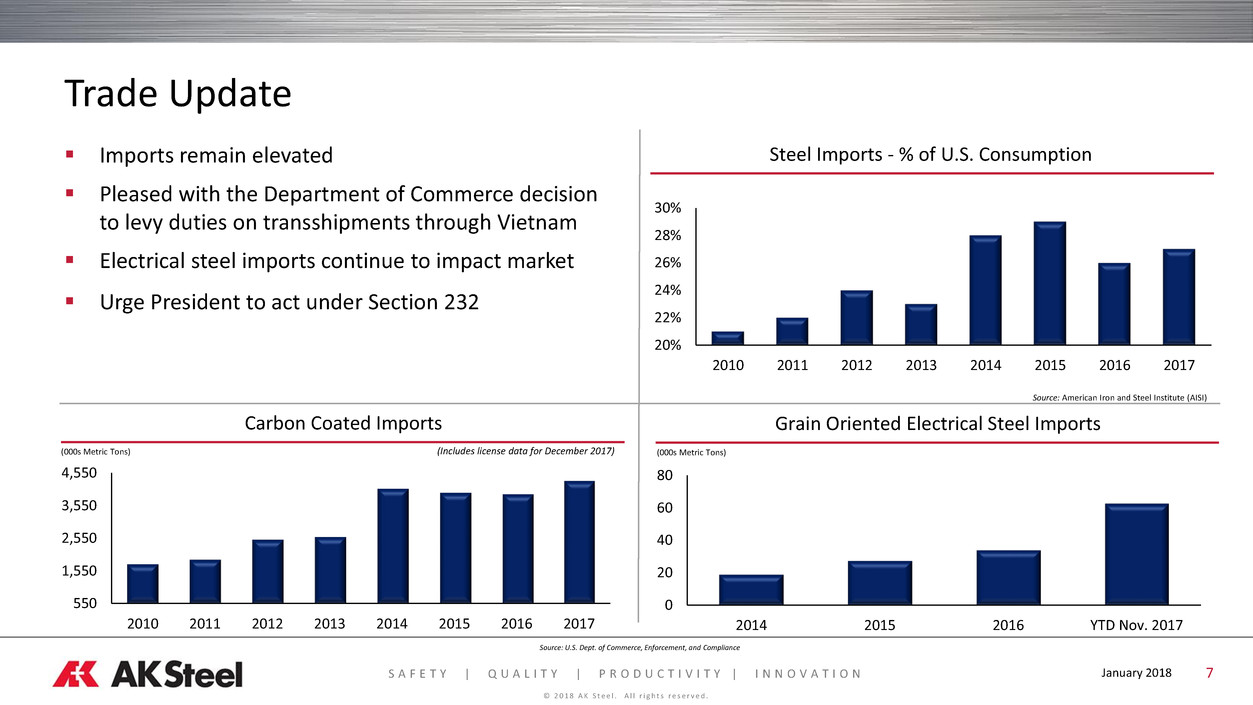

Trade Update

Source: U.S. Dept. of Commerce, Enforcement, and Compliance

(000s Metric Tons)

Imports remain elevated

Pleased with the Department of Commerce decision

to levy duties on transshipments through Vietnam

Electrical steel imports continue to impact market

Urge President to act under Section 232

Steel Imports - % of U.S. Consumption

Grain Oriented Electrical Steel ImportsCarbon Coated Imports

(000s Metric Tons)

Source: American Iron and Steel Institute (AISI)

(Includes license data for December 2017)

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

$2,316 $2,452

$2,593 $2,715

$2,811

2016 2017 2018E 2019E 2020E

17.8 17.1 17.2 17.5 17.8

2016 2017 2018E 2019E 2020E

January 2018 8

Steel Market Conditions

1.2 1.2 1.3

1.4 1.4

2016 2017 2018E 2019E 2020E

(Vehicles in Millions)

($ Billions)(Millions)

Overall economic conditions remain solid

Automotive market remains healthy

Spot market prices have increased recently

Service center inventories are well controlled

North America Light Vehicle Production

U.S. Housing Starts U.S. Non-Residential Construction Fixed Investment

Source: AK Steel estimates

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

Kirk Reich

President and Chief Operating Officer

January 2018

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

January 2018 10

Precision Partners – Growth Platform Serving Our Core Market

Creates a differentiated, innovative leader in the steel industry

Creates a premier integrated supplier to the

automotive market

Combines AK Steel’s advanced materials expertise with

Precision Partners’ leading advanced product design

engineered solutions, tool design and build, hot- and cold-

stamping capabilities and complex assemblies

Enhances our product offerings

End-to-end solutions further strengthen our close

collaboration with our automotive OEM customers and

their Tier 1 suppliers

Leverages both AK Steel’s and Precision Partners’

research and innovation capabilities

Accelerates the materials and metals-forming

development and innovation efforts in the high-growth

automotive lightweighting space

Accelerates introduction of lightweighting solutions

Advanced High Strength Steels and innovation in fast-

growing hot-stamping market

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

January 2018 11

Precision Partners Update

45%

25%

75%

90%

0%

20%

40%

60%

80%

100%

Hot-Stamping Cells 3,000 Ton Press

2017

2018E

51%

67%

92%

0%

20%

40%

60%

80%

100%

2Q 2017 3Q 2017 4Q 2017

Collaborative efforts are already yielding results

Strong new order pipeline

Operational improvements are progressing

2018E 2019E 2020E 2021E 2022E

Sales Opportunities

Press Efficiency Utilization Levels

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

January 2018 12

Investing in Core Assets

($ Millions)

Middletown Works blast

furnace top equipment

Mansfield Works

electromagnetic stirring

Middletown Works hot-end and electrogalvanizing line

Mansfield Works melt shop upgrade

Intensive preventive/predictive maintenance program

Annual maintenance expense >$600 million

Planned Maintenance Outages

$75

$51

$62

$85

$50

$0

$20

$40

$60

$80

$100

2014 2015 2016 2017 2018E

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

0.0%

2.0%

4.0%

6.0%

8.0%

2013 2014 2015 2016 2017

0.0%

0.5%

1.0%

1.5%

2.0%

2013 2014 2015 2016 2017

January 2018 13

Operational Excellence – Continued Improvements at Dearborn Works

0

10

20

30

40

2013 2014 2015 2016 2017

All-time plant

record

Since AK Steel acquired Dearborn Works in 2014

– OSHA recordables decreased 78%; 55% in last two years

– Internal quality losses improved 41%

– Internal retreats improved 47%

OSHA Recordables

Internal Quality Losses Internal Retreats

(Number of Cases)

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

14

Innovative Steel Solutions

ULTRALUME®

Press Hardenable Steel

NEXMET™ Family of Products

NanoSteel®

Third-Gen AHSS

Electrical Steels and DOE Collaboration

January 2018

440EX 1000 / 1200

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

January 2018 15

Innovative Automotive Lightweighting Solutions

Automotive

Aluminum

NanoSteel NXG 1200

NITRONIC 30

NEXMET™ 440EX

NEXMET™ 1000 / 1200

Developmental PHS

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

January 2018 16

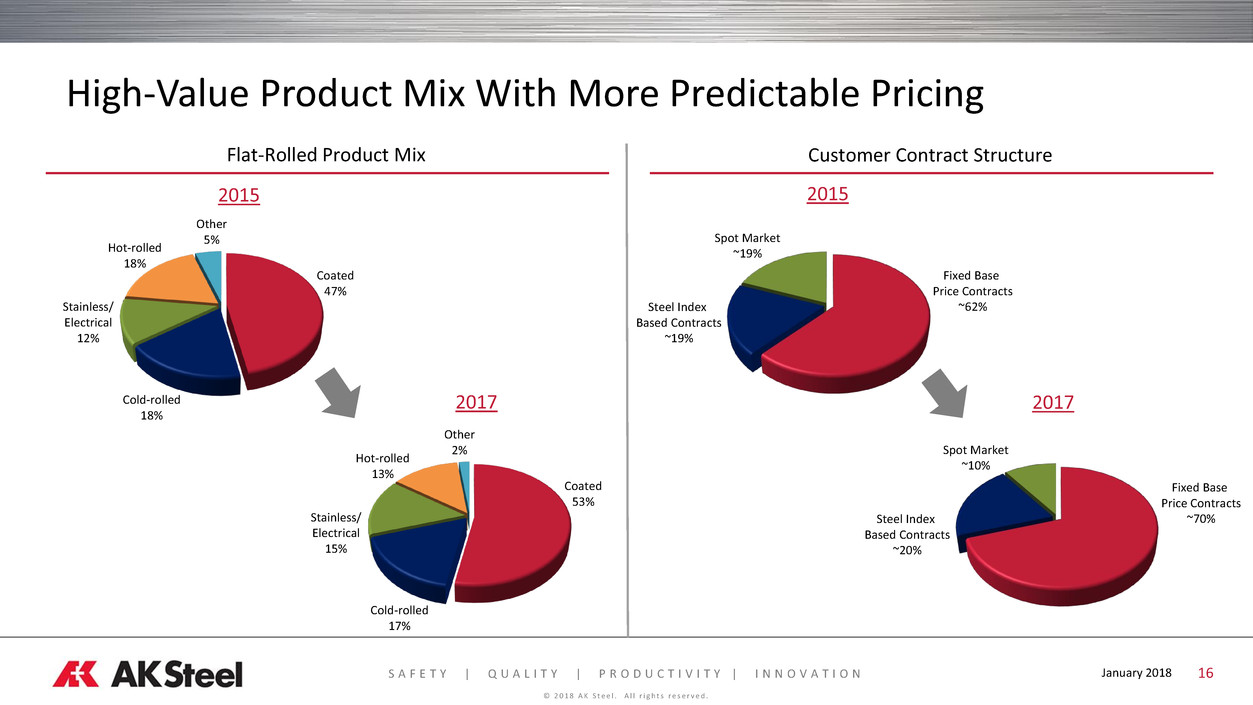

High-Value Product Mix With More Predictable Pricing

Flat-Rolled Product Mix Customer Contract Structure

2017

2015

2017

Coated

47%

Cold-rolled

18%

Other

5%

Stainless/

Electrical

12%

Hot-rolled

18%

2015

Coated

53%

Cold-rolled

17%

Other

2%

Stainless/

Electrical

15%

Hot-rolled

13%

Fixed Base

Price Contracts

~62%Steel Index

Based Contracts

~19%

Spot Market

~19%

Fixed Base

Price Contracts

~70%Steel Index

Based Contracts

~20%

Spot Market

~10%

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

Jaime Vasquez

Vice President – Finance and Chief Financial Officer

January 2018

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

January 2018 18

Financial Highlights

Note: See Appendix for reconciliations of non-GAAP financial measures

($ Millions, except per share)

Fourth Quarter 2017

4Q 2017 4Q 2016

Quarter Over

Quarter % Change

Flat-Rolled Shipments 1,337 1,386 (49) -4%

Flat-Rolled ASP $1,024 $983 $41 4%

Net Sales $1,495.6 $1,418.6 $77.0 5%

Net Income (Loss) ($107.9) (62.4) ($45.5) -73%

Adjusted Net Income (Loss) ($19.5) $75.2 ($94.7) NC

Adjusted EBITDA $65.4 $164.9 ($99.5) -60%

Adjusted EBITDA Margin 4.4% 11.6% -7.2 pts -62%

Earnings (Loss) Per Share ($0.34) ($0.22) ($0.12) -55%

Adjusted EPS ($0.06) $0.25 ($0.31) NC

Full Year 2017

2017 2016

Year Over

Year % Change

5,596 5,936 (340) -6%

$1,022 $955 $67 7%

$6,080.5 $5,882.5 $198.0 3%

$10.0 ($7.8) 17.8 NC

$98.4 $129.8 ($31.4) -24%

$419.5 $501.9 ($82.4) -16%

6.9% 8.5% -1.6 pts -19%

$0.03 ($0.03) $0.06 NC

$0.31 $0.56 ($0.25) -45%

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

19

$25

$50

$75

$100

$125

$150

$175

$200

$225

$250

2016 4Q Actual Price/Mix/Volume Raw Materials & Energy Planned Outages Operations/SG&A/Other 2017 4Q Actual

Consolidated EBITDA Bridge – 4Q 2016 to 4Q 2017

$111

$25

$65

$165

$62

$26

($ Millions)

Note: See Appendix for reconciliations of non-GAAP financial measures

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

January 2018 20

Fourth Quarter Adjustments

Lower corporate tax rate reduces value of net

deferred tax assets

4Q 2017 charge of $32.1 million to reduce value of

deferred tax assets

No cash tax impact

NOLs of ~$2.6 billion remain available to reduce

future tax liabilities

Ashland hot-end remains in temporary idle status

Non-cash asset impairment of $75.6 million in 4Q 2017

appropriate under GAAP accounting

No final decision made on future status

Railcars were leased to transport iron ore pellets

Charge of $32.9 million was taken in 4Q 2016

Railcars have been repurposed

Partial reversal of prior charge resulted in a credit of

$19.3 million in 4Q 2017

Tax Cuts and Jobs Act of 2017

Ashland Impairment Rail Car Lease

Three Months

Ended 12/31/17

Twelve Months

Ended 12/31/17

Net

Income

(Loss) EPS

Net

Income

(Loss) EPS

Net income (loss) / Diluted earnings (losses) per share, as reported ($107.9) ($0.34) $10.0 $0.03

Charges (credit) for termination of pellet agreement and related

transportation costs (19.3) (0.06) (19.3) (0.06)

Asset impairment charge 75.6 0.24 75.6 0.24

Non-cash charge for U.S. tax legislation 32.1 0.10 32.1 0.10

Adjusted net income (loss) / Earnings (losses) per share ($19.5) ($0.06) $98.4 $0.31

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

January 2018 21

Balance Sheet and Cash Flow Highlights

$1,281 $1,225

$1,135

$934

$0

$500

$1,000

$1,500

2014 2015 2016 2017

($ Millions)

Maintain focus on strengthening balance sheet

Working capital was a small source of cash in 2017

Roughly one-third of capital investments in 2018 targeted

for margin improvement

Legacy liabilities decreased ~$350 million since 2014

$81

$99

$128

$153 $160

$0

$50

$100

$150

$200

2014 2015 2016 2017 2018E

($ Millions)

$197

$24

$0

$44 $51 $35

$10

$0

$50

$100

$150

$200

$250

2014 2015 2016 2017 2018E 2019E 2020E

($ Millions)

Pension / OPEB Liabilities

Capital Investments Pension Contributions

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

$1,005 $1,040 $1,021 $1,024

$0

$300

$600

$900

$1,200

1Q 2017 2Q 2017 3Q 2017 4Q 2017

January 2018 22

1Q 2018 Guidance

* Guidance is relative to 4Q 2017 actual results

1,456 1,434 1,369 1,337

0

250

500

750

1,000

1,250

1,500

1Q 2017 2Q 2017 3Q 2017 4Q 2017

9.3% 9.1%

4.6% 4.4%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

1Q 2017 2Q 2017 3Q 2017 4Q 2017

(000s tons)

First quarter 2018 estimated outlook

– Flat-rolled shipments marginally higher*

– Average selling price marginally higher*

– Downstream revenue ~$125–150 million

– Planned maintenance outages ~$5 million

– LIFO expense ~$10 million

– Adjusted EBITDA margin ~150 basis points higher*

• Includes ~$30 million impact from unplanned outage at

Middletown Works

Flat-Rolled Shipments

Flat-Rolled Average Selling Price Per Ton Adjusted EBITDA Margin

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

January 2018 23

2018 Guidance Estimates

Note: Guidance is relative to 2017 actual results

Depreciation of ~$210 million

Pension and OPEB income of ~$32 million

Book tax rate of ~24% of LIFO expense

Minimal cash taxes

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

24

Longer Term Target Metrics

January 2018

Average EBITDA Margin

through a Cycle

>8%

Debt-to-EBITDA

<4.0x

Economic Profit:

Return on Invested Capital

>10.5%

EBITDA Contributions from

Downstream Business

>30%

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

Roger Newport

Chief Executive Officer

January 2018

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

January 2018 26

Strengthening Our Foundation

Began Portfolio

Optimization

Acquired

Dearborn

Idled Ashland

Hot-end

Operations

2014 2015 2016 2017

Completed Major

Hot-end Operations

Investments

Strengthened

Capital

Structure

Completed

Dearborn AHSS

Investment

Lowered

Interest Costs

Launched New

NEXMET™ AHSS

Products

Opened New

Research and

Innovation Center

Acquired

Precision Partners

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

January 2018

THANK YOU!

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

Appendix

January 2018

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

January 2018 29

Investor Contact

Douglas O. Mitterholzer

Assistant Treasurer and

General Manager, Investor Relations

Address

9227 Centre Pointe Drive

Cincinnati, OH 45069

E-mail Address

doug.mitterholzer@aksteel.com

Telephone Number

Office: 513.425.5215

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

January 2018 30

Non-GAAP Financial Measures

Reconciliation of Adjusted Net Income

Qtr ended Qtr ended Qtr ended Qtr ended

($ Millions) 2013 2014 2015 2016 03/31/2017 06/30/2017 09/30/2017 12/31/2017 2017

Reconciliation to Net Income (Loss) Attributable to AK Steel Holding Corporation

Net income (loss) attributable to AK Steel Holding Corporation, as reported ($46.8) ($96.9) ($509.0) ($7.8) $62.5 $61.2 ($5.8) ($107.9) $10.0

Pension and OPEB net corridor and settlement charges 5.5 131.2 68.1

Charges (credit) for termination of pellet agreement and related transportation costs 69.5 (19.3) (19.3)

Impairment of Magnetation investment 256.3

Impairment of AFSG investment 41.6

Charge for facility idling 28.1

Asset impairment charge 75.6 75.6

Non-cash charge for U.S. tax legislation 32.1 32.1

Acquisition-related expenses (net of tax) 31.7

Adjusted net income (loss) attributable to AK Steel Holding ($46.8) ($59.7) ($51.8) $129.8 $62.5 $61.2 ($5.8) ($19.5) $98.4

Reconciliation to Diluted Earnings (Losses) per Share

Diluted earnings (loss) per share, as reported ($0.34) ($0.65) ($2.86) ($0.03) $0.19 $0.19 ($0.02) ($0.34) $0.03

Pension and OPEB net corridor charge/settlement loss 0.04 0.74 0.29

Charges (credit) for termination of pellet agreement and related transportation costs 0.30 (0.06) (0.06)

Impairment of Magnetation investment 1.44

Impairment of AFSG investment 0.23

Charge for facility idling 0.16

Asset impairment charge 0.24 0.24

Non-cash charge for U.S. tax legislation 0.10 0.10

Acquisition-related expenses 0.21

Adjusted diluted earnings (loss) per share ($0.34) ($0.40) ($0.29) $0.56 $0.19 $0.19 ($0.02) ($0.06) $0.31

Flat-rolled Shipments 5,153.7 6,007.2 6,974.0 5,936.4 1,456.2 1,434.3 1,368.6 1,337.1 5,596.2

Flat-rolled Average Selling Price $1,056 $1,058 $929 $955 $1,005 $1,040 $1,021 $1,024 $1,022

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

January 2018 31

Non-GAAP Financial Measures

Reconciliation of Adjusted EBITDA

Qtr ended Qtr ended Qtr ended Qtr ended

($ Millions) 2013 2014 2015 2016 03/31/2017 06/30/2017 09/30/2017 12/31/2017 2017

Net income (loss) attributable to AK Steel Holding ($46.8) ($96.9) ($509.0) ($7.8) $62.5 $61.2 ($5.8) ($107.9) $10.0

Net income (loss) attributable to NCI 64.2 62.8 62.8 66.0 16.2 15.2 17.1 12.9 61.4

Income tax expense (benefit) (10.4) 7.7 63.4 3.2 (13.4) (8.7) (18.8) 23.1 (17.8)

Interest expense 127.4 144.7 173.0 163.9 39.4 38.2 37.5 37.2 152.3

Interest income (1.1) (0.7) (1.3) (1.6) (0.4) (0.4) (0.5) (0.1) (1.4)

Depreciation and amortization 200.0 211.0 224.4 221.4 58.9 56.1 60.8 60.6 236.4

EBITDA $333.3 $328.6 $13.3 $445.1 $163.2 $161.6 $90.3 $25.8 $440.9

Less: EBITDA of NCI (a) 78.3 77.2 77.1 80.8 20.3 19.6 21.1 16.7 77.7

Pension and OPEB net corridor charges / settlement loss 5.5 131.2 68.1

Charges (credit) for termination of pellet agreement and related transportation

costs 69.5 (19.3) (19.3)

Impairment of Magnetation investment 256.3

Impairment of AFSG investment 41.6

Charge for facility idling 28.1

Asset impairment charge 75.6 75.6

Acquisition-related expenses 23.3

Adjusted EBITDA $255.0 $280.2 $393.4 $501.9 $142.9 $142.0 $69.2 $65.4 $419.5

Adjusted EBITDA margin 4.6% 4.3% 5.9% 8.5% 9.3% 9.1% 4.6% 4.4% 6.9%

(a) The reconciliation of EBITDA of noncontrolling interest to net income attributable to noncontrolling interests is as follows:

Net income (loss) attributable to noncontrolling interests $64.2 $62.8 $62.8 $66.0 $16.2 $15.2 $17.1 $12.9 $61.4

Depreciation 14.1 14.4 14.3 14.8 4.1 4.4 4.0 3.8 16.3

EBITDA of noncontrolling interests $78.3 $77.2 $77.1 $80.8 $20.3 $19.6 $21.1 $16.7 $77.7

S A F E T Y | Q U A L I T Y | P R O D U C T I V I T Y | I N N O V A T I O N

© 2 0 1 8 A K S t e e l . A l l r i g h t s r e s e r v e d .

January 2018