Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - SCIENTIFIC GAMES CORP | ex99-1.htm |

| 8-K - CURRENT REPORT - SCIENTIFIC GAMES CORP | form8k.htm |

Exhibit 99.2

Forward-Looking Statements:In this presentation, Scientific Games Corporation (“Scientific Games,” “SGMS”, “SciGames” or the “Company”) makes "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including statements regarding the Company’s unaudited preliminary financial and operational results for the fourth quarter and full year 2017. Forward-looking statements describe future expectations, plans, results or strategies and can often be identified by the use of terminology such as "may," "will," "estimate," "intend," "plan," "continue," "believe," "expect," "anticipate," "target," "should," "could," "potential," "opportunity," "goal,“ “preliminary” or similar terminology. These statements are based upon management's current expectations, assumptions and estimates and are not guarantees of timing, future results or performance. Therefore, you should not rely on any of these forward-looking statements as predictions of future events. Actual results may differ materially from those contemplated in these statements due to a variety of risks and uncertainties and other factors, including, among other things: competition; U.S. and international economic and industry conditions; slow growth of new gaming jurisdictions, slow addition of casinos in existing jurisdictions and declines in the replacement cycle of gaming machines; ownership changes and consolidation in the gaming industry; opposition to legalized gaming or the expansion thereof; inability to adapt to, and offer products that keep pace with, evolving technology, including any failure of our investment of significant resources in our research and development efforts; inability to develop successful products and services and capitalize on trends and changes in our industries, including the expansion of internet and other forms of interactive gaming; laws and government regulations, including those relating to gaming licenses and environmental laws; legislative interpretation, regulatory perception and regulatory risks with respect to gaming and sports wagering; reliance on technological blocking systems; expectations of shift to regulated online gaming or sports wagering; dependence upon key providers in our interactive social gaming business; inability to retain or renew, or unfavorable revisions of, existing contracts, and the inability to enter into new contracts; level of our indebtedness, higher interest rates, availability or adequacy of cash flows and liquidity to satisfy indebtedness, other obligations or future cash needs; inability to consummate the potential refinancing transaction described herein or otherwise reduce or refinance our indebtedness; restrictions and covenants in debt agreements, including those that could result in acceleration of the maturity of our indebtedness; protection of our intellectual property, inability to license third-party intellectual property, and the intellectual property rights of others; security and integrity of our products and systems and reliance on or failures in information technology and other systems; challenges or disruptions relating to the implementation of a new global enterprise resource planning system; failure to maintain internal control over financial reporting; natural events that disrupt our operations or those of our customers, suppliers or regulators; inability to benefit from, and risks associated with, strategic equity investments and relationships; failure to achieve the intended benefits of our acquisitions, including the acquisition of NYX Gaming Group Limited (“NYX”); the ability to successfully integrate our acquisitions, including the acquisition of NYX; incurrence of restructuring costs; implementation of complex revenue recognition standards or other new accounting standards; changes in estimates or judgments related to our impairment analysis of goodwill or other intangible assets; fluctuations in our results due to seasonality and other factors; dependence on suppliers and manufacturers; risks relating to foreign operations, including fluctuations in foreign currency exchange rates, restrictions on the payment of dividends from earnings, restrictions on the import of products and financial instability, including the potential impact to our business resulting from the affirmative vote in the U.K. to withdraw from the European Union and the potential impact to our instant lottery game concession or video lottery terminal lease arrangements resulting from the recent economic and political conditions in Greece; changes in tax laws or tax rulings, or the examination of our tax positions; dependence on key employees; litigation and other liabilities relating to our business, including litigation and liabilities relating to our contracts and licenses, our products and systems, our employees (including labor disputes), intellectual property, environmental laws and our strategic relationships; influence of certain stockholders, including decisions that may conflict with the interests of other stockholders; and stock price volatility. Additional information regarding risks and uncertainties and other factors that could cause actual results to differ materially from those contemplated in forward-looking statements is included from time to time in our filings with the SEC, including the Company's current reports on Form 8-K, quarterly reports on Form 10-Q and its latest annual report on Form 10-K filed with the SEC on March 3, 2017 (including under the headings "Forward Looking Statements" and "Risk Factors"). Forward-looking statements speak only as of the date they are made and, except for Scientific Games' ongoing obligations under the U.S. federal securities laws, Scientific Games undertakes no and disclaims any obligation to publicly update any forward-looking statements whether as a result of new information, future events or otherwise.Additional Notes: This presentation may contain industry market data, industry forecasts and other statistical information. Such information has been obtained from publicly available information, industry publications and other third party sources, and Scientific Games makes no representations as to the accuracy of such information. Scientific Games has not independently verified any such information.“U.S. jurisdictions” refers to the 50 states in the United States plus the District of Columbia and Puerto Rico. Forward-Looking Statements; Additional Notes

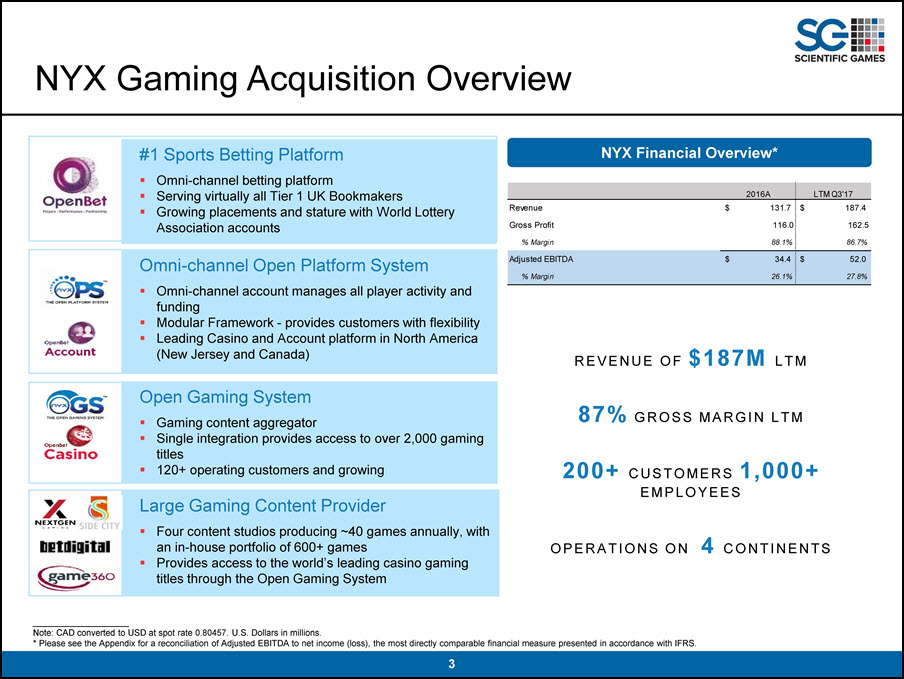

This presentation also contains financial measures with respect to NYX Gaming Group Limited (“NYX”) derived from NYX’s filings with SEDAR prior to January 5, 2018, which was the date Scientific Games acquired NYX. This presentation contains financial measures with respect to NYX, Adjusted EBITDA and Adjusted EBITDA % Margin, which are not presented in accordance with IFRS. These non-IFRS financial measures are presented as supplemental measures to net income (loss), the most directly comparable IFRS measure to Adjusted EBITDA, and should not be considered in isolation of, as a substitute for, or superior to, financial information prepared in accordance with IFRS. Adjusted EBITDA for NYX as provided herein is the same metric as publicly reported by NYX. NYX defines “Adjusted EBITDA” as net earnings (loss) before interest and other non-operating income (expense), income taxes, depreciation and amortization, impairment charges, share-based payments, gains and losses on the revaluing of contingent consideration and derivatives, foreign currency gains and losses, acquisition and restructuring costs, and other gains and losses. NYX Adjusted EBITDA % Margin is calculated as Adjusted EBITDA as a percentage of Revenue. Based on NYX’s public reports, NYX uses Adjusted EBITDA as a measure which NYX believes is appropriate to provide meaningful comparison with, and to enhance an overall understanding of, NYX’s past financial performance and prospects for the future. Based on NYX’s public reports, NYX has historically believed that Adjusted EBITDA provides useful information to both management and investors by excluding specific expenses and gains that NYX believes are not indicative of its core operating results. Further, Adjusted EBITDA is a measure of operating performance that has been used by NYX’s management, as well as industry analysts, to evaluate operations and operating performance and is widely used in the technology and gaming industry. Adjusted EBITDA as used by NYX may differ from similarly titled measures presented by other companies. Please see the Appendix for a reconciliation of NYX Adjusted EBITDA to net income (loss), the most directly comparable financial measure presented in accordance with IFRS.For the purposes of this presentation, the information for NYX is presented in United States Dollars, translated using the Canadian Dollar to U.S. Dollar assumed exchange rate of 0.80457 as of January 15, 2018. NYX Financial Measures

NYX Financial Overview* OpenBet Players Performance Partnership #1 Sports Betting Platform Omni-channel betting platform Serving virtually all Tier 1 UK Bookmakers Growing placements and stature with World Lottery Association accounts NYX OPS The open platform system OpenBet Account Omni-channel Open Platform System Omni-channel account manages all player activity and funding Modular Framework - provides customers with flexibility Leading Casino and Account platform in North America (New Jersey and Canada) NYX OGS The Open Gaming System OpenBet Casino Open Gaming System Gaming content aggregator Single integration provides access to over 2,000 gaming titles 120+ operating customers and growing Nextgen Gaming Side City betdigital game360 Large Gaming Content Provider Four content studios producing ~40 games annually, with an in-house portfolio of 600+ games Provides access to the world’s leading casino gaming titles through the Open Gaming System NYX Gaming Acquisition Overview 2016A LTM Q3'17 Revenue $131.7 $187.4 Gross Profit 116.0 162.5 % Margin 88.1% 86.7% Adjusted EBITDA $34.4 $52.0 % Margin 26.1% 27.8% REVENUE OF $187M LTM 87% GROSS MARGIN LTM 200+ CUSTOMERS 1,000+ EMPLOYEES OPERATIONS ON 4 CONTINENTS Note: CAD converted to USD at spot rate 0.80457. U.S. Dollars in millions. * Please see the Appendix for a reconciliation of Adjusted EBITDA to net income (loss), the most directly comparable financial measure presented in accordance with IFRS.

NYX Adjusted EBITDA Reconciliation Adj. EBITDA Reconciliation (USD, as converted) FY 2016 LTM Q3'17 Net Loss ($46,614) ($72,896) Net tax expense (benefit) ($7,120) ($248) Loss before tax ($53,733) ($73,143) Depreciation and amortization 25,406 30,931 Interest expense, net 24,312 35,667 EBITDA ($4,015) ($6,546) Impairment of intangibles and goodwill 75,660 70,309 Acquisition and restructuring costs 15,869 7,712 Foreign exchange loss (gain) 184 (930) Fair value adjustment to derivatives (75,000) (33,888) Loss on exchange of debt 19,194 11,397 Revaluing contingent consideration (7,598) (4,026) Share-based payments 1,415 2,243 Other expense 3,887 5,778 European poker business sale / closure 4,787 - Adjusted EBITDA $34,385 $52,049 Note: CAD converted to USD at spot rate 0.80457. U.S. Dollars in thousands.