Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Discover Financial Services | dfs20171231ex992.htm |

| EX-99.1 - EXHIBIT 99.1 - Discover Financial Services | dfs-earningsreleasex4q17ex.htm |

| 8-K - 8-K - Discover Financial Services | a4q178k.htm |

2017 and 4Q17 Financial Results

January 24, 2018

©2017 DISCOVER FINANCIAL SERVICES

Exhibit 99.3

The following slides are part of a presentation by Discover Financial Services (the "Company") in connection with

reporting quarterly financial results and are intended to be viewed as part of that presentation. No representation is made

that the information in these slides is complete. For additional financial, statistical, and business related information, as

well as information regarding business and segment trends, see the earnings release and financial supplement included

as exhibits to the Company’s Current Report on Form 8-K filed today and available on the Company’s website

(www.discover.com) and the SEC’s website (www.sec.gov).

The information provided herein includes certain non-GAAP financial measures. The reconciliations of such measures to

the comparable GAAP figures are included at the end of this presentation, which is available on the Company’s website

and the SEC’s website.

The presentation contains forward-looking statements. You are cautioned not to place undue reliance on forward-looking

statements, which speak only as of the date on which they are made, which reflect management’s estimates, projections,

expectations or beliefs at that time, and which are subject to risks and uncertainties that may cause actual results to

differ materially. For a discussion of certain risks and uncertainties that may affect the future results of the Company,

please see "Special Note Regarding Forward-Looking Statements," "Risk Factors," "Business – Competition," "Business

– Supervision and Regulation" and "Management’s Discussion and Analysis of Financial Condition and Results of

Operations" in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016, and under

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the company’s Quarterly

Report on Form 10-Q for the quarters ended September 30, 2017, June 30, 2017, and March 31, 2017, which are filed

with the SEC and available at the SEC's website (www.sec.gov). The Company does not undertake to update or revise

forward-looking statements as more information becomes available.

Notice

2

• Solid execution drove net income of $2.1Bn, diluted EPS of $5.42 and 19% return on equity

• Adjusted to exclude non-recurring charges, primarily related to the passage of tax reform, diluted EPS was

$5.98(1)

• Continued focus on prime revolvers led to strong card receivables and revenue growth

• Record originations in personal loans and student loans

• Credit normalization continued as a result of secular growth of consumer credit as well as our

organic growth; credit environment remains benign and risk-adjusted returns are strong

• Payment Services network volume increased 12% to $203Bn and income before taxes

increased 36%

• Achieved positive operating leverage of 4% driven by prudent expense management, while

continuing to invest for growth and new capabilities

• Achieved a 123% payout ratio via return of $2.5Bn of capital through dividends and share

repurchases

2017 Full Year Performance

3

Note(s)

1. Adjusted diluted EPS is a non-GAAP financial measure which should be viewed in addition to, and not as a substitute for, the Company’s reported results. Management believes

this information helps investors understand the effect of activities that are not expected to continue and provides a useful metric to evaluate the Company's ongoing operating

performance; see appendix for a reconciliation

Receivables YOY Growth

2013 2014 2015 2016 2017

$65.8

$70.0 $72.4

$77.3

$84.2

5%

6%

3%

7%

9%

Ending Loans ($Bn) Net Charge-off Rate

Solid loan growth and credit performance

4

2013 2014 2015 2016 2017

1.98% 2.04% 2.01%

2.16%

2.70%

Note(s)

1. Adjusted Diluted EPS is a non-GAAP financial measure which should be viewed in addition to, and not as a substitute for, the Company’s reported results. Management believes

this information helps investors understand the effect of activities that are not expected to continue and provides a useful metric to evaluate the Company's ongoing operating

performance; see appendix for a reconciliation

2. Pre-tax, pre-provision income, which is derived by adding provision for loan losses to pre-tax income, is a non-GAAP financial measure which should be viewed in addition to, and

not as a substitute for, the Company’s reported results. Management believes this information helps investors understand the effect of provision for loan losses on reported results

and provides an alternate presentation of the Company’s performance; see appendix for a reconciliation

Highlights

• Diluted EPS of $0.99

• Revenue net of interest expense of

$2.6Bn, up 11% YOY, driven by

higher net interest income

• Provision for loan losses increased

$101MM YOY (17%) on higher net

charge-offs, partially offset by a

smaller reserve build

• Expenses rose 15%, driven by

investments to support growth and

new capabilities

• Income tax expense includes non-

recurring charges of $179MM

associated with the passage of tax

reform

4Q17 Summary Financial Results

B / (W)

($MM, except per share data) 4Q17 4Q16 $ Δ % Δ

Revenue Net of Interest Expense $2,614 $2,358 $256 11%

Net Principal Charge-off 583 435 (148) (34%)

Reserve Change build/(release) 96 143 47 33%

Provision for Loan Losses 679 578 (101) (17%)

Operating Expense 1,036 897 (139) (15%)

Direct Banking 870 868 2 —%

Payment Services 29 15 14 93%

Total Pre-Tax Income 899 883 16 2%

Income Tax Expense 512 320 (192) (60%)

Net Income $387 $563 ($176) (31%)

ROE 14% 20%

Diluted EPS $0.99 $1.40 ($0.41) (29%)

EPS From Non-Recurring Charges ($0.56)

Adjusted Diluted EPS (1) $1.55 $ 1.40 $0.15 11%

Pre-Tax, Pre-Provision Income (2) $1,578 $1,461 $117 8%

5

Payment Services

4Q16 4Q17

$77.3

$61.5

$9.0 $6.5

$84.2

$67.3

$9.2 $7.4

+9% +9% +2% +14%

Note(s)

1. Volume is derived from data provided by licensees for Diners Club branded cards issued outside of North America and is subject to subsequent revision or amendment

Total Network Volume up 13% YOY

Ending Loans ($Bn) Volume ($Bn)

4Q16 4Q17

$34.0 $35.6

$7.3

$3.2

$36.3

$42.4

$8.4

$3.3

Total Card Student Personal

+7% +19% +14% 1%

Proprietary PULSE

Network

PartnersDiners

(1)

4Q17 Loan and Volume Growth

6

Note(s)

1. Rewards cost divided by Discover card sales volume

Highlights

• Receivables growth and margin

expansion drove 12% YOY

increase in net interest income

• Net discount and interchange

revenue increased $29MM (11%)

YOY driven by a 9% increase in

card sales volume

• Rewards rate decreased by 3 bps

YOY as a result of lower

promotional rewards

4Q17 Revenue Detail

B / (W)

($MM) 4Q17 4Q16 $ Δ % Δ

Interest Income $2,556 $2,258 $298 13%

Interest Expense 436 366 (70) (19%)

Net Interest Income 2,120 1,892 228 12%

Discount/Interchange Revenue 717 665 52 8%

Rewards Cost 434 411 (23) (6%)

Net Discount/Interchange Revenue 283 254 29 11%

Protection Products Revenue 54 59 (5) (8%)

Loan Fee Income 96 93 3 3%

Transaction Processing Revenue 43 40 3 8%

Other Income 18 20 (2) (10%)

Total Non-Interest Income 494 466 28 6%

Revenue Net of Interest Expense $2,614 $2,358 $256 11%

Direct Banking $2,543 $2,293 $250 11%

Payment Services 71 65 6 9%

Revenue Net of Interest Expense $2,614 $2,358 $256 11%

Change

($MM) 4Q17 4Q16 QOQ YOY

Discover Card Sales Volume $35,339 $32,486 10% 9%

Rewards Rate (1) 1.23% 1.26% -7 bps -3 bps

7

Highlights

• Net interest margin on receivables

increased 21 bps YOY on higher

loan yields, partially offset by higher

funding costs

• Credit card yield increased 17 bps

YOY as the prime rate increased,

partially offset by portfolio mix and

higher interest charge-offs

• Average consumer deposits grew

10% YOY and composed 46% of

total average funding

• Funding costs on interest-bearing

liabilities increased 14 bps YOY,

driven by higher market rates

partially offset by tighter credit

spreads on refinanced long-term

debt

4Q17 Net Interest Margin

4Q17 4Q16

($MM)

Average

Balance Rate

Average

Balance Rate

Credit Card $64,791 12.79% $59,121 12.62%

Private Student 9,158 7.69% 8,954 7.06%

Personal 7,455 12.27% 6,425 12.09%

Other 398 5.66% 275 4.88%

Total Loans 81,802 12.14% 74,775 11.88%

Other Interest-Earning Assets 15,566 1.34% 14,040 0.71%

Total Interest-Earning Assets $97,368 10.41% $88,815 10.12%

Direct to Consumer and Affinity $38,807 1.44% $35,396 1.26%

Brokered Deposits and Other 18,244 2.12% 14,355 1.93%

Interest Bearing Deposits 57,051 1.65% 49,751 1.45%

Borrowings 26,446 2.97% 25,860 2.85%

Total Interest-Bearing Liabilities $83,497 2.07% $75,611 1.93%

Change

(%) 4Q17 QOQ YOY

Total Interest Yield 12.14% -1bps 26bps

NIM on Receivables 10.28% 0bps 21bps

NIM on Interest-Earning Assets 8.64% 4bps 17bps

8

Note(s)

1. Defined as reported total operating expense divided by revenue net of interest expense

Highlights

• Employee compensation and

benefits up 17% YOY, primarily on

higher staffing levels, as well as

higher average salaries

• Also includes $16MM related to

a one-time bonus granted to

eligible employees following the

passage of tax reform

• Marketing up 21% YOY as a result

of higher acquisition costs and

brand advertising

• Professional fees up 24% YOY,

primarily due to investments in

technology and analytic

capabilities

4Q17 Operating Expense Detail

B / (W)

($MM) 4Q17 4Q16 $ Δ % Δ

Employee Compensation and Benefits $411 $352 ($59) (17%)

Marketing and Business Development 213 176 (37) (21%)

Information Processing & Communications 80 81 1 1%

Professional Fees 189 152 (37) (24%)

Premises and Equipment 26 23 (3) (13%)

Other Expense 117 113 (4) (4%)

Total Operating Expense $1,036 $897 ($139) (15%)

Direct Banking 995 846 ($149) (18%)

Payment Services 41 51 10 20%

Total Operating Expense $1,036 $897 ($139) (15%)

Operating Efficiency(1) 39.7% 38.0% (170) bps

9

Total Company Loans Credit Card Loans

Private Student Loans Personal Loans

NCO rate (%) 30+ day DQ rate ex-PCI (%)

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17

1.85 2.02

2.11 2.18 2.02

2.31

2.60 2.71 2.63

2.85

1.60 1.67 1.64 1.60 1.79

1.97 1.97 1.93 2.05

2.20

NCO rate (%) 30+ day DQ rate (%)

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17

2.04 2.18

2.34 2.39 2.17

2.47

2.84 2.94 2.80 3.03

1.65 1.72 1.68 1.63 1.87

2.04 2.06 2.00 2.14

2.28

NCO rate (%) 30+ day DQ rate (%)

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17

1.99

2.28 2.45 2.38

2.63 2.70

3.16 3.18 3.19

3.62

0.80 0.89 0.97 1.02 0.98

1.12 1.12 1.14 1.27

1.40

NCO rate (%) 30+ day DQ rate ex-PCI (%)

3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17

0.57

0.82

0.56 0.74 0.70

1.00

0.60

0.85

1.14 1.03

1.88 1.91 1.92 1.88 1.87

2.22 2.04 2.12 2.14

2.35

Credit Performance Trends

10

4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17

93 95 94 99 99

104 108 109

123

13.9

14.3 14.3

13.9

13.2 13.4 13.0

12.5

11.6

Capital Trends

Note(s)

1. Common Equity Tier 1 Capital Ratio (Basel III Transition)

2. Payout Ratio is displayed on a trailing twelve month basis. This represents the trailing twelve months’ Capital Return to Common Stockholders divided by the trailing twelve

months’ Net Income Allocated to Common Stockholders

Common Equity Tier 1 (CET1) Capital Ratio(1) (%) Payout Ratio(2) (%)

11

Balance Sheet

• Total loans grew 9%

($7.0Bn) YOY with strong

contributions from all

primary lending products

• Credit card loans grew 9%

($5.8Bn) YOY as sales

volume increased 9%

• Average consumer

deposits grew 10%

($3.4Bn) YOY, while

deposit rates increased 18

bps

4Q17 Financial Summary

12

• Total NCO rate of 2.85%,

up 54 bps YOY

• Driven by supply-

induced credit

normalization and loan

seasoning

• Capital plan execution

• Repurchased 8.1MM

shares of common

stock for $555MM

• CET1 capital ratio(1) of

11.6%, down 160 bps

YOY

• Net income of $387MM

and diluted EPS of $0.99

• Revenue growth of 11%

on higher net interest

income

• NIM of 10.28%, up 21 bps

YOY

• Efficiency ratio up 170

bps YOY to 40%

reflecting investments in

growth and technology

Credit and Capital Profitability

Note(s)

1. Basel III Transition

2018 Guidance

2017

Actual 2018 Guidance

Total Loan Growth 9% 7 - 9%

Operating Expense $3.8Bn $4.0 - 4.1Bn

Rewards Rate 1.24% 1.28 - 1.30%

Total Company NIM 10.2% 10.3 - 10.4%

Total Net Charge-off Rate 2.7% 3.0 - 3.25%

Effective Tax Rate 24%

13

Note(s)

1. Adjusted Diluted EPS is a non-GAAP financial measure which should be viewed in addition to, and not as a substitute for, the Company’s reported results. Management believes

this information helps investors understand the effect of activities that are not expected to continue and provides a useful metric to evaluate the Company's ongoing operating

performance; see appendix for a reconciliation

Appendix

Reconciliation of GAAP to Non-GAAP Data

(unaudited) 4Q17

Full Year

2017

Diluted EPS $0.99 $5.42

Adjusted for:

Employee compensation one-time bonus 0.03 0.03

Original issuance cost related to series B preferred stock redemption 0.04 0.04

Tax related one-time items 0.49 0.49

Adjusted diluted EPS (1) $1.55 $5.98

14

Note(s)

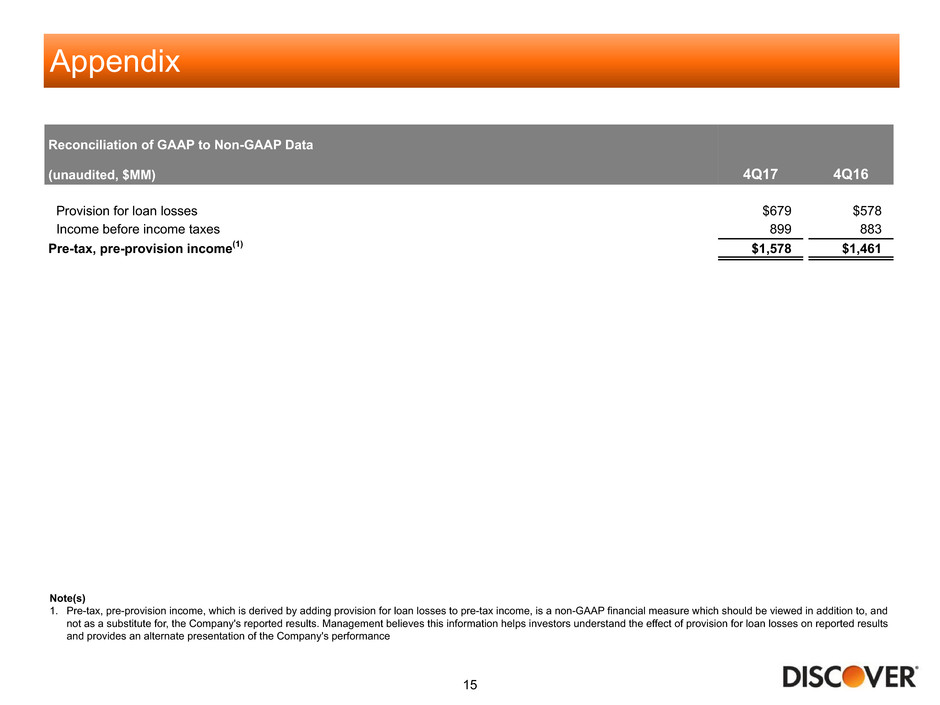

1. Pre-tax, pre-provision income, which is derived by adding provision for loan losses to pre-tax income, is a non-GAAP financial measure which should be viewed in addition to, and

not as a substitute for, the Company's reported results. Management believes this information helps investors understand the effect of provision for loan losses on reported results

and provides an alternate presentation of the Company's performance

Appendix

Reconciliation of GAAP to Non-GAAP Data

(unaudited, $MM) 4Q17 4Q16

Provision for loan losses $679 $578

Income before income taxes 899 883

Pre-tax, pre-provision income(1) $1,578 $1,461

15