Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VALLEY NATIONAL BANCORP | vly8-k2018125earningsrelea.htm |

| EX-99.1 - EXHIBIT 99.1 - VALLEY NATIONAL BANCORP | exhibit99earningsrelease01.htm |

© 2018 Valley National Bank®. Member FDIC. Equal Opportunity Lender. All Rights Reserved.

4Q 2017 Earnings Conference Call Presentation

Exhibit 99.2

Forward Looking Statements

The foregoing contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are not

historical facts and include expressions about management’s confidence and strategies and management’s expectations about new and existing programs

and products, acquisitions, relationships, opportunities, taxation, technology, market conditions and economic expectations. These statements may be

identified by such forward-looking terminology as “should,” “expect,” “believe,” “view,” “opportunity,” “allow,” “continues,” “reflects,” “typically,” “usually,”

“anticipate,” or similar statements or variations of such terms. Such forward-looking statements involve certain risks and uncertainties. Actual results may

differ materially from such forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by such forward-

looking statements include, but are not limited to: weakness or a decline in the economy, mainly in New Jersey, New York and Florida, as well as an

unexpected decline in commercial real estate values within our market areas; less than expected cost reductions and revenue enhancement from Valley's

cost reduction plans including its earnings enhancement program called "LIFT"; higher or lower than expected income tax expense or tax rates, including

increases or decreases resulting from the impact of the Tax Act and other changes in tax laws, regulations and case law; damage verdicts or settlements or

restrictions related to existing or potential litigations arising from claims of breach of fiduciary responsibility, negligence, fraud, contractual claims,

environmental laws, patent or trade mark infringement, employment related claims, and other matters; the loss of or decrease in lower-cost funding sources

within our deposit base may adversely impact our net interest income and net income; cyber attacks, computer viruses or other malware that may breach

the security of our websites or other systems to obtain unauthorized access to confidential information, destroy data, disable or degrade service, or sabotage

our systems; results of examinations by the OCC, the FRB, the CFPB and other regulatory authorities, including the possibility that any such regulatory

authority may, among other things, require us to increase our allowance for credit losses, write-down assets, require us to reimburse customers, change the

way we do business, or limit or eliminate certain other banking activities; changes in accounting policies or accounting standards, including the new

authoritative accounting guidance (known as the current expected credit loss (CECL) model) which may increase the required level of our allowance for credit

losses after adoption on January 1, 2020; our inability or determination not to pay dividends at current levels, or at all, because of inadequate future

earnings, regulatory restrictions or limitations, changes in our capital requirements or a decision to increase capital by retaining more earnings; higher than

expected loan losses within one or more segments of our loan portfolio; unanticipated loan delinquencies, loss of collateral, decreased service revenues, and

other potential negative effects on our business caused by severe weather or other external events; unexpected significant declines in the loan portfolio due

to the lack of economic expansion, increased competition, large prepayments, changes in regulatory lending guidance or other factors; the failure of other

financial institutions with whom we have trading, clearing, counterparty and other financial relationships; the risk that the businesses of Valley and USAB may

not be combined successfully, or such combination may take longer or be more difficult, time-consuming or costly to accomplish than expected; the diversion

of management's time on issues relating to merger integration; the inability to realize expected cost savings and synergies from the merger of USAB with

Valley in the amounts or in the timeframe anticipated; and the inability to retain USAB’s customers and employees. A detailed discussion of factors that could

affect our results is included in our SEC filings, including the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2016

and Quarterly Report on Form 10-Q for the period ended September 30, 2017. We undertake no duty to update any forward-looking statement to conform

the statement to actual results or changes in our expectations. Although we believe that the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

2

Highlights

3 1Refer to the appendix regarding the reconciliation of certain non-GAAP financial measures.

Reported Reported Adjusted1 Adjusted1

4Q17 3Q17 2017 2016 4Q17 3Q17 2017 2016

Return on

Average

Assets

0.44% 0.67% 0.69% 0.76% 0.83% 0.79% 0.82% 0.76%

Efficiency

Ratio

68.3% 69.4% 66.0% 66.0% 57.4% 59.2% 58.9% 61.2%

Diluted

Earnings

Per Share

$0.09 $0.14 $0.58 $0.63 $0.18 $0.17 $0.69 $0.63

Solid Relative Performance in 2017 Despite Substantial Investment and Repositioning

1 2 3 4

Valley initiated Phase

1 of its 3 year, ~$50

million, technology

infrastructure plan

Project LIFT

implementation has

begun; We remain

on track to hit our

targets

Acquisition of

USAmeriBancorp,

Inc. (closed effective

January, 1, 2018)

Completed senior

management

succession plan for

2018

Investing Executing Integrating Repositioning

• Closed USAmeriBank acquisition

on January 1, 2018

• Systems consolidation expected

to occur in the first half of 2Q

2018

• Long track record of successful

conversions

• USAmeriBank timeline consistent

with recent acquisitions

Year Institution Name* Assets* ($mil) Days to Convert

2018 USAmeriBank 4,228 ~125

2015 CNLBank 1,365 90

2014 1st United Bank 1,738 122

2012 State Bank of Long Island 1,578 90

2010 The Park Avenue Bank 509 91

2010 LibertyPoint Bank 210 86

2008 Greater Community Bank 976 40

2005 NorCrown Bank 622 50

2005 Shrewsbury Bank 424 51

2001 Merchants Bank 1,370 103

4

Merger Closing & Integration

*Principal subsidiary bank of the acquired bank holding company. Assets represent total consolidated assets acquired.

$8.8 $9.4

$5.1 $5.2

$3.4 $3.6

3Q 2017 4Q 2017

0.2% 2.1% 14.3%

0%

10%

20%

30%

40%

2017Florida New York New Jersey

5

$734mm

Reduction in short-term borrowings

to $749mm

Deposit & Balance Sheet Funding

Solid Deposit Growth1 ($ in billions)

Deposit Beta by Region for Current Cycle (3Q15 – 4Q17)2

+$841mm

Total deposits from

9/30 /17 to 12/31/17

+19%

Q/Qa

1Growth rates represent the quarter over quarter change, annualized (Q/Qa); 2Represents the change in the monthly average rate for Valley in each respective region as a percentage

of the change in the monthly average effective federal funds rate from September 30, 2015 to December 31, 2017; excludes government deposits.

Noninterest Bearing

+$126mm or 10% Q/Qa

Savings, Now & MM

+$572mm or 26% Q/Qa

Time

+$143mm or 17% Q/Qa

Diversified geographic mix of deposits is

proving to be a successful strategy

Consolidated: 8.4%

$1.0

$1.1

$1.0

$1.3

3.75%

3.85%

3.79%

4.00%

Q1 2017 Q2 2017 Q3 2017 Q4 2017

Origination Volume Yield on New Originations

6

Loans & Loan Growth

Yield & Volume of Loan Originations ($ in billions)

Diversified Loan Portfolio by Product & Region1

2017 loan growth up 6.4%, including sale of

residential mortgage loans

Well-positioned for organic growth in 2018

(proforma USAmeriBank);

• Targeting total loan growth of 8-10%

(7-9% after portfolio sales)

• Florida loan growth of 10-12%

Opportunity to enhance fees in existing

portfolio

1Balance sheet data is as of the December 31, of the year indicated; 2Florida includes the proforma impact of USAmeriBank outstanding loan

balances for both Florida and Alabama as of September 30, 2017.

15.6%

18.9%

10.8%

22.1%

13.0%

15.0%

4.6%

Construction

Owner Occupied CRE

Residential Mortgage Commercial & Industrial

Multifamily

Non-owner Occupied CRE

Consumer

$18.3bn

2017

37% 39% 32%

50% 48%

40%

13% 13%

28%

2016 2017 2017 Proforma

USAB

Florida

New Jersey

New York

2

1

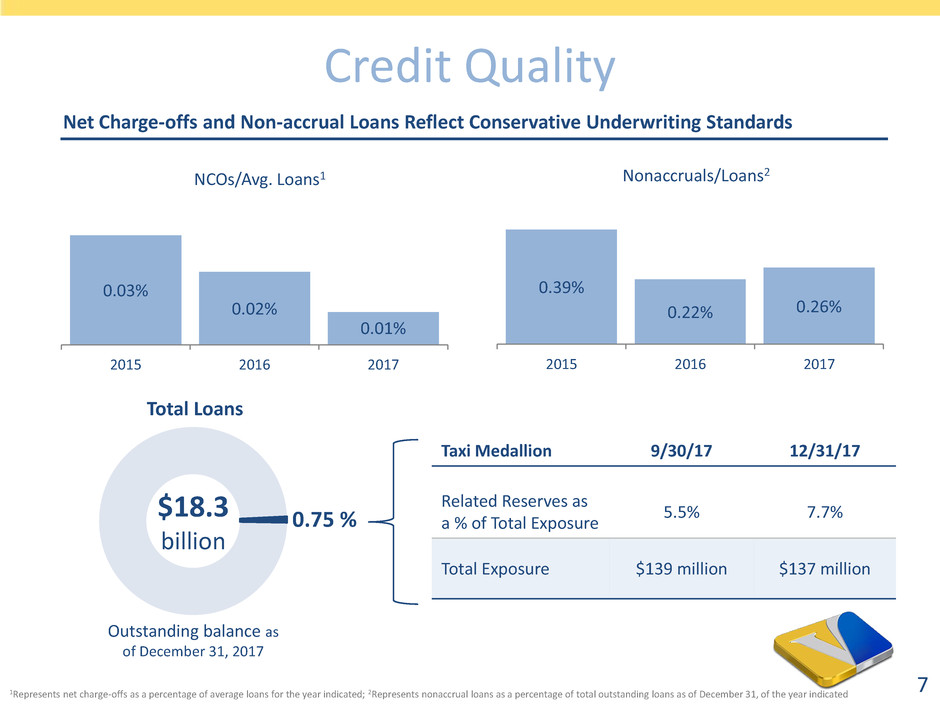

Taxi Medallion 9/30/17 12/31/17

Related Reserves as

a % of Total Exposure

5.5% 7.7%

Total Exposure $139 million $137 million

7

0.75 % $18.3

billion

Total Loans

Credit Quality

Net Charge-offs and Non-accrual Loans Reflect Conservative Underwriting Standards

Outstanding balance as

of December 31, 2017

0.03%

0.02%

0.01%

2015 2016 2017

NCOs/Avg. Loans1

0.39%

0.22% 0.26%

2015 2016 2017

Nonaccruals/Loans2

1Represents net charge-offs as a percentage of average loans for the year indicated; 2Represents nonaccrual loans as a percentage of total outstanding loans as of December 31, of the year indicated

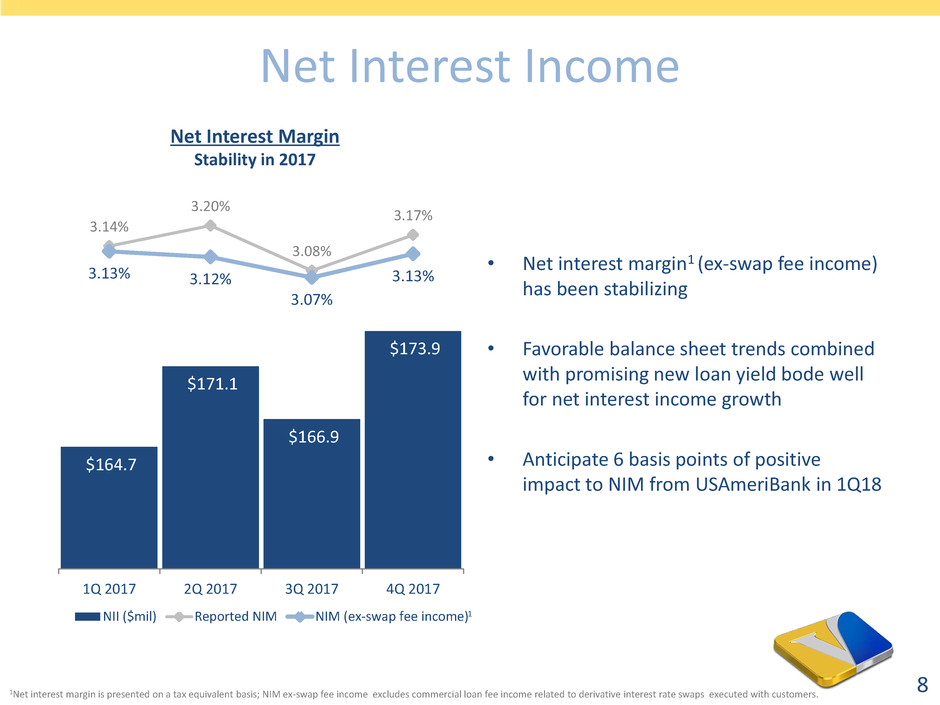

• Net interest margin1 (ex-swap fee income)

has been stabilizing

• Favorable balance sheet trends combined

with promising new loan yield bode well

for net interest income growth

• Anticipate 6 basis points of positive

impact to NIM from USAmeriBank in 1Q18

8

Net Interest Income

$164.7

$171.1

$166.9

$173.9

3.14%

3.20%

3.08%

3.17%

3.13% 3.12%

3.07%

3.13%

1Q 2017 2Q 2017 3Q 2017 4Q 2017

NII ($mil) Reported NIM NIM (ex-swap fee income)

Net Interest Margin

Stability in 2017

1Net interest margin is presented on a tax equivalent basis; NIM ex-swap fee income excludes commercial loan fee income related to derivative interest rate swaps executed with customers.

1

• Transforming Residential Mortgage

gain-on sale business from refinance

driven to home purchase focused

– More predictable origination volume

vs. refinance activity

• 4Q 2017 residential mortgage

application volume was over $450

million

• We believe we are on track to achieve

> $1.5 billion in residential

originations in 2018

9

Noninterest Income Trends

$79,557 $81,195 $82,627

$4,245

$22,030 $20,814

$0.5bn

$0.9bn

$1.0bn

$1.5bn+

2015 2016 2017 2018E

All Other Noninterest Income ($000) Net Gain on Sale of Loans ($000)

Residential Mortgage Originations

Net

Gain on

Sale of

Loans

Proforma

USAmeriBank

Noninterest Income

Emphasis on Home Purchase Gain on Sale

15% Purchase

85% Refinance

54% Purchase

46% Refinance

15% Purchase

85% Refinance

73% Purchase

27% Refinance

$476.1 $485.0

$400

$500

$600

2016 2017 "Base" 2018E 2019E

Resi. Mortgage Commissions

USAB Noninterest Expense

Tax Act Impact

USAB Merger Expense

LIFT Related Expense

"Base" Noninterest Expense

10

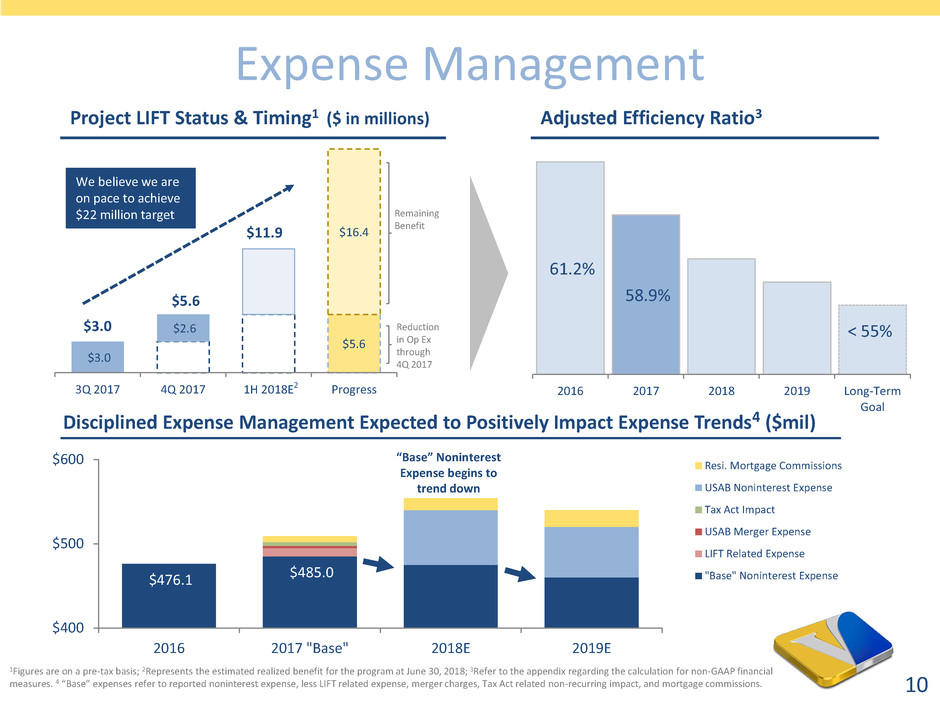

Expense Management

61.2%

58.9%

2016 2017 2018 2019 Long-Term

Goal

Project LIFT Status & Timing1 ($ in millions) Adjusted Efficiency Ratio3

Disciplined Expense Management Expected to Positively Impact Expense Trends4 ($mil)

1Figures are on a pre-tax basis; 2Represents the estimated realized benefit for the program at June 30, 2018; 3Refer to the appendix regarding the calculation for non-GAAP financial

measures. 4 “Base” expenses refer to reported noninterest expense, less LIFT related expense, merger charges, Tax Act related non-recurring impact, and mortgage commissions.

$3.0

$2.6

$11.9

$5.6

$16.4

3Q 2017 4Q 2017 1H 2018E Progress

Remaining

Benefit

Reduction

in Op Ex

through

4Q 2017

We believe we are

on pace to achieve

$22 million target

$5.6

$3.0

“Base” Noninterest

Expense begins to

trend down

2

< 55%

$1,595 $1,590

$733 $733

$210 $210

3Q17 4Q17

• Common Equity Tier 1 Capital Ratio of 9.2%

(flat with previous quarter)

• Go-forward effective tax rate in range of

21%-23%

• Expect to earn-back our capital charge (total

$22.6 million) related to Tax Reform within 2

quarters

• Over the next two years we plan to reinvest

approximately 15% or our annualized

earnings benefit from tax reform on:

– Facilities & Infrastructure

• Reinvestment of additional earnings from tax

reform is included in expense outlook on

page 10

11

Tax Act Implications & Capital

Footnote:

Preferred Stock

Goodwill &

Other Intangible

Assets

Tangible

Common Equity

Shareholders’ Equity ($ in millions)

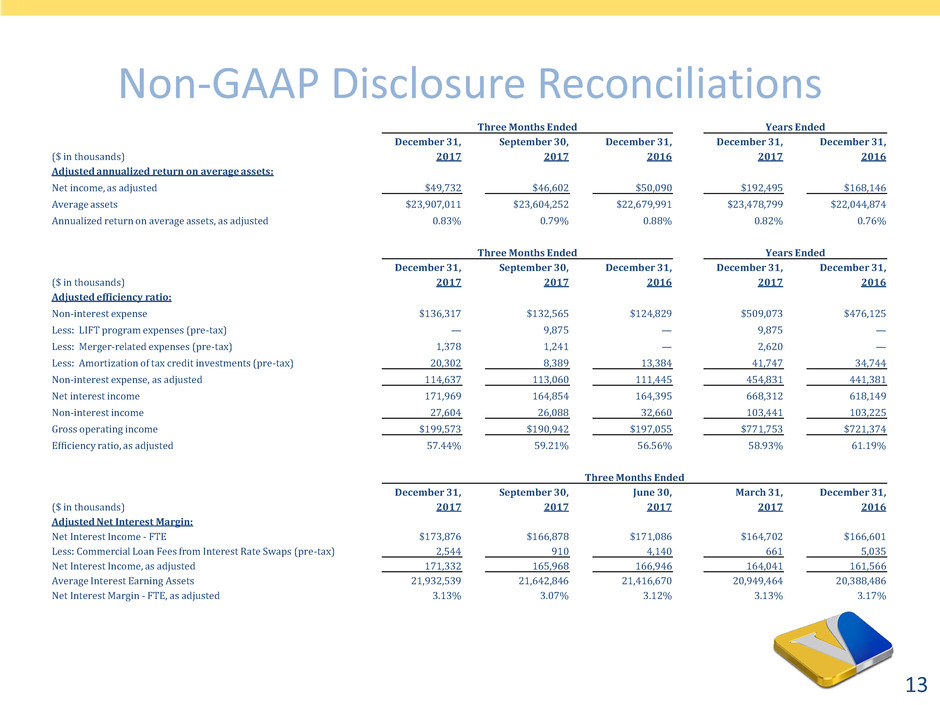

Non-GAAP Disclosure Reconciliations

12

Three Months Ended Years Ended

December 31, September 30, December 31, December 31, December 31,

($ in thousands, except for share data) 2017 2017 2016 2017 2016

Adjusted net income available to common shareholders:

Net income, as reported $26,098 $39,649 $50,090 $161,907 $168,146

Add: LIFT program expenses (net of tax)* — 5,753 — 5,753 —

Add: Merger related expenses (net of tax)** 1,073 1,200 — 2,274 —

Add: Amortization of tax credit investments (Tax Act Impact Only) 4,271 — — 4,271 —

Add: Income Tax Expense (Tax Act Impact Only) 18,290 — — 18,290 —

Net income, as adjusted $49,732 $46,602 $50,090 $192,495 $168,146

Dividends on preferred stock 3,172 2,683 1,797 9,449 7,188

Net income available to common shareholders, as adjusted $46,560 $43,919 $48,293 $183,046 $160,958

_____________

* LIFT program expenses are primarily within professional and legal fees, and salary and employee benefits expense.

** Merger related expenses are primarily within professional and legal fees.

Three Months Ended Years Ended

December 31, September 30, December 31, December 31, December 31,

($ in thousands, except for share data) 2017 2017 2016 2017 2016

Adjusted per common share data:

Net income available to common shareholders, as adjusted $46,560 $43,919 $48,293 $183,046 $160,958

Average number of shares outstanding 264,332,895 264,058,174 256,422,437 264,038,123 254,841,571

Basic earnings, as adjusted $0.18 $0.17 $0.19 $0.69 $0.63

Average number of diluted shares outstanding 265,288,067 264,936,220 256,952,036 264,889,007 255,268,336

Diluted earnings, as adjusted $0.18 $0.17 $0.19 $0.69 $0.63

Non-GAAP Disclosure Reconciliations

13

Three Months Ended Years Ended

December 31, September 30, December 31, December 31, December 31,

($ in thousands) 2017 2017 2016 2017 2016

Adjusted annualized return on average assets:

Net income, as adjusted $49,732 $46,602 $50,090 $192,495 $168,146

Average assets $23,907,011 $23,604,252 $22,679,991 $23,478,799 $22,044,874

Annualized return on average assets, as adjusted 0.83% 0.79% 0.88% 0.82% 0.76%

Three Months Ended Years Ended

December 31, September 30, December 31, December 31, December 31,

($ in thousands) 2017 2017 2016 2017 2016

Adjusted efficiency ratio:

Non-interest expense $136,317 $132,565 $124,829 $509,073 $476,125

Less: LIFT program expenses (pre-tax) — 9,875 — 9,875 —

Less: Merger-related expenses (pre-tax) 1,378 1,241 — 2,620 —

Less: Amortization of tax credit investments (pre-tax) 20,302 8,389 13,384 41,747 34,744

Non-interest expense, as adjusted 114,637 113,060 111,445 454,831 441,381

Net interest income 171,969 164,854 164,395 668,312 618,149

Non-interest income 27,604 26,088 32,660 103,441 103,225

Gross operating income $199,573 $190,942 $197,055 $771,753 $721,374

Efficiency ratio, as adjusted 57.44% 59.21% 56.56% 58.93% 61.19%

Three Months Ended

December 31, September 30, June 30, March 31, December 31,

($ in thousands) 2017 2017 2017 2017 2016

Adjusted Net Interest Margin:

Net Interest Income - FTE $173,876 $166,878 $171,086 $164,702 $166,601

Less: Commercial Loan Fees from Interest Rate Swaps (pre-tax) 2,544 910 4,140 661 5,035

Net Interest Income, as adjusted 171,332 165,968 166,946 164,041 161,566

Average Interest Earning Assets 21,932,539 21,642,846 21,416,670 20,949,464 20,388,486

Net Interest Margin - FTE, as adjusted 3.13% 3.07% 3.12% 3.13% 3.17%

For More Information

Log onto our web site: www.valleynationalbank.com

E-mail requests to: rkraemer@valleynationalbank.com

Call Rick Kraemer, Investor Relations Officer, at: (973) 686-4817

Write to: Valley National Bank

1455 Valley Road

Wayne, New Jersey 07470

Attn: Rick Kraemer, Investor Relations Officer

Log onto our website above or www.sec.gov to obtain free copies of documents

filed by Valley with the SEC

14