Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UR-ENERGY INC | tv483756_8k.htm |

Exhibit 99.1

NYSE American: URG • TSX: URE Ur - Energy 2017 Q4 Operations Teleconference and Webcast

NYSE American: URG • TSX: URE This presentation contains “forward - looking statements,” within the meaning of applicable securities laws, regarding events or conditions that may occur in the future . Such statements include without limitation the Company’s maintaining production operations ; timing of product deliveries ; the technical and economic viability of Lost Creek ; the ability to complete additional favorable uranium sales agreements, to reduce exposure to volatile market and to strike the right balance of production and purchases for delivery ; completion of (and timing for) regulatory approvals and other development at Shirley Basin and Lost Creek ; whether the new federal administration will affect the industry and/or lessen regulatory constraints ; whether the expected increases in foreign state - subsidized imports of uranium occurs in coming years ; the expected further negative impacts of such imports on U . S . uranium production and national security ; whether the Section 232 filing with the Department of Commerce will proceed to a favorable recommendation and action taken by the President of the United States ; the long term effects on the uranium market of events in Japan in 2011 including supply and demand projections ; and whether certain prospective catalysts will occur or affect the market . These statements are based on current expectations that, while considered reasonable by management at this time, inherently involve a number of significant business , economic and competitive risks, uncertainties and contingencies . Numerous factors could cause actual events to differ materially from those in the forward - looking statements . Factors that could cause such differences, without limiting the generality of the following, include : risks inherent in exploration activities ; volatility and sensitivity to market prices for uranium ; volatility and sensitivity to capital market fluctuations ; the impact of exploration competition ; the ability to raise funds through private or public equity financings ; imprecision in resource and reserve estimates ; environmental and safety risks including increased regulatory burdens ; unexpected geological or hydrological conditions ; a possible deterioration in political support for nuclear energy ; changes in government regulations and policies, including trade laws and policies ; demand for nuclear power ; weather and other natural phenomena ; delays in obtaining or failures to obtain required governmental, environmental or other project approvals ; and other exploration, development, operating, financial market and regulatory risks . Although Ur - Energy Inc . believes that the assumptions inherent in the forward - looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this presentation . Ur - Energy Inc . disclaims any intention or obligation to update or revise any forward - looking statement, whether as a result of new information, future events or otherwise . Cautionary Note Regarding Projections : Similarly, t his presentation also may contain projections relating to an extended future period and, accordingly, the estimates and assumptions underlying the projections are inherently highly uncertain, based on events that have not taken place, and are subject to significant economic, financial, regulatory, competitive and other uncertainties and contingencies beyond the control of Ur - Energy Inc . Further, given the nature of the Company's business and industry that is subject to a number of significant risk factors, there can be no assurance that the projections can be or will be realized . It is probable that the actual results and outcomes will differ, possibly materially, from those projected . The attention of investors is drawn to the Risk Factors set out in the Company's Annual Report on Form 10 - K, filed March 3 , 2017 , which is filed with the U . S . Securities and Exchange Commission on EDGAR (http : //www . sec . gov/edgar . shtml) and the regulatory authorities in Canada on SEDAR (www . sedar . com) . Cautionary Note to U . S . Investors Concerning Estimates of Measured, Indicated or Inferred Resources : the information presented uses the terms "measured", "indicated" and "inferred" mineral resources . United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize these terms . United States investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into mineral reserves . United States investors are also cautioned not to assume that all or any part of an inferred mineral resource exists, or is economically or legally minable . James A Bonner, Ur - Energy Vice President, Geology, P . Geo . , and Qualified Person as defined by NI 43 - 101 , reviewed and approved the technical information contained in this presentation . 2

NYSE American: URG • TSX: URE 3 See Disclaimer re Forward - looking Statements and Projections (slide 2) ▪ Lost Creek ISR Uranium Facility • Four years of consistent production from MU1; Initiated MU2 production in 2017 Q3 • Produced ~2.4M lbs. U 3 0 8 through 2017 Q4 including initial production from MU2 ▪ Forging a path forward for growth of the domestic uranium industry • Joint Section 232 filing requests investigation into effects of uranium imports on national security • Determination could dramatically affect the future of U.S. uranium production ▪ Flexibility and value realized through higher - priced term sales agreements (scheduling, assignments, purchases) • Balancing purchased and produced pounds for delivery • 2017 Sales of $38.3M on 780,000 lbs. at avg. $49.09/lb. • 37% gross profit margin through 2017 Q3 ▪ Growing our future - continued Lost Creek development, LC East permit amendment and Shirley Basin permitting

NYSE American: URG • TSX: URE ▪ U.S. demand is not met by U.S. production • U.S. domestic production ~1.5M lbs of uranium/ yr • U.S. utilities consume ~46.5M lbs of uranium/ yr ▪ Ur - Energy is well positioned to capitalize on this opportunity 4 See Disclaimer re Forward - looking Statements and Projections (slide 2) Source: Industry guidance; US EIA Information 2016 - 17 Uranium originating in Kazakhstan, Russia and Uzbekistan accounted for 38% of the 51 million pounds purchased by U.S. utilities

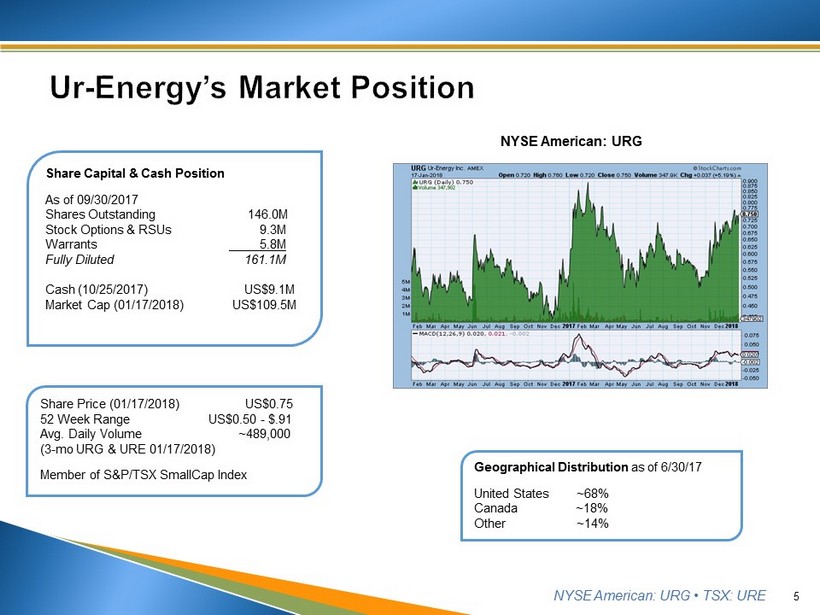

NYSE American: URG • TSX: URE 5 Share Price (01/17/2018) US$0.75 52 Week Range US$0.50 - $.91 Avg. Daily Volume ~489,000 (3 - mo URG & URE 01/17/2018) Member of S&P/TSX SmallCap Index Share Capital & Cash Position As of 09/30/2017 Shares Outstanding 146.0M Stock Options & RSUs 9.3M Warrants 5.8M Fully Diluted 161.1M Cash (10/25/2017) US$9.1M Market Cap (01/17/2018) US$109.5M Geographical Distribution as of 6/30/17 United States ~68% Canada ~18% Other ~14% NYSE American: URG

NYSE American: URG • TSX: URE ▪ Cash flow is King! ▪ Multiple long - term contracts spanning 2013 - 2021 timeframe, post Fukushima • ~1.6M lbs committed 2018 – 2021 (avg. price $49.06/ lb ) ▪ De - risking by securing contract revenue streams in an uncertain market – Consistency! • 2015 : 630,000 lbs U 3 O 8 at avg. price of $49.42/ lb - $31.1M gross revenues • 2016 : 462,000 lbs U 3 O 8 at avg. price of $41.38/ lb - $19.1M gross revenues • 2017 : 780,000 lbs U 3 O 8 at avg. price of $49.09/ lb - $38.3M gross revenues • Purchases have supplemented production. 6 ▪ Through 2017 Q3, Lost Creek realized $25 cash margins in a low $20 spot price environment. ▪ Exclusive representation by Jim Cornell of NuCore Energy, LLC See Disclaimer re Forward - looking Statements and Projections (slide 2)

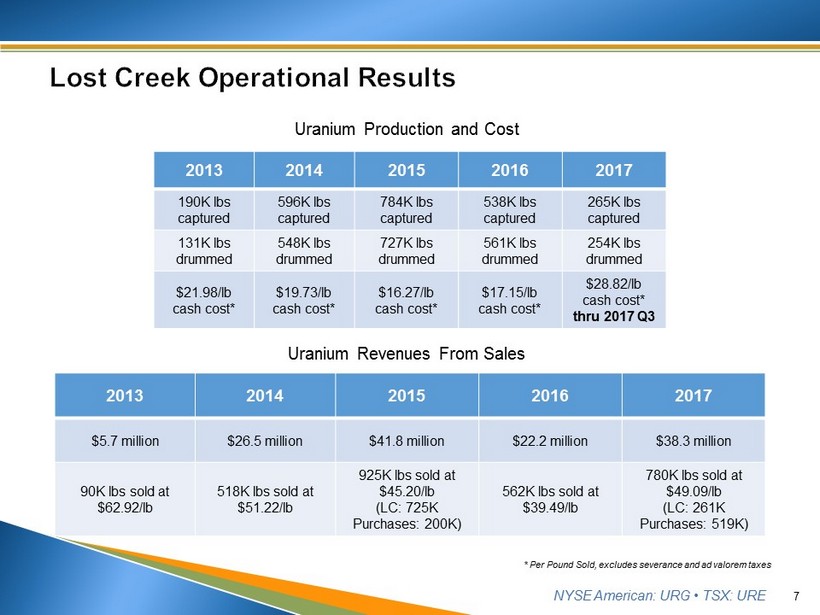

NYSE American: URG • TSX: URE 7 2013 2014 2015 2016 2017 190K lbs captured 596K lbs captured 784K lbs captured 538K lbs captured 265K lbs captured 131K lbs drummed 548K lbs drummed 727K lbs drummed 561K lbs drummed 254K lbs drummed $21.98/lb cash cost* $19.73/ lb cash cost* $16.27/ lb cash cost* $17.15/ lb cash cost* $28.82/ lb cash cost* thru 2017 Q3 Uranium Production and Cost 2013 2014 2015 2016 2017 $5.7 million $26.5 million $41.8 million $22.2 million $38.3 million 90K lbs sold at $62.92/ lb 518K lbs sold at $51.22/ lb 925K lbs sold at $45.20/ lb (LC: 725K Purchases: 200K) 562K lbs sold at $39.49/ lb 780K lbs sold at $49.09/ lb (LC: 261K Purchases: 519K) Uranium Revenues From Sales * Per Pound Sold, excludes severance and ad valorem taxes

NYSE American: URG • TSX: URE 8 Wellfield ▪ MU1: ▪ Recovered approximately 89% of under - pattern resources through December 31, 2017 ▪ All 13 header houses operational ▪ Many of the houses are in secondary recovery mode – i.e., well flow paths are modified to facilitate additional recovery ▪ MU2: ▪ Recovery similar to MU1 performance to date ▪ 2 header houses operating ▪ 3 rd house will be on in 2018 Q1 Processing Plant ▪ All plant systems functional with maintenance occurring as necessary ▪ Waste Water ▪ Class V UIC water disposal systems operational reducing waste water to Class I wells ▪ Class I UIC disposal wells utilized as necessary Lost Creek Plant Mine Unit 1 See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE American: URG • TSX: URE 9 ▪ U.S. Uranium Market is at Risk from Foreign Imports • Russia, Kazakhstan and Uzbekistan now fulfill nearly 40% of U.S. demand, while domestic production fulfills less than 5% • In 2017, U.S. uranium production fell to historic lows and continues to decline ▪ Foreign Uranium Imports Threaten U.S. National Security • U.S. uranium industry is vital to national security Required for U.S. defense programs Supplies fuel for nuclear power plants – 20% of U.S. electric grid See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE American: URG • TSX: URE ▪ Uranium used for defense, including for tritium production, nuclear weapons, and naval propulsion, must be sourced from U.S. mines pursuant to international law. ▪ U.S. nuclear utilities are growing increasingly dependent upon nations who do not share our values. ▪ Many of the nations we rely on for commercial fuel are unstable themselves or are located within unstable regions (ISIS presence). ▪ The unallocated DOE excess inventory is now less than one year’s supply for our nuclear utilities. 10

NYSE American: URG • TSX: URE ▪ Production from nations under the influence of Russia expanded through 2016 ▪ McArthur River, the largest uranium mine in the world, located in Canada, will be temporarily shutting down by the end of January 2018 11 Kazakhstan Russia + Kazak + Uzbek Canada

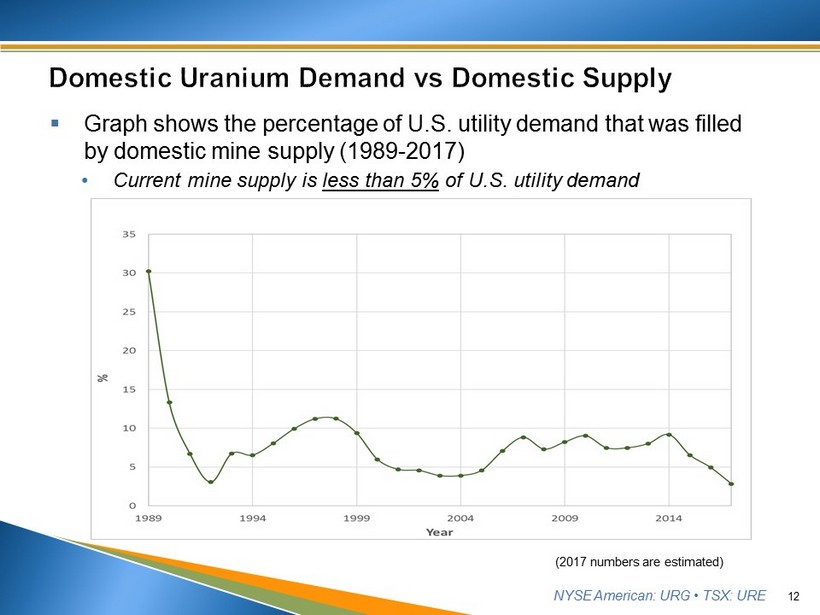

NYSE American: URG • TSX: URE ▪ Graph shows the percentage of U.S. utility demand that was filled by domestic mine supply (1989 - 2017) • Current mine supply is less than 5% of U.S. utility demand 12 (2017 numbers are estimated)

NYSE American: URG • TSX: URE ▪ Kazakhstan and Russia have different, less costly environmental, health and safety standards than the U.S. including • Use of sulfuric acid • No active groundwater restoration ▪ Kazakh and Russian uranium mining benefits from • Faster permitting • Energy subsidies • Currency valuation, absence of certain taxes, land holding costs • Differences in labor costs ▪ Lost Creek PEA if adjusted for these differences: • PEA Pre - tax IRR = 53.7%; if adjusted to Kazakh standards = 151% • PEA total cost per pound U 3 O 8 = $29.29; if adjusted, $20.01 per pound • PEA LoM OPEX = $14.58 per pound U 3 O 8 ; if adjusted, $8.97 per pound ▪ Level Field : Lost Creek production costs, an additional ~50% less, results in a lower mining cost than nearly every Kazakh ISR mine 13 See Disclaimer re Forward - looking Statements and Projections (slide 2)

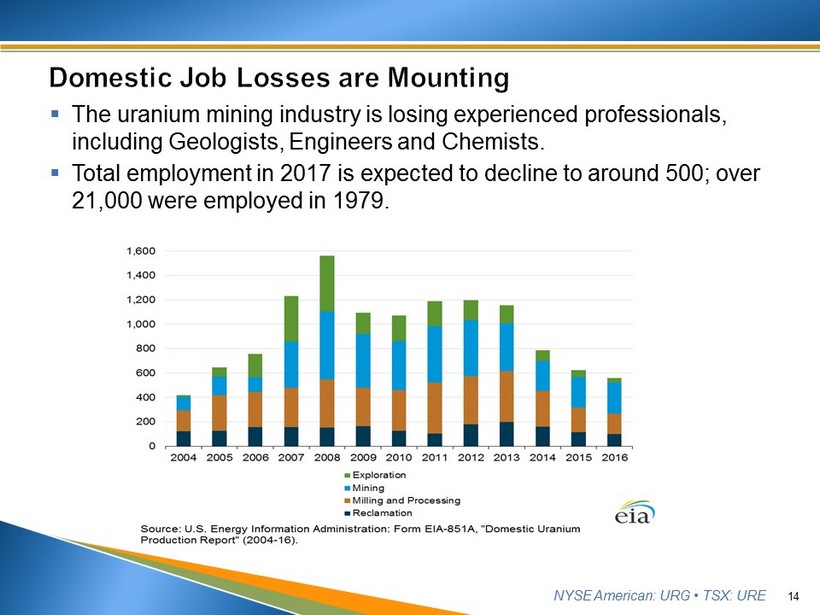

NYSE American: URG • TSX: URE ▪ The uranium mining industry is losing experienced professionals, including Geologists, Engineers and Chemists. ▪ Total employment in 2017 is expected to decline to around 500; over 21,000 were employed in 1979. 14

NYSE American: URG • TSX: URE ▪ Petitioners’ proposed remedies: • a quota that reserves 25% of the market for U.S. producers; and • a requirement that federal government utilities and agencies purchase uranium from U.S. producers in accordance with the President’s ‘Buy American’ policy. ▪ The proposed remedies: • are sensible and achievable; result in very little impact to U.S. utilities and their customers; • will provide U.S. utilities and their customers with improved supply diversification that will lessen exposure to the policies of Russia and China and protect against supply shocks, price increases, and other geopolitically motivated actions; • will maintain a high degree of competition that encourages lower prices and innovation, while supporting U.S. clean energy independence, reduction in air pollution, and lowered carbon emissions. 15 See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE American: URG • TSX: URE • Lowest - cost producer among all publicly - traded companies • Results delivered since Fukushima • Term contracts de - risk Company and protect our shareholders • Section 232 filing serves national security, while seeking remedies to sustain domestic uranium industry • Evolved strategy – proper balance between produced and purchased pounds Best cash margins in the industry: ~$25/ lb thru 2017 Q3 • Cash flow is King: Either you are cash flowing or you are diluting. There is no third option. 16 See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE American: URG • TSX: URE ▪ Supply / Demand: Growth Rate is Real • > 1Billion pounds uncontracted for requirements in next decade • 3.1% annual growth projected through 2025 • 61 reactors under construction • Real production cuts needed from Kazakhstan - plus Cameco’s announcements ▪ Current Market Forces • Kazatomprom’s planned IPO – 2H 2018 • Very few remaining uranium companies (~40 worldwide / down from 585 in 2007) • Section 232 filing creates potential for increased market for U.S. producers ▪ Geopolitical Risks • U.S. facing conflicts and uncertainty in multiple regions around the globe • Heavy dependence upon low - cost imports from Russia, Kazakhstan, and Uzbekistan increases potential for significant supply disruption 17 See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE American: URG • TSX: URE For more information, please contact: Jeff Klenda , Chairman, President & CEO By Mail: Ur - Energy 10758 W. Centennial Rd., Suite 200 Littleton, CO 80127 USA By Phone: Office 720.981.4588 Toll - Free 866.981.4588 Fax 720.981.5643 By E - mail: jeff.klenda@ur - energy.com 18