Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - United Financial Bancorp, Inc. | ex-99120171231.htm |

| 8-K - 8-K - United Financial Bancorp, Inc. | a8-k20171231.htm |

Fourth Quarter 2017 Earnings

NASDAQ Global Select Market: UBNK

Create Your Balance

2 NASDAQ: UBNK

This Presentation contains forward-looking statements that are within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements

are based upon the current beliefs and expectations of our management and are subject to significant risks and uncertainties. These risks and uncertainties

could cause our results to differ materially from those set forth in such forward-looking statements. Forward-looking statements can be identified by the fact

that they do not relate strictly to historical or current facts. Words such as “believes,” “anticipates,” “expects,” “intends,” “plans,” “estimates,” “targeted”

and similar expressions, and future or conditional verbs, such as “will,” “would,” “should,” “could” or “may” are intended to identify forward-looking

statements but are not the only means to identify these statements. Forward-looking statements involve risks and uncertainties. Actual conditions, events or

results may differ materially from those contemplated by a forward-looking statement. Factors that could cause this difference — many of which are beyond

our control — include without limitation the following: Any forward-looking statements made by or on behalf of us in this Presentation speak only as of the

date of this Presentation. We do not undertake to update forward-looking statements to reflect the impact of circumstances or events that arise after the

date the forward-looking statement was made. The reader should; however, consult any further disclosures of a forward-looking nature we may make in

future filings.

NON-GAAP FINANCIAL MEASURES

This Presentation contains certain non-GAAP financial measures in addition to results presented in accordance with Generally Accepted Accounting Principles

(“GAAP”). These non-GAAP measures provide supplemental perspectives on operating results, performance trends, and financial condition. They are not a

substitute for GAAP measures; they should be read and used in conjunction with the Company’s GAAP financial information. These non-GAAP financial

measures provide information for investors to effectively analyze financial trends of our business activities, and to enhance comparability with peers across

the financial services sector.

Forward Looking Statements

3 NASDAQ: UBNK

Corporate Contacts

William H. W. Crawford, IV

Chief Executive Officer and President

Eric R. Newell, CFA

Executive Vice President, Chief Financial Officer

860-291-3722 or ENewell@bankatunited.com

Investor Information:

Marliese L. Shaw

Executive Vice President, Corporate Secretary/Investor Relations Officer

860-291-3622 or MShaw@bankatunited.com

4 NASDAQ: UBNK

Table of Contents

Page

Branch Network 5

Market Opportunities 6

Management Team and Ownership 7

Four Key Objectives 8

Consumer Banking 9

Wholesale Banking 10

Wholesale Banking Overview 11

Shared Services 12

Financial Highlights 13

5 NASDAQ: UBNK

Branch Network

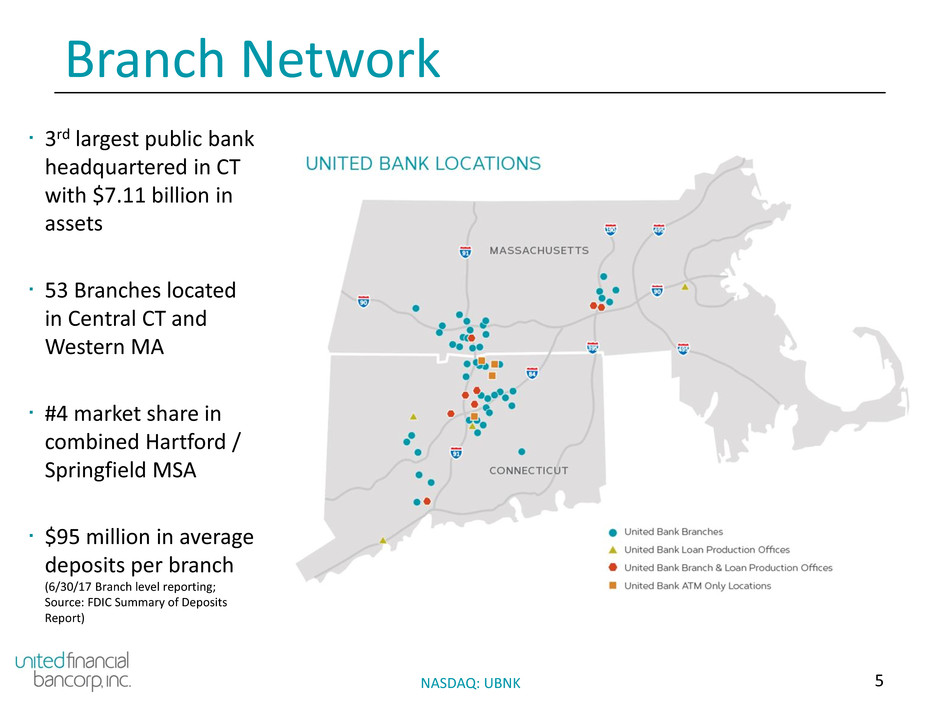

· 3rd largest public bank

headquartered in CT

with $7.11 billion in

assets

· 53 Branches located

in Central CT and

Western MA

· #4 market share in

combined Hartford /

Springfield MSA

· $95 million in average

deposits per branch

(6/30/17 Branch level reporting;

Source: FDIC Summary of Deposits

Report)

6 NASDAQ: UBNK

Market Opportunities

• United Bank operates in attractive markets with significant wealth and customer base

• New Haven and Fairfield County provide growth opportunities

• The Bank’s main operational markets have significant wealth

Markets Population

Population 35-

54 Average HHI Median Age

Hartford MSA 1,209,666 314,305 99,183 41

Springfield MSA 634,548 150,871 74,794 38

Worcester MSA 941,096 252,449 90,066 40

New Haven County 857,654 222,167 88,804 40

Fairfield County 954,291 261,415 140,792 40

Total 4,597,255 1,201,207 100,236 40

*Total Average Household Income (HHI) weighted by households and Age weighted by population

Main Operational

Markets

Opportunity Markets

NOTE: Data sourced from SNL analysis as of January 2018

7 NASDAQ: UBNK

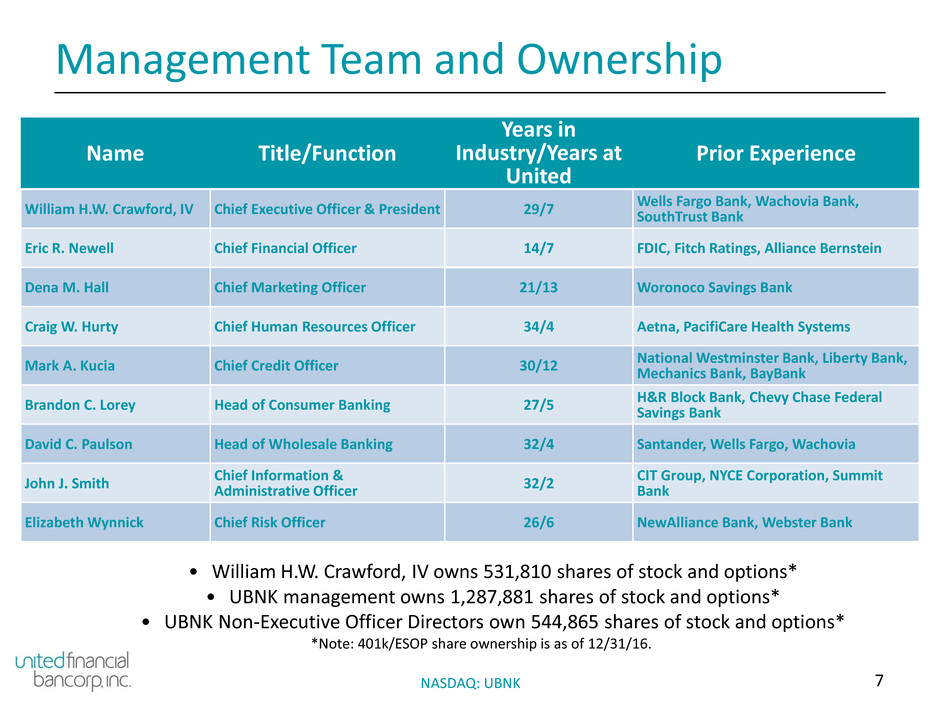

Management Team and Ownership

• William H.W. Crawford, IV owns 531,810 shares of stock and options*

• UBNK management owns 1,287,881 shares of stock and options*

• UBNK Non-Executive Officer Directors own 544,865 shares of stock and options*

*Note: 401k/ESOP share ownership is as of 12/31/16.

Name Title/Function

Years in

Industry/Years at

United

Prior Experience

William H.W. Crawford, IV Chief Executive Officer & President 29/7 Wells Fargo Bank, Wachovia Bank, SouthTrust Bank

Eric R. Newell Chief Financial Officer 14/7 FDIC, Fitch Ratings, Alliance Bernstein

Dena M. Hall Chief Marketing Officer 21/13 Woronoco Savings Bank

Craig W. Hurty Chief Human Resources Officer 34/4 Aetna, PacifiCare Health Systems

Mark A. Kucia Chief Credit Officer 30/12 National Westminster Bank, Liberty Bank, Mechanics Bank, BayBank

Brandon C. Lorey Head of Consumer Banking 27/5 H&R Block Bank, Chevy Chase Federal Savings Bank

David C. Paulson Head of Wholesale Banking 32/4 Santander, Wells Fargo, Wachovia

John J. Smith Chief Information & Administrative Officer 32/2

CIT Group, NYCE Corporation, Summit

Bank

Elizabeth Wynnick Chief Risk Officer 26/6 NewAlliance Bank, Webster Bank

8 NASDAQ: UBNK

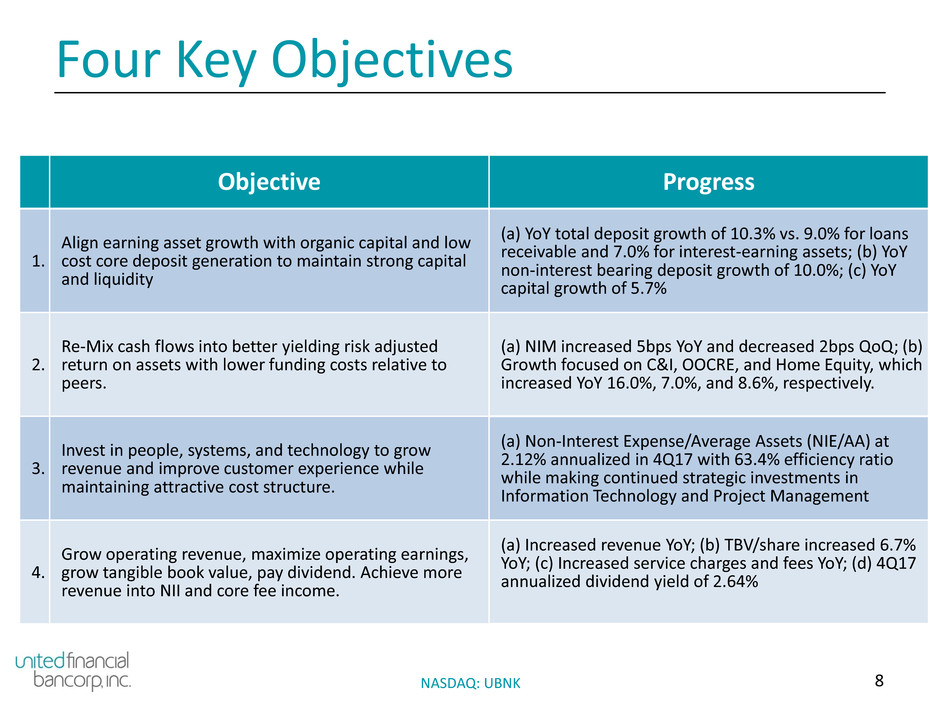

Four Key Objectives

Objective Progress

1.

Align earning asset growth with organic capital and low

cost core deposit generation to maintain strong capital

and liquidity

(a) YoY total deposit growth of 10.3% vs. 9.0% for loans

receivable and 7.0% for interest-earning assets; (b) YoY

non-interest bearing deposit growth of 10.0%; (c) YoY

capital growth of 5.7%

2.

Re-Mix cash flows into better yielding risk adjusted

return on assets with lower funding costs relative to

peers.

(a) NIM increased 5bps YoY and decreased 2bps QoQ; (b)

Growth focused on C&I, OOCRE, and Home Equity, which

increased YoY 16.0%, 7.0%, and 8.6%, respectively.

3.

Invest in people, systems, and technology to grow

revenue and improve customer experience while

maintaining attractive cost structure.

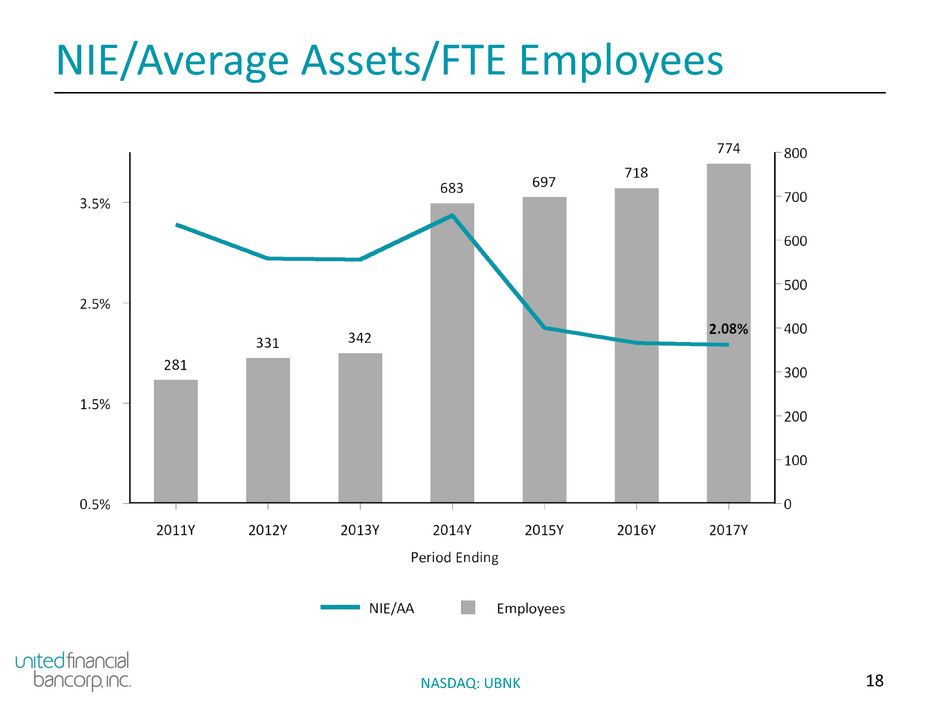

(a) Non-Interest Expense/Average Assets (NIE/AA) at

2.12% annualized in 4Q17 with 63.4% efficiency ratio

while making continued strategic investments in

Information Technology and Project Management

4.

Grow operating revenue, maximize operating earnings,

grow tangible book value, pay dividend. Achieve more

revenue into NII and core fee income.

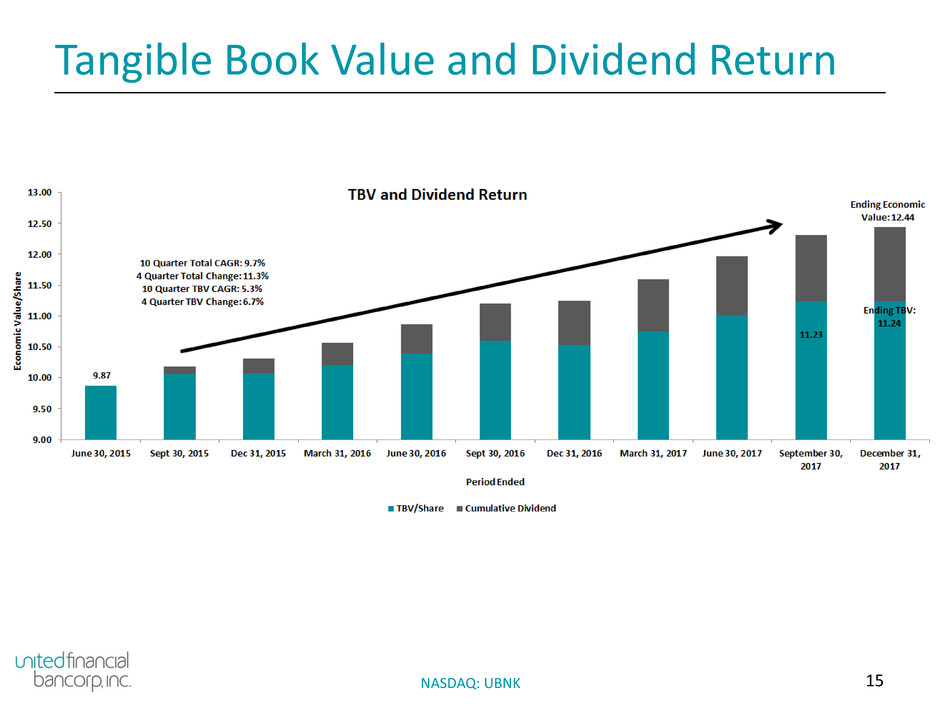

(a) Increased revenue YoY; (b) TBV/share increased 6.7%

YoY; (c) Increased service charges and fees YoY; (d) 4Q17

annualized dividend yield of 2.64%

9 NASDAQ: UBNK

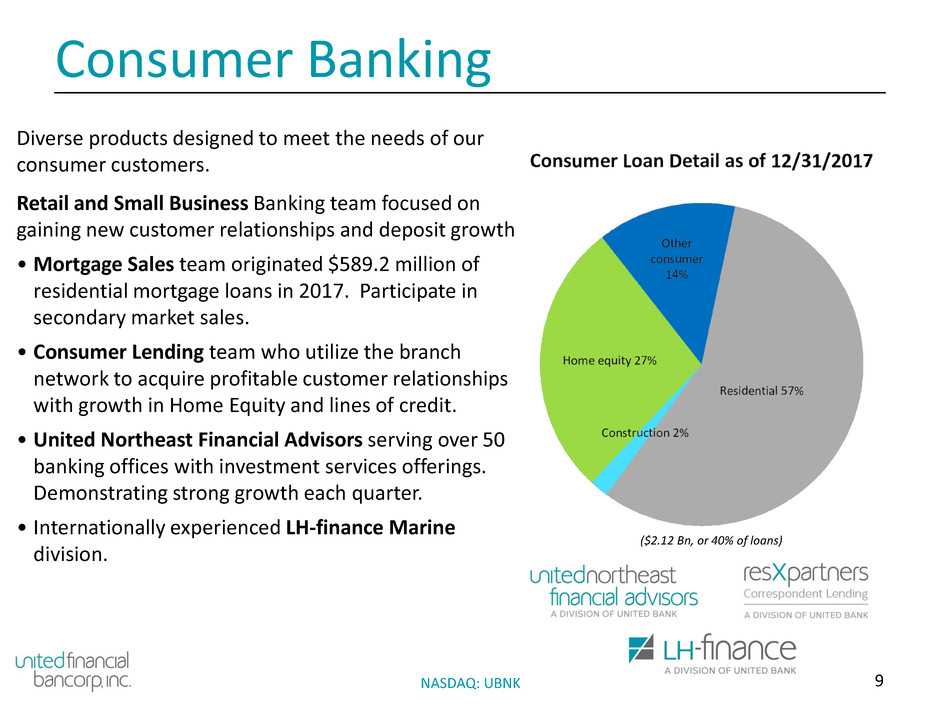

Consumer Banking

Diverse products designed to meet the needs of our

consumer customers.

Retail and Small Business Banking team focused on

gaining new customer relationships and deposit growth

• Mortgage Sales team originated $589.2 million of

residential mortgage loans in 2017. Participate in

secondary market sales.

• Consumer Lending team who utilize the branch

network to acquire profitable customer relationships

with growth in Home Equity and lines of credit.

• United Northeast Financial Advisors serving over 50

banking offices with investment services offerings.

Demonstrating strong growth each quarter.

• Internationally experienced LH-finance Marine

division.

($2.12 Bn, or 40% of loans)

10 NASDAQ: UBNK

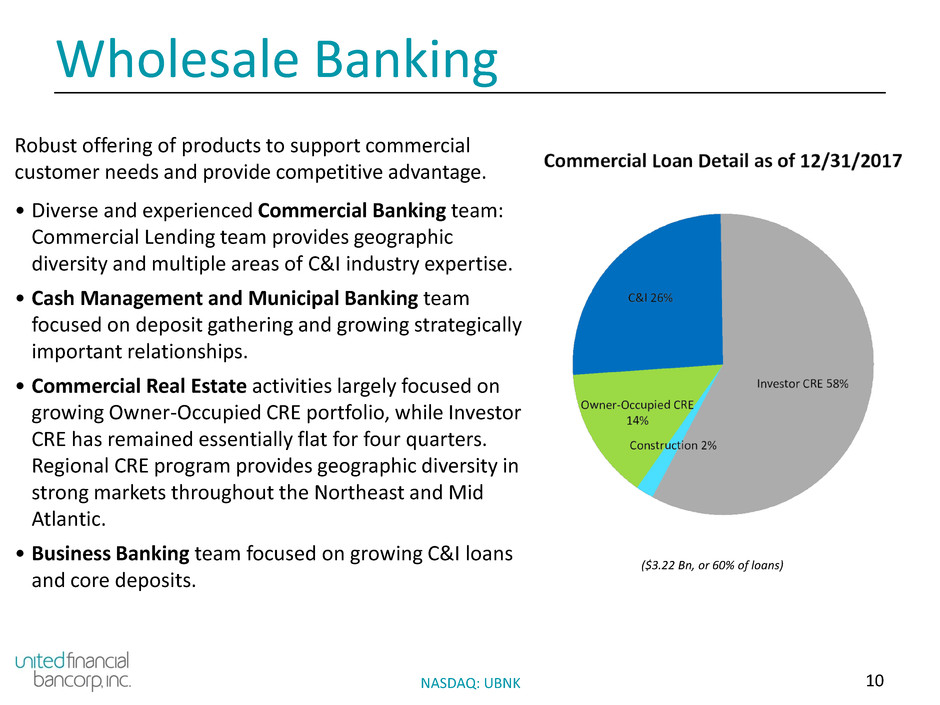

Wholesale Banking

Robust offering of products to support commercial

customer needs and provide competitive advantage.

• Diverse and experienced Commercial Banking team:

Commercial Lending team provides geographic

diversity and multiple areas of C&I industry expertise.

• Cash Management and Municipal Banking team

focused on deposit gathering and growing strategically

important relationships.

• Commercial Real Estate activities largely focused on

growing Owner-Occupied CRE portfolio, while Investor

CRE has remained essentially flat for four quarters.

Regional CRE program provides geographic diversity in

strong markets throughout the Northeast and Mid

Atlantic.

• Business Banking team focused on growing C&I loans

and core deposits.

($3.22 Bn, or 60% of loans)

11 NASDAQ: UBNK

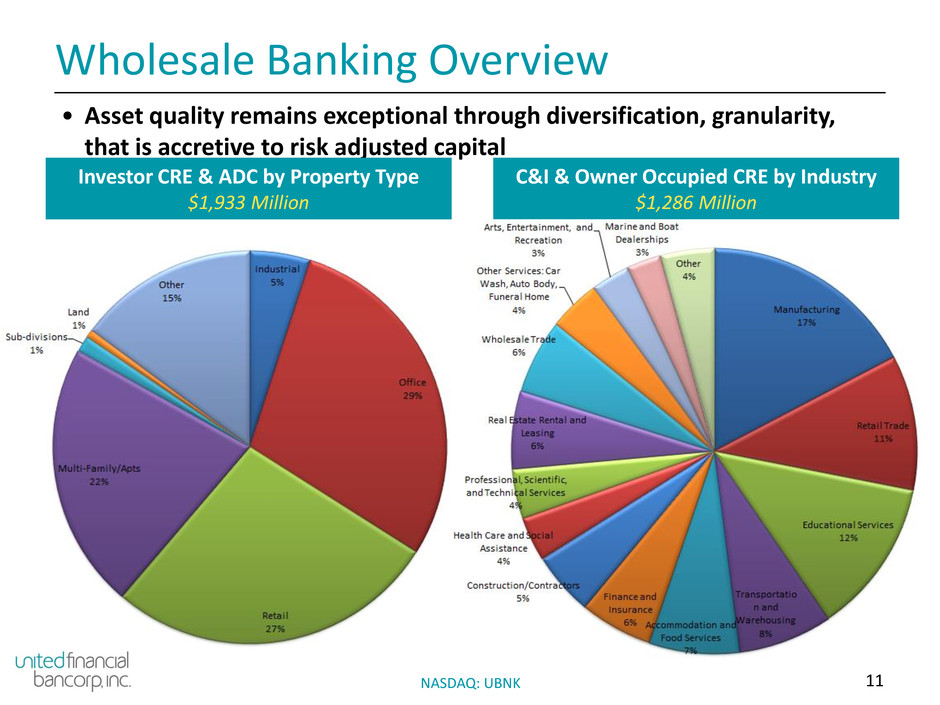

Wholesale Banking Overview

• Asset quality remains exceptional through diversification, granularity,

that is accretive to risk adjusted capital

Investor CRE & ADC by Property Type

$1,933 Million

C&I & Owner Occupied CRE by Industry

$1,286 Million

12 NASDAQ: UBNK

Shared Services

In addition to a strong and seasoned leadership team, the Company has recruited, retained

and developed deeply talented teams across the organization

· Significant investment in Information Technology resources to provide leadership

for effective strategic and tactical planning in the use of technology. Implementing

the use of leading edge development methodologies and feedback loops.

· Experienced Enterprise Risk and Credit Risk areas that maintain a strong, consistent

culture of risk discipline. Support profitable business results using vigilance, agility,

and expertise.

· Strong recruiting, retention and talent development via Human Resources division.

Focus on defining, attracting, and developing the right mix of critical talent to

support and grow the businesses.

· Deep Finance and Treasury group with talent recruited from a large and diversified

set of institutions. Provide decision support for strategic and operational goals using

key business drivers and parameters that impact future profit and revenue growth.

Experienced and talented Tax team driving profitable tax planning.

13 NASDAQ: UBNK

Financial Highlights

14 NASDAQ: UBNK

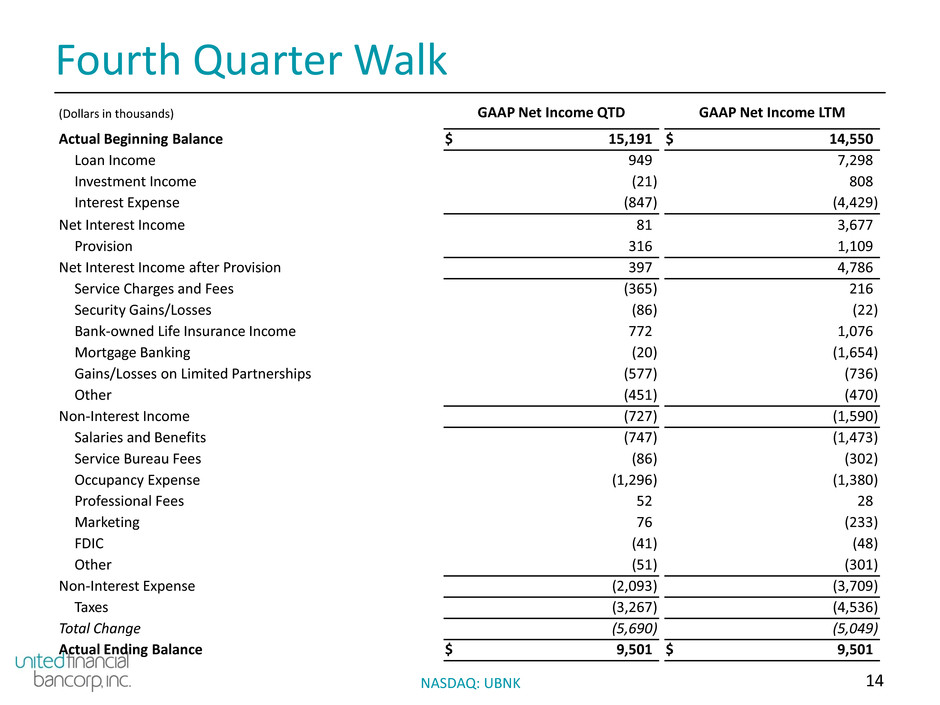

Fourth Quarter Walk

(Dollars in thousands) GAAP Net Income QTD GAAP Net Income LTM

Actual Beginning Balance $ 15,191 $ 14,550

Loan Income 949 7,298

Investment Income (21 ) 808

Interest Expense (847 ) (4,429 )

Net Interest Income 81 3,677

Provision 316 1,109

Net Interest Income after Provision 397 4,786

Service Charges and Fees (365 ) 216

Security Gains/Losses (86 ) (22 )

Bank-owned Life Insurance Income 772 1,076

Mortgage Banking (20 ) (1,654 )

Gains/Losses on Limited Partnerships (577 ) (736 )

Other (451 ) (470 )

Non-Interest Income (727 ) (1,590 )

Salaries and Benefits (747 ) (1,473 )

Service Bureau Fees (86 ) (302 )

Occupancy Expense (1,296 ) (1,380 )

Professional Fees 52 28

Marketing 76 (233 )

FDIC (41 ) (48 )

Other (51 ) (301 )

Non-Interest Expense (2,093 ) (3,709 )

Taxes (3,267 ) (4,536 )

Total Change (5,690 ) (5,049 )

Actual Ending Balance $ 9,501 $ 9,501

15 NASDAQ: UBNK

Tangible Book Value and Dividend Return

16 NASDAQ: UBNK

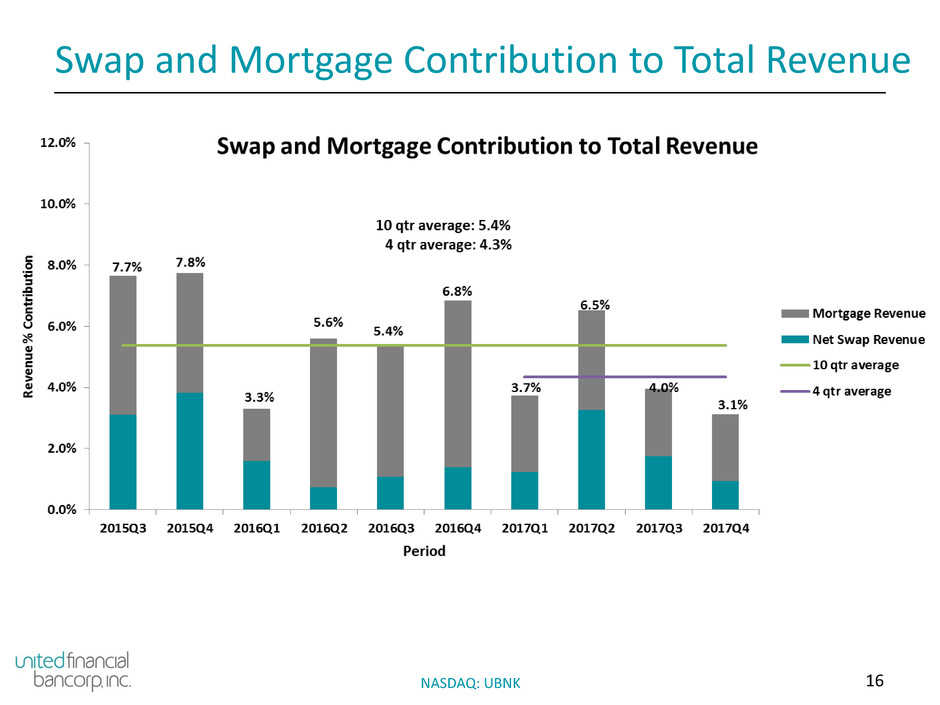

Swap and Mortgage Contribution to Total Revenue

17 NASDAQ: UBNK

Forecast

Actual

Q3 2017

Actual

Q4 2017

Actual

FY 2017

Forecast

FY 2018

Forecast

FY 2019

Tax Equivalent Net Interest

Margin 3.00% 2.98% 3.01% 2.98% - 3.02% 3.00% - 3.04%

Loan Growth* 12.0%* 10.3%* 8.9% 9% - 11% 9% - 11%

Provision / Average Gross Loans* 0.20%* 0.17%* 0.18% 0.16% - 0.18% 0.16% - 0.18%

Non-Interest Income $8.1 million $7.3 million $33.4 million $36 - 38 million $38 - 40 million

Non-Interest Expense $34.9 million $37.0 million $141.6 million $156 - 158

million

$163 - 165

million

Non-Interest Expense / Avg Assets 2.02%* 2.12%* 2.08% 2.12% - 2.15% 2.05% - 2.07%

Effective Tax Rate (YTD) 12.8% 18.1% 18.1% 10% 10%

Average Diluted Shares (000) 50,890 51,025 50,923 51,811 52,636

*Note: Loan Growth, Provision/Average Gross Loans are annualized, unless noted.

^ Tax Equivalent NIM forecast assumes no changes to interest rates in forecast period

• Forecast supports high single to double digit earnings growth and attainment of 1.0%

return on assets on a run rate basis in second half of 2019

18 NASDAQ: UBNK

NIE/Average Assets/FTE Employees

19 NASDAQ: UBNK

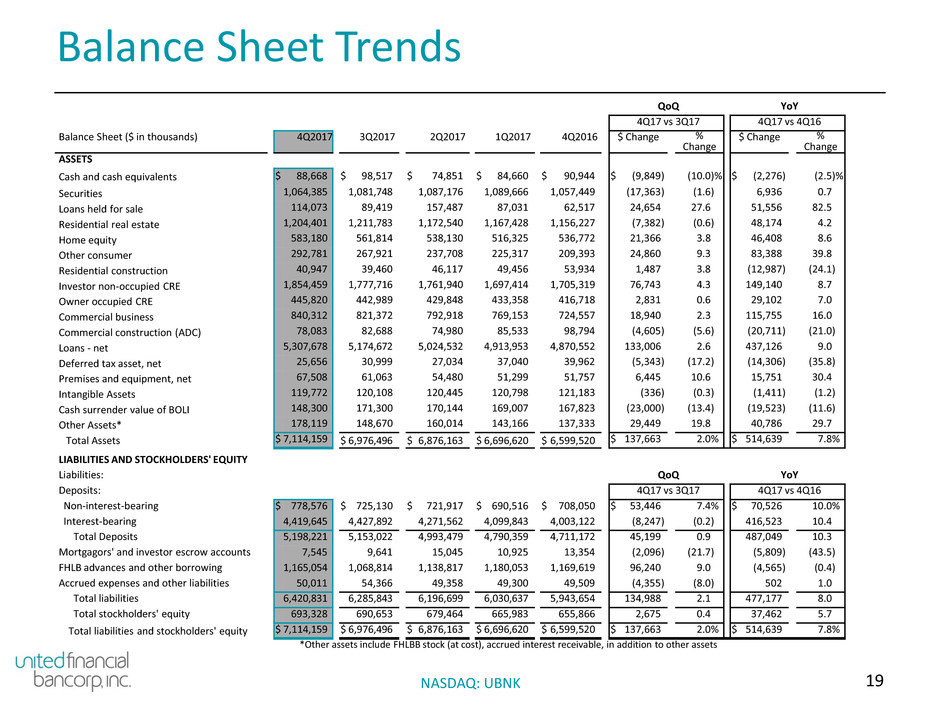

Balance Sheet Trends

QoQ YoY

4Q17 vs 3Q17 4Q17 vs 4Q16

Balance Sheet ($ in thousands) 4Q2017 3Q2017 2Q2017 1Q2017 4Q2016 $ Change %

Change

$ Change %

Change

ASSETS

Cash and cash equivalents $ 88,668 $ 98,517 $ 74,851 $ 84,660 $ 90,944 $ (9,849 ) (10.0 )% $ (2,276 ) (2.5 )%

Securities 1,064,385 1,081,748 1,087,176 1,089,666 1,057,449 (17,363 ) (1.6 ) 6,936 0.7

Loans held for sale 114,073 89,419 157,487 87,031 62,517 24,654 27.6 51,556 82.5

Residential real estate 1,204,401 1,211,783 1,172,540 1,167,428 1,156,227 (7,382 ) (0.6 ) 48,174 4.2

Home equity 583,180 561,814 538,130 516,325 536,772 21,366 3.8 46,408 8.6

Other consumer 292,781 267,921 237,708 225,317 209,393 24,860 9.3 83,388 39.8

Residential construction 40,947 39,460 46,117 49,456 53,934 1,487 3.8 (12,987 ) (24.1 )

Investor non-occupied CRE 1,854,459 1,777,716 1,761,940 1,697,414 1,705,319 76,743 4.3 149,140 8.7

Owner occupied CRE 445,820 442,989 429,848 433,358 416,718 2,831 0.6 29,102 7.0

Commercial business 840,312 821,372 792,918 769,153 724,557 18,940 2.3 115,755 16.0

Commercial construction (ADC) 78,083 82,688 74,980 85,533 98,794 (4,605 ) (5.6 ) (20,711 ) (21.0 )

Loans - net 5,307,678 5,174,672 5,024,532 4,913,953 4,870,552 133,006 2.6 437,126 9.0

Deferred tax asset, net 25,656 30,999 27,034 37,040 39,962 (5,343 ) (17.2 ) (14,306 ) (35.8 )

Premises and equipment, net 67,508 61,063 54,480 51,299 51,757 6,445 10.6 15,751 30.4

Intangible Assets 119,772 120,108 120,445 120,798 121,183 (336 ) (0.3 ) (1,411 ) (1.2 )

Cash surrender value of BOLI 148,300 171,300 170,144 169,007 167,823 (23,000 ) (13.4 ) (19,523 ) (11.6 )

Other Assets* 178,119 148,670 160,014 143,166 137,333 29,449 19.8 40,786 29.7

Total Assets $ 7,114,159 $ 6,976,496 $ 6,876,163 $ 6,696,620 $ 6,599,520 $ 137,663 2.0 % $ 514,639 7.8 %

LIABILITIES AND STOCKHOLDERS' EQUITY

Liabilities: QoQ YoY

Deposits: 4Q17 vs 3Q17 4Q17 vs 4Q16

Non-interest-bearing $ 778,576 $ 725,130 $ 721,917 $ 690,516 $ 708,050 $ 53,446 7.4 % $ 70,526 10.0 %

Interest-bearing 4,419,645 4,427,892 4,271,562 4,099,843 4,003,122 (8,247 ) (0.2 ) 416,523 10.4

Total Deposits 5,198,221 5,153,022 4,993,479 4,790,359 4,711,172 45,199 0.9 487,049 10.3

Mortgagors' and investor escrow accounts 7,545 9,641 15,045 10,925 13,354 (2,096 ) (21.7 ) (5,809 ) (43.5 )

FHLB advances and other borrowing 1,165,054 1,068,814 1,138,817 1,180,053 1,169,619 96,240 9.0 (4,565 ) (0.4 )

Accrued expenses and other liabilities 50,011 54,366 49,358 49,300 49,509 (4,355 ) (8.0 ) 502 1.0

Total liabilities 6,420,831 6,285,843 6,196,699 6,030,637 5,943,654 134,988 2.1 477,177 8.0

Total stockholders' equity 693,328 690,653 679,464 665,983 655,866 2,675 0.4 37,462 5.7

Total liabilities and stockholders' equity $ 7,114,159 $ 6,976,496 $ 6,876,163 $ 6,696,620 $ 6,599,520 $ 137,663 2.0 % $ 514,639 7.8 %

*Other assets include FHLBB stock (at cost), accrued interest receivable, in addition to other assets

20 NASDAQ: UBNK

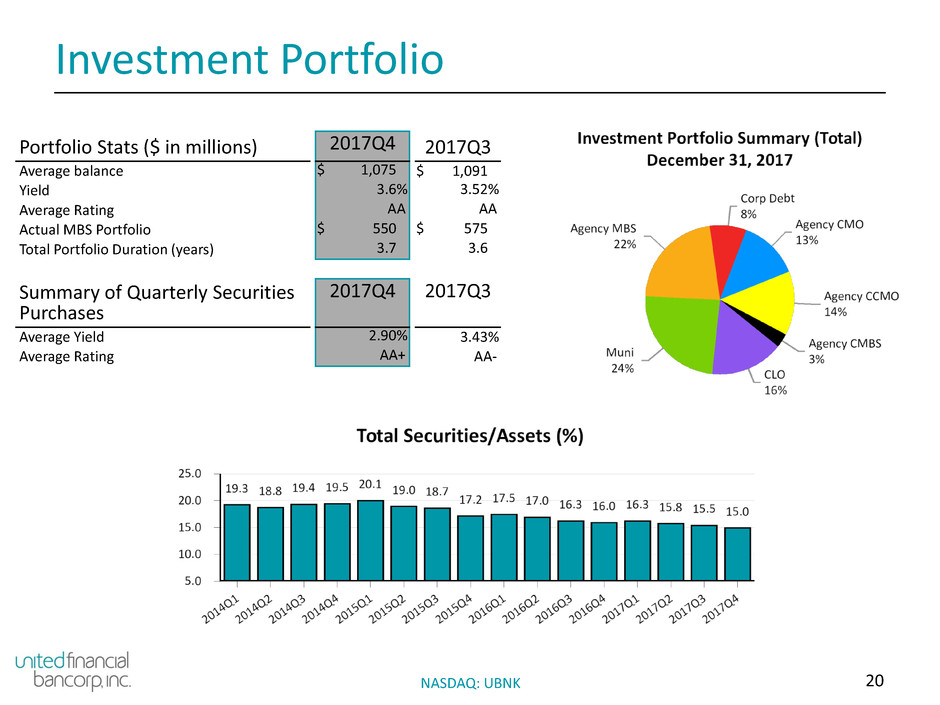

Investment Portfolio

Portfolio Stats ($ in millions) 2017Q4 2017Q3

Average balance $ 1,075 $ 1,091

Yield 3.6 % 3.52 %

Average Rating AA AA

Actual MBS Portfolio $ 550 $ 575

Total Portfolio Duration (years) 3.7 3.6

Summary of Quarterly Securities

Purchases

2017Q4 2017Q3

Average Yield 2.90 % 3.43 %

Average Rating AA+ AA-

21 NASDAQ: UBNK

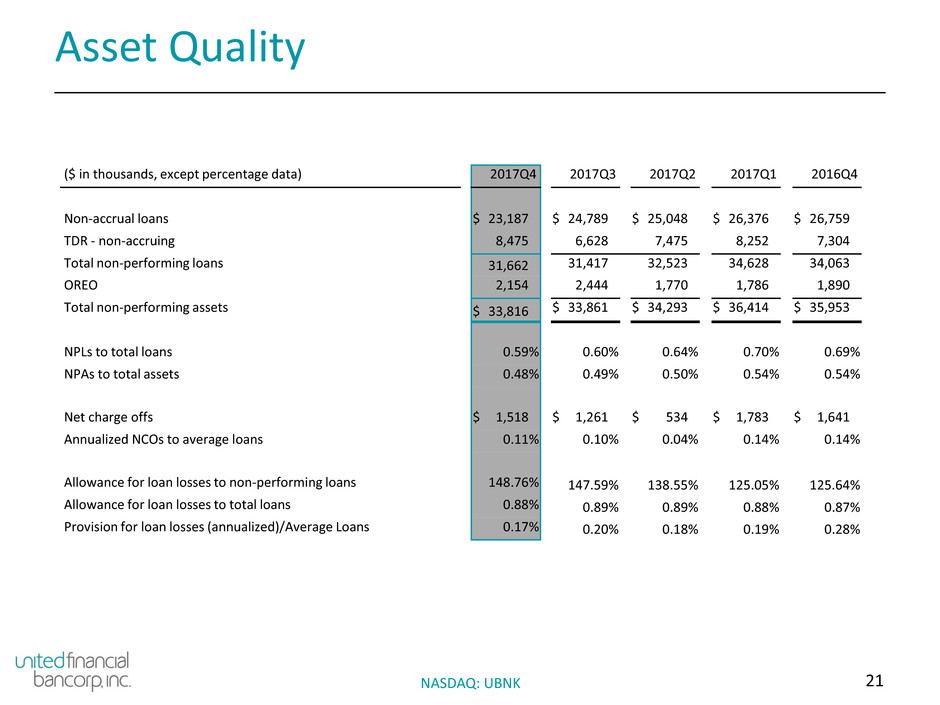

Asset Quality

($ in thousands, except percentage data) 2017Q4 2017Q3 2017Q2 2017Q1 2016Q4

Non-accrual loans $ 23,187 $ 24,789 $ 25,048 $ 26,376 $ 26,759

TDR - non-accruing 8,475 6,628 7,475 8,252 7,304

Total non-performing loans 31,662 31,417 32,523 34,628 34,063

OREO 2,154 2,444 1,770 1,786 1,890

Total non-performing assets $ 33,816 $ 33,861 $ 34,293 $ 36,414 $ 35,953

NPLs to total loans 0.59 % 0.60 % 0.64 % 0.70 % 0.69 %

NPAs to total assets 0.48 % 0.49 % 0.50 % 0.54 % 0.54 %

Net charge offs $ 1,518 $ 1,261 $ 534 $ 1,783 $ 1,641

Annualized NCOs to average loans 0.11 % 0.10 % 0.04 % 0.14 % 0.14 %

Allowance for loan losses to non-performing loans 148.76 % 147.59 % 138.55 % 125.05 % 125.64 %

Allowance for loan losses to total loans 0.88 % 0.89 % 0.89 % 0.88 % 0.87 %

Provision for loan losses (annualized)/Average Loans 0.17 % 0.20 % 0.18 % 0.19 % 0.28 %

22 NASDAQ: UBNK

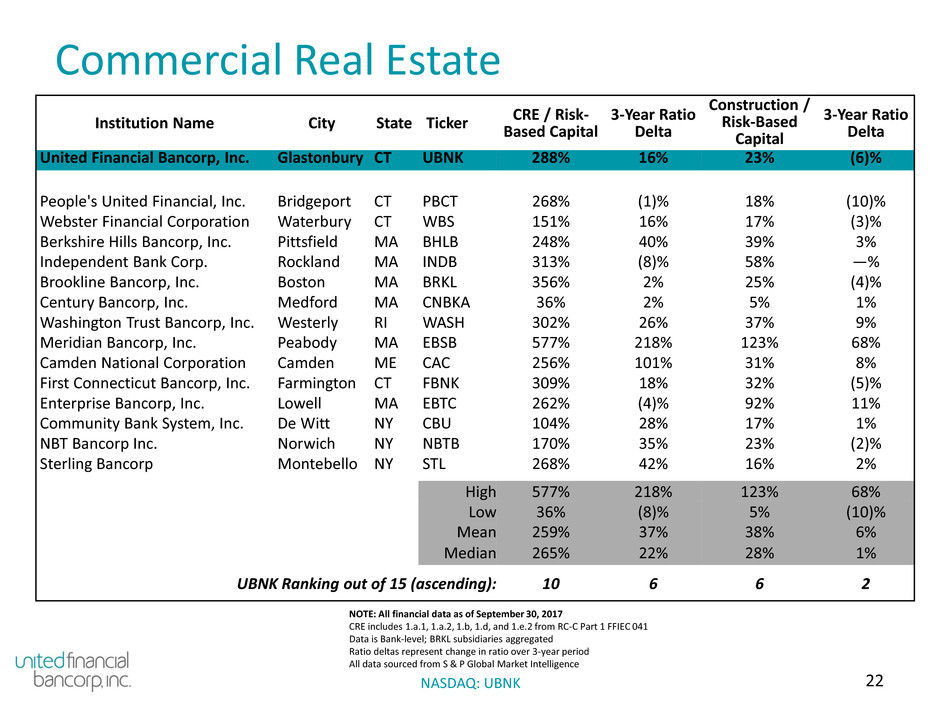

Commercial Real Estate

Institution Name City State Ticker CRE / Risk-

Based Capital

3-Year Ratio

Delta

Construction /

Risk-Based

Capital

3-Year Ratio

Delta

United Financial Bancorp, Inc. Glastonbury CT UBNK 288% 16% 23% (6)%

People's United Financial, Inc. Bridgeport CT PBCT 268% (1)% 18% (10)%

Webster Financial Corporation Waterbury CT WBS 151% 16% 17% (3)%

Berkshire Hills Bancorp, Inc. Pittsfield MA BHLB 248% 40% 39% 3%

Independent Bank Corp. Rockland MA INDB 313% (8)% 58% —%

Brookline Bancorp, Inc. Boston MA BRKL 356% 2% 25% (4)%

Century Bancorp, Inc. Medford MA CNBKA 36% 2% 5% 1%

Washington Trust Bancorp, Inc. Westerly RI WASH 302% 26% 37% 9%

Meridian Bancorp, Inc. Peabody MA EBSB 577% 218% 123% 68%

Camden National Corporation Camden ME CAC 256% 101% 31% 8%

First Connecticut Bancorp, Inc. Farmington CT FBNK 309% 18% 32% (5)%

Enterprise Bancorp, Inc. Lowell MA EBTC 262% (4)% 92% 11%

Community Bank System, Inc. De Witt NY CBU 104% 28% 17% 1%

NBT Bancorp Inc. Norwich NY NBTB 170% 35% 23% (2)%

Sterling Bancorp Montebello NY STL 268% 42% 16% 2%

High 577% 218% 123% 68%

Low 36% (8)% 5% (10)%

Mean 259% 37% 38% 6%

Median 265% 22% 28% 1%

UBNK Ranking out of 15 (ascending): 10 6 6 2

NOTE: All financial data as of September 30, 2017

CRE includes 1.a.1, 1.a.2, 1.b, 1.d, and 1.e.2 from RC-C Part 1 FFIEC 041

Data is Bank-level; BRKL subsidiaries aggregated

Ratio deltas represent change in ratio over 3-year period

All data sourced from S & P Global Market Intelligence

23 NASDAQ: UBNK

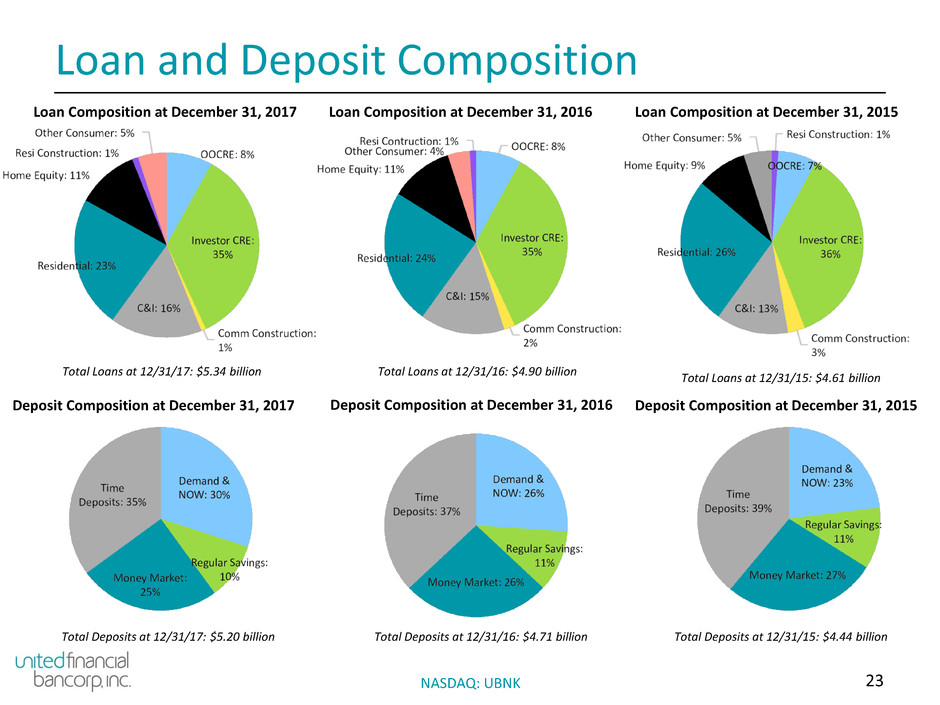

Loan and Deposit Composition

Deposit Composition at December 31, 2016 Deposit Composition at December 31, 2017

Total Deposits at 12/31/16: $4.71 billion Total Deposits at 12/31/17: $5.20 billion

Deposit Composition at December 31, 2015

Total Deposits at 12/31/15: $4.44 billion

Loan Composition at December 31, 2015

Loan Composition at December 31, 2016

Loan Composition at December 31, 2017

Total Loans at 12/31/15: $4.61 billion

Total Loans at 12/31/16: $4.90 billion Total Loans at 12/31/17: $5.34 billion

24 NASDAQ: UBNK

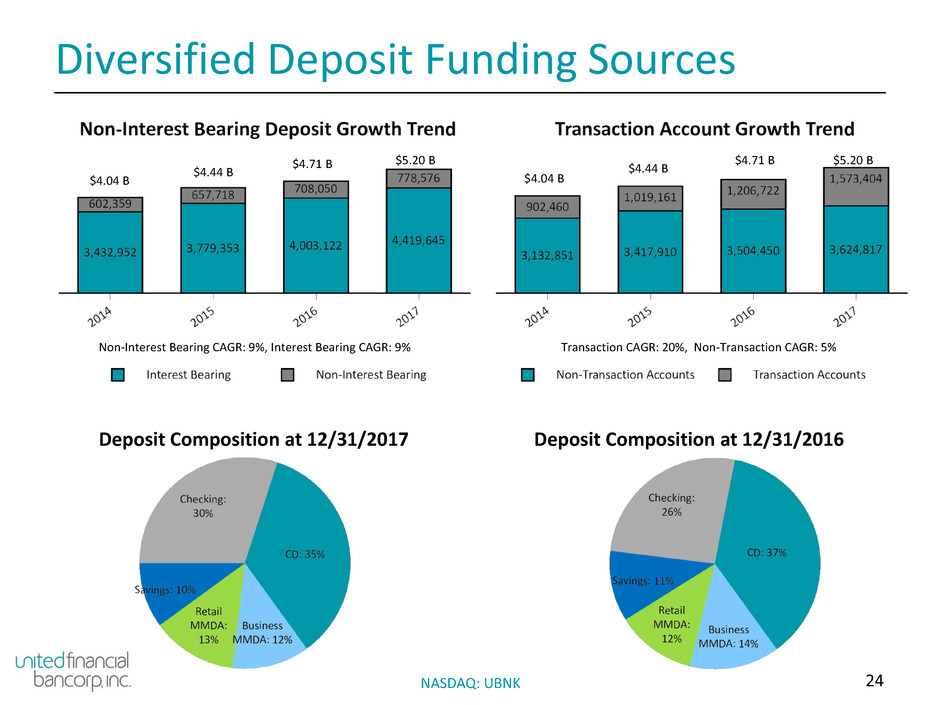

Diversified Deposit Funding Sources

$4.04 B

$4.44 B

$4.71 B $5.20 B

Non-Interest Bearing CAGR: 9%, Interest Bearing CAGR: 9%

$4.04 B

$4.44 B

$4.71 B $5.20 B

Transaction CAGR: 20%, Non-Transaction CAGR: 5%

Deposit Composition at 12/31/2017 Deposit Composition at 12/31/2016

25 NASDAQ: UBNK

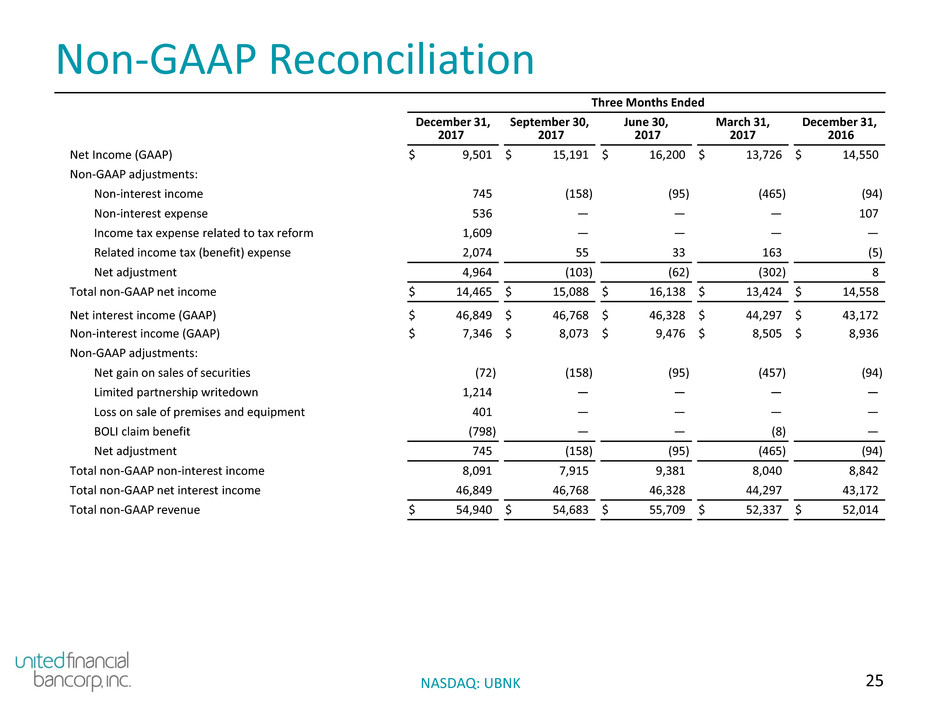

Non-GAAP Reconciliation

Three Months Ended

December 31,

2017

September 30,

2017

June 30,

2017

March 31,

2017

December 31,

2016

Net Income (GAAP) $ 9,501 $ 15,191 $ 16,200 $ 13,726 $ 14,550

Non-GAAP adjustments:

Non-interest income 745 (158 ) (95 ) (465 ) (94 )

Non-interest expense 536 — — — 107

Income tax expense related to tax reform 1,609 — — — —

Related income tax (benefit) expense 2,074 55 33 163 (5 )

Net adjustment 4,964 (103 ) (62 ) (302 ) 8

Total non-GAAP net income $ 14,465 $ 15,088 $ 16,138 $ 13,424 $ 14,558

Net interest income (GAAP) $ 46,849 $ 46,768 $ 46,328 $ 44,297 $ 43,172

Non-interest income (GAAP) $ 7,346 $ 8,073 $ 9,476 $ 8,505 $ 8,936

Non-GAAP adjustments:

Net gain on sales of securities (72 ) (158 ) (95 ) (457 ) (94 )

Limited partnership writedown 1,214 — — — —

Loss on sale of premises and equipment 401 — — — —

BOLI claim benefit (798 ) — — (8 ) —

Net adjustment 745 (158 ) (95 ) (465 ) (94 )

Total non-GAAP non-interest income 8,091 7,915 9,381 8,040 8,842

Total non-GAAP net interest income 46,849 46,768 46,328 44,297 43,172

Total non-GAAP revenue $ 54,940 $ 54,683 $ 55,709 $ 52,337 $ 52,014

26 NASDAQ: UBNK

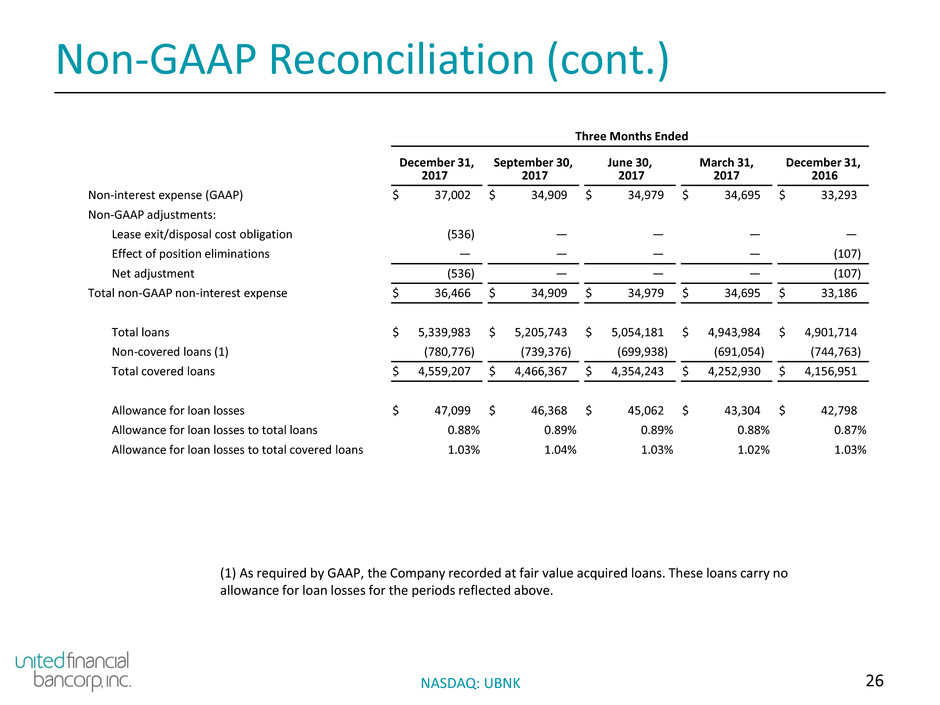

Non-GAAP Reconciliation (cont.)

Three Months Ended

December 31,

2017

September 30,

2017

June 30,

2017

March 31,

2017

December 31,

2016

Non-interest expense (GAAP) $ 37,002 $ 34,909 $ 34,979 $ 34,695 $ 33,293

Non-GAAP adjustments:

Lease exit/disposal cost obligation (536 ) — — — —

Effect of position eliminations — — — — (107 )

Net adjustment (536 ) — — — (107 )

Total non-GAAP non-interest expense $ 36,466 $ 34,909 $ 34,979 $ 34,695 $ 33,186

Total loans $ 5,339,983 $ 5,205,743 $ 5,054,181 $ 4,943,984 $ 4,901,714

Non-covered loans (1) (780,776 ) (739,376 ) (699,938 ) (691,054 ) (744,763 )

Total covered loans $ 4,559,207 $ 4,466,367 $ 4,354,243 $ 4,252,930 $ 4,156,951

Allowance for loan losses $ 47,099 $ 46,368 $ 45,062 $ 43,304 $ 42,798

Allowance for loan losses to total loans 0.88 % 0.89 % 0.89 % 0.88 % 0.87 %

Allowance for loan losses to total covered loans 1.03 % 1.04 % 1.03 % 1.02 % 1.03 %

(1) As required by GAAP, the Company recorded at fair value acquired loans. These loans carry no

allowance for loan losses for the periods reflected above.