Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - TENNECO INC | d460051dex991.htm |

| 8-K - 8-K - TENNECO INC | d460051d8k.htm |

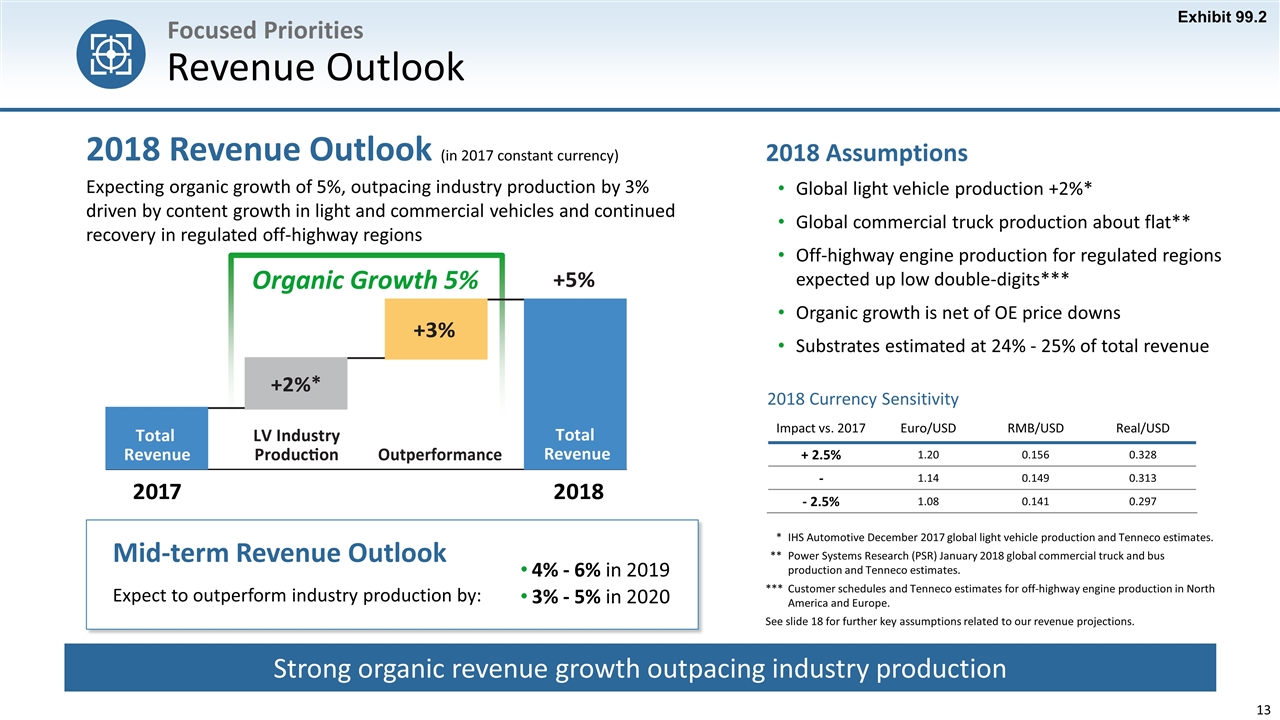

Focused Priorities Revenue Outlook Strong organic revenue growth outpacing industry production Organic Growth 5% 2018 Revenue Outlook (in 2017 constant currency) Expecting organic growth of 5%, outpacing industry production by 3% driven by content growth in light and commercial vehicles and continued recovery in regulated off-highway regions * IHS Automotive December 2017 global light vehicle production and Tenneco estimates. ** Power Systems Research (PSR) January 2018 global commercial truck and bus production and Tenneco estimates. ***Customer schedules and Tenneco estimates for off-highway engine production in North America and Europe. See slide 18 for further key assumptions related to our revenue projections. Impact vs. 2017 Euro/USD RMB/USD Real/USD + 2.5% 1.20 0.156 0.328 - 1.14 0.149 0.313 - 2.5% 1.08 0.141 0.297 2018 Assumptions Global light vehicle production +2%* Global commercial truck production about flat** Off-highway engine production for regulated regions expected up low double-digits*** Organic growth is net of OE price downs Substrates estimated at 24% - 25% of total revenue 2018 Currency Sensitivity Mid-term Revenue Outlook Expect to outperform industry production by: 4% - 6% in 2019 3% - 5% in 2020 Exhibit 99.2

Tenneco Projections In addition to the information set forth on this slide and slide 10 and 13, Tenneco’s revenue projections are based on the type of information set forth under “Outlook” in Item 7 – “Management’s Discussion and Analysis of Financial Condition and Results of Operations” as set forth in Tenneco’s Annual Report on Form 10-K/A for the year ended December 31, 2016. Please see that disclosure for further information. Key additional assumptions and limitations described in that disclosure include: Revenue projections are based on original equipment manufacturers’ programs that have been formally awarded to the company; programs where the company is highly confident that it will be awarded business based on informal customer indications consistent with past practices; and Tenneco’s status as supplier for the existing program and its relationship with the customer. Revenue projections are based on the anticipated pricing of each program over its life. Revenue projections assume a fixed foreign currency value. This value is used to translate foreign business to the U.S. dollar. Revenue projections are subject to increase or decrease due to changes in customer requirements, customer and consumer preferences, the number of vehicles actually produced by our customers, and pricing. No inflation assumed. Certain elements of our GAAP revenue cannot be forecasted accurately over long periods of time on account of the variability and volatility of precious metal pricing in the substrates that we pass through to our customers. In this respect, we are not able to forecast GAAP revenue on a forward-looking basis for the time periods provided herein on slide 10 without unreasonable efforts. Tenneco’s revenue projection constitutes a forward-looking statement. We also refer you to the cautionary language regarding our forward-looking statements set forth in the Safe Harbor statement on slide 2.