Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - POPULAR, INC. | d502973d8k.htm |

Investor Presentation Fourth Quarter 2017 Exhibit 99.1

Cautionary Note Regarding Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including without limitation those about Popular, Inc.’s (the “Corporation,” “Popular,” “us,” “our”) business, financial condition, results of operations, plans, objectives, and future performance. These statements are not guarantees of future performance, are based on management’s current expectations and, by their nature, involve risks, uncertainties, estimates and assumptions. Potential factors, some of which are beyond the Corporation’s control, could cause actual results to differ materially from those expressed in, or implied by, such forward-looking statements. Risks and uncertainties include without limitation the effect of competitive and economic factors, and our reaction to those factors, the adequacy of the allowance for loan losses, delinquency trends, market risk and the impact of interest rate changes, capital market conditions, capital adequacy and liquidity, the effect of legal proceedings and new accounting standards on the Corporation’s financial condition and results of operations, and the impact of Hurricanes Irma and Maria on us. All statements contained herein that are not clearly historical in nature, are forward-looking, and the words “anticipate,” “believe,” “continues,” “expect,” “estimate,” “intend,” “project” and similar expressions, and future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions, are generally intended to identify forward-looking statements. More information on the risks and important factors that could affect the Corporation’s future results and financial condition is included in our Annual Report on Form 10-K for the year ended December 31, 2016, the Quarterly Reports on Form 10-Q for the quarters ended March 31, 2017, June 30, 2017 and September 30, 2017, and in our Annual Report on Form 10-K for the year ended December 31, 2017 to be filed with the SEC. Those filings are available on the Corporation’s website (www.popular.com) and on the Securities and Exchange Commission website (www.sec.gov). The Corporation assumes no obligation to update or revise any forward-looking statements or information which speak as of their respective dates.

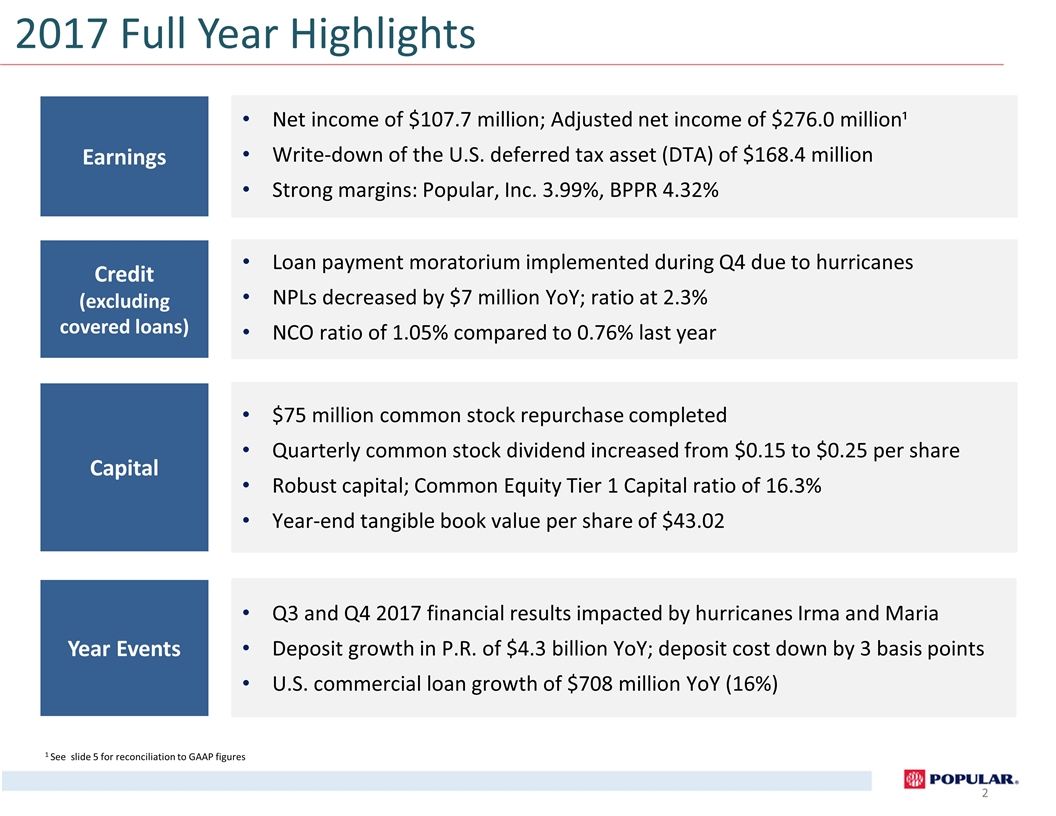

1 See slide 5 for reconciliation to GAAP figures 2017 Full Year Highlights Loan payment moratorium implemented during Q4 due to hurricanes NPLs decreased by $7 million YoY; ratio at 2.3% NCO ratio of 1.05% compared to 0.76% last year Credit (excluding covered loans) Net income of $107.7 million; Adjusted net income of $276.0 million¹ Write-down of the U.S. deferred tax asset (DTA) of $168.4 million Strong margins: Popular, Inc. 3.99%, BPPR 4.32% Earnings $75 million common stock repurchase completed Quarterly common stock dividend increased from $0.15 to $0.25 per share Robust capital; Common Equity Tier 1 Capital ratio of 16.3% Year-end tangible book value per share of $43.02 Capital Year Events Q3 and Q4 2017 financial results impacted by hurricanes Irma and Maria Deposit growth in P.R. of $4.3 billion YoY; deposit cost down by 3 basis points U.S. commercial loan growth of $708 million YoY (16%)

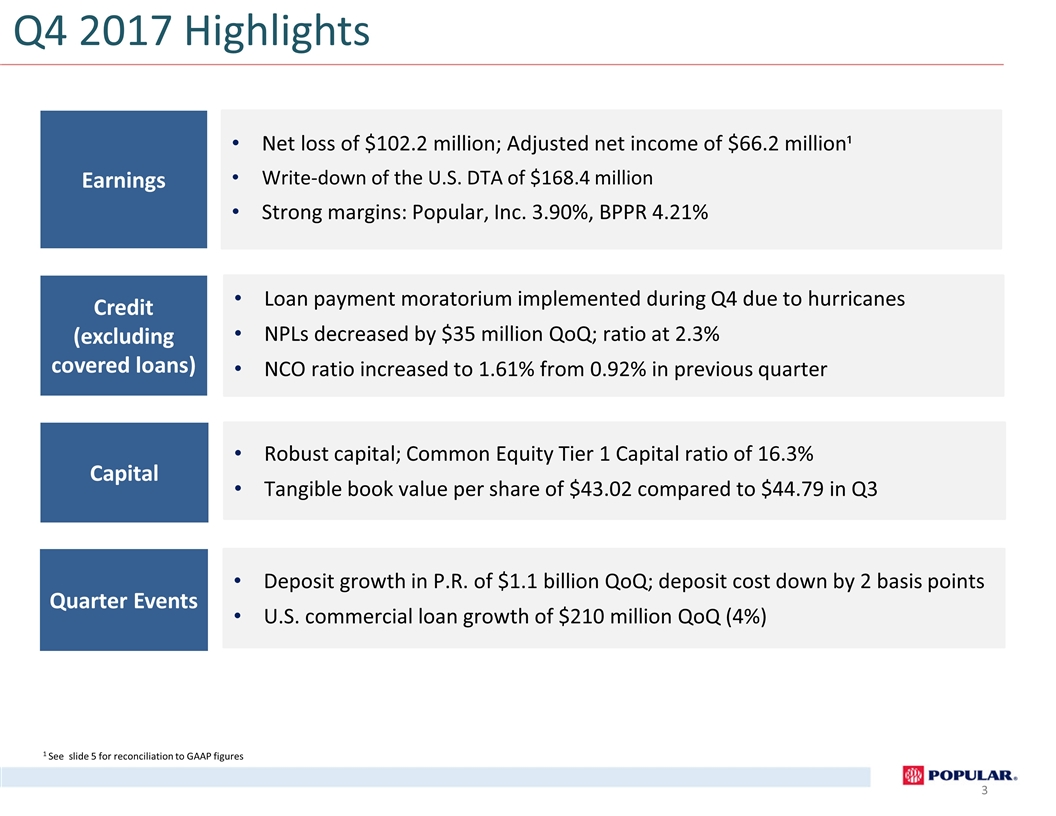

Loan payment moratorium implemented during Q4 due to hurricanes NPLs decreased by $35 million QoQ; ratio at 2.3% NCO ratio increased to 1.61% from 0.92% in previous quarter Credit (excluding covered loans) Net loss of $102.2 million; Adjusted net income of $66.2 million¹ Write-down of the U.S. DTA of $168.4 million Strong margins: Popular, Inc. 3.90%, BPPR 4.21% Earnings Robust capital; Common Equity Tier 1 Capital ratio of 16.3% Tangible book value per share of $43.02 compared to $44.79 in Q3 Capital Q4 2017 Highlights Deposit growth in P.R. of $1.1 billion QoQ; deposit cost down by 2 basis points U.S. commercial loan growth of $210 million QoQ (4%) Quarter Events 1 See slide 5 for reconciliation to GAAP figures

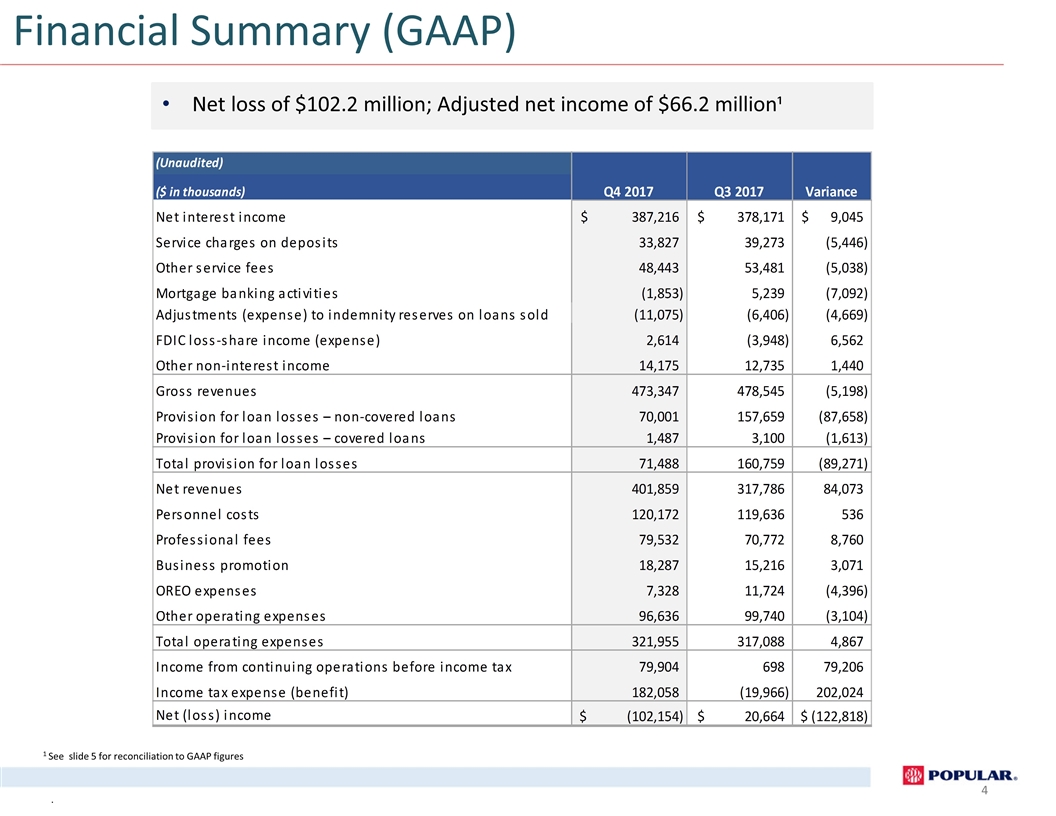

4 . Financial Summary (GAAP) 1 See slide 5 for reconciliation to GAAP figures Net loss of $102.2 million; Adjusted net income of $66.2 million¹

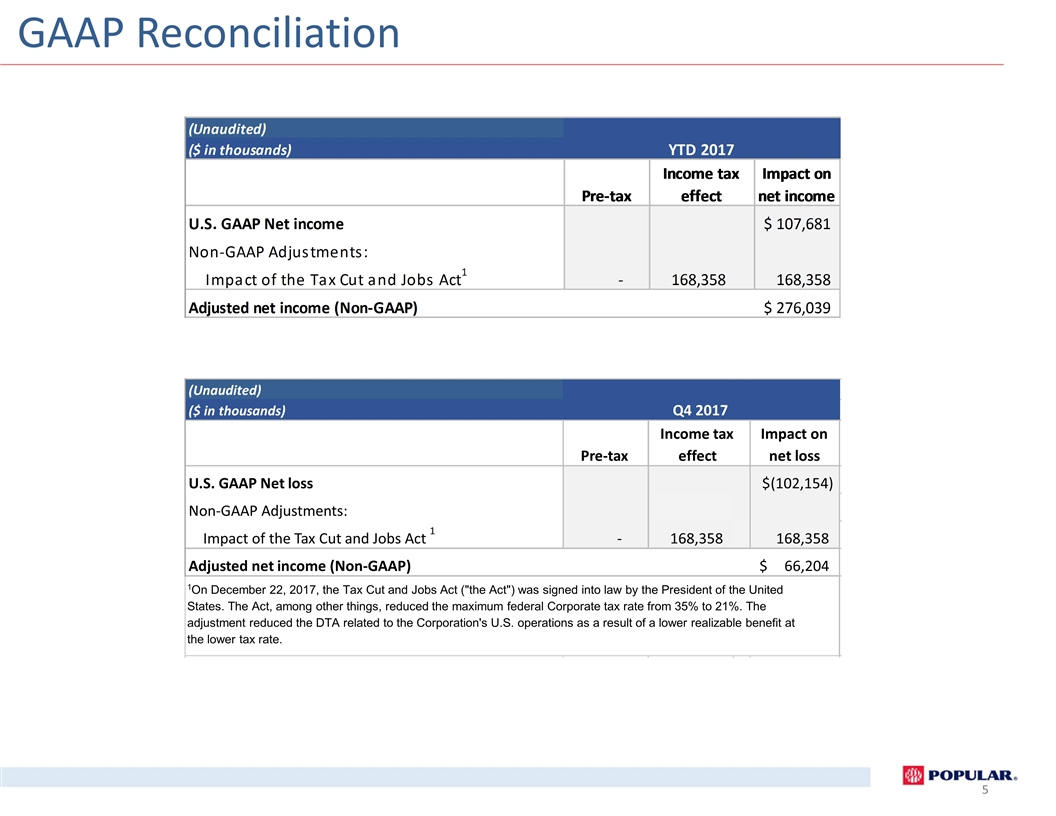

GAAP Reconciliation (Unaudited) ($ in thousands) Pre-tax Impact on net loss U.S. GAAP Net loss (102,154) $ Non-GAAP Adjustments: Impact of the Tax Cut and Jobs Act 1 - 168,358 168,358 Adjusted net income (Non-GAAP) 66,204 $ Q4 2017 Income tax effect 1 On December 22, 2017, the Tax Cut and Jobs Act ("the Act") was signed into law by the President of the United States. The Act, among other things, reduced the maximum federal Corporate tax rate from 35% to 21%. The adjustment reduced the DTA related to the Corporation's U.S. operations as a result of a lower realizable benefit at the lower tax rate.

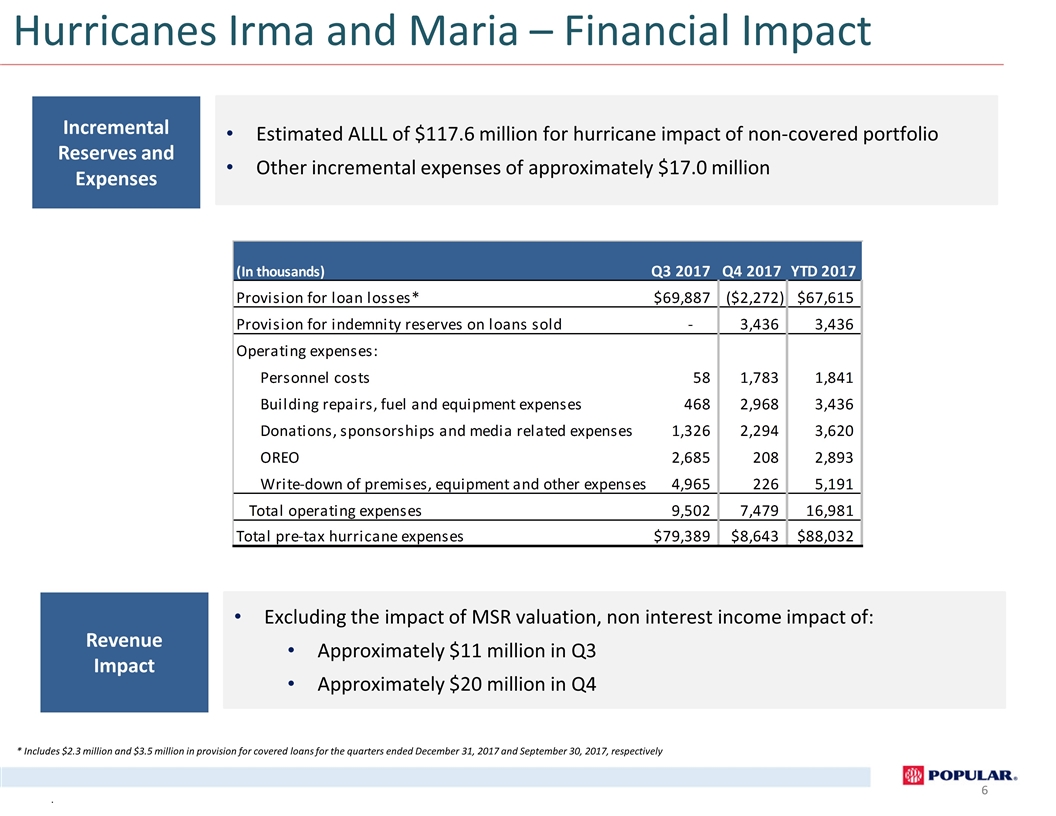

. Hurricanes Irma and Maria – Financial Impact * Includes $2.3 million and $3.5 million in provision for covered loans for the quarters ended December 31, 2017 and September 30, 2017, respectively Excluding the impact of MSR valuation, non interest income impact of: Approximately $11 million in Q3 Approximately $20 million in Q4 Revenue Impact Estimated ALLL of $117.6 million for hurricane impact of non-covered portfolio Other incremental expenses of approximately $17.0 million Incremental Reserves and Expenses

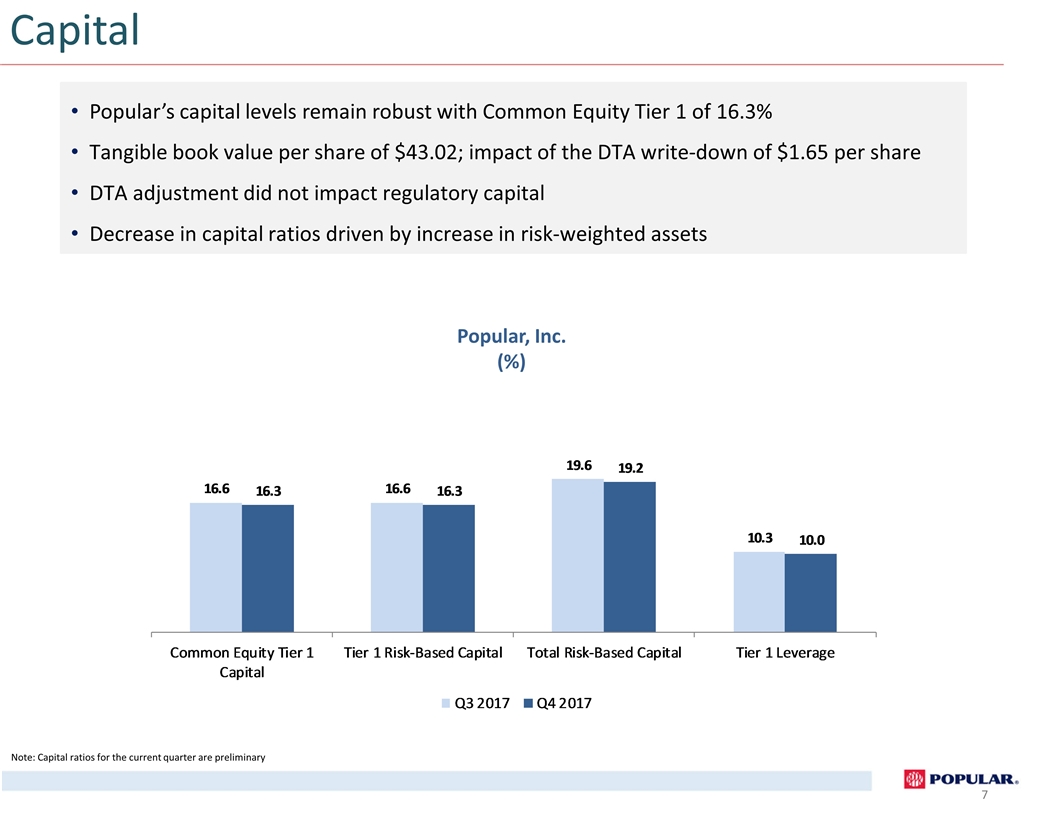

Capital 7 Note: Capital ratios for the current quarter are preliminary Popular, Inc. (%) Popular’s capital levels remain robust with Common Equity Tier 1 of 16.3% Tangible book value per share of $43.02; impact of the DTA write-down of $1.65 per share DTA adjustment did not impact regulatory capital Decrease in capital ratios driven by increase in risk-weighted assets

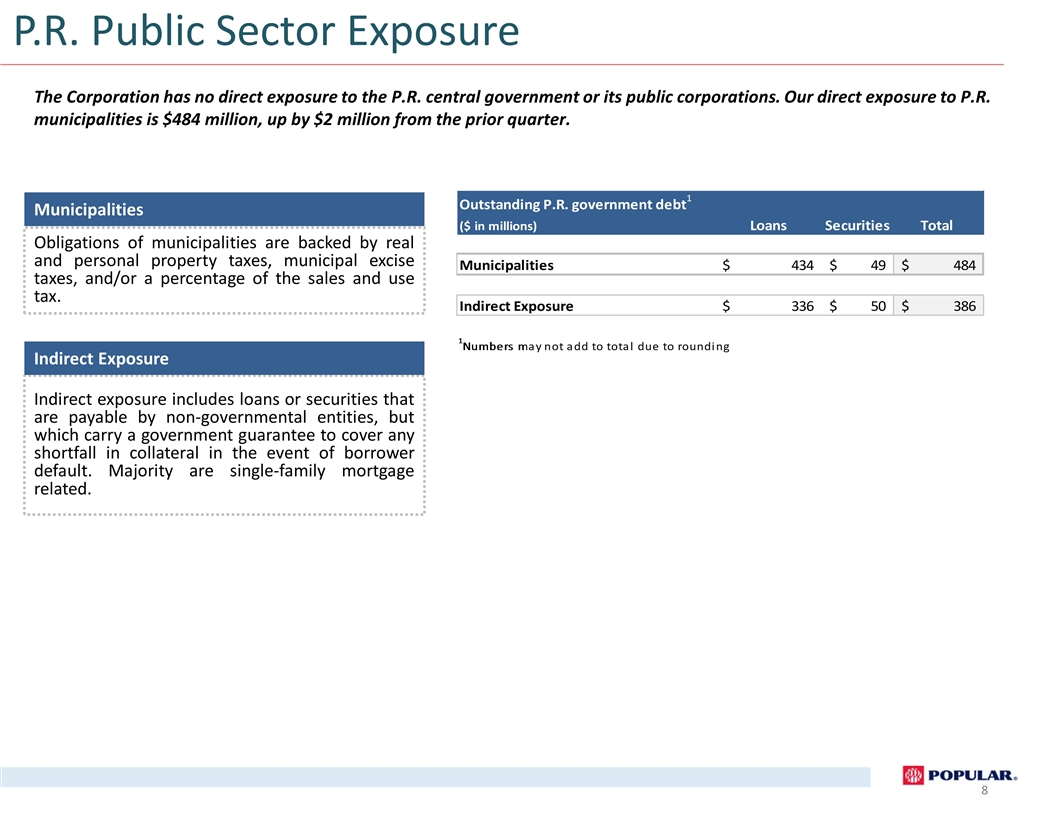

The Corporation has no direct exposure to the P.R. central government or its public corporations. Our direct exposure to P.R. municipalities is $484 million, up by $2 million from the prior quarter. Municipalities Obligations of municipalities are backed by real and personal property taxes, municipal excise taxes, and/or a percentage of the sales and use tax. Indirect exposure includes loans or securities that are payable by non-governmental entities, but which carry a government guarantee to cover any shortfall in collateral in the event of borrower default. Majority are single-family mortgage related. Indirect Exposure P.R. Public Sector Exposure

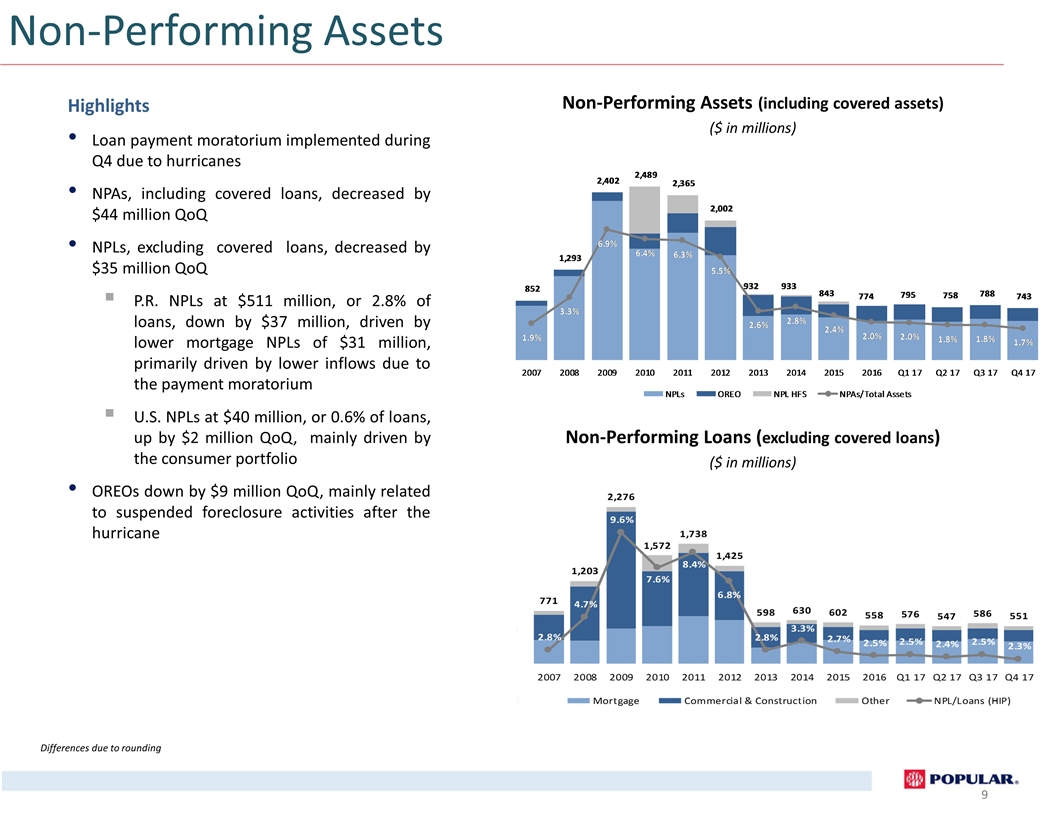

Non-Performing Assets Highlights Loan payment moratorium implemented during Q4 due to hurricanes NPAs, including covered loans, decreased by $44 million QoQ NPLs, excluding covered loans, decreased by $35 million QoQ P.R. NPLs at $511 million, or 2.8% of loans, down by $37 million, driven by lower mortgage NPLs of $31 million, primarily driven by lower inflows due to the payment moratorium U.S. NPLs at $40 million, or 0.6% of loans, up by $2 million QoQ, mainly driven by the consumer portfolio OREOs down by $9 million QoQ, mainly related to suspended foreclosure activities after the hurricane Differences due to rounding Non-Performing Assets (including covered assets) ($ in millions) Non-Performing Loans (excluding covered loans) ($ in millions)

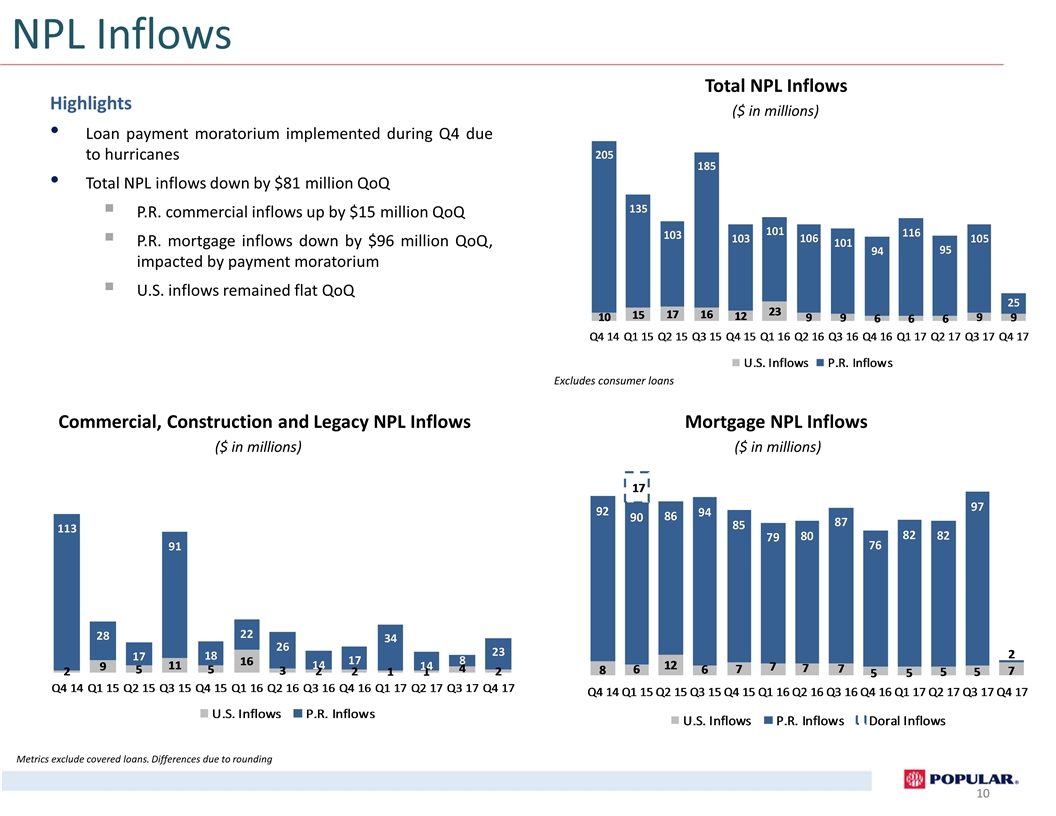

NPL Inflows Total NPL Inflows ($ in millions) Highlights Loan payment moratorium implemented during Q4 due to hurricanes Total NPL inflows down by $81 million QoQ P.R. commercial inflows up by $15 million QoQ P.R. mortgage inflows down by $96 million QoQ, impacted by payment moratorium U.S. inflows remained flat QoQ Excludes consumer loans Metrics exclude covered loans. Differences due to rounding Mortgage NPL Inflows ($ in millions) Commercial, Construction and Legacy NPL Inflows ($ in millions)

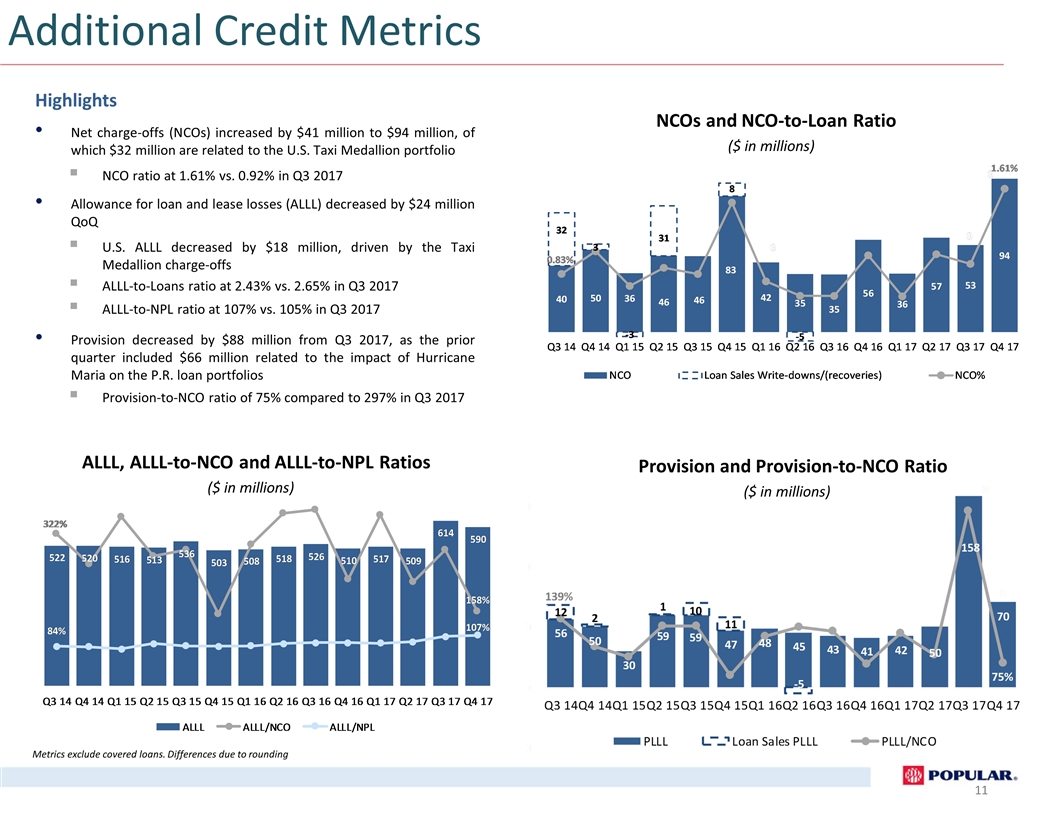

NCOs and NCO-to-Loan Ratio ($ in millions) Provision and Provision-to-NCO Ratio ($ in millions) Highlights Net charge-offs (NCOs) increased by $41 million to $94 million, of which $32 million are related to the U.S. Taxi Medallion portfolio NCO ratio at 1.61% vs. 0.92% in Q3 2017 Allowance for loan and lease losses (ALLL) decreased by $24 million QoQ U.S. ALLL decreased by $18 million, driven by the Taxi Medallion charge-offs ALLL-to-Loans ratio at 2.43% vs. 2.65% in Q3 2017 ALLL-to-NPL ratio at 107% vs. 105% in Q3 2017 Provision decreased by $88 million from Q3 2017, as the prior quarter included $66 million related to the impact of Hurricane Maria on the P.R. loan portfolios Provision-to-NCO ratio of 75% compared to 297% in Q3 2017 Metrics exclude covered loans. Differences due to rounding ALLL, ALLL-to-NCO and ALLL-to-NPL Ratios ($ in millions) Additional Credit Metrics

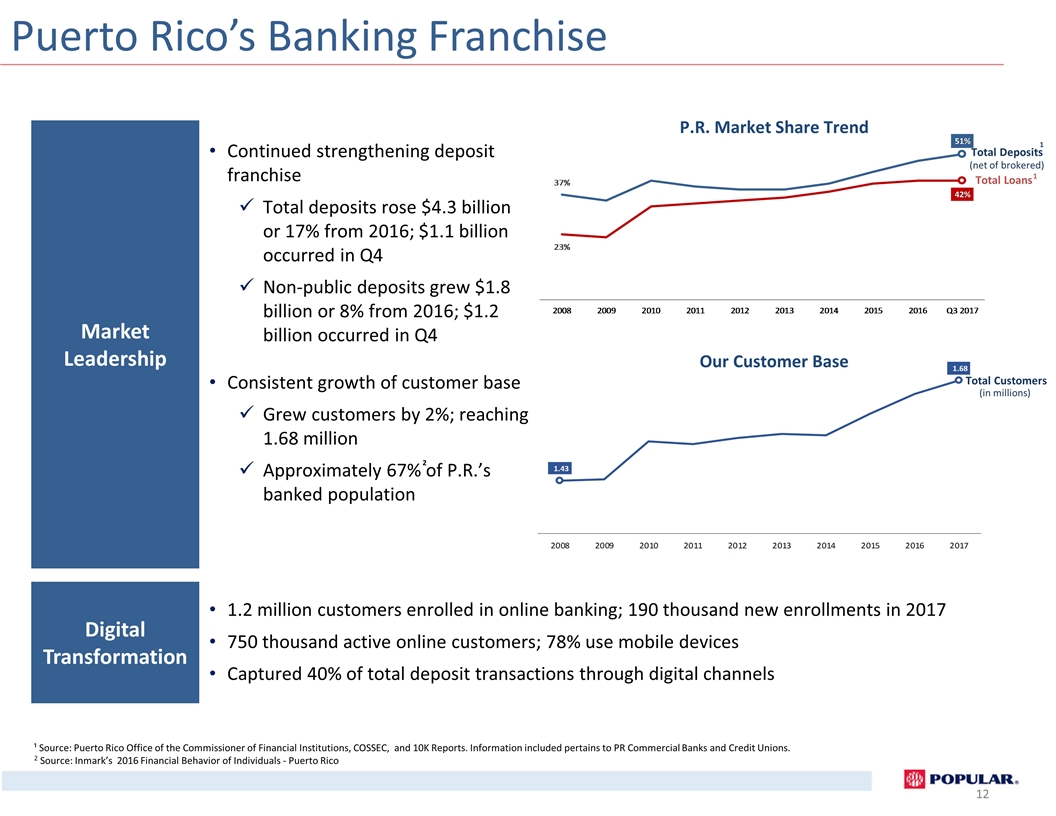

Continued strengthening deposit franchise Total deposits rose $4.3 billion or 17% from 2016; $1.1 billion occurred in Q4 Non-public deposits grew $1.8 billion or 8% from 2016; $1.2 billion occurred in Q4 1.2 million customers enrolled in online banking; 190 thousand new enrollments in 2017 750 thousand active online customers; 78% use mobile devices Captured 40% of total deposit transactions through digital channels Market Leadership Digital Transformation Consistent growth of customer base Grew customers by 2%; reaching 1.68 million Approximately 67% of P.R.’s banked population ¹ Source: Puerto Rico Office of the Commissioner of Financial Institutions, COSSEC, and 10K Reports. Information included pertains to PR Commercial Banks and Credit Unions. 2 Source: Inmark’s 2016 Financial Behavior of Individuals - Puerto Rico Puerto Rico’s Banking Franchise 2 Total Deposits (net of brokered) Total Loans 1 1 P.R. Market Share Trend Total Customers (in millions) Our Customer Base

13 EMBRACING PUERTO RICO Join us in helping rebuild Puerto Rico by making a charitable donation. Popular is leading the Embracing Puerto Rico initiative through its corporate foundations, Fundación Banco Popular and Popular Community Bank Foundation. Popular will drive donations from customers, partners and friends that want to contribute to recovery efforts in Puerto Rico. 100% of all the funds raised will be directed to rebuilding the most vulnerable communities in the Island. For 37 years, Fundación Banco Popular has been the philanthropic arm of Popular supporting communities across Puerto Rico. embracingpuertorico.com

Investor Presentation Fourth Quarter 2017 Appendix

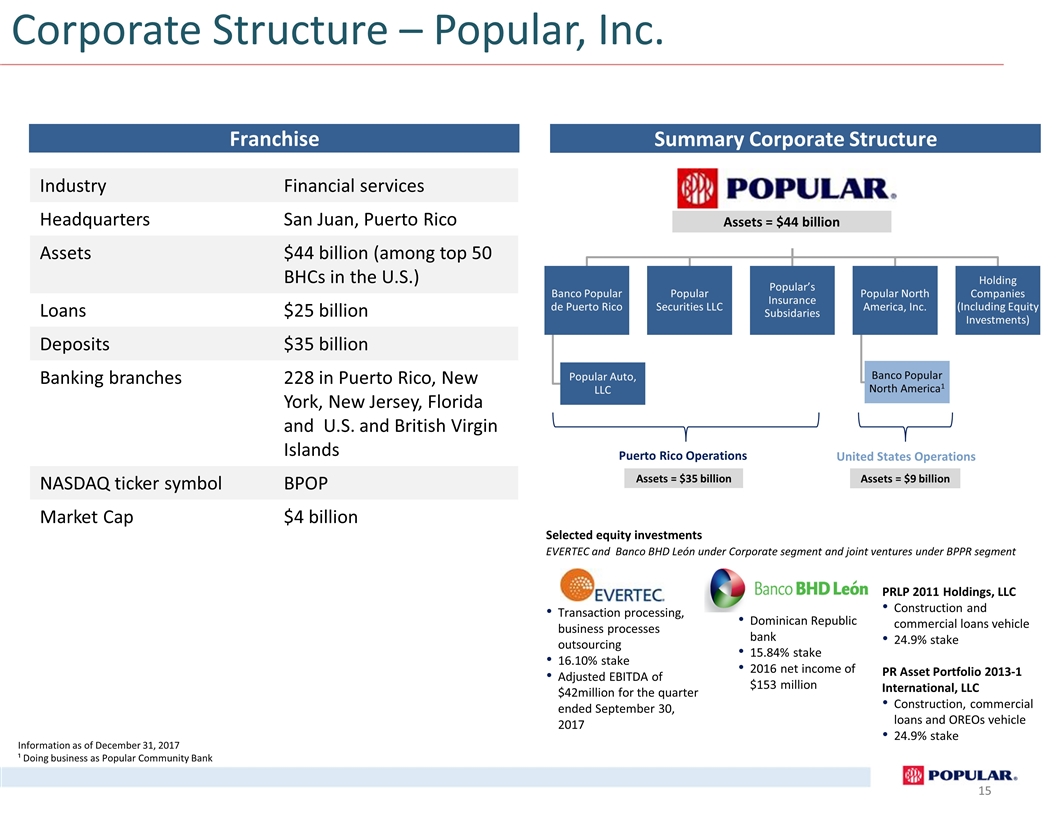

Who We Are – Popular, Inc. Franchise Information as of December 31, 2017 ¹ Doing business as Popular Community Bank Summary Corporate Structure Assets = $44 billion Assets = $35 billion Assets = $9 billion Puerto Rico Operations United States Operations Selected equity investments EVERTEC and Banco BHD León under Corporate segment and joint ventures under BPPR segment Transaction processing, business processes outsourcing 16.10% stake Adjusted EBITDA of $42million for the quarter ended September 30, 2017 Dominican Republic bank 15.84% stake 2016 net income of $153 million PRLP 2011 Holdings, LLC Construction and commercial loans vehicle 24.9% stake PR Asset Portfolio 2013-1 International, LLC Construction, commercial loans and OREOs vehicle 24.9% stake Corporate Structure – Popular, Inc. Industry Financial services Headquarters San Juan, Puerto Rico Assets $44 billion (among top 50 BHCs in the U.S.) Loans $25 billion Deposits $35 billion Banking branches 228 in Puerto Rico, New York, New Jersey, Florida and U.S. and British Virgin Islands NASDAQ ticker symbol BPOP Market Cap $4 billion Banco Popular de Puerto Rico Popular’s Insurance Subsidaries Popular North America, Inc. Popular Securities LLC Holding Companies (Including Equity Investments) Banco Popular North America 1 Popular Auto, LLC

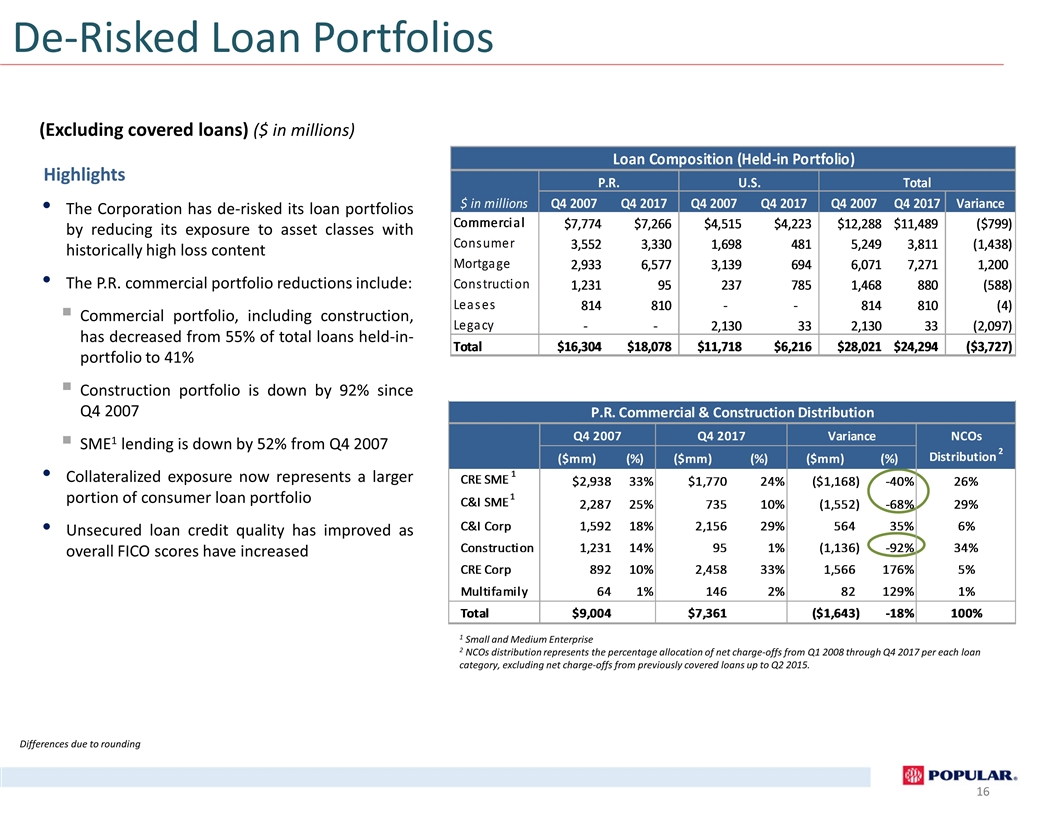

De-Risked Loan Portfolios The Corporation has de-risked its loan portfolios by reducing its exposure to asset classes with historically high loss content The P.R. commercial portfolio reductions include: Commercial portfolio, including construction, has decreased from 55% of total loans held-in-portfolio to 41% Construction portfolio is down by 92% since Q4 2007 SME1 lending is down by 52% from Q4 2007 Collateralized exposure now represents a larger portion of consumer loan portfolio Unsecured loan credit quality has improved as overall FICO scores have increased Differences due to rounding (Excluding covered loans) ($ in millions) Highlights 1 Small and Medium Enterprise 2 NCOs distribution represents the percentage allocation of net charge-offs from Q1 2008 through Q4 2017 per each loan category, excluding net charge-offs from previously covered loans up to Q2 2015.

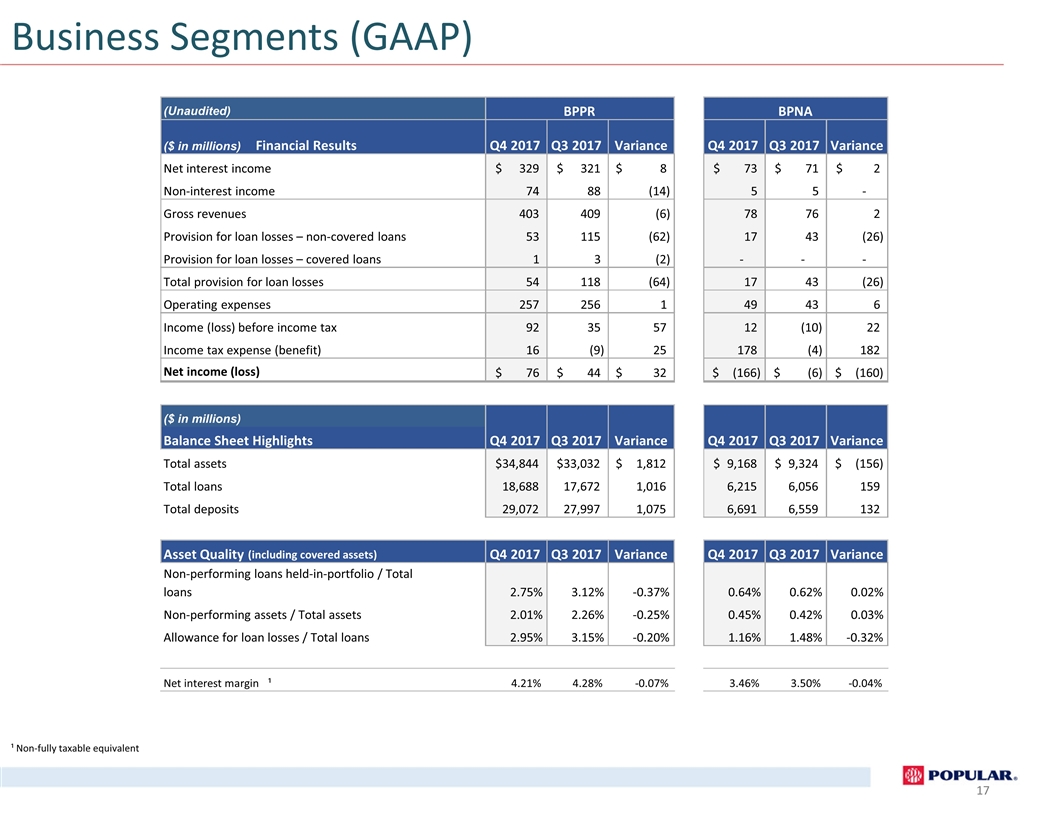

Business Segments (GAAP) ¹ Non-fully taxable equivalent (Unaudited) ($ in millions) Financial Results Q4 2017 Q3 2017 Variance Q4 2017 Q3 2017 Variance Net interest income 329 $ 321 $ 8 $ 73 $ 71 $ 2 $ Non-interest income 74 88 (14) 5 5 - Gross revenues 403 409 (6) 78 76 2 Provision for loan losses – non-covered loans 53 115 (62) 17 43 (26) Provision for loan losses – covered loans 1 3 (2) - - - Total provision for loan losses 54 118 (64) 17 43 (26) Operating expenses 257 256 1 49 43 6 Income (loss) before income tax 92 35 57 12 (10) 22 Income tax expense (benefit) 16 (9) 25 178 (4) 182 Net income (loss) 76 $ 44 $ 32 $ (166) $ (6) $ (160) $ ($ in millions) Balance Sheet Highlights Total assets 34,844 $ 33,032 $ 1,812 $ 9,168 $ 9,324 $ (156) $ Total loans 18,688 17,672 1,016 6,215 6,056 159 Total deposits 29,072 27,997 1,075 6,691 6,559 132 Asset Quality (including covered assets) Q4 2017 Q3 2017 Variance Q4 2017 Q3 2017 Variance Non-performing loans held-in-portfolio / Total loans 2.75% 3.12% -0.37% 0.64% 0.62% 0.02% Non-performing assets / Total assets 2.01% 2.26% -0.25% 0.45% 0.42% 0.03% Allowance for loan losses / Total loans 2.95% 3.15% -0.20% 1.16% 1.48% -0.32% Net interest margin ¹ 4.21% 4.28% -0.07% 3.46% 3.50% -0.04% BPPR BPNA Q4 2017 Q3 2017 Variance Q4 2017 Q3 2017 Variance

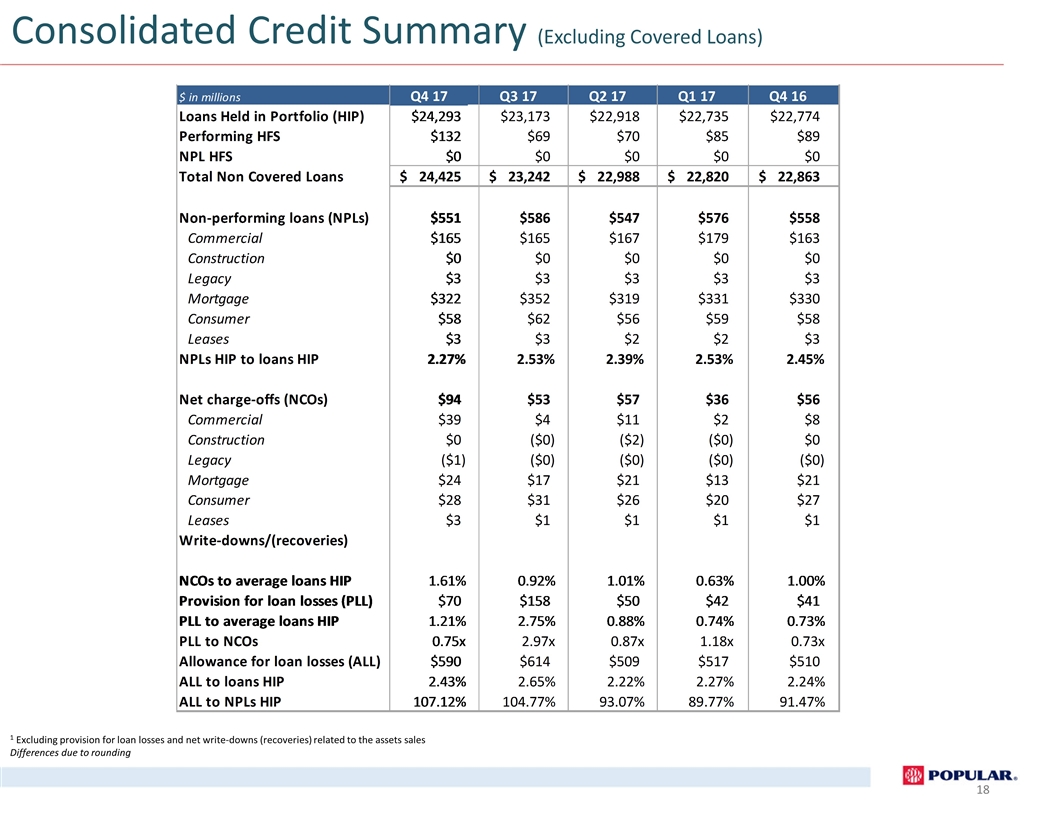

Consolidated Credit Summary (Excluding Covered Loans) 1 Excluding provision for loan losses and net write-downs (recoveries) related to the assets sales Differences due to rounding

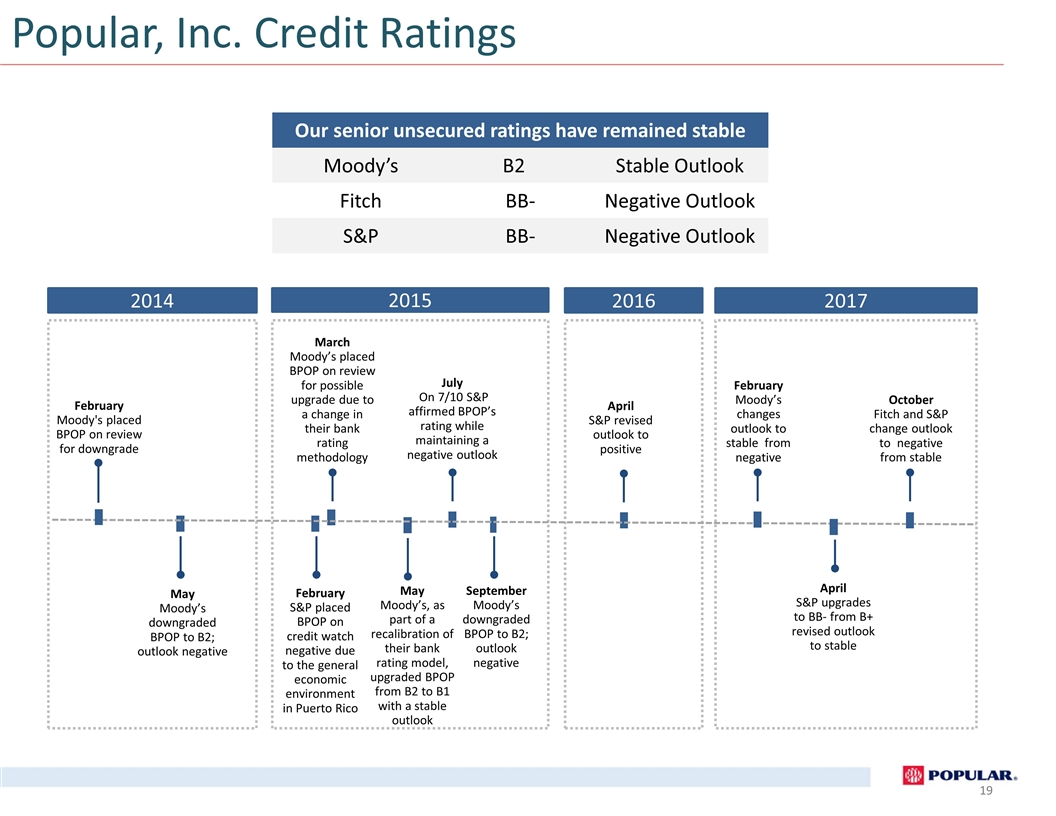

Popular, Inc. Credit Ratings Our senior unsecured ratings have remained stable Moody’s B2 Stable Outlook Fitch BB- Negative Outlook S&P BB- Negative Outlook February Moody’s changes outlook to stable from negative April S&P upgrades to BB- from B+ revised outlook to stable 2017 February S&P placed BPOP on credit watch negative due to the general economic environment in Puerto Rico February Moody's placed BPOP on review for downgrade May Moody’s downgraded BPOP to B2; outlook negative 2014 2015 May Moody’s, as part of a recalibration of their bank rating model, upgraded BPOP from B2 to B1 with a stable outlook July On 7/10 S&P affirmed BPOP’s rating while maintaining a negative outlook March Moody’s placed BPOP on review for possible upgrade due to a change in their bank rating methodology September Moody’s downgraded BPOP to B2; outlook negative 2016 April S&P revised outlook to positive October Fitch and S&P change outlook to negative from stable

Investor Presentation Fourth Quarter 2017