Attached files

| file | filename |

|---|---|

| 8-K - FB FINANCIAL CORPORATION 8-K - FB Financial Corp | a51749764.htm |

Exhibit 99.1

First Quarter 2018 Investor Presentation

This investor presentation contains “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. You can identify these forward-looking statements through the Company’s use of words such as “believes,” “anticipates,” “expects,” “may,” “will,” “assumes,” “should,” “predicts,” “could,” “would,” “intends,” “targets,” “estimates,” “projects,” “plans,” “potential,” “confident,” “strategy,” “future” and other similar words and expressions of the future or otherwise regarding the outlook for the Company’s future business and financial performance, including, without limitation, the impact of the 2017 Tax Cuts and Jobs Act on the Company and its operations and financial results, the performance of the banking and mortgage industry and the economy in general and the benefits, cost, synergies and financial impact of the Company’s acquisition of the Clayton Banks.. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties which may cause the actual results, performance or achievements of the Company to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are based on the information known to, and current beliefs and expectations of, the Company’s management and are subject to significant risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated by the forward-looking statements in this investor presentation including, without limitation, the risks and other factors set forth in the Company’s Annual Report Form 10-K for the year ended December 31, 2016, filed with the SEC on March 31, 2017 under the captions “Cautionary note regarding forward-looking statements” and “Risk factors.” Many of these factors are beyond the Company’s ability to control or predict. The Company believes the forward-looking statements contained herein are reasonable; however, undue reliance should not be placed on any forward-looking statements, which are based on current expectations and speak only as of the date that they are made. The Company does not assume any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as otherwise may be required by law. TerminologyIn this investor presentation, references to “we,” “our,” “us,” “FB Financial” or “the Company” refer to FB Financial Corporation, a Tennessee corporation, and our wholly-owned bank subsidiary, FirstBank, a Tennessee state chartered bank, unless otherwise indicated or the context otherwise requires. References to “Bank” or “FirstBank” refer to FirstBank, our wholly-owned bank subsidiary.Contents of Investor PresentationExcept as is otherwise expressly stated, the contents of this investor presentation are presented as of the date on the front cover of this investor presentation. Market Data Market data used in this investor presentation has been obtained from government and independent industry sources and publications available to the public, sometimes with a subscription fee, as well as from research reports prepared for other purposes. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. We did not commission the preparation of any of the sources or publications referred to in this presentation. We have not independently verified the data obtained from these sources, and, although we believe such data to be reliable as of the dates presented, it could prove to be inaccurate. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements in this investor presentation. Forward looking statements

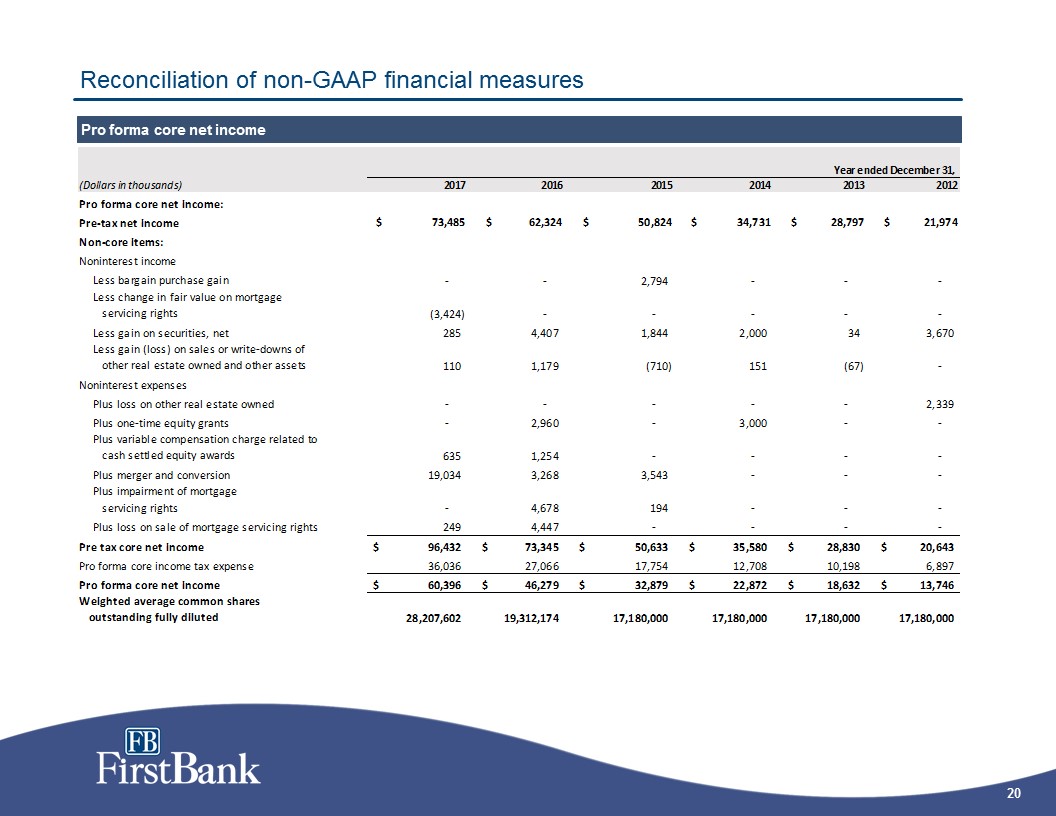

Use of non-GAAP financial measures This investor presentation contains certain financial measures that are not measures recognized under U.S. generally accepted accounting principles (GAAP) and therefore are considered non-GAAP financial measures. The Company’s management uses these non-GAAP financial measures in their analysis of the Company’s performance, financial condition and the efficiency of its operations. Management believes that these non-GAAP financial measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods as well as demonstrate the effects of significant gains and charges in the current period. The Company’s management also believes that investors find these non-GAAP financial measures useful as they assist investors in understanding our underlying operating performance and the analysis of ongoing operating trends. However, the non-GAAP financial measures discussed herein should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which we calculate the non-GAAP financial measures discussed herein may differ from that of other companies reporting measures with similar names. You should understand how such other banking organizations calculate their financial measures similar or with names similar to the non-GAAP financial measures we have discussed herein when comparing such non-GAAP financial measures. Below is a listing of the non-GAAP financial measures used in this investor presentation. Core net income, core diluted earning per share, the core efficiency ratio, the banking segment core efficiency ratio, the mortgage segment core efficiency ratio, the mortgage segment core pre-tax contribution, and core return on average assets, equity and tangible common equity are non-GAAP measures that exclude securities gains (losses), merger-related and conversion expenses, one time IPO equity grants and other selected items. The Company’s management use these measures in their analysis of the Company’s performance. The Company’s management believes these measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods, as well as demonstrate the effects of significant gains and charges. Tangible book value per common share and tangible common equity to tangible assets are non-GAAP measures that exclude the impact of goodwill and other intangibles and are used by the Company’s management to evaluate capital adequacy. Because intangible assets such as goodwill and other intangibles vary extensively from company to company, we believe that the presentation of these non-GAAP financial measures allows investors to more easily compare the Company’s capital position to other companies. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measures are provided on the appendix to this investor presentation.

Over 110 years of history in Tennessee 2003: Acquired The Bank of Murfreesboro in Nashville MSA 2007: Acquired branches from AmSouth Bank in Tennessee community markets 1984 1988 1996 1999 2001 2003 2004 2006 2012 2013 2015 Year: 2001: Opened branches in Nashville and Memphis 2004: Opened branch in Knoxville Acquisitions Organic growth Other 1999: Acquired First State Bank of Linden 1906 2010 2007 2008 2008: Opened two branches in Chattanooga 1990 1996: Purchased Bank of West Tennessee (Lexington) and Nations Bank branch (Camden) 2001: Acquired Bank of Huntingdon 2014 2014: Opened branch in Huntsville, Alabama 1990: Jim Ayers acquired sole control of the Bank 2016 $0.3 $0.5 $0.8 $1.1 $1.1 $1.5 $2.2 $2.5 $2.9 $3.3 $1.9 $2.1 $2.1 $4.7 2016:Completed core operating platform conversion 2016:Completed integration of Northwest Georgia Bank in Chattanooga 2015: Awarded “Top Workplaces" by The Tennessean 2016:Rebranded to FB Financial and Completed IPO 1988: Purchased assets of First National Bank of Lexington; Changed franchise name to FirstBank 1984: Jim Ayers and associate acquired the Bank 2015: Acquired Northwest Georgia Bank in Chattanooga Total assets ($bn) 2017 2017:Acquired Clayton Bank and Trust (Knoxville, TN) and American City Bank (Tullahoma, TN)

Snapshot of FB Financial today Financial highlights Company overview Second largest Nashville-headquartered bank and third largest Tennessee-based bankOriginally chartered in 1906, one of the longest continually operated banks in Tennessee Completed the largest bank IPO in Tennessee history in September 2016Mr. James W. Ayers is a current ~56% owner of FB FinancialAttractive footprint in both high growth metropolitan markets and stable community marketsLocated in six major metropolitan markets in Tennessee, Alabama and GeorgiaLeading market position in twelve community marketsMortgage offices located throughout footprint and strategically across the southeastProvides the personalized, relationship-based service of a community bank with the products and capabilities of a larger bankPersonal banking, commercial banking, investment services, trust and mortgage bankingLocal people, local knowledge and local authority Note: Unaudited financial data as of December 31, 20171 Non-GAAP financial measure. See “Use of non-GAAP financial measures,” “Reconciliation of non-GAAP financial measures” and the Appendix hereto. Current organizational structure Balance sheet highlights ($mm) 12/31/2017 Total assets $4,728 Loans - HFI 3,167 Total deposits 3,664 Shareholder’s equity 597 Key metrics – (%) 2017 Core ROAA (%) 1.561 Core ROATCE (%) 16.21 NIM (%) 4.46 Core Efficiency (%) 67.31 Tangible Common Equity/ Tangible Assets (%) 9.71 100% stockholder of FirstBank

Strategic drivers Great Place to Work Strategic M&A Experienced Senior Management Team Elite Financial Performer Scalable banking and mortgage platforms Local Decision Makers in Attractive Metro and Community Markets

A leading community bank headquartered in Tennessee Top 10 banks in Tennessee¹ Top 10 banks under $25bn assets in Tennessee¹ Source: SNL Financial; Note: Deposit data as of June 30, 2017; Pro forma for pending acquisitions announced as of January 23, 20181 Sorted by deposit market share, deposits are limited to Tennessee #2 community bank in Tennessee

Attractive footprint with balance between stable community markets and high growth metropolitan markets 269123Blue dots 193210228Metro markets 130131135Highway 167169172State county outlines 8715487Green dots 148194148Community markets Source files are619754_FirstBank Bancorp.ai and mapinfo 1 Source: SNL Financial. Statistics are based upon county data. Market data is as of June 30, 2017 and is presented on a pro forma basis for pending acquisitions announced as of January 23, 2018. Size of bubble represents size of company deposits in a given market.2 Financial and operational data as of December 31, 2017 Nashville MSA Knoxville MSA Chattanooga MSA Huntsville MSA Memphis MSA Jackson MSA Metropolitan marketsCommunity markets Our current footprint1 Total loans (excluding HFS)2 Total full service branches2 Total deposits2 Market rank by deposits: Nashville (13th)Chattanooga (7th) Jackson (3rd) Memphis (23rd)Knoxville (10th) Huntsville (19th)

Well positioned in attractive metropolitan markets 269123Blue dots 193210228Metro markets 130131135Highway 167169172State county outlines 8715487Green dots 148194148Community markets Source files are619754_FirstBank Bancorp.ai and mapinfo Nashville rankings: “The new 'it' City” – The New York Times1 Most attractive mid-sized cities for business (KPMG, April 2014) # 2 Fastest growing large metro economy (Headlight Data, July 2017) # 3 Healthiest economy in top 100 metro areas (ACBJ, October 2017) # 4 1 January 8, 2013 “Nashville Takes its Turn in the Spotlight” Home to great sports teams and universities Nashville growth Population growth 2010 – 2018 (%) Projected median HHI growth 2018 – 2023 (%) Projected population growth 2018 – 2023 (%) Located in northern Alabama One of the strongest technology economies in the nation, with the highest concentration of engineers in the United States6th largest county by military spending in the country Huntsville Chattanooga 4th largest MSA in TNDiverse economy with over 24,000 businesses Employs over 260,000 people Focused on attracting tech companies and start-ups; first municipality to debut a gigabit network Memphis 2nd largest MSA in TNDiversified business base and has the busiest cargo airport in North America11.5 million tourists visit annually, generating more than $3.3 billion for the local economy in 2016 Knoxville 3rd largest MSA in TN Approximately 14,000 warehousing and distribution jobs are in the area and account for an annual payroll of $3.8 billionWell situated to attract the key suppliers and assembly operations in the Southeast Source: S&P Market Intelligence; Chattanooga, Knoxville, Memphis, Huntsville Chambers of Commerce, U.S. Department of Labor, Bureau of Labor Statistics, NAICS 8th largest MSA in TNComplements and solidifies our West Tennessee franchiseFirstBank is an established leader with #3 market share Jackson Metro for professional and business service jobs (Forbes, June 2017) # 1

(Dollars in millions, except per share) 2015 2016 2017 Diluted earnings per share2 $1.91 $2.40 $2.14 Tangible book value per share2 $10.66 $11.58 $14.56 Weighted average diluted shares (in millions) 17.2 19.3 28.2 Net income1,2 $32.9 $46.3 $60.4 Return on average assets1,2 1.28% 1.54% 1.56% Return on average tangible common equity1,2 18.6% 20.7% 16.2% Core efficiency ratio2 73.1% 70.6% 67.3% Banking segment core efficiency ratio2 66.9% 64.4% 58.6% Mortgage segment core efficiency ratio2 98.0% 89.2% 82.4% NIM (tax- equivalent) 3.97% 4.10% 4.46% NIM, ex-accretion & nonaccrual interest collections3 3.96% 3.94% 4.15% 2017 Highlights Key highlights Pro forma core financial results2 1 Pro forma net income and return on average assets include a pro forma provision for federal income taxes using a combined effective income tax rate of 35.08% and 36.75% for the years ended December 31, 2015 and 2016, respectively.2 Non-GAAP financial measure. See “Use of non-GAAP financial measures,” “Reconciliation of non-GAAP financial measures” and the Appendix hereto.3 Data for nonaccrual interest collections not available prior to 2016. 2017 revenues of $294.9 million, up 15.3% from 2016Closed Clayton Banks merger on 7/31/17 - $1.2 billion in assetsOrganic loans (HFI) growth of 13.9% from 2016; total organic customer deposits grew 2.0% from 2016Noninterest bearing deposit growth of 27.4% from 2016; noninterest bearing deposits represent 24.2% of total deposits at 12/31/17Core efficiency ratio of 63.6%2 in 4Q17, over 10 percentage point improvement from 4Q16Banking Segment core efficiency ratio of 55.6%2 in 4Q17, 7 percentage point improvement from 4Q16Mortgage interest rate lock commitment (IRLC) volume was $7.57 billion, up 26.9% from 2016Mortgage Segment core pre-tax direct contribution of $16.8 million in 2017, up 6.7% from 2016Income tax benefit of $5.9 million in 4Q 2017 due to revaluation of recorded deferred tax liability; 2018 expected effective tax rate of 24.5% - 25.5%

Consistently delivering balanced profitability and growth Drivers of profitability Core pro forma return on average assets1 ($million) Net interest margin Noninterest income ($mn) Loans / deposits 1 Pro forma net income and tax-adjusted return on average assets include a pro forma provision for federal income taxes using a combined effective income tax rate of 33.76%, 35.37%, 35.63%, 35.08%, and 36.75% for the years ended December 31, 2012, 2013, 2014, 2015, and 2016, respectively. Non-GAAP financial measure. See “Use of non-GAAP financial measures,” “Reconciliation of non-GAAP financial measures” and the Appendix hereto. +94 bps NPLs (HFI) / loans (HFI) (%)

Consistent loan growth and balanced portfolio Total loan growth1 ($million) and commercial real estate concentration Loan portfolio breakdown1 4Q 2012 4Q 2017 Total HFI loans: $3,167 million 1 Exclude HFS loans; C&I includes owner-occupied CRE; CRE excludes owner-occupied CRE.2 Risk-based capital at FirstBank as defined in Call Report. 12/31/17 calculation is preliminary and subject to change. Commercial real estate (CRE) concentration2 % of risk-based Capital 12/31/15 12/31/16 12/31/17 C&D loans subject to 100% risk-based capital limit 100% 81% 96% Total CRE loans subject to 300% risk-based capital limit 210% 184% 228%

Stable, low cost core deposit franchise Total deposits ($million) 1 Includes mortgage servicing-related escrow deposits of $46.8 million and $53.7 million for the years ended December 31, 2016 and 2017, respectively. Noninterest bearing deposits ($million)1 Deposit composition as of December 31, 2017 Cost of deposits CAGR 15.0% CAGR 21.2%

Net interest margin driven by multiple levers Historical yield and costs 1 Includes tax-equivalent adjustment2 Data for nonaccrual interest collections not available prior to 2016. NIM (%) 3.52% 3.75% 3.93% 3.97% 4.10% 4.46% NIM, ex-accretion and nonaccrual interest collections (%)2 3.52% 3.75% 3.93% 3.96% 3.94% 4.15% Deposit cost (%) 0.78% 0.48% 0.36% 0.30% 0.29% 0.42% Loan (HFI) yield 2015 2016 2017 Contractual interest rate on loans HFI1 4.77% 4.69% 4.95% Origination and other loan fee income 0.28% 0.41% 0.32% 5.05% 5.10% 5.27% Nonaccrual interest collections2 0.00% 0.06% 0.14% Accretion on purchased loans 0.02% 0.20% 0.21% Loan syndication fees 0.05% 0.05% 0.04% Total loan yield (HFI) 5.12% 5.41% 5.66%

$64.3 $ 94.5 $ 110.6 $ 2.3 $ 11.2 $ (3.5) $ 3.6 $ 12.1 $ 13.2 $ -- $ -- $ (3.4) $70.2 $117.8 $116.9 Mortgage banking continues to execute across channels Mortgage segment (excludes retail footprint) pre-tax core contribution to overall Company reduced to 11.5% in 4Q17 with Clayton Banks acquisition2017 mortgage segment core pre-tax contribution of $16.8 million (excludes retail footprint contribution of $5.0 million), up 6.7% from 2016Rebalanced mix through better channel distribution as Correspondent growth offsets refinancing decline primarily in Consumer DirectBusiness model continuing to shift to increased purchase volumes given market and interest rate environment Highlights 1 See additional detail regarding Mortgage Sales on page 10 of the Quarterly Financial Supplement that was furnished as Exhibit 99.2 to the Company’s Current Report on Form 8-K filed with the SEC on January 22, 2018. Gain on Sale IRLC volume mix by purpose (%) IRLC volume by line of business (%) 1 Consumer Direct Correspondent Third party originated Retail Retail footprint Refinance Purchase 2015 2016 2017 $3.48bn $5.97bn $7.57bn IRLC volume: Mortgage sales: $2.68bn $4.36bn $6.35bn Fair value changes Fair value MSR change Mortgage banking income ($million) Total Servicing Revenue Total Income

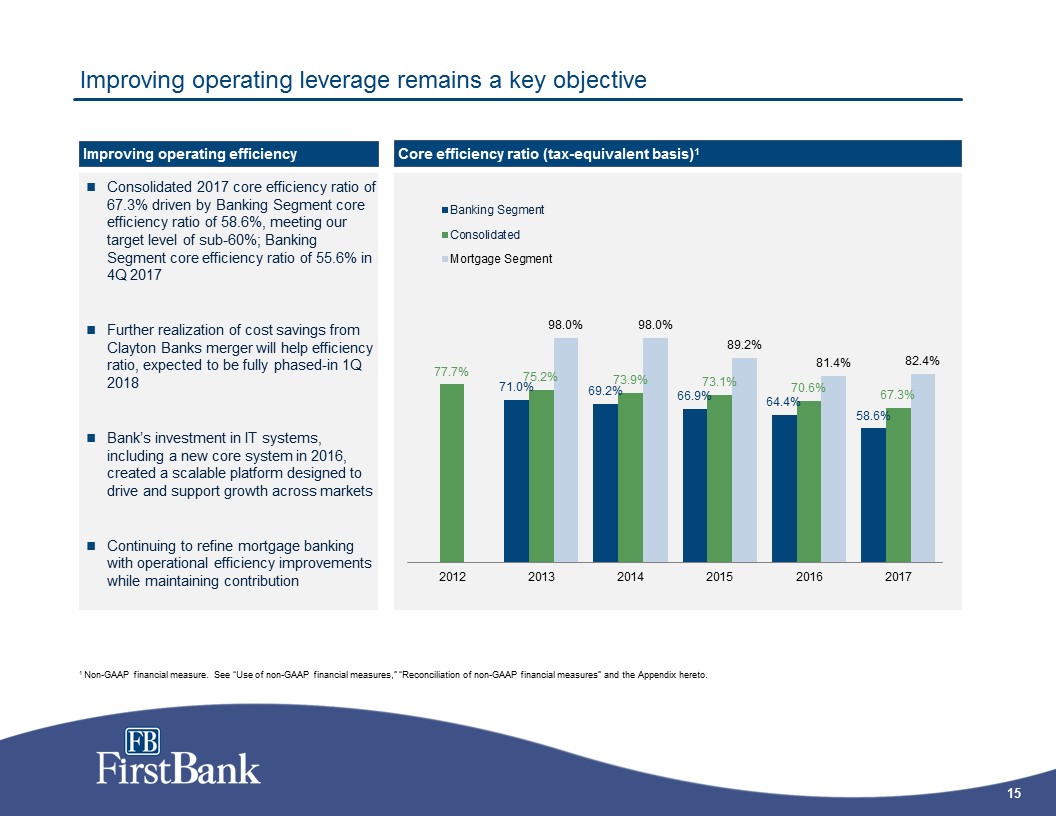

Improving operating leverage remains a key objective Consolidated 2017 core efficiency ratio of 67.3% driven by Banking Segment core efficiency ratio of 58.6%, meeting our target level of sub-60%; Banking Segment core efficiency ratio of 55.6% in 4Q 2017Further realization of cost savings from Clayton Banks merger will help efficiency ratio, expected to be fully phased-in 1Q 2018Bank’s investment in IT systems, including a new core system in 2016, created a scalable platform designed to drive and support growth across marketsContinuing to refine mortgage banking with operational efficiency improvements while maintaining contribution Core efficiency ratio (tax-equivalent basis)1 Improving operating efficiency 1 Non-GAAP financial measure. See “Use of non-GAAP financial measures,” “Reconciliation of non-GAAP financial measures” and the Appendix hereto.

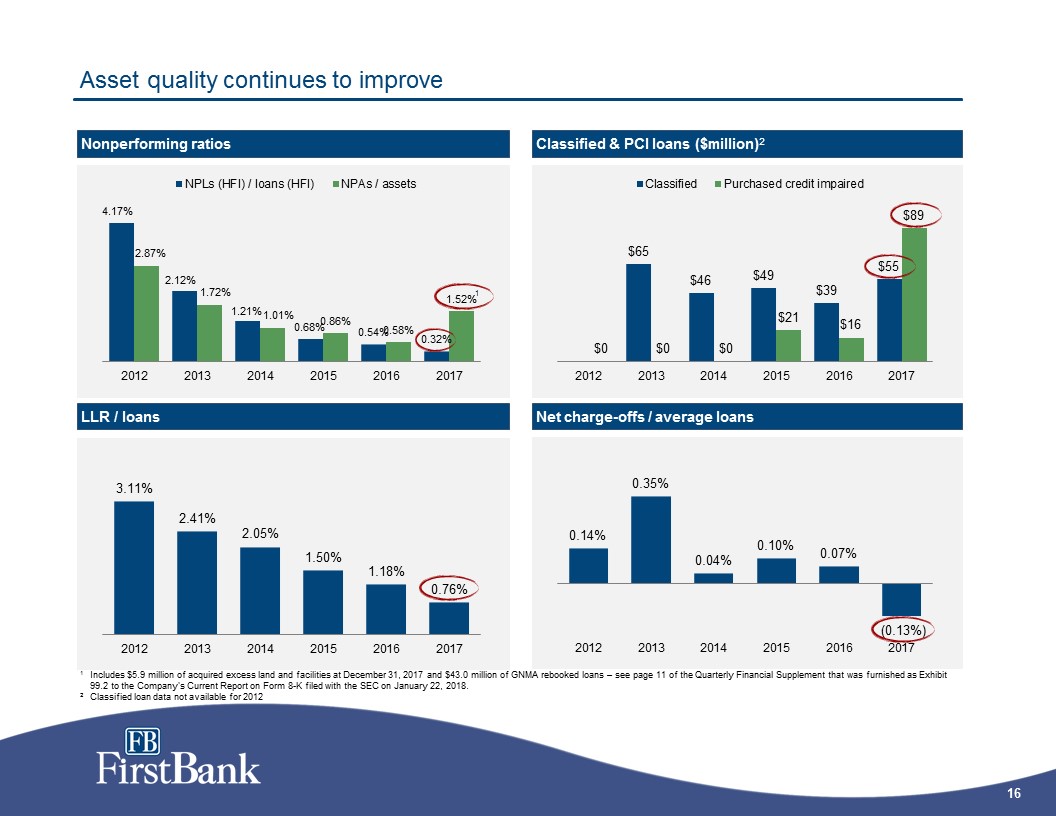

Asset quality continues to improve Classified & PCI loans ($million)2 Net charge-offs / average loans Nonperforming ratios LLR / loans 1 Includes $5.9 million of acquired excess land and facilities at December 31, 2017 and $43.0 million of GNMA rebooked loans – see page 11 of the Quarterly Financial Supplement that was furnished as Exhibit 99.2 to the Company's Current Report on Form 8-K filed with the SEC on January 22, 2018.2 Classified loan data not available for 2012 1

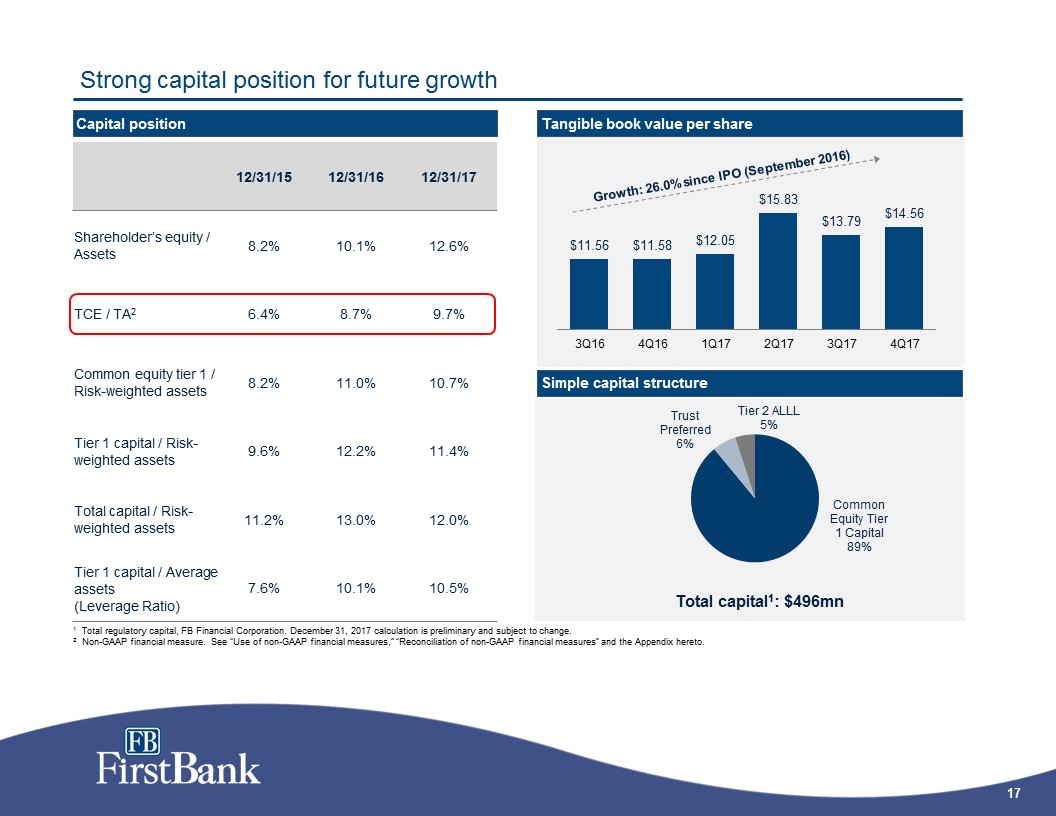

Strong capital position for future growth 1 Total regulatory capital, FB Financial Corporation. December 31, 2017 calculation is preliminary and subject to change.2 Non-GAAP financial measure. See “Use of non-GAAP financial measures,” “Reconciliation of non-GAAP financial measures” and the Appendix hereto. Capital position Simple capital structure 12/31/15 12/31/16 12/31/17 Shareholder’s equity / Assets 8.2% 10.1% 12.6% TCE / TA2 6.4% 8.7% 9.7% Common equity tier 1 / Risk-weighted assets 8.2% 11.0% 10.7% Tier 1 capital / Risk-weighted assets 9.6% 12.2% 11.4% Total capital / Risk-weighted assets 11.2% 13.0% 12.0% Tier 1 capital / Average assets (Leverage Ratio) 7.6% 10.1% 10.5% Tangible book value per share Growth: 26.0% since IPO (September 2016)

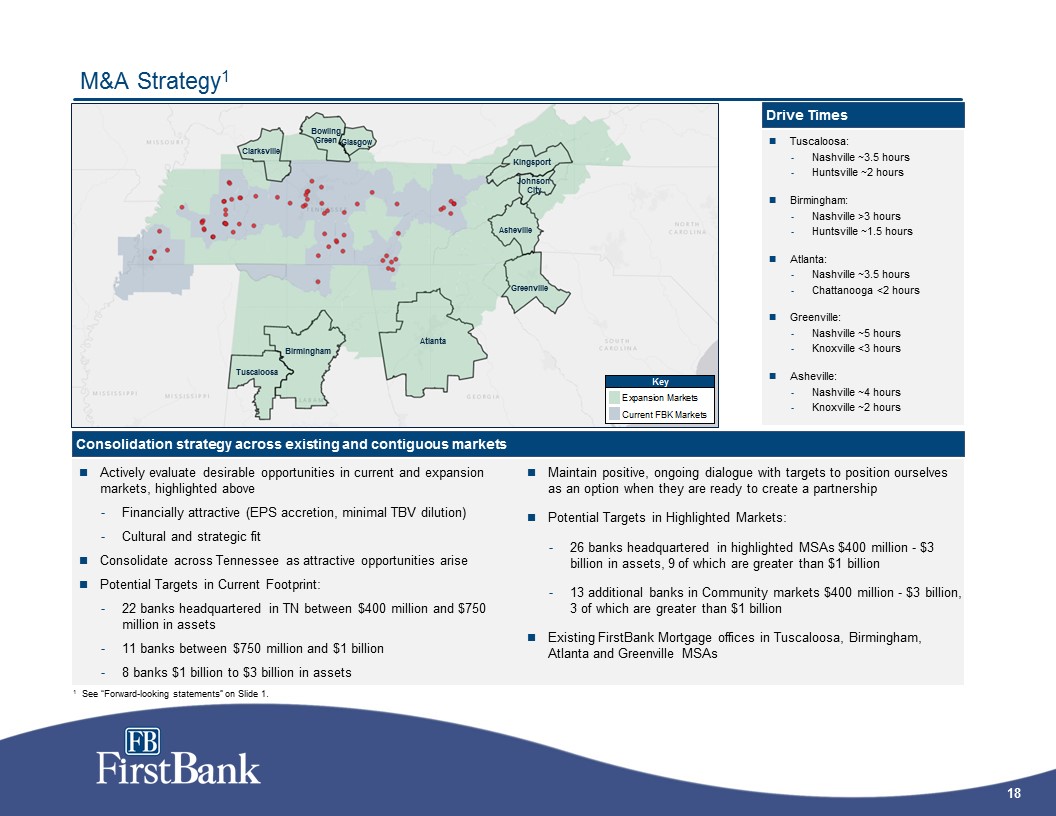

M&A Strategy1 Tuscaloosa Drive time from Nashville 3:30 / Huntsville 2:10Birmingham from Nashville 2:40 / Huntsville 1:30Atlanta 3:30 / Chattanooga 1:40Greenville 5:10 / Chattanooga 3:30 / Knoxville 2:40Asheville 4:20 / Knoxville 1:50Blacksburg 5:50 / Knoxville 3:20Roanoke 6:10 / Knoxville 3:40Bowling Green 1:00Glasgow 1:30 Consolidation strategy across existing and contiguous markets Actively evaluate desirable opportunities in current and expansion markets, highlighted aboveFinancially attractive (EPS accretion, minimal TBV dilution)Cultural and strategic fitConsolidate across Tennessee as attractive opportunities arisePotential Targets in Current Footprint:22 banks headquartered in TN between $400 million and $750 million in assets11 banks between $750 million and $1 billion8 banks $1 billion to $3 billion in assets Maintain positive, ongoing dialogue with targets to position ourselves as an option when they are ready to create a partnershipPotential Targets in Highlighted Markets:26 banks headquartered in highlighted MSAs $400 million - $3 billion in assets, 9 of which are greater than $1 billion13 additional banks in Community markets $400 million - $3 billion, 3 of which are greater than $1 billionExisting FirstBank Mortgage offices in Tuscaloosa, Birmingham, Atlanta and Greenville MSAs Drive Times Tuscaloosa:Nashville ~3.5 hoursHuntsville ~2 hoursBirmingham:Nashville >3 hoursHuntsville ~1.5 hoursAtlanta:Nashville ~3.5 hoursChattanooga <2 hoursGreenville:Nashville ~5 hoursKnoxville <3 hoursAsheville:Nashville ~4 hoursKnoxville ~2 hours Atlanta Birmingham Tuscaloosa Greenville Asheville BowlingGreen Glasgow Clarksville Kingsport JohnsonCity 1 See “Forward-looking statements” on Slide 1.

Appendix

Reconciliation of non-GAAP financial measures Pro forma core net income

Reconciliation of non-GAAP financial measures (cont’d) Pro forma core diluted earnings per share

Reconciliation of non-GAAP financial measures (cont’d) Tax-equivalent core efficiency ratio (1) Efficiency ratio (GAAP) is calculated by dividing non-interest expense by total revenue.

Reconciliation of non-GAAP financial measures (cont’d) Tax-equivalent core efficiency ratio (1) Efficiency ratio (GAAP) is calculated by dividing non-interest expense by total revenue.

Reconciliation of non-GAAP financial measures (cont’d) Segment tax-equivalent core efficiency ratio

Reconciliation of non-GAAP financial measures (cont’d) Segment tax-equivalent core efficiency ratio

Tangible book value per common share and tangible common equity to tangible assets Reconciliation of non-GAAP financial measures (cont’d) On June 28, 2016, the Company declared a 100-for-1 stock split, increasing the number of issued and authorized shares from 171,800 to 17,180,000 and 250,000 to 25,000,000, respectively. Additional shares issued as a result of the stock split were distributed immediately upon issuance to the shareholder on that date. Share and per share amounts included in the consolidated financial statements and notes thereto reflect the effect of the split for all periods presented. Additionally, in July 2016, the Company increased the authorized shares from 25,000,000 to 75,000,000.

Reconciliation of non-GAAP financial measures (cont’d) Core pro forma return on average assets and equity Core pro forma return on average tangible equity

Reconciliation of non-GAAP financial measures (cont’d) Segment core, pre-tax contribution

Reconciliation of non-GAAP financial measures (cont’d) Segment core, pre-tax contribution