Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - LINCOLN NATIONAL CORP | d520435dex991.htm |

| 8-K - 8-K - LINCOLN NATIONAL CORP | d520435d8k.htm |

Lincoln to Acquire Liberty mutual group benefits business January 19, 2018 Contact Information 484-583-1793 Christopher.Giovanni@LFG.com Exhibit 99.2

This presentation contains certain forward-looking statements that are based upon current expectations and certain unaudited pro forma information that is presented for illustrative purposes only and involves certain risks and uncertainties within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, plans, objectives, expectations and intentions and other statements contained in this news announcement that are not historical facts, including statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “outlook” or words of similar meanings. These statements are based on the Company’s current expectations and beliefs and various assumptions. There can be no assurance that the Company will realize these expectations or that these beliefs will prove correct. Numerous factors, many of which are beyond the Company’s control, could cause actual results to differ materially from those expressed as forward-looking statements. These risks and uncertainties include, but are not limited to, the possibility that expected benefits associated with the proposed transaction may not be realized as expected, or at all; the proposed transaction not being timely completed, if completed at all, including risks relating to the timing, receipt and terms and conditions of any required governmental or regulatory approvals for the proposed transaction; prior to the completion of the proposed transaction, the Company’s or Liberty’s business experiencing disruptions due to transaction-related uncertainty or other factors making it more difficult to establish or maintain relationships with employees, suppliers, customers and other business partners or governmental entities; the parties being unable to successfully implement integration strategies or to achieve anticipated synergies and operational efficiencies related to the proposed transaction within the expected time frames or at all; the failure to realize the expected benefits from the Company’s business process initiatives, including its strategic digitization initiative; the risks, challenges and uncertainties associated with the Company’s capital management plan, expense reduction initiatives and other action which may include acquisitions, divestitures or restructurings; uncertainties surrounding domestic and global economic conditions; the impact of recently enacted U.S. tax reform legislation; and other factors that are described in the Company’s filings on forms 8-K, 10-Q, and 10-K with the U.S. Securities and Exchange Commission. The Company does not undertake any obligation to update any forward-looking statements contained in this presentation as a result of new information, future events or otherwise. Forward Looking Statements – Cautionary Language

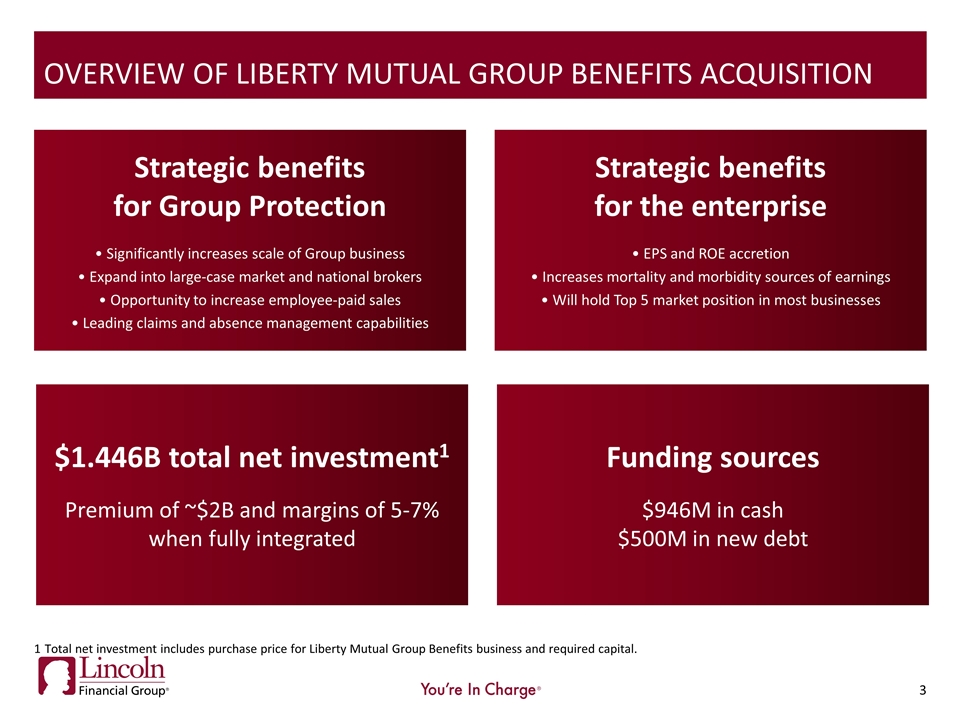

Overview of Liberty mutual group benefits Acquisition 1 Total net investment includes purchase price for Liberty Mutual Group Benefits business and required capital. Strategic benefits for Group Protection • Significantly increases scale of Group business • Expand into large-case market and national brokers • Opportunity to increase employee-paid sales • Leading claims and absence management capabilities Strategic benefits for the enterprise • EPS and ROE accretion • Increases mortality and morbidity sources of earnings • Will hold Top 5 market position in most businesses $1.446B total net investment1 Premium of ~$2B and margins of 5-7% when fully integrated Funding sources $946M in cash $500M in new debt

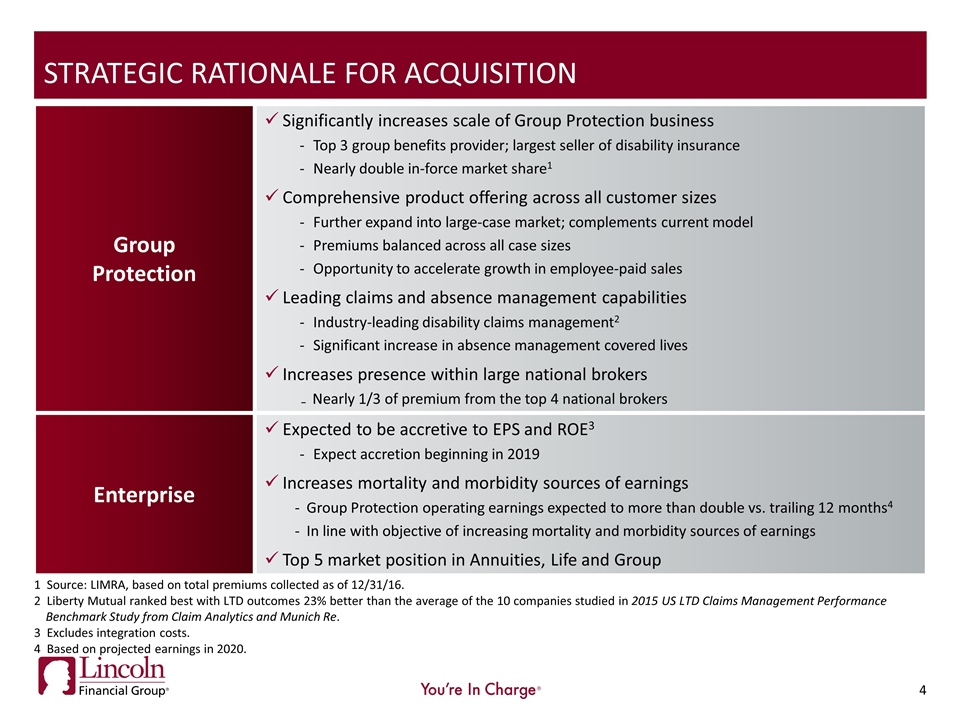

Strategic rationale for acquisition Group Protection Significantly increases scale of Group Protection business Top 3 group benefits provider; largest seller of disability insurance Nearly double in-force market share1 Comprehensive product offering across all customer sizes Further expand into large-case market; complements current model Premiums balanced across all case sizes Opportunity to accelerate growth in employee-paid sales Leading claims and absence management capabilities Industry-leading disability claims management2 Significant increase in absence management covered lives Increases presence within large national brokers Nearly 1/3 of premium from the top 4 national brokers Enterprise Expected to be accretive to EPS and ROE3 Expect accretion beginning in 2019 Increases mortality and morbidity sources of earnings Group Protection operating earnings expected to more than double vs. trailing 12 months4 In line with objective of increasing mortality and morbidity sources of earnings Top 5 market position in Annuities, Life and Group 1 Source: LIMRA, based on total premiums collected as of 12/31/16. 2 Liberty Mutual ranked best with LTD outcomes 23% better than the average of the 10 companies studied in 2015 US LTD Claims Management Performance Benchmark Study from Claim Analytics and Munich Re. 3 Excludes integration costs. 4 Based on projected earnings in 2020.

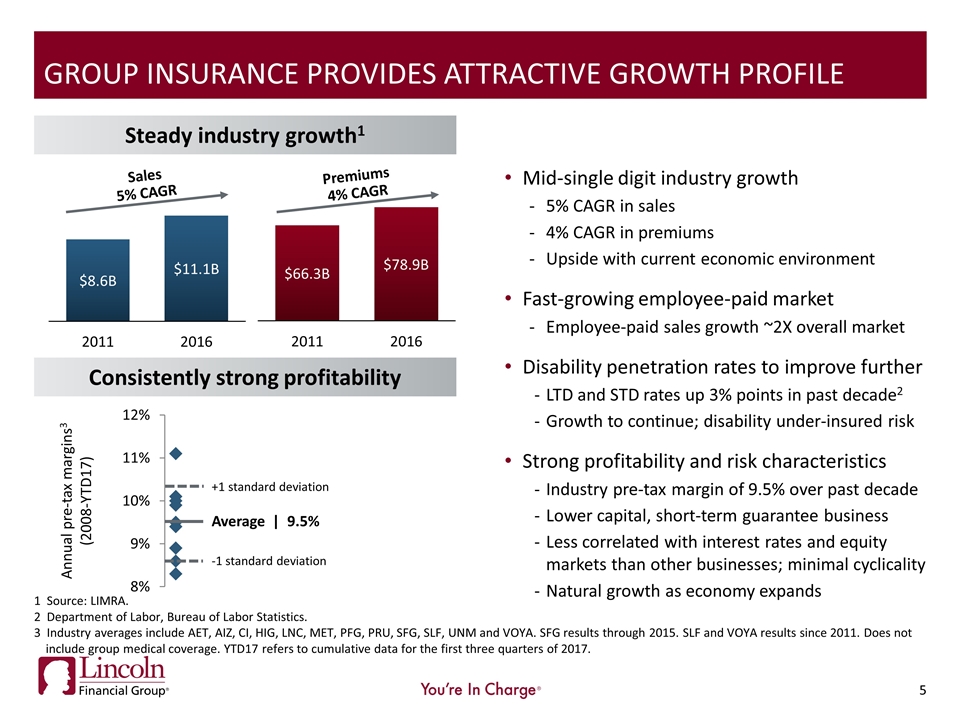

Group insurance provides attractive growth profile Mid-single digit industry growth 5% CAGR in sales 4% CAGR in premiums Upside with current economic environment Fast-growing employee-paid market Employee-paid sales growth ~2X overall market Disability penetration rates to improve further LTD and STD rates up 3% points in past decade2 Growth to continue; disability under-insured risk Strong profitability and risk characteristics Industry pre-tax margin of 9.5% over past decade Lower capital, short-term guarantee business Less correlated with interest rates and equity markets than other businesses; minimal cyclicality Natural growth as economy expands Consistently strong profitability 1 Source: LIMRA. 2 Department of Labor, Bureau of Labor Statistics. 3 Industry averages include AET, AIZ, CI, HIG, LNC, MET, PFG, PRU, SFG, SLF, UNM and VOYA. SFG results through 2015. SLF and VOYA results since 2011. Does not include group medical coverage. YTD17 refers to cumulative data for the first three quarters of 2017. Steady industry growth1 Sales 5% CAGR Premiums 4% CAGR +1 standard deviation Average | 9.5% -1 standard deviation

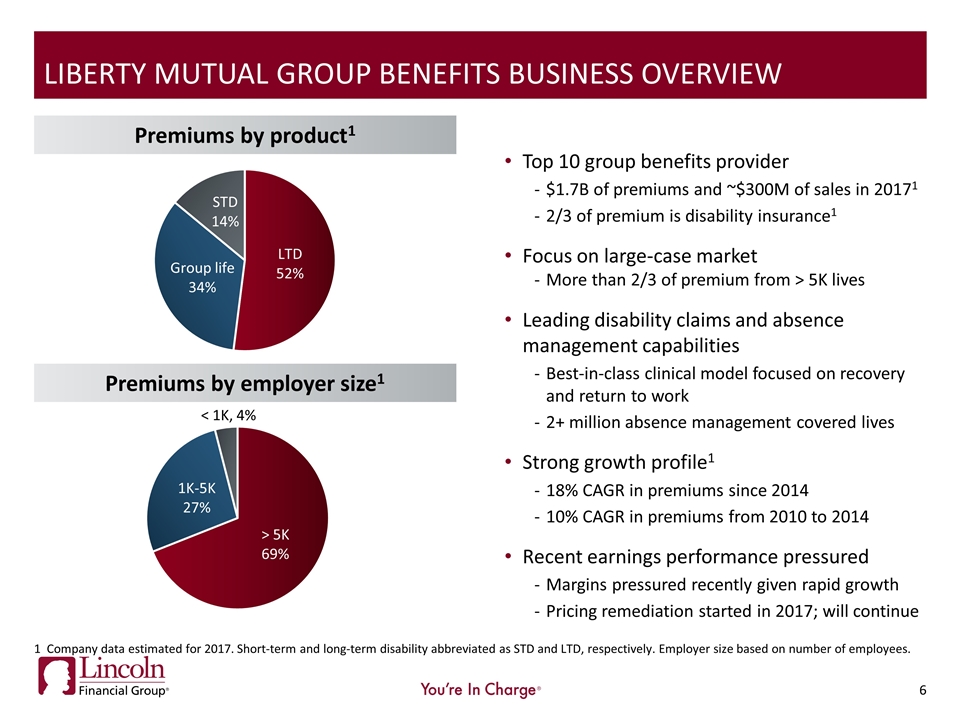

Top 10 group benefits provider $1.7B of premiums and ~$300M of sales in 20171 2/3 of premium is disability insurance1 Focus on large-case market More than 2/3 of premium from > 5K lives Leading disability claims and absence management capabilities Best-in-class clinical model focused on recovery and return to work 2+ million absence management covered lives Strong growth profile1 18% CAGR in premiums since 2014 10% CAGR in premiums from 2010 to 2014 Recent earnings performance pressured Margins pressured recently given rapid growth Pricing remediation started in 2017; will continue Liberty mutual group Benefits business overview Premiums by product1 Premiums by employer size1 1 Company data estimated for 2017. Short-term and long-term disability abbreviated as STD and LTD, respectively. Employer size based on number of employees.

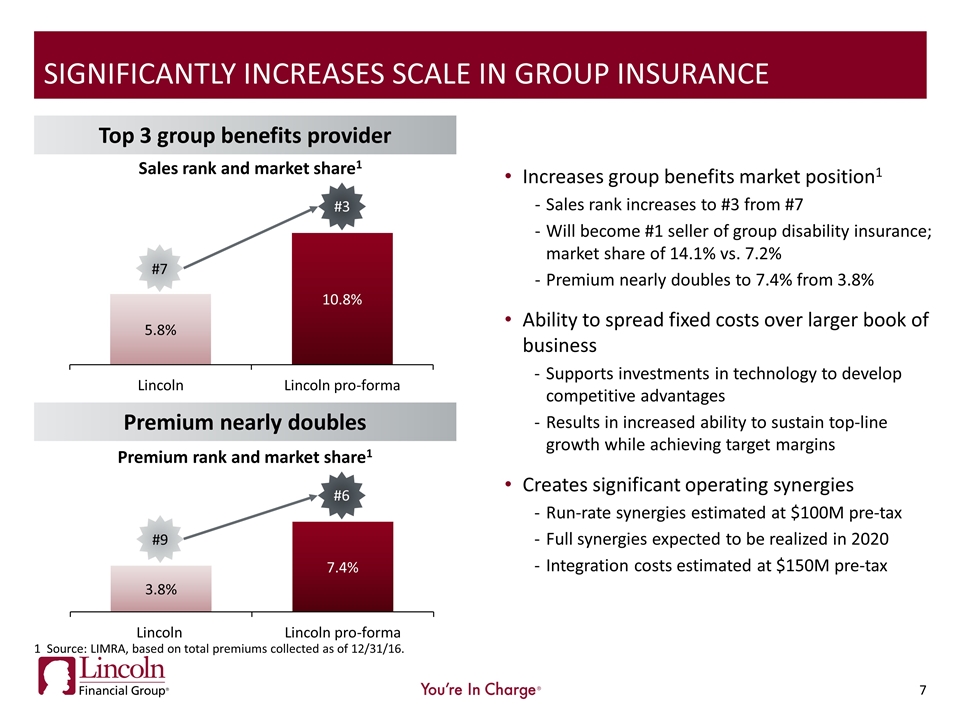

Significantly Increases Scale in Group Insurance Top 3 group benefits provider #7 #3 Premium nearly doubles #9 #6 Increases group benefits market position1 Sales rank increases to #3 from #7 Will become #1 seller of group disability insurance; market share of 14.1% vs. 7.2% Premium nearly doubles to 7.4% from 3.8% Ability to spread fixed costs over larger book of business Supports investments in technology to develop competitive advantages Results in increased ability to sustain top-line growth while achieving target margins Creates significant operating synergies Run-rate synergies estimated at $100M pre-tax Full synergies expected to be realized in 2020 Integration costs estimated at $150M pre-tax 1 Source: LIMRA, based on total premiums collected as of 12/31/16. Sales rank and market share1 Premium rank and market share1

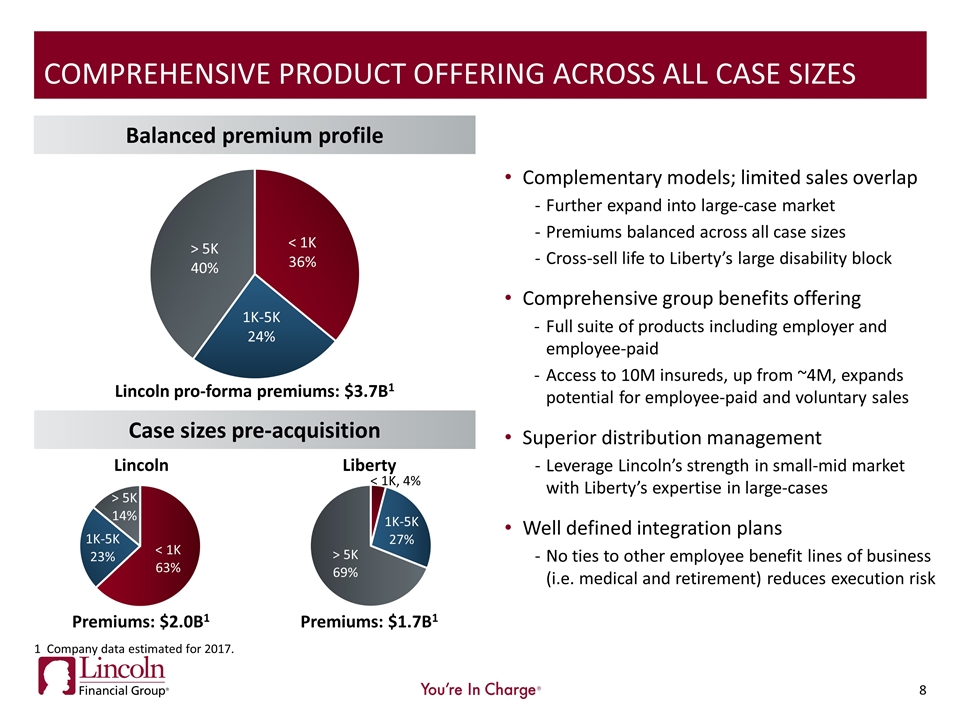

Comprehensive product offering across all case sizes 1 Company data estimated for 2017. Lincoln Liberty Balanced premium profile Premiums: $2.0B1 Premiums: $1.7B1 Lincoln pro-forma premiums: $3.7B1 Complementary models; limited sales overlap Further expand into large-case market Premiums balanced across all case sizes Cross-sell life to Liberty’s large disability block Comprehensive group benefits offering Full suite of products including employer and employee-paid Access to 10M insureds, up from ~4M, expands potential for employee-paid and voluntary sales Superior distribution management Leverage Lincoln’s strength in small-mid market with Liberty’s expertise in large-cases Well defined integration plans No ties to other employee benefit lines of business (i.e. medical and retirement) reduces execution risk Case sizes pre-acquisition

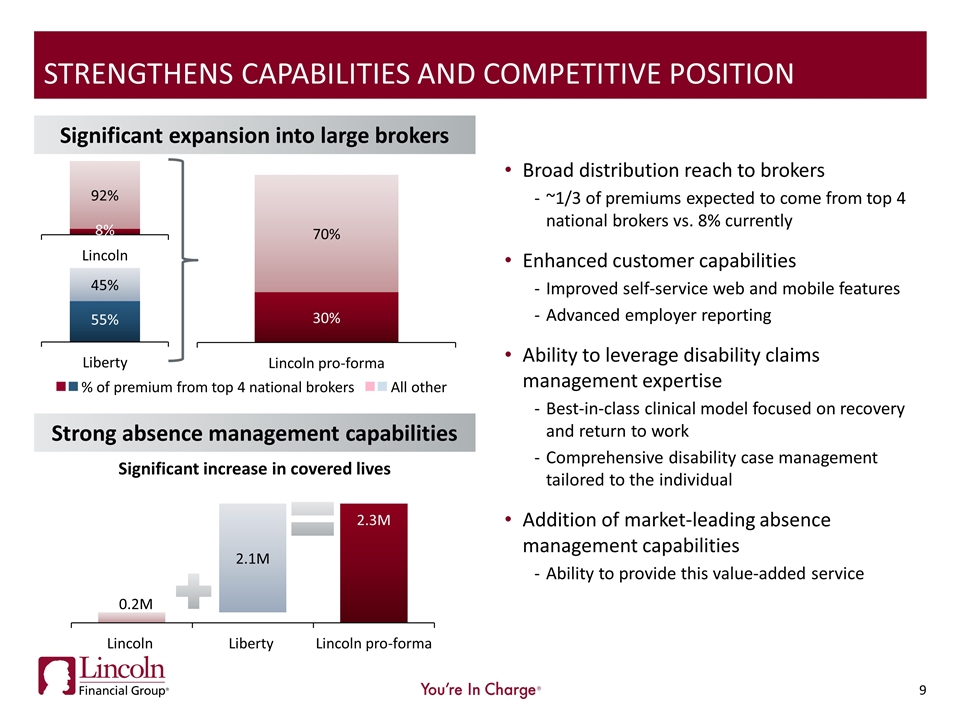

Significant increase in covered lives Strengthens Capabilities and Competitive Position Strong absence management capabilities Significant expansion into large brokers % of premium from top 4 national brokers All other ▪▪ ▪▪ Broad distribution reach to brokers ~1/3 of premiums expected to come from top 4 national brokers vs. 8% currently Enhanced customer capabilities Improved self-service web and mobile features Advanced employer reporting Ability to leverage disability claims management expertise Best-in-class clinical model focused on recovery and return to work Comprehensive disability case management tailored to the individual Addition of market-leading absence management capabilities Ability to provide this value-added service

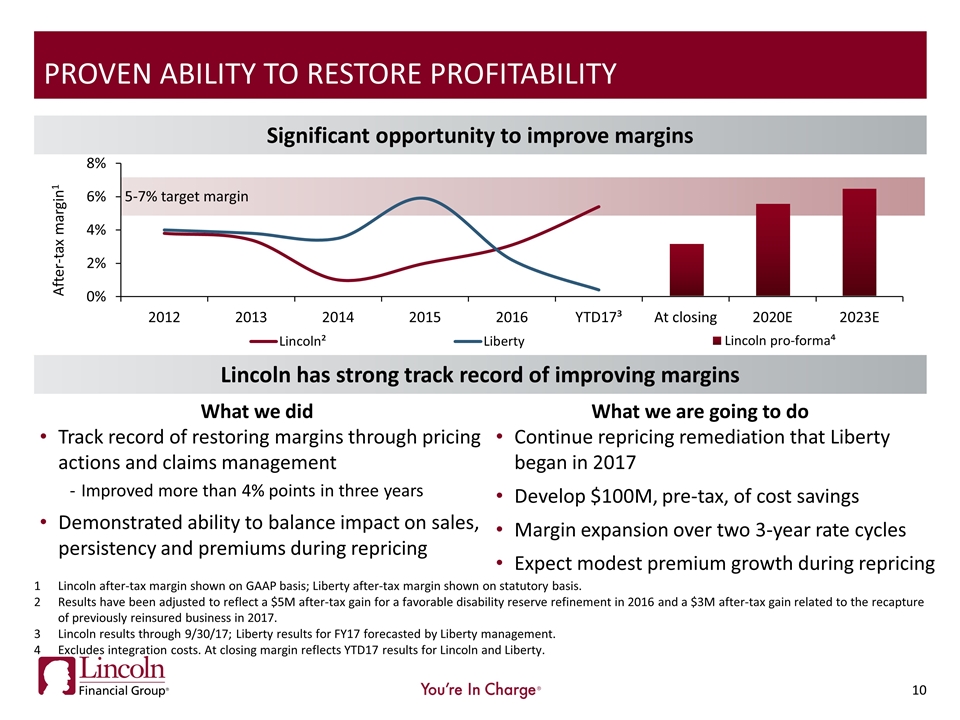

Proven ability to restore profitability Significant opportunity to improve margins Lincoln after-tax margin shown on GAAP basis; Liberty after-tax margin shown on statutory basis. Results have been adjusted to reflect a $5M after-tax gain for a favorable disability reserve refinement in 2016 and a $3M after-tax gain related to the recapture of previously reinsured business in 2017. Lincoln results through 9/30/17; Liberty results for FY17 forecasted by Liberty management. Excludes integration costs. At closing margin reflects YTD17 results for Lincoln and Liberty. Lincoln has strong track record of improving margins Continue repricing remediation that Liberty began in 2017 Develop $100M, pre-tax, of cost savings Margin expansion over two 3-year rate cycles Expect modest premium growth during repricing Track record of restoring margins through pricing actions and claims management Improved more than 4% points in three years Demonstrated ability to balance impact on sales, persistency and premiums during repricing What we did What we are going to do 5-7% target margin

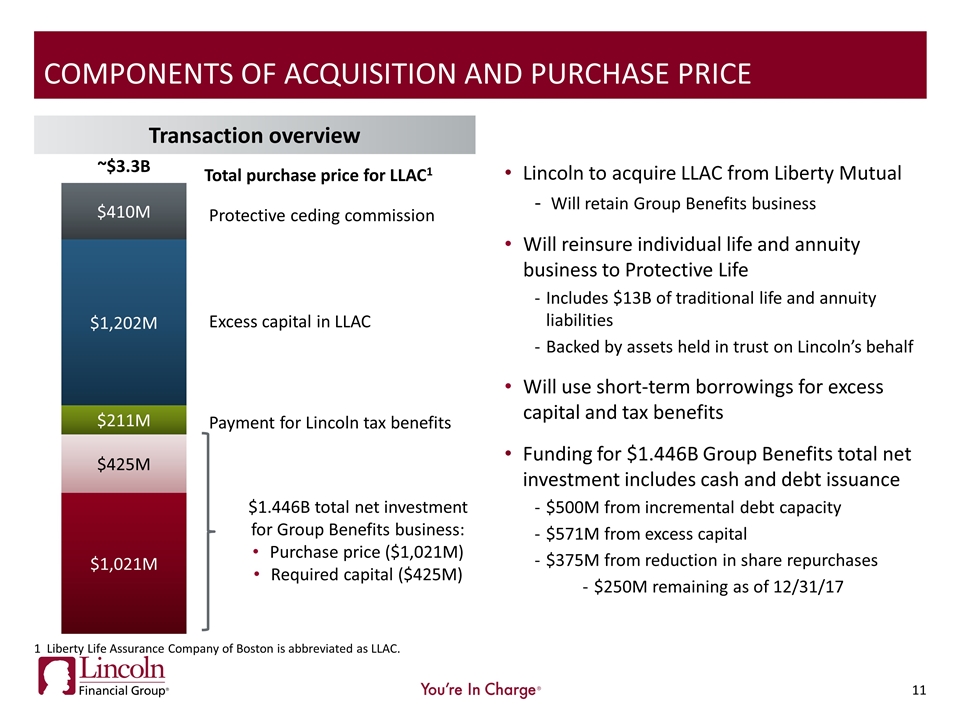

Components of acquisition and purchase price Lincoln to acquire LLAC from Liberty Mutual Will retain Group Benefits business Will reinsure individual life and annuity business to Protective Life Includes $13B of traditional life and annuity liabilities Backed by assets held in trust on Lincoln’s behalf Will use short-term borrowings for excess capital and tax benefits Funding for $1.446B Group Benefits total net investment includes cash and debt issuance $500M from incremental debt capacity $571M from excess capital $375M from reduction in share repurchases $250M remaining as of 12/31/17 Transaction overview 1 Liberty Life Assurance Company of Boston is abbreviated as LLAC. Total purchase price for LLAC1 Protective ceding commission Excess capital in LLAC Payment for Lincoln tax benefits $1.446B total net investment for Group Benefits business: Purchase price ($1,021M) Required capital ($425M)

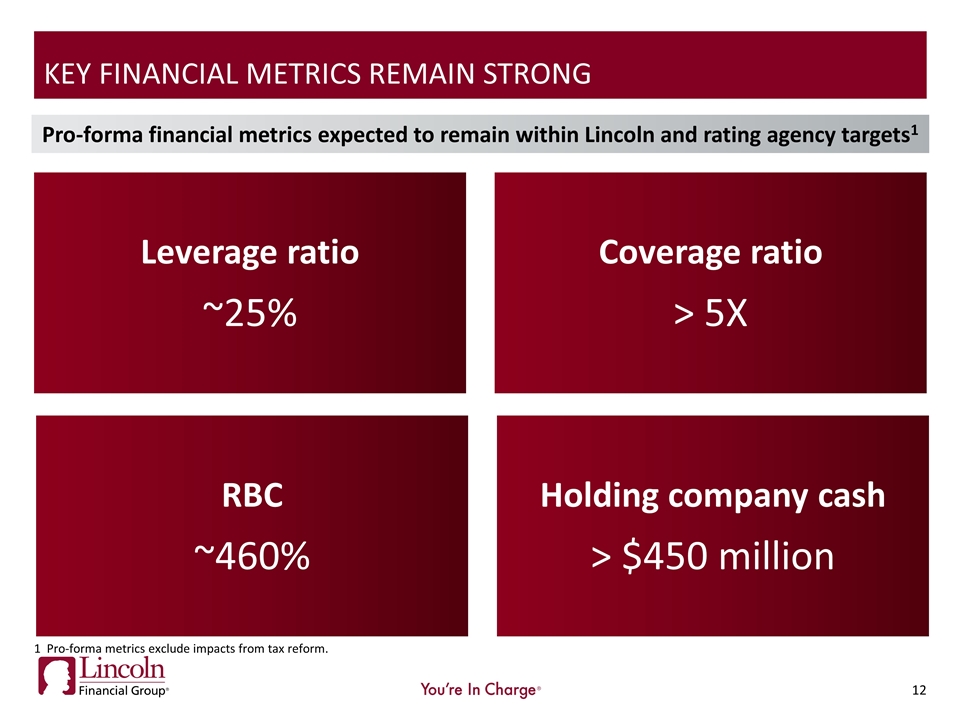

Key financial metrics remain strong Leverage ratio ~25% Coverage ratio > 5X RBC ~460% Holding company cash > $450 million Pro-forma financial metrics expected to remain within Lincoln and rating agency targets1 1 Pro-forma metrics exclude impacts from tax reform.

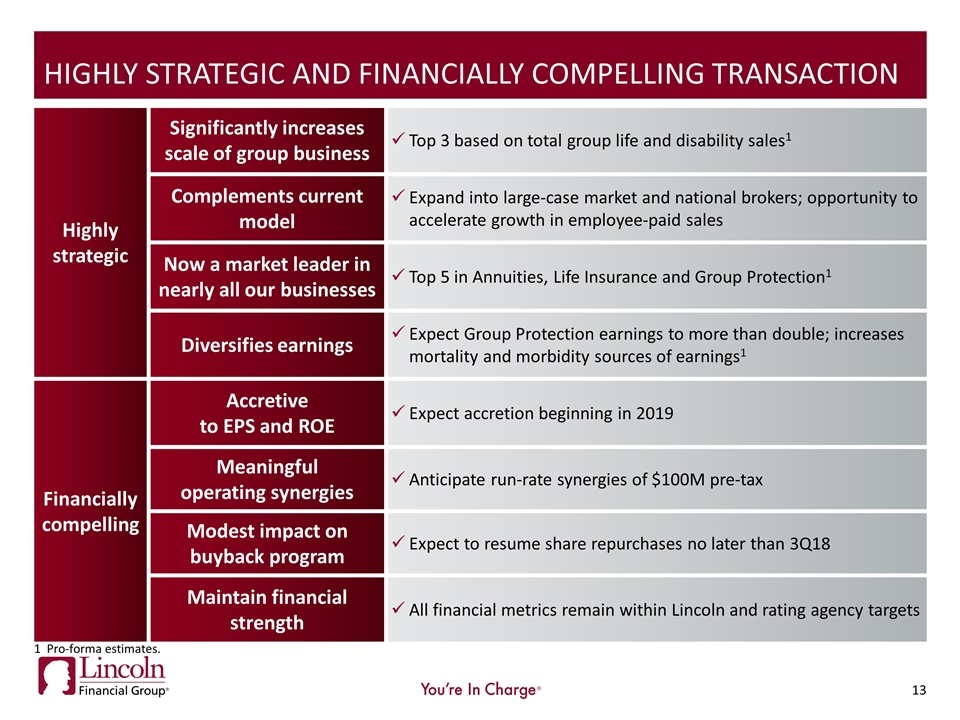

Highly strategic and financially compelling transaction Highly strategic Significantly increases scale of group business Top 3 based on total group life and disability sales1 Complements current model Expand into large-case market and national brokers; opportunity to accelerate growth in employee-paid sales Now a market leader in nearly all our businesses Top 5 in Annuities, Life Insurance and Group Protection1 Diversifies earnings Expect Group Protection earnings to more than double; increases mortality and morbidity sources of earnings1 Financially compelling Accretive to EPS and ROE Expect accretion beginning in 2019 Meaningful operating synergies Anticipate run-rate synergies of $100M pre-tax Modest impact on buyback program Expect to resume share repurchases no later than 3Q18 Maintain financial strength All financial metrics remain within Lincoln and rating agency targets 1 Pro-forma estimates.